HARBOR STRATEGIC GROWTH FUND

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE [ ], 2022

The undersigned, revoking all Proxies heretofore given, hereby appoints [ ], [ ], and [ ] or any of them as Proxies of the undersigned, with full power of substitution to each, to vote on behalf of the undersigned all shares of the above-mentioned fund, that the undersigned is entitled to vote at the meeting of shareholders, and at any adjournment(s) thereof, to be held at its offices at 111 South Wacker Drive, Chicago, Illinois 60606, at 11:00 a.m. Central Time (the “Meeting”), as fully as the undersigned would be entitled to vote if personally present.

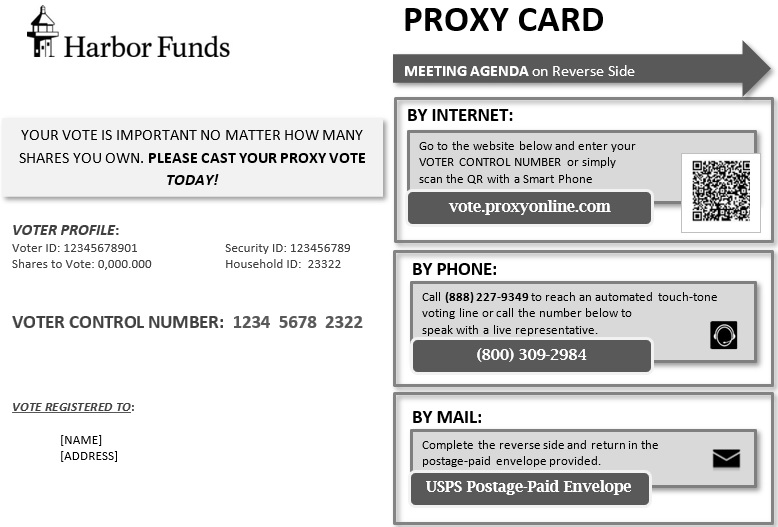

Do you have questions?

If you have any questions about how to vote your proxy or about the meeting in general, please call to (800) 209-2984 toll free. Representatives are available to assist you Monday through Friday, from 9 a.m. to 10 p.m., Eastern time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on June [ ], 2022. The proxy statement and the accompanying notice of Special Meeting of Shareholders for this meeting are available at: https://vote.proxyonline.com/harborfunds/docs/strategicgrowth.pdf

[Type text]

HARBOR STRATEGIC GROWTH FUND PROXY CARD

The votes entitled to be cast by the undersigned will be cast according to instructions given below with respect to the Proposal. If this Proxy Ballot is executed but no instructions is given, the undersigned acknowledges that the votes entitled to be cast by the undersigned will be cast by the proxies, or any of them, “FOR” the proposal. Additionally, the votes entitled to be cast by the undersigned will be cast at the discretion of the proxy holder on any other matter that may properly come before the Special Meeting.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES OF HARBOR FUNDS WHICH UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE PROPOSAL.

TO VOTE, MARK CIRCLE IN BLUE OR BLACK INK. Example: ●

| PROPOSAL: | FOR | AGAINST | ABSTAIN | |||||||||||

1. | To approve an Agreement and Plan of Reorganization providing for:(i) the acquisition by Manager Directed Portfolios, a Delaware statutory trust (the “MDP Trust”), on behalf of its series Mar Vista Strategic Growth Fund (the “Acquiring Fund”), of all of the property, goodwill and other assets of the Harbor Strategic Growth Fund (the "Existing Fund"), in exchange solely for shares of beneficial interest of the Acquiring Fund; (ii) the assumption by the MDP Trust, on behalf of the Acquiring Fund, of the existing liabilities of the Existing Fund reflected on the Existing Fund’s statement of assets and liabilities; (iii) the distribution of the shares of the Acquiring Fund to the shareholders of the Existing Fund according to their respective interests in complete liquidation of the Existing Fund; and (iv) the termination of the Existing Fund as a series of Harbor Funds as soon as practicable after the distribution. | O | O | O | ||||||||||

| 2. | To transact any other business which may properly come before the Meeting or any adjournment(s) thereof. | |||||||||||||

THANK YOU FOR CASTING YOUR VOTE

[VOTER ID] [BAR CODE] [CUSIP]