UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

Or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33008

PENDRELL CORPORATION

(Exact name of registrant as specified in its charter)

Washington | 98-0221142 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

2300 Carillon Point, Kirkland, Washington 98033

(Address of principal executive offices including zip code)

(425) 278-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Class A common stock, par value $0.01 per share | Not applicable |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☒ |

|

|

|

|

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

|

|

|

|

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

As of June 30, 2017, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $109,412,306

As of February 16, 2018, the registrant had 189,109 shares of Class A common stock and 53,660 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2017 ANNUAL REPORT ON FORM 10-K

INDEX

|

|

| Page |

|

| ||

Item 1. |

| 2 | |

Item 1A. |

| 4 | |

Item 1B. |

| 12 | |

Item 2. |

| 12 | |

Item 3. |

| 12 | |

Item 4. |

| 12 | |

|

|

|

|

|

|

| |

Item 5. |

| 13 | |

Item 6. |

| 16 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 18 |

Item 7A. |

| 26 | |

Item 8. |

| 27 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

| 51 |

Item 9A. |

| 51 | |

Item 9B. |

| 53 | |

|

|

|

|

|

|

| |

Item 10. |

| 53 | |

Item 11. |

| 58 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| 75 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

| 77 |

Item 14. |

| 78 | |

|

|

|

|

|

|

| |

Item 15. |

| 79 | |

Item 16. |

| 79 | |

| 83 | ||

1

This Annual Report on Form 10-K (“Form 10-K”) contains certain forward-looking statements regarding future events and our future operating results that are subject to the safe harbors created under the Securities Act of 1933, as amended (“Securities Act”), and the Securities Exchange Act of 1934, as amended (“Exchange Act”). These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All of these forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated by the relevant forward-looking statements. Factors that might cause or contribute to such a difference include, but are not limited to, those discussed under “Item 1A of Part I – Risk Factors” and elsewhere in this Form 10-K. The forward-looking statements included in this document are made only as of the date of this report, and we undertake no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances.

Overview

Pendrell Corporation (“Pendrell”), with its consolidated subsidiaries, is referred to as “us,” “we,” or the “Company.” Pendrell has, for the past six years, invested in, acquired and monetized intellectual property (“IP”) rights. In 2017, we divested the majority of our largest IP portfolio, known as our “Pendragon” portfolio, but continued to license the digital rights management (“DRM”) patents owned by our subsidiary ContentGuard Holdings, Inc. (“ContentGuard”), and the memory and storage patents owned by our subsidiary Memory Technologies LLC (“MTL”). We will continue efforts to license those DRM and memory patents in the future.

Pendrell was originally incorporated in 2000 as New ICO Global Communications (Holdings) Limited, a Delaware corporation. In July 2011, we changed our name to Pendrell Corporation. On November 14, 2012, we reincorporated from Delaware to Washington. Our principal executive office is located at 2300 Carillon Point, Kirkland, Washington 98033, and our telephone number is (425) 278-7100. Our website address is www.pendrell.com. The information contained in or that can be accessed through our website is not part of this Form 10-K.

Our Business

Revenue Generating Activities

We generate revenues by licensing and selling our IP rights to others. Our subsidiaries hold patents that support three IP licensing programs that we own and manage: (i) memory and storage technologies, (ii) digital media, and (iii) digital cinema.

We acquired most of our memory and storage patents (our “Memory Patents”) and patent applications from Nokia Inc. in March 2013, many of which have been declared essential to standards that are applicable to memory and storage technologies used in electronic devices. These patents cover embedded memory components and storage subsystems. Potential licensees include flash memory component suppliers, solid state disk manufacturers and device vendors. Since 2014, we have entered into license agreements with five leading memory device makers and a number of smaller companies in the memory space. We are in active license discussions with other memory component manufacturers and, early in 2018, filed litigation against Kingston Technology Corporation (“Kingston”) in federal district court alleging infringement of certain of our memory and storage patents (“Kingston Litigation”).

2

Our digital media program is supported by patents (our “DRM Patents”) and patent applications designed to protect against unauthorized duplication and use of digital content during the transfer of the digital content. The majority of our digital media patents and patent applications came to us through our October 2011 purchase of a 90.1% interest in ContentGuard, where we partnered with Time Warner to expand the development and licensing of ContentGuard’s portfolio of DRM technologies. We have granted digital media licenses to manufacturers, distributors and providers of consumer products, including Amazon, DirecTV, Fujitsu, LG Electronics, Microsoft Corporation, Nokia, Panasonic, Pantech, Sharp, Sony, Toshiba, Time Warner and Xerox Corporation.

Our digital cinema program is supported by DRM Patents and patent applications designed to protect against unauthorized creation, duplication and use of digital cinema content that is distributed to movie theaters globally, many of which also came to us through our acquisition of ContentGuard. Potential digital cinema licensees include distributors and exhibitors of digital content, including motion picture producers, motion picture distributors and equipment vendors. We launched our digital cinema program in June 2013, and signed a significant license with The Walt Disney Company in 2017. We are actively engaged in licensing discussions with other leading feature film studios.

In late 2017, we divested the majority of our “Pendragon portfolio,” which contained patents related to cellular and digital wireless devices and infrastructure. We are actively working to divest the remainder of the portfolio.

We typically license our patents via agreements that cover entire patent portfolios or large segments of portfolios. We expect licensing negotiations with prospective licensees to take approximately 12 to 24 months, and perhaps longer, measured from inception of technical discussions regarding the scope of our patents. If we are unable to secure reasonable, negotiated licenses, we may resort to litigation to enforce our IP rights, as evidenced by the claims we filed in 2016 against SanDisk at the ITC and in federal district court, and the claims we recently filed against Kingston in federal district court.

Our IP revenue generation activities are not limited to licensing and litigation. Patents that we believe may generate greater value through a sales transaction, such as the Pendragon portfolio, may be sold. Although some may characterize patent sale revenue differently than patent license revenue, we regard our IP monetization activities as integrated and not separate revenue streams, and therefore treat sale and license revenue the same for GAAP reporting purposes.

Our IP portfolio currently consists of patents that have already expired and others that expire between 2018 and 2035. See “Revenue opportunities from our IP monetization efforts are limited” under “Item 1A of Part I—Risk Factors.”

Business Outlook

From 2011 through 2015, we focused on acquiring and growing companies that developed or possessed unique, innovative technologies that could be licensed to third parties or could provide a competitive advantage to products we were developing. During the past three years, we moderated those efforts and reduced our costs by eliminating certain positions, reducing certain overhead costs and abandoning patent assets that do not support our existing licensing programs. In December 2017, we delisted from Nasdaq and filed for de-registration of our Class A common stock.

We have explored and continue to explore investment opportunities that are not premised on the value of IP, with the goal of investing our capital in operating companies that can generate solid, stable income streams. Due to high valuations that we attribute to inexpensive and widely available capital, we did not acquire any such operating companies in 2015, 2016 or 2017. We may encounter more suitable opportunities if the cost of capital increases over time. We intend to continue to explore new business opportunities that are better suited for non-listed private companies while keeping our costs contained.

Although our focus has evolved away from companies that develop or possess unique, innovative technologies, we will continue to dedicate effort and resources to generate revenue from our existing IP assets.

3

Competition

Due to the unique nature of our IP rights, we do not compete directly with other patent holders or patent applicants. However, to the extent that multiple parties seek royalties on the same product or service, we might as a practical matter compete for a share of reasonable royalties from manufacturers and distributors.

As we pursue opportunities that are not premised on the value of IP, we may compete with well-capitalized companies pursuing those same opportunities.

Divestiture of Satellite Assets

When we were formed in 2000, our intent was to develop and operate a next generation global mobile satellite communications system. In 2011, we started selling assets associated with the satellite business and, during 2012, we divested the remaining vestiges of our satellite business, including the sale of our remaining medium earth orbit (“MEO”) satellites and related equipment and our real property in Brazil, the transfer to a liquidating trust (the “Liquidating Trust”) of certain former subsidiaries associated with the satellite business (the “International Subsidiaries”) to address the winding down of the International Subsidiaries, and the settlement of our litigation with The Boeing Company (“Boeing”).

The 2012 divestiture and the corresponding transfer to the Liquidating Trust of the International Subsidiaries triggered tax losses of approximately $2.4 billion, which we believe can be carried forward for up to twenty years. Under the sales agreement for the MEO assets, the Company is entitled to a substantial portion of any proceeds generated from the resale of the MEO assets. In January 2015, the party that acquired the MEO assets from the Company resold the MEO assets and as a result, the Company received $3.9 million during 2015, which has been recorded in gain on contingencies in the statement of operations for the year ended December 31, 2015. On February 23, 2016, that party received the final scheduled payment for the MEO assets, which resulted in the Company’s recognition of an additional $2.0 million gain on contingency in 2016.

Employees

As of December 31, 2017, on a consolidated basis, we had the equivalent of 12 full-time employees located in Washington, California, Finland and Texas.

Available Information

The address of our website is www.pendrell.com. You can find additional information about us and our business on our website. We make available on this website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange Commission (“SEC”). You may read and copy this Form 10-K at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549-0102. Information on the operation of the public reference room can be obtained by calling the SEC at 1-800-SEC-0330. These filings are also accessible on the SEC’s website at www.sec.gov.

We also make available on our website in a printable format the charters for certain of our various Board of Director committees, including the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, and our Code of Conduct and Ethics in addition to our Articles of Incorporation, Bylaws and Tax Benefits Preservation Plan. This information is available in print without charge to any shareholder who requests it by sending a request to Pendrell Corporation, 2300 Carillon Point, Kirkland, Washington 98033, Attn: Corporate Secretary. The material on our website is not incorporated into or part of this Form 10-K.

The risks below address some of the factors that may affect our future operating results and financial performance. If any of the following risks develop into actual events, then our business, financial condition, results of operations or prospects could be materially adversely affected.

4

Risks Related to our Patents and Monetization Activities

Success of our licensing efforts depends on our ability to sign new license agreements or otherwise enforce our intellectual property rights.

IP licensing revenues are dependent on our ability to sign new license agreements with, or otherwise enforce our intellectual property rights against, users of our patented inventions. If users refuse to sign license agreements, we may need to resort to litigation or other measures to compel the payment of fair consideration, which to date has not been effective, and may not be effective in the future. This risk applies not only to new license agreements, but to existing license agreements with fixed expiration dates. If we fail to sign or renew license agreements on terms that are favorable to us or obtain favorable outcomes through litigation or other enforcement actions, the value of our IP could be further impaired.

We may have a limited number of prospective licensees.

We are actively pursuing licenses for our DRM and memory portfolios. However, our portfolios are applicable to only a limited number of prospective licensees. Moreover, many device makers who would have been prospective DRM licensees are shielded by adverse jury verdicts in the patent infringement cases that we filed in the Eastern District of Texas. In the memory and storage space, we believe we have licensed substantially more products than remain unlicensed. As such, we have a limited number of prospective licensees, and if we are unable to sign licenses with this limited group, licensing revenue will be adversely impacted. Moreover, if our portfolios are not demonstrably applicable to prospective licensees’ products or services, whether due to poor quality, lack of breadth or otherwise, parties may refuse to sign license agreements.

Revenue opportunities from our IP monetization efforts are limited.

Patents have finite lives. Our IP portfolio currently consists of numerous patents that have already expired, and others that expire between 2018 and 2035. Therefore, our IP revenue opportunities are limited.

Our licensing cycle is lengthy, costly and our licensing efforts may be unsuccessful.

Licensing our patents takes time, with some license negotiations spanning many years. We have incurred and expect to incur significant legal and sales expenses in our efforts to sign license agreements and generate license revenues. We also expect to spend considerable resources educating prospective licensees on the benefits of a license arrangement with us. As such, we may incur significant costs and losses before any associated revenue is generated.

Enforcement proceedings may be costly and ineffective.

We may choose to pursue litigation or other enforcement action to protect our intellectual property rights, such as the ITC and district court actions against SanDisk, and the recently-filed Kingston Litigation. Enforcement proceedings are typically protracted and complex, and might require cooperation of inventors and others who are unwilling or unable to assist with enforcement. Litigation also involves several stages, including the potential for a prolonged appeals process. The costs are typically substantial, and the outcomes are unpredictable. Enforcement actions will likely divert our managerial, technical, legal and financial resources from business operations. In certain cases, we may conclude that these costs and risks outweigh the potential benefits that would arise from successful enforcement, in which event we may opt not to pursue enforcement.

Our business could be negatively impacted by product composition and future innovation.

Our licensing revenues have been generated from manufacturers and distributors of products that use our patented inventions. Our business prospects could be negatively impacted if prospective licensees do not use our inventions in their products, or if they later modify their products to eliminate use of our inventions. Moreover, changes in technology or customer requirements could alter product composition and render our patented inventions obsolete or unmarketable.

5

Our patent management activities could impact the value of our IP.

We assess our IP portfolio to identify patents and patent applications that are worth preserving and patents and patent applications that are not worth preserving. Our assessment is driven by numerous factors, many of which are not scientific. Our assessment drives decisions to maintain or abandon patents and patent applications. If we make decisions that prompt abandonment of patents and patent applications with value, we could materially impact the value of our IP portfolio and our ability to generate revenue from our IP portfolio.

Challenges to the validity or enforceability of our key patents could significantly harm our business.

Any third party may challenge the validity, scope, enforceability and ownership of our patents. Challenges may include review requests to patent authorities, such as inter partes review and covered business method proceedings that have been initiated by ZTE, Apple, Google and SanDisk. Review proceedings are costly and time-consuming, and we cannot predict their outcome or consequences. Such proceedings may narrow the scope of our claims or may cancel some or all claims. If patent claims are canceled, we could be prevented from enforcing or earning future revenues from the canceled claims. Even if our claims are not canceled, our enforcement actions against alleged infringers may be stayed pending resolution of reviews, or courts or tribunals reviewing our patent claims could make findings adverse to our interests. Irrespective of outcome, review challenges may result in substantial legal expenses and diversion of management’s time and attention away from our other business operations, including our ability to evaluate and acquire other businesses. Adverse decisions could impair the value of our inventions or result in a loss of our proprietary rights and may adversely affect our results of operations and our financial position.

Changes in patent law could adversely impact our business.

Patent laws may continue to change, and may alter protections afforded to owners of patent rights, impose additional enforcement risks, increase the costs of enforcement, or increase our licensing cycles. For instance, the 2012 passage of the America Invents Act provided alleged infringers with new procedures to combat patent infringement claims, including inter partes review and covered business method proceedings to challenge patent validity. In 2013 and 2015, legislative initiatives were introduced to address perceived patent abuses by non-practicing entities, and some legislators continue to express their intention to sponsor or support similar legislation in the future. Even if legislative initiatives do not directly impact our business, such initiatives might encourage manufacturers to infringe our IP rights, lengthen our licensing cycles, increase the likelihood that we will litigate to enforce our IP rights, or make it more difficult and expensive to license our patents or enforce our patents against parties using our inventions without a license. Moreover, increased focus on the growing number of patent-related lawsuits may result in legislative changes which increase our costs and related risks of asserting patent enforcement actions.

Changes of interpretations of patent law could adversely impact our business.

Our success in review and enforcement proceedings relies in part on the historically consistent application of patent laws and regulations. Interpretations of patent laws and regulations by the courts and applicable regulatory bodies have evolved, and may continue to evolve, particularly with the introduction of new laws and regulations. Changes or potential changes in judicial interpretation could have a negative impact on our ability to monetize our patent rights.

Risks Related to our Acquisition Activities

We may over-estimate the value of assets or businesses we acquire.

We make investments from which we intend to generate a return. We estimate the value of these investments prior to acquisition, using both objective and subjective methodologies. If we over-estimate such value, we may not generate desired returns on our investment, or we may need to adjust the value of the investments to fair value and record a corresponding impairment charge, either of which could adversely affect our results of operations and our financial position.

6

We may not generate a return on acquired assets.

Even if we accurately value the investments we make, we must succeed in generating a return on the investments. Our success in generating a return depends on effective efforts of our employees and outside professionals. If we do not generate desired returns on our investments or if we are compelled to adjust the value of the investments to fair value and record a corresponding impairment charge, it could adversely affect our results of operations and our financial position.

We may pursue acquisition or investment opportunities that do not yield desired results.

We intend to continue investigating potential acquisitions that support our business objectives and strategy. Acquisitions are time-consuming, complex and costly. The terms of acquisition agreements tend to be heavily negotiated. We may incur significant transactional expenses, regardless of whether acquisitions are consummated. Moreover, the integration of acquired companies may create significant challenges, and we can provide no assurances that the integration of acquired businesses with our business will result in the realization of the full benefits we anticipate from such acquisitions. Investigating businesses and assets and integrating newly acquired businesses or assets may be costly and time-consuming, and such activities could divert our attention from other business concerns. In addition, we might lose key employees while integrating new organizations. Acquisitions could also result in potentially dilutive issuances of equity securities or the incurrence of debt, the assumption or incurrence of contingent liabilities, possible impairment charges related to goodwill or other intangible assets or other unanticipated events or circumstances, any of which could negatively impact our financial position. We might not be successful in integrating acquired businesses and might not achieve desired revenues and cost benefits.

The financing of our acquisition activities could threaten our ability to use NOLs to offset future taxable income.

We have substantial historical net operating losses (“NOLs”) for United States federal income tax purposes. As explained in greater detail below, our use of our NOLs will be significantly limited if we undergo a “Tax Ownership Change,” as defined in Section 382 of the Internal Revenue Code. If and to the extent we finance acquisitions through the sale or issuance of stock, we will likely cause an ownership shift that increases the possibility that a future Tax Ownership Change might occur. If a Tax Ownership Change occurs, we will be permanently unable to use most of our NOLs.

Avoiding a Tax Ownership Change may limit our ability to use our shares in an acquisition which could limit our ability to execute a transaction.

The use of our NOLs will be significantly limited if we undergo a Tax Ownership Change. Given the potential economic benefit of our NOLs, we have taken steps to reduce the risk of a Tax Ownership Change including our Tax Benefit Preservation Plan. Issuing new shares in an acquisition transaction could cause or would increase the risk of a Tax Ownership Change. As a result, if a potential seller or partner requires a large number of shares as part of an acquisition transaction, we may choose not to execute that transaction.

We rely on representations, warranties and opinions from third parties that might not be accurate.

When we acquire assets or businesses or establish relationships with inventors or strategic partners, we may rely on representations and warranties made by third parties. We also may rely on opinions of lawyers and other professionals. We may not have the opportunity to independently investigate and verify the facts upon which such representations, warranties and opinions are made. By relying on these representations, warranties and opinions, we may be exposed to unforeseen liabilities that could have a material adverse effect on our operating results and financial condition.

7

Risks Related to our Operations

Our financial and operating results have been and may continue to be uneven.

Our operating results may fluctuate and, as such, our operating results are difficult to predict. Quarterly or annual comparisons of our results of operations should not be relied upon as an indication of our future performance. Factors that could cause our operating results to fluctuate during any period or that could adversely affect our operating results include the timing of license and sales agreements, compliance with such agreements, the terms and conditions for payment under those agreements, our ability to protect and enforce our intellectual property rights, costs of enforcement, changes in demand for products that incorporate our inventions, the time period between commencement and completion of license negotiations or enforcement proceedings, revenue recognition principles, and changes in accounting policies.

Our revenues may not offset our operating expenses.

We reported operating income in 2016 and 2017, in part because we signed significant licenses in those years and in part because we significantly reduced our year-over-year operating expenses. Moving forward, it is not feasible to reduce operating expenses as dramatically as we did in 2016 and 2017. Moreover, revenue from our IP licensing business continues to be inconsistent. If we are unable to generate revenue sufficient to cover operating costs, we will report a net operating loss in future years.

Failure to effectively manage the composition of our employee base could strain our business.

Our success depends, in large part, on continued contributions of our small group of key managers and employees, many of whom are highly skilled and would be difficult to replace. Our success also depends on the ability of our personnel to function effectively, both individually and as a group. At the end of 2015, we terminated the employment of numerous IP professionals whose roles we believe were unnecessary to advance our current and anticipated business strategies. In 2016, we parted ways with our vice president of licensing. If we misjudged our ongoing personnel needs or lose any of our remaining senior managers or key personnel, it could lead to dissatisfaction among our clients or licensees, which could slow our growth or result in a loss of business. Moreover, if we fail to manage the composition of our employee base effectively or otherwise strain our relationships with our personnel, our business and financial results may be materially harmed.

If we need financing and cannot obtain financing on favorable terms, our business may suffer.

If we deploy a significant portion of our capital or encounter unforeseen difficulties in the future that deplete our capital resources more rapidly than anticipated, we may need to obtain additional financing. Financing might not be available on favorable terms, if at all, may dilute our existing shareholders, and may prompt us to pursue structural changes that could impact shareholder concentration and liquidity. If we fail to obtain additional capital as and when needed, such failure could have a material adverse impact on our business, results of operations and financial condition.

Our financial reporting will no longer be subject to an audit.

Historically, our consolidated financial statements were audited by external audit firms registered with the Public Company Accountancy Oversight Board. Having delisted our Class A common stock from Nasdaq and filed for de-registration, we will no longer be required to have our financial statements audited. Moreover, we do not intend to engage external auditors to audit our financial statements. The absence of an external audit could increase the risk that our financial statements are not accurate or reliable.

Unauthorized use or disclosure of our confidential information could adversely affect our business.

We rely primarily on a combination of license agreements, nondisclosure agreements, other contractual relationships and patent, trademark, trade secret and copyright laws to protect our confidential and proprietary information, our technology and our intellectual property. We cannot be certain that these protections have not been and will not be breached, that we will be able to timely detect unauthorized use or transfer of our trade secrets or

8

intellectual property, that we will have adequate remedies for any breach, or that our trade secrets will not otherwise become known or be independently discovered by competitors. If we are unable to detect in a timely manner the unauthorized use or disclosure of our proprietary or other confidential information or if we are unable to enforce our rights under our agreements or applicable laws, the misappropriation of such information could harm our business.

Our company has an evolving business model, which raises doubt about our ability to increase our revenues and grow our business.

We have shifted our principal focus for growth away from the IP business and are evaluating opportunities that generate solid, stable income streams with greater growth potential. Those opportunities must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in an early stage of development. We may not be successful in addressing such risks, and the failure to do so could have a material adverse effect on our business, operating results and financial condition. There can be no assurance that we will be able to increase our revenues and otherwise grow our business as we execute on new business opportunities in the future.

Risks Related to our Tax Losses

We cannot be certain that our tax losses will be available to offset any future taxable income.

A significant portion of our NOLs were triggered when we disposed of our satellite assets. We believe these NOLs can be carried forward to offset certain future taxable income. However, the NOLs have not been audited or otherwise validated by the Internal Revenue Service (“IRS”). We can make no assurance that we would prevail if the IRS were to challenge the amount or our use of the NOLs. If the IRS were successful in challenging our NOLs, all or some amount of our NOLs would not be available to offset future taxable income which would result in an increase to our future income tax liability. The NOL carryforward period begins to expire in 2025 with the bulk of our NOLs expiring in 2032.

An Ownership Change under Section 382 of the Internal Revenue Code may significantly limit our ability to use NOLs to offset future taxable income.

Our use of our NOLs will be significantly limited if we undergo a Tax Ownership Change. Broadly, a Tax Ownership Change will occur if, over a three-year testing period, the percentage of our stock, by value, owned by one or more 5% shareholder increases by more than 50 percentage points. For purposes of this test, shareholders that own less than 5% of our stock are aggregated into one or more separate “public groups,” each of which is treated as a 5% shareholder. Despite our adoption of certain protections against a Tax Ownership Change (such as our Tax Benefits Preservation Plan), we cannot control the trading activity of our significant shareholders. If shareholders acquire or divest their shares in a manner or at times that do not account for the loss-limiting provisions of the Internal Revenue Code or regulations adopted thereunder, a Tax Ownership Change could occur. If a Tax Ownership Change occurs, we will be permanently unable to use most of our NOLs.

Our ability to utilize our NOLs is dependent on the generation of future taxable income.

Our ability to utilize our NOLs is dependent upon the generation of future taxable income before the expiration of the carry forward period attributable to the NOLs, which begin to expire in 2025. We generated taxable income in 2016 and 2017, but we may not generate sufficient taxable income in future years to use the NOLs before they begin expiring.

The value of our NOLs may be reduced by changes in the federal tax laws.

The Tax Cuts and Jobs Act (“TCJA”) was signed into law in 2017. TCJA resulted in several changes to federal tax law, including a reduction of the federal tax rate for corporations to 21%. The TCJA did not change our ability to use our NOLs, including potential limitation under Section 382 described above. We believe our NOLs have value to the extent they can be used to offset future taxable income. A lower overall corporate tax rate reduces that value and any further reduction to the federal corporate rate may further reduce that value.

9

Our NOLs cannot be used to offset the Personal Holding Company tax.

The Internal Revenue Code imposes an additional tax on the undistributed income of a Personal Holding Company (“PHC”). In general, a corporation is classified as a PHC if 50% or more of its outstanding shares, measured by value, are owned directly or indirectly by five or fewer individual shareholders at any time during the second half of a calendar year (“Concentrated Ownership”) and at least 60% of its adjusted ordinary gross income is Personal Holding Company Income (“PHCI”). Broadly, PHCI includes items such as dividends, interest, rents and royalties, among others. Pendrell met the Concentrated Ownership test in 2016 and 2017 and more than 60% of Pendrell’s adjusted ordinary gross income was PHCI. Pendrell avoided payment of PHC tax on its PHCI by distributing the PHCI to its shareholders as a dividend in December 2017. ContentGuard did not meet the Concentrated Ownership test in 2016 or 2017 due to the interest held by minority shareholders, but it is possible that ContentGuard could meet the Concentrated Ownership test in 2018. If Pendrell or ContentGuard meets the Concentrated Ownership test, generates positive net PHCI and does not distribute the PHCI as a dividend, Pendrell or ContentGuard will be subject to the PHC tax. The PHC tax, which is in addition to the income tax and cannot be offset by our NOLs, is currently levied at 20% of the net PHCI not distributed to the corporation’s shareholders.

Risks Related to Our Class A Common Stock

Continued redemptions of stock will deplete our cash.

During 2017, we selectively purchased some of our Class A common stock from a small number of sophisticated shareholders in private transactions. In total, we redeemed more than 30,000 shares in the aggregate from eight shareholders. We may, within legal constraints, continue to repurchase stock, which will reduce our cash balance, cement our status as a personal holding company, and exacerbate our challenges under Section 382.

Purchases or sales of shares could significantly impact the price of our Class A common stock.

A small number of our shareholders hold a majority of our Class A common stock. Moreover, since we de-listed our Class A common stock from Nasdaq in mid-December 2017, trading in our stock has diminished and the price of our shares has fallen. Because of our concentrated holdings and limited trading volume, future purchases and sales of shares could have a significant impact on the price of our shares.

The interests of our controlling shareholder may conflict with the interests of other Class A holders.

Eagle River Satellite Holdings, LLC (“ERSH”), together with its affiliates Eagle River Investments, LLC (“ERI”), Eagle River, Inc. and Eagle River Partners, LLC (“ERP”) (collectively, “Eagle River”) controls approximately 68% of the voting power of our outstanding capital stock. Craig O. McCaw, our Executive Chairman, is the sole manager and beneficial member of ERI, which is the sole member of ERSH. Mr. McCaw is the sole shareholder of Eagle River, Inc. and the beneficial member of ERP. Accordingly, Eagle River has control over the outcome of matters requiring shareholder approval, including the election of directors, amendments to our governing documents, the adoption or prevention of mergers, consolidations or sales of all or substantially all of our assets, or control changes. Eagle River is not restricted or prohibited from competing with us.

We have delisted our shares from Nasdaq and are therefore not subject to Nasdaq corporate governance requirements.

Having delisted our Class A common stock from Nasdaq, we need not comply with Nasdaq corporate governance requirements, including (i) the requirement that a majority of the board of directors consist of independent directors, (ii) the requirement that the compensation of officers be determined, or recommended to the board of directors for determination, by a majority of the independent directors or a compensation committee comprised solely of independent directors, and (iii) the requirement that director nominees be selected, or recommended for the board of directors’ selection, by a majority of the independent directors or a nominating committee comprised solely of independent directors with a written charter or board resolution addressing the nomination process.

10

Our Tax Benefits Preservation Plan (“Tax Benefits Plan”), as well as certain provisions in our restated articles of incorporation, may discourage takeovers, which could affect the rights of holders of our Class A common stock.

Our Tax Benefits Plan is intended to act as a deterrent against any person or group acquiring or otherwise obtaining beneficial ownership of more than 4.9% of our securities without the approval of our board of directors. In addition, our articles of incorporation require us to take all necessary and appropriate action to protect certain rights of our common shareholders, including voting, dividend and conversion rights and rights in the event of a liquidation, merger, consolidation or sale of substantially all of our assets. Our articles of incorporation also provide that we will not avoid or seek to avoid the observance or performance of those rights by charter amendment, entry into an inconsistent agreement or reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution or the issuance or sale of securities. The rights protected by these provisions of the articles of incorporation include our Class B common shareholders’ right to ten votes per share on matters submitted to a vote of our shareholders and option to convert each share of Class B common stock into one share of Class A common stock. The provisions of the Tax Benefits Plan and our articles of incorporation could discourage takeovers of our company, which could adversely affect the rights of our shareholders.

Having delisted, and in light of our pending de-registration, our ability to access the capital markets could be negatively impacted.

In December 2017, we delisted our common stock from Nasdaq, and filed a de-registration notice with the SEC to de-register our Class A common stock. Elimination of our SEC reporting obligations and delisting could harm our ability to raise capital through financing sources on terms acceptable to us, or at all, and result in the potential loss of confidence by investors, increased employee turnover, and fewer business development opportunities.

Having delisted, our trading volume and common stock price may remain depressed.

Our trading volume is relatively low, and since we delisted our shares from Nasdaq in December 2017, the price of our stock has fallen. In the absence of SEC reporting obligations and the absence of a listing on Nasdaq, trading volume may further decrease, in which case the market price of our Class A common stock could decline. More specifically, our stock (i) may be more thinly traded, making it more difficult for our shareholders to sell shares, (ii) may experience greater price volatility, and (iii) may not attract analyst coverage, all of which may result in a lower stock price. For these reasons and others, shareholders may not receive what they view as a fair price for their shares.

Once we have de-registered, it may be more difficult to trade our stock in compliance with laws.

Once we are no longer required to fulfill SEC reporting obligations, we may choose not to file current or periodic reports. Even if we choose to file reports, they likely will not be audited. The absence of those reports or the absence of an audit may mean that material information regarding the Company is not in the public domain, which may make it more difficult to buy or sell shares in compliance with applicable securities laws. For these reasons and others, shareholders may not receive what they view as a fair price for their shares.

If our number of record holders increases, we may be subject to SEC reporting obligations.

We have limited ability to control our shareholders’ acquisition or disposition of shares. If our number of record holders reaches 300 or higher, we would be required to re-register our Class A common stock with the SEC, in which case we would lose the corresponding cost-saving benefits that we anticipate achieving by delisting and de-registering.

11

None.

Our corporate headquarters are located in Kirkland, Washington, where we lease 8,050 square feet in Kirkland under a lease which expires on July 31, 2019. We currently sublease 2,882 square feet of that space and occupy the remaining 5,168 square feet.

We believe our facilities are adequate for our current business and operations.

See Note 7 – “Commitments and Contingencies” of the Notes to the Consolidated Financial Statements included in Item 8 of this report.

Not Applicable.

12

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market for Our Class A Common Stock

Prior to December 15, 2017, our Class A common stock traded on the Nasdaq Capital Market under the symbol “PCO.” On December 15, 2017, we filed a Notification of Removal from Listing and/or Registration on Form 25, which prompted the Nasdaq Capital Market to suspend trading as of close of trading on December 15, 2017. We then filed a Form 15 with the SEC on December 26, 2017 to terminate the registration of our Class A common stock.

Our Class A common stock trades on OTC Pink® under the symbol “PCOA.”

At our annual meeting of shareholders in June 2017, our shareholders approved a 1-for-100 reverse stock split of our Class A common stock and Class B common stock that was implemented on November 30, 2017 (the "2017 Reverse Split"). The 2017 Reverse Split reduced our number of record shareholders to less than 300, which allowed us to (i) terminate our Nasdaq listing, effective December 15, 2017, (ii) file to de-register our Class A Stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which we filed on December 26, 2017; and (iii) cease to be a reporting company under the Exchange Act after our notice of de-registration is effective, which will be no later than March 26, 2018.

On September 20, 2017, our Board of Directors (the “Board”) announced that we do not currently plan to publish financial information following the expiration of our reporting obligations under the Exchange Act. As a result, we believe this Form 10-K for fiscal year ended December 31, 2017 will be our final financial statement filed with the SEC.

In September 2016, we consummated a 1-for-10 reverse stock split (the “2016 Reverse Split”) to remediate a stock price deficiency as required by Nasdaq’s continued listing requirements.

As a result of the 2017 and 2016 Reverse Splits, our share count, per share data and price per share reported in this annual report on Form 10-K have been adjusted retrospectively as if both reverse stock splits had been in effect for all periods presented.

The table below sets forth the high and low sales prices of our Class A common stock in U.S. dollars for each of the periods presented. Stock prices represent amounts published by Nasdaq and by OTC Markets®, as applicable. For prices on and after December 15, 2017, the quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions. As of February 6, 2018, the last sales price of our Class A common stock reported by OTC Pink® was $551.61 per share.

|

| 2017 |

|

| 2016 |

| ||||||||||

Period |

| High |

|

| Low |

|

| High |

|

| Low |

| ||||

First Quarter |

| $ | 739.00 |

|

| $ | 609.00 |

|

| $ | 654.80 |

|

| $ | 461.00 |

|

Second Quarter |

| $ | 723.00 |

|

| $ | 597.00 |

|

| $ | 692.70 |

|

| $ | 485.00 |

|

Third Quarter |

| $ | 747.00 |

|

| $ | 621.00 |

|

| $ | 733.00 |

|

| $ | 500.00 |

|

Fourth Quarter |

| $ | 739.03 |

|

| $ | 575.00 |

|

| $ | 723.00 |

|

| $ | 605.00 |

|

As of February 6, 2018, there were approximately 166 record holders of our Class A common stock.

Market for Our Class B Common Stock

There is no established trading market for our Class B common stock, of which we have 53,660 shares outstanding with two holders of record. Each share of Class B common stock is convertible at any time at the option of its holder into one share of Class A common stock.

13

Dividends

On November 30, 2017, the Board declared a dividend of $12.32 per share, payable on shares outstanding after the 2017 Reverse Split. The dividend was paid on December 27, 2017 to shareholders of record on December 15, 2017. The Company elected to pay the dividend to shareholders, rather than incur personal holding company tax. See Note 11 – “Income Taxes” for further details.

Prior to 2017, the Company had never paid cash dividends on shares of its Class A or Class B common stock.

Unregistered Sales of Equity Securities and Use of Proceeds

The Class A Stock securities purchases described in the table below represent private stock purchase transactions from a small number of sophisticated shareholders (seven) in private transactions during the fourth quarter of 2017, as well as the fractionalization of shares pursuant to our 2017 Reverse Split:

|

| Total Number of Shares Purchased |

|

| Average Price Paid Per Share |

|

| Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

|

| Approximate Dollar Value of Shares That May Yet Be Purchased Under the Publicly Announced Plans or Programs |

| ||||

October 1 – October 31, 2017 |

|

| 2,000 |

|

| $ | 673.00 |

|

|

| — |

|

|

| — |

|

November 1 – November 30, 2017 |

|

| 1,945 |

|

|

| 526.44 |

|

|

| — |

|

|

| — |

|

December 1 – December 31, 2017 |

|

| 2,205 |

|

|

| 616.85 |

|

|

| — |

|

|

| — |

|

|

|

| 6,150 |

|

| $ | 606.52 |

|

|

| — |

|

|

| — |

|

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information, as of December 31, 2017, relating to Pendrell’s equity compensation plans pursuant to which grants of stock options, restricted stock, or other rights to acquire shares may be granted from time to time:

Plan Category |

| Number of |

|

| Weighted-average |

|

| Number of |

| |||

Equity compensation plans approved by security holders |

|

| 18,589 |

|

| $ | 1,489.80 |

|

|

| 24,743 |

|

Equity compensation plans not approved by security holders |

|

| — |

|

|

| — |

|

|

| — |

|

Total |

|

| 18,589 |

|

| $ | 1,489.80 |

|

|

| 24,743 |

|

(1) | Excludes 562 shares of restricted stock awards that remain subject to forfeiture. |

(2) | Excludes the impact of 562 shares of restricted stock awards and 6,089 shares of restricted stock unit awards that have no exercise price. |

14

Performance Measurement Comparison

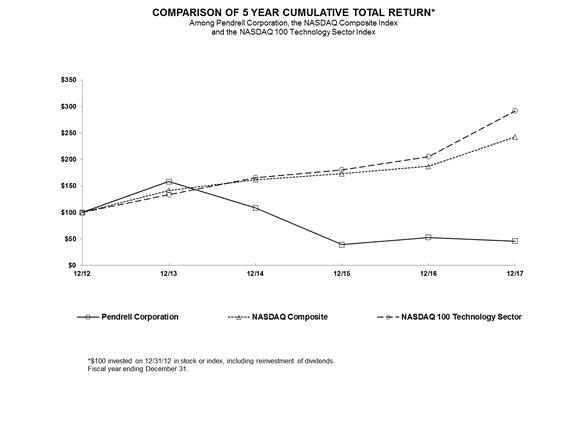

The following graph shows the total shareholder return as of the dates indicated of an investment of $100 in cash on December 31, 2012 for: (i) our Class A common stock; (ii) the Nasdaq Composite Index; and (iii) the Nasdaq 100 Technology Sector Index.

The stock price performance graph below is not necessarily indicative of future performance.

|

| 2012 |

|

| 2013 |

| 2014 |

| 2015 |

| 2016 |

| 2017 | |

Pendrell Corporation |

|

| 100.00 |

|

| 158.27 |

| 108.66 |

| 39.46 |

| 53.15 |

| 46.05 |

NASDAQ Composite |

|

| 100.00 |

|

| 141.63 |

| 162.09 |

| 173.33 |

| 187.19 |

| 242.29 |

NASDAQ 100 Technology Sector |

|

| 100.00 |

|

| 133.55 |

| 165.92 |

| 180.58 |

| 205.54 |

| 291.88 |

15

The following selected consolidated financial data should be read in conjunction with “Item 7— Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and accompanying notes included in this Form 10-K.

|

| Year Ended December 31, |

| |||||||||||||||||

|

| 2017 |

|

| 2016 |

|

| 2015 |

|

| 2014 |

|

| 2013 |

| |||||

|

| (in thousands, except per share data) |

| |||||||||||||||||

Revenue |

| $ | 42,774 |

|

| $ | 59,018 |

|

| $ | 43,519 |

|

| $ | 42,534 |

|

| $ | 13,128 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues(1) |

|

| 409 |

|

|

| 18,156 |

|

|

| 10,215 |

|

|

| 14,170 |

|

|

| 7,872 |

|

Patent administration and related costs(1) |

|

| 916 |

|

|

| 1,046 |

|

|

| 2,668 |

|

|

| 6,386 |

|

|

| 4,405 |

|

Patent litigation(1) |

|

| 8,695 |

|

|

| 4,169 |

|

|

| 13,076 |

|

|

| 9,880 |

|

|

| 4,564 |

|

General and administrative(1) |

|

| 7,675 |

|

|

| 7,508 |

|

|

| 16,750 |

|

|

| 27,467 |

|

|

| 25,939 |

|

Stock-based compensation |

|

| 3,422 |

|

|

| 3,424 |

|

|

| 4,507 |

|

|

| 9,405 |

|

|

| 12,345 |

|

Amortization of intangible assets |

|

| 2,345 |

|

|

| 9,498 |

|

|

| 13,939 |

|

|

| 15,929 |

|

|

| 15,864 |

|

Contract termination costs(2) |

|

| 3,161 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Impairment of intangible assets and goodwill(3) |

|

| — |

|

|

| — |

|

|

| 103,499 |

|

|

| 11,013 |

|

|

| — |

|

Total operating expenses |

|

| 26,623 |

|

|

| 43,801 |

|

|

| 164,654 |

|

|

| 94,250 |

|

|

| 70,989 |

|

Operating income (loss) |

|

| 16,151 |

|

|

| 15,217 |

|

|

| (121,135 | ) |

|

| (51,716 | ) |

|

| (57,861 | ) |

Net interest income (expense) |

|

| 1,603 |

|

|

| 696 |

|

|

| 103 |

|

|

| (99 | ) |

|

| (64 | ) |

Gain on contingencies (4) |

|

| — |

|

|

| 2,047 |

|

|

| 6,095 |

|

|

| — |

|

|

| — |

|

Other expense |

|

| (8 | ) |

|

| (11 | ) |

|

| (14 | ) |

|

| (16 | ) |

|

| (55 | ) |

Income (loss) before income taxes |

|

| 17,746 |

|

|

| 17,949 |

|

|

| (114,951 | ) |

|

| (51,831 | ) |

|

| (57,980 | ) |

Income tax benefit (expense)(5) |

|

| 2,110 |

|

|

| — |

|

|

| (2,631 | ) |

|

| (6,303 | ) |

|

| — |

|

Net income (loss) |

|

| 19,856 |

|

|

| 17,949 |

|

|

| (117,582 | ) |

|

| (58,134 | ) |

|

| (57,980 | ) |

Net income (loss) attributable to noncontrolling interest |

|

| 796 |

|

|

| 186 |

|

|

| (7,902 | ) |

|

| (7,132 | ) |

|

| (2,918 | ) |

Net income (loss) attributable to Pendrell |

| $ | 19,060 |

|

| $ | 17,763 |

|

| $ | (109,680 | ) |

| $ | (51,002 | ) |

| $ | (55,062 | ) |

Basic income (loss) per share attributable to Pendrell |

| $ | 76.28 |

|

| $ | 66.38 |

|

| $ | (412.79 | ) |

| $ | (192.89 | ) |

| $ | (210.06 | ) |

Diluted income (loss) per share attributable to Pendrell |

| $ | 74.22 |

|

| $ | 64.15 |

|

| $ | (412.79 | ) |

| $ | (192.89 | ) |

| $ | (210.06 | ) |

Total assets |

| $ | 208,184 |

|

| $ | 212,393 |

|

| $ | 180,892 |

|

| $ | 304,104 |

|

| $ | 351,994 |

|

Long-term obligations, including current portion of capital lease obligations(6) |

| $ | — |

|

|

| 7,796 |

|

| $ | — |

|

| $ | 1,521 |

|

| $ | 6,695 |

|

(1) | Amounts in 2013 have been reclassified to conform to the current year presentation of expenses in our consolidated statements of operations, including the presentation of “cost of revenues” and “patent litigation” as separate captions; as such costs were previously included in “patent administration, litigation and related costs” and “general and administrative.” |

(2) | Contract termination costs during the year ended December 31, 2017 represent the cost associated with the buy-out of the revenue share agreement from the company that sold us the bulk of our memory patents in 2013. |

(3) | During the fourth quarter of the year ended December 31, 2015, we recorded a non-cash impairment charge of $103.5 million related to our patents, other intangible assets and goodwill. During the fourth quarter of the year ended December 31, 2014, we recorded a non-cash impairment charge of $11.0 million related to the goodwill and proprietary micro-propagation technology of Provitro Biosciences LLC (“Provitro”). In early 2015, we suspended further development of the Provitro™ proprietary micro-propagation technology and related laboratory processes that were designed to facilitate production on a commercial scale of certain plants, particularly timber bamboo. |

16

(4) | During the years ended December 31, 2016 and 2015, we recorded gain on contingencies of $2.0 million and $3.9 million, respectively, due to the receipt of contingent payments associated with the disposition of MEO satellites and related launch vehicles of our prior satellite business. During the year ended December 31, 2015, we also recorded a gain on contingency associated with a $1.6 million settlement received from the J&J Group. See Note 10 - “Gain on Contingencies” for further discussion. |

(6) | Prior to 2015, long-term obligations consisted primarily of deferred tax liabilities. Long-term obligations at December 31, 2013 also included an installment payment obligation arising from the 2013 acquisition of our memory and storage technologies portfolio and expense related to restricted stock awards that is required to be treated as a liability. Long-term obligations at December 31, 2016 consist primarily of revenue share obligations. |

17

The following discussion and analysis should be read in conjunction with our consolidated financial statements and accompanying notes included elsewhere in this Form 10-K.

Special Note Regarding Forward-Looking Statements

With the exception of historical facts, the statements contained in this management’s discussion and analysis are “forward-looking” statements. All of these forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated by the relevant forward-looking statements. Factors that might cause or contribute to such a difference include, but are not limited to, those discussed under “Item 1A of Part I—Risk Factors” and elsewhere in this Form 10-K. The forward-looking statements included in this document are made only as of the date of this report, and we undertake no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances.

Overview

After more than a decade as a public company, we made the decision in 2017 to “go private” by delisting our Class A common stock from Nasdaq and filing for de-registration. We anticipate the delisting and de-registration will yield annual cost savings of more than one million dollars. As a non-reporting issuer, we also anticipate increased strategic and operational flexibility, with visibility to potential business partnerships that are not available as a reporting company.

As we worked through the delisting and de-registration process in 2017, the market price of our stock dropped to historically low levels: lower than our net book value per share and lower than our cash value per share. We responded by purchasing shares of our Class A common stock from a select number of sophisticated shareholders in private, exempt transactions. Federal and state securities laws limited our ability to aggressively repurchase stock, and those laws continue to impact ongoing stock repurchase efforts. However, within those legal constraints, we intend to repurchase additional shares in 2018 if those repurchases are accretive to our remaining shareholders.

While we work to capitalize on anticipated cost savings and operational flexibility from “going private," we continue our efforts to monetize our DRM Patents and our Memory Patents.

During the third quarter of 2017 we licensed our DRM Patents to The Walt Disney Company for Disney’s digital entertainment offerings. Disney joins Warner Bros and Sony Entertainment as licensees of the DRM Patents. Meanwhile, ContentGuard continues its dialogue with other movie studios and distributors of digital entertainment

Earlier in 2017, we settled our litigation against SanDisk Corporation and its affiliates, including Western Digital, by licensing our Memory Patents to SanDisk and its affiliates. The SanDisk license was the fifth significant Memory Patent license signed since we acquired the Memory Patents in 2013. Prior to 2017, pursuant to the agreement under which we acquired the Memory Patents, we shared a significant portion of license fees from our Memory Patents with the seller. In early 2017, the seller agreed to relinquish its future revenue share rights in exchange for an up-front payment and future installment payments. This resulted in a one-time charge of $3.2 million to expense in our first quarter of 2017, but significantly reduced our cost of revenues on future revenue from our Memory Patents. Our buyout of the seller’s future revenue share rights reflects our confidence in the value of our Memory Patents and our belief that standard compliant unlicensed flash memory component suppliers, solid state disk manufacturers and device vendors will ultimately need to obtain a license from us to continue their commercial activities.

In that regard, our licensing discussions with Kingston reached impasse in 2017, leading to our filing of a patent infringement suit in the federal district court for the Central District of California in early 2018, in which we seek monetary damages for Kingston’s infringement. Kingston has not yet answered our complaint, so we have no indication of whether Kingston will aggressively defend our lawsuit or be willing to negotiate a license to resolve our claims.

18

Management of our IP portfolio is not detracting us from our primary mission, which is identification of business opportunities that generate solid, stable income streams and greater growth potential. We have evaluated several opportunities. Although we have not reached agreement with any potential owners or partners, we continue to identify and evaluate new business opportunities.

Critical Accounting Policies

Critical accounting policies require difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Our estimates and judgments are based on information available at the time the estimates and judgments are made. Actual results could differ materially from those estimates. We make estimates and judgments when accounting for, among other matters, intangible assets, revenue recognition, stock-based compensation, income taxes and contingencies, as more fully described below.

Intangible Assets. We amortize finite-lived intangible assets, including patents, acquired in purchase transactions over their expected useful lives. We evaluate finite-lived intangible assets when events or circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. These events or circumstances could include: a significant change in the business climate, legal factors, operating performance indicators, or changes in technology or customer requirements. Recoverability of an asset or asset group is measured by a comparison of the carrying amount to the future undiscounted net cash flows expected to be generated by the asset or asset group over its life. This comparison requires management to make judgments regarding estimated future cash flows. Our ability to realize the estimated future cash flows may be affected by factors such as changes in operating performance, changes in business strategy, invalidation of patents, unfavorable judgments in legal proceedings and changes in economic conditions. If our estimates of the undiscounted cash flows do not equal or exceed the carrying value of the asset or asset group, we recognize an impairment charge equal to the amount by which the recorded value of the asset or asset group exceeds its fair value.

Revenue Recognition. We derive our operating revenue from IP monetization activities, including patent licensing and patent sales. Additionally, prior to our sale of the Ovidian Group LLC in December 2015, we also derived revenue from IP consulting services. Although our revenue may occur in different forms, we regard our IP monetization activities as integrated and not separate revenue streams. For example, a third party relationship could involve consulting and licensing activities, or the acquisition of a patent portfolio can lead to licensing, consulting and patent sales revenue.

Our patent licensing agreements often provide for the payment of contractually determined upfront license fees representing all or a majority of the revenues that will be generated from such agreements for nonexclusive, nontransferable, limited duration licenses. These agreements typically grant (i) a nonexclusive license to make, sell, distribute, and use certain specified products that read on our patents, (ii) a covenant not to enforce patent rights against the licensee based on such activities, and (iii) the release of the licensee from certain claims. Generally, the agreements provide no further obligation for the Company upon receipt of the minimum upfront license fee. As such, the earnings process is complete and revenue is recognized upon the execution of the agreement, when collectability is reasonably assured, or upon receipt of the minimum upfront license fee, and when all other revenue recognition criteria have been met.

Certain of our patent licensing agreements provide for future royalties or future payment obligations triggered upon satisfaction of conditions. Future royalties and future payments are recognized in revenue upon satisfaction of any related conditions, provided that all revenue recognition criteria, as described below, have been met.

We sell patents from our portfolios from time to time. These sales are part of our ongoing operations. Consequently, the related proceeds are recorded as revenue. We recognize the revenue when (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred, (iii) amounts are fixed or determinable, and (iv) collectability is reasonably assured.

Fees earned from IP consulting services were generally recognized as the services were performed.

19

The timing and amount of revenue recognized from IP monetization activities depend on the specific terms of each agreement and the nature of the deliverables and obligations. For agreements that are deemed to contain multiple elements, consideration is allocated to each element of an agreement that has stand-alone value using the relative fair value method. We recognize revenue when (i) persuasive evidence of an arrangement exists, (ii) all material obligations have been substantially performed pursuant to agreement terms or services have been rendered to the customer, (iii) amounts are fixed or determinable, and (iv) collectability is reasonably assured. As a result of the contractual terms of our patent monetization agreements and the unpredictable nature, form and frequency of monetizing transactions, our revenue may fluctuate substantially from period to period.

Stock-Based Compensation. We record stock-based compensation on stock options, performance stock awards, restricted stock awards, restricted stock units and other stock awards issued to employees, directors, consultants and/or advisors based on the estimated fair value on the date of grant and recognize compensation cost over the requisite service period for awards expected to vest. The fair value of stock options are estimated on the date of grant using the Black-Scholes option pricing model (“Black-Scholes Model”) based on the single option award approach. The fair value of restricted stock awards and restricted stock units is determined based on the number of shares granted and either the quoted market price of our Class A common stock on the date of grant for time-based and performance-based awards, or the fair value on the date of grant using the Monte Carlo Simulation model (“Monte Carlo Simulation”) for market-based awards. The fair value of stock options, restricted stock awards and restricted stock units with service conditions are typically amortized to expense on a straight-line basis over the requisite service periods of the awards, which is generally the vesting period. The fair value of stock options, restricted stock awards and restricted stock units with performance conditions deemed probable of being achieved and cliff vesting are amortized to expense over the requisite service period using the straight-line method of expense recognition. The fair value of restricted stock awards and restricted stock units with performance and market conditions are amortized to expense over the requisite service period using the straight-line method of expense recognition. The fair value of stock-based payment awards as determined by the Black-Scholes Model and the Monte Carlo Simulation are affected by our stock price as well as other assumptions. These assumptions include, but are not limited to, the expected stock price volatility over the term of the awards and actual and projected employee stock option exercise behaviors. On January 1, 2017, we elected to change our accounting policy for calculating stock-based compensation based on forfeiture estimates to one that recognizes forfeitures when they occur (see “New Accounting Pronouncements” below). Previously, forfeitures were estimated at the date of grant and revised, if necessary, in subsequent periods if actual forfeitures differed from those estimates.

Income Taxes. We must make certain estimates and judgments in determining income tax expense for financial statement purposes. These estimates and judgments occur in the calculation of tax credits, tax benefits and deductions. Significant changes to these estimates may result in an increase or decrease to our tax provision in a subsequent period.

We must assess the likelihood that we will be able to recover our deferred tax assets. If recovery is not likely, we must record a valuation allowance against the deferred tax assets that we estimate will not ultimately be recoverable. Since our utilization of our deferred tax assets is dependent upon future taxable income that is not assured, we have recorded a valuation allowance sufficient to reduce the deferred tax assets to an amount that is more likely than not to be realized. However, should there be a change in our ability to recover our deferred tax assets, our tax provision would decrease or may result in a tax benefit in the period in which we determined that the recovery was more likely than not to occur.

The application of income tax law is inherently complex. As such, we are required to make many assumptions and judgments regarding our income tax positions and the likelihood whether such tax positions would be sustained if challenged. Interpretations and guidance surrounding income tax laws and regulations change over time, and changes in our assumptions and judgments can materially affect amounts recognized in our consolidated financial statements.

Contingencies. The outcomes of legal proceedings and claims brought by and against us are subject to significant uncertainty. We accrue an estimated loss from a loss contingency, such as a legal claim against us, by a charge to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. We disclose a contingency if there is at least a reasonable possibility that a loss has been incurred. In determining whether a contingent loss should be accrued or disclosed, we evaluate, among

20

other factors, the degree of probability of an unfavorable outcome and the ability to make a reasonable estimate of the amount of loss. Changes in these factors could materially impact our financial position, results of operations or cash flows. For contingencies that might result in a gain, we do not record the gain until realized.

New Accounting Pronouncements

See Note 2 – “Summary of Significant Accounting Policies” of the Notes to Consolidated Financial Statements (Part II, Item 8 of this Form 10-K) for further discussion.

Key Components of Results of Operations

Revenue—We derive our operating revenue from IP monetization activities, including patent licensing, patent sales and, prior to 2016, from IP consulting services, or a combination thereof. Although our revenue may occur in different forms, we regard our IP monetization activities as integrated and not separate revenue streams. Our revenues from IP monetization activities continue to depend in large part on our ability to enter into new license agreements with third parties. Because our licensing agreements often provide for the payment of upfront license fees rather than a royalty stream and as a result of the unpredictable nature, form and frequency of our transactions, our revenue may fluctuate substantially from period to period.

Cost of revenue—Cost of revenue consists of certain costs that are variable in nature and are directly attributable to our revenue generating activities including (i) payments to third parties to whom we have an obligation to share revenue, (ii) commissions, and (iii) success fees. Additionally, in periods when patent sales occur, cost of revenue includes the net book value and other related costs associated with the sold patents. Depending on the patents being monetized, revenue share payments as a percentage of revenues may vary significantly.

Patent administration and related costs—Patent administration and related costs are comprised of (i) patent-related maintenance and prosecution costs incurred to maintain our patents, (ii) other costs that support our patent monetization efforts, and (iii) costs associated with the abandonment of patents, including the write-off of any remaining net book value.