- HBI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Hanesbrands (HBI) DEF 14ADefinitive proxy

Filed: 14 Mar 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Hanesbrands Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

Notice of the 2016 Annual Meeting |  |

| ||

| Monday, April 25, 2016 – 4pm EDT Embassy Suites |  |

| ||

| Message From Our Chairman and Chief Executive Officer |  |

Dear Fellow Stockholders:

In 2015, Hanesbrands again achieved record growth in sales, operating profit and EPS. Our strong balance sheet and cash flow continue to support our value-creating business model of innovation, supply chain leverage and strategic acquisitions. Over the past three years, we have generated $1.3 billion in operating cash flow, invested in our business, made three important acquisitions and returned over $691 million to our stockholders through dividends and share repurchases. Looking ahead in 2016 and beyond, we remain in a strong position to create further value.

At Hanesbrands, we strive to work hard and compete aggressively, but always do the right thing. We are protective of our strong reputation for corporate citizenship and social responsibility, and proud of our significant achievements in the areas of environmental stewardship, workplace quality and community building. We call our corporate social responsibility programHanes for Good – that’s because adhering to responsible and sustainable business practices is good for our company, good for our employees, good for our communities and good for our stockholders. We invite you to learn more about ourHanes for Good corporate responsibility initiatives atwww.HanesforGood.com.

We also take pride in our commitment to responsible corporate governance. As you will see, we continue to refine our corporate governance policies to reflect stockholder feedback and best practices – most recently by terminating our stockholder rights plan and adopting a majority voting standard in uncontested director elections. We also emphasize a “pay-for-performance” culture by linking a substantial percentage of our executives’ compensation to our performance and stockholders’ value growth.

Our 2016 Annual Meeting of Stockholders will be held on Monday, April 25, 2016, at 4:00 p.m., at the Embassy Suites, Lower Level, Gaines Ballroom, located at 460 N. Cherry Street, Winston-Salem, NC 27101. This proxy statement will serve as your guide to the business to be conducted at the annual meeting. We invite you to attend, and ask you to please vote at your earliest convenience whether or not you plan to attend. Your vote is important.

We appreciate your confidence and continued support of Hanesbrands.

Sincerely yours,

RICHARD A. NOLL

Chairman of the Board of Directors and

Chief Executive Officer

| HANESBRANDS INC. | | | 1 |

Item 1. |  |

Election of Directors ✓ The Board of Directors recommends a vote FOR the ten directors nominated for election >> See page 11 for further information about our director nominees |

Director Nominees

| Hanesbrands Committees | ||||||||

| Name | Occupation | Age | Director since | Independent | Other current directorships | A | C | G&N |

| Bobby J. Griffin | Former President, International Operations of Ryder System, Inc. | 67 | 2006 | YES | ●United Rentals, Inc. ●WESCO International, Inc. | M | ||

| James C. Johnson | Former General Counsel of Loop Capital Markets LLC | 63 | 2006 | YES | ●Ameren Corporation ●Energizer Holdings, Inc. ●Edgewell Personal Care Company | M | C | |

| Jessica T. Mathews | Distinguished Fellow, Carnegie Endowment for International Peace | 69 | 2006 | YES | ●SomaLogic, Inc. | M | ||

| Franck J. Moison | Chief Operating Officer of Emerging Markets & Business Development for the Colgate-Palmolive Company | 62 | 2015 | YES | M | |||

| Robert F. Moran | Former Chief Executive Officer and Chairman of the Board of PetSmart, Inc. | 65 | 2013 | YES | ●GNC Holdings, Inc. | C | ||

| Ronald L. Nelson* | Executive Chairman of Avis Budget Group, Inc. | 63 | 2008 | YES | ●Avis Budget Group, Inc. ●Convergys Corporation | M | M | |

| Richard A. Noll | Chief Executive Officer and Chairman of the Board of Directors of Hanesbrands Inc. | 58 | 2005 | NO | ●The Fresh Market, Inc. | |||

| Andrew J. Schindler | Former Executive Chairman, Reynolds American Inc. Former Chairman and Chief Executive Officer, R.J. Reynolds Tobacco Company | 71 | 2006 | YES | ●Krispy Kreme Doughnuts, Inc. ●ConAgra Foods, Inc. | C | M | |

| David V. Singer | Former Chief Executive Officer of Snyder’s-Lance, Inc. | 60 | 2014 | YES | ●Brunswick Corporation ●Flowers Foods, Inc. ●SPX FLOW, Inc. | M | ||

| Ann E. Ziegler | Senior Vice President and Chief Financial Officer of CDW Corporation | 57 | 2008 | YES | ●Groupon, Inc. | M | M | |

| A: Audit | *: Lead Director |

| C: Compensation | C: Chair |

| G&N: Governance & Nominating | M: Member |

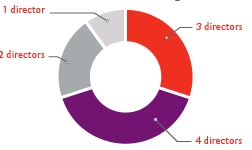

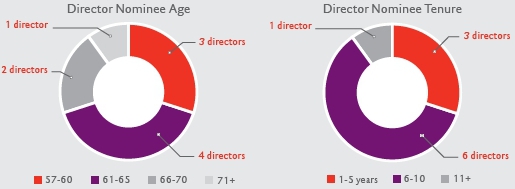

| Director Nominee Age | Director Nominee Tenure |

|  |

57-60 57-60  61-65 61-65  66-70 66-70  71+ 71+ |  1-5 years 1-5 years  6-10 6-10  11+ 11+ |

| 2 | | |

| Proxy Summary |

Director Nominee Skills and Qualifications

| Chief Executive Officer Experience |  |

| Corporate Governance Experience |  |

| Corporate Management Experience |  |

| Financial Literacy |  |

| Industry Experience |  |

| International Business Experience |  |

| Chief Financial Officer Experience |  |

Corporate Governance Highlights

| ● | The majority of director nominees are independent (9 of 10) |

| ● | Annual election of directors |

| ● | Majority voting for directors |

| ● | Strong Lead Director |

| ● | Board oversight of risk management |

| ● | Succession planning for CEO and key members of senior management |

| ● | Annual, robust Board and committee self-evaluation process |

| ● | Executive and director stock ownership guidelines |

Item 2. |  |

To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm ✓ The Board of Directors recommends a vote FOR this item We are asking you to ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent auditor for our 2016 financial year. >> See page 24 for further information about our independent auditors |

Item 3. |  |

To approve, on an advisory basis, executive compensation as disclosed in the proxy statement for our 2016 Annual Meeting ✓ The Board of Directors recommends a vote FOR this item Hanesbrands’ stockholders have the opportunity to cast a non-binding, advisory “say on pay” vote on our named executive officer compensation, as disclosed in this proxy statement. We ask for your approval of the compensation of our named executive officers. Before considering this proposal, please read our Compensation Discussion and Analysis, which explains our executive compensation programs and the Compensation Committee’s compensation decisions. >> See page 27 for further information about our executive compensation program |

| HANESBRANDS INC. | | | 3 |

| Proxy Summary |

EXECUTIVE COMPENSATION

Pay for Performance

At Hanesbrands, we emphasize a “pay-for-performance” culture, linking a substantial percentage of an executive’s compensation to our performance and stockholders’ value growth. Specifically:

| ● | To motivate our executive officers and align their interests with those of our stockholders we provide annual incentives designed to reward our executive officers for the attainment of short-term goals, and long-term incentives designed to reward them for increasing stockholder value over time. |

| ● | Performance-based compensation generally represents approximately half of our named executive officers’ total target direct compensation. |

| ● | Our compensation program is designed to reward exceptional and sustained performance. By combining a three-year vesting period for equity awards with a mandatory one-year holding period following vesting (and policies prohibiting hedging or pledging of such shares), a substantial portion of the value of our executives’ compensation package is tied to changes in our stock price, and therefore at-risk, for a significant period of time. The Compensation Committee believes this design provides an effective way to link executive compensation to long-term stockholder returns. |

2015 Results and Highlights

We achieved the following financial and strategic results in 2015:

| ● | Net sales in 2015 were $5.7 billion, compared with $5.3 billion in 2014, representing an 8% increase. |

| ● | Adjusted operating profit* was $861 million in 2015 compared with $763 million in 2014, representing a 13% increase. |

| ● | Earnings per share, excluding actions* was $1.66 in 2015, compared with $1.42 in 2014, representing a 17% increase. |

| ● | We acquired Knights Apparel, a leading seller of licensed collegiate logo apparel primarily in the mass retail channel. We believe the acquisition, when combined with our Gear For Sports business, will create a commercial business that will take advantage of combined expertise in brand building, marketing, graphic design, licensing relationships, supply chain and retailer relationships across channels. |

| ● | As part of our cash deployment strategy, we paid four quarterly dividends of $0.10 per share and also repurchased approximately 12 million shares of our stock. |

| * | Earnings per share, excluding actions, as well as adjusted operating profit, are non-GAAP financial measures, some of which are used in our executive compensation programs. On a GAAP basis, operating profit was $595 million in 2015 and $564 million in 2014, and diluted EPS was $1.06 in 2015 and $0.99 in 2014. We have chosen to provide these non-GAAP financial measures to investors to enable additional analyses of past, present and future operating performance and as a supplemental means of evaluating company operations. For a reconciliation to the most directly comparable GAAP financial measures, see Appendix A. |

Elements of 2015 Compensation

Our named executive officers’ compensation for 2015 consisted principally of the following elements:

| Base Salary | ●Fixed compensation component ●Reflects the individual responsibilities, performance and experience of each named executive officer | ●Provides a fixed base of cash compensation for fulfillment of fundamental job responsibilities |

| Annual Incentive Plan (“AIP”) Awards | ●Performance-based cash compensation ●Payout determined based on Company performance against pre-established metrics | ●Motivates performance by linking compensation to the achievement of key objectives that contribute to accomplishing consistent and strategic annual results |

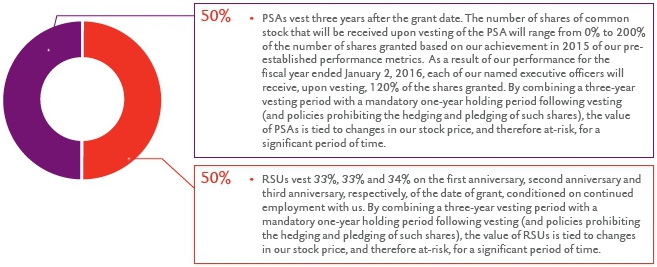

| Long-Term Incentive Program (“LTIP”) Awards | ●Performance-based and time-vested compensation ●Performance Share Awards (“PSAs”) (50% of LTIP opportunity) ●Shares eligible for vesting three years after grant date based on 2015 Company performance against pre-established metrics ●Restricted Stock Unit Awards (“RSUs”) (50% of LTIP opportunity) ●Ratable vesting over a three-year service period ●Mandatory one-year holding period following vesting for all LTIP awards | ●Encourages behavior that enhances the long-term growth, profitability and financial success of the Company, aligns executives’ interests with our stockholders and supports retention objectives |

| 4 | | |

| Proxy Summary |

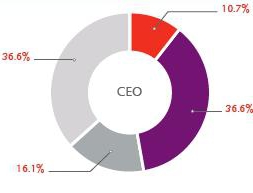

Executive Compensation Mix

Our emphasis on variable, performance-based pay is reflected in the following chart, which illustrates the 2015 total target direct compensation mix for our Chief Executive Officer and our other named executive officers (“NEOs”).

| 2015 Total Target Direct Compensation | ||||||||

|  | |||||||

Base salary Base salary |  | Time-vested, equity |  | Performance-based |  | Performance-based |

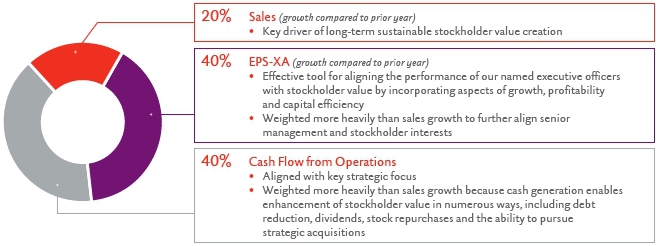

2015 Performance Criteria

The Compensation Committee chose to use sales growth, earnings per share growth excluding actions (“EPS-XA”), and cash flow from operations as performance criteria for our named executive officers’ 2015 performance-based pay opportunities, as follows:

| HANESBRANDS INC. | | | 5 |

| Proxy Summary |

2015 Executive Compensation

Summary of Compensation

The following table sets forth a summary of compensation earned by or paid to our named executive officers for our 2015, 2014 and 2013 fiscal years.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total Compensation ($) |

| Richard A. Noll Chairman and Chief Executive Officer | 2015 | $1,200,000 | $ — | $8,200,017 | $2,160,000 | $ — | $383,640 | $11,943,657 |

| 2014 | 1,200,000 | — | 6,200,072 | 3,268,800 | 110,415 | 337,221 | 11,116,508 | |

| 2013 | 1,100,000 | — | 5,500,000 | 4,738,500 | — | 334,797 | 11,673,297 | |

| Gerald W. Evans, Jr. Chief Operating Officer | 2015 | 750,000 | — | 2,450,002 | 900,000 | 8,612 | 190,895 | 4,299,509 |

| 2014 | 750,000 | — | 2,099,936 | 1,362,000 | 279,792 | 174,600 | 4,666,328 | |

| 2013 | 735,417 | — | 2,229,919 | 1,799,607 | — | 176,227 | 4,941,170 | |

| Richard D. Moss Chief Financial Officer | 2015 | 575,000 | — | 1,450,008 | 690,000 | — | 157,830 | 2,872,838 |

| 2014 | 575,000 | — | 1,250,098 | 1,044,200 | — | 142,003 | 3,011,300 | |

| 2013 | 575,000 | — | 1,150,050 | 1,412,775 | — | 127,782 | 3,265,607 | |

| Joia M. Johnson Chief Legal Officer, General Counsel and Corporate Secretary | 2015 | 515,000 | — | 960,007 | 525,300 | — | 120,248 | 2,120,556 |

| 2014 | 515,000 | — | 1,155,074 | 794,954 | — | 108,339 | 2,573,367 | |

| 2013 | 435,000 | — | 875,050 | 1,068,795 | — | 105,072 | 2,483,917 | |

| W. Howard Upchurch Group President, Innerwear Americas | 2015 | 525,000 | — | 924,972 | 535,500 | — | 111,184 | 2,096,656 |

| 2014 | 515,000 | — | 925,024 | 794,954 | 75,299 | 94,204 | 2,404,481 |

>> Please see page 43 for further explanation and detail

| 6 | | |

| Table of Contents |

| HANESBRANDS INC. | | | 7 |

|

Notice of the 2016 Annual Meeting of Stockholders

WHEN: | |||

WHERE: | |||

PURPOSE: | |||

| 1. | to elect ten directors to serve on the Hanesbrands Board of Directors until Hanesbrands’ next annual meeting of stockholders and until their successors are duly elected and qualify; | ||

| 2. | to vote on a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our 2016 fiscal year; | ||

| 3. | to vote on a proposal to approve, on an advisory basis, executive compensation as disclosed in the proxy statement for our 2016 Annual Meeting, and | ||

| 4. | to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | ||

RECORD DATE: | |||

The Board of Directors is not aware of any matter that will be presented at the Annual Meeting that is not described above. If any other matter is properly presented at the Annual Meeting, the persons named as proxies on the proxy card will, in the absence of stockholder instructions to the contrary, vote the shares for which such persons have voting authority in accordance with their discretion on any such matter. | |||

By Order of the Board of Directors  JOIA M. JOHNSON | |||

March 14, 2016 | |||

HOW TO VOTE:

Whether or not you plan to attend the meeting, we urge you to authorize a proxy to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you requested and received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided.

| BY TELEPHONE | |

| BY INTERNET | |

| BY MAIL |

ATTENDING THE MEETING

An admission ticket (or other proof of stock ownership) and some form of government-issued photo identification (such as a valid driver’s license or passport) will be required for admission to the Annual Meeting. Only stockholders who owned shares of Hanesbrands common stock as of the close of business on February 16, 2016 will be entitled to attend the Annual Meeting.

Important Notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on April 25, 2016.

The Annual Report and Proxy Statement are available at www.proxyvote.com.

The Notice of Internet Availability of Proxy Materials, or this Notice of the 2016 Annual Meeting of Stockholders, this Proxy Statement and our 2015 annual report on Form 10-K are first being mailed to stockholders on or about March 14, 2016.

| 8 | | |

| Our Board of Directors unanimously recommends a voteFOR election of these ten nominees. | ||

| HANESBRANDS INC. | | | 9 |

| Corporate Governance at Hanesbrands |

Director Nominee Skills and Qualifications

| 10 | | |

| Corporate Governance at Hanesbrands |

Nominees for Election as Directors for a One-Year Term Expiring in 2017

| Bobby J. Griffin |

| Former President, International Operations of Ryder System, Inc. Age:67 Director Since:2006 Committee Membership:Audit Other Current Directorships: ●United Rentals, Inc. ●WESCO International, Inc. Former Directorships Within the Past Five Years: ●Horizon Lines, Inc. |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions with a large organization and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | |

| International Business Experience | Served in senior leadership positions with a company engaged in international business | |

| Practical Expertise | Gained substantial experience in mergers and acquisitions, procurement and distribution, strategic planning, and transportation and security through service in senior leadership positions with a large international company | |

| Corporate Governance Experience | Gained experience in corporate governance through service as a director of other public companies |

| James C. Johnson |

| Former General Counsel of Loop Capital Markets LLC Age:63 Director Since:2006 Committee Membership:Compensation, Governance and Nominating (Chair) Other Current Directorships: ●Ameren Corporation ●Energizer Holdings, Inc. ●Edgewell Personal Care Company |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions in a large organization and has experience with corporate management issues; reporting to the General Counsel, had responsibility for the staff and legal affairs for Boeing Commercial Airplanes, a business with annual revenue in excess of $20 billion | |

| Practical Expertise | Served as Vice President, Corporate Secretary and Assistant General Counsel of The Boeing Company, where he gained practical expertise in the area of corporate governance and significant business and financial issues | |

| Corporate Governance Experience | Gained substantial experience in the oversight and administration of governance policies and programs through service as a director of other public companies, as well as through his position as Corporate Secretary of The Boeing Company |

| HANESBRANDS INC. | | | 11 |

| Corporate Governance at Hanesbrands |

| Jessica T. Mathews |

| Distinguished Fellow, Carnegie Endowment for International Peace Age:69 Director Since:2006 Committee Membership:Audit Other Current Directorships: ●SomaLogic, Inc. |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements; also serves on the Finance Committee at Harvard University overseeing a $35 billion endowment and $4.5 billion budget | |

| Practical Expertise | Serves in a policy-making role that is relevant to Hanesbrands’ international activities; also has practical expertise in the areas of environmental policy, labor and human rights advocacy and non-governmental organization relationships | |

| Corporate Governance Experience | Gained experience in corporate governance through service as a director of a privately held protein biomarker discovery and clinical diagnostics company |

| Franck J. Moison |

| Chief Operating Officer of Emerging Markets & Business Development for the Colgate-Palmolive Company Age:62 Director Since:2015 Committee Membership:Audit Former Directorships Within the Past Five Years: ●H.J. Heinz Company |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | |

| International Business Experience | Served in senior leadership positions with companies engaged in international business | |

| Industry Experience | Served in senior leadership positions with companies in the consumer products industry | |

| Corporate Governance Experience | Gained experience in corporate governance through service as a director of another public company |

| 12 | | |

| Corporate Governance at Hanesbrands |

| Robert F. Moran |

| Former Chief Executive Officer and Chairman of the Board of PetSmart, Inc. Age:65 Director Since:2013 Committee Membership:Audit (Chair) Other Current Directorships: ●GNC Holdings, Inc. Former Directorships Within the Past Five Years: ●PetSmart, Inc. ●Collective Brands, Inc. |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | |

| Chief Executive Officer Experience | Has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company | |

| Chief Financial Officer Experience | Possesses financial acumen and an understanding of financial matters and the preparation and analysis of financial statements | |

| International Business Experience | Served in senior leadership positions with companies engaged in international business | |

| Industry Experience | Served in senior leadership positions with companies in the consumer products industry | |

| Corporate Governance Experience | Gained experience in corporate governance through service as a director of other public companies |

| Ronald L. Nelson |

| Executive Chairman of Avis Budget Group, Inc. Age:63 Director Since:2008 Committee Membership:Compensation, Governance and Nominating Lead Director Other Current Directorships: ●Avis Budget Group, Inc. ●Convergys Corporation |

Specific Experience and Qualifications:

| Corporate Management Experience and Financial Literacy | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | |

| Chief Executive Officer Experience | Has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company | |

| Chief Financial Officer Experience | Possesses financial acumen and an understanding of financial matters and the preparation and analysis of financial statements | |

| International Business Experience | Served in senior leadership positions with companies engaged in international business | |

| Industry Experience | Served in senior leadership positions with companies in the consumer products industry | |

| Corporate Governance Experience | Gained experience in corporate governance through service as a director of other public companies |

| HANESBRANDS INC. | | | 13 |

| Corporate Governance at Hanesbrands |

| Richard A. Noll | |||||

| Chief Executive Officer and Chairman of the Board of Directors of Hanesbrands Inc. Age:58 Director Since:2005 Committee Membership:None Other Current Directorships: ●The Fresh Market, Inc. | ||||

Richard A. Noll has served as Chairman of the Board of Directors since January 2009 and as our Chief Executive Officer since April 2006. Previously in his career, Mr. Noll led the turnarounds of several Sara Lee Corporation bakery and apparel businesses, consulted for Strategic Planning Associates, and began his career as a systems programmer. Mr. Noll is also a member of the Business Roundtable. | |||||

Specific Experience and Qualifications: | |||||

Corporate | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | ||||

Chief Executive | Has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company | ||||

International | Served in senior leadership positions with companies engaged in international business | ||||

Industry | Served in senior leadership positions with companies in the consumer products industry | ||||

Extensive | Has extensive knowledge of Hanesbrands’ business and the apparel industry | ||||

Corporate | Gained experience in corporate governance through service as a director of another public company | ||||

| Andrew J. Schindler | |||||

| Former Executive Chairman, Reynolds Other Current Directorships: ●Krispy Kreme Doughnuts, Inc. ●ConAgra Foods, Inc. | ||||

From 1974 to 2004, Mr. Schindler served in various management positions with R.J. Reynolds Tobacco Holdings, Inc., a holding company whose operating subsidiaries included R. J. Reynolds Tobacco Company, the second largest cigarette manufacturer in the United States, including as Chairman and Chief Executive Officer from 1999 to 2004. He served as Chairman of Reynolds American Inc., a company formed in 2004 by the merger of R.J. Reynolds Tobacco Holdings, Inc. and the U.S. operations of British American Tobacco PLC, from 2004 to 2005. | |||||

Specific Experience and Qualifications: | |||||

Corporate | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | ||||

Chief Executive | Has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company | ||||

Industry | Served in senior leadership positions with companies in the consumer products industry | ||||

Corporate Governance | Gained experience in corporate governance through service as a director of other public companies | ||||

| | |||||

| 14 | | |

| Corporate Governance at Hanesbrands |

| David V. Singer | |||||

| Former Chief Executive Officer of | ||||

From 2010 to 2013, Mr. Singer served as Chief Executive Officer of Snyder’s-Lance, Inc., a manufacturer and marketer of snack foods throughout the United States and internationally. He also served as the President and Chief Executive Officer of Lance, Inc. from 2005 until its merger with Snyder’s of Hanover, Inc. in 2010. From 1987 to 2005, Mr. Singer served as Chief Financial Officer of Coca-Cola Bottling Co. Consolidated, a beverage manufacturer and distributor. Prior to 1987, Mr. Singer was Vice President of Mellon Bank, N.A. | |||||

Specific Experience and Qualifications: | |||||

Corporate | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | ||||

Chief Executive | Has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company | ||||

Chief Financial | Possesses financial acumen and an understanding of financial matters and the preparation and analysis of financial statements | ||||

International | Served in senior leadership positions with companies engaged in international business | ||||

Industry | Served in senior leadership positions with companies in the consumer products industry | ||||

Corporate | Gained experience in corporate governance through service as a director of other public companies | ||||

| Ann E. Ziegler | |||||

| Senior Vice President and Chief Financial Officer of CDW Corporation Age:57 Director Since:2008 Committee Membership:Compensation, Governance and Nominating Other Current Directorships: ●Groupon, Inc. Former Directorships Within the Past Five Years: ●Kemper Corporation (formerly known as Unitrin, Inc.) | ||||

Ms. Ziegler has served as Senior Vice President and Chief Financial Officer and a member of the executive committee of CDW Corporation, a leading provider of technology solutions for business, government, healthcare and education, since 2008. From 2005 until 2008, Ms. Ziegler served as Senior Vice President, Administration and Chief Financial Officer of Sara Lee Food and Beverage. From 2003 until 2005, she served as Chief Financial Officer of Sara Lee Bakery Group. From 2000 until 2003, she served as Senior Vice President, Corporate Development of Sara Lee. | |||||

Specific Experience and Qualifications: | |||||

Corporate | Served in senior leadership positions with large organizations and has experience with corporate management issues, including preparing or overseeing the preparation of financial statements | ||||

Chief Financial | Possesses financial acumen and an understanding of financial matters and the preparation and analysis of financial statements | ||||

Industry | Served in senior leadership positions with companies in the consumer products industry | ||||

Corporate | Gained experience in corporate governance through service as a director of other public companies | ||||

| | |||||

| HANESBRANDS INC. | | | 15 |

| Corporate Governance at Hanesbrands |

Process for Nominating Potential Director Candidates

The Governance and Nominating Committee is responsible for screening potential director candidates and recommending qualified candidates to the full Board of Directors for nomination. The Governance and Nominating Committee will consider director candidates proposed by the Chief Executive Officer, by any director or by any stockholder. From time to time, the Governance and Nominating Committee also retains search firms to assist it in identifying and evaluating director nominees. In evaluating potential director candidates, the Governance and Nominating Committee seeks to present candidates to the Board of Directors who have distinguished records of leadership and success in their arena of activity and who will make substantial contributions to the Board of Directors. The Governance and Nominating Committee considers the qualifications listed in our Corporate Governance Guidelines, which include:

| ● | personal and professional ethics and integrity; |

| ● | diversity among the existing Board members, including racial and ethnic background and gender; |

| ● | specific business experience and competence, including whether the candidate has experience in, and possesses an understanding of, business issues applicable to the success of a large publicly-traded company and whether the candidate has served in policy-making roles in business, government, education or other areas that are relevant to our global activities; |

| ● | financial acumen, including whether the candidate, through education or experience, has an understanding of financial matters and the preparation and analysis of financial statements; |

| ● | the ability to represent our stockholders as a whole; |

| ● | professional and personal accomplishments, including involvement in civic and charitable activities; |

| ● | experience with enterprise level risk management; |

| ● | educational background; and |

| ● | whether the candidate has expressed a willingness to devote sufficient time to carrying out his or her duties and responsibilities effectively and is committed to service on the Board of Directors. |

Although we do not have a standalone policy regarding diversity in the nomination process, as noted above, diversity is one of the criteria that our Corporate Governance Guidelines require that our Governance and Nominating Committee consider in identifying and evaluating director nominees. In applying this criteria, the Governance and Nominating Committee and the Board consider diversity to also include differences of viewpoint, professional experience, education, skill and other individual qualities and attributes that contribute to an active, effective Board. The Governance and Nominating Committee evaluates the effectiveness of its activities under this policy through its annual review of Board composition, which considers whether the current composition of the Board adequately reflects the balance of qualifications discussed above, including diversity, prior to recommending nominees for election. In this regard, the Board believes that its efforts have been effective based on the current composition of the Board.

Our Corporate Governance Guidelines provide that no director may stand for re-election to the Board of Directors after he or she has reached the age of 72. However, our Governance and Nominating Committee has the authority to extend the retirement age of an individual director for up to two periods of one year each.

Any recommendation submitted by a stockholder to the Governance and Nominating Committee should include information relating to each of the qualifications outlined above concerning the potential candidate along with the other information required by our bylaws for stockholder nominations. The Governance and Nominating Committee applies the same standards in evaluating candidates submitted by stockholders as it does in evaluating candidates submitted by other sources. Suggestions regarding potential director candidates, together with the required information described above, should be submitted in writing to Hanesbrands Inc., 1000 East Hanes Mill Road, Winston-Salem, North Carolina 27105, Attention: Corporate Secretary. Stockholders who want to directly nominate a director for consideration at next year’s Annual Meeting should refer to the procedures described under “Stockholder Proposals and Director Nominations for Next Annual Meeting” on page 59.

Director Independence

In order to assist our Board of Directors in making the independence determinations required by New York Stock Exchange (“NYSE”) listing standards, the Board of Directors has adopted categorical standards of independence. These standards, which are contained in our Corporate Governance Guidelines, are available on our corporate website,www.Hanes.com/investors (in the “Investors” section). Ten of the eleven current members of our Board of Directors, Mr. Griffin, Mr. Johnson, Ms. Mathews, Mr. Moison, Mr. Moran,

| 16 | | |

| Corporate Governance at Hanesbrands |

Mr. Mulcahy, Mr. Nelson, Mr. Schindler, Mr. Singer and Ms. Ziegler, are independent under NYSE listing standards and under our Corporate Governance Guidelines. In determining director independence, the Board of Directors did not discuss, and was not aware of, any related person transactions, relationships or arrangements that existed with respect to any of these directors.

Our Audit Committee’s charter requires that all of the members of the Audit Committee be independent under NYSE listing standards and the rules of the Securities Exchange Commission (“SEC”). The Board has determined that each of the members of our Audit Committee is an independent director under NYSE listing standards and meets the standards of independence applicable to audit committee members under applicable SEC rules.

Our Compensation Committee’s charter requires that all of the members of the Compensation Committee be independent under NYSE listing standards, including the enhanced independence requirements applicable to Compensation Committee members, “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and the regulations thereunder. The Board has determined that each of the members of our Compensation Committee is an independent director under NYSE listing standards, a non-employee director within the meaning of Rule 16b-3 under the Exchange Act and an outside director within the meaning of Section 162(m) of the Internal Revenue Code.

Our Governance and Nominating Committee’s charter requires that all of the members of the Governance and Nominating Committee be independent under NYSE listing standards. The Board has determined that each of the members of our Governance and Nominating Committee is an independent director under NYSE listing standards.

The Board’s Role and Responsibilities

Overview

The Board of Directors is elected by our stockholders to oversee their interests in the long-term health and the overall success of the Company’s business. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with our stockholders. The Board oversees the business of the Company, as conducted by the members of Hanesbrands’ senior management. In carrying out its responsibilities, the Board reviews and assesses Hanesbrands’ long-term strategy and its strategic, competitive and financial performance.

In 2015, our Board of Directors met five times and also held regularly scheduled executive sessions without management, presided over by our Lead Director. In addition, during 2015 our Audit Committee met five times, our Compensation Committee met fourtimes and our Governance and Nominating Committee met six times. Directors are expected to make every effort to attend the Annual Meeting, all Board meetings and the meetings of the Committees on which they serve. All of our directors at the time of our 2015 Annual Meeting of Stockholders attended that Annual Meeting. In 2015, each director also attended over 75% of the meetings of the Board and the Committees of which he or she was a member.

Risk Oversight | ||||||

The Board as a whole is ultimately responsible for the oversight of our risk management function. The Board uses its committees to assist in its risk oversight function as follows: | ||||||

The Board has delegated primary responsibility for the oversight of Hanesbrands’ risk management function to the Audit Committee. | ||||||

The Audit Committee discusses policies with respect to risk assessment and risk management, including significant financial risk exposures and the steps our management has taken to monitor, control and report such exposures. Management of Hanesbrands undertakes, and the Audit Committee reviews and discusses, an annual assessment of Hanesbrands’ risks on an enterprise-wide basis. | The Compensation Committeeis responsible for the oversight of risk associated with our compensation practices and policies. | The Governance and Nominating Committee is responsible for the oversight of Board processes and corporate governance related risks. | ||||

Our Board of Directors maintains overall responsibility for oversight regarding the work of its various committees by receiving regular reports from the committee Chairs of the work performed by their respective committees. In addition, discussions with the Board about the Company’s strategic plan, consolidated business results, capital structure, acquisition-related activities and other business include consideration of the risks associated with the particular item under consideration. | ||||||

| HANESBRANDS INC. | | | 17 |

| Corporate Governance at Hanesbrands |

Talent Management and Succession Planning

On an annual basis, our Board plans for succession to the position of Chief Executive Officer, as well as to certain other senior management positions. To assist the Board, our Chief Executive Officer annually provides the Board with an assessment of executives holding those senior management positions and of their potential to succeed him. Our Chief Executive Officer also provides the Board with an assessment of persons considered potential successors to those senior managers. The Board considers that information and their own impressions of senior management performance in planning for succession in key positions.

Communicating with our Board of Directors

Any stockholders or interested parties who wish to communicate directly with our Board, with our non-management directors as a group or with our Lead Director, may do so by writing to Hanesbrands Inc., 1000 East Hanes Mill Road, Winston-Salem, North Carolina 27105, Attention: Corporate Secretary. Stockholders and other interested parties also may communicate with members of the Board by sending an e-mail to our Corporate Secretary at corporate.secretary@hanes.com. To ensure proper handling, any mailing envelope or e-mail containing the communication intended for the Board must contain a clear notation indicating that the communication is a “Stockholder/Board Communication” or an “Interested Party/Board Communication.”

The Governance and Nominating Committee has approved a process for handling letters received by the Company and addressed to the Board, the Lead Director or to independent members of the Board. Under that process, our Corporate Secretary reviews all such correspondence and regularly forwards to the Board copies of all correspondence that, in her opinion, deals with the functions of the Board or its Committees or that she otherwise determines requires their attention. Advertisements, solicitations for business, requests for employment, requests for contributions, matters that may be better addressed by management or other inappropriate material will not be forwarded to our directors.

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Governance and Nominating Committee will from time to time consider whether the positions of Chairman of the Board and Chief Executive Officer should be held by the same person or by different persons. In accordance with these provisions, during 2008, the Board, upon recommendation of the Governance and Nominating Committee, determined that Mr. Noll, our Chief Executive Officer, should also serve as Chairman of the Board, effective January 1, 2009. In connection with that decision, the Board created the position of Lead Director, also effective January 1, 2009. Mr. Nelson has served as our Lead Director since January 28, 2015.

We believe that Mr. Noll’s service as both Chairman of the Board and Chief Executive Officer puts him in the best position to execute our business strategy and business plans to maximize stockholder value. Because Mr. Noll has primary management responsibility with respect to the day-to-day business operations of the Company, he is best able to ensure that regular meetings of the Board are focused on the most important issues facing us at any given time. These issues can be very diverse, relating to, for example, our global supply chain, broad range of brands or multiple distribution channels. Our Board leadership structure also demonstrates to all of our stakeholders (stockholders, employees, communities and customers around the world) that we are under strong leadership, with Mr. Noll setting the tone and having primary responsibility for managing our worldwide operations. The manner in which the Board oversees risk management is not a factor in the Board’s choice of leadership structure.

The Lead Director and other independent directors actively oversee Mr. Noll’s management of our operations and execution of strategies set by the Board. They also take an active role in overseeing Hanesbrands’ management and key issues related to strategy, risk, integrity, compensation and governance. For example, only independent directors serve on the Audit Committee, Compensation Committee and Governance and Nominating Committee. Non-management and independent directors regularly hold executive sessions outside the presence of our Chief Executive Officer and other Hanesbrands employees. Finally, as detailed in the following summary, the Lead Director has many important duties and responsibilities that enhance the independent oversight of management.

| 18 | | |

| Corporate Governance at Hanesbrands |

| ● | presiding at all meetings of the Board of Directors in the absence of, or upon the request of, the Chairman of the Board; |

| ● | advising the Chairman of the Board and/or the Corporate Secretary regarding the agendas for meetings of the Board of Directors; |

| ● | calling meetings of the non-management and/or independent directors, with appropriate notice; |

| ● | advising the Governance and Nominating Committee and the Chairman of the Board on the membership of the various Board committees and the selection of committee chairs; |

| ● | advising the Chairman of the Board on the retention of advisors and consultants who report directly to the Board of Directors; |

| ● | advising the Chairman of the Board and Chief Executive Officer, as appropriate, on issues discussed at executive sessions of non-management and/or independent directors; |

| ● | with the Chairman of the Compensation Committee, reviewing with the Chief Executive Officer the non-management directors’ annual evaluation of his performance; |

| ● | serving as principal liaison between the non-management and/or independent directors, as a group, and the Chairman of the Board, as necessary; |

| ● | serving as principal liaison between the Board of Directors and Hanesbrands’ stockholders, as appropriate, after consultation with the Chief Executive Officer; and |

| ● | selecting an interim lead independent director to preside over meetings at which he cannot be present. |

We believe our Board’s current leadership structure is best suited to the needs of the Company at this time.

Board and Committee Evaluation Process

The Board has established a robust self-evaluation process for the Board and its committees. Our Corporate Governance Guidelines require the Board to annually evaluate its own performance. In addition, the charters of each of the Audit Committee, Compensation Committee and Governance and Nominating Committee requires the committee to conduct an annual performance evaluation. The Governance and Nominating Committee oversees the annual self-assessment process on behalf of the Board and the implementation of the annual self-assessments by the committees.

Each year, all Board members and all members of the Audit, Compensation and Governance and Nominating Committees complete a detailed confidential questionnaire. The questionnaire provides for quantitative ratings in key areas and also seeks comments from the directors. The Chair of the Governance and Nominating Committee reviews the responses with the chairs of the Audit and Compensation Committees. The Chair of the Governance and Nominating Committee also discusses the Board self-evaluation with the full Board. Matters requiring follow-up are addressed by the Chair of the Governance and Nominating Committee or the chairs of the Audit or Compensation Committee, as appropriate.

Committees of the Board of Directors

Our Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Governance and Nominating Committee. The following is a list of current committee memberships, which is accompanied by a description of each committee. The directors who are nominated for election as directors at the Annual Meeting will, if re-elected, retain the committee memberships described in the following list immediately following the Annual Meeting, and the chairs of the committees will also remain the same.

| Committee Membership | |||||

| Audit Committee | Compensation Committee | Governance and Nominating Committee | |||

| Bobby J. Griffin | James C. Johnson | James C. Johnson * | |||

| Jessica T. Mathews | J. Patrick Mulcahy | J. Patrick Mulcahy | |||

| Franck J. Moison | Ronald L. Nelson | Ronald L. Nelson | |||

| Robert F. Moran * | Andrew J. Schindler * | Andrew J. Schindler | |||

| David V. Singer | Ann E. Ziegler | Ann E. Ziegler | |||

| * | Chair of the committee |

| HANESBRANDS INC. | | | 19 |

| Corporate Governance at Hanesbrands |

| AUDIT COMMITTEE | ||||

| Members: | Mr. Moran, Chair Mr. Griffin Ms. Mathews Mr. Moison Mr. Singer | The Audit Committee is responsible for assisting the Board of Directors in fulfilling its oversight of: ●the integrity of our financial statements, financial reporting process and systems of internal accounting and financial controls; ●our compliance with legal and regulatory requirements; ●the independent auditors’ qualifications and independence; and ●the performance of our internal audit function and independent auditor. The Audit Committee is also responsible for discussing policies with respect to risk assessment and risk management, including significant financial risk exposures and the steps our management has taken to monitor, control and report such exposures. | ||

Under SEC rules and the Audit Committee’s charter, the Audit Committee must prepare a report that is to be included in our proxy statement relating to the annual meeting of stockholders or annual report on Form 10-K. This report is provided under “Audit Committee Report” on page 25. In addition, the Audit Committee must review and discuss our annual audited financial statements and quarterly financial statements with management and the independent auditor and recommend, based on its review, that the Board of Directors include the annual financial statements in our annual report on Form 10-K.

| COMPENSATION COMMITTEE | ||||

| Members: | Mr. Schindler, Chair Mr. Johnson Mr. Mulcahy Mr. Nelson Ms. Ziegler | The Compensation Committee is responsible for assisting the Board of Directors in discharging its responsibilities relating to the compensation of our executive officers and the Chief Executive Officer performance evaluation process and for preparing a report on executive compensation that is to be included in our proxy statement relating to our annual meeting of stockholders. This report is provided under “Compensation Committee Report” on page 31. The Compensation Committee is also responsible for: ●reviewing and approving the total compensation philosophy covering our executive officers and other key executives and periodically reviewing an analysis of the competitiveness of our total compensation practices in relation to those of our peer group; ●with respect to our executive officers other than Mr. Noll, reviewing and approving the base salaries, salary ranges and the salary increase program pursuant to our executive salary administration program, the applicable standards of performance to be used in incentive compensation plans and the grant of equity incentives; ●recommending changes in non-employee director compensation to the Board of Directors; ●reviewing proposed stock incentive plans, other long-term incentive plans, stock purchase plans and other similar plans, and all proposed changes to such plans; ●reviewing the results of any stockholder advisory votes regarding our executive compensation and recommending to the Board how to respond to such votes; and ●recommending to the Board whether to have an annual, biannual or triennial advisory stockholder vote regarding executive compensation. The Chief Executive Officer’s compensation is approved by the independent members of the Board of Directors, upon the Compensation Committee’s recommendation. | ||

| 20 | | |

| Corporate Governance at Hanesbrands |

Compensation Committee Interlocks and Insider Participation.All members of the Compensation Committee during our 2015 fiscal year were independent directors, and no member was an employee or former employee of Hanesbrands. During our 2015 fiscal year, no member of the Compensation Committee had a relationship that must be described under SEC rules relating to disclosure of related party transactions and no interlocking relationship existed between our Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

| GOVERNANCE AND NOMINATING COMMITTEE | ||||

| Members: | Mr. Johnson, Chair Mr. Mulcahy Mr. Nelson Mr. Schindler Ms. Ziegler | The Governance and Nominating Committee is responsible for: ●identifying individuals qualified to serve on the Board of Directors, consistent with criteria approved by the Board of Directors; ●recommending that the Board of Directors select a slate of director nominees for election by our stockholders at our annual meeting of stockholders, in accordance with our charter and bylaws and with Maryland law; ●recommending candidates to the Board of Directors to fill vacancies on the Board or on any committee of the Board in accordance with our charter and bylaws and with Maryland law; ●evaluating and recommending to the Board of Directors a set of corporate governance policies and guidelines to be applicable to the Company; ●re-evaluating periodically such policies and guidelines for the purpose of suggesting amendments to them as appropriate; and ●overseeing annual Board and committee self-evaluations in accordance with NYSE listing standards. | ||

Annual Compensation

We compensated each non-employee director for service on our Board of Directors during 2015 as follows:

| ● | an annual cash retainer of $90,000, paid in quarterly installments; |

| ● | an additional annual cash retainer of $20,000 for the chair of the Audit Committee (Mr. Moran), $20,000 for the chair of the Compensation Committee (Mr. Schindler) and $20,000 for the chair of the Governance and Nominating Committee (Mr. Johnson); |

| ● | an additional annual cash retainer of $5,000 for each member of the Audit Committee other than the chair (Mr. Griffin, Ms. Mathews, Mr. Moison and Mr. Singer); |

| ● | an additional annual cash retainer of $25,000 for the Lead Director (Mr. Nelson); |

| ● | an annual grant of restricted stock units with a grant date fair value of approximately $125,000 that vest on the one-year anniversary of the grant date and are payable upon vesting in shares of Hanesbrands common stock; and |

| ● | reimbursement of customary expenses for attending Board, committee and stockholder meetings. |

Directors who are also our employees (Mr. Noll) receive no additional compensation for serving as a director.

In December 2015, after reviewing information about the compensation paid to non-employee directors at our peer group companies (our peer group companies are discussed in “How the Compensation Committee uses Peer Groups” on page 33), the Compensation Committee recommended, and the Board of Directors approved, an increase in the annual cash retainer from $90,000 to $95,000 and an increase in the grant date fair value of the annual grant of restricted stock units from $125,000 to $130,000. No other changes were made to our non-employee director compensation for 2016. The annual grant of restricted stock units for 2016 was made on December 8, 2015 and is reflected in the non-employee directors’ compensation for 2015.

The following table summarizes the compensation paid to our non-employee directors during the fiscal year ended January 2, 2016.

| HANESBRANDS INC. | | | 21 |

| Corporate Governance at Hanesbrands |

Director Compensation — 2015

| Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) (3) (4) | All Other Compensation ($) | Total ($) | ||||

| Franck J. Moison (5) | $ 95,000 | $ 254,955 | — | $ 349,955 | ||||

| Ronald L. Nelson | 115,000 | 129,990 | — | 244,990 | ||||

| James C. Johnson | 110,000 | 129,990 | — | 239,990 | ||||

| Robert F. Moran | 110,000 | 129,990 | — | 239,990 | ||||

| Andrew J. Schindler | 110,000 | 129,990 | — | 239,990 | ||||

| Bobby J. Griffin | 95,000 | 129,990 | — | 224,990 | ||||

| Jessica T. Mathews | 95,000 | 129,990 | — | 224,990 | ||||

| David V. Singer | 95,000 | 129,990 | — | 224,990 | ||||

| J. Patrick Mulcahy | 90,000 | 129,990 | — | 219,990 | ||||

| Ann E. Ziegler | 90,000 | 129,990 | — | 219,990 |

| (1) | Amounts shown include deferrals to the Hanesbrands Inc. Non-Employee Director Deferred Compensation Plan, or the “Director Deferred Compensation Plan.” | |

| (2) | The dollar values shown reflect the aggregate grant date fair value of awards during 2015, computed in accordance with Topic 718 of the FASB Accounting Standards Codification. The assumptions we used in valuing these awards are described in Note 5, “Stock-Based Compensation,” to our consolidated financial statements included in our annual report on Form 10-K for the fiscal year ended January 2, 2016. | |

| (3) | Amounts shown represent the grant date fair value of the annual grant of restricted stock units which was made on December 8, 2015 to each non-employee director serving on that date in consideration of his or her service on the Board of Directors in 2016. Equity awards are approved as a dollar amount, which on the grant date is converted into a specific whole number of restricted stock units. These restricted stock units vest on the one-year anniversary of the grant date and are payable immediately upon vesting in shares of our common stock on a one-for-one basis. The number of restricted stock units held by each then-current non-employee director (other than Mr. Moison) as of January 2, 2016 was 4,200. Mr. Moison held 8,644 restricted stock units as of January 2, 2016. | |

| (4) | As of January 2, 2016, Ms. Ziegler held stock options to purchase 22,572 shares of common stock. No other non-employee director holds stock options. | |

| (5) | Mr. Moison was elected to the Board of Directors on January 19, 2015. Mr. Moison’s compensation for 2015 included a grant of 4,444 restricted stock units on February 9, 2015. This grant of restricted stock units was intended to serve as the annual grant of restricted stock units for 2015, which was made to our other non-employee directors on December 9, 2014 and included in such directors’ 2014 compensation. |

Director Deferred Compensation Plan

Under the Hanesbrands Inc. Non-Employee Director Deferred Compensation Plan (the “Director Deferred Compensation Plan”), a nonqualified, unfunded deferred compensation plan, our non-employee directors may defer receipt of all (but not less than all) of their cash retainers and/or awards of restricted stock units. At the election of the director, cash amounts deferred under the Director Deferred Compensation Plan will (i) earn a return equivalent to the return on an investment in an interest-bearing account earning interest based on the Federal Reserve’s published rate for five-year constant maturity Treasury notes at the beginning of the calendar year, which was 1.61% for 2015, or (ii) be deemed to be invested in a stock equivalent account (the “HBI Stock Fund”) and earn a return based on the total shareholder return of Hanesbrands’ stock. All awards of restricted stock units deferred under the Director Deferred Compensation Plan are deemed to be invested in the HBI Stock Fund. None of the investment options available in the Director Deferred Compensation Plan provide for “above-market” or preferential earnings as defined in applicable SEC rules. The amount payable to a participant will be payable either on the distribution date elected by the participant or upon the occurrence of certain events as provided under the Director Deferred Compensation Plan. A participant may designate one or more beneficiaries to receive any portion of the obligations payable in the event of death; however, neither a participant nor his or her beneficiary may transfer any right or interest in the Director Deferred Compensation Plan.

Director Stock Ownership and Retention Guidelines

We believe that all of our directors should have a significant ownership position in Hanesbrands. To this end, our non-employee directors receive a substantial portion of their compensation in the form of restricted stock units. In addition, to promote equity ownership and further align the interests of these directors with our stockholders, we have adopted stock ownership and retention guidelines for our non-employee directors. A non-employee director may not dispose of any shares of our common stock until such director holds shares of common stock with a value equal to at least five times the current annual equity retainer, and may then only dispose of shares in excess of those with that value. In addition to vested shares directly held by a non-employee director, shares held for such director in the Director Deferred Compensation Plan (including hypothetical share equivalents held in that plan) will be

| 22 | | |

| Corporate Governance at Hanesbrands |

counted for purposes of determining whether the ownership requirements are met. All of our directors are in compliance with these stock ownership and retention guidelines.

Related Person Transactions

Our Board of Directors has adopted a written policy setting forth procedures to be followed in connection with the review, approval or ratification of “related person transactions.” For purposes of this policy, the phrase “related person transaction” refers to any financial transaction, arrangement or relationship in which Hanesbrands or any of its subsidiaries is a participant and in which any director, nominee for director or executive officer, or any of their immediate family members, has a direct or indirect material interest.

Each director, director nominee and executive officer must promptly notify our Chief Executive Officer and our Corporate Secretary in writing of any material interest that such person or an immediate family member of such person had, has or will have in a related person transaction. The Governance and Nominating Committee is responsible for the review and approval or ratification of all related person transactions involving a director, director nominee or executive officer. At the discretion of the Governance and Nominating Committee, the consideration of a related person transaction may be delegated to the full Board of Directors, another standing committee or to an ad hoc committee of the Board of Directors comprised of at least three members, none of whom has an interest in the transaction.

The Governance and Nominating Committee, or other governing body to which approval or ratification is delegated, may approve or ratify a transaction if it determines, in its business judgment, based on its review of the available information, that the transaction is fair and reasonable to us and consistent with our best interests. Factors to be taken into account in making a determination of fairness and reasonableness may include:

| ● | the business purpose of the transaction; |

| ● | whether the transaction is entered into on an arm’s-length basis on terms fair to us; and |

| ● | whether such a transaction would violate any provisions of our Global Code of Conduct. |

If the Governance and Nominating Committee decides not to approve or ratify a transaction, the transaction may be referred to legal counsel for review and consultation regarding possible further action, including, but not limited to, termination of the transaction on a prospective basis, rescission of such transaction or modification of the transaction in a manner that would permit it to be ratified and approved by the Governance and Nominating Committee.

During 2015, there were no related person transactions, or series of similar transactions, involving us and our directors or executive officers.

Code of Ethics

Our Global Code of Conduct, which serves as our code of ethics, applies to all directors and officers and other employees of the Company and its subsidiaries. Any waiver of applicable requirements in the Global Code of Conduct that is granted to any of our directors, to our principal executive officer, to any of our senior financial officers (including our principal financial officer, principal accounting officer or controller) or to any other person who is an executive officer of Hanesbrands requires the approval of the Audit Committee. Any such waiver of or amendment to the Global Code of Conduct will be disclosed on our corporate website,www.Hanes.com/investors (in the “Investors” section) or in a current report on Form 8-K.

Corporate Governance Documents

Copies of the written charters for the Audit Committee, Compensation Committee and Governance and Nominating Committee, as well as our Corporate Governance Guidelines, Global Code of Conduct and other corporate governance information are available on our corporate website,www.Hanes.com/investors (in the “Investors” section).

| HANESBRANDS INC. | | | 23 |

| |||||

| |||||

| Proposal 2 — | Ratification of Appointment of Independent Registered Public Accounting Firm | ||||

The Audit Committee is directly responsible for the appointment (subject to ratification by the Company’s stockholders), retention, compensation, evaluation, oversight and termination the Company’s independent auditor. The Audit Committee has appointed PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) as our independent registered public accounting firm for our 2016 fiscal year. While not required by law, the Board of Directors is asking our stockholders to ratify the selection of PricewaterhouseCoopers as a matter of good corporate practice.

If the appointment of PricewaterhouseCoopers as our independent registered public accounting firm for our 2016 fiscal year is not ratified by our stockholders, the adverse vote will be considered a direction to the Audit Committee to consider another independent registered public accounting firm for next year. However, because of the difficulty in making any substitution of our independent registered public accounting firm so long after the beginning of the current year, the appointment for our 2016 fiscal year will stand, unless the Audit Committee finds other good reason for making a change.

PricewaterhouseCoopers has served as the Company’s independent registered public accounting firm since July 1, 2006. In order to assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of our independent registered public accounting firm. In addition, in conjunction with the mandated rotation of PricewaterhouseCoopers’ lead engagement partner, the Audit Committee oversees and confirms the selection of PricewaterhouseCoopers’ new lead engagement partner. The members of the Audit Committee and the Board believe that the continued retention of PricewaterhouseCoopers as the Company’s independent registered public accounting firm is in the best interests of the Company and its stockholders.

Representatives of PricewaterhouseCoopers are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions. For additional information regarding our relationship with PricewaterhouseCoopers, please refer to “Relationship with Independent Registered Public Accounting Firm” on page 26.

| Our Board of Directors unanimously recommends a voteFOR ratification of the appointment of PricewaterhouseCoopers as our independent registered public accounting firm for our 2016 fiscal year. |

| 24 | | |

| Audit Information |

Audit Committee Report

Hanesbrands’ Audit Committee is composed solely of independent directors meeting the requirements of applicable SEC and NYSE rules. Each of the members of the Audit Committee is independent and financially literate as required under applicable SEC rules and NYSE listing standards. In addition, the Board of Directors has determined that Mr. Moran and Mr. Singer possessthe experience and qualifications required of an “audit committee financial expert” as defined by the rules of the SEC. No member of the Audit Committee serves on the audit committees of more than three public companies.

The key responsibilities of the Audit Committee are set forth in its charter, a copy of which is available on our corporate website,www.Hanes.com/investors (in the “Investors” section). The purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight of:

| ● | the integrity of the Company’s financial statements, financial reporting process and systems of internal accounting andfinancial controls; |

| ● | the Company’s compliance with legal and regulatory requirements; |

| ● | the independent auditor’s qualifications and independence; and |

| ● | the performance of the Company’s internal audit function and independent auditor. |

Management is primarily responsible for establishing and maintaining adequate internal financial controls, for preparing the financial statements and for the public reporting process. PricewaterhouseCoopers, the Audit Committee-appointed independent registered public accounting firm for the fiscal year ended January 2, 2016, is responsible for expressing an opinion on the conformity of Hanesbrands’ audited financial statements with accounting principles generally accepted in the United States of America. In addition, PricewaterhouseCoopers expresses its opinion on the effectiveness of Hanesbrands’ internal control over financial reporting.

In this context, the Audit Committee:

| ● | Reviewed and discussed with management and PricewaterhouseCoopers the audited financial statements for the fiscal yearended January 2, 2016 (the “2015 Financial Statements”) and audit of internal control over financial reporting; |

| ● | Discussed with PricewaterhouseCoopers the matters required to be discussed by the Statement of Auditing StandardsNo. 61 (Communication with Audit Committees), as amended by the AICPA professional standards, vol. 1 AU section 380,as adopted by the Public Company Oversight Board in Rule 3200T, which include, among other items, matters related to theconduct of the audit of the 2015 Financial Statements; and |

| ● | Received the written disclosures and the letter from PricewaterhouseCoopers required by applicable requirements of thePublic Company Accounting Oversight Board regarding their communications with the Audit Committee concerningindependence and discussed with PricewaterhouseCoopers their independence from Hanesbrands. |

Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the 2015 Financial Statements as audited by PricewaterhouseCoopers be included in Hanesbrands’ Annual Report on Form 10-K for the fiscal year ended January 2, 2016.

By the members of the

Audit Committee, consisting of:

| Robert F. Moran, Chair | Bobby J. Griffin | Jessica T. Mathews | Franck J. Moison | David V. Singer |

| HANESBRANDS INC. | | | 25 |

| Audit Information |

Relationship with Independent Registered Public Accounting Firm

The following table sets forth the fees billed to us by PricewaterhouseCoopers for services in the fiscal years ended January 2, 2016 and January 3, 2015:

| Fiscal Year Ended | Fiscal Year Ended | |||

| January 2, 2016 | January 3, 2015 | |||

| Audit fees | $ 4,709,940 | $ 4,446,570 | ||

| Audit-related fees | 93,900 | 7,800 | ||

| Tax fees | 447,555 | 467,900 | ||

| All other fees | 10,780 | 25,000 | ||

| Total fees | $ 5,262,175 | $ 4,947,270 |

In the above table, in accordance with applicable SEC rules, “Audit fees” include fees billed for professional services for the audit of our consolidated financial statements included in our annual report on Form 10-K and review of our financial statements included in our quarterly reports on Form 10-Q, fees billed for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements, fees related to services rendered in connection with securities offerings and fees for the audit of our internal control over financial reporting and consultations concerning financial accounting and reporting standards.

“Audit-related fees” are fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under the caption “Audit fees.” For the fiscal years ended January 2, 2016 and January 3, 2015, these fees primarily relate to attestation services rendered in connection with regulatory filings in certain foreign jurisdictions and various other services.

“Tax fees” for the fiscal years ended January 2, 2016 and January 3, 2015 include consultation, preparation and compliance services for domestic and certain foreign jurisdictions and consulting related to research and development credits.

“All other fees” for the fiscal years ended January 2, 2016 and January 3, 2015 include fees for a consulting project related to our environmental sustainability program.

Our Audit Committee pre-approves all services, including both audit and non-audit services, provided by our independent registered public accounting firm. For audit services (including statutory audit engagements as required under local country laws), the independent registered public accounting firm provides the Audit Committee with an engagement letter outlining the scope of the audit services proposed to be performed during the year. The independent registered public accounting firm also submits an audit services fee proposal, which is approved by the Audit Committee before the audit commences. The Audit Committee may delegate the authority to pre-approve audit and non-audit engagements and the related fees and terms with the independent auditors to one or more designated members of the Audit Committee, as long as any decision made pursuant to such delegation is presented to the Audit Committee at its next regularly scheduled meeting. All audit and permissible non-audit services provided by PricewaterhouseCoopers to Hanesbrands during the fiscal years ended January 2, 2016 and January 3, 2015 were pre-approved by the Audit Committee.

| 26 | | |

Compensation Discussion and Analysis

| |||||

| |||||

| Proposal 3 — | Advisory Vote to Approve Executive Compensation | ||||

Hanesbrands’ stockholders have the opportunity to cast a non-binding, advisory “say on pay” vote on our named executive officer compensation, as disclosed in this proxy statement. Based on the results of the stockholder advisory vote on the frequency of say on pay votes, which was held at the 2011 Annual Meeting of Stockholders, and based on the Board of Directors’ recommendation, Hanesbrands currently intends to hold such votes on an annual basis.

At our 2015 Annual Meeting of Stockholders, our stockholders overwhelmingly approved the compensation of Hanesbrands’ named executive officers. Our Board of Directors, and the Compensation Committee in particular, considered several factors in determining that the fundamental characteristics of Hanesbrands’ executive compensation program should continue this year, including the overwhelming support of our stockholders, the executive compensation programs of our peer group companies, our past operating performance and planned strategic initiatives.

We believe that our executive compensation philosophy, practices and policies have three essential characteristics. They are: | |

| ● | focused on aligning senior management and stockholder interests in a simple, quantifiable and unifying manner; |