UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2007

Commission file number 000-52511

ATWOOD MINERALS AND MINING CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

1030 Denman St. Suite 125A

Vancouver, British Columbia

Canada V6G 2M6

(Address of principal executive offices, including zip code.)

(604) 818-2617

(Registrant's telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.[ ] Yes No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:[ ] Yes No [X]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | | [ ] | Accelerated filer [ ] | |

| Non-accelerated filer | | [ ] | Smaller reporting company [X] | |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).[X] Yes[ ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as ofNovember 30, 2007: $0.00.

| TABLE OF CONTENTS |

| |

| PART I | | Page |

| |

| Item 1. | Business. | 3 |

| Item 1A. Risk Factors. | II | -1 |

| Item 1B. Unresolved Staff Comments. | II | -1 |

| Item 2. | Properties. | II | -1 |

| Item 3. | Legal Proceedings. | II | -1 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | II | -1 |

| |

| PART II | | | |

| |

| Item 5. | Market For Common Stock and Related Stockholder Matters. | II | -1 |

| Item 6. | Selected Financial Data | II | -1 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition or Plan of | | |

| | Operation. | II | -3 |

| |

| PART III | | | |

| |

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk. | II | -6 |

| Item 8. | Financial Statements and Supplementary Data. | II | -6 |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial | | |

| | Disclosure | II | -18 |

| Item 9A. Controls and Procedures | II | -19 |

| Item 9B. Other Information | II | -19 |

| Item 10. | Directors, Executive Officers, Promoters and Control Persons; Compliance with | | |

| | Section 16(a) of the Exchange Act | III | -1 |

| Item 11. | Executive Compensation | III | -3 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | III | -4 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | III | -5 |

| |

| PART IV | | | |

| |

| Item 14. | Principal Accountant Fees and Services. | III | -5 |

| Item 15. | Exhibits, Financial Statement Schedules. | III | -7 |

-2-

PART I

ITEM 1. BUSINESS

General

We were incorporated in the State of Nevada on May 12, 2005. We are an exploration stage corporation. We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. The property consists of one mineral claim containing 412.807 hectares located in the Nicola Mining Division District of British Columbia, Canada. The one property consists of four mineral claims. We intend to explore for gold on the property. Our exploration program should take approximately 365 days, weather permitting. If we do not find mineralized material on the property, we do not know what we will do.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans. Currently, we do not intend to acquire other interests in any other mineral properties. Our business plan is solely to explore one mineral property. If we are successful in our initial endeavors, we may look at other exploration situations.

Background

In June 2005, we paid Laurence Sookochoff, a non-affiliated third party, US$5,000.00 for the property. Mr Sookochoff is a professional geologist residing in Vancouver, British Columbia.

Canadian jurisdictions allow a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by depositing posts or other visible markers to indicate a claimed area. The process of posting the area is known as staking. The claim is recorded in the name of Mr. Sookochoff to avoid paying additional fees. Mr. Sookochoff suggested that the property be retained in his name and we concurred therewith. The property was selected by Mr. Brenner after consulting with Mr. Sookochoff. Mr. Sookochoff was paid US$5,000 for the property. No money was paid to Mr. Sookochoff to hold the claim. No money will be paid to Mr. Sookochoff to transfer the property to us. Mr. Sookochoff has provided us with a declaration of trust stating that he holds the property in trust for us. Mr. Sookochoff will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property.

Under British Columbia law, title to British Columbia mineral claims can only be held by British Columbia residents. In the case of corporations, title must be held by a British Columbia corporation. Since we are an American corporation, we can never possess a legal mineral claim to the land. In order to comply with the law we would have to incorporate a British Columbia wholly owned subsidiary corporation and obtain audited financial statements. We believe those costs would be a waste of our money at this time since the legal costs of incorporating a subsidiary corporation, the accounting costs of audited financial statements for the subsidiary corporation, together with the legal and accounting costs of expanding this registration statement would cost several thousands of dollars. Accordingly, we have elected not to create the subsidiary at this time, but will do so if mineralized material is discovered o n the property.

-3-

In the event that we find mineralized material and the mineralized material can be economically extracted, we will form a wholly owned British Columbia subsidiary corporation and Mr. Sookochoff will convey title to the property to the wholly owned subsidiary corporation. Should Mr. Sookochoff transfer title to another person and that conveyance is recorded before we record our conveyance, that other person will have superior title and we will have none. If that event occurs, we will have to cease or suspend activities. We will have a cause of action against Mr. Sookochoff for breach of declaration of trust. Mr. Sookochoff has agreed verbally with us not to cause the title to pass to another entity.

All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty. Ungranted minerals are commonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of the Company’s property, that is the province of British Columbia.

In the nineteenth century, the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. Our property is one such acquisition. Accordingly, fee simple title to our property resides with the Crown. That means that the Crown owns the surface and minerals.

Our claim is a mineral lease issued pursuant to the British Columbia Mineral Act. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease continued vertically downward.

The property is unencumbered, that is there are no claims, liens, charges or liabilities against the property, and there are no competitive conditions, that is the action of some unaffiliated third party, that could affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

To date we have performed only minimal work on the property. Accordingly, there is no assurance that a commercially viable mineral deposit, a reserve, exists in the property, in fact the likelihood that a commercially viable mineral deposit exists is remote.

There are no native land claims that affect title to the property. We have no plans to try to interest other companies in the property if mineralization is found. If mineralization is found, we will try to develop the property ourselves.

Mr. Sookochoff suggested purchasing the claim to Mr. Brenner. Mr. Brenner, after reviewing the matter with Mr. Sookochoff, agreed and accordingly it was decided to proceed with the project as discussed herein.

-4-

Claims

The following is a list of the claim tenure numbers, the date of recording and expiration date of our claim:

| Claim No. | Document Description | Recording | Expiration |

| 513751 | Step | June 1, 2005 | December 1, 2008 |

Our claim consists of 20 contiguous cells comprising of a total of 412.807 hectares.

In order to maintain this claim, Mr. Sookochoff or the Company must pay a fee of approximately CDN$1,700 per year for the Step Claim or we must perform an equal value of exploration and development work on the claim. As long as the fee is paid, no work has to be performed to maintain the claim. Mr. Sookochoff can renew the claim indefinitely by paying the fee. We have no idea if the fee to renew the claim will increase after 2007. There is no grace period if there is a default on the work or if Mr. Sookochoff misses renewing the claim. Mr. Sookochoff will not cause the claim to expire as a result of not renewing the same or failing to perform work on the claim, provided mineralized material is found. In the event that our exploration program does not find mineralized material, Mr. Sookochoff will allow the claim to expire and we may cease activities. We will reimburse Mr. Sookochoff for payments made by him to maintain the claim. In 2006 and 2007, the Company performed sufficient exploration work to avoid payment of the annual fee.

The property was selected because gold has been discovered in the area.

Location and Access

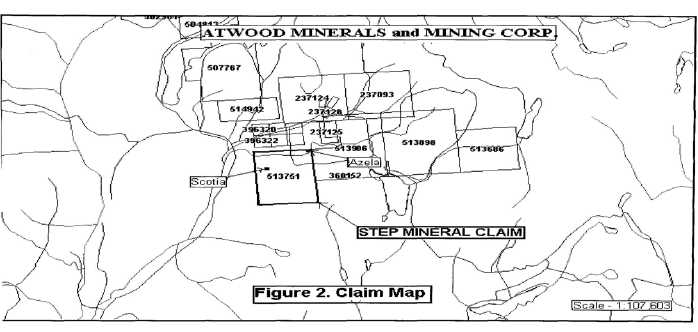

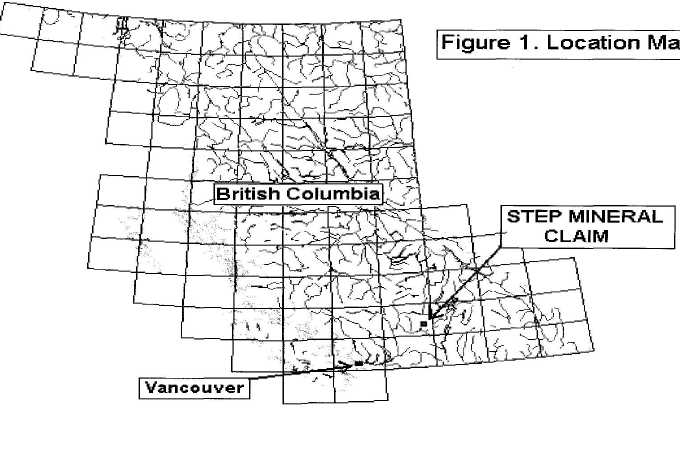

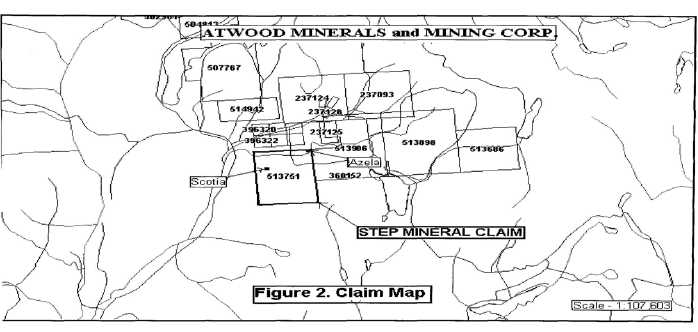

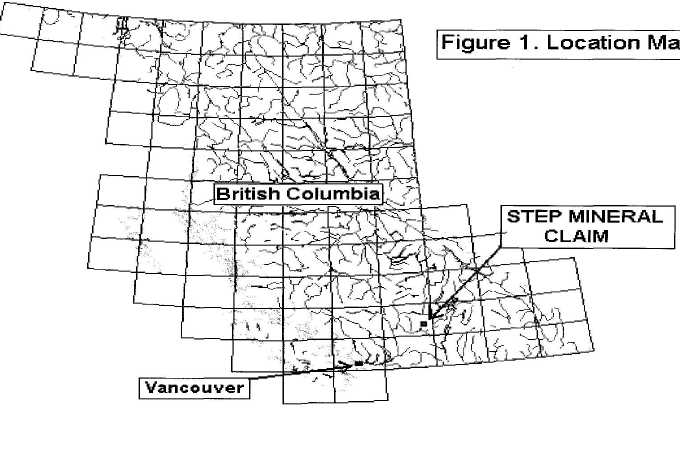

The property is located in southwestern British Columbia, northwest of Merritt, south of Kamloops and within three miles of Mineral Hill.

Access can be obtained by road from either Merritt, which is located approximately 25 miles to the southwest or from Kamloops which is located approximately 25 road miles to the north, via the Merritt-Kamloops Highway No. 5 to within two miles of the property. A secondary road, the Peter Hope Lake road, junctions off to the east within two miles south of Stump Lake and provides access to, and through, the property.

-5-

MAP 1

MAP 2

-6-

Physiography

The property lies between elevations of 2,000 feet and 3,000 feet. The terrain is gently slopping. Vegetation consists mainly of deciduous trees and scattered pine trees.

The property is snow-free from March to December, providing a nine to ten month explorationseason.

Property Geology

The major type of rocks found on the property are of the nicola group of rocks including meta-sediments, volcanics and granatoid rocks. Gold is found in such formations. As of the date hereof, we have not found or determined if gold is located on our property.

Our Exploration Program

We are prospecting for gold. Our target is mineralized material. Our success depends upon finding mineralized material. Mineralized material is a mineralized body which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we may cease activities. We anticipate being able to delineate a mineralized body, if one exists, after our exploration program has been completed.

We do not own any interest in any property, but merely have the right to conduct exploration activities on one property.

In addition, we presently do not have enough money to complete our exploration of the property. We will try to raise additional funds from a private placement or loans. However, there is no assurance that we will be able to do so.

We must conduct exploration to determine what amount of minerals, if any, exist on the property and if any minerals which are found can be economically extracted and profitably processed.

Before gold retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We cannot predict what that will be until we find mineralized material.

We do not know if we will find mineralized material.

Our exploration program is designed to economically explore and evaluate the property.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

-7-

In August 2006, our consulting geologist completed a Lineament Array Analysis. In December 2007, our consulting geologist completed a localized VLF-EM survey and identified certain structures (anomalies) to explore for mineralized material.

If sufficient financing becomes available, we intend to begin core drilling. Core drilling will cost approximately $20.00 per foot. Our plan is to drill 36 holes to a depth of 100 feet for a total cost of approximately $72,000.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for mineralized material. We may or may not find any mineralized material. We hope we do, but it is impossible to predict the likelihood of such an event.

We do not have any plans to make our company generate revenue. That is because we have not found economic mineralization yet and it is impossible to project revenue generation from nothing.

If we do not find mineralized material on the property, Mr. Sookochoff will allow the claim to expire and we may cease activities.

Competitive Factors

The gold mining industry is fragmented. We compete with other exploration companies looking for gold. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. While we compete with other exploration companies, there is no competition for the exploration or removal or mineral from our property. Readily available gold markets exist in Canada and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Regulations

Our mineral exploration program is subject to the British Columbia Mineral Tenure Act Regulation. This act sets forth rules for

| | * | locating claims |

| * | working claims |

| * | reporting work performed |

We are also subject to the British Columbia Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our activities. These regulations will not impact our exploration activities. The only current costs we anticipate at this time are reclamation costs. Reclamation costs are the costs of restoring the property to its original condition should mineralized material not be found. We estimate that it will cost between $3,000 and $9,000 to restore the property to its original condition, should mineralized material not be found. The variance is based upon the number of holes that are drilled by us.

-8-

Environmental Law

We are also subject to the Health, Safety and Reclamation Code for Mines in British Columbia. This code deals with environmental matters relating to the exploration and development of mineral properties. Its goals are to protect the environment through a series of regulations affecting:

| | 1. | Health and Safety |

| 2. | Archaeological Sites |

| 3. | Exploration Access |

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mineral activities. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our activities and know what that will involve from an environmental standpoint.

We are in compliance with the act and will continue to comply with the act in the future. We believe that compliance with the act will not adversely affect our business activities in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only “cost and effect” of compliance with environmental regulations in British Columbia is returning the surface to its previous condition upon abandonment of the property. We cannot speculate on those costs in light of our ongoing plans for exploration. When we are ready to drill, we will notify the B.C. Inspector of Mines. He will require a bond to be put in place to assure that the property will be restored to its original condition. We have estimated the cost of restoring the property to be between $3,000 to $9,000, depending upon the number of holes drilled.

Subcontractors

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no employees, other than Mr. Brenner our sole officer and director. Mr. Brenner is a part-time employees and will devote about 25% of his time to our operations. Mr. Brenner does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to Mr. Brenner. Mr. Brenner will handle our administrative duties. Because Mr. Brenner is inexperienced with exploration, he will hire qualified persons to perform the surveying, exploration, and excavating of our property.

-9-

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

None.

ITEM 3. LEGAL PROCEEDINGS

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

PART II

ITEM 5. MARKET FOR COMMON STOCK AND RELATED STOCKHOLDERMATTERS Our shares are traded on the Bulletin Board operated by the Financial Industry Regulatory Authority under the symbol “AWMM.”A summary of trading by quarter for 2006 and 2007 fiscal years is as follows:

| Fiscal Year | | High Bid | | Low Bid |

| 2007 | | | | |

| Fourth Quarter 10-1-07 to 12-31-07 | $ | 0.25 | $ | 0.25 |

| Third Quarter 7-1-07 to 9-30-07 | $ | 0.25 | $ | 0.25 |

| Second Quarter 4-1-07 to 6-30-07 | $ | 0.25 | $ | 0.25 |

| First Quarter 1-1-07 to 3-31-07 | $ | 0.25 | $ | 0.25 |

| |

| Fiscal Year | | High Bid | | Low Bid |

| 2006 | | | | |

| Fourth Quarter 10-1-06 to 12-31-06 | $ | 0.25 | $ | 0.25 |

| Third Quarter 7-1-06 to 9-30-06 | $ | 0.25 | $ | 0.25 |

| Second Quarter 4-1-06 to 6-30-06 | $ | 0.25 | $ | 0.25 |

| First Quarter 1-1-06 to 3-31-06 | $ | 0.25 | $ | 0.25 |

II-1

Of the 6,100,000 shares of common stock outstanding as of December 31, 2007, 3,000,000 shares are owned by our sole officer and director and 3,100,000 shares are owned by non-affiliates.

We issued 3,000,000 shares of our common stock to Mr. Walter Brenner on September 1, 2005 pursuant to Reg. S of the Securities Act of 1933. Mr. Brenner is our president, chief executive officer, treasurer, principal financial officer and a director. Mr. Brenner acquired these shares at a price of $0.001 per share for total proceeds to us of $3,000.00.

We completed a private placement of 2,100,000 restricted shares of our common stock at a price of $0.001 per share to five purchasers on September 1, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from the private placement was $2,100.

We completed a private placement of 800,000 restricted shares of our common stock at a price of $0.01 per share to eight purchasers on November 1, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from the private placement was $8,000.

We completed a private placement of 200,000 restricted shares of our common stock at a price of $0.05 per share to ten purchasers on November 30, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from this offering was $10,000.

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section Rule 15(g)of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6, and 15g-9 promulgated thereunder. They impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses).

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules.

Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker/dealer to engage in a penny stock transaction unless the broker/dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker/dealers from completing penny stock transactions for a customer unless the broker/dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

II-2

Rule 15g-5 requires that a broker/dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker/dealers selling penny stocks to provide their customers with monthly account statements.

Rule 15g-9 requires broker/dealers to approve the transaction for the customer’s account; obtain a written agreement from the customer setting forth the identity and quantity of the stock being purchased; obtain from the customer information regarding his investment experience; make a determination that the investment is suitable for the investor; deliver to the customer a written statement for the basis for the suitability determination; notify the customer of his rights and remedies in cases of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of the this report includes a number of forward- looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking states are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or out predictions.

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business activities.

II-3

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on the property.

We will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not have enough money to complete our exploration of the property, we will have to find alternative sources, like a public offering, another private placement of securities, or loans from our sole officer, Walter Brenner or others.

Mr. Brenner is unwilling to make any commitment to loan us any money at this time. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can't raise it, we will either have to suspend activities until we do raise the cash, or cease activities entirely. Other than as described in this paragraph, we have no other financing plans.

We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. Even if we complete our current exploration program and it is successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of this report. We are not going to buy or sell any plant or significant equipment during the next twelve months. We will not buy any equipment until we have located a reserve and we have determined it is economical to extract the minerals from the land.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

If we are unable to complete any phase of exploration because we don’t have enough money, we will cease activities until we raise more money. If we can’t or don’t raise more money, we will cease activities. If we cease activities, we don’t know what we will do and we don’t have any plans to do anything.

We do not intend to hire additional employees at this time. All of the work on the property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from activities. We cannot guarantee we will be successful in our business activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

II-4

To become profitable and competitive, we conduct research and exploration of our properties before we start production of any minerals we may find. We are seeking equity financing to provide for the capital required to implement our research and exploration phases.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our activities. Equity financing could result in additional dilution to existing shareholders.

Results of Activities

From Inception on May 12, 2005 to November 30, 2007

We acquired the right to explore one property containing one claim. We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. The property has been staked and we have initiated exploration activities.

Since inception, we have used loans from Mr. Brenner, our president, to stake the property, to incorporate us, and for legal and accounting expenses. Net cash provided by him since inception on May 12, 2005 to November 30, 2007 was $40,884. The loans are not evidenced by any written instrument and have no specific terms of repayment. The loans are without interest.

Liquidity and Capital Resources

As of the date of this report, we have yet to generate any revenues from our business activities.

We issued 3,000,000 shares of our common stock to Mr. Walter Brenner on September 1, 2005 pursuant to Reg. S of the Securities Act of 1933. Mr. Brenner is our president, chief executive officer, treasurer, principal financial officer and a director. Mr. Brenner acquired these shares at a price of $0.001 per share for total proceeds to us of $3,000.00.

We completed a private placement of 2,100,000 restricted shares of our common stock at a price of $0.001 per share to the five purchasers on September 1, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from the private placement was $2,100.

We completed a private placement of 800,000 restricted shares of our common stock at a price of $0.01 per share to eight purchasers on November 1, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from the private placement was $8,000.

We completed a private placement of 200,000 restricted shares of our common stock at a price of $0.05 per share to ten purchasers on November 30, 2005 pursuant to Reg. S of the Securities Act of 1933. The total amount received from this offering was $10,000.

As of November 30, 2007, our total assets were $8,921 and our total liabilities were $43,859.

II-5

Recent accounting pronouncements

Certain accounting pronouncements have been issued by the FASB and other standard setting organizations which are not yet effective and have not yet been adopted by the Company. The impact on the Company’s financial position and results of operations from adoption of these standards is not expected to be material.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| Atwood Minerals and Mining Corp. | |

| (An Exploration Stage Company) | |

| | |

| November 30, 2007 | |

| | Index |

| Report of Independent Registered Public Accounting Firm | F-1 |

| | |

| Report of Independent Registered Public Accounting Firm | F-2 |

| | |

| Balance Sheets | F-3 |

| | |

| Statements of Operations | F-4 |

| | |

| Statements of Stockholders’ Equity (Deficiency) | F-5 |

| | |

| Statements of Cash Flows | F-6 |

| | |

| Notes to Financial Statements | F-7 |

II-6

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Atwood Minerals and Mining Corp.

I have audited the accompanying balance sheet of Atwood Minerals and Mining Corp.(the Company), an exploration stage company, as of November 30, 2007 and the related statements of operations, stockholders’ equity (deficiency) and cash flows for the year then ended and for the period May 12, 2005 (inception) to November 30, 2007. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audit. The financial statements of Atwood Minerals and Mining Corp. as of November 30, 2006 were audited by other auditors whose report dated February 22, 2007 contained emphasis paragraphs relating to a going concern uncertainty.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Atwood Minerals and Mining Corp., an exploration stage company, as of November 30, 2007 and the results of its operations and its cash flows for the year then ended and for the period May 12, 2005 (inception) to November 30, 2007 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements referred to above have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company’s present financial situation raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MICHAEL T. STUDER CPA P.C.

Michael T. Studer CPA P.C.

Freeport, New York

February 26, 2008

F-1

II-7

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Atwood Minerals and Mining Corp. (An Exploration Stage Company)

We have audited the accompanying balance sheet of Atwood Minerals and Mining Corp. (An Exploration Stage Company) as of November 30, 2006 and the related statements of operations, stockholders’ deficit and cash flows for the year then ended and accumulated from May 12, 2005 (Date of Inception) to November 30, 2006. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the Standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above, present fairly, in all material respects, the financial position of Atwood Minerals and Mining Corp. (An Exploration Stage Company), as of November 30, 2006, and the results of its operations and its cash flows for the year then ended and accumulated from May 12, 2005 (Date of Inception) to November 30, 2006, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2(a) to the financial statements, the Company has not generated any revenue or profitable operations since inception and will need additional equity financing to begin realizing upon its business plan. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 2(a). The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MANNING ELLIOTT LLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

February 22, 2007

F-2

II-8

| Atwood Minerals and Mining Corp. | | | | | | |

| (An Exploration Stage Company) | | | | | | |

| Balance Sheets | | | | | | |

| |

| |

| ASSETS |

| | | November 30, | | | November 30, | |

| | | 2007 | | | 2006 | |

| |

| Current Assets | | | | | | |

| Cash | $ | 8,921 | | $ | 1,260 | |

| Prepaid expense | | - | | | 84 | |

| Total Current Assets | | 8,921 | | | 1,344 | |

| Mineral property acquisition costs, less reserve for | | | | | | |

| impairment of $5,000 and $5,000, respectively | | - | | | - | |

| Total Assets | $ | 8,921 | | $ | 1,344 | |

| |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY(DEFICIENCY) |

| Current Liabilities | | | | | | |

| Accounts payable | $ | 1,975 | | $ | 2,100 | |

| Accrued liabilities | | 1,000 | | | 2,027 | |

| Due to related party | | 40,884 | | | 13,884 | |

| Total current liabilities | | 43,859 | | | 18,011 | |

| Stockholders' Equity (Deficiency) | | | | | | |

| |

| Common stock, $0.001 par value; | | | | | | |

| authorized 75,000,000 shares, | | | | | | |

| issued and outstanding 6,100,000 shares | | 6,100 | | | 6,100 | |

| Additional paid-in capital | | 17,000 | | | 17,000 | |

| Donated capital | | 22,500 | | | 13,500 | |

| Deficit accumulated during the exploration stage | | (80,538 | ) | | (53,267 | ) |

| Total stockholders' equity (deficiency) | | (34,938 | ) | | (16,667 | ) |

| Total Liabilities and Stockholders' Equity (Deficiency) | $ | 8,921 | | $ | 1,344 | |

See notes to financial statements.

F-3

II-9

| Atwood Minerals and Mining Corp. | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | |

| Statements of Operations | | | | | | | | |

| |

| |

| | | | | | | | Cumulative during | |

| | | | | | | | the exploration | |

| | | Year ended | | Year ended | | | stage (May 12, | |

| | | November 30, November 30, | | | 2005 to November | |

| | | 2007 | | 2006 | | | 30, 2007) | |

| |

| Revenue | $ | - | $ | - | | $ | - | |

| |

| Cost and expenses | | | | | | | | |

| Donated rent | | 3,000 | | 3,000 | | | 7,500 | |

| Donated services | | 6,000 | | 6,000 | | | 15,000 | |

| General and administrative | | 2,691 | | 224 | | | 3,035 | |

| Impairment of mineral property acquisition costs | | - | | - | | | 5,000 | |

| Professional fees | | 15,580 | | 28,973 | | | 50,003 | |

| Total Costs and Expenses | | 27,271 | | 38,197 | | | 80,538 | |

| Net Loss | $ | (27,271 | ) $ | (38,197 | ) | $ | (80,538 | ) |

| |

| Net Loss per share | | | | | | | | |

| |

| Basic and diluted | $ | (0.00 | ) $ | (0.01 | ) | | | |

| |

| |

| Number of common shares used to compute loss per share | | | | | | | | |

| Basic and diluted | | 6,100,000 | | 6,100,000 | | | | |

See notes to financial statements.

F-4

II-10

| Atwood Minerals and Mining Corp. | | | | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | | | | |

| Statements of Stockholders' Equity (Deficiency) | | | | | | | | | | | |

| For the period May 12, 2005 (Inception) to November 30, 2007 | | | | | | | | | |

| |

| |

| | | | | | | | | | | Deficit | | | |

| | | | | | | | | | | Accumulated | | Total | |

| | | Common Stock, | | Additional | | | | During the | | Stockholders' | |

| | | $0.001 Par Value | | Paid-in | | Donated | | Development | | Equity | |

| | | Shares | | Amount | | Capital | | Capital | | Stage | | (Deficiency) | |

| Common stock issued for cash | | | | | | | | | | | | |

| - | at a price $0.001 per share | 5,100,000 | $ | 5,100 | $ | - $ | - $ | - | $ | 5,100 | |

| - | at a price $0.01 per share | 800,000 | | 800 | | 7,200 | | - | | - | | 8,000 | |

| - | at a price $0.05 per share | 200,000 | | 200 | | 9,800 | | - | | - | | 10,000 | |

| Donated services and rent | - | | - | | - | | 4,500 | | - | | 4,500 | |

| | | | | | | | | | | | | | |

| Net loss for the period May 12, | | | | | | | | | | | | |

| | 2005 (inception) to November 30, 2005 | - | | - | | - | | - | | (15,070 | ) | (15,070 | ) |

| | | | | | | | | | | | | | |

| Balance, November 30, 2005 | 6,100,00 | $ | 6,100 | $ | 17,000 | $ | 4,500 | $ | (15,070 | ) $ | 12,530 | |

| Donated services and rent | - | | - | | - | | 9,000 | | - | | 9,000 | |

| | | | | | | | | | | | | | |

| Net loss | - | | - | | - | | - | | (38,197 | ) | (38,197 | ) |

| | | | | | | | | | | | | | |

| Balance, November 30, 2006 | 6,100,000 | $ | 6,100 | $ | 17,000 | $ | 13,500 | $ | (53,267 | ) $ | (16,667 | ) |

| Donated services and rent | - | | - | | - | | 9,000 | | - | | 9,000 | |

| | | | | | | | | | | | | | |

| Net loss | - | | - | | - | | - | | (27,271 | ) | (27,271 | ) |

| | | | | | | | | | | | | | |

| Balance, November 30, 2007 | 6,100,000 | $ | 6,100 | $ | 17,000 | $ | 22,500 | $ | (80,538 | ) $ | (34,938 | ) |

See notes to financial statements.

F-5

II-11

| Atwood Minerals and Mining Corp. | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | |

| Statements of Cash Flows | | | | | | | | | |

| | | | | | | | | |

|

| | | | | | | | | the exploration | |

| | | Year ended | | | Year ended | | | stage (May 12, | |

| | | November 30, | | | November 30, | | | 2005 to November | |

| | | 2007 | | | 2006 | | | 30, 2007) | |

| |

| Cash Flows from Operating Activities | | | | | | | | | |

| Net loss | $ | (27,271 | ) | $ | (38,197 | ) | $ | (65,468 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | |

| provided by (used for) operating activities: | | | | | | | | | |

| Donated services and rent | | 9,000 | | | 9,000 | | | 18,000 | |

| Impairment of mineral property acquisition costs | | - | | | - | | | 5,000 | |

| Changes in operating assets and liabilities | | | | | | | | | |

| Prepaid expenses | | 84 | | | (84 | ) | | - | |

| Accounts payable and accrued liabilities | | (1,152 | ) | | (1,323 | ) | | 2,975 | |

| Net cash provided by (used for) operating activities | | (19,339 | ) | | (30,604 | ) | | (49,943 | ) |

| |

| Cash Flows from Investing Activities | | | | | | | | | |

| Acquisition of mineral property | | - | | | - | | | (5,000 | ) |

| Net Cash provided by (used for) investing activities | | - | | | - | | | (5,000 | ) |

| |

| Cash Flows from Financing Activities | | | | | | | | | |

| Proceeds from loans from related party | | 27,000 | | | 13,804 | | | 40,884 | |

| Proceeds from sales of common stock | | - | | | - | | | 23,100 | |

| Net cash provided by (used for) financial activities | | 27,000 | | | 13,804 | | | 63,984 | |

| |

| Increase (decrease) in cash | | 7,661 | | | (16,800 | ) | | 8,921 | |

| Cash, beginning of period | | 1,260 | | | 18,060 | | | - | |

| |

| Cash, end of period | $ | 8,921 | | $ | 1,260 | | $ | 8,921 | |

| |

| |

| Supplemental Disclosures of Cash Flow Information: | | | | | | | | | |

| Interest paid | $ | - | | $ | - | | $ | - | |

| Income taxes paid | $ | - | | $ | - | | $ | - | |

See notes to financial statements.

F-6

II-12

Atwood Minerals and Mining Corp.

(An Exploration Stage Company)

Notes to Financial Statements

November 30, 2007

| 1. | ORGANIZATION AND BUSINESS OPERATIONS |

| |

| | Organization |

| |

| | Atwood Minerals and Mining Corp. (the “Company”) was incorporated in the State of Nevada on May 12, 2005. |

| |

| | Exploration Stage Activities |

| |

| | The Company has been in the exploration stage since its formation and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining claims. Upon location of a commercial minable reserve, the Company expects to actively prepare the site for its extraction and enter a development stage. |

| |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| |

| | a) | Basis of Presentation |

| |

| | | The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States. |

| |

| | | The financial statements have been prepared on a “going concern” basis, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. At November 30, 2007, the Company had negative working capital and a stockholders’ deficiency of $34,938. For the period May 12, 2005 (inception) to November 30, 2007, the Company had no revenues and incurred a net loss of $80,538. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The Company plans to obtain additional equity capital to finance its exploration program and future operations. However, there is no assurance that the Company will be successful in accomplishing this objective. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. |

| |

| | b) | Use of Estimates and Assumptions |

| |

| | | The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company regularly evaluates estimates and assumptions related to donated expenses, and deferred income tax asset valuations. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for |

| |

F-7

II-13

Atwood Minerals and Mining Corp.

(An Exploration Stage Company)

Notes to Financial Statements

November 30, 2007

| | making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. |

| | | |

| c) | Financial Instruments |

| |

| | The carrying values of the Company’s financial instruments, consisting of cash, accounts payable and accrued liabilities, and due to related party, approximate their fair values because of the short maturity of these instruments. The Company’s operations are in Canada and some of its assets and liabilities give rise to significant exposure to market risks from changes in foreign currency rates. The Company’s financial risk is the risk that arises from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. |

| |

| d) | Cash and Cash Equivalents |

| | |

| | The Company considers all highly liquid instruments with a maturity of three months or less atthetime of issuance to be cash equivalents. |

| |

| | e) | Mineral Property Costs |

| |

| | Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred using the guidance in EITF 04-02, “Whether Mineral Rights Are Tangible or Intangible Assets”. The Company assesses the carrying costs for impairment under SFAS 144, “Accounting for Impairment or Disposal of Long Lived Assets” at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Suc h costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations. |

| |

| f) | Long-lived Assets |

| |

| | In accordance with the Financial Accounting Standards Board (“FASB”) SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the carrying value of intangible assets and other long-lived assets is reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes an impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value. |

| |

F-8

II-14

Atwood Minerals and Mining Corp.

(An Exploration Stage Company)

Notes to Financial Statements

November 30, 2007

| | g) | Foreign Currency Translation |

| |

| | The Company’s functional and reporting currency is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated in accordance with SFAS No. 52, “Foreign Currency Translation”, using the exchange rate prevailing at the balance sheet date. Gains and losses arising on settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Canadian dollars. The Company has not, to the date of these financials statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. |

| |

| h) | Comprehensive Loss |

| |

| | SFAS No. 130, “Reporting Comprehensive Income,” establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. Since inception, the Company has had no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements. |

| |

| i) | Income Taxes |

| |

| | Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. Pursuant to SFAS No. 109, the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years. |

| |

| j) | Basic and Diluted Net Earnings (Loss) Per Share |

| |

| | The Company computes net earnings (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. |

| |

| k) | Recent Accounting Pronouncements |

| |

| | Certain accounting pronouncements have been issued by the FASB and other standard setting organizations which are not yet effective and have not yet been adopted by the Company. The impact on the Company’s financial position and results of operations from adoption of these standards is not expected to be material. |

| |

F-9

II-15

Atwood Minerals and Mining Corp.

(An Exploration Stage Company)

Notes to Financial Statements

November 30, 2007

| 3. | MINERAL PROPERTY |

| |

| | In June 2005, the Company acquired a 100% interest in the STEP mineral claim located in the Nicola Mining Division, British Columbia, Canada for $5,000. The claim is registered in the name of the vendor, who has executed a trust agreement to hold the claim in trust on behalf of the Company. |

| |

| | At November 30, 2005, the Company recognized an impairment loss of $5,000 as it had not been determined whether there were proven or probable reserves on the property. |

| |

| 4. | RELATED PARTY BALANCES/TRANSACTIONS |

| |

| | a) | For the years ended November 30, 2007 and 2006, the Company recognized expenses of $6,000 for donated services at $500 per month and $3,000 for donated rent at $250 per month provided by the President of the Company. |

| |

| | b) | At November 30, 2007 and 2006, the Company is indebted to the President of the Company in the amounts of $40,884 and $13,884, respectively, for cash advances. The amounts are unsecured, non- interest bearing and have no specific terms of repayment. |

| |

| 5. | COMMON STOCK |

| |

| | On September 1, 2005, the Company issued 5,100,000 shares of common stock at a price of $0.001 per share for cash proceeds of $5,100. |

| |

| | On November 1, 2005, the Company issued 800,000 shares of common stock at a price of $0.01 per share for cash proceeds of $8,000. |

| |

| | On November 30, 2005, the Company issued 200,000 shares of common stock at a price of $0.05 per share for cash proceeds of $10,000. |

| |

| | The Company has no stock option plan. At November 30, 2007, there were no stock options, warrants or other dilutive securities outstanding. |

| |

F-10

II-16

Atwood Minerals and Mining Corp.

(An Exploration Stage Company)

Notes to Financial Statements

November 30, 2007

6. INCOME TAXES

No provisions for income taxes have been recorded in the periods presented since the Company has incurred net losses since inception.

Based on management’s present assessment, the Company has not yet determined it to be more likely than not that a deferred tax asset of $20,313 at November 30, 2007 attributable to the future utilization of the net operating loss carryforward of $58,038 will be realized. Accordingly, the Company has provided a 100% allowance against the deferred tax asset in the financial statements. The Company will continue to review this valuation allowance and make adjustments as appropriate. The $58,038 net operating loss carryforward expires $10,570 in year 2025, $29,197 in year 2026, and $18,271 in year 2027.

Current tax laws limit the amount of loss available to be offset against future taxable income when a substantial change in ownership occurs. Therefore, the amount available to offset future taxable income may be limited.

Other than the net operating loss carryforwards described above, the Company has no significant temporary differences. Since inception, the Company has not recorded any deferred tax assets or deferred tax liabilities.

The provisions for income taxes differ from the amounts computed by applying the statutory United States federal income tax rate of 35% to income before income taxes. A reconciliation follows:

| | | Year ended November 30, | |

| | | 2007 | | | 2006 | |

| Expected tax at 35% | $ | (9,545 | ) | $ | (13,369 | ) |

| Nondeductible donated rent and services | | 3,150 | | | 3,150 | |

| Change in valuation allowance | | 6,395 | | | 10,219 | |

| Actual provision for income taxes | $ | - | | $ | - | |

F-11

II-17

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE.

On January 3, 2008, our board of directors approved the dismissal of Manning Elliott LLP, Chartered Accountants as our principal independent accountants.

Manning Elliott LLP’s report dated February 22, 2007 on our financial statements for the fiscal years ended November 30, 2006 and 2005 did not contain an adverse opinion or disclaimer of opinion, or qualification or modification as to uncertainty, audit scope, or accounting principles.

In connection with the audits of our financial statements for the fiscal years ended November 30, 2006 and 2005 and in the subsequent interim periods through the date of resignation, there were no disagreements, resolved or not, with Manning Elliott LLP on any matters of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Manning Elliott LLP, would have caused Manning Elliott LLP to make reference to the subject matter of the disagreement in connection with their report on the financial statements for such years.

During the years ended November 30, 2006 and 2005, and in the subsequent interim periods through the date of resignation, there were no reportable events as described in Item 304(a)(1)(iv)(B) of Regulation S-B.

We provided Manning Elliott LLP with a copy of this Current Report on Form 8-K prior to its filing with the Securities and Exchange Commission, and requested that they furnish us with a letter addressed to the Securities and Exchange Commission stating whether they agree with the statements made in this Current Report on Form 8-K, and if not, stating the aspects with which they do not agree. A copy of the letter provided from Manning Elliott LLP was filed as Exhibit 16.1 to the Current Report on Form 8-K on January 9, 2008.

On January 3, 2008, we engaged Michael T. Studer CPA P.C. at 18 East Sunrise Highway, Suite 311, Freeport, New York 11520, an independent registered public accounting firm, as our principal independent accountant with the approval of our board of directors.

During the years ended November 30, 2007 and 2006, and the subsequent period through the date hereof, we have not, nor has any person on our behalf, consulted with Michael T. Studer CPA P.C., regarding either the application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on our financial statements, nor has Michael T. Studer CPA P.C. provided to us a written report or oral advice regarding such principles or audit opinion on any matter that was the subject of a disagreement or reportable event set forth in Item 304(a)(1)(iv) of Regulation S-B with our former principal independent accountant.

II-18

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are designed to ensure that information required to be disclosed in the reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time period specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the reports filed under the Exchange Act is accumulated and communicated to management, including the Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of ou r disclosure controls and procedures. Based upon and as of the date of that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures are effective to ensure that information required to be disclosed in the reports we file and submit under the Exchange Act is recorded, processed, summarized and reported as and when required.

Controls and Procedures over Financial Reporting

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 9B. OTHER INFORMATION

None.

II-18

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL

PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT.

The members of our board of directors serve until their successors are elected and qualified. Our officers are elected by the board of directors to a term of one (1) year and serve until their successors are duly elected and qualified, or until they are removed from office. The board of directors has no nominating or compensation committees.

The name, address, age and position of our present officers and directors are set forth below:

| Name | Age | Position Held |

| |

| Walter Brenner | 42 | President, Principal Executive Officer, and Director |

| | | Principal Financial Officer, Principal Accounting Officer, Treasurer, |

| | | Secretary and Director |

The persons named above have held their offices/positions since inception of our company and are expected to hold their offices/positions until the next annual meeting of our stockholders.

Background of officers and directors

Mr. Walter Brenner has been our president, principal executive officer and director since our inception on May 12, 2005. Mr. Brenner graduated from York University’s Osgoode Hall Law School in 1991 with a Bachelor of Laws degree. Since 1993, Mr. Brenner has been a director and senior officer of Hellix Ventures Inc. a British Columbia and Alberta reporting issuer listed on the TSX Venture Exchange. Hellix is listed as a mining company and also has producing petroleum properties. Mr. Brenner is also founder of Abington Ventures Inc. and has been its president and director since 1999. Abington is a British Columbia and Alberta reporting issuer listed on the TSX Venture Exchange as a mining company. Mr. Brenner devotes approximately 25% of his time to our affairs.

Conflicts of Interest

The only conflict that we foresee is that our officer and director devotes time to projects that do not involve us.

Involvement in Certain Legal Proceedings

Other than as described in this section, to our knowledge, during the past five years, no present or former director or executive officer of our company: (1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or present of such a person, or any partnership in which he was a general partner at or within two yeas before the time of such filing, or any corporation or business association of which he was an executive officer within two years before the time of such filing; (2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other

III-1

minor offenses); (3) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director of any investment company, or engaging in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodity laws; (4) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activity; (5) was found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal or state securities law and the judgment in subsequently reversed, suspended or vacate; (6) was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated.

Audit Committee and Charter

We have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by our employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; and, (5) funding for the outside auditor and any outside advisors engagement by the audit committee.

Audit Committee Financial Expert

None of our directors or officers have the qualifications or experience to be considered a financial expert. We believe the cost related to retaining a financial expert at this time is prohibitive. Further, because of our limited operations, we believe the services of a financial expert are not warranted.

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code.

III-2

Disclosure Committee and Charter

We have a disclosure committee and disclosure committee charter. Our disclosure committee is comprised of all of our officers and directors. The purpose of the committee is to provide assistance to the Chief Executive Officer and the Chief Financial Officer in fulfilling his responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports.

Section 16(a) of the Securities Exchange Act of 1934

As of the date of this report, we are not subject to section 16(a) of the Securities Exchange Act of1934.

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth information with respect to compensation paid by us to our officers and directors during the three most recent fiscal years. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any.

| | | Summary Compensation Table | | | |

| | | | | | Long Term Compensation | |

| | | Annual Compensation | Awards | Payouts | |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) |

| Other |

| | | | | Annual Restricted Securities | | |

| | | | | Compen | Stock | Underlying | LTIP | All Other |

| Name and Principal | | Salary Bonus | sation | Award(s) | Options / | Payouts | Compens |

| Position [1] | Year | ($) | ($) | ($) | ($) | SARs (#) | ($) | ation ($) |

| Walter Brenner | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| President | 2006 | 9,000 | 0 | 0 | 0 | 0 | 0 | 0 |

| | 2005 | 1,500 | 0 | 0 | 0 | 0 | 0 | 0 |

The following table sets forth information with respect to compensation paid by us to our directors during the last completed fiscal year. Our fiscal year end is November 30, 2007.

| Director Compensation Table |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

| | | | | | Change in | | |

| | | | | | Pension | | |

| | Fees | | | | Value and | | |

| | Earned | | | Non-Equity | Nonqualified | All | |

| | or | | | Incentive | Deferred | Other | |

| | Paid in | Stock | Option | Plan | Compensation Compen- | |

| | Cash | Awards | Awards | Compensation | Earnings | sation | Total |

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) |

| |

| Walter Brenner | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

III-3

We have no employment agreements with any of our officers. We do not contemplate entering into any employment agreements until such time as we begin profitable operations.

The compensation discussed herein addresses all compensation awarded to, earned by, or paid to our named executive officers.

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officers and directors other than as described herein.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Compensation of Directors

Our directors do not receive any compensation for serving as members of the board of directors.

Indemnification

Under our Articles of Incorporation and Bylaws of the corporation, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the date of this report, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholders listed below have direct ownership of his/her shares and possess voting and dispositive power with respect to the shares. Our office address is at 1030 Denman Street, Suite 125A, Vancouver, British Columbia, Canada V6G 2M6 and our telephone number is (604) 818-2617.

III-4

| | Direct Amount of | | Percent | |

| Name of Beneficial Owner | Beneficial Owner | Position | of Class | |

| Walter Brenner | 3,000,000 | President, Principal Executive Officer, | 49.18 | % |

| | | Principal Financial Officer, Principal | | |

| | | Accounting Officer, Treasurer, Secretary | | |

| | | and Director | | |

| |

| All Officers and Directors as a | | | | |

| Group (1 Person) | 3,000,000 | | 49.18 | % |

Changes in Control There are no arrangements which may result in a change of control of Atwood Minerals and Mining Corp.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We issued 3,000,000 shares of our common stock to Mr. Walter Brenner on September 1, 2005 pursuant to Reg. S of the Securities Act of 1933. Mr. Brenner is our president, chief executive officer, treasurer, principal financial officer and a director. Mr. Brenner acquired these shares at a price of $0.001 per share for total proceeds to us of $3,000.00.

Mr. Brenner provides services to us and allows us to use a portion of his home as our office at no cost to the Company.

Since inception to November 30, 2007, Mr. Brenner has loaned us $40,884 for our operations. The loans do not accrue interest and have no specific terms of repayment. There is no written document evidencing the loans.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

(1) Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for our audit of annual financial statements and review of financial statements included in our Form 10-QSBs or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years was:

| 2007 | $ | 6,000 | Michael T. Studer, CPA |

| 2007 | $ | 5,908 | Manning Elliott, LLP, Chartered Accountants |

| 2006 | $ | -0- | Michael T. Studer, CPA |

| 2006 | $ | 9,110 | Manning Elliott, LLP, Chartered Accountants |

III-5

(2) Audit-Related Fees