Legacy Reserves LP

A. G. Edwards Yield Conference

May 2007

Page 2

Forward-Looking Statements

Statements made by representatives of Legacy Reserves LP (the “Partnership”) during

the course of this presentation that are not historical facts are forward-looking

statements. These statements are based on certain assumptions made by the

Partnership based on management’s experience and perception of historical trends,

current conditions, anticipated future developments and other factors believed to be

appropriate. Such statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Partnership, which may cause

actual results to differ materially from those implied or expressed by the forward-looking

statements. These include risks relating to financial performance and results, availability

of sufficient cash flow to pay distributions and execute our business plan, prices and

demand for o il and natural gas, our ability to replace reserves and efficiently exploit our

current reserves, our ability to make acquisitions on economically acceptable terms, and

other important factors that could cause actual results to differ materially from those

projected as described in the Partnership’s registration statements filed with the

Securities and Exchange Commission. The Partnership undertakes no obligation to

publicly update any forward-looking statements, whether as a result of new information

or future events.

Legacy Reserves LP

Legacy Overview

Page 4

Legacy History

1981

•Dale Brown and Jack McGraw formed Brothers Production

Company

•McGraws bought out Dale Brown in Brothers Production

Company

•Petroleum Strategies and Moriah Properties, Ltd. are formed

by Dale and Cary Brown

•Significant growth through acquisition through

Brothers-Moriah joint venture

•Initiated process of forming MLP

•Completed private equity placement and acquired properties

from Brothers, Moriah, MBN and related entities

•Completed first IPO of the year

1990

1991

1999 - 2005

2005

2006

2007

Page 5

S. Wil VanLoh, Jr.

Managing Partner

Quantum Energy Partners

William D. Sullivan

Former EVP

Anadarko Petroleum

G. Larry Lawrence

Former Controller

Pure Resources

Kyle D. Vann

Former CEO

Entergy - Koch, LP

Legacy Management Team

Page 6

(1)Taken from reserve reports prepared by LaRoche Petroleum Consultants, Ltd. as of 12/31/06 for Legacy Reserves LP plus proved reserves from announced acquisitions from internal

reserve reports: Binger (4.1 MMBoe), TSF/Ameristate (1.4 MMBoe), and Slaughter/Rocker A (1.0 MMBoe).

(2)4th quarter 2006 plus the estimated current production from announced acquisitions: Binger (734 Boe/d), TSF/Ameristate (284 Boe/d), and Slaughter/Rocker A (215 Boe/d).

Asset Overview

•25.3 MMBoe of proved reserves (1)

•Reserves-to-production ratio of

over 14 years

•Diversified across over 1,900

wells

•70% operated

•Over 4,800 net Boe per day (2)

•70% oil

Page 7

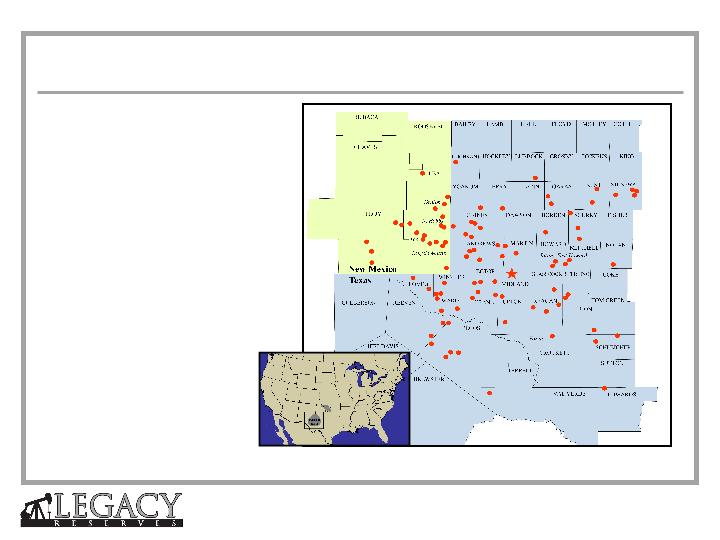

(1)Source: http://www.utpb.edu

Map Source: Midland Map Company.

Why the Permian Basin?

•Over 24 BBbls produced since

1921

•Represents 20% of lower 48 states

and 68% of Texas oil production (1)

•Multiple producing formations

•Established infrastructure and

ample take-away capacity

•Long-lived reserves

•Predictable, shallow decline rates

•Fragmented ownership

Page 8

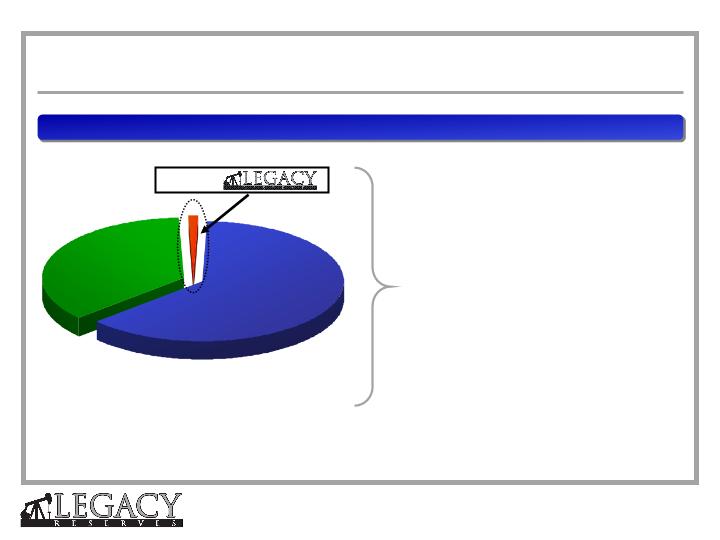

Top 5

Operators

1,700+

Operators

0.3%

(1) Ownership based on production. Permian Basin includes Texas Railroad Commission Districts 7C, 8, 8A and Lea and Eddy County, New Mexico.

Permian Basin data as of July 31, 2005; Legacy production data as of September 30, 2006.

63.6%

36.1%

Consolidation Opportunities in the Permian Basin

•Fragmented ownership provides

numerous acquisition opportunities

•Acquisition niche - large PDP

component

•Connected in Permian Basin deal

network

Page 9

Note: Per John S. Herold, Inc’s 2007 Global Upstream M&A Review (from publicly available data). Mid-Continent includes the Permian Basin, excludes corporate transactions.

Active Acquisition Market

Page 10

Aggregate cost of $146

million at an average cost

of $6.42 per Boe

Acquisition Track Record

Page 11

Binger Acquisition

•Closed the purchase on April 16, 2007 of properties from Nielson & Associates, Inc., for an aggregate

purchase price of approximately $44.5 million subject to further post-closing adjustments

•$29.5 million cash and 611,247 Legacy units issued to Nielson

•Acquired interests in the East Binger (Marchand) Unit in Caddo County, Oklahoma

•Estimated proved reserves of 4.1 MMBoe, 83% Proved Developed Producing

•Miscible nitrogen injection project

•Reserve life index of approximately 15.7 years

•Current net production of approximately 734 Boe per day

•Over 50 producing wells and 30 gas injection wells

•13,000 gross acres within the unit boundary

•Operated through joint venture company to be 50% owned by Legacy

•Agreement with Iron Creek (Nielson affiliate) to jointly pursue acquisitions in the N. Rockies

Page 12

TSF & Ameristate Acquisitions

•Signed definitive purchase agreements to acquire properties from two private companies for an

aggregate stated purchase price of $20.8 million in cash

•Closed Ameristate on May 1, TSF to close by end of May

•Located in Midland, Upton and Reagan counties of West Texas and Lea and Eddy counties of

southeast New Mexico

•Estimated proved reserves of 1.44 MMBoe

•Approximately 89% proved developed producing reserves

•Reserve life index of approximately 12 years

•Current net production of approximately 284 Boe per day

•19 operated and 30 non-operated producing wells

•Near existing Permian Basin properties

•Negotiated transaction

Page 13

Slaughter and Rocker A Field Acquisitions

•Signed definitive purchase agreement to acquire properties from two private companies for an

aggregate stated purchase price of $12.9 million in cash

•Located in Cochran and Garza counties of West Texas

•Estimated proved reserves of 1.0 MMBoe

•100% proved developed producing reserves

•Reserve life index of approximately 13 years

•Current net production of approximately 215 Boe per day (98% oil)

•83 producing wells, 90% operated

•Near existing Permian Basin properties

•Negotiated transaction

Legacy Reserves LP

Financial Summary

Page 15

GP Interest

<0.1%

New Unitholders

27%

144A

Unitholders

20%

Sellers of Assets to

Legacy

1%

Founding Investors,

Directors and Management

52%

IPO Offering Summary - Post IPO Ownership

Page 16

Legacy Balance Sheet

Page 17

Note: Adjusted EBITDA for the quarter ended 9-30-06 unfavorably impacted by $4.0 million swap termination payment for 2007-2008 oil swaps.

Summary Financial Information

Page 18

(1) Production volumes based on a reserve report prepared by LaRoche Petroleum Consultants, Ltd. as of 12/31/06 for Legacy Reserves LP and from an

internal report for the Binger acquisition. Waha-NYMEX basis swaps in place on all hedged gas volumes. Natural gas and oil prices shown are for NYMEX

futures, except for certain gas volumes hedged on ANR-Oklahoma which trades at a discount to NYMEX Henry Hub. Additional natural gas liquids swaps have

been placed for the Binger acquisition as previously announced.

Commodity Price Hedging Summary

Legacy Reserves LP

Upstream MLP / LLC Sector Overview

Page 20

•Harvest properties need the right home - all properties are eventually

harvest properties

•Lower cost of capital than a C-Corp as the yield is the cost of equity

•MLPs are not subject to entity level federal taxation

–Income and tax benefits flow through to the limited partners:

cost/statutory depletion, IDC’s L&WE depreciation

–40-90%+ tax shield among peer group, Legacy >90%

•Appetite for yield in the marketplace

•Mature assets may have been neglected by their C-Corp owners focused on

drilling

Why Should MLPs Own Mature Producing Assets?

Page 21

Drivers of New Upstream MLP / LLC Activity

Long-Lived,

Predictable

Reserve Base

Availability of

Longer-Term

Hedging

Exploitation

Strategy, Not

Exploration

Conservative

Balance Sheet /

Coverage Ratio

•Low decline rates / High R/P ratios

•High levels of PDP with predictable PUD opportunities

•Low development costs

•New upstream MLPs/LLCs focus on exploitation, rather than rely

on exploration to support cash flow.

•Factory-like development of a well-known reserve base is ideal.

•Development of the longer-term hedging market has provided

support to MLPs by facilitating visibility into production

economics and available cash for distribution.

•Analysts are emphasizing more robust coverage ratios of

distributions to distributable cash flow in new MLPs/LLCs, in

order to support the sustainability of cash flows.

Page 22

Significant Advantages of MLP without IDR

•Lower cost of capital than traditional MLP structure

–Unit distribution growth not burdened by IDRs to the GP

–Cost of equity equals market yield

•Simple and fair alignment of interests among all investors

–Investors share equally in all cash flows

–With significant ownership, management is strongly motivated to

increase distributions

•Facilitates accretive acquisitions

–Acquisitions are more accretive at a given price

–Ability to use units as acquisition currency

Page 23

Note: Market data as of 5/10/2007.

Large Cap Pipeline / Midstream MLPs Index: Market Cap > $1.4 B. Includes Buckeye, Boardwalk, Enbridge, Energy, Enterprise, Kinder Morgan, Magellan, Oneok, Plains, TEPPCO, Valero/NuStar.

Coal MLPs Index: Alliance, Natural Resource, Penn Virginia.

Small Cap Pipeline / Midstream MLPs Index: Market Cap < $1.4 B. Includes Atlas, Copano, Crosstex, DCP, Genesis, Global, Hiland, Holly, MarkWest, Martin, Pacific, Regency, Sunoco, TC, Transmontaigne, Williams.

Public MLP General Partner Index: General Partners of Alliance, Atlas, Buckeye, Crosstex, Energy Transfer, Enterprise, Inergy, Magellan, Valero/NuStar, Penn Virginia, Hiland.

Distribution Yield

Page 24

Legacy Summary

•Only MLP focused on the oil-weighted Permian Basin

•Experienced management team with significant equity ownership

•Tax advantaged yield

•Significant organic and external growth opportunities

•Long-lived, diversified multi-pay properties

•Demonstrated reserve replacement capability

•Long-term hedges in place

•Low level of debt

•MLP structure with no IDRs

Page 25

Adjusted EBITDA Reconciliation

This presentation, the financial tables and other supplemental information, including the

reconciliations of certain non-generally accepted accounting principles ("non-GAAP")

measures to their nearest comparable generally accepted accounting principles

("GAAP") measures, may be used periodically by management when discussing

Legacy's financial results with investors and analysts and they are also available on

Legacy's website under the Investor Relations tab. Adjusted EBITDA is defined in our

revolving credit facility as net income (loss) plus interest expense; depletion,

depreciation, amortization and accretion; impairment of long-lived assets; (gain) loss on

sale of partnership investment; (gain) loss on sale of assets; equity in (income) loss of

partnerships; non-cash compensation expense and unrealized (gain) loss on oil and

natural gas swaps. Adjuste d EBITDA is presented as management believes it provides

additional information and metrics relative to the performance of Legacy's business, such

as the cash distributions we expect to pay to our unitholders, as well as our ability to

meet our debt covenant compliance tests. Management believes that these financial

measures indicate to investors whether or not cash flow is being generated at a level that

can sustain or support an increase in our quarterly distribution rates. Adjusted EBITDA

may not be comparable to a similarly titled measure of other publicly traded limited

partnerships or limited liability companies because all companies may not calculate

Adjusted EBITDA in the same manner.

Page 26

Note: Adjusted EBITDA is a non-GAAP financial measure.

Adjusted EBITDA Reconciliation