UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-134090

Intcomex, Inc.

(Exact name of Registrant as Specified in its Charter)

| | |

| Delaware | | 65-0893400 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3505 NW 107th Avenue, Miami, FL 33178

(Address, including Zip Code, of Principal Executive Offices)

(305) 477-6230

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

NONE | | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark if registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated Filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant had 100,000 shares of Common Stock, par value $0.01 per share and 2,182 shares of Class B non-voting Common Stock, par value $0.01 per share, outstanding at December 31, 2006. There is no public trading market for the stock.

DOCUMENTS INCORPORATED BY REFERENCE:

TABLE OF CONTENTS

PART I

ITEM 1.BUSINESS

The following discussion includes forward-looking statements, including but not limited to, management’s expectations of competition; revenues, margin, expenses and other operating results or ratios; contingencies and litigation; operating efficiencies; economic conditions; capital expenditures; liquidity; capital requirements; acquisitions and integration costs; operating models; exchange rate fluctuations and rates of return. In evaluating our business, readers should carefully consider the important factors discussed under “Risk Factors.” We disclaim any responsibility to update any forward-looking statements.

Introduction

Intcomex, Inc. is a leading, United States-based value-added distributor of information technology (“IT”) products to Latin America and the Caribbean. Intcomex distributes computer components, peripherals, software, computer systems, accessories, networking products and digital consumer electronics to more than 40,000 customers in 45 countries. We offer single source purchasing to our customers by providing an in-stock selection of more than 5,700 products from over 220 vendors, including the world’s leading IT product manufacturers.

History

Michael Shalom and Anthony Shalom founded the company as a small software retailer in South Florida in 1988. In 1989, we started exporting IT products from Miami to Latin America and moved our headquarters to the vicinity of the Port of Miami and the Miami International Airport in order to capitalize on the growing export trade of IT products to Latin America and the Caribbean. We established our first in-country operations in Mexico in 1992, and expanded our presence to include Panama and Chile in 1994; Peru, Guatemala and Uruguay in 1997; El Salvador, Ecuador, Costa Rica and Jamaica in 2000; Argentina in 2003; and Colombia in 2004. In 2001, we sold our participation in our then-existing Mexican operations, although we re-established our presence in Mexico by acquiring Centel in June 2005. Our growth into new markets has been organic, typically in partnership with talented local managers knowledgeable about the IT products distribution business in their country. Though our geographic coverage in the region is now extensive, our in-country operations, which have been introduced over a period of several years, are at different stages of development.

In August 2004, CVC International, a division of Citigroup engaged in private equity investments in emerging markets, acquired 52.5% of the voting equity interests of the company, and we redeemed all of the equity interests in our company held by our former non-management shareholders and some of the equity interests in our company held by our management shareholders. After giving effect to the acquisition and redemptions, Anthony Shalom and Michael Shalom became our second and third largest shareholders (after CVC International), with holdings of 23.0% and 9.0% of our voting stock, respectively. The other shareholders in our company are also members of our management. At the time of the acquisition, our shareholders entered into a shareholders agreement providing for, among other things, certain governance arrangements concerning our company. We incorporated in the state of Delaware in August 2004.

Industry

IT products generally follow a three-tiered distribution system from the manufacturer to end-users in Latin America and the Caribbean:

| • | | Wholesale aggregators, typically based in Miami, purchase IT products from vendors, and sell such products to other Miami-based exporters and in-country distributors. They typically maintain warehouses and sales forces in Miami and do not have substantial operations outside of Miami. |

| • | | In-country distributors purchase IT products from wholesale aggregators and sell them to local resellers. The in-country distributors typically have a limited geographic focus (generally limited to one country or even certain cities within one country), a local sales force in direct contact with their customers and local warehousing. The in-country distributors’ limited size, capital and geographic reach often prevent them from establishing and maintaining direct relationships with vendors, |

1

| | which are located predominantly in North America and Asia and which limit their relationships to IT distributors with broad geographic coverage or large order sizes. In most markets, in-country distributors are not of sufficient size to benefit from economies of scale and are not sufficiently capitalized to offer their customers a full range of products and services. |

| • | | Resellers acquire IT products from the in-country distributors and resell them to the end-user (typically individuals, small and medium businesses or governments). Resellers vary greatly in size and type, from one-person operations to large retailers. |

The distribution model for IT products in Latin America and the Caribbean is markedly different from that of more advanced markets where direct sales by IT vendors are common. In our region, IT vendors rely extensively on wholesale distribution rather than direct sales. According to IDC, in 2006 IT distributors (including local dealers, local assemblers and resellers) comprised 82% of PCs sold in Latin America, while the remaining 18% were sold directly to end-users through the internet and named OEM direct sales.

The Latin American and Caribbean region is comprised of more than 40 countries, many unique in such areas as logistical infrastructure, regulatory and legal framework, trade barriers, taxation, currency and language. This fragmentation presents challenges to IT product manufacturers seeking to establish a regional distribution, sales, logistics and service network, as such a network would have to be created for each country, with limited economies of scale due to the small size of most markets and barriers to entry associated with cross-border complexities. We believe that our network of 24 sales and distribution operations and 13 country geographic presence in the region is not only unique, but also valuable and difficult to replicate.

Company Strengths

Since the opening of our first in-country operation in 1992, we have concentrated on developing a regional distribution network providing resellers of IT products in Latin America and the Caribbean with the broadest product selection and availability. In achieving a leadership position in the markets we serve, we have capitalized on our strengths, which include:

Defensible position as a key player in the IT products supply chain. Our distribution capabilities in Latin America and the Caribbean, combined with our long-term business experience, create a market presence and infrastructure unmatched by any of our competitors. The large number of resellers in the region, their relatively small size and their geographic fragmentation make it cost effective for vendors to rely on wholesale distributors with a broad regional distribution channel. We provide vendors with extensive regional coverage, larger orders, lower selling and delivery costs, quality pre- and post-sale marketing and technical support and a significant simplification of their customer credit risk management. Similarly, our reseller customers who rely on wholesale aggregators and distributors for timely product supply, benefit from our one-stop shop for IT products. Typically, resellers’ small order sizes prevent them from establishing direct relationships with major IT product vendors, and resellers’ limited in-stock inventory creates a need for aggregators and distributors that can provide rapid delivery of a wide variety of products. We provide resellers with broad and timely product availability, multi-vendor single source purchasing, technical support and local warranty service. Consequently, we are a critical component of the supply chain between vendors located primarily in North America and Asia and resellers in Latin America and the Caribbean. We believe that the combination of the significant time and investment required to establish an efficient distribution infrastructure in each of our countries and the valuable services we provide to both vendors and customers affords us a defensible position in each of the 12 markets in which we have in-country operations.

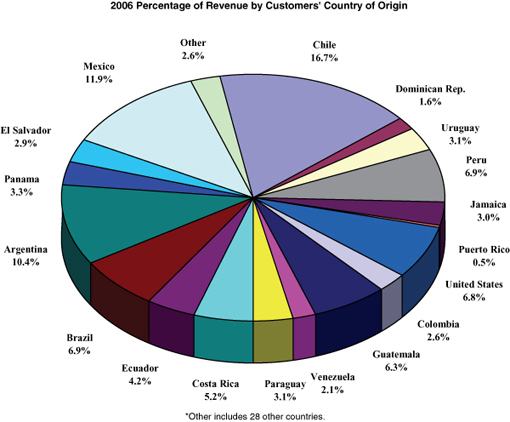

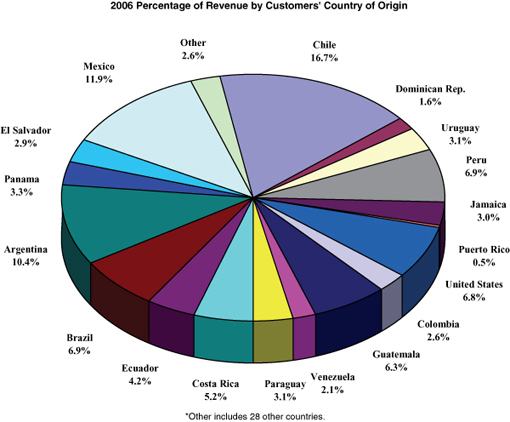

Balanced and diversified geographic presence, customer base and vendor base. Our balanced and diversified geographic presence, customer base and vendor base are key to managing our business risks. In 2006, no single country represented more than 16.7% of our revenue. Our country diversification limits our exposure to macroeconomic cycles and political risk. No single customer represented more than 2.0% of our revenue and no single vendor represented more than 14.8% of our revenue for the year ended December 31, 2006. Our customer fragmentation allows for broad diversification of credit risk. Our diversified vendor base permits us to avoid reliance on any one product or manufacturer, which in turn gives us purchasing and pricing flexibility and significant latitude in tailoring the product selection we offer to our customers. See note 11 to our Consolidated Financial Statements, included in Item 8 of this Annual Report on Form 10-K.

2

Leading market positions. We believe that we hold a number one or number two market share position within each country in which we have an in-country distribution presence (excluding Mexico, where we believe we are the third largest IT distributor, and Colombia). Our leading market positions, the significant benefits we deliver to our vendors and customers and our established brand name have been important factors that have allowed us to achieve profitable growth and to obtain and maintain favorable relationships with vendors. Most importantly, we believe that our leading market positions would allow us to compete effectively against any new entrants to our markets, especially in the case of our smaller markets where economies of scale are more difficult to achieve.

Focused working capital management. Historically, our focus on our working capital accounts, coupled with our attractive margins, has allowed us to fund our organic growth through internally generated cash flows. Our cash conversion cycle (trade accounts receivable days + inventory days - accounts payable days) for 2006 was 35.9 days. We have managed our cash conversion cycle through the following methods:

| • | | centralized purchasing that creates purchasing and pricing economies of scale; |

| • | | frequent product shipments that allow for lean in-country inventory levels; |

| • | | spot pricing contracts with logistics providers that allow us competitive rates and fast delivery times; |

| • | | our large number of over 40,000 customers in 2006 and our strict credit policies that dilute and limit our credit and collection risk, resulting in low bad-debt expenses of 0.1% and 0.2% of revenue in 2006 and 2005, respectively; and |

| • | | regional diversity and on-going inventory and demand monitoring that allow us to efficiently ship products to high-demand areas, resulting in low inventory obsolescence of 0.16% and 0.19% of revenue in 2006 and 2005, respectively. |

Experienced management team with significant equity ownership. Each of our two co-founders, who today are our Chief Executive Officer and our President, has more than 15 years of industry experience in the region. Our senior management team has an average tenure of 10 years with us. Each of our executive officers has had substantial experience working in the Latin American and Caribbean region. Members of our management team (including certain managers of in-country operations) own approximately 48.6% of the shares in our company. As a result of their substantial equity interest, we believe that our management has significant incentive to continue to increase our revenue and cash flows through profitable growth.

Customers

We currently sell to over 40,000 distributors and resellers. Although the end users of our products are mostly individuals and small and medium businesses, we supply these end users through a well-established network of in-country distributors, value added resellers, system builders and retailers, as well as through United States-based distributors selling into these regions. We have always emphasized customer care and long-term customer development. We seek to build customer loyalty not only by having wide product selection and quick delivery times, but also by offering product training and support and by granting credit (when the customer is approved under our credit policies). We believe that the extension of payment terms to creditworthy customers is one of our key competitive advantages, as many of our local competitors do not have the financial resources to do so and as a result offer products only on a cash-and-carry basis.

For the year ended December 31, 2006, no single customer accounted for more than 2.0% of our revenue on a consolidated basis and the top ten customers by volume of sales accounted for less than 9.1% of our consolidated revenue. For the year ended December 31, 2005, no single customer accounted for more than 2.9% of our revenue on a consolidated basis and the top ten customers by volume of sales accounted for less than 11.2% of our consolidated revenue. Our strategy is not to rely on any single customer for a large percentage of sales, and to diversify sales in addition to maximizing sales from individual customers.

3

Sales and Marketing

As of December 31, 2006 we maintained a sales force of 525 individuals in our in-country operations. Our Miami operations employed 27 people dedicated to serving third-party customers.

Each in-country sales force is managed by a general manager and, depending on the size of the operation, a sales manager. The general managers and the sales managers are responsible for customer relationships and development of new accounts. Our Chief Executive Officer and our commercial director also spend a considerable amount of time visiting customers and our in-country operations to develop new customer accounts and solidify and improve existing relationships.

We use an incentive-based compensation structure for our sales force that varies from country to country. Generally, the compensation consists of a base salary and variable commission and includes supplier promotional rebates. The commission is generally calculated as a percentage of collected gross profits.

As of December 31, 2006 our marketing department consisted of 5 employees in Miami and 47 employees throughout the region. The marketing department’s responsibilities include oversight of our corporate identity, the preparation of marketing materials, various types of media activity and the development of marketing research studies and specialized reseller-focused events. In addition, the department works with vendors to establish periodic marketing and sales programs to generate vendor brand awareness and product demand. In this regard, our marketing department acts as a liaison between our company and our vendors.

The marketing department uses marketing and business development funds available from vendors of branded IT products for various activities, including the preparation of our annual product catalog and monthly pricing books, customer training, specialized events and trade shows. Our Miami operations administer all marketing funds and allocates them to our in-country operations to support local marketing programs.

Some of our more notable marketing events are Connections (a semi-annual product and technology training events offered by vendors to the general managers and product managers of the in-country operations) and INTCOMEXPO (a private trade show at each of our in-country operations organized for the benefit of our customers, with 15 to 30 vendors present at each show).

Products

We aim to offer single source purchasing to our reseller customers so that they can purchase from us all of their IT product needs, and we believe that our wide selection of products is a key attraction for resellers that do business with us. The single source purchasing concept is especially important for assemblers of unbranded, or “white-box” personal computers, which must source all the necessary components before they can commence assembly. White-box personal computers, which typically have lower retail selling prices but higher margins than branded computer systems, comprise about 57.3% of the Latin American personal computer market according to Gartner. We do not sell branded desktop personal computers other than our own NEXXT Solutions and Blue Code lines of personal computers and personal computers we assemble under our customers’ brands.

Our product categories are:

| • | | Components. This category consists of the components that are the basic building blocks of a personal computer and includes motherboards, processors, memory chips, internal hard drives, internal optical drives, cases and monitors; |

| • | | Peripherals. This category consists of devices that are used in conjunction with computer systems and includes printers, power protection/backup devices, mice, scanners, external disk drives, multimedia peripherals, modems, projectors and digital cameras; |

4

| • | | Software. This category includes operating system, productivity, office, security and anti-virus software; |

| • | | Computer systems. This category consists of self-standing computer systems capable of functioning independently. In addition, most of our operations assemble and sell personal computers and notebook computers under our own brands, under our customers’ brands and in unbranded cases; |

| • | | Accessories. This category includes computer cables, connectors, computer and networking tools, media, media storage, keyboard and mouse accessories, speakers, computer furniture and networking accessories; |

| • | | Networking. This category consists of hardware that enables two or more personal computers to communicate, and includes modems, routers, switches, hubs and wireless local area network access points, local area network (“LAN”) interface cards and wireless LAN interface cards; and |

| • | | Other products. This category includes digital consumer electronics and special order products. |

Our primary focus is on the components, peripherals and accessories categories, as these tend to have higher margins than the other product categories. We believe that a focus on components, peripherals and accessories, together with the vendor protection policies described below, help us reduce the risks of inventory obsolescence. We believe that our inventory obsolescence rates, at 0.16% and 0.19% of revenue in 2006 and 2005, respectively, are very low by industry standards. Our strategy is to maintain this core mix of product categories, and in particular to maintain high levels of sales in the components category, as more people in Latin America and the Caribbean become computer users.

Among our strategies for growth is the expansion of our offerings in the following categories or subcategories: enterprise-class networking products (including networking products, servers, storage and software), enterprise IP telephony products (including IP PBX systems and IP telephones), gaming and infotainment products (including video game systems) digital consumer electronics (including digital cameras and plasma displays) and products sold under our proprietary brands (for example, NEXXT Networking Solutions). We plan to expand into these categories gradually as demand for these products grows among our customers and end user markets, our existing vendors start offering these products and we initiate relationships with new vendors offering these products.

| | | | | | | | | | | |

| | | | | Percentage of consolidated revenue in year ended December 31, | |

Category | | | | 2006 | | | 2005 | | | 2004 | |

Components | | 51.0 | % | | 56.5 | % | | 55.2 | % |

Peripherals | | 18.2 | % | | 23.3 | % | | 25.3 | % |

Software | | 4.9 | % | | 5.8 | % | | 6.9 | % |

Computer systems | | 10.5 | % | | 7.5 | % | | 6.5 | % |

Accessories | | 10.4 | % | | 4.8 | % | | 3.2 | % |

Networking | | 2.2 | % | | 1.9 | % | | 2.0 | % |

Other products | | 2.8 | % | | 0.2 | % | | 0.9 | % |

| | | | | | | | | |

Total: | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | |

5

Vendors

We have established direct relationships with many of the major global manufacturers of branded computer products, including Epson, Hewlett Packard, Intel, Kingston, Microsoft, Samsung, Seagate and Western Digital, as well as a host of generic component vendors from the United States and Asia. For the year ended December 31, 2006, our top ten vendors manufactured products that accounted for 63.8% of our revenue and our top vendor accounted for 14.8% of our revenue. For the year ended December 31, 2005, our top ten vendors manufactured products that accounted for 64.0% of our revenue and our top vendor accounted for 14.8% of our revenue. We continue to believe in the strategic importance of diversifying our revenues among multiple vendors.

We have entered into written distribution agreements with many of our vendors, which typically provide for nonexclusive distribution rights for specific territories. We believe that it is not common in our industry for vendors to have exclusive relationships with distributors, and, because the market for IT products is subject to rapid change and reliant upon product innovation, we believe that our customers are better served by our ability to carry competing brands. The agreements are generally short term and subject to periodic renewal.

Our vendors typically extend us payment terms of between 30 and 60 days. Vendors of branded products often offer us back-end rebates, promotions and incentives.

Like other IT distributors, we are subject to the risk that the value of our inventory will be affected adversely by vendors’ price reductions or by technological changes affecting the usefulness or desirability of the products comprising the inventory. It is the policy of many vendors of IT products to offer distributors some protection from the loss in value of inventory due to technological change or a vendor’s price reductions. Under many of these agreements, the distributor is restricted to a designated period of time in which products may be returned for credit or exchanged for other products or during which price protection credits may be claimed. We take various actions, including monitoring our inventory levels, soliciting frequent input from country managers about demand projections and controlling the timing of purchases, to maximize our protection under supplier programs and reduce our inventory risk.

When we sell a product, our customer receives a warranty for the product from our vendors. We administer our vendor’s warranties and track the unique serial numbers of most products passing through our distribution facilities. By tracking unique serial numbers, we are able to determine whether specific products presented by our customers or our in-country operations for service or repair under warranty are eligible. This system allows us to limit the quantity of unauthorized returns of merchandise and to provide what we believe is the fastest and highest-quality return-to-manufacturer authorization service in the region. Our annual expense incurred in administering the warranties issued to our customers was less than $2.0 million and $2.1 million in 2006 and 2005, respectively.

6

Competition

The IT products distribution industry in Latin America and the Caribbean is highly competitive. The factors on which IT distributors compete include:

| • | | availability and quality of products and services; |

| • | | terms and conditions of sale; |

| • | | availability of credit and credit terms; |

| • | | timeliness of delivery; |

| • | | flexibility in tailoring specific solutions to customers’ needs; |

| • | | effectiveness of marketing and sales programs; |

| • | | availability of technical and product information; and |

| • | | availability and effectiveness of warranty programs. |

Distribution of IT products in Latin America and the Caribbean is a very fragmented industry containing a few multinational companies, such as Ingram Micro, Inc. (present in Brazil, Chile, Mexico, Peru and Argentina), Tech Data Corporation (present in Brazil, Chile, Uruguay and Peru), Bell Microproducts Inc. (present in Argentina, Brazil, Chile and Mexico) and SYNNEX Corporation (present in Mexico), and a large number of local companies that operate in a single country, such as Grupo Deltron S.A. in Peru and Airoldi Computación in Argentina. We have broad geographic coverage in Latin America and the Caribbean that is unique in our industry.

Our principal competitors are Ingram Micro and Tech Data, each of which operates local distribution centers in the limited number of our addressed markets. In contrast, we are able to offer our vendors an in-country distribution channel to many Latin American and Caribbean markets. Additionally, while our product offering is more focused on components for white-box personal computers, Ingram and Tech Data are focused on high-end branded equipment, including servers. While these competitors are larger and better capitalized than we are, and in the case of the Mexican market have a significantly larger market share than we do, we believe that our multi-country, components-focused business model is better suited for sustainable growth in Latin America and the Caribbean.

Our relatively large size, on the other hand, provides us with certain advantages over smaller local distributors, who sometimes have a lower cost structure than we do, in part because they may operate in the “informal” economy. Our advantages include more developed vendor relationships, broader product offerings, greater product availability and more effective customer service (including credit and technical support).

We believe that our geographical focus on and wide scope in Latin America and the Caribbean allow us to adopt a business model well suited to take advantage of the current characteristics of the market and of expected growth in the region. By combining the two roles of Miami aggregator and local distributor, we are able to take advantage of the economies of scale and relationships with vendors provided by a single home office in Miami and the direct contact and knowledge of the local markets gained from our offices in the various countries in which we operate. Our size and geographical focus benefit both our vendors and our customers. Vendors are able to sell to us in substantial order sizes and to sell their products throughout Latin America and the Caribbean. Customers benefit from the wide selection of products and support services of a larger company while at the same time having access to a local staff that is knowledgeable and service-oriented.

7

Asset Management

We seek to maintain sufficient quantities of product inventories to achieve immediate inventory availability for our customers. Our business, like that of other distributors, is subject to the risk that the value of our inventory will be affected adversely by suppliers’ price reductions or by technological changes affecting the usefulness or desirability of the products comprising the inventory. It is the policy of many suppliers of technology products to offer distributors like us, who purchase directly from them, limited protection from the loss in value of inventory due to technological change or a supplier’s price reductions. Under many of these agreements, the distributor is restricted to a designated period of time in which products may be returned for credit or exchanged for other products or during which price protection credits may be claimed. We take various actions, including monitoring our inventory levels and controlling the timing of purchases, to maximize our protection under supplier programs and reduce our inventory risk. However, no assurance can be given that current protective terms and conditions will continue or that they will adequately protect us against declines in inventory value, or that they will not be revised in such a manner as to adversely impact our ability to obtain price protection. In addition, suppliers may become insolvent and unable to fulfill their protection obligations to us. We are subject to the risk that our inventory values may decline and protective terms under supplier agreements may not adequately cover the decline in values. In addition, we distribute private label products for which price protection and rights of return are not customarily contractually available, and for which we bear certain increased risks. We manage these risks through pricing and continual monitoring of existing inventory levels relative to customer demand. On an ongoing basis, we reserve for excess and obsolete inventories and these reserves are appropriately utilized for liquidation of such inventories, reflecting our forecasts of future demand and market conditions.

Inventory levels may vary from period to period, due, in part, to the addition of new suppliers or new lines with current suppliers and strategic purchases of inventory. In addition, payment terms with inventory suppliers may vary from time to time, and could result in less inventories being financed through vendor trade credit and a greater amount of inventory being financed by our capital resources.

Trademarks and Domain Names

We have registered a number of trademarks and domain names for use in our business. We have registered trademarks such as “Intcomex”, “KLIP XTREME”, “KLIP”, “FORZA”, “Blue Code”, “CENTEL” and “NEXXT Solutions” in the United States and in various Latin American and Caribbean jurisdictions. We also have registered domain names, including intcomex.com, nexxtsolutions.com, intcomex.cl, intcomex.ec and incomex.com.pe. We believe that our trademarks will help us build greater name recognition in the region in which we operate.

Employees

As of December 31, 2006 we employed 1,548 persons. Of these, 151 were located in Miami, with the remaining 1,397 located in our in-country operations. We do not have any collective bargaining agreements with our employees, nor are they unionized except for the employees in certain in-country operations, such as Mexico. We believe that our relations with our employees are generally good. Our annual employee turnover rate varies by location. Based on management estimates, we believe our employee turnover is below the industry average with 28.7% of our employees in our Miami operations having been with the company for over five years.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended. We therefore file periodic reports and other information with the Securities and Exchange Commission (the “SEC”). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at (800) SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information.

Financial and other information can also be accessed through our website atwww.intcomex.com. There, we make available, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC. The information posted on our website is not incorporated into this Annual Report on Form 10-K.

8

ITEM 1A.RISK FACTORS

CAUTIONARY STATEMENTS FOR PURPOSES OF THE “SAFE

HARBOR” PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a “safe harbor” for “forward-looking statements” to encourage companies to provide prospective information, so long as such information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed in the forward-looking statement(s). Intcomex desires to take advantage of the safe harbor provisions of the Act.

Our Annual Report on Form 10-K for the year ended December 31, 2006, our quarterly reports on Form 10-Q, our current reports on Form 8-K, periodic press releases, as well as other public documents and statements, may contain forward-looking statements within the meaning of the Act, including, but not limited to, management’s expectations for process improvement; competition; revenues, expenses and other operating results or ratios; contingencies and litigation; economic conditions; liquidity; capital requirements; and exchange rate fluctuations. Forward-looking statements also include any statement that may predict, forecast, indicate or imply future results, performance, or achievements. Forward-looking statements can be identified by the use of terminology such as “believe,” “anticipate,” “expect,” “estimate,” “may,” “will,” “should,” “project,” “continue,” “plans,” “aims,” “intends,” “likely,” or other similar words or phrases.

We disclaim any duty to update any forward-looking statements. In addition, our representatives participate from time to time in:

| | • | | speeches and calls with market analysts, |

| | • | | conferences, meetings and calls with investors and potential investors in our securities, and |

| | • | | other meetings and conferences. |

Some of the information presented in these calls, meetings and conferences may be forward-looking within the meaning of the Act.

Our actual results could differ materially from those projected in forward-looking statements made by or on behalf of Intcomex. In this regard, from time to time, our results may have differed from estimates of revenue or earnings. In future quarters, our operating results may differ significantly from the expectations of public market analysts or investors or those projected in forward-looking statements made by or on behalf of Intcomex due to unanticipated events, including, but not limited to, those discussed in this section. Because of our narrow gross margins, the impact of the risk factors stated below may magnify the impact on our operating results and/or financial condition

9

We operate in a highly competitive environment. The IT products distribution industry in Latin America and the Caribbean is highly competitive. The factors on which IT distributors compete include:

| | • | | availability and quality of products and services; |

| | • | | terms and conditions of sale; |

| | • | | availability of credit and credit terms; |

| | • | | timeliness of delivery; |

| | • | | flexibility in tailoring specific solutions to customers’ needs; |

| | • | | effectiveness of marketing and sales programs; |

| | • | | availability of technical and product information; and |

| | • | | availability and effectiveness of warranty programs. |

The IT products distribution industry in Latin America and the Caribbean is very fragmented. In certain markets, we compete against large multinational companies (including Ingram Micro, Inc., Tech Data Corporation, SYNNEX Corp. and Bell Microproducts Inc.), which are significantly better capitalized than we are and potentially enjoy greater bargaining power with vendors than we do. In addition, our main competitor in Mexico, Ingram Micro, Inc., has a significantly larger market share than we do in that country. In all of our in-country markets, we also compete against a substantial number of locally based distributors, many of which have a lower cost structure than we do, in some cases because they operate in the local “informal” economy. Due to intense competition in our industry, we may not be able to compete effectively against our existing competitors or against new entrants to the industry, or to maintain or increase our sales, market share or margins.

Our relatively high margins, together with improving economic conditions, may attract new competitors into our markets, which may cause our results of operations to decline. Historically, we have had relatively high margins as compared to our principal competitors. Our relatively high margins may attract new competition into our markets, including competition from companies employing alternate business models such as manufacturer direct sales. Improvements in economic conditions in countries in which we operate, including an increase in per capita income levels, will likely lead to an increase in demand for IT products in these countries, thereby making them more attractive to our competitors. Loss of existing or future market share to new competitors and increased price competition could adversely affect our results of operations.

Political and economic developments in Latin America and the Caribbean may have an adverse effect on our results of operations. In 2006, sales to customers servicing Latin America and the Caribbean accounted for virtually all of our consolidated revenue. Our financial results are sensitive to the performance of the economies of Latin America and the Caribbean. If local, regional or worldwide economic trends adversely affect the economies of any of the countries in which we have operations, our financial condition and results of operations could be affected adversely. In addition, we believe that the end-users of a significant portion of the products sold to United States customers by our Miami operations are also located in Latin America and the Caribbean. The following are examples of significant risks to which we are subject and important events affecting us:

| • | | Our sales in foreign countries could decline if those countries were to impose additional tariffs, import and export controls or other trade barriers that restrict our ability to sell products in such countries. Potential transportation delays across national borders resulting from more complex customs procedures could also lead to reduced sales and increased costs or working capital requirements. |

10

| • | | Worsening local economic or political conditions or changes in laws governing capital controls, the liquidity of bank accounts or the repatriation of capital and dividends could prevent or inhibit our receipt of cash from our foreign reseller customers or our foreign subsidiaries, result in longer payment cycles, or impair our collection of accounts receivable. |

| • | | The demand for IT products could decline as a result of political, social or economic instability in the region. Economic slow-downs in the region, including those resulting from changes in fiscal or monetary policies, could decrease demand for the products we distribute, result in higher levels of inventories in our distribution channels and decrease our gross and operating margins. |

| • | | We could experience difficulties in staffing, monitoring and managing our foreign operations. |

| • | | We could be subject to adverse tax consequences, including the imposition of withholding or other taxes on payments made by our subsidiaries or increases in value added tax or sales tax on the products we sell. |

| • | | We could incur significant costs in complying with a variety of foreign laws, trade customs and practices and changes in regulatory requirements. |

| • | | The value of our accounts receivable and other assets could decline if foreign countries were to devalue their currencies. Any devaluation could also make our products more expensive in local currency and decrease demand for our products. |

Fluctuations in foreign currency exchange rates could adversely affect the results of our operations. In the years ended December 31, 2006 and 2005, 40.7% and 34.9%, respectively, of our revenue were invoiced in currencies other than the United States dollar, while 96.1% and 96.6%, respectively, of our costs were denominated in United States dollars. We do not hedge against all of the risk to which we are exposed if the currency in which our invoices are denominated were to devalue against the United States dollar between the time of invoicing and the date of payment on the invoice. In certain markets in which the United States dollar is not the local currency, we nonetheless invoice in United States dollars. In these markets, a significant and sustained devaluation of the relevant local currency could adversely affect the ability of our customers to pay those invoices, thus affecting adversely the value of our receivables, our revenue and our results of operations.

In addition, large and sustained devaluations of local currencies can make many of our products, the cost of which in almost all cases is denominated in United States dollars, more expensive in local currencies, which in turn could adversely impact demand for our products and our revenue.

Finally, a large and sustained devaluation of the United States dollar could make our local currency costs greater in United States dollar terms, thereby possibly reducing our margins.

If we lose the services of our key executive officers, we may not succeed in implementing our business strategy. We are currently managed by certain key senior management personnel, including both of our founders, Anthony Shalom and Michael Shalom. These individuals have extensive experience and knowledge of our industry and the many local markets in which we operate. The loss of their services could adversely affect our ability to implement our business strategy, and new members of management may not be able to implement our strategy successfully. With the exception of an employment agreement with our Chief Financial Officer, we have no employment agreements with any of our executive officers or in-country managers.

In addition, in establishing and developing many of our in-country operations, we have relied in large part on the local market knowledge and entrepreneurial skills of a limited number of local managers in those markets. The loss of the services of any of these managers could adversely impact our operations and financial results in the market in which the manager is located.

11

Our expansion into new markets may present additional risks that could materially and adversely affect the results of our operations. We currently operate in 12 Latin American and Caribbean countries and expect to enter into new geographic markets both within the countries where we already conduct operations and in new countries where we have no prior operating or distribution experience. In such new markets, we will face challenges such as customers’ lack of awareness of our brand, difficulties in hiring personnel and problems arising from our unfamiliarity with local IT products distribution industry markets and demographics. New markets may also have different competitive conditions from our existing markets. Any failure on our part to recognize or respond to these differences may adversely affect the success of our operations in those markets, which in turn could materially and adversely affect our results of operations.

We may not realize the expected benefits from any of our acquisitions, which could have a material adverse effect on our business, financial condition and results of operations. We may in the future pursue acquisitions. Our success in realizing the expected benefits from any of our acquisitions depends on a number of factors, including retaining or hiring local management personnel, successful integration of the operations, IT systems, customers, vendors and partner relationships of the acquired companies and our ability to devote capital and management attention to the newly acquired companies in light of other operational needs. Our efforts to implement our strategy could be affected by a number of factors beyond our control, such as increased competition and general economic conditions in the countries where the newly acquired companies operate. Any failure to effectively implement our strategy could have a material adverse effect on our results of operations.

We depend on a relatively small number of vendors for products that make up a significant portion of our revenue. A significant portion of our revenue is derived from products manufactured by a relatively small number of vendors. For the year ended December 31, 2006 and 2005, our top ten vendors manufactured products that accounted for 63.8% and 64.0% of our revenue and our top vendor accounted for 14.8% and 14.8% of our revenue, respectively. We expect that we will continue to obtain most of our products from a relatively small number of vendors and that the portion of our revenue that we obtain from such vendors may continue to increase in the future. Due to intense competition in the IT products distribution industry, our key vendors can choose to work with many other distributors and, pursuant to standard terms in our vendor agreements, may terminate their relationships with us on short notice. The loss of a relationship with any of our key vendors may adversely affect our results of operations.

Our ability to stay competitive in the IT products distribution industry and increase our customer base depends on our ability to offer, on a continuous basis, a selection of appealing products that reflect our customers’ preferences. To be successful, our product offerings must be broad in scope, affordable, well-made, innovative and attractive to a wide range of consumers whose preferences may change regularly. This depends in large part on the ability of our key vendors to respond quickly to technological changes and innovations and to manufacture new products that correspond to the new demands of our customers and requires on the part of vendors a continuous investment of resources to develop and manufacture new products. If our key vendors fail to respond on a timely basis to the rapid technological changes that have been characteristic of the IT products industry, fail to provide new products that are desired by consumers or otherwise fail to compete effectively against other IT products manufacturers, the products that we offer may be less desirable to consumers and we could suffer a significant decline in our revenue, including revenue driven by end-users’ upgrades of their existing IT products. The ability and willingness of our vendors to develop new products depends on factors beyond our control. If our product offerings fail to satisfy customers’ tastes or respond to changes in customer preferences, our revenues may decline and our competitors may gain additional market share.

We are dependent on vendors to maintain adequate inventory levels. We depend on vendors to maintain adequate inventory. Any supply shortages or delays (some or all of which are beyond our control) could cause us to be unable to service customers on a timely basis, which in turn could adversely affect our results of operations.

12

We are subject to the risk that our inventory values may decline. The IT products distribution industry is subject to rapid technological change, new and enhanced product specification requirements and evolving industry standards. These factors may cause a substantial decline in the value of our inventory or may render all or substantial portions of our inventory obsolete. Changes in customs or security procedures in the countries through which our inventory is shipped, as well as other logistical difficulties that slow the movement of our products to our customers, can also exacerbate the impact of these factors. While some of our vendors offer us limited protection against the decline in value of our inventory due to technological change or new product developments in the form of credit or partial refunds, these protective policies are largely subject to the discretion of our vendors. The protective terms of our vendor agreements may not adequately cover declines in our inventory value. In addition, these vendors may not continue to offer protective terms in the future.

A loss of, or reduction in, trade credit from our vendors could reduce our liquidity, increase our working capital needs and/or limit our ability to purchase products. Our business is working capital intensive and our ability to pay for products is largely dependent on our principal vendors providing us with payment terms that facilitate the efficient use of our capital. The payment terms that we receive from our vendors are based on several factors, including:

| • | | our recent operating results, financial position, including our level of indebtedness, and cash flows; |

| • | | our payment history with the vendor; |

| • | | the vendor’s credit granting policies, any contractual restrictions to which it is subject, our creditworthiness (as determined by various entities) and general industry conditions; |

| • | | prevailing interest rates; and |

| • | | the vendor’s ability to obtain credit insurance in respect of amounts that we owe it. |

Adverse changes in any of these factors, many of which are not within our control, could increase the costs to us of financing our inventory, which may limit or eliminate our ability to obtain vendor financing and adversely affect our operating results.

Vertical integration by our vendors or customers could adversely affect us. Our company occupies a middle position in the IT products distribution chain in Latin America and the Caribbean, between IT vendors on the one hand and locally-based distributors and resellers on the other. Further industry consolidation, increased competition, technological changes and other developments, including improvements in regional infrastructure, may cause our vendors to bypass us and sell directly to our customers. As a result, our reseller and distributor customers and our vendors may increase the level of direct business they do with each other, which could have a material adverse effect on our business and results of operations.

We are dependent on the terms of the sales agreements provided by our vendors. Our business is highly dependent on the terms of the sales agreements provided by our vendors. Generally, each vendor has the ability to change the terms and conditions of its sales agreements, including by reducing the level of purchase discounts, rebates and marketing programs available to us. If we are unable to pass the impact of these changes through to our reseller customers, our results of operations could be adversely affected.

We are exposed to the risk of natural disasters, war and terrorism. Our Miami headquarters, some of our sales and distribution centers and certain of our vendors and customers are located in areas prone to natural disasters such as floods, hurricanes, tornadoes or earthquakes. In addition, demand for our services is concentrated in major metropolitan areas. Adverse weather conditions, major electrical or telecommunications failures or other events in these major metropolitan areas may disrupt our business and may adversely affect our ability to distribute products. We operate in multiple geographic markets, several of which may be susceptible to acts of war and terrorism. Security measures and customs inspection procedures have been implemented in a number of jurisdictions in response to the threat of terrorism. These procedures have made the import and export of goods to and from our Miami headquarters more time-consuming and expensive. Such measures have added complexity to our logistical operations and may extend our inventory cycle. Our business may be adversely affected if our ability to distribute products is further impacted by any such events.

13

In addition, more stringent processes for the issuance of visas and the admission of non-U.S. persons to the United States may make travel to our headquarters in Miami by representatives of some vendors and customers more difficult. These developments may adversely affect our relationships with these vendors and customers.

The combination of our Miami headquarters’ location in an area prone to hurricanes, the increased difficulties and cost in processing imports and exports through United States airports and seaports, and the increased difficulties in travel by certain non-U.S. persons to the United States could diminish the attractiveness of Miami as a leading business center for Latin America and the Caribbean in general, and as the central hub for the Latin American and Caribbean IT products distribution industry in particular. In the event of the emergence of one or more other hubs serving the Latin American and Caribbean market that are more favorable to IT distributors, competitors operating in those locations could have an advantage over us. The partial or total relocation of our main warehouse and logistics center in Miami to any such new hubs could materially increase our operating costs or capital expenditures.

Our substantial debt could adversely affect our financial condition.

We have now and will continue to have a substantial amount of debt, which requires significant interest and principal payments. As of December 31, 2006, we had $137.9 million total debt outstanding (consisting of $119.2 million outstanding under our high yield notes, net of discount, $16.6 million outstanding under the revolving credit facility of Software Brokers of America, or SBA, our fully-owned subsidiary, $1.5 million of outstanding debt of our in-country subsidiaries and $0.6 million of capital leases). Subject to the limits contained in the indenture governing our high yield notes and our other debt instruments, we may be able to incur additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our high level of debt could intensify. Specifically, our high level of debt could have important consequences to the holders of our common stock, including the following:

| | • | | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| | • | | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes; |

| | • | | increasing our vulnerability to general adverse economic and industry conditions; |

| | • | | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; |

| | • | | placing us at a disadvantage compared to other, less leveraged competitors; and |

| | • | | increasing our cost of borrowing. |

The indenture governing our high yield notes and the credit agreement governing SBA’s revolving credit facility impose significant operating and financial restrictions on our company and our subsidiaries, which may prevent us from capitalizing on business opportunities.

The indenture governing our high yield notes imposes significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

| | • | | incur additional indebtedness or enter into sale and leaseback obligations; |

| | • | | pay certain dividends or make certain distributions on our capital stock or repurchase our capital stock; |

| | • | | make certain investments or other restricted payments; |

| | • | | place restrictions on the ability of subsidiaries to pay dividends or make other payments to us; |

| | • | | engage in transactions with shareholders or affiliates; |

| | • | | sell certain assets or merge with or into other companies; |

| | • | | guarantee indebtedness; and |

14

SBA’s revolving credit facility limits SBA’s ability, among other things, to:

| | • | | incur additional indebtedness; |

| | • | | make certain capital expenditures; |

| | • | | guarantee obligations, other than SBA’s guarantee of our high yield notes; |

| | • | | create or allow liens on assets, other than liens securing our high yield notes; |

| | • | | make investments, loans or advances; |

| | • | | pay dividends, make distributions and undertake stock and other equity interest buybacks; |

| | • | | make certain acquisitions; |

| | • | | engage in mergers, consolidations or sales of assets; |

| | • | | use proceeds of the revolving credit facility for certain purposes; |

| | • | | enter into certain lease obligations; |

| | • | | enter into transactions with affiliates on non-arms’ length terms; |

| | • | | sell or securitize receivables; |

| | • | | make certain payments on subordinated indebtedness; or |

| | • | | create or acquire subsidiaries. |

In addition, SBA’s revolving credit facility requires SBA to:

| | • | | maintain a tangible effective net worth of at least $37.0 million which minimum level shall decline from the end of the fourth fiscal quarter of 2006 to the end of the third fiscal quarter of 2007 to $25.0 million and remain at $25.0 million thereafter (tested quarterly); |

| | • | | maintain a ratio of senior debt to tangible effective net worth of not more than 2.5 to 1.0 (tested quarterly); and |

| | • | | maintain, for each fiscal year, net income of not less than $0. |

As a result of these covenants and restrictions, we are limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We may not be able to maintain compliance with these covenants in the future and, if we fail to do so, we may not be able to obtain waivers from the lenders and/or amend the covenants.

In early 2005, we were in default under covenants in our then existing senior secured credit facility as a result of the timing of a capital expenditure and maintaining excess cash balances at our foreign subsidiaries. We obtained waivers to avoid continuing to be in default under the facility. In addition, SBA was in default under its existing revolving credit facility as a result of SBA’s repayment of a portion of the outstanding principal under our intercompany loan to SBA. SBA was prohibited from repaying any principal under the intercompany loan pursuant to a subordination agreement with the lender under the revolving credit facility. The lender granted a waiver of the default and amended the revolving credit facility and related subordination agreement to allow SBA to repay the principal under the intercompany loan ($22.6 million of which remained outstanding) provided no default exists under the revolving credit facility, which amounts will be used by us to pay interest and sinking funds payments due under our high yield notes.

If SBA is required to seek similar or other waivers under its revolving credit facility or any replacement facility in the future, SBA may not be able to obtain them on acceptable terms or at all. If SBA fails to obtain such waivers or a replacement facility, we may not have resources sufficient to meet our anticipated debt service requirements, capital expenditures and working capital needs.

Our and SBA’s failure to comply with the restrictive covenants described above could result in an event of default, which, if not cured or waived, could result in our or SBA’s being required to repay these borrowings before their respective due dates. If we or SBA is forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected.

15

We have significant credit exposure to our customers. Should we become unable to manage our accounts receivable, our results of operations and liquidity could be adversely affected. We extend credit for a significant portion of sales to our customers. We are subject to the risk that our customers may fail to pay or delay payment for the products they purchase from us, resulting in longer payment cycles, increased collection costs, defaults exceeding our expectations and an adverse impact on the cost or availability of financing. These risks may be exacerbated by such factors as adverse economic conditions, decreases in demand for our products and negative trends in the businesses of our reseller customers.

We have a number of credit facilities under which the amount we are able to borrow is based on the value and quality of our accounts receivable. Our borrowing capacity under these facilities is affected by several factors, principally including:

| • | | the estimated collectibility of our accounts receivable; |

| • | | general and regional industry and economic conditions; |

| • | | our and our customers’ creditworthiness, as determined by various entities; and |

| • | | our and our customers’ operating results, financial position and cash flows. |

Any reduction in our borrowing capacity under these credit facilities could adversely affect our ability to finance our working capital and other needs.

We may suffer from theft of inventory. We store significant quantities of inventory at warehouses in Miami and throughout Latin America and the Caribbean. In the past, we have experienced inventory theft at, or in transit to or from, certain of these facilities. We may be subject to future significant inventory losses due to theft from our warehouses, hijacking of trucks carrying our inventory or other forms of theft. The implementation of security measures beyond those already utilized by the Company, which include alarm systems in our warehouses, GPS tracking systems on delivery vehicles and armed escorts for shipment of our products in certain Latin American countries, would increase our operating costs. Also, any such losses of inventory could exceed the limits of, or be subject to an exclusion from, coverage under our insurance policies. Claims filed by us under our insurance policies could lead to increases in the insurance premiums payable by us or the termination of coverage under the relevant policy.

We are dependent on a variety of IT and telecommunications systems. We are dependent on a variety of IT and telecommunications systems, including systems for managing our inventories, accounts receivable, accounts payable, order processing, shipping and accounting. In addition, our ability to price products appropriately and the success of our expansion plans depend to a significant degree upon our IT and telecommunications systems. We are in the process of implementing a company-wide financial reporting system, and our experience with this new platform is limited. This platform may require further modifications and user training in order to properly handle all of the different accounting requirements of the countries in which we operate. Furthermore, in order to adapt to higher shipping volumes, we have recently upgraded the logistics and inventory management system employed in our Miami-based distribution center and are currently upgrading these systems in our in-country distribution centers. Any temporary or long-term failure of these systems could adversely impact our business and results of operations. Further, our failure to adapt and upgrade our systems to keep pace with our future development and expansion could have an adverse effect on our business and results of operation

16

We do not have a comprehensive disaster recovery system or disaster recovery plan. Our failure to have such a system or plan in place could adversely affect our business and results of operations.

We may be unable to obtain and maintain adequate insurance at reasonable costs. Due to the risks associated with our business, we carry substantial amounts of insurance. In particular, we insure inventory shipments from our vendors and intra-company inventory shipments and we obtain credit insurance against the failure to pay or delay in payment for our products by some of the customers of our Miami operations. Because of concerns arising from large damage awards and incidents of terrorism, it has become increasingly difficult for us to obtain adequate insurance coverage at reasonable costs. Our operations and financial condition could be adversely affected by a loss for which we do not have insurance, that is subject to an exclusion or that exceeds our applicable policy limits. In addition, increasing insurance premiums could adversely affect our results of operations. Failure to obtain credit insurance may have a negative impact on the amount of borrowing capacity available to our Miami-based operations under our revolving credit facility.

We are reliant on third party shippers and carriers whose operations are outside our control. We rely on arrangements with third-party shippers and carriers such as independent shipping companies for timely delivery of our products to our in-country operations and third-party distributors and resellers. As a result, we are subject to carrier disruptions and increased costs due to factors that are beyond our control, including labor strikes, inclement weather and increased fuel costs. If the services of any of these third parties become unsatisfactory, we may experience delays in meeting our customers’ product demands and we may not be able to find a suitable replacement on a timely basis or on commercially reasonable terms. Any failure to deliver products to our customers in a timely and accurate manner may damage our reputation and could cause us to lose customers.

We anticipate that we may need to raise additional financing, which may not be available on terms acceptable to us, if at all. We expect our operating expenditures and working capital needs to increase over the next several years as our sales volume increases and we expand our geographic presence and product portfolio. While we currently believe that we have adequate financing to sustain our business, we may not be able to accurately predict future operating results or changes in our industry. Thus, we may have to raise additional capital to support our business operations, including obligations to vendors. In the event that such additional financing is necessary, we may seek to raise such funds through public or private equity or debt financing or other means. We may not be able to raise additional financing when we need it, or we may not be able to raise financing on terms acceptable to us. In the event that adequate funds are not available, our business and results of operations may be materially adversely affected.

The interests of our principal shareholder may not be aligned with yours. As our controlling shareholder, CVC International is able to elect a majority of our board of directors, select our management team, determine our corporate and management policies and make decisions relating to fundamental corporate actions. Our controlling shareholder’s interests may not be aligned with your interests as a holder of the notes. In addition, under the shareholders agreement among us and our shareholders, the members of our board of directors appointed by Anthony Shalom and Michael Shalom have veto rights over certain decisions, which could result in a deadlock and consequently could delay our management’s decision-making process.

We are exposed to increased costs and risks associated with complying with the Sarbanes-Oxley Act of 2002 and other corporate governance and disclosure standards. Our overhead costs may increase and our net income may decline as a result of the additional costs associated with complying with the complex legal requirements resulting from being a public reporting company. In addition, Section 404 of the Sarbanes-Oxley Act of 2002, or SOX, requires management’s annual review and evaluation of our internal controls over financial reporting and attestations of the effectiveness of these controls by our management for our fiscal year ended December 31, 2007 and by our independent registered public accounting firm for our fiscal year ended December 31, 2008. We are currently working towards ensuring that adequate resources and expertise, both internal and external, are put in place to meet this requirement. We intend to work closely with our independent registered public accounting firm during this process. Though we are currently making efforts to become compliant with Section 404 requirements in a timely manner, our efforts may not result in management assurance or an attestation by the independent auditors that our internal controls over financial reporting are adequate. In the event that our Chief Executive Officer, Chief Financial Officer or independent registered public accounting firm determines that our controls over financial reporting are not effective as required by Section 404 of SOX, investor perceptions of us may be adversely affected and we may incur significant additional costs to remedy shortcomings in our internal controls.

17

We may face additional expenses and disruption due to the relocation of our main warehouse in Miami. Our Miami warehouse serves as the central hub of our distribution system to our in-country operations. In order to accommodate growth in our operations, we entered into a lease for a 221,000 square foot facility that serves as our new Miami headquarters and distribution center. We moved into the new facility on March 23, 2007. As a result of the move, we incurred and will incur additional expenses and may encounter disruption of operations related to the move, all of which could delay shipment of products to our in-country operations, reduce our sales volumes and increase our working capital requirements.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our corporate headquarters is located in Miami, Fl. We support our operations through an extensive sales and administrative office and distribution network throughout Latin America and the Caribbean. As of December 31, 2006, we operated 25 distribution centers throughout our markets.

As of December 31, 2006, we leased substantially all our facilities on varying terms. We do not anticipate any material difficulties with the renewal of any of our leases when they expire or in securing replacement facilities on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS

As of December 31, 2006, the Company had no material legal proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report, through the solicitation of proxies or otherwise. On February 27, 2007 the Board of Directors of the Company authorized the one-time issuance of 1,540 options under the 2007 Founders’ Grant Stock Option Plan (“Plan”) which is subject to final shareholder approval.

18

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock. The Company had 100,000 shares of Common Stock and 2,182 shares of Class B non-voting Common Stock, which we collectively refer to as Common Stock outstanding as of December 31, 2006 and 2005, respectively. The Company’s Common Stock is privately held and not traded on a public stock exchange.

As of March 30, 2007, there were 17 holders of record of our Common Stock. See “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for a discussion of the ownership of the Company.

Dividend Policy. The Company declared and paid a $20.0 million dividend on our Common Stock on August 25, 2005 upon completion of the $120.0 million 11 3/4% Second Priority Senior Secured Notes due January 2011 offering. We have neither declared nor paid a dividend on our Common Stock subsequently. We currently intend to retain future earnings to fund on-going operations and finance the growth and development of our business and, therefore, do not anticipate declaring or paying cash dividends on our Common Stock for the foreseeable future. Any future decision to declare or pay dividends will be at the discretion of the Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as the Board of Directors deems relevant. In addition, certain of our debt facilities contain restrictions on the declaration and payment of dividends.

Equity Compensation Plan Information. As of December 31, 2006 the Company did not offer equity compensation plans under which equity securities of our company are authorized for issuance. On February 27, 2007 the Board of Directors of the Company authorized a one-time issuance of 1,540 options under the 2007 Founders’ Grant Stock Option Plan (“Plan”) to certain management employees and independent directors of the Company. The Plan considers a three-year vesting period, a ten-year exercise life and an exercise strike price determined by a study conducted by an independent expert.

19

ITEM 6. SELECTED FINANCIAL DATA

SELECTED CONSOLIDATED FINANCIAL DATA

The following table presents selected financial information and other data as of and for the years ended December 31, 2006, 2005, 2004, 2003 and 2002 and includes the results of operations of our acquisitions that have been combined with our results of operations beginning on their acquisition dates. We derived the statement of operations and other data set forth below for the years ended December 31, 2006, 2005 and 2004, and the balance sheet data as of December 31, 2006 and 2005 from our audited consolidated financial statements (together with the notes thereto) included elsewhere in this Annual Report on Form 10-K. We derived the selected financial information and other data for the years ended December 31, 2003 and 2002 and as of December 31, 2004 and 2003 from our audited consolidated financial statements with respect to such date and period not included in this Annual Report on Form 10-K. The balance sheet and statement of operations data as of December 31, 2002 are unaudited combined financial information and other data reflecting the combination of Intcomex Holdings, LLC, our direct subsidiary (which in turn is a direct or indirect parent of our operating subsidiaries), and a predecessor parent company of Intcomex Holdings, LLC, the derivation of which is described in footnote 2 to the table below. The information set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and notes thereto, included elsewhere in this Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2005(1) | | | 2004 | | | 2003 | | | 2002 | |

| | | (dollars in thousands, except per share data) | | | (unaudited) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 889,779 | | | $ | 716,440 | | | $ | 554,345 | | | $ | 418,330 | | | $ | 333,442 | |

Cost of revenue | | | 797,665 | | | | 642,737 | | | | 495,536 | | | | 371,262 | | | | 295,200 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 92,114 | | | | 73,703 | | | | 58,809 | | | | 47,068 | | | | 38,242 | |

Operating expenses | | | 57,537 | | | | 43,343 | | | | 33,815 | | | | 26,259 | | | | 23,054 | |

| | | | | | | | | | | | | | | | | | | | |