UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

SUSSER HOLDINGS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

| | |

| | 4433 Baldwin Boulevard Corpus Christi, TX 78408 |

April 13, 2007

To our fellow shareholders:

You are cordially invited to attend the annual meeting of shareholders of Susser Holdings Corporation to be held on Tuesday, May 8, 2007 at 11:00 a.m., Central Time, at the Omni Marina Hotel, 707 North Shoreline Boulevard, Corpus Christi, Texas 78401.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying notice of annual meeting and proxy statement.

We hope you plan to attend the annual meeting, but even if you are planning to do so, we strongly encourage you to vote as soon as possible by completing and returning in the pre-addressed envelope the enclosed proxy card.Your vote is very important and returning the proxy card will ensure that your vote is counted at the meeting, even if you are present.Additional information about proxy voting can be found in the enclosed proxy statement.

Thank you for your continuing support of Susser Holdings Corporation. We look forward to your participation in the annual meeting.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Bruce W. Krysiak | | | | Sam L. Susser |

| Non-executive Chairman of the Board | | | | President, Chief Executive Officer and Director |

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Susser Holdings Corporation

4433 Baldwin Boulevard

Corpus Christi, Texas 78408

| | |

| Date and Time: | | 11:00 a.m. Central Time, Tuesday, May 8, 2007 |

| |

| Place: | | Omni Marina Hotel, 707 North Shoreline Boulevard, Corpus Christi, Texas 78401 |

| |

| Items of Business: | | (1) To elect 2 Class I directors to serve terms expiring at the 2010 annual shareholder meeting of shareholders (2) To consider and act upon a proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2007 (3) To consider such other business as may properly come before the meeting |

| |

| Adjournments and Postponements: | | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed |

| |

| Record Date: | | You are entitled to vote only if you were a Susser shareholder as of the close of business on April 4, 2007 |

| |

| Voting: | | Your vote is very important. Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. For specific instructions on how to vote your shares, please refer to the section entitled Questions and Answers—Voting Information beginning on page 3 of this proxy statement and the instructions on the proxy or voting instruction card. |

|

| By order of the Board of Directors, |

|

|

| E.V. BONNER, JR. |

Executive Vice President, Secretary and General Counsel |

This notice of annual meeting and proxy statement and form of proxy are first being distributed on or

about April 13, 2007.

QUESTIONS AND ANSWERS

Proxy Materials

1. Why am I receiving these materials?

The Board of Directors (the “Board”) of Susser Holdings Corporation (“Susser” or the “Company”) is providing these proxy materials for you in connection with Susser’s annual meeting of shareholders (the “Meeting”), which will take place on Tuesday, May 8, 2007. As a shareholder, you are invited to attend the Meeting and are entitled to and requested to vote on the items of business described in this proxy statement.

2. What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the Meeting, the voting process, Susser's Board and Board committees, the compensation of directors and certain executive officers for fiscal 2006, and other required information.

3. How may I obtain Susser’s Form 10-K and other financial information?

A copy of our 2006 Annual Report, which includes our 2006 Form 10-K, is enclosed.

Shareholders may request another free copy of our 2006 Annual Report, which includes our 2006 Form 10-K, from:

Susser Holdings Corporation

Attn: Investor Relations

P.O. Box 9036

Corpus Christi, TX 78469-9036

(361) 884-2463

Alternatively, current and prospective investors can access the 2006 Annual Report, which includes our 2006 Form 10-K and other financial information, on our Investor Relations web site at:

http://investor.susser.com/

We will also furnish any exhibit to the 2006 Form 10-K if specifically requested.

4. How may I obtain a separate set of proxy materials?

If you share an address with another shareholder, you may receive only one set of proxy materials (including our 2006 Annual Report with our 2006 Form 10-K and proxy statement) unless you have provided contrary instructions. If you wish to receive a separate set of proxy materials now, please request the additional copies by contacting our Investor Relations department at the address and/or phone number specified in question 3 above. A separate set of proxy materials will be sent promptly following receipt of your request.

If you are a shareholder of record and wish to receive a separate set of proxy materials in the future, please call Computershare Investor Services, LLC (“Computershare”) at (303) 262-0600.

5. How may I request a single set of proxy materials for my household?

If you share an address with another shareholder and have received multiple copies of our proxy materials, you may write us at the address specified in question 3, above, to request delivery of a single copy of these materials.

2

6. What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive.

Voting Information

7. What items of business will be voted on at the annual meeting?

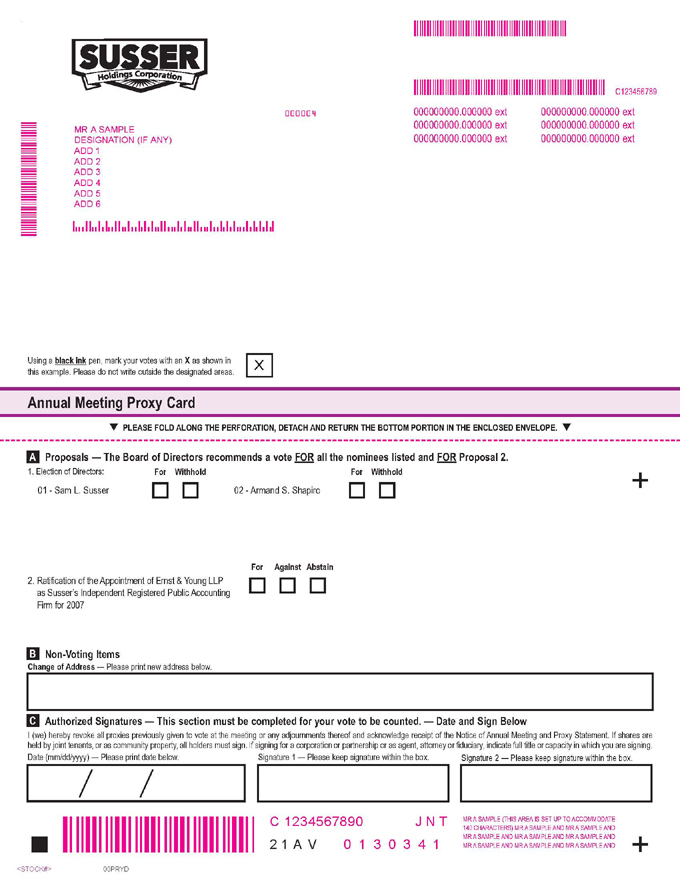

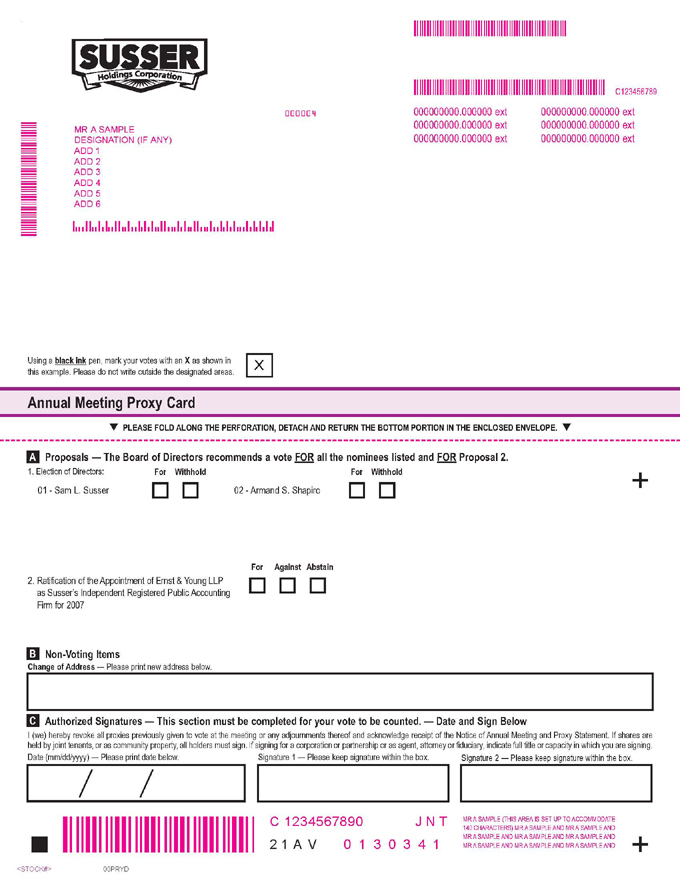

The items of business scheduled to be voted on at the Meeting are:

| | • | | The election of 2 directors |

| | • | | The ratification of our independent registered public accounting firm for the 2007 fiscal year |

We also will consider any other business that properly comes before the Meeting. See question 18 “What happens if additional matters are presented at the annual meeting?” below.

8. How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” each of the nominees to the Board and “FOR” the ratification of our independent registered public accounting firm for the 2007 fiscal year.

9. How many shares must be present or represented to conduct business at the annual meeting?

The quorum requirement for holding the Meeting and transacting business is that holders of a majority of shares of Susser common stock entitled to vote must be present in person or represented by proxy. Both abstentions and broker non-votes described in question 17 are counted for the purpose of determining the presence of a quorum.

10. What shares can I vote?

Each share of Susser common stock issued and outstanding as of the close of business on April 4, 2007 (the “Record Date”), is entitled to be voted on a one vote per share basis on all items being voted upon at the Meeting. You may vote all shares owned by you as of this time, including shares held directly in your name as the shareholder of record, and shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank (i.e., in ‘street name’). On the Record Date, Susser had approximately 16,831,662 shares of common stock issued and outstanding.

11. How can I vote my shares in person at the annual meeting?

Shares held in your name as the shareholder of record may be voted in person at the Meeting. Shares held beneficially in street name may be voted in person at the Meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.Even if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

3

12. How can I vote my shares without attending the annual meeting?

Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Meeting. If you are a shareholder of record, you may vote by submitting a proxy. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee.

Shareholders of record may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Susser shareholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instruction cards provided and mailing them in the accompanying pre-addressed envelopes.

13. What is the deadline for voting my shares?

If you hold shares as the shareholder of record, your vote by proxy must be received before the polls close at the Meeting. If you hold shares beneficially in street name with a broker, trustee or nominee, please follow the voting instructions provided by your broker, trustee or nominee.

14. May I change my vote?

You may change your vote at any time prior to the vote at the Meeting. If you are the shareholder of record, you may change your vote by granting a new proxy bearing a later date (which automatically revokes the earlier proxy), by providing a written notice of revocation to the Corporate Secretary prior to your shares being voted, or by attending the Meeting and voting in person. Attendance at the Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the Meeting and voting in person.

15. Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Susser or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation.

16. How are votes counted?

In the election of directors, you may vote “FOR” or “WITHHOLD” with respect to each of the nominees. In tabulating the voting results for the election of directors, only “FOR” votes are counted. For the ratification of the appointment of our independent registered public accounting firm, and any other items of business that may be properly brought before the Meeting, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention has the same effect as a vote “AGAINST.”

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If you sign your proxy card or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR” both of the proposals).

17. What is the voting requirement to approve each of the proposals?

In the election of directors, each director will be elected by the vote of a plurality of “FOR” votes cast with respect to that director nominee. For the ratification of the appointment of our independent registered public

4

accounting firm, and any other items of business that may be properly brought before the meeting, the affirmative vote of a majority of those shares present in person or by proxy and entitled to vote is required.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Meeting, assuming that a quorum is obtained. Abstentions have the same effect as votes against the matter except in the election of directors, as described above.

18. What happens if additional matters are presented at the annual meeting?

Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Meeting. If you grant a proxy, the persons named as proxy holders, E.V. Bonner, Jr. and Mary E. Sullivan, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Meeting. If for any reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

19. Who will bear the cost of soliciting votes for the annual meeting?

Susser is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities.

20. Where can I find the voting results of the Meeting?

We intend to announce preliminary voting results at the Meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal 2007.

Stock Ownership Information

21. What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most Susser shareholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

22. Shareholder of Record

If your shares are registered directly in your name with Susser’s transfer agent, Computershare, you are considered, with respect to those shares, theshareholder of record, and these proxy materials are being sent directly to you by Susser. As theshareholder of record, you have the right to grant your voting proxy directly to Susser or to a third party, or to vote in person at the Meeting. Susser has enclosed a proxy card for you to use.

23. Beneficial Owner

If your shares are held in a brokerage account or by another nominee, you are considered thebeneficial owner of shares heldin street name and these proxy materials are being forwarded to you together with a voting

5

instruction card on behalf of your broker, trustee or nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and you also are invited to attend the Meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

Because a beneficial owner is not theshareholder of record, you may not vote these shares in person at the Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Meeting.

24. What if I have questions for Susser’s transfer agent?

Please contact our transfer agent, at the phone number or address listed below, with questions concerning stock certificates, transfer of ownership or other matters pertaining to your stock account.

Computershare Investor Services

350 Indiana Street, Suite 800

Golden, CO 80401

(303) 262-0600

6

BENEFICIAL OWNERSHIP OF OUR COMMON STOCK

The following table sets forth, as of April 4, 2007, information regarding the beneficial ownership of the common stock of Susser Holdings Corporation and shows the number and percentage owned by:

| | • | | each person who is known by us to beneficially own more than 5% of our outstanding equity interests (based solely on public filings with the Securities and Exchange Commission as of such date); |

| | • | | each member of our Board; |

| | • | | each of our executive officers; and |

| | • | | all members of our Board and executive officers as a group. |

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulation of the Securities and Exchange Commission. These rules generally provide that a person is the beneficial owner of securities if they have or share the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof, or have the right to acquire such powers with sixty (60) days. Accordingly, the foregoing table does not include options to purchase our shares of common stock by any of such persons which are not exercisable within the next sixty (60) days.

| | | | | |

| | | Shares Beneficially Owned | |

Name and Address | | Number | | % | |

Wellspring Capital Partners III, L.P. and affiliates(1)(2) | | 6,604,882 | | 39.3 | % |

Sam L. Susser(3) | | 2,278,130 | | 13.5 | % |

FMR Corp.(4) | | 1,912,032 | | 11.4 | % |

Lord Abbett & Co. LLC(5) | | 1,165,439 | | 6.9 | % |

E.V. Bonner, Jr. | | 131,574 | | * | |

Roger D. Smith | | 183,991 | | 1.1 | % |

Rocky B. Dewbre | | 53,240 | | * | |

Mary E. Sullivan | | 45,265 | | * | |

William F. Dawson, Jr.(6) | | 6,604,882 | | 39.3 | % |

Bruce W. Krysiak | | 31,458 | | * | |

Armand S. Shapiro | | 5,874 | | * | |

Sam J. Susser | | 27,458 | | * | |

Jerry E. Thompson | | 10,000 | | * | |

Ronald D. Coben | | 4,000 | | * | |

| | | | | |

All executive officers and directors as a group (11 persons)(7) | | 2,770,990 | | 16.5 | % |

| (1) | The address of each such person and/or entity is c/o Wellspring Capital Management LLC, Lever House, 390 Park Avenue, New York, NY 10022. |

| (2) | The following natural persons have investment or voting power over the shares held by Wellspring Capital Partners III, L.P. and its affiliates: Greg S. Feldman, William F. Dawson, Jr., Carl M. Stanton and David C. Mariano. |

| (3) | The total number of shares of common stock include shares held in trust in which Mr. Susser acts as Trustee. The address for Mr. Susser is P.O. Box 9036, Corpus Christi, TX 78469. |

| (4) | The information contained in the table and this footnote with respect to FMR Corp. is based solely on a filing on Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2007. The business address of the reporting party is 82 Devonshire Street, Boston, Massachusetts 02109. |

(5) | The information contained in the table and this footnote with respect to Lord Abbott & Co. is based solely on a filing on Schedule 13G filed with the Securities and Exchange Commission on February 14, 2007. The business address of the reporting party is 90 Hudson Street, 11th Floor, Jersey City, New Jersey 07302. |

| (6) | Mr. Dawson is a partner of Wellspring Capital Management LLC, an affiliate of Wellspring Capital Partners III, L.P. and Stripes Holdings, L.P. and may be deemed to beneficially own the shares of common stock held of record by such entities. Mr. Dawson disclaims beneficial ownership of such shares of common stock except to the extent of any pecuniary interest therein. |

| (7) | Includes shares of common stock held in trust in which Mr. Susser acts as trustee. Does not include 6,604,882 shares of common stock held of record by Wellspring Capital Partners III, L.P. and Stripes Holdings, L.P. of which Mr. Dawson may be deemed to be the beneficial owner by virtue of his relationship with affiliates of those entities. Mr. Dawson disclaims beneficial ownership of such shares of common stock except to the extent of any pecuniary interest therein. |

7

INFORMATION ABOUT OUR BOARD

General

Our amended and restated certificate of incorporation and bylaws provide for an authorized number of directors of between six and nine members (as determined by the Board) and for a classified Board consisting of three classes of directors, each serving staggered three-year terms. The Board currently consists of six members, three of whom have been determined by the Board to be independent under the rules and regulations of the NASDAQ Global Market. Directors of each class are chosen for three-year terms upon the expiration of their current terms, and one class of directors will be elected by the shareholders each year. We believe that classification of our Board helps to assure the continuity and stability of our business strategies and policies as determined by the Board. Holders of common stock will have no right to cumulative voting in the election of directors. Consequently, at each annual meeting of shareholders, the holders of a plurality of shares of common stock will be able to elect all of the successors of the class of directors whose term expires at that meeting.

Our Board of Directors held six meetings in the 2006 fiscal year, following our formation in May of 2006. Directors are expected, but are not required, to attend all Board meetings and meetings of the Board committees on which they serve. In the 2006 fiscal year, each of our Directors attended 75% or more of the total number of meetings of the Board of Directors and of the meetings of the Board committees on which he served. Directors are also requested, but are not required, to attend each annual meeting of security holders.

Board Independence

NASDAQ Global Market rules require that our board be comprised of a majority of independent directors within one year of our listing thereon. The Board has determined that, of its current members, each of Messrs. Shapiro, Krysiak and Thompson qualify as an “independent director” within the meaning of that term under the rules and regulations of the NASDAQ Global Market. We expect that the Board will elect at least one additional “independent director” to serve on our board within the time prescribed for compliance with the NASDAQ Global Market’s rules. In accordance with NASDAQ Global Market rules, our Board holds executive sessions of the non-management directors regularly.

Director Compensation

Each of our non-employee directors who are not affiliated with Wellspring currently receives an annual retainer ranging between $36,000 to $75,000. Messrs. Shapiro, Krysiak and Sam J. Susser were also granted 14,408 class B units of Stripes Holdings LLC on December 21, 2005 for their services as directors. Concurrently with the consummation of our initial public offering, those class B units were converted into 1,874 restricted shares of our common stock and options to purchase 14,158 shares of our common stock at the initial public offering price of $16.50. Mr. Thompson, who was elected to our board in May 2006, received options to purchase 14,158 shares of our common stock at the initial public offering price of $16.50. These director shares and options vest over five years, withone-third vesting on the third, fourth and fifth anniversary of the original grant date. Other directors receive no additional compensation for serving as a director. All directors are entitled to reimbursement for their expenses incurred in attending meetings.

Committees of Our Board of Directors

Audit Committee. Our board of directors has formed an audit committee currently chaired by Mr. Shapiro, who has been determined to be an independent board member, and qualifies as the audit committee financial expert. Mr. Thompson and Mr. Krysiak also serve on the audit committee. The audit committee reviews and monitors our internal controls, financial reports and accounting practices, as well as the scope and extent of the audits performed by both the independent and internal auditors, reviews the nature and scope of our internal audit program and the results of internal audits, and meets with the independent auditors. The audit committee operates

8

under a written charter adopted by the Board, a current copy of which is available on our website athttp://investor.susser.com/governance.cfm. The audit committee met once following our corporate restructuring and initial public offering in October of last year. The audit committee of the board of directors of our predecessor, Stripes Holdings LLC, met four times during the year.

Compensation Committee. Our board of directors has formed a compensation committee currently chaired by Mr. Krysiak. Mr. Shapiro and Mr. Thompson also serve on the compensation committee. The compensation committee oversees our compensation and employee benefit plans and practices and produces a report on executive compensation. The compensation committee operates under a written charter adopted by the Board, a current copy of which is available on our website athttp://investor.susser.com/governance.cfm.The compensation committee met twice following our corporate restructuring and initial public offering in October of last year. The compensation committee of the board of directors of our predecessor, Stripes Holdings LLC met once during the year.

Nominating and Governance Committee. Our board of directors has formed a nominating and governance committee which is chaired by Mr. Thompson. Mr. Shapiro and Mr. Krysiak also serve on the nominating and governance committee. The primary purpose of the nominating and corporate governance committee is to identify and to recommend to the board individuals qualified to serve as directors of our company and on committees of the board, advise the board with respect to the board composition, procedures and committees, develop and recommend to the board a set of corporate governance principles and guidelines applicable to us; and oversee the evaluation of the board and our management.

Other Committees. Our board of directors may on occasion establish other committees as it deems necessary or required.

Procedure for Nominations of Directors

Shareholder Recommendations and Nominations. Our nominating and corporate governance committee will consider properly submitted shareholder recommendations of candidates for membership on the Board. In evaluating such recommendations, the nominating and corporate governance committee seeks to achieve a balance of independence, sound judgment, business specialization, technical skills, diversity and other desired qualities within the membership criteria described below and the Board composition requirements of the NASDAQ Global Market rules. Any shareholder recommendations proposed for consideration by the nominating and corporate governance committee should include the candidate’s name and qualifications for Board membership and should be addressed to:

Corporate Secretary

Susser Holdings Corporation

P.O. Box 9036

Corpus Christi, TX 78469-9036

Our Bylaws also provide procedures for the nomination of directors directly by our shareholders. Our Bylaws provide that nominations for the election of directors may be made, if certain procedures are followed, by any shareholder who is entitled to vote generally in the election of directors. Any shareholder of record entitled to vote generally in the election of directors may nominate one or more persons for election as directors at a meeting of shareholders only if written notice of such shareholder’s intent to make such nomination or nominations has been delivered to our Secretary at our principal executive offices not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which we first publicly announce the date of such meeting). Each such notice of a shareholder’s intent to nominate a director must set forth certain information as specified in our Bylaws.

9

Director Selection Criteria and Procedures. Although our nominating and corporate governance committee does not believe in setting specific minimum qualifications for candidates for membership on the Board, the nominating and corporate governance committee is committed to the belief that candidates for membership on the Board should have the highest professional and personal ethics and values—consistent with the Company’s longstanding values and standards—and should have broad experience at the policy-making level in business, government, education, the retail industry or public service. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all shareholders of the Company.

The nominating and corporate governance committee intends to use a variety of methods for identifying and evaluating nominees for director and to regularly assess the appropriate size of the Board and to recommend to the Board any appropriate changes. The Company’s bylaws provide for a minimum of six and a maximum of nine directors. In the event that vacancies are anticipated, or otherwise arise, the nominating and corporate governance committee will consider various potential candidates for director. Candidates may come to the attention of the nominating and corporate governance committee through current Board members, professional search firms, shareholders or other persons. Identified candidates will be evaluated at regular or special meetings of the nominating and corporate governance committee and may be considered at any point during the year. As described above, the nominating and corporate governance committee will consider properly submitted shareholder recommendations for candidates for the Board to be included in the Company’s annual proxy statement. Following verification of the shareholder status of people proposing candidates, recommendations will be considered together by the nominating and corporate governance committee at a regularly scheduled meeting. The nominating and corporate governance committee may also engage the services of a professional search firm to identify and assist in evaluating and conducting due diligence on potential director nominees.

Shareholder Communications

Our shareholders may communicate directly with the members of the Board or the individual chairperson of standing Board committees by writing directly to those individuals at the following address: Susser Holdings Corporation, P.O. Box 9036, Corpus Christi, Texas 78469. Our general policy is to forward, and not to intentionally screen, any mail received at our corporate office that is sent directly to an individual unless we believe the communication may pose a security risk.

Code of Ethics

Our Board has approved Susser’s Code of Business Conduct and Ethics, which is applicable to all directors, officers and employees of the company, including the principal executive officer and the principal financial officer. The Code of Business Conduct and Ethics is available on our website athttp://investor.susser.com/governance.cfmand in print without charge to any shareholder who sends a written request to the Company's Secretary at our principal executive offices. The Company intends to post any amendments to or waivers of this code for its directors and executive officers, including its principal executive officer and principal financial officer, at this location on its website.

10

Compensation Committee Report

The Compensation Committee of the Susser Holdings Corporation Board of Directors (the “Compensation Committee”) is comprised of three independent directors and operates under a written charter. In carrying out its responsibilities, the Compensation Committee reviewed the section of this Proxy Statement entitled “Compensation Discussion and Analysis” (“CD&A”), with Susser management and provided comments on its content.

Based on the review and discussions described above, the Compensation Committee recommended to the Board that the CD&A be included in the Proxy Statement for the Company’s 2007 Annual Meeting of Shareholders.

Submitted by our Compensation Committee

Bruce Krysiak (Chair)

Armand Shapiro

Jerry Thompson

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee was formerly an officer or employee of the Company or is a “related person” as defined by the regulations to the Securities Exchange Act of 1934. None of our executive officers has served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers serve as a director of the Company or member of our compensation committee.

11

COMPENSATION DISCUSSION AND ANALYSIS

General Philosophy

Our compensation setting process consists of establishing targeted compensation levels for each member of senior management and then allocating that compensation among base salary and incentive compensation. Our incentive compensation program is designed to reward company-wide performance by tying short-term and long-term awards to (i) the achievement of targeted company financial objectives, (ii) the achievement of specific operational goals within the purview of an individual’s scope of responsibilities, as applicable and (iii) growth in shareholder value. Our executive officers are also eligible to participate in benefit plans generally available to our other employees. We believe our approach to compensation will enable us to achieve several key objectives necessary to promote growth in shareholder value while practicing good corporate governance, including the following:

| | • | | Aligning the interests of our executives with those of our shareholders by tying incentive compensation to actual measurements of company and segment performance and the performance of our stock price over the long term; |

| | • | | Providing compensation to our executives that is competitive for our industry, region and size to enable us to recruit and retain key individuals; and |

| | • | | Communicating and reinforcing the importance of achieving growth and productivity targets, which drive performance to our business plan, while reserving compensation committee discretion to reward merit outside of a rigid structural framework. |

Process and Timing of Compensation Decisions. The compensation committee reviews and approves all compensation targets and payments for the named executive officers. The Chief Executive Officer evaluates the performance of the other named executive officers and develops individual recommendations. Both the Chief Executive Officer and the compensation committee may make adjustments to the recommended compensation based upon an assessment of an individual’s performance and contributions to the Company. The compensation for the Chief Executive Officer is reviewed and approved by the compensation committee and by the Board, based upon their independent evaluation of the Chief Executive Officer’s performance and contributions.

In the first quarter of each fiscal year, the compensation committee establishes the target levels of annual incentive compensation for the current fiscal year and recommends, and subsequently approves, new salary rates to become effective approximately two weeks thereafter. The compensation committee may, however, review salaries at other times during the year because of new appointments or promotions during the year. The compensation committee may also consider recommendations and grant long-term incentive awards from time to time as deemed appropriate during the year.

The following table summarizes the approximate timing of some of our more significant compensation events:

| | |

Event | | Timing |

• Determine annual incentive bonus for preceding fiscal year | | First quarter |

| |

• Consider base salary adjustments for executive officers for current fiscal year | | First quarter |

| |

• Establish financial performance objectives for annual incentive bonus for next fiscal year | | Fourth quarter |

| |

• Consider long-term incentive compensation awards | | From time to time |

12

Components of Executive Compensation. The following is a summary description of the key components of our executive compensation program:

| | • | | Base salary—Component of pay based on an individual’s competencies, skills, experience, responsibility and performance, as well as internal equity considerations. Base salary is designed to provide a fixed level of competitive pay as well as a foundation upon which incentive opportunities and benefit levels are established. |

| | • | | Annual incentives—Performance-based component of pay based on achievement of annual internal financial goals, the achievement of individual-specific operational goals and/or business unit performance. Our annual incentive bonuses are primarily designed to focus our executives on attainment of key annual financial performance measures that we believe drive the long-term financial growth of the Company. |

| | • | | Long-term incentives—Performance-based component of pay based on achievement of long-term internal financial goals and stock price performance. |

| | • | | Severance benefits—Provides pay and benefits in the event an executive’s job is eliminated or employment is terminated in certain circumstances. |

| | • | | Other benefits and perquisites—Provides enhanced benefits for executives, which vary by executive level. |

Determination of Executive Compensation. Each of our named executive officers is party to an employment agreement that sets each such executive’s annual salary and target bonus level, in either case, subject to annual review and discretionary increase by our compensation committee to reflect changes in job responsibility or to reward individual performance. The table below presents the 2006 base salary level and target bonus level (expressed as a percentage of base salary) for each of our named executive officers, as well as our Chief Marketing Officer, after giving effect to increases by the compensation committee from the levels otherwise specified in their employment agreements:

| | | | | | |

Executive Officer | | 2006 Base Salary(a) | | 2006 Target Bonus Percentage | |

Sam L. Susser President and Chief Executive Officer | | $ | 500,000 | | 40 | % |

| | |

E.V. Bonner, Jr. Executive Vice President, Secretary and General Counsel | | $ | 279,537 | | 33 | % |

| | |

Roger D. Smith Executive Vice President and Chief Operating Officer—Retail | | $ | 240,240 | | 33 | % |

| | |

Rocky B. Dewbre Executive Vice President and Chief Operating Officer—Wholesale | | $ | 188,405 | | 33 | % |

| | |

Mary E. Sullivan Executive Vice President, Chief Financial Officer and Treasurer | | $ | 165,000 | | 33 | % |

| | |

Ronald D. Coben Executive Vice President and Chief Marketing Officer | | $ | 300,000 | | 33 | %(b) |

| (a) | Annualized 2006 base salary, which, to the extent of any increase from 2005, became effective on February 13, 2006, except for that of Mr. Coben, who joined the Company on November 28, 2006 and whose salary became effective as of that date. |

| (b) | As an inducement to join the Company, Mr. Coben’s employment agreement provides for a guaranteed bonus of $25,000 in 2006 and of $100,000 in 2007. |

13

Relative Size of Major Compensation Elements. In setting executive compensation, the compensation committee considers the aggregate amount of compensation payable to an executive officer and the form of the compensation. The compensation committee seeks to achieve an appropriate balance between immediate cash rewards for the achievement of Company and personal objectives and equity awards and other long-term incentives designed to align the interests of executive officers with those of shareholders. The level of incentive compensation typically corresponds to an executive officer’s responsibilities within the Company, with the level of incentive compensation for more senior executive officers being a greater percentage of total compensation than for less senior executive officers. Through a combination of personal investment and prior equity awards, our named executive officers have acquired a significant equity stake in the Company. In view of this, the compensation committee determined to pay 2006 bonuses solely in cash to all of our named executive officers other than our President and Chief Executive Officer who, in lieu of a cash award and in consultation with the compensation committee, received a 2006 bonus in the form of 7,500 shares of restricted common stock subject to a five year vesting schedule.

Annual Incentive Compensation. Annual incentive compensation is intended to motivate and reward the Company’s named executive officers by tying annual bonuses to the achievement of Company and segment-specific financial goals for the performance year, while reserving discretion in the compensation committee to adjust annual bonus payments based upon certain subjective performance criteria. Bonus dollars available are determined in accordance with the target percentages specified in each of the named executive officers’ employment agreements; which range from 40% of annual salary, in the case of our Chief Executive Officer, to 33% of annual salary, in the case of our other named executive officers. Actual award determinations are made by multiplying bonus dollars available by a weighted index reflecting company performance based upon one or more categories of financial or operational metrics.

For the 2006 performance year, incentive target levels amounts for our Chief Executive Officer, Chief Financial Officer and General Counsel consisted of a weighted index based 90% upon actual performance relative to internal target levels of consolidated adjusted EBITDAR (earnings before interest, taxes, depreciation, amortization and rent) and 10% upon achieving levels of employee turnover below targeted thresholds. Annual incentive target for our Chief Operating Officer—Wholesale was based on a weighted index based 80% upon performance of our wholesale segment relative to internal target levels of wholesale segment adjusted EBITDAR and 20% on company-wide performance relative to internal target levels of consolidated adjusted EBITDAR. This initial bonus level was subject to further adjustment based upon actual wholesale gallons sold such that (i) no bonus would be awarded upon reaching only 0%-90% of targeted gallonage, (ii) a downward adjustment would be made based upon reaching 91% to 95% of target, (iii) no adjustment would be made based upon gallons sold between 96% and 102% of target and (iv) and an upward adjustment of 25%-50% would be made upon reaching gallonage within 103%-105% of target. The incentive target level for our Chief Operating Officer—Retail for the 2006 performance year was based on a weighted index based (i) 40% upon performance of our retail segment relative to internal target levels of retail segment adjusted EBITDAR, (ii) 40% upon achieving minimum target levels of positive variance (an internal metric that compares annual non-fuel gross profit percentage increases with percentage cost increases in store level operating expenses), (iii) 10% upon achieving levels of employee turnover below targeted thresholds and (iv) 10% upon actual Company performance relative to internal target levels of consolidated adjusted EBITDAR. The compensation committee considered these target levels along with other factors impacting our business performance during 2006 in determining the actual amount of incentive compensation paid to our executive officers, which is set forth in the Summary Compensation Table.

For fiscal 2007, incentive target levels for our Chief Operating Officer—Retail and Chief Operating Officer—Wholesale, will each be based 66.7% on achievement of targeted consolidated EBITDAR with the remaining 33.3% being based on achieving targeted levels of retail segment EBITDAR and wholesale segment EBITDAR, respectively. Incentive target levels for our Chief Executive Officer, Chief Financial Officer and General Counsel will be based upon performance of the Company relative to internal target levels of consolidated adjusted EBITDAR. The following table reflects the correlation between (i) achievement of internal target levels of these metrics and (ii) corresponding bonus levels for our named executive officers (expressed as a percentage of base salary) for the 2007 fiscal year.

14

2007 Management Bonus Program

Relationship of Bonus (As Percentage of Annual Salary)

To Achievement of Internal EBITDAR Target

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Annual EBITDAR as a Percentage of Internal Target | |

Name | | 90.0% | | | 95.0% | | | 100.0% | | | 103.4% | | | 106.8% | | | 110.3% | | | 113.7% | | | 117.1% | | | 120.5% | | | 124.0% | |

Sam L. Susser(1) President and Chief Executive Officer | | * | | | * | | | 40.0 | % | | * | | | * | | | * | | | * | | | * | | | * | | | * | |

| | | | | | | | | | |

Mary E. Sullivan(1) Executive Vice President and Chief Financial Officer | | 3.0 | % | | 10.0 | % | | 33.0 | % | | 41.5 | % | | 51.5 | % | | 64.0 | % | | 80.0 | % | | 97.5 | % | | 120.0 | % | | 150.0 | % |

| | | | | | | | | | |

E.V. Bonner, Jr.(1) Executive Vice President and General Counsel | | 3.0 | % | | 10.0 | % | | 33.0 | % | | 41.5 | % | | 51.5 | % | | 64.0 | % | | 80.0 | % | | 97.5 | % | | 120.0 | % | | 150.0 | % |

| | | | | | | | | | |

Roger D. Smith(2) Executive Vice President and Chief Operating Officer—Retail | | 3.0 | % | | 10.0 | % | | 33.0 | % | | 41.5 | % | | 51.5 | % | | 64.0 | % | | 80.0 | % | | 97.5 | % | | 120.0 | % | | 150.0 | % |

| | | | | | | | | | |

Rocky Dewbre(3) Executive Vice President and Chief Operating Officer—Wholesale | | 3.0 | % | | 10.0 | % | | 33.0 | % | | 41.5 | % | | 51.5 | % | | 64.0 | % | | 80.0 | % | | 97.5 | % | | 120.0 | % | | 150.0 | % |

| * | Mr. Susser’s Employment Agreement specifies a bonus of 40% of base salary when the Company achieves its target, but the compensation committee has the discretion and flexibility to set appropriate bonus payments for performance below or above the internal target level. |

| (1) | Bonus payment expressed as a percentage of annual salary based upon percentile level at which actual annual consolidated adjusted EBITDAR of Susser Holdings Corporation corresponds to internal target. |

| (2) | Bonus payment expressed as a percentage of annual salary based (i) 66.7% upon percentile level at which actual annual consolidated adjusted EBITDAR of Susser Holdings Corporation corresponds to internal target and (ii) 33.3% upon percentile level at which actual annual EBITDAR of retail segment of Susser Holdings Corporation corresponds to internal target, after neutralizing effects of differences between targeted and actual retail fuel margins. |

| (3) | Bonus payment expressed as a percentage of annual salary based (i) 66.7% upon percentile level at which actual annual consolidated adjusted EBITDAR of Susser Holdings Corporation corresponds to internal target and (ii) 33.3% upon percentile level at which actual annual EBITDAR of Susser Petroleum Company (which operates our wholesale segment) corresponds to internal target. |

For purposes of making annual bonus determinations, the compensation committee selects internal target levels that it believes are achievable while also indicative of strong company-wide or, as the case may be, segment-specific performance. While the Company believes our target levels are reasonably attainable, they are necessarily based on certain assumptions as to variables beyond the Company’s control, including future weather patterns, commodity price levels and the impact of outside competition—all of which have historically had a significant impact on our business. Consequently, while the compensation committee looks generally to these objective performance measures when making bonus determinations, it may also consider any number of individual, subjective factors, as discussed below, in making final bonus determinations.

Individual Performance and Contributions. In making salary and bonus determinations, the compensation committee evaluates the individual performance and contributions of the Chief Executive Officer and our other named executive officers. Compensation for our Chief Executive Officer is reviewed and approved by the compensation committee and, ultimately, by the Board. For officers other than the Chief Executive

15

Officer, individual performance is evaluated with the recommendations of the Chief Executive Officer. Individual performance objectives are specific to each officer position and may relate to the following matters, among others:

| | • | | Customer/Frontline Employee Experience |

| | • | | Financial Performance/Acumen |

| | • | | Planning, Execution and Problem Solving |

| | • | | Strategic Vision/Direction |

| | • | | Leadership Development/Succession Planning |

| | • | | Internal Controls/Risk Management |

| | • | | Board Relations and Operations |

This evaluation information is used to supplement our objective compensation criteria for purposes of assisting the compensation committee in making decisions with respect to increases in annual base salary above the level specified in an individual’s employment agreement and/or increases or decreases in an individual’s annual performance bonus above or below the level called for by reference to achievement of specific financial targets.

Long Term Incentive Awards

In connection with our initial public offering, we adopted the Susser Holdings Corporation 2006 Equity Incentive Plan (the “Plan”) which governs the terms of equity awards granted to our management team prior to our initial public offering as well as any future equity awards granted by us. The Plan is intended to provide incentives that will attract, retain and motivate highly competent persons as directors and employees of, and consultants to, the Company and our subsidiaries, by providing them with opportunities to acquire shares of our common stock or to receive monetary payments. Additionally, the Plan provides us a means of directly tying our executives’ financial reward opportunities to our shareholders’ return on investment.

Administration. The Plan is administered by our compensation committee. Among the committee’s powers are to determine the form, amount and other terms and conditions of awards, establish such rules as it deems necessary or desirable for the proper administration of the Plan and to take such action in connection with the Plan and any awards granted thereunder as it deems necessary.

Shares Available. The Plan makes available an aggregate of 2,637,277 shares of our common stock, subject to adjustments. In the event that any outstanding award expires, is forfeited, cancelled or otherwise terminated without consideration, the shares of our common stock allocable to such award, including the unexercised portion of such award, shall again be available for the purposes of the Plan. If any award is exercised by tendering shares of our common stock to us, either as full or partial payment, in connection with the exercise of such award under this Plan or to satisfy our withholding obligation with respect to an award, only the number of shares of our common stock issued net of the shares of our common stock tendered will be deemed delivered for purposes of determining the maximum number of shares of our common stock then available for delivery under the Plan.

Eligibility for Participation. Employees and directors of, and consultants to, us or any of our subsidiaries are eligible to participate in the Plan. The selection of participants is within the sole discretion of the compensation committee.

16

Types of Awards. The Plan provides for the grant of stock options, including incentive stock options and non-qualified stock options, shares of restricted stock, and other stock-based awards. The committee determines, with regard to each type of award, the terms and conditions of the award, including the number of shares subject to the award, the vesting terms of the award, and the purchase price for each award. Awards may be made in assumption of or in substitution for outstanding awards previously granted by us or our affiliates, or a company acquired by us or with which we combine.

Award Agreement. Awards granted under the Plan are evidenced by award agreements (which need not be identical) that provide additional terms, conditions restrictions and/or limitations covering the grant of the award as determined by the compensation committee in its sole discretion; provided, however, that in the event of any conflict between the provisions of the Plan and any such agreement, the provisions of the Plan shall prevail.

Options. An option granted under the Plan enables the holder to purchase a number of shares of our common stock on set terms. Options are generally nonqualified stock options unless the award agreement specifies that an option is intended to be an incentive stock option. An option granted as an incentive stock option will, to the extent it fails to qualify as an incentive stock option, be treated as a nonqualified option. Each option will be subject to such terms and conditions, including exercise price, vesting and conditions and timing of exercise, consistent with the Plan and as the compensation committee may impose from time to time. No option holder has any rights to dividends or other shareholder rights with respect to shares of our common stock subject to an option until the holder has given written notice of exercise of the option, paid in full for such shares of our common stock and, if applicable, has satisfied any other conditions imposed by the compensation committee pursuant to the Plan.

Restricted Stock. The compensation committee may grant awards of restricted stock. Restricted stock awards may be subject to such terms and conditions, including vesting, as the compensation committee determines appropriate, including, without limitation, restrictions on the sale or other disposition of such shares of our common stock and our right to reacquire such shares for no consideration upon termination of the participant’s service with us within specified periods of time. The award agreement with respect to the restricted stock sets forth a participant’s rights, if any, as a shareholder.

Other Stock-Based Awards. The compensation committee may also grant awards of shares of our common stock and awards that are valued by reference to, or are otherwise based on the fair market value of, shares of our common stock. These other stock-based awards will be in a form and subject to conditions determined by the compensation committee. The compensation committee determines to whom and when other stock-based awards are made, the number of shares of our common stock awarded under (or otherwise related to) such other stock-based awards, whether such other stock-based awards are settled in cash, shares of our common stock or a combination of cash and such shares, and all other terms and conditions of such awards.

Performance-Based Awards. Certain other stock-based awards granted may be granted in a manner which is intended to be deductible by us under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). A participant’s performance-based award is determined based on the attainment of written performance goals approved by the compensation committee for an established performance period. The performance goals, which must be objective, may be based upon various business performance criteria. The criteria may relate to the Company, an individual, any of our subsidiaries or one or more of our divisions or units, or any combination of the foregoing, and may be applied on an absolute basis and/or be relative to one or more peer group companies or indices, or any combination thereof. The maximum amount of a performance-based award during a calendar year to any participant is limited to 75,000 shares of our common stock, or the cash equivalent to the extent awards are payable in cash or property. The compensation committee will determine whether, with respect to a performance period, the applicable performance goals have been met with respect to a given participant. The amount of the performance-based award actually paid to a given participant may be less than the amount determined by the applicable performance goal formula, at the discretion of the compensation committee.

17

Transferability. Unless otherwise determined by the compensation committee, awards are not transferable other than by beneficiary designation, will or the laws of descent and distribution.

Adjustment of Awards. In the event of any corporate event or transaction such as a merger, consolidation, reorganization, recapitalization, stock split, or other like change in capital structure (other than normal cash dividends) or similar corporate event or transaction, the compensation committee will determine whether and to what extent it should substitute or adjust, as applicable, the number and kind of shares of stock that may be issued under the Plan or under particular form and conditions of such awards.

In the event we are a party to a merger or consolidation or similar transaction (including a change of control), the compensation committee is authorized (but not obligated) to make adjustments in the terms and conditions of outstanding awards, including, without limitation, that at any time prior to such transaction, all then outstanding awards shall become immediately exercisable or vested and any restrictions on any awards shall immediately lapse. In addition, the compensation committee may provide that all awards held by participants who are at the time of the event in our service or the service of any of our subsidiaries or affiliates shall remain exercisable for the remainder of their terms notwithstanding any subsequent termination of a participant’s service or that all awards will be substituted with awards that will substantially preserve the otherwise applicable terms of affected awards previously granted hereunder, in each case, as determined by the compensation committee in its sole discretion.

Amendment and Termination. The compensation committee has the right to amend, suspend or terminate the Plan at any time, provided that no amendment may adversely affect in any material respect any participant’s rights under any award grant previously made or granted under the Plan without the participant’s consent. Also, no amendment of the Plan may be made without approval of our shareholders if the approval is necessary to comply with any tax or regulatory requirement applicable to the Plan.

Compliance with Code Section 409A. In the event that the compensation committee determines that the Plan and/or awards are subject to Code Section 409A, the compensation committee may, in its sole discretion and without a participant’s prior consent, amend the Plan and/or awards, adopt policies and procedures, or take any other actions (including amendments, policies, procedures and actions with retroactive effect) as are necessary or appropriate to (i) exempt the Plan and/or any award from the application of Code Section 409A, (ii) preserve the intended tax treatment of any such award, and (iii) comply with the requirements of Code Section 409A, including any regulations or other interpretive guidance that may be issued after the grant of any award. However, neither the Company nor the compensation committee is obligated to ensure that awards comply with Code Section 409A or to take any actions to ensure such compliance.

Perquisites and Other Benefits

We provide certain perquisites to our executive officers. Executives are eligible to receive annual health examinations and personal administrative and financial services support from corporate staff.In addition, we provide our President and Chief Executive Officer with a company vehicle and reimburse him for his business use of private aircraft.

We do not provide executive officers with supplemental executive medical benefits or coverage. In addition, we generally do not reimburse executives for aircraft time relating to personal use, such as travel to and from vacation destinations. However, spouses (or other family members) occasionally accompany executives when executives are traveling on private aircraft for business purposes, such as attending an industry business conference at which spouses are invited and expected to attend.

We provide other benefits, including medical, life, dental, and disability insurance in line with competitive market conditions. Our named executive officers are eligible for the same benefit plans provided to our other non-store employees, including insurance plans and supplemental plans chosen and paid for by employees who wish additional coverage.

18

We have established a 401(k) benefit plan for the benefit of our employees. All full-time employees who are over 21 years of age and have greater than six months tenure are eligible to participate. Under the terms of the 401(k) plan, employees can contribute up to 100% of their wages, subject to IRS limitations, which, for 2006, were generally a maximum contribution amount of $15,000 on maximum compensation of $220,000. We match 20% of the first 6% of salary that the employee contributes as a “guaranteed” match. Additionally, we may make a discretionary match that we determine in the first quarter of each year, based on the prior year’s financial performance against internal targets. For fiscal 2006, 2005 and 2004, we made a discretionary match of 0%, 30% and 40%, respectively, of the first 6% of salary that each employee contributed in addition to the 20% match.

We have also implemented a nonqualified deferred compensation (NQDC) plan for key executives, officers, and certain other employees to allow compensation deferrals in addition to that allowable under the 401(k) plan limitations, in that the contribution limits and compensation limits of the 401(k) plan do not apply to the NQDC plan. Participants in the NQDC plan may defer up to 75% of their salary. We match a portion of the participant’s contribution each year on the first 6% of salary deferred, using the same percentage of guaranteed and discretionary matches that are used for its 401(k) plan. The investment options available in the NQDC plan are identical to those offered in the 401(k) plan. Plan benefits are paid from our assets.

Stock Ownership Guidelines

Our Board, the compensation committee and our executives recognize that ownership of our common stock is an effective means by which to align the interests of our directors and executives with those of our shareholders. We have long emphasized the importance of stock ownership among our executives and directors. We believe the existing ownership positions of our named executive officers combined with Plan-based equity awards issued in 2005 and 2006 create a strong incentive to achieve long-term growth in the price of our common stock. We encourage our management team to continue to invest in our stock and intend to continue to use Plan-based equity awards to promote the further alignment of management and shareholder interests.

Prohibition on Insider Trading

We have established policies prohibiting our officers, directors, and employees from purchasing or selling Susser securities while in possession of material, nonpublic information, or outside of certain “window periods” following the release of annual and quarterly financial results, or otherwise using such information for their personal benefit or in any manner that would violate applicable laws and regulations.

19

Summary Compensation Table

The following table provides a summary of total compensation paid for 2006 to our named executive officers, and the base salary, bonus and other compensation for 2005 and 2004. The table shows amounts earned by such persons for services rendered to Susser in all capacities in which they served. The elements of compensation listed in the table are more fully described in the “Compensation Discussion and Analysis” section of this proxy statement and in the footnotes that follow this table.

| | | | | | | | | | | | | | |

Name | | Year | | Salary ($) (1) | | Bonus ($) (2) | | Stock Awards ($) (4) | | Option Awards ($) (5) | | All Other Compensation ($) (6) | | Total ($) (7) |

Sam L. Susser President and Chief Executive Officer | | 2006

2005

2004 | | 496,154

503,846

500,000 | | Note(3)

242,500

242,500 | | 181,525

—

— | | 145,435

—

— | | 195,952

22,390

18,000 | | 1,019,066

—

— |

| | | | | | | |

Mary E. Sullivan Executive Vice President and Chief Financial Officer | | 2006

2005

2004 | | 156,843

118,561

114,640 | | 16,500

45,784

46,288 | | 43,864

—

— | | 35,143

—

— | | 11,862

4,889

4,127 | | 264,212

—

— |

| | | | | | | |

E.V. Bonner, Jr. Executive Vice President and General Counsel | | 2006

2005

2004 | | 276,197

272,974

264,776 | | 25,000

105,414

132,021 | | 43,864

—

— | | 35,143

—

— | | 21,881

12,000

9,532 | | 402,085

—

— |

| | | | | | | |

Roger D. Smith Executive Vice President and Chief Operating Officer—Retail | | 2006

2005

2004 | | 238,392

240,408

218,400 | | 25,000

7,207

168,209 | | 43,864

—

— | | 35,143

—

— | | 20,688

10,845

28,508 | | 363,087

—

— |

| | | | | | | |

Rocky B. Dewbre Executive Vice President and Chief Operating Officer—Wholesale | | 2006

2005

2004 | | 186,025

182,161

165,235 | | 247,069

259,121

119,945 | | 43,864

—

— | | 35,143

—

— | | 19,083

5,413

9,216 | | 531,184

—

— |

| (1) | Includes base salary paid to each named executive officer during the fiscal year. 2005 base salary for each of the named executive officers includes a timing difference of 2 days of pay that would have normally been paid during 2006. Effective with the December 2005 recapitalization, members of our management team that chose to invest in Stripes Holdings LLC became “members” instead of employees, and we cut off 2005 salary for these members on December 20, 2005, rather than December 18, 2005, as for all other “non-member” employees. The first payment that members received in 2006 was reduced by the 2 days already paid in 2005. Effective with the IPO and corporation formation transactions completed on October 24, 2006, the named executive officers reverted back to “employee” status. |

| (2) | Amounts included in bonus column are the amounts earned for each fiscal year, but such amounts were paid in March of the following year. |

| (3) | Sam L. Susser was granted 7,500 shares of restricted stock on March 27, 2007, in lieu of a cash bonus for 2006. The shares vest over five years, with one-third of such shares vesting on the third, fourth, and fifth anniversary of grant date. The fair value of the grant is $134,400 based on the closing price of $17.92 per share on March 27, 2007, and compensation cost will be recognized over the five-year vesting period in accordance with SFAS No. 123(R). |

| (4) | Represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2006 in accordance with SFAS No. 123(R), which requires companies to expense the fair value of equity awards over the period in which an employee is required to provide service in exchange for the awards. The reported amounts represent the amount of compensation expense recognized by Susser in 2006 pertaining to restricted units of Stripes Holdings LLC originally granted in December 2005, and converted to equivalent unvested restricted shares of Susser concurrent with the IPO. See the “Outstanding Equity Awards at December 31, 2006” table for more information on restricted shares granted. |

The amounts stated in the table reflect Susser’s accounting expense for these awards, and do not correspond to the actual value that will be recognized by the named executive officers. The amounts shown exclude the

20

impact of estimated forfeitures related to service-based vesting conditions. For additional information on the valuation assumptions with respect to the restricted shares, refer to Note 19—Share Based Compensation of Notes to Consolidated Financial Statements in our Form 10-K for the year ended December 31, 2006, as filed with the SEC. Amounts have not been presented for 2004 or 2005 fiscal years.

| (5) | Represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2006 in accordance with SFAS 123(R), which requires companies to expense the fair value of equity awards over the period in which an employee is required to provide service in exchange for the awards. The reported amounts represent the amount of compensation expense recognized by Susser in 2006 pertaining to stock options granted in 2006. See the “Grants of Plan Based Awards” table for more information on stock options granted. |

The amounts stated in the table reflect Susser’s accounting expense for these awards, and do not correspond to the actual value that will be recognized by the named executive officers. The amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional information on the valuation assumptions with respect to the stock options, refer to Note 19—Share Based Compensation of Notes to Consolidated Financial Statements in our Form 10-K for the year ended December 31, 2006, as filed with the SEC. Amounts have not been presented for 2004 or 2005 fiscal years.

| (6) | The details of amounts listed as “All Other Compensation” are presented in the “All Other Compensation Table” below. |

| (7) | Total compensation is not being presented for 2004 and 2005, as the components of compensation presented for these years are not consistent with those required to be presented for 2006. |

All Other Compensation Table

| | | | | | | | | | | | |

Name | | Year | | Perquisites and Other Personal Benefits ($) (1) | | Tax Reimbursements ($) (2) | | Company Contributions to 401(k) and Deferred Compensation Plans

($) (3) | | Management Fees ($) (4) | | Total ($) |

Sam L. Susser | | 2006 | | 33,605 | | 15,259 | | 9,047 | | 138,041 | | 195,952 |

| | 2005 | | — | | — | | 22,390 | | — | | 22,390 |

| | 2004 | | — | | — | | 18,000 | | — | | 18,000 |

| | | | | | |

Mary E. Sullivan | | 2006 | | — | | 7,818 | | 2,433 | | 1,611 | | 11,862 |

| | 2005 | | — | | — | | 4,889 | | — | | 4,889 |

| | 2004 | | — | | — | | 4,127 | | — | | 4,127 |

| | | | | | |

E. V. Bonner, Jr. | | 2006 | | — | | 10,326 | | 4,654 | | 6,901 | | 21,881 |

| | 2005 | | — | | — | | 12,000 | | — | | 12,000 |

| | 2004 | | — | | — | | 9,532 | | — | | 9,532 |

| | | | | | |

Roger D. Smith | | 2006 | | — | | 8,466 | | 3,019 | | 9,203 | | 20,688 |

| | 2005 | | — | | — | | 10,845 | | — | | 10,845 |

| | 2004 | | 21,956 | | — | | 6,552 | | — | | 28,508 |

| | | | | | |

Rocky B. Dewbre | | 2006 | | — | | 11,393 | | 5,389 | | 2,301 | | 19,083 |

| | 2005 | | — | | — | | 5,413 | | — | | 5,413 |

| | 2004 | | — | | — | | 9,216 | | — | | 9,216 |

| (1) | Perquisites and other personal benefits for 2006 are included for each named executive officer only to the extent the aggregate value is equal to or greater than $10,000 in any year. Amounts shown for 2005 and 2004 have not been restated to reflect the new requirements effective for our fiscal year ended December 31, 2006. For Sam L. Susser, 2006 perquisites consisted of $29,739 estimated value of personal financial and administrative services provided by Susser personnel and $3,875 for personal use of company-provided vehicle. For Roger D. Smith, 2004 perquisites consisted of relocation assistance. |

21

| (2) | Tax reimbursements for 2006 are tax gross-up amounts paid to each named executive officer prior to the IPO, during which time we were organized as a partnership and each of our named executive officers was considered a member, rather than an employee, for Federal tax purposes as each had made an investment in Stripes Holdings LLC. We paid to each member an amount equal to the amount of payroll tax that we would have otherwise incurred had that member been considered an employee, and each member was then responsible for paying taxes as if self-employed. Effective with the IPO and corporate formation transactions completed October 24, 2006, each named executive officer became an employee of Susser Holdings Corporation and the tax reimbursements ceased. |

| (3) | Each of our named executive officers is eligible to participate in a 401(k) plan that is generally available to all employees. Additionally, certain highly compensated employees, including our named executive officers, are eligible to participate in our NQDC plan. The investment options in the NQDC plan mirror those available in our 401(k) plan, and do not contain any above-market or preferential earnings. The Company’s contributions to the 401(k) and NQDC plans accrued for fiscal 2006, 2005 and 2004 included a discretionary match of 0%, 30% and 40%, respectively, on the first 6% of salary deferred in addition to the 20% guaranteed match. |

| (4) | We entered into a management services agreement, or the “Services Agreement”, with Wellspring Capital Management LLC and Sam L. Susser concurrently with the December 2005 recapitalization. Wellspring Capital Management LLC and Sam L. Susser provided general advice and counsel to us in connection with our long-term strategic plans, financial management, strategic transactions and other business matters. Sam L. Susser assigned his rights to receive a portion of the compensation under the Services Agreement to certain other members of our senior management and board of directors. The Services Agreement terminated upon the completion of the IPO. |

Grants of Plan Based Awards

For Fiscal Year Ended December 31, 2006

| | | | | | | | | | |