[EXECUTION VERSION] FIRST AMENDMENT TO STOCK AND ASSET PURCHASE AGREEMENT This First Amendment to Stock and Asset Purchase Agreement (this “Amendment”) is entered into effective as of September 25, 2024 (the “Effective Date”), by and among Hanesbrands Inc., a Maryland corporation (“Seller”), ABG-Champion LLC (f/k/a ABG-Sparrow IPCo LLC), a Delaware limited liability company (“ABG Purchaser”), and other Persons who may become party to the Purchase Agreement (as defined below). Each of the parties named above may be referred to as a “Party” and collectively as the “Parties.” RECITALS A. The Parties entered into that certain Stock and Asset Purchase Agreement dated as of June 4, 2024 (as amended, restated or otherwise modified from time to time, the “Purchase Agreement”) by and among Seller, ABG Purchaser, the other Persons who may become party to the Purchase Agreement following June 4, 2024 by execution of a Joinder and, solely for purposes of Section 11.17 of the Purchase Agreement, Authentic Brands Group LLC, a Delaware limited liability company. Capitalized terms used but not otherwise defined herein shall have the meanings respectively ascribed to such terms in the Purchase Agreement. B. The Parties desire to amend the Purchase Agreement as set forth herein. C. Section 11.04 of the Purchase Agreement permits the amendment of the Purchase Agreement pursuant to a written agreement executed by each of ABG Purchaser and Seller. AGREEMENT NOW, THEREFORE, in consideration of the foregoing recitals, the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows: 1. Amendments to the Purchase Agreement. Effective as of the Effective Date, the Purchase Agreement is hereby amended as follows: 1.1. Section 1.02(a) to the Purchase Agreement shall be amended and restated in its entirety as follows: (a) The closing of the purchase and sale of the Purchased Assets and Acquired Shares other than the Deferred Business Purchased Assets (the “Initial Closing”) shall be held at the offices of Kirkland & Ellis LLP, 601 Lexington Avenue, New York, New York 10022, at 10:00 a.m., or remotely via the electronic exchange of documents and signatures, on the first Business Day immediately following the Seller Accounting Month End that immediately follows the date that all conditions set forth in Article VII are satisfied (or, to the extent permitted by applicable Law, waived) (other than those conditions that, by their terms or nature, are to be satisfied by delivery of documents or are otherwise to be satisfied by actions taken at the Initial Closing and that would be so satisfied, but subject to the satisfaction (or, to the extent permitted by applicable Law, written waiver) of such conditions at the Initial Closing), or at such other place, time and date as shall be mutually agreed in writing between ABG, Purchaser and Seller; provided that notwithstanding the foregoing, the Initial Closing shall not occur prior to August 30, Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2 EXHIBIT 2.2

2024 without the prior written consent of ABG Purchaser. The date on which the Initial Closing takes place is referred to in this Agreement as (the “Initial Closing Date”). For the avoidance of doubt, the “Measurement Time” shall be 12:01 a.m. on September 29, 2024. 1.2. Section 1.03 to the Purchase Agreement shall be amended and restated in its entirety as follows: SECTION 1.03 Estimated Statement. No later than five (5) Business Days prior to the anticipated Initial Closing Date, Seller shall deliver to ABG Purchaser a written statement setting forth its good faith estimate of each of the following, in each case, determined and calculated in accordance with the Accounting Principles and the applicable definitions set forth herein: (i) the aggregate amount of all Cash of each member of the Acquired Group to be transferred at the Initial Closing to the extent included in Purchased Assets, calculated as of the Measurement Time (but giving effect to any cash dividends and distributions following the Measurement Time and prior to the Initial Closing Date), (ii) Indebtedness of each member of the Acquired Group to be transferred at the Initial Closing or otherwise included in Assumed Liabilities to be transferred at the Initial Closing, calculated as of immediately prior to the Initial Closing, (iii) Working Capital of the Business to be transferred at the Initial Closing, calculated as of the Measurement Time and (iv) Unpaid Company Transaction Expenses of each member of the Acquired Group transferred at the Initial Closing, together with a calculation of the Closing Date Purchase Price based on such amounts, in each case, determined and calculated in accordance with the Accounting Principles and the applicable definitions set forth herein, together with reasonable supporting detail therefor (the “Estimated Statement”); provided, however, that with respect to the foregoing clauses (i)-(iv), such items shall be prepared separately for the Sports Apparel Business, on the one hand, and the remainder of the Business to be transferred at the Initial Closing, on the other hand. Following delivery of the Estimated Statement, Seller shall, upon the written request of ABG Purchaser, promptly make financial records of Seller and its Affiliates to the extent reasonably related to the preparation of, or otherwise reasonably related to, the Estimated Statement available to ABG Purchaser and its Representatives in connection therewith (subject to the execution of customary work access letters if required by applicable accountants). ABG Purchaser shall have the opportunity to comment on and request reasonable changes to the foregoing estimates and calculations set forth in the Estimated Statement, and Seller shall consider in good faith any comments made by ABG Purchaser with respect to the calculations set forth in the Estimated Statement and, to the extent Seller agrees to any such comments, incorporate the same into the Estimated Statement; provided that, for the avoidance of doubt, absent manifest error, Seller shall have no obligation to agree to or incorporate any such comments into the Estimated Statement and in no event shall any review, comment or request on or in respect of the Estimated Statement by Purchaser, or any dispute related thereto, prevent or delay the Initial Closing. 1.3. Section 1.04(a) to the Purchase Agreement shall be amended and restated in its entirety as follows: (a) As soon as reasonably practicable following the Initial Closing Date, and, in any event, no later than two hundred ten (210) days thereafter, ABG Purchaser shall prepare - 2 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

and deliver to Seller a statement (the “Statement”) setting forth, in each case, ABG Purchaser’s good faith calculation of (A) Cash of each member of the Acquired Group transferred at the Initial Closing to the extent included in Purchased Assets, calculated as of the Measurement Time (but giving effect to any cash dividends and distributions following the Measurement Time and prior to the Initial Closing Date), (B) Indebtedness of each member of the Acquired Groups transferred at the Initial Closing or otherwise included in Assumed Liabilities to be assumed at the Initial Closing as of immediately prior to the Initial Closing, (C) Working Capital of the Business to be transferred at the Initial Closing as of the Measurement Time and (D) Unpaid Company Transaction Expenses of each member of the Acquired Group that is transferring at the Initial Closing, together with a calculation of the Purchase Price based on such amounts and reasonable supporting detail, based on the books and records of the Business and determined and calculated in accordance with the Accounting Principles, the applicable definitions set forth herein and without taking into account (x) any changes in assets or liabilities as a result of purchase accounting adjustments or other changes arising from or resulting from the Transactions (other than the Pre-Closing Restructuring Transactions), (y) any actions taken at the express direction of a Purchaser before the Measurement Time outside of the ordinary course of business or (z) any change, circumstance, act, decision, fact or development occurring after the Initial Closing for purposes of establishing or altering a reserve or otherwise except in the ordinary course of business; provided, however, that with respect to the foregoing clauses (A)-(D), such items shall be prepared separately for the Sports Apparel Business, on the one hand, and the remainder of the Business to be transferred at the Initial Closing, on the other hand. Nothing in this Section 1.04 is intended to be used to adjust for errors or omissions that may be found with respect to the Financial Statements or any inconsistencies between the Accounting Principles, on the one hand, and GAAP, on the other hand. If ABG Purchaser fails to timely deliver or cause to be delivered a Statement in accordance with this Section 1.04(a), then the Estimated Statement shall be deemed to be the Statement and Seller may deliver a Notice of Disagreement with respect thereto in accordance with Section 1.04(b). 1.4. The following shall be added as Section 2.07(q): (q) As of the Initial Closing, there are no Contracts or other arrangements (including, for the avoidance of doubt, intercompany loans, license agreements, and management agreements) (i) between Seller or any of its Affiliates (other than any member of the Acquired Group), on the one hand, and any member of the Acquired Group, on the other hand and (ii) between any member of the Acquired Group, on the one hand, and any other member of the Acquired Group, on the other hand, in each case, other than External Intercompany Arrangements and the Internal Intercompany Arrangements. 1.5. Section 4.04 to the Purchase Agreement shall be amended and restated in its entirety as follows: Section 4.04 Intercompany Arrangements and Cash Repatriation. (a) Section 4.04(a) of the Disclosure Schedule sets forth a true and complete list of the parties to all Contracts and other arrangements (including, for the avoidance of doubt, intercompany loans, license agreements, and management agreements) - 3 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

(i) between Seller or any of its Affiliates (other than any member of the Acquired Group), on the one hand, and any member of the Acquired Group, on the other hand, that were entered into prior to the Applicable Closing (the “External Intercompany Arrangements”) and (ii) between any member of the Acquired Group, on the one hand, and any other member of the Acquired Group, on the other hand (the “Internal Intercompany Arrangements”), in each case that are outstanding as of the date hereof. (b) Seller and each of the Purchasers acknowledges and agrees that upon and effective as of the Initial Closing, all External Intercompany Arrangements shall be terminated in full, as further described in this Section 4.04. (c) On or prior to the Initial Closing, Seller shall cause the repayment, termination or other final resolution of all outstanding balances existing under the External Intercompany Arrangements and the Internal Intercompany Arrangements as of the Seller Accounting Month End for the period immediately prior to the period in which Initial Closing occurs (the “Initial Intercompany Settlements”) pursuant to a mutually agreed steps plan setting forth, among other things, the actions contemplated to consummate the Initial Intercompany Settlements (the “Intercompany Arrangements Steps Plan”). (d) On or prior to the Initial Closing, Seller shall cause the repayment, termination or other final resolution of all estimated outstanding balances existing under the External Intercompany Arrangements and the Internal Intercompany Arrangements as of the Initial Closing in accordance with a good faith estimate of such balances (and all such arrangements shall be reflected as having a $0 balance in the Estimated Statement). If, following the Initial Closing, it is determined that a net balance is owing under any External Intercompany Arrangement or any Internal Intercompany Arrangement, in each case, taking into account the payments described in the prior sentence, such balance shall remain outstanding until settled in full. Not later than ten (10) days after the Initial Closing, Seller shall provide ABG Purchaser such actual net balances existing under the External Intercompany Arrangements and the Internal Intercompany Arrangements as of the Measurement Time, and Seller and ABG Purchaser shall cause the settlement of such net balances promptly thereafter in accordance with the terms of the applicable External Intercompany Arrangements and (at the discretion of the ABG Purchaser) the Internal Intercompany Arrangements. Any amounts paid pursuant to the prior sentence with respect to an External Intercompany Arrangement (including interest that accrued thereon after the Applicable Closing) shall be reflected as a current asset or a current liability, as applicable, in the final determination of Working Capital pursuant to Section 1.04. (e) Seller shall reimburse the ABG Purchaser for all documented out-of-pocket expenses and any cash Taxes (in the case of repayment, termination or final resolution occurring after the determination of Final Purchase Price, solely to the extent that such Taxes were not taken into account as an increase to Restricted Cash, as finally determined) actually incurred by ABG Purchaser, any Purchaser Designee or its or their respective Affiliates (including the members of the - 4 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

Acquired Group) to the extent directly resulting from the repayment, termination or other final resolution of such Internal Intercompany Arrangements (as in effect as of the Initial Closing) to the extent (i) with respect to the Internal Intercompany Arrangements as set forth on Section 4.04(a) of the Disclosure Schedule, ABG Purchaser, such Purchaser Designee or such Affiliate elects to repay, terminate or otherwise finally resolve any such net balances in respect of the Internal Intercompany Arrangements prior to 90 days following the Initial Closing and (ii) with respect to any Internal Intercompany Arrangements not set forth on Section 4.04(a) of the Disclosure Schedule, ABG Purchaser, such Purchaser Designee or such Affiliate within a reasonable period of time following the identification of such arrangements, elects to repay, terminate or otherwise finally resolve any such net balances in respect of the Internal Intercompany Arrangements. The ABG Purchaser or such other Purchaser shall consult with Seller in good faith prior to repaying, terminating or other resolving any such Internal Intercompany Arrangement. (f) The resolution (including the payment of any post-closing interest) of any External Intercompany Arrangements or Internal Intercompany Arrangements pursuant to Section 4.04(d) or (e) shall not be taken into consideration in the determination of Cash (except as described in the proviso below), Minimum Cash Amounts or Maximum Cash Amounts; provided, that, without duplication of any amounts reimbursed by Seller pursuant to Section 4.04(e), such resolution shall be taken into account in determining the fees, costs and expenses (including Taxes) described in clause (d) of the definition of “Restricted Cash” as though such resolution occurred as of immediately prior of the Initial Closing. (g) If, as of the Initial Closing, either the Irish Company or Champion Deutschland GmbH holds cash that constitutes “Restricted Cash” pursuant to clause (a) of the definition thereof (such cash, the “Trapped Cash”), the ABG Purchaser shall use commercially reasonable efforts to cause the transfer of such Trapped Cash (through distributions and/or contributions, as applicable) to ABG-Champion AcquireCo S.r.l. (the “Italy Purchaser”) reasonably promptly following the Initial Closing and, in any event, prior to the date on which ABG Purchaser elects to transfer or sell the European Business to any operating partner of ABG Purchaser (the “Trapped Cash Transfers”). Promptly following the Trapped Cash Transfers, the Italy Purchaser shall transfer to HBI Holdings Switzerland GmbH, as additional consideration for the Italy Company, all Trapped Cash received by the Italy Purchaser pursuant to the prior sentence, less any documented and reasonable out-of-pocket fees, costs and expenses (including cash Taxes) incurred by the ABG Purchaser or the Italy Purchaser and its Affiliates (including the members of the Acquired Group) to the extent attributable to the Trapped Cash Transfers. The ABG Purchaser shall consult with the Seller in good faith prior to consummating the Trapped Cash Transfers. For the avoidance of doubt, the ABG Purchaser shall not be required to transfer any of the Trapped Cash to the extent that such transfer could jeopardize (or materially increase the costs incurred in connection with) the transfer of the Intellectual Property held by the Irish Company after the Initial Closing. - 5 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

(h) To the extent that the Italy Company or any of its Subsidiaries accrue any store receipts or credit card receivables prior to the Measurement Time that cause the amount of Cash held by Italy Company and its Subsidiaries to exceed the applicable Maximum Cash Amount (the amount of such excess, the “Excess Store and Credit Card Receivables”), such Excess Store and Credit Card Receivables will be treated as Cash for purposes of calculating the Purchase Price notwithstanding that Cash will exceed the applicable Maximum Cash Amount; provided, however, that, solely for the purposes of determining the Closing Date Purchase Price, such Excess Store and Credit Card Receivables shall be treated as Cash and subject to the applicable Maximum Cash Amount. 1.6. The below paragraph in Exhibit G (JOINDER TO STOCK AND ASSET PURCHASE AGREEMENT) shall be amended and restated in its entirety as follows: This Agreement shall be subject to the provisions set forth, mutatis mutandis, in Sections 11.01 (Assignment), 11.02 (No Third-Party Beneficiaries), 11.04 (Amendments; Waivers), 11.05 (Notices), and 11.08 (Counterparts) through 11.14 (Governing Law) of the Purchase Agreement. Notwithstanding the foregoing, the Joining Party (i) shall be deemed a party to the Purchase Agreement as a “Purchaser” thereunder for purposes of all covenants and other agreements thereunder only to the extent they are applicable to the Joining Party’s obligations as a Purchaser Designee of ABG Purchaser for the portion of the Business such Joining Party acquires and (ii) shall be entitled to enforce the terms of the Purchase Agreement only with respect to such portion of the Business that such Joining Party acquires, in each case as set forth on the Purchaser Designation Annex. 1.7. Section 4.12 to the Purchase Agreement shall be amended and restated in its entirety as follows: Intellectual Property Sale. Notwithstanding anything to the contrary in this Agreement, at the Initial Closing but immediately prior to the other transactions occurring at the Initial Closing, (a) (i) Champion Europe S.r.l. shall sell, transfer, convey, assign and deliver to ABG Purchaser, free and clear of any Liens (other than Permitted Liens), all of Champion Europe S.r.l.’s right, title and interest in, to and under the Intellectual Property held by Champion Europe S.r.l., and in exchange therefor, subject to Section 1.06, ABG Purchaser or a Purchaser Designee of ABG Purchaser shall pay or cause to be paid to Champion Europe S.r.l. $1,000,000 in cash (such amount, the “Italy IP Purchase Price” and such exchange, the “Italy IP Sale”), and (ii) immediately after the Italy IP Sale, Champion Europe S.r.l. shall distribute the Italy IP Purchase Price to the Italy Company, (iii) immediately after the distribution described in clause (ii), the Italy Company shall distribute the Italy IP Purchase Price to HBI Holdings Switzerland GmbH, (b) (i) each of GFSI LLC and Knights Apparel LLC shall sell, transfer, convey, assign and deliver to ABG Purchaser, free and clear of any Liens (other than Permitted Liens), all of GFSI LLC and Knights Apparel LLC’s respective right, title and interest in, to and under the Intellectual Property held by such Persons, and in exchange therefor, subject to Section 1.06, ABG Purchaser shall pay or cause to be paid to GFSI LLC $5,000,000 (the “GFSI IP Purchase Price”) and Knights Apparel LLC $5,000,000 (the “KA IP Purchase Price”), in each case, in cash (such exchanges described in this clause (b) (i), collectively, the “United States IP Sale”), and (ii) immediately after the United - 6 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

States IP Sale, GFSI LLC shall distribute the GFSI IP Purchase Price to Hanesbrands Inc. and Knights Apparel LLC shall distribute the KA IP Purchase Price to Knights Holdco LLC, which shall in turn distribute the KA IP Purchase Price to Hanesbrands Inc. and (c) HBI Branded Apparel Enterprises, LLC shall sell, transfer, convey, assign and deliver to ABG Japan Purchaser, free and clear of any Liens (other than Permitted Liens), all of HBI Branded Apparel Enterprises, LLC’s right, title and interest in, to and under the Intellectual Property of the Japan Business held by HBI Branded Apparel Enterprises, LLC, and in exchange therefor, subject to Section 1.06, ABG Japan Purchaser shall pay or cause to be paid to HBI Branded Apparel Enterprises, LLC $18,000,000 in cash (the “Japan IP Purchase Price”, and collectively with the Italy IP Purchase Price, the GFSI IP Purchase Price and the KA IP Purchase Price, the “Separate IP Purchase Price”, and such exchange, the “Japan IP Sale” and collectively with the Italy IP Sale and the United States IP Sale, the “Separate IP Sales”). For the avoidance of doubt, (x) the Intellectual Property conveyed to ABG Purchaser pursuant to this Section 4.12 shall constitute Purchased Assets and (y) the Separate IP Purchase Price is included in the Purchase Price. 1.8. The following shall be added as Section 5.02(d): (d) Notwithstanding anything to the contrary in Section 5.02(a) or 5.02(b)(i) (but subject, for the avoidance of doubt, to the terms and conditions of Section 5.02(b)(ii) and (iii)), from the Initial Closing until the earlier of (i) the consummation of a sale of the Europe Business by ABG Purchaser or its Affiliate to its applicable operating partner and (ii) six (6) months following the Initial Closing (such earlier date, the “LC Efforts Date”), unless ABG Purchaser provides written notice to Seller to terminate, replace, cash collateralize or otherwise backstop the EU Lease Letters of Credit in a manner reasonably acceptable to Seller, in each case, prior to the consummation of such sale of the Europe Business, (i) Seller shall, and shall cause its Affiliates to, maintain and renew such EU Lease Letters of Credit in accordance with the terms thereof and the terms of the applicable store lease guaranteed by such EU Lease Letter of Credit as in effect as of the Initial Closing and (ii) without limiting the applicable Purchaser’s obligation under Section 5.02(b)(iii), ABG Purchaser or such Purchaser shall reimburse Seller or its applicable Affiliate for all maintenance and renewal fees actually incurred and payable by Seller or such Affiliate in respect of such EU Lease Letter of Credit until such time that such EU Lease Letter of Credit is so terminated, replaced, cash collateralized or otherwise backstopped. For the avoidance of doubt, in the event the EU Lease Letters of Credit have not been terminated, replaced, cash collateralized or backstopped by the ABG Purchaser or its Affiliates prior to the LC Efforts Date, ABG Purchaser or its Affiliates or its applicable operating partner shall be subject to Section 5.02, including Section 5.02(b)(i) with respect to each EU Lease Letter of Credit, provided, that in such case, the twenty-four (24) month period referenced in 5.02(b)(i) shall begin on the LC Efforts Date. 1.9. Section 6.12(g) of the Purchase Agreement shall be amended and restated in its entirety as follows: (i) From September 25, 2024 until January 15, 2025, Seller shall, and shall cause its Affiliates to, use their commercially reasonable efforts to either (i) sell the Choloma - 7 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

Facilities to one or more unaffiliated third parties (a “Choloma Sale”) or (ii) transfer the Choloma Facilities to a third party selected with ABG’s consent (not to be unreasonably withheld, conditioned or delayed) who will take ownership of the Choloma Facilities and undertake to sell them (a “Choloma Transfer”). (ii) In the event a Choloma Sale occurs by January 15, 2025, the proceeds of such Choloma Sale (net of Seller’s and its Affiliates’ reasonable and customary out of pocket expenses and Taxes incurred in connection with such Choloma Sale) shall be equally shared between ABG Purchaser and Seller and Seller shall, promptly following the consummation of such Choloma Sale, deliver to ABG Purchaser its share of such proceeds, in cash, together with any supporting documentation entered into in connection with such Choloma Sale, as ABG Purchaser may reasonably request. (iii) In the event a Choloma Transfer occurs, the transferee (the “Agent”) will (A) agree to use its commercially reasonable efforts to sell the Choloma Facilities in return for an agreed upon fee to be paid to the Agent from the proceeds of such sale, (B) submit the details of any such proposed sale to Seller and ABG Purchaser for their prior approval, and (C) remit to Seller or its applicable Affiliate the proceeds of such sale net of (x) Agent’s reasonable and customary out of pocket expenses incurred in connection with such sale and (y) the agreed upon Agent fee (the “Net Proceeds”). Seller agrees to promptly remit to ABG Purchaser in cash 50% of the amount calculated as (A) the Net Proceeds less (B) Seller’s and its Affiliates’ reasonable and customary out of pocket expenses and Taxes incurred in connection with such sale, together with any supporting documentation entered into in connection with such sale, as ABG Purchaser may reasonably request. (iv) If by January 15, 2025 (A) any of the Choloma Facilities have not been sold by Seller or its Affiliates, or (B) a Choloma Transfer has not occurred, then (x) ABG Purchaser may, upon written notice to Seller, elect to acquire (for its own account or on behalf of its designee) any such Choloma Facilities (the “Transferring Choloma Facilities”) and (y) if ABG Purchaser has made the election contemplated by the foregoing clause (x), Seller shall, and shall cause its Affiliates to, transfer the Transferring Choloma Facilities to ABG Purchaser or its designee for no additional consideration on or prior to January 31, 2025 (or such other date as may be reasonably agreed between Seller and ABG Purchaser, taking into account Seller’s plans for discontinuing operations in Honduras), at which time Seller shall, or shall cause its Affiliates to, execute and deliver such bills of sale, deeds, assignments, assumptions and other documents and instruments of sale, conveyance, assignment, transfer and assumption in order to effectuate the transfer of the Transferring Choloma Facilities to ABG Purchaser or its designee, in a form that is reasonably agreed upon by Seller and ABG Purchaser (or such designee) and as is customary in the applicable jurisdiction or required by applicable Law. Each Transferring Choloma Facility that is ultimately transferred to ABG Purchaser (or its designee) pursuant to this Section 6.12(g) shall be deemed a Purchased Asset that shall be transferred to ABG Purchaser or such designee (and, upon such transfer, such designee shall be deemed a Purchaser hereunder). (v) In the event any of the Choloma Facilities have not been sold by Seller or its Affiliates, a third party has not been engaged to sell such Choloma Facilities and ABG Purchaser has not elected to acquire such Choloma Facilities by January 15, 2025, Seller - 8 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

or its applicable Affiliate shall retain and within a reasonable period of time shut down such Choloma Facilities and neither ABG Purchaser, nor any of its Affiliates, shall have any Liabilities arising or resulting from or in connection with such Choloma Facilities; provided that the foregoing does not limit the obligations of ABG Purchaser with respect to the payment of the Honduras Facility Shutdown Cost or the Actual Severance Costs relating to such Choloma Facilities. 1.10.The following shall be added as Section 6.12(h): (h) Seller shall, and shall cause its Affiliates to, use reasonable best efforts to, at Seller’s sole cost and expense, shut down and vacate each Month-to-Month Store on or prior to January 31, 2025 and shall take all reasonable and customary steps required for such closure in a manner consistent with Seller’s past practice and the terms of the leave agreements covering such stores, including effectuating the termination of each lease in respect of a Month-to-Month Store (a “Month-to-Month Store Lease”), removing signage and fixtures, removing inventory and personal property, making lease-required repairs, cleaning and all other lease-required actions, including all such actions as may be necessary to restore the premises to its original condition (collectively, “Month-to-Month Store Exit Costs”). Without limiting Seller’s obligations under the foregoing sentence, ABG Purchaser or its designee shall assume financial responsibility for each Month-to-Month Store Lease remaining in effect as of February 1, 2025 (or such other date as shall be mutually agreed in writing between ABG Purchaser and Seller); provided, however, that Seller shall pay, defend, discharge and indemnify ABG Purchaser and any other Purchaser Indemnitees against, and hold each of them harmless from, any and all Losses suffered or incurred by any Purchaser Indemnitee to the extent arising or resulting from or in connection with assuming such financial responsibility, including payments of rent and other amounts due under any Month-to-Month Store Lease, any Month-to-Month Store Exit Costs and, if applicable, any Lease Breakage Costs. 1.11.Section 6.13(c) to the Purchase Agreement shall be amended and restated in its entirety as follows: (c) Deferred Closing Payment. On the applicable Deferred Closing Date, ABG Purchaser shall pay, or cause to be paid, to Seller, by wire transfer of immediately available funds, the applicable Deferred Business Closing Payment in respect of the applicable Deferred Business; provided, however, that, without limiting the generality of Section 1.08 or Section 6.13(e)(i)(B), in the case of the Purchaser of the portion of the Inventory held in customs in Argentina, transfer of such Inventory to such Purchaser and payment of the Deferred Business Closing Payment to be made in respect of such Inventory in Argentina shall be conditioned upon execution and delivery of such Local Transfer Agreements as may be reasonably necessary to effectuate the transfer of such Inventory to such Purchaser as mutually agreed upon by Seller and such Purchaser. “Deferred Business Closing Payment” means an amount equal to the Deferred Business Consideration, calculated using the estimates of Residual Inventory Consideration, Compensation Amount, Retained Retention Bonus Amount and Deferred Business Reserves included in the Estimated Deferred Business Statement. - 9 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

1.12.Section 6.13(f)(vi) to the Purchase Agreement shall be amended and restated in its entirety as follows: (vi) Within thirty (30) days of the applicable Deferred Closing Date (or, in the case of the Purchaser of the portion of the LATAM Business conducted in Argentina, sixty (60) days of the applicable Deferred Closing Date), the applicable Purchaser shall prepare and deliver to Seller a statement (the “Deferred Business Statement”) setting forth such Purchaser’s good faith determination of (A) the Residual Deferred Business Inventory actually received by Purchaser, (B) the Compensation Amount (if any), (C) the Retained Retention Bonus Amount with respect to the applicable Deferred Business (if any), (D) the applicable Deferred Business Reserves and (E) a calculation of the Deferred Business Consideration in respect thereof, in each case, together with reasonable supporting documentation. If ABG Purchaser fails to timely deliver or cause to be delivered a Deferred Business Statement in accordance with this Section 6.13(f)(vi), then the Estimated Deferred Business Statement shall be deemed final and binding upon the Seller and such Purchaser. 1.13.Section 6.14 to the Purchase Agreement shall be amended and restated in its entirety as follows: Section 6.14 Transition Services. Seller and Purchasers acknowledge and agree that: (a) as of the date hereof, the term sheet set forth on Exhibit C (the “TSA Term Sheet”) reflects the material terms regarding the Transition Services (as defined in the TSA Term Sheet) that the Parties agree Seller will provide or cause to be provided to Purchasers following the Closing; and (b) prior to the Applicable Closing and as promptly as practicable following the execution of this Agreement, ABG Purchaser or its designated Affiliate, on the one hand, and Seller or its designated Affiliate, on the other hand (collectively, the “TSA Parties”), shall negotiate reasonably and in good faith the terms of a transition services agreement pursuant to which Seller will provide or cause to be provided the Transition Services to Purchasers following the Applicable Closing, which agreement shall (i) be consistent with the TSA Term Sheet, and to the extent mutually agreed by the TSA Parties, include other commercially reasonable, customary terms, taking into consideration the nature and circumstances of the transactions contemplated by this Agreement, and (ii) upon the TSA Parties’ mutual agreement, be the Transition Services Agreement referenced in this Agreement. In the event that the TSA Parties are unable, despite their reasonable, good faith efforts, to agree upon and enter into the Transition Services Agreement by the Initial Closing, then Seller hereby agrees that it will provide, or cause to be provided, to Purchaser and its designated Affiliates and operating partners the Transition Services (as defined in the TSA Term Sheet and as may be revised following the date hereof pursuant to this Section 6.14) from and after the Initial Closing in accordance with the terms and conditions set forth in the TSA Term Sheet; provided, however, that the Parties acknowledge and agree that, notwithstanding any other provision of this Section 6.14, the Transition Services Agreement or the TSA Term Sheet, the ELA shall be deemed to satisfy any obligation of Seller to provide, and be in lieu of Seller providing, HR Services (as such term is defined in the TSA Term Sheet) to those Leased Employees covered by the ELA. For the avoidance of doubt, “HR Services” shall not include any service set forth in the Sports Apparel Business Transition Services Schedule A to the TSA. - 10 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

1.14.Section 6.15 to the Purchase Agreement shall be amended and restated in its entirety as follows: (a) IP License Agreements. Seller and Purchasers acknowledge and agree that: (a) as of the date hereof, the term sheets set forth on Exhibit J and Exhibit K reflect the material terms regarding the Patent and Technology License Agreement and Trademark License Agreement, respectively, that the Parties will enter at the Initial Closing, and (b) prior to the Initial Closing and as promptly as practicable following the execution of this Agreement, Seller and Purchaser shall negotiate reasonably and in good faith and finalize the terms of the Patent and Technology License Agreement and Trademark License Agreement, which agreements shall be consistent with the respective term sheets, and to the extent mutually agreed by the Parties, include other commercially reasonable, customary terms, taking into consideration the nature and circumstances of the transactions contemplated by this Agreement. In the event that ABG Purchaser and Seller are unable, despite their reasonable, good faith efforts, to agree upon and enter into a Patent and Technology License Agreement and Trademark License Agreement by the Initial Closing, then the term sheets set forth on Exhibit J and Exhibit K hereto shall serve as the Patent and Technology License Agreement and Trademark License Agreement from and after the Initial Closing in accordance with the terms and conditions set forth therein. Notwithstanding any of the foregoing, except for the Technology License Agreement, the ABG Purchaser hereby acknowledges and confirms that it has opted to not license from Seller any Licensed Patents or Licensed Technology contemplated by the Patent and Technology License Agreement, or any Licensed Trademarks contemplated by the Trademark License Agreement. References to the Intellectual Property to be licensed to the Purchasers as of the Initial Closing in Section 2.10(a) shall be deemed amended to refer to the Intellectual Property to be licensed to a Purchaser or one of its operating partners pursuant to the Technology License Agreement. 1.15.The following shall be added as Section 6.20: Notwithstanding anything to the contrary herein, prior to the Initial Closing, Seller shall be permitted to cause Champion Products Europe Limited to convert to an Irish unlimited liability company (the “Conversion”) and to take all actions in connection therewith to the extent required by Applicable Law, including effecting any required name change for Champion Products Europe Limited and its branches and adopting a new memorandum and articles of association. To the extent such actions are not completed prior to the Initial Closing, the ABG Purchaser shall and shall cause its Affiliates to use commercially reasonable efforts to complete such necessary actions upon the written request of Seller. Subject to the terms, conditions and limitations set forth in Article X (other than, for the avoidance of doubt, the Basket or the Cap), from and after the Initial Closing, Seller shall indemnify and hold harmless and keep indemnified and held harmless, on demand and on a continuing basis the Purchaser Indemnitees for and against all Losses suffered or out-of-pocket amounts incurred by the Purchaser Indemnitees arising from the effective date of the Conversion (being the date on which the Irish Companies Registration Office issues the certificate of re-registration) to the extent arising in connection with (i) the Conversion and (ii) the subsequent - 11 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

distributions made by the Acquired Group prior to or on the date of Initial Closing. Further, the Seller shall reimburse, indemnify and hold harmless and keep indemnified and held harmless the Purchaser Indemnitees for their reasonable out of pocket costs (including but not limited to legal, accounting and filing fees and Taxes) actually incurred in subsequently re-registering Champion Products Europe Unlimited Company as a limited liability company. The covenants and obligations of Seller set forth in this paragraph, and all claims with respect to any of the foregoing, shall survive the Initial Closing and shall terminate on the date that is the five (5) year anniversary of the Initial Closing. 1.16.Section 9.01(a) to the Purchase Agreement shall be amended and restated in its entirety as follows: (a) Seller shall update the Business Employee List from time to time as reasonably requested by Purchaser, which shall not exceed once per a month, until the Initial Closing (or, with respect to Business Employees relating to the Deferred Business, until the Deferred Closing), in order to maintain the accuracy of such schedule, including as a result of employee terminations, transfers (within Seller or its Affiliates), and new hires (which, in each case, must be in compliance with Section 4.02(b)(v)). Notwithstanding anything to the contrary herein, Seller shall timely cooperate with Purchaser and timely take all necessary or appropriate actions that are reasonably requested by Purchaser in connection with such Purchaser’s or its Affiliate’s obligations to offer employment to Business Employees pursuant to this Article IX and the ELA. Pursuant to the terms of the ELA, which is incorporated herein by reference, Seller shall lease to Recipient (as defined in the ELA) (i) all Seller Entity Business Employees who are employed at or report to the locations set forth on Section 9.01(a)(i) of the Disclosure Schedule (“Sports Apparel Business Employees,” which such Sports Apparel Business Employees will be materially consistent with the Sports Apparel Business Employees reflected on the Sports Apparel Business Employees census provided to Purchaser prior to the date hereof (other than changes in the ordinary course of business consistent with past practice)) and (ii) all employees listed on Section 9.01(a)(ii) of the Disclosure Schedule who are located in the United States (the “Sports Apparel Shared Services Employees” and with the Sports Apparel Business Employees, the “Leased Employees”) for the period beginning immediately following the Initial Closing and ending on the last day of the Term (as defined in the ELA), unless the employment of such Leased Employee is terminated earlier pursuant to the terms of the ELA. Purchaser or its designee (including Recipient or its Affiliate) shall make an offer of employment to each Leased Employee for employment effective no later than January 1, 2025 (or such later date as contemplated for any Leave Leased Employees (as such term is defined in the ELA) in accordance with the terms of the ELA) for a comparable position and work location and that is otherwise consistent with terms of this Article IX and the ELA. Prior to the Initial Closing (or, with respect to the Deferred Business, from the period between the Initial Closing and the applicable Deferred Closing), each applicable Purchaser or one of its Affiliates shall review the Business Employee List and, in its sole discretion and consistent with applicable Law, select the applicable Seller Entity Business Employees (other than the Leased Employees and Automatic Transfer Employees (as defined below)) to which it intends to make - 12 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

an offer of employment and make an offer of employment to each such Seller Entity Business Employee so selected (such Business Employees so selected, the “Offer Employees”). Each such offer of employment shall be for a comparable position and work location and shall be otherwise compliant with the terms of this Article IX. Upon finalization of the list of Offer Employees for an applicable business segment in a jurisdiction Purchaser or one of its Affiliates or assignees shall provide Seller with a list of the Offer Employees for such business segment (for each segment in a jurisdiction, its “Offer Employee List”) and following its receipt of the Offer Employee List for any business segment in a jurisdiction, notwithstanding anything to the contrary in this Agreement, (i) Seller and its Affiliates (including the Acquired Group) shall not terminate or make any changes to the terms and conditions of employment of any Offer Employee in such business segment in such jurisdiction, (x) except for any changes in terms or conditions as would have been permitted under clauses (A) through (D) of Section 4.02(b)(v), or (y) without Purchaser’s prior express written consent and (ii) Seller may terminate the employment of any Seller Entity Business Employee in such business segment in such jurisdiction who is not included on the Offer Employee List for such business segment in such jurisdiction. Each Business Employee whose employment is required to and does transfer to the Purchaser or its Affiliates upon the Applicable Closing automatically by operation of applicable Law (including each Acquired Group Business Employee) shall be referred to herein as an “Automatic Transfer Employee.” Each Offer Employee who receives and accepts such an offer of employment pursuant to this Section 9.01, and each Leased Employee who accepts an offer of employment pursuant to the this Section 9.01 and the ELA, and actually commences employment with such Purchaser or its Affiliate or designee (including the Recipient or its Affiliate), together with each Acquired Group Business Employee as of immediately prior to the Applicable Closing, and each Automatic Transfer Employee and Specified Employee, shall be referred to herein as (and, for purposes of this Agreement, shall be treated solely following his or her Transfer Date as) a “Transferred Employee.” Solely for the purposes of this Article IX, “Affiliates” of such Purchaser shall include, for the period following the Applicable Closing, the members of the Acquired Group. Notwithstanding the foregoing and to the extent necessary, the Parties agree to negotiate in good faith and, prior to the Applicable Closing, enter into, execute and deliver a mutually acceptable employee transfer agreement (the “Employee Transfer Agreement”) that addresses the employment and transfer of employment of the Offer Employees primarily performing services in countries outside the United States, as of immediately prior to the Initial Closing or the applicable Deferred Closing (the “Specified Employees”) and transfer of Assumed Liabilities relating solely to such Specified Employees’ employment following their respective Transfer Date(s) to the applicable Purchaser or its Affiliates. Notwithstanding the foregoing or anything to the contrary in this Article IX, the offers of employment for any Offer Employee who is covered by a Union Contract shall be governed exclusively by the terms of the applicable Union Contract, to the extent applicable. 1.17.Section 9.02(a) to the Purchase Agreement shall be amended and restated in its entirety as follows: - 13 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

(a) For the period from the applicable the Transfer Date (or for each Transferred Employee who was a Leased Employee, the Initial Closing Date) through the twelve (12)- month period thereafter (the “Continuation Period”), each applicable Purchaser shall, or shall cause one of its Affiliates or assignees to, provide to each Transferred Employee who remains employed by such Purchaser or such Affiliate or assignee (i) a base salary or base wage rate (as applicable) and annual target cash incentive or bonus opportunities that are no less favorable in the aggregate than the base salary or base wage rate and annual target cash incentive or bonus opportunities in effect immediately prior to the Initial Closing or the applicable Deferred Closing, and (ii) other employee benefits (excluding equity and equity-based incentive, defined benefit pension benefits, nonqualified deferred compensation benefits, retention, transaction or change in control benefits, retiree health benefits, retiree welfare benefits and executive perquisites (“Excluded Benefits”)) that are either (A) substantially comparable in the aggregate to those in effect for such Transferred Employee immediately prior to the Initial Closing or the applicable Deferred Closing (excluding Excluded Benefits) or (B) no less favorable than those in effect for similarly situated employees of Purchaser or its applicable Affiliate or assignee. Notwithstanding the foregoing or anything to the contrary in this Article IX, the compensation, benefits and other terms and conditions of employment for the Transferred Employees who are covered by a Union Contract (such Transferred Employees, the “Union Employees”) shall be governed by the terms of the applicable Union Contract and this Section 9.02(a) will not apply to the Union Employees. 1.18.Section 9.02(b) to the Purchase Agreement shall be amended and restated in its entirety as follows: (b) Effective as of the Initial Closing Date or, if later, the applicable Transfer Date (which, for the avoidance of doubt, shall be after the Term (as defined in the ELA) with respect to any Leased Employee), each Transferred Employee shall cease to participate as an active employee in each Benefit Plan and Seller shall terminate each member of the Acquired Group’s participation in each Benefit Plan (other than, in each case, any Acquired Group Benefit Plan or Assumed Benefit Plan). 1.19.Section 9.03 to the Purchase Agreement shall be amended and restated in its entirety as follows: Section 9.03 Severance Obligations. Each applicable Purchaser shall, or shall cause its Affiliates to, provide to each Transferred Employee whose employment is terminated by such Purchaser or any of its Affiliates during the Continuation Period, cash severance and cash termination benefits in an amount equal to the cash severance and cash termination benefits (including employer-paid COBRA premiums or welfare benefit subsidy but, for the avoidance of doubt, excluding any self-insured or other costs related to such benefits) that would have been provided to such Transferred Employee in connection with such termination under the applicable Benefit Plan in effect immediately prior to the Initial Closing and set forth on Section 2.14(a) of the Disclosure Schedule, subject to the affected Transferred Employee’s execution and nonrevocation of a general release of claims for the benefit of such Purchaser and its Affiliates in such Purchaser’s applicable form. Notwithstanding the foregoing or anything to the contrary in this Article IX, (i) the severance or termination benefits for any Transferred Employee who is covered by a Union Contract shall be governed exclusively by the terms of the - 14 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

applicable Union Contract and (ii) the severance and termination benefits to be provided under this Section 9.03 shall not include any retiree health or retiree welfare benefits. 1.20.Section 9.04 to the Purchase Agreement shall be amended and restated in its entirety as follows: Section 9.04 US Benefit Plan and COBRA Obligations. Without limiting the generality of Section 9.02, each applicable Purchaser shall, or shall cause its Affiliates or designee (including, with respect to Leased Employees, the Recipient or its Affiliate) to, establish, as soon as reasonably practicable after the Initial Closing Date (or, if later, the applicable Transfer Date (which, for the avoidance of doubt, shall be after the Term (as defined in the ELA) with respect to Leased Employees)), a group health plan or plans to provide health benefits to each Transferred Employee primarily performing services in the United States (and his or her eligible spouse and dependents) with coverage effective immediately following the Initial Closing Date (or, if later, the applicable Transfer Date); provided that, if Purchaser or one of its Affiliates or assignees requests that the Transition Services include the ability of such Transferred Employees to continue to participate in the group health plan or plans of Seller and its Affiliates for a reasonable period of time following the Initial Closing Date (or, if later, the applicable Transfer Date) and if Seller and its Affiliates provide for such participation under the terms and conditions of the Transition Services Agreement or otherwise under Section 6.14, then such Transition Service shall be deemed to satisfy such Purchaser’s or its Affiliate’s obligations to provide health coverage pursuant to this provision, and such Purchaser or its Affiliate shall have in effect a replacement group health plan immediately following the termination of such Transition Services. During the term of the ELA, Seller or its applicable Affiliate shall provide eligible Leased Employees group health benefits under its applicable Benefit Plans in accordance with the terms of the ELA. (b) Subject to the applicable Purchaser’s compliance with Section 9.04(a) (other than non-compliance due to Seller’s breach of Section 9.04(a)), Seller and its Affiliates (excluding, for the avoidance of doubt, the Acquired Group) shall be solely responsible for any and all obligations arising under COBRA with respect to all “M&A qualified beneficiaries” as defined in Treasury Regulation Section 54.4980B-9, including with respect to obligations to provide continuation coverage for Former Business Employees (or spouse or dependent thereof) who are “M&A qualified beneficiaries,” and each Business Employee (or spouse or dependent thereof) who has a COBRA qualifying event occurring in connection with the Transactions. With respect to any Leased Employee (or his or her qualified beneficiary) who has a COBRA qualifying event during the term of the ELA, Seller or its applicable Affiliate shall be responsible for providing the applicable notices and continuation coverage required under COBRA, subject to Recipient’s payment of related Employee Costs (as defined in the ELA) in accordance with the terms of the ELA until the earlier of (i) the last day of the Term (as defined in the ELA) or (ii) the end of the applicable COBRA continuation period for such Leased Employee (or qualified beneficiary), and thereafter Purchaser and its Affiliates (including the Recipient or its Affiliates) shall have the obligation to provide the applicable notices and continuation coverage required under COBRA. - 15 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

1.21.Section 10.05(h) to the Purchase Agreement shall be amended and restated in its entirety as follows: No Indemnified Party shall be entitled to indemnification pursuant to this Article X with respect to any Loss to the extent that such Loss relates to (i) except in the case of (x) any inaccuracy of a representation set forth in Sections 2.07(d), (h), (i), (l), or (q), (y) the breach of any covenant set forth in Section 4.04, or (z) the indemnity set out in Section 6.20, Taxes for or attributable to any taxable period beginning after the Applicable Closing Date or, with respect to any Straddle Period, the portion of such Straddle Period beginning after the Applicable Closing Date or (ii) except to the extent arising from any breach of a covenant set forth in Section 4.10 or Section 6.06(l), the existence, amount, usability, expiration date or limitations on (or availability of) any Tax attribute (including net operating losses) of any member of the Acquired Group or related to any Purchased Asset in any taxable period (or portion thereof) beginning after the Applicable Closing Date. 1.22.The below language in Exhibit H (WC Inventory Valuation Schedule) beginning with “Argentina/Mexico:” and ending with “…and (ii) ecommerce and retail store returns” shall be amended and restated in its entirety as follows: Mexico: Goods In transit: no additional reserve over current policy. Active/Perennial: 25% reserve Obsolete: 75% reserve Markdown and eCommerce Returns Reserves: There will be reserves, netted against the inventory value, for, as appropriate, (i) end of season FW24 markdown allowances and returns to vendor for FW24 wholesale shipments, and (ii) ecommerce and retail store returns. Argentina: Goods In transit (goods sitting in customs for which Hanes has not yet paid duties on such goods): 45% reserve against the landed cost of such inventory. For the avoidance of doubt, Buyer will pay to Seller, as part of the Residual Inventory Consideration, the landed cost of such in transit inventory excluding duties. All On-Hand Inventory (including Active/Perennial, Seasonal and Obsolete Inventory): 45% reserve on the landed duty paid cost of such inventory Markdown and eCommerce Returns Reserves: There will be reserves, netted against the inventory value, for, as appropriate, (i) end of season FW24 markdown allowances and returns to vendor for FW24 wholesale shipments, and (ii) ecommerce and retail store returns. - 16 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

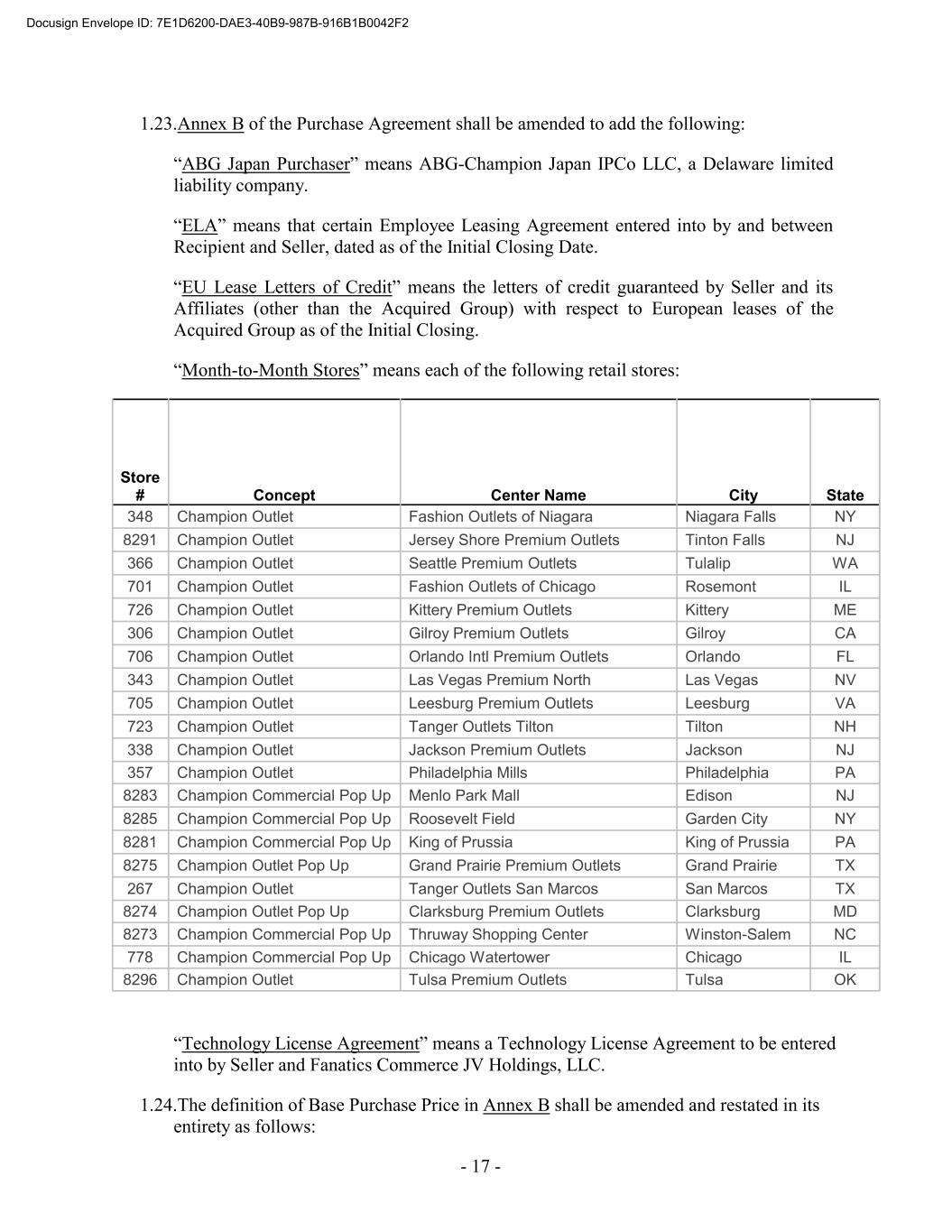

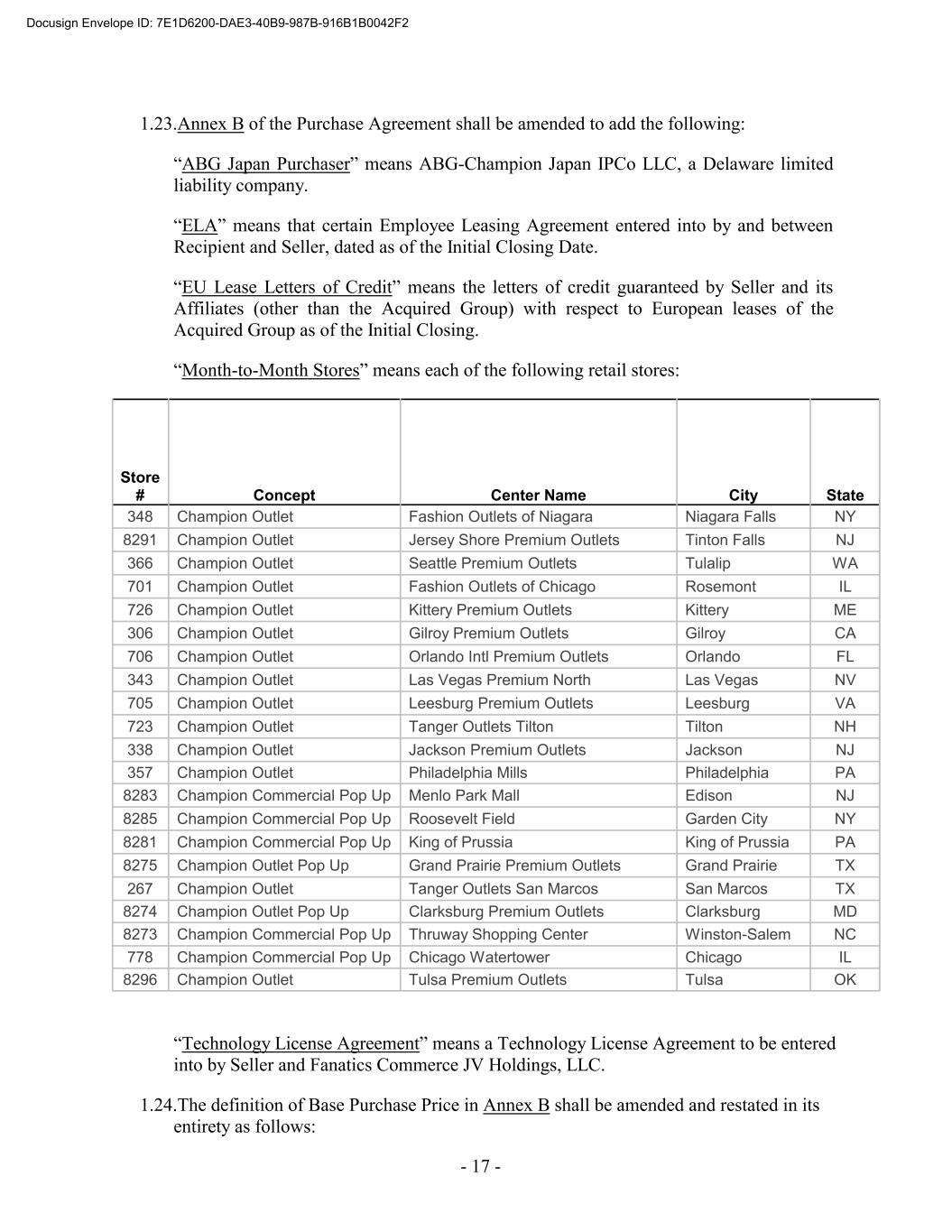

- 17 - NH 726 Champion Outlet 338 Champion Outlet Champion Outlet Store # Jackson Premium Outlets Kittery Premium Outlets Jackson Jersey Shore Premium Outlets NJ Kittery 357 ME Champion Outlet Tinton Falls Philadelphia Mills Philadelphia PA 306 NJ 8283 Champion Outlet Champion Commercial Pop Up 348 Menlo Park Mall Gilroy Premium Outlets Edison NJ Gilroy Concept 8285 CA Champion Commercial Pop Up 366 Roosevelt Field Garden City Champion Outlet NY 706 Champion Outlet 8281 Champion Outlet Champion Commercial Pop Up 1.23.Annex B of the Purchase Agreement shall be amended to add the following: “ABG Japan Purchaser” means ABG-Champion Japan IPCo LLC, a Delaware limited liability company. “ELA” means that certain Employee Leasing Agreement entered into by and between Recipient and Seller, dated as of the Initial Closing Date. “EU Lease Letters of Credit” means the letters of credit guaranteed by Seller and its Affiliates (other than the Acquired Group) with respect to European leases of the Acquired Group as of the Initial Closing. “Month-to-Month Stores” means each of the following retail stores: King of Prussia Orlando Intl Premium Outlets King of Prussia Seattle Premium Outlets PA Orlando Fashion Outlets of Niagara 8275 FL Champion Outlet Pop Up Tulalip Grand Prairie Premium Outlets Grand Prairie Center Name TX 343 WA 267 Champion Outlet Champion Outlet Niagara Falls Tanger Outlets San Marcos Las Vegas Premium North San Marcos TX Las Vegas 8274 NV Champion Outlet Pop Up 701 Clarksburg Premium Outlets Clarksburg NY MD 705 Champion Outlet 8273 Champion Outlet Champion Commercial Pop Up City Thruway Shopping Center Leesburg Premium Outlets Winston-Salem Fashion Outlets of Chicago NC Leesburg 778 VA Champion Commercial Pop Up Rosemont Chicago Watertower Chicago IL 723 IL 8296 Champion Outlet Champion Outlet 8291 Tulsa Premium Outlets Tanger Outlets Tilton Tulsa OK Tilton “Technology License Agreement” means a Technology License Agreement to be entered into by Seller and Fanatics Commerce JV Holdings, LLC. 1.24.The definition of Base Purchase Price in Annex B shall be amended and restated in its entirety as follows: State Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

“Base Purchase Price” means $679,000,000, plus the Separate IP Purchase Price. 1.25.The definition of Company Owned Intellectual Property in Annex B shall be amended and restated in its entirety as follows: “Company Owned Intellectual Property” means all Intellectual Property (a) owned by the members of the Acquired Group and (b) all Intellectual Property owned by the Seller Entities that (i) is currently being developed primarily for the Business or the Japan Business, (ii) is primarily related to and used in or held for use in the Business or the Japan Business, or (iii) is set forth on Section 1.01(f) of the Disclosure Schedules, including (A) the patents set forth on Section 1.01(f)(i) of the Disclosure Schedules, (B) the Internet Properties set forth on Section 1.01(f)(ii) of the Disclosure Schedules, (C) the Copyrights set forth on Section 1.01(f)(iii) of the Disclosure Schedules, and (D) the Marks set forth on Section 1.01(f)(iv) of the Disclosure Schedules, but excluding the Retained Intellectual Property. 1.26.The definition of Transaction Documents in Annex B shall be amended and restated in its entirety as follows: “Transaction Documents” means (a) this Agreement, (b) the Transition Services Agreement, (c) the Share Assignment Agreement, (d) each Assignment and Assumption Agreement and Bill of Sale, (e) each Local Transfer Agreement (if any), (f) each Employee Transfer Agreement, (g) the IP Assignment Agreement, (h) the Manufacturing and Supply Agreement, (i) the Japan License Agreement, (j) any Joinders, (k) the ELA and (l) the Technology License Agreement. 1.27.Schedule 6.06(h)(i) of the Purchase Agreement will be amended to allocate the following portion of Final Purchase Price to the Acquired Shares of Hanesbrands (HK) Limited: “The greater of (i) the Working Capital plus Cash less Indebtedness (each as finally determined), in each case, of Hanesbrands (HK) Limited and (ii) $1.”.”. 1.28.Schedule 6.06(h)(i) of the Purchase Agreement will be amended to add the following: “The Japan IP Purchase Price to the Intellectual Property sold by HBI Branded Apparel Enterprises LLC to the ABG Japan Purchaser.” 1.29.The Entity Classification Elections language in Annex F shall be amended and restated in its entirety as follows: Entity Classification Elections: 1. Effective as of one day prior to the Initial Closing, the following entities will file Form 8832, Entity Classification Election (the “CTB Elections”), and elect to be treated as disregarded entities for U.S. federal income tax purposes: a. Champion Deutschland GmbH; b. Universo Sport Immobiliarie S.r.l.; c. Game 7 Athletics S.r.l.; - 18 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

d. Champion Europe S.r.l.; and e. HBI Italy Acquisition Co. S.r.l. Pursuant to Treas. Reg. § 301.7701-3(g)(3)(iii), an “order of elections” statement should be included with each Form 8832 referenced above indicating that each election is part of successive elections for a series of tiered entities that will be effective on the same day and specifying the ordering of the effective date/time of the elections as “bottom-up” (i.e., with the lowest-tier entity’s election occurring before the next lowest-tier entity’s election, and so forth up the chain for each eligible entity). 2. Effective as of September 16, 2024, Champion Products Europe Unlimited Company (f/k/a Champion Products Europe Limited) will file an initial classification election on Form 8832, Entity Classification Election, and elect to be treated as a disregarded entity for U.S. federal income tax purposes. 2. General Provisions. 2.1. Covenants, Terms and Conditions. This Amendment shall be governed by the covenants, terms and conditions set forth in Article XI (Miscellaneous) of the Purchase Agreement, as applicable. 2.2. Severability. Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction. 2.3. Continuing Effect. Except as amended by this Amendment, the Purchase Agreement is hereby ratified and confirmed and shall remain in full force and effect. [remainder of page intentionally left blank – signature page follows] - 19 - Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2

[Signature page to First Amendment to SAPA] IN WITNESS WHEREOF, the undersigned have duly executed this Amendment as of the date first set forth above. HANESBRANDS INC. By: Name: Stephen Bratspies Title: Chief Executive Officer Docusign Envelope ID: 5795A20B-5067-43B6-909D-C913A45C80E3

[Signature page to First Amendment to SAPA] ABG-CHAMPION LLC By: Name: Title: Docusign Envelope ID: 7E1D6200-DAE3-40B9-987B-916B1B0042F2 Jay Dubiner Chief Legal Officer