Master Limited Partnership Investor

Conference

March 8, 2007

EV Energy Partners, L.P.

Risks and Forward-Looking Statements

This presentation includes “forward-looking statements” as defined by the Securities and Exchange Commission. All

statements, other than statements of historical facts, included in this presentation that address activities, events or

developments that the partnership expects, believes or anticipates will or may occur in the future are forward-looking

statements. Words such as “anticipates,” “intends,” “plans,” “projects,” “believes,” and similar words are intended to

identify such forward-looking statements. These statements are based on certain assumptions made by the partnership

based on its experience and perception of historical trends, current conditions, expected future developments and other

factors it believes are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks

and uncertainties, many of which are beyond the control of the partnership, which may cause our actual results to differ

materially from those implied or expressed by the forward-looking statements. These include risks relating to financial

performance and results, availability of sufficient cash flow to pay distributions and execute out business plan, prices and

demand for natural gas and oil, our ability to replace reserves and efficiently develop and produce our current reserves

and other important factors that could cause actual results to differ materially from those projected. These factors are

described in more detail in our reports filed with the Securities and Exchange Commission, which are available at

www.sec.gov or on our Web site, or by calling us at 713-651-1144.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or

future events.

2

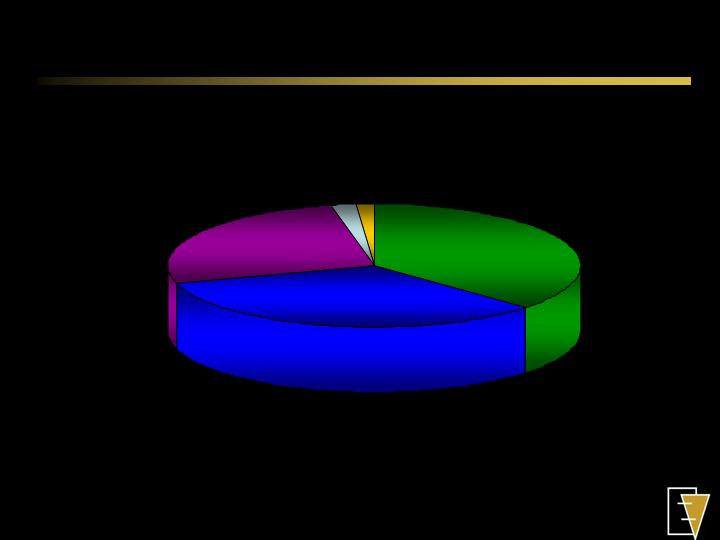

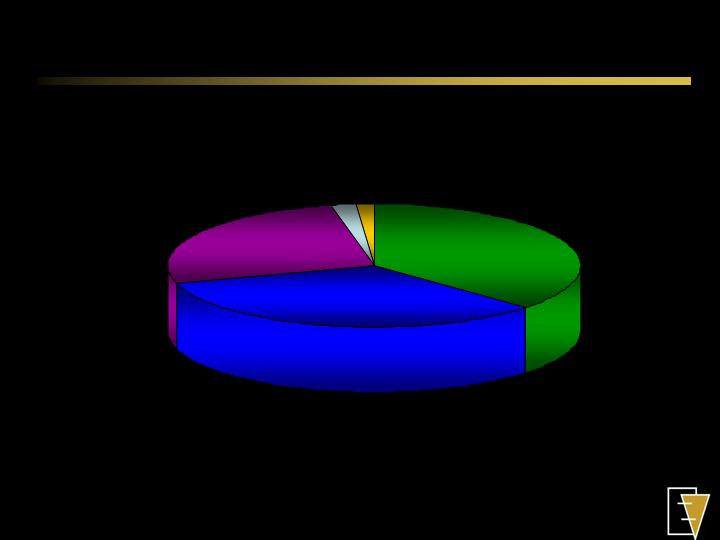

EVEP Units

IPO

Common

Units

37%

Subordinated

Units

26%

Sponsor

Common

Units

1%

General

Partner

Interest

2%

Private

Placement

Common

Units

34%

3

Unit Price History

4

EVEP’s General Partner

GP Ownership

EnerVest 71.25%

EnCap 23.75%

Management 5%

EnerVest formed in 1992

EnCap formed in 1988

5

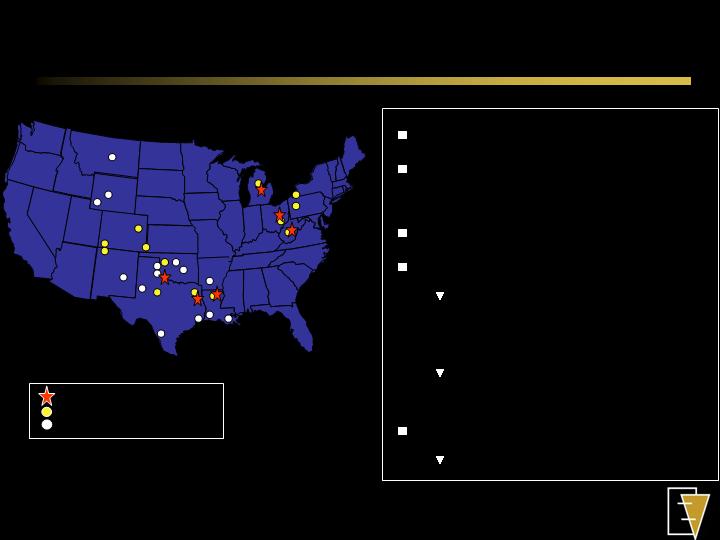

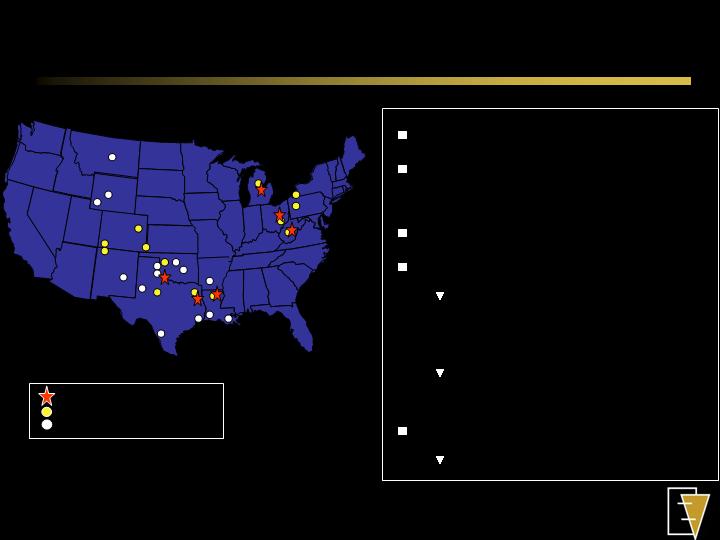

EnerVest Areas of Operations

15-year A&D Track Record

Operates > 10,000 Wells

in 11 States

> 850 Bcfe Reserves

Active in U.S. Market

Acquired > $1.2 billion and

divested $300 million since

January 2005

Acquired > $250 million in

2006

~ 360 Employees

> 50 technical professionals

EVEP Assets

EnerVest Operations

EnerVest Historical Operations

* Pro forma for Michigan acquisition.

6

Complementary Business Lines

Combined

Ability to maintain large presence in key basins over the long term

Economies of Scale

Drilling services, marketing

Scale to maintain employee base more effectively

Maintain Basin expertise

MLP Business - EVEP

Focus on mostly producing

reserves

>80% PDP

Buy and hold

Yield focus

Logical alternative buyer for

certain assets from Institutional

Business

Institutional Business

Focus on reserves with more upside

50% PDP/50% Upside

Acquire/Exploit/Sell model

Shorter hold times

More IRR Focused

7

EVEP Business Strategy and Philosophy

Increase reserves and production through accretive acquisitions

Maintain conservative debt levels to reduce risk and facilitate acquisitions

Reduce exposure to commodity price risk through hedging

Keep inventory of PUD drilling locations sufficient to maintain production

Retain operational control

Focus on controlling costs

Provide Stability and Growth in Cash Distributions

Per Unit Over Time

8

Activity Since IPO

September 2006EV Energy Partners prices IPO

December 2006 Closed two acquisitions for $28 MM

Negotiated transactions with Five States

Energy

January 2007 Closed $71.6 MM Mich acquisition

Drop down acquisition from EnerVest

Fund IX

Management anticipates recommending

increase in distribution for 1Q 2007 to

$0.46/unit

9

Activity Since IPO

February 2007 Paid initial distribution of $0.40/unit

for 4Q 2006

February 2007 Completed $100 MM equity private

placement

Proceeds to repay existing debt

Significant financing capacity to

continue to capitalize on future growth

opportunities

March 2007 Announced $96 MM acquisition of

Monroe Field assets

10

Attractive Acquisition Metrics

Acquisition Price Reserves Rate $/mcfe $/mcfepd

($mm) (Bcfe) (Mcfepd)

Five States 28 14.8 3,100 1.90 9,032

Michigan 72 56.3 6,850 1.27 10,453

Monroe 96 65.4 7,600 1.47 12,631

Total/Average 196 136.4 17,550 1.43 11,166

Further Diversification

All transactions are negotiated

Newly acquired assets in basins where EnerVest has expertise

Increased EVEP portfolio diversification

11

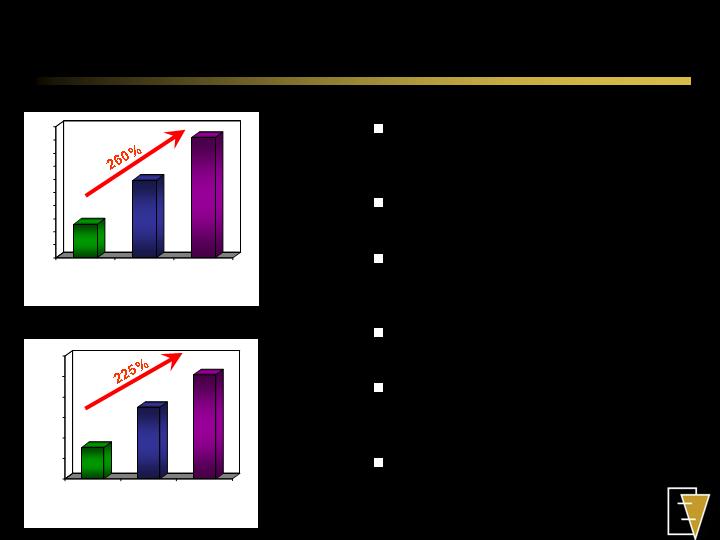

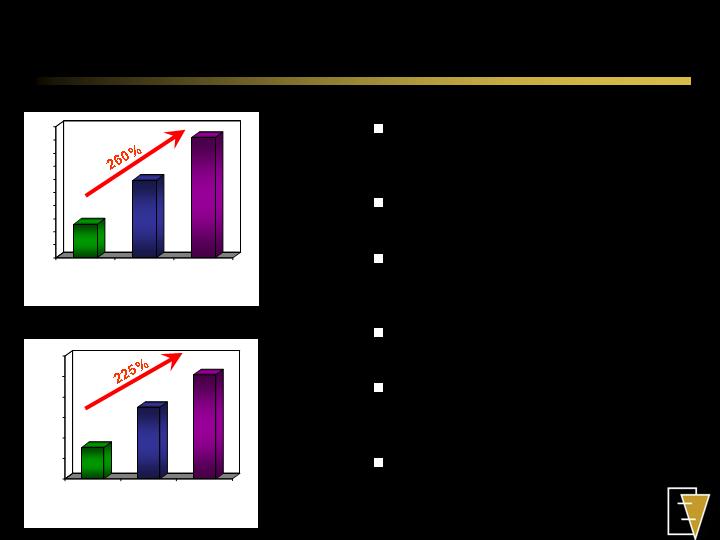

Dramatic Growth Since IPO

0

20

40

60

80

100

120

140

160

180

200

12/31/2005

12/31/06

Pro forma

Michigan

12/31/06

Pro forma

Monroe

51 bcfe

183 bcfe

118 bcfe

Proved Reserves - BCFE

0

5,000

10,000

15,000

20,000

25,000

30,000

IPO

Current

Pro forma

Michigan

Current

Pro forma

Monroe

7,700 mcfe/d

17,500 mcfe/d

25,100 mcfe/d

Production – MCFE/D

12

Asset Overview

EV Energy Partners, L.P.

EVEP Areas of Operations

* Pro forma for Michigan and Monroe acquisitions

EVEP Total Assets *

Proved Reserves: 183.4 Bcfe

Current Net Prod.: 25.1 mmcfe/d

Natural Gas: 93%

PDP: 94%

PDP Decline Rate (2007-2008): 7.1%

14

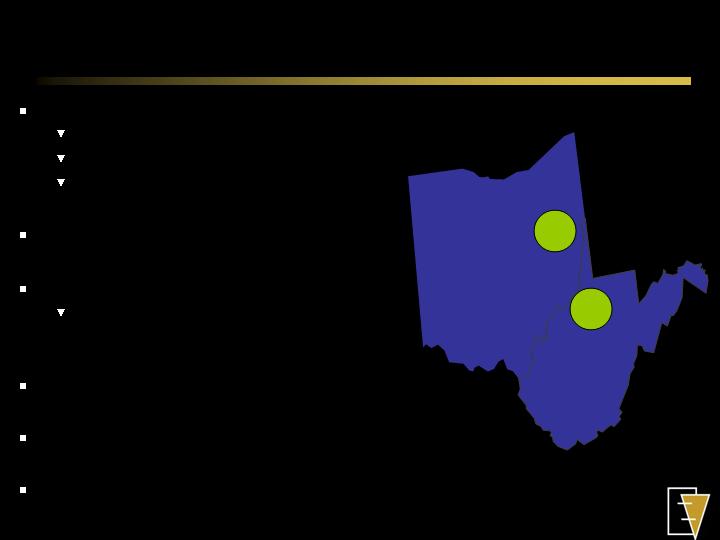

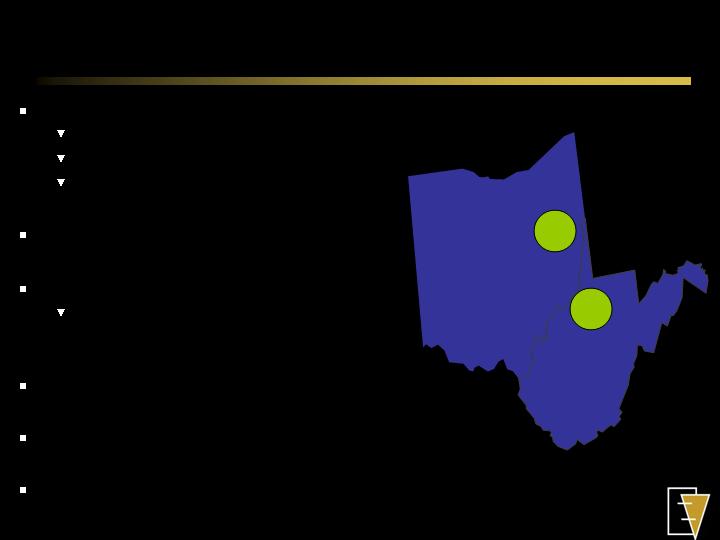

Appalachia/Michigan Assets

EnerVest

Proved Reserves

395 BCFE

69 MMCFE/D

Attractive Characteristics

Long-lived reserves, predictable decline rates

Premium pricing

High drilling success rates, low maintenance capital requirements

Significant consolidation opportunities

EVEP

Proved Reserves

88.7 BCFE

12.2 MMCFE/D

15

EVEP Appalachia Assets

Proved Reserves (12/31/06):

32.4 Bcfe

81% Gas

87% PDP

Average working interest >90%

Premium Pricing

Average premium to NYMEX of over

$1.00

Drilling targets: 1,000 to 6,000 feet

Current Net Rate ~ 5,300 Mcfed

R/P ratio 17 years

16

Michigan Acquisition

Antrim Play Area

Proved Reserves (12/31/06):

56.3 Bcfe

100% Gas

89% PDP

100% operated, 91% average

working interest

Otsego & Montmorency Counties,

Michigan, 341 producing wells

Reservoir: Antrim Shale

Current Net Rate ~ 6,850 Mcfed

R/P ratio >20 years

Note: Michigan acquisition closed 1/31/07.

17

Mid-Continent Acquisitions

Proved Reserves (12/31/06)

14.7 Bcfe

60% gas

97% PDP

~9% Average working interest

100% Outside Operated

Current Net Rate ~ 3,100 Mcfed

R/P Ratio 13 Years

18

Monroe Field Acquisition

Substantially increases

presence in field

65.4 Bcfe increase in

reserves to 80.2 Bcfe

7,600 mcfed increase in

current production rate to

9,850 mcfed

Significant increase in

transportation and

marketing

Discovered in 1916

Produced > 7 Tcf

Covers 460 miles in 3 parishes

EnerVest has operated since

1988

19

Monroe Field Acquisition

EVEP -

Jacobs

EVEP -

Primos

Approximate

field limits

EnerVest

Monroe, LP

Six

miles

Ouachita

river

Pro forma Proved Reserves

(12/31/06)

80.2 Bcfe

100% gas

99% PDP

100% working interest

160,000 gross acres

Gas transportation and marketing

~ $2.1 MM per year

Additional unbooked potential from

shallow zones

Current Net Rate ~ 9,850 Mcfe/d

R/P ratio 22 years

Field Dominance

20

Financial Overview

EV Energy Partners, L.P.

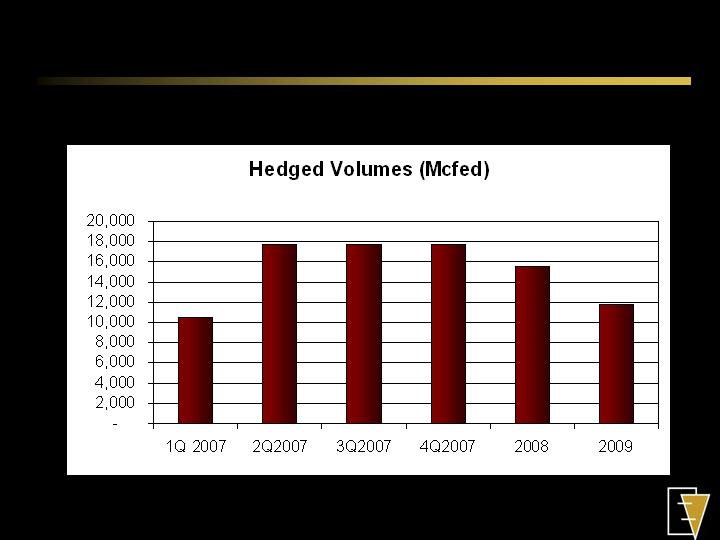

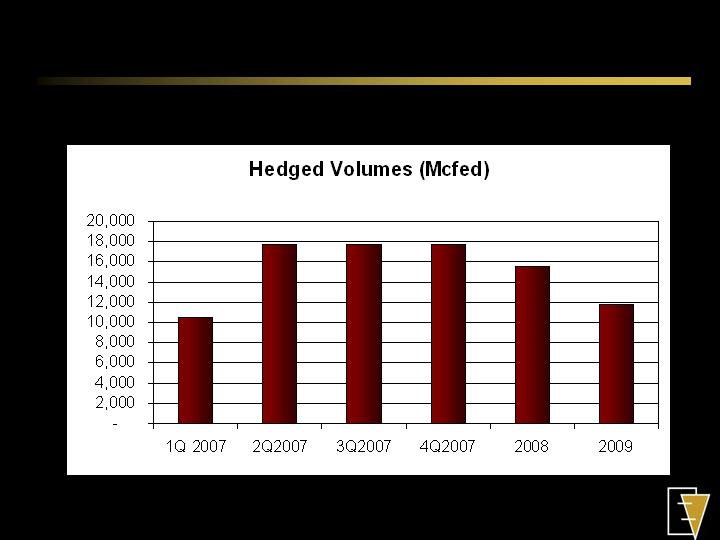

Commodity Price Hedging

22

Commodity Price Hedging

23

Commodity Price Hedging

24

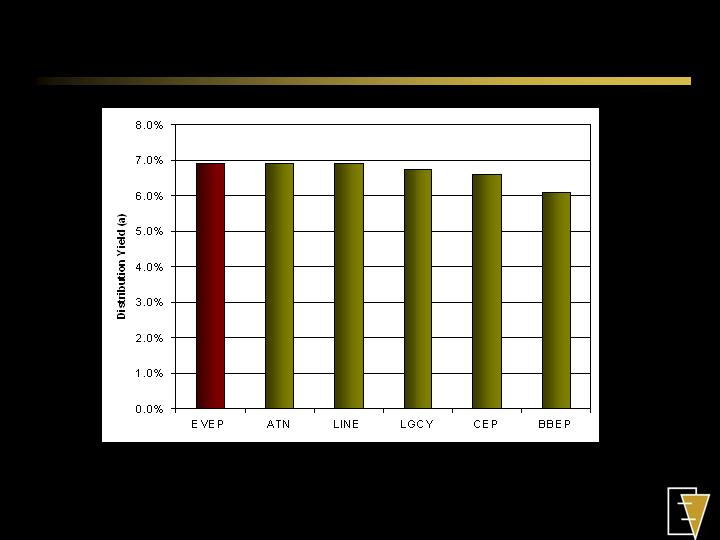

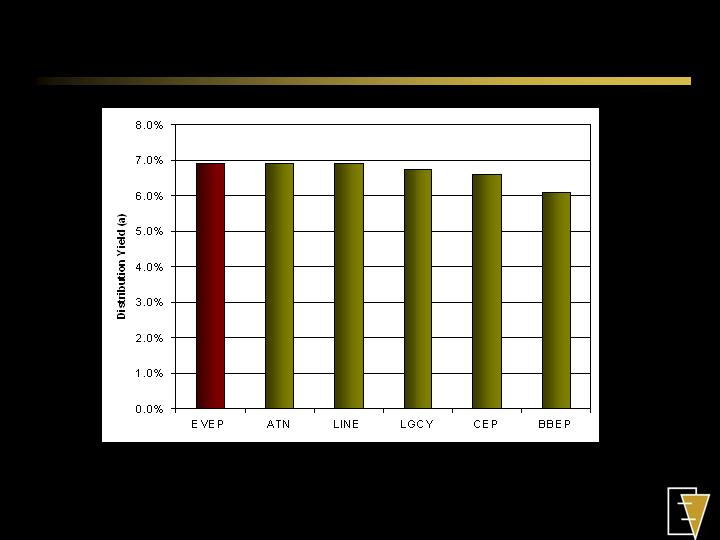

Attractive Distribution Yield (a)

(a)

Source: Company filings and announcements. Distribution Yield calculated based on 1) closing unit prices at 02/27/07 and 2) recent

announcements regarding expected distribution rates for EVEP ($1.84 annualized beginning 1Q 2007) and Linn Energy ($2.28

annualized beginning 2Q 2007), initial quarterly distribution rates from recent prospectus’ for ATN, CEP and LGCY; and recent analyst

estimate ($1.70 annualized) for BBEP pro forma for acquisition announced on 1/22/07.

EVEP has an attractive distribution yield, as well as a significant estimated

cushion over distributions.

25

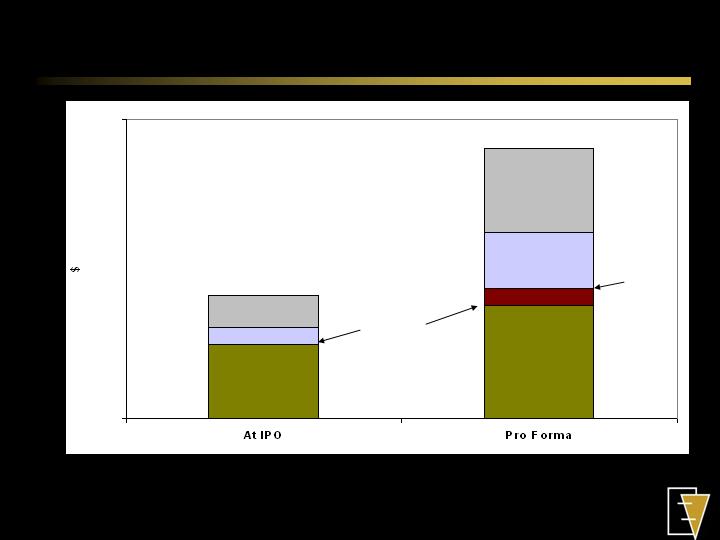

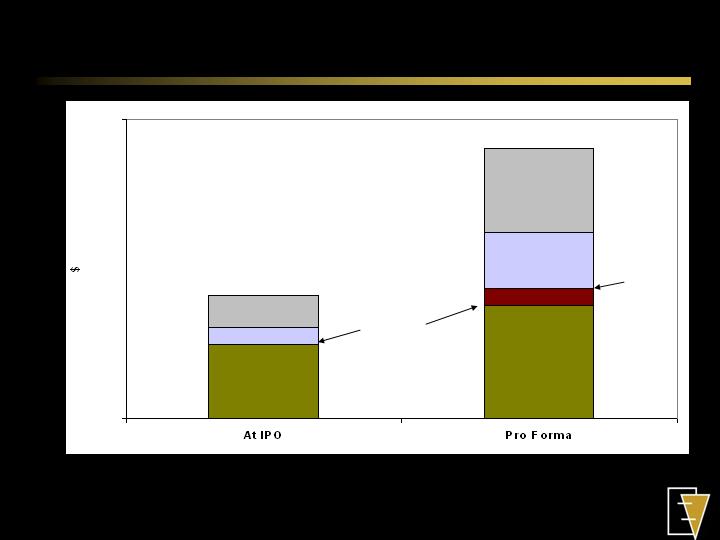

Significant Cushion Over Distributions

Note: At IPO based on forecasted operating surplus in prospectus dated 9/26/06. Pro Forma is based on midpoint

of 2007 Guidance estimates, assumed 2007 NYMEX prices of $7.50 for natural gas and $60.00 for crude oil,

$100 million equity issuance in February, 2007 and inclusion of the Monroe acquisition (financed 100% with bank

debt) beginning 2Q 2007.

Estimated

Excess “Cushion”

Distribution

Excess “Cushion”

Maintenance Capital

Estimated

Maintenance Capital

MQD $1.60

@ $1.84

26

Summary Highlights

Proved Reserves - BCFE

0

20

40

60

80

100

120

140

160

180

200

12/31/2005

12/31/06

Pro forma

Michigan

12/31/06

Pro forma

Monroe

51

bcfe

183

bcfe

118

bcfe

0

5,000

10,000

15,000

20,000

25,000

30,000

IPO

Current

Pro forma

Michigan

Current

Pro forma

Monroe

7,700

mcfe/d

17,500

mcfe/d

25,100

mcfe/d

Production – MCFE/D

Long reserve life with low

annual decline rates

Low-risk PUD locations

Experienced management

team

Strong financial position

Relationship with EnerVest

and EnCap

Attractive yield with strong

cash distribution coverage

27

Master Limited Partnership Investor

Conference

EV Energy Partners, L.P.