Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-131111

Prospectus Supplement (to Prospectus dated April 17, 2006)

$1,320,974,000

NovaStar Mortgage Funding Trust, Series 2006-1

Issuing Entity

NovaStar Home Equity Loan Asset-Backed Notes, Series 2006-1

NovaStar Mortgage, Inc.

(Sponsor and Servicer)

NovaStar Certificates Financing Corporation

(Depositor)

The trust fund —

| • | The trust fund consists primarily of two groups of residential mortgage loans. One group contains first lien and second lien fixed- and adjustable-rate conforming balance, subprime mortgage loans and the other group contains first lien and second lien fixed- and adjustable rate conforming and non-conforming balance, subprime mortgage loans. |

The notes —

| • | The issuing entity will issue five classes of senior notes and eleven classes of mezzanine notes. |

Credit enhancement —

| • | The Class A Notes will be supported by the Class M Notes. Each class of Class M Notes will be supported by the classes of Class M Notes having a lower payment priority, with the most subordinate class being supported by overcollateralization. |

| • | Excess interest and net swap and cap payments will be used to maintain a required level of overcollateralization. |

| • | The Class A Notes will be cross-collateralized to a limited extent and the Class M Notes will be collateralized by mortgage loans in both groups. |

| • | Certain mortgage loans are covered by a mortgage insurance policy. |

You should read the section entitled “Risk Factors” starting on page S-17 of this prospectus supplement and on page 5 of the accompanying prospectus and consider these factors before making a decision to invest in the notes.

The notes represent non-recourse obligations of the issuing entity only and are not interests in or obligations of any other person.

Neither the notes nor the mortgage loans will be insured or guaranteed by any governmental agency or instrumentality.

Original Class Note Balance | Pass-Through Rate | Price to Public | Underwriting Discount | Proceeds to the Depositor (2) | ||||||||||

Class A-1A Notes | $ | 767,078,000 | LIBOR + 0.16%(1) | 100.00000 | % | 0.19455 | % | $ | 765,585,613.70 | |||||

Class A-2A Notes | $ | 182,000,000 | LIBOR + 0.06%(1) | 100.00000 | % | 0.21500 | % | $ | 181,608,700.00 | |||||

Class A-2B Notes | $ | 91,700,000 | LIBOR + 0.11%(1) | 100.00000 | % | 0.22000 | % | $ | 91,498,260.00 | |||||

Class A-2C Notes | $ | 71,400,000 | LIBOR + 0.16%(1) | 100.00000 | % | 0.22500 | % | $ | 71,239,350.00 | |||||

Class A-2D Notes | $ | 32,621,000 | LIBOR + 0.27%(1) | 100.00000 | % | 0.23000 | % | $ | 32,545,971.70 | |||||

Class M-1 Notes | $ | 78,300,000 | LIBOR + 0.30%(1) | 100.00000 | % | 0.23000 | % | $ | 78,119,910.00 | |||||

Class M-2 Notes | $ | 21,600,000 | LIBOR + 0.35%(1) | 100.00000 | % | 0.25000 | % | $ | 21,546,000.00 | |||||

Class M-3 Notes | $ | 18,900,000 | LIBOR + 0.41%(1) | 100.00000 | % | 0.27500 | % | $ | 18,848,025.00 | |||||

Class M-4 Notes | $ | 18,225,000 | LIBOR + 0.44%(1) | 100.00000 | % | 0.30000 | % | $ | 18,170,325.00 | |||||

Class M-5 Notes | $ | 12,825,000 | LIBOR + 0.53%(1) | 100.00000 | % | 0.35000 | % | $ | 12,780,112.50 | |||||

Class M-6 Notes | $ | 10,125,000 | LIBOR + 1.00%(1) | 100.00000 | % | 0.40000 | % | $ | 10,084,500.00 | |||||

Class M-7 Notes | $ | 8,775,000 | LIBOR + 1.12%(1) | 100.00000 | % | 0.43000 | % | $ | 8,737,267.50 | |||||

Class M-8 Notes | $ | 7,425,000 | LIBOR + 1.95%(1) | 100.00000 | % | 0.52441 | % | $ | 7,386,062.60 | |||||

Total | $ | 1,320,974,000 | $ | 1,318,150,098.00 | ||||||||||

| (1) | Subject to increase as described herein and subject to a related available funds cap rate described herein and a maximum rate of 11%. |

| (2) | Before deducting expenses, estimated to be $740,000.00. |

Table of Contents

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

Greenwich Capital Markets, Inc., Deutsche Bank Securities Inc., Wachovia Capital Markets, LLC and Morgan Stanley & Co. Incorporated as underwriters, will offer the offered notes only after the offered notes have been issued, delivered to and accepted by the underwriters. The underwriters have the right to reject any order. We expect to deliver the offered notes on or about April 28, 2006 through The Depository Trust Company and upon request through Clearstream Banking Luxembourg or the Euroclear System.

| RBS GREENWICH CAPITAL | DEUTSCHE BANK SECURITIES | WACHOVIA SECURITIES |

(Joint Lead Managers and Joint Book-Runners)

MORGAN STANLEY

(Co-Manager)

The date of this Prospectus Supplement is April 20, 2006.

Table of Contents

Important notice about the information presented in this

prospectus supplement and the accompanying prospectus

We provide information to you about the notes in two separate documents that provide progressively more detail:

| • | the accompanying prospectus, which provides general information, some of which may not apply to your series of notes, and |

| • | this prospectus supplement, which describes the specific terms of your series of notes. |

If the accompanying prospectus contemplates multiple options, you should rely on the information in this prospectus supplement as to the applicable option.

We cannot sell the notes to you unless you have received both this prospectus supplement and the accompanying prospectus.

We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find further information concerning a particular topic. The following table of contents provides the pages on which these captions are located.

i

Table of Contents

| S-1 | ||

| S-3 | ||

| S-17 | ||

| S-26 | ||

Formation of the Issuing Entity and Issuance of the Trust Certificates | S-26 | |

| S-26 | ||

| S-26 | ||

| S-27 | ||

| S-27 | ||

| S-28 | ||

| S-49 | ||

| S-67 | ||

| S-86 | ||

| S-90 | ||

| S-90 | ||

| S-95 | ||

| S-95 | ||

| S-96 | ||

| S-96 | ||

Foreclosure and Delinquency Experience with Non-Conforming Mortgage Loans | S-96 | |

| S-97 | ||

| S-97 | ||

| S-97 | ||

| S-98 | ||

| S-98 | ||

| S-98 | ||

| S-99 | ||

| S-99 | ||

| S-99 | ||

| S-100 | ||

| S-101 | ||

| S-102 | ||

| S-102 | ||

| S-103 | ||

| S-104 | ||

| S-106 | ||

| S-106 | ||

| S-108 | ||

| S-110 | ||

| S-110 | ||

| S-114 | ||

| S-114 | ||

| S-115 | ||

| S-115 | ||

| S-117 | ||

| S-118 | ||

| S-118 | ||

| S-118 | ||

| S-119 | ||

| S-119 | ||

| S-119 | ||

Relief Act Interest Shortfalls and Prepayment Interest Shortfalls | S-119 | |

| S-120 | ||

| S-120 | ||

| S-121 | ||

| S-123 | ||

| S-125 | ||

| S-125 | ||

| S-143 | ||

| S-143 | ||

| S-146 | ||

| S-147 | ||

| S-147 | ||

| S-147 | ||

| S-151 | ||

| S-151 | ||

| S-153 | ||

ii

Table of Contents

S-1

Table of Contents

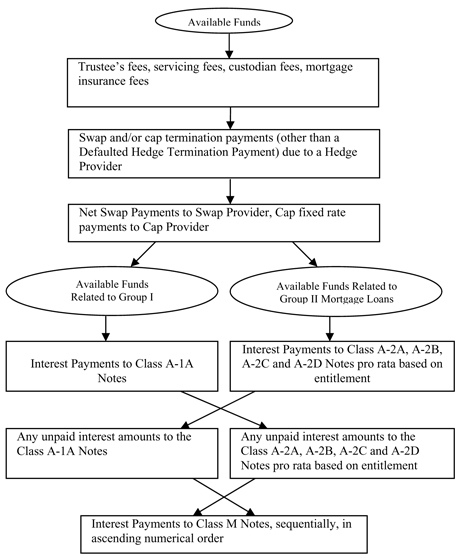

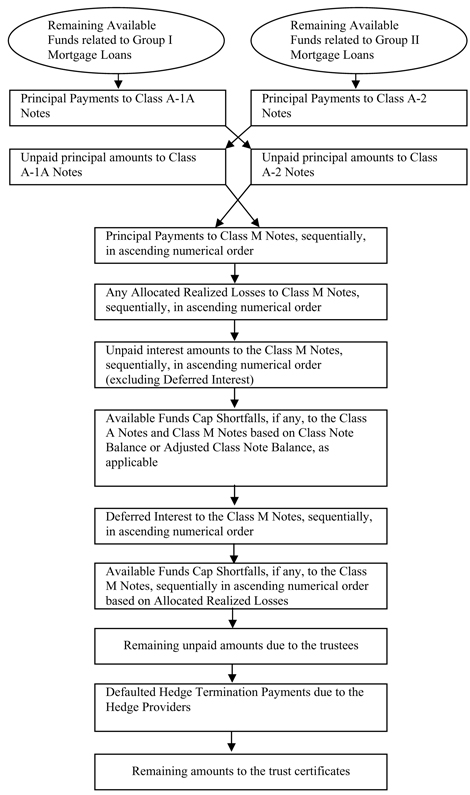

Flow of Funds Diagram (cont’d)

S-2

Table of Contents

This section gives a brief summary of the information contained herein. The summary does not include all of the important information about the notes. We encourage you to review carefully the more detailed information in this prospectus supplement and in the attached prospectus.

Capitalized terms used in this prospectus supplement are defined under the caption“Glossary.”

| Issuing Entity | NovaStar Mortgage Funding Trust, Series 2006-1. | |

| Sponsor, Originator and Servicer | NovaStar Mortgage, Inc. | |

| Depositor | NovaStar Certificates Financing Corporation. | |

| Indenture Trustee | JPMorgan Chase Bank, National Association, a banking association organized under the laws of the United States. | |

| Owner Trustee | Wilmington Trust Company. | |

| Custodian | U.S. Bank National Association. | |

| Swap Providers | Deutsche Bank AG, The Royal Bank of Scotland plc and Wachovia Bank, N.A. | |

| Cap Provider | Wachovia Bank, N.A. The Swap Providers and the Cap Provider are sometimes collectively referred to herein as the Hedge Providers. | |

| Mortgage Insurance Providers | Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc. and PMI Mortgage Insurance Company. | |

| Cut-off Date | April 1, 2006. | |

| Closing Date | On or about April 28, 2006. | |

| Payment Date | The 25th day of each month, or if such day is not a business day, on the next business day, beginning in May 2006. | |

| Record Date | For any payment date, the last business day immediately preceding the related payment date so long as the notes are in book-entry form and for notes in definitive form, the last business day of the month immediately preceding the month in which the payment date occurs. | |

| The Trust | The notes represent obligations of the issuing entity and will be secured by conventional, first and second lien, fixed and adjustable rate, fully amortizing, interest only and balloon, residential, subprime mortgage loans having a total principal balance as of the related cut-off date, of approximately $1,349,999,494. The mortgage loans to be included in the trust will be divided into two loan groups, as described under “The Mortgage Loans” below. | |

S-3

Table of Contents

| Classes of Notes | The issuing entity will issue the classes of notes listed in the table on the front cover of this prospectus supplement. The issuing entity will also issue the following securities which will not be offered by this prospectus supplement: the Class M-9 Notes, the Class M-10 Notes, the Class M-11 Notes and the trust certificates including the Class C Certificates which (i) entitle the holder to receive payments from excess cashflow, (ii) entitle the holder to receive all collected prepayment charges, (iii) represent the overcollateralization amount and (iv) represent ownership of the issuing entity. | |

| The issuing entity will initially issue the notes in book-entry form. You will hold your interest in the notes through The Depository Trust Company in the United States, or Clearstream Banking, société anonyme or the Euroclear Bank, S.A./N.V. in Europe, or indirectly through participants in these systems. You will not be entitled to receive a definitive note representing your interest except under limited circumstances. | ||

| See“Description of the Notes and the Trust Certificates” for a discussion of the minimum denominations and the incremental denominations of each class of notes and“Description of the Notes and the Trust Certificates—Book-Entry Notes” in this prospectus supplement. | ||

| The issuing entity will issue the notes under an indenture, dated as of April 1, 2006, between the issuing entity and the indenture trustee. | ||

| As used in this prospectus supplement, the following terms refer to the following classes of notes: | ||

| Offered Notes: | Class A and Class M Notes (other than the Class M-9, Class M-10 and Class M-11 Notes). | |||

| Class A Notes: | Class A-1A and Class A-2 Notes. | |||

| Class A-2 Notes: | Class A-2A, Class A-2B, Class A-2C and Class A-2D Notes. The Class A-2 Notes are sometimes referred to herein as the Group II Notes. | |||

| Class M Notes: | Class M-1 Notes, Class M-2 Notes, Class M-3 Notes, Class M-4 Notes, Class M-5 Notes, Class M-6 Notes, Class M-7 Notes, Class M-8 Notes, Class M-9 Notes, Class M-10 Notes and Class M-11 Notes. The Class M Notes are sometimes referred to herein as the mezzanine notes. | |||

S-4

Table of Contents

| Payments on the Class A-1A Notes will be based primarily on collections from the Group I mortgage loans. | ||

| Payments on the Class A-2 Notes will be based primarily on collections from the Group II mortgage loans. | ||

| Payments on the Class M Notes will be based on collections from both groups of mortgage loans. | ||

| The right of the holders of each class of Class M Notes to receive payments is subordinate to the right of the holders of each class of Class A Notes to receive payments, as well as to the rights of the holders of more senior classes of Class M Notes to receive payments. | ||

| Trust Certificates | The issuing entity will also issue one or more classes of trust certificates representing the entire beneficial ownership interest in the issuing entity. The trust certificates are not offered by this prospectus supplement. | |

| Payments of Interest | On each payment date, each class of notes is entitled to receive: | |

• Accrued Note Interest. The amount of interest that accrued during the related accrual period for that class on the outstanding principal balance of that class, at the Note Rate for that class, as reduced by certain shortfalls described herein,provided,however, that in the case of any Class M Note, such amount shall be reduced by the amount of Deferred Interest for such class, and

• Unpaid Interest Shortfalls. Any Accrued Note Interest that was due on a prior payment date that was not paid, together with interest on that previously unpaid amount. | ||

| Accrual Periods. The accrual period for the Offered Notes for each payment date is the period from and including the prior payment date (or, in the case of the first payment date, from the closing date) to but excluding the current payment date. Interest will accrue on the Class A and Class M Notes on the basis of a 360-day year and the actual number of days elapsed in the accrual period. | ||

| Interest Rate Swap Agreements. On the closing date, the issuing entity will enter into thirteen interest rate swap agreements with the Swap Providers. Under each interest rate swap agreement, on each payment date the issuing entity will pay to each swap provider a fixed payment as described more fully herein, and each swap provider will pay to the | ||

S-5

Table of Contents

| issuing entity a floating payment equal to one-month LIBOR (as determined pursuant to the related interest rate swap agreement), in each case calculated on a scheduled notional amount. To the extent that any fixed payment exceeds the related floating payment on any payment date, amounts otherwise available to noteholders will be applied to make a net payment to the applicable swap provider, and to the extent that any floating payment exceeds the related fixed payment on any payment date, the applicable swap provider will owe a net payment to the issuing entity. Any net amounts received or paid by the issuing entity under an interest rate swap agreement will either increase or reduce the amount available to make payments on the notes, as described in this prospectus supplement. The interest rate swap agreements terminate after the payment dates in the months described herein. | ||

Interest Rate Cap Agreements. On the closing date, the issuing entity will enter into four interest rate cap agreements with Wachovia Bank, N.A. Under each interest rate cap agreement, on each payment date until that cap agreement is retired, the issuing entity will make a payment equal to a fixed rate on a notional amount to the cap provider, and the issuing entity will receive a payment from the cap provider equal to the product of (a) the excess, if any, of one month LIBOR over the related strike price and (b) a notional amount.

The interest rate swap agreements and interest rate cap agreements are sometimes collectively referred to herein as the Hedge Agreements.

On each payment date amounts received by the issuing entity in respect of the Hedge Agreements will be available to cover Realized Losses experienced during the Collection Period relating to such payment date.

See “Description of the Notes and the Trust Certificates -- Interest Rate Swap and Cap Agreements” in this prospectus supplement. | ||

| Payments of Principal | The amount of principal payable to the notes will be determined by (1) formulas that allocate portions of principal payments received on the mortgage loans in the related group to specified classes of notes, (2) funds actually received on the mortgage loans that are available to make principal payments on the notes, (3) the application of excess interest funds from each mortgage group to pay principal on the notes and (4) amounts advanced by the servicer in respect of principal. Funds actually received on the mortgage loans may consist of monthly scheduled payments, unscheduled payments resulting from prepayments by borrowers, | |

S-6

Table of Contents

liquidation of defaulted mortgage loans, insurance proceeds applied to principal or repurchases of mortgage loans under the circumstances described in this prospectus supplement.

The manner of allocating payments of principal on the mortgage loans to the related classes of notes will differ, as described in this prospectus supplement, depending upon whether a payment date occurs before the payment date in May 2009 or on or after that date, and depending upon whether the Class A Notes have been retired and whether the delinquency or loss performance of the mortgage loans is worse than certain levels set by the rating agencies.

See “Description of the Notes and Trust Certificates—Payments of Principal” in this prospectus supplement.

The notes are due and payable in full, if not sooner paid, on the payment date occurring in May 2036 referred to as the final scheduled payment date. The notes could be retired before the final scheduled payment date.

See “Prepayment and Yield Consequences” in this prospectus supplement for a discussion of the factors that could affect when the principal of each class of notes will be paid in full.

Limited Recourse. The only source of funds available to make interest and principal payments on the notes will be the assets of the issuing entity. The issuing entity will have no source of funds other than collections and recoveries on the mortgage loans through insurance or otherwise (including the mortgage insurance policy) and payments, if any, received under the cap agreements and the interest rate swap agreements. No other entity will be required or expected to make any payments on the notes.

Enhancement of Likelihood of Payment on the Notes. The payment structure of this securitization includes excess interest, overcollateralization, subordination, limited cross-collateralization and the mortgage insurance policy. Each subordinate class of notes is more likely to experience losses than any class that is senior to such subordinate class.

See “Risk Factors—Potential inadequacy of credit enhancement” and “Description of the Notes and the Trust Certificates” in this prospectus supplement for a more detailed description of the excess interest, overcollateralization, subordination, limited cross-collateralization features, and the interest rate swap and cap agreements and see “The Mortgage Loans—The Private Mortgage Insurance Policy” in this prospectus supplement for a more detailed description of the mortgage insurance policy. |

S-7

Table of Contents

Subordination of Payments. The right of the holders of the more junior classes of notes to receive payments is subordinated to the right of the holders of the more senior classes of notes to receive payments.

In general, the protection afforded the holders of more senior classes of notes by means of this subordination will be effected by the preferential right of the holders of the more senior classes to receive, prior to any payment being made on any payment date to the holders of the more junior classes of notes, the amount of interest and principal due on such more senior classes of notes and, if necessary, by the right of such more senior holders to receive future payments on the mortgage loans that would otherwise have been allocated to the holders of the more junior classes of notes.

Excess Interest. The mortgage loans bear interest each month that, in the aggregate, is expected to exceed the amount needed to pay monthly interest on the notes and certain fees and expenses of the issuing entity. The “excess interest” received from the mortgage loans each month will be available, after taking into account certain payments received by or paid by the issuing entity under the interest rate swap and cap agreements as described herein, to absorb Realized Losses on the mortgage loans, to maintain overcollateralization at the required level, and to provide a limited cross-collateralization.

Overcollateralization. The overcollateralization amount is the excess of the aggregate outstanding scheduled principal balance of the mortgage loans over the aggregate principal amount of the notes. On the closing date, the overcollateralization amount will equal approximately $6,750,494 (which represents approximately 0.50% of the closing date pool balance).

Generally, because more interest is required to be paid by the mortgagors than is necessary to pay the interest accrued on the notes and the expenses of the issuing entity, there is expected to be excess interest. If the overcollateralization amount is reduced below the required overcollateralization amount as a result of losses on the mortgage loans, the issuing entity will apply some or all of this excess interest as principal payments on those classes of notes then entitled to receive payments of principal, until the overcollateralization target is restored, resulting in an acceleration of amortization of such notes relative to the mortgage loans. This acceleration feature is intended to restore overcollateralization. Once the required level of overcollateralization is restored, the acceleration feature will |

S-8

Table of Contents

cease, unless it becomes necessary again to restore the required level of overcollateralization. The actual level of overcollateralization may increase or decrease over time. This could result in a temporarily faster or slower amortization of the notes.

See “Risk Factors—Potential inadequacy of credit enhancement” and “Description of the Notes and the Trust Certificates—Overcollateralization Provisions” in this prospectus supplement.

Cross-Collateralization. Excess interest from one group may be used to fund shortfalls in certain interest payments due to the holders of Class A Notes relating to the other group and to maintain the overcollateralization amount at its target level. In addition, if the Class A Notes relating to one group have been retired, then principal payments on the mortgage loans relating to the retired Class A Notes will be paid to the remaining Class A Notes relating to the other group, if any, before being paid to the Class M Notes. Collections from both groups, to the extent available after making payments to the Class A Notes, will be used to make payments on the Class M Notes.

See “Description of the Notes and the Trust Certificates—Payments of Principal” and “—Cross-collateralization Provisions” in this prospectus supplement. | ||

Mortgage Insurance. Approximately 56.67% of the mortgage loans are covered by a mortgage insurance policy issued by Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc. or PMI Mortgage Insurance Co. Each such mortgage loan has an original loan-to-value ratio of at least 60% and the related mortgage insurance policy insures losses to the extent that the uninsured exposure of the related mortgage loan is reduced to an amount equal to 55%, 50% or 51%, respectively, of the original loan-to-value ratio of such mortgage loan, as more fully described in the related mortgage insurance policy.

Approximately 99.92%, 0.02% and 0.06% of the mortgage loans that are covered by a mortgage insurance policy are insured by Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc. and PMI Mortgage Insurance Co., respectively. | ||

| See “The Mortgage Loans—The Private Mortgage Insurance Policies” in this prospectus supplement. | ||

S-9

Table of Contents

| Allocation of Losses | Following the reduction of the Overcollateralization Amount to zero, all allocable Realized Losses will be allocated in reverse sequential order, first to the Class M-11 Notes, second to the Class M-10 Notes, third to the Class M-9 Notes, fourth to the Class M-8 Notes, fifth to the Class M-7 Notes, sixth to the Class M-6 Notes, seventh to the Class M-5 Notes, eighth to the Class M-4 Notes, ninth to the Class M-3 Notes, tenth to the Class M-2 Notes and eleventh to the Class M-1 Notes; provided, however, the allocation of Realized Losses to the Class M Notes will not result in a write down of the related Class Note Balances. | |

| It is possible that under certain loss scenarios there will not be enough principal and interest on the mortgage loans to pay the Class A Notes all interest and principal amounts to which such notes are then entitled and it is likely that under certain loss scenarios there will not be enough principal and interest on the mortgage loans to pay the Class M Notes all interest and principal amounts to which such notes are entitled. | ||

| The Mortgage Loans | The mortgage loans will be secured by first lien or second lien mortgages or deeds of trust on residential properties. The mortgage loans will be segregated as follows: | |

| Group I | fixed and adjustable rate, level pay, interest-only and balloon loans with principal balances at origination that conform to certain agency investment guidelines. | |||

| Group II | fixed and adjustable rate, level pay, interest-only and balloon loans with principal balances at origination that may or may not conform to certain agency investment guidelines. | |||

| The mortgage loans consist of loans used to purchase a new home, to refinance an existing mortgage loan, to consolidate debt and/or to obtain cash proceeds by borrowing against the mortgagor’s equity in the property. The issuing entity will purchase the mortgage loans on the closing date. | ||

| The Group I mortgage loans will consist of 5,679 loans, with an aggregate principal balance of $904,573,565. The Group II mortgage loans will consist of 2,205 loans with an aggregate principal balance of $445,425,930. | ||

The mortgage loans have the following approximate characteristics as of the cut-off date: | ||

Adjustable-rate mortgage loans: 83.52% | ||

Fixed-rate mortgage loans: 16.48% | ||

Interest only mortgage loans: 18.91% | ||

Second lien mortgage loans: 3.60% | ||

Range of mortgage rates: 5.400% to 13.100% | ||

Weighted average mortgage rate: 8.626% | ||

S-10

Table of Contents

Range of gross margins of the adjustable-rate mortgage loans: 0.850% to 8.150% | ||

Weighted average gross margin of the adjustable-rate mortgage loans: 5.675% | ||

Range of minimum mortgage rates of the adjustable-rate mortgage loans: 4.850% to 13.100% | ||

Weighted average minimum mortgage rate of the adjustable-rate mortgage loans: 8.568% | ||

Range of maximum mortgage rates of the adjustable-rate mortgage loans: 11.450% to 20.100% | ||

Weighted average maximum mortgage rate of the adjustable-rate mortgage loans: 15.537% | ||

Weighted average next adjustment date of the adjustable-rate mortgage loans: February 1, 2008 | ||

Weighted average remaining term to stated maturity: 349 months | ||

Range of principal balances as of the cut-off date: $6,144 to $1,140,000 | ||

Average principal balance as of the cut-off date: $171,233 | ||

Range of original loan- to-value ratios(1): 11.11% to 100.00% | ||

Weighted average original loan-to-value ratio(1): 80.62% | ||

Geographic concentrations in excess of 5%: | ||

California 19.43% | ||

Florida 24.33% | ||

Maryland 6.68% | ||

________ (1) As used in this prospectus supplement, the loan-to-value ratio for any second lien mortgage loan will mean the combined loan-to-value ratio. | ||

The Group I Mortgage Loans have an aggregate principal balance of approximately $904,573,565 as of the cut-off date and have the following approximate characteristics as of the cut-off date: | ||

Adjustable-rate Group I Mortgage Loans: 81.66% | ||

Fixed-rate Group I Mortgage Loans: 18.34% | ||

Interest-only Group I Mortgage Loans: 14.25% | ||

Second lien Group I Mortgage Loans: 1.32% | ||

S-11

Table of Contents

Range of mortgage rates: 5.400% to 13.100% | ||

Weighted average mortgage rate: 8.597% | ||

Range of gross margins of the adjustable-rate Group I Mortgage Loans: 3.450% to 8.150% | ||

Weighted average gross margin of the adjustable-rate Group I Mortgage Loans: 5.754% | ||

Range of minimum mortgage rates of the adjustable-rate Group I Mortgage Loans: 4.850% to 13.100% | ||

Weighted average minimum mortgage rate of the adjustable-rate Group I Mortgage Loans: 8.622% | ||

Range of maximum mortgage rates of the adjustable-rate Group I Mortgage Loans: 11.750% to 20.100% | ||

Weighted average maximum mortgage rate of the adjustable-rate Group I Mortgage Loans: 15.591% | ||

Weighted average next adjustment date of the adjustable-rate Group I Mortgage Loans: February 1, 2008 | ||

Weighted average remaining term to stated maturity: 353 months | ||

Range of principal balances as of the cut-off date: $10,688 to $573,915 | ||

Average principal balance as of the cut-off date: $159,284 | ||

Range of original loan-to-value ratios(1): 11.11% to 100.00% | ||

Weighted average original loan-to-value ratio(1): 78.81% | ||

Geographic concentrations in excess of 5%: | ||

California 14.61% | ||

Florida 23.34% | ||

Maryland 7.53% | ||

________ (1) As used in this prospectus supplement, the loan-to-value ratio for any second lien mortgage loan will mean the combined loan-to-value ratio. | ||

The Group II Mortgage Loans have an aggregate principal balance of approximately $445,425,930 as of the cut-off date and have the following approximate characteristics as of the cut-off date: | ||

Adjustable-rate Group II Mortgage Loans: 87.29% | ||

S-12

Table of Contents

Fixed-rate Group II Mortgage Loans: 12.71% | ||

Interest-only Group II Mortgage Loans: 28.38% | ||

Second lien Group II Mortgage Loans: 8.22% | ||

Range of mortgage rates: 5.625% to 13.000% | ||

Weighted average mortgage rate: 8.684% | ||

Range of gross margins of the adjustable-rate Group II Mortgage Loans: 0.850% to 8.000% | ||

Weighted average gross margin of the adjustable-rate Group II Mortgage Loans: 5.523% | ||

Range of minimum mortgage rates of the adjustable-rate Group II Mortgage Loans: 6.150% to 12.990% | ||

Weighted average minimum mortgage rate of the adjustable-rate Group II Mortgage Loans: 8.465% | ||

Range of maximum mortgage rates of the adjustable-rate Group II Mortgage Loans: 11.450% to 19.990% | ||

Weighted average maximum mortgage rate of the adjustable-rate Group II Mortgage Loans: 15.434% | ||

Weighted average next adjustment date of the adjustable-rate Group II Mortgage Loans: February 1, 2008 | ||

Weighted average remaining term to stated maturity: 343 months | ||

Range of principal balances as of the cut-off date: $6,144 to $1,140,000 | ||

Average principal balance as of the cut-off date: $202,007 | ||

Range of original loan- to-value ratios(1): 37.50% to 100.00% | ||

Weighted average original loan-to-value ratio(1): 84.28% | ||

Geographic concentrations in excess of 5%: | ||

California 29.22% | ||

Florida 26.36% | ||

________ (1) As used in this prospectus supplement, the loan-to-value ratio for any second lien mortgage loan will mean the combined loan-to-value ratio. | ||

S-13

Table of Contents

For additional information on the Mortgage Loans, see “The Mortgage Loans” in this prospectus supplement. | ||

| Removal and Substitution of Mortgage Loans | Upon the earlier of discovery or receipt of notice by the sponsor of a breach of any of the representations and warranties contained in the sale and servicing agreement which materially and adversely affects the value of the related mortgage loan or the interests of the noteholders in the related mortgage loan, the sponsor will have a period of sixty days to effect a cure. If the breach is not cured within the sixty-day period, the sponsor will either (a) substitute for such mortgage loan a Qualified Substitute Mortgage Loan or (b) purchase such mortgage loan from the issuing entity.See “Description of the Notes and Trust Certificates—Representations and Warranties of the Sponsor” in this prospectus supplement.

The custodian will review each mortgage loan file and if during the process of reviewing the mortgage files, finds any document constituting a part of a mortgage file which is not executed, has not been received, is unrelated to the mortgage loan, or does not conform to the requirements in the sale and servicing agreement, the custodian will promptly so notify the servicer and the sponsor in writing with details thereof. If, within sixty days after the custodian’s notice of such defect, the sponsor has not caused the defect to be remedied and the defect materially and adversely affects the value of the related mortgage loan or the interest of the noteholders in the related mortgage loan, the sponsor will either (a) substitute such mortgage loan with a Qualified Substitute Mortgage Loan or (b) purchase such mortgage loan.See“Description of the Notes and Trust Certificates—Delivery of Mortgage Loan Documents” in this prospectus supplement. | |

| Servicing Fee | The servicer will receive a servicing fee on each payment date in an amount equal to interest at the servicing fee rate for a mortgage loan on the outstanding principal balance of that mortgage loan. The servicing fee rate with respect to each mortgage loan will be 0.50% per annum. The servicing fee will be paid out of Available Funds on each payment date prior to any payments on the notes. | |

| Calculation of LIBOR | The London interbank offered rate (“LIBOR”) with respect to any payment date will be determined by the indenture trustee and will equal the posted rate for United States dollar deposits for one month that appeared on Telerate Page 3750 as of 11:00 a.m., London time, on the second LIBOR Business Day prior to the immediately preceding payment date (or, in the case of the first payment date, the second LIBOR business day preceding the closing date). If no such | |

S-14

Table of Contents

| posted rate appears, LIBOR will be determined on the basis of the offered quotation of the reference banks (which shall be four major banks that are engaged in transactions in the London interbank market) identified in the indenture for United States dollar deposits for one month to prime banks in the London interbank market as of 11:00 a.m., London time, on such date.See “Description of the Notes and the Trust Certificates-Calculation of LIBOR” in this prospectus supplement. | ||

| Advancing | The servicer will be required to advance amounts representing delinquent payments of scheduled principal and interest, as well as expenses to preserve and to protect the value of collateral, in each case to the extent considered recoverable. Reimbursement of these advances is senior to payments to noteholders. | |

Optional Clean-up Call by the Sponsor | The sponsor may, at its option, terminate the trust on any payment date when the outstanding principal balance of the mortgage loans is equal to or less than 10% of the original principal balance of the mortgage loans, after giving effect to distributions on that payment date. | |

| Step-Up Margin | If the sponsor does not elect to exercise its clean-up call option, the margin with respect to each class of Class A Notes will double and the margin with respect to each class of Class M Notes will increase by one and a half times on the next payment date following the earliest possible Clean-up Call Date. | |

| ERISA Consequences | Subject to the conditions and considerations described in this prospectus supplement and in the accompanying prospectus, the offered notes may be purchased by pension, profit-sharing and other employee benefit plans, as well as individual retirement accounts and Keogh plans, and by persons investing on behalf of or with plan assets of such plans. | |

| Federal Income Tax Status | It is the opinion of Dewey Ballantine LLP, federal tax counsel to the issuing entity, that for federal income tax purposes: | |

• the notes, other than notes held by the owner of the trust certificates, will be characterized as indebtedness, and | ||

• as long as the trust certificates are held by a “real estate investment trust” or a “qualified REIT subsidiary,” as such terms are defined in Section 856 of the Code, the issuing entity will be treated as a qualified REIT subsidiary. | ||

S-15

Table of Contents

| Each noteholder, by the acceptance of a note, will agree to treat the notes as indebtedness. | ||

| Legal Investment | The Notes will not be “mortgage related securities” under the Secondary Mortgage Market Enhancement Act of 1984. | |

| Ratings | In order to be issued, the notes must receive at least the following ratings from the rating agencies: | |

Class | Ratings (S&P/Moody’s/Fitch) | |||

| Class A-1A | AAA/Aaa/AAA | |||

| Class A-2A | AAA/Aaa/AAA | |||

| Class A-2B | AAA/Aaa/AAA | |||

| Class A-2C | AAA/Aaa/AAA | |||

| Class A-2D | AAA/Aaa/AAA | |||

| Class M-1 | AA/Aa2/AA+ | |||

| Class M-2 | AA/Aa3/AA | |||

| Class M-3 | AA/A1/AA | |||

| Class M-4 | AA-/A2/A+ | |||

| Class M-5 | A+/A3/A+ | |||

| Class M-6 | A/Baa1/A | |||

| Class M-7 | A-/Baa2/A- | |||

| Class M-8 | BBB+/Baa3/BBB+ |

| These ratings subsequently may be lowered, qualified or withdrawn by the rating agencies. These ratings do not cover any payment of Available Funds Cap Shortfalls and Deferred Interest. | ||

| Use of Proceeds | The net proceeds to be received from the sale of the notes, net of expenses of $740,000 to be paid out of the proceeds of this offering, will be applied primarily to repay financing for the mortgage loans. The underwriters or affiliates of the underwriters have provided financing for certain of the mortgage loans. | |

S-16

Table of Contents

An investment in the notes involves significant risks. Before you decide to invest in the notes, we recommend that you carefully consider the following risk factors and the risk factors discussed under the heading“Risk Factors” beginning on page 5 of the prospectus.

Some of the loans in the mortgage pool were underwritten to non-conforming standards and may experience higher delinquency and loss rates

The underwriting standards for the mortgage loans are described under “Description of the Mortgage Pool—Underwriting Standards for the Mortgage Loans”, and are primarily intended to provide single family mortgage loans for non-conforming credits which do not satisfy the requirements of typical “A” credit borrowers. A “non-conforming credit” means a borrower whose mortgage loan would be ineligible for direct purchase by Fannie Mae due to credit characteristics that do not meet the Fannie Mae underwriting guidelines, for reasons such as creditworthiness and repayment ability. These mortgagors may have a record of credit write-offs, outstanding judgments, prior bankruptcies and other negative credit items. Accordingly, mortgage loans underwritten to non-conforming credit underwriting standards or to standards that do not meet the requirements for typical “A” credit borrowers are likely to experience rates of delinquency, foreclosure and loss that are higher, and may be substantially higher, than mortgage loans originated in accordance with the Fannie Mae underwriting guidelines or to typical “A” credit borrowers.

The mortgage pool contains high original loan-to-value loans which could cause losses to holders of the Class A and Class M Notes

Approximately 60.90% of the Group I mortgage loans and approximately 60.55% of the Group II mortgage loans (in each case, by aggregate principal balance of the related loan group as of the cut-off date), respectively, with an original loan-to-value ratio (references to loan-to-value ratios in this prospectus supplement are references to combined loan-to-value ratios with respect to second-lien mortgage loans) of at least 60% will be covered by a mortgage insurance policy obtained on behalf of the issuing entity.

Approximately 44.00% and 42.91% of the Group I mortgage loans and Group II mortgage loans (in each case, by aggregate principal balance of the related loan group as of the cut-off date), respectively, have original loan-to-value ratios in excess of 80%. Mortgage loans with a loan-to-value ratio in excess of 80% will be affected to a greater extent than mortgage loans with a loan-to-value ratio equal to or less than 80% by any decline in the value of the related property securing such mortgage loans. We can give no assurance that values of the mortgaged properties have remained or will remain at their levels on the dates of origination of the related mortgage loans. If the residential real estate market should experience an overall decline in property values such that the outstanding balances of the mortgage loans, and any secondary financing on the mortgaged properties, become equal to or greater than the value of the mortgaged properties, the actual rates of delinquencies, foreclosures and losses could be higher than those now generally experienced in the mortgage lending industry.

Potential inadequacy of credit enhancement

The overcollateralization, subordination, limited cross-collateralization, loss allocation, excess cashflow and primary mortgage insurance features described in this prospectus supplement are intended to enhance the likelihood that the noteholders will receive regular payments of interest and principal, but such credit enhancements are limited in nature and may be insufficient to cover all losses on the mortgage loans.

S-17

Table of Contents

Although a primary mortgage insurance policy has been acquired on behalf of the issuing entity from each of the mortgage insurance providers, such coverage will provide only limited protection against losses on defaulted covered mortgage loans. Unlike a financial guaranty policy, coverage under each mortgage insurance policy is subject to certain limitations and exclusions including, for example, losses resulting from fraud and physical damage to the mortgaged property and to certain conditions precedent to payment, such as notices and reports. As a result, coverage may be denied or limited on covered mortgage loans. In addition, since the amount of coverage depends on the loan-to-value ratio at the time of origination of the covered mortgage loan, a decline in the value of a mortgaged property will not result in increased coverage, and the issuing entity may still suffer a loss on a covered mortgage loan. The mortgage insurance providers also may affect the timing and conduct of foreclosure proceedings and other servicing decisions regarding defaulted mortgage loans covered by the policy.

The mortgage pool includes balloon loans, which can create increased risk of losses

Approximately 1.72% and 7.39% of the Group I and the Group II mortgage loans (in each case, by aggregate principal balance of the related loan group as of the cut-off date), respectively, are fixed-rate “balloon loans”; that is, they require monthly payments of principal based on 30-year amortization schedules and have scheduled maturity dates of 15 years from the due date of the first monthly payment or they require monthly payments of principal based on 40-year amortization schedules and have scheduled maturity dates of 30 years from the due date of the first monthly payment, in each case leaving a substantial portion of the original principal amount due and payable on the respective scheduled maturity date; or they are adjustable rate “balloon loans”; that is, they have interest rates that are fixed for two or three years and then the interest rates float for twenty-eight or twenty-seven years, respectively, and they require monthly payments of principal based on 40-year amortization schedules and have scheduled maturity dates of 30 years from the due date of the first monthly payment. The balloon loans entail a greater degree of risk for prospective investors because the ability of a mortgagor to make a balloon payment typically will depend upon the mortgagor’s ability either to refinance the related balloon loan or to sell the related mortgaged property. The mortgagor’s ability to sell or refinance will be affected by a number of factors, including the level of prevailing mortgage rates at the time of sale or refinancing, the mortgagor’s equity in the related mortgaged property, the financial condition and credit profile of the mortgagor, applicable tax laws and general economic conditions. No person is obligated to refinance any balloon loan.

The mortgage pool includes mortgage loans secured by second-liens on the related mortgaged property

Approximately 1.32% of the Group I mortgage loans and approximately 8.22% of the Group II mortgage loans (by aggregate principal balance as of the cut-off date) are secured by second-liens on the related mortgaged properties. The proceeds from any liquidation, insurance or condemnation proceedings will be available to satisfy the outstanding balance of such mortgage loans only to the extent that the claims of the related senior mortgages have been satisfied in full, including any related foreclosure costs. In circumstances when it has been determined to be uneconomical to foreclose on the mortgaged property, the servicer may write off the entire balance of such second-lien mortgage loan as a bad debt. The foregoing considerations will be particularly applicable to mortgage loans secured by second-liens that have high loan-to-value ratios because it is comparatively more likely that the servicer would determine foreclosure to be uneconomical in the case of such mortgage loans. The rate of default of second-lien mortgage loans may be greater than that of mortgage loans secured by first-liens on comparable properties.

An overall decline in the residential real estate markets could adversely affect the values of the mortgaged properties and cause the outstanding principal balances of the second-lien mortgage loans,

S-18

Table of Contents

together with the senior mortgage loans secured by the same mortgaged properties, to equal or exceed the value of the mortgaged properties. This type of a decline would adversely affect the position of a second mortgagee before having the same effect on the related first mortgagee. A rise in interest rates over a period of time and the general condition of a mortgaged property as well as other factors may have the effect of reducing the value of the mortgaged property from the appraised value at the time the mortgage loan was originated. If there is a reduction in value of the mortgaged property, the ratio of the amount of the mortgage loan to the value of the mortgaged property may increase over what it was at the time the mortgage loan was originated. This type of increase may reduce the likelihood of liquidation or other proceeds being sufficient to satisfy the second-lien mortgage loan after satisfaction of any senior liens.

The prepayment experience of the second lien loans may differ from that of the first lien loans. Second lien mortgage loans often are not viewed as permanent financing and may be more likely to be prepaid. However, the smaller monthly payment relative to that of a first lien mortgage loan may reduce the perceived benefits of refinancing. Changes in the tax laws governing deductibility of mortgage interest are likely to have a greater effect on second lien loans than on first lien loans.

The mortgage pool includes interest-only mortgage loans, which may have an increased risk of loss

Approximately 14.25% and 28.38% of the Group I and Group II mortgage loans (by aggregate principal balance of the related loan group as of the cut-off date), respectively, do not provide for any required payments of principal during the first five or ten years of their term. These loans are sometimes referred to as interest only loans. Interest only loans may have risks and payment characteristics that are not present with fully amortizing mortgage loans, including the following:

| • | no principal distributions will be made to noteholders from interest only loans during their interest only period except in the case of a prepayment, which may extend the weighted average lives of the notes; |

| • | during the interest only period interest only loans may be less likely to prepaid since the perceived benefits of refinancing may be less than with a fully amortizing mortgage loan; |

| • | as the end of the interest only period approaches, an interest only loan may be more likely to be refinanced in order to avoid the increase in the monthly payment required to amortize the loan over its remaining term; |

| • | interest only loans may be more likely to default than fully amortizing loans a the end of the interest only period due to the increased monthly payment required to amortize the loan over its remaining term; and |

| • | if an interest only loan defaults, the severity of loss may be greater due to the larger unpaid principal balance. |

The mortgage loans have geographic concentrations which could cause losses to the holders if certain events occur in such regions

Approximately 14.61%, 23.34% and 7.53% of the Group I mortgage loans (by aggregate principal balance of the Group I mortgage loans as of the cut-off date) are secured by properties located in California, Florida and Maryland, respectively. Approximately 29.22%, and 26.36% of the Group II mortgage loans (by aggregate principal balance of the Group II mortgage loans as of the cut-off date) are secured by properties located in California and Florida respectively. In the event any of these states experiences a decline in real estate values, losses on the mortgage loans may be greater than otherwise would be the case. Such mortgage loans may be subject to prepayment or loss, both of which could affect the yield on the class A and mezzanine notes.

S-19

Table of Contents

Certain risks are associated with the 40/30 mortgage loans owned by the issuing entity

Approximately 4.04% of the mortgage loans by cut-off date principal balance are adjustable rate mortgage loans and are intended to have a maturity date set at 30 years from origination and monthly payments set to amortize the principal balance of the loan over a term of 40 years from origination. The 40 year amortization schedule results in lower monthly payments for the borrower compared to traditional 30 year mortgage loans. Unless the loan is prepaid by the borrower, the 40 year amortization schedule will also result in the borrower owing a significant balloon payment on the 30th anniversary of origination.

A possible interpretation of the mortgage loans may be that the monthly payments are to be reset after the first adjustment date so that the monthly payment will amortize the principal balance of the mortgage loans over a term of 30 years from origination. If such interpretation were correct, it could result in a reduction of collections otherwise due to the issuing entity and could mean that the disclosures made to the borrower may have violated applicable law. The sponsor has agreed to send written correspondence to each borrower who received this type of loan confirming with the borrower that they understand that the loan they received has a 30 year maturity date and a 40 year amortization term. The correspondence will also confirm with the borrower that they understand these loans will result in a significant balloon payment on the 30th year. There can be no assurance that such letters will fully resolve any potential risks involved with the interpretation of these loans or the required legal disclosures.

In the event it is determined that any such loan is considered to provide for a 30 year amortization or that the disclosures violated applicable law, the sponsor will be required to repurchase the applicable loan from the issuing entity. If a significant number of loans are repurchased, the weighted average lives of the notes may be shortened.

The rate and timing of principal prepayments on the mortgage loans could adversely affect the yield on the class A and mezzanine notes

The rate and timing of principal payments on the notes will depend on the rate and timing of principal payments (including prepayments, defaults, liquidations, purchases of the mortgage loans due to a breach of a representation or warranty and the servicer’s limited right to purchase delinquent mortgage loans) on the mortgage loans. Accordingly, the notes are subject to inherent cash-flow uncertainties because the mortgage loans may be prepaid at any time. The Class A-1A Notes will primarily bear the prepayment risk of the Group I mortgage loans, the Group II Notes will primarily bear the prepayment risk of the Group II mortgage loans and the mezzanine notes will bear the prepayment risk of both Groups of mortgage loans. Generally, when prevailing interest rates increase, prepayment rates on mortgage loans tend to decrease, resulting in a slower return of principal to investors at a time when reinvestment at such higher prevailing rates would be desirable. Conversely, when prevailing interest rates decline, prepayment rates on mortgage loans tend to increase, resulting in a faster return of principal to investors at a time when reinvestment at comparable yields may not be possible.

Approximately 59.94% and 58.64% of the Group I mortgage loans and Group II mortgage loans (in each case, by aggregate principal balance of the related loan group as of the cut-off date), respectively, are subject to prepayment charges as of the cut-off date. Of the Group I mortgage loans that are subject to prepayment charges, approximately 80.33% are ARM loans and 19.67% are fixed-rate mortgage loans. Of the Group II mortgage loans that are subject to prepayment charges, approximately 88.19% are ARM

S-20

Table of Contents

loans and 11.81% are fixed-rate mortgage loans. Typically, the mortgage loans with a prepayment charge provision provide for a prepayment charge for partial prepayments and full prepayments. Prepayment charges may be payable for a period of time ranging from one to five years from the related origination date. Such prepayment charges may reduce the rate of prepayment on the mortgage loans. Under certain circumstances, as described in the sale and servicing agreement, the servicer may waive the payment of any otherwise applicable prepayment charge. Investors should conduct their own analysis of the effect, if any, that the prepayment charges, and decisions by the servicer with respect to the waiver thereof, may have on the prepayment performance of the mortgage loans. The depositor makes no representations as to the effect that the prepayment charges, and decisions by the servicer with respect to the waiver thereof, may have on the prepayment performance of the mortgage loans.

See “Certain Yield and Prepayment Considerations” herein and“Description of the Securities—Weighted Average Life of the Securities” in the prospectus.

The yields to maturity on the notes will depend on, among other things, the rate and timing of principal payments (including prepayments, defaults, liquidations, purchases of the mortgage loans due to a breach of a representation or warranty and purchases of delinquent loans by the servicer) on the mortgage loans. The yields to maturity on the notes will also depend on the related note rate and the purchase price for such notes.

If the notes are purchased at a premium and principal payments thereon occur at a rate faster than anticipated at the time of purchase, the investor’s actual yield to maturity will be lower than that assumed at the time of purchase. Conversely, if the notes are purchased at a discount and principal payments thereon occur at a rate slower than that assumed at the time of purchase, the investor’s actual yield to maturity will be lower than that assumed at the time of purchase. The notes were structured assuming, among other things, a prepayment rate and corresponding weighted average lives as described herein. The prepayment, yield and other assumptions to be used for pricing purposes for the notes may vary as determined at the time of sale.

See “Certain Yield and Prepayment Considerations” herein and “Description of the Securities—Weighted Average Life of the Securities” in the prospectus.

Effect of Mortgage Rates on the Note Rates

The Class A and Mezzanine Notes accrue interest at Note Rates based on a one-month LIBOR index plus a specified margin, but such Note Rates are subject to an Available Funds Cap Rate. As a result of the effect of the Available Funds Cap Rate on the Note Rates on the Class A and Mezzanine Notes, such notes may accrue less interest than they would otherwise accrue if their Note Rates were based solely on the one month LIBOR index plus the specified margin.

The adjustable-rate mortgage loans have mortgage rates that adjust based on a six-month LIBOR index. The adjustable-rate mortgage loans have periodic and maximum limitations on adjustments to their mortgage rates, and will have the first adjustment to their mortgage rates generally two years, three years or five years after the origination thereof. The fixed-rate mortgage loans have mortgage rates that will not adjust.

A variety of factors could limit the Note Rates and adversely affect the yields to maturity on the Class A and Mezzanine Notes. Some of these factors are described below.

| • | The Note Rates for the Class A and Mezzanine Notes may adjust monthly while the mortgage rates on the adjustable-rate mortgage loans adjust less frequently and the mortgage rates on the |

S-21

Table of Contents

fixed-rate mortgage loans do not adjust. Furthermore, the adjustable-rate mortgage loans will have the first adjustment to their mortgage rates generally two years, three years or five years following their origination. Consequently, the Available Funds Cap Rate on the Note Rates on the Class A and Mezzanine Notes may prevent any increases in the Note Rates on such notes for extended periods.

| • | If prepayments, defaults and liquidations occur more rapidly on the mortgage loans with relatively higher mortgage rates than on the mortgage loans with relatively lower mortgage rates, the Note Rates on the Class A and Mezzanine Notes are more likely to be limited. |

| • | The index used to determine the mortgage rates on the adjustable-rate mortgage loans may respond to different economic and market factors than does one-month LIBOR. It is possible that the mortgage rates on certain of the adjustable-rate mortgage loans may decline while the Note Rates on the Class A and Mezzanine Notes are stable or rising. It is also possible that the mortgage rates on the adjustable-rate mortgage loans and the Note Rates on the Class A and Mezzanine Notes may both decline or increase during the same period, but that the Note Rates on the Class A and Mezzanine Notes may decline more slowly or increase more rapidly. |

If the Note Rate on any class of Class A and Mezzanine Notes is limited by the Available Funds Cap Rate on any payment date, the resulting Available Funds Cap Shortfalls may be recovered by the holders of such class of notes on such payment date or future payment dates, to the extent that on such payment dates there are Available Funds remaining after certain other payments on the Class A and Mezzanine Notes and the payment of certain fees and expenses of the trust (including the net swap payment, if any, the fixed rate cap payment, or any hedge termination payment owed to a Hedge Provider other than a Defaulted Hedge Termination Payment).

Amounts used to pay such shortfalls on the Class A and Mezzanine Notes may be supplemented by the Hedge Agreements to the extent described in this prospectus supplement. However, the amount received from the Hedge Provider under the Hedge Agreements may be insufficient to pay the holders of the applicable notes the full amount of interest which they would have received absent the Available Funds Cap Rate.

Prepayment Interest Shortfalls and Relief Act Shortfalls

When a mortgage loan is prepaid, the mortgagor is charged interest on the amount prepaid only up to the date on which the prepayment is made, rather than for an entire month. This may result in a shortfall in interest collections available for payment on the next payment date. The servicer is required to cover a portion of such Prepayment Interest Shortfall in interest collections that are attributable to prepayments, but only up to the amount of the servicer’s servicing fee for the related period. The servicer is not required to off-set Prepayment Interest Shortfalls from any interest income or ancillary income otherwise payable to the servicer. In addition, certain shortfalls in interest collections arising from the application of the Relief Act or any state law providing for similar relief will not be covered by the servicer.

On any payment date, any shortfalls resulting from the application of the Relief Act or any state law providing for similar relief and any Prepayment Interest Shortfalls to the extent not covered by Compensating Interest paid by the servicer will be allocated, first, to the Net Monthly Excess Cashflow, and second to the Accrued Note Interest with respect to the Class A and Mezzanine Notes on a pro rata basis based on the respective amounts of interest accrued on such notes for such payment date. The holders of the Class A and Mezzanine Notes will not be entitled to reimbursement for any such interest shortfalls. If these are allocated to the Class A and Mezzanine Notes, the amount of interest paid to those certificates will be reduced, adversely affecting the yield on your investment.

S-22

Table of Contents

The assignment of certain of the mortgages in the name of MERS may result in delays and additional costs in commencing, prosecuting and completing foreclosure proceedings

The assignment of certain of the mortgages in the name of Mortgage Electronic Registration Systems, Inc. (“MERS”) is a new practice in the mortgage lending industry. The depositor expects that the servicer or successor servicer will be able to commence foreclosure proceedings on the mortgaged properties, when necessary and appropriate; however, public recording officers and others may have limited, if any, experience with lenders seeking to foreclose mortgages, assignments of which are registered with MERS. Accordingly, delays and additional costs in commencing, prosecuting and completing foreclosure proceedings, defending litigation commenced by third parties and conducting foreclosure sales of the mortgaged properties could result. Those delays and additional costs could in turn delay the distribution of liquidation proceeds to the noteholders and increase the amount of Realized Losses on the mortgage loans.

The mezzanine notes are particularly sensitive to the timing and amount of losses and prepayments on the mortgage loans

The weighted average lives of, and the yields to maturity on, the mezzanine notes, in the increasing order of their class designations, will be progressively more sensitive to the rate and timing of mortgagor defaults and the severity of ensuing losses on the mortgage loans. If the actual rate and severity of losses on the mortgage loans is higher than those assumed by an investor in those notes, the actual yield to maturity of such notes may be lower than the yield anticipated by such holder based on such assumption. The timing of losses on the mortgage loans will also affect an investor’s actual yield to maturity, even if the rate of defaults and severity of losses over the life of the mortgage pool are consistent with an investor’s expectations. In general, the earlier a loss occurs, the greater the effect on an investor’s yield to maturity. Realized losses on the mortgage loans, to the extent they exceed the amount of excess interest and overcollateralization following payments of principal on the related payment date, will be allocated to the classes of mezzanine notes sequentially in reverse order of their numerical class designation. Although losses will be allocated to the Class M Notes, the Class Note Balances thereof will not be written down. However, the interest that accrues on the portion of the Class Note Balance equal to the related Allocated Loss Amount will be deferred and will only be paid to the extent funds are available therefor in the priority described herein.

Unless the note balances of the Class A Notes have been reduced to zero, the mezzanine notes will not be entitled to any principal payments until, at the earliest, the distribution date in May 2009. Even after the date on which the mezzanine notes are scheduled to begin to amortize they may become locked out of receiving principal payments during periods in which delinquencies or losses on the mortgage loans exceed certain levels. As a result, the weighted average lives of such notes will be longer than would otherwise be the case if payments of principal were allocated among all of the notes at the same time. As a result of the longer weighted average lives of such notes, the holders of such notes have a greater risk of suffering a loss on their investments. Further, because such notes might not receive any principal if certain delinquency levels occur, it is possible for such notes, for so long as the Class A Notes are outstanding, to receive no principal payments even if no losses have occurred on the mortgage pool.

The structure of the mezzanine notes causes the yield of such classes to be particularly sensitive to changes in the rates of prepayment of the mortgage loans. Because distributions of principal will be made to the holders of such notes according to the priorities described in this prospectus supplement, the yield to maturity on such classes of notes will be sensitive to the rates of prepayment on the mortgage loans experienced both before and after the commencement of principal distributions on such classes.

S-23

Table of Contents

Ratings on the offered notes are dependent upon the creditworthiness of Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc. and PMI Mortgage Insurance Company

The ratings assigned to the Class A and Mezzanine Notes by the rating agencies will be based in part on the credit characteristics of the mortgage loans and on ratings assigned to Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc. and PMI Mortgage Insurance Company. Mortgage Guaranty Insurance Corporation insures all of the Group I mortgage loans having a mortgage insurance policy obtained on behalf of the issuing entity and approximately 99.78% of the Group II mortgage loans (by aggregate principal balance of the related loan group as of the cut-off date) having a mortgage insurance policy obtained on behalf of the issuing entity. Radian Guaranty Inc. insures none of the Group I mortgage loans having a mortgage insurance policy obtained on behalf of the issuing entity and approximately 0.06% of the Group II mortgage loans (by aggregate principal balance of the related loan group as of the cut-off date) having a mortgage insurance policy obtained on behalf of the issuing entity. PMI Mortgage Insurance Company insures none of the Group I mortgage loans having a mortgage insurance policy obtained on behalf of the issuing entity and approximately 0.16% of the Group II mortgage loans (by aggregate principal balance of the related loan group as of the cut-off date) having a mortgage insurance policy obtained on behalf of the issuing entity. Any reduction in the ratings assigned to Mortgage Guaranty Insurance Corporation by the rating agencies could result in the reduction of the ratings assigned to the offered notes. This reduction in ratings would likely adversely affect the liquidity and market value of the offered notes.

The call of soldiers into active duty could limit the servicer’s ability to collect on the loans

As described in the prospectus, the Servicemembers Civil Relief Act, as amended, and similar state laws limit the rate of interest and the ability of the servicer to foreclose on mortgages if the mortgagor is called into military service after the origination of the loan. A number of reservists and other soldiers have been recently called into active duty and additional soldiers could be called into service in the future. If any of the borrowers enter into active military duty, shortfalls and losses to the issuing entity and the notes could result, particularly since any interest otherwise due to the noteholders will be reduced by application of the Servicemembers Civil Relief Act, as described herein.

NovaStar Financial, Inc. is subject to certain class action litigation

Since April 2004, a number of substantially similar class action lawsuits have been filed and consolidated into a single action in the United States District Court for the Western District of Missouri. The consolidated complaint generally alleges that NovaStar Financial, Inc. (the “Company”) made public statements that were misleading for failing to disclose certain regulatory and licensing matters. The plaintiffs purport to have brought this consolidated action on behalf of all persons who purchased the Company’s common stock (and sellers of put options on the Company’s stock) during the period from October 29, 2003 through April 8, 2004. On January 14, 2005, the Company filed a motion to dismiss this action, and on May 12, 2005, the court denied such motion. The Company believes that these claims are without merit and intends to vigorously defend against them.

Violation of various federal and state laws may result in losses on the mortgage loans

Numerous federal and state consumer protection laws impose requirements applicable to the origination of the contracts, including the Truth in Lending Act, the Federal Trade Commission Act, the Fair Credit Billing Act, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, the Fair Debt Collection Practices Act and the Uniform Consumer Credit Code. In the case of some of these laws, the failure to comply with their provisions may affect the enforceability of the related contract.

S-24

Table of Contents

In addition to the Home Ownership and Equity Protection Act of 1994 (the “Homeownership Act”), a number of legislative proposals have been introduced at the federal, state and municipal level that are designed to discourage predatory lending practices. Some states have enacted, or may enact, laws or regulations that prohibit inclusion of some provisions in mortgage loans that mortgage rates or origination costs in excess of prescribed levels, and require that borrowers be given certain disclosures prior to the consummation of such mortgage loans. In some cases, state law may impose requirements and restrictions greater than those in the Homeownership Act. The originator’s failure to comply with these laws could subject the issuing entity and other assignees of the mortgage loans, to monetary penalties and could result in the borrowers rescinding such mortgage loans whether held by the issuing entity or subsequent holders of the mortgage loans. Lawsuits have been brought in various states making claims against assignees of high cost loans for violations of state law. Named defendants in these cases include numerous participants within the secondary mortgage market, including some securitization trusts.

Violations of certain provisions of these laws may limit the ability of the servicer to collect all or part of the principal of or interest on the mortgage loans, could subject the issuing entity to damages and administrative enforcement and could result in the borrowers rescinding such mortgage loans against either the issuing entity or subsequent holders of the mortgage loans.

The sponsor will represent that as of the Closing Date, each mortgage loan is in compliance with applicable federal and state laws and regulations. In the event of a breach of such representation, the sponsor will be obligated to cure such breach or repurchase or replace the affected mortgage loan in the manner described under “Description of the Notes—Assignment of Mortgage Loans” herein.

Taxation of the issuing entity

It is anticipated that the issuing entity will be characterized as one or more taxable mortgage pools, or TMPs, for federal income tax purposes. In general, a TMP is treated as a separate corporation not includible with any other corporation in a consolidated income tax return, and is subject to corporate income taxation. However, it is anticipated that the issuing entity will be entirely owned by the depositor, that at all times that it owns all of the classes of equity in the issuing entity, intends to qualify as a “qualified REIT subsidiary” of its parent, NovaStar Financial, Inc. So long as the issuing entity is owned by the depositor (or another REIT or “qualified REIT subsidiary”), and NovaStar Financial Inc. continues to qualify as a REIT, classification of the issuing entity as a TMP will not cause it to be subject to corporate income tax.

In the event that the issuing entity is not wholly owned by a REIT or a “qualified REIT subsidiary,” (for instance, as a consequence of NovaStar Financial Inc. losing its REIT status), the issuing entity would become subject to federal income taxation as a corporation and would not be permitted to be included in a consolidated income tax return of another corporate entity. No transfer of the trust certificates will be permitted to an entity that is not a REIT or a qualified REIT subsidiary.

In the event that federal income taxes are imposed on the issuing entity, the cash flow available to make payments on the offered notes would be reduced. In addition, the need for cash to pay such taxes could result in a liquidation of the issuing entity, with a consequential redemption of the offered notes at a time earlier than anticipated.

S-25

Table of Contents

Formation of the Issuing Entity and Issuance of the Trust Certificates

The issuing entity will be formed pursuant to the terms of a trust agreement between the owner trustee and the depositor and upon the filing of a certificate of trust with the Secretary of State of the State of Delaware. Under the trust agreement, the issuing entity will also issue one or more classes of trust certificates evidencing the entire beneficial ownership interest in the issuing entity.

The trust estate will consist of:

| • | the mortgage loans, together with the mortgage files relating thereto, |

| • | all scheduled collections on the mortgage loans and proceeds thereof due after the Cut-off Date and all unscheduled collections on the mortgage loans and proceeds thereof received on or after the Cut-off Date, |

| • | REO property acquired through the foreclosure or other realization upon defaulted mortgage loans, and collections on and proceeds of such REO property, |

| • | assets that are deposited in the accounts, |

| • | rights under all insurance policies required to be maintained pursuant to the sale and servicing agreement and any insurance proceeds thereof, |

| • | proceeds upon the liquidation of any mortgage loans, |

| • | the interest rate swap and cap agreements, and |

| • | released mortgaged property proceeds. |

Sale and Servicing of the Mortgage Loans

The mortgage loans have been originated or purchased by the sponsor pursuant to its underwriting guidelines, as described under “The Originator” herein. The sponsor conveyed the mortgage loans to its affiliate, the depositor. The sponsor will direct the depositor to sell the mortgage loans to the issuing entity pursuant to a sale and servicing agreement, dated as of April 1, 2006, among the depositor, the issuing entity, the indenture trustee, the sponsor, and the servicer. The servicer will service the mortgage loans pursuant to the terms of the sale and servicing agreement.

Pursuant to the terms of an indenture, dated as of April 1, 2006, between the issuing entity and the indenture trustee, the issuing entity will pledge the trust estate to the indenture trustee, for the benefit of the noteholders, and issue the notes.

S-26

Table of Contents

Each mortgage loan owned by the issuing entity will be assigned to either Group I or Group II. Each of the mortgage loans in each group will bear interest at a fixed or adjustable mortgage interest rate and be secured by a first or second lien on the related mortgaged property.

The mortgage loans were made for the purpose of purchasing a new home, obtaining construction-to-permanent financing, refinancing an existing mortgage loan, consolidating debt and/or obtaining cash proceeds by borrowing against the borrower’s equity in the mortgaged property. The mortgage loans may be detached, part of a one- to four-family dwelling, a condominium unit or a unit in a planned unit development. The mortgaged properties may be owner occupied or non-owner occupied investment properties. A substantial number of the mortgage loans in both groups were originated pursuant to the sponsor’s exception policy. See“The Sponsor and the Servicer – Underwriting” herein.

The pool balances for Group I and Group II were approximately $904,573,565 and $445,425,930, respectively.

As of the Cut-off Date, no mortgage loan had a remaining term to maturity greater than 30 years. As of the cut-off date, sixteen of the mortgage loans were at least 30 but less than 90 days past due, each of the mortgage loans was an “actuarial” loan and each of the mortgage loans was secured by a first or second lien on the related mortgaged property.