Our Business

Overview

We are a fully integrated, self-administered and internally managed real estate investment trust, or REIT, primarily focused on acquiring, owning and operating high-quality medical office buildings that are predominantly located on or aligned with campuses of nationally or regionally recognized healthcare systems. We are one of the largest public REITs focused on medical office buildings in the United States based on gross leasable area, or GLA, and have strong industry relationships, a stable and diversified tenant mix and an extensive and active acquisition network. Our primary objective is to maximize stockholder value with disciplined growth through strategic investments and to provide an attractive risk-adjusted return for our stockholders by consistently increasing our cash flow. In pursuing this objective, we target mid-sized acquisitions of high-quality medical office buildings in markets with dominant healthcare systems, attractive demographics and that complement our existing portfolio, actively manage our balance sheet to maintain flexibility with conservative leverage, and seek internal growth through proactive asset management, leasing and property management oversight.

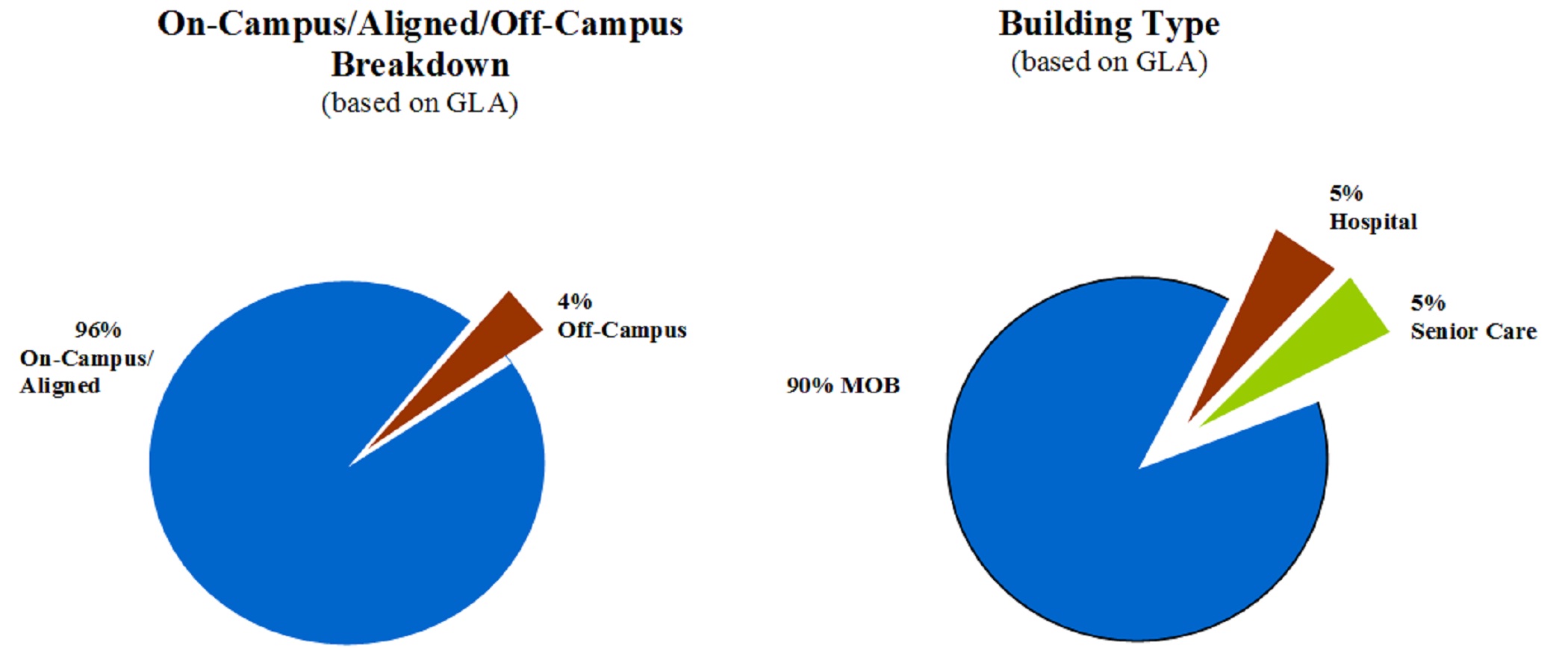

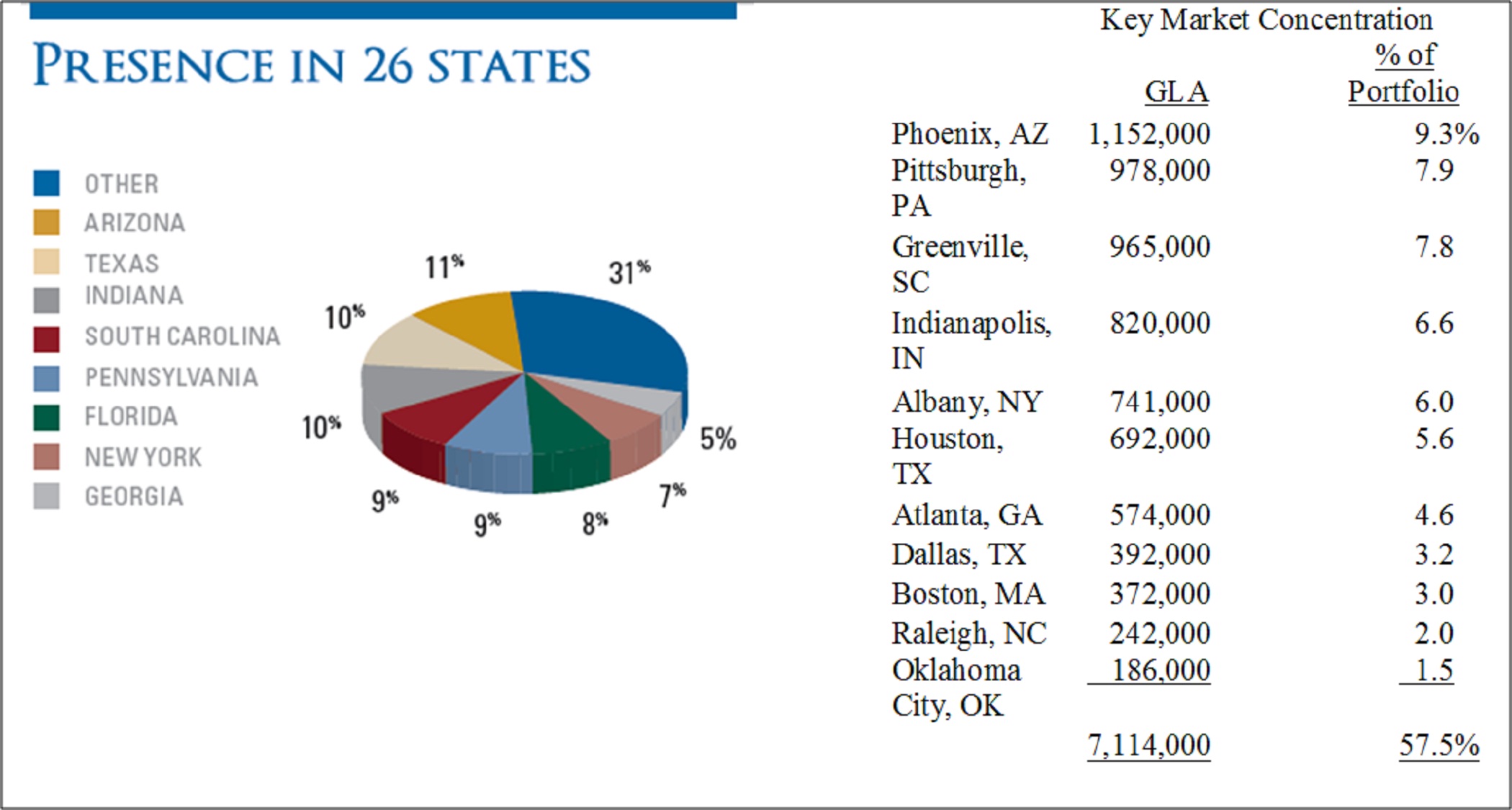

We invest primarily in high-quality medical office buildings in our target markets. We have acquired high-quality medical office buildings and other facilities that serve the healthcare industry with an aggregate purchase price of approximately $2.5 billion through March 31, 2012. As of March 31, 2012, our portfolio consisted of 245 medical office buildings and 19 other facilities that serve the healthcare industry, as well as two portfolios of mortgage loans receivable secured by medical office buildings. Our portfolio is comprised of approximately 12.4 million square feet of GLA, with an occupancy of approximately 91%, including leases we have executed, but which have not yet commenced. Approximately 96% of our portfolio, based on GLA, is located on or aligned with campuses of nationally or regionally recognized healthcare systems. Our portfolio is diversified geographically across 26 states, with no state having more than 11.0% of the total portfolio GLA as of March 31, 2012. We are concentrated in locations that we have determined to be strategic based on demographic trends and projected demand for medical office buildings and we expect to continue to invest in these markets. We have concentrations in the following key markets: Phoenix, Arizona; Greenville, South Carolina; Indianapolis, Indiana; Albany, New York; Houston, Texas; Atlanta, Georgia; Pittsburgh, Pennsylvania; Dallas, Texas; Boston, Massachusetts; Raleigh, North Carolina and Oklahoma City, Oklahoma.

The following charts depict the composition of our portfolio as of March 31, 2012:

As of March 31, 2012, we had more than 1,000 tenants within our portfolio, with no single tenant accounting for more than 6% of our annualized base rent. Our tenants include large and nationally recognized healthcare systems, as well as a wide variety of medical practices, specialty clinics, individual physicians and outpatient services. As of March 31, 2012, approximately 56% of our annualized base rent was derived from tenants that have (or whose parent companies have) a credit rating from a nationally recognized rating agency, with 39% of our annualized base rent derived from tenants that have (or whose parent companies have) an investment grade credit rating from one or more nationally recognized rating agencies.

The following chart depicts the credit quality of the tenants (or the parent companies of tenants) in our portfolio based on annualized base rent as of March 31, 2012:

We believe demographic and other trends affecting the healthcare industry will increase the demand for, and the value of, high-quality medical office buildings. According to Rosen Consulting Group, or RCG, higher demand for healthcare services has led to a rapid employment growth in the industry for at least two decades, driving demand for high-quality medical office space. Hospital systems have been facing economic limitations on expansion and, as a result, more procedures are being performed in outpatient facilities, which have lower overhead costs than hospitals. Insurance companies and government healthcare programs also have been formulating their reimbursement policies in order to direct patients to less costly outpatient care, as opposed to expensive inpatient procedures, driving increased outpatient surgeries and physicians' office visits. Medical office buildings are also typically flexible spaces which can adapt to changes in healthcare service delivery over time, and, unlike many other types of healthcare facilities, have little or no licensing requirements. As the healthcare industry continues to evolve to seek to serve a diverse and growing population efficiently, we believe opportunities for medical office building acquisition and asset management should increase over time.

Our senior management team, led by Mr. Scott D. Peters, our co-founder, Chairman, Chief Executive Officer and President, has significant healthcare real estate expertise and public company experience. The team has successfully managed our large, geographically diverse portfolio, while maintaining a flexible balance sheet, substantial liquidity and low leverage. Some of the achievements that demonstrate our proven track record of growth, prudent capital management and performance include:

| |

| • | terminated our former external advisor, eliminated acquisition and asset management fees of over $60.0 million through March 31, 2012, net of our internal costs, hired and trained a staff of more than 70 employees independent of the former external advisor and developed an entire corporate infrastructure and systems; |

| |

| • | acquired $1.5 billion of high-quality medical office buildings and other facilities that serve the healthcare industry since January 2009, expanding the portfolio into new markets with new healthcare system relationships; |

| |

| • | built key industry relationships with large nationally or regionally recognized healthcare systems and quality tenants; |

| |

| • | maintained a flexible balance sheet, with the ratio of our indebtedness to undepreciated assets, of 30.4% as of March 31, 2012, and enhanced access to capital in March 2012 by obtaining a $575.0 million unsecured revolving credit facility and a $300.0 million unsecured term loan facility, which we refer to collectively as our revolving credit and term loan facility, thereby providing us with additional capacity to acquire high-quality medical office buildings; |

| |

| • | obtained investment grade credit ratings from two nationally recognized credit rating agencies; |

| |

| • | maintained portfolio occupancy, including leases we have executed but which have not yet commenced, based on GLA, of over 90% as of December 31, 2010 and 2011 and March 31, 2012; and |

| |

| • | implemented, developed and managed the roll out of our in-house property management platform, which was responsible for 48% of our portfolio by GLA as of March 31, 2012, as compared to 31% of our portfolio by GLA as of December 31, 2010. |

We believe our combined experience and strengths will enable us to successfully grow our company through continued execution of our strategies and future acquisition opportunities.

Recent Developments

| |

| • | Since January 1, 2012, we have completed three new acquisitions and expanded one of our existing portfolios through the purchase of an additional medical office building for an aggregate purchase price of $214.2 million. In January 2012, we acquired an approximately 0.2 million square foot, on-campus medical office building located in Novi, Michigan as well as an additional building on our Camp Creek campus in Atlanta, Georgia. In March 2012, we acquired an approximately 0.6 million square foot office building aligned with Highmark in Pittsburgh, Pennsylvania and a 13 building portfolio totaling approximately 0.4 million square feet from Steward Healthcare System in Boston, Massachusetts. These purchases are comprised of approximately 1.2 million square feet of GLA, bringing our total portfolio value, based on purchase price, to $2.5 billion and our total portfolio GLA to approximately 12.4 million square feet. |

| |

| • | To establish more direct relationships and in an effort to reduce fees paid to third parties, we continue to focus on transitioning property management, leasing and construction management of our portfolio from third party teams to our internal teams. In the past year, we have focused on internalizing the property management of our largest markets, including Indiana, Arizona and South Carolina. We expected we will continue to transition other locations during 2012 to our in-house property management platform and anticipate having approximately 58% of our current portfolio's GLA, including the GLA acquired in the first quarter, managed internally by the end of the year. |

| |

| • | In March 2012, we entered into our new revolving credit agreement and term loan facility, consisting of a $575.0 million unsecured revolving credit facility and a $300.0 million unsecured term loan facility, which replaced our previous $575.0 million credit facility. The facility has a $175.0 million accordion feature for an aggregate maximum principal amount of $1.05 billion, subject to certain conditions. Our new revolving credit agreement and term loan facility has a four-year term which expires in March 2016 and includes a one-year extension option, subject to certain conditions. |

| |

| • | As of March 31, 2012, our new revolving credit facility was undrawn and $100.0 million was available under our $300.0 million term loan facility, with each facility having approximately four years remaining until the initial maturity, with a one-year extension option, subject to certain conditions. We believe our borrowing capacity under our new revolving credit agreement and term loan facility as well as our access to other sources of debt and equity capital, while remaining within our low leverage range, should allow us to capitalize on favorable acquisitions opportunities that arise. |

| |

| • | From April 1 through May 11, 2012, we drew $65.0 million on our unsecured credit facility. We used these funds plus cash on hand to pay down a total of $68.7 million of our mortgage loans payable. |

U.S. Healthcare Industry and Medical Office Market Overview

Unless otherwise indicated, all information contained in this Market Overview section is derived from market studies prepared for us by RCG as of February 2012 and the projections and beliefs of RCG stated herein are as of that date.

We believe that there will be a substantial increase in demand for high-quality medical office buildings due to a number of macroeconomic drivers and trends in the delivery of healthcare services. With the combination of our existing relationships, our ability to source off-market acquisition opportunities and operate assets efficiently, together with our access to capital through the public markets, we believe that we are well-positioned to take advantage of these opportunities.

Introduction

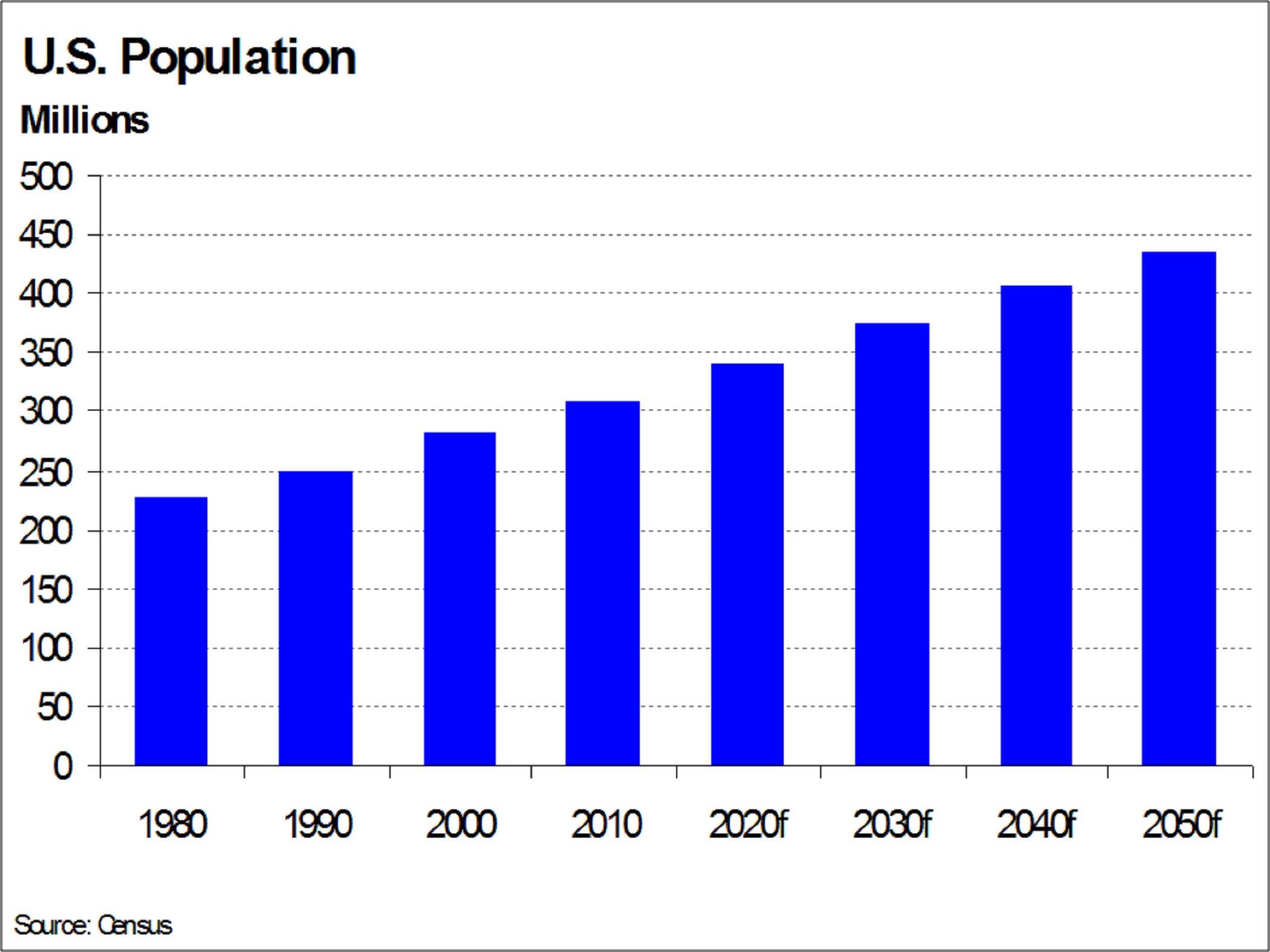

Driven by a continually expanding population, the healthcare industry has been growing at a strong pace for decades. Looking forward, this trend is expected to accelerate as baby boomers reach retirement age and echo boomers begin to establish their own families. As demand for medical services increases, this will further increase the need for physicians, lab technicians, and other medical support staff, driving demand for the high-quality medical office buildings that house them.

Evolution in the healthcare industry is also contributing to opportunities in the medical office space. Driven by shifting consumer preferences, limited space in hospitals, and lower costs, procedures that have traditionally been performed in hospitals, such as surgery, have been moving to outpatient facilities. Additionally, increased specialization in the medical field has been driving demand for medical office facilities suited to the needs of the particular profession. Finally, some hospital systems have been divesting real estate holdings in order to focus on the delivery of care. As the healthcare industry continues to evolve to serve a diverse and growing population in the most efficient way, opportunities for medical office development, acquisition and asset management should increase.

The healthcare industry has been a major topic of national political debate, particularly since the Patient Protection and Affordable Care Act passed in March 2010. The broad-based initiative has the potential to expand coverage for many Americans, further increasing the number of people who are able to utilize medical services. The Congressional Budget Office estimates that an additional 32 million Americans will have insurance coverage in 2016 as a result of the reform. This surge in demand could cause more hospital systems to monetize real estate holdings in order to increase staff, investments in technology or other aspects of their capacity to serve patients. Additionally, proponents of healthcare reform emphasize the importance of preventative care, which should increase the number of medical office visits if the legislation is successful in its current form. Irrespective of the potential impact of healthcare reform, demographic shifts in the United States are continuing to result in increased demand for medical services and therefore, medical office space.

Healthcare Industry Drivers

Demographic Growth Forms Base of Demand

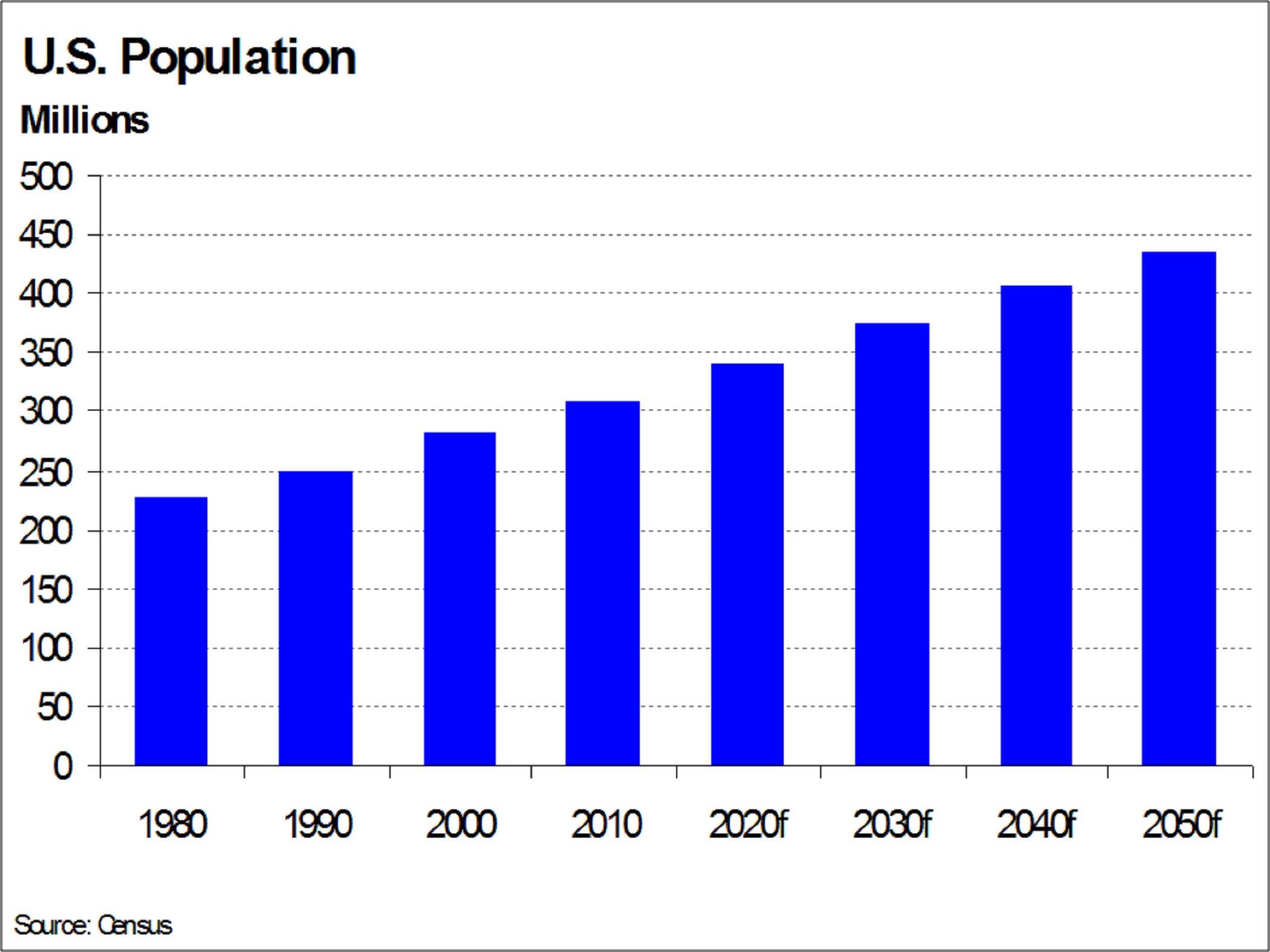

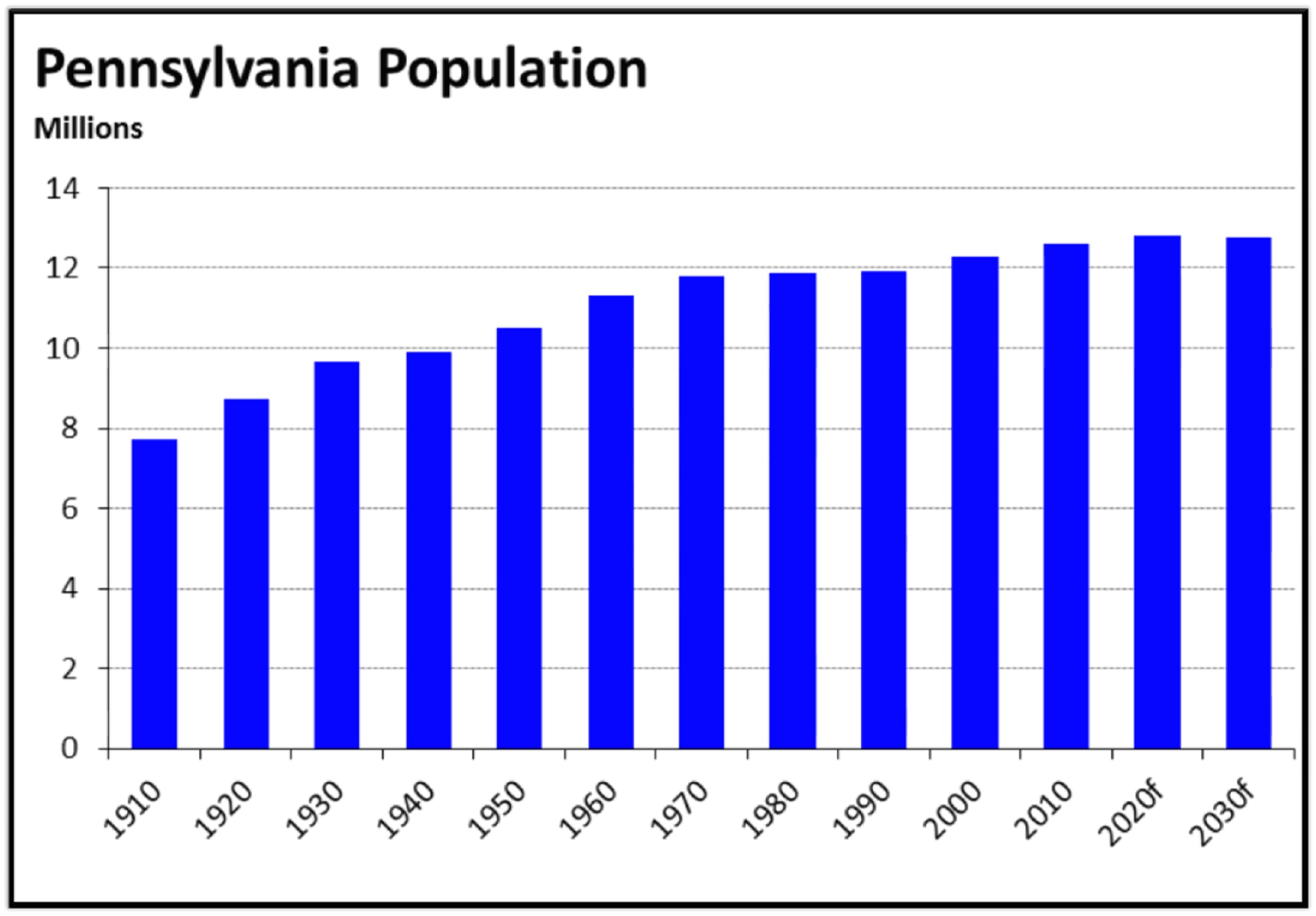

The total estimated population of the United States was 309.3 million people in 2010, a 36.1% increase from 1980 when the population totaled 227.2 million. Going forward, the total population is expected to increase by an average of 0.9% annually through 2050, according to the Census. By 2050, the Census Bureau projects that the population will reach 436.7 million people, an increase of approximately 127.4 million or a 41.2% increase from the total population in 2010. Population growth will be driven by births as well as net international migration, helping the United States maintain one of the highest population growth rates among industrialized nations. As measured by expenditures as a percentage of GDP, the U.S. healthcare industry is the largest in the world and healthcare spending should continue to increase as the domestic population grows. This expanding population will fuel the growing demand for healthcare services and medical office space.

Advancements in medical technology and changes in the methodology of treatment have helped individuals to live longer and resulted in a growing elderly population in the United States. In 2010, there were 40.4 million people over the age of 65, a staggering 57.2% increase from the 25.7 million people that made up this age cohort in 1980. This increase resulted in this age cohort accounting for 13% of the total population in 2010 versus an 11.3% share 30 years ago. During this same time period, life expectancy for this segment increased to 78 years, up from the expected lifespan of 74 years in 1980. The Census projects that the average life span will near 80 years by 2020. In the coming years, the over-65 age cohort will increase significantly as the average life span is extended further and the baby boomer population continues to move into the cohort. The growth of the elderly population will drive increased utilization of medical care throughout the country. In addition to the absolute growth in the elderly population, which remains an important component of the projected demand for medical services, this age cohort will continue to contribute to domestic migration trends and the location of healthcare demand. As individuals retire, historical demographic analysis indicates a migration preference toward the warmer Sunbelt states, a trend that is unlikely to reverse in the foreseeable future.

The baby boomer generation generally comprises individuals born between 1946 and 1964, meaning those who in 2010 were between the ages of 46 and 64 years old. In 2010 there were 76.2 million people in this generation. In comparison, in 1980 the 46 to 64 age cohort was only 44.5 million people. In 2010 this group represented 24.6% of the total U.S. population, significantly higher than the 19.6% share in 1980. This generation is particularly important not only due to its sheer size, but also because individuals who are beginning to reach their retirement years are entering a period of increased healthcare utilization. With the baby boomer generation at the cusp of the 65 years and older age cohort, this large segment of the population will drive a surge in demand for medical care. This trend, coupled with baby boomers' shifting preference toward delivery of care outside of hospitals, should produce a sustainable growth period within the medical office sector.

The echo boomer generation is generally defined as individuals who were born between 1982 and 1994, and is primarily composed of the children of baby boomers. In 2010 these individuals were between the ages of 16 and 28 years and totaled 56.3 million people. In comparison, Generation X, which is loosely defined as individuals between the ages of 34 and 45 years in 2010, was comprised of 49.6 million people. The echo boomer population is 13.6% larger than that of the preceding Generation X population, and in 2010 represented 18.2% of the total population of the United States. The bulk of the echo boomers are approaching entry into the workforce, establishing independent lives and starting their own families. Medical care utilization by echo boomers should increase as they progress through their 20s. Additionally, the large wave of 20 year-olds and under that will soon enter the workforce and likely obtain health insurance should provide increased demand for medical services.

Healthcare Spending on the Rise as Americans Age

Annual healthcare spending has been on the rise in the United States since tracking began in 1960. According to the latest data from 2010, Americans spent nearly $2.6 trillion, or 17.9% of total GDP, on healthcare expenditures, an increase of 3.5% from the previous year. Of this total, the total amount of spending by government healthcare programs Medicare, Medicaid and the Children's Health Insurance Program (CHIP) reached more than $937 million in 2010, or 6.5% of GDP. The U.S. Centers for Medicare & Medicaid Services projects that total healthcare expenditures will reach more than $4.6 trillion by 2020. The annual rate of growth in total healthcare expenditures should increase from 3.5% in 2010 to a peak of 8.3% in 2014, before moderating to an average annual increase of 6.2% from 2016 to 2020. Spending on hospital care and physician services comprised about half of total healthcare expenditures (including insurance premiums) in 2010.

According to the 2010 Consumer Expenditure Survey, persons aged 65 to 74 years spent the highest amount annually for healthcare with more than $4,900 in annual personal expenditures including health insurance premiums. Those aged more than 75 years followed with nearly $4,800 spent on healthcare per year. Persons aged less than 25 years spent only $775 per year on healthcare; however, the next highest group spent $1,800 on healthcare, a nearly three-fold increase. The aging of the echo boomers, who are in transition from the under-25 age group to the next oldest cohort, will increase demand for healthcare because healthcare spending increases as people age. In general, annual healthcare expenditures increased as income level increased. As people age, their incomes usually rise and they tend to spend more on healthcare because of lifestyle changes such as starting a family, the effects of aging, and the ability to afford more advanced healthcare.

Industry Evolution Leads to More Medical Office Visits

Healthcare utilization is on the rise, with increased medical office visits driving hiring in the healthcare sector. In turn, this increased hiring is driving expansion of medical office facilities. The continued evolution of the United States' healthcare industry has resulted in shifting public perception of personal health management, driving changes in the way healthcare is utilized. The increased dissemination of health research through media outlets, marketing of healthcare products such as brand name prescription drugs, and availability of advanced screening techniques and medical procedures have contributed to a more active and engaged community of healthcare users. Demand for preventive, integrative, and specialized healthcare services increased sharply as a result, fueling the need for customized space for each specialty. Driven by this increased demand, the rate of employment growth in physicians' offices and outpatient care facilities outpaced employment growth in hospitals during the past decade, further supporting the trend of increased utilization of healthcare services outside of the hospital. The nature of

these services, coupled with changing consumer preferences, led to the increased utilization of medical office space, a trend we expect to continue through the long term. According to the Bureau of Labor Statistics, employment in physicians' offices is expected to increase by a cumulative 36.4% from 2010 to 2020, as compared with a projected 25.9% increase in all healthcare professions and a forecasted increase of 14.3% in total employment during this time. Employment in the healthcare industry has steadily increased for at least 20 years despite three recessions. These new hires eventually fill medical office space.

Advancements in healthcare have led to a steady increase in average life expectancy, in spite of the rising incidence of chronic disease. For the medical community, this trend will result in increased utilization of healthcare, as more patients seek treatment for longer periods of time. With more people living longer and continued consumer demand for preventative and other specialized care services, the demand for quality medical office space should increase as well.

The total number of physicians' office visits increased from 682 million in 1994 to 956 million in 2008, according to the latest available data. During the same period, the average number of office visits per person increased from 2.6 to 3.2 per year. Between 1994 and 2008, the number of visits to physicians' offices increased by 40.3%, compared to an increase in the number of emergency room visits of 32.5%. Increased utilization of preventative care and specialized medicine contributed to this trend. As the baby boomers age, we expect the total number of physicians' office visits and per capita visits to continue to trend upward, driving demand for medical services. In turn, this will lead to increased healthcare employment and greater need for medical office space.

Growing demand for healthcare services and a projected shortage of qualified doctors and nurses has caused many medical schools across the country to increase absolute enrollment. The number of medical school matriculants increased by 18.6% from 16,301 in 2000 to 19,230 in 2011. Total U.S. enrollment in medical schools during 2011 was 79,070. Medical school enrollment is clustered in highly populated areas where demand for health services is higher. With medical schools typically affiliated with or located near world-class hospitals, demand for high-quality medical office space in these areas is also strong. Demand for medical school graduates should remain strong through the long term, as America's growing, aging population necessitates more medical services.

National Medical Office Market Opportunity

Overview

The U.S. privately owned medical office market was comprised of approximately 478 million square feet in 2011, with an estimated 74.2 million or 15.5% of this total owned by publicly traded healthcare REITs. According to the last comprehensive survey of buildings from the U.S. Energy Information Administration, the total square footage of all outpatient facilities was 1.3 billion in 2003. Medical office buildings are typically classified as either on-campus, for facilities located on or connected to a hospital campus, and off-campus, for facilities outside of the hospital campus. Physicians are increasingly attracted to medical office space on or very near hospital campuses in order to leverage hospital services and increase traffic to their practice. Additionally, some physicians are affiliated with hospital systems and require proximity to its campus. A limited amount of medical office supply in these areas drives strength in related medical office market fundamentals and significant investment opportunities.

Demographic and Utilization Trends Will Drive Need for Medical Office Space

Demand for healthcare in the United States has been steadily increasing, driven by a growing population, increased healthcare spending by aging baby and echo boomers, and an overarching trend of increased healthcare utilization, evidenced by a rising number of annual physicians' office visits per person. As a result of higher demand for healthcare, employment in the industry has been increasing at a rapid pace for at least two decades, in turn driving demand for high-quality medical office space. Long-term demographic trends should continue to drive increasing demand for healthcare services and medical office space, causing future improvement in medical office market fundamentals.

Hospital systems have been facing limitations on expansion and as a result, more procedures are being performed in outpatient facilities, which have lower overhead costs than hospital space. Insurance companies and government healthcare programs also have been formulating their reimbursement policies in order to direct patients to less costly outpatient care, as opposed to expensive inpatient procedures, driving increased outpatient surgeries and physicians' office visits. Additionally, changing consumer preferences and increasing reliance on specialists and preventative and alternative care providers (such as

cosmetic surgery, nutritionists, acupuncture) have been driving healthcare employment in these areas, leading to accelerating demand for medical office facilities. This decentralization of healthcare systems has allowed for an expanded range of patient services, as well as opportunities for medical office development and acquisition by private sector real estate owners and operators.

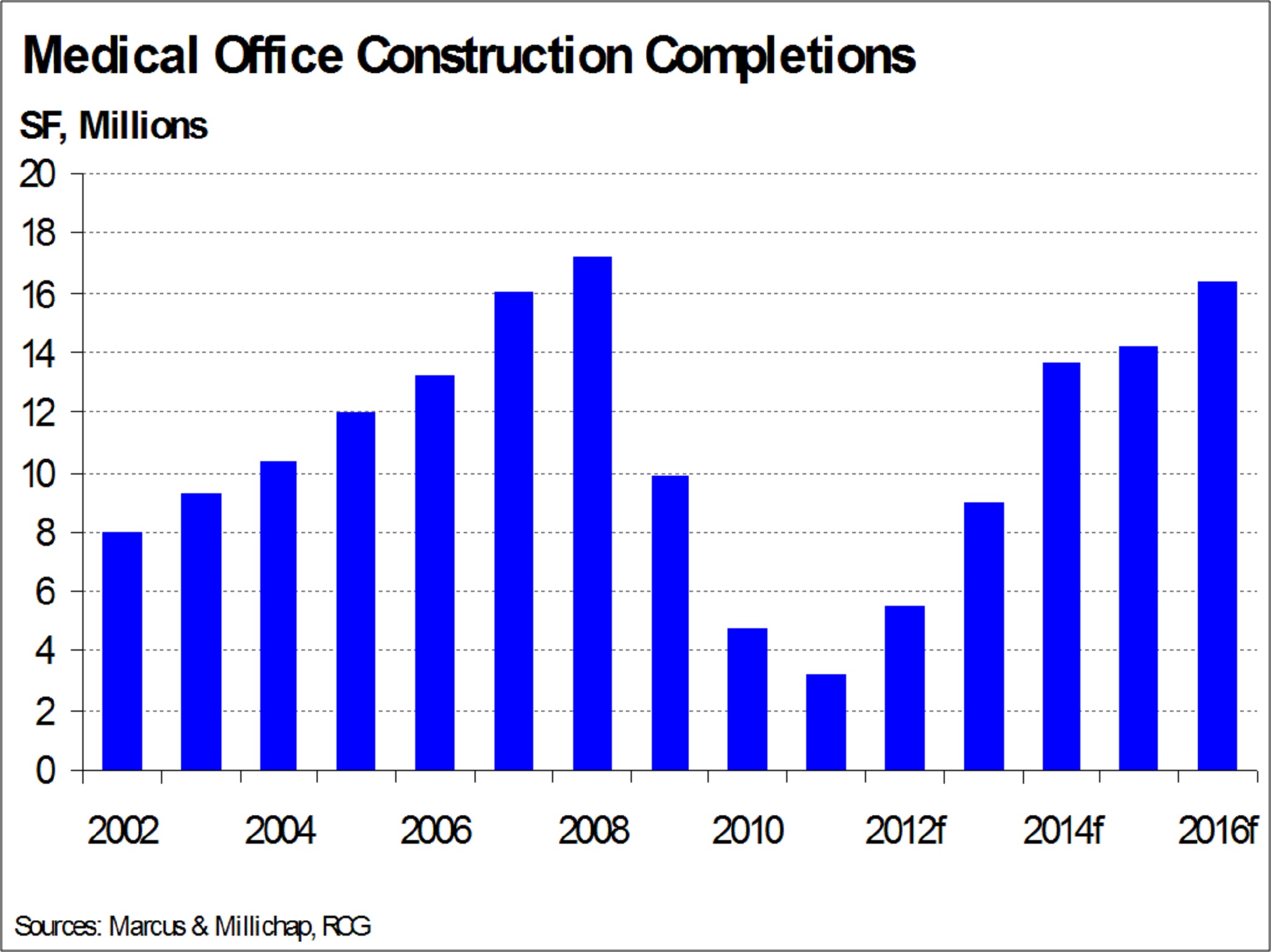

Limited New Construction Will Fuel Rapid Recovery

Construction activity in the medical office sector has been relatively constrained, particularly considering the two large population waves that are just entering periods of increased healthcare utilization. Additionally, the importance of close proximity to medical campuses or hospitals, which are oftentimes locations with little developable land or high cost barriers to development, curtails new medical office construction. With little new medical office product expected in the near term, tenant demand will focus on existing well-located properties, likely driving accelerated rent growth in these areas.

In 2011, the value of put-in-place construction for medical buildings fell to $5.9 billion in chained 2005 dollars, approximately 26.8% lower than the recent peak of $8.0 billion in 2005. According to the Census, this medical building category includes medical offices, doctor and dentist offices, clinics, medical labs, outpatient clinics and non-hospital research labs. The lingering effects of the recent recession, including limited availability and high cost of construction financing, caused the rapid decrease in development activity in recent years. Even as medical office construction levels fell, other types of healthcare-related building activity, such as hospitals and specialized care including nursing homes, continued. Of the $31.8 billion of healthcare construction activity in 2011, medical buildings accounted for 18.5%.

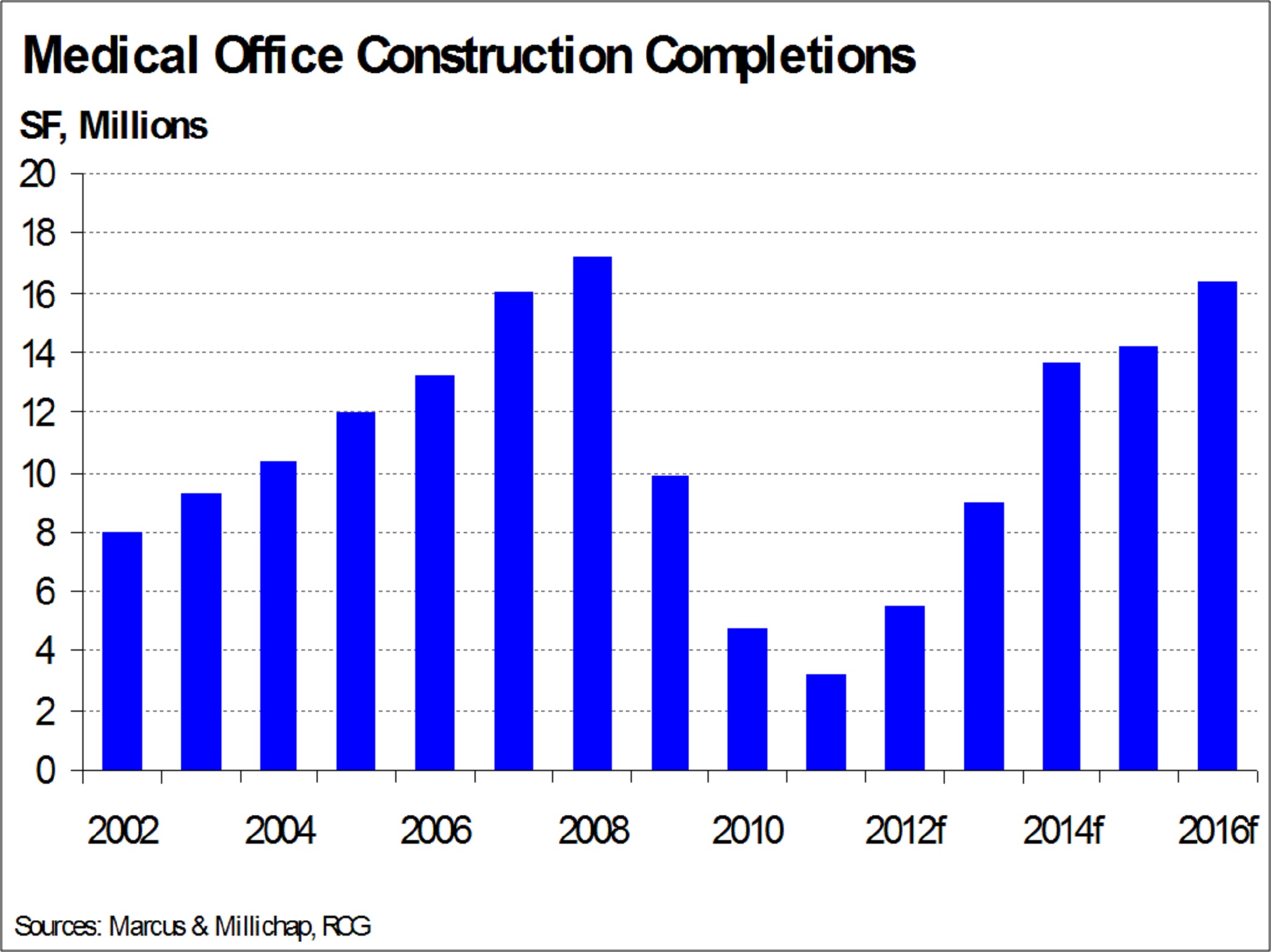

During the last decade, construction of private medical office space accelerated as developers responded to the growing elderly population and the inexpensive financing environment. With the onset of the last recession and disruption in the capital markets, construction financing became scarce and new development activity fell significantly. In 2011, approximately 3.2 million square feet of medical office space were delivered, less than one-fifth of the deliveries recorded just three years earlier. The amount of medical office deliveries peaked at 17.2 million square feet in 2008, according to Marcus & Millichap. Since 2001, 111.7 million square feet of new medical office space were delivered throughout the country.

Going forward, RCG expects construction activity to remain limited in the near term. The RCG forecast calls for 5.5 million square feet of medical office construction to be delivered in 2012 and an additional 9.0 million square feet in 2013. This limited amount of new construction will limit tenants' relocation options, focusing occupancy demand on existing properties. By 2014, the demographic shifts led by baby boomers entering their retirement years as well as expectations for clarity regarding the scope of healthcare reform, should fuel the further increase of development activity. RCG expects new

construction to increase to 13.7 million square feet in 2014. Development of medical office space should accelerate further, reaching 14.3 million square feet in 2015 and 16.4 million square feet in 2016. This increase in medical office development will coincide with increased healthcare utilization by an aging population; as a result, the growing demand will most likely outpace new supply.

Historically Tight Medical Office Market to Improve as Demand Escalates

The medical office vacancy rate has traditionally been lower than the total office vacancy rate. Physicians need to remain near their patient base and as a result, medical office facilities tend to have a higher rate of tenant retentions. Additionally, both higher medical office tenant improvement costs and the difficulty of relocating medical equipment contribute to increased tenant retention for medical office properties. High levels of new construction during the last decade caused the medical office vacancy rate to increase, but at a very slow pace as demand remained robust. In 2009, the combination of a sizeable amount of new speculative supply coupled with an increasing amount of vacant medical office space lead the vacancy rate to reach 12.3%. Still, the vacancy rate for medical office space remained much more stable during the downturn than the vacancy rate for traditional office space. This is largely due to the fact that physicians are deterred from relocating from current space as they need to remain close to their patients or hospital campuses and there are high costs associated with making the necessary tenant improvements. While the medical office vacancy rate peaked in 2009 at 12.3%, it quickly began to decrease to 11.8% in 2010 before slowly trending lower to 11.5% in 2011. The traditional office vacancy rate remained elevated at 17.6% in 2010 before tightening to 16.7% in 2011.

Going forward, demand for healthcare and healthcare employment growth will accelerate as a result of continuing demographic trends. At the same time, limited new supply will come online in the near term. This growing demand for medical office space will outpace new supply, causing the vacancy rate to decline by 50 basis points from its level in 2011 to 11.0% in 2012, afterward falling further to 10.3% in 2013. In the latter end of the forecast, demand will increase sharply as baby boomers reach retirement age and the majority of echo boomers enter their mid twenties, periods where medical service utilization increases sharply. Although construction of medical office space will also accelerate during this time, leasing demand is expected to outpace even these higher levels of new supply. This combination should lead to an accelerating pace of decline for the medical office vacancy rate. RCG predicts a decrease of 110 basis points per year in 2014 and 2015, reaching 8.1% by 2015. In 2016, a higher level of new construction and slowing absorption should cause the vacancy rate to decline by only 40 basis points to reach 7.7% in 2016. The strong wave of demographic demand, driven by healthcare utilization trends of the baby and echo boomers, is expected to cause the vacancy rate to fall well below the average vacancy rate of 2000 through 2010.

Strong Rent Growth Forecasted as Medical Office Market Conditions Tighten

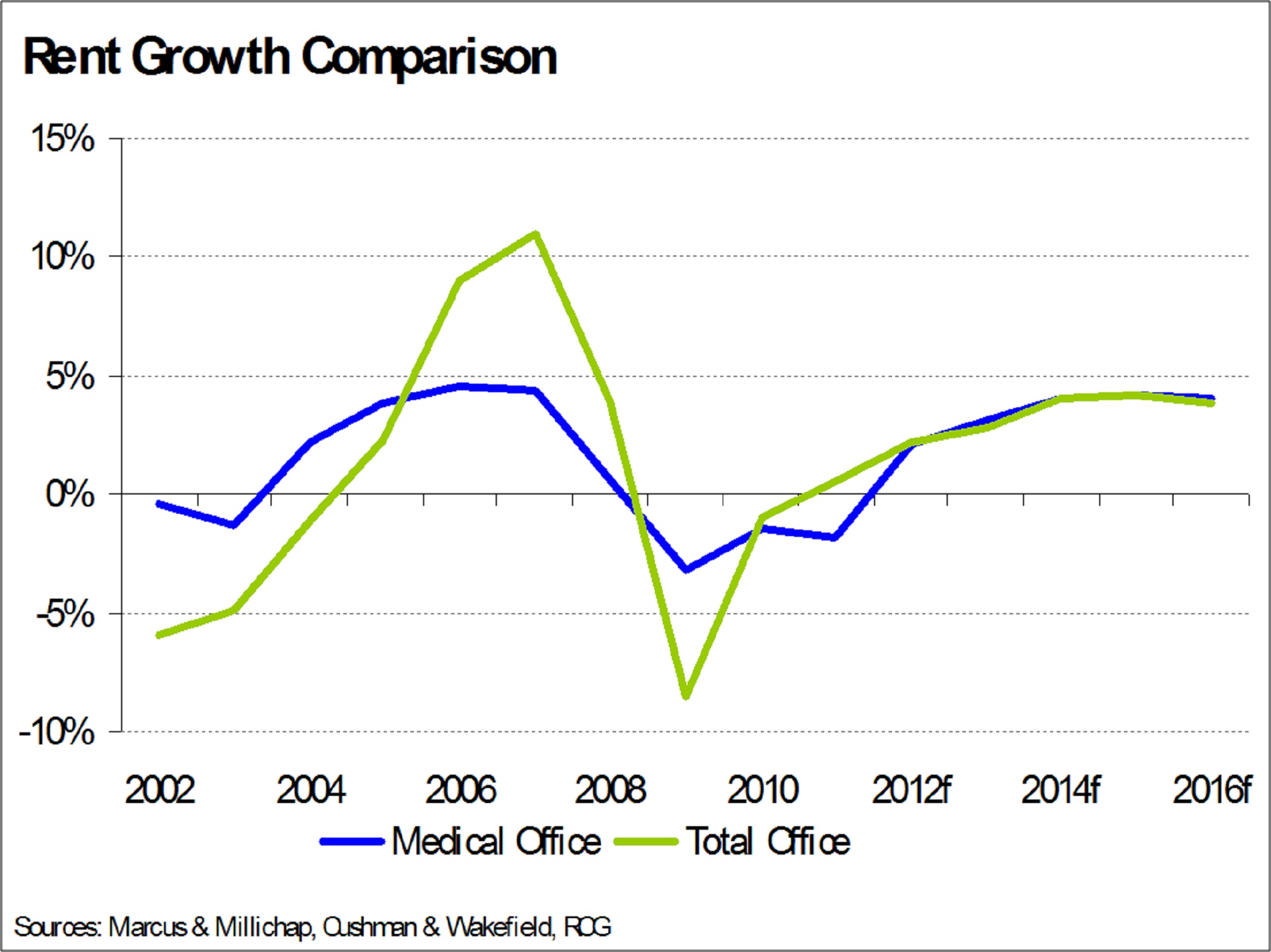

Because of the constructs of the healthcare industry, average asking rental rates for medical office space are typically less volatile than traditional office asking rents. Healthcare is a local business and physicians tend to remain in one place in order to stay close to their patients. Less available space coming to market contributes to lower volatility of asking rental rates. Additionally, asking rents for medical office properties near hospital campuses compete with hospital facilities, which are often subject to legislated restrictions on rental rate increases. Therefore, medical office buildings located near hospital campuses tend to exhibit similar trends in asking rental rates, while still commanding a premium.

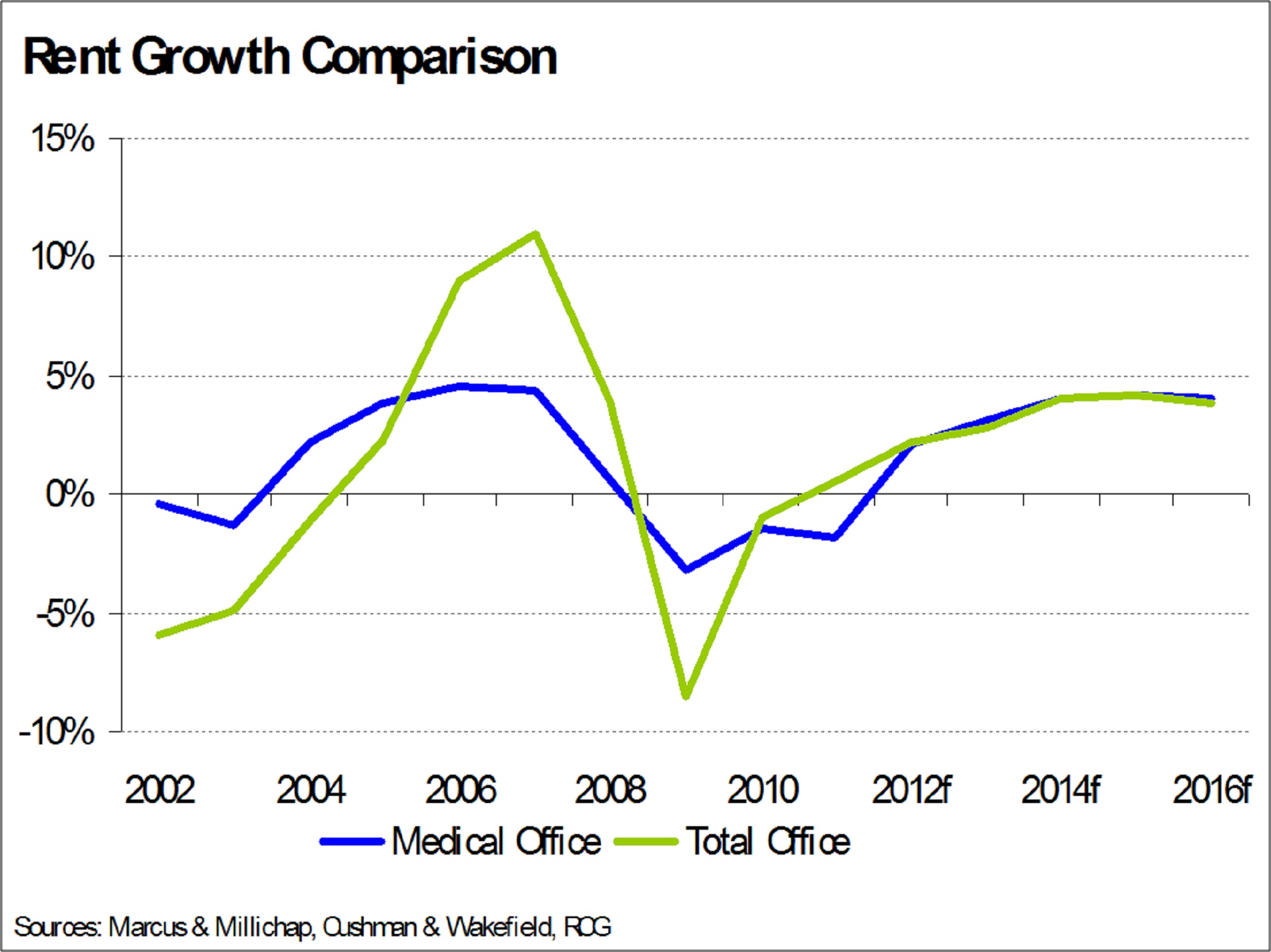

In previous economic downturns, medical office rents performed better than traditional office rents. At the beginning of the decade, medical office rents declined by a cumulative 1.6% in 2002 and 2003, as compared with a decline of 10.6% in traditional office asking rents during the same period. Medical office rents increased annually from 2004 to 2008, for a cumulative increase of 14.0%. Between 2009 and 2011, the average asking medical office rental rate decreased by a cumulative 6.3% as compared with a 8.7% decline for traditional office properties.

With rents typically lagging movement in the vacancy rate, RCG expects medical office asking rents to recover in 2012, after the market continued to tighten during 2011. We predict an annual increase of 2.1% in 2012 as new construction remains moderate and the vacancy rate continues to decline. In 2012, a combination of strong growth in healthcare employment and a still-low level of new supply should contribute to a 50 basis-point fall in the medical office vacancy rate. With larger numbers of baby boomers entering retirement and echo boomers beginning to start families, demand for healthcare should accelerate quickly in the latter part of the forecast period, outpacing new construction. Annual rent growth should increase from 3.1% in 2013 to an annual average of 4.1% in 2014 through 2016 as the vacancy rate continues to tighten. Beginning in 2013, rent growth for medical office buildings is expected to outpace rent growth for traditional office properties, as healthcare employment increases at a faster pace than traditional office-using industries. Facilities located on or near hospital campuses should record even stronger rent growth as the combination of high demand for this space and extremely limited new construction allows landlords to bid up rents.

Medical Office Investment Activity Increasing as Public Companies Post Solid Returns

Increasing demand for healthcare driven by demographic growth is a well-known trend. Additionally, the medical office sector benefits from a high rate of tenant retention, a long-term lease structure, and high rental rates. Some hospital systems have also been divesting real estate, in order to divert capital to other uses, providing greater opportunities for investment. These trends, coupled with increased allocation of capital to commercial real estate, caused private sector investment in medical office buildings to increase in recent years. Although medical office transaction activity slowed during 2008 and 2009 as a result of tight credit conditions, sales velocity rebounded in 2010. Additionally, the slowdown in medical office investment volume during the recession was less pronounced than that in most other types of commercial real estate. In recent years, investment activity has been concentrated on high-quality, on-campus properties as investors sought safe, fully-leased assets.

In spite of a growing number of buyers in the medical office space, the size of the combined medical office portfolios for all publicly traded REITs is rather small as compared with the size of the total medical office market. In 2011, publicly traded REITs only held 15.5% of currently investable medical office space and a much smaller percentage of all healthcare-related real estate. Additionally, private and public medical office owners, including hospital systems, may struggle with liquidity in the near term as the lending environment remains stringent and state and local governments trim their budgets. Divestiture of real estate is one way these institutions may choose to raise funds, providing acquisition opportunities for specialized real estate owners and operators. Publicly traded REITs continued to be active buyers of medical office properties during 2011. Strong demand for properties, an increasing pool of capital and competition for assets should drive up the price of medical office properties and allow for increased liquidity for long-term holders of medical office real estate.

With stable occupancy and limited volatility in asking rental rates, medical office buildings tend to record relatively steady net operating incomes. This trend contributes to limited movement in capitalization rates, although changes in the real estate capital markets can affect property valuations. According to the PwC Real Estate Investor Survey, the average overall cap rate for medical office properties hit a recent peak of 8.9% in late 2009 and has since declined to 7.3% at the end of 2011. Most other types of commercial real estate recorded much larger increases in the average cap rate during the recession.

Strong income growth and increases in asset valuation resulted in strong, positive returns for medical office space from 2000 to 2007. According to NAREIT, annual returns for publicly traded healthcare REITs (which can include medical office, hospitals, and senior housing facilities) averaged 25.7% during this time. Compared with public REITs specializing in other property types, healthcare REITs have historically recorded more positive and stable returns, likely a result of the stability and attractiveness of the medical office sector. Annual returns averaged 16.5% growth per year for office REITs from 2000 to 2007, while annual returns for all REITs averaged 17.5%.

Healthcare REIT returns declined by 12.0% in 2008, as the credit crunch caused property valuations to plummet. However, the medical office sector actually benefited from the drop in confidence, as investors fled to quality assets with higher stability. Publicly traded REITs specializing in other sectors recorded much larger declines in returns during the recession. Annual total returns for other property types declined in 2007 and 2008, for a cumulative drop of 52.2% for office REITs and 48.5% for all REITs. Returns for healthcare REITs increased by 13.6% during 2011, while office REITs declined by approximately 0.8% and all REITs increased by 8.3% during the same period. Healthcare REITs should continue to produce stable, strong returns as a result of the unique advantages of the medical office market, particularly as rent growth is expected to accelerate, driving up net operating income and valuations. Additionally, the advantageous tax structure and capital-raising abilities of REITs in the current environment should contribute to strong returns, as compared with private investments.

Our Competitive Strengths

We believe that the following competitive strengths in particular position us to execute upon growth opportunities in the medical office building sector:

Primary Focus on Medical Office Buildings

We are an internally managed REIT primarily focused on acquiring, owning and operating high-quality medical office buildings that are predominantly located on or aligned with campuses of nationally or regionally recognized healthcare systems. We believe that the specialized nature of medical office buildings, their highly fragmented ownership nationwide and the integrated nature of these assets with the operations of healthcare providers give a competitive advantage to companies with a specific focus on medical office buildings as compared to companies with a broader investment focus that includes senior housing communities, skilled nursing facilities, hospitals, and life sciences office buildings. We believe that medical office building performance is more closely aligned with true real estate fundamentals such as location (on campus) and demand (outpatient services) rather than seniors housing and skilled nursing facilities, which rely more heavily on general economic conditions such as employment, government reimbursements and housing affordability. We have developed extensive and valuable relationships with healthcare systems, physicians, and building owners, which we believe makes us attractive to tenants, enables us to source acquisitions with hospitals and developers directly, and enhances our management and leasing efforts. We believe our medical office building focus, together with our in-house property management team, makes us more attuned to the needs of our tenants and better equipped to address those needs.

High-Quality and Geographically Diverse Medical Office Building Portfolio Concentrated in On-Campus Locations

We own a national portfolio of primarily high-quality medical office buildings. Approximately 96% of our portfolio was located on or aligned with campuses of nationally or regionally recognized healthcare systems as of March 31, 2012. We believe that demand for on-campus and aligned locations by physicians and other healthcare providers seeking to benefit from and maintain patient referrals and on-campus resources associated with a healthcare system can result in higher retention rates and higher average rents than more distant locations. Our portfolio is also geographically diversified in 26 states, with approximately 57% of our portfolio based on GLA as of March 31, 2012, concentrated in 11 markets that we consider to be strategic based on favorable business environments, demographic trends and projected demand for healthcare. We believe that demographic trends in these markets, including the high projected rates of population increase, significant aging populations, and high state healthcare spending forecasts in these markets, are expected to result in higher growth in medical office building demand than the national average. Our portfolio occupancy, including leases we have executed but which have not yet commenced, based on GLA, exceeded 90% as of December 31, 2010 and 2011 and March 31, 2012.

With 1.1 million square feet of GLA available for rent as of March 31, 2012, our portfolio also provides built-in, value-add opportunities, including potential occupancy increases, increasing rental rates, and enhanced margins through property management initiatives. We believe the size and quality of our portfolio, as well as the attractive demographics in our markets, will further strengthen and develop our long-term relationships with healthcare systems, as well as attract a strong and stable tenant base.

The following charts depict the geographic presence of our portfolio by state and key market concentrations as of March 31, 2012, based on GLA:

Diverse, High-Credit Quality and Stable Tenant Base

As of March 31, 2012, our portfolio had more than 1,000 tenants with over 1,700 leases, and included large and nationally recognized healthcare systems, as well as a wide variety of medical practices, specialty clinics and outpatient services. We believe high-credit quality tenants are important to portfolio performance as they reduce our exposure to tenant default risk. As of March 31, 2012, approximately 39% of the tenants in our portfolio, based on annualized base rent, have (or their parent companies have) an investment grade credit rating from nationally recognized rating agencies. Overall, 56% of our annualized base rent as of March 31, 2012 was derived from tenants that have (or whose parent companies have) a credit rating with a nationally recognized rating agency. As of March 31, 2012, no one tenant (including affiliated entities of the same healthcare system) represented more than 6% of our total annualized base rent, our top ten tenants represented less than 34% of our total annualized base rent, and our bad debt expense was less than 1% of our rental revenues for each of the years ended December 31, 2009, 2010 and 2011.

The following table sets forth information regarding the twenty largest tenants in our portfolio based on annualized base rent as of March 31, 2012:

__________________

(1) Credit ratings of our tenants or their parent companies.

(2) Annualized base rent is calculated by multiplying contractual base rent for March 2012 by 12 (but excluding the impact of renewals, future step-ups in rent, abatements, concessions, and straight-line rent).

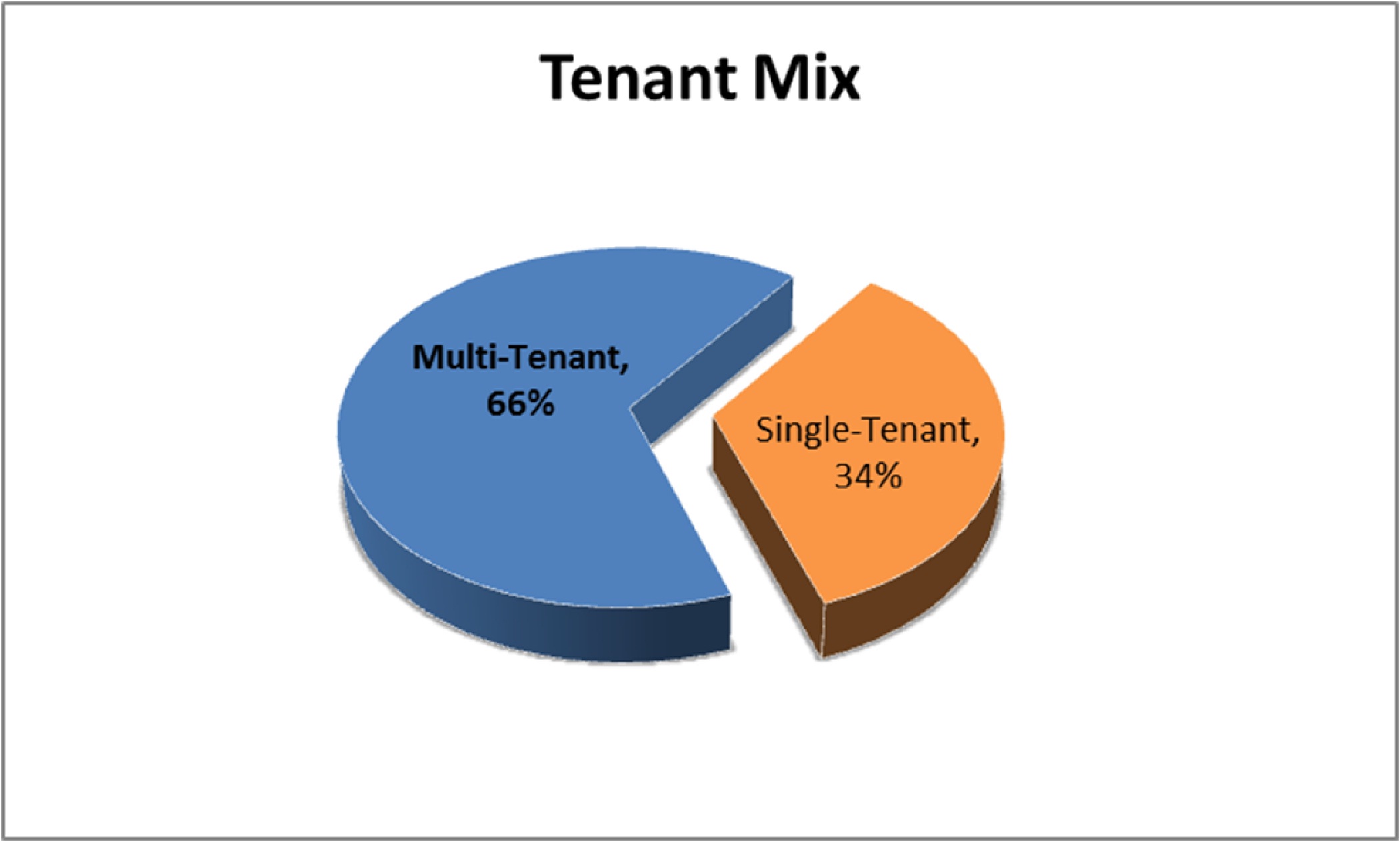

We also believe we have a strategic tenancy mix within our buildings, with approximately 34% and 66% of our portfolio, based on GLA, representing single tenant buildings, and multi-tenant buildings, respectively. This mix provides us the stable cash flows and limited short-term fluctuations typically associated with single tenant buildings, while providing the opportunity for rent growth from the shorter-term leases typically associated with multi-tenant buildings. Our single tenant buildings are generally leased via triple net leases structured with longer term and built-in rental increases providing stable cash flows with limited short-term fluctuations, while our multi-tenant buildings are a combination of triple net leases, full service gross leases or modified gross leases. Multi-tenant buildings typically have shorter term leases with the opportunity for higher rent growth upon rollover. As of March 31, 2012, based on GLA, our weighted average lease term was 8.2 years and 5.7 years for our single tenant leases and multi-tenant leases, respectively.

The following chart illustrates our tenant mix as of March 31, 2012:

Proven and Disciplined Acquisition Capability

We have a proven track record of acquiring medical office buildings and other facilities that serve the healthcare industry utilizing a disciplined acquisition strategy, which leverages our existing relationships, extensive underwriting capabilities, and experience in structuring and executing transactions. From January 2007 through March 2012, we deployed approximately $2.5 billion of capital in the acquisition of 245 medical office buildings and 19 other facilities that serve the healthcare industry, with approximately 12.4 million square feet of GLA. We believe that our primary focus on medical office buildings, our knowledge of healthcare real estate, and our relationships with healthcare systems and physicians provide us with a competitive advantage relative to other buyers. We believe that our flexibility and creativity in structuring acquisitions to address the needs of sellers or tenants, as well as our ability to quickly identify, negotiate, finance and consummate acquisitions of all sizes, has positioned us as a preferred buyer of medical office buildings.

Conservative Balance Sheet with Growth-Oriented Capital Structure

We believe our conservative leverage and financial flexibility with carefully staged debt maturities positions us to take advantage of strategic investment opportunities. As of March 31, 2012, our leverage ratio of indebtedness to undepreciated assets was 30.4% and our aggregate indebtedness had staggered maturities and a weighted average effective interest rate of 4.33% per annum. As of May 15, 2012, $510.0 million was available under our revolving credit facility and approximately $100.0 million was available under our term loan facility, with each facility having approximately four years remaining until the initial maturity, with a one-year extension option, subject to certain conditions. We believe our borrowing capacity under our revolving credit and term loan facility as well as our access to other sources of debt and equity capital while remaining within our low leverage range should allow us to capitalize on favorable acquisition opportunities that arise.

Experienced Senior Management Team

We believe the extensive healthcare real estate expertise and public company financial management experience of our senior management team, led by Mr. Scott D. Peters, our co-founder, Chairman, Chief Executive Officer and President, will enable us to effectively implement our operating and acquisition strategies. Our senior management team also includes Kellie S. Pruitt, our Chief Financial Officer; Mark D. Engstrom, our Executive Vice President-Acquisitions; and Amanda Houghton, our Executive Vice President-Asset Management. Our management team is further complemented by our experienced board of directors, all of whom have served in CEO, CFO, director and/or management positions for hospital systems, public and private companies in the real estate and healthcare sectors, and major accounting firms. Our management team has successfully managed our large, geographically diverse portfolio, while maintaining a flexible balance sheet, substantial liquidity and low leverage. Among other achievements, the team has supervised our acquisition and integration of over $1.5 billion of high-quality medical office buildings and other facilities that serve the healthcare industry since January 2009, and has built key relationships with large nationally or regionally recognized healthcare systems and quality tenants.

Business and Growth Strategies

Our primary objective is to maximize stockholder value with disciplined growth through strategic investments and to provide an attractive risk-adjusted return for our stockholders by consistently increasing our cash flow. The strategies we intend to execute to achieve this objective include:

Achieve Growth through Targeted Acquisitions

We plan to continue to focus primarily on mid-sized acquisitions, in the $25.0 million to $75.0 million range, of high-quality medical office buildings in our target markets as noted above. We also have completed larger acquisitions from time to time and expect to continue to do so when attractive opportunities emerge. In particular, we seek properties that have the following attributes:

| |

| • | high occupancy and located on or aligned with campuses of recognized healthcare systems, which we believe provide for better tenant retention rates and rental rate growth as compared to facilities not affiliated with a healthcare system; |

| |

| • | affiliated with top national and regional healthcare systems which are dominant in their respective markets, which we believe attract top physicians seeking healthcare systems, with significant market share and high credit quality; |

| |

| • | located in markets with attractive demographics and favorable regulatory environments in business friendly states or those with high barriers to entry; |

| |

| • | a strategic mix of high-credit quality single-tenant buildings with long-term, triple-net leases and fixed rental increases and multi-tenant buildings with short-term leases; and |

| |

| • | provide accretive returns based on our cost of capital. |

Leverage and Expand Our Strategic Relationships to Generate New Opportunities

In order to access acquisition opportunities for our future growth, we plan to continue to emphasize building long-term relationships, cultivated by our senior management team with key industry participants, which have traditionally provided us with valuable sources of potential investment opportunities. We have significant relationships with large and nationally recognized healthcare systems such as Aurora Health, Banner Health, Catholic Healthcare Partners, Greenville Hospital System and Indiana University Health, among others. Through these relationships, we believe that we have developed a reputation of reliability, trustworthiness and high tenant satisfaction. In this regard, approximately 69% of our acquisitions from January 1, 2009 through March 31, 2012, based on purchase price, were sourced directly from hospitals and developers. We intend to continue building upon our existing relationships with healthcare systems to establish long-term lease arrangements, and to develop other strategic alignments with new healthcare systems.

Actively Maintain Strong, Flexible Capital Structure and Balance Sheet

We seek to actively manage our balance sheet to maintain conservative leverage and financing flexibility with carefully staged debt maturities, thereby positioning us to take advantage of new strategic investment opportunities. We believe our borrowing capacity under our new revolving credit and term loan facility as well as our access to other sources of debt and equity capital, while remaining within our targeted leverage range should allow us to capitalize on favorable acquisition opportunities that arise. While we believe our new revolving credit and term loan facility will enable us to take advantage of acquisition opportunities on a short-term basis, we intend to take advantage of multiple sources of capital that we can use to effectively manage our long-term leverage strategy, repay our secured debt maturities, or finance future acquisition opportunities. These other sources of capital include unsecured public debt financing, additional equity issuances, unsecured bank loans, and secured property-level debt. Over the long-term, we intend to continue to focus on migrating our capital structure toward a higher volume of unsecured debt. We also will seek to maintain our investment grade credit ratings, which we first received in July 2011. We believe this is important to preserving our access to these capital sources on favorable terms. In addition, we may also pursue dispositions of properties that no longer align with our strategic objectives in order to redeploy capital.

Maximize Internal Growth through Proactive Asset Management, Leasing and Property Management Oversight

Our asset management strategy focuses on achieving internal growth through initiatives to lease vacant space and increase rental rates while maximizing operating efficiencies at our properties. Specific components of our overall strategy include:

| |

| • | migrating our properties toward our in-house property management platform in geographic areas where we have significant portfolio concentrations and can achieve the necessary scale (in particular, we are targeting approximately 58% of our existing portfolio to be managed internally by December 31, 2012); |

| |

| • | leveraging and proactively partnering with recognized property management and leasing companies in markets where our in-house property management platform is not currently active; |

| |

| • | increasing our average rental rates, maintaining or increasing renewal rates and actively leasing our vacant space; |

| |

| • | improving the quality of service provided to tenants by being attentive to their needs, managing expenses, and strategically investing capital; |

| |

| • | maintaining the high quality of our properties and building our reputation as a desirable recognized landlord; |

| |

| • | maintaining regional offices in markets where we have a significant presence, which enables us to create closer relationships with national and regional healthcare systems and other tenants and better respond to their needs; and |

| |

| • | using market knowledge and economies of scale to continually reduce our operating costs. |

We believe that we are well positioned for future rental growth in our medical office buildings. We believe that we will be able to generate cash flow growth through the leasing of vacant space in our medical office buildings as well as rent increases, particularly due to the limited supply of medical office space, the recovering economy and the general reluctance of medical office building tenants to move or relocate because of the desire to remain close to nationally or regionally affiliated healthcare systems. As of March 31, 2012, our buildings were approximately 91% leased, including leases we have executed, but which have not yet commenced.

Our Properties

As of March 31, 2012, our geographically diverse portfolio contained 264 buildings located in 26 states, comprised of 245 medical office buildings and 19 other facilities that serve the healthcare industry, as well as two portfolios of mortgage loans receivable secured by medical office buildings. The aggregate purchase price, including two portfolios of mortgage loans receivable, was $2.5 billion. Our portfolio consisted of approximately 12.4 million square feet of GLA, with an occupancy rate, including leases signed but not yet commenced, of 91% as of March 31, 2012. Each of our properties is 100% owned by our operating partnership, except for the 7900 Fannin medical office building in which we own an approximate 84% interest through our operating partnership.

Our properties include medical office buildings, specialty inpatient facilities (long term acute care hospitals or rehabilitation hospitals), and skilled nursing and assisted living facilities.

As of March 31, 2012, we owned fee simple interests in 175 of our buildings, representing 64.6% of our total portfolio's GLA, with long-term leasehold interests in the remaining 89 buildings as of March 31, 2012 within our portfolio, which represent approximately 35.4% of our total GLA. As of March 31, 2012, these leasehold interests had an average remaining term of approximately 83.4 years. We believe all of our properties are adequately covered by insurance and are suitable for their intended purposes. Depreciation for buildings is provided on a straight-line basis over the estimated useful lives, 39 years, and for tenant improvements, is provided over the shorter of the lease term or the useful lives.

The following table provides an overview of our portfolio of medical office buildings and other facilities that serve the healthcare industry as of March 31, 2012:

___________________

(1) Represents the number of buildings within each particular state as of March 31, 2012.

(2) Annualized base rent is calculated by multiplying contractual base rent for March 2012 by 12 (but excluding the impact of renewals, future step-ups in rent, abatements, concessions, and straight-line rent). Annualized base rent data for our properties is for March 2012 and does not reflect scheduled lease expirations for the 9 months ending December 31, 2012.

(3) Total percent leased calculated as follows: 11,287,000 total square feet leased divided by 12,386,000 total GLA.

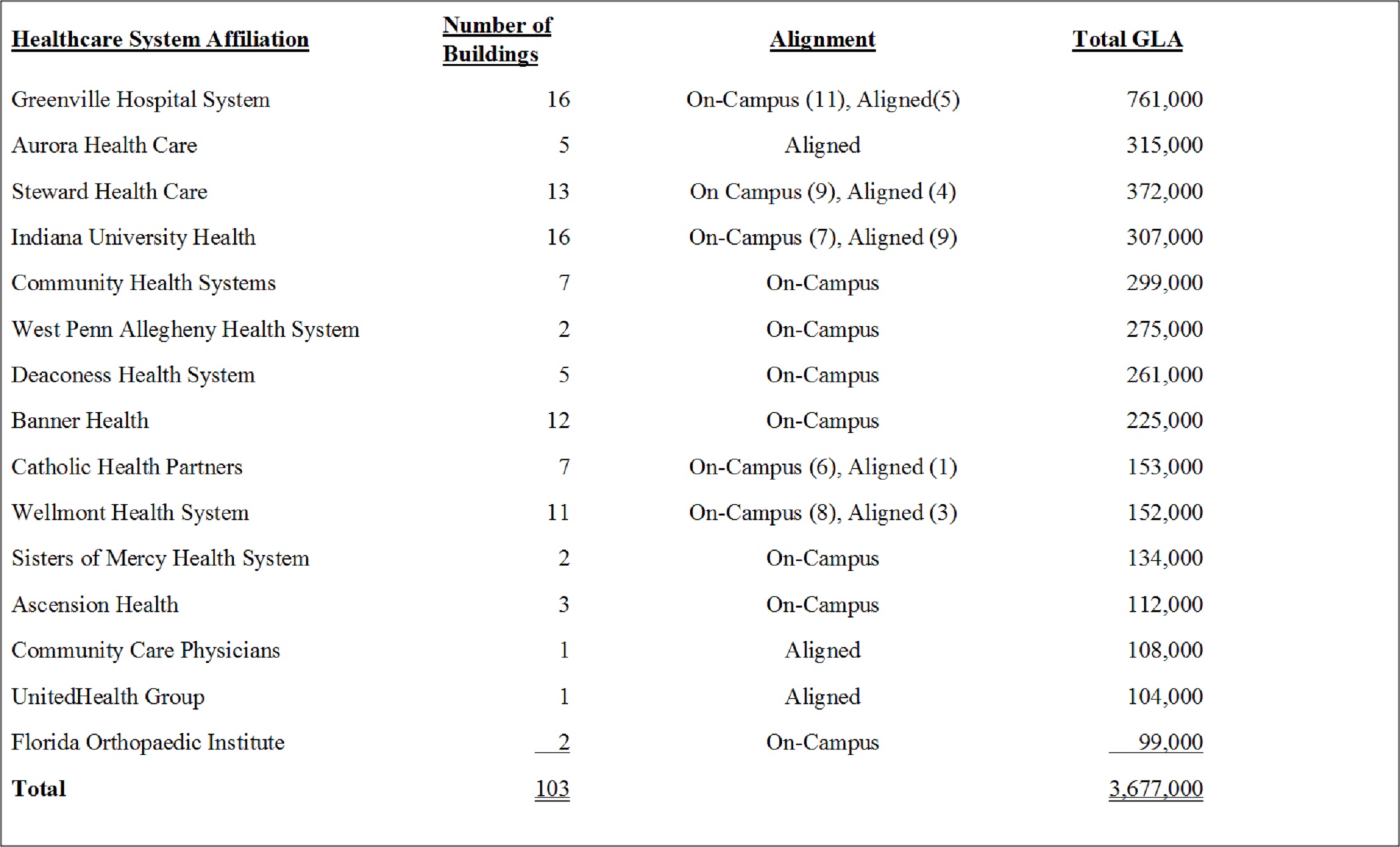

Campus Proximity and Healthcare System Alignment of Our Properties

The following table provides information regarding the top 15 healthcare system affiliations including the number of buildings, type of alignment, and total GLA that comprise our properties:

Lease Expirations

The following table presents the sensitivity of our annualized base rent due to lease expirations for the next 10 years at our properties, by number, square feet, percentage of leased area, annualized base rent, and percentage of annualized base rent as of March 31, 2012:

___________________

| |

| (1) | The annualized base rent percentage is based on the total annual contractual base rent as of March 31, 2012, excluding the impact of renewals, future step-ups in rent, abatements, concessions, and straight-line rent. Amounts include any contractual rent increases over the life of the lease. |

| |

| (2) | Leases scheduled to expire on December 31 of a given year are included within that year in the table. |

Tenant Improvements

We anticipate that tenant improvements required at the time of our acquisition of a property will be funded from operating cash flows. However, at such time as a tenant of one of our properties does not renew its lease or otherwise vacates its space in one of our buildings, it is likely that, in order to attract new tenants, we will be required to expend substantial funds for tenant improvements and tenant refurbishments to the vacated space. We will retain independent contractors to perform the actual construction work on tenant improvements, such as installing heating, ventilation and air conditioning systems.

Terms of Leases

A majority of our leases require the tenant to pay or reimburse us for some or all of the operating expenses of the building based on the tenant's proportionate share of rentable space within the building. Operating expenses typically include, but are not limited to, real estate taxes, sales and use taxes, special assessments, utilities, insurance and building repairs, and other building operation and management costs. We will be responsible for the replacement of specific structural components of a property, such as the roof of the building or the parking lot. Many of our leases will generally have terms of five or more years, some of which may have renewal options.

Key Geographic Markets

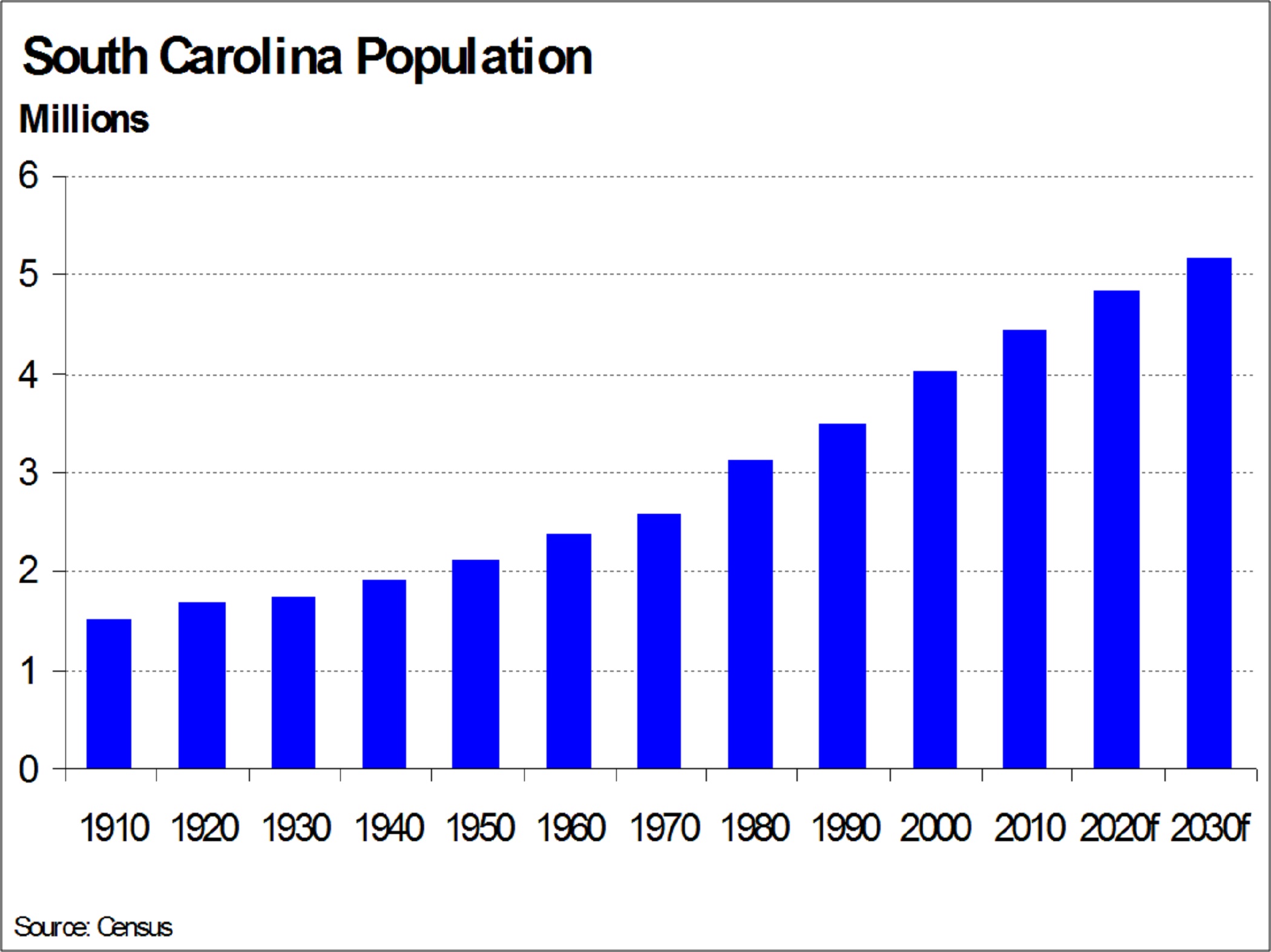

We have concentrations in what we have targeted as our key markets as follows: 1.2 million square feet in Phoenix, Arizona; 1.1 million square feet in Dallas and Houston, Texas; 1.0 million square feet in Pittsburgh, Pennsylvania; 1.0 million square feet in Greenville, South Carolina, 0.8 million square feet in Indianapolis, Indiana; 0.6 million square feet in Atlanta, Georgia and 0.4 million square feet in Boston, Massachusetts. Our key markets have strong fundamentals that we believe are vital to our continued success in portfolio performance, occupancy and rental rate growth. Each of our key markets have a growing population base, strong employment and economic fundamentals, aging populations, significant healthcare spending, strong medical office rent growth and low vacancy rates. The following sets forth the fundamentals for each of our key markets.

Unless otherwise indicated, all information contained in the following section is derived from market studies prepared for us by RCG as of April 2012 and the projections and beliefs of RCG stated herein are as of that date.

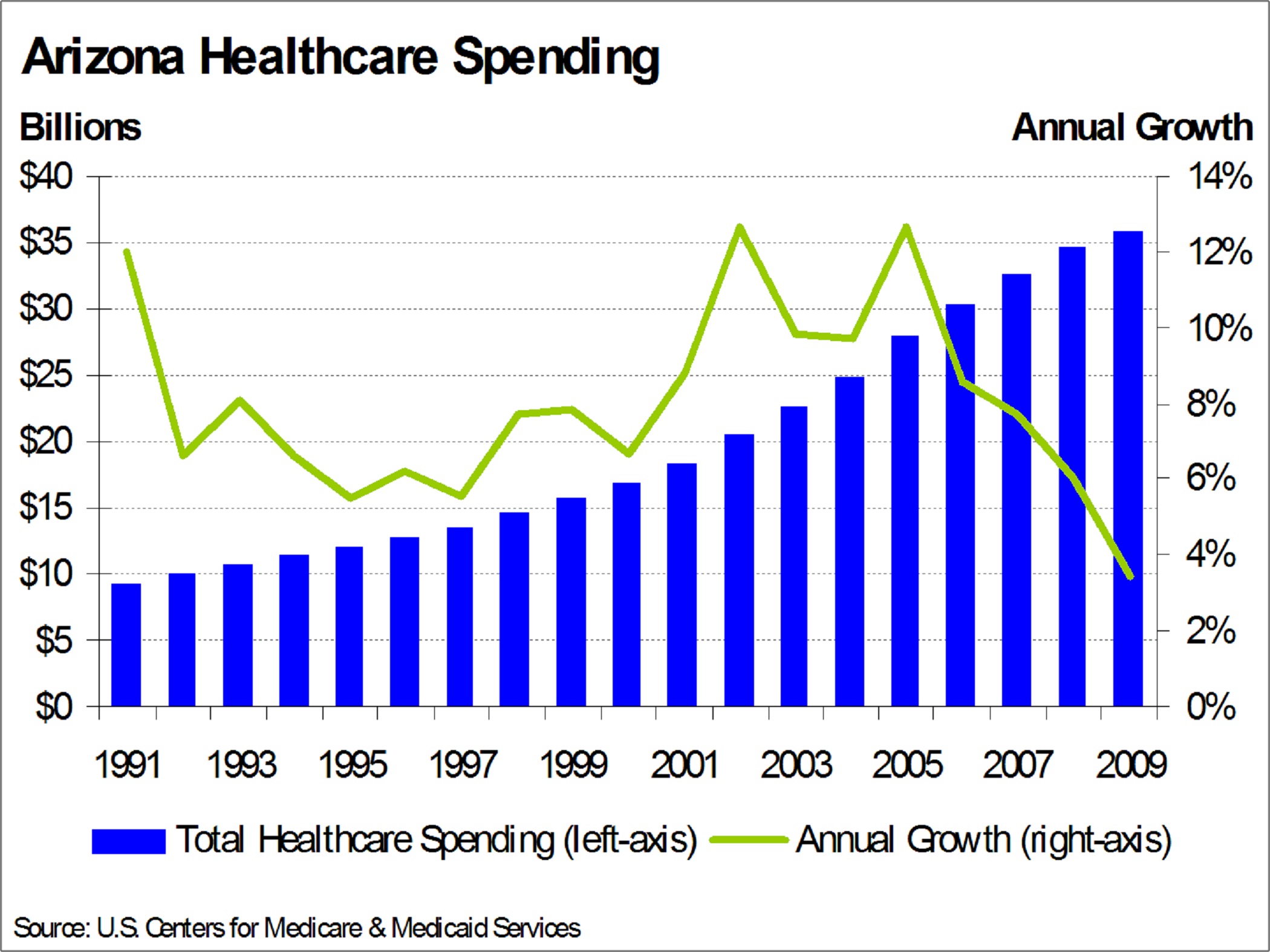

Arizona

As one of the most popular retirement destinations, the state of Arizona recorded a strong rate of in-migration during the past few decades, particularly among the 65 years and older age cohort. From 2000 to 2011, this demographic group increased by an estimated 43.9% to total 961,000 residents of retirement age in Arizona. Those aged 65 and older composed 14.1% of the total Arizona population in 2011, driving demand for healthcare and medical office space throughout the state.

A high rate of in-migration has fueled the growing demand for healthcare in Arizona. The total population expanded by 32.6%, or 1.7 million residents, from 2000 to 2011. Baby boomers sought cheap housing and a low cost of living, causing their ranks to swell to an estimated 1.7 million in 2011, equivalent to 25.2% of Arizona's population. Attracted by job opportunities, young professionals also migrated to Arizona in the past decade. The echo boomer cohort totaled 1.2 million in 2011. The aging of these two large age cohorts and strong population growth, particularly in the 65 years and older age group, should drive increasing demand for medical services, physicians and medical office space.

The percentage of Arizona's population aged 65 years and over should increase rapidly in the next decade. According to Census projections, this age cohort should grow to 18.0% of the state's population in 2020, expanding by nearly 600,000 residents as a result of in-migration and the aging of current baby boomer residents. Total population growth should remain brisk. Arizona's total population should increase by 1.7 million residents to more than 8.4 million in 2020, a 27.4% increase. These trends, coupled with resident echo boomers beginning to start families and use more medical services, should drive a rapid increase in the demand for medical services. As demand for health services increases and the expansion of expensive hospital systems remains limited, utilization of medical office space is forecasted to increase.

In Arizona, the number of outpatient visits per person increased to 1.2 in 2008 from a recent low of 0.9 in 2004. This figure has generally trended upward, as consumer preferences and insurance company incentives cause growth in outpatient visits as compared with inpatient procedures. A higher number of visits per person coupled with a rising population compounded the growth of demand for physicians' services in Arizona, leading to higher demand for medical office space.

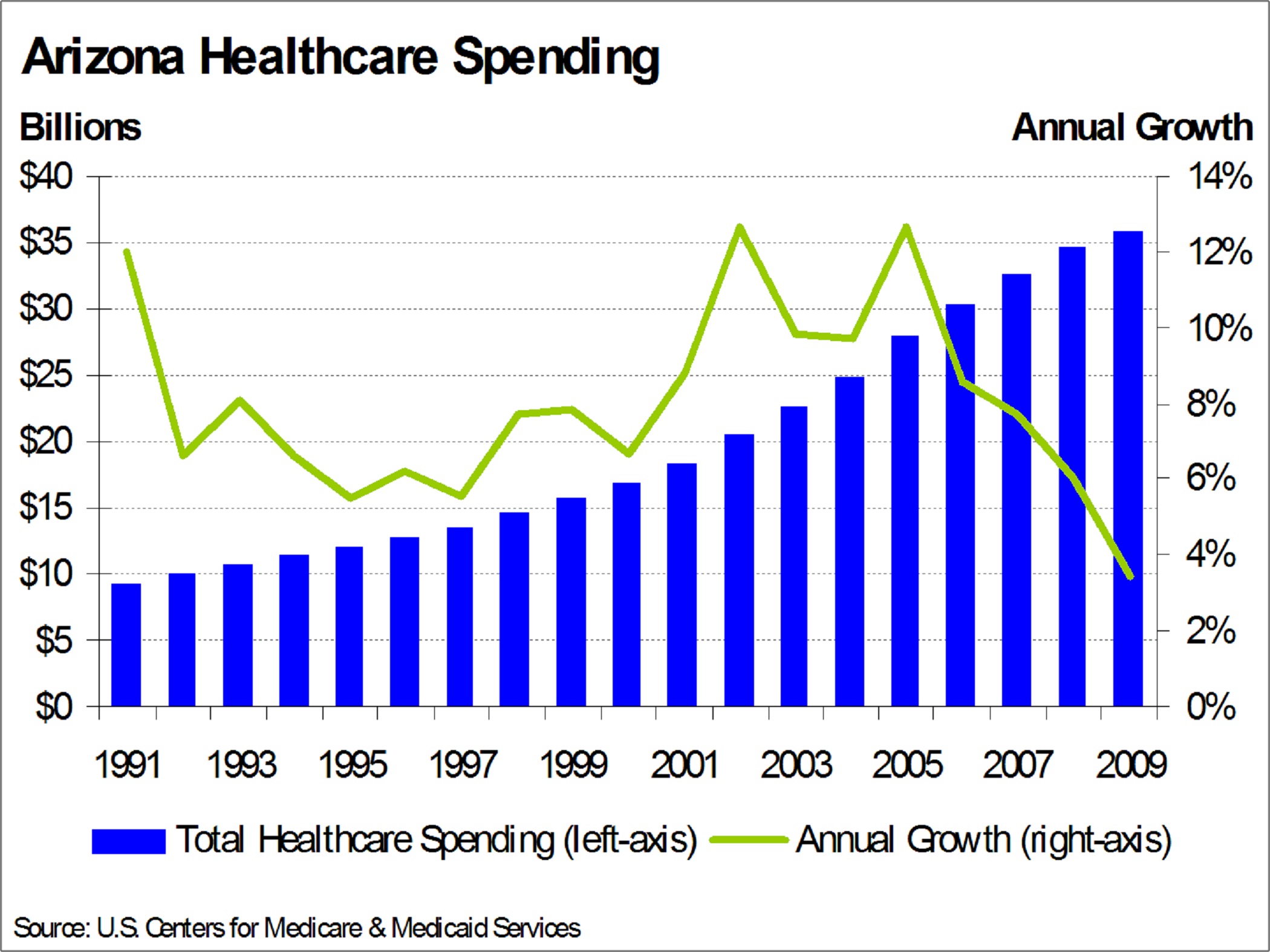

With more people using medical services more often, the amount of spending on healthcare in Arizona increased accordingly. According to the latest available data, Arizona healthcare providers spent approximately $35.8 billion in 2009, a 128% increase from the amount spent in 1999. Of this total, $9.5 billion or 26.6% was spent on physical and clinical services in 2009, up by 112% from 1999. A combination of continued rapid population growth and an increasing rate of healthcare utilization, particularly among key demographic groups, should result in the continued growth of healthcare spending in Arizona. As demand, utilization and spending on healthcare rises, healthcare employment should follow suit, driving the need for medical office space.

Even during the most recent recession, the healthcare industry continued to expand in Arizona. Healthcare payrolls expanded by a cumulative 54.2% from 2001 to 2011, while total employment in Arizona increased by only 7.3% during this time. Employment in the ambulatory care sub-sector, which contains employment in physicians' offices, increased at an even faster pace, growing by 74.2% during the same period. Rapid growth in the demand for medical services should continue to spur hiring in the Arizona healthcare industry, particularly in physicians' offices, which should drive demand for medical office space.

With a warm climate, low cost of living, and existing senior-friendly infrastructure, Arizona's reputation as a retirement destination is unlikely to change. As a result, the number of Arizona residents aged 65 years and over is projected to increase by more than 1.4 million or 157% during the next twenty years. This rapid growth of the elderly population, whose utilization of and spending on healthcare services outpaces every other age group, will drive the need for medical office space in Arizona through the long term. Additionally, robust growth of the total Arizona population will augment this demand, particularly in the state's two major metropolitan areas of Phoenix and Tucson, which were estimated to account for almost 80% of the state's population in 2011.

Texas

The population of the state of Texas has been growing at a rapid pace for decades, a trend RCG expects to continue in the future. A high level of in-migration should drive demand for healthcare services, particularly as the state's large number of baby boomers reach retirement age and echo boomers migrate to the region for jobs. In 2011, Texas was estimated to have had more than 25 million residents, a 20.0% increase from 2000. Approximately 10.6% of the state's population, or 2.7 million residents, were over the age of 65 years in 2011.

Texas's 5.8 million baby boomers, defined as those aged 46 to 65 years in 2011, composed an estimated 23.3% of the state's population in 2011. The number of echo boomers, those aged 17 to 29 years, totaled 4.7 million or 18.9% of the state's population. The impact of a rapidly growing population, coupled with these two demographic groups entering periods of higher healthcare utilization, should drive a sharp increase in the need for healthcare services, employment and medical office space in Texas through the forecast period and beyond.

According to Census projections, the total population is expected to reach 28.6 million in 2020, up by 14.4% as both domestic and international migration to Texas remains strong. As the baby boomer cohort reaches retirement age, the portion of the population aged 65 years and over should increase at a rapid pace. The Census forecasts the number of Texas residents over 65 years old should increase to 37.6 million in 2020, an increase of 41.0%. In Texas, strong overall population growth fueled by net migration should drive increasing demand for healthcare through the long term, as a sharp increase in the retiree population and aging of echo boomers augment this trend. As demand for healthcare grows alongside Texas's expanding, aging population, demand for physicians and medical office space should follow.

The rate of healthcare utilization has increased in Texas in recent years, compounding the effect of a growing population on the demand for healthcare. According to the latest available data, the number of hospital outpatient visits per person increased to 1.4 in 2008 from 1.3 in 2007. RCG believes that the national trend of increased physician visits, particularly in specialized, preventative and alternative care, holds true in Texas as well.

Driven by the combination of a rapidly growing population, increased utilization and rising healthcare costs, the total amount of healthcare spending in Texas increased by 103% from 1999 to 2009 to almost $105 billion, according to the latest data available. Spending on physician and clinical services, which composed 26.1% of total healthcare spending, was one of the fastest-growing sub-segments during this time, increasing by nearly 96.0%. With demographic growth and higher healthcare utilization projected to drive demand for medical services going forward, RCG believes that healthcare spending in Texas will increase accordingly, contributing to the growing need for medical office space.

Increased healthcare utilization and spending drove demand for healthcare employment in Texas. Growth in the healthcare sub-sector outpaced total employment growth in the past decade, expanding by a cumulative 37.2% from 2001 to 2011 as compared with a 12.7% increase in Texas total employment. Within the healthcare sub-sector, hiring at physicians' offices increased at a faster rate than hiring at hospitals, as patients increasingly sought care outside of the hospital system. From 2001 to 2011, employment in physicians' offices increased by a cumulative 41.8%, compared with 20.8% growth in hospital payrolls, fueling the need for medical office space. Increased decentralization of healthcare caused a greater population to be served at a lower cost by physicians in medical office space, as compared with hospital systems, driving employment growth in physicians' offices. RCG expects this trend to accelerate going forward, resulting in an increased need for Texas medical office space.

As the Texas population increases by more than four million residents in the next ten years and nearly nine million in the next twenty years, increased demand for healthcare services is inevitable. Given constraints in the expansion of hospital systems, this additional demand for healthcare will be met in medical office space. Strong population growth and increased healthcare utilization by the large echo and baby boomer cohorts will continue to drive demand for Texas healthcare services, physicians, and medical office space in the future. Clustering of healthcare service providers in large healthcare complexes, such as the Texas Medical Center in Houston, the largest in the world, should contribute to demand for on-campus medical office space, in particular.

Pennsylvania

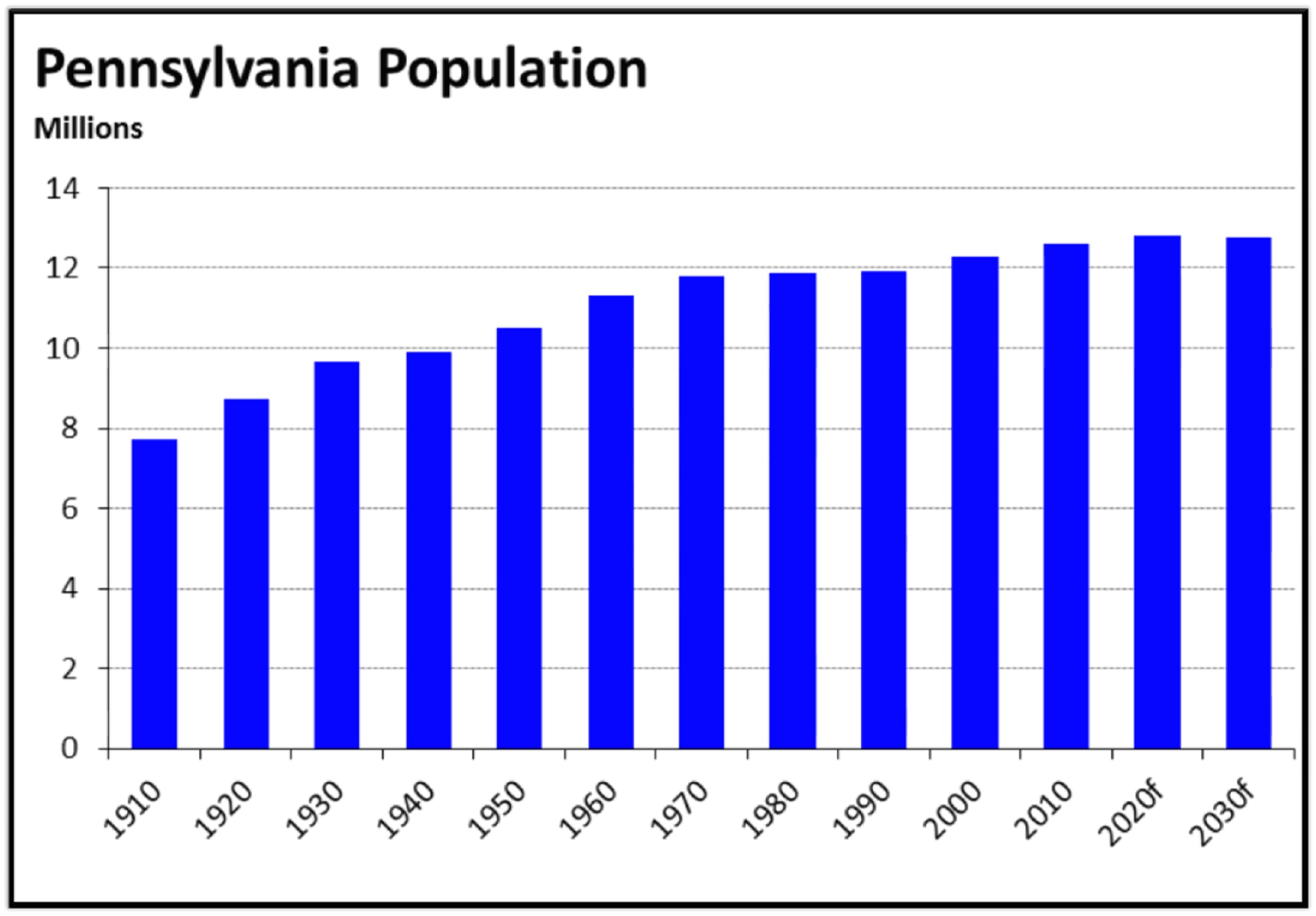

Similar to other states in the Northeast region, Pennsylvania contains a large population with a high proportion of older residents. In 2011, the Pennsylvania population was estimated at 12.6 million with nearly 2.0 million residents aged 65 years and older, equal to 15.6% of the state's population. On the national level, an estimated 13.0% of residents were aged 65 years and older in 2011. According to the 2010 American Community Survey, the median age of a Pennsylvania resident was 40.2 years as compared with 37.2 on the national level. In addition to its large consumer base for medical services, Pennsylvania also contains world-class health systems, including the University of Pittsburgh Medical Center, the Hospital of the University of Pennsylvania, Thomas Jefferson University Hospital, and Allegheny General Hospital. All of these institutions were nationally ranked among the best in select specialties by U.S. News & World Report in 2012. The combination of significant local demand for healthcare and institutions that can attract patients from across state lines should drive demand for Pennsylvania medical office space through the long term.

In line with regional trends, the state of Pennsylvania recorded modest population growth during the last decade. The state population increased by 2.4% from 2000 to 2010, equal to the net addition of more than 300,000 residents. During this period, echo boomers composed a significant portion of in-migrants, as many entered the area to attend one of Pennsylvania's many universities or take a job opportunity. Additionally, university graduates will frequently remain in the area and work at local companies. Although Philadelphia employment growth is currently lagging the national rate, Pittsburgh is outpacing the national average. This trend should be reflected in demographic growth trends, with younger people, who are generally more willing to relocate for job opportunities, entering the Pittsburgh metro area at an increasing pace. These new echo boomer residents represent a source of future demand for medical services, as they are poised to acquire their own health insurance and start families. In 2011, echo boomers comprised an estimated 17.2% of the Pennsylvania state population, equal to 2.2 million residents.

Baby boomers represent the largest generational group in the state of Pennsylvania with an estimated 3.5 million residents in 2011, equal to 27.5% of the state population. Aged 46 to 65 years in 2011, this cohort will reach retirement age during the next 20 years, gaining access to Medicare. Additionally, as this sizeable group ages, their need for medical products and services should increase in concert. Driven by this trend, the proportion of the Pennsylvania population aged 65 years and older should reach 18.8% in 2020, equal to 2.4 million residents. By 2030, this proportion will rise to 22.6%, or 2.9 million residents, according to Census projections. The combination of aging echo boomers and baby boomers should result in a sharp increase in demand for medical services and therefore medical office space.

Looking forward, the Pennsylvania state population should expand at a modest pace, driven by natural increase and in-migration, comprised largely of younger citizens and foreign-born people. From 2010 to 2020, the population should increase to 12.8 million, a cumulative increase of 1.6% or the addition of more than 200,000 residents. The region's demographic profile, skewed toward older residents, should provide a source of long-term demand for healthcare and medical office space. This demand should be bolstered by new residents and echo boomers, many of whom will be starting families in the coming years.

According to the latest data from the American Hospital Association, the average number of outpatient visits per 1,000 Pennsylvania residents increased to 3.0 in 2008 from 2.4 in 1999. Nationally, the number of outpatient visits per 1,000 residents increased to 2.1 from 1.8 during the same period. In Pennsylvania, a large proportion of older residents with relatively high incomes results in strong demand for and access to medical services as compared with the national average. This rapid rise in outpatient visits was also supported by shifting patient preferences and insurance company incentives that favor outpatient treatment over hospital admissions. The projected rise in demand for medical services should result in increased outpatient visits, thereby supporting demand for medical office space.

Healthcare spending rose dramatically in recent years, caused by both increased utilization of medical services and rising costs. In Pennsylvania, the amount spent on healthcare increased to $97.4 billion in 2009, up 79.3% from 1999, according to the latest available data. Physician and clinical services accounted for $21.3 billion or 21.9% of total healthcare spending in 2009, up 78.9% from 1999. Healthcare spending should continue to increase at a brisk pace going forward, as Pennsylvania's large, aging population utilizes more medical services. As this utilization should disproportionately take place in outpatient facilities, more medical office space will be needed to satisfy rising demand.

Pennsylvania healthcare employment increased steadily since at least 1990, as demand for medical services increased irrespective of economic cycles. Reflecting shifting trends in healthcare utilization, the rate of growth in physicians' office employment surpassed the rate of growth in hospital payrolls during the past decade. Year-over-year in December 2011, employment in physicians' offices increased by 1.5% as compared with 0.8% employment growth in hospitals. Total Pennsylvania healthcare payrolls expanded by 0.6% at the same time. The Pennsylvania medical office market should benefit from future increases in healthcare employment.

From a demand perspective, the outlook for the Pennsylvania medical office market is positive through the long term. The state's large resident base, skewed toward the older age cohorts, should demand more medical services as they age going forward. Increased utilization of medical services should result in higher levels of healthcare spending and employment. The trend of increased utilization of outpatient services as compared with hospital treatment should hold in the coming years. The effect of increased utilization, spending, employment and preference for outpatient services should lead to strong demand for Pennsylvania medical office space through the long term.

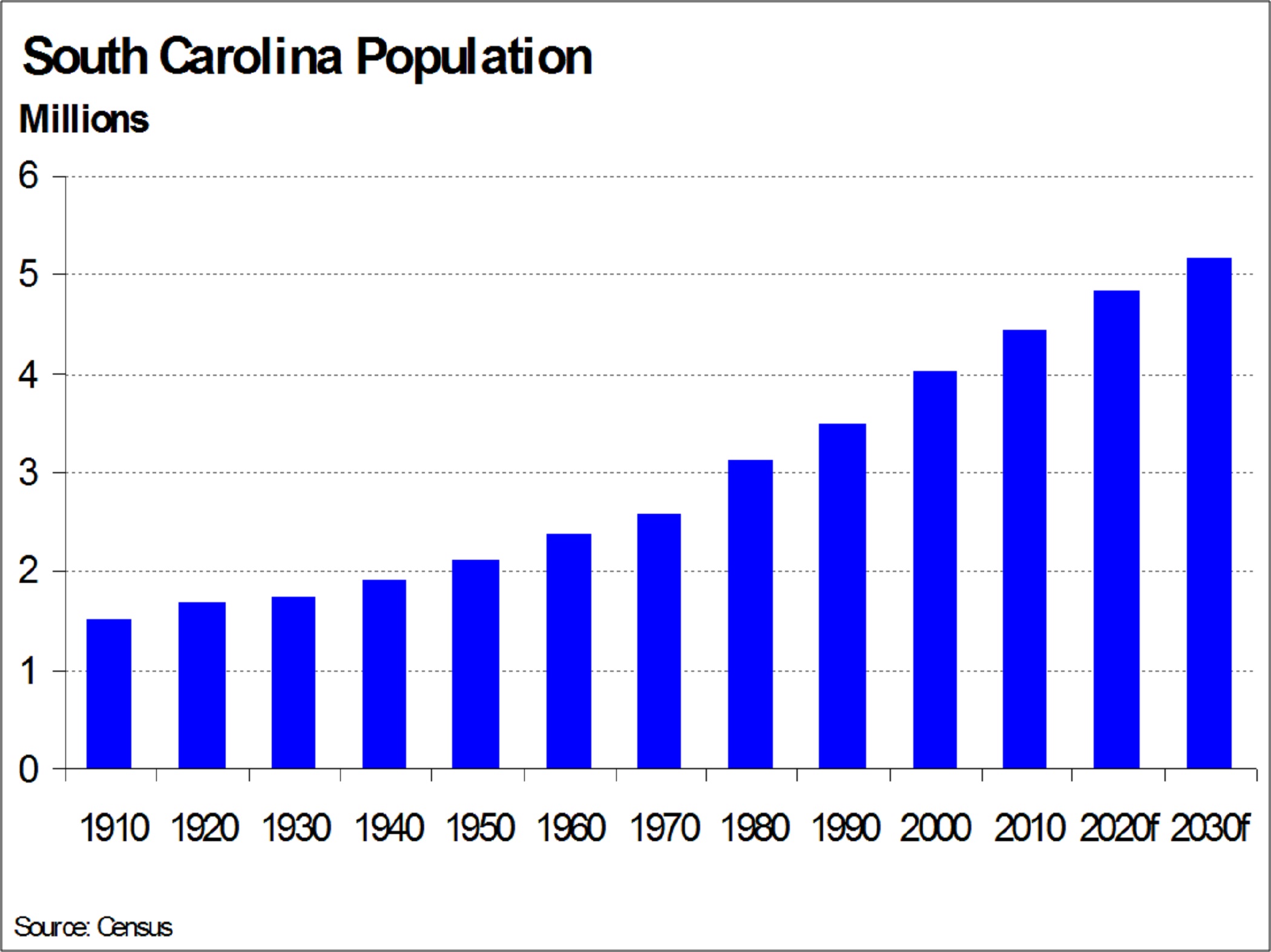

South Carolina