Biodiesel – Fueling A Better Future

October 2008 Newsletter

Volume 4, Number 4

SECOND QUARTER 2008 RESULTS

The following table shows the results of our operations for the six months ended June 30, 2008 and 2007, and the percentage of revenues, cost of sales, operating expenses and other items to total revenues in our statement of operations:

| | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2008 (Unaudited) | | | 2007 (Unaudited) | |

| Statement of Operations Data | | Amount | | | % | | | Amount | | | % | |

| | | | | | | | | | | | | | | | | |

| Revenues | | $ | 45,630,824 | | | | 100.00 | % | | $ | 39,055,190 | | | | 100.00 | % |

| | | | | | | | | | | | | | | | | |

| Cost of Sales | | $ | 41,378,763 | | | | 90.68 | % | | $ | 35,923,065 | | | | 91.98 | % |

| | | | | | | | | | | | | | | | | |

| Gross Profit | | $ | 4,252,061 | | | | 9.32 | % | | $ | 3,132,125 | | | | 8.02 | % |

| | | | | | | | | | | | | | | | | |

| Operating Expenses | | $ | 1,108,860 | | | | 2.43 | % | | $ | 1,013,549 | | | | 2.60 | % |

| | | | | | | | | | | | | | | | | |

| Other Expense | | $ | (339,990 | ) | | | 0.75 | % | | $ | (631,598 | ) | | | 1.62 | % |

| | | | | | | | | | | | | | | | | |

| Net Income (Loss) | | $ | 2,803,211 | | | | 6.14 | % | | $ | 1,486,978 | | | | 3.81 | % |

Revenues

Our revenues from operations primarily come from biodiesel sales, glycerin sales and fatty acid and soap stock sales. The following table shows the sources of our revenues for the six months ended June 30, 2008 and 2007:

| | | | | | | | | | | | | | | | | |

| | | June 30, 2008 | | | June 30, 2007 | |

| Revenue Sources | | Amount | | | % of Revenues | | | Amount | | | % of Revenues | |

| | | | | | | | | | | | | | | | | |

| Biodiesel Sales | | $ | 43,899,438 | | | | 96.2 | % | | $ | 38,498,320 | | | | 98.6 | % |

| Glycerin Sales | | $ | 1,271,603 | | | | 2.8 | % | | $ | 441,459 | | | | 1.1 | % |

| Fatty Acid Sales & Soap Stock Sales | | $ | 459,783 | | | | 1.0 | % | | $ | 115,411 | | | | 0.3 | % |

| Total Revenues | | $ | 45,630,824 | | | | 100.0 | % | | $ | 39,055,190 | | | | 100.0 | % |

Revenues from operations for the six months ended June 30, 2008 totaled $45,630,824, compared to $39,055,190 for the same period in 2007. The increase from period to period is primarily due to the higher average sales price for biodiesel and glycerin during the six months ended June 30, 2008. Included within our net sales of biodiesel are incentive funds we have received from the federal government for sales of 99.9% biodiesel. The amount of incentive receivables for the six months ended June 30, 2008 was $6,373,165 as compared to $4,970,312 for the six months ended June 30, 2007. Revenues were higher for the fiscal quarter ended June 2008, compared to the same quarter of 2007 due to an increase in the average selling price of biodiesel. The average biodiesel sale price we received for the quarter ended June 30, 2008 was approximately 52.5% higher than our average biodiesel sale price for the comparable period in 2007, an increase of $1.55 per gallon.

1

It is expected that biodiesel sales prices will remain higher in the short-term as compared to historical averages due to current historically high energy prices. Because biodiesel is primarily used to blend with petroleum-based diesel, biodiesel prices have generally correlated to diesel fuel prices. Although the price of diesel fuel has increased over the last several years, reaching record highs, diesel fuel prices per gallon remain at levels below or equal to the price of biodiesel. Biodiesel prices have recently reached historical highs and, therefore, have helped to offset high input costs, such as soybean oil and animal fats. In addition, based on historical trends, we anticipate that demand for biodiesel will decrease during the third quarter due to users’ typical decrease in biodiesel blend percentages due to cold flow concerns in the fall and winter months but it is expected that this seasonal drop will be smaller than in previous years. Such decrease in demand could cause downward pressure on biodiesel selling prices. Beginning in January 2009, the Renewable Fuel Standard (“RFS”) will require the use of 500 million gallons of biodiesel in the United States; however, at this time it is unclear what the extent of the impact of the RFS will be on biodiesel demand in the fall and winter months. Our financial condition could be negatively affected by decreases in the sales price of biodiesel. This is especially true during periods when feedstock costs for soybean oil and animal fats are high, causing our profit margins to decrease.

As of June 30, 2008, the average sale price for our glycerin has increased by about 315% from its levels at June 30, 2007, an increase of 8.6¢ per pound. The sales price of glycerin has increased due to increased demand for crude glycerin. The crude glycerin that WIE produces does not command a premium price due to its animal fat component. As biodiesel production increases nationally, so does the supply of glycerin. We anticipate that increases in glycerin supplies could put downward pressure on glycerin prices. We have already experienced a variance between 2¢ and 24¢ per pound.

Cost of Sales

Our cost of sales for our products increased as a percentage of our revenues from 89.65% of our revenues for the three months ended June 30, 2007, to 91.06% of our revenues for the three months ended June 30, 2008. This increase is primarily due to the increase of feedstock costs. Average soybean oil costs for the three months ended June 30, 2008 were approximately 89% higher than soybean oil costs for the same period in 2007. Likewise, animal fat costs for the three months ended June 30, 2008 were approximately 60% higher than animal fat costs for the same period in 2007. The average selling price of WIE-produced biodiesel increased by approximately 52.5% for the three months ended June 30, 2008, as compared to the same period for 2007 which offset the increase in price paid for soybean oil and animal fats for the three months ended June 30, 2008 compared to the same period for 2007.

Soybean oil prices have been extremely volatile in recent months and have nearly doubled from the price one year ago. Despite these recent high prices, soybean oil prices have been trending downward in recent weeks. Accordingly, based on recent trends, it is expected that cost of goods sold on a per-gallon basis may decrease for the remainder of the 2008 fiscal year. Soybean crushing, soybean acres planted, and weather conditions could increase volatility in the soybean oil market. Animal fats prices have also increased significantly, although they still remain lower than soybean oil prices.

Operating Expense

Our operating expenses as a percentage of revenues were slightly lower for the six-month period ended June 30, 2008 than they were for the same period of 2007. These percentages were 2.43% and 2.60% for the six months ended June 30, 2008 and 2007, respectively. We expect that going forward our operating expenses will remain fairly consistent if plant production levels remain consistent or as projected.

Other Expenses

Our other expenses for the six months ended June 30, 2008 was 0.75% of our revenues, down from 1.62% for the same period of 2007. This expense resulted primarily from interest expense of $501,173.

2

GENERAL MANAGER’S REPORT

I hope that you are encouraged by the financial report that you have read in this newsletter. As you digest all of the data contained herein, please don’t take the $2.8 million in earnings for the first six months, multiply it by two, and use that as your expectation for the entire year. We are encountering some challenges with the economy as we proceed into the last half of the year. Part of our success during the first half has been due to the higher-than-normal energy prices; those prices are coming back down. We believe that we will continue to operate profitably; we just don’t anticipate doing so at the same rate as we have already.

During the last quarter, I have had the privilege of meeting some of you personally as you have visited WIE and toured the facility. I have thoroughly enjoyed having the opportunity to talk with you and to answer the questions that you have. We are going to continue to make the plant available for tour opportunities as we finish the year. We have set aside three Friday afternoons: October 24; November 7; and December 5. We will be touring at 1:30PM on each of those dates. The guidelines to be followed will be the same as before:

| | • | | the space on each tour will be limited to eight persons; |

| | • | | the tour will be by reservation only; |

| | • | | we prefer to have no one on the tour who is under the age of 10; |

| | • | | reservations can be made by calling the WIE office and providing the name, address, and contact information for each person in the tour group; |

| | • | | proper dress (long pants, sleeved shirts, flat shoes with closed toes) on the day of the tour will be required and strictly enforced; |

| | • | | no cell phones, cameras, lighters, pagers, etc will be allowed in the plant; and |

| | • | | you will be required to wear a hard hat and safety glasses (provided by WIE) as you tour the facility. |

I will look forward to meeting and visiting with you!

CHALLENGES AND SUCCESSES

The Company has produced biodiesel for sale to customers since June of 2006. During that time, the price of crude oil has ranged from the mid-$30’s to a high of $147 per barrel on the Chicago Board of Trade. Since we began production, the biodiesel industry has faced numerous challenges, primarily a dramatic increase in the cost of its inputs. Much of that increase resulted from a large decrease in United States soybean acreage during the 2007 growing season, which in turn resulted in the cost of soybean oil increasing from 25¢ per pound to over 70¢ per pound in early 2008.

During our short history, the cost of our feedstock has ranged from a low of 19¢ per pound to as high as 69¢ per pound; methanol from a low of 95¢ per gallon to a high of $2.62 per gallon. During that time, the sale price of our biodiesel has ranged from a low of $2.38 per gallon to a high of $6.00 per gallon and the sale price of glycerin from a low of 1¢ per pound to a high of 29¢ per pound. Unlike many industries, historically there has been no direct correlation between the cost of our inputs and the sale price of biodiesel which is directly related to the sale price of petroleum diesel. It has been the challenge of the management of WIE to produce fuel that can be sold for a positive profit margin without the benefit of this correlation of inputs to outputs.

The Company has become an industry leader in processing large quantities of animal fat into biodiesel that meets the ASTM D-6751 fuel standard and has gained customer acceptance of biodiesel made from animal fat. As a result, during the first half of 2008, the Company’s net income was $2,803,211. The Company repaid $3.8 million of its seasonal loan, and, subsequent to June 30, 2008, has repaid approximately $5.15 million of its revolving line of credit. The Company has also experimented with using corn oil as an alternative to soybean oil in the production process. The Company may need to invest in additional infrastructure to efficiently utilize certain alternative feed stocks.

3

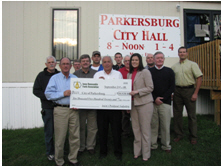

Iowa’s Biodiesel Industry Donates Biodiesel for the Parkersburg Tornado Recovery Effort

Representatives from Iowa’s biodiesel industry presented members of the Parkersburg City Council with a check signifying a $10,520 biodiesel donation to help Parkersburg fuel equipment needed to rebuild the city after a devastating F5 tornado hit the city on May 25.

Members from all sectors of Iowa’s biodiesel industry contributed to the effort including producers, marketers and the railroad companies that transport biodiesel across the state. In addition to Iowa’s biodiesel industry, Iowans donated gallons of biodiesel to aid in the rebuilding of Parkersburg.

“We were overwhelmed with the support that we received both from the biodiesel industry and Iowans and their concern for a fellow Iowa community in need,” said Julie Vyskocil, Iowa Renewable Fuels (IRFA) Biofuels Specialist. “Donating biodiesel was a unique and practical way that we could help Parkersburg. Iowa is the leader in renewable fuels production and it seemed fitting to donate fuel produced in the state of Iowa that would be necessary in the rebuilding process.”

There were many Iowans and industry leaders that contributed to the effort, including Central Iowa Energy, Iowa Renewable Energy, the IRFA, Renewable Energy Group, Western Dubuque Biodiesel and Western Iowa Energy, along with GATX Rail, the Iowa Biodiesel Board and Cargill.

This newsletter contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance, or our expected future operations and actions. These forward-looking statements are only our predictions based upon current information and involve numerous assumptions, risks and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the reasons described in our filings with the Securities and Exchange Commission. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this newsletter. We qualify all of our forward-looking statements by these cautionary statements.

Western Iowa Energy, LLC

1220 S. Center St.

PO Box 399

Wall Lake, IA 51466

www.westerniowaenergy.com

Phone: 712-664-2173

Fax: 712-664-2183

Larry Breeding – General Manager –lbreeding@westerniowaenergy.com

Joe Reed – Operations Manager –jreed@westerniowaenergy.com

Joe Neppl – Accountant –jneppl@westerniowaenergy.com

Jeanne Sorensen – Compliance Coordinator –jsorensen@westerniowaenergy.com

Kris Ziegmann – Accounting Assistant /Receptionist–kziegmann@westerniowaenergy.com