Exhibit 99.1

Healthcare Trust of America, Inc.

A Leading Owner of Medical Office Buildings

Company Presentation

May 2012

Forward looking statements

This document contains both historical and forward-looking statements. Forward-looking statements are based on current expectations, plans, estimates, assumptions and beliefs, including expectations, plans, estimates, assumptions and beliefs about our company, the real estate industry and the debt and equity capital markets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include information concerning possible or assumed future results of operations of our company. The forward-looking statements included in this document are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: changes in economic conditions affecting the healthcare property sector, the commercial real estate market and the credit market; competition for acquisition of medical office buildings and other facilities that serve the healthcare industry; economic fluctuations in certain states in which our property investments are geographically concentrated; retention of our senior management team; financial stability and solvency of our tenants; supply and demand for operating properties in the market areas in which we operate; our ability to acquire real properties, and to successfully operate those properties once acquired; changes in property taxes; legislative and regulatory changes, including changes to laws governing the taxation of REITs and changes to laws governing the healthcare industry; fluctuations in reimbursements from third party payors such as Medicare and Medicaid; delays in liquidating defaulted mortgage loan investments; changes in interest rates; the availability of capital and financing; restrictive covenants in our credit facilities; changes in our credit ratings; our ability to remain qualified as a REIT; completion of the listing of our Class A common stock on the New York Stock Exchange; and the risk factors set forth in our 2011 Annual Report on Form 10-K.

Forward-looking statements speak only as of the date made. Except as otherwise required by the federal securities laws, we undertake no obligation to update any forward-looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward looking statements included in this document or that may be made elsewhere from time to time by, or on behalf of, us.

1 |

|

Table of Contents

1. Company Overview

2. Portfolio and Asset Management Overview

3. Healthcare Sector Fundamentals

4. Financial Review

5. Investment Execution & Summary

2 |

|

|

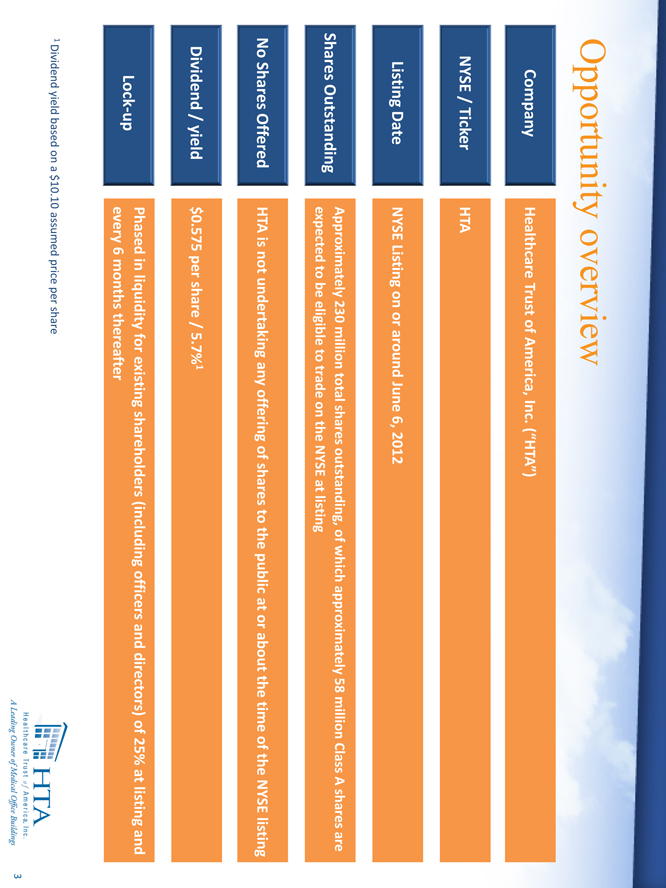

Opportunity overview

Issuer Healthcare Trust of America (“HTA”)

NYSE / Ticker HTA

Listing Date NYSE Listing on or around June 6, 2012

Approximately 230 million total shares outstanding, of which approximately 58 million Class A shares are

Shares Outstanding

expected to be eligible to trade on the NYSE at listing

No Shares Offered HTA is not undertaking any offering of shares to the public at or about the time of the NYSE listing

Dividend / yield $0.575 per share / 5.7%1

Phased in liquidity for existing shareholders (including officers and directors) of 25% at listing and Lock-up every 6 months thereafter

1 Dividend yield based on a $10.10 assumed price per share

Company Overview

4 |

|

Overview

Healthcare Trust of America, Inc.

•HTA is a self managed $2.5 billion¹ healthcare REIT focused on medical office buildings (MOBs)

•96% of portfolio is located on or adjacent to campus, or affiliated with leading health systems

•Well-defined investment strategy and investment grade balance sheet

•Greater than 50% credit-rated tenants

•Experienced management team in place since 2009, executing on high quality acquisitions with significant healthcare systems

•Favorable macroeconomic trends

•Healthcare reform impacting individuals (additional 30 million insured) and pushing health systems towards MOB

•Increased healthcare spending as a portion of U.S. GDP (19.3% by 2019)

•Aging population (additional 30mm aged 65+ by 2013)—increased demand for lower cost, outpatient services

•Constrained new MOB development

A Leading Owner of Medical Office Buildings

Focused MOB REIT

Strong Governance and Conservative Balance Sheet

Significant Demographic and Legislative Trends

¹ As of March 31, 2012, based on acquisition price

5 |

|

|

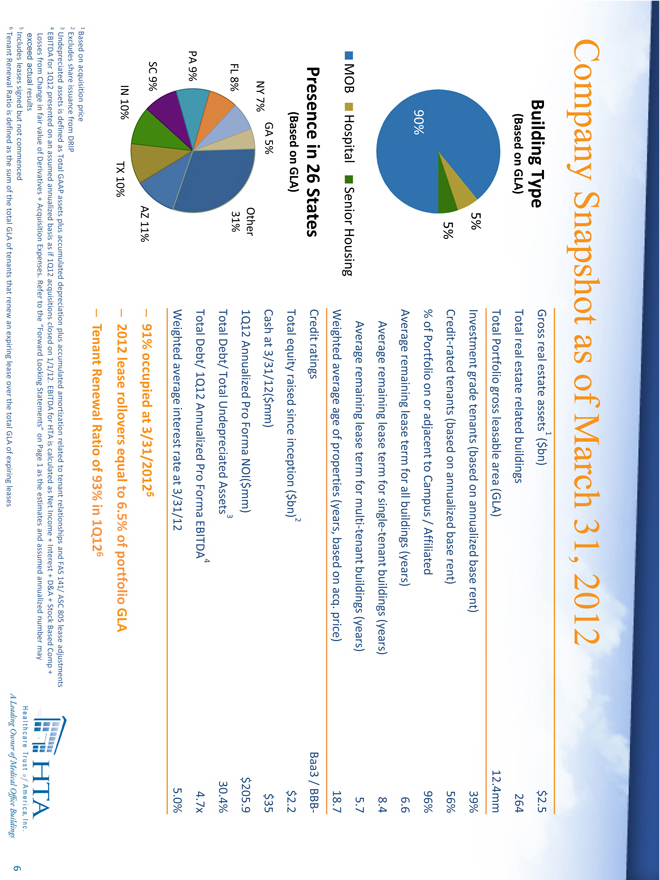

Company Snapshot as of March 31, 2012

Building Type Gross real estate assets1 ($bn) $2.5 (Based on GLA) Total real estate related buildings 264 Total Portfolio gross leasable area (GLA) 12.4mm

5% Investment grade tenants (based on annualized base rent) 39%

5% Credit-rated tenants (based on annualized base rent) 56% % of Portfolio on or adjacent to Campus / Affiliated 96% 90% Average remaining lease term for all buildings (years) 6.6 Average remaining lease term for single-tenant buildings (years) 8.4 Average remaining lease term for multi-tenant buildings (years) 5.7 MOB Hospital Senior Housing Weighted average age of properties (years, based on acq. price) 18.7 Presence in 26 States Credit ratings Baa3 / BBB- (Based on GLA) Total equity raised since inception ($bn)2 $2.2 GA 5% Cash at 3/31/12($mm) $35 NY 7% Other 1Q12 Annualized Pro Forma NOI($mm) $205.9 FL 8% 31% Total Debt/ Total Undepreciated Assets3 30.4% Total Debt/ 1Q12 Annualized Pro Forma EBITDA4 4.7x PA 9% Weighted average interest rate at 3/31/12 5.0% SC 9% – 91% occupied at 3/31/20125

AZ 11%

IN 10% TX 10% – 2012 lease rollovers equal to 6.5% of portfolio GLA

– Tenant Renewal Ratio of 93% in 1Q126

1 Based on acquisition price

2 Excludes share issuance from DRIP

3 Undepreciated assets is defined as Total GAAP assets plus accumulated depreciation plus accumulated amortization related to tenant relationships and FAS 141/ ASC 805 lease adjustments

4 EBITDA for 1Q12 presented on an assumed annualized basis as if 1Q12 acquisitions closed on 1/1/12. EBITDA for HTA is calculated as Net Income + Interest + D&A + Stock Based Comp + Losses from Change in fair value of Derivatives + Acquisition Expenses. Refer to the “Forward Looking Statements” on Page 1 as the estimates and assumed annualized number may exceed actual results Leading owner of Medical Office Buildings

5 Includes leases signed but not commenced 6

6 Tenant Renewal Ratio is defined as the sum of the total GLA of tenants that renew an expiring lease over the total GLA of expiring leases

|

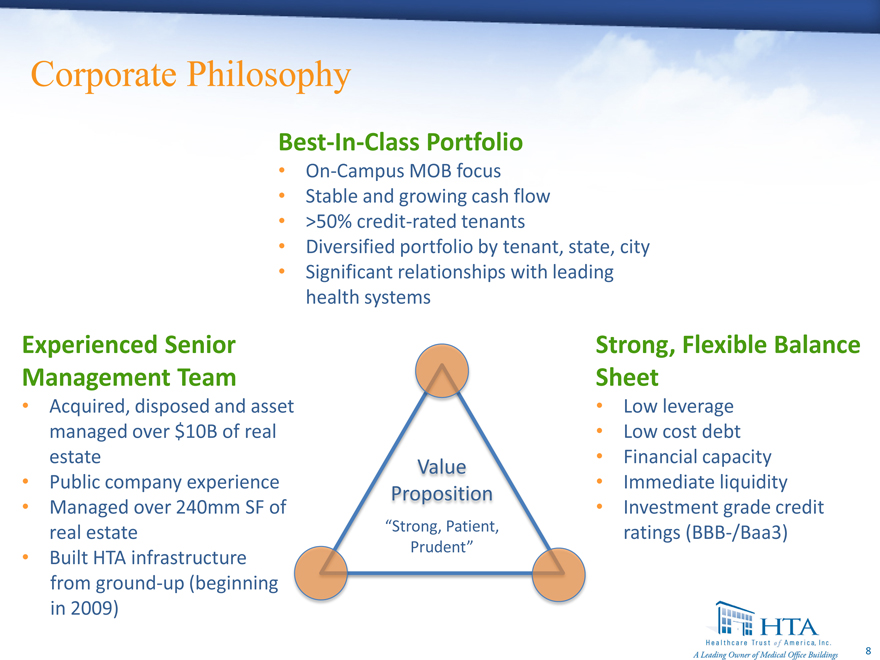

Corporate Philosophy

HTA’s strategy is to be patient, prudent, and disciplined while acquiring high quality Medical Office Buildings, on or adjacent to campuses of or affiliated with leading healthcare systems. HTA focuses on high growth markets, with the potential for near-term income generation and long-term value appreciation.

Relationship driven acquisitions of mid-sized, on-campus or aligned MOBs (generally $25mm to

Targeted Transactions $100mm), located in key markets

Target on-campus medical office buildings in locations that are in high demand by physicians and Location in Key Markets other healthcare providers

On-campus locations provide for high retention rates and rental rate growth

Target properties affiliated with the top healthcare systems, which attract the top doctors Healthcare System Seek healthcare systems with dominant market share and high credit quality

Target high growth markets with attractive demographics and favorable regulatory environments

Market

Target business friendly states and those with high barriers to entry

Target credit-rated tenants for longer-term, triple net leases

Credit Tenants

Attractive mix of single-tenant and multi-tenant buildings balances long-term stability with the potential for market driven growth

Conservative capital structure provides flexibility to pursue attractive opportunities Poised for Growth Most defensive asset class in the healthcare sector provides stable income

Internal growth opportunities stemming from lease up of vacant space, increased rents over time, and the continued shift to in-house management

Corporate Philosophy

Best-In-Class Portfolio

On-Campus MOB focus Stable and growing cash flow >50% credit-rated tenants

Diversified portfolio by tenant, state, city Significant relationships with leading health systems

Experienced Senior Management Team

Acquired, disposed and asset managed over $10B of real estate Public company experience Managed over 240mm SF of real estate Built HTA infrastructure from ground-up (beginning in 2009)

Value Proposition

“Strong, Patient, Prudent”

Strong, Flexible Balance Sheet

Low leverage Low cost debt Financial capacity Immediate liquidity Investment grade credit ratings (BBB-/Baa3)

8 |

|

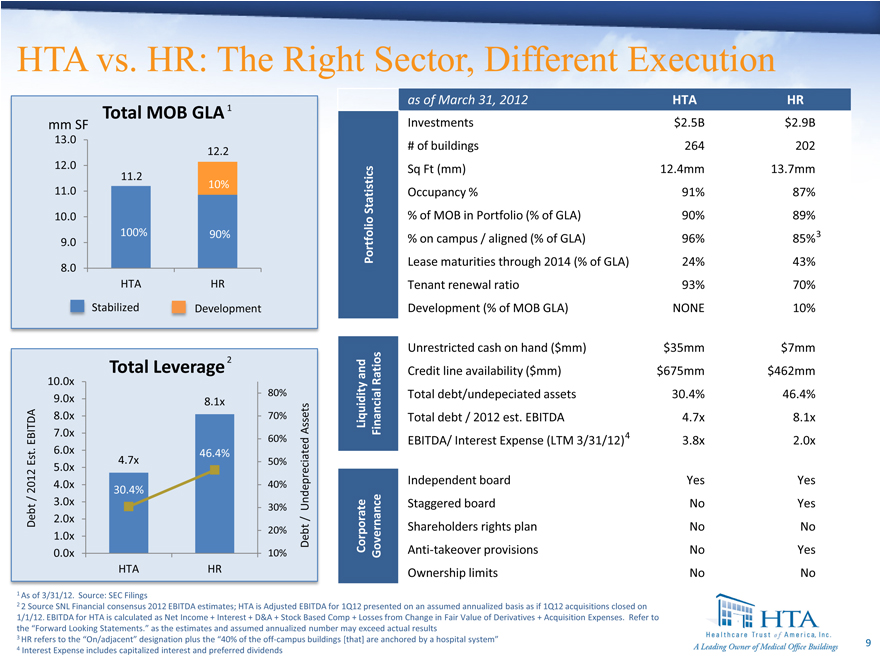

HTA vs. HR: The Right Sector, Different Execution

mm SF Total MOB GLA 1

13.0

12.2

12.0

11.2

11.0 10%

10.0

9.0 100% 90%

8.0

HTA HR

Stabilized Development

Total Leverage 2

10.0x

9.0x 8.1x 80%

8.0x 70%

EBITDA 7.0x 60% Assets

Est. 6.0x 4.7x 46.4% 50%

2012 4.0x 5.0x 40%

30.4%

/ 3.0x

30% Undepreciated

Debt 2.0x /

1.0x 20% Debt

0.0x 10%

HTA HR

as of March 31, 2012 HTA HR

Investments $2.5B $2.9B

# of buildings 264 202

Sq Ft (mm) 12.4mm 13.7mm

Statistics Occupancy % 91% 87%

% of MOB in Portfolio (% of GLA) 90% 89%

Portfolio % on campus / aligned (% of GLA) 96% 85%3

Lease maturities through 2014 (% of GLA) 24% 43%

Tenant renewal ratio 93% 70%

Development (% of MOB GLA) NONE 10%

Unrestricted cash on hand ($mm) $35mm $7mm

and Ratios Credit line availability ($mm) $675mm $462mm

Total debt/undepeciated assets 30.4% 46.4%

Liquidity Financial Total debt / 2012 est. EBITDA 4.7x 8.1x

EBITDA/ Interest Expense (LTM 3/31/12)4 3.8x 2.0x

Independent board Yes Yes

Staggered board No Yes

Shareholders rights plan No No

Corporate Governance Anti-takeover provisions No Yes

Ownership limits No No

1 As of 3/31/12. Source: SEC Filings

2 2 Source SNL Financial consensus 2012 EBITDA estimates; HTA is Adjusted EBITDA for 1Q12 presented on an assumed annualized basis as if 1Q12 acquisitions closed on 1/1/12. EBITDA for HTA is calculated as Net Income + Interest + D&A + Stock Based Comp + Losses from Change in Fair Value of Derivatives + Acquisition Expenses. Refer to the “Forward Looking Statements.” as the estimates and assumed annualized number may exceed actual results

3 HR refers to the “On/adjacent” designation plus the “40% of the off-campus buildings [that] are anchored by a hospital system”

4 |

| Interest Expense includes capitalized interest and preferred dividends |

9

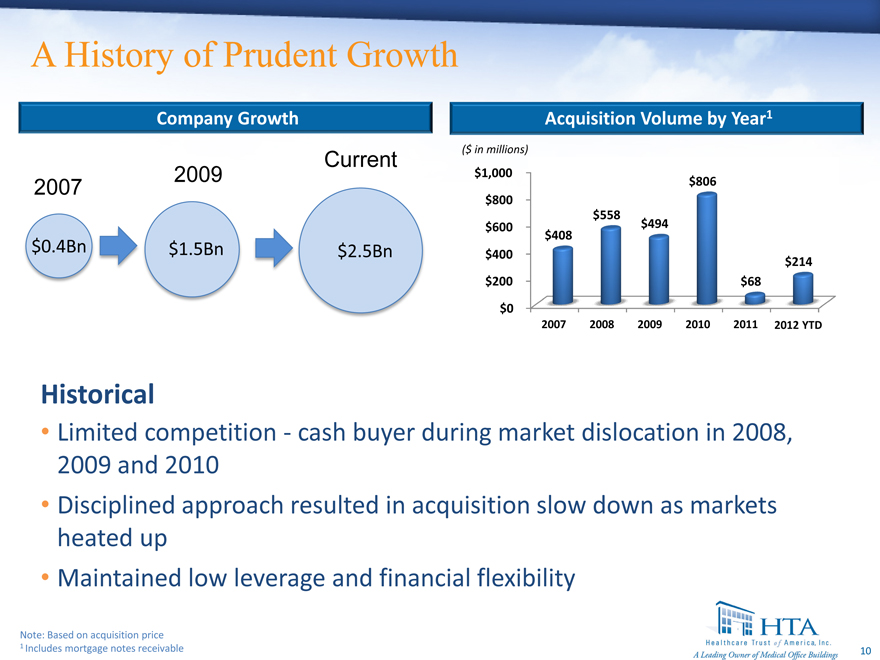

A History of Prudent Growth

Company Growth

Current

2007 2009

$0.4Bn $1.5Bn $2.5Bn

Historical

Limited competition—cash buyer during market dislocation in 2008, 2009 and 2010 Disciplined approach resulted in acquisition slow down as markets heated up Maintained low leverage and financial flexibility

Acquisition Volume by Year 1

($ in millions)

$1,000 $806

$800

$558

$600 $494

$408

$400 $214

$200 $68

$0

2007 2008 2009 2010 2011 2012 YTD

Note: Based on acquisition price

1 |

| Includes mortgage notes receivable |

10

Next Phase of Growth

Access to public equity markets in the future; lowering our cost of capital Utilize Investment Grade ratings for future access to the public debt and bond markets Expand financial flexibility to prudently execute on acquisition pipeline Potential future equity issuances when trading at premium to NAV to make accretive acquisitions Enhance enterprise value through increased in-house management A NYSE listing is expected to provide a robust platform for future growth and value creation

11

Key Strategic Investments

Greenville Hospital Portfolio

$163mm / September 2009 856k SF / 16 buildings 91% NNN to Greenville Hospital System (Moody’s: A1)

Banner Sun City

$107mm / December 2009 641k SF / 23 buildings Anchored by Banner Health (Fitch: AA-)

Albany Medical Portfolio

$197mm / November 2010 960k SF / 9 buildings Multiple Tenants

Pittsburgh Metro

$133.5mm / 2010-2012 978k SF / 3 buildings Majority anchored by Highmark (S&P: A) and its affiliates

Steward Portfolio

$100mm / March 2012 372k SF / 13 buildings 100% NNN to Steward Healthcare

12

Key Strategic Investments (cont’d)

Indiana University Hospital

$90mm / June 2008 690k SF / 24 buildings

Anchored by Indiana University Health (A1)

Aurora Wisconsin Portfolio

$74mm / February 2009 315k SF / 6 buildings

100% NNN to Aurora Health Care (A3)

Raleigh Portfolio

$44mm / December 2010 242k SF / 10 buildings Multi-tenant, on-campus

Deaconess Clinic Portfolio

$45mm / March 2010 261k SF / 5 buildings

100% NNN to Deaconess Health System (A+)

13

Experienced Management Team

Scott Peters

Chairman, CEO, and President

•Co-Founded HTA in 2006

•CEO of Grubb & Ellis (NYSE), ‘07-’08

•CEO of NNN Realty Advisors, ‘06-’08

•EVP, CFO, Triple Net Properties, Inc., ‘04-’06

•Co-Founder, CFO of Golf Trust America, Inc. (AMEX), ‘97-’07

•EVP, Pacific Holding Company/LSR, ‘92-’96

•EVP, CFO, Castle & Cooke Properties, Inc. (Dole Food Co.), ‘88-’92

Mark Engstrom, EVP -Acquisitions

CEO, InSite Medical Properties, ‘06–’09

Mgr.of Real Estate Services, Hammes Company, ‘01–’05

Vice President, PM Realty Group, ‘98–’01

Founder/Principal–Pacific Health Properties, ‘95–’98

Hospital Administrator, Good Samaritan Health System, ‘87–’95

Kellie Pruitt, EVP -Chief Financial Officer

VP of Financial Reporting and Compliance, Fender Musical Instruments Corporation, ‘07-’08

Senior Manager, Real Estate and Public Companies, Deloitte and Touche, LLP, ‘95-’07

Certified Public Accountant, Texas and Arizona

Amanda Houghton, EVP -Asset Management

Manager of Joint Ventures, Glenborough LLC, ‘06–’09

Senior Analyst, ING Clarion, ‘05 –’06

Senior Analyst, Weyerhauser Realty Investors, ‘04–’05

RSM EquiCo and Bernstein, Conklin, & Balcombe, ‘01-’03

Member of the CFA Institute and CREW

Appointed to the NAIOP Medical & Life Sciences Forum

14

Strong corporate governance

Strong Corporate Governance

•6 |

| Member board of directors, with option to increase to 15 |

•5 |

| Independent directors |

•Five board committees

Audit Committee (Chair: Maurice DeWald)

Composed solely of independent directors

Selects and reviews the independent public accountants who audit our annual financial statements Reviews the adequacy of our internal accounting controls

Compensation Committee (Chair: Gary Wescombe)

Composed solely of independent directors

Advises the board on compensation policies, establishes performance objectives for executive officers, and provides recommendation to Board on company compensation policies

Nominating and Corporate Governance Committee (Chair: Warren Fix)

Composed solely of independent directors

Identifies individuals qualified to serve on the Board of Directors

Develops and recommends corporate governance policies and principles and periodically re-evaluates such policies Makes recommendations regarding the composition of the board of directors and its committees

Investment Committee (Chair: W Brad Blair, ll)

Reviews and advises the board of directors on investment criteria and acquisitions Has the ability to reject but not approve proposed acquisitions

Risk Management Committee (Chair: Larry Mathis)

Composed solely of independent directors

Primary function is to review, assess and discuss with our management team, general counsel and auditors material risks or exposures associated with business Provides guidance on management’s in-place risk management system

Highlights

Annual election of all board members – no staggered board

5 |

| of 6 independent directors |

All directors have continuously served on the Board for at least 5 years Board members have investment in HTA

Proactive governance

Opted out of Maryland anti-takeover provisions (1)

No stockholder rights plan (poison pill)

1 Includes Maryland Law “Business and Combination Provision” (Section 3-602) and “Control Share Acquisition” (Sections 3-701 through 3-710)

15

Portfolio and Asset Management Overview

16

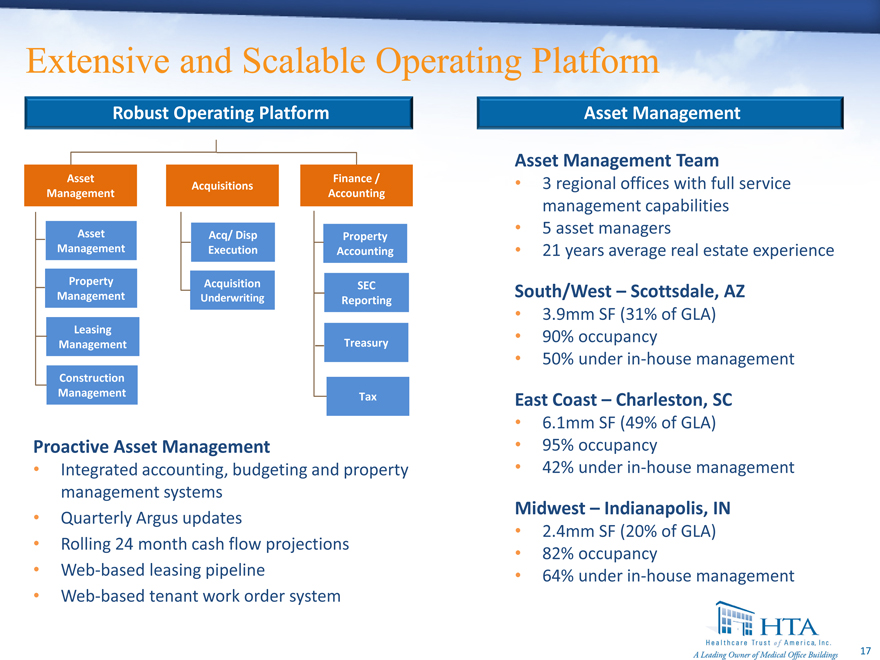

Extensive and Scalable Operating Platform

Robust Operating Platform

Asset Finance /

Acquisitions

Management Accounting

Asset Acq/ Disp Property

Management Execution Accounting

Property Acquisition SEC

Management Underwriting Reporting

Leasing

Management Treasury

Construction

Management Tax

Proactive Asset Management

Integrated accounting, budgeting and property management systems Quarterly Argus updates Rolling 24 month cash flow projections Web-based leasing pipeline Web-based tenant work order system

Asset Management

Asset Management Team

3 |

| regional offices with full service management capabilities 5 asset managers 21 years average real estate experience |

South/West – Scottsdale, AZ

3.9mm SF (31% of GLA) 90% occupancy

50% under in-house management

East Coast – Charleston, SC

6.1mm SF (49% of GLA) 95% occupancy

42% under in-house management

Midwest – Indianapolis, IN

2.4mm SF (20% of GLA) 82% occupancy

64% under in-house management

17

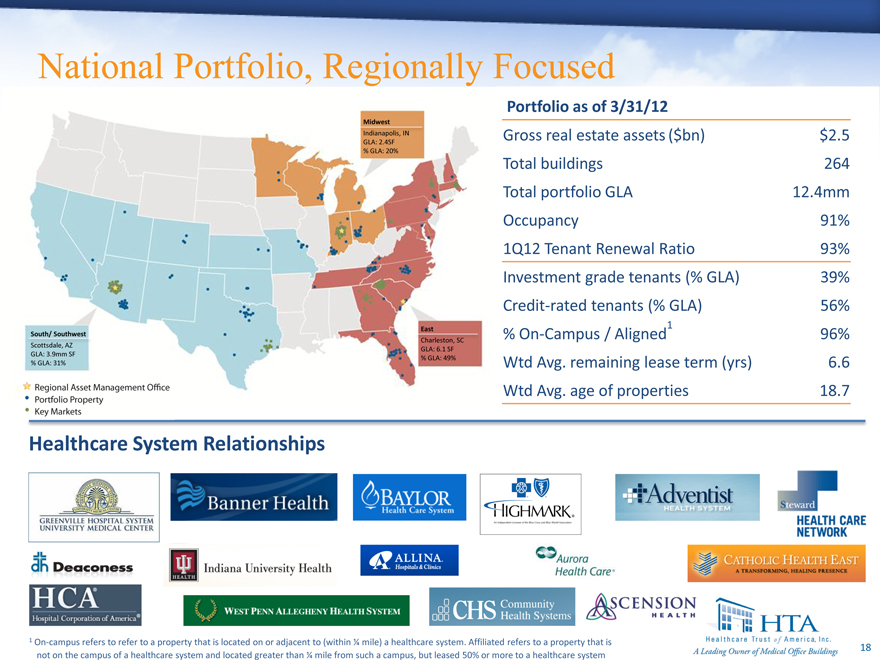

National Portfolio, Regionally Focused

Midwest

Indianapolis, IN GLA: 2.4SF

% GLA: 20%

East South/ Southwest

Charleston, SC Scottsdale, AZ

GLA: 6.1 SF GLA: 3.9mm SF

% GLA: 49%

% GLA: 31%

Portfolio as of 3/31/12

Gross real estate assets ($bn) $2.5

Total buildings 264

Total portfolio GLA 12.4mm

Occupancy 91%

1Q12 Tenant Renewal Ratio 93%

Investment grade tenants (% GLA) 39%

Credit-rated tenants (% GLA) 56%

% On-Campus / Aligned1 96%

Wtd Avg. remaining lease term (yrs) 6.6

Wtd Avg. age of properties 18.7

1 On-campus refers to refer to a property that is located on or adjacent to (within 1/4 mile) a healthcare system. Affiliated refers to a property that is not on the campus of a healthcare system and located greater than 1/4 mile from such a campus, but leased 50% or more to a healthcare system

18

Diversified Portfolio

Geographic Diversification

(by GLA)

NY 7% GA 5%

Other

FL 8% 31%

PA 9%

SC 9% AZ 11%

IN 10% TX 10%

264 buildings in 26 states

Top 5 states constitute just under 50% of GLA and ABR No one state comprises more than 11% of GLA or 13% of ABR

Tenant Mix

(by Annual Base Rent)

56%

Credit

Tenants Not

Rated

44%

56% credit-rated tenants (mainly larger heath systems) 39% investment grade 44% non-rated tenants (mainly independent physicians)

Lease Type

(by GLA)

60%

NNN

Gross

40% 60% NNN leases – more conservative lease structure with stable cash flows. Tenant bears expense risk 40% Gross Leases – provides upside with expense savings

66%

Multi- Tenant

Single Tenant 34%

Strong mix of single and multi-tenant buildings

Multi-tenanted buildings have weighted average lease term of 5.7 years Single-tenanted buildings have weighted average lease term of 8.4 years

19

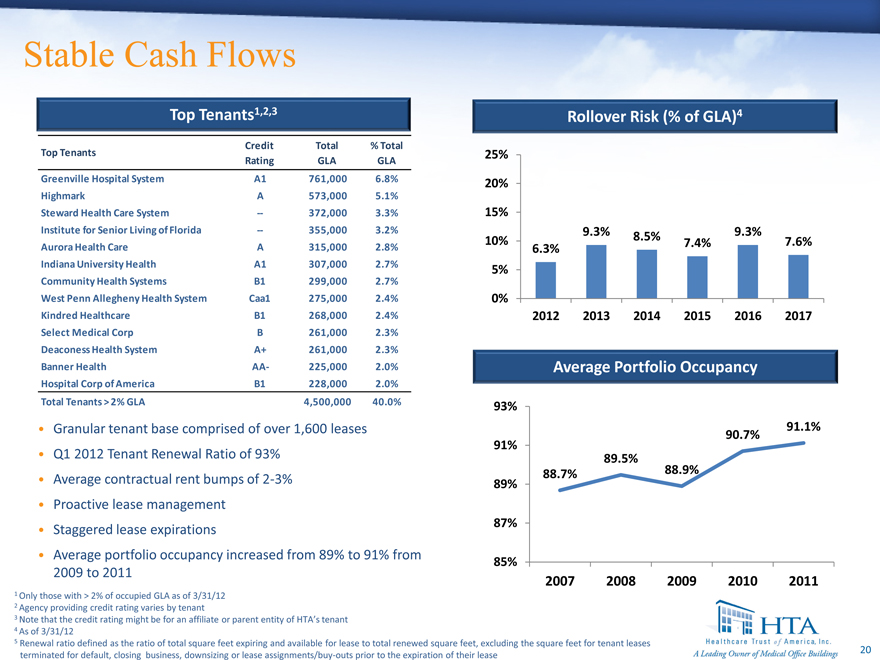

Stable Cash Flows

Top Tenants1,2,3

Top Tenants Credit Total % Total

Rating GLA GLA

Greenville Hospital System A1 761,000 6.8%

Highmark A 573,000 5.1%

Steward Health Care System — 372,000 3.3%

Institute for Senior Living of Florida — 355,000 3.2%

Aurora Health Care A 315,000 2.8%

Indiana University Health A1 307,000 2.7%

Community Health Systems B1 299,000 2.7%

West Penn Allegheny Health System Caa1 275,000 2.4%

Kindred Healthcare B1 268,000 2.4%

Select Medical Corp B 261,000 2.3%

Deaconess Health System A+ 261,000 2.3%

Banner Health AA- 225,000 2.0%

Hospital Corp of America B1 228,000 2.0%

Total Tenants > 2% GLA 4,500,000 40.0%

Granular tenant base comprised of over 1,600 leases Q1 2012 Tenant Renewal Ratio of 93% Average contractual rent bumps of 2-3% Proactive lease management Staggered lease expirations

Average portfolio occupancy increased from 89% to 91% from 2009 to 2011

Rollover Risk (% of GLA)4

25%

20%

15%

10% 9.3% 8.5% 9.3%

6.3% 7.4% 7.6%

5%

0%

2012 2013 2014 2015 2016 2017

Average Portfolio Occupancy

93%

90.7% 91.1%

91%

89.5%

88.7% 88.9%

89%

87%

85%

2007 2008 2009 2010 2011

1 |

| Only those with > 2% of occupied GLA as of 3/31/12 |

2 |

| Agency providing credit rating varies by tenant |

3 |

| Note that the credit rating might be for an affiliate or parent entity of HTA’s tenant |

4 |

| As of 3/31/12 |

5 Renewal ratio defined as the ratio of total square feet expiring and available for lease to total renewed square feet, excluding the square feet for tenant leases terminated for default, closing business, downsizing or lease assignments/buy-outs prior to the expiration of their lease

20

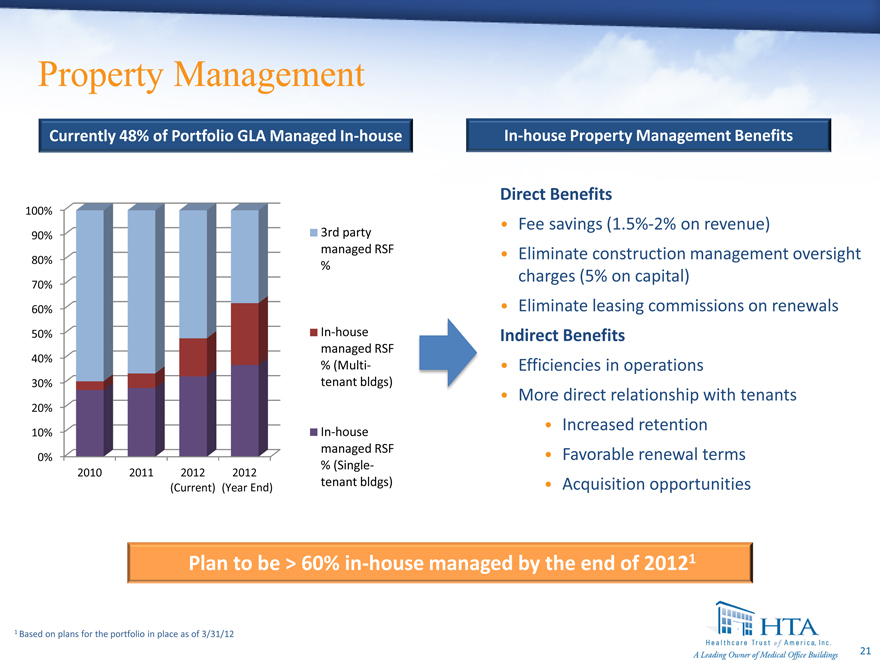

Property Management

Currently 48% of Portfolio GLA Managed In-house

100%

90% 3rd party

managed RSF

80% %

70%

60%

50% In-house

managed RSF

40% % (Multi-

30% tenant bldgs)

20%

10% In-house

managed RSF

0% % (Single-

2010 2011 2012 2012

(Current) (Year End) tenant bldgs)

In-house Property Management Benefits

Direct Benefits

Fee savings (1.5%-2% revenue)

Eliminate construction management oversight

charges (5% on capital) Eliminate leasing commissions on renewals

Indirect Benefits

Efficiencies in operations

More direct relationship with tenants

Increased retention Favorable renewal terms Acquisition opportunities

Plan to be > 60% in-house managed by the end of 20121

1 Based on plans for the portfolio in place as of 3/31/12

21

Intensive Asset Management – Indiana Case Study

Situation

Major health system undergoing strategic changes •Significant near-term rollover in portfolio •Third party property management and leasing

Asset Management Improvements

HTA focused internal resources on Midwest market •Established asset and property management systems key actions included:

2010 — established regional office •2010/11 – hired 10 person team

2011/12 – transitioned 1.2mm SF in-house

Value Enhancement

2.5% Y-o-Y same store occupancy growth 91% retention in 2011 vs 80% in 2010 4.0% same store cash NOI growth over 2010

Significant improvement in property fundamentals1

Total estimated annualized savings of over $450k in 2012 •Total of 2.0M SF, or 84% of regional GLA, projected to be under in-house management by end of 2012

1 Excludes one property designated for redevelopment

2 Retention rate defined as the ratio of total square feet expiring and available for lease to total renewed square feet, excluding the square feet for tenant leases terminated for default, closing business, downsizing or lease assignments/buy-outs prior to the expiration of their lease

22

Healthcare Sector Fundamentals

23

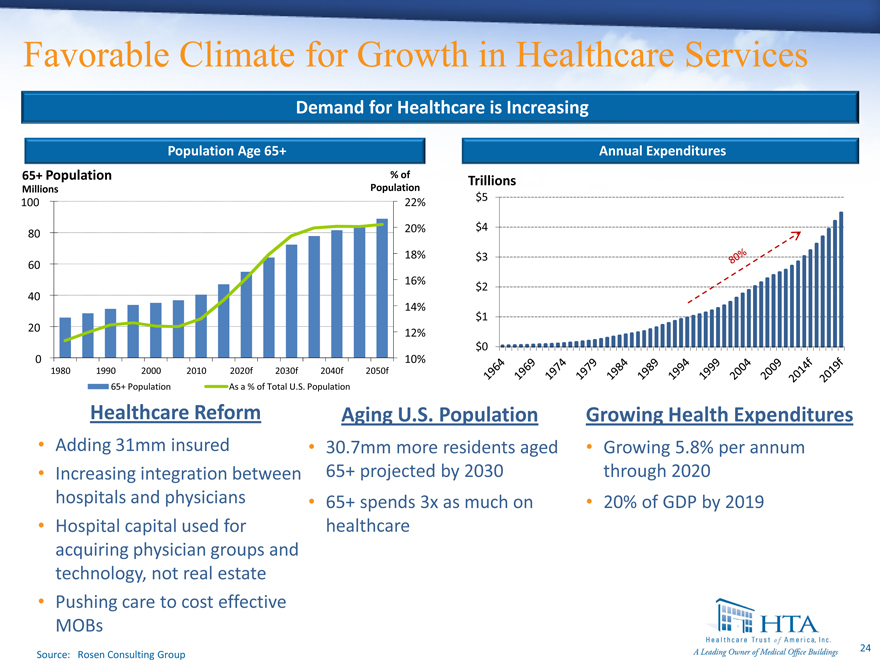

Favorable Climate for Growth in Healthcare Services

Demand for Healthcare is Increasing

Population Age 65+

65+ Population % of

Millions Population

100 22%

80 20%

18%

60

16%

40

14%

20 12%

0 10%

1980 1990 2000 2010 2020f 2030f 2040f 2050f

65+ Population As a % of Total U.S. Population

Annual Expenditures

80%

Trillions 1964

$5 1969

$4 1974

$3 1979

$2 1984

$1 1989

$0 1994

1999

2004

2009

2014f

2019f

Healthcare Reform

Adding 31mm insured

Increasing integration between hospitals and physicians Hospital capital used for acquiring physician groups and technology, not real estate

Pushing care to cost effective MOBs

Aging U.S. Population

30.7mm more residents aged 65+ projected by 2030

65+ spends 3x as much on healthcare

Growing Health Expenditures

Growing 5.8% per annum through 2020

20% of GDP by 2019

Source: Rosen Consulting Group

24

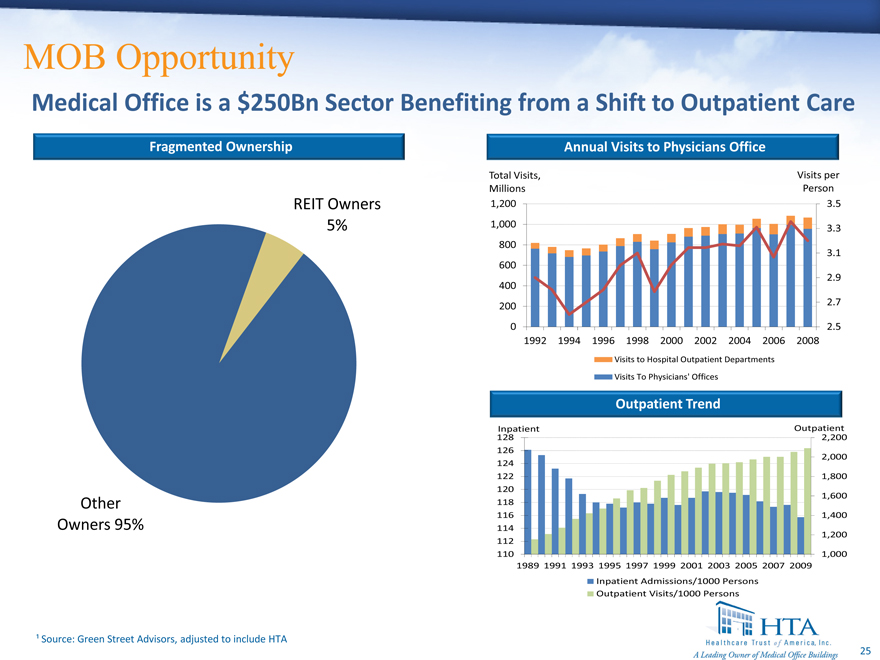

MOB Opportunity

Medical Office is a $250Bn Sector Benefiting from a Shift to Outpatient Care

Fragmented Ownership

REIT Owners 5%

Other Owners 95%

Annual Visits to Physicians Office

Total Visits, Visits per

Millions Person

1,200 3.5

1,000 3.3

800

3.1

600

2.9

400

200 2.7

0 2.5

1992 1994 1996 1998 2000 2002 2004 2006 2008

Visits to Hospital Outpatient Departments Visits To Physicians’ Offices

Outpatient Trend

Inpatient Outpatient

128 2,200

126

2,000

124

122 1,800

120

1,600

118

116 1,400

114

1,200

112

110 1,000

1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009

Inpatient Admissions/1000 Persons Outpatient Visits/1000 Persons

¹ Source: Green Street Advisors, adjusted to include HTA

25

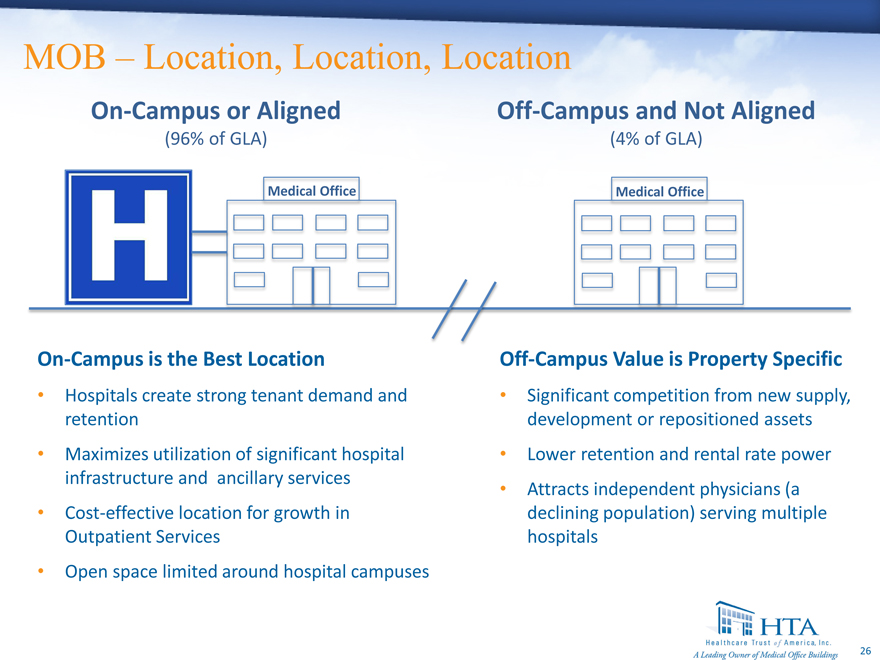

MOB – Location, Location, Location

On-Campus or Aligned

(96% of GLA)

Medical Office

Off-Campus and Not Aligned

(4% of GLA)

Medical Office

On-Campus is the Best Location

Hospitals create strong tenant demand and retention Maximizes utilization of significant hospital infrastructure and ancillary services Cost-effective location for growth in Outpatient Services Open space limited around hospital campuses

Off-Campus Value is Property Specific

Significant competition from new supply, development or repositioned assets

Lower retention and rental rate power

Attracts independent physicians (a declining population) serving multiple hospitals

26

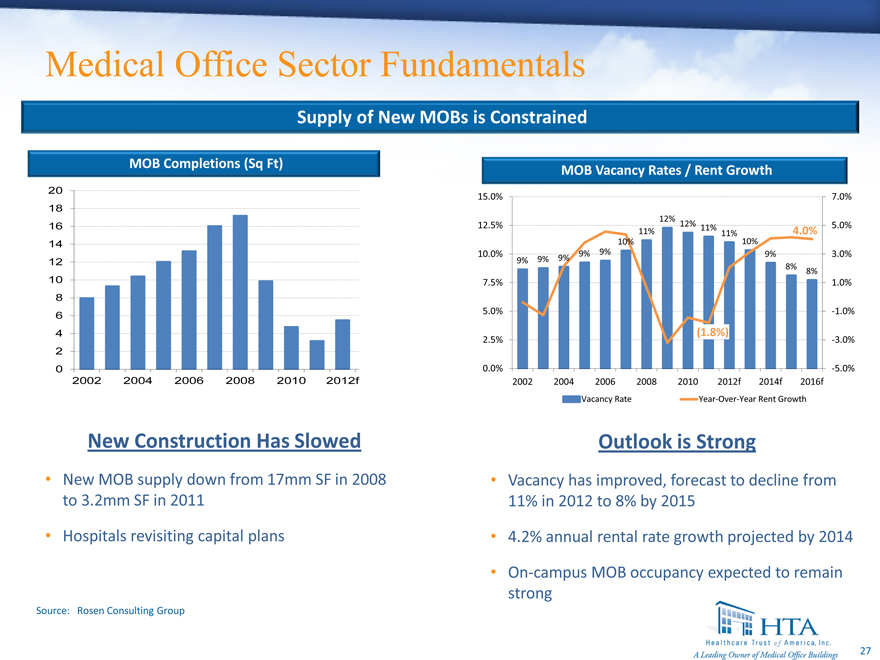

Medical Office Sector Fundamentals

Supply of New MOBs is Constrained

MOB Completions (Sq Ft)

20

18

16

14

12

10

8

6

4

2

0

2002 2004 2006 2008 2010 2012f

MOB Vacancy Rates / Rent Growth

15.0% 7.0%

12.5% 12% 12% 5.0%

11% 11% 11% 4.0%

10% 10%

10.0% 9% 9% 9% 3.0%

9% 9% 9%

8% 8%

7.5% 1.0%

5.0% -1.0%

(1.8%)

2.5% -3.0%

0.0% -5.0%

2002 2004 2006 2008 2010 2012f 2014f 2016f

Vacancy Rate

Year-Over-Year Rent Growth

New Construction Has Slowed

New MOB supply down from 17mm SF in 2008 to 3.2mm SF in 2011

Hospitals revisiting capital plans

Outlook is Strong

Vacancy has improved, forecast to decline from 11% in 2012 to 8% by 2015

4.2% annual rental rate growth projected by 2014

On-campus MOB occupancy expected to remain strong

Source: Rosen Consulting Group

27

Acquisition Strategy

HTA Positioned to Capitalize

Healthcare

Systems

Hospitals Developers

Mortgage Lenders

Brokers

Real Estate

Brokers

HTA has developed and maintains extensive industry relationships that continue to provide opportunities to

access both direct and off-market transactions

MOB developers continue to bring existing and future acquisitions to HTA because, unlike other healthcare

REITs, we do not compete for new MOB development opportunities

o HTA acquired over $650 million in MOBs directly from MOB developers since 2009

o HTA acquired over $400 million in MOBs directly from Health Systems since 2009

o Hospital and Developer acquisitions represent approximately 69% of transactions1 2009- present

Strong relationships with hospital systems drive incremental demand for our MOB space, support increased

tenant retention rates and provide further investment opportunities

1 Transactions measured by acquisition price

Financial Review

29

Financial Highlights

Strong Business Model

MOB fundamentals provide for stable, steady growth Healthcare sector – fastest growing part of the economy On-campus and affiliated buildings in key locations

Proven Track Record of Growth

Historical NOI / FFO growth

Acquisition target size achieves substantial growth Strong financial performance model

Stable, Predictable Cash Flows

Credit Tenants

Lease structure—good mix of stability and growth

Consistently high occupancy Limited lease rollover Best in class assets

Investment Grade Balance Sheet

Leverage – low relative to peers Limited near-term debt maturities Significant growth capacity

Lowering the cost of borrowing through recent unsecured debt issuances

30

Proven Growth Track Record

Total NOI ($mm)

$206

$200 $186

$150 $137

$100 $85

$52

$50

$0

2008 2009 2010 2011 1Q12 2

Normalized Funds From Operations1 ($mm)

$140

$128

$120 $115

$100

$84

$80

$60

$43

$40

$22

$20

$0

2008 2009 2010 2011 1Q12 2

NOI growth driven by prudent, disciplined acquisitions and same store growth Normalized FFO growing faster than NOI as scale improves

Note: NOI and Normalized FFO are non-GAAP measures. Please refer to HTA’s Form 10K for the period ended 12/31/11 for complete reconciliation of these calculations.

1 Normalized FFO is defined as net income excluding depreciation and amortization, gain and loss from the sale of real estate, acquisition expense, gain and loss from derivative instruments, lease termination fees, and other one-time items

2 1Q12 is presented on an assumed annualized basis as if 1Q12 acquisitions closed on 1/1/12. Refer to the “Forward Looking Statements”, as the assumed annualized number may exceed actual results

31

|

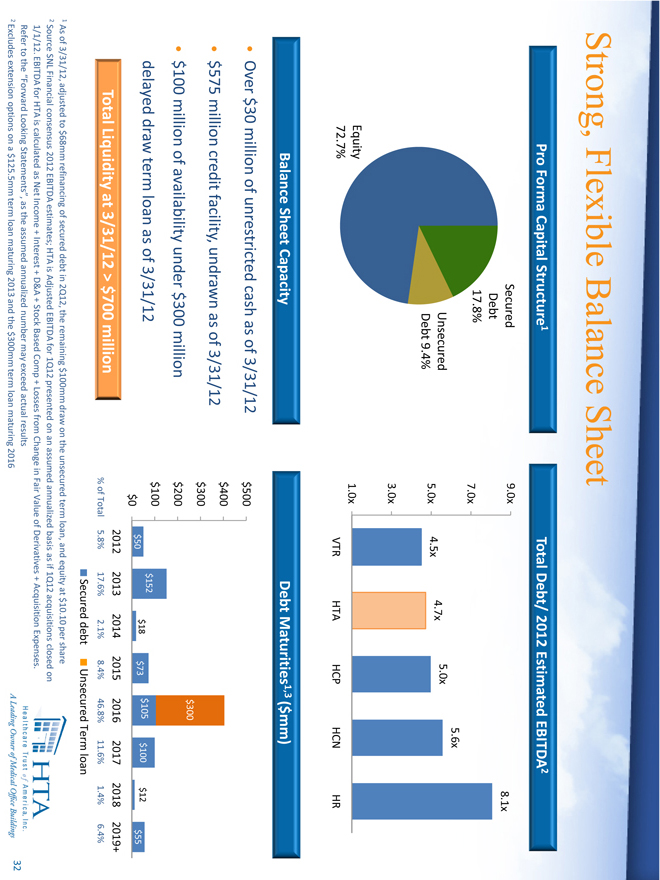

Strong, Flexible Balance Sheet

Pro Forma Capital Structure1 Total Debt/ 2012 Estimated EBITDA2

Secured 9.0x

8.1x Debt 17.8% 7.0x Unsecured 5.0x 5.6x 4.5x 4.7x Debt 9.4% 5.0x 3.0x

Equity 1.0x

72.7% VTR HTA HCP HCN HR

Balance Sheet Capacity Debt Maturities1,3 ($mm)

Over $30 million of unrestricted cash as of 3/31/12 $500

$400

$575 million credit facility, undrawn as of 3/31/12 $300

$300

$100 million of availability under $300 million $200

$100

delayed draw term loan as of 3/31/12 $152 $105

$18 $73 $100 $12 $0 $50 $55

Total Liquidity at 3/31/12 > $700 million 2012 2013 2014 2015 2016 2017 2018 2019+

% of Total 5.8% 17.6% 2.1% 8.4% 46.8% 11.6% 1.4% 6.4% Secured debt Unsecured Term loan

1 As of 3/31/12, adjusted to $68mm refinancing of secured debt in 2Q12, the remaining $100mm draw on the unsecured term loan, and equity at $10.10 per share

2 Source SNL Financial consensus 2012 EBITDA estimates; HTA is Adjusted EBITDA for 1Q12 presented on an assumed annualized basis as if 1Q12 acquisitions closed on 1/1/12. EBITDA for HTA is calculated as Net Income + Interest + D&A + Stock Based Comp + Losses from Change in Fair Value of Derivatives + Acquisition Expenses. Refer to the “Forward Looking Statements”, as the assumed annualized number may exceed actual results

2 Excludes extension options on a $125.5mm term loan maturing 2013 and the $300mm term loan maturing 2016

|

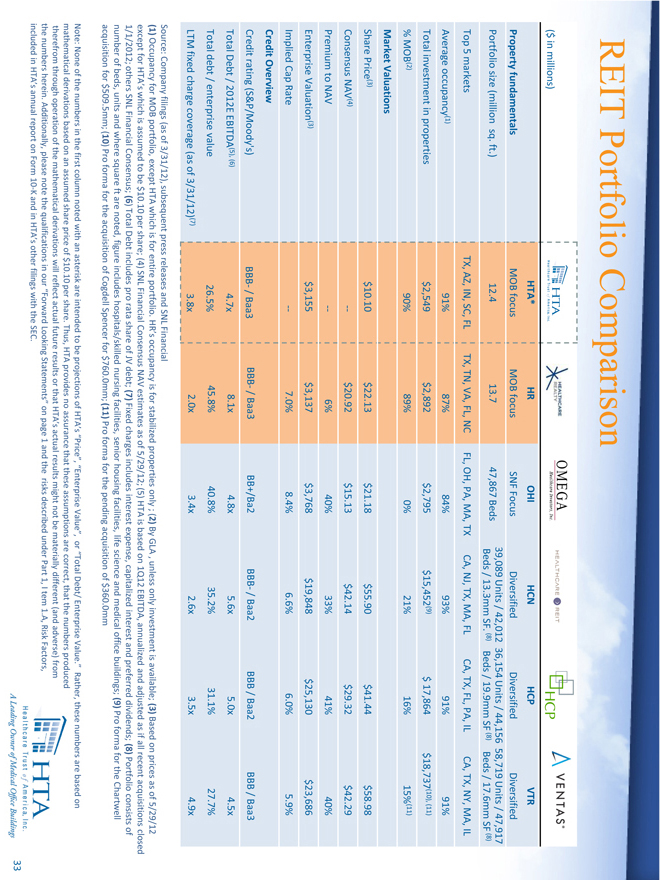

REIT Portfolio Comparison

($ in millions)

HTA* HR OHI HCN HCP VTR Property fundamentals MOB focus MOB focus SNF Focus Diversified Diversified Diversified 39,089 Units / 42,012 36,154 Units / 44,156 58,719 Units / 47,917 Portfolio size (million sq. ft.) 12.4 13.7 47,867 Beds (8) (8) (8) Beds / 13.3mm SF. Beds / 19.9mm SF Beds / 17.6mm SF Top 5 markets TX, AZ, IN, SC, FL TX, TN, VA, FL, NC FL, OH, PA, MA, TX CA, NJ, TX, MA, FL CA, TX, FL, PA, IL CA, TX, NY, MA, IL Average occupancy(1) 91% 87% 84% 93% 91% 91% Total investment in properties $2,549 $2,892 $2,795 $15,452(9) $ 17,864 $18,737(10), (11)

% MOB(2) 90% 89% 0% 21% 16% 15%(11)

Market Valuations

Share Price(3) $10.10 $22.13 $21.18 $55.90 $41.44 $58.98 Consensus NAV(4) -- $20.92 $15.13 $42.14 $29.32 $42.29 Premium to NAV -- 6% 40% 33% 41% 40% Enterprise Valuation(3) $3,155 $3,137 $3,768 $19,848 $25,130 $23,686 Implied Cap Rate -- 7.0% 8.4% 6.6% 6.0% 5.9%

Credit Overview

Credit rating (S&P/Moody’s) BBB- / Baa3 BBB- / Baa3 BB+/Ba2 BBB- / Baa2 BBB / Baa2 BBB / Baa3 Total Debt / 2012E EBITDA(5), (6) 4.7x 8.1x 4.8x 5.6x 5.0x 4.5x Total debt / enterprise value 26.5% 45.8% 40.8% 35.2% 31.1% 27.7% LTM fixed charge coverage (as of 3/31/12)(7) 3.8x 2.0x 3.4x 2.6x 3.5x 4.9x

Source: Company filings (as of 3/31/12), subsequent press releases and SNL Financial

(1) Occupancy for MOB portfolio, except HTA which is for entire portfolio. HR’s occupancy is for stabilized properties only ; (2) By GLA , unless only investment is available; (3) Based on prices as of 5/29/12 except for HTA’s which is assumed to be $10.10 per share; (4) SNL Financial Consensus NAV estimates as of 5/29/12; (5) HTA is based on 1Q12 EBITDA, annualized and adjusted as if all recent acquisitions closed 1/1/2012; others SNL Financial Consensus; (6) Total Debt includes pro rata share of JV debt; (7) Fixed charges includes interest expense, capitalized interest and preferred dividends; (8) Portfolio consists of number of beds, units and where square ft are noted, figure includes hospitals/skilled nursing facilities, senior housing facilities, life science and medical office buildings; (9) Pro forma for the Chartwell acquisition for $509.5mm; (10) Pro forma for the acquisition of Cogdell Spencer for $760.0mm; (11) Pro forma for the pending acquisition of $360.0mm

Note: None of the numbers in the first column noted with an asterisk are intended to be projections of HTA’s “Price”, “Enterprise Value”, or “Total Debt/ Enterprise Value.” Rather, these numbers are based on mathematical derivations based on an assumed share price of $10.10 per share. Thus, HTA provides no assurance that these assumptions are correct, that the numbers produced therefrom through operation of the mathematical derivations will reflect actual future results or that HTA’s actual results might not be materially different (and adverse) from the numbers herein. Additionally, please note the qualifications in our “Forward Looking Statements” on page 1 and the risks described under Part 1, I tem 1.A, Risk Factors, included in HTA’s annual report on Form 10-K and in HTA’s other filings with the SEC.

Key Investment Highlights

High Quality Medical Office Building Portfolio

Attractive Industry Fundamentals

Extensive Relationships Generating Attractive External Growth Opportunities

Experienced Senior Management Team with Proven Track Record

Conservative Balance Sheet with Growth-Oriented Capital Structure

Greenville Life Center

(Greenville, SC)

Desert Ridge

(Phoenix, AZ)

34

Investment Execution & Summary

35

Listing on the NYSE

HTA has applied to list its shares1 on the NYSE Anticipated timing is on or about June 6, 2012

HTA will lower the dividend per share to $0.575 to provide a yield competitive with HTA’s publicly traded peers

1 |

| 1st tranche of Class A shares |

36

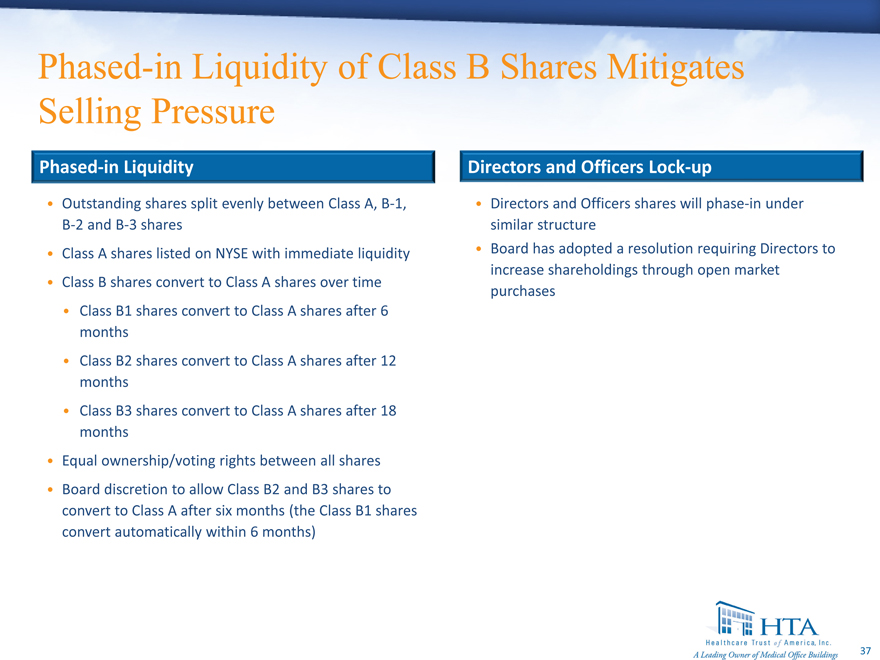

Phased-in Liquidity of Class B Shares Mitigates Selling Pressure

Phased-in Liquidity

Outstanding shares split evenly between Class A, B-1, B-2 and B-3 shares

Class A shares listed on NYSE with immediate liquidity

Class B shares convert to Class A shares over time

Class B1 shares convert to Class A shares after 6 months

Class B2 shares convert to Class A shares after 12 months

Class B3 shares convert to Class A shares after 18 months

Equal ownership/voting rights between all shares

Board discretion to allow Class B2 and B3 shares to convert to Class A after six months (the Class B1 shares convert automatically within 6 months)

Directors and Officers Lock-up

Directors and Officers shares will phase-in under similar structure

Board has adopted a resolution requiring Directors to increase shareholdings through open market purchases

37