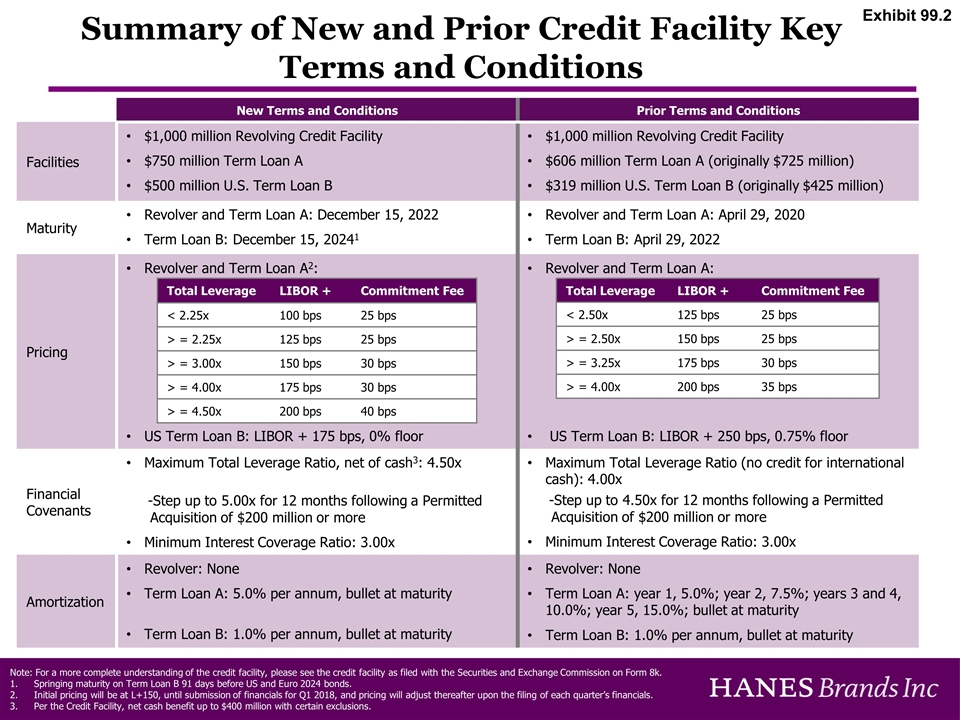

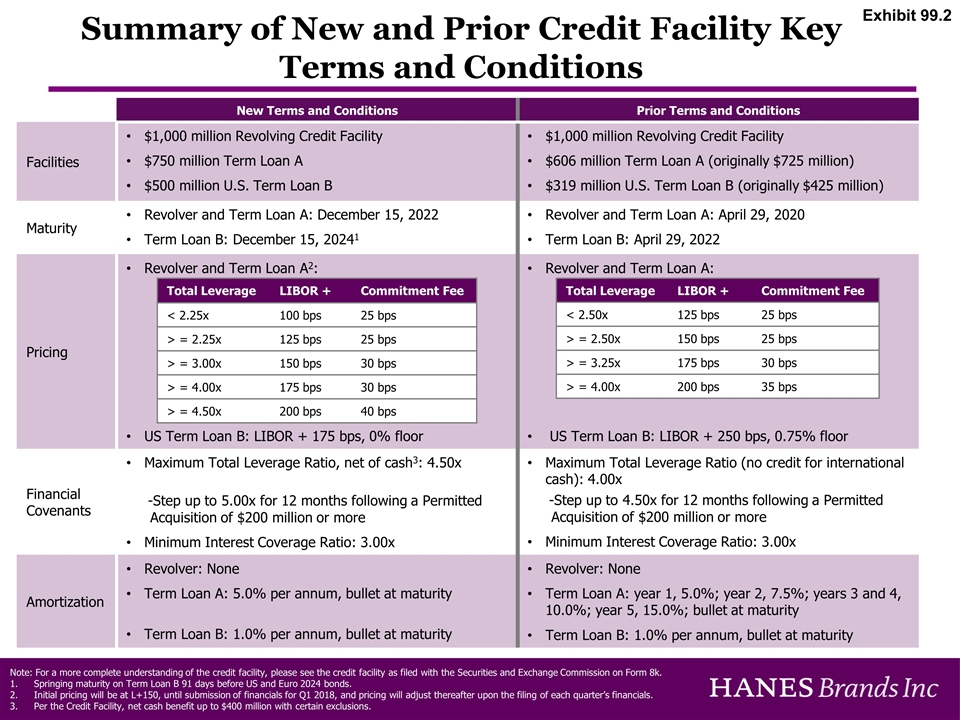

Summary of New and Prior Credit Facility Key Terms and Conditions New Terms and Conditions Prior Terms and Conditions Facilities $1,000 million Revolving Credit Facility $750 million Term Loan A $500 million U.S. Term Loan B $1,000 million Revolving Credit Facility $606 million Term Loan A (originally $725 million) $319 million U.S. Term Loan B (originally $425 million) Maturity Revolver and Term Loan A: December 15, 2022 Term Loan B: December 15, 20241 Revolver and Term Loan A: April 29, 2020 Term Loan B: April 29, 2022 Pricing Revolver and Term Loan A2: US Term Loan B: LIBOR + 175 bps, 0% floor Revolver and Term Loan A: US Term Loan B: LIBOR + 250 bps, 0.75% floor Financial Covenants Maximum Total Leverage Ratio, net of cash3: 4.50x -Step up to 5.00x for 12 months following a Permitted Acquisition of $200 million or more Minimum Interest Coverage Ratio: 3.00x Maximum Total Leverage Ratio (no credit for international cash): 4.00x -Step up to 4.50x for 12 months following a Permitted Acquisition of $200 million or more Minimum Interest Coverage Ratio: 3.00x Amortization Revolver: None Term Loan A: 5.0% per annum, bullet at maturity Term Loan B: 1.0% per annum, bullet at maturity Revolver: None Term Loan A: year 1, 5.0%; year 2, 7.5%; years 3 and 4, 10.0%; year 5, 15.0%; bullet at maturity Term Loan B: 1.0% per annum, bullet at maturity Total Leverage LIBOR + Commitment Fee < 2.50x 125 bps 25 bps > = 2.50x 150 bps 25 bps > = 3.25x 175 bps 30 bps > = 4.00x 200 bps 35 bps Total Leverage LIBOR + Commitment Fee < 2.25x 100 bps 25 bps > = 2.25x 125 bps 25 bps > = 3.00x 150 bps 30 bps > = 4.00x 175 bps 30 bps > = 4.50x 200 bps 40 bps Note: For a more complete understanding of the credit facility, please see the credit facility as filed with the Securities and Exchange Commission on Form 8k. Springing maturity on Term Loan B 91 days before US and Euro 2024 bonds. Initial pricing will be at L+150, until submission of financials for Q1 2018, and pricing will adjust thereafter upon the filing of each quarter’s financials. Per the Credit Facility, net cash benefit up to $400 million with certain exclusions. Exhibit 99.2