99.1 3Q 2014 Supplemental Information Exhibit 99.2

Company Overview Company Information 3 Current Period Highlights 4 Financial Highlights 5 Company Snapshot 6 Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA 7 Capitalization, Interest Expense and Covenants 8 Debt Composition and Maturity Schedule 9 Portfolio Information 2014 Acquisition and Dispositions and Annual Investments 10 Regional Portfolio Distribution and Key Market Concentration 11 Same-Property Performance and NOI 12 Portfolio Diversification by Type and Historical Campus Proximity 13 Tenant Lease Expirations and Historical Leased Rate 14 Top 15 Health System Relationships and In-House Property Management 15 Health System Relationship Highlights 16 Financial Statements Condensed Consolidated Balance Sheets 17 Condensed Consolidated Statements of Operations 18 Reporting Definitions 19 Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements about our plans, strategies and prospects and estimates regarding future medical office building market performance. Additionally, such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Forward-looking statements express expectations of future events. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC. Table of Contents 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 2

Company Information Healthcare Trust of America, Inc. (NYSE: HTA), a publicly traded real estate investment trust, is a full-service real estate company focused on acquiring, owning and operating high-quality medical office buildings that are predominately located on or aligned with campuses of nationally or regionally recognized healthcare systems in the U.S. Since its formation in 2006, HTA has built a portfolio of properties that total approximately $3.3 billion based on purchase price and is comprised of approximately 14.6 million square feet of gross leasable area (GLA) located in 27 states. HTA has developed a national property management and leasing platform which it directs through its regional offices located in Albany, Atlanta, Boston, Charleston, Dallas, Indianapolis, Miami, Pittsburgh and Scottsdale. Company Overview Senior Management Scott D. Peters I Chairman, Chief Executive Officer and President Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer Mark D. Engstrom I Executive Vice President - Acquisitions Amanda L. Houghton I Executive Vice President - Asset Management Contact Information Corporate Headquarters Healthcare Trust of America, Inc. I NYSE: HTA 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 www.htareit.com Investor Relations Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 info@htareit.com Transfer Agent DST Systems, Inc. 430 West 7th Street Kansas City, MO 64105 888.801.0107 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 3

Operating • Normalized FFO: Increased 19.9% to $45.5 million, compared to Q3 2013. • Normalized FFO Per Share: $0.19 per diluted share, an increase of $0.03 per diluted share, or 19%, compared to Q3 2013. • Normalized FAD: $0.15 per diluted share, or $37.2 million, an increase of $0.01 per diluted share, or 7%, compared to Q3 2013. • Same-Property Cash NOI: Increased 3.1% compared to Q3 2013. Portfolio • Acquisitions: During the quarter, HTA acquired $106.1 million of high quality medical office buildings (96% leased and approximately 301,000 square feet of GLA), increasing the total year-to-date investments to $317.6 million. The acquisitions during the quarter included properties located in Charleston, South Carolina; Clearwater, Florida and White Plains, New York. • Dispositions: During the quarter, HTA initiated its asset recycling program and sold two portfolios of medical office buildings for an aggregate gross sales price of $42.0 million. HTA realized gains of $11.8 million from these two dispositions. • Leasing: During the quarter, HTA entered into new or renewal leases on approximately 555,000 square feet of GLA, or 3.8% of its portfolio. Tenant retention for the quarter was 85% by GLA. • Leased Rate: At the end of the quarter, the leased rate by GLA was 91.8%, an increase from 91.4% as of Q3 2013. The leased rate increased 30 basis points from June 30, 2014. • In-House Property Management and Leasing Platform: HTA expanded its in-house property management and leasing platform by approximately 258,000 square feet of GLA during the quarter, bringing total in-house GLA to 13.3 million square feet, or 91% of HTA’s total portfolio. Balance Sheet and Liquidity • Balance Sheet: At the end of the quarter, HTA had total liquidity of $627.9 million, including $609.5 million of availability on its unsecured revolving credit facility and $18.4 million of cash and cash equivalents. The leverage ratio of debt to total capitalization was 34.8%. Company Overview Current Period Highlights 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 4

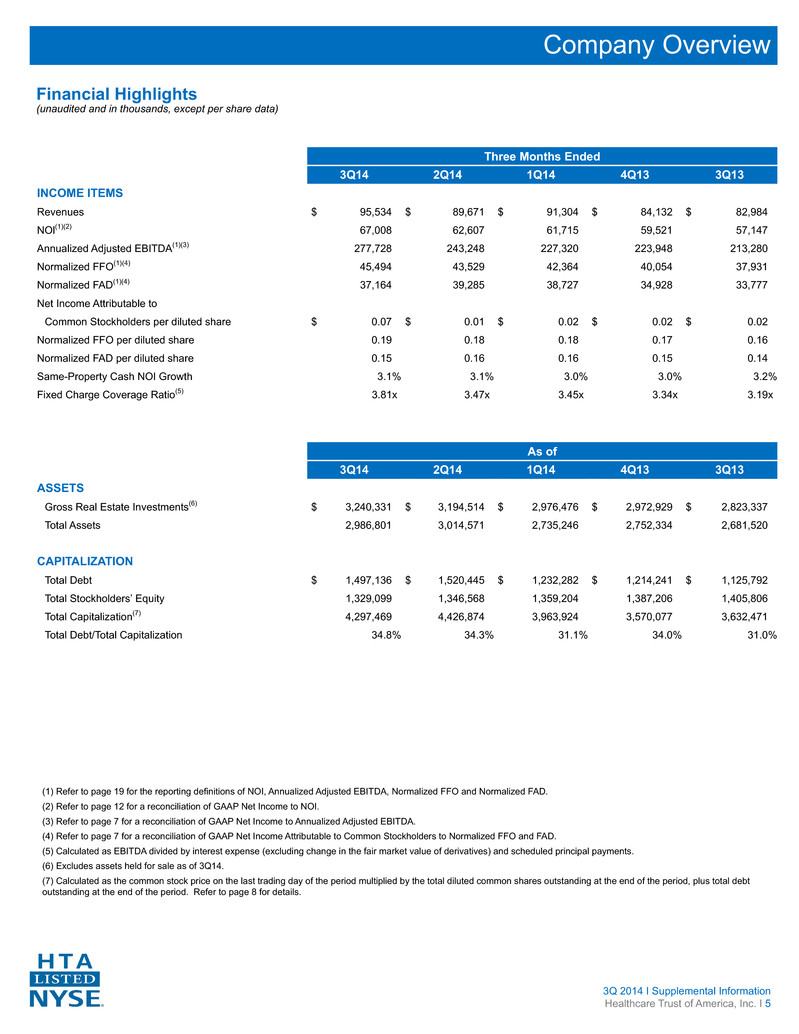

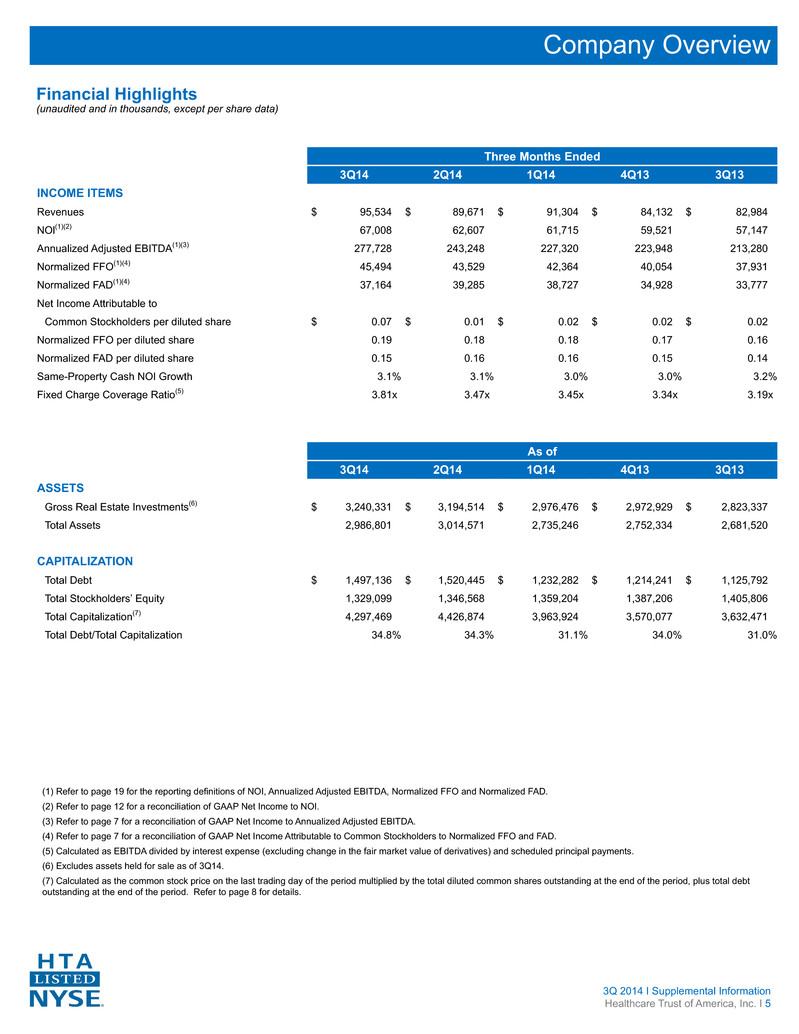

(1) Refer to page 19 for the reporting definitions of NOI, Annualized Adjusted EBITDA, Normalized FFO and Normalized FAD. (2) Refer to page 12 for a reconciliation of GAAP Net Income to NOI. (3) Refer to page 7 for a reconciliation of GAAP Net Income to Annualized Adjusted EBITDA. (4) Refer to page 7 for a reconciliation of GAAP Net Income Attributable to Common Stockholders to Normalized FFO and FAD. (5) Calculated as EBITDA divided by interest expense (excluding change in the fair market value of derivatives) and scheduled principal payments. (6) Excludes assets held for sale as of 3Q14. (7) Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period, plus total debt outstanding at the end of the period. Refer to page 8 for details. Financial Highlights (unaudited and in thousands, except per share data) Three Months Ended 3Q14 2Q14 1Q14 4Q13 3Q13 INCOME ITEMS Revenues $ 95,534 $ 89,671 $ 91,304 $ 84,132 $ 82,984 NOl(1)(2) 67,008 62,607 61,715 59,521 57,147 Annualized Adjusted EBITDA(1)(3) 277,728 243,248 227,320 223,948 213,280 Normalized FFO(1)(4) 45,494 43,529 42,364 40,054 37,931 Normalized FAD(1)(4) 37,164 39,285 38,727 34,928 33,777 Net Income Attributable to Common Stockholders per diluted share $ 0.07 $ 0.01 $ 0.02 $ 0.02 $ 0.02 Normalized FFO per diluted share 0.19 0.18 0.18 0.17 0.16 Normalized FAD per diluted share 0.15 0.16 0.16 0.15 0.14 Same-Property Cash NOI Growth 3.1% 3.1% 3.0% 3.0% 3.2% Fixed Charge Coverage Ratio(5) 3.81x 3.47x 3.45x 3.34x 3.19x As of 3Q14 2Q14 1Q14 4Q13 3Q13 ASSETS Gross Real Estate Investments(6) $ 3,240,331 $ 3,194,514 $ 2,976,476 $ 2,972,929 $ 2,823,337 Total Assets 2,986,801 3,014,571 2,735,246 2,752,334 2,681,520 CAPITALIZATION Total Debt $ 1,497,136 $ 1,520,445 $ 1,232,282 $ 1,214,241 $ 1,125,792 Total Stockholders’ Equity 1,329,099 1,346,568 1,359,204 1,387,206 1,405,806 Total Capitalization(7) 4,297,469 4,426,874 3,963,924 3,570,077 3,632,471 Total Debt/Total Capitalization 34.8% 34.3% 31.1% 34.0% 31.0% Company Overview 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 5

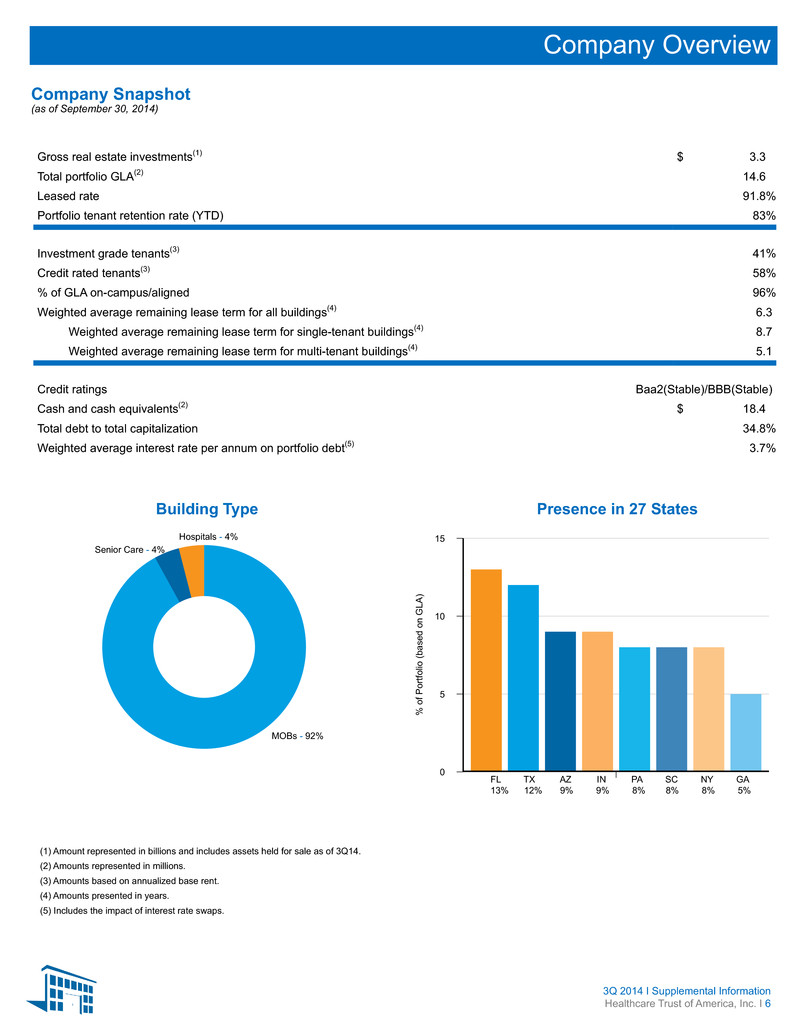

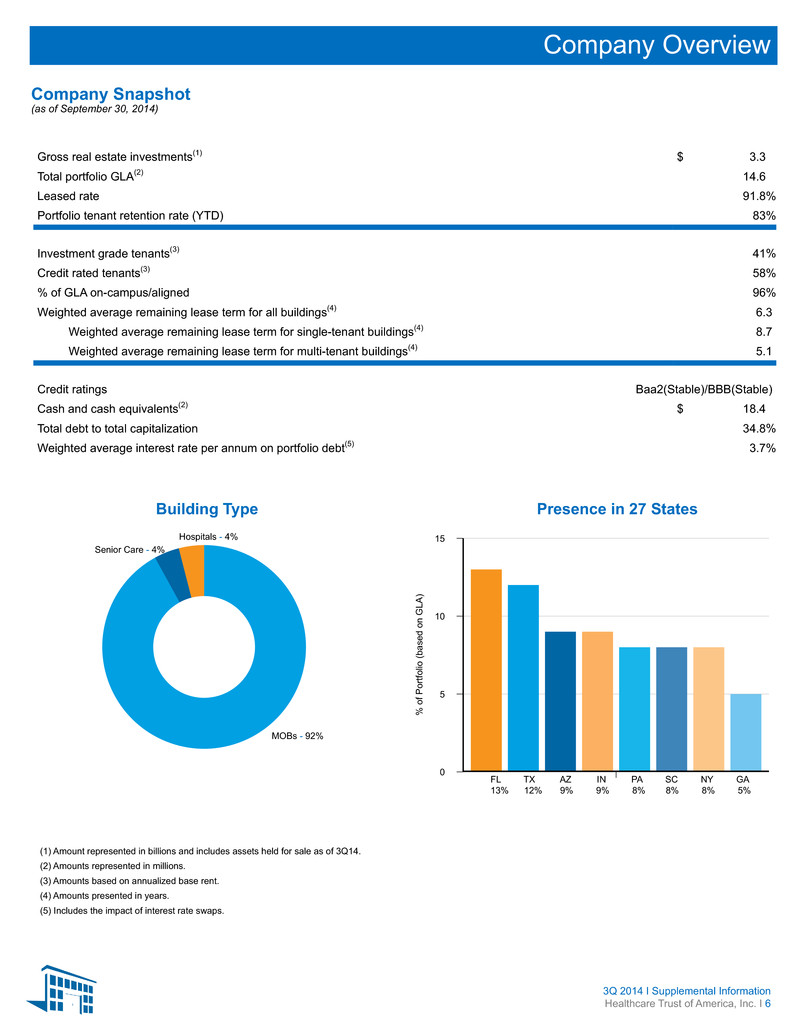

15 10 5 0 % of Po rtf ol io (b as ed on G LA ) Gross real estate investments(1) $ 3.3 Total portfolio GLA(2) 14.6 Leased rate 91.8% Portfolio tenant retention rate (YTD) 83% Investment grade tenants(3) 41% Credit rated tenants(3) 58% % of GLA on-campus/aligned 96% Weighted average remaining lease term for all buildings(4) 6.3 Weighted average remaining lease term for single-tenant buildings(4) 8.7 Weighted average remaining lease term for multi-tenant buildings(4) 5.1 Credit ratings Baa2(Stable)/BBB(Stable) Cash and cash equivalents(2) $ 18.4 Total debt to total capitalization 34.8% Weighted average interest rate per annum on portfolio debt(5) 3.7% Building Type Presence in 27 States Company Snapshot (as of September 30, 2014) Company Overview 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 6 (1) Amount represented in billions and includes assets held for sale as of 3Q14. (2) Amounts represented in millions. (3) Amounts based on annualized base rent. (4) Amounts presented in years. (5) Includes the impact of interest rate swaps. MOBs - 92% Senior Care - 4% Hospitals - 4% FL TX AZ IN PA SC NY GA 13% 12% 9% 9% 8% 8% 8% 5%

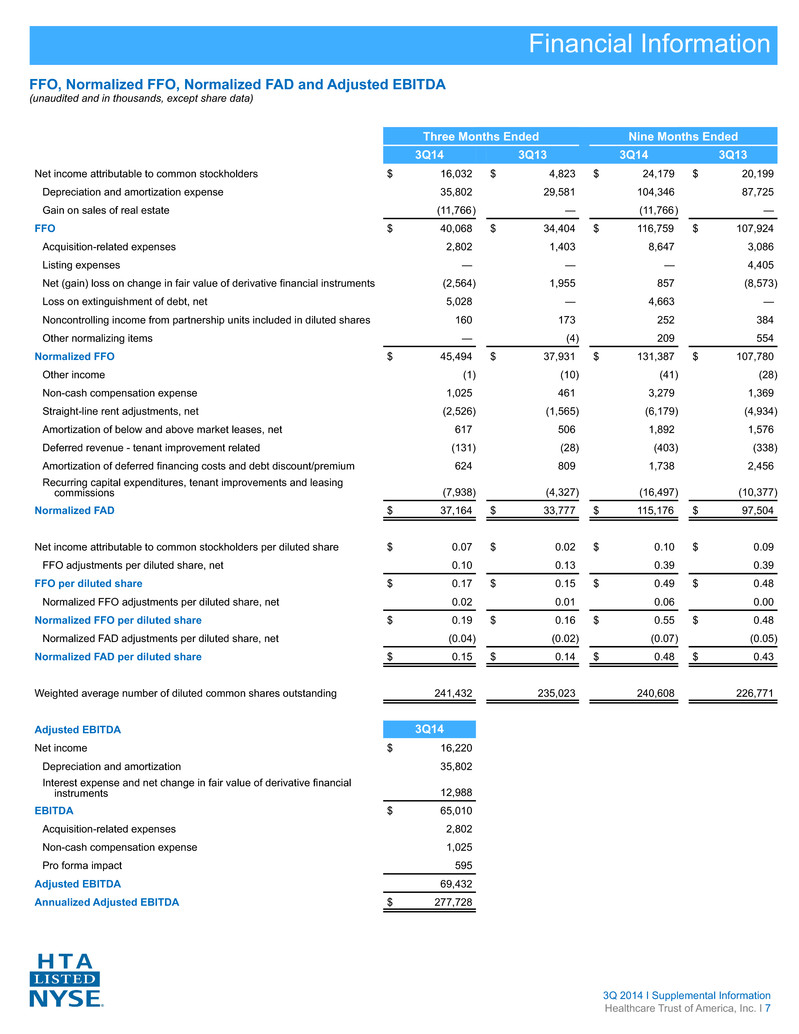

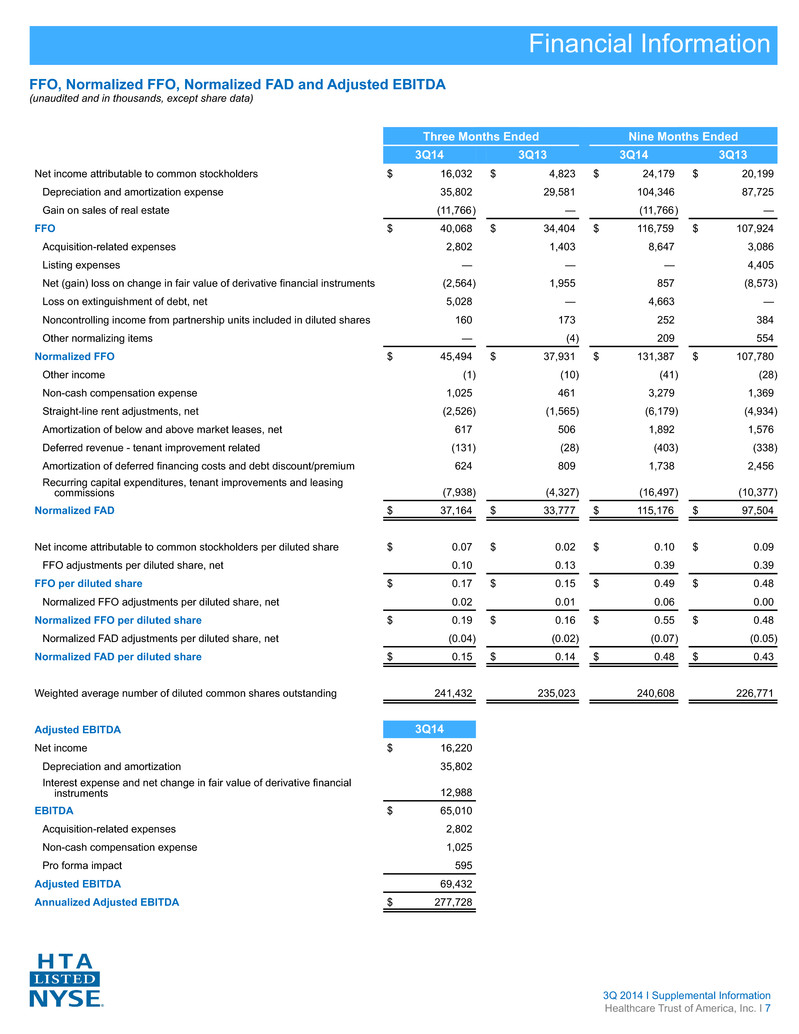

Three Months Ended Nine Months Ended 3Q14 3Q13 3Q14 3Q13 Net income attributable to common stockholders $ 16,032 $ 4,823 $ 24,179 $ 20,199 Depreciation and amortization expense 35,802 29,581 104,346 87,725 Gain on sales of real estate (11,766) — (11,766) — FFO $ 40,068 $ 34,404 $ 116,759 $ 107,924 Acquisition-related expenses 2,802 1,403 8,647 3,086 Listing expenses — — — 4,405 Net (gain) loss on change in fair value of derivative financial instruments (2,564) 1,955 857 (8,573) Loss on extinguishment of debt, net 5,028 — 4,663 — Noncontrolling income from partnership units included in diluted shares 160 173 252 384 Other normalizing items — (4) 209 554 Normalized FFO $ 45,494 $ 37,931 $ 131,387 $ 107,780 Other income (1) (10) (41) (28) Non-cash compensation expense 1,025 461 3,279 1,369 Straight-line rent adjustments, net (2,526) (1,565) (6,179) (4,934) Amortization of below and above market leases, net 617 506 1,892 1,576 Deferred revenue - tenant improvement related (131) (28) (403) (338) Amortization of deferred financing costs and debt discount/premium 624 809 1,738 2,456 Recurring capital expenditures, tenant improvements and leasing commissions (7,938) (4,327) (16,497) (10,377) Normalized FAD $ 37,164 $ 33,777 $ 115,176 $ 97,504 Net income attributable to common stockholders per diluted share $ 0.07 $ 0.02 $ 0.10 $ 0.09 FFO adjustments per diluted share, net 0.10 0.13 0.39 0.39 FFO per diluted share $ 0.17 $ 0.15 $ 0.49 $ 0.48 Normalized FFO adjustments per diluted share, net 0.02 0.01 0.06 0.00 Normalized FFO per diluted share $ 0.19 $ 0.16 $ 0.55 $ 0.48 Normalized FAD adjustments per diluted share, net (0.04) (0.02) (0.07) (0.05) Normalized FAD per diluted share $ 0.15 $ 0.14 $ 0.48 $ 0.43 Weighted average number of diluted common shares outstanding 241,432 235,023 240,608 226,771 Adjusted EBITDA 3Q14 Net income $ 16,220 Depreciation and amortization 35,802 Interest expense and net change in fair value of derivative financial instruments 12,988 EBITDA $ 65,010 Acquisition-related expenses 2,802 Non-cash compensation expense 1,025 Pro forma impact 595 Adjusted EBITDA 69,432 Annualized Adjusted EBITDA $ 277,728 FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA (unaudited and in thousands, except share data) Financial Information 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 7

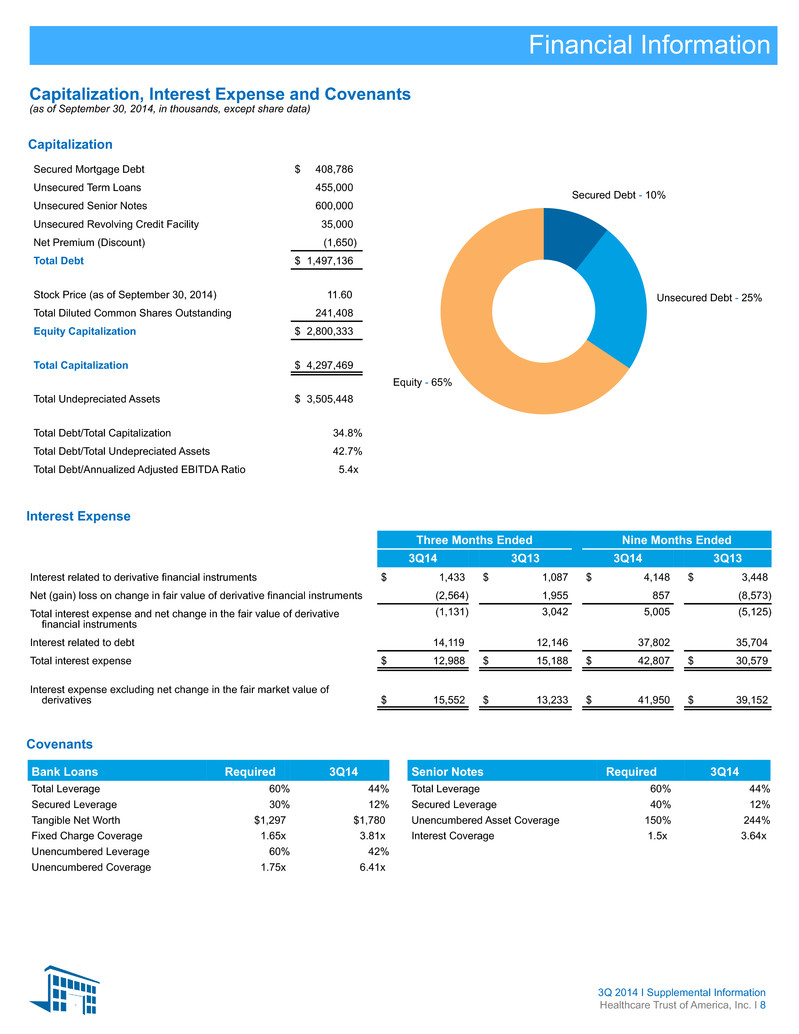

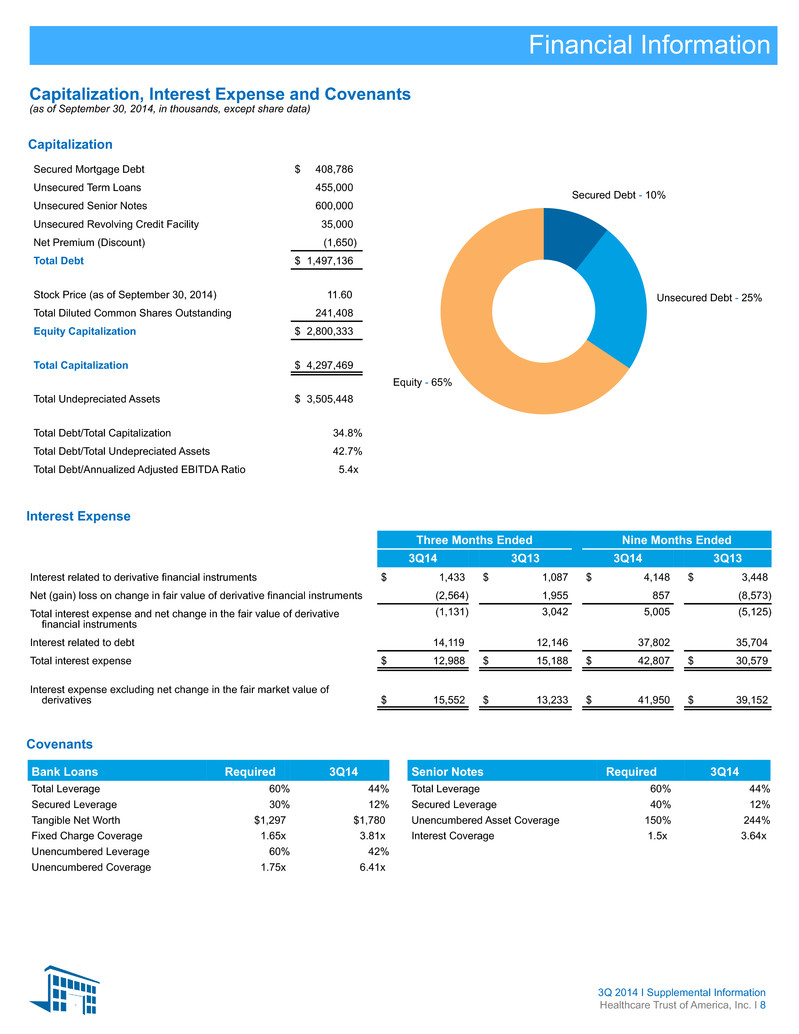

Capitalization Secured Mortgage Debt $ 408,786 Unsecured Term Loans 455,000 Unsecured Senior Notes 600,000 Unsecured Revolving Credit Facility 35,000 Net Premium (Discount) (1,650) Total Debt $ 1,497,136 Stock Price (as of September 30, 2014) 11.60 Total Diluted Common Shares Outstanding 241,408 Equity Capitalization $ 2,800,333 Total Capitalization $ 4,297,469 Total Undepreciated Assets $ 3,505,448 Total Debt/Total Capitalization 34.8% Total Debt/Total Undepreciated Assets 42.7% Total Debt/Annualized Adjusted EBITDA Ratio 5.4x Equity - 65% Secured Debt - 10% Unsecured Debt - 25% Financial Information Capitalization, Interest Expense and Covenants (as of September 30, 2014, in thousands, except share data) 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 8 Interest Expense Covenants Three Months Ended Nine Months Ended 3Q14 3Q13 3Q14 3Q13 Interest related to derivative financial instruments $ 1,433 $ 1,087 $ 4,148 $ 3,448 Net (gain) loss on change in fair value of derivative financial instruments (2,564) 1,955 857 (8,573) Total interest expense and net change in the fair value of derivative financial instruments (1,131) 3,042 5,005 (5,125) Interest related to debt 14,119 12,146 37,802 35,704 Total interest expense $ 12,988 $ 15,188 $ 42,807 $ 30,579 Interest expense excluding net change in the fair market value of derivatives $ 15,552 $ 13,233 $ 41,950 $ 39,152 Bank Loans Required 3Q14 Total Leverage 60% 44% Secured Leverage 30% 12% Tangible Net Worth $1,297 $1,780 Fixed Charge Coverage 1.65x 3.81x Unencumbered Leverage 60% 42% Unencumbered Coverage 1.75x 6.41x Senior Notes Required 3Q14 Total Leverage 60% 44% Secured Leverage 40% 12% Unencumbered Asset Coverage 150% 244% Interest Coverage 1.5x 3.64x

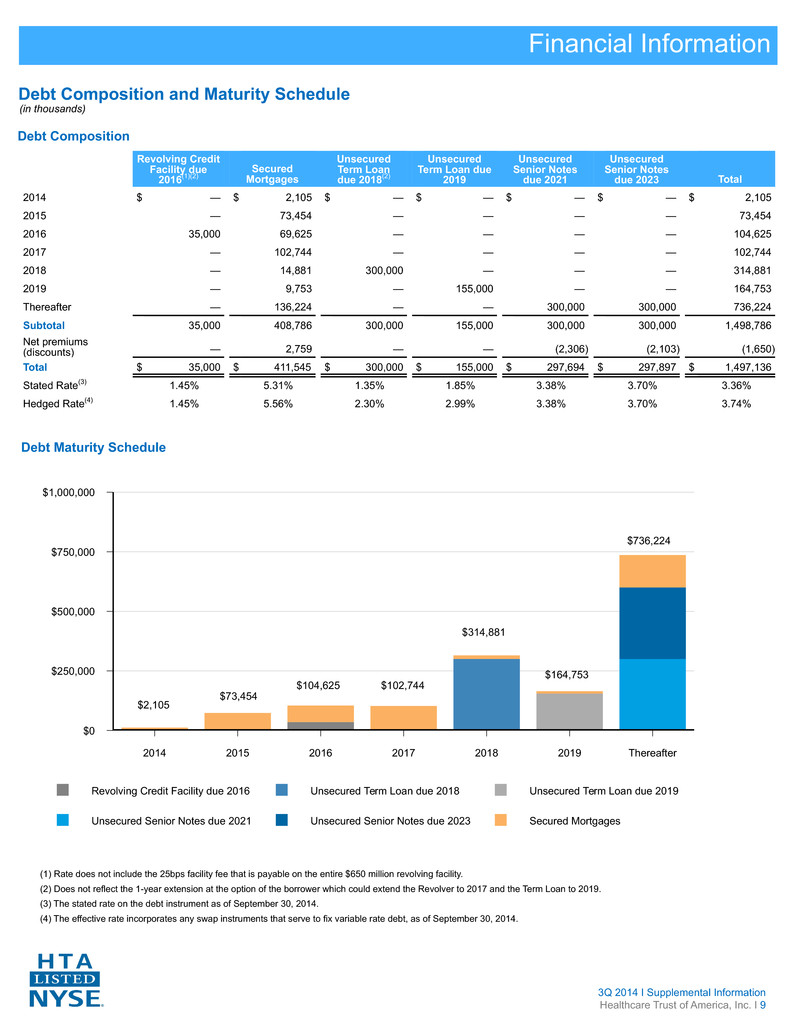

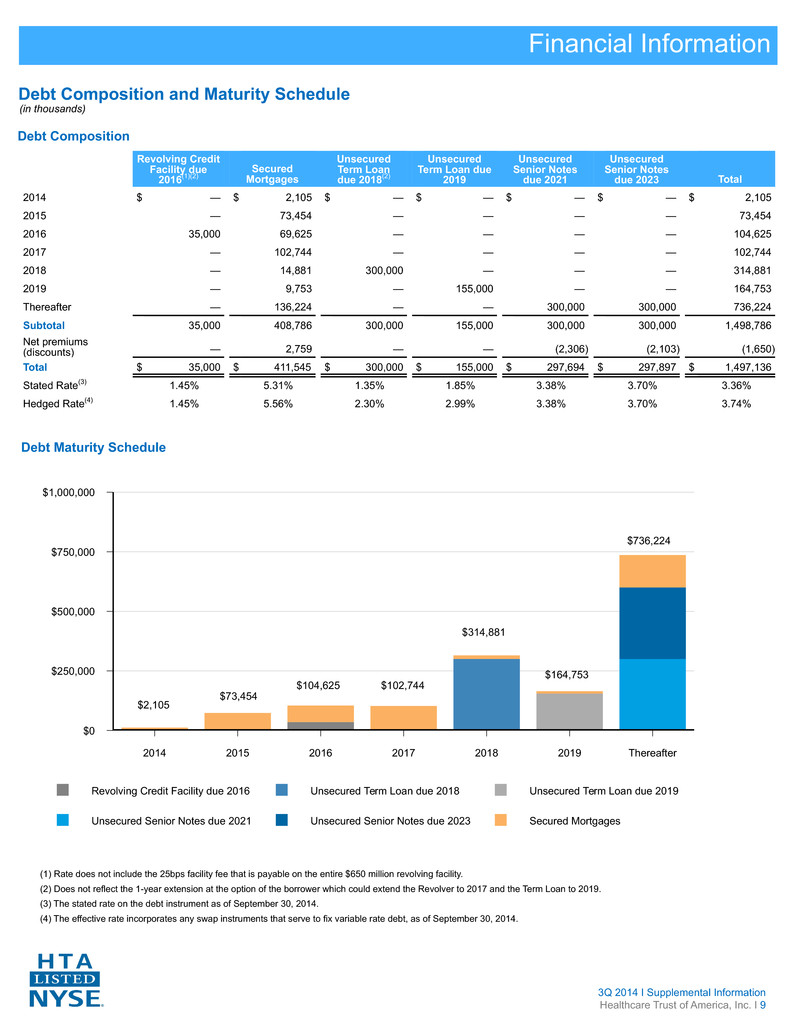

Financial Information Debt Composition and Maturity Schedule (in thousands) 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 9 Revolving Credit Facility due 2016(1)(2) Secured Mortgages Unsecured Term Loan due 2018(2) Unsecured Term Loan due 2019 Unsecured Senior Notes due 2021 Unsecured Senior Notes due 2023 Total 2014 $ — $ 2,105 $ — $ — $ — $ — $ 2,105 2015 — 73,454 — — — — 73,454 2016 35,000 69,625 — — — — 104,625 2017 — 102,744 — — — — 102,744 2018 — 14,881 300,000 — — — 314,881 2019 — 9,753 — 155,000 — — 164,753 Thereafter — 136,224 — — 300,000 300,000 736,224 Subtotal 35,000 408,786 300,000 155,000 300,000 300,000 1,498,786 Net premiums (discounts) — 2,759 — — (2,306) (2,103) (1,650) Total $ 35,000 $ 411,545 $ 300,000 $ 155,000 $ 297,694 $ 297,897 $ 1,497,136 Stated Rate(3) 1.45% 5.31% 1.35% 1.85% 3.38% 3.70% 3.36% Hedged Rate(4) 1.45% 5.56% 2.30% 2.99% 3.38% 3.70% 3.74% Debt Composition (1) Rate does not include the 25bps facility fee that is payable on the entire $650 million revolving facility. (2) Does not reflect the 1-year extension at the option of the borrower which could extend the Revolver to 2017 and the Term Loan to 2019. (3) The stated rate on the debt instrument as of September 30, 2014. (4) The effective rate incorporates any swap instruments that serve to fix variable rate debt, as of September 30, 2014. Debt Maturity Schedule Revolving Credit Facility due 2016 Unsecured Term Loan due 2018 Unsecured Term Loan due 2019 Unsecured Senior Notes due 2021 Unsecured Senior Notes due 2023 Secured Mortgages $1,000,000 $750,000 $500,000 $250,000 $0 2014 2015 2016 2017 2018 2019 Thereafter $2,105 $73,454 $104,625 $102,744 $314,881 $736,224 $164,753

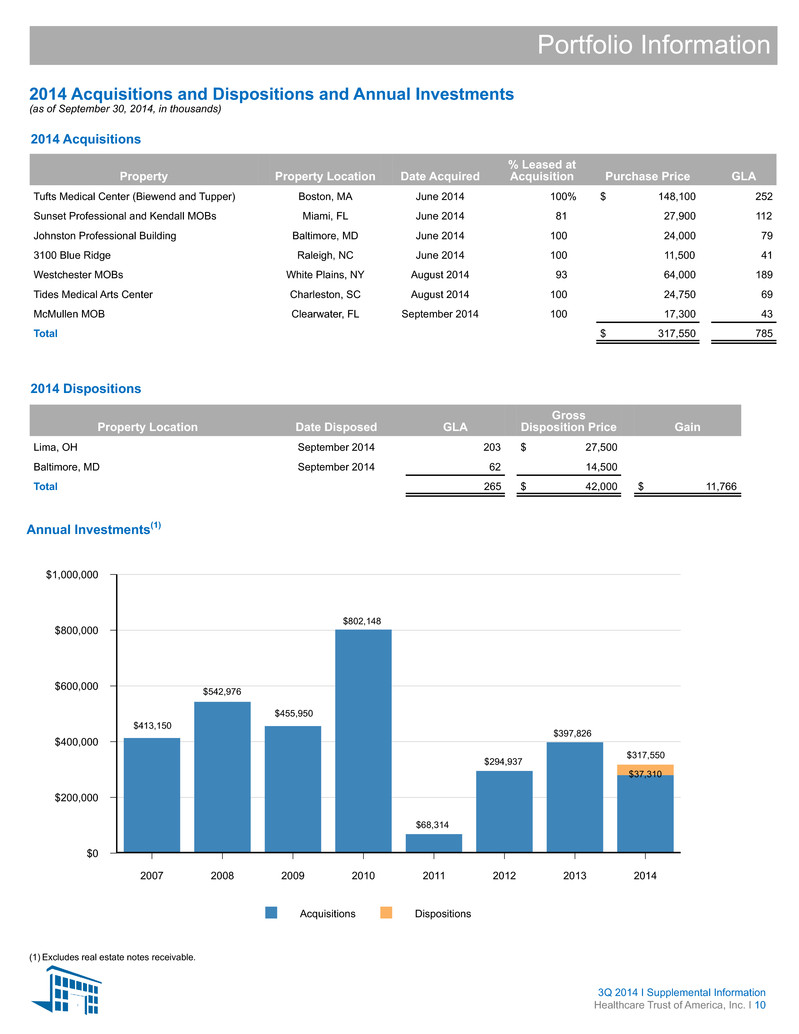

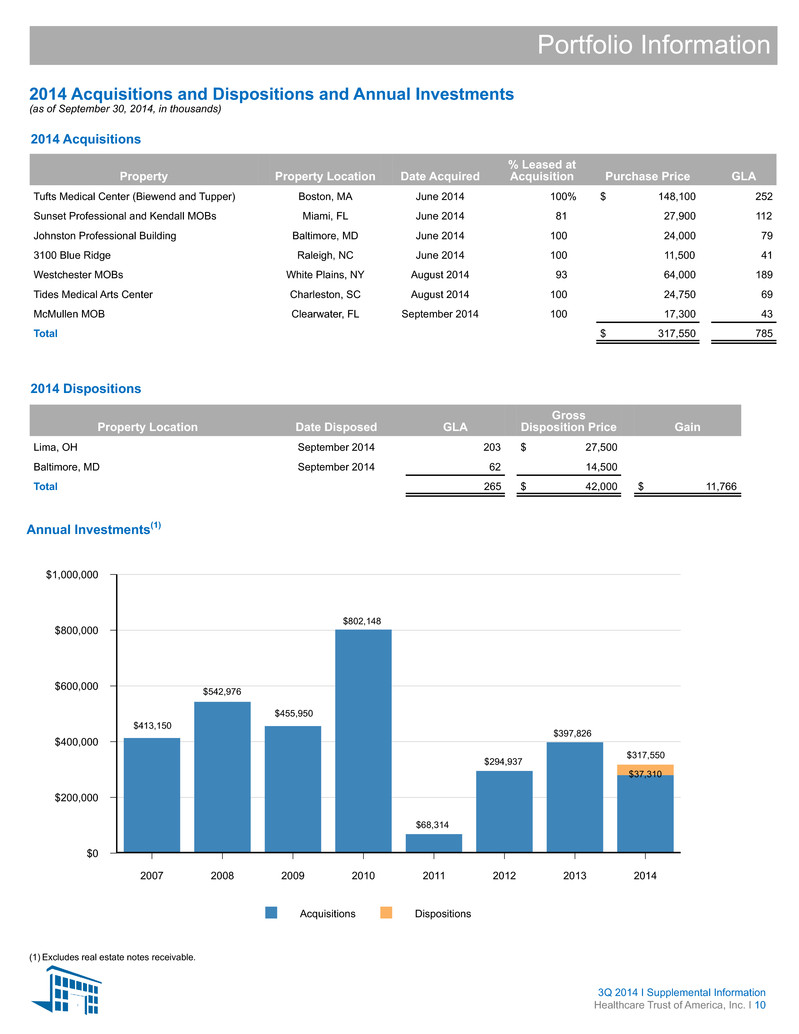

Property Property Location Date Acquired % Leased at Acquisition Purchase Price GLA Tufts Medical Center (Biewend and Tupper) Boston, MA June 2014 100% $ 148,100 252 Sunset Professional and Kendall MOBs Miami, FL June 2014 81 27,900 112 Johnston Professional Building Baltimore, MD June 2014 100 24,000 79 3100 Blue Ridge Raleigh, NC June 2014 100 11,500 41 Westchester MOBs White Plains, NY August 2014 93 64,000 189 Tides Medical Arts Center Charleston, SC August 2014 100 24,750 69 McMullen MOB Clearwater, FL September 2014 100 17,300 43 Total $ 317,550 785 Portfolio Information 2014 Acquisitions and Dispositions and Annual Investments (as of September 30, 2014, in thousands) 2014 Acquisitions Annual Investments(1) 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 10 Property Location Date Disposed GLA Gross Disposition Price Gain Lima, OH September 2014 203 $ 27,500 Baltimore, MD September 2014 62 14,500 Total 265 $ 42,000 $ 11,766 2014 Dispositions Acquisitions Dispositions $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 2007 2008 2009 2010 2011 2012 2013 2014 $37,310 $413,150 $542,976 $455,950 $802,148 $68,314 $294,937 $397,826 $317,550 (1) Excludes real estate notes receivable.

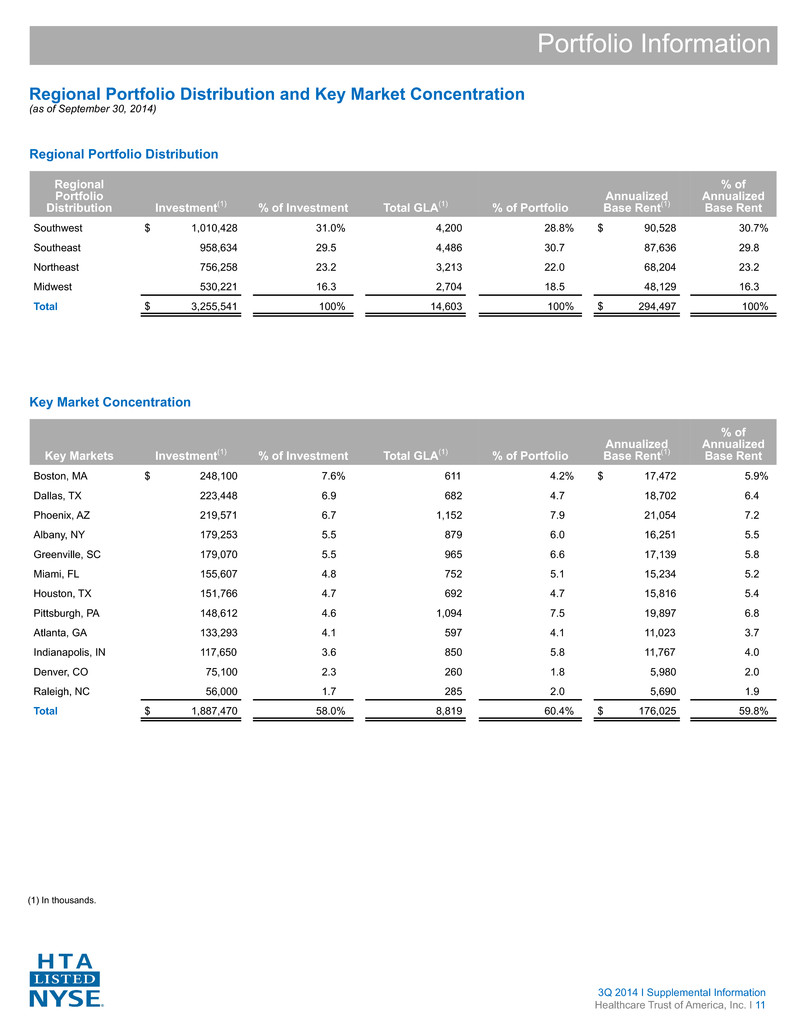

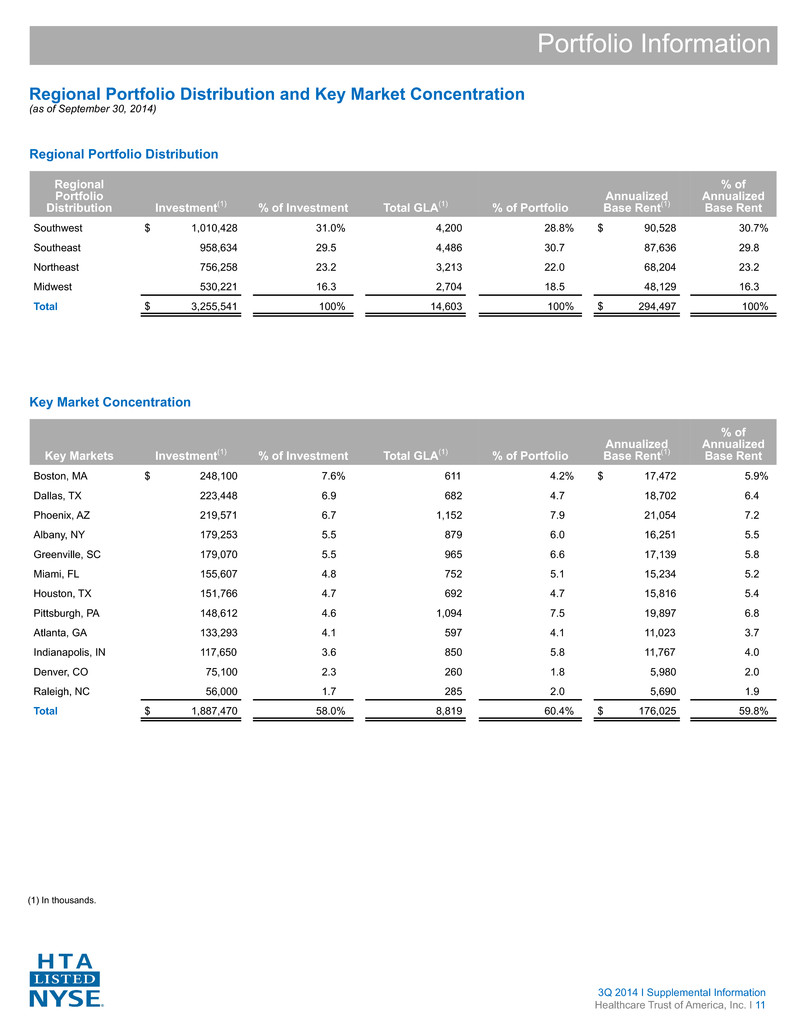

Regional Portfolio Distribution Investment(1) % of Investment Total GLA(1) % of Portfolio Annualized Base Rent(1) % of Annualized Base Rent Southwest $ 1,010,428 31.0% 4,200 28.8% $ 90,528 30.7% Southeast 958,634 29.5 4,486 30.7 87,636 29.8 Northeast 756,258 23.2 3,213 22.0 68,204 23.2 Midwest 530,221 16.3 2,704 18.5 48,129 16.3 Total $ 3,255,541 100% 14,603 100% $ 294,497 100% Key Markets Investment(1) % of Investment Total GLA(1) % of Portfolio Annualized Base Rent(1) % of Annualized Base Rent Boston, MA $ 248,100 7.6% 611 4.2% $ 17,472 5.9% Dallas, TX 223,448 6.9 682 4.7 18,702 6.4 Phoenix, AZ 219,571 6.7 1,152 7.9 21,054 7.2 Albany, NY 179,253 5.5 879 6.0 16,251 5.5 Greenville, SC 179,070 5.5 965 6.6 17,139 5.8 Miami, FL 155,607 4.8 752 5.1 15,234 5.2 Houston, TX 151,766 4.7 692 4.7 15,816 5.4 Pittsburgh, PA 148,612 4.6 1,094 7.5 19,897 6.8 Atlanta, GA 133,293 4.1 597 4.1 11,023 3.7 Indianapolis, IN 117,650 3.6 850 5.8 11,767 4.0 Denver, CO 75,100 2.3 260 1.8 5,980 2.0 Raleigh, NC 56,000 1.7 285 2.0 5,690 1.9 Total $ 1,887,470 58.0% 8,819 60.4% $ 176,025 59.8% Portfolio Information Regional Portfolio Distribution and Key Market Concentration (as of September 30, 2014) Regional Portfolio Distribution Key Market Concentration (1) In thousands. 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 11

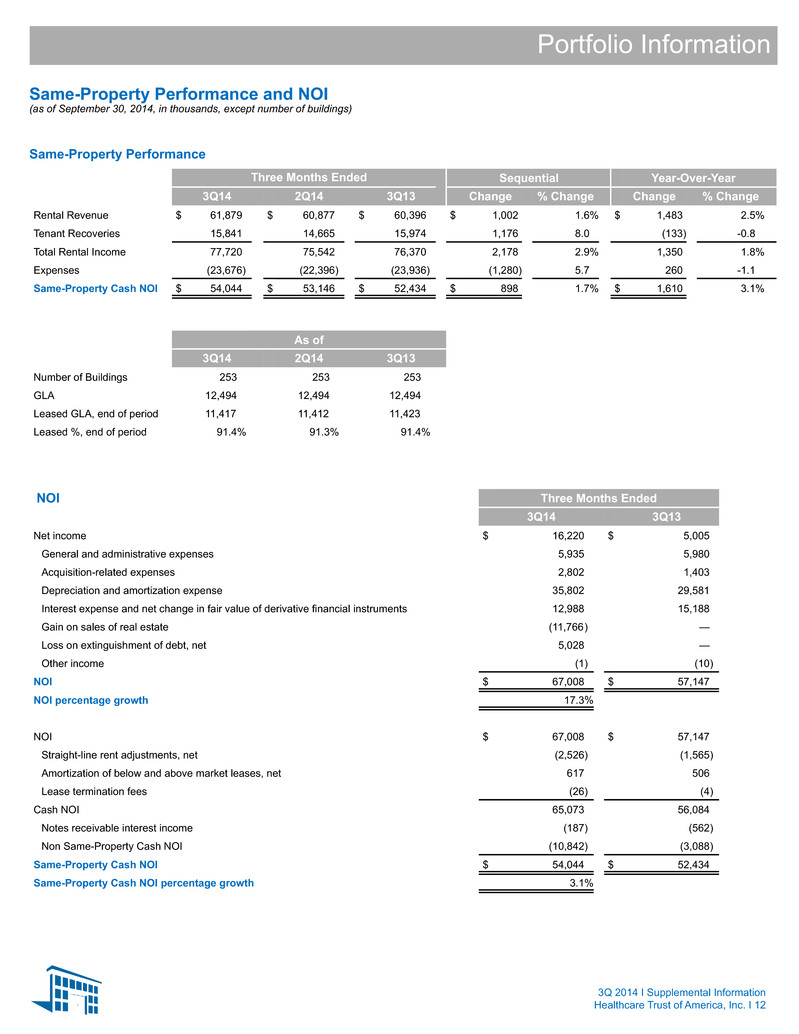

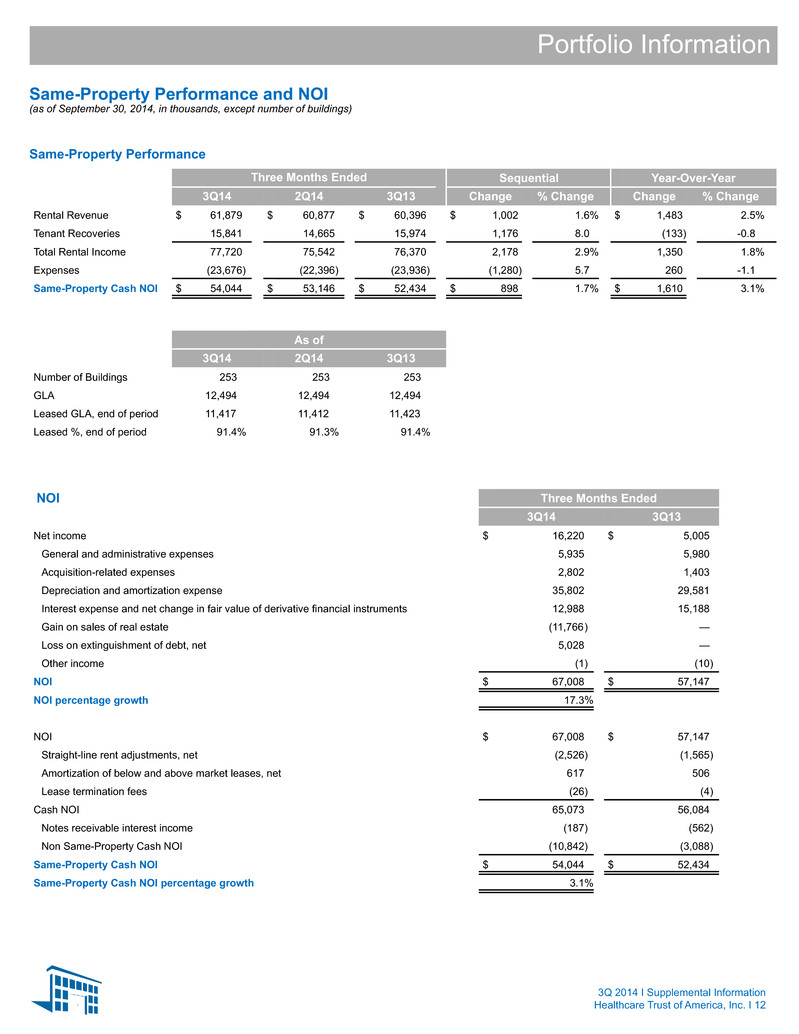

Three Months Ended Sequential Year-Over-Year 3Q14 2Q14 3Q13 Change % Change Change % Change Rental Revenue $ 61,879 $ 60,877 $ 60,396 $ 1,002 1.6% $ 1,483 2.5% Tenant Recoveries 15,841 14,665 15,974 1,176 8.0 (133) -0.8 Total Rental Income 77,720 75,542 76,370 2,178 2.9% 1,350 1.8% Expenses (23,676) (22,396) (23,936) (1,280) 5.7 260 -1.1 Same-Property Cash NOI $ 54,044 $ 53,146 $ 52,434 $ 898 1.7% $ 1,610 3.1% As of 3Q14 2Q14 3Q13 Number of Buildings 253 253 253 GLA 12,494 12,494 12,494 Leased GLA, end of period 11,417 11,412 11,423 Leased %, end of period 91.4% 91.3% 91.4% NOI Three Months Ended 3Q14 3Q13 Net income $ 16,220 $ 5,005 General and administrative expenses 5,935 5,980 Acquisition-related expenses 2,802 1,403 Depreciation and amortization expense 35,802 29,581 Interest expense and net change in fair value of derivative financial instruments 12,988 15,188 Gain on sales of real estate (11,766) — Loss on extinguishment of debt, net 5,028 — Other income (1) (10) NOI $ 67,008 $ 57,147 NOI percentage growth 17.3% NOI $ 67,008 $ 57,147 Straight-line rent adjustments, net (2,526) (1,565) Amortization of below and above market leases, net 617 506 Lease termination fees (26) (4) Cash NOI 65,073 56,084 Notes receivable interest income (187) (562) Non Same-Property Cash NOI (10,842) (3,088) Same-Property Cash NOI $ 54,044 $ 52,434 Same-Property Cash NOI percentage growth 3.1% 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 12 Portfolio Information Same-Property Performance and NOI (as of September 30, 2014, in thousands, except number of buildings) Same-Property Performance

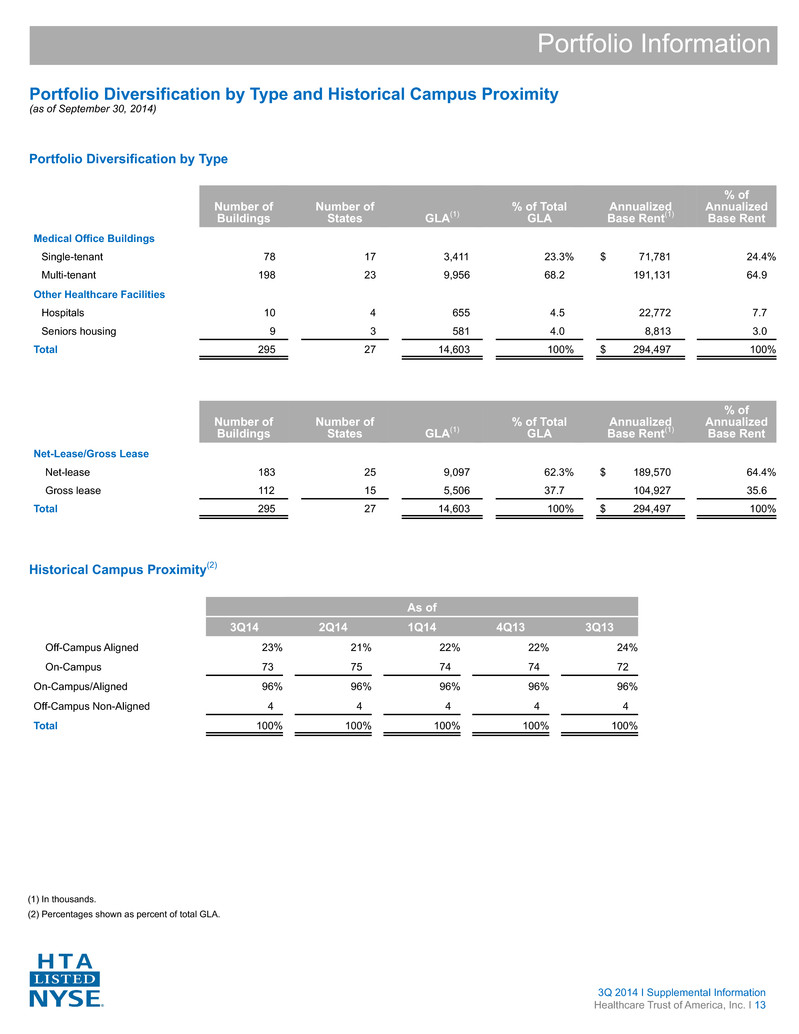

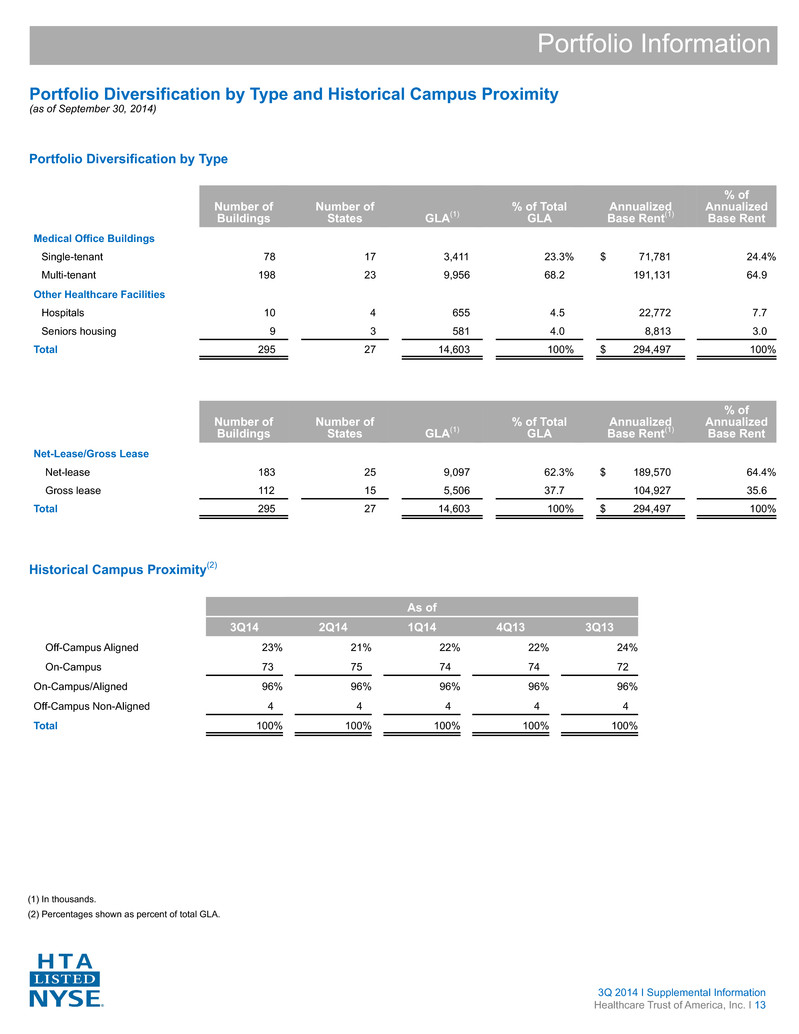

As of 3Q14 2Q14 1Q14 4Q13 3Q13 Off-Campus Aligned 23% 21% 22% 22% 24% On-Campus 73 75 74 74 72 On-Campus/Aligned 96% 96% 96% 96% 96% Off-Campus Non-Aligned 4 4 4 4 4 Total 100% 100% 100% 100% 100% Number of Buildings Number of States GLA(1) % of Total GLA Annualized Base Rent(1) % of Annualized Base Rent Medical Office Buildings Single-tenant 78 17 3,411 23.3% $ 71,781 24.4% Multi-tenant 198 23 9,956 68.2 191,131 64.9 Other Healthcare Facilities Hospitals 10 4 655 4.5 22,772 7.7 Seniors housing 9 3 581 4.0 8,813 3.0 Total 295 27 14,603 100% $ 294,497 100% Number of Buildings Number of States GLA(1) % of Total GLA Annualized Base Rent(1) % of Annualized Base Rent Net-Lease/Gross Lease Net-lease 183 25 9,097 62.3% $ 189,570 64.4% Gross lease 112 15 5,506 37.7 104,927 35.6 Total 295 27 14,603 100% $ 294,497 100% 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 13 (1) In thousands. (2) Percentages shown as percent of total GLA. Portfolio Information Portfolio Diversification by Type and Historical Campus Proximity (as of September 30, 2014) Portfolio Diversification by Type Historical Campus Proximity(2)

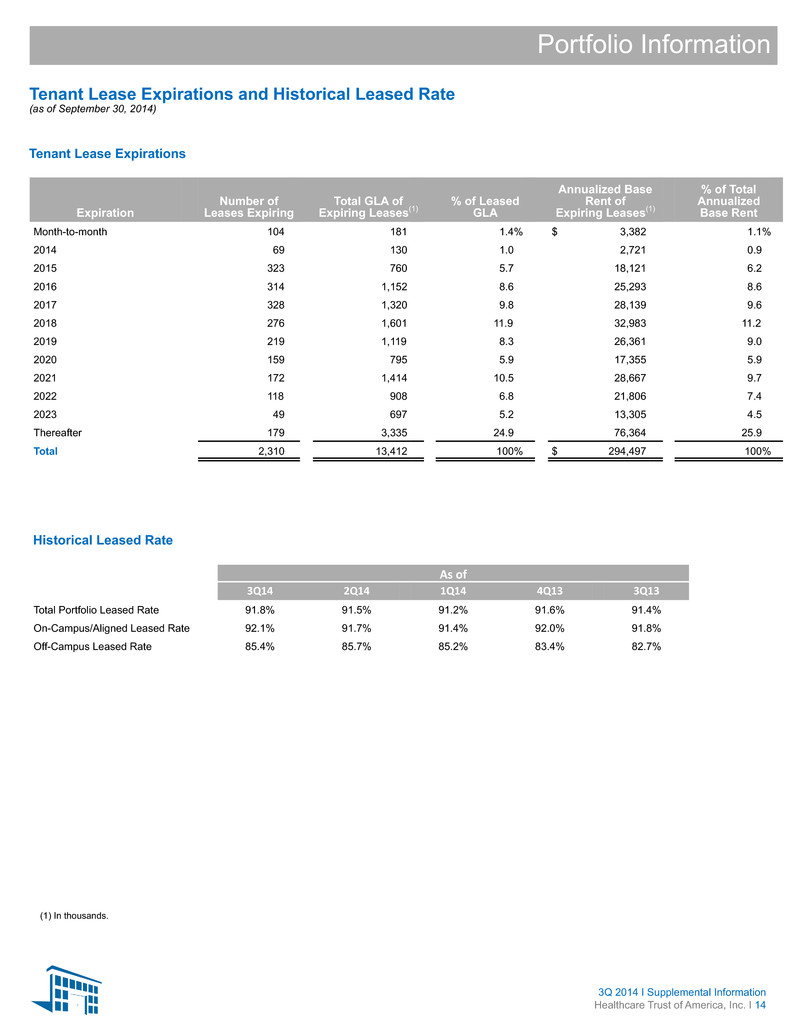

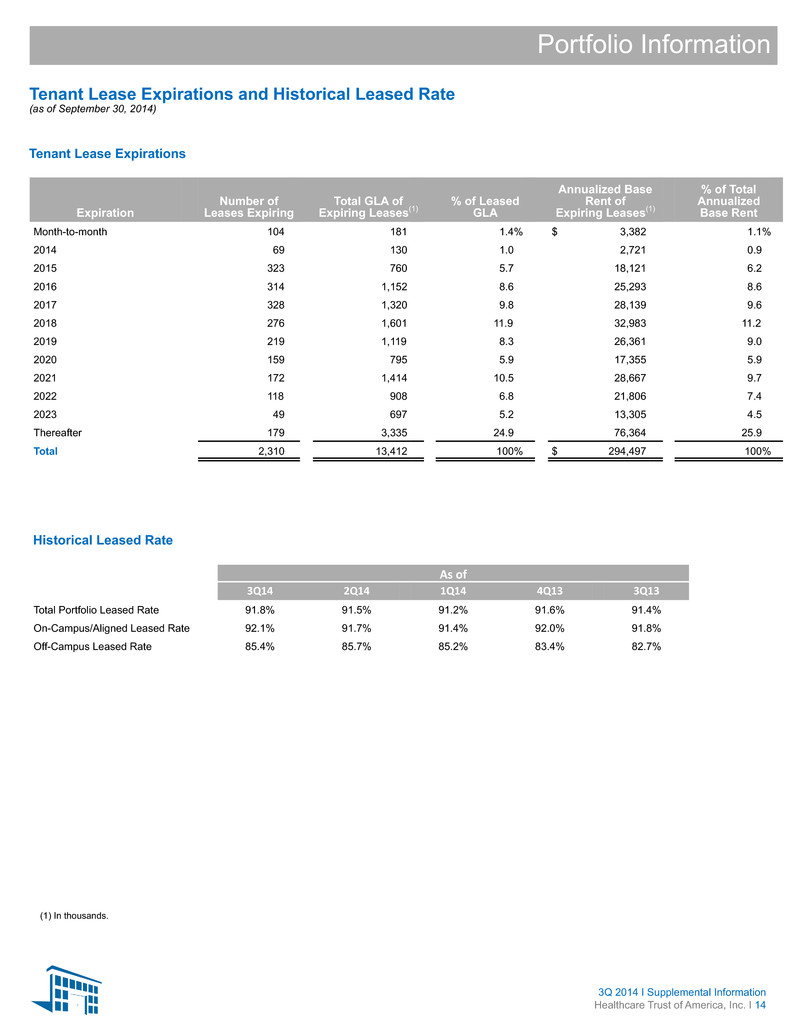

As of 3Q14 2Q14 1Q14 4Q13 3Q13 Total Portfolio Leased Rate 91.8% 91.5% 91.2% 91.6% 91.4% On-Campus/Aligned Leased Rate 92.1% 91.7% 91.4% 92.0% 91.8% Off-Campus Leased Rate 85.4% 85.7% 85.2% 83.4% 82.7% Expiration Number of Leases Expiring Total GLA of Expiring Leases(1) % of Leased GLA Annualized Base Rent of Expiring Leases(1) % of Total Annualized Base Rent Month-to-month 104 181 1.4% $ 3,382 1.1% 2014 69 130 1.0 2,721 0.9 2015 323 760 5.7 18,121 6.2 2016 314 1,152 8.6 25,293 8.6 2017 328 1,320 9.8 28,139 9.6 2018 276 1,601 11.9 32,983 11.2 2019 219 1,119 8.3 26,361 9.0 2020 159 795 5.9 17,355 5.9 2021 172 1,414 10.5 28,667 9.7 2022 118 908 6.8 21,806 7.4 2023 49 697 5.2 13,305 4.5 Thereafter 179 3,335 24.9 76,364 25.9 Total 2,310 13,412 100% $ 294,497 100% 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 14 (1) In thousands. Portfolio Information Tenant Lease Expirations and Historical Leased Rate (as of September 30, 2014) Tenant Lease Expirations Historical Leased Rate

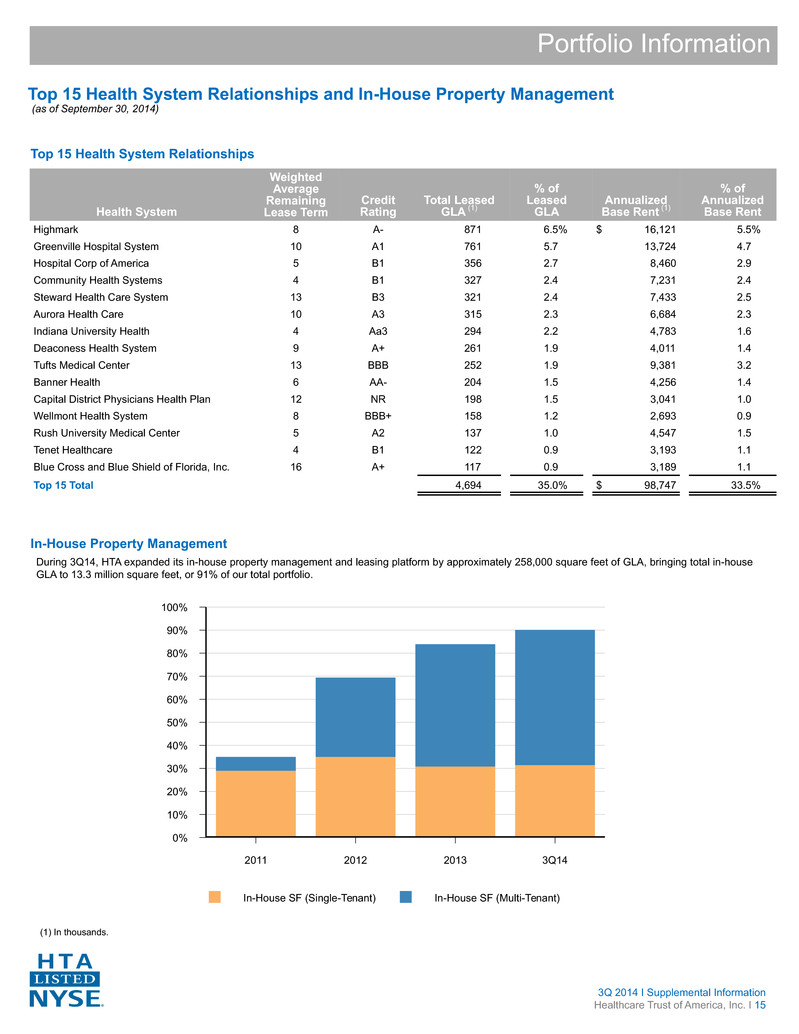

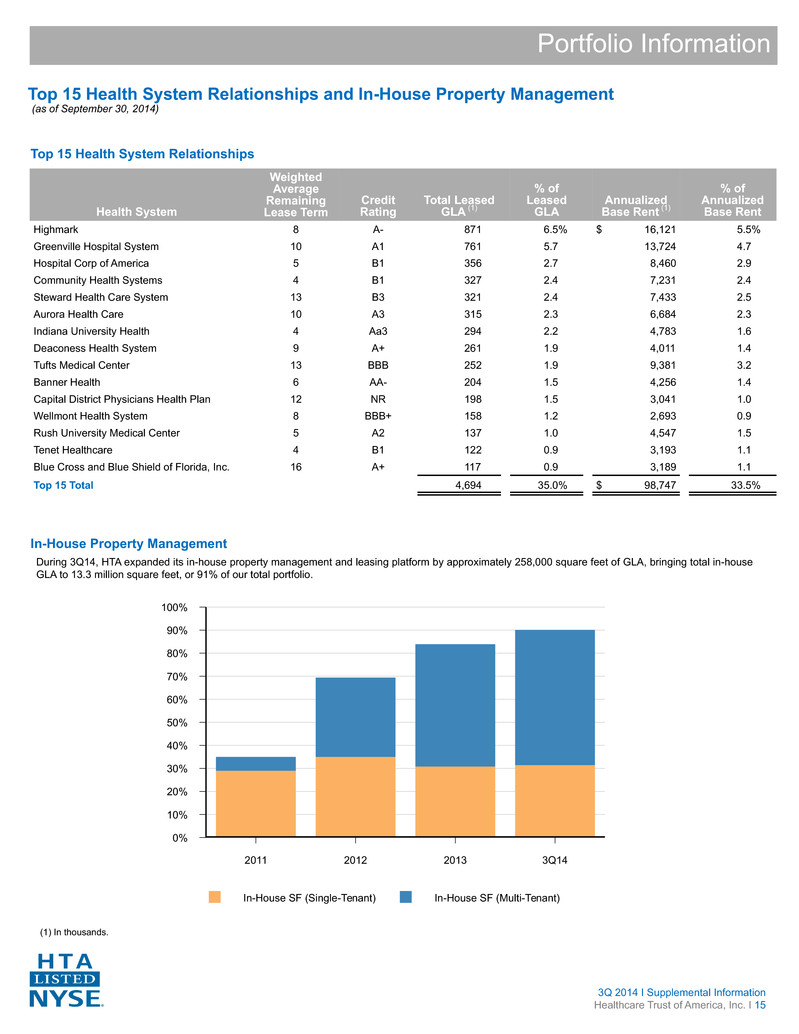

Health System Weighted Average Remaining Lease Term Credit Rating Total Leased GLA (1) % of Leased GLA Annualized Base Rent (1) % of Annualized Base Rent Highmark 8 A- 871 6.5% $ 16,121 5.5% Greenville Hospital System 10 A1 761 5.7 13,724 4.7 Hospital Corp of America 5 B1 356 2.7 8,460 2.9 Community Health Systems 4 B1 327 2.4 7,231 2.4 Steward Health Care System 13 B3 321 2.4 7,433 2.5 Aurora Health Care 10 A3 315 2.3 6,684 2.3 Indiana University Health 4 Aa3 294 2.2 4,783 1.6 Deaconess Health System 9 A+ 261 1.9 4,011 1.4 Tufts Medical Center 13 BBB 252 1.9 9,381 3.2 Banner Health 6 AA- 204 1.5 4,256 1.4 Capital District Physicians Health Plan 12 NR 198 1.5 3,041 1.0 Wellmont Health System 8 BBB+ 158 1.2 2,693 0.9 Rush University Medical Center 5 A2 137 1.0 4,547 1.5 Tenet Healthcare 4 B1 122 0.9 3,193 1.1 Blue Cross and Blue Shield of Florida, Inc. 16 A+ 117 0.9 3,189 1.1 Top 15 Total 4,694 35.0% $ 98,747 33.5% During 3Q14, HTA expanded its in-house property management and leasing platform by approximately 258,000 square feet of GLA, bringing total in-house GLA to 13.3 million square feet, or 91% of our total portfolio. In-House SF (Single-Tenant) In-House SF (Multi-Tenant) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2011 2012 2013 3Q14 Portfolio Information Top 15 Health System Relationships and In-House Property Management (as of September 30, 2014) Top 15 Health System Relationships In-House Property Management (1) In thousands. 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 15

Community Health Systems, Inc. (B1), headquartered in Franklin, Tennessee, is one of the nation’s leading operators of general acute care hospitals. The organization includes 207 affiliated hospitals in 29 states with approximately 31,100 licensed beds. Affiliated hospitals are dedicated to providing quality healthcare for local residents and contribute to the economic development of their communities. Based on the unique needs of each community served, these hospitals offer a wide range of diagnostic, medical and surgical services in inpatient and outpatient settings. Forest Park Medical Center (NR), headquartered in Dallas, Texas, is leading physician-owned healthcare system focused on private- pay hospitals in key markets throughout Texas. FPMC’s vision is to provide superior care and service in a vibrant and diverse environment while maintaining and enhancing their status as a leader in the healthcare industry. Patients at FPMC experience state-of- the-art medicine in world-class facilities. Greenville Health System (A1), located in Greenville, South Carolina, is a public not-for-profit academic healthcare delivery system committed to medical excellence through clinical care, education and research. GHS is a health resource for its community and a leader in transforming the delivery of health care for the benefit of people and communities served. The University of South Carolina School of Medicine Greenville is located on GHS’ Greenville Memorial Medical Campus. The medical school is focused on transforming healthcare by training physicians to connect with communities, patients, colleagues and technology is a new, more progressive way. Highmark (A-), based in Pittsburgh, Pennsylvania, is a diversified healthcare partner that serves members across the United States through its businesses in health insurance, dental insurance, vision care and reinsurance. Highmark is the fourth largest BlueCross and Blue Shield-affiliated company. In 2013, Highmark and West Penn Allegheny combined to create an integrated care delivery model which they believe will preserve an important community asset that provides high-quality, efficient health care for patients. Highmark’s mission is to deliver high quality, accessible, understandable and affordable experiences, outcomes and solutions to their customers. Hospital Corporation of America (B1), Nashville-based HCA was one of the nation’s first hospital companies. Today, they are a company comprised of locally managed facilities that includes about 165 hospitals, 115 freestanding surgery centers in 20 states and England employing approximately 204,000 people. Approximately four to five percent of all inpatient care delivered in the country today is provided by HCA facilities. HCA is committed to the care and improvement of human life and strives to deliver high quality, cost effective healthcare in the communities they serve. Indiana University Health (Aa3), based in Indianapolis, Indiana, is Indiana’s most comprehensive healthcare system. A unique partnership with Indiana University School of Medicine, one of the nation’s leading medical schools, gives patients access to innovative treatments and therapies. IU Health is comprised of hospitals, physicians and allied services dedicated to providing preeminent care throughout Indiana and beyond. Piedmont Healthcare (Aa3), based in Atlanta, Georgia, is the Atlanta region’s premier community healthcare system. Founded in 1905, Piedmont is driven by the mission to create a system committed to compassion, advanced treatments, access to care and strong connections to make their patients, communities and region better. A single hospital started a century ago has grown into an integrated healthcare system with five hospitals and close to 100 physician and specialist offices across greater Atlanta and North Georgia. Steward Health Care System (B3), located in Boston, Massachusetts, is a community-based accountable care organization and community hospital network with more than 17,000 employees serving more than one million patients annually. The system includes 11 hospitals and over 2,000 beds that reach over 150 communities in the greater Boston area. Other Steward Health Care entities include Steward Medical Group, Steward Health Care network, and Steward Home Care. Tenet Healthcare System (B1), located in Dallas, Texas, is a leading health care services company. Through its network, Tenet operates 80 hospitals, over 200 outpatient centers and has over 105,000 employees. Across the network, compassionate, quality care is provided to millions of patients through a wide range of services. Tenant is affiliated with Conifer Health Solutions, which helps hospitals, employers and health insurance companies improve the efficiency and performance of their operations and the health of the people they serve. Tufts Medical Center (BBB), located in Boston, Massachusetts, is a 415-bed academic medical center, providing everything from routine and emergency care to treating the most complex diseases and injuries affecting adults and children throughout New England. Tufts Medical Center is the principal teaching hospital for Tufts University School of Medicine, and has consistently been ranked in the top quartile of major academic medical centers in the country by The University HealthSystem Consortium. Portfolio Information Health System Relationship Highlights 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 16

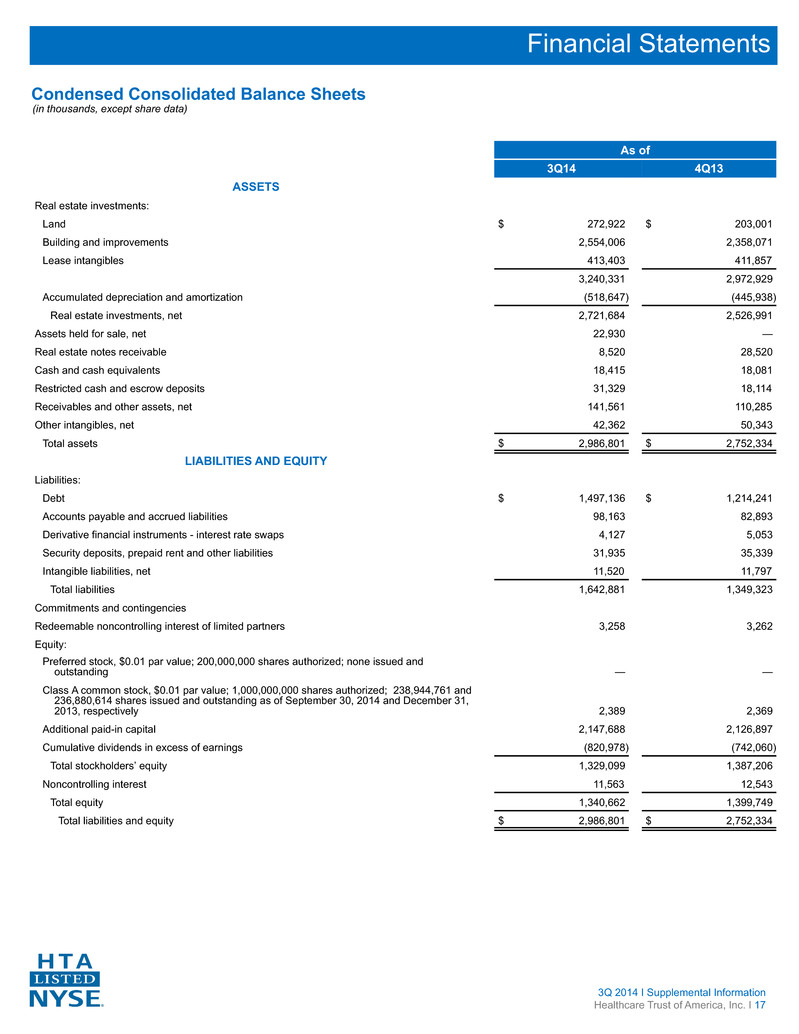

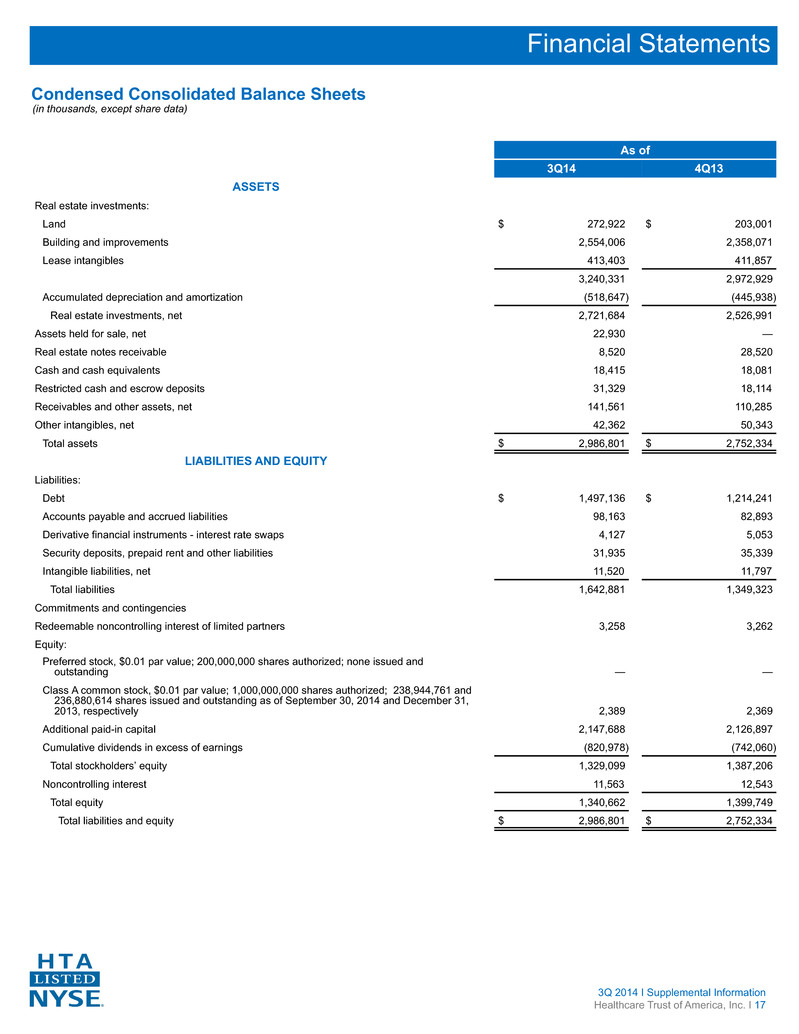

As of 3Q14 4Q13 ASSETS Real estate investments: Land $ 272,922 $ 203,001 Building and improvements 2,554,006 2,358,071 Lease intangibles 413,403 411,857 3,240,331 2,972,929 Accumulated depreciation and amortization (518,647) (445,938) Real estate investments, net 2,721,684 2,526,991 Assets held for sale, net 22,930 — Real estate notes receivable 8,520 28,520 Cash and cash equivalents 18,415 18,081 Restricted cash and escrow deposits 31,329 18,114 Receivables and other assets, net 141,561 110,285 Other intangibles, net 42,362 50,343 Total assets $ 2,986,801 $ 2,752,334 LIABILITIES AND EQUITY Liabilities: Debt $ 1,497,136 $ 1,214,241 Accounts payable and accrued liabilities 98,163 82,893 Derivative financial instruments - interest rate swaps 4,127 5,053 Security deposits, prepaid rent and other liabilities 31,935 35,339 Intangible liabilities, net 11,520 11,797 Total liabilities 1,642,881 1,349,323 Commitments and contingencies Redeemable noncontrolling interest of limited partners 3,258 3,262 Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 238,944,761 and 236,880,614 shares issued and outstanding as of September 30, 2014 and December 31, 2013, respectively 2,389 2,369 Additional paid-in capital 2,147,688 2,126,897 Cumulative dividends in excess of earnings (820,978) (742,060) Total stockholders’ equity 1,329,099 1,387,206 Noncontrolling interest 11,563 12,543 Total equity 1,340,662 1,399,749 Total liabilities and equity $ 2,986,801 $ 2,752,334 Financial Statements Condensed Consolidated Balance Sheets (in thousands, except share data) 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 17

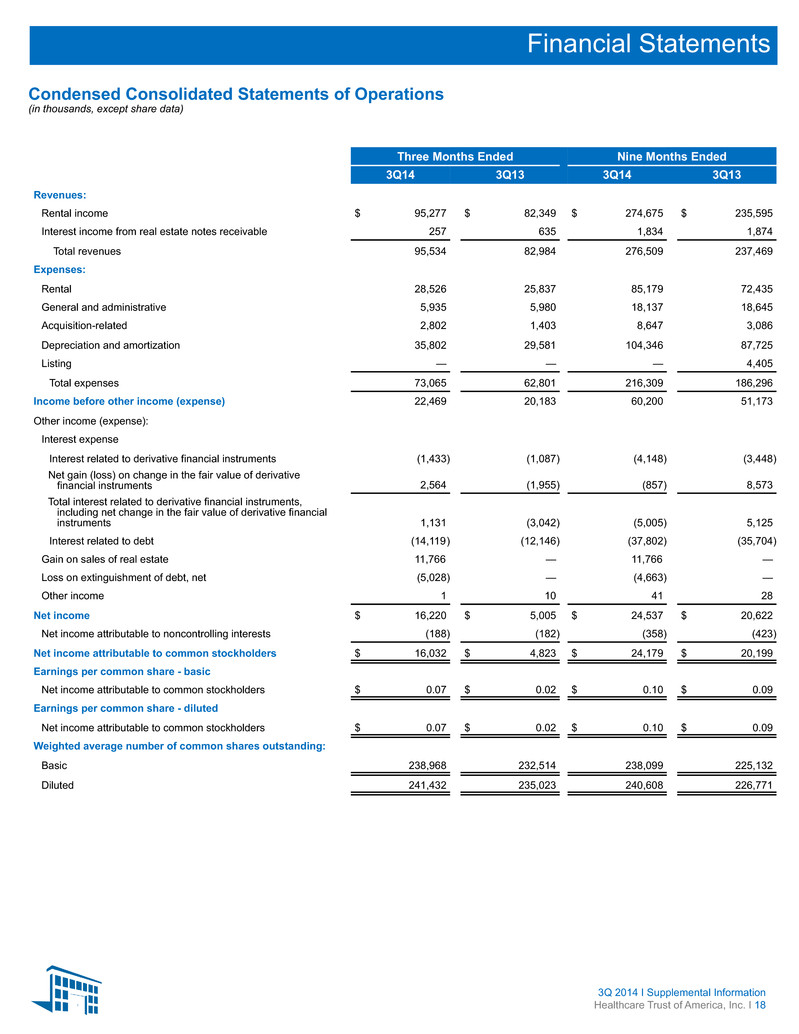

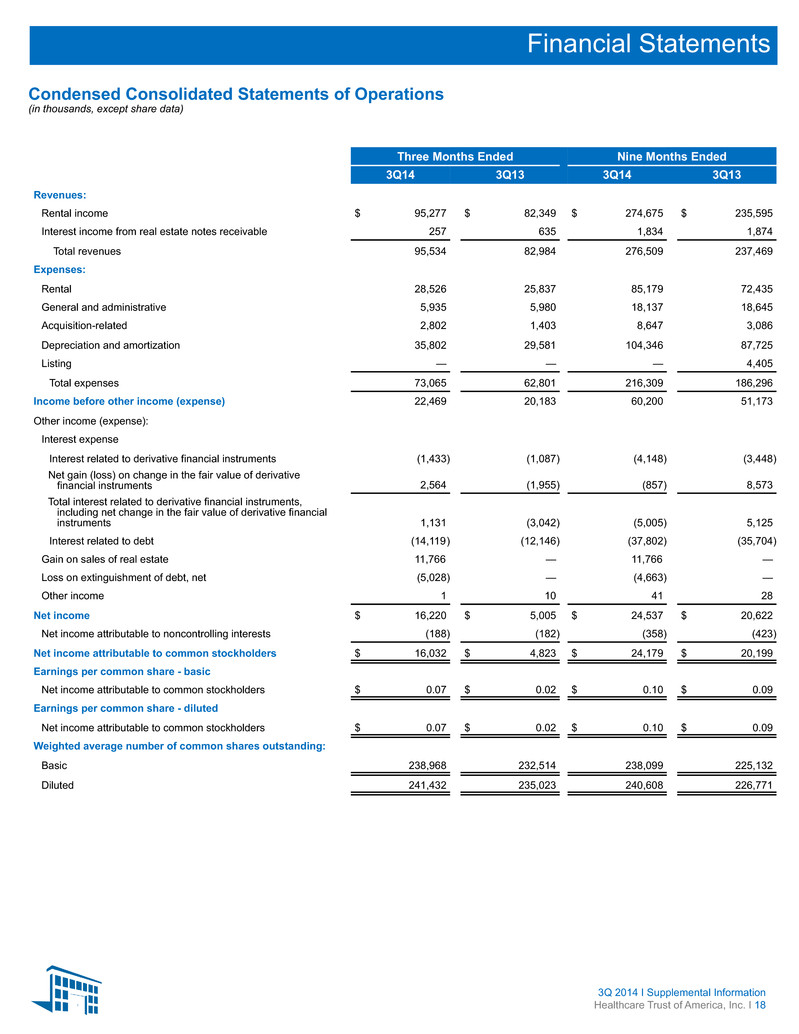

Three Months Ended Nine Months Ended 3Q14 3Q13 3Q14 3Q13 Revenues: Rental income $ 95,277 $ 82,349 $ 274,675 $ 235,595 Interest income from real estate notes receivable 257 635 1,834 1,874 Total revenues 95,534 82,984 276,509 237,469 Expenses: Rental 28,526 25,837 85,179 72,435 General and administrative 5,935 5,980 18,137 18,645 Acquisition-related 2,802 1,403 8,647 3,086 Depreciation and amortization 35,802 29,581 104,346 87,725 Listing — — — 4,405 Total expenses 73,065 62,801 216,309 186,296 Income before other income (expense) 22,469 20,183 60,200 51,173 Other income (expense): Interest expense Interest related to derivative financial instruments (1,433) (1,087) (4,148) (3,448) Net gain (loss) on change in the fair value of derivative financial instruments 2,564 (1,955) (857) 8,573 Total interest related to derivative financial instruments, including net change in the fair value of derivative financial instruments 1,131 (3,042) (5,005) 5,125 Interest related to debt (14,119) (12,146) (37,802) (35,704) Gain on sales of real estate 11,766 — 11,766 — Loss on extinguishment of debt, net (5,028) — (4,663) — Other income 1 10 41 28 Net income $ 16,220 $ 5,005 $ 24,537 $ 20,622 Net income attributable to noncontrolling interests (188) (182) (358) (423) Net income attributable to common stockholders $ 16,032 $ 4,823 $ 24,179 $ 20,199 Earnings per common share - basic Net income attributable to common stockholders $ 0.07 $ 0.02 $ 0.10 $ 0.09 Earnings per common share - diluted Net income attributable to common stockholders $ 0.07 $ 0.02 $ 0.10 $ 0.09 Weighted average number of common shares outstanding: Basic 238,968 232,514 238,099 225,132 Diluted 241,432 235,023 240,608 226,771 3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 18 Financial Statements Condensed Consolidated Statements of Operations (in thousands, except share data)

3Q 2014 I Supplemental Information Healthcare Trust of America, Inc. I 19 Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA): Is presented on an assumed annualized basis. We define Adjusted EBITDA for HTA as net income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, acquisition- related expenses and non-cash compensation expense. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for September 2014 by 12 (excluding the impact of abatements, concessions, and straight-line rent). Credit Ratings: Credit ratings of our tenants or their parent companies. Funds from Operations (FFO): HTA computes FFO in accordance with the current standards established by the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT defines FFO, as net income or loss attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from sales of property and impairment write-downs of depreciable assets, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents this non- GAAP financial measure because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Historical cost accounting assumes that the value of real estate assets diminishes ratably over time. Since real asset values have historically risen or fallen based on market conditions, many industry investors have considered presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Because FFO excludes depreciation and amortization unique to real estate, among other items, it provides a perspective not immediately apparent from net income or loss attributable to common stockholders. HTA’s methodology for calculating FFO may be different from methods utilized by other REITs and, accordingly, may not be comparable to such other REITs. FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of sufficient cash flow to fund all of our needs. FFO should be reviewed in connection with other GAAP measurements. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price and includes a portfolio of real estate notes receivable. Leased Rate: Leased rate represents the percentage of total gross leasable area that is leased, including month-to-month leases and leases which have been executed, but which have not yet commenced, as of the date reported. Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss (computed in accordance with GAAP) before (i) general and administrative expenses, (ii) acquisition-related expenses, (iii) depreciation and amortization expense, (iv) listing expenses, (v) interest expense and net change in the fair value of derivative financial instruments, (vi) gain or loss on sales of real estate, (vii) gain or loss on extinguishment of debt and (viii) other income or expense. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance in the evaluation of REITs. However, HTA’s use of the term NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. NOI should be reviewed in connection with other GAAP measurements. Cash Net Operating Income (Cash NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI (i) straight-line rent adjustments, (ii) amortization of below and above market leases and (iii) lease termination fees. HTA believes that Cash NOI provides another measurement of the operating performance of its operating assets. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating performance of REITs. However, HTA’s use of the term Cash NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Cash NOI should be reviewed in connection with other GAAP measurements. Normalized Funds Available for Distribution (Normalized FAD): HTA computes Normalized FAD, which excludes from Normalized FFO (i) other income or expense, (ii) non-cash compensation expense, (iii) straight-line rent adjustments, (iv) amortization of below and above market leases, (v) deferred revenue - tenant improvement related, (vi) amortization of deferred financing costs and debt premium/discount and (vii) recurring capital expenditures, tenant improvements and leasing commissions. HTA believes this non-GAAP financial measure provides a meaningful supplemental measure of its ability to fund its ongoing dividends. Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of sufficient cash flow to fund all of our needs. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): HTA computes Normalized FFO, which excludes from FFO (i) acquisition-related expenses, (ii) listing expenses, (iii) net gain or loss on change in the fair value of derivative financial instruments, (iv) gain or loss on the extinguishment of debt, (v) noncontrolling income or loss from partnership units included in diluted shares and (vi) other normalizing items. HTA presents this non-GAAP financial measure because it allows for the comparison of our operating performance to other REITs and between periods on a consistent basis. HTA’s methodology for calculating Normalized FFO may be different from the methods utilized by other REITs and, accordingly, may not be comparable to such other REITs. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of sufficient cash flow to fund our needs. Normalized FFO should be reviewed in connection with other GAAP measurements. Off-Campus: A building or portfolio that is not located on or adjacent to key hospital based-campuses and is not aligned with recognized healthcare systems. On-Campus/Aligned: On-campus refers to a property that is located on or adjacent to a healthcare system. Aligned refers to a property that is not on the campus of a healthcare system, but anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements, Leasing Commissions: Represents amounts paid for i) recurring capital expenditures required to maintain and re-tenant our properties, ii) second generation tenant improvements, and iii) leasing commissions paid to secure new tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing agreements. Retention: Tenant Retention Rate is defined as the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA of leases that renewed or expired during the period. Same-Property Cash Net Operating Income (Same-Property Cash NOI): Same-Property Cash NOI excludes properties which have not been owned and operated during the entire span of all periods presented or are intended to be sold in the near term, notes receivable interest income, and certain non-routine items. Same-Property Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Same-Property Cash NOI should be reviewed in connection with other GAAP measurements.