UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(AMENDMENT NO. 1)

| | | | | |

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| |

For the fiscal year ended September 30, 2024

| | | | | | | | |

| o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| | |

| For the transition period from __________ to __________ |

| | |

| COMMISSION FILE NUMBER | 000-52033 |

RED TRAIL ENERGY, LLC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| North Dakota | | 76-0742311 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

3682 Highway 8 South, P.O. Box 11, Richardton, ND 58652

(Address of principal executive offices, Zip code)

(701) 974-3308

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

Securities registered pursuant to Section 12(g) of the Act: Class A Membership Units

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☑ Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☑ | | Smaller Reporting Company | ☐ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

The aggregate market value of the membership units held by non-affiliates of the registrant as of March 31, 2024 was $34,969,920. There is no established public trading market for our membership units. The aggregate market value was computed by reference to the most recent offering price of our Class A units which was $1 per unit.

As of January 28, 2025, there were 40,148,160 Class A Membership Units outstanding.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our Annual Report on Form 10-K for the fiscal year ended September 30, 2024 (the “Original Form 10-K”), as filed with the Securities and Exchange Commission (“SEC”) on January 15, 2025, solely to: (i) include the information required by and not included in Part III of the Original Form 10-K because we do not intend to file our definitive proxy statement within 120 days of the end of our fiscal year ended September 30, 2024 and (ii) to include the information required by Item 408(b) (Company Insider Trading Policies and Procedures), of Regulation S-K which was omitted from the Original Form 10-K in error. In connection with the filing of this Amendment and pursuant to the rules of the SEC, we are including new certifications of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 with this Amendment. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications. Because no financial statements are contained within this Amendment, we are not filing currently dated certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, no other changes have been made to the Original Form 10-K. The Original Form 10-K continues to speak as of the date of the Original Form 10-K, and we have not updated the disclosure contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Form 10-K other than as expressly indicated in this Amendment.

INDEX

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This Amendment contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance, or our expected future operations and actions. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "future," "intend," "could," "hope," "predict," "target," "potential," or "continue" or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions based on current information and involve numerous assumptions, risks, and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the reasons described in this Amendment.

We are not under any duty to update the forward-looking statements contained in this Amendment. We cannot guarantee future results, levels of activity, performance, or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this Amendment. You should read this Amendment and the documents that we reference in this Amendment and have filed as exhibits completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements.

PART III

ITEM 10. GOVERNORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Board of Governors

Our Board of Governors (the "Board") is currently composed of seven (7) members. Information with respect to our Governors is set forth below.

Each person identified below is a United States citizen. Unless otherwise noted, (a) all Governors are U.S. citizens; (b) all Governors have been employed in the principal occupations noted below for the past five years or more, and (c) the principal business address of each person identified is 682 Highway 8 South, P.O. Box 11, Richardton, ND 58652.

| | | | | | | | | | | | | | | | | |

| Name | Term Expires | Age | Position | Independent(1) | Committee Membership |

| Group I Governors | | | | | |

| Ronald Alberle | 2026 | 61 | Governor | X | Compensation, Audit, Nominating, Risk Management |

| Ambrose Hoff | 2026 | 73 | Governor, Secretary | X | Compensation, Audit, Nominating |

| Group II Governors |

| Mike Appert | 2027 | 56 | Governor, Vice Chairman | X | Compensation, Risk Management, Nominating |

| William Price | 2027 | 61 | Governor | X | Compensation, Nominating |

| Group III Governors |

| Frank Kirshenheiter | 2025 | 74 | Governor (Nominee) | X | Compensation |

| Syd Lawler | 2025 | 68 | Governor (Nominee) | X | Compensation, Audit |

| Sid Mauch | 2025 | 78 | Governor, Chairman (Nominee) | X | Compensation, Risk Management |

(1) Independence governed and determined by our Audit Committee Charter

Class I Governors

Ronald Aberle, Governor - Age 61

Mr. Aberle has served as a Governor since our inception and is the chair of our Audit Committee. Mr. Aberle is also a member of our Compensation, Nominating and Risk Management Committees. Mr. Aberle is an owner and managing partner of Aberle Farms, a diversified farm and ranch, and most recently added an RV Campground to the enterprise. Mr. Aberle is a trustee of St. Hildegard's Church.

Ambrose Hoff, Governor, Secretary - Age 73

Mr. Hoff has served intermittently as a Governor since 2006 and also serves as the Company's Secretary. Mr. Hoff has served as the Secretary of the Company since 2013. He is also a member of our Audit, Nominating, and Compensation Committees. Mr. Hoff is the president of Stone Mill, Inc., a grain processing plant and also the CEO of Amber Waves, Inc., a manufacturing facility, both located in Richardton, North Dakota. Mr. Hoff is an active board member of the Richardton Development Company.

Class II Governors

Mike Appert, Governor, Vice Chairman - Age 56

Mr. Appert currently serves as vice chairman of the Board and has served as a Governor since our inception. Mr. Appert will continue as the Company's vice chairman until his earlier resignation or removal. He previously served as chairman and secretary. Mr. Appert is also a member of our Compensation, Nominating and Risk Management Committees. Mr. Appert has been the owner and president of Appert Acres, Inc., a corn, soybean, sunflowers and small grains farming operation since 1991, as well as operating a Mycogen Seeds Dealership. He also serves on several boards which include the Hazelton Airport Authority as president, the Goose Lake Chapter Pheasants Forever as treasurer, the St. Paul Catholic Church Finance Council, and the North Dakota Soybean Council. Mr. Appert has a degree in Financial Management from the University of North Dakota.

William Price, Governor - Age 61

Mr. Price has served as a Governor since our inception. Mr. Price currently serves as a member of the Compensation and Nominating Committees. Mr. Price served as vice president from the inception of the Company until May 2007. Since 1980, Mr. Price has been the managing partner and is currently vice president of Price Cattle Ranch LLP, a cattle operation. Since 1997, he has been the managing partner and is currently the president of Missouri River Feeders LLP, a feedlot and diversified farm. Mr. Price is also a governor of North Dakota Sow Center LLLP, a 10,000 head ISO wean facility and serves as a board member for Eco Balance Global. Mr. Price is a member of multiple associations, including the North Dakota Stockmen's Association, the National Cattlemen's Beef Association, and the Great Bend Irrigation District, and has served on the Missouri Slope Irrigation Board of Governors and served as chairman of the North Dakota Feeder Council.

Class III Governors

Frank Kirschenheiter, Governor - Age 74

Mr. Kirschenheiter has served as a Governor since May 2007. Mr. Kirschenheiter previously served as Treasurer of the Board and is a member of the Compensation Committee. Mr. Kirschenheiter and his wife Earlene have been involved with their children in a small cattle operation outside of Richardton, North Dakota. Mr. Kirschenheiter has also previously served as the mayor of the City of Richardton, North Dakota for over twenty years. Mr. Kirchenheiter was selected as a nominee based on his prior experience with the Company and agriculture generally. If elected, Mr. Kirschenheiter has agreed to serve as a Governor.

Syd Lawler, Governor - Age 68

Mr. Lawler currently serves as a Governor and was elected to the Board of Governors in 2022. Mr. Lawler currently serves as a member of the Audit and Compensation Committees. Mr. Lawler has been a farmer in Emmons County since 1976 raising small grains, corn and sunflowers. Prior to his retirement in 2020, Mr. Lawler was a Business Banking Manager then Chief Credit Officer with Cornerstone Bank. Mr. Lawler has been active in Linton community affairs by serving as a City Alderman for Linton and as a director on the Linton Airport Authority. Mr. Lawler was selected as a nominee based on his prior experience with the Company, agriculture and finance generally. If elected, Mr. Lawler has agreed to serve as a Governor.

Sidney (Sid) Mauch, Governor, Chairman - Age 78

Mr. Mauch currently serves as chairman of the Board and has served as a Governor since March 2009. Mr. Mauch will likely continue as the Company's chairman if he is re-elected by the members to serve as a Governor at the 2025 Annual Meeting. Mr. Mauch also currently serves on our Risk Management and Compensation Committees. Mr. Mauch was the manager and controller of Maple River Grain & Agronomy, LLC, a grain elevator and agronomy supplier located in Casselton, North Dakota, from 1976 to 2012. Mr. Mauch was selected as a nominee based on his prior experience with the Company and agriculture generally. If elected, Mr. Price has agreed to serve as a Governor.

Executive Officers & Significant Employees

The following sets forth information about our executive officers and significant employees.

| | | | | | | | |

| Name | Age | Position |

| Jodi Johnson | 44 | Chief Executive Officer |

| Joni Entze | 37 | Chief Financial Officer |

| Ryan Wiege | 40 | Grain Merchandiser - Significant Employee |

Jodi Johnson, Chief Executive Officer - Age 44

Ms. Johnson has served as the Company's Chief Executive Officer since April 2023 and had previously served as the Company's Chief Financial Officer since April 2013. She is a Certified Public Accountant who operated her own tax preparation service for the last ten years where she prepared tax returns and provided other financial services for her clients. Ms. Johnson was also the Accounting Assistant and then Controller for the Theodore Roosevelt Medora Foundation since August 2004 where she prepared financial statements, supervised other accounting staff and performed other accounting related duties. Ms. Johnson serves at the appointment of the Board until her earlier resignation or removal.

Joni Entze, Chief Financial Officer - Age 37

Ms. Entze has served as the Company's Chief Financial Officer since April 2023. She has been an employee of the Company since November 2021. Prior to her employment with the Company, Ms. Entze served as an assistant business manager for the Beulah School District. Ms. Entze serves at the appointment of the Board until her earlier resignation or removal.

Ryan Wiege, Grain Merchandiser - Age 40

Mr. Wiege has served as the Company's Grain Merchandiser since December 2008 and currently serves on our Risk Management Committee. Prior to his employment with the Company, he worked at the Bobcat Company in Bismarck as an Assembly Mechanic for four years. Mr. Wiege serves at the appointment of the Board until his earlier resignation or removal.

Material Proceedings

There are no material proceedings in which a Governor or executive officer or any associate of these parties is adverse to the Company or has any material interest adverse to the Company.

Corporate Governance

The Company has seven Governors. Under our Amended and Restated Operating Agreement (the "Operating Agreement") and our Amended and Restated Member Control Agreement, as amended (the "Member Control Agreement", and collectively with the Operating Agreement, the "Existing Governing Documents"), each Governor is elected to a three year term. The terms of the Governors are staggered, so that the terms of no more than three Governors expire in any given year. The staggering of the terms of the Governors commenced at the annual meeting of the members which was held on May 30, 2007, at which meeting two Governors were elected to an initial one year term (Group I), two Governors were elected to an initial two year term (Group II), and three Governors were elected to an initial three year term (Group III).

The Nominating Committee is responsible for selecting candidates for Governor. The Nominating Committee undertook a review of all prospective nominees. Frank Kirschenheiter, Syd Lawler and Sid Mauch, the Group III incumbent Governors, are being considered for nomination to their existing seats at the 2025 Annual Meeting. The Nominating Committee did not receive any potential candidate nominations from any of the members.

The three nominees who receive a plurality of the votes for the election of Governors will be elected to the position of Governor.

Board of Governors' Meetings and Committees

The Board generally meets once per month. The Board held nine regularly scheduled meetings and two special meetings during the fiscal year ended September 30, 2024. Each Governor attended all of the meetings of the Board during the fiscal year ended September 30, 2024.

The Board does not have a policy with regard to Governors' attendance at annual meetings. Last year, all seven Governors attended the Company's annual meeting. Due to this high attendance record, it is the view of the Board that such a policy is unnecessary.

Committees

The Board has four standing committees: the Audit Committee, Compensation Committee, Nominating Committee and Risk Management Committee. Each committee member attended at least 75% of the committee meetings for all committees on which they served.

Audit Committee

The Audit Committee of the Board operates under a charter adopted by the Board on December 22, 2010. A copy of our Audit Committee charter is available to our members by logging in to the Investors portal on our website at https://redtrailenergy.com and at our website, https://redtrailenergy.com, under the tab "How to Invest". Under the charter, the Audit Committee must have at least three members. Our Audit Committee members are Ronald Aberle, Ambrose Hoff and Syd Lawler. The chairperson of the Audit Committee is Mr. Aberle. Our Audit Committee currently does not have an individual designated as a financial expert and has communicated this to the Nominating Committee for their consideration as they review potential nominees for the Board. The reason the Audit Committee does not have a financial expert is that none of our current Governors qualify as a financial expert. Since the Company is not registered with a national securities exchange, the Audit Committee is exempt from the independence listing standards required by such national securities exchanges. Our Audit Committee charter requires a majority of our committee members to be independent as defined in the Audit Committee charter. All three members of our Audit Committee are independent as required by our Audit Committee charter.

The Audit Committee held five meetings during the fiscal year ended September 30, 2024. Each audit committee member attended at least 75% of the audit committee meetings during the fiscal year ended September 30, 2024.

Compensation Committee

The Company's standing Compensation Committee consists of all members of the Board. Sid Mauch serves as the chairman of the Compensation Committee. The Compensation Committee has the overall responsibility for approving and evaluating the Company's Governors' and Chief Executive Officer's compensation. Each member of the Compensation Committee is independent pursuant to the independence standard included in the Company's Audit Committee charter. The Compensation Committee has delegated to the Chief Executive Officer the authority to set compensation for lower executive officers, including the Company's Chief Financial Officer and Grain Merchandiser, and also the authority to implement compensation plans, policies and programs consistent with the Company's philosophy and objectives. The Compensation Committee has not engaged compensation consultants or any other person to assist in determining or recommending the amount or form of executive or governor compensation, but would consider doing so in those situations where it felt such an engagement was warranted or appropriate.

The Compensation Committee does not operate under a charter and is exempt from the independence listing standards because the Company's securities are not listed on a national securities exchange or listed in an automated inter-dealer quotation system or a national securities association or to issuers of such securities. The Compensation Committee held one meeting during the fiscal year ended September 30, 2024 and each member of the Compensation Committee attended the meeting.

For additional information on the responsibilities and activities of the compensation committee, including the process for determining executive compensation, please see Item 11. "Executive Compensation" of this Amendment.

Nominating Committee

The Nominating Committee of the Board consists of Ronald Aberle, Ambrose Hoff, Mike Appert, and William Price. Mr. Appert serves as chairman of the Nominating Committee. Each member of the Nominating Committee is independent pursuant to the independence standard included in the Company's Audit Committee charter. The Nominating Committee held one meeting during the fiscal year ended September 30, 2024 and each member of the Nominating Committee attended the meeting. The Nominating Committee does not operate under a written charter.

Governor Nominations Policy

Our Nominating Committee will consider Governor candidates recommended by members in accordance with the Company's Operating Agreement. Members interested in submitting the name of a candidate for consideration as Governor should send a letter to the Secretary of the Company, P.O. Box 11, 3682 Highway 8 South, Richardton, ND 58652, and specify that the letter should be forwarded to the chairman of the Nominating Committee. The Board has not yet adopted a formal policy regarding qualifications of Governor candidates and we do not have a policy regarding considering diversity in Governor nominees. In evaluating Governor nominees, the Nominating Committee and the Board considers a variety of factors, including the appropriate size of the Board; our needs with respect to the particular talents and experience of our Governors; the knowledge, skills and experience of nominees, including: experience in the ethanol, corn or feed industries, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; experience with accounting rules and practices; and the desire to balance the benefit of continuity with the periodic injection of fresh perspectives provided by new Board members. To date, we have not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in the future to retain a third party search firm, if necessary. The Nominating Committee's evaluation process with respect to candidates brought to them by members as opposed to other Governors does not differ.

On July 31, 2008, the Board adopted the Operating Agreement, which provided that members must give advance notice to the Company of any business that they propose to bring before an annual meeting or of any person that they propose be nominated as Governor. Under the advance notice provision, to be timely, a member's notice must be received at the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the anniversary date of the immediately preceding annual meeting of members. With regard to Governor nominations, the notice must also set forth (a) the name and address of the member who intends to make the nomination, (b) the name, age, business address and, if known, residence address of each person so proposed, (c) the principal occupation or employment of each person so proposed for the past five years, (d) the number of membership units of the Company beneficially owned by each person so proposed and the earliest date of acquisition of any such membership units, (e) a description of any arrangement or understanding between each person so proposed and the member(s) making such nomination with respect to such person's proposal for nomination and election as a Governor and actions to be proposed or taken by such person if elected a Governor; and (f) the written consent of each person so proposed to serve as a Governor if nominated and elected as a Governor.

Risk Management Committee

The Risk Management Committee of the Board consists of Ronald Aberle, Mike Appert, and Sid Mauch. Mr. Appert serves as chairman of the Risk Management Committee. The Risk Management Committee is involved in setting the direction for the Company in relation to its corn and ethanol hedging strategies. The Risk Management Committee met fifty-four times during our fiscal year ended September 30, 2024 and each committee member attended at least 75% of such meetings.

Policy Regarding Employee, Officer and Director Hedging

We do not have a policy prohibiting our Governors, officers or employees from purchasing financial instruments that are designed to hedge or offset any decrease in the market value of the Company's Class A Units held by such persons. As a limited liability company, we are required to restrict the transfers of our units in order to preserve our partnership tax status. Our units may not be traded on any established securities market or readily traded on a secondary market (or the substantial equivalent thereof). Because there is no public market for our units, it is the view of the Board that such a policy is unnecessary.

Board Leadership Structure and Role In Risk Oversight

The Company is managed by a Chief Executive Officer that is separate from the Chairman of the Board. The Board has determined that its leadership structure is effective to create checks and balances between the executive officers of the Company and the Board. The Board is actively involved in overseeing all material risks that face the Company. The Board administers its oversight functions by reviewing the operations of the Company, by overseeing the executive officers' management of the Company, and through its risk management committee.

Communications with Governors

The Board does not have a formalized process for holders of units to send communications to the Board. The Board feels this is reasonable given the accessibility of our Governors. Members desiring to communicate with the Board are free to do so by contacting a Governor or by calling the Company's office at (701) 974-3308.

Insider Trading Policies

The Company, through their Code of Business Conduct (described below), has adopted insider trading procedures governing the purchase, sale and/or other dispositions by Governors, officers and employees of our securities that are reasonably designed to promote compliance with insider trading laws, rules and regulations. The Company's Code of Business Conduct was filed with the Securities Exchange Commission as Exhibit 10.38 to our Annual Report on Form 10-K for the year ended December 31, 2006.

Code of Ethics

The Company has adopted a Code of Business Conduct that applies to all of our employees, officers and Governors, and a Code of Ethics for Senior Financial Officers that applies to our Chief Executive Officer, Chief Financial Officer and Grain Merchandiser and other persons performing similar functions. The Code of Business Conduct and Code of Ethics are available to our members by logging in to the Investors portal on our website at https://redtrailenergy.com.

ITEM 11. EXECUTIVE COMPENSATION.

Compensation Discussion and Analysis

Overview

Throughout this Amendment, the individuals who serve as our Chief Executive Officer, Chief Financial Officer and Grain Merchandiser are referred to as the "executive officers". The Compensation Committee has responsibility for establishing, implementing and regularly monitoring adherence to the Company's compensation philosophy and objectives.

In setting compensation, the Compensation Committee took into account the member vote at our 2023 annual member meeting called the "Say-on-Pay," where the Company's members overwhelmingly voted to endorse the Company's system of compensating its executive officers.

The Company does not maintain any equity incentive plans or like plans which give awards to any employees of the Company. The Company does not provide any pensions.

Compensation Philosophy and Objectives

Our compensation programs are designed to achieve the following objectives:

•Attract, retain and motivate highly qualified and talented executives who will contribute to the Company's success by reason of their ability, ingenuity and industry;

•Link compensation realized to the achievement of the Company's short and long-term financial and strategic goals;

•Align management and member interests by encouraging long-term member value creation;

•Maximize the financial efficiency of the compensation program from tax, accounting, cash flow and dilution perspectives; and

•Support important corporate governance principles and comply with best practices.

Compensation Committee Procedures

The Compensation Committee is responsible for determining the nature and amount of compensation for the Company's Chief Executive Officer and has delegated to the Chief Executive Officer the authority to set compensation for lower executive officers, including the Company's Chief Financial Officer and Grain Merchandiser. The Compensation Committee has also delegated to the Chief Executive Officer the authority to implement compensation plans, policies and programs consistent with the Company's philosophy and objectives.

The Compensation Committee recommended that the Company enter into an employment agreement with the Company's current Chief Executive Officer, Jodi Johnson, effective April 24, 2023. This employment agreement provides for an annual base salary and a year-end bonus based on the Company's net income.

Base Salary

The evaluation of the Chief Executive Officer's employment agreement was based on the scope of their role, responsibilities, experience level and performance, and taking into account competitive market compensation paid by comparable companies for similar positions.

Bonus

In addition to the base salary, the evaluation of the Chief Executive Officer's employment agreement also included the potential to earn a year-end bonus based on the Company's net income. The Compensation Committee believed that the alignment of bonus potential with the Company's financial performance is consistent with the Company's compensation philosophy and objectives.

Accounting and Tax Treatment of Awards

None of our executive officers, governors, or employees receives compensation in excess of $1,000,000 and therefore the entire amount of their compensation is deductible by the Company as a business expense. Certain large executive compensation awards are not tax deductible by companies making such awards. None of our compensation arrangements are likely to reach this cap in the foreseeable future.

Compensation Committee Report

The Compensation Committee has reviewed and discussed this Compensation Discussion and Analysis with management. Based upon this review and discussion, the Board determined that the Compensation Discussion and Analysis should be included in this Amendment and any other related proxy statement for the 2025 Annual Meeting of the members.

Compensation Committee

Sid Mauch, Chair

Ronald Aberle

Mike Appert

Ambrose Hoff

Frank Kirschenheiter

Syd Lawler

William Price

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee have been an employee of the Company. There are no interlocking relationships between the Company and other entities that might affect the determination of the compensation of our executive officers.

Summary Compensation Table

The following table sets forth all compensation paid or payable by the Company during the last three fiscal years, or such shorter period that they were covered by this requirement, to our Chief Executive Officer, Chief Financial Officer and Grain Merchandiser.

We did not have any compensatory security option plan or other plan for long term compensation for our executive officers or governors in place as of September 30, 2024. Further, as of September 30, 2024, none of our governors or executive officers had any options, warrants, or other similar rights to purchase securities of the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Fiscal Year | | Salary | | Bonus | | Other(4) | | Total |

Chief Executive Officer - (Jodi Johnson)(1) | | 2024 | | $ | 214,518 | | | $ | 14,903 | | | $ | 2,998 | | | $ | 232,419 | |

| Jodi Johnson | | 2023 | | $ | 80,385 | | | $ | — | | | — | | | $ | 80,385 | |

Gerald Bachmeier (2) | | 2023 | | $ | 138,553 | | | $ | 120,000 | | | $ | 10,851 | | | $ | 269,404 | |

| Gerald Bachmeier | | 2022 | | $ | 240,000 | | | $ | 64,420 | | | $ | 10,985 | | | $ | 315,405 | |

Chief Financial Officer - Jodi Entze (3) | | 2024 | | $ | 89,660 | | | $ | 5,500 | | | — | | | $ | 95,160 | |

| Joni Entze | | 2023 | | $ | 32,371 | | | $ | — | | | — | | | $ | 32,371 | |

| Jodi Johnson | | 2023 | | $ | 108,169 | | | $ | 40,000 | | | | | $ | 148,169 | |

| Jodi Johnson | | 2022 | | $ | 149,423 | | | $ | 26,292 | | | | | $ | 175,715 | |

Grain Merchandizer - Ryan Wiege | | 2024 | | $ | 145,660 | | | $ | 11,500 | | | — | | | $ | 157,160 | |

| | 2023 | | $ | 125,539 | | | $ | 15,000 | | | — | | | $ | 140,539 | |

| | 2022 | | $ | 119,731 | | | $ | 11,292 | | | — | | | $ | 131,023 | |

(1)Ms. Johnson was appointed CEO effective as of April 24, 2023 and had previously served as CFO of the Company from April 2013 to April 24, 2023.

(2)Mr. Bachmeier resigned as CEO effective as of April 24, 2023 and had previously served as CEO of the Company since July of 2010.

(3)Ms. Entze was appointed CFO effective April 24, 2023.

(4)The amounts noted under "Other" reflects the portion of health insurance premium the Company has paid on the CEO's behalf. The CEO was and is still required to pay a portion of this premium out of pocket.

Employment Agreements with Governors or Officers

The Company entered into an employment agreement with Gerald Bachmeier for the position of Chief Executive Officer of the Company effective July 8, 2010. The employment agreement provided for an annual base salary as well as a year-end bonus based on the Company's net income. On April 24, 2023, Mr. Bachmeier resigned as the Chief Executive Officer and the Company's employment agreement with Mr. Bachmeier has terminated.

The Company entered into an employment agreement with Jodi Johnson for the position of Chief Executive Officer effective as of April 24, 2023. The employment agreement provides for an annual base salary as well as a year-end bonus based on the Company's net income.

We do not have any employment agreements with any other officer or Governor.

Potential Payments upon Termination or Change-in-Control.

In connection with the Company's expected sale of substantially all of its assets, which was approved by the Members at a Special Meeting of the Members on December 5, 2024, as described in the definitive proxy statement filed by the Company with the SEC on October 18, 2024 (the "Asset Sale"), Jodi Johnson has been offered employment with Gevo, Inc., a Delaware corporation, the parent corporation of the buyer in the Asset Sale, after closing and subject to consummation of the Asset Sale. The acceptance of employment by Ms. Johnson is a condition to the buyer's obligation to complete the Asset Sale.

Ms. Johnson will receive a retention bonus of approximately $25,000 from the Company in connection with the closing of the Asset Sale.

Pay Versus Performance

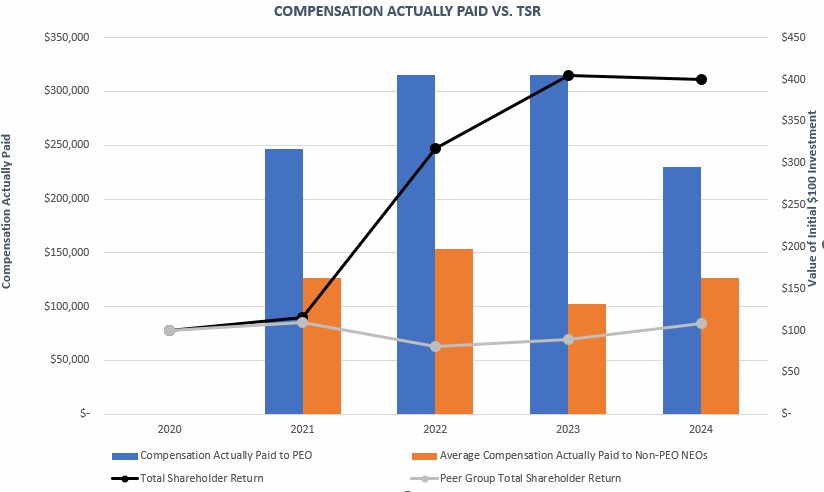

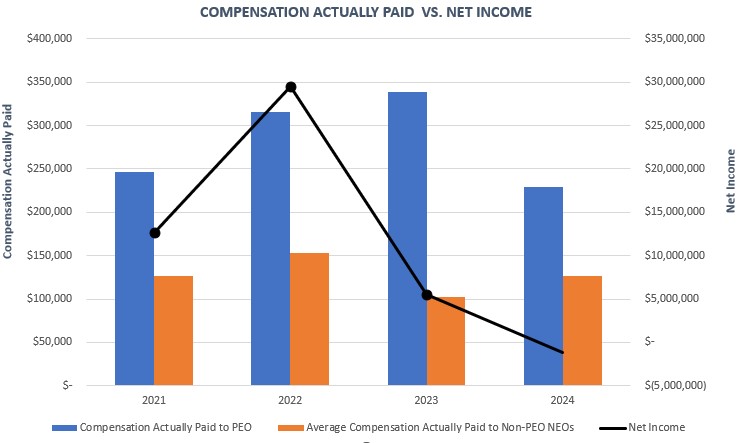

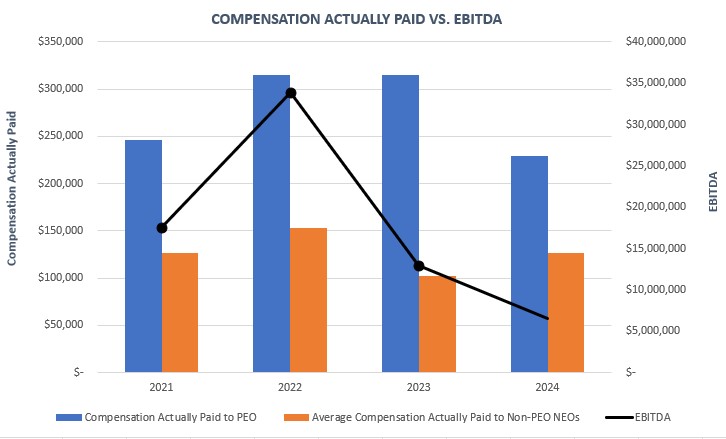

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, we are providing the following table and related disclosure to illustrate the relationship between executive compensation “actually paid” (as calculated herein) and certain measures of Company financial performance. For information regarding the Company’s pay-for-performance philosophy and how the Company aligns executive compensation with its performance in practice, refer to the “Compensation Discussion and Analysis” section above. References to “PEO” in the tables below refer to Jodi Johnson, our Chief Executive Officer.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year

(a) | Summary comp. table total for PEO (1) *Johnson ($)

(b) | Summary comp. table total for PEO (2) *Bachmeier ($)

(b) | Comp. actually paid to PEO (3) *Johnson ($)

(c) | Comp. actually paid to PEO (4)*Bachmeier ($)

(c) | Average summary comp. table total for non-PEO named executive officers (5) ($)

(d) | Average comp. actually paid to non-PEO named executive officers (6) ($)

(e) | Value of initial fixed $100 investment based on: | Net income(8) ($)

(h) | EBITDA(9) ($)

(i) |

TSR (7) ($)

(f) | Peer group TSR (8) ($)

(g) |

| 2024 | 232,419 | 0 | 229,421 | 0 | 126,160 | 126,160 | 400 | 108 | -1,172,777 | 6,480,867 |

| 2023 | 80,385 | 269,404 | 80,385 | 258,553 | 102,026 | 102,026 | 405 | 89 | 5,561,255 | 12,983,937 |

| 2022 | 0 | 315,405 | 0 | 304,420 | 153,369 | 153,369 | 317 | 81 | 29,496,680 | 33,847,660 |

| 2021 | 0 | 246,196 | 0 | 236,154 | 126,973 | 126,973 | 116 | 109 | 12,625,679 | 17,597,905 |

(1) The amounts reported in this column reflect, for each applicable fiscal year, the amounts of total compensation reported for Jodi Johnson (our current Chief Executive Officer, appointed on April 24, 2023) in the “Total Compensation” column of the Summary Compensation Table.

(2) The amounts reported in this column reflect, for each applicable fiscal year, the amounts of total compensation reported for Gerald Bachmeier, who served as our Chief Executive Officer until April 24, 2023.

(3) The amounts reported in this column reflect, for each applicable fiscal year, the “compensation actually paid” as calculated under SEC rules (“CAP”) to Ms. Johnson. The CAP represents differences in payment amounts to account for excess medical insurance benefits the Ms. Johnson receives compared to the reimbursement the Company makes for its other employees.

(4) The amounts reported in this column reflect, for each applicable fiscal year, the “compensation actually paid” as calculated under SEC rules (“CAP”) to Mr. Bachmeier. The CAP represents differences in payment amounts to account for excess medical insurance benefits Mr. Bachmeier received compared to the reimbursement the Company made for its other employees.

(5) The amounts reported in this column reflect, for each applicable fiscal year, the amounts of average compensation reported in the "Total Compensation" column of the Summary Compensation Table for the Company’s named executive officers other than the PEO. The named executive officers included for the 2024 fiscal year are Joni Entze (our Chief Financial Officer) and Ryan Wiege (our Grain Merchandiser). The named executive officers included for the 2023 fiscal year are Joni Entze (our Chief Financial Officer, appointed on April 24, 2024), Jodi Johnson (our previous Chief Financial Officer, who was appointed as our Chief Executive Officer on April 24, 2024) and Ryan Wiege (our Grain Merchandiser). The named executive officers included for the 2022 fiscal year are Jodi Johnson (our previous Chief Financial Officer) and Ryan Wiege (our Grain Merchandiser). The named executive officers included for the 2021 fiscal year are Jodi Johnson (our previous Chief Financial Officer) and Ryan Wiege (our Grain Merchandiser).

(6) The amounts reported in this column reflect, for each applicable fiscal year, the average amount of CAP to the Company’s named executive officers other than the PEO. The CAP is the same as the total compensation reported in column (d) as no adjustments were required. Information is reported for the same persons named in footnote 5 to column (d).

(7) The amounts reported in this column reflect the value based on the cumulative total member return, during the period from September 30, 2020 through the applicable fiscal year, of a hypothetical investment of $100 in the Company’s units. The table assumes continual investment from September 30, 2020 through the applicable fiscal year and includes the initial $100 investment.

(8) The amounts reported in this column reflect the value based on the weighted average cumulative total shareholder return of a peer group relative to the Company, of over forty five (45) companies with a SIC code of 2869, during the period from September 30, 2020 through the end of the applicable fiscal year, of a hypothetical investment of $100. The table assumes continual investment from September 30, 2020 through the applicable fiscal year and includes the initial $100 investment.

(9) The amounts reported in this column represent the amount of net income reflected in the Company’s audited consolidated financial statements for each applicable year.

(10) We have selected EBITDA as the Company-Selected Measure.

Relationship Between CAP and Performance

Below are three (3) graphs showing the relationship of “Compensation Actually Paid” to our PEO and non-PEO named executive officers for our fiscal years 2021, 2022, 2023 and 2024 compared to: (1) the Total Shareholder Return (TSR) of both our units and our peer group, (2) net income, and (3) EBITDA, each separately.

Tabular List of Most Important Financial Performance Measures

The following is a list of the most important financial performance measures that the Company has used to link compensation of our named executive officers to Company performance for the 2024 fiscal year:

•Net Income

•EBITDA

•Unit Value

CEO Pay Ratio

In accordance with SEC rules, we are disclosing the following information regarding the relationship of the annual total compensation of our employees and the annual total compensation of our Chief Executive Officer for the fiscal year ended September 30, 2024:

•The median of the annual total compensation of all of our employees (excluding the Chief Executive Officer) was $93,636.68.

•The annual total compensation of our Chief Executive Officer, as reported on our Summary Compensation Table, was $232,419.00

•Based on this information, the ratio of our Chief Executive Officer's annual total compensation to our median employee was 2.49:1.00.

Our employee population as of September 30, 2024 (the date we selected to identify our median employee compensation), consisted of 55 individuals, with all of these individuals located in the United States. We identified our median employee compensation based on the annual total compensation paid during the fiscal year ended September 30, 2024, calculated consistent with the disclosure requirements of executive compensation under Item 402(c)(2)(x) of Regulation S-K.

In addition, for purposes of reporting the ratio of annual total compensation of the Chief Executive Officer to the median employee compensation, both the Chief Executive Officer(s) and the median employee’s total compensation paid during the fiscal year ended September 30, 2024, were calculated consistent with the disclosure requirements of executive compensation under Item 402(c)(2)(x) of Regulation S-K. The Company has not made any of the adjustments permissible by the SEC, nor have any material assumptions or estimates been made to identify the median employee compensation total or to determine annual total compensation.

GOVERNOR COMPENSATION

Pursuant to our Governor compensation policy, we currently pay Governor fees as follows:

•$1,000.00 per in-person Board meeting or $500.00 per conference call.

•$400.00 per in-person Audit Committee meeting or conference call.

•$400.00 per in-person Risk Management Committee meeting or conference call.

•$400.00 per in-person Nominating Committee meeting or $100.00 per conference call.

The compensation policy also provides for reimbursement to Governors for all out-of-pocket costs and mileage for travel to and from meetings and other locations to perform these tasks.

In the fiscal year ended September 30, 2024, the Company had incurred an aggregate of $132,000 in Governor fees and related expenses.

The table below shows the compensation paid to each of our Governors for the fiscal year ended.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fiscal Year | | Fees Earned or Paid in Cash(1) | | All Other Compensation(2) | | Total Compensation |

| Ronald Aberle | | 2024 | | $ | 32,400 | | | $ | — | | | $ | 32,400 | |

| Mike Appert | | 2024 | | $ | 31,500 | | | $ | — | | | $ | 31,500 | |

| Ambrose Hoff | | 2024 | | $ | 10,400 | | | $ | — | | | $ | 10,400 | |

| Frank Kirschenheiter | | 2024 | | $ | 8,200 | | | $ | — | | | $ | 8,200 | |

| Syd Lawler | | 2024 | | $ | 11,100 | | | $ | — | | | $ | 11,100 | |

| Sid Mauch | | 2024 | | $ | 30,300 | | | $ | — | | | $ | 30,300 | |

| William Price | | 2024 | | $ | 8,100 | | | $ | — | | | $ | 8,100 | |

| | | | $ | 132,000 | | | $ | — | | | $ | 132,000 | |

(1)Includes reimbursement for regular board meetings as well as committee meetings.

(2)Includes reimbursement for mileage incurred in connection with services rendered to the Board and for services rendered to the Company.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED MEMBER MATTERS.

For purposes of our Governors, management and members who beneficially own 5% or more of our Class A Units, beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated by footnote, a person named in the tables below has sole voting and sole investment power for all of the Class A Units beneficially owned by that person. In addition, unless otherwise indicated, all persons named below can be reached at the Company at 3682 Highway 8 South, P.O. Box 11, Richardton, ND 58652.

| | | | | | | | | | | | | | | | | | | | |

| Title of Class | | Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

| Class A Membership Units | | Ronald Aberle, Governor | | 334,587(1) | | 0.83% |

| Class A Membership Units | | Mike Appert, Governor | | 1,350,000(2) | | 3.36% |

| Class A Membership Units | | Ambrose Hoff, Governor | | 780,000(3) | | 1.94% |

| Class A Membership Units | | Frank Kirschenheiter, Governor and Nominee | | 100,000 | | * |

| Class A Membership Units | | Syd Lawler, Governor and Nominee | | 205,000(4) | | * |

| Class A Membership Units | | Sid Mauch, Governor and Nominee | | 66,500(5) | | * |

| Class A Membership Units | | William Price, Governor | | 400,000(7) | | * |

| Class A Membership Units | | Jodi Johnson, CEO | | — | | —% |

| Class A Membership Units | | Joni Entze, CFO | | — | | —% |

| Class A Membership Units | | Ryan Wiege, Grain Merchandiser | | — | | —% |

| TOTAL: | | Governors/Officers/Nominees as a Group | | 5,138,920 | | 12.80% |

(*) Designates less than one percent ownership.

(1) Includes 314,587 Class A Units owned jointly with Mr. Aberle's spouse. Additionally, 20,000 Class A Units are held by Old Ten Investment, of which Mr. Aberle is a partner and of which Mr. Aberle disclaims beneficial ownership.

(2) Includes 380,000 Class A Units which Mr. Appert owns jointly with his spouse and 100,000 Class A Units held directly by his son of which Mr. Appert disclaims beneficial ownership. Additionally, 160,000 Class A Units are held by Appert Acres, Inc., of which Mr. Appert is a partial owner and of which Mr. Appert disclaims beneficial ownership, and 210,000 Class A Units are held by Appert Farms, Inc., of which Mr. Appert is a partial owner and of which Mr. Appert disclaims beneficial ownership.

(3) Includes 480,000 Class A Units owned jointly with Mr. Hoff's spouse. Additionally, 300,000 Class A Units are held by Richardton Development Company, of which Mr. Hoff serves as an officer and of which Mr. Hoff disclaims beneficial ownership.

(4) Includes 105,000 Class A Units owned jointly with Mr. Lawler's spouse.

(5) Includes 65,500 Class A Units owned jointly with Mr. Mauch's spouse.

(7) Includes 300,000 Class A Units which Mr. Price owns jointly with his brother and 100,000 Class A Units held jointly with his brother and mother.

Recent Transactions

There has been no change in the ownership of the Company's Class A Units by any of the Company's Governors or executive officers within the last 60 days.

Beneficial Ownership

There is only one (1) beneficial owner of our Class A Units known by the Governors that have beneficial ownership of 5% or more of the outstanding Class A Units as of January 28, 2025.

| | | | | | | | | | | | | | | | | | | | |

| Title of Class | | Name of Beneficial Owner | | Amount of Beneficial Ownership | | Percent of Class |

| Class A Membership Units | | Gerald and Carolyn Keller | | 2,403,791 | | 6.0% |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's officers and governors, and persons who own more than 10% of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, governors and greater than 10% beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations from our officers and governors, all Section 16(a) filing requirements were complied with during the fiscal year ended September 30, 2024.

ITEM 13. CERTAIN RELATIONSHIPS, AND RELATED TRANSACTIONS, AND GOVERNOR INDEPENDENCE

The Board has adopted a written policy requiring all Governors, officers and employees, and their immediate family members, to notify the Board about any transaction, of any size, with the Company. The Board is responsible for enforcing this policy. Some of our Governors, officers and employees and their immediate family members have sold corn to the Company or purchased E85 or distillers grains from the Company. These purchases and sales were made on terms available to all parties that do business with the Company, and were as follows for our 2024 fiscal year:

Ronald Aberle, a Governor, and a company owned in part by Mr. Aberle, sold corn to the Company in an amount equal to $3,238,774.17 during our fiscal year ended September 30, 2024.

Mike Appert, a Governor, and various companies owned in part by Mr. Appert, sold corn to the Company in an amount equal to $4,367,195.83 during our fiscal year ended September 30, 2024.

Ambrose Hoff, a Governor, rented some land to the Company for our carbon capture system project resulting in payments of $9,691.66 to him from the Company during our fiscal year ended September 30, 2024. Total payments due to Mr. Hoff under the lease for the entire 50 year term equal an estimated amount of $1,202,415.

The Board reviews all transactions with related parties, as that term is defined by Item 404 of SEC Regulation S-K, or any transaction in which related persons have an indirect interest. The Company's Code of Business Conduct and Code of Ethics also includes a written policy governing related party transactions, that applies to all of our employees, officers and governors. The Board believes these transactions were no less favorable to the Company than the Company could receive from an independent third party.

Governor Independence

All of our Governors are independent, as defined by our Audit Committee Charter. In evaluating the independence of our Governors, we considered the following factors: (i) the business relationships of our Governors; (ii) positions our Governors hold with other companies; (iii) family relationships between our Governors and other individuals involved with the Company; (iv) transactions between our Governors and the Company; and (v) compensation arrangements between our Governors and the Company.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

Independent Registered Public Accounting Firm

The Audit Committee has selected Eide Bailly LLP as the independent registered public accountants for the fiscal year October 1, 2024 to September 30, 2025. A representative of Eide Bailly LLP is expected to be represented at the 2025 Annual Meeting to respond to questions from the members and will have an opportunity to make a statement if they desire.

Audit Fees

The aggregate fees billed to the Company by our independent registered public accountants, Eide Bailly LLP, during our 2024 and 2023 fiscal years are as follows:

| | | | | | | | | | | | | | |

| Category | | Fiscal Year | | Eide Bailly

Fees |

Audit Fees(1) | | 2024 | | $ | 122,760 | |

| | 2023 | | $ | 131,574 | |

| Audit-Related Fees | | 2024 | | — | |

| | 2023 | | — | |

Tax Fees(2) | | 2024 | | $ | 53,674 | |

| | 2023 | | $ | 58,652 | |

| All Other Fees | | 2024 | | — | |

| | 2023 | | — | |

(1) Audit Fees. This category includes the fees and out-of-pocket expenses for professional services rendered by the principal accountant for the audit of the Company's annual financial statements and review of financial statements included in the Company's Form 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

(2) Tax Fees. This category consists of fees for tax compliance, tax advice and tax planning.

The Board is required to pre-approve all audit and non-audit services performed by the Company's independent auditor to assure that the provision of such services does not impair the auditor's independence. All audit and non-audit services performed by the Company's independent auditor during 2023 and 2024 were pre-approved by the Board. The Board will not authorize the independent auditor to perform any non-audit service which independent auditors are prohibited from performing under the rules and regulations of the Securities and Exchange Commission or the Public Company Accounting Oversight Board. The Board may delegate its pre-approval authority to one or more of its Governors, but not to management. The Governor or Governors to whom such authority is delegated shall report any pre-approval decisions to the Board at its next scheduled meeting.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

Exhibits Filed as Part of this Report and Exhibits Incorporated by Reference.

The following exhibits and financial statements are filed as part of, or are incorporated by reference into, this report:

(1)Financial Statements

The financial statements required by Item 15(a) were filed as part of the Original Form 10-K under Item 8 "Financial Statements and Supplementary Data.".

(2)Financial Statement Schedules

All supplemental schedules are omitted as the required information is inapplicable or the information is presented in the financial statements or related notes.

(3)Exhibits

| | | | | | | | | | | | | | | | | |

| Exhibit No. | Exhibit | | Filed Herewith | | Incorporated by Reference |

| 2.1 | | | | | Filed as Exhibit 2.1 to the registrant's registration statement on Form 8-K on September 16, 2024 (000-52033) and incorporated by reference herein. |

| 3.1 | | | | | Filed as Exhibit 3.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 3.2 | | | | | Filed as exhibit 3.1 to our Current Report on Form 8-K on August 6, 2008. (000-52033) and incorporated by reference herein. |

| 4.1 | | | | | Filed as Exhibit 4.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 4.2 | | | | | Filed as Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. |

| 4.3 | | | | | Filed as Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 (000-52033) and incorporated by reference herein. |

| 10.1 | | | | | Filed as Exhibit 10.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.2 | | | | | Filed as Exhibit 10.10 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.3 | | | | | Filed as Exhibit 10.12 to the registrant's registration statement on Form 10-12G/A-3 (000-52033) and incorporated by reference herein. |

| 10.4 | | | | | Filed as Exhibit 10.12 at Exhibit D to the registrant's registration statement on Form 10-12G/A-3 (000-52033) and incorporated by reference herein. |

| | | | | | | | | | | | | | | | | |

| 10.5 | | | | | Filed as Exhibit 10.19 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.6 | | | | | Filed as Exhibit 10.20 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.7 | | | | | Filed as Exhibit 10.21 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.8 | | | | | Filed as Exhibit 10.28 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. |

| 10.9 | | | | | Filed as Exhibit 10.29 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. |

| 10.10 | | | | | Filed as Exhibit 10.30 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. |

| 10.11 | | | | | Filed as Exhibit 10.31 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. |

| 10.12 | | | | | Filed as Exhibit 10.34 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. |

| 10.13 | | | | | Filed as Exhibit 10.36 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. |

| 10.14 | | | | | Filed as Exhibit 10.37 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. |

| 10.15 | | | | | Filed as Exhibit 10.38 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. |

| 10.16 | | | | | Filed as Exhibit 10.41 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. |

| 10.17 | | | | | Filed as Exhibit 10.42 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. |

| 10.18 | | | | | Filed as Exhibit 10.44 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. |

| 10.19 | | | | | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended March 31, 2008 (000-52033) and incorporated by reference herein. |

| 10.20 | | | | | Filed as exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on August 13, 2008 (000-52033) and incorporated by reference herein. |

| | | | | | | | | | | | | | | | | |

| 10.21 | | | | | Filed as exhibit 4.2 to our Current Report on Form 8-K filed with the SEC on June 1, 2009 (000-52033) and incorporated by reference herein. |

| 10.22 | | | | | Filed as Exhibit 10.2 to our Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 (000-52033) and incorporated by reference herein. |

| 10.23 | | | | | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010 (000-52033) and incorporated by reference herein. |

| 10.24 | | | | | Filed as Exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on December 20, 2010 (000-52033) and incorporated by reference herein. |

| 10.25 | | | | | Filed as Exhibit 10.56 to our Current Report on Form 10-K for the fiscal year ended December 31, 2010 (000-52033) and incorporated by reference herein. |

| 10.26 | | | | | Filed as Exhibit 99.2 to our Current Report on Form 8-K dated June 1, 2011 (000-52033) and incorporated by reference herein. |

| 10.27 | | | | | Filed as Exhibit 10.1 to our Current Report on Form 10-Q for the quarter ended June 30, 2011 (000-52033) and incorporated by reference herein. |

| 10.28 | | | | | Filed as Exhibit 10.60 to our Current Report on Form 10-K for the transition period ended September 30, 2011 (000-52033) and incorporated by reference herein. |

| 10.29 | | | | | Filed as Exhibit 10.1 to our Current Report on Form 10-Q for the quarter ended March 31, 2012 (000-52033) and incorporated by reference herein. |

| 10.30 | | | | | Filed as Exhibit 10.62 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. |

| 10.31 | | | | | Filed as Exhibit 10.63 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. |

| 10.32 | | | | | Filed as Exhibit 10.64 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. |

| 10.33 | | | | | Filed as Exhibit 10.31 to our Annual report on Form 10-K for the fiscal year ended September 30, 2013 (000-52033) and incorporated by reference herein. |

| 10.34 | | | | | Filed as Exhibit 10.32 to our Annual report on Form 10-K for the fiscal year ended September 30, 2014 (000-52033) and incorporated by reference herein. |

| 10.35 | | | | | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. |

| | | | | | | | | | | | | | | | | |

| 10.36 | | | | | Filed as Exhibit 10.2 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. |

| 10.37 | | | | | Filed as Exhibit 10.3 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. |

| 10.38 | | | | | Filed as Exhibit 10.4 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. |

| 10.39 | | | | | Filed as Exhibit 10.5 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. |

| 10.40 | | | | | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2017 and incorporated by reference herein. |

| 10.41 | | | | | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. |

| 10.42 | | | | | Filed as Exhibit 10.2 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. |

| 10.43 | | | | | Filed as Exhibit 10.3 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. |

| 10.44 | | | | | Filed as Exhibit 10.4 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. |

| 10.45 | | | | | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended December 31, 2020 (000-52033) and incorporated by reference herein. |

| 10.46 | | | | | Filed as Exhibit 10.2 to our Quarterly Report on Form 10-Q for the quarter ended December 31, 2020 (000-52033) and incorporated by reference herein |

| 10.47 | | | | | Filed as Exhibit 99.1 to our Current Report on Form 8-K dated April 18, 2024 (000-52033) and incorporated by reference herein. |

| 31.1 | | | | | Filed as Exhibit 31.1 to our Original 10-K Filing dated January 15, 2024 (000-52033) and incorporated by reference herein. |

| 31.2 | | | | | Filed as Exhibit 31.2 to our Original 10-K Filing dated January 14, 2024, (000-52033) and incorporated by reference herein. |

| 31.3 |

| | X | | |

| | | | | | | | | | | | | | | | | |

| 31.4 |

| | X | | |

| 32.1 | | | | | Filed as Exhibit 32.1 to our Original 10-K Filing dated January 15, 2024 (000-52033) and incorporated by reference herein. |

| 32.2 | | | | | Filed as Exhibit 32.2 to our Original 10-K Filing dated January 14, 2024, (000-52033) and incorporated by reference herein. |

| 101.INS | Inline XBRL Instance Document | | X | | |

| 101.SCH | Inline XBRL Schema Document | | X | | |

| 101.CAL | Inline XBRL Calculation Document | | X | | |

| 101.LAB | Inline XBRL Labels Linkbase Document | | X | | |

| 101.PRE | Inline XBRL Presentation Linkbase Document | | X | | |

| 101.DEF | Inline XBRL Definition Linkbase Document | | X | | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in the Interactive Data Files submitted as Exhibit 101) | | | | |

(+) Confidential Treatment Requested.

(X) Filed herewith.

(**) Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | RED TRAIL ENERGY, LLC |

| | | |

| Date: | January 28, 2025 | | /s/ Jodi Johnson |

| | | Jodi Johnson |

| | | President and Chief Executive Officer |

| | | (Principal Executive Officer) |

| | | |

| Date: | January 28, 2025 | | /s/ Joni Entze |

| | | Joni Entze |

| | | Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |