Marmont Redwood

International Equity Fund

Semi-Annual Report

April 30, 2018

Table of Contents

| Sector Allocation | 3 |

| Schedule of Investments | 4 |

| Statement of Assets and Liabilities | 7 |

| Statement of Operations | 8 |

| Statement of Changes in Net Assets | 9 |

| Financial Highlights | 10 |

| Notes to the Financial Statements | 11 |

| Expense Example | 19 |

| Notice to Shareholders | 21 |

| Approval of the Investment Advisory Agreement | |

| and Sub-Advisory Agreement | 22 |

| Notice of Privacy Policy & Practices | 27 |

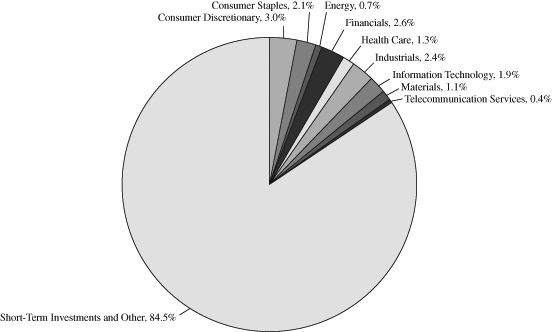

| SECTOR ALLOCATION OF PORTFOLIO ASSETS |

| at April 30, 2018 (Unaudited) |

| COUNTRY ALLOCATION OF PORTFOLIO ASSETS |

| at April 30, 2018 (Unaudited) |

| Japan | 4.0% |

| France | 1.9% |

| Switzerland | 1.3% |

| Canada | 1.1% |

| Hong Kong | 1.0% |

| Sweden | 1.0% |

| Netherlands | 1.0% |

| United Kingdom | 0.8% |

| Italy | 0.6% |

| Singapore | 0.5% |

| Germany | 0.4% |

| Australia | 0.4% |

| Spain | 0.4% |

| Guernsey | 0.3% |

| Belgium | 0.3% |

| Cayman Islands | 0.3% |

| New Zealand | 0.2% |

| Short-Term Investments and Other | 84.5% |

The Fund experienced a large subscription near the end of the reporting period which explains the large short-term investment percentage.

Percentages represent market value as a percentage of net assets.

| SCHEDULE OF INVESTMENTS |

| at April 30, 2018 (Unaudited) |

| | | Number of | | | | |

| COMMON STOCKS – 15.5% | | Shares | | | Value | |

| Consumer Discretionary – 3.0% | | | | | | |

| Aristocrat Leisure Ltd. (c) | | | 125 | | | $ | 2,508 | |

| Dollarama, Inc. (c) | | | 22 | | | | 2,532 | |

| Fast Retailing Co. Ltd. (c) | | | 5 | | | | 2,195 | |

| Fiat Chrysler Automobiles NV (a)(c) | | | 95 | | | | 2,111 | |

| LVMH Moet Hennessy Louis Vuitton SE (c) | | | 10 | | | | 3,480 | |

| Moncler SpA (c) | | | 48 | | | | 2,164 | |

| Suzuki Motor Corp. (c) | | | 48 | | | | 2,580 | |

| Wynn Macau Ltd. (c) | | | 554 | | | | 2,047 | |

| | | | | | | | 19,617 | |

| Consumer Staples – 2.1% | | | | | | | | |

| A2 Milk Co. Ltd. (a)(c) | | | 165 | | | | 1,391 | |

| Coca-Cola HBC AG (c) | | | 87 | | | | 2,915 | |

| Pigeon Corp. (c) | | | 51 | | | | 2,391 | |

| Remy Cointreau SA (c) | | | 15 | | | | 2,067 | |

| Shiseido Co. Ltd. (c) | | | 31 | | | | 2,011 | |

| Unicharm Corp. (c) | | | 100 | | | | 2,811 | |

| | | | | | | | 13,586 | |

| Energy – 0.7% | | | | | | | | |

| Encana Corp. (c) | | | 155 | | | | 1,930 | |

| Lundin Petroleum AB (c) | | | 85 | | | | 2,343 | |

| | | | | | | | 4,273 | |

| Financials – 2.6% | | | | | | | | |

| AIA Group Ltd. (c) | | | 400 | | | | 3,575 | |

| Burford Capital Ltd. (c) | | | 113 | | | | 2,231 | |

| DBS Group Holdings Ltd. (c) | | | 148 | | | | 3,415 | |

| Hong Kong Exchanges & Clearing Ltd. (c) | | | 100 | | | | 3,239 | |

| Partners Group Holding AG (c) | | | 4 | | | | 2,917 | |

| UniCredit SpA (c) | | | 86 | | | | 1,866 | |

| | | | | | | | 17,243 | |

| Health Care – 1.3% | | | | | | | | |

| Indivior PLC (a)(c) | | | 367 | | | | 2,273 | |

| Ipsen SA (c) | | | 23 | | | | 3,723 | |

| Vifor Pharma AG (c) | | | 16 | | | | 2,525 | |

| | | | | | | | 8,521 | |

The accompanying notes are an integral part of these financial statements.

| SCHEDULE OF INVESTMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

| | | Number of | | | | |

| COMMON STOCKS – 15.5% (Continued) | | Shares | | | Value | |

| Industrials – 2.4% | | | | | | |

| Ashtead Group PLC (c) | | | 112 | | | $ | 3,110 | |

| HOCHTIEF AG (c) | | | 12 | | | | 2,190 | |

| International Consolidated Airlines Group SA (c) | | | 265 | | | | 2,291 | |

| Komatsu Ltd. (c) | | | 100 | | | | 3,409 | |

| Recruit Holdings Co. Ltd. (c) | | | 130 | | | | 2,997 | |

| Volvo AB (c) | | | 119 | | | | 2,016 | |

| | | | | | | | 16,013 | |

| Information Technology – 1.9% | | | | | | | | |

| Hexagon AB (c) | | | 39 | | | | 2,252 | |

| Keyence Corp. (c) | | | 4 | | | | 2,439 | |

| Nintendo Co. Ltd. (c) | | | 7 | | | | 2,941 | |

| STMicroelectronics NV (c) | | | 55 | | | | 1,201 | |

| Ubisoft Entertainment SA (a)(c) | | | 30 | | | | 2,867 | |

| Wirecard AG (c) | | | 3 | | | | 410 | |

| | | | | | | | 12,110 | |

| Materials – 1.1% | | | | | | | | |

| Koninklijke DSM NV (c) | | | 31 | | | | 3,204 | |

| Shin-Etsu Chemical Co. Ltd. (c) | | | 21 | | | | 2,107 | |

| Umicore SA (c) | | | 38 | | | | 2,114 | |

| | | | | | | | 7,425 | |

| Telecommunication Services – 0.4% | | | | | | | | |

| Rogers Communications, Inc. (c) | | | 57 | | | | 2,691 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $100,027) | | | | | | | 101,479 | |

The accompanying notes are an integral part of these financial statements.

| SCHEDULE OF INVESTMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

| | | Number of | | | | |

| SHORT-TERM INVESTMENTS – 84.4% | | Shares | | | Value | |

| MONEY MARKET FUNDS – 84.4% | | | | | | |

| First American Government Obligations Fund – | | | | | | |

| Class X, 1.58% (b) | | | 552,578 | | | $ | 552,578 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $552,578) | | | | | | | 552,578 | |

| TOTAL INVESTMENTS | | | | | | | | |

| (Cost $652,605) – 99.9% | | | | | | | 654,057 | |

| Other Assets in Excess of Liabilities – 0.1% | | | | | | | 663 | |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 654,720 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | The rate shown represents the fund’s 7-day yield as of April 30, 2018. The Fund experienced a large subscription near the end of the reporting period which explains the large short-term investment. |

| (c) | U.S. traded security of a foreign issuer or corporation. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF ASSETS AND LIABILITIES |

| at April 30, 2018 (Unaudited) |

| Assets: | | | |

| Investments, at value (cost of $652,605) | | $ | 654,057 | |

| Receivables: | | | | |

| Securities sold | | | 1,140 | |

| Dividends and interest | | | 211 | |

| Due from Advisor | | | 23,521 | |

| Prepaid expenses | | | 18,462 | |

| Total assets | | | 697,391 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Securities purchased | | | 2,272 | |

| Administration and accounting fees | | | 17,589 | |

| Reports to shareholders | | | 1,849 | |

| Custody fees | | | 4,391 | |

| Trustee fees | | | 1,952 | |

| Transfer agent fees and expenses | | | 7,561 | |

| Other accrued expenses | | | 7,057 | |

| Total liabilities | | | 42,671 | |

| | | | | |

| Net assets | | $ | 654,720 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 654,915 | |

| Accumulated net investment income | | | 82 | |

| Accumulated net realized loss on investments | | | (1,725 | ) |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 1,452 | |

| Foreign currency related transactions | | | (4 | ) |

| Net assets | | $ | 654,720 | |

| | | | | |

| Institutional Shares: | | �� | | |

| Net assets applicable to outstanding Institutional Shares | | $ | 654,720 | |

| Shares issued (Unlimited number of beneficial | | | | |

| interest authorized, $0.01 par value) | | | 65,456 | |

| Net asset value, offering price and redemption price per share | | $ | 10.00 | |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF OPERATIONS |

| For the Period Ended April 30, 2018* (Unaudited) |

| Investment income: | | | |

| Dividends (net of foreign taxes withheld of $55) | | $ | 285 | |

| Interest | | | 61 | |

| Total investment income | | | 346 | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees (Note 4) | | | 264 | |

| Administration fees (Note 4) | | | 17,589 | |

| Transfer agent fees and expenses | | | 7,561 | |

| Federal and state registration fees | | | 7,079 | |

| Audit fees | | | 2,774 | |

| Compliance expense | | | 3,333 | |

| Legal fees | | | 2,466 | |

| Reports to shareholders | | | 1,849 | |

| Trustees’ fees and expenses | | | 1,952 | |

| Custody fees | | | 4,391 | |

| Other | | | 1,851 | |

| Total expenses before reimbursement from advisor | | | 51,109 | |

| Expense reimbursement from advisor (Note 4) | | | (50,845 | ) |

| Net expenses | | | 264 | |

| Net investment income | | | 82 | |

| | | | | |

| Realized and unrealized gain (loss) on investments: | | | | |

| Net realized loss on transactions from: | | | | |

| Investments | | | (1,213 | ) |

| Foreign currency related transactions | | | (512 | ) |

| Net change in unrealized gain (loss) on: | | | | |

| Investments | | | 1,452 | |

| Foreign currency related transactions | | | (4 | ) |

| Net realized and unrealized gain (loss) on investments | | | (277 | ) |

| Net decrease in net assets resulting from operations | | $ | (195 | ) |

| * | The Marmont Redwood International Equity Fund commenced operations on February 14, 2018. |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF CHANGES IN NET ASSETS |

| |

| | | Period Ended | |

| | | April 30, 2018* | |

| | | (Unaudited) | |

| Operations: | | | |

| Net investment income | | $ | 82 | |

| Net realized loss on investments | | | (1,725 | ) |

| Net change in unrealized appreciation on investments | | | 1,448 | |

| Net decrease in net assets resulting from operations | | | (195 | ) |

| | | | | |

| Capital Share Transactions: | | | | |

| Proceeds from shares sold | | | | |

| Institutional shares | | | 654,915 | |

| Net increase in net assets from capital share transactions | | | 654,915 | |

| | | | | |

| Total increase in net assets | | | 654,720 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | — | |

| End of period | | $ | 654,720 | |

| | | | | |

| Accumulated net investment income | | $ | 82 | |

| | | | | |

| Changes in Shares Outstanding: | | | | |

| Shares sold | | | | |

| Institutional shares | | | 65,456 | |

| Net increase in shares outstanding | | | 65,456 | |

| * | The Marmont Redwood International Equity Fund commenced operations on February 14, 2018. |

The accompanying notes are an integral part of these financial statements.

For a capital share outstanding throughout the period

Institutional Shares

| | | February 14, 2018 | |

| | | through | |

| | | April 30, 2018* | |

| | | (Unaudited) | |

| Net Asset Value – Beginning of Period | | $ | 10.00 | |

| | | | | |

| Income from Investment Operations: | | | | |

Net investment income1 | | | 0.01 | |

| Net realized and unrealized gain on investments | | | (0.01 | ) |

| Total from investment operations | | | — | |

| | | | | |

| Net Asset Value – End of Period | | $ | 10.00 | |

| | | | | |

| Total Return | | 0.00 | %^ |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of period (thousands) | | $ | 655 | |

| Ratio of operating expenses to average net assets: | | | | |

| Before Reimbursements | | | 193.49 | %+ |

| After Reimbursements | | | 1.00 | %+ |

| Ratio of net investment income/(loss) to average net assets: | | | | |

| Before Reimbursements | | | (192.18 | )%+ |

| After Reimbursements | | | 0.31 | %+ |

| Portfolio turnover rate | | 64 | %^ |

| * | Commencement of operations for Institutional Shares was February 14, 2018. |

+ | Annualized |

| ^ | Not Annualized |

1 | The net investment income per share was calculated using the average shares outstanding method. |

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

| at April 30, 2018 (Unaudited) |

NOTE 1 – ORGANIZATION

The Marmont Redwood International Equity Fund (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment management company and was organized as a Delaware statutory trust on April 4, 2006. The Fund is a diversified series of the Trust. The Fund commenced operations on February 14, 2018 and only offers Institutional Shares. Marmont Partners LLC (the “Advisor”) serves as the investment advisor to the Fund. Redwood Investments, LLC (the “Sub-Advisor”) serves as the sub-advisor to the Fund. As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The investment objective of the Fund is to seek long term capital appreciation.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”).

| | A. | Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| | | |

| | B. | Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required. |

| | | |

| | | The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions to be taken or expected to be taken on a tax return. The tax returns for the Fund for the prior three fiscal years are open for examination. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware. |

| | | |

| | C. | Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized using the effective interest method. |

| | | |

| | | The Fund distributes substantially all of its net investment income, if any, and net realized capital gains, if any, annually. Distributions from net realized gains for |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

| | | book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment. |

| | | |

| | | The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are typically allocated among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s respective net assets, or by other equitable means. |

| | | |

| | D. | Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates. |

| | | |

| | E. | Redemption Fees: The Fund does not charge redemption fees to shareholders. |

| | | |

| | F. | Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. |

| | | |

| | G. | Foreign Currency: Values of investments denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, government regulations, differences in accounting standards, and other factors. |

| | | |

| | H. | Events Subsequent to the Fiscal Period End: In preparing the financial statements as of April 30, 2018, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements and had concluded that no additional disclosures are necessary. |

| | | |

| | I. | Recent Accounting Pronouncements: In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount; which continues to be amortized to maturity. The ASU is effective for fiscal years and interim periods |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

| | within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying this provision. |

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period, and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement. |

| | | |

| | Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data). |

| | | |

| | Level 3 – | Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities: Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds and real estate investment trusts (REITs), that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and asked prices. Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities which are not traded in the NASDAQ Global Market System shall be valued at the mean between the bid and asked prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy.

The fair valuation of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

indices of domestic securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. The effect of using fair value pricing is that the Fund’s NAV will reflect the affected portfolio securities’ values as determined by the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from the foreign security’s most recent closing price and from the prices used by other investment companies to calculate their NAVs and are generally classified in Level 2 of the fair valuation hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when you will not be able to purchase or redeem your shares.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Short-Term Debt Securities: Short-term debt instruments having a maturity of less than 60 days are valued at the evaluated mean price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. In the absence of prices from a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term debt securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities.

The Board has delegated day-to-day valuation issues to a Valuation Committee of the Trust which, as of April 30, 2018, was comprised of officers of the Trust as well as an interested trustee of the Trust. The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available, or the closing price does not represent fair value, by following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. All actions taken by the Valuation Committee are subsequently reviewed and ratified by the Board.

Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its net asset value (“NAV”) because most foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a security needs to be fair valued because it appears that the value of the security might have been materially affected by events occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV, such as by a development that affects an entire market or region (e.g., weather-related events) or a potentially global development (e.g., a terrorist attack that may be expected to have an effect on investor expectations worldwide).

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either level 2 or level 3 of the fair value hierarchy.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the fair valuation hierarchy of the Fund’s securities as of April 30, 2018:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 2,532 | | | $ | 17,085 | | | $ | — | | | $ | 19,617 | |

| Consumer Staples | | | — | | | | 13,586 | | | | — | | | | 13,586 | |

| Energy | | | 1,930 | | | | 2,343 | | | | — | | | | 4,273 | |

| Financials | | | 1,866 | | | | 15,377 | | | | — | | | | 17,243 | |

| Health Care | | | — | | | | 8,521 | | | | — | | | | 8,521 | |

| Industrials | | | — | | | | 16,013 | | | | — | | | | 16,013 | |

| Information Technology | | | 410 | | | | 11,700 | | | | — | | | | 12,110 | |

| Materials | | | — | | | | 7,425 | | | | — | | | | 7,425 | |

| Telecommunication Services | | | 2,691 | | | | — | | | | — | | | | 2,691 | |

| Short-Term Investments | | | 552,578 | | | | — | | | | — | | | | 552,578 | |

| Total Investments in Securities | | $ | 562,007 | | | $ | 92,050 | | | $ | — | | | $ | 654,057 | |

Refer to the Fund’s schedule of investments for a detailed break-out of securities by industry classification. Transfers among levels are recognized at the end of the reporting period. During the period February 14, 2018 through April 30, 2018, the Fund recognized no transfers among levels. There were no level 3 securities held in the Fund during the period February 14, 2018 through April 30, 2018.

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For the period February 14, 2018 through April 30, 2018, the Advisor provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities, and provides most of the personnel needed by the Fund. For the period February 14, 2018 through April 30, 2018, the Fund incurred $264 in advisory fees. The Advisor has hired Redwood Investments, LLC as a sub-advisor to the Fund. The Advisor pays the Sub-Advisor fee for the Fund from its own assets and these fees are not an additional expense of the Fund.

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive its management fees and/or absorb expenses of the Fund to ensure that the total annual operating expenses [excluding Acquired Fund Fees and Expenses, taxes, brokerage commissions, interest and extraordinary expenses (collectively, “Excludable Expenses”)] do not exceed the following amount of the average daily net assets for the Institutional Shares:

| | Marmont Redwood International Equity Fund | |

| | Institutional Shares | 1.00% | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

For the period February 14, 2018 through April 30, 2018, the Advisor reduced its fees and absorbed Fund expenses in the amount of $50,845 for the Fund. The waivers and reimbursements will remain in effect through February 14, 2021 unless terminated sooner by, or with the consent of, the Board.

U.S. Bancorp Fund Services, LLC (the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. U.S. Bancorp Fund Services, LLC also serves as the fund accountant and transfer agent to the Fund. Vigilant Compliance, LLC serves as the Chief Compliance Officer to the Fund. U.S. Bank N.A., an affiliate of U.S. Bancorp Fund Services, serves as the Fund’s custodian. For the period February 14, 2018 through April 30, 2018, the Fund incurred the following expenses for administration, fund accounting, transfer agency, custody and Chief Compliance Officer fees:

| | Administration & fund accounting | $17,589 | |

| | Custody | $ 4,391 | |

| | Transfer agency(a) | $ 5,034 | |

| | Chief Compliance Officer | $ 3,333 | |

| | | | |

| | (a) Does not include out-of-pocket expenses. | | |

At April 30, 2018, the Fund had payables due to U.S. Bancorp Fund Services, LLC for administration, fund accounting, transfer agency and Chief Compliance Officer fees and to U.S. Bank N.A. for custody fees in the following amounts:

| | Administration & fund accounting | $17,589 | |

| | Custody | $ 4,391 | |

| | Transfer agency(a) | $ 5,034 | |

| | Chief Compliance Officer | $ 0 | |

| | | | |

| | (a) Does not include out-of-pocket expenses. | | |

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the Administrator.

Certain officers of the Fund are employees of the Administrator. A Trustee of the Trust is affiliated with USBFS and U.S. Bank N.A. This same Trustee is an interested person of the Distributor.

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

NOTE 5 – SECURITIES TRANSACTIONS

For the period February 14, 2018 through April 30, 2018, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were as follows:

| | | Purchases | Sales |

| | International Equity Fund | $149,810 | $48,157 |

There were no purchases or sales of long-term U.S. Government securities.

NOTE 6 – PRINCIPAL RISKS

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, market price, yield, and total return. Further information about investment risks is available in the Fund’s prospectus and Statement of Additional Information.

Equity Market Risk: Equity securities are susceptible to general stock market fluctuations due to economic, market, political and issuer-specific considerations and to potential volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Foreign Securities and Currency Risk: Foreign securities are subject to risks relating to political, social and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Those risks are increased for investments in emerging markets. Securities that are denominated in foreign currencies are subject to further risk that the value of the foreign currency will fall in relation to the U.S. dollar and/or will be affected by volatile currency markets or actions of U.S. and foreign governments or central banks. Income earned on foreign securities may be subject to foreign withholding taxes.

Management Risk: The ability of the Fund to meet its investment objective is directly related to the Advisor’s and Sub-Advisor’s management of the Fund. The value of your investment in the Fund may vary with the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. If the investment strategies do not produce the expected results, the value of your investment could be diminished or even lost entirely.

New Fund Risk: There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may determine to liquidate the Fund. Liquidation of the Fund can be initiated without shareholder approval by the Board if it determines that liquidation is in the best interest of shareholders. As a result, the timing of the Fund’s liquidation may not be favorable.

Emerging and Frontier Markets Risk: Countries in emerging markets are generally more volatile and can have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries, and securities markets that trade a small number of issues. Frontier market countries generally have smaller economies and even less developed capital markets than emerging markets. As a

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at April 30, 2018 (Unaudited) |

result, the risks of investing in emerging markets are magnified in frontier markets, and include potential for extreme price volatility and illiquidity; government ownership or control of parts of private sector and of certain companies; trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures; and relatively new and unsettled securities laws.

Large Capitalization Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Larger companies also may not be able to attain the high growth rates of successful smaller companies.

Medium and Small Capitalization Risk: Investing in medium and small capitalization companies may involve special risks because those companies may have narrower product lines, more limited financial resources, fewer experienced managers, dependence on a few key employees, and a more limited trading market for their stocks, as compared with larger companies. Securities of medium and smaller capitalization issuers may be subject to greater price volatility and may decline more significantly in market downturns than securities of larger companies.

NOTE 7 – GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

NOTE 8 – SIGNIFICANT OWNERSHIP CONCENTRATION

At April 30, 2018, the International Equity Fund invested 84.4% of its total net assets in the First American Government Obligations Fund – Class X. The First American Government Obligations Fund – Class X seeks to provide maximum current income and daily liquidity by purchasing U.S. government securities and repurchase agreements collateralized by such obligations.

| EXPENSE EXAMPLE |

| April 30, 2018 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) and redemption fees, if applicable; and (2) ongoing costs, including management fees; distribution and/or service (12b-1 fees), if applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from November 1, 2017 to April 30, 2018 for the Institutional Shares.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is charged to the account annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| EXPENSE EXAMPLE (Continued) |

| April 30, 2018 (Unaudited) |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 2/14/2018(1) | 4/30/2018 | 2/14/2018 – 4/30/2018 |

| Actual | | | |

| Institutional Shares | $1,000.00 | $1,000.00 | $2.05(2) |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | | | |

| Institutional Shares | $1,000.00 | $1,019.84 | $5.01(3) |

(1) | Inception date of the Fund. |

(2) | Expenses are equal to the Institutional Shares’ annualized expense ratio of 1.00% multiplied by the average account value over the period, multiplied by 75/365 (to reflect the period). |

(3) | Expenses are equal to the Institutional Shares’ annualized expense ratio of 1.00% multiplied by the average account value over the period, multiplied by 181/365 to reflect the period. |

| NOTICE TO SHAREHOLDERS |

| at April 30, 2018 (Unaudited) |

How to Obtain a Copy of the Fund’s Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-833-MAR-MONT or on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain a Copy of the Fund’s Proxy Voting Records for the most recent 12-Month Period Ended June 30

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available no later than August 31 without charge, upon request, by 1-833-MAR-MONT. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

Quarterly Filings on Form N-Q

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090. Information included in the Fund’s Form N-Q is also available, upon request, by calling 1-833-MAR-MONT.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses and annual and semi-annual reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-833-MAR-MONT to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT |

The Board of Trustees (the “Board” or “Trustees”) of Manager Directed Portfolios (the “Trust”) met on November 20, 2017 to consider the initial approval of the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust, on behalf of the Marmont Redwood International Equity Fund and the Marmont Redwood Emerging Markets Fund (each, a “Fund,” and together, the “Funds”), each a series of the Trust, and the Funds’ investment advisor, Marmont Partners, LLC (“Marmont”), and the Sub-Advisory Agreement (the “Sub-Advisory Agreement”) between Marmont and the Funds’ sub-advisor, Redwood Investments, LLC (“Redwood”). Prior to the meeting on November 20, 2017, the Board requested and received materials to assist them in considering the approval of the Advisory Agreement and the Sub-Advisory Agreement. The materials provided contained information with respect to the factors enumerated below, including copies of the Advisory Agreement and Sub-Advisory Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing in detail the Board’s fiduciary obligations and the factors the Board should consider in considering the approval of the Advisory Agreement and the Sub-Advisory Agreement, detailed comparative information relating to the performance of the Funds, as well as the management fee and other expenses of the Funds, due diligence materials relating to Marmont and Redwood, including the current Form ADV for Marmont and Redwood, and other pertinent information. Based on their evaluation of the information provided by Marmont and Redwood, the Trustees (including a majority of the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”)), approved the Advisory Agreement and Sub-Advisory Agreement, each for an initial two-year term. Below is a summary of the factors considered by the Board and the conclusions that formed the basis for the Board’s approval of the Advisory Agreement and Sub-Advisory Agreement.

| 1. | NATURE, EXTENT AND QUALITY OF SERVICES TO BE PROVIDED TO THE FUNDS |

The Trustees considered the nature, extent and quality of services that would be provided by Marmont and Redwood to the Funds and the amount of time to be devoted by Marmont’s and Redwood’s staff to the Funds’ operations. The Trustees considered the specific responsibilities of Marmont and Redwood in all aspects of day-to-day management of the Funds, as well as the qualifications, experience and responsibilities of key personnel at Marmont and Redwood who would be involved in the day-to-day activities of the Funds, including Mr. Gui Costin, the President of Marmont, and Mr. Daniel DiDomenico, who would serve as Marmont’s Chief Compliance Officer, and Michael Mufson, Ezra Samet, Gregory Jones and Pragna Shere, who would serve as the portfolio managers of the Funds. The Trustees noted Marmont was a start-up firm, and had no performance track record or other accounts under management but that the principals of Marmont have extensive experience in the mutual fund industry and have access to the resources of Dakota Funds Group, a related company. The Board also considered compliance support services to be provided by an industry consultant.

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Continued) |

The Trustees considered the performance of a composite of accounts managed by Redwood with investment objective and strategies substantially similar to that which would be applied to the International Equity Fund. The Trustees further noted Redwood did not manage other accounts with investment strategies similar to that which would be applied to the Emerging Markets Fund, but noted that members of the portfolio management team had previous experience managing investments similar to those that would be held by the Emerging Markets Fund. The Trustees reviewed the information provided by Marmont and Redwood in response to the due diligence questionnaire and other information provided by Marmont and Redwood, all of which was included in the Meeting materials. The Trustees also noted any services that extended beyond portfolio management, and considered the overall capability of Marmont and Redwood to manage the Fund’s assets. The Trustees reviewed each firms’ Form ADV, noting Marmont would be required to provide confirmation of the firm’s registration with the SEC, along with a copy of its final Form ADV, prior to the execution of the Marmont Advisory Agreement. The Trustees, in consultation with counsel to the Independent Trustees and the Trust’s CCO, reviewed the compliance program maintained by Redwood, including the firm’s code of ethics, and received an affirmation from the Trust’s CCO that the compliance program was compliant with Rule 206(4)-7(a) promulgated under the Advisors Act. The Trustees noted as a start-up firm Marmont had not completed drafting of its advisor compliance program, and that Marmont would be required to present its compliance program and code of ethics to the Board for approval prior to executing the Marmont Advisory Agreement. The Trustees concluded that Marmont and Redwood had, or were expected to have in the case of Marmont’s compliance program, sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures necessary to performing their duties under the Marmont Advisory Agreement and the Sub-Advisory Agreement, respectively, and that the nature, overall quality and extent of the management services to be provided by Marmont and Redwood to the Funds were satisfactory.

| 2. | INVESTMENT PERFORMANCE OF THE ADVISOR AND THE SUB-ADVISOR |

In assessing the management services to be provided by Marmont and Redwood, the Trustees reviewed the investment management experience of Mr. Costin and Mr. DiDomenico, who would determine guidelines for the Funds’ investment portfolios and provide general oversight of Redwood, and the portfolio management experience of Messrs. Mufson, Jones and Samet, and Ms. Shere, who would serve as the portfolio managers of the Funds. As part of their review, the Trustees noted Marmont was a start-up firm, and had no performance or operating history. With regard to Redwood, the Trustees reviewed the performance of the Redwood’s International Developed Markets strategy, a composite of other accounts managed by Redwood with strategies similar to the investment strategy of the International Equity Fund. The Trustees noted the Redwood International Developed Markets composite had outperformed the MSCI World Ex-US Index for the year-to-date period ended September 30, 2017, and the since inception period ended December 31, 2016, but had trailed the index for the one-year period ended

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Continued) |

December 31, 2016. The Trustees noted Redwood did not currently manage other accounts with investment strategies substantially similar to the Emerging Markets Fund.

The Trustees concluded the performance obtained by Redwood for accounts managed using strategies similar to the International Fund was satisfactory. Although past performance is not a guarantee or indication of future results, the Trustees determined that the Funds and their shareholders were likely to benefit from Marmont’s advisory services and Redwood’s portfolio management services.

| 3. | COSTS OF SERVICES PROVIDED AND PROFITS TO BE REALIZED BY THE ADVISOR AND SUB-ADVISOR |

The Trustees considered the cost of services and the proposed management fees to be paid to Marmont by the Funds, including a review of the expense analyses and other pertinent material with respect to the Funds. The Trustees considered the cost structure of the International Equity Fund relative to a peer group of U.S. foreign large growth funds with assets in the $10-$150 million range, and of the Emerging Markets Fund relative to a peer group of U.S. diversified emerging markets funds in the $10 to $50 million range, each as compiled by Morningstar (each, a “Morningstar Peer Group”). In reviewing the Funds’ proposed advisory fees and total expense structures, the Trustees took into account the Funds’ sub-advised structure, noting Marmont would pay Redwood’s sub-advisory fees for each Fund out of its own management fees, and that the Funds would not be directly responsible for payment of any sub-advisory fees.

The Trustees considered Marmont’s financial condition. The Trustees also examined the level of profits anticipated from the fees payable under the Marmont Advisory Agreement, noting Marmont only expected the Funds to be minimally profitable to Marmont in their first year of operation. These considerations were based on materials requested by the Trustees and the Trust’s administrator specifically for the Meeting, as well as the presentations made by the Marmont during the Meeting.

The Trustees considered data relating to the cost structure of each of the Funds relative to its Morningstar Peer Group, which had been included in the Meeting materials. The Board considered the International Equity Fund’s proposed management fee of 1.00% of the average annual net assets of the Fund, noting the fee fell at the top of the third quartile for the Morningstar Peer Group, above the Morningstar Peer Group average fee of 0.85%, which fell at the top of the second quartile. The Board also noted that Marmont proposed to contractually waive its management fees and/or reimburse the International Equity Fund’s expenses to ensure that the Fund’s total annual operating expenses do not exceed 1.00% of the average annual net assets of the Fund for at least the first three years of the International Equity Fund’s operation. The Trustees noted the International Equity Fund’s net expense ratio of 1.00%, exclusive of Rule 12b-1 fees for the Retail Shares, fell within the second quartile, below the Morningstar Peer Group average of 1.14%, which fell within the third quartile. The Board considered the Emerging Markets Fund’s proposed management fee of 1.00% of the average annual net assets of the Fund, noting the fee fell at the top of the

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Continued) |

second quartile for the Morningstar Peer Group, and was equal to the Morningstar Peer Group average fee. The Board also noted that Marmont proposed to contractually waive its management fees and/or reimburse the International Equity Fund’s expenses to ensure that the Fund’s total annual operating expenses do not exceed 1.25% of the average annual net assets of the Fund for at least the first three years of the International Equity Fund’s operation. The Trustees noted the International Equity Fund’s net expense ratio of 1.25%, exclusive of Rule 12b-1 fees for the Retail Shares, fell within the second quartile, below the Morningstar Peer Group average of 1.34%, which fell within the third quartile. The Trustees noted that the Funds were Marmont’s only clients, and therefore there were no relevant comparisons to fees paid by other comparable accounts.

The Trustees concluded the Funds’ expenses and the management fees to be paid to Marmont under the Marmont Advisory Agreement were fair and reasonable in light of the comparative expense and management fee information. The Trustees further concluded, based on the pro forma profitability analysis prepared by Marmont, that while Marmont did not expect to realize significant profits in connection with its management of the Funds during its initial year of operation, Marmont had sufficient financial resources to support its services to the Funds, despite anticipated subsidies necessary to support certain of the Funds’ operations.

The Trustees reviewed and considered the sub-advisory fees to be payable by Marmont to Redwood under the Marmont Sub-Advisory Agreement. The Trustees noted Marmont had confirmed to the Trustees that the sub-advisory fees payable under the Marmont Sub-Advisory Agreement were reasonable in light of the quality of the services to be performed by Redwood. Since the sub-advisory fees are paid by Marmont, the overall advisory fee paid by the Funds would not be directly affected by the sub-advisory fees paid to Redwood. Consequently, the Trustees did not consider the costs of services provided by Redwood or the profitability of Redwood’s relationship with the Funds to be material factors for consideration given that Redwood is not affiliated with Marmont and, therefore, the sub-advisory fees were negotiated on an arm’s-length basis. Based on all these factors, the Trustees concluded that the sub-advisory fees to be paid to Redwood by Marmont were reasonable in light of the services to be provided by Redwood.

| 4. | EXTENT OF ECONOMIES OF SCALE AS THE FUND GROWS |

The Trustees compared the Funds’ proposed expenses relative to each respective Morningstar Peer Group and discussed potential economies of scale. The Trustees also reviewed the structure of the Funds’ management fees and whether economies of scale would be expected to be realized as Funds assets grow (and if so, how those economies of scale would be shared with shareholders). The Trustees noted that the Funds’ management fee structures did not contain any breakpoint reductions as the Funds’ assets grow in size, and that the possibility of incorporating breakpoints could be reviewed in the future should assets grow significantly. The Trustees concluded that the proposed fee structure was reasonable.

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Continued) |

Since the sub-advisory fees payable to Redwood would not paid by the Funds, the Trustees did not consider whether the sub-advisory fees should reflect any potential economies of scale that might be realized as the Funds’ assets increase.

| 5. | BENEFITS TO BE DERIVED FROM THE RELATIONSHIP WITH THE FUND |

The Trustees considered the direct and indirect benefits that could be received by Marmont and Redwood from each firm’s association with the Funds. Based on the information presented, the Trustees did not consider any ancillary benefits to Marmont from serving as advisor to the Funds to be relevant factors. The Board noted that Redwood expected to benefit from soft dollars as the Fund grows but believed such benefits to Redwood as sub-advisor to the Funds were appropriate.

CONCLUSIONS

The Trustees considered all of the foregoing factors. In considering the approval of the Advisory Agreement and the Sub-Advisory Agreement, the Trustees did not identify any one factor as all-important, but rather considered these factors collectively in light of the Fund’s surrounding circumstances. Based on this review, the Trustees, including a majority of the Independent Trustees, approved the Advisory Agreement and Sub-Advisory Agreement, each for an initial two-year term as being in the best interests of the Fund and its shareholders.

| NOTICE OF PRIVACY POLICY & PRACTICES |

| |

Protecting the privacy of Fund shareholders is important to us. The following is a description of the practices and policies through which we protect the privacy and security of your non-public personal information.

What Information We Collect

We collect and maintain information about you so that we can open and maintain your account in the Fund and provide various services to you. We collect non-public personal information about you from the following sources:

| | • | information we receive about you on applications or other forms; |

| | | |

| | • | information you give us orally; and |

| | | |

| | • | information about your transactions with us or others. |

The types of non-public personal information we collect and share can include:

| | • | social security number; |

| | | |

| | • | account balances; |

| | | |

| | • | account transactions; |

| | | |

| | • | transaction history; |

| | | |

| | • | wire transfer instructions; and |

| | | |

| | • | checking account information. |

What Information We Disclose

We do not disclose any non-public personal information about shareholders or former shareholders of the Fund without the shareholder’s authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share information with affiliated parties and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibility.

How We Protect Your Information

All shareholder records will be disposed of in accordance with applicable law. We maintain physical, electronic and procedural safeguards to protect your non-public personal information and require third parties to treat your non-public personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared with unaffiliated third parties.

If you have any questions or concerns regarding this notice or our Privacy Policy, please contact us at 1-833-MAR-MONT.

Investment Advisor

Marmont Partners LLC

925 West Lancaster Avenue, Suite 220

Bryn Mawr, PA 19010

Investment Sub-Advisor

Redwood Investments, LLC

One Gateway Center, Suite 802

Newton, MA 02458

Distributor

Quasar Distributors, LLC

777 East Wisconsin Avenue, 6th Floor

Milwaukee, WI 53202

Transfer Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(833) MAR-MONT

Custodian

U.S. Bank National Association

Custody Operations

1555 North River Center Drive, Suite 302

Milwaukee, WI 53212

Independent Registered Public Accounting Firm

BBD, LLP

1835 Market Street, 3rd Floor

Philadelphia, PA 19103

Legal Counsel

Godfrey & Kahn S.C.

833 East Michigan Street, Suite 1800

Milwaukee, WI 53202

This report is intended for shareholders of the Fund and may not be used as sales literature unless preceded or accompanied by a current prospectus.

Past performance results shown in this report should not be considered a representation of future performance. Share price and returns will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are dated and are subject to change.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Experts.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

(a) Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

(b) Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Principal Executive Officer and Treasurer/Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended, (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is subject to the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

| (b) | Certifications pursuant to Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Manager Directed Portfolios

By (Signature and Title)* /s/Douglas J. Neilson

Douglas J. Neilson, President/

Principal Executive Officer

Date 7/9/2018

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Douglas J. Neilson

Douglas J. Neilson, President/

Principal Executive Officer

Date 7/9/2018

By (Signature and Title)* /s/Matthew J. McVoy

Matthew J. McVoy, Treasurer/

Principal Financial Officer

Date 7/9/2018

* Print the name and title of each signing officer under his or her signature.