UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Harvest Oil & Gas Corp. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1001 Fannin Street, Suite 750

Houston, Texas 77002

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Harvest Oil & Gas Corp.:

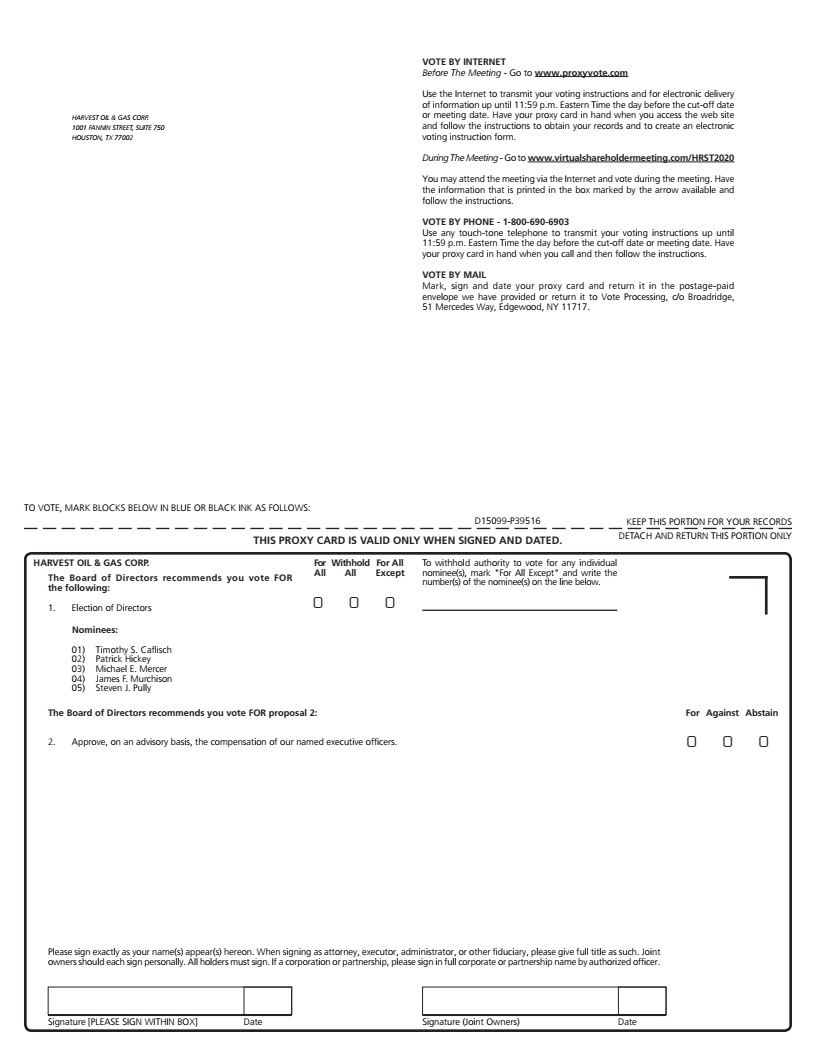

The 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Harvest Oil & Gas Corp. will be held on Tuesday, June 16, 2020 at 10:00 a.m., Central Time. In light of the emerging public health impact of the coronavirus, or COVID-19, outbreak and taking into account recent federal, state and local guidance that has been issued, Harvest has determined that the Annual Meeting will be held in a virtual meeting format only, with log-in beginning at 9:45 a.m., Central Time. You may attend the Annual Meeting online, including to vote or submit questions, at the following website address www.virtualshareholdermeeting.com/HRST2020, by entering the company number and control number included on your Notice of Internet Availability of Proxy Materials, on the proxy card you received and in the instructions that accompanied your proxy materials. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com. The Annual Meeting is being held, to consider and vote upon the following proposals:

| 1. | To elect five directors to serve until the 2021 Annual Meeting of Stockholders and until their successors are duly elected and qualified; |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers; and |

| 3. | Such other matters as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

Only stockholders of record as of the close of business on April 23, 2020 are entitled to notice of, and to vote at, the Annual Meeting and any postponement, adjournment or continuation thereof.

We are furnishing proxy materials to stockholders over the internet. This process expedites the delivery of proxy materials, ensures that proxy materials remain easily accessible to our stockholders, saves costs and reduces the environmental impact of the Annual Meeting. The Notice of Internet Availability of Proxy Materials, which contains instructions for use in this process, including how to access our proxy materials over the internet, how to vote, and how to attend and participate in the Annual Meeting via the internet is first being sent on or about May 7, 2020 to all stockholders entitled to notice of, and to vote at, the Annual Meeting. The Notice of Internet Availability of Proxy Materials also contains instructions on how to obtain paper copies of the proxy materials if preferred.

Your vote is important. Even if you expect to attend the Annual Meeting, please vote over the internet, by telephone or, if you have requested a paper copy of the proxy materials, by completing and returning a proxy card by mail, so that your shares may be represented at the Annual Meeting if you later decide to not attend the Annual Meeting. If you attend the Annual Meeting, you will be able to vote, even if you have previously submitted your proxy.

| By Order of the Board of Directors, | ||

| ||

| Michael E. Mercer | ||

| President, CEO and Director | ||

| Houston, Texas | ||

| April 29, 2020 |

TABLE OF CONTENTS

PROXY STATEMENT FOR THE

2020 ANNUAL MEETING OF STOCKHOLDERS

______________________________

As used herein, the terms the “Company,” “we,” “our” or “us��� refer to (i) Harvest Oil & Gas Corp. (“Harvest”) after June 4, 2018 (the “Emergence Date”) and (ii) EV Energy Partners, L.P. (“EVEP” or the “Predecessor”) prior to, and including, the Emergence Date, in each case, together with their respective consolidated subsidiaries or on an individual basis, depending on the context in which the statements are made.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

Why did I receive a Notice Regarding the Internet Availability of Proxy Materials?

We sent you a Notice Regarding the Internet Availability of Proxy Materials (the “Notice”) to access the Company’s proxy materials because we are holding our 2020 Annual Meeting of Stockholders (the “Annual Meeting”) and our board of directors (the “Board”) is asking for your proxy to vote your shares of the Company’s common stock, par value $0.01 per share (“common stock”), at the Annual Meeting and any adjournments or postponements thereof. The Notice was first sent to stockholders on or about May 7, 2020.

The Securities and Exchange Commission (the “SEC”) has approved rules allowing companies to furnish proxy materials to stockholders by providing access to such documents on the internet instead of mailing paper copies. We believe this process expedites the delivery of proxy materials, ensures that proxy materials remain easily accessible to our stockholders, saves costs and reduces the environmental impact of the Annual Meeting. Accordingly, we mailed the Notice rather than paper copies of our proxy materials. Instructions on how to access the proxy materials over the internet or how to request a paper copy by mail may be found in the Notice. The proxy materials, including this proxy statement, summarize the information that you need to make an informed decision on the proposals to be considered at the Annual Meeting.

When and where will the Annual Meeting be held?

The Annual Meeting will take place on Tuesday, June 16, 2020 at 10:00 a.m., Central Time. In light of the emerging public health impact of the coronavirus, or COVID-19, outbreak and taking into account recent federal, state and local guidance that has been issued, Harvest has determined that the Annual Meeting will be held in a virtual meeting format only, with log-in beginning at 9:45 a.m., Central Time. You may attend the Annual Meeting online, including to vote or submit questions, at the following website address www.virtualshareholdermeeting.com/HRST2020 by entering the company number and control number included on your Notice of Internet Availability of Proxy Materials, on the proxy card you received and in the instructions that accompanied your proxy materials. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com.

What proposals will be addressed at the Annual Meeting?

Stockholders will be asked to consider and vote upon the following proposals at the Annual Meeting:

| 1. | To elect the five director nominees named in this proxy statement to serve until the 2021 Annual Meeting of Stockholders and until their successors are duly elected and qualified; and |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers. |

We will also consider any other matters properly brought before the Annual Meeting, although we are not currently aware of any matters to be acted upon at the Annual Meeting other than the matters discussed in this proxy statement.

| 1 |

How does the Board recommend that I vote?

The Board unanimously recommends that stockholders vote:

| ● | “FOR” the election of each of the five director nominees named in this proxy statement, and |

| ● | “FOR” the approval, on an advisory basis, of the compensation of our named executive officers. |

Who may attend and vote at the Annual Meeting?

Stockholders who owned shares of common stock as of the close of business on April 23, 2020 (the “Record Date”) are entitled to attend and vote on all items properly presented at the Annual Meeting. As of the Record Date, there were 10,173,707 shares of common stock outstanding and entitled to vote at the Annual Meeting. Each such share of common stock is entitled to one vote on each matter that is properly presented at the Annual Meeting.

How do I vote?

Stockholders of record: If your shares of common stock are registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares. If you are a stockholder of record as of the Record Date, you may vote during the Annual Meeting by following the instructions provided at the Annual Meeting. To attend the meeting, you must enter the company number and control number included on your Notice of Internet Availability of Proxy Materials, on the proxy card you received and in the instructions that accompanied your proxy materials. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com.

If you are a stockholder of record, you may also vote by proxy by having one or more individuals who will attend the Annual Meeting vote your shares for you. These individuals are called “proxies” and using them to cast your ballot during the Annual Meeting is called voting “by proxy.” If you wish to vote by proxy, you may either (i) submit your proxy over the internet at www.proxyvote.com or by calling 1-800-690-6903 and following the instructions or (ii) if you have requested a paper copy of the proxy materials, complete and return the proxy card in the envelope provided. If you do so, you will appoint Michael E. Mercer, our President, Chief Executive Officer and Director, and Ryan Stash, our Vice President and Chief Financial Officer, each to act as your proxy at the Annual Meeting. One of them will then vote your shares during the Annual Meeting in accordance with the instructions you have given them in the proxy. Proxy cards that are signed and returned, but do not include voting instructions, will be voted by the proxy holders as recommended by the Board. Proxies will extend to, and be voted at, any adjournment(s) or postponement(s) of the Annual Meeting. While we know of no other matters to be acted upon at the Annual Meeting, it is possible that other matters may be properly presented at the Annual Meeting. If that happens and you have submitted your proxy, the proxy holders will vote on such other matters in accordance with their best judgment.

Beneficial owners of shares held in street name: If your shares of common stock are held in an account at a broker, bank or other nominee, then you are the beneficial owner of shares held in street name. If you are a beneficial owner of shares of common stock as of the Record Date, you have the right to instruct the nominee on how to vote the shares held in your account, but you must follow the voting instructions provided by your nominee to do so. A beneficial owner of shares should generally be able to vote by returning the voting instruction form provided by the nominee to the nominee. The availability of internet or telephone voting will depend on the voting process of the nominee. If you are a beneficial owner, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee. You may still attend the Annual Meeting virtually even if you do not have a legal proxy. For admission to the Annual Meeting, you must provide proof of beneficial ownership as of the Record Date (e.g., your most recent account statement reflecting your stock ownership as of the Record Date) and you must enter the company number and control number included on your Notice of Internet Availability of Proxy Materials, on the proxy card you received and in the instructions that accompanied your proxy materials.

| 2 |

Can I change my vote or revoke my proxy?

If you are a stockholder of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Annual Meeting. Proxies may be revoked by any of the following actions:

| ● | delivering a timely written notice of revocation to our Manager – Investor Relations at 1001 Fannin Street, Suite 750, Houston, Texas 77002; |

| ● | submitting a new, later-dated proxy over the internet, by telephone or by mail to our Manager – Investor Relations at 1001 Fannin Street, Suite 750, Houston, Texas 77002; or |

| ● | attending the Annual Meeting and voting via the internet (attendance at the Annual Meeting will not, by itself, revoke a proxy). |

If your shares are held in an account at a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee.

What vote is required to elect directors?

Directors are elected by a plurality of the votes cast at the Annual Meeting. A plurality means that the five persons receiving the highest number of affirmative “FOR” votes at the Annual Meeting will be elected. There are no cumulative voting rights. Abstentions and broker non-votes will have no direct effect on this proposal, assuming that a quorum is present.

What vote is required for the advisory approval of the compensation of our named executive officers?

The advisory approval of the compensation of our named executive officers requires the affirmative vote of holders of a majority of the shares of common stock present, via the internet or by proxy, at the Annual Meeting and entitled to vote and voting on the matter. Abstentions and broker non-votes will have no direct effect on this proposal, assuming that a quorum is present.

What is the quorum requirement for the Annual Meeting?

A quorum is the minimum number of shares required to be present or represented for a meeting to be properly held. Under our bylaws, a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, present via the internet or represented by proxy, will constitute a quorum for the Annual Meeting. On the Record Date, there were 10,173,707 shares of common stock outstanding and entitled to vote at the Annual Meeting. Consequently, holders of at least 5,086,854 shares of common stock must be present, via the internet or by proxy, at the beginning of the Annual Meeting to constitute a quorum. Abstentions and “withhold” votes are counted as present for purposes of determining a quorum. If there is no quorum, the chairman of the meeting may adjourn the meeting to another time or place.

What are broker non-votes?

Generally, broker non-votes occur when shares held by a broker, bank or other nominee in street name for a beneficial owner are not voted with respect to a particular proposal because the nominee (i) has not received voting instructions from the beneficial owner and (ii) lacks discretionary voting power to vote those shares with respect to that particular proposal. A broker, bank or other nominee is entitled to vote shares held for a beneficial owner only on “routine” matters without instructions from the beneficial owner of those shares. The election of our directors and the approval, on an advisory basis, of the compensation of our named executive officers are not routine matters. If you hold your shares in street name and you do not instruct your broker, bank or other nominee on how you want to vote in these non-routine matters, no votes on these matters will be cast on your behalf.

| 3 |

Who bears the cost of soliciting proxies?

The Board is soliciting your proxy to vote your shares of common stock at the Annual Meeting. The Company will bear the cost of soliciting proxies and will reimburse brokerage firms and other nominees for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. The Company’s directors and officers may solicit proxies in person, electronically or by telephone or mail; they will not receive any special remuneration for these efforts.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one Notice. How may I obtain an additional copy of the Notice?

Unless we have received contrary instructions, we may send a single copy of the Notice to any household at which two or more stockholders reside if we believe the stockholders are members of the same family. This process, known as “householding,” reduces the volume of duplicate information received at any one household and helps to reduce our expenses. However, if a stockholder prefers to receive multiple copies at the same address this year or in future years, the stockholder should follow the instructions described below. Similarly, if an address is shared with another stockholder and together both of the stockholders would like to receive only a single set of our disclosure documents, the stockholders should follow these instructions:

| ● | If the shares are registered in the name of the stockholder, the stockholder should contact our Manager – Investor Relations by telephone at (713) 651-1144 or by mail at 1001 Fannin Street, Suite 750, Houston, Texas 77002, to inform us of his or her request. |

| ● | If a broker, bank or other nominee holds the shares, the stockholder should contact that nominee directly. |

| 4 |

We maintain a Code of Business Conduct that qualifies as a “code of ethics” under applicable SEC regulations. Our Code of Business Conduct applies to all of our directors, officers and other employees, including our principal executive officer, principal financial officer and principal accounting officer. A copy of the Code of Business Conduct is posted on the Investor Relations section of our website at https://ir.hvstog.com. We intend to disclose future amendments to certain provisions of our Code of Business Conduct, or waivers of such provisions granted to our principal executive officer, principal financial officer or principal accounting officer, on this website within four business days following the date of such amendment or waiver.

Our Executive Officers and Directors

The executive officers and directors of the Company, and their ages as of April 29, 2020, are as follows:

Name | Position | Age | |||

| Michael E. Mercer | President, Chief Executive Officer and Director | 61 | |||

| Ryan Stash | Vice President and Chief Financial Officer | 44 | |||

| Timothy S. Caflisch | Director | 34 | |||

| Patrick Hickey | Director | 58 | |||

| James F. Murchison | Director | 43 | |||

| Steven J. Pully | Director | 60 | |||

Michael E. Mercer has served as President and Chief Executive Officer of Harvest and as a member of the Board since June 2018. Mr. Mercer served as President and Chief Executive Officer of EVEP from March 2015 to June 2018. Prior to that, he was the Senior Vice President and Chief Financial Officer of EVEP since 2006. He was a consultant to EnerVest, Ltd. (“EnerVest”) from 2001 to 2006. Prior to that, Mr. Mercer was an investment banker for 12 years. He was a Director in the Energy Group at Credit Suisse First Boston in Houston and a Director in the Energy Group at Salomon Smith Barney in New York and London. He holds a BBA in Petroleum Land Management from the University of Texas at Austin and an MBA from the University of Chicago Booth School of Business. The Board believes that Mr. Mercer’s broad knowledge of the oil and gas industry, his extensive financial expertise, his significant experience in corporate finance and strategic planning and his daily insight into corporate matters as the Company’s President and Chief Executive Officer qualify him to serve as a director.

Ryan Stash has served as Vice President and Chief Financial Officer of Harvest since October 2018. Mr. Stash previously served as a Managing Director at Regions Securities, where he focused on the energy sector, since September 2018. Prior to that, Mr. Stash spent 11 years in the Energy Investment Banking Group for Wells Fargo Securities in Houston, rising to the level of Director in February 2015. Before moving to Wells Fargo Securities, Mr. Stash spent five years as an auditor working at Hewlett-Packard and Ernst & Young, LLP. Mr. Stash is a Certified Public Accountant in the State of Texas. Mr. Stash received an MBA from the McCombs School of Business, a Masters in Professional Accounting and a Bachelor of Business Administration, all at the University of Texas at Austin.

Timothy S. Caflisch has served as a member of the Board since March 2019. He is a member of the investment team of Finepoint Capital LP (“Finepoint”), a Boston-based investment firm. Mr. Caflisch joined Finepoint in November 2015, and is focused on value and event driven opportunities across industries and geographies. Prior to joining Finepoint, Mr. Caflisch was a member of KKR’s Special Situations team since 2008, based in London, where he concentrated on publicly traded distressed credit and privately originated rescue financings. He graduated from Stanford University with a bachelor’s degree in Economics. The Board believes that Mr. Caflisch’s extensive financial expertise and his significant experience in corporate finance, strategic planning and financings qualify him to serve as a director.

Patrick Hickey has served as a member of the Board since June 2018. He is a Managing Director and a senior member of the Houston-based oil and gas investment team for EIG Global Energy Partners, LLC (“EIG”), which specializes in private investments in energy and energy-related infrastructure on a global basis. Prior to joining EIG in 2003, Mr. Hickey was with Wells Fargo Energy Capital, where he was responsible for originating and executing mezzanine financings for oil and gas producers. Prior to joining Wells Fargo, Mr. Hickey held a similar position with Duke Capital Partners, where he was responsible for senior debt and equity financings in addition to mezzanine financings. Prior to that, he spent ten years with Enron Corporation in various energy finance and marketing roles. Mr. Hickey also worked for ARCO as a reservoir engineer for five years. Mr. Hickey received a Petroleum Engineering degree from the University of Texas and a Master of Business Administration from Harvard University.The Board believes that Mr. Hickey’s broad knowledge of the oil and gas industry, his extensive financial expertise and his significant experience in corporate finance, strategic planning and financings qualify him to serve as a director.

| 5 |

James F. Murchison has served as a member of the Board since June 2018. He is the founder and Chief Executive Officer of Hatch Resources LLC (“Hatch”), which was formed in January 2019 with a partnership with Ridgemont Equity Partners to pursue the acquisition of oil and gas assets in the Permian Basin. Prior to forming Hatch, Mr. Murchison served as Chief Financial Officer and Board Member of Venado Oil & Gas, LLC (“Venado”) from September 2016 to May 2018, during which time Venado acquired $1.6 billion of Eagle Ford assets. Prior to joining Venado, Mr. Murchison spent 15 years in the banking industry, focusing on the oil and gas space. Over the course of his career, Mr. Murchison’s work touched most of the major basins in the lower 48 states and involved capital formation, corporate mergers and acquisitions, asset acquisitions and divestitures, restructuring, reserve based lending, and IPOs. Mr. Murchison joined Raymond James & Associates (“Raymond James”) in their energy investment banking group as a Senior Associate in 2005 and departed in 2016 as a Managing Director and Head of E&P Advisory. Prior to Raymond James, Mr. Murchison spent four years as a credit analyst at BNP Paribas and Southwest Bank of Texas, originating and structuring reserve and cash flow based loans. Mr. Murchison received his Bachelor’s degree in Liberal Arts in the English Honors Program from the University of Texas in 1999 and his Master of Business Administration from the University of Texas in 2005. The Board believes that Mr. Murchison’s broad knowledge of the oil and gas industry and his significant experience in capital formation, corporate mergers and acquisitions, asset acquisitions and divestitures, restructuring and reserve-based lending qualify him to serve as a director.

Steven J. Pully has served as the Chairman of the Board since March 2019 and as a member of the Board since June 2018. He provides consulting and investment banking services for companies and investors focused on the oil and gas sector. From 2008 until 2014, Mr. Pully served as General Counsel and a Partner of the investment firm Carlson Capital, L.P. Mr. Pully was also previously a Senior Managing Director at Bear Stearns and a Managing Director at Bank of America Securities focused on energy investment banking. Mr. Pully also serves on the board of VAALCO Energy. He has also served on numerous other boards of public and private companies in the oil and gas and other industries, including as a director of EPL Oil & Gas, Goodrich Petroleum, Bellatrix Exploration, Energy XXI and Titan Energy within the past five years. Mr. Pully is a Chartered Financial Analyst, a Certified Public Accountant in the State of Texas and a member of the State Bar of Texas. Mr. Pully earned his undergraduate degree in Accounting from Georgetown University and is also a graduate of The University of Texas School of Law. The Board believes that Mr. Pully’s broad knowledge of the oil and gas industry, his extensive financial, accounting and legal expertise, and his experience in corporate finance and strategic planning qualify him to serve as a director.

Pursuant to the listing requirements of the OTCQX U.S. Premier Marketplace (the “OTCQX”), on which our common stock is listed, the Board must include at least two “independent directors,” which is defined by the listing requirements as a person other than an executive officer or employee of the Company or any other individual having a relationship that, in the opinion of the Board would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based on this standard, as well as the independence standards established by NASDAQ, the Board has determined that each of Messrs. Caflisch, Hickey, Murchison and Pully are independent and that Mr. Dunn, a former member of the Board, was independent.

In accordance with our bylaws, the roles of Chairman of the Board and Chief Executive Officer are filled by separate individuals. Mr. Pully is the Chairman of the Board, and Mr. Mercer is the Chief Executive Officer. The Board believes that the separation of these two roles is the most appropriate leadership structure for the Board at this time as it allows the Chief Executive Officer to focus on our day-to-day operations while the Chairman of the Board leads the Board in its role of providing independent oversight and advice to management.

| 6 |

The Board’s Role in Risk Oversight

The Board has general oversight of the management of the Company’s risks, which includes working with management to establish and monitor the Company’s risk appetite and the significant risks that may affect the Company. The committees of the Board also assist the Board in carrying out its risk oversight function. For example, the Audit Committee of the Board (the “Audit Committee”) has responsibility for inquiring management and the Company’s independent auditors about the Company’s risk assessment and risk management policies, including the Company’s major financial risk exposures and the steps management has taken to mitigate such risks. In addition, the Compensation Committee of the Board (the “Compensation Committee”) provides oversight with respect to risks related to the Company’s compensation practices.

During 2019, the Board met 20 times. During 2019, each incumbent director attended at least 75%, in the aggregate, of (i) the total number of Board meetings held during the period in which he was a director and (ii) the total number of meetings held by all committees of the Board on which he served (during the periods that he served).

Although we encourage all of our directors to attend our annual meetings of stockholders, we do not maintain a formal policy regarding director attendance at such meetings. All of our directors attended the 2019 annual meeting.

The Board currently has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. These committees have the responsibilities set forth in written charters adopted by the Board, which can be reviewed on the Investor Relations section of our website at https://ir.hvstog.com. The table below shows the current chairman and members of each of these standing Board committees.

Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||||

| Timothy S. Caflisch | ● | |||||||

| Patrick Hickey | C | |||||||

| Michael E. Mercer | ||||||||

| James F. Murchison | ● | C | ● | |||||

| Steven J. Pully | C | ● | ||||||

| C Chair | ||||||||

| ● Member | ||||||||

Audit Committee.The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act and accordingly assists the Board in overseeing our accounting and financial reporting processes and the audits of our financial statements. In addition, the principal functions of the Audit Committee include (i) providing a direct and independent line of communication between the Company’s internal audit function, its independent auditors and the Board, (ii) the appointment, compensation, retention, oversight and replacement of the Company’s independent auditors, (iii) reviewing with management and the Company’s independent auditors the Company’s financial statements and earnings releases and (iv) considering and reviewing with management and the Company’s independent auditors the effectiveness of the Company’s system of internal controls over financial reporting and disclosure controls and procedures. The Board has determined that both members of the Audit Committee, Messrs. Murchison and Pully, qualify as an “audit committee financial expert” as defined under applicable SEC rules and meet the independence requirements of the OTCQX. The Audit Committee met six times during 2019.

| 7 |

Compensation Committee.The Compensation Committee is responsible for assisting the Board in, among other things, discharging its responsibilities relating to establishing and reviewing the compensation of our executive officers and approving, overseeing and monitoring incentive and other benefit plans for our employees. The Compensation Committee met five times during 2019.

Nominating and Corporate Governance Committee. The Board’s Nominating and Corporate Governance Committee (the “Nominating and Corporate Governance Committee”) assists the Board in identifying individuals qualified to become members of the Board, oversees the evaluation of the Board and management, oversees and approves the management continuity planning process, and otherwise takes a leadership role in shaping the Company’s corporate governance. The Nominating and Corporate Governance Committee met one time during 2019.

The Nominating and Corporate Governance Committee identifies director candidates based upon suggestions by other members of the Board, management and stockholders. In addition, the Nominating and Corporate Governance Committee may engage search firms to assist it in identifying director candidates. The Nominating and Corporate Governance Committee applies the same criteria to candidates recommended by stockholders and candidates recommended by other members of the Board and management.

A stockholder that wants to recommend a candidate for election to the Board should send a recommendation in writing to our Manager – Investor Relations at 1001 Fannin Street, Suite 750, Houston, Texas 77002. Such recommendation should describe the candidate’s qualifications and other relevant biographical information and provide confirmation of the candidate’s consent to serve as director. Stockholders may also nominate directors at an annual meeting by adhering to the advance notice procedure described under “Other Matters—Submission of Stockholder Proposals for the 2021 Annual Meeting” elsewhere in this proxy statement.

The Nominating and Corporate Governance Committee, in recommending director candidates, and the Board, in nominating director candidates, takes into account all factors it considers appropriate, which include the current needs of the Board as well as the qualifications of the candidate, such as the candidate’s strength of character, judgment, familiarity with the Company’s business and industry, independence of thought, ability to work collegially, diversity of background, existing commitments to other businesses, potential conflicts of interest with other pursuits, corporate governance background, various and relevant career experience, relevant technical skills, relevant business acumen, financial and accounting background and executive compensation background. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it believes that it is important that the Board members represent diverse viewpoints, with a broad array of experiences, professions, skills and backgrounds that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities.

Stockholders desiring to communicate directly with the Board, the Audit Committee or any individual director or directors may do so by sending such communication in writing addressed to the attention of the intended recipient(s), c/o Manager – Investor Relations at 1001 Fannin Street, Suite 750, Houston, Texas 77002. Stockholders may communicate anonymously and/or confidentially if they desire. The Board has instructed the Manager – Investor Relations to review correspondence directed to the Board and, at her discretion, to forward items that she deems appropriate for the Board’s consideration as addressed. All such correspondence that relate to accounting, internal accounting controls or auditing matters that are not addressed will be referred to the chairman of the Audit Committee.

| 8 |

Policies and Procedures for Transactions with Related Persons

The Board has adopted a policy providing that the Audit Committee is responsible for reviewing transactions, arrangements or relationships (or any series of similar transactions, arrangements or relationships) to which we are a party, in which the aggregate amount involved exceeds or may be expected to exceed $100,000 in any calendar year and in which a related person has or will have a direct or indirect interest. For purposes of this policy, a related person is defined as (i) a director, director nominee, executive officer or a stockholder owning more than 5% of our capital stock (a “5% stockholder”), (ii) an immediate family member, or any person (other than a tenant or household employee) sharing the household, of any of the persons listed in clause (i), or (iii) any entity in which any of the persons in clause (i) or (ii) have a substantial ownership interest. In determining whether to approve or ratify any such transaction, the Audit Committee will take into account, among other factors it deems appropriate, (a) whether the transaction is on terms no less favorable than terms generally available to unaffiliated third-parties under the same or similar circumstances, (b) the extent of the related party’s interest in the transaction and (c) whether the transaction is material to the Company.

Transactions with Related Persons in 2018 and 2019

On March 13, 2018, EVEP and 13 affiliated debtors (collectively, the “Debtors”) entered into a Restructuring Support Agreement (the “Restructuring Support Agreement”). The Restructuring Support Agreement set forth, subject to certain conditions, the commitment of the Debtors and the consenting creditors to support a comprehensive restructuring of the Debtors’ long term debt (the “Restructuring”), EnerVest is no longer a related party to the Company. However, we continue to have a relationship with EnerVest through a services agreement entered into in connection with the Restructuring pursuant to which EnerVest operates the majority of our properties and provides other administrative services.

Pursuant to an omnibus agreement, the Predecessor paid EnerVest $7.2 million for general and administrative services provided during the five months ended May 31, 2018. These fees were based on an allocation of charges between Enervest and the Predecessor based on the estimated use of such services by each party. The Predecessor believed that the allocation method employed by EnerVest was reasonable and reflective of the estimated level of costs the Predecessor would have incurred on a standalone basis.

The Predecessor also had operating agreements with EnerVest whereby EnerVest Operating, a subsidiary of EnerVest, acted as contract operator of the oil and natural gas wells and related gathering systems and production facilities in which the Predecessor owned an interest. The Predecessor reimbursed EnerVest approximately $8.4 million in the five months ended May 31, 2018 for direct expenses incurred in the operation of its wells and related gathering systems and production facilities and for the allocable share of the costs of EnerVest employees who performed services on its properties. As the vast majority of such expenses were charged to the Predecessor on an actual basis (i.e. no mark up or subsidy is charged or received by EnerVest), the Predecessor believed that the aforementioned services were provided to the Predecessor at fair and reasonable rates relative to the prevailing market and were representative of what the amounts would have been on a standalone basis.

In 2011, the Predecessor and certain institutional partnerships managed by EnerVest carved out 7.5% overriding royalty interests (the “ORRI”) from certain acres in Ohio (the “Underlying Properties”), which the Predecessor believed may be prospective for the Utica Shale, and contributed the ORRI to a newly formed limited partnership. EnerVest is the general partner of this partnership. The ORRI entitles the Predecessor to an average approximate 5.64% of the gross revenues from the Underlying Properties. The Predecessor owned a 48% limited partner interest in the partnership and accounted for the investment using the equity method of accounting. The Predecessor recognized $0.1 million of income during the five months ended May 31, 2018, and the Predecessor received $0.3 million of distributions during the five months ended May 31, 2018.

The Company did not have any transactions with related persons during 2019.

| 9 |

Section 16(a) Beneficial Ownership Reporting Compliance

Beneficial ownership reporting pursuant to Section 16(a) of the Exchange Act is not applicable to our officers, directors and beneficial owners because our common stock is not registered pursuant to Section 12(b) or Section 12(g) of the Exchange Act.

| 10 |

The non-employee members of the Board received compensation in 2019 as reflected in the following table:

Name | Fees Earned or Paid in Cash(2) ($) | Stock | Total ($) |

| Timothy S. Caflisch | — | — | — |

| Colby Dunn(1) | — | — | — |

| Patrick Hickey | — | — | — |

| James F. Murchison | 100,000 | 74,040 | 174,040 |

| Steven J. Pully | 120,000 | 74,040 | 194,040 |

| (1) | Mr. Dunn resigned his directorship on March 15, 2019 at which time Mr. Caflisch was appointed to the Board and assumed his duties as a director. |

| (2) | Reflects the aggregate of the quarterly retainers and Board and committee chair retainers (as applicable) earned by each of our directors pursuant to our director compensation program (as described below) for services performed during 2019. |

| (3) | In 2019, 4,936 restricted stock units (“RSUs”) were granted to each of our directors who were not officers, employees or paid consultants or advisors of the Company or its affiliates (i.e., Messrs. Murchison and Pully); all such RSUs remained outstanding as of December 31, 2019, and are scheduled to vest on June 5, 2020. Amounts reported in this column represent the grant date fair value of such RSUs determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). Such amounts are based on the closing price of our common stock on the grant date, which was May 30, 2019, and do not correspond to the actual value that will be recognized by the director. The value ultimately received by the director may or may not be equal to the values reflected above. Pursuant to SEC rules, the amounts reported in the table above exclude the effect of estimated forfeitures. |

Our compensation program for directors is designed to attract and retain qualified candidates to serve on the Board. In setting director compensation, we consider the significant amount of time that directors expend in fulfilling their duties to us as well as the skill level we require of members of the Board. Under our current program, which we adopted in August 2018, our directors who are not officers, employees or paid consultants or advisors of the Company or its affiliates receive a $18,750 quarterly base retainer. In addition, the chairman of the Audit Committee and the chairman of the Compensation Committee each receive a $6,250 quarterly supplemental retainer. In May 2019 (effective for the second quarter of 2019), the Compensation Committee and Board approved a quarterly retainer to be paid to the Chairman of the Board of $2,500, and in January 2020 (effective for the fourth quarter of 2019), the Compensation Committee and Board approved an increase to the quarterly retainer paid to the Chairman of the Board from $2,500 to $15,000. The Board expects to make grants of RSUs to directors who are not officers, employees or paid consultants or advisors of the Company or its affiliates in 2020 and in future years. In 2019, such directors received 4,936 RSUs, which are scheduled to vest on June 5, 2020.

Resignation of Colby Dunn and Appointment of Timothy Caflisch

On March 15, 2019, Colby Dunn notified Board of his decision to resign from his positions as Chairman of the Board and member of the Board, effective as of such date. Prior to his resignation, Mr. Dunn served on the Compensation Committee of the Board. Mr. Dunn’s decision to resign was for personal reasons and not the result of a disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

On March 15, 2019, the Board appointed Timothy Caflisch to serve as a member of the Board, effective immediately upon Mr. Dunn’s resignation. The Board appointed Mr. Caflisch to serve as a member of the Compensation Committee. In connection with his election to the Board, Mr. Caflisch entered into the Company’s standard indemnification agreement for directors and officers.

Also on March 15, 2019, the Board appointed Steven J. Pully, a current member of the Board, to serve as Chairman of the Board.

| 11 |

PROPOSAL ONE—ELECTION OF DIRECTORS

On the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following persons for election as directors at the Annual Meeting, each to serve until the next annual meeting of stockholders and until his successor is duly elected and qualified:

| 1. | Timothy S. Caflisch |

| 2. | Patrick Hickey |

| 3. | Michael E. Mercer |

| 4. | James F. Murchison |

| 5. | Steven J. Pully |

All incumbent directors are nominees for re-election to the Board. All of the nominees have been recommended for nomination by the Nominating and Corporate Governance Committee, and all of them are currently serving as directors. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. If any nominee is unable or declines to serve as director at the time of the Annual Meeting, an event that we do not currently anticipate, proxies will be voted for any nominee designated by the Board to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the nominees named above.

For biographies of each nominee, please see the section entitled “Corporate Governance—Our Executive Officers and Directors.”

Directors are elected by a plurality of the votes cast at the Annual Meeting. A plurality means that the five persons receiving the highest number of affirmative “FOR” votes at the Annual Meeting will be elected. You may withhold votes from any or all nominees.

The Board recommends a vote “FOR” the election to the Board of each of the abovementioned nominees.

| 12 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP (“Deloitte”) served as our independent registered public accounting firm for the fiscal year ended December 31, 2019. Representatives of Deloitte are expected to be present at the Annual Meeting. They will have the opportunity to make a statement and will be available to respond to appropriate questions. The Audit Committee is evaluating independent registered public accounting firms for the fiscal year ending December 31, 2020 and has not yet made a selection.

The fees billed by Deloitte for professional services rendered for 2019 and 2018 are reflected in the following table:

| 2019 | 2018 | ||||||

| Audit Fees(1) | $ | 750,000 | $ | 1,812,727 | |||

| Audit-Related Fees | — | — | |||||

| Tax Fees(2) | 17,000 | 25,000 | |||||

| All Other Fees(3) | — | 380,898 | |||||

| Total | $ | 767,000 | $ | 2,218,625 | |||

| (1) | Represents fees for professional services provided in connection with the audit of our annual financial statements, reviews of our quarterly financial statements and our SEC registration statements. |

| (2) | In 2019 and 2018 represents fees for tax compliance and advisory services. |

| (3) | In 2018, represents fees for professional services related to the Restructuring. |

All of the services of Deloitte for 2019 and 2018 listed above were approved by the Audit Committee or the Audit Committee of the Predecessor Board. The Audit Committee has concluded that the provision of the non-audit services listed above is compatible with maintaining the independence of Deloitte.

The Audit Committee’s charter requires that it pre-approve all audit and non-audit services of our independent registered public accounting firm. The Audit Committee may consult with management in determining which services are to be performed, but may not delegate to management the authority to make these determinations.

| 13 |

The Audit Committee has reviewed and discussed the Company’s audited financial statements and internal controls for the year ended December 31, 2019 with management and has discussed with Deloitte, the Company’s independent registered public accounting firm, the matters required to be discussed by the applicable rules and standards promulgated by the Public Company Accounting Oversight Board (the “PCAOB”). Additionally, the Audit Committee has received the written disclosures and the letter from Deloitte required by the applicable requirements of the PCAOB and has discussed with Deloitte its independence. Based upon such review and discussions, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2019.

Submitted by:

The Audit Committee

Steven J. Pully, Chairman

James F. Murchison, Member

| 14 |

EXECUTIVE COMPENSATION Discussion

We are currently considered a smaller reporting company for the purposes of the SEC’s executive compensation disclosure rules. In accordance with such rules, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year End Table, as well as limited narrative disclosures. Our reporting obligations extend only to the individuals serving as our chief executive officer and our two other most highly compensated executive officers. We refer to the two executives listed below as “named executive officers.”

Name | Principal Position |

| Michael E. Mercer | President, Chief Executive Officer and Director |

| Ryan Stash | Vice President and Chief Financial Officer |

We are an independent oil and natural gas company formed in 2018 in connection with the reorganization of the Predecessor and engaged in the efficient operation and development of onshore oil and natural gas properties in the continental United States. We seek to create value for stockholders, employees, energy consumers and the communities in which we work. With these goals in mind, our executive compensation program is designed to attract, retain, motivate and appropriately reward talented and experienced executives while ensuring that the interests of our named executive officers are aligned with the interests of our stockholders.

Objectives of Our Compensation Program

Our executive compensation program is intended to align the interests of our management team with those of our stockholders by motivating our executive officers to achieve strong financial and operating results for us, which we believe closely correlate to long-term shareholder value. In addition, our program is designed to attract and retain talented executive officers by providing reasonable total compensation levels competitive with that of executives holding comparable positions in similarly situated organizations.

How We Make Compensation Decisions

Role of the Compensation Committee.The Compensation Committee has overall responsibility for the approval, evaluation and oversight of all of our compensation programs, including administering our 2018 Omnibus Incentive Plan (the “2018 OIP”). The Compensation Committee’s primary purpose is to assist the Board in the discharge of its fiduciary responsibilities relating to fair and competitive compensation. The Compensation Committee is also responsible for reviewing our Compensation Discussion and Analysis and producing the Compensation Committee Report, each to be included in our annual meeting proxy statement or Annual Report on Form 10-K, with respect to our executive compensation disclosures. Finally, the Compensation Committee establishes our compensation objectives to maintain a competitive and effective compensation program. For more detailed information regarding the Compensation Committee, the current Compensation Committee charter is posted on the Investor Relations section of our website at https://ir.hvstog.com.

Performance Metrics. The Compensation Committee makes a subjective determination at the end of the fiscal year as to the appropriate compensation based on a recommendation from our President and Chief Executive Officer and given their view of our performance for the year.

Elements of Our Compensation Program

To accomplish our objectives, we seek to offer a total direct compensation program to our executive officers that, when valued in its entirety, serves to attract, motivate and retain executives with the character, experience and professional accomplishments required to execute our strategy in a demanding environment. Our compensation program is currently comprised of the following elements: (i) base salary, (ii) cash bonus, (iii) long-term equity based compensation and (iv) benefits. In addition, our compensation program in 2018 contained a key employee incentive element.

| 15 |

Base Salary. We pay base salary in order to recognize each executive officer’s unique value and historical contributions to our success in light of salary norms in the industry and the general marketplace; to effectively compete with others for executive talent; to provide executives with sufficient, regularly-paid income; and to reflect position and level of responsibility.

Cash Bonus. We include an annual cash bonus as part of our compensation program because we believe this element of compensation helps to motivate management to achieve key operational objectives by rewarding the achievement of these objectives. The annual cash bonus also allows us to be competitive from a total remuneration standpoint. Our current key operational objectives include production and capital expenditure results relative to budget, lease operating and general administrative expense control, performance in completing asset divestitures, implementing appropriate commodity hedging programs and successful management of our credit facility and banking relationships.

Long-Term Equity-Based Compensation. Long-term equity-based compensation has traditionally been an element of our compensation policy because we believe it aligns executives’ interests with the interests of our stockholders, rewards long-term performance, is required in order for us to be competitive from a total remuneration standpoint, encourages executive retention and gives executives the opportunity to share in our long-term performance.

In 2018, we adopted the 2018 OIP, pursuant to which any individual employed by any member of the Company Group (as defined in the 2018 OIP), director of any member of the Company Group, or consultant or advisor to any member of the Company Group who may be offered securities registrable on Form S-8 under the Exchange Act are eligible to receive stock options, stock appreciation rights, restricted stock, RSUs, other stock-based awards and cash-based awards. There are 27 participants who have received awards under the 2018 OIP, including Messrs. Mercer and Stash.

In 2019, Messrs. Mercer and Stash were granted performance-based RSUs and time-vesting RSUs under the 2018 OIP. The performance-based RSUs vest upon the consummation of the sale of certain assets of the Company. As a result of the consummation of the sales of certain assets of the Company during 2019, Messrs. Mercer and Stash received 25,596 and 17,081 shares of common stock, respectively, upon the vesting of performance-based RSUs. The time-vesting RSUs vest in three equal annual installments, beginning June 5, 2019. Messrs. Mercer and Stash received 11,947 and 7,974 shares of common stock, respectively, upon the vesting of time-vesting RSUs on June 5, 2019.

Benefits. We believe in a simple, straight-forward compensation program and, as such, our executive officers are not provided unique perquisites or other personal benefits. Consistent with this strategy, no perquisites or other personal benefits for any of our executive officers have in 2019 exceeded, or are expected to exceed in 2020, $10,000.

We offer our executive officers health and welfare benefits that are generally available to our other employees and that we believe are standard in the industry. These benefits consist of a group medical, dental and vision insurance program for employees and their qualified dependents, group life insurance, accidental death and dismemberment coverage and a 401(k) retirement plan. We make safe harbor nonelective contributions equal to 6%, and other nonelective contributions equal to 3%, of a 401(k) plan participant’s compensation to his or her 401(k) plan account each payroll period.

Prior to the Emergence Date, certain officers and other highly compensated employees of EnerVest and its subsidiaries participated in the EnerVest Ltd. Retirement Plan (the “Retirement Plan”), a defined benefit plan under ERISA. The purpose of the Retirement Plan was to provide a company funded tax-qualified plan for retirement benefits on a tax-advantaged basis. The participants accrued a benefit based on their age, designated “allocation group,” the investment yield on the Retirement Plan’s assets and other factors, subject to the limits on benefits prescribed under the Internal Revenue Code. The benefit was payable in various annuity forms or as a lump sum. All benefit election forms were actuarially equivalent, and there were no subsidies to any election. On the Emergence Date, our employees ceased to participate in the Retirement Plan. Employees who were eligible to participate in the Retirement Plan received their cash compensation in two forms: (i) base salary and annual bonus, subject to applicable taxes and withholdings, and (ii) a fully vested annual company contribution to the Retirement Plan. Therefore, the overall level of compensation was not enhanced for the Retirement Plan participants because a portion of compensation was contributed to the Retirement Plan by us in lieu of current cash compensation. In 2018, the total bonus paid to Mr. Mercer was inclusive of the amount delivered in cash and in company contributions under the Retirement Plan.

| 16 |

At the time of the adoption of the Retirement Plan, EnerVest amended its 401(k) plan with regard to EnerVest’s contributions. Under the 401(k) plan, all employees who were eligible to participate received a 3% “safe harbor” contribution from EnerVest. In addition, under the 401(k) plan, EnerVest could make a discretionary profit sharing contribution that was allocated to participant accounts based on their designated “allocation group.” The allocation groups were structured so that certain officers and other highly paid employees received a profit sharing contribution that was a greater percentage of compensation than the percentage applicable to other participants. Until the Emergence Date, Mr. Mercer participated in the Retirement Plan and received discretionary profit sharing 401(k) contributions in an allocation group that paid a higher percent of their compensation than allocated to other participants. We reimbursed EnerVest for any amounts contributed to the Retirement Plan and the EnerVest 401(k) plan attributable to Mr. Mercer.

The 2018 OIP and all of our named executive officers’ employment agreements are subject to deductions and clawbacks that may be required to be made pursuant to any law, government regulation or stock exchange listing requirement or by any policy adopted by us. To date, the Board has not adopted a formal clawback policy to recoup incentive-based compensation upon the occurrence of a financial restatement, misconduct or other specified events. The Sarbanes-Oxley Act of 2002 mandates that the chief executive officer and chief financial officer reimburse the Company for any bonus or other incentive-based or equity-based compensation paid to them in a year following the issuance of financial statements that are later required to be restated as a result of misconduct.

Anti-Hedging and Anti-Pledging Policy

The Company maintains an insider trading policy that prohibits trading shares of our common stock when in possession of material non-public information. It also prohibits, unless a waiver is obtained from our compliance officer, the hedging and the pledging of our shares. Since the adoption of our insider trading policy, no waivers to the policy’s general prohibition on hedging and pledging have been granted.

Accounting and Tax Considerations

The Compensation Committee reviews and considers the tax, accounting and securities law implications of our compensation programs, as well as the effect the awards will have on our consolidated financial statements.

Section 162(m). Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) prohibits deductions for compensation paid in excess of $1 million during a single fiscal year to certain executive officers. Prior to implementation of the Tax Cuts and Jobs Act (the “Tax Act”), there was an exception to this prohibition for performance-based awards (as that term is defined in the Code), which exception (the “Performance-Based Exception”) will continue with respect to compensation paid pursuant to certain written contracts in effect on November 2, 2017. We take the economic effects of Code Section 162(m) into consideration when determining the structure, implementation and amount of awards paid to our executive officers, including the deductibility of our executive compensation programs. Prior to the implementation of the Tax Act, awards granted under our incentive program, including our annual cash bonuses, were generally structured to not be subject to Code Section 162(m), but the elimination of the Performance-Based Exception has greatly reduced our flexibility in this regard. Accordingly, we reserve the right to pay non-deductible compensation to our executive officers.

Section 409A. If an executive is entitled to nonqualified deferred compensation benefits that are subject to Code Section 409A, and such benefits do not comply with Code Section 409A, then the benefits are taxable in the first year they are not subject to a substantial risk of forfeiture. In such case, the service provider is subject to regular federal income tax, interest and an additional federal penalty tax of 20% of the benefit includible in income. Our compensation arrangements are generally designed to be exempt from or compliant with Code Section 409A.

| 17 |

Accounting for Executive Compensation. Currently, all equity-based compensation is accounted for under the rules of the FASB ASC Topic 718. This rule requires us to estimate the expense of each equity award over the vesting period of the award and record it as such. We are also obligated to record cash-based awards as an expense at the time our payment obligation is accrued.

| 18 |

We have entered into employment agreements with each of our named executive officers. The Compensation Committee has determined that having employment agreements with these executive officers is in the best interests of the Company and its stockholders. Many of the companies with which we compete for executive talent provide similarly situated executives with employment agreements and, as such, the agreements are an important recruiting and retention tool. We believe that the current executive officers have been integral to our success and are vital to the continuing performance of the Company.

President and Chief Executive Officer

Our employment agreement with Mr. Mercer provides that Mr. Mercer will serve as our President and Chief Executive Officer beginning on the Emergence Date and the initial term ended on June 4, 2019. However, the agreement is subject to automatic one-year renewals of the term if neither Mr. Mercer nor the Company submits a notice of termination at least 60 days prior to the end of the then-current term. In addition, each of the Company and Mr. Mercer has the right to give notice of termination to terminate his employment and the employment agreement, subject to certain severance obligations in the event of certain qualifying terminations of employment as described below, provided that any termination by Mr. Mercer without “good reason” requires at least 45 days prior notice.

Mr. Mercer’s employment agreement provides for a minimum annual base salary of $400,000, subject to upward adjustment by the Company (but not a decrease), in its sole discretion, and eligibility to participate in the employee and executive benefit plans and programs of the Company.

In the event of the termination of Mr. Mercer’s employment (i) by Mr. Mercer for “good reason,” (ii) by the Company “without cause” or (iii) due to the Company’s non-renewal of the employment agreement, subject to his timely execution delivery and non-revocation of a release of claims and continued compliance with the restrictive covenants to which he is subject (including perpetual confidentiality, assignment of inventions, 12-month non-solicitation of employees and independent contractors and mutual non-disparagement), he will be entitled to receive from the Company a lump-sum cash payment equal to two times the sum of (x) his annual base salary in effect as of the termination date and (y) the target bonus amount, if any, established by the Compensation Committee that he is eligible to receive under the Company’s cash bonus program in effect as of the time of the qualifying termination, but not less than 100% of his base salary.

In addition, Mr. Mercer will also receive continued group health plan coverage following the termination date for himself and his eligible spouse and dependents, under all group health plans in which he participates that are subject to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), for the maximum period for which they are eligible to receive COBRA coverage in accordance with applicable law. He will not be required to pay more for such coverage than is charged by the Company to its officers in active service and receiving coverage under such plan (however, if there are no officers in active service participating in such plan during which COBRA coverage is provided, then he will not be required to pay more for such COBRA coverage than the monthly premium rate as in effect of the termination date). In the event that COBRA coverage ceases during the period in which it is to be provided under the employment agreement due to the Company liquidating and no such plan being in existence (the “Liquidating Event”), the Company will pay to Mr. Mercer an amount equal to the product of (x) the Company’s portion of the monthly premium rate in effect as of the termination date and (y) the number of full or partial months remaining in the 18-month period after the termination date following the occurrence of a Liquidating Event, payable in a lump sum within 60 days following the occurrence of a Liquidating Event.

Mr. Mercer will not be entitled to receive a severance payment or the discontinued COBRA rate in the event of his resignation or other voluntary termination of employment by him without “good reason,” his termination by the Company “for cause,” his non-renewal of the employment term, or a termination due to his death or disability.

“Good reason” is defined in Mr. Mercer’s employment agreement as the occurrence of any of the following events without Mr. Mercer’s express written consent: (i) a reduction of his annual base salary; (ii) a material reduction in his authority, duties or responsibilities; (iii) his primary place of employment being moved to a location greater than 50 miles away from its then-current location; or (iv) any other action or inaction that constitutes a material breach by the Company of the employment agreement. In the case of his allegation of a “good reason” event, (a) Mr. Mercer must provide notice to the Board or the Compensation Committee of the event alleged to constitute “good reason” within 60 days of his knowledge of the event and (b) the Company will have the opportunity to cure the alleged event within 30 days from receipt of notice of such allegation. If the Company does not cure the circumstance giving rise to “good reason” prior to the end of the 30 day cure period, Mr. Mercer’s termination must occur within 30 days following the end of the cure period for such a termination to be considered a termination for “good reason.”

| 19 |

“Cause” is defined as Mr. Mercer’s (w) conviction by a court of competent jurisdiction as to which no further appeal can be taken of a felony or entering a plea of guilty or nolo contendere to such felony; (x) commission of a demonstrable act of fraud, or misappropriation of material funds or property of the Company or any of its affiliates; (y) without prior written approval of the Board or the Compensation Committee, engagement in any activity that directly competes with the business of the Company or any of its affiliates, or which would directly result in a material injury to the business or reputation of the Company or any of its affiliates; or (z) repeated nonperformance of his duties to the Company or any of its affiliates (other than by reason of his illness or incapacity) that continues after notice from the Board or the Compensation Committee and his continued failure to remedy such nonperformance.

The foregoing description of Mr. Mercer’s employment agreement does not purport to be complete and is qualified in its entirety by the full text of such agreement.

Our employment agreement with Mr. Stash provides for a minimum annual base salary of $250,000, subject to upward adjustment by the Company (but not a decrease), in its sole discretion, and eligibility to participate in the employee and executive benefit plans and programs of the Company. Additionally, Mr. Stash is eligible to receive an annual discretionary bonus under the Company’s annual bonus program. For 2018, Mr. Stash was entitled to receive a minimum annual bonus equal to $150,000 (to be prorated based on days of actual employment), and commencing in 2019, he is eligible to receive an annual bonus with a target amount between $100,000 and $200,000 based upon the attainment of goals established by the Board or the Compensation Committee. In addition, pursuant to this employment agreement, Mr. Stash is entitled to receive a one-time grant of 48,000 RSUs, subject to the terms and conditions of the award agreement and the 2018 OIP.

In the event of a termination of Mr. Stash’s employment, he shall be entitled to receive: (i) accrued unpaid base salary through the termination date; (ii) accrued and unused paid time off through the termination date; and (iii) reimbursement of reasonable business expenses that were incurred but unpaid as of the termination date. In the event of the termination of Mr. Stash’s employment (i) by Mr. Stash for “good reason,” (ii) by the Company “without cause” or (iii) due to the Company’s non-renewal of the employment agreement, subject to his timely execution delivery and non-revocation of a release of claims and continued compliance with the restrictive covenants to which he is subject (including perpetual confidentiality, assignment of inventions, 12-month non-solicitation of employees and independent contractors and mutual non-disparagement), he will be entitled to receive from the Company a lump sum cash payment equal to one times his base salary.

In addition, Mr. Stash will also receive continued group health plan coverage following the termination date for himself and his eligible spouse and dependents, under all group health plans in which he participates that are subject to COBRA for the maximum period for which they are eligible to receive COBRA coverage in accordance with applicable law. He will not be required to pay more for such coverage than is charged by the Company to its officers in active service and receiving coverage under such plan (however, if there are no officers in active service participating in such plan during which COBRA coverage is provided, then he will not be required to pay more for such COBRA coverage than the monthly premium rate as in effect of the termination date). In the event that COBRA coverage ceases during the period in which it is to be provided under the employment agreement due to a Liquidating Event, the Company will pay to Mr. Stash an amount equal to the product of (x) the Company’s portion of the monthly premium rate in effect as of the termination date and (y) the number of full or partial months remaining in the 18-month period after the termination date following the occurrence of a Liquidating Event, payable in a lump sum within 60 days following the occurrence of a Liquidating Event.

| 20 |

Mr. Stash will not be entitled to receive a severance payment or the discontinued COBRA rate in the event of his resignation or other voluntary termination of employment by him without “good reason,” his termination by the Company “for cause,” his non-renewal of the employment term, or a termination due to his death or disability.

“Good reason” is defined in Mr. Stash’s employment agreement as the occurrence of any of the following events without Mr. Stash’s express written consent: (i) a reduction of his base salary; (ii) a material reduction in his authority, duties or responsibilities; (iii) his primary place of employment being moved to a location greater than 50 miles away from its then-current location; or (iv) any other action or inaction that constitutes a material breach by the Company of the employment agreement. In the case of his allegation of a “good reason” event, (a) Mr. Stash must provide notice to the Board or the Compensation Committee of the event alleged to constitute “good reason” within 60 days of his knowledge of the event and (b) the Company will have the opportunity to cure the alleged event within 30 days from receipt of notice of such allegation. If the Company does not cure the circumstance giving rise to “good reason” prior to the end of the 30 day cure period, Mr. Stash’s termination must occur within 30 days following the end of the cure period for such a termination to be considered a termination for “good reason.”

“Cause” is defined as Mr. Stash’s (w) conviction by a court of competent jurisdiction as to which no further appeal can be taken of a felony or entering a plea of guilty or nolo contendere to such felony; (x) commission of a demonstrable act of fraud, or misappropriation of material funds or property of the Company or any of its affiliates; (y) without prior written approval of the Board or the Compensation Committee, engagement in any activity that directly competes with the business of the Company or any of its affiliates, or which would directly result in a material injury to the business or reputation of the Company or any of its affiliates; or (z) repeated nonperformance of his duties to the Company or any of its affiliates (other than by reason of his illness or incapacity) that continues after notice from the Board or the Compensation Committee and his continued failure to remedy such nonperformance.

The foregoing description of Mr. Stash’s employment agreement does not purport to be complete and is qualified in its entirety by the full text of such agreement.

| 21 |

All of our named executive officers have employment agreements with us that provide for compensatory payments and benefits upon certain termination events, including a termination event in connection with a change in control. In addition, certain awards pursuant to the 2018 OIP provide for termination and change in control payments. For a discussion regarding the mechanics and amounts of these payments, please see “Executive Compensation—Potential Payments Upon Termination or Change in Control” below. We do not have any single-trigger arrangements (i.e., arrangements that provide for payments to executives solely upon a change in control). In exchange for the severance benefits afforded to our named executive officers in their employment agreements, our named executive officers must execute (and not revoke) a general release and, in addition, are subject to certain ongoing obligations that accrue to the benefit of the Company, including certain confidentiality, non-competition, and non-solicitation obligations.

We provide these post-employment arrangements in order to retain our named executive officers and to allow them to focus on enhancing the value of the Company without taking into account the personal impact of their business decisions. Our post-employment arrangements allow our named executive officers to objectively manage the Company and provide a competitive benefit for attracting and retaining executives.

| 22 |

2019 Summary Compensation Table

The following table summarizes the compensation awarded to, earned by or paid to our named executive officers for the fiscal years ended December 31, 2019 and 2018.

| Name and Principal Position | Year | Salary ($) | Bonus (1)($) | Stock/Unit Awards (2)($) | All Other Compensation (3)($) | Total ($) | ||||||||||||||||

| Michael E. Mercer President, Chief Executive Officer and Director | 2019 2018 | 416,000 400,000 | 208,000 367,110 | 1,137,986 460,090 | 25,200 94,502 | 1,787,186 1,321,702 | (4) | |||||||||||||||

| Ryan Stash Vice President and Chief Financial Officer | 2019 2018 | 260,000 43,836 | 156,000 26,302 | 759,450 — | 23,400 5,829 | 1,198,850 75,967 | ||||||||||||||||

| (1) | Bonuses for 2019 include $208,000 for Mr. Mercer and $156,000 for Mr. Stash, paid in December 2019 as bonuses for services in 2019. Bonuses for 2018 include $367,110 for Mr. Mercer, paid in 2018 under the KEIP. The remaining bonus included in these amounts represent amounts paid in December 2018 as bonuses for services in 2018. |