Filed Pursuant to Rule 424(b)(3)

File Number 333-140692

PROSPECTUS SUPPLEMENT NO. 1

to Prospectus dated February 12, 2008

(Registration No. 333-140692)

ASIA TIME CORPORATION

This Prospectus Supplement No. 1 supplements our Prospectus dated February 12, 2008. The securities that are the subject of the Prospectus have been registered to permit their resale to the public by the selling security holders named in the Prospectus. We are not selling any securities in this offering and therefore will not receive any proceeds from this offering. You should read this Prospectus Supplement No. 1 together with the Prospectus.

This Prospectus Supplement No. 1 includes the attached report, as set forth below, as filed by us with the Securities and Exchange Commission (the “SEC”): Annual Report on Form 10-K filed with the SEC on March 31, 2008.

Our common stock is traded on the American Stock Exchange under the symbol “TYM.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement No. 1 is April 14, 2008.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 |

OR |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM _______ TO ___________ |

COMMISSION FILE NO. 001-33956

ASIA TIME CORPORATION

(Exact Name Of Registrant As Specified In Its Charter)

Delaware | 20-4062619 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Room 1601-1604, 16/F., CRE Centre 889 Cheung Sha Wan Road, Kowloon, Hong Kong | N/A | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (852)-23100101

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.0001 par value | American Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

The registrant’s common stock commenced trading on the American Stock Exchange on February 12, 2008. The aggregate market value of the registrant's issued and outstanding shares of common stock held by non-affiliates of the registrant as of March 3, 2008 (based on the price at which the registrant’s common stock was last sold on such date) was approximately $24,449,363.

There were 24,684,649 shares outstanding of the registrant’s common stock, par value $.0001 per share, as of March 15, 2008. The registrant’s common stock is listed on the American Stock Exchange under the ticker symbol “TYM.”

DOCUMENTS INCORPORATED BY REFERENCE: The information required by Part III of Form 10-K is incorporated by reference from the registrant's definitive proxy statement on Schedule 14A that will be filed no later than the end of the 120-day period following the registrant's fiscal year end, or, if the registrant's definitive proxy statement is not filed within that time, the information will be filed as part of an amendment to this Annual Report on Form 10-K/A, not later than the end of the 120-day period.

ASIA TIME CORPORATION

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2007

ITEM | Page | |||||

PART I | 2 | |||||

| Item 1. | Business | 2 | ||||

| Item 1A. | Risk Factors | 6 | ||||

| Item 1B. | Unresolved Staff Comments | 18 | ||||

| Item 2. | Properties | 18 | ||||

| Item 3. | Legal Proceedings | 19 | ||||

| Item 4. | Submission of Matters to a Vote of Security Holders | 19 | ||||

PART II | 20 | |||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 20 | ||||

| Item 6. | Selected Financial Data | 22 | ||||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 23 | ||||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 36 | ||||

| Item 8. | Financial Statements and Supplementary Data | 37 | ||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 37 | ||||

| Item 9A. | Controls and Procedures | 37 | ||||

| Item 9B. | Other Information | 38 | ||||

PART III | 39 | |||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 39 | ||||

| Item 11. | Executive Compensation | 39 | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 | ||||

| Item 14. | Principal Accounting Fees and Services | 39 | ||||

PART IV | 39 | |||||

| Item 15. | Exhibits, Financial Statement Schedules | 39 | ||||

| Signatures | 40 | |||||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this report, including in the documents incorporated by reference into this report, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our and their management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties’ control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following:

| · | Dependence on a limited number of suppliers; |

| · | Cyclicality of our business; |

| · | Decline in the value of our inventory; |

| · | Significant order cancellations, reductions or delays; |

| · | Competitive nature of our industry; |

| · | Vulnerability of our business to general economic downturn; |

| · | Our ability to obtain all necessary government certifications and/or licenses to conduct our business; |

| · | Development of a public trading market for our securities; |

| · | The cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; |

| · | Costs and expenses related to the Bonds and Bond Warrants; and |

| · | The other factors referenced in this report, including, without limitation, under the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” |

These risks and uncertainties, along with others, are also described below under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1

PART I

Item 1. Business

Overview

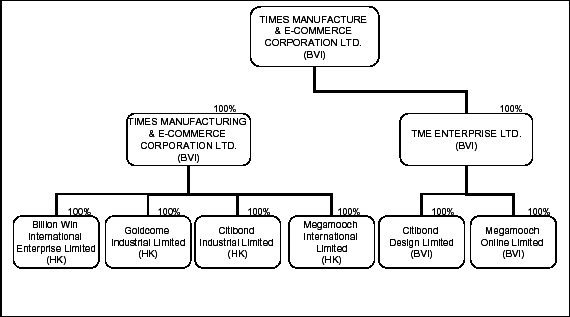

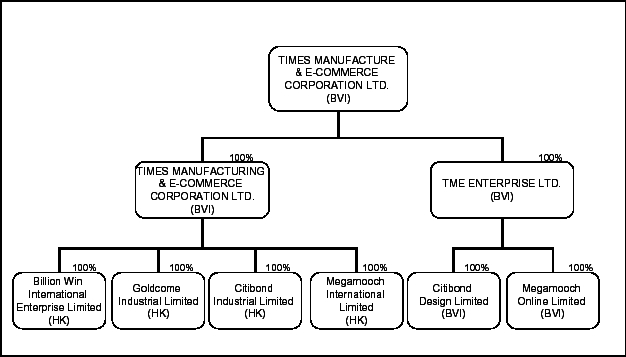

With respect to this discussion, the terms “we” and “our” refer to Asia Time Corporation, its 100%-owned subsidiary Times Manufacture & E-Commerce Corporation Limited, a British Virgin Islands corporation, (“Times Manufacture”) and its subsidiaries, Times Manufacturing & E-Commerce Corporation Ltd., TME Enterprise Ltd., Citibond Design Ltd. and Megamooch Online Ltd., each of which is a British Virgin Islands corporation, and the Hong Kong corporate subsidiaries Billion Win International Enterprise Ltd., Goldcome Industrial Ltd., Citibond Industrial Ltd., and Megamooch International Ltd. Times Manufacture was founded in March 2002 and is based in Hong Kong.

Our Company

We are a distributor of watch movements components used in the manufacture and assembly of watches to a wide variety of timepiece manufacturers. Our core customer base consists primarily of wholesalers, and medium-to-large sized watch manufacturers that produce watches primarily for consumer sale. To a lesser extent, we design watches for manufacturers and exporters of watches and manufacture and distribute complete watches primarily to internet marketers.

We have distribution centers and strategically located sales offices throughout Hong Kong and the People’s Republic of China (“China” or “PRC”). We distribute more than 350 products from over 30 vendors, including such market leaders as Citizen Group, Seiko Corporation and Ronda AG, to a base of over 300 customers primarily through our direct sales force. As a part and included in our sale of watch movements, we provide a variety of value-added services, including automated inventory management services, integration, design and development, management, and support services.

Our Industry

A typical watch manufacturing process begins with the watch being designed, either from scratch or based on a chosen watch movement according to the required features. For example, if a watch manufacturer wants to design a three-hand chronograph with split-second, three dials and date, they will source the watch movements that meet these requirements and design the watch according to the specifications of this movement. Next in the process is the sourcing, purchasing or manufacture of the required components, including the watch case, watch movement, strap and crown. The last steps in the process are the assembly of the watch components, followed by testing and quality control.

Except for the largest watch manufactures, such as Citizen, Seiko, and Swatch, which produce and use their own watch movements, most watch manufacturers source and purchase the movements in the market.

In the watch manufacturing process, we provide watch movements directly to the manufacturers or through movement wholesalers, assisting the manufacturers to source the movement by providing technical information, advise, and pricing. We also assist provide our customers with watch design and technical assistance.

There are two categories of watch movements, quartz and mechanical. The main parts of an analog quartz watch movement are the battery; the oscillator, a piece of quartz that vibrates in response to the electric current; the integrated circuit, which divides the oscillations into seconds; the stepping motor, which drives the gear train; and the gear train itself, which makes the watch’s hands move. A digital watch movement has the same timing components as an analog quartz movement but has no stepping motor or gear train.

The main parts of a mechanical watch movement are the winding mechanism; the mainspring, which is the source of the watch’s power; the gear train, which transmits power from the mainspring to the escapement and drives the watch’s minutes and seconds hands; the escapement, which distributes power to the oscillator (i.e., the balance) and controls how fast the mainspring unwinds; the balance itself, which measures out time by vibrating at a steady rate; and the motion works, which moves the watch’s hour hand.

2

Most mechanical and quartz analog watch movements are made by one of three companies: Japan’s Citizen and Seiko, or Switzerland’s ETA, which is owned by the Swatch Group watch conglomerate. There are several smaller watch movement companies: Ronda, ISA, and others. Digital watch movements are made by various companies, most of them in China. Most watch manufacturers buy the movements, case them and sell them under their own brand names.

Watch movement distributors relieve movement manufacturers of a portion of the costs and personnel needed to warehouse, sell and deliver their products. Distributors market movement manufacturers’ products to a broader range of customers than such manufacturers could economically serve with their direct sales forces. Today, movement distributors have become an integral part of a watch manufacturer’s purchasing and inventory processes. Generally, companies engaged in the distribution of watch movement components, including us, are required to maintain a relatively significant investment in inventories and accounts receivable to be responsive to the needs of customers. To meet these requirements, we, as well as other companies in our industry, typically depend on internally generated funds as well as external sources of financing.

Products

We currently offer over 350 items. Our products primarily consist of watch movements and, to a lesser extent, complete watches.

Watch Movements

We primarily distribute quartz watch movements that were produced primarily in Switzerland and Japan. All quartz watch movements distributed by our company are multi-function and have three hands. The watch movements have high adaptability so that a range of watches, from inexpensive to luxury, may be made from the same watch movement. To a lesser extent, we also offer mechanical movements manufactured by Citizen and Tsinlien Sea Gull Co. Ltd. For the year ended December 31, 2007, we acquired most of our watch movement products from the following two manufacturers: Citizen Miyota Co., Ltd., which is a member company in the Citizen Group, supplied 63% and Seiko Corporation supplied 27%. The next highest supplier was Hip Shun Industrial (HK) Ltd., which supplied us with less than 4% of our watch movements.

Complete Watches

To a lesser extent we also distribute complete analog-quartz and automatic watches with pricing between $20.00 to $50.00. Manufacturing for these watches is currently outsourced to third party factories in China. Our top three brand names include NxTime, SIDIO and Marcellus. The watches are primarily designed by U.S. designers and range from fashion watches to classic designs. Watches can either be made-to-order or design-to-order.

Strategy

Our goal is to be a leading watch movement and timepiece distributor in Hong Kong and China through the following strategies.

Offer wide-ranging product spectrum to customers. Management estimates that it can increase revenues by broadening our product spectrum and offering more brands of quartz movement to customers. Apart from quartz movement, we intend to offer mechanical movements. By broadening our product spectrum, we hope to increase our market share through sales to manufacturers of high-end watches utilizing sophisticated mechanical movements. We plan to source other brands of quartz and mechanical movement in order to broaden our product spectrum. The number of brands and products that we plan to introduce will depend on the terms and conditions offered by our suppliers.

Manufacture branded proprietary watch movements. To further diversify our product offering and reduce our reliance on third party watch movement manufacturers, we eventually hope to manufacture our own brands of quartz movements and high end mechanical movements in-house. We estimate that our company can replace a portion of our current third-party watch movement sales with our own brand movements, watch movements manufactured in-house would be higher margin offerings than distributed products of third-party suppliers. In addition, in-house manufacturing will allow product offerings at more competitive price points which we believe will enhance our competitive position. To manufacture our own brands of quartz and mechanical movements in-house, would need to acquire watch movement facilities in China and invest in new equipments and research and development. We expect that up to $5.5 million will be required to obtain the equipment and facilities to manufacture branded proprietary watch movements. Our plan to acquire manufacturing facilities and equipment to manufacture our own brand of quartz and mechanical movements in-house is still underway and we have identified certain targets for negotiations and will disclose in due course.

3

Developing closer relationships with product brands owners and distributors. We believe it is important for our company to develop closer relationships with product brand owners and its distributors, which we believe would lead to more competitive pricing and stable supply of products. We also have plans to develop closer relationships with our existing brands and distributors by expanding our sales force. We commenced expansion of our sales force in the fourth quarter of 2007 and will continue in 2008.

Expand the distribution of complete watches. Currently, the distribution of complete watches represents less than 12% of our revenues. As part of our expansion plan, we intend to expand our sales and marketing efforts in China. We believe that a heightened focus in this area can lead to an increase in market share and enhance our earning capacity. It is expected that these watches will be marketed through a lower to middle pricing strategy, with sales price range from US$100-$200. We plan to appoint watch distributors in larger China cities in the next two years to expand the distribution of our complete watches.

Value-Added Services

As a part of and included in our sale of watch movements, we provide a number of value-added services which are intended to attract new customers and to maintain and increase sales to existing customers. These value-added services include:

| — | Automated inventory management services. We manage our customers’ inventory reordering, stocking and administration functions. We believe these services reduce paperwork, inventory, cycle time and the overall cost of doing business for our customers. The automated inventory management services are provided through our computer system through which we can manage our customer’s inventory reordering, stocking and administration functions. We believe this helps us to provide better service to our customers by understanding their stock level, purchase behavior and allows us to be more responsive to their demands and queries. |

| — | Integration. Our sales specialists work directly with our customers to develop and deliver customized solutions and technical support to meet specific requirements for our customers’ applications. We are able to offer customers a one-stop source for their integration needs. |

Sales and Marketing

Watch Movements

We believe we have developed valuable long-term customer relationships and an understanding of our customers’ requirements. Our sales personnel are trained to identify our customers’ requirements and to actively market our entire product line to satisfy those needs. We serve a broad range of wholesalers, medium to small watch manufacturers and volume users in China and Hong Kong. We have established inventory management programs to address the specific distribution requirements of our customers.

As a distributor for leading watch movement manufacturers, we are able to offer technical support as well as a variety of supply chain management programs. Technical support and supply chain management services enhance our ability to attract new customers. Many of our services revolve around our use of software automation, computer-to-computer transactions through Internet-based solutions, technically competent product managers and business development managers.

Sales are made throughout China and Hong Kong from the sales departments maintained at our distribution facilities located in Hong Kong and from strategically located sales offices. Sales are made primarily through personal visits by our employees and telephone sales personnel who answer inquiries and receive and process orders from customers. Sales are also made through general advertising, referrals and marketing support from component manufacturers.

4

Complete Watches

Currently, the main distribution channels of our watches are US direct marketers, online retailers and China department stores. As part of our expansion plan, we intend to increase our focus on China’s complete watch market along with exportation to overseas markets.

With our foothold in Southern China, we intend further develop Eastern China and Northern China regions so as to cover the entire China market in complete watches.

We intend continue to outsource the production of complete watches to third parties. As part of our integrated efforts, we intend to supply these manufacturers with watch movements.

We are also exploring opportunities to establish a retail network in China through teaming up with fashion, apparel or accessories chain stores to market our completed watches in China.

Suppliers

Manufacturers of watch movements are increasingly relying on the marketing, customer service, technical support and other resources of distributors who market and sell their product lines to customers not normally served by the manufacturer, and to supplement the manufacturer’s direct sales efforts for other accounts often by providing value-added services not offered by the manufacturer. Manufacturers seek distributors who have strong relationships with desirable customers, have the infrastructure to handle large volumes of products and can assist customers in the design and use of the manufacturers’ products. Currently, we have stable supplies from many manufacturers, including Miyota, Seiko, Ronda and Suissebaches. We continuously seek to identify potential new suppliers. During the year ended December 31, 2007, products purchased from our ten largest suppliers accounted for 92% of our total net purchases.

Operations

Inventory management is critical to a distributor’s business. We constantly focus on a high number of resales or “turns” of existing inventory to reduce our exposure to product obsolescence and changing customer demand.

Our central computer system facilitates the control of purchasing and inventory, accounts payable, shipping and receiving, and invoicing and collection information for our distribution business. Our distribution software system includes financial systems, customer order entry, purchase order entry to manufacturers, warehousing and inventory control. Each of our sales departments and offices is electronically linked to our central computer systems, which provide fully integrated on-line, real-time data with respect to our inventory levels. We track inventory turns by vendor and by product, and our inventory management system provides immediate information to assist in making purchasing decisions and decisions as to which inventory to exchange with suppliers under stock rotation programs. In some cases, customers use computers that interface directly with our computers to identify available inventory and to rapidly process orders. Our computer system also tracks inventory turns by customer. We also monitor supplier stock rotation programs, inventory price protection, rejected material and other factors related to inventory quality and quantity. This system enables us to more effectively manage our inventory and to respond quickly to customer requirements for timely and reliable delivery of components.

Competition

The watch movement distribution industry is highly competitive, primarily with respect to price, product availability, knowledge of product and quality of service. We believe that the breadth of our customer base, services and product lines, our level of technical expertise and the overall quality of our services are particularly important to our competitive position. We compete with large distributors such as National Electronics Holding Ltd., as well as mid-size distributors, such as PTS Resources Ltd., many of whom distribute the same or competitive products as we do.

5

Our major competitors in complete watches include designer brands from overseas, China and Hong Kong such as Guess, Calvin Klein and Dolce & Gabanna.

Backlog

As is typical of watch movement distributors, we have a backlog of customer orders. At December 31, 2007, we had a backlog of approximately $3.5 million as compared to a backlog of approximately $1.4 million at December 31, 2006. We believe that a substantial portion of our backlog represents orders due to be filled within the next 90 days. In recent years, the trend in our industry has been toward outsourcing, with more customers entering into just-in-time contracts with distributors, instead of placing orders with long lead times. As a result, the correlation between backlog and future sales is changing. In addition, we have increased our use of transactions where we purchase inventory based on electronically transmitted forecasts from our customers that may not become an order until the date of shipment and, therefore, may not be reflected in our backlog. Our backlog is subject to delivery rescheduling and cancellations by the customer, sometimes without penalty or notice. For the foregoing reasons our backlog is not necessarily indicative of our future sales for any particular period.

Employees

At December 31, 2007, we had a total of 35 full-time employees. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

Available Information

Our principal executive offices are located at Room 1601-1604, 16/F., CRE Centre, 889 Cheung Sha Wan Road, Kowloon, Hong Kong. Our telephone number is (852) 23100101. Our Internet address is www.asiatimecorp.com. We make available free of charge on or through our Internet Website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Item 1A. Risk Factors

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this report before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. Our shares of common stock are currently listed for trading on the American Stock Exchange under the ticker symbol “TYM.” The trading price could decline due to any of these risks, and an investor may lose all or part of his or her investment. Some of these factors have affected our financial condition and operating results in the past or are currently affecting us. This report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below and elsewhere in this report.

RISKS RELATED TO OUR OPERATIONS

We are dependent on a limited number of suppliers. Loss of one or more of our key suppliers could harm our ability to manufacture and deliver our products to our customers, which would have a material adverse effect on our business.

We rely on a limited number of suppliers for products that generate a significant portion of our sales. During the year ended December 31, 2007, products purchased from our 10 largest suppliers accounted for 92% of our total net purchases. Substantially all of our inventory has been and will be purchased from suppliers with which we have entered into non-exclusive distribution agreements. Moreover, most of our distribution agreements are cancelable upon short notice. As a result, in the event that one or more of those suppliers experience financial difficulties or are not willing to do business with us in the future on terms acceptable to management, our ability to manufacture and deliver our products to our customers would be harmed, which would result in a material adverse effect on our business, results of operations or financial condition. Additionally, our relationships with our customers could be materially adversely affected because our customers depend on our distribution of watch movements from the industry’s leading suppliers.

6

Our industry is highly cyclical, and an industry downturn could limit our ability to generate revenues and have a material adverse effect on our business.

The watch movement distribution industry and, in particular, the timepiece manufacturing industry has historically been affected by general economic downturns and fluctuations in product supply and demand, often associated with changes in technology and manufacturing capacity. These industry cycles and economic downturns have often had an adverse economic effect upon manufacturers, end-users of watch movements and watch movement distributors, including our company. We cannot predict the timing or the severity of the cycles within our industry, or how long and to what levels any industry downturn and/or general economic weakness will last or be exacerbated by terrorism or war or other factors on our industry. Our revenues closely follow the strength or weakness of the timepiece market, and future downturns in this industry, would have a material adverse effect on our business, results of operations and financial condition.

Rapid technological change and new and enhanced products could cause declines in the value of our inventory or result in obsolescence of our inventory.

The watch movements industry is subject to rapid technological change, new and enhanced products and evolving industry standards, which can contribute to a decline in value or obsolescence of inventory. During an industry and/or economic downturn, it is possible that prices will decline due to an oversupply of product and, therefore, there may be greater risk of declines in inventory value. We cannot assure you that unforeseen new product developments or declines in the value of our inventory will not materially adversely affect our business, results of operations or financial condition, or that we will successfully manage our existing and future inventories.

We make commitments regarding the level of business we sill seek and accept, including production schedules and personnel levels, and significant order cancellations, reductions, or delays by our customers could materially adversely affect our commitments and business.

Our sales are typically made pursuant to individual purchase orders, and we generally do not have long-term supply arrangements with our customers, but instead work with our customers to develop nonbinding forecasts of future requirements. Based on these forecasts, we make commitments regarding the level of business that we will seek and accept, the timing of production schedules and the levels and utilization of personnel and other resources. A variety of conditions, both specific to each customer and generally affecting each customer’s industry, may cause customers to cancel, reduce or delay orders that were either previously made or anticipated. Generally, customers may cancel, reduce or delay purchase orders and commitments without penalty, except for payment for services rendered or products competed and, in certain circumstances, payment for materials purchased and charges associated with such cancellation, reduction or delay. Significant or numerous order cancellations, reductions or delays by our customers could have a material adverse effect on our business, financial condition or results of operations.

The market for our products is very competitive and, if we cannot effectively compete, our business will be harmed.

The market for our products is very competitive and subject to rapid technological change. We compete with many other distributors of watch movements and complete watches many of which are larger and have significantly greater assets, name recognition and financial, personnel and other resources than we have. As a result, our competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. Occasionally, we compete for customers with many of our own suppliers and additional competition has emerged from, fulfillment companies, catalogue distributors and e-commerce companies, including on-line distributors and brokers, which have grown with the expanded use of the Internet. We cannot assure you that we will be able to maintain or increase our market share against the emergence of these or other sources of competition. Failure to maintain and enhance our competitive position could materially adversely affect our business and prospects.

7

Additionally, prices for our products tend to decrease over their life cycle. This reduces resale per component sold. There is also continuing pressure from customers to reduce their total cost for products. Our suppliers may also seek to reduce our margins on the sale of their products in order to increase their own profitability or to be competitive with other suppliers of comparable product. We incur substantial costs on our value-added services required to remain competitive, retain existing business and gain new customers, and we must evaluate the expense of those efforts against the impact of price and margin reductions.

Substantial defaults by our customers on accounts receivable or the loss of significant customers could have a material adverse effect on our liquidity and results of operations.

A substantial portion of our working capital consists of accounts receivable from customers. If customers responsible for a significant amount of accounts receivable were to become insolvent or otherwise unable to pay for products and services, or to make payments in a timely manner, our liquidity and results of operations could be materially adversely affected. An economic or industry downturn could materially adversely affect the servicing of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. A significant deterioration in our ability to collect on accounts receivable could also impact the cost or availability of financing available to us.

We are dependent on Japanese manufacturers for our watch movements and subject to trade regulations which expose us to political and economic risk.

Approximately 90% of watch movements that we sell are manufactured by Japanese companies. As a result, our ability to sell certain products at competitive prices could be adversely affected by any of the following:

| · | increases in tariffs or duties on imports from Japan; |

| · | changes in trade treaties between Japan and Hong Kong; |

| · | strikes or delays in air or sea transportation between Japan and Hong Kong; |

| · | future legislation with respect to pricing and/or import quotas on products imported from Japan; and |

| · | turbulence in the Japanese economy or financial markets. |

Trade regulations between Hong Kong and Japan have remained stable for the past five years. However, there is long-standing political tension between China and Japan, which could intensify, causing trade retaliation and changes in trade regulations. As a special administrative region of China, Hong Kong could be indirectly affected by changes in trade regulation between China and Japan, which would limit our ability to sell our products.

Our industry is subject to supply shortages that could prevent us from manufacturing and delivering our products to our customers in a timely manner. Any delay or inability to deliver our products may have a material adverse effect on our results of operations.

During prior periods, there have been shortages of components in the watch movements industry and the availability of certain movements have been limited by some of our suppliers. We cannot assure you that any future shortages or allocations would not have such an effect on us. A future shortage can be caused by and result from many situations and circumstances that are out of our control, and such shortage could limit the amount of supply available of certain required movements and increase prices affecting our profitability.

We face risks related to our recent accounting restatements in December 2007 and February 2008.

In December 2007 and February 2008, we determined that we had accounting inaccuracies in previously reported financial statements and decided to restate our financial statements for the years ended December 31, 2006, 2005, and 2004, the three months ended March 31, 2007, the three months and six months ended June 30, 2007, and the three months and nine months September 30, 2007. The restatements for the foregoing periods related to the correction of errors with respect to the accounting for inventory by adjusting watch movement costing for the effects of vendor incentives from an as received basis to an accrual basis, as we were able to estimate the value of the incentives as inventory is purchased, the accounting for fees and costs related to the January 2007 reverse merger as a charge to operations, and the recognition of stock-based compensation cost related to the Escrow Shares. As a result of these adjustments, various income tax calculations were also revised, which effected net income and also caused reclassifications to cash flows. We also corrected average and actual shares outstanding retroactively (and related earnings per share calculations) to reflect the January 2007 reverse merger. We also made various changes to footnote disclosures relating to these revisions. It is possible that such restatement of our financial statements could lead to litigation claims and/or regulatory proceedings against us. The defense of any such claims or proceedings may cause the diversion of management's attention and resources, and we may be required to pay damages if any such claims or proceedings are not resolved in our favor.

8

The prices of our products are subject to volatility, which could have a negative impact on our sales and gross profit margins.

A portion of the watch movements products we sell have historically experienced volatile pricing. If market pricing for these products decreases significantly, we may experience periods when our investment in inventory exceeds the market price of such products. In addition, at times there are price increases from our suppliers that we are unable to pass on to our customers. These market conditions could have a negative impact on our sales and gross profit margins unless and until our suppliers reduce the cost of these products to us. Furthermore, in the future, the need for aggressive pricing programs in response to market conditions, an increased number of low-margin, large volume transactions and/or increased availability of the supply of certain products, could further impact our gross profit margins.

A reversal of the trend for distribution to play an increasing role in the watch movements industry could limit demand for our services and materially adversely affect our results of operations.

In recent years, there has been a growing trend for large wholesalers and watch manufacturers to outsource their procurement, inventory and materials management processes to third parties, particularly watch movement distributors, including our company. A reversal of this trend for could limit demand for our services, materially adversely affecting our ability to generate revenues. If such a reversal occurs, we may be forced to change the focus of our operations if we are unable to generate sufficient revenues to support our operations as currently conducted.

Our manufacturing capacity restraints and limited experience may cause unexpected costs, delays and make it more difficult to compete, which may have an adverse effect on our results of operations.

As part of our expansion plan, we intend to substantially expand the design and manufacture of our own brands of complete watches and commence the manufacture of branded watch movements in-house. In order to produce our watches and watch movements in quantities sufficient to meet our anticipated market demand we will need to increase our manufacturing capacity by a significant factor over the current level. There are technical challenges to increasing manufacturing capacity, including equipment design and automation, material procurement, problems with production yields and quality control and assurance. Developing commercial scale manufacturing facilities will require the investment of substantial funds and the hiring and retaining of additional management and technical personnel who have the necessary manufacturing experience. We may encounter some difficulties, such as significant unexpected costs and delays, in scaling up the necessary manufacturing operations to produce required quantities of watch movements and watches. The failure to scale-up manufacturing operations in a timely and cost-effective way may adversely affect our income. Moreover, the lack of experience in watch movement and watch manufacture design may make it difficult to compete against companies that have more senior management and experience. If we are unable to satisfy demand for products, our ability to generate revenue could be impaired, market acceptance of our products could be adversely affected and customers may instead purchase our competitors’ products.

If third-party carriers were unable to transport our products on a timely basis, we may be unable to timely deliver products to our customers and our operations could be materially adversely affected.

All of our products are shipped through third party carriers. If a strike or other event prevented or disrupted these carriers from transporting our products, other carriers may be unavailable or may not have the capacity to deliver our products to our customers. If adequate third party sources to ship our products were unavailable at any time, our business would be materially adversely affected.

9

Our products may be found to be defective and, as a result, warranty and/or product liability claims may be asserted against us which could have a material adverse effect on our business.

Our products are sold at prices that are significantly lower than the cost of the watches in which they are incorporated. Since a defect or failure in a product could give rise to failures in the end products that incorporate them (and claims for consequential damages against us from our customers), we may face claims for damages that are disproportionate to the sales and profits we receive from our products involved. Our business could be materially adversely affected as a result of a significant quality or performance issue in the products sold by us depending on the extent to which we are required to pay for the damages that result. Although we currently have product liability insurance, such insurance is limited in coverage and amount.

The failure to manage growth effectively could have an adverse effect on our business, financial condition, and results of operations.

Any significant growth in the market for our products or entry into new markets by Asia Time may require us to expand our employee base for managerial, operational, financial, and other purposes. As of December 31, 2007, we had 35 full time employees. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees. Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance. For effective growth management, we will be required to continue improving our operations, management, and financial systems and control. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability.

We are dependent on certain key personnel and loss of our sole executive officer, which would have a material adverse effect on our business and results of operations.

Our success is, to a certain extent, attributable to our sole executive officer, Kwong Kai Shun. Kwong Kai Shun oversees the operation of our business. There can be no assurance that we will be able to retain Kwong Kai Shun or that he may not receive and/or accept competing offers of employment. The loss of Kwong Kai Shun could have a material adverse effect upon our business, financial condition, and results of operations.

Our planned expansion into new international markets poses additional risks and could fail, which could cost us valuable resources and affect our results of operations.

We plan to expand sales of products into new international markets including developing and developed countries, such as South America and Europe. These markets are untested for our products and we face risks in expanding the business overseas, which include differences in regulatory product testing requirements, intellectual property protection (including patents and trademarks), taxation policy, legal systems and rules, marketing costs, fluctuations in currency exchange rates and changes in political and economic conditions.

RISKS RELATED TO US DOING BUSINESS IN CHINA

All of our assets are located in Hong Kong and China and substantially all of our revenues are derived from our operations in Hong Kong and China, and changes in the political and economic policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the results of operations and financial condition.

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, particularly the pharmaceutical industry, through regulation and state ownership. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

10

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes, in which system decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

| · | levying fines; |

| · | revoking our business and other licenses; |

| · | requiring that we restructure our ownership or operations; and |

| · | requiring that we discontinue any portion or all of our business. |

Inflation in the PRC could negatively affect our profitability and growth.

While the Chinese economy has experienced rapid growth in recent years, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Also, many observers believe that this rapid growth cannot continue at its current pace and that an economic correction may be imminent. Rapid economic growth can also lead to growth in the money supply and rising inflation. During the past two decades, the rate of inflation in China has been as high as approximately 20% and China has experienced deflation as low as minus 2%. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies such as raw materials, it may have an adverse effect on our profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. The implementation of such policies may impede economic growth. In October 2004, the People’s Bank of China, the PRC’s central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. During 2007, the interest rate was increased from 5.67% to 7.83%. Repeated rises in interest rates by the central bank could slow economic activity in China which could, in turn, materially increase our costs and also reduce demand for our products.

Recent PRC regulations relating to acquisitions of PRC companies by foreign entities may create regulatory uncertainties that could restrict or limit our ability to operate.

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice in January 2005 concerning foreign exchange regulations on mergers and acquisitions in China. The public notice states that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to strict examination by the relevant foreign exchange authorities. The public notice also states that the approval of the relevant foreign exchange authorities is required for any sale or transfer by the PRC residents of a PRC company’s assets or equity interests to foreign entities for equity interests or assets of the foreign entities.

11

In April 2005, SAFE issued another public notice further explaining the January notice. In accordance with the April notice, if an acquisition of a PRC company by an offshore company controlled by PRC residents has been confirmed by a Foreign Investment Enterprise Certificate prior to the promulgation of the January notice, the PRC residents must each submit a registration form to the local SAFE branch with respect to their respective ownership interests in the offshore company, and must also file an amendment to such registration if the offshore company experiences material events, such as changes in the share capital, share transfer, mergers and acquisitions, spin-off transaction or use of assets in China to guarantee offshore obligations. The April notice also provides that failure to comply with the registration procedures set forth therein may result in restrictions on our PRC resident shareholders and subsidiaries. Pending the promulgation of detailed implementation rules, the relevant government authorities are reluctant to commence processing any registration or application for approval required under the SAFE notices.

In addition, on August 8, 2006, the Ministry of Commerce (“MOFCOM”), joined by the State-Owned Assets Supervision and Administration Commission of the State Council, State Administration of Taxation, State Administration for Industry and Commerce, China Securities Regulatory Commission and SAFE, amended and released the Provisions for Foreign Investors to Merge and Acquire Domestic Enterprises, new foreign-investment rules which took effect September 8, 2006, superseding much, but not all, of the guidance in the prior SAFE circulars. These new rules significantly revise China’s regulatory framework governing onshore-offshore restructurings and how foreign investors can acquire domestic enterprises. These new rules signify greater PRC government attention to cross-border merger, acquisition and other investment activities, by confirming MOFCOM as a key regulator for issues related to mergers and acquisitions in China and requiring MOFCOM approval of a broad range of merger, acquisition and investment transactions. Further, the new rules establish reporting requirements for acquisition of control by foreigners of companies in key industries, and reinforce the ability of the Chinese government to monitor and prohibit foreign control transactions in key industries.

These new rules may significantly affect the means by which offshore-onshore restructurings are undertaken in China in connection with offshore private equity and venture capital financings, mergers and acquisitions. It is expected that such transactional activity in China in the near future will require significant case-by-case guidance from MOFCOM and other government authorities as appropriate. It is anticipated that application of the new rules will be subject to significant administrative interpretation, and we will need to closely monitor how MOFCOM and other ministries apply the rules to ensure its domestic and offshore activities continue to comply with PRC law. Given the uncertainties regarding interpretation and application of the new rules, we may need to expend significant time and resources to maintain compliance, which could divert the attention of our management and adversely affect our results of operations.

It is uncertain how our business operations or future strategy will be affected by the interpretations and implementation of the SAFE notices and new rules. Our business operations or future strategy could be adversely affected by the SAFE notices and the new rules. For example, we may be subject to a more stringent review and approval process with respect to our foreign exchange activities, which could limit our ability to acquire companies in the PRC, restricting our ability to expand our operations.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC, and our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to the completion of the Share Exchange. We can make no assurance that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

12

Any recurrence of Severe Acute Respiratory Syndrome (SARS), Avian Flu, or another widespread public health problem, in the PRC could adversely affect our employees, customers, and our ability to continue our operations, including manufacturing and distribution.

A renewed outbreak of Severe Acute Respiratory Syndrome, Avian Flu or another widespread public health problem in China, where all of our manufacturing facilities are located and where all of our sales occur, could have a negative effect on our operations. Our business is dependent upon our ability to continue to manufacture our products. Such an outbreak could have an impact on our operations as a result of:

| · | quarantines or closures of some of our manufacturing facilities, which would severely disrupt our operations, |

| · | the sickness or death of our key officers and employees, and |

| · | a general slowdown in the Chinese economy. |

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our operations.

A downturn in the economy of the PRC may slow our growth and profitability.

The growth of the Chinese economy has been uneven across geographic regions and economic sectors. There can be no assurance that growth of the Chinese economy will be steady or that any downturn will not have a negative effect on our business, especially if it results in either a decreased use of our products or in pressure on us to lower our prices.

Because our business is located in the PRC, we may have difficulty establishing adequate management, legal and financial controls, which we are required to do in order to comply with U.S. securities law.

PRC companies have historically not adopted a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and, computer, financial and other control systems. Most of our middle and top management staff are not educated and trained in the Western system. In addition, we may need to rely on a new and developing communication infrastructure to efficiently transfer our information from retail nodes to the headquarters. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This may result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our business.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

Most of our current operations are conducted in Hong Kong and China. Moreover all of our directors and officers are nationals and residents of Hong Kong and China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or our officers and/or directors predicated upon the civil liability provisions of the securities law of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

13

RISKS RELATED TO OUR CAPITAL STRUCTURE

The price of our common stock may be volatile, and if an active trading market for our common stock does not develop, the price of our common stock may suffer and decline.

Prior to our initial public offering and listing of our common stock on the American Stock Exchange on February 12, 2008, there has been no public market for our securities in the United States. Accordingly, we cannot assure you that an active trading market will develop or be sustained or that the market price of our common stock will not decline. The price at which our common stock will trade after our initial public offering is likely to be highly volatile and may fluctuate substantially due to many factors, some of which are outside of our control.

Shares eligible for future sale may adversely affect the market price of our common stock, as the future sale of a substantial amount of outstanding stock in the public marketplace could reduce the price of our common stock.

As of March 15, 2008, we had 24,684,649 shares of common stock outstanding, and our certificate of incorporation permits the issuance of up to approximately 75,315,351additional shares of common stock. Thus, we have the ability to issue substantial amounts of common stock in the future, which would dilute the percentage ownership held by the existing investors.

Pursuant to the terms of the Share Exchange, we registered the 2,250,348 shares of common stock underlying shares of our Series A Convertible Preferred Stock issued in an equity financing, in addition to 1,703,017 shares held by other shareholders. In addition, we agreed to file a registration statement no later than 90 days after our securities become listed for trading on the American Stock Exchange to register the Bonds, the 2,285,714 shares of our common stock, subject to adjustment, issuable upon the conversion of the Bonds, the Bond Warrants, and the 600,000 shares of our common stock, subject to adjustment, issuable upon the exercise of the Bond Warrants. We also intend to register the 200,000 shares of common stock issued in connection with our investor relations agreement that we entered into in February 2007. The preferred stockholders of the 2,250,348 registered shares are subject to a lock up agreement pursuant to which they agreed not to sell their shares until our common stock began trading on the American Stock Exchange, which occurred on February 12, 2008, after which their shares will automatically be released from the lock up every 30 days on a pro rata over a nine month period beginning on the date that is 30 days after listing of the shares. All of the shares included in an effective registration statement as described above may be freely sold and transferred, except if subject to a lock up agreement.

In connection with the public offering that we conducted on February 15, 2008, in which we issued 963,700 shares of freely tradable common stock, we, each of our directors and senior officers, and each holder of 5% or more of our common stock agreed, with limited exceptions, that we and they will not, without the prior written consent of the offering’s underwriter, through February 12, 2008, among other things, directly or indirectly, offer to sell, sell or otherwise dispose of any of shares of our common stock or file a registration statement with the SEC. After the lock-up agreements, up to the shares that had been locked up will be eligible for future sale in the public market at prescribed times pursuant to Rule 144 under the Securities Act, or otherwise, sales of a significant number of these shares of common stock in the public market could reduce the market price of the common stock.

Further, effective February 15, 2008, the SEC revised Rule 144, which provides a safe harbor for the resale of restricted securities, shortening applicable holding periods and easing other restrictions and requirements for resales by our non-affiliates, thereby enabling an increased number of our outstanding restricted securities to be resold sooner in the public market. Sales of substantial amounts of our stock at any one time or from time to time by the investors to whom we have issued them, or even the availability of these shares for sale, could cause the market price of our common stock to decline.

Our principal stockholder has significant influence over us.

Our largest shareholder, Kwong Kai Shun, who is also our Chairman of the Board, Chief Executive Officer and Chief Financial Officer, beneficially owns or controls approximately 84.0% of our outstanding shares as of January 1, 2008. As a result of his holding, this shareholder has a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our shareholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. This shareholder also has the power to prevent or cause a change in control. In addition, without the consent of this shareholder, we could be prevented from entering into transactions that could be beneficial to us. The interests of this shareholder may differ from the interests of our shareholders.

14

The ability of our operating subsidiaries to pay dividends may be restricted due to foreign exchange control regulations of China.

The ability of our operating subsidiaries to pay dividends may be restricted due to the foreign exchange control policies and availability of cash balance of our operating subsidiaries. We expect in the future that a substantial portion of our revenue being earned and currency received may be denominated in Renminbi (RMB). RMB is subject to the exchange control regulation in China, and, as a result, we may unable to distribute any dividends outside of China due to PRC exchange control regulations that restrict our ability to convert RMB into US Dollars.

We may not be able to achieve the benefits we expect to result from the Share Exchange.

On December 15, 2006, we entered into the Exchange Agreement with the sole shareholder of Times Manufacture, pursuant to which we agreed to acquire 100% of the issued and outstanding securities of Times Manufacture in exchange for shares of our common stock. On January 23, 2007, the Share Exchange closed, Times Manufacture became our 100%-owned subsidiary and our sole business operations became that of Times Manufacture. Also, the management and directors of Times Manufacture became the management and directors of us and we changed our corporate name from SRKP 9, Inc. to Asia Time Corporation.

We may not realize the benefits that we hoped to receive as a result of the Share Exchange, which includes:

| · | access to the capital markets of the United States; |

| · | the increased market liquidity expected to result from exchanging stock in a private company for securities of a public company that may eventually be traded; |

| · | the ability to use registered securities to make acquisition of assets or businesses; |

| · | increased visibility in the financial community; |

| · | enhanced access to the capital markets; |

| · | improved transparency of operations; and |

| · | perceived credibility and enhanced corporate image of being a publicly traded company. |

There can be no assurance that any of the anticipated benefits of the Share Exchange will be realized in respect to our new business operations. In addition, the attention and effort devoted to achieving the benefits of the Share Exchange and attending to the obligations of being a public company, such as reporting requirements and securities regulations, could significantly divert management’s attention from other important issues, which could materially and adversely affect our operating results or stock price in the future.

In connection with Mr. Kwong’s agreement to release, under certain conditions, up to 2,326,000 shares of his common stock in our company to investors in our January 2007 Private Placement, we recorded a compensation charge of approximately $2.4 million for 2007.

In connection with the Private Placement, Kwong Kai Shun, our Chairman of the Board, Chief Executive Officer and Chief Financial Officer, entered into an agreement (the “Escrow Agreement”) with the investors in the Private Placement pursuant to which Mr. Kwong agreed to place 2,326,000 shares of his common stock in escrow for possible distribution to the investors (the "Escrow Shares"). Pursuant to the Escrow Agreement, if our net income for 2006 or 2007, subject to specified adjustments, is less than $6.3 million or $7.7 million, respectively, a portion, if not all, of the Escrow Shares will be transferred to the investors based upon our actual net income, if any, for such fiscal years. We have accounted for the Escrow Shares as the equivalent of a performance-based compensatory stock plan between Mr. Kwong and us. Accordingly, during the year ended December 31, 2007, we recorded a charge to operations of $2,433,650 to recognize the grant date fair value of stock-based compensation in conjunction with the Escrow Shares. The expense will have a negative effect on our results of operations for 2007 and cause our net income to be reduced by $2.4 million for the year. We may not realize a benefit from services provided under the agreement that is comparable to such negative effect. As a result, our operations may suffer and our stock price may decline.

15

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

Our internal control over financial reporting may have weaknesses and conditions that need to be addressed, the disclosure of which may have an adverse impact on the price of our common stock. We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Our failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Standards for compliance with Section 404 of the Sarbanes-Oxley Act Of 2002 are uncertain, and if we fail to comply in a timely manner, our business could be harmed and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and attestation of this assessment by our company’s independent registered public accountants. The SEC extended the compliance dates for non-accelerated filers, as defined by the SEC. Accordingly, we believe that the annual assessment of our internal controls requirement will first apply to our annual report for the 2007 fiscal year and the attestation requirement of management’s assessment by our independent registered public accountants will first apply to our annual report for the 2008 fiscal year. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. In addition, the attestation process by our independent registered public accountants is new and we may encounter problems or delays in completing the implementation of any requested improvements and receiving an attestation of our assessment by our independent registered public accountants. If we cannot assess our internal control over financial reporting as effective, or our independent registered public accountants are unable to provide an unqualified attestation report on such assessment, investor confidence and share value may be negatively impacted.

We recently completed a placement of convertible bonds that included a beneficial conversion feature and are mandatorily redeemable and 600,000 warrants exercisable at $0.0001 per share. The features of the bonds and the value of the warrants will have the effect of reducing our reported operating results during the term of the bonds.

In November 2007, we issued $8,000,000 Variable Rate Convertible Bonds due in 2012, or the Bonds. The terms of Bonds include conversion features allowing the holders to convert the Bonds into shares of our common stock. Certain of those conversion features that allow for the reduction in conversion price upon the occurrence of stated events constitute a “beneficial conversion feature” for accounting purposes. In addition, we may be required to repurchase the Bonds at the request of the holders if certain events occur or do not occur, as set forth in the Trust Deed. If our common stock ceases to be listed on AMEX or there is a change of control of the company as defined in the Trust Deed, each holder will have the right to require us to redeem all or part of that holder’s Bonds. If on or before November 13, 2008, the Bonds, Bond Warrants, and shares underlying the Bonds and Bond Warrants are not registered with the SEC, then holders of the Bonds can require us to redeem the Bonds at 106.09% of the principal amount of the Bonds. In addition, at any time after November 13, 2010, each holder can require us to redeem the Bonds at 126.51% of the principal amount of the Bonds and we are required to redeem any outstanding Bonds at 150.87% of its principal amount on November 13, 2012. If a triggering event occurs and we are requested by the holders to repurchase all or a portion of the Bonds, we will be required to pay cash to redeem all or a portion of the Bonds. Finally, in connection with the issuance of the Bonds, we issued the holder of the Bonds the Bond Warrants exercisable at a per share exercise price of $0.0001.

16