UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

SCHEDULE 14A

(Rule 14a-101)

_____________________________

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

_____________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

_____________________________

HEALTHCARE REALTY TRUST INCORPORATED

(Exact name of Registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each Class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

3310 West End Avenue, Suite 700

Nashville, Tennessee 37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

April 24, 2023

Annual Meeting

of Stockholders

TO OUR STOCKHOLDERS:

You are cordially invited to attend the 2023 annual meeting of stockholders of Healthcare Realty Trust Incorporated, to be held on June 5, 2023, at 10:00 a.m. (local time) at the offices of Holland & Knight LLP, 511 Union Street, Suite 2700, Nashville, Tennessee 37219.

The following pages contain the formal notice of the annual meeting and our proxy statement, which describe the specific business to be considered and voted upon at the annual meeting. Whether or not you plan to attend the meeting, we would greatly appreciate your efforts to vote your shares as soon as possible by following the instructions located in the Notice of Internet Availability of Proxy Materials sent to you or in our proxy statement. If you attend the meeting and wish to vote in person, you may withdraw your proxy and vote your shares personally.

Sincerely,

John Knox Singleton

Chairman of the Board of Directors

3310 West End Avenue, Suite 700

Nashville, Tennessee 37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

April 24, 2023

Notice of Annual Meeting

of Stockholders

TO OUR SHAREHOLDERS:

The annual meeting of stockholders of Healthcare Realty Trust Incorporated (the “Company”) will be held on Monday, June 5, 2023, at 10:00 a.m. (local time) at the offices of Holland & Knight LLP, 511 Union Street, Suite 2700, Nashville, Tennessee 37219, for the following purposes:

(1)To elect thirteen nominees as directors to serve one-year terms expiring at the 2024 annual meeting of stockholders or until their successors are duly elected and qualified;

(2)To ratify the appointment of BDO USA, LLP as the independent registered public accounting firm for the Company and its subsidiaries for the Company’s 2023 fiscal year;

(3)To vote to approve, on a non-binding advisory basis, a resolution approving the Company’s compensation of its named executive officers as disclosed pursuant to Item 402 of Regulation S-K;

(4)To vote to approve, on a non-binding advisory basis, the frequency of a non-binding advisory vote on executive compensation; and

(5)To transact any other business that properly comes before the meeting or any adjournment thereof.

The Board recommends that the stockholders vote FOR the election of the nominees to the Board of Directors and FOR each of the other proposals listed above. Holders of record of the Company’s common stock at the close of business on April 14, 2023 are entitled to vote at the meeting or at any adjournment of the meeting.

By order of the Board of Directors,

Andrew E. Loope

Senior Vice President, Corporate Counsel and Secretary

Proxy Statement

Proposal Overview

| | | | | |

| Proposal 1 |

| Election of Directors |

| BOARD RECOMMENDATION: | Vote FOR |

| | | | | |

| Proposal 2 |

| Ratification of Appointment of Independent Registered Public Accounting Firm |

| BOARD RECOMMENDATION: | Vote FOR |

| | | | | |

| Proposal 3 |

| Non-Binding Advisory Vote on Executive Compensation |

| BOARD RECOMMENDATION: | Vote FOR |

| | | | | |

| Proposal 4 |

| Non-Binding Advisory Vote on the Frequency of the Vote on Executive Compensation |

| BOARD RECOMMENDATION: | Vote "ANNUAL" |

Table of Contents

Proxy Statement

This Proxy Statement contains information related to the annual meeting of stockholders of Healthcare Realty Trust Incorporated (the "Company" or "HR") to be held at the offices of Holland & Knight LLP at 511 Union Street, Suite 2700, Nashville, Tennessee 37219, on Monday, June 5, 2023, at 10:00 a.m. (local time) for the purposes set forth in the accompanying notice, and any adjournment thereof (the "Annual Meeting"). This Proxy Statement and the Annual Report to Stockholders for the Year Ended December 31, 2022 (the "Annual Report to Stockholders") are available to you on the Internet or, upon your request, will be delivered to you by mail or email in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting. The Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") is scheduled to be distributed on or about April 24, 2023.

Under rules adopted by the Securities and Exchange Commission (the "SEC"), the Company is making this Proxy Statement and the Annual Report to Stockholders available on the Internet instead of mailing a printed copy of these materials to each stockholder. Stockholders who receive the Notice of Internet Availability by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice of Internet Availability contains instructions as to how stockholders may access and review the materials on the Internet, including information about how stockholders may submit proxies by telephone or over the Internet.

You can ensure that your shares are voted at the Annual Meeting by submitting your instructions by telephone or Internet, or, if you requested a printed copy of the proxy materials, by completing, signing, dating and returning the proxy card accompanying the materials in the envelope provided to you. Submitting your instructions or proxy by any of these methods will not affect your right to attend and vote at the Annual Meeting. We encourage our stockholders to submit proxies in advance of the Annual Meeting. A stockholder who gives a proxy may revoke it at any time before it is exercised by voting in person at the Annual Meeting by delivering a subsequent proxy or by notifying the inspectors of election in writing of such revocation. If your shares are held for you in a brokerage, bank or other institutional account, you must obtain a proxy from that entity and bring it with you to hand in with your ballot in order to be able to vote your shares at the Annual Meeting.

The close of business on April 14, 2023 has been fixed as the record date for the determination of stockholders entitled to vote at the meeting. The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of the Company's Class A common stock, $0.01 par value per share (the "Common Stock"), outstanding on the record date will constitute a quorum, permitting the conduct of business at the meeting. Without your instructions, your broker or nominee is permitted to use its own discretion and vote your shares on certain routine matters (such as Proposal 2), but is not permitted to use its discretion and vote your shares on non-routine matters (such as Proposals 1, 3, and 4). We urge you to give voting instructions to your broker or nominee on all proposals. Shares that are not permitted to be voted by your broker or nominee because you did not execute or return the proxy with instructions are called "broker non-votes." These so-called "broker non-votes" will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum. Additionally, the inspectors of election for the Annual Meeting will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

As of the close of business on the record date, the Company had 1,000,000,000 authorized shares of Common Stock, of which 380,816,429 shares were outstanding and entitled to vote. The Common Stock is the Company’s only outstanding class of voting stock. Each share of Common Stock will have one vote on each matter to be voted upon at the meeting.

Completed Merger

On July 20, 2022 (the “Closing Date”), pursuant to the Agreement and Plan of Merger dated as of February 28, 2022 (the “Merger Agreement”), by and among Healthcare Realty Trust Incorporated, a Maryland corporation (now known as HRTI, LLC, a Maryland limited liability company) (“Legacy HR”), Healthcare Trust of America, Inc., a Maryland corporation (now known as Healthcare Realty Trust Incorporated) (“Legacy HTA”), Healthcare Trust of America Holdings, LP, a Delaware limited partnership (now known as Healthcare Realty Holdings, L.P.) (the “OP”), and HR Acquisition 2, LLC, a Maryland limited liability company (“Merger Sub”), Merger Sub merged with and into Legacy HR, with Legacy HR continuing as the surviving entity and a wholly-owned subsidiary of Legacy HTA (the “Merger”).

On the Closing Date, each outstanding share of Legacy HR common stock, $0.01 par value per share (the “Legacy HR Common Stock”), was cancelled and converted into the right to receive one share of Legacy HTA class A common stock at a fixed ratio of 1.00 to 1.00. Per the terms of the Merger Agreement, Legacy HTA declared a special dividend of $4.82 (the “Special Dividend”) for each outstanding share of Legacy HTA class A common stock, $0.01 par value per share ( the “Legacy HTA Common Stock”), and the OP declared a corresponding distribution to the holders of its partnership units, payable to Legacy HTA stockholders and OP unitholders of record on July 19, 2022.

Immediately following the Merger, Legacy HR converted to a Maryland limited liability company and changed its name to HRTI, LLC and Legacy HTA changed its name to “Healthcare Realty Trust Incorporated”. In addition, the equity interests of Legacy HR were contributed by Legacy HTA by means of a contribution and assignment agreement to the OP such that Legacy HR became a wholly-owned subsidiary of the OP. As a result, Legacy HR became a part of an umbrella partnership REIT (“UPREIT”) structure, which is intended to align the corporate structure of the combined company after giving effect to the Merger and UPREIT reorganization (the “Combined Company”).

The combined company operates under the name “Healthcare Realty Trust Incorporated” and its shares of class A common stock, $0.01 par value per share, trade on the New York Stock Exchange (the “NYSE”) under the ticker symbol “HR”.

For accounting purposes, the Merger was treated as a “reverse acquisition” in which Legacy HTA was considered the legal acquirer and Legacy HR was considered the accounting acquirer based on various factors, including, but not limited to: (i) the composition of the board of directors of the Combined Company, (ii) the composition of senior management of the Combined Company, and (iii) the premium transferred to the Legacy HTA stockholders. As a result, the historical financial statements of the accounting acquirer, Legacy HR, became the historical financial statements of the Combined Company. Further, the information presented in this Proxy Statement is the historical information of Legacy HR for periods prior to the closing of the Merger and that of the Combined Company for periods from and after the closing of the Merger. The named executive officers of Legacy HR remained in their respective roles following the closing of the Merger and all information presented herein with respect to the named executive officers reflects the continuity of their positions and compensation.

Proposal 1

Election of Directors

The Board of Directors is organized in a single class, and the stockholders vote on the entire Board of Directors each year. The Company's Fifth Articles of Amendment and Restatement, as amended and supplemented, do not provide for cumulative voting and, accordingly, each stockholder may cast one vote per share of Common Stock for each nominee. According to Maryland law, directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. An abstention may not be specified with respect to the election of directors. Broker non-votes will have no effect on the outcome of the election. The Company has a director resignation policy that is applicable to any director that does not receive a majority of votes cast "for" his or her election to the Board in an uncontested election. This policy is described in greater detail beginning on page 10 of this Proxy Statement.

Unless a proxy specifies otherwise or results in a broker non-vote, the persons named in the proxy will vote the shares covered thereby for the nominees designated by the Board of Directors listed below. Should any nominee become unavailable for election, shares covered by a proxy will be voted for a substitute nominee selected by the Board of Directors upon the recommendation of the Nominating and Corporate Governance Committee. For more detail about this process, see page 12.

Qualifications of Nominees to be Directors

As described in the table below, the nominees to serve on the Board of Directors are individuals from diverse backgrounds and experiences. The Board believes that each nominee possesses unique qualifications, skills and attributes that complement the performance of the full Board. The experiences that each has obtained from their respective professional backgrounds, as set forth individually in the table below, have qualified them to serve on the Board of Directors. The Board believes that the nominees set forth below will work together well and contribute individual strengths and skills to effectively carry out the Board’s duties. Four director nominees are female (Ms. Agee, Ms. Booth, Ms. Moore, and Ms. Vasquez) and two director nominees represent racial/ethnic minority groups (Mr. Gupta and Ms. Vasquez).

Director Nominees

| | | | | | | | | | | |

| JOHN KNOX SINGLETON | AGE: 74 | DIRECTOR SINCE 1993 |

| Chairman of the Board; Retired CEO, Inova Health System |

Mr. Singleton retired in 2018 from his position as Chief Executive Officer of Inova Health

System headquartered in Falls Church, Virginia. He also serves as a director of Washington

Mutual Investors Fund, a mutual fund located in Los Angeles, California. The experience Mr.

Singleton has gained in these roles has enabled him to provide the Board with insight

regarding the business of large, not-for-profit health systems, as well as general compensation

practices and governance matters. |

Committee Role: Chair of Compensation Committee

Highlighted Skills: Healthcare; Executive Leadership; Corporate Governance |

| | | | | | | | | | | |

| TODD J. MEREDITH | AGE: 48 | DIRECTOR SINCE 2017 |

| President and CEO, Healthcare Realty |

| Mr. Meredith was appointed President and Chief Executive Officer of the Company in December 2016. Previously, he served as the Company's Executive Vice President - Investments since 2011, where he was responsible for overseeing the Company's investment activities, including the acquisition, financing, and development of medical office buildings. Mr. Meredith has been with the Company since 2001 and provides the Board with strategic vision and depth of understanding of the Company's business from his many years of experience in directing and shaping key aspects of the business. |

Committee Role: As President and CEO, no committee assignments

Highlighted Skills: Executive Leadership; Real Estate; Corporate Finance |

| | | | | | | | | | | |

| JOHN V. ABBOTT | AGE: 68 | DIRECTOR SINCE 2019 |

| Retired CEO, Aviation Asset Management Group, General Electric Company |

| Mr. Abbott retired from the General Electric Company in 2015 after over 38 years with the firm. At the time of his retirement, he was Executive Vice President of GE Capital Aviation Services, where he served as President and Chief Executive Officer of the Asset Management Group. Prior to that, Mr. Abbott held several leadership positions in GE's aircraft engine manufacturing business, including serving as Chief Financial Officer of multiple divisions. Mr. Abbott's experience in business leadership, finance, and innovation adds valuable perspective and oversight capability to the Board. |

Committee Role: Compensation Committee

Highlighted Skills: Executive Leadership; Corporate Governance; Human Capital |

| | | | | | | | | | | |

| NANCY H. AGEE | AGE: 70 | DIRECTOR SINCE 2016 |

| President and CEO, Carilion Clinic |

| Ms. Agee has served as the Chief Executive Officer of Carilion Clinic, a not-for-profit healthcare organization based in Roanoke, Virginia, since 2011. During the previous ten years, she served as the Chief Operating Officer of Carilion Clinic. Ms. Agee also serves as a director of RGC Resources, Inc., an energy company located in Roanoke, Virginia. In 2018, Ms. Agee served as the chair of the Board of Trustees of the American Hospital Association. Ms. Agee provides the Board with valuable insight regarding the real estate needs and concerns of major health systems. Ms. Agee also has extensive financial experience to be considered an audit committee financial expert. |

Committee Role: Audit Committee

Highlighted Skills: Executive Leadership; Healthcare; Financial Expert |

| | | | | | | | | | | |

| W. BRADLEY BLAIR, II | AGE: 78 | DIRECTOR SINCE 2022 (1) |

| Retired Chairman, Healthcare Trust of America |

Mr. Blair was chairman of the board of directors of Legacy HTA from August 2021 until the closing of the Merger in 2022, at which time he was appointed vice chair of the Board. Mr. Blair was previously appointed as the lead independent director of the board of directors of Legacy HTA in December 2014 and served as an independent director of Legacy HTA since September 2006. Mr. Blair provides the Board with broad real estate and legal experience, having served with a variety of companies in advisory, executive, and/or director roles for over 40 years, including over 10 years as chief executive officer, president and chairman of the board of directors of a publicly traded REIT. His diverse background in other business disciplines, coupled with his deep understanding and knowledge of real estate, contributes to the quality guidance and oversight he brings to the Board. (1) Director of Legacy HTA from 2006 to 2022. |

Committee Role: Compensation Committee

Highlighted Skills: Executive Leadership; Real Estate; Corporate Governance |

| | | | | | | | | | | |

| VICKI U. BOOTH | AGE: 59 | DIRECTOR SINCE 2022 (1) |

| President and Board Chair, Ueberroth Family Foundation |

Ms. Booth has served as an independent director of Legacy HTA since March 2018. Ms. Booth currently serves as the President and Board Chair of the Ueberroth Family Foundation and as a director of Hoag Hospital, where she chairs the Nominating and Governance Committee and serves on the Real Estate Committee, Women's Health Services Committee and Community Benefit Committee. She also serves as a Director of the Hoag Clinic. Ms. Booth brings to the Board experience within the healthcare sector through the various positions she has held with healthcare universities and hospitals. These roles have allowed Ms. Booth to develop extensive relationships with leading healthcare communities and provides her with in-depth knowledge and understanding of the healthcare industry. (1) Director of Legacy HTA from 2006 to 2022. |

Committee Role: Nominating and Corporate Governance Committee

Highlighted Skills: Healthcare; Corporate Governance; Human Capital |

| | | | | | | | | | | |

| EDWARD H. BRAMAN | AGE: 66 | DIRECTOR SINCE 2018 |

| Retired Audit Partner, Ernst & Young LLP |

| Mr. Braman served as a self-employed finance and accounting consultant from 2015 to 2018. He was a partner at Ernst & Young LLP from 1997 until his retirement in 2015. At Ernst & Young, Mr. Braman audited public and private companies in a variety of industries. He is a certified public accountant and serves as a director and audit committee chairman of U.S. Xpress Enterprises, Inc., a publicly traded truckload carrier headquartered in Chattanooga, Tennessee. Mr. Braman brings to the Board extensive accounting and financial reporting experience and provides further depth as an audit committee financial expert. |

Committee Role: Chair of Audit Committee

Highlighted Skills: Audit Expert; Corporate Governance; Human Capital |

| | | | | | | | | | | |

| AJAY GUPTA | AGE: 45 | DIRECTOR SINCE 2021 |

| CEO, Physical Rehabilitation Network |

| Mr. Gupta has served as the Chief Executive Officer of Physical Rehabilitation Network since 2019 and as Chief Executive Officer of Gupta Capital Partners since 2017. He previously served as the Chief Operating Officer and Chief Financial Officer of Envision Healthcare in the Evolution Health Division. From 2013 to 2015, Mr. Gupta was Chief Operating Officer and Chief Financial Officer of Integrated Oncology Network, LLC. In 2012, Mr. Gupta was a senior advisor at the Center for Medicare and Medicaid Services. Mr. Gupta was also as a division Chief Financial Officer for HCA Healthcare. Mr. Gupta's financial background, understanding of healthcare regulation and reimbursement, and expertise in the delivery of healthcare services provides valuable insight in the business of the Company's tenants and health system partners. Mr. Gupta has the requisite background and experience to be an audit committee financial expert. |

Committee Role: Audit Committee

Highlighted Skills: Executive Leadership; Healthcare; Financial Expert |

| | | | | | | | | | | |

| JAMES J. KILROY | AGE: 50 | DIRECTOR SINCE 2020 |

| President and Portfolio Manager, Willis Investment Counsel |

| Mr. Kilroy serves as President and Portfolio Manager at Willis Investment Counsel, an investment firm located in Gainesville, Georgia. Prior to joining Willis Investment Counsel in 2009, Mr. Kilroy was an analyst with a long/short hedge fund, a sell-side equity research analyst on Wall Street, and an investment banker specializing in real estate corporate finance. Mr. Kilroy’s diverse background of portfolio management, equity research and capital markets experience provide the Board with particular insight into capital allocation decisions and investment community perspectives. |

Committee Role: Nominating and Corporate Governance

Highlighted Skills: Capital Markets; Corporate Finance; Real Estate |

| | | | | | | | | | | |

| JAY P. LEUPP | AGE: 58 | DIRECTOR SINCE 2022 (1) |

| Managing Partner and Senior Portfolio Manager, Terra Firma Asset Management |

Mr. Leupp is the Managing Partner and Senior Portfolio Manager for Terra Firma Asset Management, LLC ("TFAM"). He was appointed as an independent director of Legacy HTA in January 2020. Prior to TFAM, Mr. Leupp was Managing Director, Senior Portfolio Manager for Lazard Asset Management LLC in San Francisco, where he worked from 2011 to June 2020. He currently serves on the Boards of Directors of G.W. Williams Company, Apartment Investment and Management Company, and Marathon Digital Holdings. Mr. Leupp brings to the Board extensive and broad real estate, financial, and capital markets expertise and has held several board of director and leadership positions.

Mr. Leupp has the financial background and experience to be considered an audit committee financial expert.

(1) Director of Legacy HTA from 2006 to 2022. |

Committee Role: Audit Committee

Highlighted Skills: Real Estate; Corporate Finance; Financial Expert |

| | | | | | | | | | | |

| PETER F. LYLE SR. | AGE: 58 | DIRECTOR SINCE 2016 |

| EVP, Medical Management Associates |

Mr. Lyle serves as Executive Vice President and Principal at Medical Management Associates, Inc.,

a healthcare consulting firm based in Atlanta, Georgia. Mr. Lyle's experience in advising health systems and physician practices on key aspects of practice management, mergers and acquisitions, and compensation adds to the Board's understanding of the business and delivery of healthcare services. |

Committee Role: Compensation Committee

Highlighted Skills: Healthcare; Human Capital; Corporate Finance |

| | |

| | | | | | | | | | | |

| CONSTANCE B. MOORE | AGE: 67 | DIRECTOR SINCE 2022 |

| Retired CEO and President of BRE Properties, Inc. |

| Ms. Moore was elected to the board of directors of Legacy HTA in March 2022. She has served as a director of Civeo Corporation and TriPointe Homes since 2014. From 2017 to 2021, she served as a director of Columbia Property Trust, including one year as chair of its board of directors. In 2009, she served as chair of Nareit. She served as President and CEO of BRE Properties, Inc., a publicly-traded REIT, from 2005 until the completion of its merger with Essex Property Trust in 2014. Ms. Moore's business and financial acumen, leadership, integrity, judgment, experience with public companies and extensive experience in the real estate industry provides substantial benefit to the Board. |

Committee Role: Nominating and Corporate Governance

Highlighted Skills: Executive Leadership; Real Estate; Corporate Governance |

| | | | | | | | | | | |

| CHRISTANN M. VASQUEZ | AGE: 62 | DIRECTOR SINCE 2015 |

| Retired EVP and COO, Ascension Texas |

| Ms. Vasquez served as Chief Operating Officer of Ascension Texas from September 2019 to February 2023. Prior to that, she served as President of Dell Seton Medical Center at the University of Texas, a teaching hospital in Austin, President of Seton Shoal Creek Hospital, and President of Seton Medical Center Austin. From 2009 to 2014, Ms. Vasquez was Executive Vice President and Chief Operating Officer of University Health System in San Antonio. Ms. Vasquez's extensive experience in healthcare operations and leadership roles with large health systems further expands the Board's understanding of operational planning associated with the delivery of healthcare services in major markets by leading health systems. |

Committee Role: Chair of the Nominating and Corporate Governance Committee

Highlighted Skills: Executive Leadership; Healthcare; Corporate Governance |

Except as indicated, each of the nominees has had the principal occupation indicated for more than five years.

Each nominee has consented to be a candidate and to serve if elected.

The Board of Directors recommends that the stockholders vote FOR the election of all of the proposed nominees to the Board of Directors.

Corporate Governance

Leadership Structure

The Company's Chairman of the Board and Chief Executive Officer positions are held by separate persons. John Knox Singleton is the independent Chairman of the Board and Todd J. Meredith serves as the Chief Executive Officer. The Board of Directors believes that separation of these roles is appropriate given the continuity provided by Mr. Singleton's long tenure on the Board and the leadership abilities demonstrated by Mr. Meredith to the Board of Directors.

Lead Independent Director; Non-Management Executive Sessions; Communicating With the Board

Periodically, the independent directors meet in executive session. As the independent Chairman of the Board, Mr. Singleton presides over the executive sessions. During 2022, the independent directors held four executive sessions. Any interested party may communicate with the independent directors as a group by contacting Mr. Singleton in writing c/o Healthcare Realty Trust Incorporated, 3310 West End Avenue, Suite 700, Nashville, Tennessee 37203. Any interested party may communicate directly with the full Board of Directors or any individual director by writing to Healthcare Realty Trust Incorporated, 3310 West End Avenue, Suite 700, Nashville, Tennessee 37203, Attention: Secretary. The Secretary of the Company will review all correspondence intended for the entire Board and will forward to the Board copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or committees thereof or that otherwise requires their attention.

Committee Membership

The Board of Directors has a Nominating and Corporate Governance Committee, Audit Committee, and Compensation Committee. The Board of Directors has adopted written charters for each committee. The committee charters are posted in the Corporate Governance section of the Company’s website, www.healthcarerealty.com, under the “Investor Relations” tab and are available in print free of charge to any stockholder who requests a copy. All committee members are non-employee, independent directors.

The following sets forth the current members of the committees:

| | | | | | | | |

AUDIT (1) | COMPENSATION | NOMINATING AND

CORPORATE GOVERNANCE |

| | |

| Edward H. Braman, Chair | John Knox Singleton, Chair | Christann M. Vasquez, Chair |

| Nancy H. Agee | John V. Abbott | Vicki U. Booth |

| Ajay Gupta | W. Bradley Blair, II | James J. Kilroy |

| Jay P. Leupp | Peter F. Lyle | Constance B. Moore |

(1) The Board has determined that Ms. Agee, Mr. Braman, Mr. Gupta, and Mr. Leupp meet the criteria to be audit committee financial experts.

Committee Duties

Nominating and Corporate Governance Committee Four meetings in 2022

•Reviews and implements the Nominating and Corporate Governance Committee charter and reports to the Board.

•Develops and implements policies and practices relating to corporate governance.

•Monitors implementation of the Company’s Corporate Governance Principles.

•Develops criteria for selection of members of the Board.

•Seeks individuals qualified to become Board members for recommendation to the Board.

•Evaluates the independence and performance of the Board and Board committees.

•Provides oversight of the Company's sustainability programs, including environmental, social and governance ("ESG") initiatives.

Audit Committee Five meetings in 2022

•Reviews and implements the Audit Committee charter and reports to the Board.

•Selects the Company’s independent registered public accounting firm, whose duty it is to audit the consolidated financial statements and internal control over financial reporting of the Company for the fiscal year in which it is appointed, and has the sole authority and responsibility to negotiate and pre-approve all audit and audit-related fees and terms, as well as all permitted non-audit services by the Company’s independent registered public accounting firm.

•Meets with the Company's independent auditors periodically, both together with management and separately, to review and discuss the scope of the audit and all significant matters related to the audit.

•Meets with key members of management in separate executive sessions to discuss the Company's internal controls over financial reporting, the completeness and accuracy of the Company's financial statements and any other matters that the Committee or any of these persons believe should be discussed privately.

•Reviews the adequacy and effectiveness of the Company’s internal control over financial reporting with management, internal audit and compliance, and the independent auditors.

•Reviews the Company's financial statements, Forms 10-Q and 10-K, the earnings press releases and supplemental information and discusses them with the Chief Financial Officer, Chief Accounting Officer, and the independent auditors.

•Reviews and discusses with management the Company's major financial risk exposures and steps taken by management to monitor and mitigate such exposure.

•Reviews and discusses new accounting pronouncements with the Chief Financial Officer, Chief Accounting Officer and the independent auditors to assess applicability to and the effect on the Company.

•Performs an annual evaluation of the independent auditors' qualifications, assessing the firm's quality of service; the firm's sufficiency of resources; the quality of the communication and interaction with the firm; and the firm's independence, objectivity, and professional skepticism. The Audit Committee also considers whether to appoint a different independent auditor.

•Discusses items of interest or concern to the Audit Committee with management, internal audit and compliance, and/or the independent auditors.

•Assists the Board in its risk management function regarding cybersecurity oversight by regularly discussing with management any cyber security incidents and cybersecurity measures taken by the Company.

Compensation Committee Nine meetings in 2022

•Reviews and implements the Compensation Committee charter and reports to the Board.

•Reviews corporate performance relevant to the compensation of the Company’s executive officers and key employees.

•Establishes a general compensation policy and approves salaries paid to the Chief Executive Officer and the other executive officers named in the Summary Compensation Table that appears under the section entitled “Executive Compensation” in this Proxy Statement (collectively, the “Named Executive Officers” or "NEOs") and fees paid to directors.

•Administers the Company’s incentive stock plans and employee stock purchase plan. Determines, subject to the provisions of the Company’s plans, the directors, officers and employees of the Company eligible to participate in each of the plans, the extent of such participation and the terms and conditions under which benefits may be vested, received or exercised.

•Reviews the development and succession plans of the Named Executive Officers.

•Provides oversight on behalf of the full Board of the Company's human capital development and talent management.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all officers, directors, and employees of the Company, including its principal executive officer, principal financial officer, principal accounting officer, and controller, or persons performing similar functions. The Code of Ethics is posted in the Corporate Governance section of the Company’s website, www.healthcarerealty.com, under the “Investor Relations” tab. Interested parties may address a written request for a printed copy of the Code of Ethics to Healthcare Realty Trust Incorporated, 3310 West End Avenue, Suite 700, Nashville, Tennessee 37203, Attention: Investor Relations. The Company intends to satisfy the disclosure requirement regarding any amendment to or a waiver of a provision of the Code of Ethics for the Company’s principal executive officer, principal financial officer, principal accounting officer, controller, or persons performing similar functions by posting such information on its website.

Director Resignation Policy

The director resignation policy provides that, in an uncontested election, any director who receives a greater number of withheld votes than votes for election must tender his or her resignation to the Board promptly following certification of the stockholder vote. Upon such resignation, the Nominating and Corporate Governance Committee will have 45 days following certification of the stockholder vote to consider the resignation and recommend to the Board whether or not to accept such resignation. Following the recommendation of the Nominating and Corporate Governance Committee, the Board must decide within 90 days following certification of the stockholder vote whether or not to accept the resignation. After making its decision, the Board will promptly disclose the decision in a Current Report on Form 8-K filed with the SEC. The director resignation policy is included in the Company’s Corporate Governance Principles, which are posted in the Corporate Governance section of the Company’s website at www.healthcarerealty.com under the “Investor Relations” tab.

Meeting Attendance

The Board of Directors held a total of 24 meetings in 2022. Each director attended at least 75% of the meetings of the Board and committees of the Board on which such director served. The Company does not have a formal policy regarding director attendance at annual meetings of stockholders. One member of the Board attended the 2022 Annual Meeting of Stockholders.

Director Education

The Nominating and Corporate Governance Committee has adopted a set of education guidelines and encourages all directors to pursue ongoing education and development studies on topics that they deem relevant given their individual backgrounds and committee assignments on the Board of Directors. Each director is requested to attend at least one director education program every three years. The Company pays for each director’s expenses incurred to attend director education programs.

Risk Oversight

The Board of Directors is responsible for overseeing the Company's overall risk management practices to ensure its business strategy appropriately monitors and manages risks inherent in its efforts to create long-term value for the Company's stockholders. The Board of Directors oversees the Company’s exposure to risk through various means, including specific communications with management. Board deliberations involving strategy and operational initiatives are integrated with

reviews of risk exposure to the Company. In addition to reviewing significant transactions, such as capital raises or investments, for consistency with the Company’s risk profile, the Board annually reviews risks affecting the Company as part of management’s review of appropriate risk factor disclosures. The Board regularly communicates with members of the management team, including officers responsible for identifying potential investments and bringing those investments to fruition, either through acquisition or development. The Board also discusses with management on at least a semi-annual basis the Company’s internal forecast, including discussions regarding the Company’s acquisition and development pipeline. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities by monitoring, reviewing and discussing the Company’s financial risk exposures. The Audit Committee considers enterprise level risks and financial risks and discusses with management those risks and the measures taken by the management team to mitigate such risks. The Compensation Committee assesses risks related to the Company's executive compensation programs, as discussed further on page 25 of this Proxy Statement. The Company believes that these interactions between the Board and the management team regarding risk exposures and mitigation strengthen and focus the combined efforts of management and the Board on developing strategies that contain risk and enhance long-term stockholder value.

MUTA Opt-Out

In 2017, the Board of Directors adopted a resolution prohibiting the Company from electing to be subject to Section 3-803 of Subtitle 8 of Title 3 of Maryland General Corporation Law (the “MGCL”) which is commonly referred to as MUTA. Section 3-803 of the MGCL, together with other provisions of Subtitle 8 of Title 3 of the MGCL, permits the board of directors of a Maryland corporation with a class of equity securities registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and at least three independent directors to elect to classify the board of directors without stockholder approval. By adopting this resolution, the Company will be prohibited from classifying the Board of Directors without first obtaining stockholder approval.

Proxy Access

In 2018, the Company amended its bylaws to provide stockholders with proxy access for director nominations subject to certain conditions. In summary, the proxy access provisions of the bylaws permit qualifying stockholders, or a qualifying group of no more than 20 stockholders, that have continuously owned at least 3% of the Company’s outstanding shares of common stock throughout at least a three-year period, to nominate and to require the Company to include in its proxy materials director nominees constituting up to the greater of two director nominees or 20% of the number of directors up for election, for inclusion in the Company’s proxy materials, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the Company’s bylaws and subject to the terms and conditions therein.

Anti-Hedging Policy

The Company's anti-hedging policy prohibits the purchase of financial instruments, including prepaid variable forward contracts, instruments for the short sale or purchase or sale of call or put options, equity swaps, collars, or units of exchangeable funds, that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Company. The policy is applicable to all Company employees and directors.

Independence of Directors

The Board of Directors has adopted a set of Corporate Governance Principles (the “Principles”) addressing, among other things, standards for evaluating the independence of the Company’s directors. The full text of the Principles can be found in the Corporate Governance section of the Company’s website, www.healthcarerealty.com, under the “Investor Relations” tab. A copy may also be obtained upon request from the Company’s Secretary.

Pursuant to the Principles, the Board undertook its annual review of director independence under the leadership of the Nominating and Corporate Governance Committee in February 2023. During this review, the Nominating and Corporate Governance Committee and the Board considered transactions and relationships between each director and nominee or any member of his or her immediate family and the Company and its subsidiaries, affiliates and equity investors. The Nominating and Corporate Governance Committee and the Board also examined transactions and relationships between directors and nominees or their affiliates and members of senior management or their affiliates. As provided in the Principles, the purpose of

this review was to determine whether any such relationship or transaction was inconsistent with a determination that a director or nominee is independent.

To aid in making its annual review of director and nominee independence, the Board has adopted categorical standards for determining independence consistent with New York Stock Exchange ("NYSE") requirements. A director or nominee is independent unless:

•The director or nominee is or has been an employee of the Company within the past three years or has an immediate family member that is or has been an executive officer of the Company within the past three years;

•The director or nominee, or his or her immediate family member, has received more than $120,000 within any of the past three years in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service);

•(A) The director or nominee, or his or her immediate family member, is a current partner of a firm that is the Company’s internal or external auditor; (B) the director or nominee is a current employee of such firm; (C) the director or nominee has an immediate family member who is a current employee of such firm and who participates in the Company’s audit, assurance or tax compliance (but not tax planning) practice; or (D) the director or nominee, or his or her immediate family member, was within the last three years (but is no longer) a partner or employee of such firm and personally worked on the Company’s audit within that time;

•The director or nominee, or his or her immediate family member, has been employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee within the past three years;

•The director or nominee is a current employee, or has an immediate family member that is an executive officer of a company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such company’s consolidated gross revenues within the past three years; or

•The director or nominee has any other material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company.

In addition to the above criteria, with respect to members of the Compensation Committee, the Board considers all factors relevant to determining whether a director has a relationship to the Company that is material to that director's ability to be independent from management in connection with the duties of a Compensation Committee member. Specifically, the Board considers the source of compensation of such director, and whether the director receives compensation from any person or entity that would impair his or her ability to make independent judgments about executive compensation. The Board also considers whether the director is affiliated with the Company, any subsidiary of the Company or any affiliate of a subsidiary of the Company.

As a result of this review, the Board affirmatively determined that, except for Mr. Meredith, all of the directors and nominees are independent of the Company and its management under the standards adopted pursuant to the Principles.

Director Nominee Evaluation Process

The Nominating and Corporate Governance Committee is responsible for developing and implementing policies and practices relating to corporate governance. As part of its duties, the Nominating and Corporate Governance Committee develops and reviews background information on candidates for the Board and makes recommendations to the Board regarding such candidates. The Committee also prepares and supervises the Board’s annual review of director independence and the Board’s performance self-evaluation. A copy of the Nominating and Corporate Governance Committee’s charter can be found in the Corporate Governance section of the Company’s website, www.healthcarerealty.com, under the “Investor Relations” tab.

Once the Nominating and Corporate Governance Committee has identified a prospective nominee, the Committee reviews the information provided to it with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others.

The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. The Nominating and Corporate Governance Committee then evaluates the prospective nominee against the following standards and qualifications:

•Personal integrity and reputation for high ethical standards;

•The ability to devote sufficient time to the duties of a director;

•Experience relevant to the Company's business, including real estate, health care, finance, accounting, investment banking, capital markets, or senior management;

•Depth and breadth of leadership experience, and a proven record of accomplishment;

•The ability to think independently and work collaboratively;

•The ability to satisfy the NYSE requirements of the Audit Committee and the Compensation Committee; and

•The ability to meet and comply with the requirements of the Code of Business Conduct and Ethics.

The Nominating and Corporate Governance Committee also considers other relevant factors as it deems appropriate, including the current composition and diversity of the Board, the need for Audit Committee expertise and the evaluations of other prospective nominees. The Nominating and Corporate Governance Committee is committed to the Company's goal to have females and/or minorities represent at least a third of the Board of Directors. In connection with the evaluation process, the Committee determines whether to interview the prospective nominee and, if warranted, one or more members of the Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation, the Nominating and Corporate Governance Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines whether to nominate such persons after considering the recommendation and report of the Nominating and Corporate Governance Committee.

Stockholder Recommendation or Nomination of Director Candidates

The Nominating and Corporate Governance Committee will consider candidates for our Board of Directors recommended by our stockholders. Properly communicated stockholder recommendations will be considered in the same manner as recommendations received from other sources. Recommendations should be delivered to Healthcare Realty Trust Incorporated, Board of Directors, 3310 West End Avenue, Suite 700, Nashville, Tennessee 37203, Attention: Secretary. Recommendations must include, among other things, the full name and age of the candidate, a brief description of the proposed candidate’s business experience for at least the previous five years and descriptions of the candidate’s qualifications and the relationship, if any, to the stockholder, and a representation that the nominating stockholder is a beneficial or record owner of our common stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected and a completed questionnaire (which questionnaire shall be provided by us, upon request, to the stockholder making the recommendation). Stockholders who are recommending candidates for consideration by our Board of Directors in connection with the next annual meeting of stockholders should submit their written recommendations not earlier than 150 days nor later than 120 days prior to the first anniversary of the date of this proxy statement.

Stockholders who wish to nominate an individual for election as a director in connection with an annual meeting of stockholders (as opposed to making a recommendation to the Nominating and Corporate Governance Committee as described above) must deliver written notice to our Secretary in the manner described in Article II, Section 11 of our current bylaws and within the time periods set forth herein under the section titled “General Information; Proposals for 2024 Annual Meeting of Stockholders” on page 59.

The Company’s stockholders also possess the right to nominate candidates for election to the Board through the “proxy access” provisions of the Company’s bylaws, pursuant to which stockholders, may nominate up to the greater of two director nominees or 20% of the number of directors up for election, for inclusion in the Company’s proxy materials.

Environmental, Social, and Governance Oversight and Practices

The Board of Directors and management believe that embedding and integrating leading environmental, social and governance practices into its culture, strategy, and operations is fundamental to the Company's long-term growth. The Board of Directors is committed to overseeing Healthcare Realty’s ESG initiatives, receiving quarterly updates from management regarding the Company’s strategy, goals, opportunities, risks, reporting, and performance. To underscore its importance to our overall strategy, an ESG performance metric has been incorporated into the Company’s executive officer short-term incentive plan, linking executive compensation to the Company’s ESG performance. For additional information, see this proxy statement’s "Compensation Discussion and Analysis" section below.

In 2022, the Company:

•Published its fourth Corporate Responsibility Report (CRR), highlighting the Company’s meaningful progress on its ESG initiatives and Key Performance Indicators ("KPIs") with expanded disclosures in alignment with leading industry frameworks including Sustainable Accounting Standards Board (SASB) and the Task Force on Climate-Based Financial Disclosures (TCFD);

•Received GRESB's 4 Green Star ranking, earning a score of 80 on its 2022 assessment, up from 73 in 2021. Additionally, we received a GRESB Public Disclosure rating of "A", ranking second out of a peer group of 10 healthcare real estate companies with respect to transparency of public reporting of sustainability practices;

•Implemented third-party assurance of our energy, water, greenhouse gas and waste data;

•Increased green building certifications to include 30 properties totaling 2.6 million square feet for the combined portfolio including 11 LEED certifications (five inherited from the legacy HTA portfolio), 5 IREM Certified Sustainable Properties, and 14 ENERGY STAR certifications;

•Expanded physical climate risk assessments to measure risks across multiple climate scenarios and time horizons;

•Was recognized in Nareit’s 2022 REIT Industry ESG report featuring our efforts to enhance employee health, wellbeing, and culture as well as the Department of Energy’s 2022 Better Buildings Progress Report, highlighting our renewable energy program; and

•Increased women and/or minority representation to 38% of our board, exceeding our goal of 33%.

Following the Merger, the Company has been working to gather, evaluate, and integrate ESG data, compare best practices, prioritize strategic initiatives, streamline and integrate policies and procedures, and evaluate new baselines and goals for the combined company.

Additional information about the Company's ESG initiatives, KPIs, performance, and practices can be found in its 2022 Corporate Responsibility Report and Sustainability Principles and Policies published on its website www.healthcarerealty.com/sustainability.

Security Ownership of Certain

Beneficial Owners and Management

The following table sets forth, as of February 15, 2023, the beneficial ownership of the Company’s equity securities as determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Accordingly, all Company securities over which the directors, nominees and executive officers directly or indirectly have or share voting or investment power are listed as beneficially owned. As of February 15, 2023, there were 380,779,861 shares of the Company’s Common Stock outstanding.

| | | | | | | | | | | |

| NAME OF BENEFICIAL OWNER | COMMON SHARES BENEFICIALLY OWNED | | PERCENT OF COMMON SHARES BENEFICIALLY OWNED |

| Todd J. Meredith | 659,870 | | (1) | * |

| J. Christopher Douglas | 263,797 | | (1) | * |

| John M. Bryant, Jr. | 224,355 | | (1) | * |

| Robert E. Hull | 207,177 | | (1) | * |

| Julie F. Wilson | 128,321 | | (1) | * |

| John V. Abbott | 17,441 | | (1) | * |

| Nancy H. Agee | 39,500 | | (1)(2) | * |

| W. Bradley Blair, II | 102,806 | | (1)(3) | * |

| Vicki U. Booth | 27,849 | | (1) | * |

| Edward H. Braman | 28,565 | | (1) | * |

| Ajay Gupta | 10,789 | | (1) | * |

| James J. Kilroy | 14,201 | | (1) | * |

| Jay P. Leupp | 17,259 | | (1) | * |

| Peter F. Lyle, Sr. | 23,228 | | (1)(4) | * |

| Constance B. Moore | 9,804 | | (1) | * |

| John Knox Singleton | 63,505 | | (1)(5) | * |

| Christann M. Vasquez | 32,815 | | (1) | * |

| All executive officers, directors, and nominees to be director as a group (17 persons) | 1,871,282 | | | 0.49 | % |

| | | |

| The Vanguard Group | 54,845,205 | | (6) | 14.41 | % |

| Cohen & Steers, Inc. | 51,540,582 | | (7) | 13.52 | % |

| BlackRock, Inc. | 45,325,967 | | (8) | 11.90 | % |

| State Street Corporation | 22,618,951 | | (9) | 5.94 | % |

| APG Asset Management US, Inc. | 12,367,121 | | (10) | 3.30 | % |

| Principal Real Estate Investors, LLC | 10,434,109 | | (11) | 2.74 | % |

(1) Includes shares of restricted stock.

(2) Includes 3,431 shares held in a living trust.

(3) Includes 11,750 shares held in IRAs and 1,000 shares held by spouse.

(4) Includes 6,652 shares held in a trust.

(5) Includes 19,082 shares held in an IRA.

(6) Information is based on a Schedule 13G filed on February 9, 2023 by The Vanguard Group, an investment adviser located at 100 Vanguard Blvd., Malvern, Pennsylvania 19355. The Vanguard Group, Inc. reported that it possesses no sole power to vote, shared power to vote 558,082 shares, sole power to dispose of 53,995,984 shares and shared power to dispose of 849,221 shares of the Common Stock.

(7) Information is based on a Schedule 13G filed on February 14, 2023 by Cohen & Steers, Inc., an investment adviser located at 280 Park Avenue, 10th Floor, New York, New York 10017. Cohen & Steers, Inc. reported that, through various of its subsidiaries, it possesses the sole power to vote 36,167,467 shares and to dispose of 51,450,582 shares of the Common Stock.

(8) Information is based on a Schedule 13G filed on January 31, 2023 by BlackRock, Inc., a holding company located at 55 East 52nd Street, New York, New York 10055. BlackRock, Inc. reported that, through various of its subsidiaries, it possesses the sole power to vote 42,987,641 shares and to dispose of 45,325,967 shares of the Common Stock.

(9) Information is based on a Schedule 13G filed on February 1, 2023 by State Street Corporation, a holding company located at One Lincoln Street, Boston, Massachusetts 02111. State Street Corporation reported that it possesses no sole power to vote or dispose and shared power to vote 16,872,401 shares and shared power to dispose of 22,618,951 shares of the Common Stock.

(10) Information is based on a Schedule 13G filed on January 12, 2023 by APG Asset Management US, Inc., an investment advisor located at 666 3rd Ave., 2nd Floor, New York, New York 10017. APG Asset Management, US, Inc., reported that, through various of its subsidiaries, it possesses no sole power to vote or dispose and shared power to vote and dispose of 12,367,121 shares of the Common Stock.

(11) Information is based on a Schedule 13G filed on February 15, 2023 by Principal Real Estate Investors, LLC, an investment advisor located at 801 Grand Avenue, Des Moines, Iowa 50392. Principal Real Estate Investors, LLC reported that it possesses no sole power to vote or dispose and shared power to vote and dispose of 10,434,109 shares of the Common Stock.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers, and persons who own more than 10% of the Company’s Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of the Common Stock. These officers, directors and greater than 10% stockholders of the Company are required by SEC rules to furnish the Company with copies of all Section 16(a) reports they file. There are specific due dates for these reports and the Company is required to report in this Proxy Statement any failure to file reports as required during 2022.

During 2022, based upon a review of these filings and written representations from the Company’s directors and executive officers, the Company believes that all reports required to be filed with the SEC by Section 16(a) during the most recent fiscal year were timely filed.

Proposal 2

Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee has appointed BDO USA, LLP ("BDO") as the Company’s independent registered public accounting firm for the fiscal year 2023. Representatives of this firm are expected to be present at the Annual Meeting and will have an opportunity to make a statement and will be available to respond to appropriate questions.

The affirmative vote of a majority of the votes cast at the meeting is needed to ratify the appointment of BDO as the Company’s independent registered public accounting firm for the fiscal year 2023. If the appointment is not ratified, the matter will be referred to the Audit Committee for further review. Abstentions and broker non-votes will have no effect on the outcome of the vote on this proposal.

Audit and Non-Audit Fees

The following table details fees and expenses for professional services rendered by BDO to the Company for the last two fiscal years.

| | | | | | | | |

| 2022 | 2021 |

Audit fees (1) | $ | 3,558,899 | | $ | 1,233,599 | |

| Audit-related fees | — | | — | |

| Tax fees | — | | — | |

| All other fees | — | | — | |

| Total | $ | 3,558,899 | | $ | 1,233,599 | |

(1) Includes fees for services related to the audit and quarterly reviews of the Company’s consolidated financial statements and internal control over financial reporting of $3,288,100 and $1,135,190, respectively, for 2022 and 2021, and fees in connection with the Company’s equity offerings of $270,799 and $98,409, respectively, for 2022 and 2021. Audit fees for 2022 included fees related to the Merger.

For the purpose of ensuring the continued independence of BDO, the Company determined that its independent registered public accounting firm will not provide consulting services to the Company. Additionally, the charter of the Audit Committee provides that the Audit Committee must pre-approve all services to be provided by the independent registered public accounting firm. Proposed services exceeding pre-approved cost levels or budgeted amounts also require specific pre-approval by the Audit Committee. All services provided by the Company’s independent registered public accounting firm were pre-approved by the Audit Committee, which concluded that the provision of such services by BDO was compatible with the maintenance of such accounting firm’s independence in the conduct of its auditing functions.

The Board of Directors recommends that the stockholders vote FOR ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm.

Audit Committee Report

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

The Audit Committee of the Board of Directors of the Company consists entirely of directors who meet the independence and experience requirements of the NYSE. Audit Committee members may serve on the audit committees of no more than three public companies.

Pursuant to the Sarbanes-Oxley Act of 2002 and rules adopted by the SEC, the Company must disclose which members, if any, of the Audit Committee are “audit committee financial experts” (as defined in the SEC’s rules). The Company’s Board of Directors has determined that Edward H. Braman, the chairman of the Audit Committee, Nancy H. Agee, Ajay Gupta, and Jay P. Leupp meet the criteria to be “audit committee financial experts.”

The Company’s management has primary responsibility for preparing the Company’s Consolidated Financial Statements and implementing internal controls over financial reporting. The Company’s 2022 independent registered public accounting firm, BDO, is responsible for expressing an opinion on the Company’s Consolidated Financial Statements and on the effectiveness of its internal control over financial reporting.

The roles and responsibilities of the Audit Committee are set forth in its charter, which has been approved by the Board and is available on the Company’s website.

As more fully described in its charter, the Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the Consolidated Financial Statements and the reporting process. BDO is responsible for performing an integrated audit of the Company’s Consolidated Financial Statements in accordance with the standards of the Public Company Accounting Oversight Board (United States of America) and expressing an opinion on the conformity of the Consolidated Financial Statements to accounting principles generally accepted in the United States of America and on the effectiveness of internal control over financial reporting. The Company's internal audit function ("Internal Audit") is responsible to the Audit Committee and the Board for testing the integrity of the financial accounting and reporting control systems and such other matters as the Audit Committee and the Board determine.

To fulfill its responsibilities, the Audit Committee met and held discussions with management, Internal Audit, and BDO concerning the Consolidated Financial Statements for the fiscal year ended December 31, 2022 and the Company’s internal control over financial reporting as of December 31, 2022. Management, Internal Audit, and BDO made presentations to the Audit Committee throughout the year on specific topics of interest, including, among other items, the Company's (i) risk assessment process; (ii) information technology systems and controls; (iii) income tax risk and compliance; (iv) 2022 integrated audit plan; (v) updates on completion of the audit plan; (vi) critical accounting policies; (vii) assessment of the impact of new accounting guidance; (viii) compliance with the internal controls required under Section 404 of the Sarbanes-Oxley Act; (ix) ethics and compliance program; (x) strategy and management of the implementation of new systems; (xi) non-GAAP measures and key performance indicators; and (xii) cybersecurity. The Audit Committee also discussed all communications required by the standards of the Public Company Accounting Oversight Board, the NYSE and the SEC with BDO.

The Audit Committee met with BDO quarterly, both together with management and separately, to review and discuss the scope of the audit and all significant matters related to the audit. The Audit Committee also met with key members of management in separate executive sessions, including the Company's Chief Executive Officer, Chief Financial Officer, General Counsel, Corporate Counsel, Chief Accounting Officer, heads of investments, technology services, leasing and management, taxation, and compliance and Internal Audit to discuss the Company's internal controls over financial reporting, the completeness and accuracy of the Company's Consolidated Financial Statements, and other matters.

The Audit Committee, along with the Company's management and Internal Audit, reviewed BDO's performance as a part of the Audit Committee's consideration whether to reappoint the firm as the Company's independent auditors. As part of this

review, the Audit Committee considered (i) the continued independence of the audit firm; (ii) evaluations of the audit firm by management and Internal Audit; (iii) the audit firm's effectiveness of communications and working relationships with the Audit Committee, management and Internal Audit; (iv) the length of time the audit firm has served as the Company's independent auditors; and (v) the quality and depth of the audit firm and the audit team's expertise and experience in the industry. As a part of the appointment process, the Audit Committee approves the selection of the independent auditor's lead engagement partner and independent review partner at the respective mandatory five-year rotation periods. In 2022, the Company's lead engagement partner rotated after five years of service. The Audit Committee also considered the advisability and potential impact of selecting a different independent registered public accounting firm.

In addition, the Audit Committee has received from BDO the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding auditor communications with the Audit Committee concerning independence, and has discussed independence with BDO.

The Audit Committee discussed with management and Internal Audit the Company’s financial risk exposures, internal controls and reporting procedures. As part of this process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal auditing program, reviewing staffing levels and steps taken to implement recommended improvements in internal procedures and controls.

Based on the Audit Committee’s review of the audited Consolidated Financial Statements and discussions with management and BDO as described above and in reliance thereon, the Audit Committee recommended to the Company’s Board of Directors that the audited Consolidated Financial Statements for the fiscal year ended December 31, 2022 be included in the Company’s Annual Report on Form 10-K filed with the SEC.

Members of the Audit Committee

Edward H. Braman (Chair)

Nancy H. Agee

Ajay Gupta

Jay P. Leupp

Compensation Discussion and Analysis

2022 Compensation Highlights

Named Executive Officers

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Todd J.

Meredith | | J. Christopher Douglas | | John M.

Bryant, Jr. | | Robert E.

Hull | | Julie F.

Wilson |

| President and Chief Executive Officer | | Executive Vice

President, Chief Financial Officer | | Executive Vice President, General Counsel | | Executive Vice President, Investments | | Executive Vice President, Operations |

| | | | | | | | |

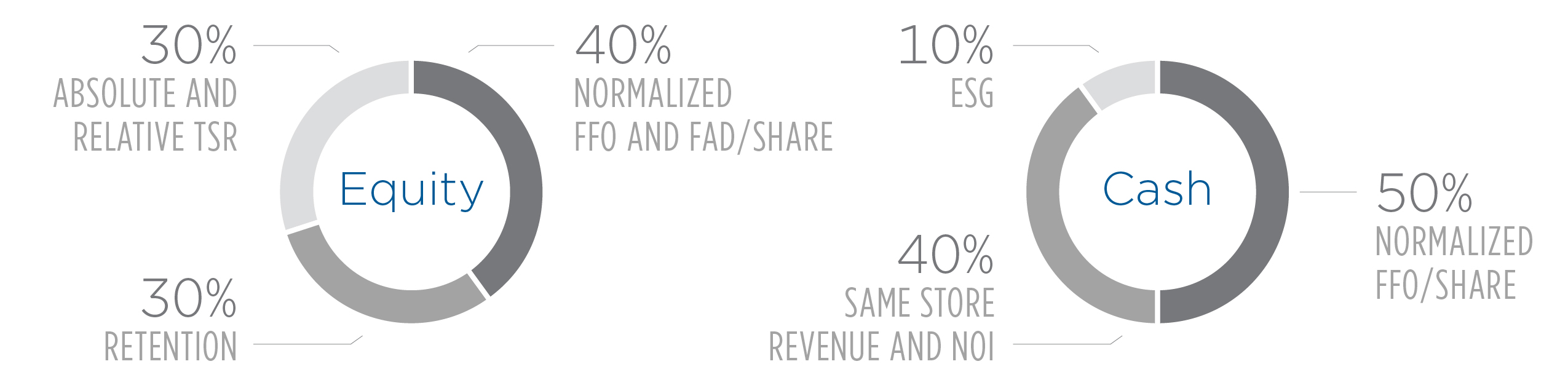

2022 Compensation Mix

At-Risk Performance Metrics (1)

(1) Equity incentive metrics are based on three-year performance periods and cash incentive metrics are based on one-year performance periods.

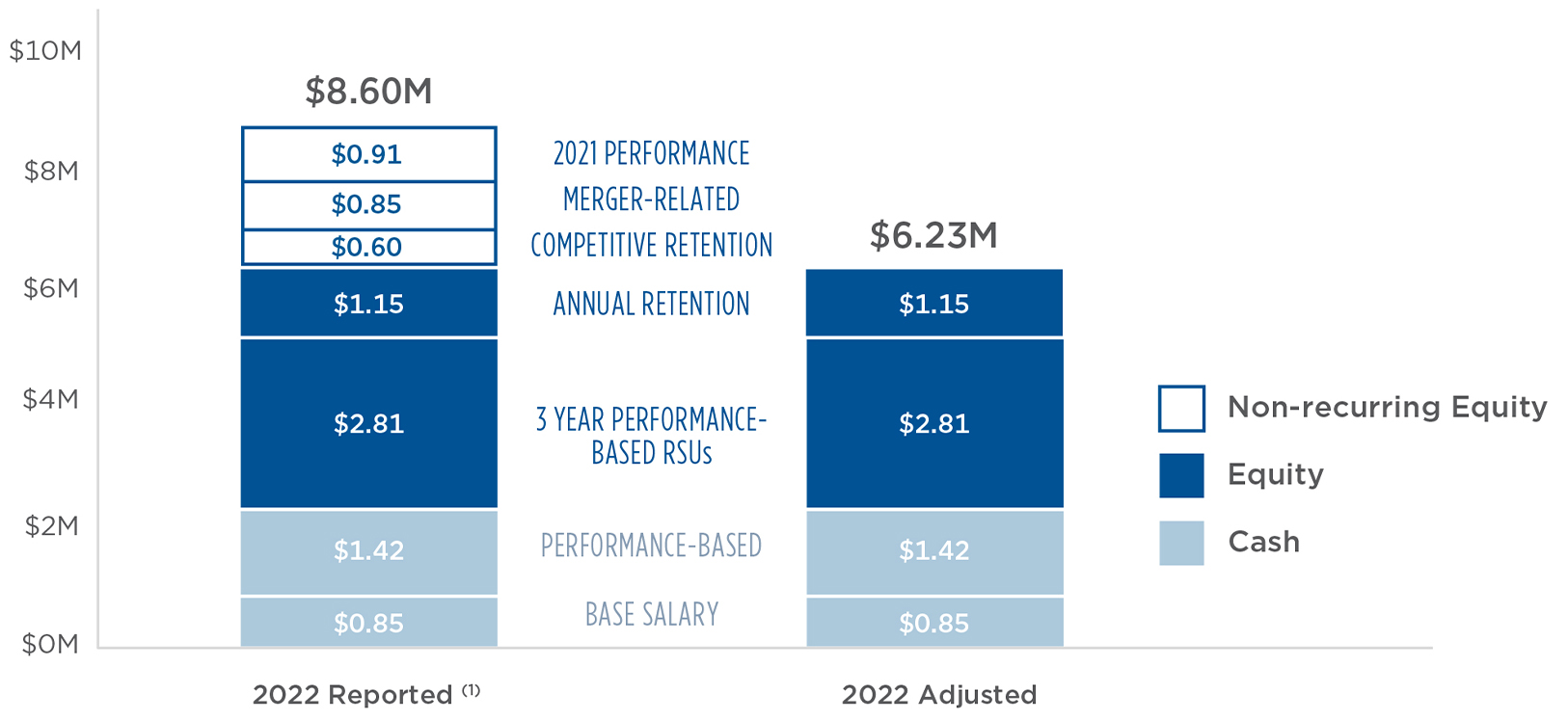

2022 Executive Compensation Changes

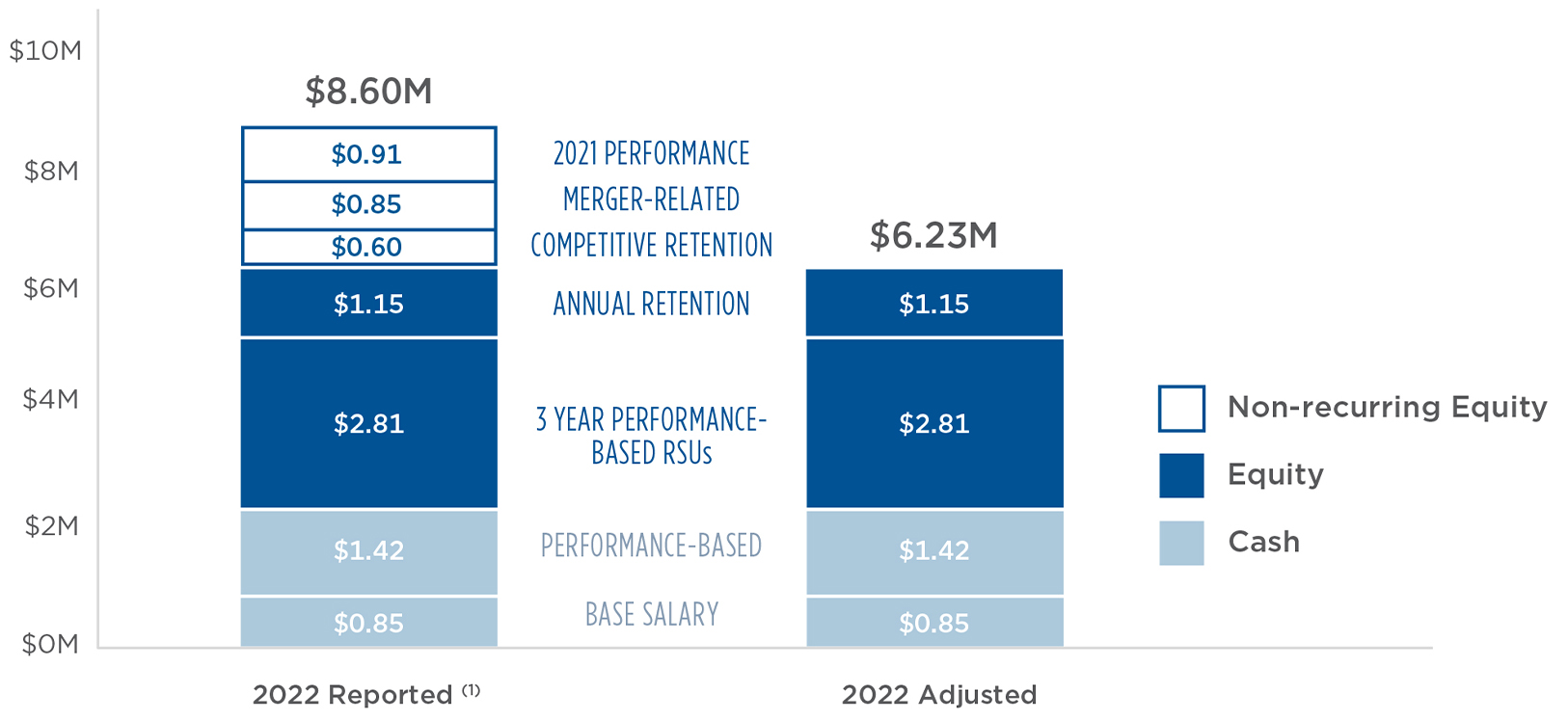

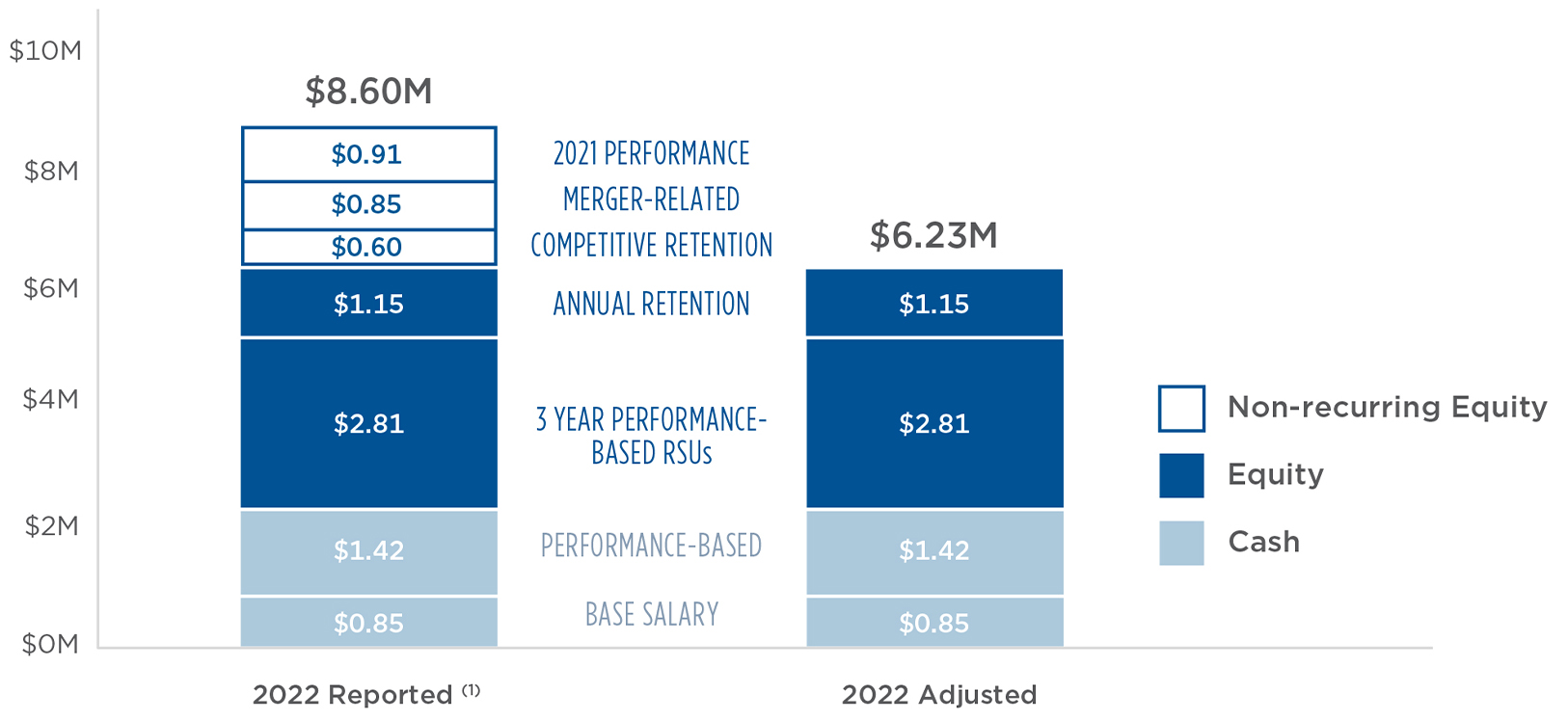

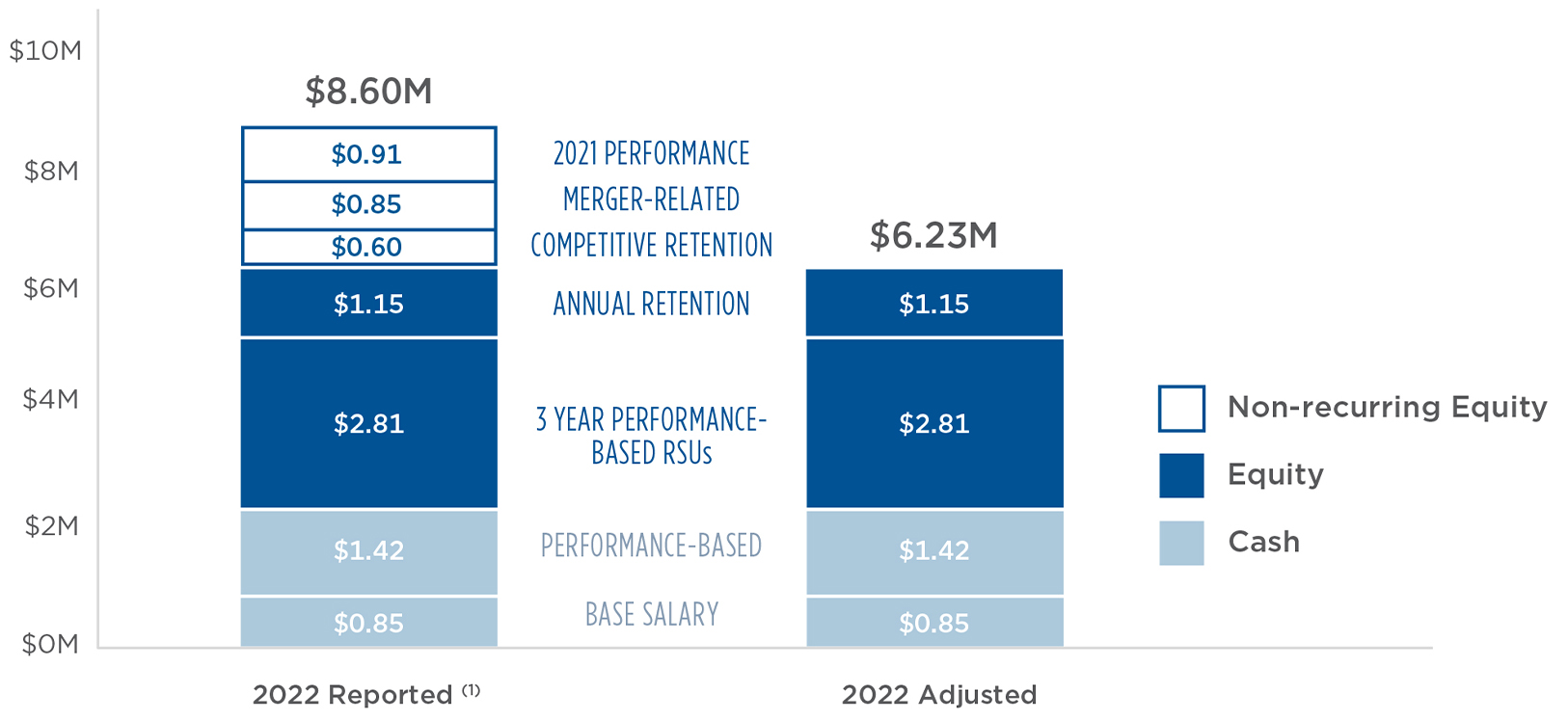

For 2022, the Company changed its compensation methodology to include forward-looking long-term equity incentive targets and made certain one-time equity awards to its NEOs. The Company does not expect these one-time awards to recur. The following summarizes the non-recurring awards and equity incentive changes:

•In December 2021, the Compensation Committee modified the equity compensation program from restricted stock awards based on backward-looking performance measures to forward-looking restricted stock unit awards subject to three-year performance measures plus two years of additional time-based vesting.

•In February 2022, backward-looking restricted stock awards for 2021 performance were awarded, resulting in summary compensation table overlap with forward-looking awards granted in 2022.

•The Compensation Committee annually awards retention-based restricted stock for the purposes of aligning the interests of the NEOs with those of the stockholders. In January 2022, the Compensation Committee granted enhanced retention awards to address the increased competition in the sector at that time. For the CEO, this award was approximately 50% larger than otherwise would have been expected.

•In December 2022, the Compensation Committee awarded one-time equity awards to NEOs equal to one times base salary in recognition of the efforts of the management team in successfully completing the Merger, funding the $1.1 billion special dividend with asset sales and joint venture contributions, and integration of the two companies, including the achievement of projected G&A savings.

•The following chart illustrates 2022 compensation of the CEO excluding the non-recurring items discussed above:

(1) As reported in the Summary Compensation Table on page 37.

2022 Financial and Operational Highlights

On July 20, 2022, Legacy HR and Legacy HTA completed a merger between the companies in which Legacy HR merged with and into a wholly-owned subsidiary of Legacy HTA, with Legacy HR continuing as the surviving entity and a wholly-owned subsidiary of Legacy HTA. Immediately following the Merger, Legacy HTA changed its name to “Healthcare Realty Trust Incorporated.”

For accounting purposes, the Merger was treated as a “reverse acquisition” in which Legacy HR was considered the acquirer. Accordingly, the information discussed in this section reflects, for periods prior to the closing of the Merger, the financial

condition and results of operations of Legacy HR, and for periods from the closing of the Merger, that of the consolidated company. Legacy HTA properties that met the Company's same store criteria are included in same store results.

Significant results and activities in 2022 included:

•As noted above, the Company closed the Merger, bringing together two of the largest owners of medical office buildings. The combination provides market scale in concentrated clusters, increases diversification, and strengthens the balance sheet to enhance liquidity and improve access to capital.

•The Company completed the planned asset sales and joint venture contributions of $1.125 billion at a weighted average capitalization rate of 4.8%. Proceeds from these transactions fully funded the special dividend of $4.82 per share paid to the stockholders of Legacy HTA in connection with the Merger.

•Aside from the Merger, the Company invested $504.6 million in 33 medical office buildings through acquisitions and joint venture investments.

•Normalized FFO attributable to common stockholders was $430.1 million or $1.69 per share, down from $1.71 in 2021, primarily due to an approximately 450 basis point increase in short term borrowing rates. This increased cash interest expense by approximately $0.12 per share.

•Executed $550 million of new interest rate swaps to fix rates on over half of all variable rate debt and to reduce variable rate debt to 13% of overall debt at December 31, 2022.

•Same store revenue per occupied square foot grew by 3.6% and occupancy increased by 50 basis points.

•Same store revenue grew 3.8% over 2021.

•Same store operating expense growth of 6.3% was reduced through favorable lease structures, resulting in 4.6% expense growth, net of recoveries.

•Same store cash NOI grew 2.5% over 2021.

•Net debt to adjusted EBITDA was 6.4x at December 31, 2022, within the Company's target range of 6.0x to 6.5x.

•The Company published its fourth annual Corporate Responsibility Report, highlighting progress in its ESG initiatives and its commitment to incorporate sustainability principles into the Company's business practices. Additional information about the Company's ESG practices can be found in its 2022 Corporate Responsibility Report published on its website.

Certain information included in the highlights above constitute Non-GAAP financial measures. Such measures are presented herein for reference in connection with our explanation of the relationship between executive pay and company performance. The most comparable measures determined in accordance with GAAP and a reconciliation of all Non-GAAP financial measures to such measures determined in accordance with GAAP are provided beginning on page 56 of this Proxy Statement.

Comprehensive Compensation Policy

The Compensation Committee believes that the compensation of the Company’s officers, including the named executive officers ("NEOs"), should align their interests with those of the stockholders, link compensation to the Company's overall performance, provide a competitive level of total compensation necessary to attract and retain talented and experienced officers, and motivate the officers to contribute to the Company’s success.

Executive Incentive Plan

The Amended and Restated Executive Incentive Plan, as amended (the "Executive Incentive Plan"), governed incentive compensation for the NEOs and served to connect executive compensation to Company performance in 2022. Under this plan, the NEOs earned incentive awards in the form of cash, restricted stock units ("RSUs") and restricted stock based on Company performance. For 2022, Company performance was measured over the relevant period against targeted financial and operational metrics set in advance by the Compensation Committee. The various awards available under the Executive Incentive Plan are discussed below under the heading "Components of Compensation."

Pay For Performance