iM DBi Managed Futures Strategy ETF

Semi-Annual Report

June 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, www.imglobalpartner.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-888-898-1041, sending an e-mail request to contact@imglobalpartner.com, or by enrolling at www.imglobalpartner.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund you can call 1-888-898-1041 or send an e-mail request to contact@imglobalpartner.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

iM DBi Managed Futures Strategy ETF

Table of Contents

Composition of Consolidated Schedule of Investments | 3 |

Consolidated Schedule of Investments | 4 |

Consolidated Schedule of Open Futures Contracts | 5 |

Consolidated Statement of Assets and Liabilities | 6 |

Consolidated Statement of Operations | 7 |

Consolidated Statement of Changes in Net Assets | 8 |

Consolidated Financial Highlights | 9 |

Notes to Consolidated Financial Statements | 10 |

Expense Example | 32 |

Notice to Shareholders | 34 |

Approval of the Investment Advisory Agreement | |

and Investment Sub-Advisory Agreement | 35 |

Notice of Privacy Policy and Practices | 39 |

iM DBi Managed Futures Strategy ETF

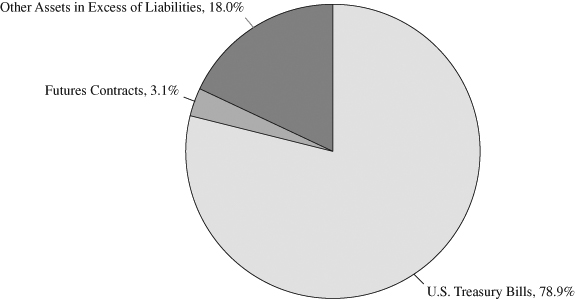

| COMPOSITION OF CONSOLIDATED SCHEDULE OF INVESTMENTS |

| at June 30, 2019 (Unaudited) |

Percentages represent market value as a percentage of net assets.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED SCHEDULE OF INVESTMENTS |

| at June 30, 2019 (Unaudited) |

| | | Principal | | | | |

| SHORT-TERM INVESTMENTS – 78.9% | | Amount | | | Value | |

| | | | | | | |

| U.S. Treasury Bills – 78.9% | | | | | | |

2.33%, 07/02/2019 (b)(c) | | $ | 465,000 | | | $ | 464,975 | |

2.38%, 07/05/2019 (b)(c) | | | 160,000 | | | | 159,966 | |

2.29%, 07/09/2019 (a)(b)(c) | | | 142,000 | | | | 141,938 | |

2.145%, 7/30/2019 (b)(c) | | | 81,000 | | | | 80,864 | |

2.38%, 08/08/2019 (b)(c) | | | 1,842,000 | | | | 1,838,043 | |

2.20%, 08/13/2019 (b)(c) | | | 398,000 | | | | 397,023 | |

2.36%, 08/15/2019 (b)(c) | | | 34,000 | | | | 33,912 | |

2.36%, 08/15/2019 (a)(b)(c) | | | 374,000 | | | | 373,036 | |

2.105%, 08/20/2019 (b)(c) | | | 1,671,000 | | | | 1,666,181 | |

2.105%, 8/20/2019 (a)(b)(c) | | | 242,000 | | | | 241,302 | |

2.335%, 08/22/2019 (b)(c) | | | 1,643,000 | | | | 1,638,090 | |

2.31%, 08/29/2019 (b)(c) | | | 106,000 | | | | 105,636 | |

2.30%, 09/05/2019 (b)(c) | | | 59,000 | | | | 58,775 | |

2.24%, 09/12/2019 (b)(c) | | | 1,736,000 | | | | 1,728,747 | |

2.24%, 09/12/2019 (a)(b)(c) | | | 47,000 | | | | 46,804 | |

2.17%, 09/19/2019 (b)(c) | | | 189,000 | | | | 188,131 | |

2.085%, 09/26/2019 (b)(c) | | | 256,000 | | | | 254,721 | |

2.38%, 10/03/2019 (b)(c) | | | 137,000 | | | | 136,255 | |

2.38%, 10/03/2019 (a)(b)(c) | | | 35,000 | | | | 34,810 | |

2.395%, 10/31/2019 (b)(c) | | | 375,000 | | | | 372,448 | |

2.38%, 11/7/2019 (b)(c) | | | 1,852,000 | | | | 1,838,412 | |

2.38%, 11/07/2019 (a)(b)(c) | | | 33,000 | | | | 32,758 | |

2.355%, 11/14/2019 (b)(c) | | | 56,000 | | | | 55,568 | |

2.355%, 11/14/2019 (a)(b)(c) | | | 25,000 | | | | 24,807 | |

2.34%, 11/21/2019 (a)(b)(c) | | | 229,000 | | | | 227,140 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

(Cost $12,136,894) | | | | | | | 12,140,342 | |

| TOTAL INVESTMENTS | | | | | | | | |

(Cost $12,136,894) | | | | | | | 12,140,342 | |

Other Assets in Excess of Liabilities – 21.1% | | | | | | | 3,250,167 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 15,390,509 | |

Percentages are stated as a percent of net assets.

| (a) | All or a portion of this se.curity is held by the iM DBi Managed Futures Subsidiary. |

| (b) | Zero coupon bond. The effective yield is listed. |

| (c) | All or a portion of this security is held as collateral for certain futures contracts. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED SCHEDULE OF OPEN FUTURES CONTRACTS |

| at June 30, 2019 (Unaudited) |

| | | Number of | | | | | | | | | | Unrealized | |

| | | Contracts | | Settlement | | Notional | | | | | | Appreciation | |

| Description | | Purchased/(Sold) | | Month | | Amount | | | Value | | | (Depreciation) | |

| Purchased Contracts: | | | | | | | | | | | | | |

U.S. Treasury | | | | | | | | | | | | | |

2-Year Note Futures | | | 62 | | Sep-19 | | $ | 13,282,147 | | | $ | 13,341,141 | | | $ | 58,994 | |

MSCI EAFE | | | | | | | | | | | | | | | | | |

Index Futures | | | 57 | | Sep-19 | | | 5,392,446 | | | | 5,481,405 | | | | 88,959 | |

S&P 500 E-mini | | | | | | | | | | | | | | | | | |

Index Futures | | | 49 | | Sep-19 | | | 7,113,925 | | | | 7,213,290 | | | | 99,365 | |

U.S. Treasury | | | | | | | | | | | | | | | | | |

10-Year Note Futures | | | 48 | | Sep-19 | | | 6,055,848 | | | | 6,142,500 | | | | 86,652 | |

U.S. Treasury 10-Year | | | | | | | | | | | | | | | | | |

Ultra Bond Futures | | | 48 | | Sep-19 | | | 6,512,587 | | | | 6,630,000 | | | | 117,413 | |

90-day Euro- | | | | | | | | | | | | | | | | | |

Dollar Futures | | | 25 | | Sep-19 | | | 6,120,269 | | | | 6,124,687 | | | | 4,418 | |

U.S. Treasury Long | | | | | | | | | | | | | | | | | |

Bond Futures | | | 19 | | Sep-19 | | | 2,889,750 | | | | 2,956,281 | | | | 66,531 | |

U.S. Treasury Ultra | | | | | | | | | | | | | | | | | |

Bond Futures | | | 19 | | Sep-19 | | | 3,284,408 | | | | 3,373,688 | | | | 89,280 | |

Gold 100 Oz. | | | | | | | | | | | | | | | | | |

Futures (b) | | | 16 | | Aug-19 | | | 2,269,790 | | | | 2,261,920 | | | | (7,870 | ) |

| | | | | | | | | | | | | | | | | 603,742 | |

| Contracts Sold: | | | | | | | | | | | | | | | | | |

Euro FX | | | | | | | | | | | | | | | | | |

Currency Futures | | | (8) |

| Sep-19 | | | (11,409,008 | ) | | | (11,446,500 | ) | | | (37,492 | ) |

MSCI Emerging | | | | | | | | | | | | | | | | | |

Markets Index Futures | | | (42) |

| Sep-19 | | | (2,145,364 | ) | | | (2,212,140 | ) | | | (66,776 | ) |

Fed Fund 30-Day Futures | | | (7) |

| Oct-19 | | | (2,860,579 | ) | | | (2,862,645 | ) | | | (2,066 | ) |

Fed Fund 30-Day Futures | | | (7) |

| Nov-19 | | | (2,862,746 | ) | | | (2,865,125 | ) | | | (2,379 | ) |

Japanese Yen | | | | | | | | | | | | | | | | | |

Currency Futures | | | (7) |

| Sep-19 | | | (812,731 | ) | | | (816,463 | ) | | | (3,732 | ) |

WTI Crude Futures (b) | | | (6) |

| Sep-19 | | | (341,126 | ) | | | (351,120 | ) | | | (9,994 | ) |

| | | | | | | | | | | | | | | | | (122,439 | ) |

| | | | | | | | | | | | | | | | $ | 481,303 | |

| (a) | Societe Generale is the counterparty for all Open Futures Contracts held by the Fund and the iM DBi Cayman Managed Futures Subsidiary at June 30, 2019. |

| (b) | Contract held by the iM DBi Cayman Managed Futures Subsidiary. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| at June 30, 2019 (Unaudited) |

| Assets: | | | |

Investments, at value (cost of $12,136,894) | | $ | 12,140,342 | |

Cash | | | 1,350,048 | |

Deposits with broker for futures (Note 2) | | | 1,927,602 | |

| Total assets | | | 15,417,992 | |

| | | | | |

| Liabilities: | | | | |

Distribution payable | | | 18,113 | |

Payable for investment management fees | | | 9,370 | |

| Total liabilities | | | 27,483 | |

| | | | | |

| Net assets | | $ | 15,390,509 | |

| | | | | |

| Net assets consist of: | | | | |

Paid in capital | | $ | 15,018,310 | |

Total distributable earnings | | | 372,199 | |

| Net assets | | $ | 15,390,509 | |

| | | | | |

| Net Asset Value: | | | | |

| Net assets | | $ | 15,390,509 | |

| Shares outstanding^ | | | 600,000 | |

| Net asset value, offering and redemption price per share | | $ | 25.65 | |

^ | $0.01 par value, unlimited number of shares authorized. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED STATEMENT OF OPERATIONS |

| For the Period Ended June 30, 2019 (Unaudited) |

| Investment Income: | | | |

Interest | | $ | 40,993 | |

| Total investment income | | | 40,993 | |

| | | | | |

| Expenses: | | | | |

Management fees (Note 5) | | | 17,724 | |

| Total expenses | | | 17,724 | |

| Net investment income | | | 23,269 | |

| | | | | |

| Realized and unrealized gain (loss) on investments: | | | | |

Net realized gain (loss) on: | | | | |

| Investments | | | (81 | ) |

| Futures | | | (117,627 | ) |

Net change in unrealized appreciation on: | | | | |

| Investments | | | 3,448 | |

| Futures | | | 481,303 | |

| Net realized and unrealized gain (loss) on investments | | | 367,043 | |

| Net increase in net assets resulting from operations | | $ | 390,312 | |

* | The iM DBi Managed Futures Strategy ETF commenced operations on May 7, 2019. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS |

| |

| | | Period Ended | |

| | | June 30, 2019* | |

| | | (Unaudited) | |

| Operations: | | | |

Net investment income | | $ | 23,269 | |

Net realized loss on investments and futures contracts | | | (117,708 | ) |

Net change in unrealized appreciation | | | | |

on investments and futures contracts | | | 484,751 | |

| Net increase in net assets resulting from operations | | | 390,312 | |

| | | | | |

| Distributions to Shareholders: | | | | |

Distributable earnings | | | (18,113 | ) |

| Total distributions | | | (18,113 | ) |

| | | | | |

| Capital Share Transactions: | | | | |

Proceeds from shares sold | | | 17,562,910 | |

Payment for shares redeemed | | | (2,544,600 | ) |

| Net increase in net assets from capital share transactions | | | 15,018,310 | |

| Total increase in net assets | | | 15,390,509 | |

| | | | | |

| Net Assets: | | | | |

Beginning of period | | | — | |

End of period | | $ | 15,390,509 | |

| | | | | |

| Change in Shares Outstanding: | | | | |

Shares sold | | | 700,000 | |

Shares redeemed | | | (100,000 | ) |

Net increase in shares outstanding | | | 600,000 | |

* | The iM DBi Managed Futures Strategy ETF commenced operations on May 7, 2019. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

| |

For a capital share outstanding throughout the period

| | | May 7, 2019* | |

| | | through | |

| | | June 30, 2019 | |

| | | (Unaudited) | |

| Net Asset Value – Beginning of Period | | $ | 25.00 | |

| | | | | |

| Income from Investment Operations: | | | | |

Net investment income1 | | | 0.04 | |

Net realized and unrealized gain on investments | | | 0.64 | |

| Total from investment operations | | | 0.68 | |

| | | | | |

| Less Distributions: | | | | |

Distributions from net investment income | | | (0.03 | ) |

| Total distributions | | | (0.03 | ) |

| | | | | |

| Net Asset Value – End of Period | | $ | 25.65 | |

| | | | | |

| Total Return | | 2.72%^ | |

| | | | | |

| Ratios and Supplemental Data: | | | | |

Net assets, end of period (thousands) | | $ | 15,391 | |

Ratio of operating expenses to average net assets: | | | 0.85 | %+ |

Ratio of net investment income to average net assets: | | | 1.12 | %+ |

Portfolio turnover rate | | 0%^ | |

* | Commencement of operations was May 17, 2019. |

+ | Annualized |

^ | Not Annualized |

1 | The net investment income per share was calculated using the average shares outstanding method. |

The accompanying notes are an integral part of these financial statements.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| at June 30, 2019 (Unaudited) |

NOTE 1 – ORGANIZATION

The iM DBi Managed Futures Strategy ETF (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and was organized as a Delaware statutory trust on April 4, 2006. The Fund is an actively managed exchange-traded fund that is an open-end investment management company and is a non-diversified series of the Trust. The Fund commenced operations on May 7, 2019. iM Global Partner US LLC (“iM Global” or the “Advisor”) serves as the investment advisor to the Fund. Dynamic Beta investments, LLC (the “Sub-Advisor”) serves as the sub-advisor to the Fund. As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies. The investment objective of the Fund is to seek long-term capital appreciation.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”).

| | A. | Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

| | B. | Consolidation of Subsidiary: The Fund may invest up to 10% of its total assets in the iM DBi Cayman Managed Futures Subsidiary (the “Subsidiary”). The Subsidiary, which is organized under the laws of the Cayman Islands, is wholly-owned and controlled by the iM DBi Managed Futures Strategy ETF. The financial statements of the iM DBi Managed Futures Strategy ETF include the operations of the Subsidiary. All intercompany accounts and transactions have been eliminated in consolidation. The Subsidiary acts as an investment vehicle in order to invest in commodity-linked derivative instruments consistent with the Fund’s investment objectives and policies. The iM DBi Managed Futures Strategy ETF had 9.30% of its total assets invested in the Subsidiary as of June 30, 2019.

|

| | | The Subsidiary is an exempted Cayman Islands investment company and as such is not subject to Cayman Islands taxes at the present time. For U.S. income tax purposes, the Subsidiary is a Controlled Foreign Corporation (“CFC”) not subject to U.S. income taxes. As a wholly-owned CFC, however, the Subsidiary’s net income and capital gains, if any, will be included each year in the Fund’s investment company taxable income.

|

| | C. | Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required. |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | | The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s 2019 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware.

|

| | | The Subsidiary is classified as a CFC under Subchapter N of the Internal Revenue Code. Therefore, the Fund is required to increase its taxable income by its share of the Subsidiary’s income. Net investment loss of the Subsidiary cannot be deducted by the Fund in the current period nor carried forward to offset taxable income in future periods.

|

| | D. | Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized/accreted using the effective interest method.

|

| | | The Fund distributes substantially all of its net investment income, if any, quarterly, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which may differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment.

|

| | E. | Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

| | F. | Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

|

| | G. | Events Subsequent to the Fiscal Period End: In preparing the financial statements as of June 30, 2019, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements and had concluded that no additional disclosures are necessary. |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | H. | Foreign Securities and Currency: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

|

| | | Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

|

| | I. | CFTC Regulation: Because of the nature of its investments, the Fund is subject to regulation under the Commodities Exchange Act, as amended (the “CEA”), as a commodity pool and each of the Advisor and Sub-Adviser is subject to regulation under the CEA as a commodity pool operator (“CPO”), as those terms are defined under the CEA. The Advisor and Sub-Adviser are regulated by the CFTC, the National Futures Association and the SEC and are subject to each regulator’s disclosure requirements. The CFTC has adopted rules that are intended to harmonize certain CEA disclosure requirements with SEC disclosure requirements.

|

| | J. | Futures Contracts: Investments in futures contracts obligate a Fund and the clearing broker to settle monies on a daily basis representing changes in the prior days “mark-to-market” of the open contracts. If a Fund has unrealized appreciation the clearing broker would credit the Fund’s account with an amount equal to appreciation and conversely if a Fund has unrealized depreciation the clearing broker would debit the Fund’s account with an amount equal to depreciation. These daily cash settlements are also known as “variation margin.” Variation margin is recognized as a receivable and/or payable for “Variation margin on futures contracts” on the Statement of Assets and Liabilities.

|

| | | During the period the futures contract is open, changes in the value of a contract are recognized as an unrealized gain or loss by “marking-to-market” on a daily basis to reflect the changes in market value of the contract, which is recognized as a component of “Change in net unrealized appreciation/depreciation on futures” on the Statement of Operations. When the contract is closed or expired, a Fund records a realized gain or loss equal to the difference between the value of the contract on the closing date and value of the contract when originally entered into, which is recognized as a component of “Net realized gain (loss) on futures” on the Statement of Operations. |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | K. | Deposits with Broker: When trading derivative instruments, such as forward or futures contracts, the Fund and the Subsidiary are only required to post initial or variation margin with the exchange or clearing broker. The use of margin in trading these instruments has the effect of creating leverage, which can expose the Fund to substantial gains or losses occurring from relatively small price changes in the value of the underlying instrument and can increase the volatility of the Fund’s returns. Volatility is a statistical measure of the dispersion of returns of an investment, where higher volatility generally indicates greater risk.

|

| | | Upon entering into a futures contract, and to maintain the Fund’s open positions in futures contracts, the Fund would be required to deposit with its custodian or futures broker in a segregated account in the name of the futures broker an amount of cash, U.S. government securities, suitable money market instruments, or other liquid securities, known as “initial margin.” The margin required for a particular futures contract is set by the exchange on which the contract is traded, and may be significantly modified from time to time by the exchange during the term of the contract. Futures contracts are customarily purchased and sold on margins that may range upward from less than 5% of the value of the contract being traded.

|

| | | At June 30, 2019, the Fund and Subsidiary, collectively, had $1,927,602 in cash and cash equivalents on deposit with brokers for futures, which are presented on the Fund’s consolidated statement of assets and liabilities.

|

| | | If the price of an open futures contract changes (by increase in underlying instrument or index in the case of a sale or by decrease in the case of a purchase) so that the loss on the futures contract reaches a point at which the margin on deposit does not satisfy margin requirements, a broker will require an increase in the margin. However, if the value of a position increases because of favorable price changes in the futures contract so that the margin deposit exceeds the required margin, a broker will pay the excess to the Fund.

|

| | | These subsequent payments, called “variation margin,” to and from the futures broker, are made on a daily basis as the price of the underlying assets fluctuate making the long and short positions in the futures contract more or less valuable, a process known as “marking to the market.” The Fund expects to earn interest income on any margin deposits.

|

| | L. | Counterparty, Credit and Market Risk: Many of the protections afforded to participants on some organized exchanges, such as the performance guarantee of an exchange clearing house, might not be available in connection with over-the-counter transactions or off-exchange transactions. Therefore, in those instances in which the Fund enters into such transactions, the Fund will be subject to the risk that its counterparty will be unable or unwilling to perform its obligations under the transactions and that the Fund will sustain losses. Over-the-counter (“OTC”) and off-exchange transactions have greater liquidity risk, and often do not have liquidity beyond the counterparty to the instrument. In general, there is less |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | | government regulation and supervision of transactions in the OTC markets or off-exchange than of transactions entered into on organized exchanges. Furthermore, if any futures commission merchant, broker-dealer, or financial institution holding the Fund’s assets were to become bankrupt or insolvent, it is possible that the Fund would be able to recover only a portion, or in certain circumstances, none of its assets held by such bankrupt or insolvent entity.

|

| | | The risk that an issuer, guarantor or liquidity provider of an instrument (including the counterparty to an OTC position) held by the Fund will be unable or unwilling to perform its obligations is considered credit risk. It includes the risk that one or more of the securities will be downgraded by a credit rating agency; generally, lower rated issuers have higher credit risks. Credit risk also includes the risk that an issuer or guarantor of a security, or a bank or other financial institution that has entered into a repurchase agreement with the Fund, may default on its payment or repurchase obligation, as the case may be. Credit risk generally is inversely related to credit quality. To the extent that the Fund invests in derivative or other over-the-counter transactions, including forward contracts, the Fund may be exposed to a credit risk with respect to the parties with whom it trades and may also bear the risk of settlement default. These risks may differ materially from those entailed in exchange- traded transactions, which generally are backed by clearing organization guarantees, daily marking-to-market and settlement, and segregation and minimum capital requirements applicable to intermediaries. Transactions entered into directly between two counterparties generally do not benefit from such protections and expose the parties to the risk of counterparty default.

|

| | | The market value of a security or instrument may fluctuate, sometimes rapidly and unpredictably. These fluctuations, which are often referred to as “volatility,” may cause a security or instrument to be worth less than it was worth at an earlier time. Recent turbulence in financial markets and reduced liquidity in credit and fixed income markets may negatively affect many issuers, which may have an adverse effect on the Fund. Market risk may affect a single issuer, industry, commodity, sector of the economy, or the market as a whole. Market risk is common to most investments – including stocks, bonds, derivatives and commodities, and the mutual funds that invest in them. The risk of bonds can vary significantly depending upon factors such as issuer and maturity. The bonds of some companies may be riskier than the stocks of others.

|

| | M. | Recent Accounting Pronouncements and Rule Issuances: In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount; |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | which continues to be amortized to maturity. The ASU is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018.

|

| | In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has evaluated the impact of this change in guidance, and due to the permissibility of early adoption, modified the Fund’s fair value disclosures for the current reporting period.

|

| | In August 2018, the Securities and Exchange Commission issued Final Rule Release No. 33-10532, Disclosure Update and Simplification, which in part amends certain financial statement disclosure requirements of Regulation S-X that have become redundant, duplicative, overlapping, outdated, or superseded, in light of other Commission disclosure requirements, U.S. Generally Accepted Accounting Principles, or changes in the information environment. The amendments are intended to facilitate the disclosure of information to investors and simplify compliance without significantly altering the total mix of information provided to investors. The amendments to Rule 6-04.17 of Regulation S-X (balance sheet) were amended to require presentation of the total, rather than the components of net assets, of distributable earnings on the balance sheet. Consistent with U.S. GAAP, funds will be required to disclose total distributable earnings. The amendments to Rule 6-09 of Regulation S-X (statement of changes in net assets) omit the requirement to separately state the sources of distributions paid as well as omit the requirement to parenthetically state the book basis amount of undistributed net investment income. Instead, consistent with U.S. GAAP, funds will be required to disclose the total amount of distributions paid, except that any tax return of capital must be separately disclosed. The requirements of the Final Rule Release were effective November 5, 2018 and the Fund’s Consolidated Statement of Assets and Liabilities and the Statement of Changes in Net Assets for the current reporting period have been modified accordingly. |

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

valuation techniques and related inputs during the period, and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement.

|

| | Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

| | Level 3 – | Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Debt Securities: Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate market observable data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 2 of the fair value hierarchy.

Futures: Futures contracts are valued at the settlement price on the exchange on which they are principally traded. Futures are generally categorized as Level 1 of the fair value hierarchy.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Short-Term Debt Securities: Short-term debt instruments having a maturity of less than 60 days are valued at the evaluated mean price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

quotations. In the absence of prices from a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term debt securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities.

The Board has delegated day-to-day valuation issues to a Valuation Committee of the Trust which, as of June 30, 2019, was comprised of officers of the Trust. The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available, or the closing price does not represent fair value, by following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume, news events and significant events such as those described previously. All actions taken by the Valuation Committee are subsequently reviewed and ratified by the Board.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either level 2 or level 3 of the fair value hierarchy.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the fair valuation hierarchy of the Fund’s consolidated investments and other financial instruments as of June 30, 2019:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| ASSETS: | | | | | | | | | | | | |

| Short-Term Investments | | $ | — | | | $ | 12,140,342 | | | $ | — | | | $ | 12,140,342 | |

| Total Investments in Securities | | | — | | | | 12,140,342 | | | | — | | | | 12,140,342 | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Futures | | $ | 481,303 | | | $ | — | | | $ | — | | | $ | 481,303 | |

| * | Other financial instruments are derivative instruments not reflected in the Consolidated Schedule of Investments, such as futures. Futures are reflected as the unrealized appreciation (depreciation) on the instrument. |

NOTE 4 – DERIVATIVE INSTRUMENTS

During the period ended June 30, 2019, the Fund invested in Derivative Instruments such as futures contracts and forward currency contracts in order to pursue its managed futures strategy. The Derivative Instruments are not designated as hedging instruments. The Fund’s managed futures strategy employs long and short positions in derivatives, primarily futures contracts and forward contracts, across the broad asset classes of equities, fixed income, currencies and, through the Subsidiary, commodities. Fund positions in those contracts are determined based on a proprietary, quantitative model – the Dynamic Beta Engine – that seeks to identify the main drivers of performance by approximating the current asset allocation of a selected pool of the largest commodity trading advisor hedge funds (“CTA”), which are hedge funds that use futures or forward contracts to achieve their investment objectives. The Dynamic Beta Engine analyzes recent historical performance in order to estimate the current asset allocation of a selected pool of the largest CTAs. The Sub-Adviser relies exclusively on the model and does not

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

have discretion to override the model-determined asset allocation or portfolio weights. The Sub-Adviser will periodically review whether instruments should be added to or removed from the model in order to improve the model’s efficiency. The model’s asset allocation is limited to asset classes that are traded on U.S.-based exchanges. Based on this analysis, the Fund will invest in an optimized portfolio of long and short positions in domestically-traded, liquid derivative contracts selected from a pool of the most liquid derivative contracts, as determined by the Sub-Adviser.

Futures contracts and forward contracts are contractual agreements to buy or sell a particular currency, commodity or financial instrument at a pre-determined price in the future. The Fund takes long positions in derivative contracts that provide exposure to various asset classes, sectors and/or markets that the Fund expects to rise in value, and takes short positions in asset classes, sectors or and/or markets that the Fund expects to fall in value. Currently, the Fund expects to limit its investments to highly-liquid, domestically-traded contracts that the Sub-Adviser believes exhibit the highest correlation to what the Sub-Adviser perceives to be the core positions of the target hedge funds. Such core positions are generally long and short positions in domestically-traded derivative contracts viewed as highly liquid by the Sub-Adviser.

The Fund may have gross notional exposure, which is defined as the sum of the notional exposure of both long and short derivative positions across the Fund, that approximates the current asset allocation and matches the risk profile of a diversified pool of the largest CTAs. The Investment Company Act of 1940, as amended (the “1940 Act”), and the rules and interpretations thereunder, impose certain limitations on the Fund’s ability to use leverage. Under normal market conditions, the Sub-Adviser, on average, will target an annualized volatility level for the Fund of 8-10%.

The Sub-Adviser will, in an effort to reduce certain risks (e.g., volatility of returns), limit the Fund’s gross notional exposure on certain futures contracts whose returns are expected to be particularly volatile. In addition to these specific exposure limits, the Sub-Adviser will use quantitative methods to assess the level of risk for the Fund.

There are significant risks associated with the Fund’s use of futures contracts, including the following: (1) the success of a hedging strategy may depend on the Sub-Adviser’s ability to predict movements in the prices of individual securities, fluctuations in markets and movements in interest rates; (2) there may be an imperfect or no correlation between the changes in market value of the instruments held by the Fund and the prices of futures; (3) there may not be a liquid secondary market for a futures contract; (4) trading restrictions or limitations may be imposed by an exchange; and (5) government regulations may restrict trading in futures contracts. In addition, some strategies reduce the Fund’s exposure to price fluctuations, while others tend to increase its market exposure.

The Fund has adopted derivative instruments disclosure standards, in order to enable the investor to understand how and why an entity used derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

Statement of Assets and Liabilities – Values of Derivative Instruments as of June 30, 2019

| | | Asset Derivatives | |

| | | Statement of Assets and | | | |

| | | Liabilities Location | | Value | |

Commodity Contracts – Futures* | | Unrealized appreciation | | | |

| |

| on futures contracts** | | $ | — | |

Equity Contracts – Futures* | | Unrealized appreciation | | | | |

| | | on futures contracts** | | | 188,324 | |

Foreign Exchange Contracts – Futures* | | Unrealized appreciation | | | | |

| | | on futures contracts** | | | 4,418 | |

Interest Rate Contracts – Futures* | | Unrealized appreciation | | | | |

| | | on futures contracts** | | | 418,870 | |

Total | | | | $ | 611,612 | |

| | | | |

| | | Liability Derivatives | |

| | | Statement of Assets and | | | | |

| | | Liabilities Location | | Value | |

Commodity Contracts – Futures* | | Unrealized depreciation | | | | |

| | | on futures contracts** | | $ | 17,864 | |

Equity Contracts – Futures* | | Unrealized depreciation | | | | |

| | | on futures contracts** | | | 66,776 | |

Foreign Exchange Contracts – Futures* | | Unrealized depreciation | | | | |

| | | on futures contracts** | | | 41,224 | |

Interest Rate Contracts – Futures* | | Unrealized depreciation | | | | |

| | | on futures contracts** | | | 4,445 | |

Total | | | | $ | 130,309 | |

* | Includes cumulative appreciation/depreciation as reported on the Consolidated Schedule of Open Futures Contracts. |

** | Included in total distributable earnings on the Consolidated Statement of Assets and Liabilities. |

The Effect of Derivative Instruments on the Statement of Operations for the period ended June 30, 2019

| Amount of Realized Gain (Loss) on Derivatives | |

| | | Futures Contracts | |

Commodity Contracts | | $ | (447,063 | ) |

Equity Contracts | | | 2,193 | |

Foreign Exchange Contracts | | | (178,346 | ) |

Interest Rate Contracts | | | 505,589 | |

Total | | $ | (117,627 | ) |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | |

| | | Futures Contracts | |

Commodity Contracts | | $ | (17,864 | ) |

Equity Contracts | | | 121,548 | |

Foreign Exchange Contracts | | | (36,806 | ) |

Interest Rate Contracts | | | 414,425 | |

Total | | $ | 481,303 | |

Volume Disclosures

The average monthly notional amount outstanding of futures during the period ended June 30, 2019 were as follows:

| | | iM DBi Managed | |

| Long Positions | | Futures Strategy ETF | |

Futures | | $ | 5,800,053 | |

| Short Positions | | | | |

Futures | | $ | (4,135,976 | ) |

Offsetting Assets and Liabilities

The Fund is subject to various Master Netting Arrangements, which govern the terms of certain transactions with select counterparties. The Master Netting Arrangements allow the Fund to close out and net its total exposure to a counterparty in the event of a default with respect to all the transactions governed under a single agreement with a counterparty. The Master Netting Arrangements also specify collateral posting arrangements at pre-arranged exposure levels. Under the Master Netting Arrangements, collateral is routinely transferred if the total net exposure to certain transactions (net of existing collateral already in place) governed under the relevant Master Netting Arrangement with a counterparty in a given account exceeds a specified threshold depending on the counterparty and the type of Master Netting Arrangement.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

The table below, as of June 30, 2019, discloses both gross information and net information about instruments and transactions eligible for offset in the Consolidated Statements of Assets and Liabilities, and instruments and transactions that are subject to an agreement similar to a master netting agreement as well as amounts related to collateral held at clearing brokers and counterparties. For financial reporting purposes, the Fund does not offset derivative assets and liabilities, and any related collateral received or pledged, on the Consolidated Statements of Assets and Liabilities, except in the case of futures contracts.

| Assets | | | | | | | | | | | Gross Amounts not offset | | | | |

| | | | | | | | | | | | in the Consolidated Statement | | | | |

| | | | | | | | | | | | of Assets and Liabilities | | | | |

| | | | | | | | | Net | | | | | | | | | | |

| | | | | | Gross | | | Amounts | | | | | | | | | | |

| | | | | | Amounts | | | Presented | | | | | | | | | | |

| | | | | | Offset in the | | | in the | | | | | | | | | | |

| | | Gross | | | Consolidated | | | Consolidated | | | | | | | | | | |

| | | Amounts of | | | Statement of | | | Statement of | | | | | | | | | | |

| Description / | | Recognized | | | Assets and | | | Assets and | | | Financial | | | Collateral | | | Net | |

Counterparty | | Assets | | | Liabilities | | | Liabilities | | | Instruments | | | Received | | | Amount | |

Futures* | | | | | | | | | | | | | | | | | | |

Societe Generale | | $ | 611,612 | | | $ | (130,309 | ) | | $ | 481,303 | | | $ | — | | | $ | 481,303 | | | $ | — | |

| | | $ | 611,612 | | | $ | (130,309 | ) | | $ | 481,303 | | | $ | — | | | $ | 481,303 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | Gross Amounts not offset | | | | | |

| | | | | | | | | | | | | | | in the Consolidated Statement | | | | | |

| | | | | | | | | | | | | | | of Assets and Liabilities | | | | | |

| | | | | | | | | | | Net | | | | | | | | | | | | | |

| | | | | | | Gross | | | Amounts | | | | | | | | | | | | | |

| | | | | | | Amounts | | | Presented | | | | | | | | | | | | | |

| | | | | | | Offset in the | | | in the | | | | | | | | | | | | | |

| | | Gross | | | Consolidated | | | Consolidated | | | | | | | | | | | | | |

| | | Amounts of | | | Statement of | | | Statement of | | | | | | | | | | | | | |

| Description / | | Recognized | | | Assets and | | | Assets and | | | Financial | | | Collateral | | | Net | |

Counterparty | | Liabilities | | | Liabilities | | | Liabilities | | | Instruments | | | Pledged | | | Amount | |

Futures* | | | | | | | | | | | | | | | | | | | | | | | | |

Societe Generale | | $ | 130,309 | | | $ | (130,309 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | $ | 130,309 | | | $ | (130,309 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

* | Cumulative appreciation/ depreciation on futures contracts is reported in the consolidated schedule of open futures contracts. Variation margin and receivable/payable for unsettled open futures contracts presented above, if any, is presented in the Consolidated Statements of Assets and Liabilities. |

In some instances, the collateral amounts disclosed in the tables were adjusted due to the requirement to limit the collateral amounts to avoid the effect of overcollateralization. Actual collateral received/pledged may be more than the amounts disclosed herein.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

NOTE 5 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Advisor. Under the Advisory Agreement, the Advisor provides a continuous investment program for the Fund’s assets in accordance with its investment objectives, policies and limitations, and oversees the day-to-day operations of the Fund subject to the supervision of the Board, including the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act (the “Independent Trustees”).

Pursuant to the Advisory Agreement between the Trust, on behalf of the Fund, and iM Global, the Fund pays a unified management fee to the Advisor, which is calculated daily and paid monthly, at an annual rate of 0.85% of the Fund’s average daily net assets. Under the Investment Advisory Agreement, the Advisor has agreed to pay all expenses of the Fund except for interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, distribution fees and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act, and the unified management fee payable to the Advisor. iM Global, in turn, compensates the Fund’s sub-adviser from the management fee it receives.

Dynamic Beta investments, LLC, serves as the sub-adviser to the Fund. Pursuant to a Sub-Advisory Agreement between the Advisor and the Sub-Adviser (the “Sub-Advisory Agreement”), the Sub-Adviser manages the investment program for the Fund, including the purchase, retention and disposition of investments in the Fund’s portfolio, in accordance with the Fund’s investment objectives, policies and restrictions. The Advisor has ultimate responsibility to oversee the Sub-Adviser and recommend to the Board of Trustees its hiring, termination, and replacement. In this capacity, the Advisor, among other things: (i) monitors the compliance of the Sub-Adviser with the investment objectives and related policies of the Fund; (ii) reviews the performance of the Sub-Adviser; and (iii) reports periodically on such performance to the Board of Trustees. The Sub-Adviser is paid a sub-advisory fee by the Advisor for its services as sub-adviser to the Fund. The Advisor is a minority owner of the Sub-Adviser.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. Vigilant Compliance, LLC serves as the Chief Compliance Officer to the Fund. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the Administrator. A Trustee of the Trust is deemed to be an interested person of the Trust due to his former position with the Distributor.

Certain officers of the Fund are employees of the Administrator and are not paid any fees by the Fund for serving in such capacities.

NOTE 6 – SECURITIES TRANSACTIONS

For the period ended June 30, 2019, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were as follows:

| | | Purchases | Sales |

| | iM DBi Managed Futures Strategy ETF | $ — | $ — |

There were no purchases or sales of long-term U.S. Government securities.

NOTE 7 – SHARE TRANSACTIONS

Shares of the Fund are listed and traded on NYSE Arca, Inc. Market prices for the shares may be different from their NAV. The Fund issues and redeems shares on a continuous basis at NAV generally in blocks of 100,000 shares, called “Creation Units.” The Fund generally issues and redeems Creation Units in exchange for a designated amount of U.S. cash and/or a portfolio of securities closely approximating the holdings of the Fund. Once created, shares generally trade in the secondary market at market prices that change throughout the day. Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem shares directly from the Fund. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

The Fund currently offers one class of shares, which has no front-end sales load, no deferred sales charge, and no redemption fee. A fixed transaction fee is imposed for the transfer and other transaction costs associated with the purchase or sale of Creation Units. The standard fixed transaction fee for the Fund is $250, payable to the Custodian. The fixed transaction fee may be waived on certain orders if the Fund’s Custodian has determined to waive some or all of the costs associated with the order, or another party, such as the Advisor, has agreed to pay such fee. In addition, a variable fee may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of 2% as a percentage of the value of the Creation Units subject to the transaction. There

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

were no variable fees received during the period. The Fund may issue an unlimited number of shares of beneficial interest, with $0.01 par value.

NOTE 8 – PRINCIPAL RISKS

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, market price, yield, and total return. Further information about investment risks is available in the Fund’s prospectus and Statement of Additional Information.

Managed Futures Strategy Risk: In seeking to achieve its investment objective, the Fund will utilize various investment strategies that involve the use of complex investment techniques, and there is no guarantee that these strategies will succeed. The use of such strategies and techniques may subject the Fund to greater volatility and loss. There can be no assurance that utilizing a certain approach or model will achieve a particular level of return or reduce volatility and loss.

Futures Contracts Risk: Futures contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. There is an imperfect correlation between the change in market value of the futures contracts and the market value of the underlying instrument or reference assets with respect to such contracts. Futures contracts pose the risk of a possible lack of a liquid secondary market, resulting in the potential inability to close a futures contract when desired. Futures contracts are also subject to risks related to possible market disruptions or other extraordinary events, including but not limited to, governmental intervention, and potentially unlimited losses caused by unanticipated market movements. Futures contracts are subject to the possibility that the counterparties to the contracts will default in the performance of their obligations. If the Fund has insufficient cash, it may either have to sell securities from its portfolio to meet daily variation margin requirements with respect to its futures contracts, or close certain positions at a time when it may be disadvantageous to do so. The successful use of futures contracts draws upon the Sub-Adviser’s skill and experience with respect to such instruments and is subject to special risk considerations.

The use of futures contracts, which are derivative instruments, will have the economic effect of financial leverage. Financial leverage magnifies exposure to the swings in prices of an asset class underlying an investment and results in increased volatility, which means the Fund will have the potential for greater losses than if the Fund did not employ leverage in its investment activity. Leveraging tends to magnify, sometimes significantly, the effect of any increase or decrease in the Fund’s exposure to an asset class and may cause the value of the Fund’s securities or related derivatives instruments to be volatile. There is no assurance that the Fund’s investment in a futures contract with leveraged exposure to certain investments and markets will enable the Fund to achieve its investment objective.

Forward Contracts Risk: Forward contracts involve an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract as agreed by the parties in an amount and at a price set at the time of the

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

contract. At the maturity of a forward contract, a fund may either accept or make delivery of the currency specified in the contract or, at or prior to maturity, enter into a closing transaction involving the purchase or sale of an offsetting contract. The Fund may invest in non-deliverable forwards, which are cash-settled, short-term forward contracts on foreign currencies that are non-convertible and that may be thinly traded or illiquid. The use of forward contracts involves various risks, including the risks associated with fluctuations in foreign currency and the risk that the counterparty will fail to fulfill its obligations.

Commodities Risk: Exposure to the commodities markets (including financial futures markets) may subject the Fund, through its investment in the Subsidiary, to greater volatility than investments in traditional securities. Prices of commodities and related contracts may fluctuate significantly over short periods for a variety of reasons, including changes in interest rates, supply and demand relationships and balances of payments and trade; weather and natural disasters; and governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies. The commodity markets are subject to temporary distortions and other disruptions. U.S. futures exchanges and some foreign exchanges have regulations that limit the amount of fluctuation in futures contract prices which may occur during a single business day. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices.

Counterparty Risk: The derivative contracts entered into by the Fund or its Subsidiary may be privately negotiated in the over-the-counter market. These contracts also involve exposure to credit risk, since contract performance depends in part on the financial condition of the counterparty. Relying on a counterparty exposes the Fund to the risk that a counterparty will not settle a transaction in accordance with its terms and conditions because of a dispute over the terms of the contract (whether or not bona fide) or because of a credit or liquidity problem, thus causing the Fund to suffer a loss. If a counterparty defaults on its payment obligations to the Fund, this default will cause the value of an investment in the Fund to decrease. In addition, to the extent the Fund deals with a limited number of counterparties, it will be more susceptible to the credit risks associated with those counterparties. The ability of the Fund to transact business with any one or number of counterparties and the absence of a regulated market to facilitate settlement may increase the potential for losses by the Fund.

Credit Risk: Credit risk refers to the possibility that the issuer of the security or a counterparty in respect of a derivative instrument will not be able to satisfy its payment obligations to the Fund when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. Securities rated in the four highest categories by the rating agencies are considered investment grade but they may also have some speculative characteristics. Investment grade ratings do not guarantee that bonds will not lose value or default. In addition, the credit quality of securities may be lowered if an issuer’s financial condition changes.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

Currency Risk: The Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar, or, in the case of short positions, that the U.S. Dollar will decline in value relative to the currency that the Fund is short. Currency rates in foreign countries may fluctuate significantly over short periods of time for any number of reasons, including changes in interest rates and the imposition of currency controls or other political developments in the U.S. or abroad.

Derivatives Risk: Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures swap agreements and forward contracts. Derivatives typically have economic leverage inherent in their terms. The primary types of derivatives in which the Fund or the Subsidiary invest are futures contracts and forward contracts. Futures contracts and forward contracts can be highly volatile, illiquid and difficult to value, and changes in the value of such instruments held directly or indirectly by the Fund may not correlate with the underlying instrument or reference assets, or the Fund’s other investments. Although the value of futures contracts and forward contracts depends largely upon price movements in the underlying instrument or reference asset, there are additional risks associated with futures contracts and forward contracts that are possibly greater than the risks associated with investing directly in the underlying instruments or reference assets, including illiquidity risk, leveraging risk and counterparty credit risk. A small position in futures contracts or forward contracts could have a potentially large impact on the Fund’s performance. Trading restrictions or limitations may be imposed by an exchange, and government regulations may restrict trading in futures contracts and forward contracts.

Equity Securities Risk: The Fund may invest in, or have exposure to, equity securities. Equity securities tend to be more volatile than other investment choices, such as debt and money market instruments. The value of your investment may decrease in response to overall stock market movements or the value of individual securities.

ETF Risks: The Fund is an ETF, and, as a result of an ETF’s structure, it is exposed to the following risks:

| | o | Authorized Participants, Market Makers, and Liquidity Providers Limitation Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions. |

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

| | o | Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

|

| | o | Shares May Trade at Prices Other Than NAV. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

|

| | o | Trading. Although Shares are listed for trading on a national securities exchange, and may be traded on other U.S. exchanges, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares.

|

Debt Securities and Fixed-Income Risk: Fixed income securities, such as U.S. Treasuries, or derivatives based on fixed income securities, are subject to credit risk and interest rate risk. Credit risk, as described more fully below, refers to the possibility that the issuer of a debt security will be unable to make interest payments or repay principal when it becomes due. Interest rate risk refers to fluctuations in the value of a debt security resulting from changes in the general level of interest rates. Prices of fixed income securities tend to move inversely with changes in interest rates. Typically, a rise in rates will adversely affect fixed income security prices and, accordingly, the Fund’s returns and share price. In addition, the Fund may be subject to “call” risk, which is the risk that during a period of falling interest rates the issuer may redeem a security by repaying it early (which may reduce the Fund’s income if the proceeds are reinvested at lower interest rates), and “extension” risk, which occurs during a rising interest rate environment because certain obligations will be paid off by an issuer more slowly than anticipated (causing the value of those securities held by the Fund to fall).

General Market Risk: The Fund’s NAV and investment return will fluctuate based upon changes in the value of its portfolio securities. You could lose money on your investment in the Fund, or the Fund could underperform other investments.

Government Securities and Agency Risk: Direct obligations of the U.S. Government such as Treasury bills, notes and bonds are supported by its full faith and credit. Indirect obligations issued by Federal agencies and government-sponsored entities generally are not backed by the full faith and credit of the U.S. Treasury. Accordingly, while U.S.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

Government agencies and instrumentalities may be chartered or sponsored by Acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. Some of these indirect obligations may be supported by the right of the issuer to borrow from the Treasury; others are supported by the discretionary authority of the U.S. Government to purchase the agency’s obligations; still others are supported only by the credit of the instrumentality.

Interest Rate Risk: Interest rate risk is the risk that prices of fixed income securities generally increase when interest rates decline and decrease when interest rates increase. The Fund may lose money if short term or long-term interest rates rise sharply or otherwise change in a manner not anticipated by the Sub-Adviser. The Fund may be subject to heightened interest rate risk due to rising rates as the current period of historically low interest rates may be ending. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations, but increasing interest rates may have an adverse effect on the value of the Fund’s investment portfolio as a whole, as investors and markets adjust expected returns relative to such increasing rates. The negative impact on fixed income securities from the resulting rate increases for that and other reasons could be swift and significant.

Leverage Risk: Although the Fund will not borrow funds for trading, the Fund should be considered highly leveraged and is suitable only for investors with high tolerance for investment risk. Leverage embedded in the various derivative instruments traded may result in the Fund or its Subsidiary holding positions whose face or notional value may be many times the Fund’s NAV. As a result of this leveraging, even a small movement in the price of a commodity can cause a correspondingly large profit or loss. Losses incurred on leveraged investments increase in direct proportion to the degree of leverage employed. Furthermore, derivative instruments and futures contracts are highly volatile and are subject to occasional rapid and substantial fluctuations. Volatility is a statistical measurement of the variation of returns of a security or fund or index over time. Higher volatility generally indicates higher risk. You could lose all or substantially all of your investment in the Fund should the Fund’s trading positions suddenly turn unprofitable.

Liquidity Risk: The Fund is subject to liquidity risk primarily due to its investments in derivatives. Investments in derivative instruments involve the risk that the Fund may be unable to sell the derivative instrument or sell it at a reasonable price.

Management Risk: The Fund is actively-managed and may not meet its investment objective based on the portfolio managers’ success or failure to implement investment strategies for the Fund.

Market Risk: The trading prices of equity securities and other instruments fluctuate in response to a variety of factors, including the activities and financial condition of individual companies, the market in which an issuer competes, and general economic conditions. The Fund’s NAV and market price may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time.

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |

New Fund Risk: The Fund is a recently organized management investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision.

Non-Diversified Fund Risk: Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

OTC Trading Risk: Certain of the derivatives in which the Fund may invest may be traded (and privately negotiated) in the “over-the-counter” or “OTC” market. While the OTC derivatives market is the primary trading venue for many derivatives, it is largely unregulated. As a result and similar to other privately negotiated contracts, the Fund is subject to counterparty credit risk with respect to such derivative contracts.

Portfolio Turnover Risk: The Fund may frequently buy and sell portfolio securities and other assets to rebalance the Fund’s exposure to various market sectors. Higher portfolio turnover may result in the Fund paying higher levels of transaction costs and generating greater tax liabilities for shareholders. Portfolio turnover risk may cause the Fund’s performance to be less than you expect.

Regulatory Risk: Governments, agencies or other regulatory bodies may adopt or change laws or regulations that could adversely affect the issuer, or market value, of an instrument held by the Fund or its Subsidiary or that could adversely impact the Fund’s performance.

Short Sales Risk: The Fund may take a short position in a derivative instrument, such as a future, or forward, or swap or a security. A short position on a derivative instrument or security involves the risk of a theoretically unlimited increase in the value of the underlying instrument. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses.

Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the 1940 Act, and, unless otherwise noted in this Prospectus, is not subject to all the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to continue to operate as it does currently and could adversely affect the Fund.

Tax Risk: In order to qualify as a RIC under Subchapter M of the Code and be eligible to receive “pass-through” tax treatment, the Fund must, among other things, must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its income. Under the source of income test, at least 90% of a RIC’s gross income each year must be “qualifying income,” which generally consists of dividends, interest, gains on investment assets and certain other categories of investment

iM DBi Managed Futures Strategy ETF

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| at June 30, 2019 (Unaudited) |