99.1 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 HEALTHCARE TRUST OF AMERICA, INC. NYSE: HTA Healthcare Trust of America, Inc. A Leading Owner of Medical Office Buildings Exhibit 99.2

Table of Contents Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Such statements include, in particular, statements about our plans, strategies and prospects and estimates regarding future medical office market performance. Such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward- looking statements are generally identifiable by use of the terms such as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. Forward looking statements speak only as of the date made and we do not intendto publicly updateor revise anyforward-looking statements, whether as a result of new information,future events,or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially and adversely affect our financial results, is included herein and in our other filings with the SEC. 2 Company Overview Company Information 3 Current Period Highlights 4 Financial Highlights 5 Company Snapshot 6 Financial Information Funds From Operations (FFO), Normalized Funds From Operations, and Normalized Funds Available for Distribution 7 Market Capitalization and Debt Composition 8 Interest Expense and Covenants 9 2013 Acquisitions and Historical Acquisition Activity 10 Portfolio Information Key Market Concentration and Regional Portfolio Distribution 11 Same-Property Performance and Net Operating Income 12 Portfolio Diversification by Type and Historical Campus Proximity 13 Tenant Lease Expirations and Historical Occupancy 14 Top 15 Health System Relationships and In-House Property Management 15 Health System Relationship Highlights 16 Consolidated Balance Sheets 17 Consolidated Statements of Operations 18 Reporting Definitions 19 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

Senior Management Scott D. Peters Kellie S. Pruitt Mark D. Engstrom Chairman, Chief Executive Officer, Chief Financial Officer, Secretary, Executive Vice President- and President and Treasurer Acquisitions Amanda L. Houghton Robert A. Milligan Executive Vice President- Senior Vice President- Asset Management Corporate Finance Contact Information Corporate Headquarters 16435 North Scottsdale Road Suite 320 Scottsdale, AZ 85254 (480) 998-3478 Transfer Agent Financial Contact Investor Relations DST Systems, Inc. Kellie S. Pruitt Robert A. Milligan 430 West 7th Street Chief Financial Officer Senior Vice President- Corporate Finance Kansas City, MO 64105 16435 North Scottsdale Road 16435 North Scottsdale Road (888) 801-0107 Suite 320 Suite 320 Scottsdale, AZ 85254 Scottsdale, AZ 85254 (480) 258-6637 (480) 998-3478 Email: kelliepruitt@htareit.com Email: robertmilligan@htareit.com Healthcare Trust of America, Inc. (NYSE: HTA), a publicly traded real estate investment trust, is a fully-integrated, leading owner of medical office buildings, or "MOBs". HTA is a full-service real estate company focused on acquiring, owning and operating high-quality medical office buildings that are predominantly located on, or aligned with, campuses of nationally or regionally recognized healthcare systems in the U.S. Since its formation in 2006, HTA has built a portfolio of properties that totals approximately $3.0 billion based on purchase price and is comprised of approximately 14.1 million square feet of gross leasable area, or "GLA", located in 27 states. HTA has developed a national property management and leasing platform which it directs through its primary regional offices in Albany, Atlanta, Boston, Charleston, Dallas, Indianapolis, Pittsburgh and Scottsdale. At the end of the fourth quarter, approximately 85% of HTA’s total portfolio GLA is managed internally on this platform. 3 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

Current Period Highlights Operating - Fourth Quarter • FFO: $0.16 per diluted share, or $38.0 million, an increase of $0.03 per diluted share, compared to Q4 2012. • Normalized FFO: $0.17 per diluted share, or $40.1 million, an increase of $0.01 per diluted share, or 6.3%, compared to Q4 2012. • Normalized FAD: $0.15 per diluted share, or $34.9 million, an increase of $0.01 per diluted share, or 7.1%, compared to Q4 2012. • Same-Property Adjusted NOI: $51.4 million, an increase of $1.5 million, or 3.0%, compared to Q4 2012. Same-property cash rental revenue increased 2.2%, compared to Q4 2012. • NOI: $59.3 million, an increase of $7.3 million, or 14.0%, compared to Q4 2012. Portfolio • Acquisitions: During the quarter, HTA completed three acquisitions totaling $155.9 million (98% leased and approximately 450,000 square feet of GLA). For the full year, HTA acquired $397.8 million of medical office buildings (95% leased and approximately 1.5 million square feet of GLA), an increase in HTA's total investments by more than 15%, by purchase price. • Occupancy: Grew occupancy of GLA by approximately 50 basis points to 91.6% from 91.1% at December 31, 2012. • Leasing: During the quarter, HTA entered into new or renewal leases on approximately 199,000 square feet of GLA, or approximately 1.4% of its portfolio. Tenant retention for the quarter was approximately 86% by GLA. For the year, HTA entered into new or renewal leases on approximately 1,396,000 square feet of GLA, or approximately 9.9% of its portfolio and tenant retention was approximately 85% by GLA. • In-House Property Management and Leasing Platform: During 2013, HTA transitioned an additional 3.2 million square feet to the in-house property management and leasing platform which operates 12.0 million square feet, or 85% of total GLA, as of year-end 2013. Balance Sheet and Liquidity • Balance Sheet: At the end of the quarter, HTA had total liquidity of $613.1 million, including $595.0 million of availability on its unsecured revolving credit facility, and $18.1 million of cash and cash equivalents. The leverage ratio of total debt to total capitalization was 34.0%. • Credit Rating Upgrade: In December 2013, Moody’s upgraded HTA's investment grade credit rating to Baa2, with a stable outlook. This upgrade reduced the borrowing rate and facility fees on the variable rate term loans and revolving credit facility. The total interest expense savings on the current outstanding balances on these facilities is expected to be approximately $2.5 million in 2014. • Share Conversion: In November 2013, the remaining shares of Class B common stock converted to shares of Class A common stock providing full liquidity to the original stockholders. As a result, all outstanding shares of HTA's common stock have converted to shares of Class A common stock and are eligible to trade on the NYSE. • Debt Refinance: Subsequent to the end of the quarter, HTA amended its $300.0 million term loan which extended the initial maturity to January 2018 and decreased the interest rate to LIBOR plus 1.2% based on our upgraded credit rating. 4 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

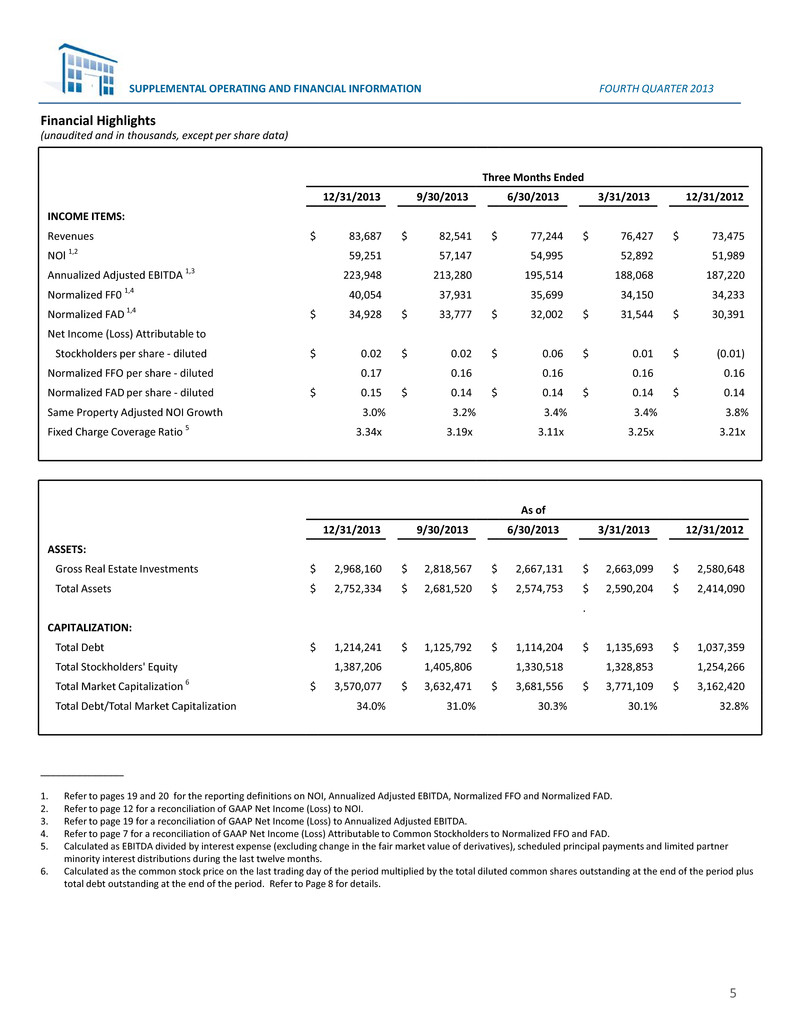

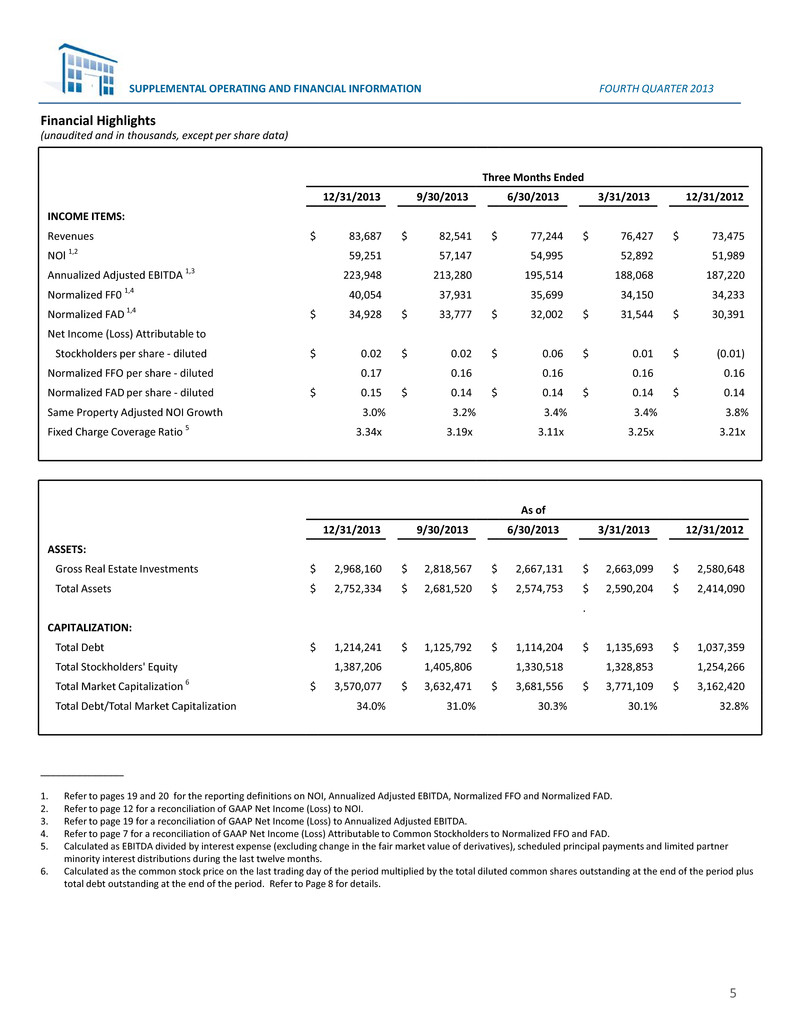

________________ 1. Refer to pages 19 and 20 for the reporting definitions on NOI, Annualized Adjusted EBITDA, Normalized FFO and Normalized FAD. 2. Refer to page 12 for a reconciliation of GAAP Net Income (Loss) to NOI. 3. Refer to page 19 for a reconciliation of GAAP Net Income (Loss) to Annualized Adjusted EBITDA. 4. Refer to page 7 for a reconciliation of GAAP Net Income (Loss) Attributable to Common Stockholders to Normalized FFO and FAD. 5. Calculated as EBITDA divided by interest expense (excluding change in the fair market value of derivatives), scheduled principal payments and limited partner minority interest distributions during the last twelve months. 6. Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period plus total debt outstanding at the end of the period. Refer to Page 8 for details. Financial Highlights (unaudited and in thousands, except per share data) 5 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Three Months Ended 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012 INCOME ITEMS: Revenues $ 83,687 $ 82,541 $ 77,244 $ 76,427 $ 73,475 NOl 1,2 59,251 57,147 54,995 52,892 51,989 Annualized Adjusted EBITDA 1,3 223,948 213,280 195,514 188,068 187,220 Normalized FF0 1,4 40,054 37,931 35,699 34,150 34,233 Normalized FAD 1,4 $ 34,928 $ 33,777 $ 32,002 $ 31,544 $ 30,391 Net Income (Loss) Attributable to Stockholders per share - diluted $ 0.02 $ 0.02 $ 0.06 $ 0.01 $ (0.01) Normalized FFO per share - diluted 0.17 0.16 0.16 0.16 0.16 Normalized FAD per share - diluted $ 0.15 $ 0.14 $ 0.14 $ 0.14 $ 0.14 Same Property Adjusted NOI Growth 3.0% 3.2% 3.4% 3.4% 3.8% Fixed Charge Coverage Ratio 5 3.34x 3.19x 3.11x 3.25x 3.21x As of 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012 ASSETS: Gross Real Estate Investments $ 2,968,160 $ 2,818,567 $ 2,667,131 $ 2,663,099 $ 2,580,648 Total Assets $ 2,752,334 $ 2,681,520 $ 2,574,753 $ 2,590,204 $ 2,414,090 . CAPITALIZATION: Total Debt $ 1,214,241 $ 1,125,792 $ 1,114,204 $ 1,135,693 $ 1,037,359 Total Stockholders' Equity 1,387,206 1,405,806 1,330,518 1,328,853 1,254,266 Total Market Capitalization 6 $ 3,570,077 $ 3,632,471 $ 3,681,556 $ 3,771,109 $ 3,162,420 Total Debt/Total Market Capitalization 34.0% 31.0% 30.3% 30.1% 32.8%

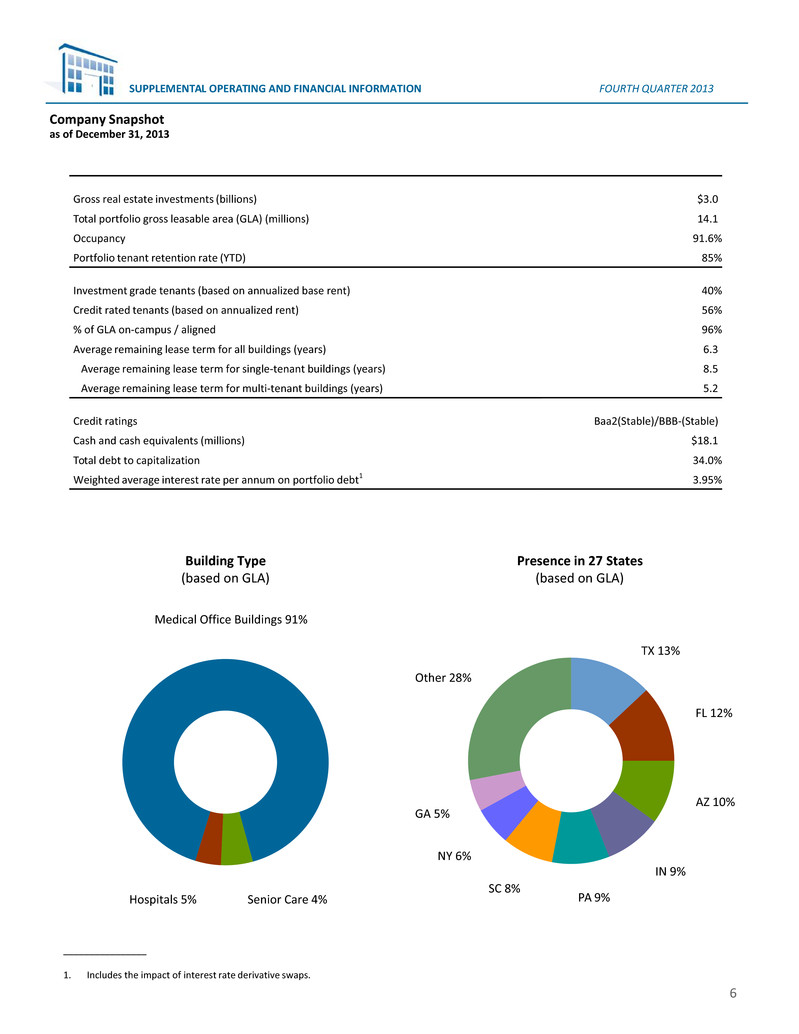

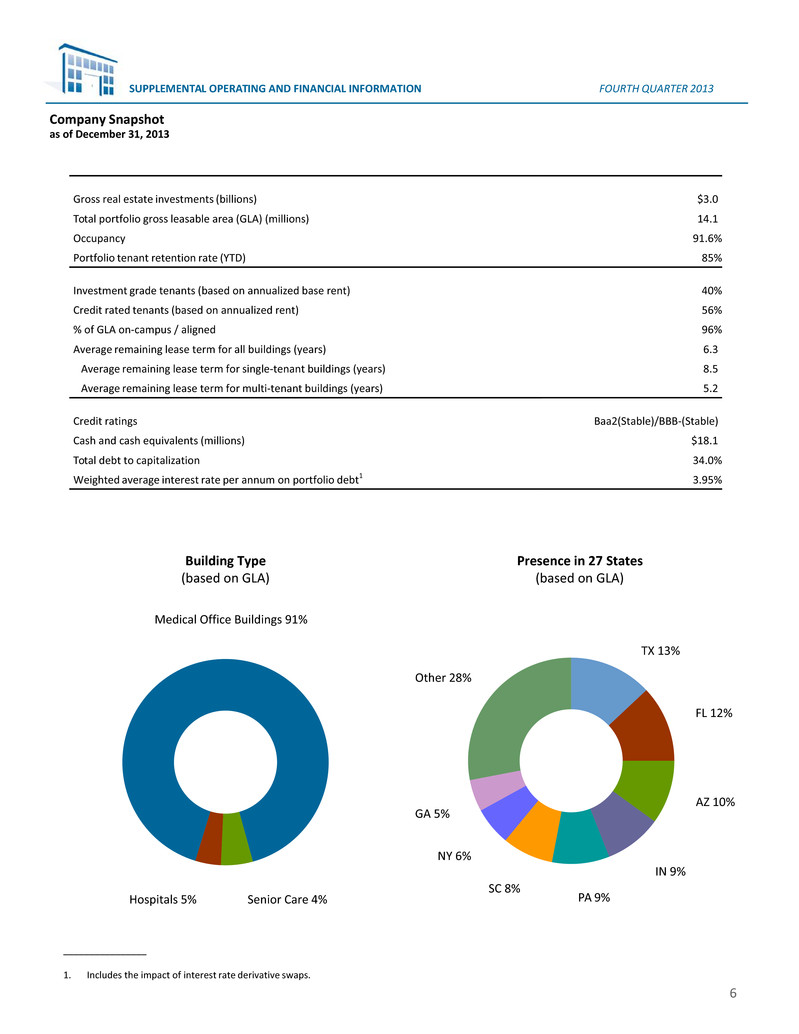

Company Snapshot as of December 31, 2013 ________________ 1. Includes the impact of interest rate derivative swaps. Gross real estate investments (billions) $3.0 Total portfolio gross leasable area (GLA) (millions) 14.1 Occupancy 91.6% Portfolio tenant retention rate (YTD) 85% Investment grade tenants (based on annualized base rent) 40% Credit rated tenants (based on annualized rent) 56% % of GLA on-campus / aligned 96% Average remaining lease term for all buildings (years) 6.3 Average remaining lease term for single-tenant buildings (years) 8.5 Average remaining lease term for multi-tenant buildings (years) 5.2 Credit ratings Baa2(Stable)/BBB-(Stable) Cash and cash equivalents (millions) $18.1 Total debt to capitalization 34.0% Weighted average interest rate per annum on portfolio debt1 3.95% Building Type (based on GLA) Presence in 27 States (based on GLA) 6 Hospitals 5% Senior Care 4% Medical Office Buildings 91% TX 13% FL 12% AZ 10% IN 9% PA 9% Other 28% GA 5% NY 6% SC 8% SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

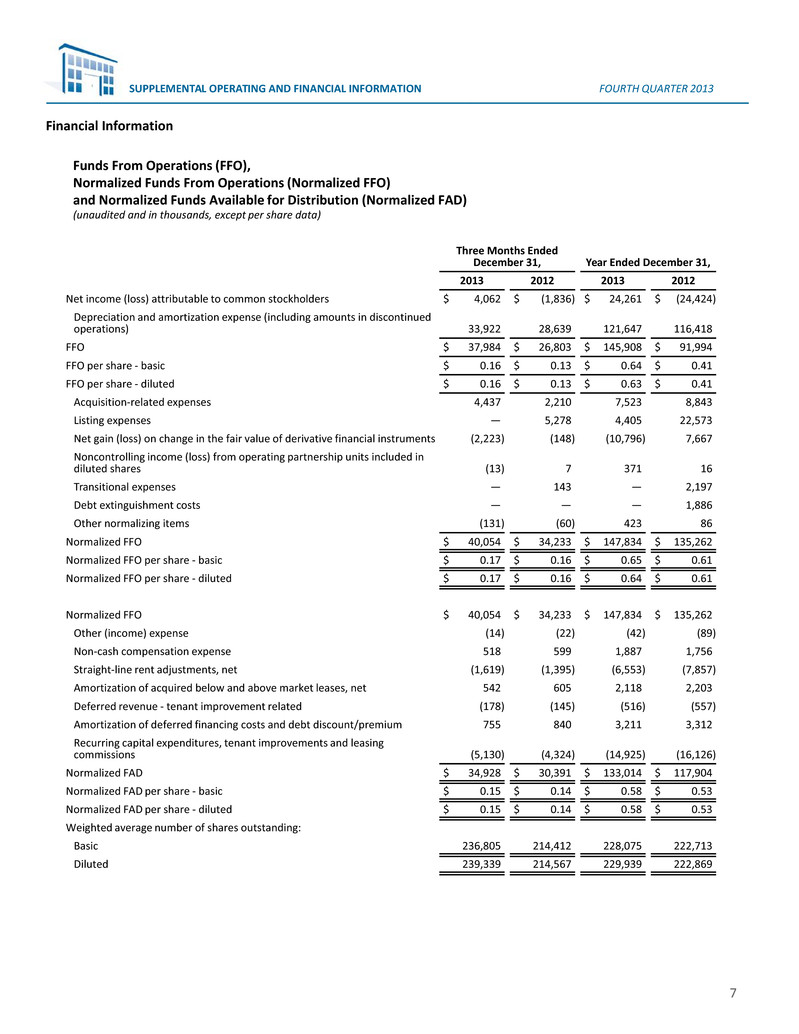

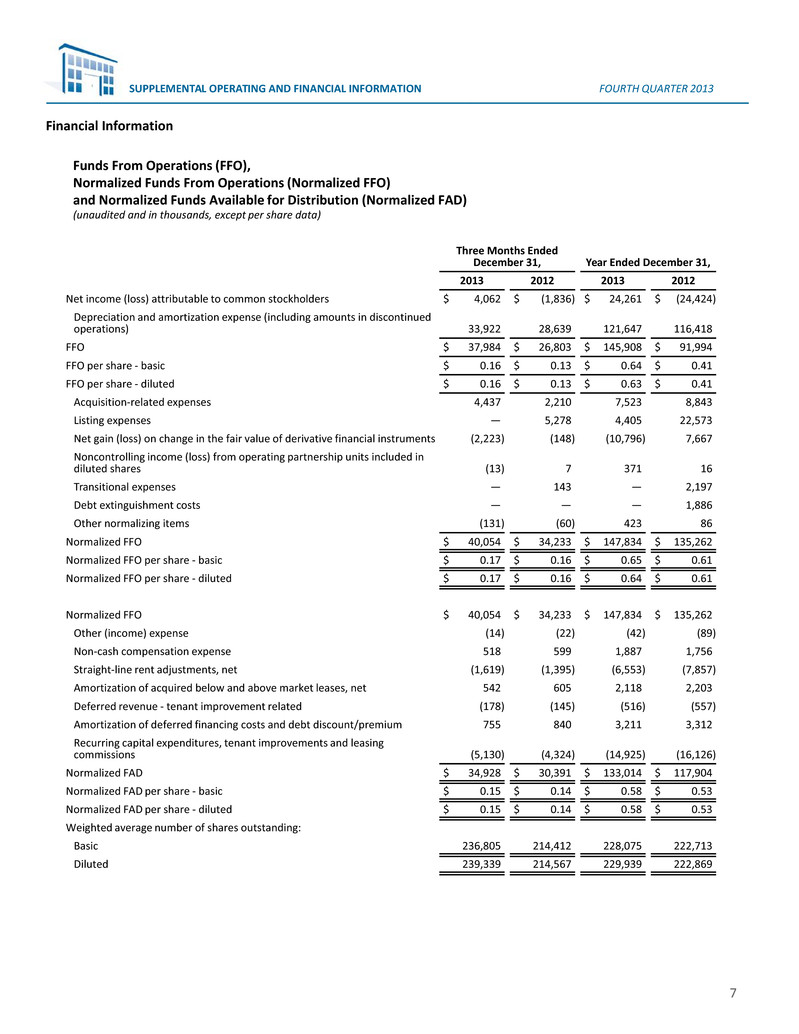

Funds From Operations (FFO), Normalized Funds From Operations (Normalized FFO) and Normalized Funds Available for Distribution (Normalized FAD) (unaudited and in thousands, except per share data) Financial Information Three Months Ended December 31, Year Ended December 31, 2013 2012 2013 2012 Net income (loss) attributable to common stockholders $ 4,062 $ (1,836) $ 24,261 $ (24,424) Depreciation and amortization expense (including amounts in discontinued operations) 33,922 28,639 121,647 116,418 FFO $ 37,984 $ 26,803 $ 145,908 $ 91,994 FFO per share - basic $ 0.16 $ 0.13 $ 0.64 $ 0.41 FFO per share - diluted $ 0.16 $ 0.13 $ 0.63 $ 0.41 Acquisition-related expenses 4,437 2,210 7,523 8,843 Listing expenses — 5,278 4,405 22,573 Net gain (loss) on change in the fair value of derivative financial instruments (2,223) (148) (10,796) 7,667 Noncontrolling income (loss) from operating partnership units included in diluted shares (13) 7 371 16 Transitional expenses — 143 — 2,197 Debt extinguishment costs — — — 1,886 Other normalizing items (131) (60) 423 86 Normalized FFO $ 40,054 $ 34,233 $ 147,834 $ 135,262 Normalized FFO per share - basic $ 0.17 $ 0.16 $ 0.65 $ 0.61 Normalized FFO per share - diluted $ 0.17 $ 0.16 $ 0.64 $ 0.61 Normalized FFO $ 40,054 $ 34,233 $ 147,834 $ 135,262 Other (income) expense (14) (22) (42) (89) Non-cash compensation expense 518 599 1,887 1,756 Straight-line rent adjustments, net (1,619) (1,395) (6,553) (7,857) Amortization of acquired below and above market leases, net 542 605 2,118 2,203 Deferred revenue - tenant improvement related (178) (145) (516) (557) Amortization of deferred financing costs and debt discount/premium 755 840 3,211 3,312 Recurring capital expenditures, tenant improvements and leasing commissions (5,130) (4,324) (14,925) (16,126) Normalized FAD $ 34,928 $ 30,391 $ 133,014 $ 117,904 Normalized FAD per share - basic $ 0.15 $ 0.14 $ 0.58 $ 0.53 Normalized FAD per share - diluted $ 0.15 $ 0.14 $ 0.58 $ 0.53 Weighted average number of shares outstanding: Basic 236,805 214,412 228,075 222,713 Diluted 239,339 214,567 229,939 222,869 7 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

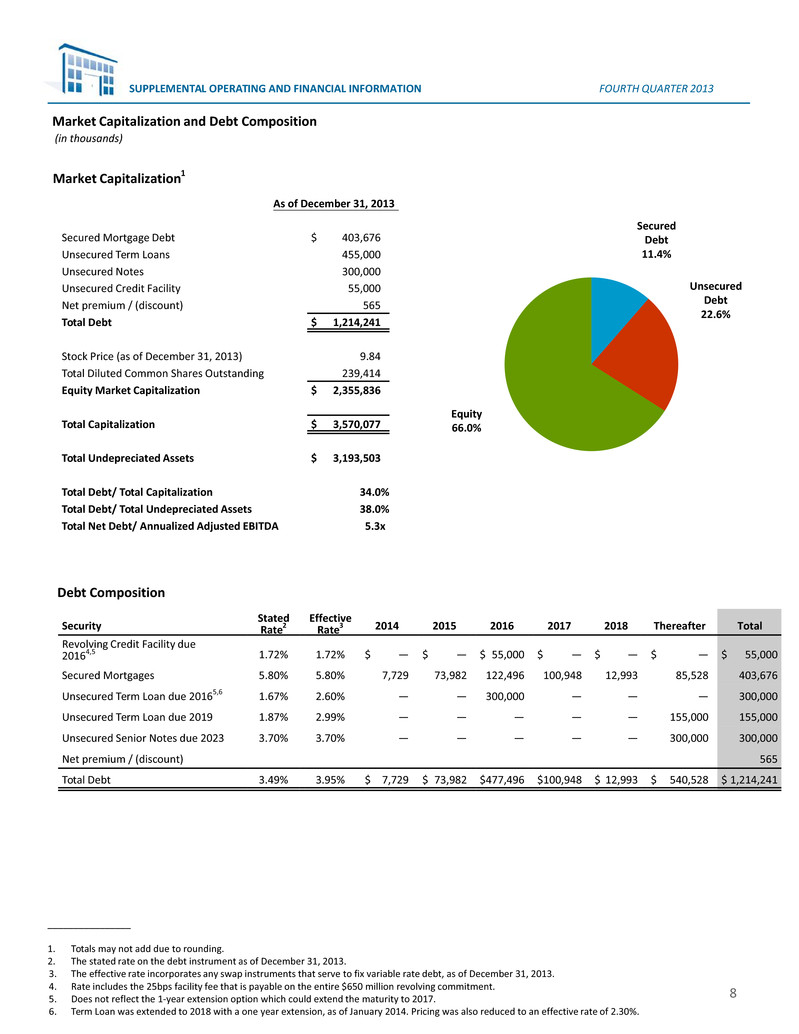

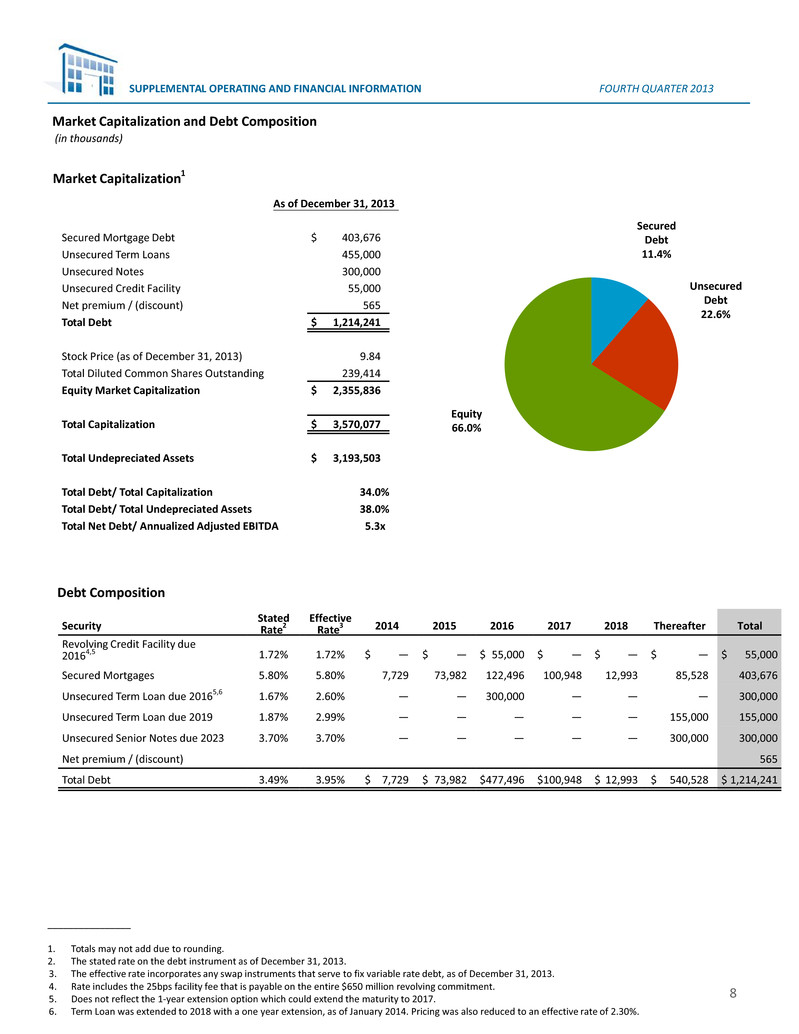

Market Capitalization and Debt Composition Market Capitalization1 ________________ 1. Totals may not add due to rounding. 2. The stated rate on the debt instrument as of December 31, 2013. 3. The effective rate incorporates any swap instruments that serve to fix variable rate debt, as of December 31, 2013. 4. Rate includes the 25bps facility fee that is payable on the entire $650 million revolving commitment. 5. Does not reflect the 1-year extension option which could extend the maturity to 2017. 6. Term Loan was extended to 2018 with a one year extension, as of January 2014. Pricing was also reduced to an effective rate of 2.30%. (in thousands) Debt Composition As of December 31, 2013 Secured Mortgage Debt $ 403,676 Unsecured Term Loans 455,000 Unsecured Notes 300,000 Unsecured Credit Facility 55,000 Net premium / (discount) 565 Total Debt $ 1,214,241 Stock Price (as of December 31, 2013) 9.84 Total Diluted Common Shares Outstanding 239,414 Equity Market Capitalization $ 2,355,836 Total Capitalization $ 3,570,077 Total Undepreciated Assets $ 3,193,503 Total Debt/ Total Capitalization 34.0% Total Debt/ Total Undepreciated Assets 38.0% Total Net Debt/ Annualized Adjusted EBITDA 5.3x Security Stated Rate2 Effective Rate3 2014 2015 2016 2017 2018 Thereafter Total Revolving Credit Facility due 20164,5 1.72% 1.72% $ — $ — $ 55,000 $ — $ — $ — $ 55,000 Secured Mortgages 5.80% 5.80% 7,729 73,982 122,496 100,948 12,993 85,528 403,676 Unsecured Term Loan due 20165,6 1.67% 2.60% — — 300,000 — — — 300,000 Unsecured Term Loan due 2019 1.87% 2.99% — — — — — 155,000 155,000 Unsecured Senior Notes due 2023 3.70% 3.70% — — — — — 300,000 300,000 Net premium / (discount) 565 Total Debt 3.49% 3.95% $ 7,729 $ 73,982 $477,496 $100,948 $ 12,993 $ 540,528 $ 1,214,241 8 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Equity 66.0% Secured Debt 11.4% Unsecured Debt 22.6%

SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Covenants Bank Loans Required 12/31/2013 Total Leverage 60% 39% Secured Leverage 40% 13% Tangible Net Worth 1,288 1,757 Fixed Charge Coverage 1.65x 3.34x Unencumbered Leverage 60% 35% Unencumbered Coverage 1.75x 5.70x Senior Notes Required 12/31/2013 Total Leverage 60% 39% Secured Leverage 40% 13% Unencumbered Asset Coverage 150% 299% Interest Coverage 1.50x 3.97x Three Months Ended December 31, 2013 Year Ended December 31, 2013 Interest related to derivative financial instruments $ 1,866 $ 5,314 Net (gain) loss on change in fair market value of derivative financial instruments (2,223) (10,796) Total interest related to derivative financial instruments, including net change in the fair value of derivative financial instruments (357) (5,482) Interest related to debt 11,398 46,941 Total Interest Expense $ 11,041 $ 41,459 Interest Expense excluding net change in the fair market value of derivatives $ 13,264 $ 52,255 Interest Expense (in thousands) Interest Expense and Covenants as of December 31, 2013 9

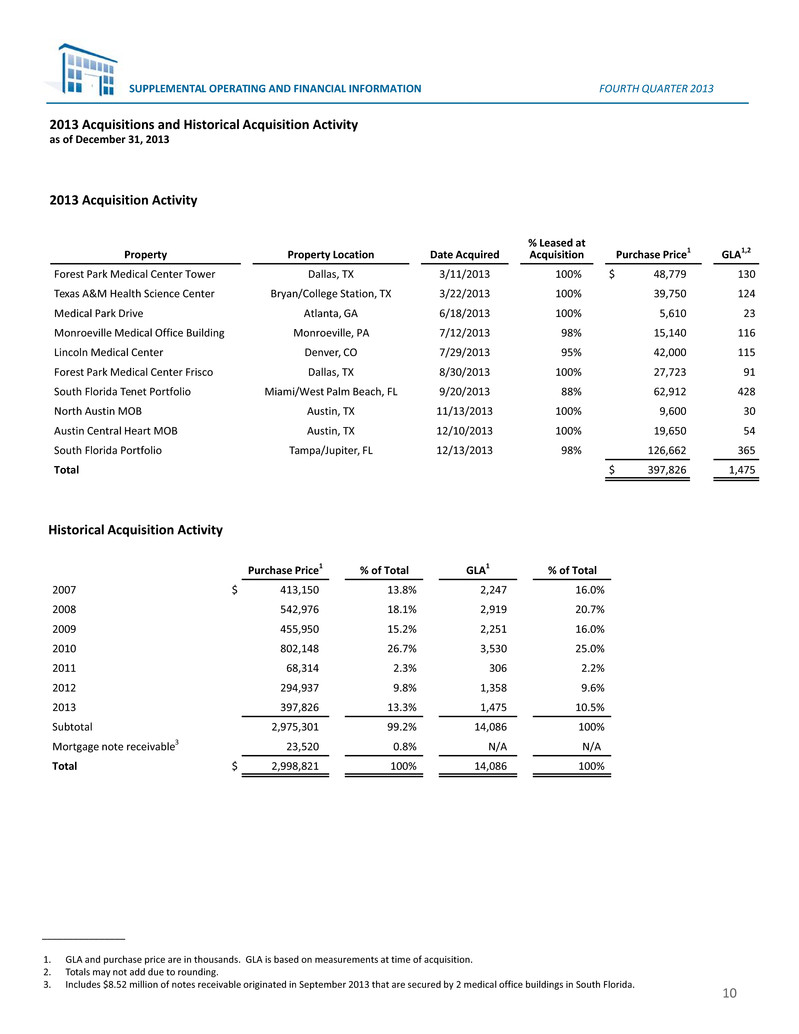

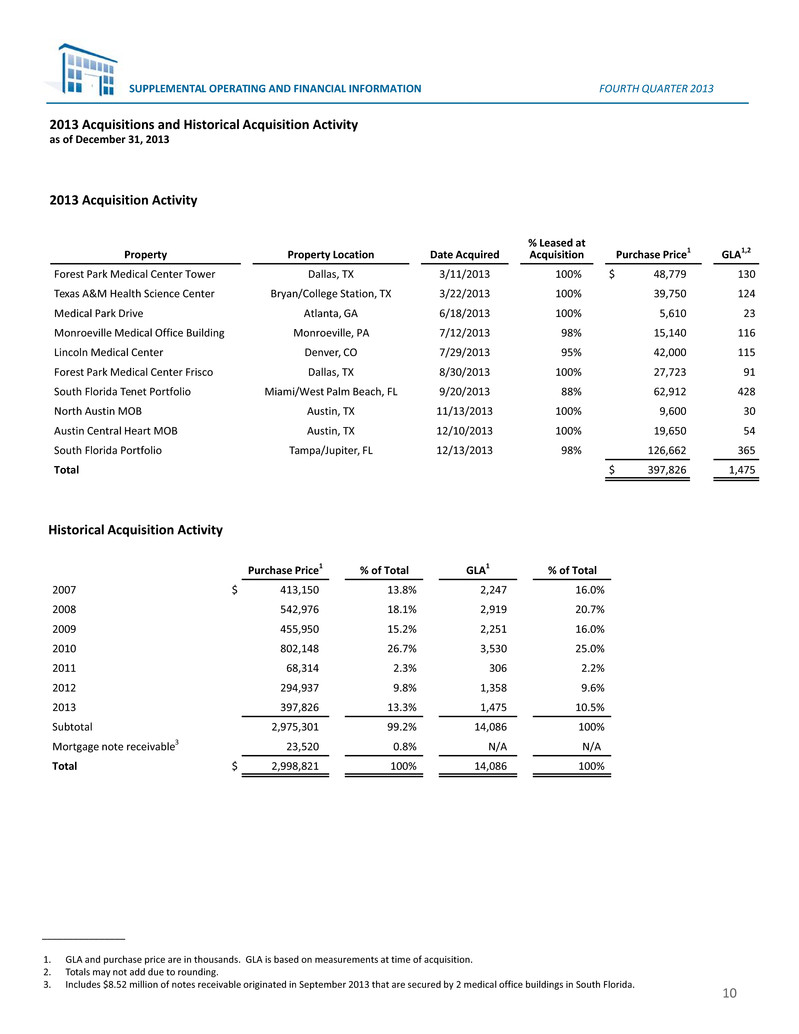

2013 Acquisitions and Historical Acquisition Activity as of December 31, 2013 ________________ 1. GLA and purchase price are in thousands. GLA is based on measurements at time of acquisition. 2. Totals may not add due to rounding. 3. Includes $8.52 million of notes receivable originated in September 2013 that are secured by 2 medical office buildings in South Florida. 2013 Acquisition Activity Historical Acquisition Activity Property Property Location Date Acquired % Leased at Acquisition Purchase Price1 GLA1,2 Forest Park Medical Center Tower Dallas, TX 3/11/2013 100% $ 48,779 130 Texas A&M Health Science Center Bryan/College Station, TX 3/22/2013 100% 39,750 124 Medical Park Drive Atlanta, GA 6/18/2013 100% 5,610 23 Monroeville Medical Office Building Monroeville, PA 7/12/2013 98% 15,140 116 Lincoln Medical Center Denver, CO 7/29/2013 95% 42,000 115 Forest Park Medical Center Frisco Dallas, TX 8/30/2013 100% 27,723 91 South Florida Tenet Portfolio Miami/West Palm Beach, FL 9/20/2013 88% 62,912 428 North Austin MOB Austin, TX 11/13/2013 100% 9,600 30 Austin Central Heart MOB Austin, TX 12/10/2013 100% 19,650 54 South Florida Portfolio Tampa/Jupiter, FL 12/13/2013 98% 126,662 365 Total $ 397,826 1,475 Purchase Price1 % of Total GLA1 % of Total 2007 $ 413,150 13.8% 2,247 16.0% 2008 542,976 18.1% 2,919 20.7% 2009 455,950 15.2% 2,251 16.0% 2010 802,148 26.7% 3,530 25.0% 2011 68,314 2.3% 306 2.2% 2012 294,937 9.8% 1,358 9.6% 2013 397,826 13.3% 1,475 10.5% Subtotal 2,975,301 99.2% 14,086 100% Mortgage note receivable3 23,520 0.8% N/A N/A Total $ 2,998,821 100% 14,086 100% 10 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

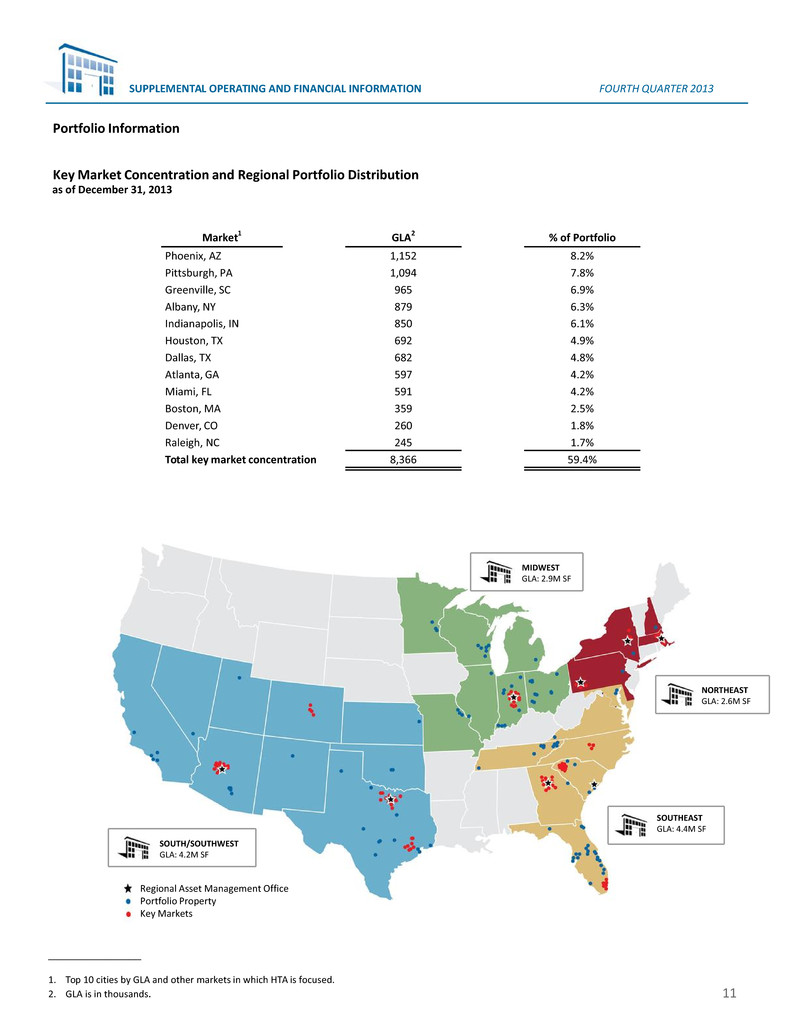

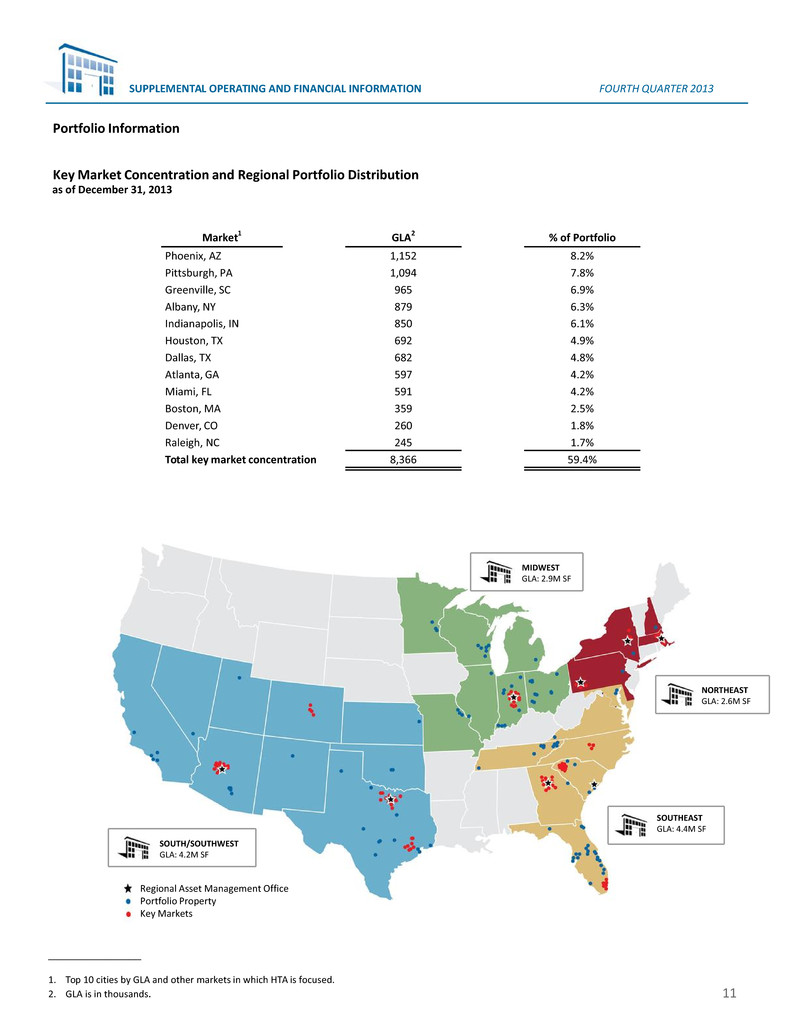

Key Market Concentration and Regional Portfolio Distribution as of December 31, 2013 ________________ 1. Top 10 cities by GLA and other markets in which HTA is focused. 2. GLA is in thousands. Portfolio Information Market1 GLA2 % of Portfolio Phoenix, AZ 1,152 8.2% Pittsburgh, PA 1,094 7.8% Greenville, SC 965 6.9% Albany, NY 879 6.3% Indianapolis, IN 850 6.1% Houston, TX 692 4.9% Dallas, TX 682 4.8% Atlanta, GA 597 4.2% Miami, FL 591 4.2% Boston, MA 359 2.5% Denver, CO 260 1.8% Raleigh, NC 245 1.7% Total key market concentration 8,366 59.4% 11 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 SOUTH/SOUTHWEST GLA: 4.2M SF MIDWEST GLA: 2.9M SF NORTHEAST GLA: 2.6M SF SOUTHEAST GLA: 4.4M SF Regional Asset Management Office Portfolio Property Key Markets

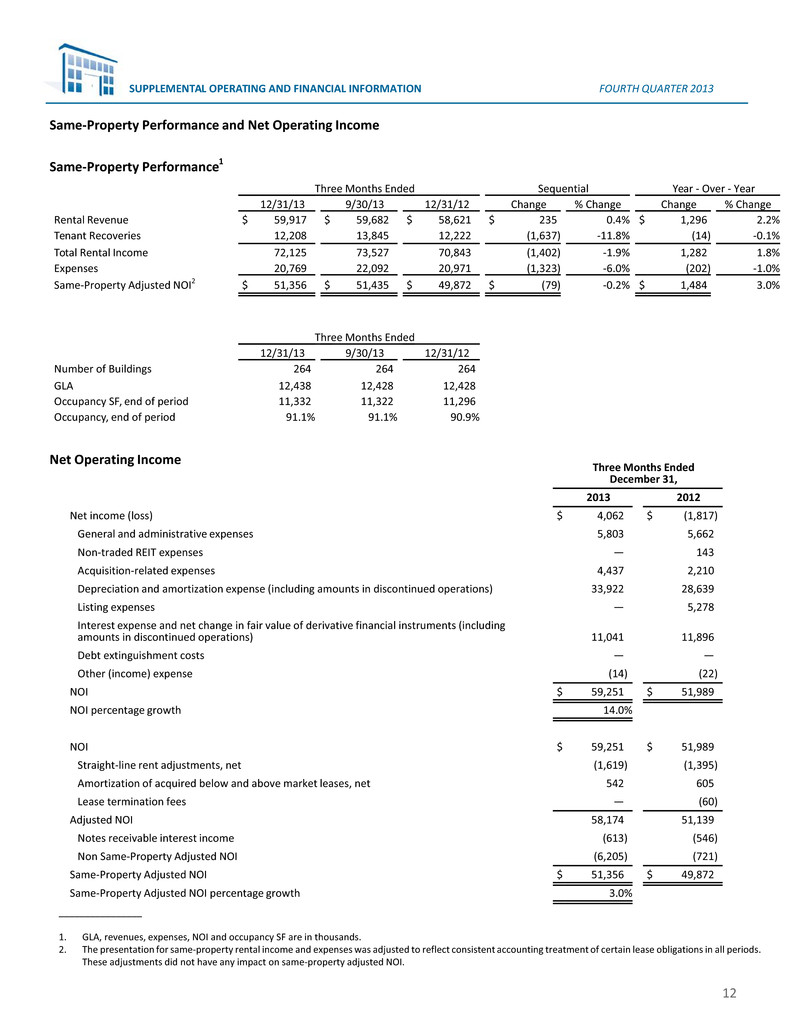

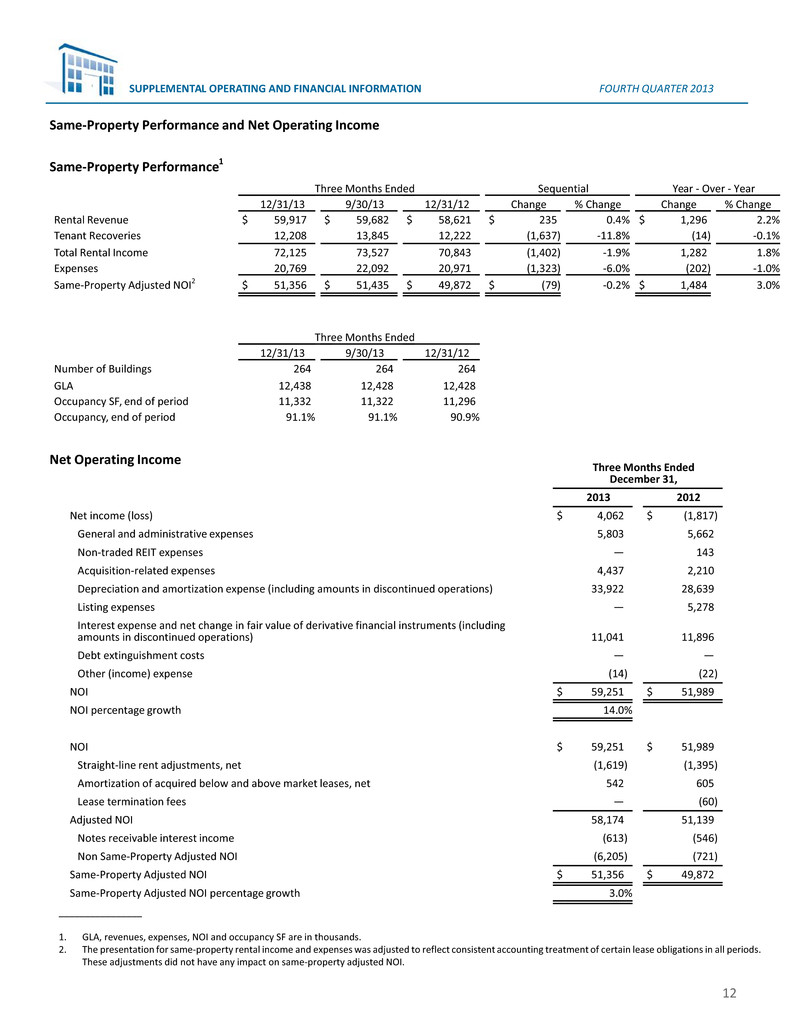

Same-Property Performance1 ________________ 1. GLA, revenues, expenses, NOI and occupancy SF are in thousands. 2. The presentation for same-property rental income and expenses was adjusted to reflect consistent accounting treatment of certain lease obligations in all periods. These adjustments did not have any impact on same-property adjusted NOI. Same-Property Performance and Net Operating Income Three Months Ended Sequential Year - Over - Year 12/31/13 9/30/13 12/31/12 Change % Change Change % Change Rental Revenue $ 59,917 $ 59,682 $ 58,621 $ 235 0.4% $ 1,296 2.2% Tenant Recoveries 12,208 13,845 12,222 (1,637) -11.8% (14) -0.1% Total Rental Income 72,125 73,527 70,843 (1,402) -1.9% 1,282 1.8% Expenses 20,769 22,092 20,971 (1,323) -6.0% (202) -1.0% Same-Property Adjusted NOI2 $ 51,356 $ 51,435 $ 49,872 $ (79) -0.2% $ 1,484 3.0% Three Months Ended 12/31/13 9/30/13 12/31/12 Number of Buildings 264 264 264 GLA 12,438 12,428 12,428 Occupancy SF, end of period 11,332 11,322 11,296 Occupancy, end of period 91.1% 91.1% 90.9% 12 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Three Months Ended December 31, 2013 2012 Net income (loss) $ 4,062 $ (1,817) General and administrative expenses 5,803 5,662 Non-traded REIT expenses — 143 Acquisition-related expenses 4,437 2,210 Depreciation and amortization expense (including amounts in discontinued operations) 33,922 28,639 Listing expenses — 5,278 Interest expense and net change in fair value of derivative financial instruments (including amounts in discontinued operations) 11,041 11,896 Debt extinguishment costs — — Other (income) expense (14) (22) NOI $ 59,251 $ 51,989 NOI percentage growth 14.0% NOI $ 59,251 $ 51,989 Straight-line rent adjustments, net (1,619) (1,395) Amortization of acquired below and above market leases, net 542 605 Lease termination fees — (60) Adjusted NOI 58,174 51,139 Notes receivable interest income (613) (546) Non Same-Property Adjusted NOI (6,205) (721) Same-Property Adjusted NOI $ 51,356 $ 49,872 Same-Property Adjusted NOI percentage growth 3.0% Net Operating Income

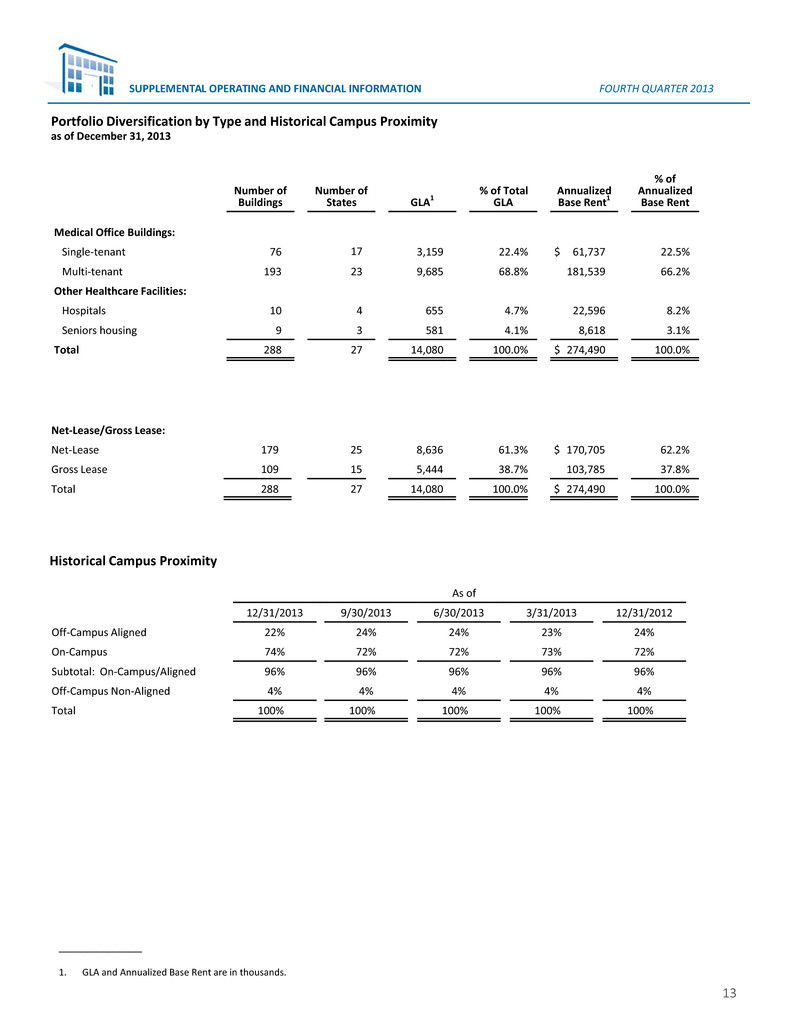

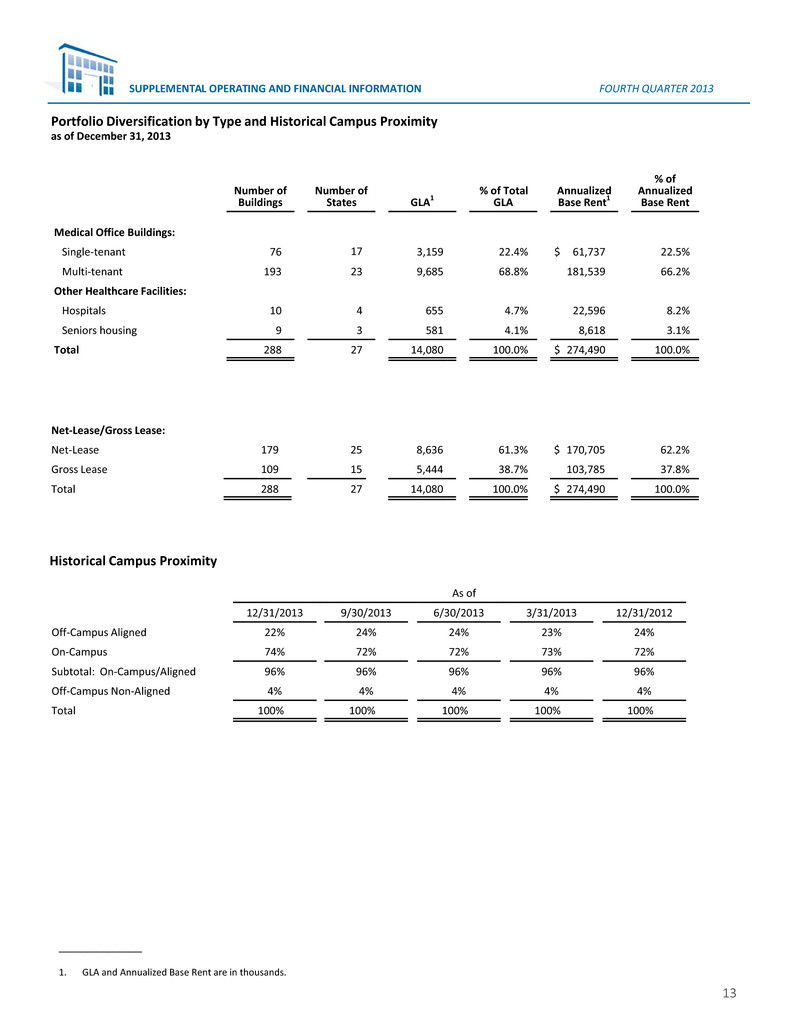

As of 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012 Off-Campus Aligned 22% 24% 24% 23% 24% On-Campus 74% 72% 72% 73% 72% Subtotal: On-Campus/Aligned 96% 96% 96% 96% 96% Off-Campus Non-Aligned 4% 4% 4% 4% 4% Total 100% 100% 100% 100% 100% Portfolio Diversification by Type and Historical Campus Proximity as of December 31, 2013 Historical Campus Proximity ________________ 1. GLA and Annualized Base Rent are in thousands. Number of Buildings Number of States GLA1 % of Total GLA Annualized Base Rent1 % of Annualized Base Rent Medical Office Buildings: Single-tenant 76 17 3,159 22.4% $ 61,737 22.5% Multi-tenant 193 23 9,685 68.8% 181,539 66.2% Other Healthcare Facilities: Hospitals 10 4 655 4.7% 22,596 8.2% Seniors housing 9 3 581 4.1% 8,618 3.1% Total 288 27 14,080 100.0% $ 274,490 100.0% 13 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Net-Lease/Gross Lease: Net-Lease 179 25 8,636 61.3% $ 170,705 62.2% Gross Lease 109 15 5,444 38.7% 103,785 37.8% Total 288 27 14,080 100.0% $ 274,490 100.0%

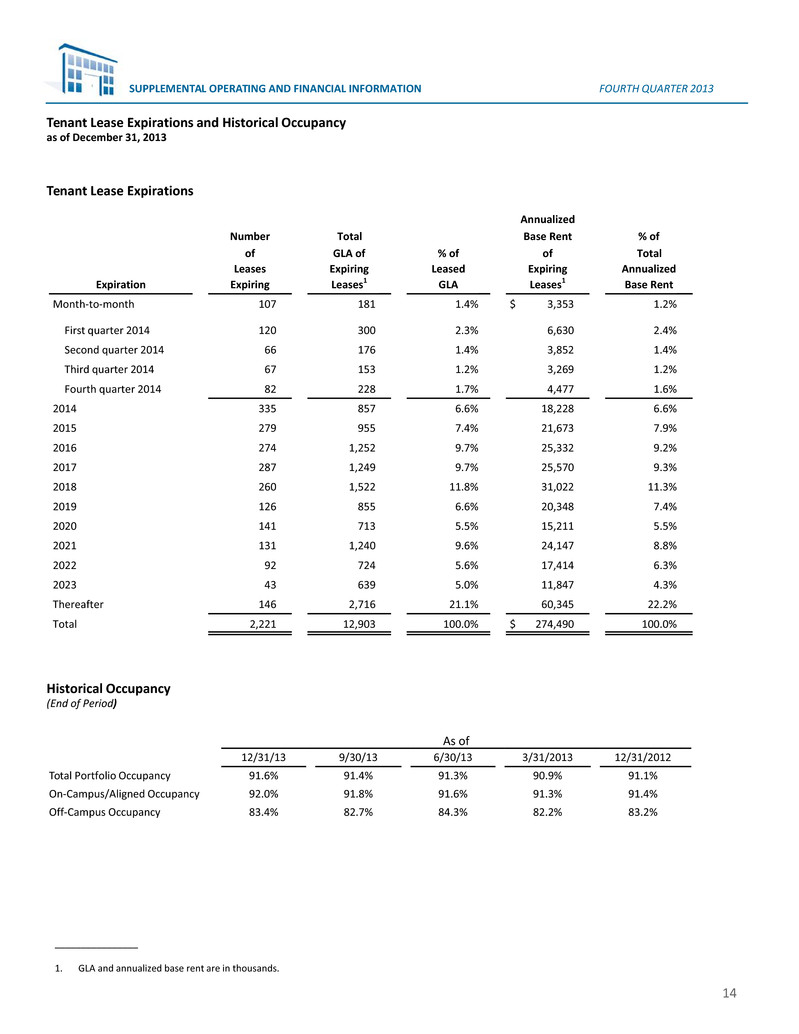

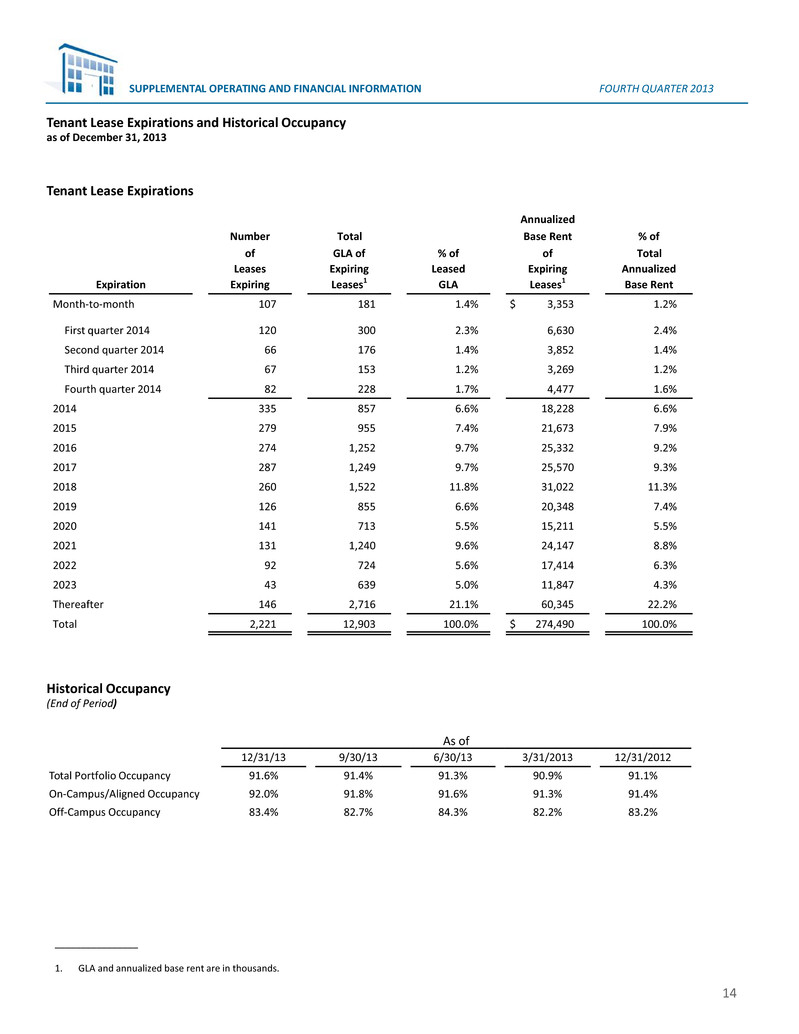

Tenant Lease Expirations and Historical Occupancy as of December 31, 2013 Historical Occupancy (End of Period) ________________ 1. GLA and annualized base rent are in thousands. Tenant Lease Expirations As of 12/31/13 9/30/13 6/30/13 3/31/2013 12/31/2012 Total Portfolio Occupancy 91.6% 91.4% 91.3% 90.9% 91.1% On-Campus/Aligned Occupancy 92.0% 91.8% 91.6% 91.3% 91.4% Off-Campus Occupancy 83.4% 82.7% 84.3% 82.2% 83.2% Annualized Number Total Base Rent % of of GLA of % of of Total Leases Expiring Leased Expiring Annualized Expiration Expiring Leases1 GLA Leases1 Base Rent Month-to-month 107 181 1.4% $ 3,353 1.2% First quarter 2014 120 300 2.3% 6,630 2.4% Second quarter 2014 66 176 1.4% 3,852 1.4% Third quarter 2014 67 153 1.2% 3,269 1.2% Fourth quarter 2014 82 228 1.7% 4,477 1.6% 2014 335 857 6.6% 18,228 6.6% 2015 279 955 7.4% 21,673 7.9% 2016 274 1,252 9.7% 25,332 9.2% 2017 287 1,249 9.7% 25,570 9.3% 2018 260 1,522 11.8% 31,022 11.3% 2019 126 855 6.6% 20,348 7.4% 2020 141 713 5.5% 15,211 5.5% 2021 131 1,240 9.6% 24,147 8.8% 2022 92 724 5.6% 17,414 6.3% 2023 43 639 5.0% 11,847 4.3% Thereafter 146 2,716 21.1% 60,345 22.2% Total 2,221 12,903 100.0% $ 274,490 100.0% 14 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

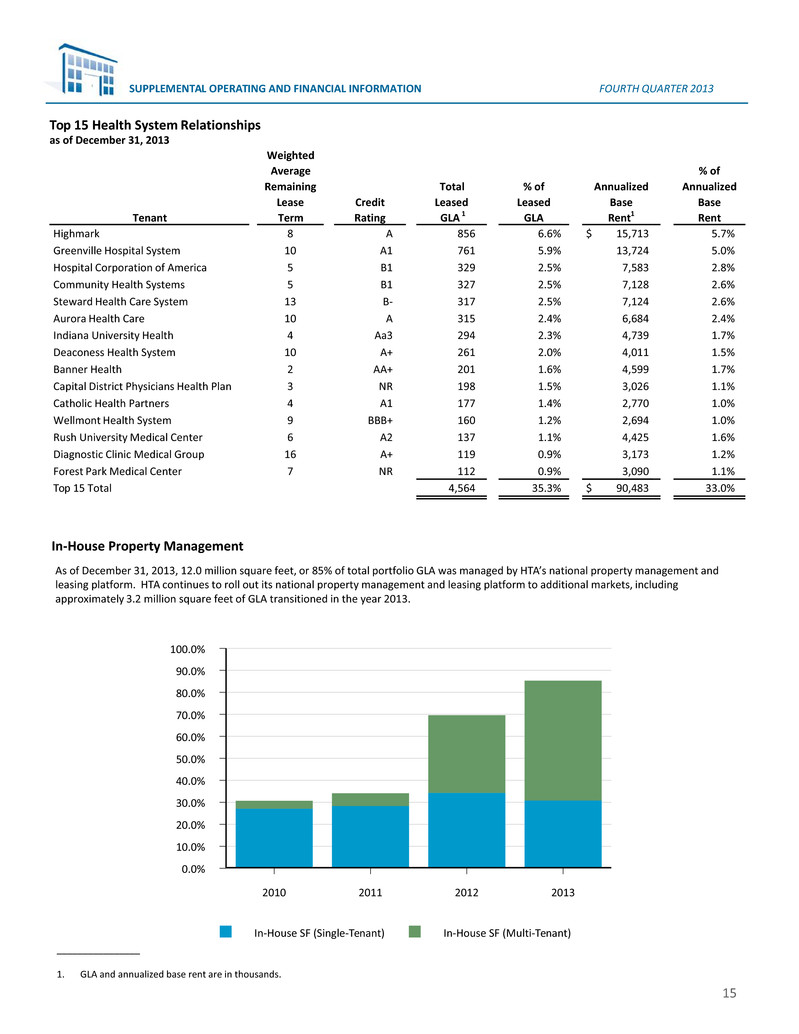

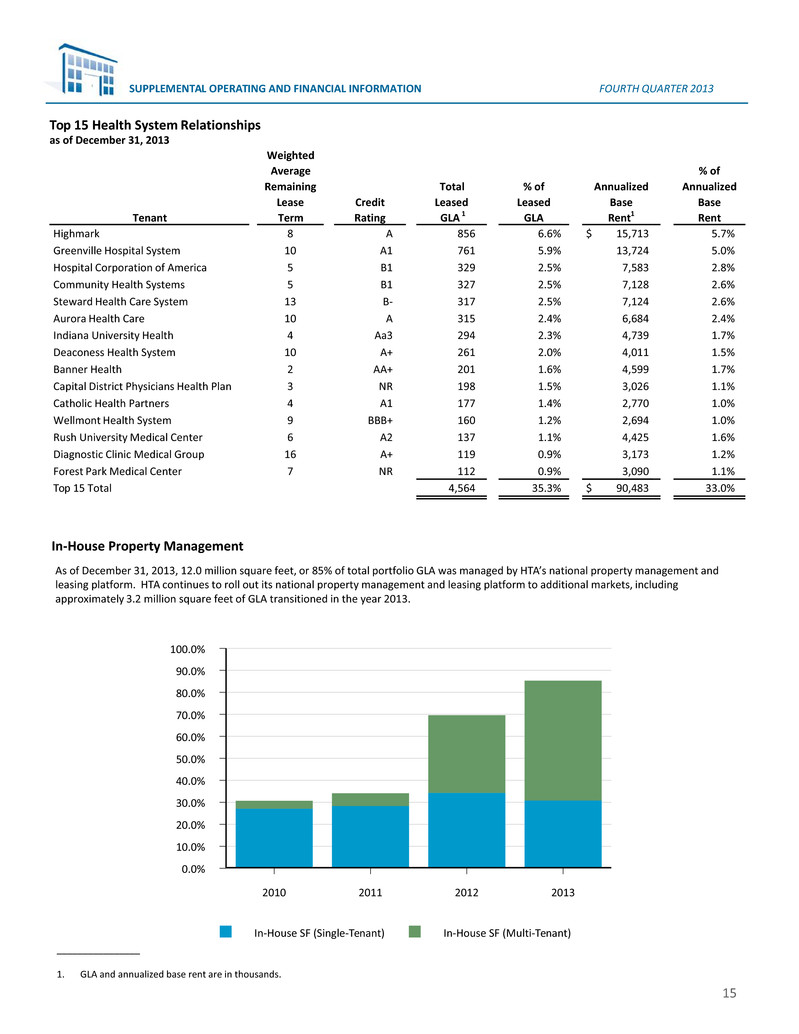

Top 15 Health System Relationships as of December 31, 2013 ________________ 1. GLA and annualized base rent are in thousands. Weighted Average % of Remaining Total % of Annualized Annualized Lease Credit Leased Leased Base Base Tenant Term Rating GLA 1 GLA Rent1 Rent Highmark 8 A 856 6.6% $ 15,713 5.7% Greenville Hospital System 10 A1 761 5.9% 13,724 5.0% Hospital Corporation of America 5 B1 329 2.5% 7,583 2.8% Community Health Systems 5 B1 327 2.5% 7,128 2.6% Steward Health Care System 13 B- 317 2.5% 7,124 2.6% Aurora Health Care 10 A 315 2.4% 6,684 2.4% Indiana University Health 4 Aa3 294 2.3% 4,739 1.7% Deaconess Health System 10 A+ 261 2.0% 4,011 1.5% Banner Health 2 AA+ 201 1.6% 4,599 1.7% Capital District Physicians Health Plan 3 NR 198 1.5% 3,026 1.1% Catholic Health Partners 4 A1 177 1.4% 2,770 1.0% Wellmont Health System 9 BBB+ 160 1.2% 2,694 1.0% Rush University Medical Center 6 A2 137 1.1% 4,425 1.6% Diagnostic Clinic Medical Group 16 A+ 119 0.9% 3,173 1.2% Forest Park Medical Center 7 NR 112 0.9% 3,090 1.1% Top 15 Total 4,564 35.3% $ 90,483 33.0% 15 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 As of December 31, 2013, 12.0 million square feet, or 85% of total portfolio GLA was managed by HTA’s national property management and leasing platform. HTA continues to roll out its national property management and leasing platform to additional markets, including approximately 3.2 million square feet of GLA transitioned in the year 2013. In-House Property Management In-House SF (Single-Tenant) In-House SF (Multi-Tenant) 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 2010 2011 2012 2013

Health System Relationship Highlights Deaconess Health System (A+), based in Evansville, Indiana, is a premier provider of health care services in the Tri- State. Since its founding, Deaconess has grown into an award-winning, multi-facility health system providing compassionate, high-quality health care. The system includes six hospitals and over 20 primary care locations and several specialty facilities. Additionally, Deaconess has several ancillary facilities and partnerships with many other community health care providers. Forest Park Medical Center (NR), headquartered in Dallas, Texas, is a leading physician-owned health system focused on private-pay hospitals in key markets. With medical center locations in Dallas, Frisco, and Southlake, and plans to expand to Fort Worth, Austin, and San Antonio. Forest Park will include over 280 beds and 70 operating suites upon completion, in world-class facilities. Greenville Health System (A1), located in Greenville, South Carolina, is a nonprofit academic delivery system and is one of the largest health systems in the state of South Carolina with five medical campuses, outpatient centers, wellness centers, long-term care facilities, and research and academics – including the University of South Carolina School of Medicine-Greenville and Clemson University. The system has 1,268 beds, approximately 1,271 physicians included in medical staff, and approximately 11,000 employees. Highmark (A), based in Pittsburgh, Pennsylvania, is among the largest health insurers in the United States and the fourth largestBlue Cross and Blue Shield-affiliatedcompany. In 2013, Highmark and West Penn Allegheny combined to create an integrated care delivery model which they believe will preserve an important community asset that provides high-quality, efficient health care for patients. Highmark's mission is to be the leading health and wellness company. Hospital Corporation of America (B1), Nashville-based HCA was one of the nation's first hospital companies. Today, they are the nation's leading provider of healthcare services, a company comprised of locally managed facilities that includes about 165 hospitals and 115 freestanding surgery centers in 20 states and England and employing approximately 204,000 people. Approximately four to five percent of all inpatient care delivered in the country today is provided by HCA facilities. HCA is committed to the care and improvement of human life and strives to deliver high quality, cost effective healthcare in the communities they serve. Indiana UniversityHealth (Aa3), based in Indianapolis, Indiana, is Indiana’s mostcomprehensivehealthcaresystem. A unique partnership with Indiana University School of Medicine, one of the nation’s leading medical schools, gives patients access to innovative treatments and therapies. IU Health is comprised of hospitals, physicians and allied services dedicated to providing preeminent care throughout Indiana and beyond. Piedmont HealthCare (Aa3), based in Atlanta, Georgia, is the Atlanta region’s premier community healthcare system. Founded in 1905, Piedmont is driven by the mission to createa system committedto compassion, advanced treatments, access to care and strong connections to make their patients, communities and region better. What started as a single hospital a century ago has grown into an integrated healthcare system with five hospitals and close to 100 physician and specialist offices across greater Atlanta and North Georgia. Steward Health Care System (B-), located in Boston, Massachusetts, is the largest fully integrated community care organization and community hospital network in New England. Steward is the third largest employer in Massachusetts with more than 17,000 employees serving more than one million patients annually. The system includes 11 hospitals and over 2,000 beds that reach over 150 communities in the greater Boston area. Other Steward Health Care entities include Steward Physician Network, and Steward Home Care and Hospice, Laboure College and Por Cristo. Tenet Healthcare System (B1), located in Dallas, TX is a leading health care services company whose subsidiaries and affiliates,following the acquisition of Vanguard Health in 2013, operates77 acute care hospitals, 173 outpatient centers,and ConiferHealth Solutions, which provides business process solutions to more than 600 hospitals. Tenet's hospital's are concentrated in Texas, California, Florida, and Michigan. The system employs more than 100,000 employees; their mission is to improve the quality of life of every patient and deliver high-quality care while remaining well-positioned for success in the new healthcare environment. 16 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

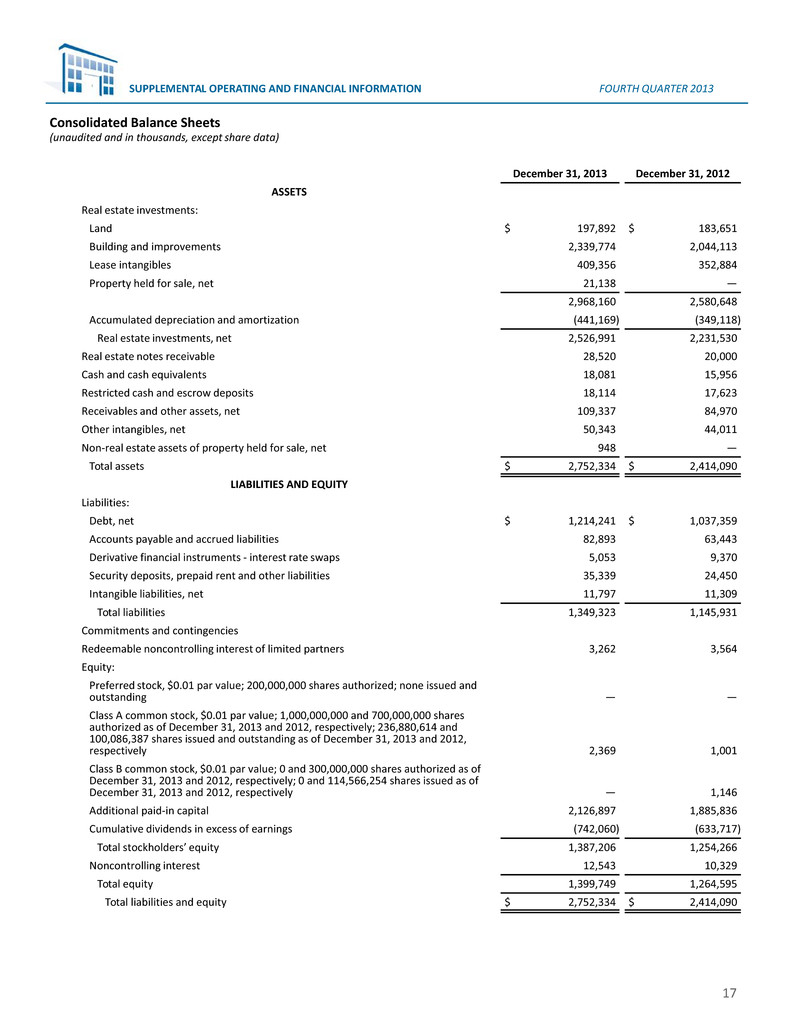

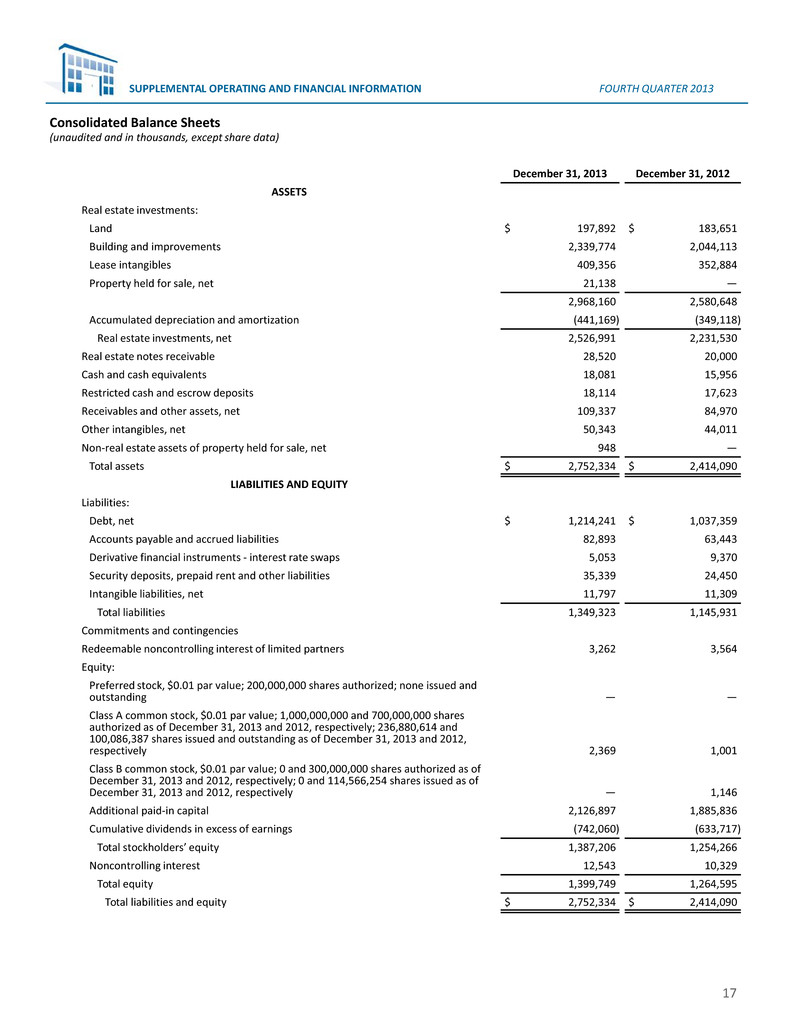

Consolidated Balance Sheets (unaudited and in thousands, except share data) December 31, 2013 December 31, 2012 ASSETS Real estate investments: Land $ 197,892 $ 183,651 Building and improvements 2,339,774 2,044,113 Lease intangibles 409,356 352,884 Property held for sale, net 21,138 — 2,968,160 2,580,648 Accumulated depreciation and amortization (441,169) (349,118) Real estate investments, net 2,526,991 2,231,530 Real estate notes receivable 28,520 20,000 Cash and cash equivalents 18,081 15,956 Restricted cash and escrow deposits 18,114 17,623 Receivables and other assets, net 109,337 84,970 Other intangibles, net 50,343 44,011 Non-real estate assets of property held for sale, net 948 — Total assets $ 2,752,334 $ 2,414,090 LIABILITIES AND EQUITY Liabilities: Debt, net $ 1,214,241 $ 1,037,359 Accounts payable and accrued liabilities 82,893 63,443 Derivative financial instruments - interest rate swaps 5,053 9,370 Security deposits, prepaid rent and other liabilities 35,339 24,450 Intangible liabilities, net 11,797 11,309 Total liabilities 1,349,323 1,145,931 Commitments and contingencies Redeemable noncontrolling interest of limited partners 3,262 3,564 Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 and 700,000,000 shares authorized as of December 31, 2013 and 2012, respectively; 236,880,614 and 100,086,387 shares issued and outstanding as of December 31, 2013 and 2012, respectively 2,369 1,001 Class B common stock, $0.01 par value; 0 and 300,000,000 shares authorized as of December 31, 2013 and 2012, respectively; 0 and 114,566,254 shares issued as of December 31, 2013 and 2012, respectively — 1,146 Additional paid-in capital 2,126,897 1,885,836 Cumulative dividends in excess of earnings (742,060) (633,717) Total stockholders’ equity 1,387,206 1,254,266 Noncontrolling interest 12,543 10,329 Total equity 1,399,749 1,264,595 Total liabilities and equity $ 2,752,334 $ 2,414,090 17 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

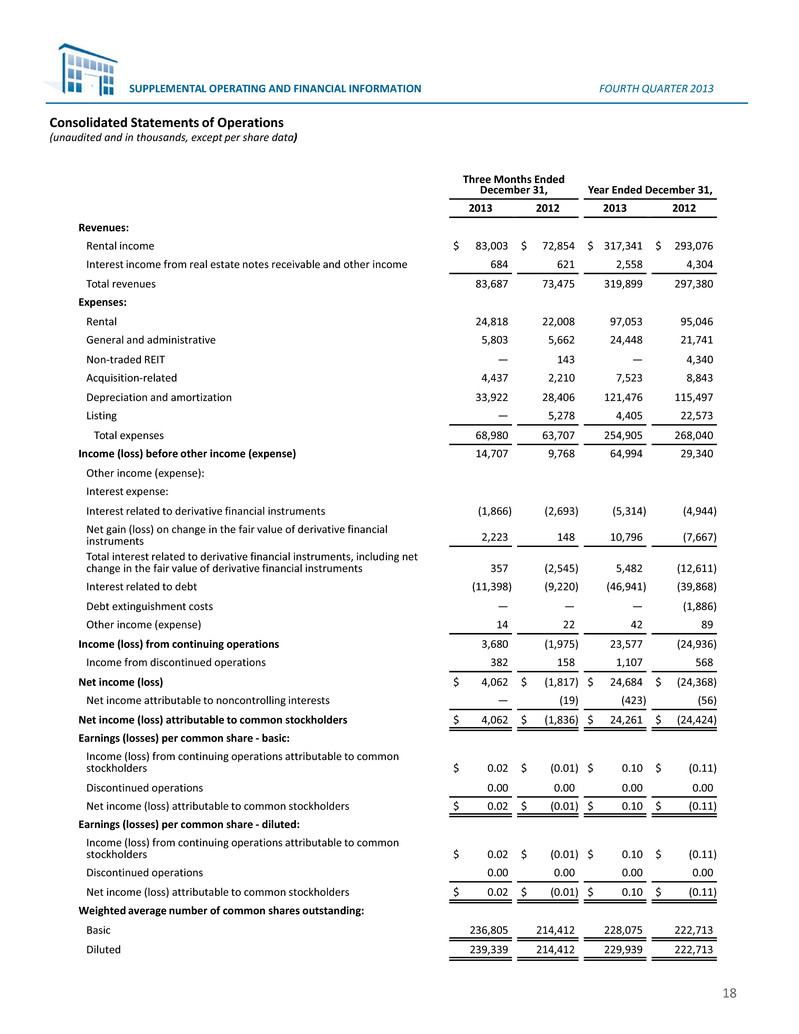

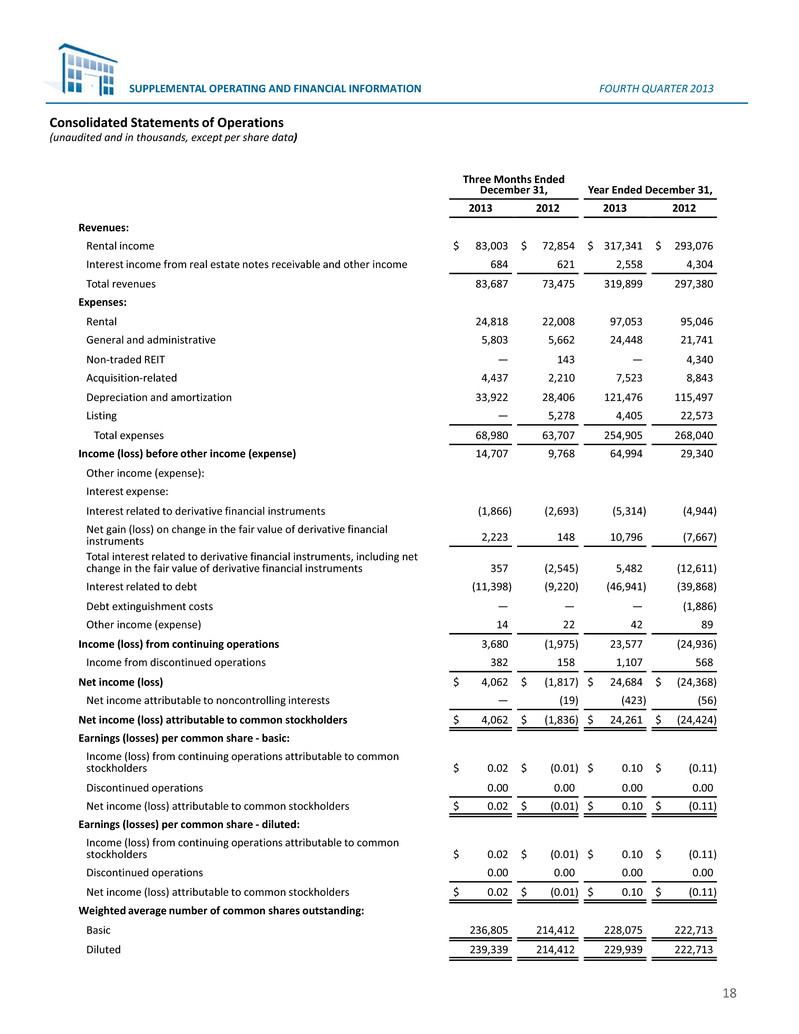

Consolidated Statements of Operations (unaudited and in thousands, except per share data) Three Months Ended December 31, Year Ended December 31, 2013 2012 2013 2012 Revenues: Rental income $ 83,003 $ 72,854 $ 317,341 $ 293,076 Interest income from real estate notes receivable and other income 684 621 2,558 4,304 Total revenues 83,687 73,475 319,899 297,380 Expenses: Rental 24,818 22,008 97,053 95,046 General and administrative 5,803 5,662 24,448 21,741 Non-traded REIT — 143 — 4,340 Acquisition-related 4,437 2,210 7,523 8,843 Depreciation and amortization 33,922 28,406 121,476 115,497 Listing — 5,278 4,405 22,573 Total expenses 68,980 63,707 254,905 268,040 Income (loss) before other income (expense) 14,707 9,768 64,994 29,340 Other income (expense): Interest expense: Interest related to derivative financial instruments (1,866) (2,693) (5,314) (4,944) Net gain (loss) on change in the fair value of derivative financial instruments 2,223 148 10,796 (7,667) Total interest related to derivative financial instruments, including net change in the fair value of derivative financial instruments 357 (2,545) 5,482 (12,611) Interest related to debt (11,398) (9,220) (46,941) (39,868) Debt extinguishment costs — — — (1,886) Other income (expense) 14 22 42 89 Income (loss) from continuing operations 3,680 (1,975) 23,577 (24,936) Income from discontinued operations 382 158 1,107 568 Net income (loss) $ 4,062 $ (1,817) $ 24,684 $ (24,368) Net income attributable to noncontrolling interests — (19) (423) (56) Net income (loss) attributable to common stockholders $ 4,062 $ (1,836) $ 24,261 $ (24,424) Earnings (losses) per common share - basic: Income (loss) from continuing operations attributable to common stockholders $ 0.02 $ (0.01) $ 0.10 $ (0.11) Discontinued operations 0.00 0.00 0.00 0.00 Net income (loss) attributable to common stockholders $ 0.02 $ (0.01) $ 0.10 $ (0.11) Earnings (losses) per common share - diluted: Income (loss) from continuing operations attributable to common stockholders $ 0.02 $ (0.01) $ 0.10 $ (0.11) Discontinued operations 0.00 0.00 0.00 0.00 Net income (loss) attributable to common stockholders $ 0.02 $ (0.01) $ 0.10 $ (0.11) Weighted average number of common shares outstanding: Basic 236,805 214,412 228,075 222,713 Diluted 239,339 214,412 229,939 222,713 18 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

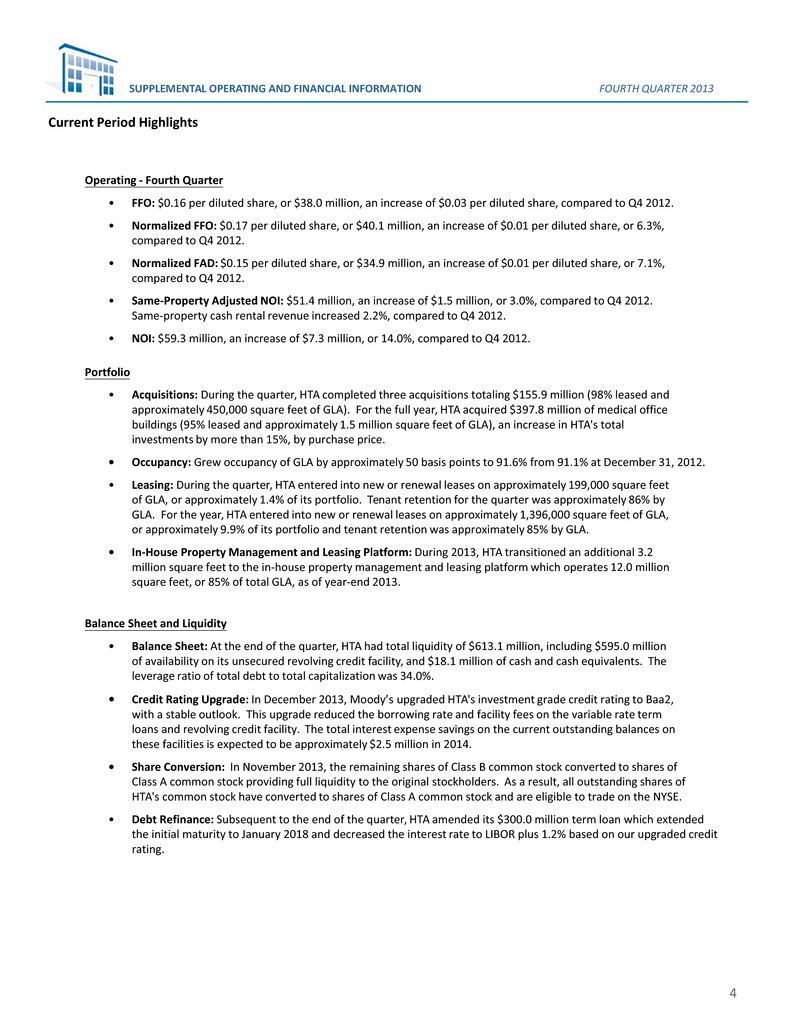

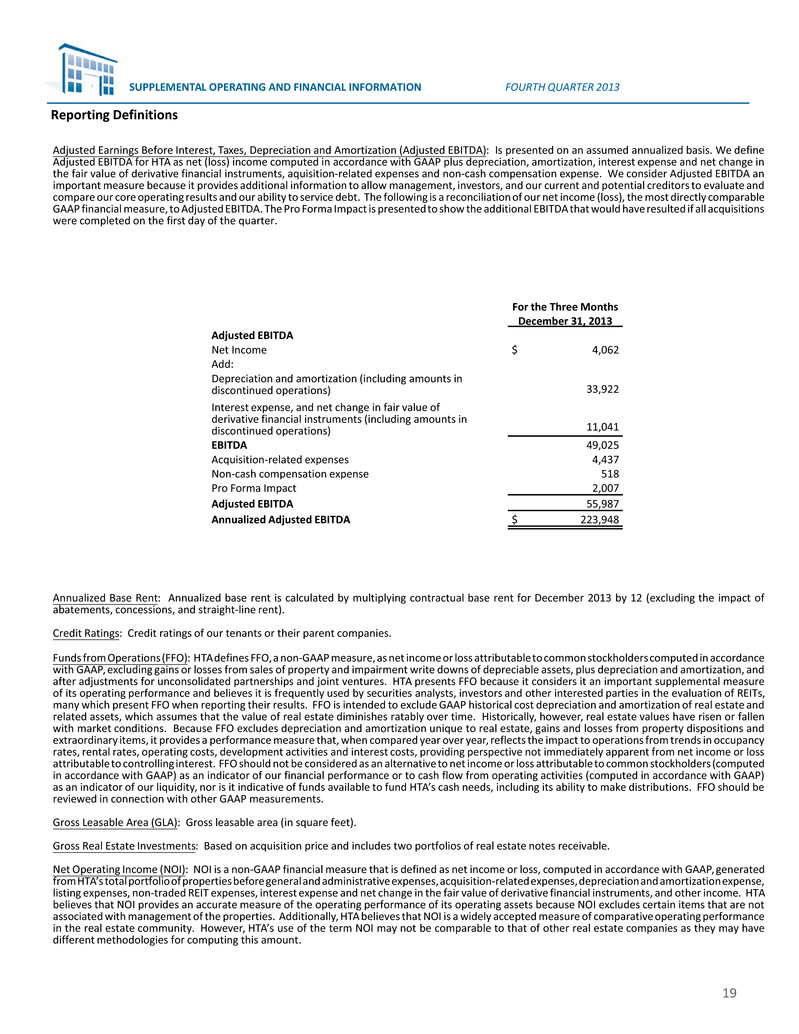

Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA): Is presented on an assumed annualized basis. We define Adjusted EBITDA for HTA as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, aquisition-related expenses and non-cash compensation expense. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. The following is a reconciliation of our net income (loss), the most directly comparable GAAP financial measure, to Adjusted EBITDA. The Pro Forma Impact is presentedto show the additional EBITDA that would have resulted if all acquisitions were completed on the first day of the quarter. Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for December 2013 by 12 (excluding the impact of abatements, concessions, and straight-line rent). Credit Ratings: Credit ratings of our tenants or their parent companies. Funds from Operations(FFO): HTAdefines FFO,a non-GAAP measure, as net income or loss attributableto common stockholderscomputed in accordance with GAAP, excluding gains or losses from sales of property and impairment write downs of depreciable assets, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents FFO because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization unique to real estate, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income or loss attributable to controlling interest. FFO should not be considered as an alternative to net income or loss attributable to common stockholders(computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund HTA’s cash needs, including its ability to make distributions. FFO should be reviewed in connection with other GAAP measurements. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price and includes two portfolios of real estate notes receivable. Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated fromHTA’s totalportfolioof propertiesbeforegeneraland administrativeexpenses,acquisition-relatedexpenses,depreciationand amortizationexpense, listing expenses, non-traded REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and other income. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance in the real estate community. However, HTA’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. For the Three Months December 31, 2013 Adjusted EBITDA Net Income $ 4,062 Add: Depreciation and amortization (including amounts in discontinued operations) 33,922 Interest expense, and net change in fair value of derivative financial instruments (including amounts in discontinued operations) 11,041 EBITDA 49,025 Acquisition-related expenses 4,437 Non-cash compensation expense 518 Pro Forma Impact 2,007 Adjusted EBITDA 55,987 Annualized Adjusted EBITDA $ 223,948 19 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013

Reporting Definitions (continued) Normalized Funds Available for Distribution (Normalized FAD): HTA defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFOother income,non-cashcompensationexpense,straight-line rentadjustments,amortizationof acquiredbelow and abovemarket leases, deferred revenue - tenant improvement related, amortization of deferred financing costs, and debt discount/premium and recurring capital expenditures, tenant improvements and leasing commissions. HTA believes Normalized FAD provides a meaningful supplemental measure of its ability to fund its ongoingdistributions. In ordertounderstand and analyzeHTA’s liquidity,NormalizedFAD should be comparedwith cashflow(computedin accordance with GAAP). Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of HTA’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of HTA’s liquidity. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operatingitems included in FFO,as defined. Therefore, HTAuses Normalized FFO,which excludesfrom FFO acquisition- related expenses, listing expenses, net change in fair value of derivative financial instruments, noncontrolling income from operating partnership units included in diluted shares, transitional expenses, debt extinguishment costs and other normalizing items, to further evaluate how its portfolio might perform after its acquisition stage is completeand the sustainability of its distributions in the future. However,HTA’s use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of HTA’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of HTA’s liquidity, nor is it indicative of funds available to fund HTA’s cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy: Occupancy represents the percentage of total gross leasable area that is leased, including month-to-month leases and leases that are signed but not yet commenced, as of the date reported. Off-Campus: A building or portfolio that is not located on or adjacent to key hospital based-campuses and is not aligned with recognized healthcare systems. On-Campus / Aligned: On-campus refers to a property that is located on or adjacent to a healthcare system. Aligned refers to a property that is not on the campus of a healthcare system, but anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements,Leasing Commissions: Representsamounts paid for (i) recurring capital expenditures required to maintain and re-tenant our properties, (ii) second generation tenant improvements, and 3) leasing commissions paid to secure new tenants. Retention: Tenant Retention Rate is defined as the sum of the total leased GLA of tenants that renew an expiring lease over the total GLA of expiring leases. Same-Property Adjusted Net Operating Income: To facilitate the comparison of Adjusted NOI between periods, HTA calculates comparable amounts for a subset of its owned properties referred to as “same-property.” Same-property Adjusted NOI excludes properties recently acquired, disposed of, held for sale, notes receivable interest income and certain non-routine items. Same-Property Adjusted NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Same-Property Adjusted NOI should be reviewed in connection with other GAAP measurements. 20 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FOURTH QUARTER 2013 Adjusted Net Operating Income (NOI): Adjusted NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and lease termination fees. HTA believes that Adjusted NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, HTA believes that Adjusted NOI is a widely accepted measure of comparative operating performance in the real estate community. However, HTA’s use of the term Adjusted NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount.