Susser Holdings to Acquire Town & Country Food Stores

Transaction expands and diversifies Susser’s geographic footprint into West Texas

and Eastern New Mexico, increases retail store count by 50 percent

Investor conference call and webcast scheduled for 10 a.m. ET Friday, Sept. 21

Town & Country is a privately owned company and a leading convenience store operator in West Texas and Eastern New Mexico, with 140 locations serving Central and West Texas and the Texas Panhandle, and 28 locations serving Eastern New Mexico. Town & Country had total reported sales of $842 million and EBITDA (earnings before interest, taxes, depreciation and amortization) of $50 million during the 12 months ended Aug. 4, 2007. Town & Country owns approximately 80 percent of its stores, along with a land bank of 14 undeveloped locations for future development.

“Town & Country is an extremely profitable and well-run convenience store chain, with a leadership position in attractive and complementary markets where we want to be,” said Sam L. Susser, Susser Holdings President and Chief Executive Officer. “Town & Country provides us with increased scale and market diversification in an energy-producing region that is experiencing strong economic growth. We believe there’s considerable opportunity for additional store development in these markets,” Susser said. “Most importantly, Town & Country’s culture is people and customer focused, and their management team has a demonstrated track record of success. We are very pleased that Alvin New, Town & Country President and CEO, will continue to lead the Town & Country organization and will become an integral part of Susser’s ongoing executive leadership team.”

Mr. New commented, “Susser Holdings is a fine company that we’ve respected for years. While their offer was unsolicited, it was compelling because of the value it will bring to our shareholders and the additional access to capital we will have to accelerate growth. This will also provide great opportunities for many folks from both companies under the combined organization.”

Susser Holdings to Acquire Town & Country Food Stores - Page 2

Susser expects to finance the transaction through a combination of committed debt financing, lease financing and excess cash. The transaction is expected to be accretive to earnings per share in 2008. The transaction is anticipated to be completed in 60 to 90 days and is subject to federal antitrust review, required consents and other regulatory approvals, and customary closing conditions.

In connection with this transaction, Merrill Lynch & Co. acted as exclusive financial advisor to Susser and rendered a fairness opinion to its Board of Directors. Morgan Keegan & Co., Trefethen & Co. and Houlihan Lokey Howard & Zukin acted as financial advisors to the parent company of Town & Country. Weil, Gotshal & Manges LLP acted as outside legal counsel to Susser, and Haynes & Boone, LLP acted as outside legal counsel to the parent company of Town & Country. Bank of America, Merrill Lynch & Co., Wachovia Securities and BMO Capital Markets have provided commitments for the debt portion of the financing for the transaction, which are subject to customary conditions.

Investor Conference Call and Webcast

Susser’s management team will hold an investor conference call to discuss the pending Town & Country acquisition on Friday, Sept. 21, at 10 a.m. Eastern Time. To participate in the call, dial (303) 262-2140 at least 10 minutes early and ask for the Susser conference call. A replay will be available approximately two hours after the call ends and will be accessible through Sept. 28. To access the replay, dial (303) 590-3000 and enter the pass code 11097905#.

The conference call will also be accessible via Susser’s web site at www.susser.com. To listen to the live call, please visit the Investor Relations page of Susser’s web site at least 10 minutes early to register and download any necessary software. Informational slides that will accompany the conference call presentation also will be available on Susser’s website prior to the call. An archive of the webcast will be available shortly after the call for approximately 15 days.

About Susser Holdings Corporation

Corpus Christi, Texas-based Susser Holdings Corporation is a third generation family led business that operates 330 convenience stores in Texas and Oklahoma under the Stripes banner and supplies branded motor fuel to over 370 independent dealers through its wholesale fuel division. Susser owns and operates over 150 Laredo Taco Company restaurants inside the Stripes convenience stores that feature authentic "made from scratch" Mexican food.

Susser Holdings to Acquire Town & Country Food Stores - Page 3

About Town & Country Food Stores

Town & Country Food Stores is a leading convenience store operator in West Texas and Eastern New Mexico, with 168 stores, of which 161 operate under the Town & Country banner and seven under the Village Market banner. The Company operates restaurants in 110 stores, primarily operating under the Country Cookin’ name. Town & Country stores offer a broad selection of merchandise, gasoline and ancillary products and services designed to appeal to the convenience needs of their customers. The Company’s operations also include a small wholesale motor fuel distribution business.

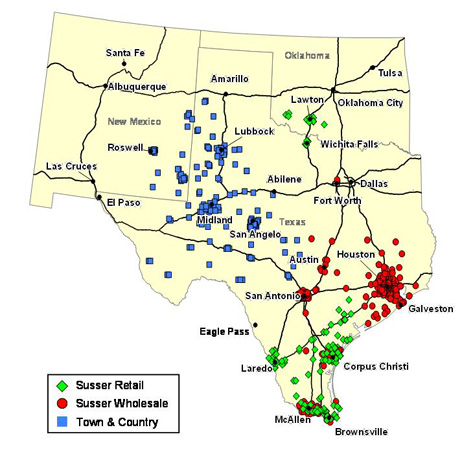

Combined Market Footprint

Susser Holdings to Acquire Town & Country Food Stores - Page 4

Forward-Looking Statements

This news release contains statements that we believe are “forward-looking statements.” These forward-looking statements generally can be identified by use of phrases such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “forecast” or other similar words or phrases. Descriptions of our objectives, goals, targets, plans, strategies, costs, anticipated capital expenditures, expected cost savings, operational synergies of acquired businesses or assets, expansion of our foodservice offerings, potential acquisitions, and potential new store openings and dealer locations, are also forward-looking statements. These forward-looking statements are based on our current plans and expectations and involve a number of risks and uncertainties that could cause actual results and events to vary materially from the results and events anticipated or implied by such forward-looking statements, including competitive pressures from convenience stores, gasoline stations, other non-traditional retailers located in our markets and other wholesale fuel distributors; inability to integrate acquisitions successfully or realize expected synergies; changes in economic conditions generally and in the markets we serve; volatility in crude oil and wholesale motor fuel costs; political conditions in crude oil producing regions, including South America and the Middle East; wholesale cost increases of tobacco products, or future legislation or campaigns to discourage smoking; adverse publicity concerning food quality, food safety or other health concerns related to our restaurant facilities; consumer behavior, travel and tourism trends; devaluation of the Mexican peso or imposition of restrictions on access of Mexican citizens to the United States; unfavorable weather conditions; changes in state and federal environmental and other regulations; dependence on one principal supplier for merchandise, two principal suppliers for gasoline and one principal provider for the transportation of substantially all of our motor fuel; financial leverage and debt covenants; changes in the credit ratings assigned to our debt securities, credit facilities and trade credit; inability to identify or acquire new stores; dependence on senior management; acts of war and terrorism; and other unforeseen factors.

For a discussion of these and other risks and uncertainties, please refer to “Risk Factors” in our Quarterly Reports on form 10-Q for the first and second quarters of this year as well as those contained in our Annual Report on Form 10-K for the year ended December 31, 2006. The list of factors that could affect future performance and the accuracy of forward-looking statements is illustrative, but by no means exhaustive. Accordingly, all forward-looking statements should be evaluated with the understanding of their inherent uncertainty. The forward-looking statements included in this release are based on, and include, our estimates as of the date hereof. We anticipate that subsequent events and market developments will cause our estimates to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if new information becomes available in the future.

Reconciliations of Non-GAAP Measures to GAAP Measures

We define EBITDA as net income before interest expense, net, income taxes and depreciation, amortization and accretion. EBITDAR adds back rent to EBITDA.

The following table presents a reconciliation of Town & Country Food Stores’ net income to EBITDA and EBITDAR:

| | | Twelve Months Ended | |

| | | August 4, 2007 | |

| | | (in millions) | |

| Net Income | | $ | 16 | |

| Depreciation, amortization and accretion | | | 13 | |

| Interest expense, net | | | 12 | |

| Income tax expense | | | 9 | |

| EBITDA | | $ | 50 | |

| Rent expense | | | 1 | |

| EBITDAR | | $ | 51 | |

# # #