UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

WESTWAY GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

WESTWAY GROUP, INC.

365 CANAL STREET, SUITE 2900

NEW ORLEANS, LOUISIANA 70130

(504) 525-9741

May , 2010

Dear Stockholders:

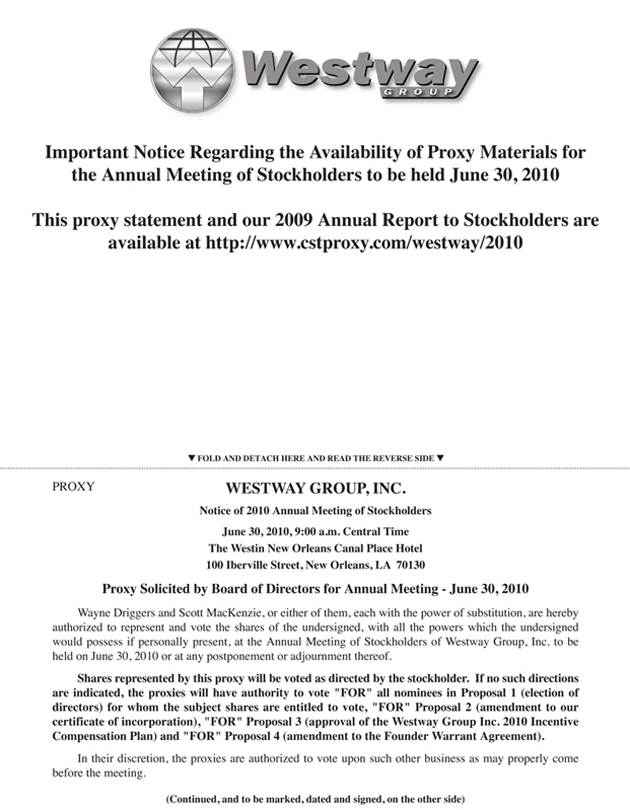

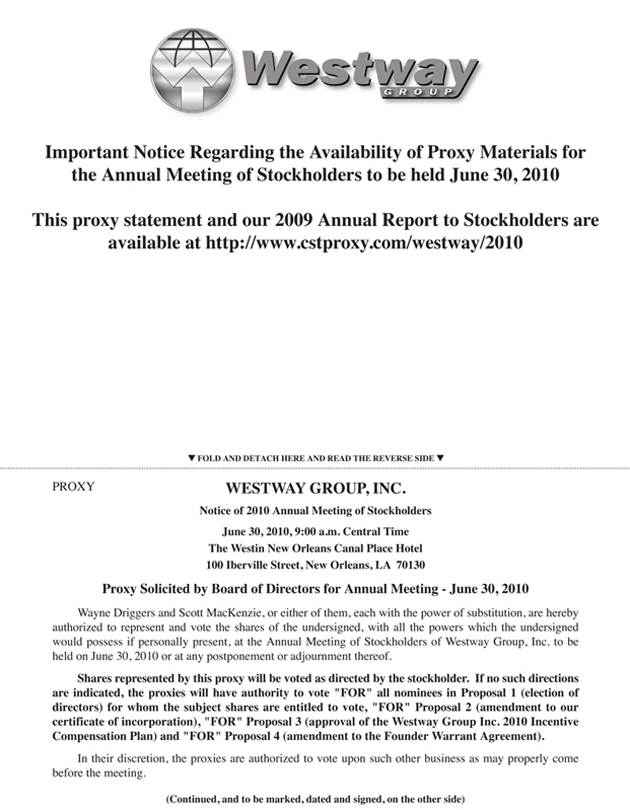

We are pleased to invite you to attend our 2010 annual meeting of stockholders to be held on Wednesday, June 30, 2010 at 9:00 a.m., local time, at The Westin New Orleans Canal Place Hotel, 100 Iberville Street, New Orleans, Louisiana 70130.

Details regarding admission to the meeting and the business to be conducted are described in the accompanying Notice of Annual Meeting and Proxy Statement.

Our proxy materials are also posted on the Internet at http://www.cstproxy.com/westway/2010, in compliance with the Securities and Exchange Commission’s “notice and access” rules. For more information, please see the Questions and Answers section beginning on page 1 of the accompanying proxy statement.

Your vote is important. You are invited to attend the 2010 annual meeting to vote on the proposals described in this proxy statement; however, you do not need to attend the meeting to vote your shares. We hope you will vote as soon as possible, whether or not you plan to attend the meeting. You may vote your shares on the Internet, by telephone or by completing, signing and returning the enclosed proxy card. Please review the instructions on each of your voting options described in the accompanying notice and proxy statement.

Also, please let us know if you plan to attend our annual meeting by marking the appropriate box on the enclosed proxy card.

On behalf of our Board of Directors, I thank you for your support and appreciate your consideration of these matters.

|

| Sincerely, |

|

| |

| Francis P. Jenkins, Jr. |

| Chairman of the Board of Directors |

2010 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | |

| Time and Date | | 9:00 a.m., on Wednesday, June 30, 2010 |

| |

| Place | | The Westin New Orleans Canal Place Hotel, 100 Iberville Street, New Orleans, LA 70130 |

| |

| Items of Business | | (1) To elect a total of four members of the Board of Directors, consisting of one Class I Director, to be elected by the holders of Class A common stock, to hold office for a three-year term, or until such director’s successor has been elected and qualified, and three directors, to be elected by the holders of Class B common stock, to hold office until the 2011 annual meeting of stockholders, or until their successors are elected and qualified. |

| |

| | (2) To approve an amendment to Section 8.4 of our amended and restated certificate of incorporation to clarify that section 9.1 (Power to Amend) and Articles II (Meetings of Stockholders) and III (Directors) of our by-laws, as amended and restated as of May 28, 2009, may be amended either (i) by our Board of Directors by a vote of the directors that includes the affirmative votes of a majority of the directors elected by the holders of our Class A common stock and a majority of the directors elected by the holders of our Class B common stock,or (ii) by our stockholders at an annual or special meeting called for such purpose by the affirmative votes by holders of at least a majority of the voting power of our Class A common stock and by holders of at least a majority of the voting power of our Class B common stock. The complete text of Section 8.4 of our certificate, as it is proposed to be amended, is included in our accompanying proxy statement for our 2011 annual meeting and incorporated herein by this reference. |

| |

| | (3) To approve the Westway Group, Inc. 2010 Incentive Compensation Plan, a copy of which is attached to the accompanying proxy statement asAppendix A. |

| |

| | (4) To approve an amendment to the Founder Warrant Agreement dated as of May 20, 2007 between the Company and Continental Stock Transfer & Trust Company, which governs the terms of the outstanding warrants issued to our founders (the “founder warrants”), to (i) extend the exercise dates of the founder warrants; (ii) provide for the exercise of the founder warrants on a cashless basis; (iii) change the method of calculating the value of our Class A common stock used to determine the amount received by a holder of warrants upon a cashless exercise; and (iv) require the consent of the holders prior to any future modifications to the Founder Warrant Agreement. The complete text of Amendment No. 1 to the Founder Warrant Agreement is attached to the accompanying proxy statement asAppendix B. |

| |

| | (5) To consider such other business as may properly come before the meeting. |

i

| | |

Adjournments and Postponements | | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

| |

| Record Date | | You are entitled to vote only if you were a holder of our common stock as of the close of business on May 3, 2010 (the “record date”). |

| |

| Meeting Admission | | You are entitled to attend the annual meetingonly if you were a stockholder as of the close of business on the record date or hold a valid proxy for the annual meeting.You should be prepared to present photo identification for admittance. If you are not a stockholder of record but hold shares through a broker, bank, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to the record date, a copy of the voting instruction card provided by your broker, bank, trustee or nominee, or similar evidence of ownership. |

| |

| | If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the annual meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the meeting. Please let us know if you plan to attend the meeting by marking the appropriate box on the enclosed proxy card. The annual meeting will begin promptly at 9:00 a.m., local time. Check-in will begin at 8:00 a.m., local time. |

Your vote is very important. Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers About the Proxy Materials and the Annual Meeting” beginning on page 1 of this proxy statement and the enclosed proxy card.

|

| By order of the Board of Directors, |

|

| |

| Thomas A. Masilla, Jr. |

| Corporate Secretary |

This notice of annual meeting and proxy statement and the accompanying form of proxy are being distributed and made available on or about May [ ], 2010.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF

PROXY MATERIALS FOR THE SHAREHOLDER MEETING

TO BE HELD ON JUNE 30, 2010

This proxy statement and our 2009 annual report to shareholders are available at http://www.cstproxy.com/westway/2010.

ii

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Why am I receiving these materials?

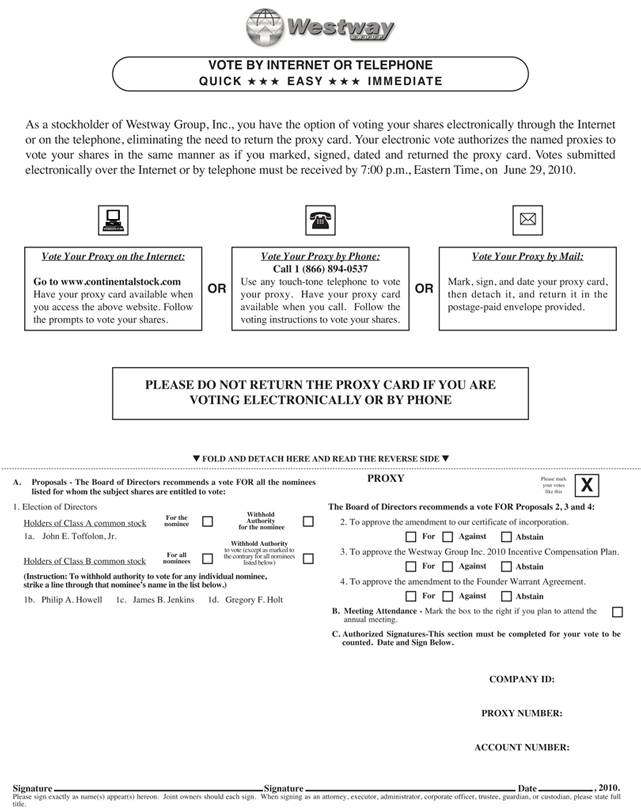

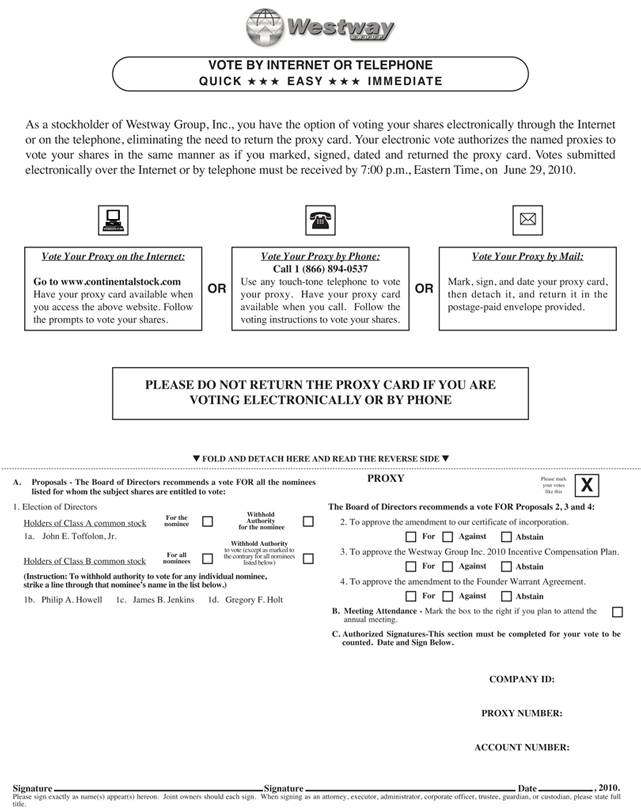

We sent you this proxy statement and the enclosed proxy card because our Board of Directors is soliciting on our behalf your proxy to vote at the 2010 annual meeting of stockholders. You are invited to attend the 2010 annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. You may instead vote your shares on the Internet, by telephone or by completing, signing and returning the enclosed proxy card. Please review the instructions on the proxy card regarding each of these voting options.

We are mailing this proxy statement and the accompanying proxy card on or about May [ ], 2010 to all stockholders of record entitled to vote at the annual meeting.

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and most highly paid executive officers, corporate governance matters, related person transactions and certain other required information.

What items of business will be voted on at the Annual Meeting?

The items of business scheduled to be voted on at the annual meeting are:

| | • | | The election of four directors; |

| | • | | The approval of an amendment to our certificate of incorporation; |

| | • | | The approval of the Westway Group, Inc. 2010 Incentive Compensation Plan; and |

| | • | | The approval of an amendment to the Founder Warrant Agreement. |

We will also consider any other business that properly comes before the annual meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares as follows:

| | |

“FOR” | | each of the nominees to the Board of Directors named in this proxy statement for whom your shares may be voted (Proposal 1); |

| |

“FOR” | | the approval of the amendment to our certificate of incorporation (Proposal 2); |

| |

“FOR” | | the approval of the Westway Group, Inc. 2010 Incentive Compensation Plan (Proposal 3); and |

| |

“FOR” | | the approval of the amendment to the Founder Warrant Agreement (Proposal 4). |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are thestockholder of record with respect to those shares. As a stockholder of record, you may grant your voting proxy directly to us or another person, or vote in person at the annual meeting.

1

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If your shares are held not in your name, but rather in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization, then you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the annual meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares.

What shares can be voted?

Each share of Class A common stock and Class B common stock issued and outstanding as of the close of business on May 3, 2010 (the “record date”) is entitled to be voted on all items being voted on at the annual meeting except for the election of directors. With respect to the election of directors, each share of Class A common stock may be voted in the election of the nominee to be voted on by holders of shares of Class A common stock, and each share of Class B common stock may be voted in the election of the three nominees to be voted on by holders of Class B common stock. Further, with respect to Proposal 2 (Amendment to Certificate of Incorporation), the holders of Class A common stock and the holders of Class B common stock will vote as separate classes.

You may vote all shares of common stock owned by you as of the record date, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee or other nominee.

How many shares are entitled to vote?

On the record date we had 26,576,036 shares of common stock issued and outstanding, consisting of 13,952,033 shares of Class A common stock and 12,624,003 shares of Class B common stock.

How many votes am I entitled to per share?

Each holder of Class A common stock is entitled to one vote for each share held on the record date on each item for which shares of Class A common stock are entitled to vote, and each holder of Class B common stock is entitled to one vote for each share held on the record date on each item for which shares of Class B common stock are entitled to vote.

How can I attend the Annual Meeting?

You are entitled to attend the annual meeting only if you were a stockholder of the Company as of the record date or you hold a valid proxy for the annual meeting. Since seating is limited, admission to the meeting will be on a first-come, first-served basis. You should be prepared to present photo identification for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you should provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to May 3, 2010, a copy of the voting instruction card provided by your broker, bank, trustee or nominee, or other similar evidence of ownership.

The meeting will begin promptly at 9:00 a.m., local time. Check-in will begin at 8:00 a.m., local time.

How do I vote?

You may vote in the following ways:

(a)In person: We will distribute written ballots at the annual meeting to any stockholder of record who wants to vote in person. If you hold your shares in street name, you must bring to the annual meeting a valid legal proxy, which you can obtain by contacting your broker, bank or nominee, in order to vote in person at the annual meeting.

2

(b)By mail: You may complete and sign the enclosed proxy card and return it to us by mail in the enclosed pre-addressed envelope.

(c)By Internet: The web address for Internet voting can be found on the enclosed proxy card. Internet voting is available 24 hours a day. Have your proxy card in hand when you access the website and then follow the instructions.

(d)By telephone: The number for telephone voting can be found on the enclosed proxy card. Telephone voting is available 24 hours a day. Have your proxy card in hand when you call and then follow the instructions.

If you choose to vote by Internet or telephone, you do not need to return the proxy card. To be valid, your vote by Internet, telephone or mail must be received by the deadline specified on the enclosed proxy card. If you vote by Internet or telephone and subsequently obtain a legal proxy from your account representative, then your prior vote will be revoked regardless of whether you vote that legal proxy.

If you properly submit your proxy voting instructions by mail, Internet or telephone, and you do not subsequently revoke your proxy, the persons named as proxies, Wayne Driggers and Scott MacKenzie (the “proxies”), will vote your shares as you instruct. However, if you sign and return your proxy card without giving specific voting instructions on an item, the proxies will vote as recommended by our Board. If an additional proposal comes up for a vote at the annual meeting that is not on the proxy card, your shares will be voted in the best judgment of the proxies.

What are broker non-votes?

Generally, broker non-votes occur when shares held by a broker, bank, or other nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker, bank, or other nominee (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares with respect to that particular proposal.

Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on certain “non-routine” matters. All of the proposals described in this proxy statement are considered to be non-routine matters and, thus, if you hold your shares in street name, you must provide instructions to your broker in order for your shares to be voted on these matters. (Prior to 2010, the uncontested election of directors was considered a routine matter for which brokers were permitted to vote your shares without instruction. Beginning this year, brokers are no longer permitted to vote your shares in the election of directors.)

Can I revoke my proxy or change my vote?

Yes. You may change your vote at any time prior to the taking of the vote at the annual meeting. If you are the stockholder of record, you may change your vote by (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy), (2) providing a written notice of revocation to our Corporate Secretary at Westway Group, Inc., 365 Canal Street, Suite 2900, New Orleans, Louisiana 70130, prior to your shares being voted, or (3) attending the annual meeting and voting in person. Attendance at the meeting without voting in person will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, bank, trustee or nominee following the instructions they provided or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the annual meeting and voting in person.

How many shares must be present or represented to conduct business at the annual meeting?

The quorum requirement for holding the annual meeting and transacting business is that holders of a majority of the voting power of the issued and outstanding shares of stock must be present in person or

3

represented by proxy, along with the holders of a majority of the voting power of our Class A common stock and of our Class B common stock. Both abstentions and broker non-votes (described above) are counted for the purpose of determining the presence of a quorum.

How are votes counted and what vote is required to approve each proposal?

Proposal 1: The Election of Directors

Our Board currently has seven members. Under our current ownership structure, the holders of Class A common stock are entitled to elect four members of our Board, who serve staggered three year terms, and the holders of Class B common stock are entitled to elect three members of our Board, each of whom serves until the next annual meeting of stockholders. At the annual meeting, the holders of Class A common stock will be entitled to vote to elect one director, and the holders of Class B common stock will be entitled to vote to elect three directors.

The nominee to be voted on by the holders of shares of Class A common stock who receives the highest number of affirmative “FOR” votes at the annual meeting will be elected. The three nominees to be voted on by the holders of shares of Class B common stock who receive the highest number of affirmative “FOR” votes at the annual meeting will be elected.

Each holder of shares of Class A common stock may vote “FOR” the nominee for whom that stockholder is entitled to vote or may “WITHHOLD” such stockholder’s vote with respect to that nominee. Each holder of shares of Class B common stock may vote “FOR” all or some of the nominees for whom such stockholder is entitled to vote, or may “WITHHOLD” such stockholder’s vote with respect to one or more of the nominees.In tabulating the voting results for the election of directors, only “FOR” votes will be counted. Broker non-votes are not considered votes “FOR” and therefore will have no direct impact on this proposal.

Proposal No. 2 - Approval of the Amendment to our Certificate of Incorporation

Approval of the proposed amendment to our certificate of incorporation requires the affirmative vote of a majority of the outstanding shares of our common stock, the affirmative majority vote of the holders of the Class A common stock, voting as a separate class, and of the affirmative majority vote of the holders of the Class B common stock, voting as a separate class.

Each holder of common stock may vote “FOR,” “AGAINST,” or “ABSTAIN” on the proposal to amend the certificate of incorporation.Abstentions and broker non-votes will have the same effect as a vote “AGAINST” this proposal.

Proposal No. 3 - Approval of Westway Group, Inc. 2010 Incentive Compensation Plan

Approval of the Westway Group, Inc. 2010 Incentive Compensation Plan requires the affirmative vote of a majority of the shares of common stock present in person or represented by proxy.

Each holder of common stock may vote “FOR,” “AGAINST,” or “ABSTAIN” on the proposal to approve the Westway Group, Inc. 2010 Incentive Compensation Plan. Abstentions will have the same effect as a vote “AGAINST” the proposal. Broker non-votes will have no effect on this proposal.

Proposal No. 4 - Approval of the Amendment to the Founder Warrant Agreement

Approval of the proposed amendment to the Founder Warrant Agreement requires the affirmative vote of a majority of the shares of common stock present in person or represented by proxy.

4

Each holder of common stock may vote “FOR,” “AGAINST,” or “ABSTAIN” on the proposal to extend the exercise period of the founder warrants. Abstentions will have the same effect as a vote “AGAINST” the proposal. Broker non-votes will have no effect on this proposal.

What happens if additional matters are presented at the annual meeting?

Other than the four items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxy holders, Wayne Driggers and Scott MacKenzie or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxy holders will be authorized to vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

Who will serve as inspector of elections?

The inspector of elections will be a representative from Continental Stock Transfer & Trust Company.

Who will bear the cost of soliciting votes for the annual meeting?

We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities.

Where can I find the voting results of the annual meeting?

We intend to announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K filed within four business days after the date of the annual meeting. We also plan to disclose the preliminary vote results and the final vote results on our web site at www.westway.com as soon as possible after the annual meeting.

5

CORPORATE GOVERNANCE

Board of Directors

Our business and affairs are overseen by our Board of Directors pursuant to the Delaware General Corporation Law, our certificate of incorporation, and our by-laws (as amended and restated to date, our “by-laws”). The members of our Board of Directors are kept informed of our business through discussions with our Chairman, our Chief Executive Officer and other key members of our management, by reviewing materials provided to them and by participating in Board meetings.

The composition of our Board changed on May 28, 2009, in connection with the business combination (the “business combination,” as more fully described under the caption “Certain Relationships and Related Transactions”) by which we acquired the bulk liquid storage and animal feed supplements businesses of ED&F Man Holdings Limited (“ED&F Man”). Under our certificate of incorporation and our current ownership structure, the holders of our Class A common stock are entitled to elect four members of our Board and the holders of our Class B common stock are entitled to elect three members of our Board. The directors elected by holders of Class A common stock are divided into three classes and serve staggered three-year terms. The directors elected by holders of Class B common stock are not classified and are elected to serve until the next annual meeting of stockholders. Since May 28, 2009, those Board members elected by holders of Class A common stock have been Messrs. Francis P. Jenkins, Jr., John Toffolon, Jr., G. Kenneth Moshenek and Peter Harding, and those directors elected by holders of our Class B common stock have been Messrs. Philip Howell, James Jenkins and Gregory Holt. Mr. Francis P. Jenkins, Jr. also serves as the Chairman of the Board. Selected information about the members of our current Board is presented in the following table:

| | | | | | | | |

Name | | Age | | Positions, Offices and Committee Memberships | | Date First Elected

to Board | | Term Expires at

Annual Meeting in |

Directors elected by holders of Class A common stock | | | | | | | | |

| | | | |

Francis P. Jenkins, Jr. (Class III) | | 67 | | Chairman of the Board of Directors Director Compensation Committee Chair | | April 2006 | | 2012 |

| | | | |

G. Kenneth Moshenek (Class II) | | 58 | | Director Audit Committee Nominating Committee Compensation Committee | | April 2006 | | 2011 |

| | | | |

John E. Toffolon, Jr. (Class I) | | 59 | | Director Audit Committee Chair Compensation Committee Nominating Committee | | April 2006 | | 2010 |

| | | | |

Peter J.M. Harding (Class III) | | 57 | | Director Chief Executive Officer | | May 2009 | | 2012 |

| | | | |

Directors elected by holders of Class B common stock | | | | | | | | |

| | | | |

Philip A. Howell | | 51 | | Director | | May 2009 | | 2010 |

| | | | |

James B. Jenkins | | 52 | | Director | | May 2009 | | 2010 |

| | | | |

Gregory F. Holt | | 63 | | Director Nominating Committee Chair Audit Committee Compensation Committee | | May 2009 | | 2010 |

6

There is no understanding or arrangement between any director and any other person pursuant to which the director was or is to be selected as a director or nominee for director, excluding any arrangements or understandings with directors or officers of the Company acting solely in their capacity as such.

Director Independence

Our securities are listed on NASDAQ and we adhere to NASDAQ listing standards in determining whether a director is independent. The NASDAQ listing standards define an “independent director” as a person, other than an executive officer or employee of a company or any other individual having a relationship which, in the opinion of the issuer’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Under the NASDAQ listing standards, the following persons will not be considered independent:

| | • | | a director who is, or at any time during the past three years was, employed by the Company; |

| | • | | a director who accepted or who has a family member who accepted any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence (other than compensation for Board or Board Committee service, compensation paid to a family member who is an employee (other than an executive officer) of the Company, or benefits under a tax-qualified retirement plan, or non-discretionary compensation); |

| | • | | a director who is a family member of an individual who is, or at any time during the past three years was, employed by the Company as an executive officer; |

| | • | | a director who is, or has a family member who is, a partner in, or a controlling stockholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more (other than payments arising solely from investments in the Company’s securities; or payments under non-discretionary charitable contribution matching programs); |

| | • | | a director of the issuer who is, or has a family member who is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of the issuer serve on the Compensation Committee of such other entity; or |

| | • | | a director who is, or has a family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years. |

Before the business combination during the period that the Company was a special purpose acquisition company, Messrs. Francis Jenkins, Jr., G. Kenneth Moshenek and John E. Toffolon, Jr. served as executive officers and directors; however, they received no compensation for their service as such. They served as executive officers and directors only to facilitate the business combination and resigned as executive officers upon the closing of the business combination. NASDAQ has provided that, for non-employee executive officers and directors of special purpose acquisition companies that meet these criteria, those executive officers and directors will not be deemed to be non-independent solely based upon such individuals’ service as executive officers or directors of a special purpose acquisition company prior to its consummation of a business combination.

Consistent with these considerations, our Board of Directors has evaluated the relationships between each current director (and his or her immediate family members and related interests) and the Company and its subsidiaries, and determined that a majority of our directors meet or exceed the criteria for independence established by the NASDAQ listing standards. Our Board has determined that Messrs. Francis Jenkins, Jr., G. Kenneth Moshenek, John E. Toffolon, Jr., and Gregory Holt are independent directors of the Company. Our Board of Directors has determined that Messrs. Harding, Howell and James Jenkins will not be considered independent.

7

The Board has also determined that each member of the Audit Committee, the Compensation Committee, and the Nominating Committee is independent.

Board Meetings

The Board held eleven meetings in 2009. We expect each director to attend every meeting of the Board of Directors and the Committees on which he or she serves as well as the annual stockholders’ meeting. No director attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors (held during the period for which each director was a director) and the total number of meetings held by all Committees of the Board of Directors on which that director served. All members of the then-current Board attended the 2009 annual meeting of stockholders.

Board Leadership Structure

In accordance with our by-laws, our Board elects our Chairman and our Chief Executive Officer. Our by-laws permit these positions to be held by the same person. The Board does not have a policy regarding the separation of the roles of Chairman and Chief Executive Officer, but instead believes that it is in the best interest of the Company to retain flexibility in determining whether to separate or combine these roles based on our circumstances. Currently, the offices of Chairman and Chief Executive Officer are separated. Francis P. Jenkins, Jr. currently serves as our Chairman and Peter J.M. Harding currently serves as our Chief Executive Officer. The Board believes that the separation of these offices is appropriate at this time as it allows our Chief Executive Officer to focus primarily on his management responsibilities.

Board Committees

The Board has a standing Audit Committee, Nominating Committee and Compensation Committee. Each Committee operates under a written charter approved by the Board. All of the Committee charters are available on our website at www.westway.com, under the “Corporate Governance” menu. The Board has determined that all Committee members are independent under the applicable NASDAQ listing standards. The members of each Committee are identified in the table below.

| | | | | | |

Director | | Audit

Committee | | Nominating

Committee | | Compensation

Committee |

Francis P. Jenkins, Jr. | | | | | | Chair |

| | | |

G. Kenneth Moshenek | | ü | | ü | | ü |

| | | |

John E. Toffolon, Jr. | | Chair | | ü | | ü |

| | | |

Gregory F. Holt | | ü | | Chair | | ü |

Audit Committee

The Board has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Each member of the Audit Committee is independent in accordance with the rules and regulations of the NASDAQ listing standards and the SEC. The Board has determined that Mr. Toffolon is an “Audit Committee Financial Expert” as defined by the SEC.

The primary responsibility of the Audit Committee is to oversee our accounting and financial reporting processes and the audits of our financial statements. In that regard, the Audit Committee assists the Board in monitoring the quality and integrity of the financial statements, the independent accountants’ qualifications and independence, the performance of our internal audit function and independent accountants and compliance with legal and regulatory requirements. The responsibilities and activities of the Audit Committee are described in more detail in the Audit Committee Report, below, and in the Audit Committee’s charter.

The Audit Committee met a total of six times during 2009.

8

Nominating Committee

The Nominating Committee is appointed by the Board for the purpose of assisting the Board in its selection of individuals as nominees for election to the Board by holders of our Class A common stock and to fill any vacancies or newly created directorships on the Board. The Nominating Committee was formed in May 2009 following the business combination, in which we acquired the bulk liquid storage and liquid feed supplements businesses of ED&F Man group, and did not hold any meetings in 2009. The Nominating Committee held its first meeting in April 2010 in connection with the consideration of the nominee for election by the holders of Class A common stock at the 2010 annual meeting.

The process by which the Nominating Committee recommends director nominees depends on whether the candidate is an incumbent director or a new candidate. For incumbent directors, the Committee reviews the director’s continuing qualifications and overall service as a director to determine whether to recommend that director for re-election.

With regard to new director candidates, the Committee first determines the qualifications needed, considering the Board’s needs at that time (e.g., the knowledge, skill and business experience that the new director must possess to yield a well balanced board). The Committee may identify candidates through its own network of contacts and, if it deems necessary, by engaging a professional search firm. To date, the Nominating Committee has not engaged a professional search firm for this purpose. The Committee adds to the list of candidates that it has identified any candidates recommended to it by the holders of Class A common stock. The Committee evaluates each candidate against a set of minimum criteria that must be met by any nominee, including proven leadership capabilities, significant business experience, a high level of personal and professional integrity, ethical values and moral character, and a high level of financial literacy. The Committee invites those candidates who appear best suited to meet our needs for interviews conducted by the Committee and members of the Board. Based on all of the information gathered throughout the process, the Committee makes its recommendation to the Board. The Board then votes to determine the final slate of nominees.

The Nominating Committee values diversity as a factor in selecting nominees to serve on the Board. Although the Committee does not have a specific policy on diversity, it seeks to maintain a Board composed of members that represent a diversity of backgrounds, skills and experience.

The Nominating Committee will consider director candidates recommended by the holders of Class A common stock and evaluate the qualifications of such potential nominees using the same selection criteria that it uses to evaluate other potential nominees. To recommend an individual for nomination by the Board, a stockholder must submit to the Nominating Committee the information outlined below for communications to the Board relating to director nominations, under the caption “Stockholder Communications with the Board of Directors.”

Compensation Committee

The Compensation Committee is appointed by the Board for the purpose of discharging the Board’s responsibilities in respect of compensation of our executive officers, including approving individual executive officer compensation; overseeing the company’s overall compensation and benefit philosophies; and producing an annual report on executive compensation for inclusion in our proxy statement, in accordance with applicable rules and regulations. In addition, the Compensation Committee is charged with reviewing the competitiveness of our executive compensation programs while balancing the Board’s overall objective of increasing stockholder value. The responsibilities and activities of the Compensation Committee are described in more detail in the Compensation Committee’s charter. Under the Compensation Committee charter, the Compensation Committee may delegate any of its responsibilities to one of its subcommittees, if any, to the extent consistent with our certificate of incorporation, by-laws and applicable law and the NASDAQ rules. The Compensation Committee held two meetings in 2009.

The Compensation Committee determines the Company’s overall compensation philosophy and sets the compensation of our executive officers, other than the Chief Executive Officer. The Compensation Committee

9

looks to the Chief Executive Officer and the compensation consultant retained by the Compensation Committee to make recommendations to the Compensation Committee. Our Chief Executive Officer and Chief Financial Officer are invited to attend the Compensation Committee’s meetings as needed to provide their perspectives on the competitive landscape and the needs of the business, information regarding the Company’s performance, and technical advice.

Our Chief Executive Officer provides the Board and the Compensation Committee with his perspective on the performance of our other executive officers and recommends to the Committee specific compensation amounts for those officers. Our Chief Executive Officer also makes recommendations to the Board regarding the allocation among employees of the overall bonus pool and the allocation of the bonus between cash bonuses and awards of the Company’s stock. The Committee considers the Chief Executive Officer’s recommendations along with information provided by its compensation consultant concerning peer group comparisons and industry trends.

The Compensation Committee reviews and recommends to the Board for approval all compensation arrangements of our Chief Executive Officer, in consultation with the compensation consultant it retains. Our Chief Executive Officer is not present when the Compensation Committee and the Board make decisions with respect to his compensation. In addition, in connection with the business combination, we entered into the Stockholder’s Agreement dated May 28, 2009, with Westway Holdings Corporation (“Holdings”), a subsidiary of ED&F Man, pursuant to which we agreed not to approve or ratify our Chief Executive Officer’s compensation or benefits without the approval of Holdings. This obligation continues for so long as Holdings and its affiliates own at least 20% of our outstanding shares of common stock (treating any Series A Convertible Preferred Stock issued in the name of Holdings and its affiliates as having been converted into shares of common stock). Please see “Certain Relationships and Related Transactions - Stockholder’s Agreement” beginning on page 68 of this proxy statement.

In 2009, the Committee retained Board Advisory LLC as its compensation consultant to provide advice, its opinion, and resources to help develop and execute our overall compensation strategy. Board Advisory LLC reported directly to the Compensation Committee, and the Compensation Committee had the sole power to terminate or replace and authorize payment of fees to Board Advisory LLC at any time. As part of its engagement, the Committee directed Board Advisory LLC to work with members of our management to obtain information necessary for it to form its recommendations and evaluate management’s recommendations. Board Advisory LLC also met with the Compensation Committee during the Committee’s regular meetings, in executive session (where no members of management are present), and with the Compensation Committee chair and other members of the Committee outside of the regular meetings.

As part of its engagement in 2009, Board Advisory LLC was asked to evaluate the Company’s peer group for performance and compensation benchmarking, make recommendations regarding the composition of the company’s peer group used in setting compensation guidelines, assess compensation for the Board of Directors, evaluate compensation levels at the peer group companies, and develop the related equity and cash compensation guidelines. The Committee will periodically review its relationship with its compensation consultant. The Committee believes that the consultants it retains are able to provide it with independent advice.

In 2009 and through the date hereof in 2010, with the Compensation Committee’s approval, management engaged Board Advisory LLC to provide the Company with additional services related to compensation matters, including compensation matters related to the development of the Westway Group, Inc. 2010 Incentive Compensation Plan that will be considered by the stockholders at the 2010 annual meeting of stockholders. These services were one-time projects (as opposed to ongoing services).

Board’s Role in Risk Oversight

Management is responsible for managing the risks the Company faces. Our Board of Directors is responsible for overseeing management’s approach to risk management. The involvement of the full Board in

10

reviewing our strategic objectives and plans is a key part of the Board’s assessment of management’s approach and tolerance to risk. While the Board has ultimate oversight responsibility for overseeing management’s risk management process, various Committees of the Board assist it in fulfilling that responsibility.

The Audit Committee assists the Board in its oversight of risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation Committee assists the Board in its oversight of the evaluation and management of risks related to Westway’s compensation policies and practices.

Code of Conduct and Ethics

We have adopted a Code of Conduct and Ethics that applies to all of our employees, including our principal executive officer, principal financial officer, principal accounting officer, controller, and any persons performing similar functions. Our Code of Conduct and Ethics is posted on our website, which is www.westway.com. Also, we will provide to any person without charge, upon request, a copy of our Code of Conduct and Ethics; such request may be made by sending a letter to Mr. Thomas Masilla, Westway Group, Inc., 365 Canal Street, Suite 2900, New Orleans, LA 70130. We intend to satisfy the disclosure requirement under Item 10 of Form 8-K regarding an amendment to, or waiver from, certain provisions of our Code of Conduct and Ethics by posting any such information on our website.

Stockholder Communications with the Board of Directors

We make every effort to ensure that the views of our stockholders are heard by our Board of Directors or individual directors, as applicable. Stockholders may communicate with the Board of Directors, any of its constituent committees, or any member thereof by means of a letter addressed to the Board of Directors, its constituent committees, or individual directors.

All stockholder communications must: (i) be sent to our Corporate Secretary at the address set forth in this proxy statement; (ii) be in writing; (iii) be signed by the stockholder sending the communication, (iv) indicate whether the communication is intended for the entire Board of Directors, a Committee of the Board of Directors, or an individual director; and (v) if the communication relates to a stockholder proposal or director nominee, contain the information required to be provided in connection with any such proposal or nomination by our existing by-laws, which is described below.

If the communication relates to a stockholder proposal, the communication must include:

| | • | | a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting; |

| | • | | the name and address, as they appear on our books, of the stockholder proposing such business; |

| | • | | the class and the number of shares of our stock which are beneficially owned by the stockholder; and |

| | • | | a description of all arrangements or understandings between such stockholder and any other person or persons (including their names) in connection with such business and any material interest of the stockholder in such business. |

If the communication relates to a director nomination, the communication must set forth:

| | • | | as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act (including such person’s written consent to being named as a nominee and to serving as a director if elected); and |

11

| | • | | as to the stockholder giving the notice (i) the name and address, as they appear on our books, of such stockholder, (ii) the class and number of shares of our stock that are beneficially owned by such stockholder, and (iii) a description of all arrangements or understandings between such stockholder and any other person or persons (including their names) in connection with such nomination and any material interest of such stockholder in such nomination. |

Upon receipt of a stockholder communication that is compliant with the requirements identified above, our Corporate Secretary will promptly deliver that communication to the Board of Directors or the Committee or member(s) identified by the stockholder as the intended recipient of such communication. The Corporate Secretary may, in his or her sole discretion and acting in good faith, provide copies of any such stockholder communication to any one or more of our directors and executive officers, except that in processing any stockholder communication addressed to our independent directors, our Corporate Secretary may not copy any member of management in forwarding such communication to such directors.

12

DIRECTOR COMPENSATION

The following table summarizes compensation paid to our non-employee directors for the year ended December 31, 2009.

Director Summary Compensation for Fiscal Year 2009

| | |

Name | | Fees Paid in Cash

for Service as a

Director ($) |

Francis P. Jenkins, Jr. | | 88,900 |

G. Kenneth Moshenek | | 73,500 |

Philip A. Howell | | — |

James B. Jenkins | | — |

Gregory F. Holt | | 74,800 |

John E. Toffolon, Jr. | | 83,900 |

The ED&F Man subsidiaries that comprised the acquired business did not have directors that received compensation in 2009 for their services on a board of directors. Our directors did not receive compensation for services rendered prior to the business combination.

Since the business combination, Messrs. Francis Jenkins, Jr., John Toffolon, Jr., G. Kenneth Moshenek, and Gregory Holt have all received compensation for their service on the Board of Directors, in the form of fees that are paid in advance in cash on an annual basis. Our Chairman, Francis P. Jenkins, Jr., has been paid an additional fee for his service as Chairman of the Board. As an employee director of the Company, Mr. Harding has not received separate compensation for his Board service. Two of our directors, Philip Howell and James Jenkins, have elected to date not to receive compensation for their services as directors. Both are employees of ED&F Man or its affiliates and were appointed as directors by the holder of our Class B common stock. Mr. Howell and Mr. Jenkins could be paid compensation for their services in the future. In that event, it is expected they would be paid amounts consistent with the amounts paid other directors. In addition to any compensation paid, Board members are reimbursed for out-of-pocket expenses incurred in connection with attending Board or Committee meetings.

13

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board currently consists of seven directors. Under our certificate of incorporation and depending on our ownership structure, a certain number of directors must be elected by the holders of Class B common stock and a certain number of directors are to be elected by the holders of Class A common stock. As a result of our current ownership structure, holders of Class A common stock are entitled to elect four members of our Board and the holders of Class B common stock are entitled to elect three members of our Board. Those directors elected by the holders of Class A common stock are divided into three classes, Class I, Class II and Class III, and each class is elected to serve a staggered three-year term. Directors elected by the holders of Class B common stock are elected to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified. Our Board currently consists of one Class I Director (John E. Toffolon, Jr.), one Class II Director (G. Kenneth Moshenek), two Class III Directors (Francis P. Jenkins, Jr. and Peter J.M. Harding) and three directors elected by the holders of Class B common stock (Philip Howell, James Jenkins and Gregory Holt).

The term of office for the Class I Director is set to expire at the 2010 annual meeting. The Nominating Committee has recommended to the Board of Directors, and the Board of Directors has accepted the recommendation of the Nominating Committee, to nominate John E. Toffolon, Jr. for the position of Class I Director. Further, due to uncertainty caused by a possible ambiguity in the by-laws regarding the manner of making director nominations and the power of the Board to make such nominations see “Proposal 2: Amendment to Certificate of Incorporation” beginning on page 18 of this proxy statement) and out of an abundance of caution, Peter J.M. Harding, the holder of 582,569 shares of Class A common stock, has also nominated Mr. Toffolon for the position of Class I Director.

The terms of office for the three directors elected by the holders of shares of Class B common stock are also set to expire at the 2010 annual meeting. Westway Holdings Corporation, the holder of 100% of the shares of Class B common stock, has properly nominated the following individuals to stand for election for the three positions for which holders of Class B common stock are entitled to vote: Philip Howell, James Jenkins and Gregory Holt.

Of the four nominees for director, Messrs. Toffolon and Holt are independent within the meaning of the NASDAQ listing rules. All four nominees are current members of the Board. Each nominee who is re-elected as a director will continue in office until his successor has been duly elected and qualified, or until his earlier death, resignation or removal.

Each holder of shares of Class A common stock may vote “FOR” the nominee for Class I Director or may “WITHHOLD” such stockholder’s vote with respect to that nominee. Each holder of shares of Class B common stock may vote “FOR” all or some of the nominees for whom they are entitled to vote (Messrs. Howell, James Jenkins, and Holt), or may “WITHHOLD” such stockholder’s vote with respect to one or more of the nominees.Directors are elected by the affirmative vote of a plurality of the shares of either Class A or Class B common stock, as applicable, entitled to vote in the election of such director(s).

All of our directors have high-level managerial experience in relatively complex organizations or are accustomed to dealing with complex problems. We believe all of our directors are individuals of high character and integrity, are able to work well with others, and have sufficient time to devote to the affairs of Westway Group Inc. In addition to these attributes, in each individual’s biography set forth below, we have highlighted specific experience, qualifications, and skills that led the Board to conclude that each individual should continue to serve as a director of Westway Group Inc. We have also set forth the other directorships held during the past five years by each director in any public company (i.e., any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of the Exchange Act) or any company registered as an investment company under the Investment Company Act of 1940.

John E. Toffolon, Jr. has served as a member of our Board of Directors since our inception and is the Chairman of our Audit Committee and a member of our Nominating and Compensation Committees. He served

14

as our Chief Financial Officer from August 3, 2006 until May 28, 2009. The Board concluded that Mr. Toffolon should continue to serve as a director of Westway Group, Inc. in part due to his experience as a director and Lead Director with the Cowen Group, Inc. Mr. Toffolon has been an active independent investor and consultant since his resignation from Nomura Holdings, a holding company, in 2001. He started his career in 1973 as a member in the Management Training Program of the Federal Reserve Bank of New York, as the Bank Supervisor function rotating through various analyst positions. In 1978, Mr. Toffolon joined the investment banking firm of Blyth Eastman Dillon as a Vice President in its Capital Markets subsidiary, Blyth Capital Markets Inc. Shortly after Blyth Eastman Dillon’s acquisition by Paine-Webber in 1979, Mr. Toffolon accepted an offer to join The First Boston Corporation to manage its Fixed-Income Credit Department. Mr. Toffolon served as Managing Director of The First Boston Corporation since 1986 and subsequently served as its Chief Financial Officer until 1990. In November 1992, Mr. Toffolon joined Nomura Holding America Inc. (holding company), and Nomura Securities International (broker-dealer) as Executive Managing Director and Chief Financial Officer. He was also a member of the Board of Directors of both companies. Since September 14, 2006, Mr. Toffolon has served as a director of The Cowen Group Inc., which together with its subsidiaries operates as an investment bank. He served as Lead Director from February 2007 until July 2008, and from November 2009 until present, and as Chairman of the Board from July 15, 2008 until November 2009. Subsequent to Cowen being acquired by Ramius LLC, Mr. Toffolon was voted Lead Director on the newly-formed Board of Directors. Mr. Toffolon, after serving the maximum term of 6 years on the Board of Trustees of Fordham University, continues to serve on Fordham’s Board as a Trustee fellow and is also a member of the Board of Trustees of the Berkshire School, a private preparatory school located in Massachusetts. He also serves as Chairman of the Audit Committee and as a member of the Compensation Committee of The Cowen Group Inc.’s Board of Directors.

Philip A. Howell is a member of our Board of Directors. The Board concluded that Mr. Howell should serve as a director of Westway Group, Inc. in part due to his experience with commodities and his role as Main Board Director of ED&F Man. Mr. Howell also currently serves as Director of Corporate Finance and Group Strategy of ED&F Man and has served in this capacity since March 2010. Prior to March 2010, he served as Chief Financial Officer and Chief Operating Officer of ED&F Man, from March 2000 and July 2007 respectively. Mr. Howell also served on ED&F Man’s Audit Committee from 2000 until 2009.Mr. Howell joined ED&F Man in 1990 as finance director of ED&F Man’s futures brokerage business. Mr. Howell qualified as a chartered accountant with Coopers & Lybrand before working for two years with Security Pacific Hoare Govett in its financial control function.

James B. Jenkins is a member of our Board of Directors. The Board concluded that Mr. Jenkins should serve as a director of Westway Group, Inc. in part due to his experience in executive and director roles with various commodity and trading businesses. Mr. Jenkins served as Managing Director of the ED&F Man group’s Commodity Services Division, an integrated research, brokerage and risk management operation, and as a member of ED&F Man’s Executive Committee from November 2005 until September 2009. Prior to his role at ED&F Man Commodity Services, Mr. Jenkins was President of ED&F Man Cocoa, Inc., a merchant of cocoa beans and released products. Mr. Jenkins has 26 years of service in the soft commodities industry. Mr. Jenkins has served as a member of the New York Board of Trade’s Cocoa and Control Committees, and as Chairman of the Board of Directors of the Cocoa Merchants’ Association of America, as well as on a number of the Association’s committees. Mr. Jenkins is not related to Francis P. Jenkins, Jr., our Chairman.

Gregory F. Holt is a member of our Board of Directors and serves as the Chairman of our Nominating Committee and a member of our Audit and Compensation Committees. The Board concluded that Mr. Holt should serve as a director of Westway Group, Inc. in part due to his experience in executive roles of commodity companies. Mr. Holt has served as the founding Principal, Chairman and Chief Executive Officer since inception in 1990 of Daybrook Holdings Inc. and Daybrook Fisheries Inc., a North American/Dutch owned Menhaden fishmeal and fish oil production company headquartered in Louisiana. Prior to that, from 1969 to 1985 he served as a senior officer of International Proteins Corporation, an American Stock Exchange listed company engaged in the production of fishmeal, fish oil and frozen shrimps in Peru, Chile, Panama and Canada and the trading of various agri-products, protein meals and feedstuffs. In 1985 he founded his own trading, shipping and financing

15

firm, ultimately raising the capital necessary to commence the operations of the Daybrook companies. He has served on numerous industry boards and trade associations, including National Fisheries Institute and The International Fishmeal and Fish Oil Association, and is a past Co-Chairman of the Rutgers University Marine Aquaculture Funding Task Force. Mr. Holt has served as an advisor/investor in various capital asset commodity transactions designed to acquire strategic manufacturing capacity in these core businesses in Latin America and import/export commodity terminal distribution operations in the United States. Mr. Holt, a United States citizen, was born in the United Kingdom and moved to the United States in 1969.

Our Board of Directors recommends a vote “FOR” the election to the Board of each of the foregoing nominees.

16

DIRECTORS CONTINUING IN OFFICE UNTIL OUR 2011 ANNUAL MEETING

G. Kenneth Moshenekhas served as a member of our Board of Directors since our inception and is a member of our Audit, Compensation and Nominating Committees. Mr. Moshenek served as our President and Chief Operating Officer from our inception until May 2009. The Board concluded that Mr. Moshenek should serve as a director of Westway Group, Inc. in part due to his executive experience with commodities and mergers and acquisitions. Mr. Moshenek served as the President of Unity Envirotech LLC, a company servicing the commercial fertilizer and municipal wastewater markets, from October 2006 to December of 2007. Mr. Moshenek served as the President and Chief Operating Officer of Royster-Clark, Inc., a retailer and wholesale distributor of mixed fertilizer, fertilizer materials, seed, crop protection products and agronomic services to farmers, from December 1997 to February 2006. Mr. Moshenek had served as Chief Operating Officer since 1995 and was a director from August 1997 until April 1999 of Royster-Clark, Inc. From August 1997 until April 1999, he served as Chief Investment Officer of Royster-Clark, Inc. Prior to that he held several positions during his tenure with Royster-Clark, Inc., including Senior Vice President of Sales and Marketing from September 1994 until July 1995, Vice President and Divisional Sales Manager from 1992 until September 1994 and a Division Manager from 1990 to 1992. Mr. Moshenek joined W.S. Clark & Sons, Inc. in 1981. Mr. Moshenek has been involved in the fertilizer industry since 1976. Mr. Moshenek formerly served on the Board of Directors of The Fertilizer Institute and was a member of that Board’s Executive Committee and served as Chairman of the Distributors Council. He also formerly served on the Board of Directors of the Agricultural Retailers Association, the Foundation of Agronomic Research and the Fertilizer Roundtable.

DIRECTORS CONTINUING IN OFFICE UNTIL OUR 2012 ANNUAL MEETING

Francis P. Jenkins, Jr.has served as our Chairman and a member of our Board of Directors since our inception and is the Chairman of our Compensation Committee. Mr. Jenkins served as our Chief Executive Officer from our inception until May 2009. The Board concluded that Mr. Jenkins should serve as a director of Westway Group, Inc. in part due to his executive experience within financial and commodity companies. He served as the Chairman of the Board and Chief Executive Officer of Royster-Clark, Inc., a retailer and wholesale distributor of mixed fertilizer, fertilizer materials, seed, crop protection products and agronomic services to farmers, from January 1994 to 2006. From 1988 until 1994, Mr. Jenkins served in various capacities on the Board of Directors for Royster-Clark, Inc. From 1988 to 1992, he served as Chairman of the Board of Royster-Clark, Inc. From 1979 to 1988, Mr. Jenkins was employed by The First Boston Corporation, where he was one of the four members of the Executive Committee, co-managed First Boston’s Equity Capital Investments and was the principal financial officer. Prior to that position, he had responsibility for all security sales, trading and research, as well as holding positions as a Managing Director and a member of the Management Committee. Mr. Jenkins currently serves on the Board of Trustees of Babson College, as the Chairman of its Alumni and Development Committee and as a member of the Executive Committee of the Board.

Peter J.M. Harding is our Chief Executive Officer and a member of our Board of Directors. The Board concluded that Mr. Harding should serve as a director of Westway Group, Inc. in part due to his experience in executive roles of commodity companies as well as his prior affiliation with ED&F Man and because he is our Chief Executive Officer. Prior to May 2009, he served as Managing Director of the ED&F Man group’s Molasses & Palm Oil Trading, Feed Products, Third Party Storage, Biofuels Division from 2003. Mr. Harding also served on the Executive Committee of ED&F Man. Mr. Harding joined the ED&F Man group in June 1995. A British citizen presently residing in New Orleans, Louisiana, Mr. Harding has diverse career experience beginning in 1972 as a sugar trader with Tate and Lyle Sugars. His accomplishments include Vice President of Sales & Marketing of Refined Sugars, Inc. from 1985 to 1989, CEO of Savannah Cocoa, Inc. from 1992 to 1995, CEO of ED&F Man North American Cocoa Processing Group from 1995 to 1997, CEO of Westway Holdings Corporation from 1997 to 2006, and President of Westway Terminal Company Inc. from 2001 to 2004. During his tenure as CEO of Westway Holdings Corporation, Mr. Harding was responsible for management of the Westway Terminal Company Inc., Westway Feed Products Inc. and Westway Trading Corp. Additionally, Mr. Harding owned and managed an asset management firm and commodity fund during the late 1980s and early 1990s. In 1985, Mr. Harding attended the Harvard Business School program for Management Development.

17

PROPOSAL 2: AMENDMENT TO CERTIFICATE OF INCORPORATION

Introduction

The following proposal to amend our certificate of incorporation is made by our Board of Directors and separately by Francis P. Jenkins, Jr., one of our Class A stockholders, who is also our Chairman.

Our stockholders are being asked to approve an amendment to our certificate of incorporation. In the judgment of our Board of Directors, the proposed amendment is advisable to remove a possible ambiguity from our certificate of incorporation regarding the vote required to amend certain provisions of our by-laws. Our Board of Directors has unanimously approved, and recommends that our stockholders approve, a proposal to amend section 8.4 of our certificate of incorporation.

Description of and Reason for Proposed Amendment to Certificate of Incorporation

Our certificate of incorporation authorizes our Board of Directors to make, alter, amend and repeal our by-laws by majority vote, subject to the power of our stockholders to make, alter, amend or repeal the by-laws; however, special voting restrictions apply to any proposed amendment to section 9.1 (Power to Amend) and Articles II (Meetings of Stockholders) and III (Directors). Under our certificate of incorporation, Section 9.1 and Articles II and III may be amended or repealed only (i) by our Board of Directors by a vote of the directors that includes the affirmative votes of a majority of the directors elected by the holders of our Class A common stock and a majority of the directors elected by the holders of our Class B common stock, and (ii) by our stockholders at an annual or special meeting called for such purpose by the affirmative votes by holders of at least a majority of the voting power of our Class A common stock and by holders of at least a majority of the voting power of our Class B common stock. Our Board of Directors believes that the intention of the by-laws is that section 9.1 and Articles II and III may be amendedeither by the requisite vote of the Board described in clause (i) above,or by the requisite vote of the stockholders described in clause (ii) above. To make this intention clearer, we are proposing to amend Section 8.4 to delete the word “and” between clauses (i) and (ii) and to substitute in its place the word “or,” as follows:

8.4. Amendment of By-Laws. In furtherance and not in limitation of the powers conferred by law, the Board of Directors is expressly authorized to make, alter, amend and repeal the Bylaws, subject to the power of stockholders of the Corporation to make, alter, amend or repeal the Bylaws;provided,however, that Section 9.1 and Articles II and III of the By-Laws may be amended or repealed, and new By-Laws may be adopted that would supersede, limit or otherwise alter the effect of Section 9.1 or Articles II and III of the By-Laws, only (i) by the Board of Directors by a vote of the directors that includes the affirmative votes of a majority of the directors elected by the holders of shares of Class A Common Stock and a majority of the directors elected by the holders of shares of Class B Common Stock, andor (ii) by the stockholders at an annual or special meeting called for such purpose by the affirmative votes by holders of at least a majority of the voting power of the shares of Class A Common Stock and by holders of at least a majority of the voting power of the shares of Class B Common Stock.

The amendment to Section 8.4 will make clearer the power of either the Board or the stockholders acting alone to amend Section 9.1 and Articles II and III of the by-laws from time to time, provided any such change to the by-laws is approved by the requisite class votes described above.

If the amendment to the certificate of incorporation is approved, the Board expects to adopt certain amendments to the by-laws, as follows:

| | • | | The Board expects to amend the by-laws to correct an inconsistency between Section 2.2 and Section 2.9 of the by-laws. Section 2.2 addresses, among other things, nominations of persons for election as directors and proposals for business to be conducted at the annual meeting, in each case as specified in a notice of meeting given at the direction of the Board of Directors or otherwise properly |

18

| | brought at the direction of the Board. Section 2.9 provides certain procedures with respect to nominations and proposals made by stockholders. Read literally, paragraphs (c) and (d) of section 2.9 might be construed to mean (among other things) that all nominations of persons for election as directors and all proposals for business to be conducted at the annual meeting must be made by stockholders and not by the Board of Directors. This reading of section 2.9 is inconsistent with section 2.2. Accordingly, if the amendment to the certificate of incorporation is approved, the Board is expected to approve an amendment to the by-laws to make clearer the power of the Board of Directors to make nominations and propose business for consideration at the annual meeting. |

| | • | | The Board also expects to amend our by-laws to establish the office of “Chief Operating Officer” and to divide between the Chief Executive Officer and Chief Operating Officer the responsibilities that our by-laws currently assign to the president. As a result, the title “President” will be eliminated in favor of “Chief Operating Officer.” |

| | • | | The Board is also expected to make non-substantive changes to the by-laws to correct section references and cross-references. |

The Board does not currently contemplate making other changes to the by-laws.

Vote Required and Effective Date

Under the Delaware General Corporation Law, the approval of the proposed amendment to our certificate of incorporation requires the affirmative vote of a majority of the outstanding shares of our common stock. Under our certificate of incorporation, the approval of the proposed amendment will also require the affirmative majority vote of the holders of the Class A common stock, voting as a separate class, and the affirmative majority vote of the holders of the Class B common stock, voting as a separate class.

If approved by our stockholders, the amendment to our certificate of incorporation will become effective upon its filing with the Secretary of State of the State of Delaware, which we expect to occur promptly after the stockholder vote on the amendment.

Recommendation

Our Board of Directors unanimously recommends that our stockholders vote “FOR” the approval of the proposal to amend our certificate of incorporation.

19

PROPOSAL 3: APPROVAL OF THE WESTWAY GROUP, INC.

2010 INCENTIVE COMPENSATION PLAN

At the annual meeting, stockholders will be asked to approve the Westway Group, Inc. 2010 Incentive Compensation Plan, a copy of which is attached asAppendix A (the “2010 Plan”). The proposal to approve the 2010 Plan is made by our Board of Directors and separately by Francis P. Jenkins, Jr., one of our Class A stockholders, who is also our Chairman.

Our Board of Directors, upon the recommendation of the Compensation Committee, approved and adopted the 2010 Plan on April 14, 2010, to be effective as of January 1, 2010, subject to the approval of the 2010 Plan by our stockholders. Pursuant to the NASDAQ listing rules, the 2010 Plan requires the approval of our stockholders. In addition, the 2010 Plan must be approved by our stockholders for payments to certain executive officers under the 2010 Plan to be deductible by us for federal income tax purposes.

The 2010 Plan is an element of our overall compensation strategy to align employee compensation with our business objectives, strategy, and performance. The purpose of the 2010 Plan is to align compensation with annual performance and to enable us to attract, retain, and reward highly qualified individuals who contribute to our success and motivate them to enhance the value of the company. The 2010 Plan is designed to reward employees for both individual performance and the success of the company as a whole.

The 2010 Plan reserves for awards a number of shares equal to ten percent (10%) of the number of shares of Class A common stock, Class B common stock, and Series A Convertible Preferred Stock of the Company outstanding on January 1st of each Plan year available for awards under the Plan and for issuance to non-employee Directors under the Plan. Equity awards to key employees under the 2010 Plan may be granted as restricted stock, performance share units, stock appreciation rights or stock options.

As described below under “Code Section 162(m),” Section 162(m) of the Internal Revenue Code of 1986 (the “Code”) denies a tax deduction to public companies for compensation paid to certain “covered employees” in a taxable year to the extent the compensation paid to a covered employee exceeds $1,000,000, unless the 2010 Plan contains certain features that qualify the compensation as “performance-based compensation.” The 2010 Plan is intended to satisfy the requirements for “performance-based compensation” as required by Section 162(m) of the Code. One of the requirements of “performance-based compensation” is that compensation be paid pursuant to a compensation plan that has been approved by the company’s stockholders. This is the first year we are asking stockholders to approve the 2010 Plan.

The Board believes approval of the 2010 Plan is in the best interest of the company and its stockholders. The 2010 Plan motivates and rewards our employees for achievement of strategic, operational and financial goals that drive stockholder value, and will be structured to be advantageous for federal income tax purposes.

If the 2010 Plan is not approved by stockholders, it is currently contemplated that we would pay bonuses to our executive officers in cash; however, any such bonuses to “covered employees” would not be deductible under Section 162(m) of the Code to the extent that (in combination with other non-exempt compensation, e.g., salary) they exceed the $1,000,000 limit. The Compensation Committee estimates that, if the 2010 Plan is not approved by the stockholders, up to $1,060,000 in bonuses paid with respect to 2010 would not be deductible.

A summary of the 2010 Plan is set forth below. The discussion below is qualified in its entirety by reference to the 2010 Plan, a copy of which is attached asAppendix A to this proxy statement.

The following description of the 2010 Plan may contain statements regarding corporate performance targets and goals. These targets and goals are disclosed in the limited context of our proposed 2010 Plan and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.

20

Summary of the Plan