The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

Filed pursuant to Rule 424(b)(3)

Registration No. 333-179981

SUBJECT TO COMPLETION, DATED MARCH 8, 2012

Preliminary prospectus supplement

(To the prospectus dated March 8, 2012)

EV Energy Partners, L.P.

EV Energy Finance Corp.

$100,000,000

8.0% Senior Notes due 2019

We are offering $100,000,000 aggregate principal amount of 8.0% senior notes due 2019, which we refer to as the notes. The notes are being offered as additional notes under an indenture under which we initially issued $300,000,000 principal amount of our 8.0% senior notes due 2019 on March 22, 2011. The notes will have identical terms, other than issue date and issue price, and will constitute part of the same series as and be fungible with the initial notes. The notes will mature on April 15, 2019. We will pay a fixed interest of 8.0% on the notes on April 15 and October 15 of each year, beginning on April 15, 2012.

We may redeem some or all of the notes at any time on or after April 15, 2015 at the redemption prices listed in the accompanying prospectus, together with accrued and unpaid interest, if any, to the date of redemption, and we may redeem some or all of the notes at any time prior to April 15, 2015, at a price equal to 100% of the aggregate principal amount of the notes redeemed, plus a “make-whole” premium. In addition, before April 15, 2014, we may redeem up to 35% of the aggregate principal amount of the notes with the net proceeds of certain equity offerings at the redemption price equal to 108.000% of the aggregate principal amount of the notes redeemed provided that at least 65% of the original principal amount of the notes remain outstanding after the redemption. If we sell certain of our assets or experience specific kinds of changes of control, we may be required to repurchase all or a portion of the notes.

The notes will be the senior unsecured obligations of EV Energy Partners, L.P. and EV Energy Finance Corp., a wholly owned subsidiary of ours that has no material assets and was formed for the sole purpose of being a co-issuer of some of our debt, including the notes. The notes will rank equal in right of payment with all of our existing and future senior indebtedness, and senior in right of payment to any future subordinated indebtedness. The guarantees will rank equal in right of payment with all of the existing and future senior indebtedness of our subsidiary guarantors and senior in right of payment to any future subordinated indebtedness of our subsidiary guarantors. The notes will be guaranteed on a senior unsecured basis by all of our existing direct and indirect subsidiaries (other than EV Energy Finance Corp.) and certain future subsidiaries. The notes and guarantees will be effectively subordinated to any existing or future secured indebtedness, including indebtedness under our senior secured credit facility, to the extent of the value of the collateral securing such indebtedness.

See “Risk factors” beginning on page S-15 of this prospectus supplement for a discussion of certain risks that you should consider in connection with an investment in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per note | | | Total | |

| | |

Public offering price(1) | | | % | | | $ | | |

| | |

Underwriting discount | | | % | | | $ | | |

| | |

Proceeds to EV Energy Partners, L.P. (before expenses) | | | % | | | $ | | |

| |

| (1) | | Plus accrued interest from October 15, 2011. |

The notes will not be listed on any national securities exchange or quoted on any automated quotation system. Currently, there is no established market for the notes.

We expect that delivery of the notes will be made to investors in book-entry form through the facilities of The Depository Trust Company on or about March , 2012.

Joint Book-Running Managers

| | | | | | | | |

| J.P. Morgan | | RBC Capital Markets | | Wells Fargo Securities | | Citigroup |

Co-Managers

| | | | | | |

| Credit Suisse | | Comerica Securities | | Credit Agricole CIB | | ING |

| | | | |

| Mitsubishi UFJ Securities | | Scotiabank | | US Bancorp |

The date of this prospectus supplement is March , 2012.

You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus is accurate as of any date other than the date on the front of those documents or that any information that we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

We are not making an offer to sell or soliciting offers to buy securities in any jurisdiction where the offer or sale is not permitted.

You should not consider any information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding an investment in our securities.

Table of contents

Prospectus supplement

Prospectus dated March 8, 2012

| | | | |

| |

About this prospectus | | | 1 | |

| |

Information regarding forward-looking statements | | | 1 | |

| |

Prospectus summary | | | 3 | |

| |

Risk factors | | | 8 | |

| |

Use of proceeds | | | 14 | |

| |

Ratio of earnings to fixed charges | | | 15 | |

| |

Description of the notes | | | 16 | |

| |

Description of other indebtedness | | | 70 | |

| |

Certain United States federal income tax considerations | | | 71 | |

| |

Plan of distribution | | | 76 | |

| |

Legal matters | | | 78 | |

| |

Experts | | | 78 | |

| |

Where you can find more information | | | 78 | |

| |

Incorporation of certain information by reference | | | 79 | |

About this prospectus supplement

and the accompanying prospectus

This document is in two parts. The first part is the prospectus supplement, which describes our business and the specific terms of this offering of the notes and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated March 8, 2012, gives more general information about securities we may offer from time to time, some of which may not apply to this offering.

We are not making an offer to sell securities in any jurisdiction where the offer or sale is not permitted.

Before investing in the notes, you should read both this prospectus supplement and the accompanying prospectus together with the additional information described under the heading “Where you can find more information.”

In making your investment decision, you should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus prepared by or on behalf of us. To the extent that there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any earlier-dated document incorporated by reference, you should rely on the information in this prospectus supplement. Neither we nor the underwriters have authorized anyone to provide you with any other information. If anyone provides you with additional, different or inconsistent information, you should not rely on it.

S-i

Information regarding forward-looking statements

This prospectus supplement, the accompanying prospectus and the documents we incorporate by reference contain certain “forward-looking statements” within the meaning of the federal securities laws. Statements included in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference that are not historical facts, but that address activities, events or developments that we expect or anticipate will or may occur in the future, including references to future goals or intentions or other such references, are forward-looking statements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “may,” “likely” and similar expressions, and the negative thereof, are intended to identify forward-looking statements. We make these statements based on our past experience and our perception of historical trends, current conditions and expected future developments, as well as other considerations we believe are appropriate under the circumstances. Whether actual results and developments in the future will conform to our expectations is subject to numerous risks and uncertainties, many of which are beyond our control. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecasted in these statements. Any differences could be caused by a number of factors, including, but not limited to:

| • | | fluctuations in prices of oil and natural gas; |

| • | | significant disruptions in the financial markets; |

| • | | future capital requirements and availability of financing; |

| • | | uncertainty inherent in estimating our reserves; |

| • | | risks associated with drilling and operating wells; |

| • | | discovery, acquisition, development and replacement of oil and natural gas reserves; |

| • | | cash flows and liquidity; |

| • | | timing and amount of future production of oil and natural gas; |

| • | | availability of drilling and production equipment; |

| • | | marketing of oil and natural gas; |

| • | | developments in oil and natural gas producing countries; |

| • | | general economic conditions; |

| • | | governmental regulations; |

| • | | receipt of amounts owed to us by purchasers of our production and counterparties to our derivative financial instrument contracts; |

| • | | hedging decisions, including whether or not to enter into derivative financial instruments; |

| • | | events similar to those of September 11, 2001; |

| • | | actions of third party co–owners of interest in properties in which we also own an interest; |

S-ii

| • | | fluctuations in interest rates and the value of the U.S. dollar in international currency markets; and |

| • | | our ability to effectively integrate companies and properties that we acquire. |

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference include cautionary statements identifying important factors that could cause actual results to materially differ from our expectations, including in conjunction with the forward-looking statements referred to above. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference. All forward-looking statements included in those documents and all subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements, other than as required by law, whether as a result of new information, future events or otherwise.

S-iii

Summary

This summary highlights information contained elsewhere in this prospectus supplement. It does not contain all of the information that may be important to you. You should read carefully this entire prospectus supplement, the accompanying prospectus, the documents incorporated by reference and the other documents to which we refer you for a more complete understanding of this offering. Unless the context requires otherwise, references to “EV Energy,” “the Partnership,” “we,” “us,” “our” and similar terms refer to EV Energy Partners, L.P. and its subsidiaries, including EV Energy Finance Corp. With respect to the cover page and in the sections entitled “Summary—The offering,” and “Underwriting,” “EV Energy,” “the partnership,” “we,” “our” and “us” refer only to EV Energy Partners, L.P. and EV Energy Finance Corp. and not to our subsidiaries. References to “EnerVest” refer to EnerVest, Ltd. and its partnerships and other entities under common ownership.

EV Energy Partners, L.P.

We are an independent oil and natural gas partnership focused on the acquisition, production and development of oil and natural gas properties in the United States. Our assets consist primarily of interests in producing and non-producing oil and natural gas properties located onshore in the United States. At December 31, 2011, our estimated net proved oil and gas reserves were 1,144.4 billion cubic feet of natural gas equivalents (Bcfe), consisting of 808.6 billion cubic feet (Bcf) of natural gas, 40.9 million barrels (MMBbls) of natural gas liquids and 15.1 MMBbls of oil. Approximately 68% of our proved reserves were classified as proved developed as of December 31, 2011, and the total standardized measure of discounted future net cash flows was $1,406.1 million.

Reserve information

Oil and natural gas reserve information is derived from our reserve report prepared by Cawley, Gillespie & Associates, Inc., our independent reserve engineers. All of our proved oil and natural gas reserves are located in the United States. The following table summarizes information about our oil and natural gas reserves by geographic region as of December 31, 2011:

| | | | | | | | | | | | | | | | | | | | |

| | | Estimated net proved reserves | |

| | | Oil (MMBbls) | | | Natural gas (Bcf) | | | Natural gas liquids (MMBbls) | | | Bcfe | | | PV-10(1) ($ in millions) | |

| |

Barnett Shale | | | 1.3 | | | | 467.4 | | | | 28.7 | | | | 647.4 | | | $ | 623.4 | |

Appalachian Basin | | | 5.1 | | | | 95.8 | | | | — | | | | 126.4 | | | | 244.2 | |

Mid-Continent area | | | 3.5 | | | | 51.1 | | | | 1.5 | | | | 81.2 | | | | 159.0 | |

San Juan Basin | | | 1.3 | | | | 40.2 | | | | 3.5 | | | | 68.6 | | | | 86.6 | |

Monroe Field | | | — | | | | 60.9 | | | | — | | | | 60.9 | | | | 22.0 | |

Permian Basin | | | 0.7 | | | | 20.2 | | | | 5.0 | | | | 54.1 | | | | 104.9 | |

Central and East Texas | | | 3.2 | | | | 28.1 | | | | 2.2 | | | | 60.9 | | | | 148.7 | |

Michigan | | | — | | | | 44.9 | | | | — | | | | 44.9 | | | | 28.3 | |

| | | | |

Total | | | 15.1 | | | | 808.6 | | | | 40.9 | | | | 1,144.4 | | | $ | 1,417.1 | |

| |

| (1) | | At December 31, 2011, our standardized measure of discounted future net cash flows was $1,406.1 million. Because we are a limited partnership, we made no provision for federal income taxes in the calculation of standardized measure; however, we |

S-1

| | made a provision for future obligations under the Texas gross margin tax. The present value of future net pre-tax cash flows attributable to estimated net proved reserves, discounted at 10% per annum, or PV-10, is a computation of the standardized measure of discounted future net cash flows on a pre-tax basis. PV-10 is computed on the same basis as standardized measure but does not include a provision for federal income taxes or the Texas gross margin tax. PV-10 is considered a non-GAAP financial measure under the Securities and Exchange Commission’s, or SEC, regulations. We believe PV-10 to be an important measure for evaluating the relative significance of our oil and natural gas properties. We further believe investors and creditors may utilize our PV-10 as a basis for comparison of the relative size and value of our estimated reserves to other companies. PV-10, however, is not a substitute for the standardized measure. Our PV-10 measure and the standardized measure do not purport to present the fair value of our oil and natural gas reserves. See “Non-GAAP financial measures” beginning on page S-13 of this prospectus supplement. |

Business strategy

Our primary business objective is to manage our oil and gas properties for the purpose of generating cash flow and providing stability and growth of distributions per unit for the long-term benefit of our unitholders. To meet this objective, we intend to execute the following business strategies:

| • | | pursue acquisitions of long-lived producing oil and natural gas properties with relatively low decline rates, predictable production profiles and low risk development opportunities; |

| • | | reduce cash flow volatility and exposure to commodity price and interest rate risk through commodity price and interest rate derivatives; |

| • | | maximize asset value and cash flow stability through our operating and technical expertise; |

| • | | maintain focus on controlling the costs of our operations; |

| • | | maintain conservative levels of indebtedness to reduce risk and facilitate acquisition opportunities; and |

| • | | pursue monetization alternatives for all or a portion of our working interests in the Utica Shale. |

Competitive strengths

We believe that we are well positioned to achieve our primary business objective and to execute our strategies because of the following competitive strengths:

| • | | Geographically diversified asset base characterized by long life reserves and predictable decline rates. We own a diversified portfolio of oil and natural gas properties, producing from multiple formations in eight producing basins with an average reserve life of 19 years as of December 31, 2011. Our properties have well understood geologic features and relatively predictable production profiles. |

| • | | Significant inventory of low risk development opportunities. We have a significant inventory of development projects in our core areas of operation. At December 31, 2011, we had 1,800 identified gross drilling locations, of which approximately 1,000 were proved undeveloped drilling locations and the remainder were unproved drilling locations. In 2011, we drilled a total of 169 gross (32.3 net) wells with a 95% gross success rate. Our development program is focused on lower risk drilling opportunities to maintain and increase production. |

S-2

| • | | Relationship with EnerVest. Our relationship with EnerVest provides us with a wide breadth of operational, financial, technical, risk management and other expertise across a broad geographical range, which assists us in evaluating acquisition and development opportunities. In addition, we believe that our relationship with EnerVest allows us to participate in much larger acquisitions than would otherwise be available to us. |

| • | | Experienced management, operating and technical teams. Our executive officers have on average over 25 years of experience in the oil and natural gas industry and over ten years of experience acquiring and managing oil and natural gas properties for EnerVest partnerships. |

| • | | Substantial hedging through 2015 at attractive average prices. By removing the price volatility from a significant portion of our production, we have mitigated, but not eliminated the potential effects of changing commodity prices on our cash flow from operations for the hedged periods. |

Recent acquisitions

On November 1, 2011, we acquired oil and natural gas properties in the Mid–Continent area for $74.3 million, subject to customary purchase price adjustments.

On December 1, 2011, we, along with certain institutional partnerships managed by EnerVest, acquired oil and natural gas properties in the Barnett Shale. We acquired a 31.02% proportional interest in these properties for $75.7 million, subject to customary purchase price adjustments.

On December 20, 2011 and on February 7, 2012, we, along with certain institutional partnerships managed by EnerVest, acquired additional oil and natural gas properties in the Barnett Shale. We acquired a 31.63% proportional interest in these properties for $300.1 million, subject to customary purchase price adjustments.

In addition to the acquisitions described above, we also recently made the following smaller acquisitions:

| • | | we, along with certain institutional partnerships managed by EnerVest, acquired a proportional 31.02% interest in oil and natural gas properties in the Barnett Shale for an aggregate purchase price of $17.3 million; and |

| • | | we acquired oil and natural gas properties in the Appalachian Basin from certain institutional partnerships managed by EnerVest for $31.1 million, subject to customary purchase price adjustments. |

Recent developments

Our partnership agreement provides that any time after the holders of incentive distribution rights have received distributions at or above the 23% level for four consecutive quarters, the holders of our incentive distribution rights may reset the minimum quarterly distribution and the first and second target distribution levels in exchange for our issuance to them of Class B Units. In

S-3

December 2011, our general partner, as the holder of all of the incentive distribution rights, elected to reset the minimum quarterly distribution and target distribution levels. In accordance with the partnership agreement, the minimum quarterly distribution was reset to $0.7615 (the average distribution per unit for the two preceding quarters) and the first and second target distribution levels were reset to $0.875725 and $0.951875 respectively. The holders of the incentive distribution rights are entitled to 13% and 23% of distributions per unit in excess of the first and second target distribution levels, respectively. In accordance with a formula set forth in our partnership agreement, our general partner was issued 3,873,357 Class B Units in connection with the reset. The holders of Class B Units will have the right to convert the Class B Units into common units after December 12, 2012 on a one-for-one basis. Prior to conversion, the Class B Units have the same distribution and voting rights as the common units.

In February 2012, we closed a public offering of 4.025 million common units at an offering price of $67.95 per common unit. We received net proceeds from this offering of $268.2 million, including a contribution of $5.4 million by our general partner to maintain its 2% interest in us. In connection with our offering of common units, we incurred offering expenses of approximately $0.2 million. We used the net proceeds to repay indebtedness outstanding under our credit facility.

Our relationship with EnerVest

Our general partner is EV Energy GP, L.P., and its general partner is EV Management, LLC. EV Management, LLC is a wholly owned subsidiary of EnerVest. Through our omnibus agreement, EnerVest agrees to make available its personnel to permit us to carry on our business. We therefore benefit from the technical expertise of EnerVest, which we believe would generally not otherwise be available to a company of our size.

EnerVest’s principal business is to act as general partner or manager of EnerVest partnerships, formed to acquire, explore, develop and produce oil and natural gas properties. A primary investment objective of the EnerVest partnerships is to make periodic cash distributions. EnerVest was formed in 1992, and has acquired for its own account and for the EnerVest partnerships oil and natural gas properties for a total purchase price of more than $6.0 billion, which includes over $1.8 billion related to our acquisitions of oil and natural gas properties. EnerVest acts as an operator of over 20,000 oil and natural gas wells in 12 states. EnerVest operates wells which represented 93% of our estimated proved reserves as of December 31, 2011.

Principal executive offices

Our principal executive offices are located at 1001 Fannin, Suite 800, Houston, Texas 77002. Our telephone number is 713-651-1144. Our web site address is www.evenergypartners.com. The information on our web site is not part of this prospectus.

S-4

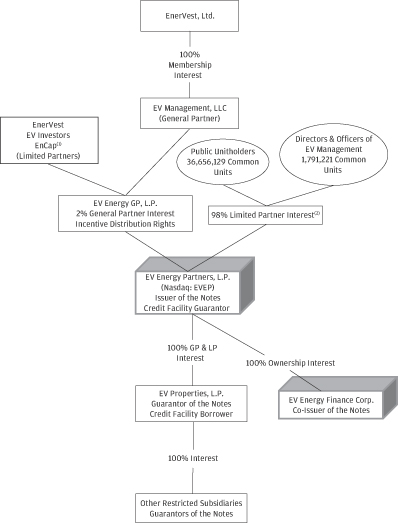

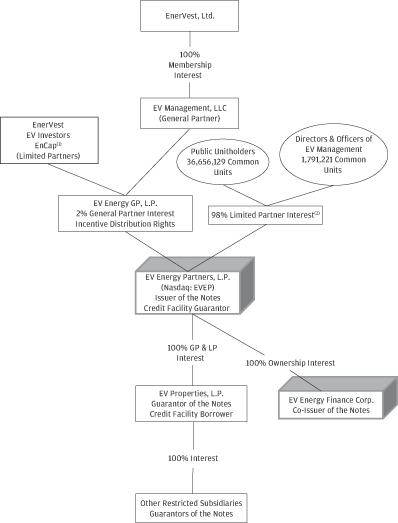

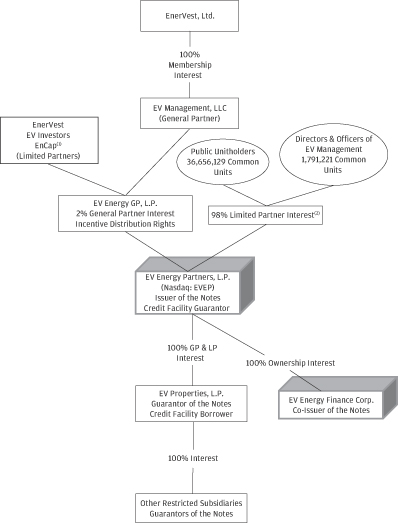

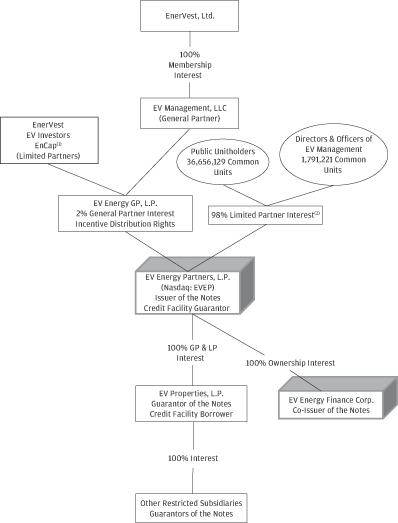

Our ownership and organizational structure

As a limited partnership, we are managed by our general partner, EV Energy GP, L.P., which in turn is managed by its general partner, EV Management, LLC. EV Management is ultimately responsible for the business and operations of our general partner and conducts our business and operations, and the board of directors and officers of EV Management makes decisions on our behalf. EV Management is owned by EnerVest. The limited partners of EV Energy GP, L.P. are EnerVest, EV Investors, L.P., a limited partnership formed by EnerVest and members of our senior management, and institutional partnerships managed by EnCap Investments, L.P. The diagram below depicts our organizational structure and ownership as of March 7, 2012.

| (1) | | Investment funds formed by EnCap Investments, L.P. (“EnCap”). |

| (2) | | The diagram above does not include 3,873,357 Class B Units issued in connection with the reset of our IDRs, 2,052,581 of which are beneficially owned by our officers and directors. |

S-5

The offering

The following is a brief summary of some of the terms of this offering. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of accompanying prospectus contains a more detailed description of the terms and conditions of the notes.

Issuers | EV Energy Partners, L.P. and EV Energy Finance Corp. |

EV Energy Finance Corp., a Delaware corporation, is a wholly owned subsidiary of EV Energy Partners, L.P. which has no material assets or any liabilities other than as a co-issuer of the notes.

Notes offered | $100,000,000 principal amount of 8.0% senior notes due 2019. These notes will be issued as additional notes under the indenture governing our outstanding 8.0% senior notes due 2019. The notes offered hereby, together with the $300,000,000 in aggregate principal amount of notes issued under our indenture dated March 22, 2011, will be treated as a single class for all purposes under the indenture, including without limitation waivers, amendments, redemptions and offers to purchase. |

Maturity date | April 15, 2019. |

Interest rate | 8.0% per year (calculated using a 360-day year). |

Interest payment dates | Each April 15 and October 15, beginning on April 15, 2012. |

Ranking | The notes will be our senior unsecured obligations. Accordingly, they will rank: |

| | • | | equal in right of payment to all of our existing and future senior indebtedness including our existing 8.0% senior notes due 2019; |

| | • | | effectively junior in right of payment to all of our existing and future secured indebtedness, including indebtedness under our senior secured credit facility, to the extent of the value of the collateral securing such indebtedness; |

| | • | | effectively junior in right of payment to all existing and future indebtedness and other liabilities of any subsidiaries that do not guarantee the notes (other than indebtedness and liabilities owed to us); and |

| | • | | senior in right of payment to any future subordinated indebtedness. |

S-6

| | At December 31, 2011, on an as further adjusted basis after giving effect to this offering, the offering of common units we closed in February 2012, and the other transactions described under “Capitalization:” |

| | • | | our only indebtedness for borrowed money would have been $400.0 million represented by the notes, including the original notes; |

| | • | | our operating partnership would have had $294.1 million of borrowings under its senior secured credit facility and no outstanding letters of credit, all of which we guarantee; and |

| | • | | our operating partnership would have had $480.9 million of available borrowing capacity under its senior secured credit facility. |

Guarantees | The notes will be unconditionally guaranteed, jointly and severally, on a senior unsecured basis, by all of our existing subsidiaries other than EV Energy Finance Corp., which is a co-issuer of the notes, and by certain of our future subsidiaries. All of our subsidiary guarantors (except our operating partnership) also guarantee our senior secured credit facility on a senior secured basis. |

In the future, the guarantees may be released and terminated under certain circumstances. Each guarantee will rank:

| | • | | equal in right of payment to all existing and future senior indebtedness of the guarantor subsidiary; |

| | • | | effectively junior in right of payment to all existing and future secured indebtedness of the guarantor subsidiary, including its guarantee of indebtedness under the senior secured credit facility, to the extent of the value of the collateral securing such indebtedness; and |

| | • | | senior in right of payment to any future subordinated indebtedness of the guarantor subsidiary. |

| | Our subsidiary guarantors own substantially all of our assets and substantially all of our liabilities other than the notes. The co-issuer of the notes, EV Energy Finance Corp., has no significant assets or liabilities, other than with respect to the notes. |

Use of proceeds | We will receive net proceeds from this offering of approximately $97.8 million after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will use the net proceeds from this offering to repay borrowings outstanding under our senior secured credit facility. See “Use of proceeds.” |

Optional redemption | We will have the option to redeem the notes, in whole or in part, at any time on or after April 15, 2015, at the redemption prices described |

S-7

| | in the accompanying prospectus under the heading “Description of Notes—Optional Redemption,” together with any accrued and unpaid interest to the date of redemption. In addition, before April 15, 2015, we may redeem all or any part of the notes at the make-whole price set forth under “Description of Notes—Optional Redemption” in the accompanying prospectus. |

| | Before April 15, 2014, we may, at any time or from time to time, redeem up to 35% of the aggregate principal amount of the notes with the net proceeds of a public or private equity offering at a redemption price of 108.000% of the principal amount of the notes, plus any accrued and unpaid interest to the date of redemption, if at least 65% of the aggregate principal amount of the notes issued under the indenture remains outstanding immediately after such redemption and the redemption occurs within 180 days after the closing date of such equity offering. |

Change of control | If a change of control event occurs, each holder of notes may require us to repurchase all or a portion of its notes for cash at a price equal to 101% of the aggregate principal amount of such notes, plus any accrued and unpaid interest to the date of repurchase. |

Certain covenants | The indenture governing the notes will contain covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| | • | | pay distributions on, purchase or redeem our units or purchase or redeem subordinated debt; |

| | • | | incur or guarantee additional indebtedness or issue certain types of equity securities; |

| | • | | consolidate, merge or transfer all or substantially all of our assets; |

| | • | | enter into agreements that restrict distributions or other payments from our restricted subsidiaries to us; |

| | • | | engage in transactions with affiliates; and |

| | • | | create unrestricted subsidiaries. |

| | These covenants are subject to important exceptions and qualifications that are described under “Description of Notes” in the accompanying prospectus. |

| | If the notes achieve an investment grade rating from each of Moody’s Investor Service, Inc. and Standard & Poor’s Ratings Services, many of these covenants will terminate. |

S-8

Listing for trading | We do not intend to list the notes for trading on any securities exchange or quoted on any automated quotation system. We can provide no assurance as to the liquidity of, or development of any trading market for, the notes. |

Further issuances | We may from time to time create and issue additional notes having the same terms as the notes being issued in this offering, so that such additional notes shall be consolidated and form a single series with the notes. |

Form | The notes will be represented by one or more global notes registered in the name of The Depository Trust Company, referred to as DTC, or its nominee. Beneficial interests in the notes will be evidenced by, and transfers thereof will be effected only through, records maintained by participants in DTC. |

Trustee | U.S. Bank National Association. |

Delivery and clearance | We will deposit the global notes representing the notes with the trustee as custodian for DTC. You may hold an interest in the notes through DTC, Clearstream Banking S.A. or Euroclear Bank S.A./N.V., as operator of the Euroclear System, directly as a participant of any such system or indirectly through organizations that are participants in such systems. |

Governing law | The notes offered hereby will be, and the indenture relating to the notes is, governed by New York law. |

Risk factors | Investing in the notes involves risks. See “Risk factors” beginning on page S-15 of this prospectus supplement and in the documents incorporated by reference, as well as the other cautionary statements throughout this prospectus supplement, for a discussion of factors you should carefully consider before deciding to invest in the notes. |

Conflict of interest | Certain of the underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory, investment banking, commercial banking and other services for us for which they received or will receive customary fees and expenses. See “Underwriting (Conflicts of interest).” |

| | Affiliates of the underwriters are lenders and agents under our senior secured credit facility. As described under “Use of proceeds,” we intend to use the net proceeds of this offering to repay borrowings outstanding under our senior secured credit facility and, therefore, affiliates of the underwriters will receive a portion of the net proceeds from this offering. |

S-9

Summary historical consolidated financial data

The following table shows certain summary historical consolidated financial data for each of the three years ended December 31, 2011, 2010 and 2009. The summary historical consolidated financial data for the three years ended December 31, 2011, 2010 and 2009, are derived from our audited consolidated financial statements.

You should read the following summary data in connection with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes incorporated by reference into this prospectus supplement. Our historical results are not necessarily indicative of results to be expected in future periods.

| | | | | | | | | | | | |

| | | At or for the year ended

December 31, | |

| (in thousands) | | 2011 | | | 2010 | | | 2009 | |

| |

| | | |

Statement of Operations Data: | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | |

Oil, natural gas and natural gas liquids revenues | | $ | 256,370 | | | $ | 165,738 | | | $ | 114,066 | |

Transportation and marketing-related revenues | | | 5,470 | | | | 5,780 | | | | 7,846 | |

| | | | |

Total revenue | | | 261,840 | | | | 171,518 | | | | 121,912 | |

| | | | |

| | | |

Operating costs and expenses: | | | | | | | | | | | | |

Lease operating expenses | | | 74,419 | | | | 53,736 | | | | 41,495 | |

Cost of purchased natural gas | | | 4,078 | | | | 4,353 | | | | 4,509 | |

Dry hole and exploration costs | | | 12,140 | | | | 417 | | | | — | |

Production taxes | | | 11,247 | | | | 7,867 | | | | 5,983 | |

Asset retirement obligations accretion expense | | | 3,914 | | | | 3,153 | | | | 2,035 | |

Depreciation, depletion and amortization | | | 74,723 | | | | 55,221 | | | | 52,048 | |

General and administrative expenses | | | 34,968 | | | | 23,313 | | | | 18,556 | |

Impairment of oil and natural gas properties | | | 11,037 | | | | — | | | | — | |

Gain on sales of oil and natural gas properties | | | (4,017 | ) | | | (40,656 | ) | | | — | |

| | | | |

Total operating costs and expenses | | | 222,509 | | | | 107,404 | | | | 124,626 | |

| | | | |

| | | |

Operating income (loss) | | | 39,331 | | | | 64,114 | | | | (2,714 | ) |

Other income (expense), net: | | | | | | | | | | | | |

Realized gains on derivatives, net | | | 58,402 | | | | 49,042 | | | | 68,984 | |

Unrealized gains (losses) on derivatives, net | | | 35,505 | | | | 2,994 | | | | (51,665 | ) |

Interest expense | | | (30,568 | ) | | | (10,442 | ) | | | (12,321 | ) |

Other income (expense), net | | | 325 | | | | 628 | | | | (626 | ) |

| | | | |

Total other income, net | | | 63,664 | | | | 42,222 | | | | 4,372 | |

| | | | |

| | | |

Income before income taxes | | | 102,995 | | | | 106,336 | | | | 1,658 | |

Income taxes | | | (354 | ) | | | (285 | ) | | | (248 | ) |

| | | | |

Net income | | $ | 102,641 | | | $ | 106,051 | | | $ | 1,410 | |

| | | | |

S-10

| | | | | | | | | | | | |

| | | At or for the year ended

December 31, | |

| (in thousands) | | 2011 | | | 2010 | | | 2009 | |

| |

| | | |

Cash Flow Data: | | | | | | | | | | | | |

Net cash flows provided by operating activities | | $ | 167,212 | | | $ | 122,353 | | | $ | 109,525 | |

Net cash flows used in investing activities | | | (518,962 | ) | | | (550,559 | ) | | | (53,917 | ) |

Net cash provided by (used in) financing activities | | | 358,935 | | | | 432,527 | | | | (78,430 | ) |

| | | |

Other Operations Data: | | | | | | | | | | | | |

Adjusted EBITDAX(1) | | $ | 212,418 | | | $ | 148,112 | | | $ | 132,213 | |

| | | |

Balance Sheet Data: | | | | | | | | | | | | |

Total assets | | $ | 2,003,224 | | | $ | 1,486,757 | | | $ | 907,705 | |

Long-term debt | | | 953,023 | | | | 619,000 | | | | 302,000 | |

| | | | |

Total owners’ equity | | $ | 920,039 | | | $ | 773,947 | | | $ | 547,431 | |

| |

| (1) | | We define Adjusted EBITDAX, a non-GAAP financial measure, as net income (loss) adjusted for income taxes, interest expense, net, realized losses on interest rate swaps, depreciation, depletion and amortization, asset retirement obligation accretion expense, non-cash losses (gains) on derivatives, amortization of upfront premiums paid to enter into commodity price hedge agreements, non-cash equity compensation, (gain) on sales of oil and natural gas properties, (gain) on settlement of asset retirement obligations, write down of crude oil inventory, and dry hole and exploration costs. See “Non-GAAP financial measures,” beginning on page S-13 of this prospectus supplement. |

S-11

Summary historical reserve data

The following table summarizes our estimated net proved reserves as of December 31, 2011, 2010 and 2009. Oil and natural gas reserve information is derived from our reserve reports prepared by Cawley, Gillespie & Associates, Inc., our independent reserve engineers.

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| (in thousands) | | 2011(1) | | | 2010 | | | 2009 | |

| |

| | | |

Estimated net proved reserves: | | | | | | | | | | | | |

Natural gas (Bcf) | | | 808.6 | | | | 575.2 | | | | 257.3 | |

Oil (MMBbls) | | | 15.1 | | | | 12.9 | | | | 7.4 | |

NGLs (MMBbls) | | | 40.9 | | | | 27.5 | | | | 10.7 | |

Total (Bcfe) | | | 1,144.4 | | | | 817.3 | | | | 365.6 | |

Percent proved developed reserves | | | 68.1% | | | | 70.7% | | | | 93.1% | |

Standardized measure of discounted future net cash flows | | $ | 1,406,131 | | | $ | 1,020,235 | | | $ | 351,481 | |

| |

| (1) | | Excludes reserves attributable to the portion of the oil and gas properties in the Barnett Shale acquired from Encana in February 2012. |

S-12

Summary historical production data

The following table summarizes our historical production for the years ended December 31, 2011, 2010 and 2009.

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| (in thousands) | | 2011 | | | 2010 | | | 2009 | |

| |

| | | |

Production data: | | | | | | | | | | | | |

Oil (MBbls) | | | 891 | | | | 679 | | | | 514 | |

Natural gas liquids (MBbls) | | | 1,096 | | | | 728 | | | | 768 | |

Natural gas (MMcf) | | | 29,247 | | | | 19,486 | | | | 16,519 | |

Net production (MMcfe) | | | 41,169 | | | | 27,933 | | | | 24,210 | |

| | | |

Average sales price per unit: | | | | | | | | | | | | |

Oil (Bbl) | | $ | 91.72 | | | $ | 74.78 | | | $ | 56.17 | |

Natural gas liquids (Bbl) | | | 52.99 | | | | 42.64 | | | | 31.08 | |

Natural gas (Mcf) | | | 3.99 | | | | 4.30 | | | | 3.71 | |

Mcfe | | | 6.23 | | | | 5.93 | | | | 4.71 | |

| | | |

Average unit cost per Mcfe: | | | | | | | | | | | | |

Production costs: | | | | | | | | | | | | |

Lease operating expenses | | $ | 1.81 | | | $ | 1.92 | | | $ | 1.71 | |

Production taxes | | | 0.27 | | | | 0.28 | | | | 0.25 | |

| | | | |

Total | | | 2.08 | | | | 2.20 | | | | 1.96 | |

| | | | |

Asset retirement obligations accretion expense | | | 0.10 | | | | 0.11 | | | | 0.08 | |

Depreciation, depletion and amortization | | | 1.82 | | | | 1.98 | | | | 2.15 | |

General and administrative expenses | | | 0.85 | | | | 0.83 | | | | 0.77 | |

| |

Non-GAAP financial measures

We use the non-GAAP financial measures “Adjusted EBITDAX” and “PV-10” in this prospectus supplement. These measures are not calculated or presented in accordance with GAAP. We explain these measures below and reconcile them to the most directly comparable financial measure calculated and presented in accordance with GAAP.

We define Adjusted EBITDAX as net income (loss) plus income tax provision, interest expense, net, realized losses on interest rate swaps, depreciation, depletion and amortization, asset retirement obligation accretion expense, non-cash and unrealized gains losses on derivatives, amortization of premiums on derivatives, non-cash equity compensation, impairments of oil and natural gas properties, (gain) on sales of oil and natural gas properties, inventory write down, and dry hole and exploration costs. Adjusted EBITDAX is used by our management to provide additional information relative to the performance of our business, including (prior to the creation of any reserves) the cash available to pay principal and interest on our indebtedness and to make distributions to our unitholders. In addition, we believe investors use this financial measure to evaluate whether or not we are generating cash flow at a level that can sustain or support an increase in our indebtedness and quarterly distribution rates. Finally, Adjusted EBITDAX is also a quantitative standard used throughout the investment community with respect to performance of publicly-traded

S-13

partnerships. Adjusted EBITDAX should not be considered as an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDAX excludes some, but not all, items that effect net income and operating income and these measures may vary among companies. Therefore, our Adjusted EBITDAX may not be comparable to similarly titled measures of other companies.

The following table reconciles Adjusted EBITDAX to net income:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| (in thousands) | | 2011 | | | 2010 | | | 2009 | |

| |

Net income | | $ | 102,641 | | | $ | 106,051 | | | $ | 1,410 | |

Add: | | | | | | | | | | | | |

Income taxes | | | 354 | | | | 285 | | | | 248 | |

Interest expense, net | | | 30,551 | | | | 10,398 | | | | 12,189 | |

Realized losses on interest rate swaps | | | 6,171 | | | | 8,652 | | | | 8,351 | |

Depreciation, depletion and amortization | | | 74,723 | | | | 55,221 | | | | 52,048 | |

Asset retirement obligation accretion expense | | | 3,914 | | | | 3,153 | | | | 2,035 | |

Non-cash losses on derivatives | | | 577 | | | | — | | | | — | |

Unrealized (gains) losses on derivatives | | | (35,505 | ) | | | (2,994 | ) | | | 51,665 | |

Amortization of premiums on derivatives | | | — | | | | — | | | | 608 | |

Non-cash equity compensation expense | | | 9,834 | | | | 5,043 | | | | 3,659 | |

Impairment of oil and natural gas properties | | | 11,037 | | | | — | | | | — | |

Gain on sales of oil and natural gas properties | | | (4,017 | ) | | | (40,656 | ) | | | — | |

Non-cash inventory write down expense | | | — | | | | 2,542 | | | | — | |

Dry hole and exploration costs | | | 12,140 | | | | 417 | | | | — | |

| | | | |

Adjusted EBITDAX | | $ | 212,418 | | | $ | 148,112 | | | $ | 132,213 | |

| |

We also use the non-GAAP financial measure of PV-10, which we define as the present value of future net pre-tax cash flows attributable to estimated net proved reserves, discounted at 10% per annum. At December 31, 2011, our standardized measure of discounted future net cash flows, a GAAP financial measure, was $1,406.1 million. Because we are a limited partnership, we made no provision for federal income taxes in the calculation of standardized measure; however, we made a provision for future obligations under the Texas gross margin tax. PV-10 is computed on the same basis as standardized measure but does not include a provision for federal income taxes or the Texas gross margin tax. We believe PV-10 to be an important measure for evaluating the relative significance of our oil and natural gas properties. We further believe investors and creditors may utilize our PV-10 as a basis for comparison of the relative size and value of our reserves to other companies. PV-10, however, is not a substitute for the standardized measure. Our PV-10 measure and the standardized measure do not purport to present the fair value of our oil and natural gas reserves. The following table reconciles PV-10 to standardized measure (in millions).

| | | | |

| |

PV-10 | | $ | 1,417.1 | |

Future Texas gross margin taxes, discounted at 10% | | | (11.0 | ) |

| | | | |

Standardized measure | | $ | 1,406.1 | |

| |

S-14

Risk factors

An investment in the notes involves risk. You should read carefully the risk factors included below and under the caption “Risk Factors” beginning on page 8 of the accompanying prospectus, as well as the risk factors included in Item 1A. “Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2011, together with all of the other information included or incorporated by reference in this prospectus supplement. If any of these risks were to occur, our business, financial condition, results of operations or prospects could be materially adversely affected. In such case, we may be unable to pay the principal and interest on the notes, and you could lose all or part of your investment.

Risks related to the notes and other indebtedness

Our leverage and debt service obligations may adversely affect our financial condition, results of operations, business prospects and our ability to make distributions to our unitholders and to service the notes.

We have a substantial amount of indebtedness. We are party to a $1.0 billion revolving credit facility with a borrowing base of $800 million. As of February 29, 2012, we had approximately $420 million in borrowings outstanding under the credit facility with additional borrowing capacity of $380 million. Total debt outstanding was $720 million, including the original notes. The terms and conditions governing our indebtedness, including the notes and our senior secured credit facility:

| • | | require us to dedicate a substantial portion of our cash flow from operations to service our existing debt, thereby reducing the cash available to finance our operations and other business activities and could limit our flexibility in planning for or reacting to changes in our business and the industry in which we operate; |

| • | | increase our vulnerability to economic downturns and adverse developments in our business; |

| • | | limit our ability to access the capital markets to raise capital on favorable terms or to obtain additional financing for working capital, capital expenditures or acquisitions or to refinance existing indebtedness; |

| • | | place restrictions on our ability to obtain additional financing, make investments, lease equipment, sell assets and engage in business combinations; |

| • | | place us at a competitive disadvantage relative to competitors with lower levels of indebtedness in relation to their overall size or less restrictive terms governing their indebtedness; |

| • | | make it more difficult for us to satisfy our obligations under the notes or other debt and increase the risk that we may default on our debt obligations; and |

| • | | limit management’s discretion in operating our business. |

Our ability to meet our expenses and debt obligations will depend on our future performance, which will be affected by financial, business, economic, regulatory and other factors. We will not be able to control many of these factors, such as economic conditions and governmental regulation. We depend on our senior secured credit facility for future capital needs, because we

S-15

use operating cash flows for investing activities and borrow as needed. We cannot be certain that our cash flow will be sufficient to allow us to pay the principal and interest on our debt, including the notes, and meet our other obligations. If we do not have enough money, we may be required to refinance all or part of our existing debt, including the notes, sell assets, borrow more money or raise equity. We may not be able to refinance our debt, sell assets, borrow more money or raise equity on terms acceptable to us, if at all. Our ability to comply with the financial and other restrictive covenants in our indebtedness will be affected by the levels of cash flow from our operations and future events and circumstances beyond our control. Failure to comply with these covenants would result in an event of default under our indebtedness, and such an event of default could adversely affect our business, financial condition and results of operations.

Availability under our senior secured credit facility is determined semi-annually, as well as upon the occurrence of certain events, by the lenders in their sole discretion, based primarily on reserve reports that reflect our banks’ projections of future commodity prices at such time. Significant declines in natural gas, NGL or oil prices may result in a decrease in our borrowing base. The lenders can unilaterally adjust the borrowing base and the borrowings permitted to be outstanding under our senior secured credit facility. Any increase in the borrowing base requires the consent of all the lenders. Outstanding borrowings in excess of the borrowing base must be repaid immediately, or we must pledge other properties as additional collateral. We do not currently have any substantial unpledged properties, and we may not have the financial resources in the future to make any mandatory principal prepayments required under our senior secured credit facility.

We may not be able to generate enough cash flow to meet our debt obligations.

We expect our earnings and cash flow to vary significantly from year to year due to the cyclical nature of our industry. As a result, the amount of debt that we can service in some periods may not be appropriate for us in other periods. Additionally, our future cash flow may be insufficient to meet our debt obligations and commitments, including the notes. Any insufficiency could negatively impact our business. A range of economic, competitive, business and industry factors will affect our future financial performance, and, as a result, our ability to generate cash flow from operations and to pay our debt, including the notes. Many of these factors, such as oil and natural gas prices, economic and financial conditions in our industry and the global economy or competitive initiatives of our competitors, are beyond our control.

If we do not generate enough cash flow from operations to satisfy our debt obligations, we may have to undertake alternative financing plans, such as:

| • | | refinancing or restructuring our debt; |

| • | | reducing or delaying capital investments; or |

| • | | seeking to raise additional capital. |

However, we cannot assure you that undertaking alternative financing plans, if necessary, would allow us to meet our debt obligations. Our inability to generate sufficient cash flow to satisfy our debt obligations, including our obligations under the notes, or to obtain alternative financing, could materially and adversely affect our ability to make payments on the notes and our business, financial condition, results of operations and prospects.

S-16

We distribute all of our available cash to our unitholders after reserves established by our general partner, which may limit the cash available to service the notes or repay them at maturity.

Subject to the limitations on restricted payments contained in the indenture governing the notes offered hereby and in our senior secured credit facility, we will distribute all of our “available cash” each quarter to our unitholders. “Available cash” is defined in our partnership agreement, and it generally means, for each fiscal quarter, all cash on hand at the end of the quarter:

| • | | less the amount of cash reserves established by our general partner to: |

| • | | provide for the proper conduct of our business; |

| • | | comply with applicable law, any of our debt instruments or other agreements; or |

| • | | provide funds for distributions to our unitholders and to our general partner for any one or more of the next four quarters; |

| • | | plus, if our general partner so determines, all or a portion of cash on hand on the date of determination of available cash for the quarter including cash from working capital borrowings. |

As a result, we may not accumulate significant amounts of cash. These distributions could significantly reduce the cash available to us in subsequent periods to make payments on the notes.

The notes and the guarantees will be unsecured and effectively subordinated to our and our subsidiary guarantors’ existing and future secured indebtedness.

The notes and the guarantees will be general unsecured senior obligations ranking effectively junior in right of payment to all existing and future secured debt of ours and that of each subsidiary guarantor, respectively, including obligations under our senior secured credit facility, to the extent of the value of the collateral securing the debt. At February 29, 2012, consolidated indebtedness was $720 million, $420 million of which is secured by liens on our assets.

If we or a subsidiary guarantor is declared bankrupt, becomes insolvent or is liquidated or reorganized, any secured debt of ours or of that subsidiary guarantor will be entitled to be paid in full from our assets or the assets of the guarantor, as applicable, securing that debt before any payment may be made with respect to the notes or the affected guarantees. Holders of the notes will participate ratably with all holders of our other unsecured indebtedness that does not rank junior to the notes, including all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of the notes would likely receive less, ratably, than holders of secured indebtedness.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our senior secured credit facility bear interest at variable rates and expose us to interest rate risk. If interest rates increase and we are unable to effectively hedge our interest rate risk, our debt service obligations on the variable rate indebtedness would increase even if the amount borrowed remained the same, and our net income and cash available for servicing

S-17

our indebtedness would decrease. If interest rates on our facility increased by 1%, interest expense for the year ended December 31, 2011 would have increased by approximately $3.2 million.

Despite our and our subsidiaries’ current level of indebtedness, we may still be able to incur substantially more debt. This could further exacerbate the risks associated with our indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, subject to certain limitations, including under our senior secured credit facility and under the indenture for the notes offered hereby. For example, our borrowing base under our senior secured credit facility is currently set at $800 million leaving additional borrowing capacity of $380 million. If new debt is added to our current debt levels, the related risks that we and our subsidiaries now face could increase. Our level of indebtedness could, for instance, prevent us from engaging in transactions that might otherwise be beneficial to us or from making desirable capital expenditures. This could put us at a competitive disadvantage relative to other less leveraged competitors that have more cash flow to devote to their operations. In addition, the incurrence of additional indebtedness could make it more difficult to satisfy our existing financial obligations, including those relating to the notes.

We may not be able to repurchase the notes upon a change of control.

Upon the occurrence of certain change of control events, we would be required to offer to repurchase all or any part of the notes then outstanding for cash at 101% of the principal amount plus accrued and unpaid interest. The source of funds for any repurchase required as a result of any change of control will be our available cash or cash generated from our operations or other sources, including:

| • | | borrowings under our senior secured credit facility or other sources; |

We cannot assure you that sufficient funds would be available at the time of any change of control to repurchase your notes after first repaying any of our senior debt that may exist at the time. In addition, restrictions under our senior secured credit facility will not allow such repurchases and additional credit facilities we enter into in the future also may prohibit such repurchases. We cannot assure you that we can obtain waivers from the lenders. Additionally, using available cash to fund the potential consequences of a change of control may impair our ability to obtain additional financing in the future, which could negatively impact our ability to conduct our business operations.

A Delaware court has held that a provision similar to the change of control put right that will be in the indenture for the notes may not be enforceable if it is used to improperly limit the ability of equity owners to effect a change of control.

The Chancery Court of Delaware recently held that a provision in an indenture requiring a majority of board of directors of the company issuing the notes be “continuing directors” could breach the fiduciary duties of the board of directors and be unenforceable if improperly used to prevent shareholders from effecting a change of control of the company. Under the continuing director provision, a majority of the board of directors must be “continuing directors” defined as either (i) a director on the date of the indenture or (ii) a director whose election to the board of

S-18

directors was approved by a majority of the continuing directors. Under the court’s decision, a decision by a board of directors not to approve dissident shareholder nominees as continuing directors and to allow a change of control to occur would be subject to enhanced fiduciary duties typically applied in corporate change of control disputes. If the directors did not properly discharge those fiduciary duties, the change of control put right could be unenforceable by the holders of the notes. As a result, the ability of the holders of notes to enforce the continuing director provision in situations in which the provision acted to impede a change of control would be subject to the enhanced judicial scrutiny of the actions by our directors not to approve the director nominees whose election caused the provision to be invoked.

A subsidiary guarantee could be voided if it constitutes a fraudulent transfer under U.S. bankruptcy or similar state law, which would prevent the holders of the notes from relying on that subsidiary to satisfy claims.

Under U.S. bankruptcy law and comparable provisions of state fraudulent transfer laws, our subsidiary guarantees can be voided, or claims under the subsidiary guarantees may be subordinated to all other debts of that subsidiary guarantor if, among other things, the subsidiary guarantor, at the time it incurred the indebtedness evidenced by its guarantee or, in some states, when payments become due under the guarantee, received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee and:

| • | | was insolvent or rendered insolvent by reason of such incurrence; |

| • | | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| • | | intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature. |

A court would likely find that a subsidiary guarantor did not receive reasonably equivalent value or fair consideration for its guarantee if the subsidiary guarantor did not substantially benefit directly or indirectly from the issuance of the guarantees. If a court were to void a subsidiary guarantee, you would no longer have a claim against the subsidiary guarantor. Sufficient funds to repay the notes may not be available from other sources, including the remaining subsidiary guarantors, if any. In addition, the court might direct you to repay any amounts that you already received from the subsidiary guarantor.

The measures of insolvency for purposes of fraudulent transfer laws vary depending upon the governing law. Generally, a guarantor would be considered insolvent if:

| • | | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets; |

| • | | the present fair saleable value of its assets is less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | | it could not pay its debts as they become due. |

Our subsidiary guarantees may also be voided, without regard to the above factors, if a court finds that the subsidiary guarantor entered into the guarantee with the actual intent to hinder, delay or defraud its creditors.

S-19

Each subsidiary guarantee contains a provision intended to limit the subsidiary guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its subsidiary guarantee to be a fraudulent transfer. Such provision may not be effective to protect the subsidiary guarantees from being voided under fraudulent transfer law.

A financial failure by us or our subsidiaries may result in the assets of any or all of those entities becoming subject to the claims of all creditors of those entities.

A financial failure by us or our subsidiaries could affect payment of the notes if a bankruptcy court were to substantively consolidate us and our subsidiaries. If a bankruptcy court substantively consolidated us and our subsidiaries, the assets of each entity would become subject to the claims of creditors of all entities. This would expose holders of notes not only to the usual impairments arising from bankruptcy, but also to potential dilution of the amount ultimately recoverable because of the larger creditor base. Furthermore, forced restructuring of the notes could occur through the “cram-down” provisions of the bankruptcy code. Under these provisions, the notes could be restructured over your objections as to their general terms, primarily interest rate and maturity.

Because we are a holding company, we are financially dependent on receiving distributions from our subsidiaries.

We are a holding company and our assets consist primarily of investments in our subsidiaries. Our rights and the rights of our creditors, including holders of the notes, to participate in the distribution of assets of any entity in which we own an equity interest will be subject to prior claims of the entity’s creditors upon the entity’s liquidation or reorganization. However, we may ourselves be a creditor with recognized claims against this entity, but our claims would still be subject to the prior claims of any secured creditor of this entity and of any holder of indebtedness of this entity that is senior to that held by us. Accordingly, a holder of our debt securities, including holders of the notes, may be deemed to be effectively subordinated to those claims.

Many of the covenants contained in the indenture will terminate if the notes are rated investment grade by both Standard & Poor’s and Moody’s and no default (other than a reporting default) has occurred and is continuing.

Many of the covenants in the indenture governing the notes will terminate if the notes are rated investment grade by both Standard & Poor’s and Moody’s provided at such time no default (other than a reporting default) has occurred and is continuing. The covenants will restrict, among other things, our ability to pay distributions on our common units, incur debt and to enter into certain other transactions. There can be no assurance that the notes will ever be rated investment grade. However, termination of these covenants would allow us to engage in certain transactions that would not have been permitted while these covenants were in force, and the effects of any such transactions will be permitted to remain in place even if the notes are subsequently downgraded below investment grade. See “Description of Notes—Covenant Termination” in the accompanying prospectus.

S-20

If we were to become subject to entity-level taxation for U.S. federal income tax purposes or in states where we are not currently subject to entity-level taxation, our cash available for payment on the notes could be materially reduced.

In order for us to avoid paying U.S. federal income tax at the entity level, we must qualify for treatment as a partnership for U.S. federal income tax purposes. In order to qualify for partnership treatment, at least 90% of our annual gross income must be “qualifying income” derived from marketing crude oil and natural gas and other specified activities. While we believe 90% or more of our gross income for each taxable year consists of qualifying income, and we intend to meet this gross income requirement for future taxable years, we may not find it possible, regardless of our efforts, to meet this gross income requirement or we may inadvertently fail to meet this gross income requirement. Moreover, at the federal level, legislation has recently been considered by members of Congress that would have eliminated partnership tax treatment for certain publicly traded partnerships. Although it does not appear that the legislation considered would have affected our tax treatment, we are unable to predict whether any of these changes or other proposals will ultimately be enacted. Moreover, any modification to the federal income tax laws and interpretations thereof may or may not be applied retroactively.

If we were treated as a corporation for U.S. federal income tax purposes, we would pay U.S. federal income tax on our income at the corporate tax rate, which is currently a maximum of 35%, and would likely pay state income taxes at varying rates in some states where we are not currently subject to state income tax. If we were required to pay tax on our taxable income, our anticipated cash flow could be materially reduced, which could materially and adversely affect our ability to make payments on the notes and on our other debt obligations.

In addition, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise and other forms of taxation. The imposition of such taxes could reduce the cash available for payment on the notes and on our other debt obligations.

S-21

Ratio of earnings to fixed charges

The following table presents our ratios of earnings to fixed charges for the years ended December 31, 2011, 2010, 2009, 2008 and 2007. For purposes of computing the ratios of earnings to fixed charges, earnings consist of pre-tax income from continuing operations before adjustment for equity income from equity method investees plus fixed charges, amortization of capitalized interest and distributed income from investees, and our share of pre-tax losses of investees for which charges arising from guarantees are included in fixed charges, each as accounted for under the equity method, less capitalized interest, preference security dividend requirements of consolidated subsidiaries, and the noncontrolling interest in pre-tax income of subsidiaries that have not incurred fixed charges. Fixed charges consist of the sum of interest expensed and capitalized, plus amortized premiums, discounts and capitalized expenses related to indebtedness, an estimated interest component of rental expense, and preference security dividend requirements of consolidated subsidiaries.

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| |

Ratio of earnings to fixed charges | | | 4.37 | | | | 11.18 | | | | 1.13 | | | | 15.00 | | | | 2.40 | |

| |

S-22

Use of proceeds

We expect to receive net proceeds of approximately $97.8 million from this offering, after deducting underwriters’ discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to repay borrowings outstanding under our senior secured credit facility. We used borrowings under our senior secured credit facility primarily to finance the purchase price of the acquisitions described under “Summary—Recent acquisitions.”

At February 29, 2012, debt incurred under our senior secured credit facility was $420 million and was used primarily to finance acquisitions. As of February 29, 2012, interest on borrowings under our senior secured credit facility had a weighted average effective interest rate of approximately 3.24%. The senior secured credit facility matures on April 26, 2016.

Because affiliates of the underwriters are lenders under our senior secured credit facility, the underwriters or their affiliates may receive more than 5% of the proceeds of this offering (not including underwriting discounts and commissions). Nonetheless, in accordance with the Financial Industry Regulatory Authority Rule 5121, the appointment of a qualified independent underwriter is not necessary in connection with this offering because the notes offered hereby are interests in a direct participation program. See “Underwriting (Conflicts of interest).”

S-23

Capitalization

The following table sets forth our cash and cash equivalents and our consolidated capitalization at December 31, 2011:

| • | | as adjusted to give effect to our recent common unit offering described in this prospectus supplement under “Summary—Recent developments;” and |

| • | | as further adjusted, giving effect to the issuance of the notes in this offering and the application of the estimated net proceeds of this offering to repay amounts outstanding under our senior secured credit facility. |

You should read our financial statements and notes thereto that are incorporated by reference into this prospectus supplement for additional information regarding our capitalization.

| | | | | | | | | | | | |

| | | December 31, 2011 | |

| (in thousands) | | Actual | | | As adjusted | | | As further adjusted | |

| |

Cash and cash equivalents | | $ | 30,312 | | | $ | 30,312 | | | $ | 30,312 | |

| | | | |

Long-term debt: | | | | | | | | | | | | |

Senior secured credit facility(1) | | $ | 660,000 | | | $ | 391,804 | | | $ | 294,054 | |

Outstanding 8% senior notes due 2019 | | | 300,000 | | | | 300,000 | | | | 400,000 | |

| | | | |

Total long-term debt, net | | | 960,000 | | | | 691,804 | | | | 694,054 | |

Total owners’ equity | | | 920,039 | | | | 1,188,235 | | | | 1,188,235 | |

| | | | |

Total capitalization | | $ | 1,880,039 | | | $ | 1,880,039 | | | $ | 1,882,289 | |

| |

| (1) | | As of February 29, 2012, we had total borrowings of approximately $420 million outstanding under our senior secured credit facility and no outstanding letters of credit. |

S-24

Underwriting (conflicts of interest)

Subject to the terms and conditions stated in the underwriting agreement dated the date of this prospectus supplement by and among us and the underwriters named below, for whom J.P. Morgan Securities LLC is acting as representative, we have agreed to sell to each of the underwriters, and each of the underwriters has agreed, severally and not jointly, to purchase from us, the principal amount of the notes indicated in the following table.

| | | | |

| Underwriter | | Principal amount

of notes | |

| |

J.P. Morgan Securities LLC | | $ | | |

RBC Capital Markets, LLC | | | | |

Wells Fargo Securities, LLC | | | | |

Citigroup Global Markets Inc. | | | | |

Credit Suisse Securities (USA) LLC | | | | |

Comerica Securities, Inc. | | | | |

Credit Agricole Securities (USA) Inc. | | | | |

ING Financial Markets LLC | | | | |

Mitsubishi UFJ Securities (USA), Inc. | | | | |

Scotia Capital (USA) Inc. | | | | |

U.S. Bancorp Investments, Inc. | | | | |

| | | | |

Total | | $ | 100,000,000 | |

| |

Under the terms and conditions of the underwriting agreement, if the underwriters take any of the notes, then they are obligated to take and pay for all the notes.

The notes are new issues of securities with no established trading market and will not be listed on any national securities exchange or quoted on any automated quotation system. The underwriters have advised us that they intend to make a market for the notes, but they have no obligation to do so and may discontinue market-making at any time without providing any notice. No assurance can be given as to the liquidity of any trading market for the notes.

Notes sold by the underwriters to the public will initially be offered at the public offering price set forth on the cover page of this prospectus supplement. Any notes sold by the underwriters to securities dealers may be sold at a discount from the public offering price of up to % of the principal amount of the notes. The underwriters may allow, and any such dealer may reallow, a concession not in excess of % of the principal amount of the notes to certain other dealers. After the initial offering of the notes to the public, the underwriters may change the offering price and other selling terms.

The following table summarizes the compensation to be paid by us to the underwriters:

| | | | | | | | |

| | | Per note | | | Total | |

| |

Underwriting discount paid by us | | $ | | | | $ | | |

| |

We estimate that the total expenses of this offering to be paid by us, excluding underwriting discounts, will be approximately $0.5 million.

S-25

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments that the underwriters may be required to make in respect of any such liabilities.