WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

xPreliminary Information Statement

oConfidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

oDefinitive Information Statement

DRIVER PASSPORT, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box)

xNo fee required.

oFee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

oFee Paid previously with preliminary materials.

oCheck box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

DRIVER PASSPORT, INC.

123 Worthington St. Suite 203

Spring Valley, CA. 91977-6100

INFORMATION STATEMENT

PURSUANT TO SECTION 14

OF THE SECURITIES EXCHANGE ACT OF 1934

AND REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A PROXY

Spring Valley, California

*, 2009

This information statement has been mailed on or about *, 2009 to the stockholders of record on *, 2009 (the “Record Date”) of Driver Passport, Inc., a North Dakota corporation (the "Company") in connection with certain actions to be taken by the written consent by stockholders holding a majority of the outstanding voting stock of the Company, dated as of November 24, 2008. The actions to be taken pursuant to the written consent shall be taken on or about *, 2009, 20 days after the mailing of this information statement.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN.

| | By Order of the Board of Directors, | |

| | | | |

| | By: | /s/ Daniel Correa | |

| | | Director and Chief Executive Officer | |

NOTICE OF ACTION TO BE TAKEN PURSUANT THE WRITTEN CONSENT OF STOCKHOLDERS HOLDING A MAJORITY OF THE OUTSTANDING VOTING STOCK IN LIEU OF A SPECIAL MEETING OF THE STOCKHOLDERS, DATED NOVEMBER 24, 2008

To Our Stockholders:

NOTICE IS HEREBY GIVEN that Driver Passport, Inc. (the "Company") has received written consents in lieu of special meeting from shareholders representing more than fifty percent (50%) of the total voting shares of the Company, approving the following actions:

1. The reincorporation of the Company in the State of Nevada.

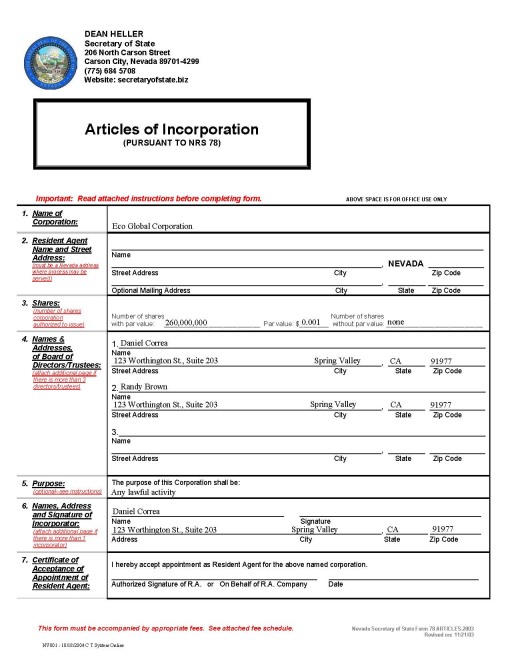

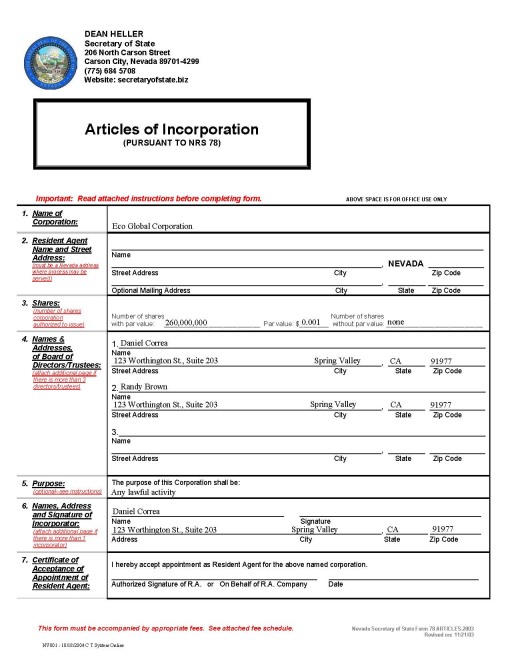

2. Changing the Company’s name to Eco Global Corporation as a result of the reincorporation.

3. Increasing the authorized capital stock of the Company as a result of the reincorporation.

4. Adopting blank check preferred stock as a result of the reincorporation.

WE ARE NOT ASKING FOR YOUR PROXY. Because the written consent of the shareholder holding a majority of the outstanding voting stock satisfies any applicable stockholder voting requirement of the North Dakota Business Corporation Act and our Articles of Incorporation and By-Laws, we are not asking for a proxy and you are not requested to send one.

The accompanying Information Statement is for information purposes only. Please read the accompanying Information Statement carefully.

OUTSTANDING SHARES AND VOTING RIGHTS

As of the Record Date, the Company's authorized capitalization consisted of 40,000,000 shares of common stock and 10,000,000 shares of preferred stock, of which 33,622,000 shares of common stock and no shares of preferred stock were issued and outstanding as of the Record Date. Holders of Common Stock of the Company have no preemptive rights to acquire or subscribe to any of the additional shares of Common Stock.

Each share of Common Stock entitles its holder to one vote on each matter submitted to the stockholders. However, because stockholders holding at least a majority of the voting rights of all outstanding shares of capital stock as at the Record Date have voted in favor of the foregoing proposals by resolution dated November 24, 2008; and having sufficient voting power to approve such proposals through their ownership of capital stock, no other stockholder consents will be solicited in connection with this Information Statement.

Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the proposals will not be adopted until a date at least 20 days after the date on which this Information Statement has been mailed to the stockholders. The Company anticipates that the actions contemplated herein will be effected on or about the close of business on *, 2009.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

This Information Statement will serve as written notice to stockholders pursuant to Section 10-19.1-75 of the North Dakota Business Corporation Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY.

RESOLUTION 1

REINCORPORATION IN THE STATE OF NEVADA

The following discussion summarizes certain aspects of the Reincorporation of the Company in Nevada. This summary does not include all of the provisions of the Agreement and Plan of Merger between the Company and Eco Global Corporation, a wholly owned subsidiary of the Company which the Company will merge into (“Eco Global”). A copy of the Agreement and Plan of Merger is attached hereto as Exhibit "A," and the Articles of Incorporation of Eco Global (the "Nevada Articles") are attached hereto as Exhibit "B." Copies of the Articles of Incorporation and the Bylaws of the Company (the "North Dakota Articles" and the "North Dakota Bylaws," respectively) and the Bylaws of Eco Global (the "Nevada Bylaws") are available for inspection at the principal office of the Company and copies will be sent to shareholders upon request.

SUMMARY

Transaction: Reincorporation in Nevada.

Purpose: To provide greater flexibility and simplicity in corporate transactions and reduce taxes and other costs of doing business. For more information, see "Principal Reasons for Reincorporation in Nevada."

Method: Merger with and into our wholly-owned subsidiary, Eco Global. For more information, see "Principal Features of the

Reincorporation."

Exchange Ratios: One share of Eco Global common stock will be issued for each share of our common stock. For more information, see "Principal Features of the Reincorporation."

Right to Dissent: Any shareholder is entitled to be paid the fair value of his or its shares if the shareholder timely dissents to the Reincorporation or any of the actions resulting from or in connection with the Reincorporation. For more information, see "Rights of Dissenting Shareholders."

QUESTIONS AND ANSWERS

The following questions and answers are intended to respond to frequently asked questions concerning our Reincorporation in Nevada. These questions do not, and are not intended to, address all the questions that may be important to you. YOU SHOULD CAREFULLY READ THE ENTIRE INFORMATION STATEMENT, AS WELL AS ITS EXHIBITS.

Q: Why is the Company reincorporating in Nevada?

A: We believe that the Reincorporation in Nevada will give us a greater measure of flexibility and simplicity in corporate governance than is available under North Dakota law and will increase the marketability of our securities.

Q: Why are we not holding a meeting of shareholders to approve the Reincorporation?

A: We have received the written consent of shareholders holding more than 50% of the outstanding voting power of our securities. Under the North Dakota Business Corporation Act ("North Dakota law") and our Articles of Incorporation and Bylaws, this transaction may be approved by the written consent of a majority of the shares entitled to vote on it. Since we have already received written consents representing the necessary number of votes, a meeting is not necessary and represents a substantial and avoidable expense.

Q: What are the principal features of the Reincorporation?

A: The Reincorporation will be accomplished by merging with and into our wholly-owned subsidiary, Eco Global. One new share of Eco Global common stock will be issued for each outstanding share of our common held by our shareholders on the record date for the Reincorporation. Shares of Eco Global will be eligible to trade in their place beginning on or about the effective date of the Reincorporation under a new CUSIP number and trading symbol that have not yet been assigned.

Q: What are the differences between Nevada and North Dakota law?

A: There are certain differences between the laws of North Dakota and Nevada that impact your rights as a shareholder. For information regarding the differences between the corporate laws of the Nevada and North Dakota, please see "Similarities and Differences Between the Corporate Laws of North Dakota and Nevada."

Q: How will the Reincorporation affect my ownership?

A: Your ownership interest will not be affected by the Reincorporation.

Q: Will the principal office of the Company change after the Reincorporation?

A. The principal office of the Company, which is the same as the principal office of Eco Global, shall remain the principal office of Eco Global.

Q: How will the Reincorporation affect our business?

A: Eco Global will continue our business at the same location and with the same assets. The Company will cease its corporate existence in the State of North Dakota on the effective date of the Reincorporation.

Q: What do I do with my stock certificates?

A: Delivery of your certificates issued prior to the effective date of the Reincorporation will constitute "good delivery" of shares in transactions subsequent to Reincorporation. Certificates representing shares of Eco Global will be issued with respect to transfers consummated after the Reincorporation. New certificates will also be issued upon the request of any shareholder, subject to normal requirements as to proper endorsement, signature guarantee, if required, and payment of applicable taxes.

It will not be necessary for shareholders of the Company to exchange their existing stock certificates for certificates of Eco Global. Outstanding stock certificates of the Company should not be destroyed or sent to us.

Q: What if I have lost my certificate?

A: If you have lost your certificate, you can contact our transfer agent to have a new certificate issued. You may be required to post a bond or other security to reimburse us for any damages or costs if the certificate is later delivered for sale of transfer. Our transfer agent may be reached at:

Olde Monmouth Stock Transfer

200 Memorial Parkway

Atlantic Highlands, NJ 07716-1655

Q: Can I require the Company to purchase my stock?

A: Yes. Under North Dakota law you are entitled to appraisal and purchase of your stock as a result of the Reincorporation.

Q: Who will pay the costs of Reincorporation?

A: We will pay all of the costs of Reincorporation in Nevada, including distributing this Information Statement. We may also pay brokerage firms and other custodians for their reasonable expenses for forwarding information materials to the beneficial owners of our common stock. We do not anticipate contracting for other services in connection with the Reincorporation.

Q: Will I have to pay taxes on the new certificates?

A: We believe that the Reincorporation is not a taxable event and that you will be entitled to the same basis in the shares of Eco Global that you had in our common stock. Everyone's tax situation is different and you should consult with your personal tax advisor regarding the tax effect of the Reincorporation.

Principal Reasons for Reincorporation

The Board of Directors believes that the Reincorporation will give the Company a greater measure of flexibility and simplicity in corporate governance than is available under North Dakota law and will increase the marketability of the Company's securities.

The State of Nevada is recognized for adopting comprehensive modern and flexible corporate laws which are periodically revised to respond to the changing legal and business needs of corporations. For this reason, many major corporations have initially incorporated in Nevada or have changed their corporate domiciles to Nevada in a manner similar to that proposed by the Company. Nevada corporate law, accordingly, has been, and is likely to continue to be, interpreted in many significant judicial decisions, a fact which may provide greater clarity and predictability with respect to the Company's corporate legal affairs. For these reasons, the Board of Directors believes that the Company's business and affairs can be conducted to better advantage if the Company is able to operate under Nevada law. See "Certain Significant Differences between the Corporation Laws of Nevada and North Dakota."

Principal Features of the Reincorporation

The Reincorporation will be accomplished by a merger (the "Merger") of the Company into Eco Global pursuant to an Agreement and Plan of Merger (the "Plan of Merger") between the Company and Eco Global dated January 13, 2009, with Eco Global surviving the merger. A copy of the Plan of Merger is attached to this Information Statement at Exhibit A. The Reincorporation will become effective upon the filing of the Articles of Merger with the Secretary of States of Nevada and North Dakota. Under federal securities laws, the Company cannot file the Articles of Merger until at least 20 days after the mailing of this Information Statement (the "Effective Date").

Upon completion of the Reincorporation, each of our shareholders as of the Record Date will be entitled to receive one share of Eco Global common stock for each share of the Company's common stock he owned on the Record Date. There are no shares of Eco Global common or preferred stock currently outstanding. As a result of the Reincorporation, the Company will cease its corporate existence in the State of North Dakota.

The Articles of Incorporation and Bylaws of Eco Global are not significantly different from our Articles of Incorporation and Bylaws. Your rights as shareholders may be affected by the Reincorporation by, among other things, the differences between the laws of the State of North Dakota, which govern the Company, and the laws of the State of Nevada, which govern Eco Global. See the information under "Similarities and Differences Between The Corporate Laws Of North Dakota And Nevada" for a summary of the differences between the corporate laws of the State of North Dakota and the State of Nevada.

The Reincorporation will not result in any changes in our business, assets, liabilities or net worth. Eco Global is currently our wholly-owned subsidiary and, upon completion of the Reincorporation, will succeed by operation of law to all of our business, assets and liabilities. Our daily business operations will continue at our principal executive offices at 123 Worthington St., Suite 203, Spring Valley, California 91977.

Survivor's Succession to Corporate Rights

Eco Global, the surviving corporation, shall thereupon and thereafter possess all the rights, privileges, powers and franchises of both a public and private nature, and subject to all the restrictions, disabilities and duties of the Company, and all property, real, personal, and mixed, and all debts due to the Company on whatever account, as well for stock subscriptions as all other things in action or belonging to the Company shall be vested in the surviving corporation; and all property, rights, privileges, powers and franchises, and all and every other interest shall thereafter effectively be the property of the surviving corporation as they were of the Company, and the title to any real estate vested by deed or otherwise in the Company shall not revert or be in any way impaired by reason of the merger; but all rights of creditors and all liens upon any property of the Company shall be preserved unimpaired, and all debts, liabilities and duties of the Company shall thenceforth attach to the surviving corporation and may be enforced against it to the same extent as if said debts, liabilities and duties had been incurred or contracted by it. Specifically, but not by way of limitation, the surviving corporation shall be responsible and liable to dissenting shareholders who are accorded and who preserve rights of appraisal as required by the North Dakota Business Corporation Act (the "NDBCA"); and any action or proceeding whether civil, criminal or administrative, pending by or against the Company shall be prosecuted as if the Plan had not taken place, or the surviving corporation may be substituted in such action or proceeding.

Survivor's Succession to Corporate Acts, Plans, Contracts and Similar Rights

All corporate acts, plans, policies, contracts, approvals and authorizations of the Company, its shareholders, its Board of Directors, committees, elected or appointed by its Board of Directors, and its officers and agents, which were valid and effective immediately prior to the effective time of the merger, shall be taken for all purposes as the acts, plans, policies, contracts, approvals and authorizations of the surviving corporation and shall be as effective and binding thereon as the same were with the surviving corporation and continue to be entitled to the same rights and benefits which they enjoyed as employees of the Company.

Survivor's Rights to Assets, Liabilities, Reserves, etc.

The assets, liabilities, reserves and accounts of the Company shall be recorded on the books of the surviving corporation at the amounts at which they, respectively, shall then be carried on the books of Eco Global, subject to such adjustments or eliminations of intercompany items as may be appropriate in giving effect to the merger.

Description of Securities of Eco Global.

Eco Global is authorized to issue 260,000,000 shares of capital stock, consisting of 250,000,000 shares of common stock and 10,000,000 shares of blank check preferred stock, each having a par value of $.001 per share. For a description of blank check preferred stock see the heading Blank Check Preferred Stock below. Eco Global's Certificate of Incorporation provides that each outstanding share of common stock is entitled to one vote on each matter submitted at a meeting of stockholders. The common stock carries no preemptive rights or cumulative voting rights. For a complete description of the securities of Eco Global see the Certificate of Incorporation of Eco Global included with this Information Statement as Exhibit B.

Neither the Company nor Eco Global has any dividends in arrears or has defaulted in principal or interest in respect of any outstanding securities.

Blank Check Preferred Stock

Upon reincorporation into Eco Global, the Board will, without further action by the shareholders, unless otherwise required by law, be authorized to issue up to 10,000,000 shares of Preferred Stock at such times, for such purposes and for such consideration as it may determine. The foregoing is a summary of the terms and conditions relating to the ability of the Board of Directors of Eco Global to issue Preferred Stock. See the attached Exhibit B, the Certificate of Incorporation of Eco Global, for a complete description of the terms and conditions relating to the ability of the Board of Directors of Eco Global to issue Preferred Stock.

The issuance of Preferred Stock could be used to create voting impediments and to make it more difficult for persons seeking to effect a merger or otherwise gain control of the Company. Neither the Board of Directors nor management of the Company or Eco Global is considering the use of Preferred Stock for such purposes. The authorization and issuance of a series of Preferred Stock could have certain effects on the holders of Common Stock. Such effects might include (a) restrictions on dividends on Common Stock if dividends on Preferred Stock are in arrears, (b) possible dilution of the voting power of the Common Stock to the extent that the Preferred Stock has voting rights, and (c) holders of the Common Stock not being entitled to share in the Company's assets upon liquidation until satisfaction of any liquidation preference granted to the Preferred Stock. The ability to issue Preferred Stock gives the Company greater flexibility for future financing needs, acquisitions, and other corporate purposes. The Company currently has no shares of preferred stock issued and outstanding.

Regulatory Requirements

With the exception of filings to be made with the Secretary of State of the State of Nevada and the Secretary of State of the State of North Dakota, there are no federal or state regulatory requirements to be complied with or approvals that must be obtained in connection with the proposed change of domicile.

Reports, Opinions or Appraisals

No report, opinion or appraisal has been sought in connection with the proposed change of domicile.

FEDERAL INCOME TAX CONSEQUENCES OF THE REINCORPORATION

The reincorporation provided for in the Merger Agreement is intended to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended. Assuming the reincorporation qualifies as a reorganization, no gain or loss will be recognized to the holders of capital stock of the Company as a result of consummation of the reincorporation, and no gain or loss will be recognized by the Company or Eco Global. Each former holder of capital stock of the Company will have the same basis in the capital stock of Eco Global received by such holder pursuant to the reincorporation as such holder has in the capital stock of the Company held by such holder at the time of consummation of the reincorporation. Each shareholder's holding period with respect to Eco Global's capital stock will include the period during which such holder held the corresponding Company capital stock, provided the latter was held by such holder as a capital asset at the time of consummation of the reincorporation. The Company has not obtained a ruling from the Internal Revenue Service or an opinion of legal or tax counsel with respect to the consequences of the reincorporation.

A successful IRS challenge to the reorganization status of the proposed reincorporation (in consequence or a failure to satisfy the "continuity of interest" requirement or otherwise) would result in a shareholder recognizing gain or loss with respect to each share of the Company's capital stock exchanged in the proposed reincorporation equal to the difference between the shareholder's basis in such share and the fair market value, as of the time of exchange therefor. In such event, a shareholder's aggregate basis in the shares of the capital stock received in the exchange would equal their fair market value on such date, and the shareholder's holding period for such stock would commence anew.

THE FOREGOING IS ONLY A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES. SHAREHOLDERS SHOULD CONSULT THEIR OWN TAX ADVISERS REGARDING THE SPECIFIC TAX CONSEQUENCES TO THEM OF THE PROPOSED REINCORPORATION, INCLUDING THE APPLICABILITY OF THE LAWS OF ANY STATE OR OTHER JURISDICTION.

SIMILARITIES AND DIFFERENCES BETWEEN THE CORPORATE LAWS OF

NORTH DAKOTA AND NEVADA

The corporation laws of North Dakota and Nevada differ in some respects. It is impracticable to summarize all of the differences in this Information Statement, but certain differences between the corporation laws of North Dakota and Nevada that could affect the rights of shareholders of the Company are as follows:

Cumulative Voting for Directors

Under cumulative voting, each share of stock entitled to vote in the election of directors has a number of votes equal to the number of directors to be elected. A shareholder may then cast all of his votes for a single candidate, or may allocate them among as many candidates as such shareholder may choose. Under Nevada law, shares may not be cumulatively voted for the election of directors unless the certificate of incorporation specifically provides for cumulative voting. In North Dakota, cumulative voting is mandatory upon notice given by a shareholder at a shareholders' meeting at which directors are to be elected. Once notice is given by one shareholder, all shareholders are entitled to cumulate their votes. The Articles of Incorporation of the Company do not and the Certificate of Incorporation of Eco Global will not, provide for cumulative voting in the election of directors.

Shareholder Vote for Mergers

North Dakota law and Nevada law relating to mergers and other corporate reorganizations are substantially the same.

Indemnification

North Dakota and Nevada have similar laws with respect to indemnification by a corporation of its directors. For example, the laws of both states permit corporations to adopt a provision in the Articles of Incorporation eliminating the liability of a director to the corporation or its shareholders for monetary damages for breach of the director's fiduciary duty of care (and the fiduciary duty of loyalty in the case of Nevada). North Dakota allows indemnification of directors, officers and employees (or other persons by contract or otherwise). Nevada also extends the indemnification provisions to officers, employees and other agents of the corporation. The Certificate of Incorporation of Eco Global eliminates the liability of directors, officers, employees and other agents of the corporation to the fullest extent permissible under Nevada law.

Payments of Dividends

Nevada and North Dakota law are similar regarding the payment of dividends. In both North Dakota and Nevada, the law permits the payment of dividends if, after the dividends have been paid, the corporation is able to pay its debts as they become due in the usual course of business (equity test for insolvency), and the corporation's total assets are not less than the sum of its total liabilities plus the amount that would be needed, if the corporation were to be dissolved at the time of the dividend payment, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the dividend (balance sheet test for insolvency). In addition, both North Dakota and Nevada law generally provides that a corporation may redeem or repurchase its shares only if the same equity and balance sheet test for insolvency are satisfied. In determining whether the balance sheet test has been satisfied, the board may: (i) use financial statements prepared on the basis of accounting practices that are reasonable under the circumstances; (ii) make its determination based on a fair valuation, (in the case of Nevada including, but not limited to, unrealized appreciation and depreciation); or (iii) make its determination based upon any other method that is reasonable in the circumstances.

Restrictions on Business Combinations

In the last several years, a number of states (but not North Dakota) have adopted special laws which contain provisions restricting the ability of a corporation to engage in business combinations with an interested shareholder.

Nevada law defines an "interested shareholder" as a beneficial owner (directly or indirectly) of ten percent (10%) or more of the voting power of the outstanding shares of the corporation. Under Nevada law the three-year moratorium can be lifted only by advance approval by a corporation's board of directors. After the three-year period, combinations with "interested shareholders" remain prohibited unless (i) they are approved by the board of directors, the disinterested shareholders or a majority of the outstanding voting power not beneficially owned by the interested party, or (ii) the interested shareholders satisfy certain fair value requirements. A Nevada corporation may opt-out of the statute with appropriate provisions in its articles of incorporation.

Eco Global has opted out of the applicable statutes in its Articles of Incorporation initially filed with the Secretary of State.

Dissenters' Rights of Appraisal

The shareholders of the Company are afforded dissenters' rights of appraisal under the laws of the State of North Dakota.

Section 10-19.1-87 of the NDBCA, provides that any shareholder, is entitled to dissent from and obtain payment of the fair value of shares held in the consummation of any plan if required by NDBCA Section 10-19.1-87 or the articles of incorporation and the shareholder is entitled to vote on the merger or consolidation.

Pursuant to Section 10-19.1-98 of the NDBCA, a corporation is required to send a notice to all shareholders as of the applicable record date, regardless of whether such shareholders are entitled to vote, notifying them that they are entitled to assert dissenters' rights under the NDBCA. A shareholder who wishes to assert dissenters' rights must comply with the procedural requirements of Section 10-19.1-88 of the NDBCA and cause the corporation to receive, before the vote is taken, written notice of intent to demand payment for shares if the proposed actions is effectuated; and such shareholder may not vote any shares in favor of the proposed actions. In order to assert dissenters' rights, a shareholder must have been a shareholder with respect to the shares for which payment is demanded as of the date the proposed corporate action creating dissenters' rights is approved by the shareholders, if such approval is required, or as of the effective date of the corporate action, if no such approval is required.

Pursuant to Section 10-19.1-88 of the NDBCA, the dissenters are required to receive notice stating the address to which a demand for payment and share certificates must be sent in order to obtain payment and the date by which they must be received; supply a form to be used to certify the date on which the shareholder, or the beneficial owner on whose behalf the shareholder dissents, acquired the shares or an interest in them and to demand payment; a copy of Sections 10-19.1-87 and 10-19.1- 88 of the NDBCA. Accordingly, a copy of Sections 10-19.1-87 and 10-19.1-88 of the NDBCA is attached hereto and is incorporated herein by reference. See Exhibit C herein.

In order to receive the fair value of shares, a dissenting shareholder must demand payment and deposit certificated shares within 30 days after the notice was given, but the dissenter retains all other rights of a shareholder until the proposed action takes effect.

Section 10-19.1-88 of the NDBCA provides that after the corporate action takes effect, or after the corporation receives a valid demand for payment, whichever is later, the corporation shall remit to each dissenting shareholder who has complied with subsections three four and five of Section 10-19.1-88 of the NDBCA, the amount the corporation estimates to be the fair value of the shares, plus interest. Each payment made shall be accompanied by a balance sheet and statement of income of the corporation for a fiscal year ending not more than 16 months before the effective date of the corporate action, together with the latest available interim financial statements; a statement of the corporation's estimate of the fair value of the shares and a brief description of the method used to reach the estimate; and a copy of Sections 10-19.1-87 and 10-19.1-88 of the NDBCA. Accordingly, a copy of Sections 10-19.1-87 and 10-19.1- 88 of the NDBCA is attached hereto and is incorporated herein by reference. See the caption "Exhibits" herein.

If a dissenter believes that the amount remitted by the corporation is less than the fair value of the shares plus interest, the dissenter may give written notice to the corporation of the dissenter's own estimate of the fair value of the shares plus interest, within 30 days after the corporation mails the remittance and demand payment of the difference. Otherwise, a dissenter is entitled only to the amount remitted by the corporation.

The corporation shall commence a proceeding within 60 days after receipt of the counter-payment demand from the dissenting shareholder and petition the court to determine the fair value of the shares and the amount of interest; if the corporation does not commence the proceeding within the 60 day period, it shall pay each dissenter whose demand remains unresolved the amount demanded. Any such action shall be brought in the district court in the county where the corporation maintains its registered office at 3727 Kingston Dr., Bismark, North Dakota 58503, and all dissenters who have satisfied all requirements of any counter- proposal for the payment of the fair value of their shares and whose demands remain unresolved, shall be made party to the action. The court may appoint one or more persons to determine the fair value of the shares, and each dissenter made party to the proceeding is, entitled to judgment for the amount, if any, by which the court finds the fair value of the shares, plus interest, exceeded the amount paid by the corporation, but shall not be liable to the corporation for the amount remitted to the dissenter that exceeds the fair value of the shares as determined by the court, plus interest. The court may assess costs and counsel fees, including the reasonable compensation expenses of appraisers appointed by the court. These fees will be assessed against the corporation, except that the court may assess costs against all or some of the dissenters, in amounts the court finds equitable, to the extent the court finds that the dissenters acted arbitrarily, vexatiously or not in good faith in making demand for payment of the fair value of their shares. The court may also assess fees and expenses of counsel in amounts the court finds equitable, and against either the corporation or one or more dissenters or in favor of any other party, if the court finds that the party against whom the fees and expenses are assessed acted arbitrarily, vexatiously or not in good faith. If the court finds that the services of counsel for any dissenters were of substantial benefit to other dissenters similarly situated, and that the fees for those services should not be assessed against the corporation, the court may award to those counsel reasonable fees to be paid out of the amounts awarded the dissenters who were benefited. See Section 10-19.1-88 of the NDBCA.

MEMBERS OF THE BOARD OF DIRECTORS COLLECTIVELY OWN SUFFICIENT VOTING SECURITIES OF THE COMPANY TO ADOPT, RATIFY AND APPROVE THE MERGER PURSUANT TO WHICH THE COMPANY WILL CHANGE ITS DOMICILE FROM THE STATE OF NORTH DAKOTA TO THE STATE OF NEVADA. NO FURTHER CONSENTS, VOTES OR PROXIES ARE NEEDED, AND NONE ARE REQUESTED.

The information contained in this Information Statement and the Dissenting Shareholders' Payment Demand Form which is attached hereto constitutes the only notice any dissenting shareholder will be provided under the NDBCA relative to dissenting shareholders' rights of appraisal.

RESOLUTION 2

CHANGING THE COMPANY’S NAME TO ECO GLOBAL CORPORATION

The Reincorporation whereby the Company will merge into Eco Global, with Eco Global as the surviving entity, will result in a change to the Company's name from “Driver Passport, Inc.” to “Eco Global Corporation”. The Company is changing to more closely allign its name with its new business focus on selling licenses, developing INCABLOCK™ manufacturing facilities, related engineering and training and marketing of the INCABLOCK™ System. The Reincorporation and the change in the Company’s name were approved by the written consent by stockholders holding a majority of the outstanding voting stock of the Company, dated as of November 24, 2008.

RESOLUTION 3

INCREASE THE AUTHORIZED CAPITAL STOCK OF THE COMPANY

The Company’s North Dakota's Articles of Incorporation, as currently in effect, authorizes the Company to issue up to 50,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. The Board of Directors and the shareholders holding a majority of the issued and outstanding shares of common stock have approved an increase in the number of authorized shares of the common stock of the Company to be effected as a result of the Reincorporation. Upon the merger into Eco Global Articles of Incorporation, the Company will be authorized to issue 250,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share.

The Board of Directors believes that it is in the Company's and the Company's stockholders' best interests to increase the availability of additional authorized but unissued capital stock to provide the Company with the flexibility to issue equity for other proper corporate purposes which may be identified in the future. Such future activities may include, without limitation, raising equity capital, adopting Employee Stock Plans or making acquisitions through the use of stock. The Board of Directors has no immediate plans, understandings, agreements or commitments to issue additional shares of stock for any purposes.

The Board of Directors believes that the increase in authorized capital will make a sufficient number of shares available, should the Company decide to use its shares for one or more of such previously mentioned purposes or otherwise. The Company reserves the right to seek a further increase in authorized shares from time to time in the future as considered appropriate by the Board of Directors.

The increased capital will provide the Board of Directors with the ability to issue additional shares of stock without further vote of the stockholders of the Company, except as provided under Nevada corporate law or under the rules of any national securities exchange on which shares of stock of the Company are then listed. Under Eco Global's Articles, the Company's stockholders do not have preemptive rights to subscribe to additional securities which may be issued by the Company, which means that current stockholders do not have a prior right to purchase any new issue of capital stock of the Company in order to maintain their proportionate ownership of the Company's stock. In addition, if the Board of Directors elects to issue additional shares of stock, such issuance could have a dilutive effect on the earnings per share, voting power and shareholdings of current stockholders.

In addition to the corporate purposes discussed above, the authorization of additional capital, under certain circumstances, may have an anti-takeover effect, although this is not the intent of the Board of Directors. For example, it may be possible for the Board of Directors to delay or impede a takeover or transfer of control of the Company by causing such additional authorized shares to be issued to holders who might side with the Board in opposing a takeover bid that the Board of Directors determines is not in the best interests of the Company and our stockholders. The increased authorized capital therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the increased capital may limit the opportunity for the Company's stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The increased authorized capital may have the effect of permitting the Company's current management, including the current Board of Directors, to retain its position, and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of the Company's business. However, the Board of Directors is not aware of any attempt to take control of the Company and the Board of Directors did not approve the increase in the Company's authorized capital with the intent that it be utilized as a type of anti-takeover device.

RESOLUTION 4

ADOPTION OF BLANK CHECK PREFERRED STOCK

The Reincoproation and the resulting merger of the Company into Eco Global will result in the creation of 10,000,000 authorized shares of "blank check" preferred stock. Although the Company’s North Dakota Articles of Incorporation provides for the issuance of preferred stock, these shares are not considered "blank check" preferred stock.

The terms of the "blank check" preferred stock are included in Eco Global’ certificate of incorporation which is attached as Exhibit "B" to this information statement and contains provisions related to the "blank check" preferred stock. The following summary does not purport to be complete and is qualified in its entirety by reference to the certificate of incorporation of Eco Global.

The term "blank check" refers to preferred stock, the creation and issuance of which is authorized in advance by the stockholders and the terms, rights and features of which are determined by the board of directors of the Company upon issuance. The authorization of such blank check preferred stock would permit the board of directors to authorize and issue preferred stock from time to time in one or more series.

Subject to the provisions of Eco Global’ Certificate of Incorporation and the limitations prescribed by law, the board of directors would be expressly authorized, at its discretion, to adopt resolutions to issue shares, to fix the number of shares and to change the number of shares constituting any series and to provide for or change the voting powers, designations, preferences and relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, including dividend rights (including whether the dividends are cumulative), dividend rates, terms of redemption (including sinking fund provisions), redemption prices, conversion rights and liquidation preferences of the shares constituting any series of the preferred stock, in each case without any further action or vote by the stockholders. The board of directors would be required to make any determination to issue shares of preferred stock based on its judgment as to the best interests of the Company and its stockholders.

The creation of the “blank check” preferred stock will provide the Company with increased financial flexibility in meeting future capital requirements by providing another type of security in addition to its Common Stock, as it will allow preferred stock to be available for issuance from time to time and with such features as determined by the board of directors for any proper corporate purpose. It is anticipated that such purposes may include, without limitation, the issuance for cash as a means of obtaining capital for use by the Company, or issuance as part or all of the consideration required to be paid by the Company for acquisitions of other businesses or assets.

Any issuance of preferred stock with voting rights could, under certain circumstances, have the effect of delaying or preventing a change in control of the Company by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change in control of the Company. Shares of voting or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to render more difficult or discourage an attempt to obtain control of the Company by means of a tender offer, proxy contest, merger or otherwise. The ability of the board of directors to issue such additional shares of preferred stock, with the rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of the Company by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of such additional shares of preferred stock to persons friendly to the board of directors could make it more difficult to remove incumbent managers and directors from office even if such change were to be favorable to stockholders generally.

While the issuance of preferred stock may have anti-takeover ramifications, the board of directors believes that the financial flexibility outweighs any disadvantages. To the extent that the amendment may have anti-takeover effects, the use of blank check preferred stock may encourage persons seeking to acquire the Company to negotiate directly with the board of directors enabling the board of directors to consider the proposed transaction in a manner that best serves the stockholders' interests.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS FOR

OUR NEXT ANNUAL MEETING

Stockholders may submit proper proposals for inclusion in our next proxy statement and for consideration at our 2010 annual meeting of our stockholders by submitting their proposals in writing to the Secretary of Driver Passport, Inc. in a timely manner. In order to be included in our proxy materials for the next Special meeting of stockholders to be held in the year 2010, stockholder proposals must be received by our Secretary no later than December 31, 2009, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table lists stock ownership of the Company’s Common Stock entitled to vote as of the Record Date. The information includes beneficial ownership by (i) holders of more than 5% of the Company’s Common Stock, (ii) each of our current directors and executive officers and (iii) all directors and executive officers as a group. The information is determined in accordance with Rule 13d-3 promulgated under the Exchange Act based upon information furnished by the persons listed or contained in filings made by them with the Commission. Except as noted below, to our knowledge, each person named in the table has sole voting and investment power with respect to all shares of Common Stock beneficially owned by them.

| Name and Address of Beneficial Owner (1) | Director/Officer | Amount and Nature of Beneficial Ownership(2) | Percentage of Class(2) |

| Daniel Correa (3) | Y | 0 | * |

| Randy Brown (3) | Y | 8,925,000(4) | 26.5% |

| Inca Block International. (5) | N | 20,000,000 | 59.4% |

| All directors and officers as a group (2 persons) | | 8,925,000(4) | 26.5% |

| (1) | Except as otherwise indicated, the address of each beneficial owner is c/o Driver Passport, Inc., 123 Worthington Street, Spring Valley, California 91977. |

| (2) | Percentages of common stock are computed on the basis of 33,620,000 shares of common stock outstanding as of January 13, 2009 and include in each case shares of Common Stock issuable upon exercise of options or warrants exercisable within 60 days for the subject individual only. |

| (3) | An officer and/or director of the Company. |

The Company will provide upon request and without charge to each stockholder receiving this Information Statement a copy of the Company's Annual Report on Form 10-KSB for the fiscal year ended December 31, 2007, including the financial statements and financial statement schedule information included therein, as filed with the SEC. The Annual Report is incorporated in this Information Statement. You are encouraged to review the Annual Report together with subsequent information filed by the Company with the SEC and other publicly available information.

EXHIBITS INDEX

A. AGREEMENT AND PLAN OF MERGER

B. NEVADA ARTICLES OF INCORPORATION

C. NORTH DAKOTA STATUTES REGARDING DISSENTER'S RIGHTS

D. NOTICE TO SHAREHOLDERS OF DISSENTERS' RIGHTS OF APPRAISAL PURSUANT TO NORTH DAKOTA BUSINESS CORPORATION ACT SECTION 10-19.1-98

E. DISSENTING SHAREHOLDERS' PAYMENT DEMAND FORM

By Order of the Board of Directors

| | | | | |

| /s/ Daniel Correa | | | | |

Daniel Correa | | | | |

Dated: *, 2009

EXHIBIT A

PLAN AND AGREEMENT OF MERGER

OF

DRIVER PASSPORT, INC.

(A NORTH DAKOTA CORPORATION)

AND

ECO GLOBAL CORPORATION

(A NEVADA CORPORATION)

PLAN AND AGREEMENT OF MERGER entered into on January 13, 2008, by and between DRIVER PASSPORT, INC., a North Dakota corporation ("Driver Passport"), and ECO GLOBAL CORPORATION, a Nevada corporation ("Eco Global").

WHEREAS, Driver Passport is a business corporation of the State of North Dakota with its registered office therein located at 123 Worthington Street, Suite 203, Spring Valley, CA 91977; and

WHEREAS, the total number of shares of stock which Driver Passport has authority to issue is 50,000,000, of which 40,000,000 are common stock, $.001 par value per share, and 10,000,000 are preferred stock, $.001 par value per share; and

WHEREAS, Eco Global is a business corporation of the State of Nevada with its registered office therein located at 123 Worthington Street, Suite 203, Spring Valley, CA 91977; and

WHEREAS, the total number of shares of stock which Eco Global has authority to issue is 260,000,000, of which 250,000,000 are common stock, $.001 par value per share, and 10,000,000 are preferred stock, $.001 par value per share; and

WHEREAS, the North Dakota Business Corporation Act permits a merger of a business corporation of the State of North Dakota with and into a business corporation of another jurisdiction; and

WHEREAS, the General Corporation Law of the State of Nevada permits the merger of a business corporation of another jurisdiction with and into a business corporation of the State of Nevada; and

WHEREAS, Driver Passport and Eco Global and the respective Boards of Directors thereof declare it advisable and to the advantage, welfare, and best interests of said corporations and their respective stockholders to merge Driver Passport with and into Eco Global pursuant to the provisions of the North Dakota Business Corporation Act and pursuant to the provisions of the General Corporation Law of the State of Nevada upon the terms and conditions hereinafter set forth;

NOW, THEREFORE, in consideration of the premises and of the mutual agreement of the parties hereto hereby determine and agree as follows.

ARTICLE I

MERGER

1.1. CONSTITUENT CORPORATIONS. The name, address and jurisdiction of organization of each of the constituent corporations are set forth below.

A. Driver Passport, a corporation organized under and governed by the laws of the State of North Dakota with a principal place of business at 123 Worthington Street, Suite 203, Spring Valley, CA 91977 (the "terminating corporation").

B. Eco Global, a corporation organized under and governed by the laws of the State of Nevada with a principal place of business at 123 Worthington Street, Suite 203, Spring Valley, CA 91977 (the "surviving corporation").

1.2. SURVIVING CORPORATION. Eco Global shall be the surviving corporation. The principal place of business, Articles of Incorporation, bylaws, officers and directors of Eco Global shall survive the merger without amendment or revision and be the principal place of business, Articles of Incorporation, bylaws, officers and directors of the surviving corporation.

1.3. MERGER. On the Effective Date (as hereinafter set forth) and subject to the terms and conditions of this Agreement, the applicable provisions of the North Dakota Business Corporation Act ("North Dakota Law"), and the applicable provisions of Title 7, Chapter 78 of the Nevada Revised Statutes ("Nevada Law"), Driver Passport is merged with and into Eco Global. The separate existence of Driver Passport shall cease on and after the Effective Date.

ARTICLE II

EXCHANGE AND CONVERSION OF SHARES

2.1. CONVERSION OF CAPITAL STOCK. On the Effective Date, each issued and outstanding share of the common stock, $.001 par value per share, of Driver Passport shall be converted into the right to receive one (1) fully paid and non-assessable share of the common stock, $.001 par value per share, of Eco Global.

2.2. FRACTIONAL SHARES. No fractional shares or script representing fractional shares shall be issued by Eco Global as a result of the merger. Each fractional share that would otherwise result from the merger shall be cancelled and returned to the authorized and unissued capital stock of Eco Global and a full share of Eco Global common stock, $.001 par value per share, shall be issued in its place.

2.3. NO MANDATORY EXCHANGE. It will not be necessary for shareholders of Driver Passport to exchange their existing stock certificates for certificates of Eco Global. Outstanding stock certificates of the Company should not be destroyed or sent to the surviving corporation.

2.4. EXISTING SHARES. Prior to the merger, no shares of common or preferred stock of Eco Global had been issued.

ARTICLE III

ADDITIONAL COVENANTS AND AGREEMENTS

3.1. OUTSTANDING OPTIONS AND WARRANTS. Except to the extent otherwise provided in outstanding options, warrants, and other rights to purchase shares of the common stock, $.001 par value per share, of Driver Passport, each option, warrant or other right to purchase shares of the common stock, $.001 par value per share, of Driver Passport, shall be exercisable to purchase shares of Eco Global on the same terms and conditions.

3.2. SUBMISSION TO SERVICE IN NORTH DAKOTA. Eco Global agrees that it may be served with process in the State of North Dakota in any proceeding for enforcement of any obligation of the Eco Global arising from this merger, including any suit or other proceeding to enforce the rights of any stockholders as determined in appraisal proceedings pursuant to the provisions of Section 10-19.1-98 of the North Dakota Business Corporation Act, and irrevocably appoints the Secretary of State of North Dakota as its agent to accept services of process in any such suit or proceeding.

3.3. COOPERATION. In the event that this Agreement is approved and adopted by the stockholders of Driver Passport in accordance with North Dakota Law, the parties hereto agree that they will cause to be executed and filed and recorded any document or documents prescribed by North Dakota Law or Nevada Law, and that they will cause to be performed all necessary acts within the State of North Dakota and the State of Nevada and elsewhere to effectuate the merger herein provided for.

3.4. ADDITIONAL ASSURANCES. Driver Passport hereby appoints the officers and directors, each acting alone, as its true and lawful attorneys in fact to do any and all acts and things, and to make, execute, deliver, file, and record any and all instruments, papers, and documents which shall be or become necessary, proper, or convenient to carry out or put into effect any of the provisions of this Agreement or of the merger herein provided for.

ARTICLE IV

EFFECTIVE DATE

4.1. EFFECTIVE DATE. This merger shall be effective in the State of North Dakota and the State of Nevada, shall be on the date a certificate of merger meeting the requirements of Nevada Law, is filed with the Secretary of State of the State of Nevada.

4.2. TERMINATION. Notwithstanding the full approval and adoption of this Agreement, the said Agreement may be terminated by either party at any time prior to the filing thereof with the Secretary of State of the State of Nevada.

4.3. AMENDMENT. Notwithstanding the full approval and adoption of this Agreement, this Agreement may be amended at any time and from time to time prior to the filing thereof with the Secretary of State of the State of Nevada except that, without the approval of the stockholders of Driver Passport and the stockholders of Eco Global, no such amendment may (a) change the rate of exchange for any shares of Driver Passport or the types or amounts of consideration that will be distributed to the holders of the shares of stock of Driver Passport; (b) change any term of the Articles of Incorporation of Eco Global; or (c) adversely affect any of the rights of the stockholders of Driver Passport or Eco Global.

ARTICLE V

MISCELLANEOUS

5.1. COUNTERPARTS. This Agreement may be executed in one or more counterparts, each of which may have different signatures and be signed at different times. When all parties have signed at least one counterpart, each counterpart shall be deemed complete and shall constitute the same instrument.

5.2. ENTIRE AGREEMENT. This Agreement and the is intended by the parties to be the final expression of their agreement with respect to the matter set forth herein and is intended to contain all of the terms of such agreement without the need to refer to other documents. There are no other understandings, written or oral, among the parties with respect to the matter set forth herein.

5.3. AMENDMENT. This Agreement may not be amended except by a written instrument signed by the parties hereto.

IN WITNESS WHEREOF, this Agreement is hereby executed upon behalf of each of the parties thereto this 13th day of January, 2009.

DRIVER PASSPORT, INC. (North Dakota

| | | | | |

/s/ Daniel Correa | | | | |

Daniel Correa President and Secretary | | | | |

ECO GLOBAL CORPORATION (Nevada)

| | | | | |

/s/ Daniel Correa | | | | |

Daniel Correa President and Secretary | | | | |

EXHIBIT B

ARTICLES OF INCORPORATION

OF

ECO GLOBAL CORPORATION

EXHIBIT A

EIGHT: The corporation is authorized to issue two classes of stock. One class of stock shall be common stock, par value $0.001, of which the Corporation shall have the authority to issue 250,000,000 shares. The second class of stock shall be preferred stock, par value $0.001, of which the corporation shall have the authority to issue 10,000,000 shares. The preferred stock, or any series thereof, shall have such designations, preferences and relative, participating, optional or other special rights and qualifications, limitations or restrictions thereof as shall be expressed in the resolution or resolutions providing for the issue of such stock adopted by the board of directors and may be made dependent upon facts ascertainable outside such resolution or resolutions of the board of directors, provided that the matter in which such facts shall operate upon such designations, preferences, rights and qualifications; limitations or restrictions of such class or series of stock is clearly and expressly set forth in the resolution or resolutions providing for the issuance of such stock by the board of directors.

NINTH: The governing board of this corporation shall be known as the Board of Directors, and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the bylaws of this corporation, providing that the number of directors shall not be reduced to less than one (1).

TENTH: After the amount of the subscription price, the purchase price, of the par value of the stock of any class or series is paid into the corporation, owners or holders of shares of any stock in the corporation may never be assessed to pay the debts of the corporation.

ELEVENTH: The corporation is to have a perpetual existence.

TWELFTH: No director or officer of the corporation shall be personally liable to the corporation or any of its stockholders for damages for breach of fiduciary duty as a director or officer of for any act or omission of any such director or officer; however, the foregoing provision shall not eliminate or limit the liability of a director or officer for (a) acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or (b) the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. Any repeal or modification of this Article by the stockholders of this corporation shall be prospective only and shall not adversely affect any limitation on the personal liability of a director or officer of the corporation for acts or omissions prior to such repeal or modification.

THIRTEENTH: No shareholder shall be entitled as a matter of right to subscribe for or receive additional shares of any class of stock of the corporation, whether now or hereafter authorized, or any bonds, debentures or securities convertible into stock, but such additional shares of stock or other securities convertible into stock may be issued or disposed of by the Board of Directors to such persons and on such terms as in its discretion it shall deem advisable.

FOURTEENTH: This corporation reserves the right to amend, alter, change or repeal and provision contained in the Articles of Incorporation, in the manner now or hereafter prescribed by statute, or by the Articles of Incorporation, and all rights conferred upon the Stockholders herein are granted subject to this reservation.

EXHIBIT C

RIGHTS OF DISSENTING OWNERS

UNDER THE NORTH DAKOTA BUSINESS CORPORATION ACT

10-19.1-87. Rights of dissenting shareholders.

1. A shareholder of a corporation may dissent from, and obtain payment for the fair value of the shareholder's shares in the event of, any of the following corporate actions:

a. An amendment of the articles that materially and adversely affects the rights or preferences of the shares of a dissenting shareholder in that it:

(1) Alters or abolishes a preferential right of the shares;

(2) Creates, alters, or abolishes a right in respect of the redemption of the shares, including a provision respecting a sinking fund for the redemption or repurchase of shares;

(3) Alters or abolishes a preemptive right of the holder of the shares to acquire shares, securities other than shares, or rights to purchase shares or securities other than shares; or

(4) Excludes or limits the right of a shareholder to vote on a matter, or to accumulate votes, except as the right may be excluded or limited through the authorization or issuance of securities of an existing or new class or series with similar or different voting rights;

b. A sale, lease, transfer, or other disposition of all or substantially all of the property and assets of the corporation, but not including a transaction permitted without shareholder approval in subsection 1 of section 10-19.1-104, or a disposition in dissolution described in subsection 2 of section 10-19.1-109 or a disposition pursuant to an order of a court, or a disposition for cash on terms requiring that all or substantially all of the net proceeds of disposition be distributed to the shareholders in accordance with their respective interests within one year after the date of disposition;

c. A plan of merger to which the corporation is a party, except as provided in subsection 3;

d. A plan of exchange, whether under this chapter or under chapter 10-32, to which the corporation is a constituent organization as the corporation whose shares will be acquired by the acquiring corporation, except as provided in subsection 3; or

e. Any other corporate action taken pursuant to a shareholder vote with respect to which the articles, the bylaws, or a resolution approved by the board directs that dissenting shareholders may obtain payment for their shares.

2. A shareholder may not assert dissenters' rights as to less than all of the shares registered in the name of the shareholder, unless the shareholder dissents with respect to all the shares that are beneficially owned by another person but registered in the name of the shareholder and discloses the name and address of each beneficial owner on whose behalf the shareholder dissents. In that event, the rights of the dissenter must be determined as if the shares as to which the shareholder has dissented and the other shares were registered in the names of different shareholders. The beneficial owner of shares who is not the shareholder may assert dissenters' rights with respect to shares held on behalf of the beneficial owner, and must be treated as a dissenting shareholder under the terms of this section and section 10-19.1-88, if the beneficial owner submits to the corporation at the time of or before the assertion of the rights a written consent of the shareholder. 3. Unless the articles, the bylaws, or a resolution approved by the board otherwise provide, the right to obtain payment under this section does not apply to the shareholders of:

a. The surviving corporation in a merger with respect to shares of the shareholders that are not entitled to be voted on the merger and are not canceled or exchanged in the merger; or

b. The corporation whose shares will be acquired by the acquiring corporation in a plan of exchange with respect to shares of the shareholders that are not entitled to be voted on the plan of exchange and are not exchanged in the plan of exchange.

4. The shareholders of a corporation who have a right under this section to obtain payment for their shares do not have a right at law or in equity to have a corporate action described in subsection 1 set aside or rescinded, except when the corporate action is fraudulent with regard to the complaining shareholder or the corporation.

5. If a date is fixed according to subsection 1 of section 10- 19.1-73.2 for the determination of shareholders entitled to receive notice of and to vote on an action described under subsection 1, only shareholders as of the date fixed and beneficial owners as of the date fixed who hold through shareholders, as provided in subsection 2, may exercise dissenters' rights.

10-19.1-88. Procedures for asserting dissenters' rights.

1. For purposes of this section, the terms defined in this subsection have the meanings given them.

a. "Corporation" means the issuer of the shares held by a dissenter before the corporate action referred to in subsection 1 of section 10-19.1-87 or the successor by merger of that issuer.

b. "Fair value of the shares" means the value of the shares of a corporation immediately before the effective date of a corporate action referred to in subsection 1 of section 10-19.1-87.

c. "Interest" means interest commencing five days after the effective date of the corporate action referred to in subsection 1 of section 10-19.1-87, up to and including the date of payment, calculated at the rate provided in section 28-20-34 for interest on verdicts and judgments.

2. If a corporation calls a shareholder meeting at which any action described in subsection 1 of section 10-19.1-87 is to be voted upon, the notice of the meeting shall inform each shareholder of the right to dissent and shall include a copy of section 10-19.1-87 and this section.

3. If the proposed action must be approved by the shareholders, a shareholder who is entitled to dissent under section 10- 19.1-87 and who wishes to exercise dissenter's rights shall file with the corporation before the vote on the proposed action a written notice of intent to demand the fair value of the shares owned by the shareholder and may not vote the shares in favor of the proposed action.

4. After the proposed action has been approved by the board and, if necessary, the shareholders, the corporation shall send to all shareholders who have complied with subsection 3 and to all shareholders entitled to dissent if no shareholder vote was required, a notice that contains:

a. The address to which a demand for payment and share certificates must be sent in order to obtain payment and the date by which they must be received;

b. A form to be used to certify the date on which the shareholder, or the beneficial owner on whose behalf the shareholder dissents, acquired the shares or an interest in them and to demand payment; and

c. A copy of section 10-19.1-87 and this section.

5. In order to receive the fair value of shares, a dissenting shareholder must demand payment and deposit certificated shares within thirty days after the notice required by subsection 4 was given, but the dissenter retains all other rights of a shareholder until the proposed action takes effect.

6. After the corporate action takes effect, or after the corporation receives a valid demand for payment, whichever is later, the corporation shall remit, to each dissenting shareholder who has complied with subsections 3, 4, and 5, the amount the corporation estimates to be the fair value of the shares, plus interest, accompanied by:

a. The corporation's closing balance sheet and statement of income for a fiscal year ending not more than sixteen months before the effective date of the corporate action, together with the latest available interim financial statements;

b. An estimate by the corporation of the fair value of the shares and a brief description of the method used to reach the estimate; and

c. A copy of section 10-19.1-87 and this section.

7. The corporation may withhold the remittance described in subsection 6 from a person who was not a shareholder on the date the action dissented from was first announced to the public or who is dissenting on behalf of a person who was not a beneficial owner on that date. If the dissenter has complied with subsections 3, 4, and 5, the corporation shall forward to the dissenter the materials described in subsection 6, a statement of the reason for withholding the remittance, and an offer to pay to the dissenter the amount listed in the materials if the dissenter agrees to accept the amount in full satisfaction. The dissenter may decline the offer and demand payment under subsection 9. Failure to do so entitles the dissenter only to the amount offered. If the dissenter makes demand, subsections 10 and 11 apply.

8. If the corporation fails to remit within sixty days of the deposit of certificates, it shall return all deposited certificates. However, the corporation may again give notice under subsections 4 and 5 and require deposit at a later time.

9. If a dissenter believes that the amount remitted under subsections 6, 7, and 8 is less than the fair value of the shares plus interest, the dissenter may give written notice to the corporation of the dissenter's own estimate of the fair value of the shares plus interest, within thirty days after the corporation mails the remittance under subsections 6, 7, and 8, and demand payment of the difference. Otherwise, a dissenter is entitled only to the amount remitted by the corporation.

10. If the corporation receives a demand under subsection 9, it shall, within sixty days after receiving the demand, either pay to the dissenter the amount demanded or agreed to by the dissenter after a discussion with the corporation or file in court a petition requesting that the court determine the fair value of the shares plus interest. The petition shall be filed in the county in which the registered office of the corporation is located, except that a surviving foreign corporation that receives a demand relating to the shares of a constituent corporation shall file the petition in the county in this state in which the last registered office of the constituent corporation was located. The petition shall name as parties all dissenters who have demanded payment under subsection 9 and who have not reached agreement with the corporation. The corporation, after filing the petition, shall serve all parties with a summons and copy of the petition under the rules of civil procedure. The residents of this state may be served by registered mail or by publication as provided by law. Except as otherwise provided, the rules of civil procedure apply to the proceeding. The jurisdiction of the court is plenary and exclusive. The court may appoint appraisers, with powers and authorities the court deems proper, to receive evidence on and recommend the amount of the fair value of the shares. The court shall determine whether the shareholder or other shareholders in question have fully complied with the requirements of this section, and shall determine the fair value of the shares, taking into account any and all factors the court finds relevant, computed by any method or combination of methods that the court, in its discretion, sees fit to use, whether or not used by the corporation or by a dissenter. The fair value of the shares as determined by the court is binding on all shareholders, wherever located. A dissenter is entitled to judgment for the amount by which the fair value of the shares as determined by the court, plus interest, exceeds the amount, if any, remitted under subsections 6, 7, and 8, but shall not be liable to the corporation for the amount, if any, by which the amount, if any, remitted to the dissenter under subsections 6, 7, and 8 exceeds the fair value of the shares as determined by the court, plus interest.

11. The court shall determine the costs and expenses of a proceeding under subsection 10, including the reasonable expenses in compensation of any appraisers appointed by the court, and shall assess those costs and expenses against the corporation, except that the court may assess part or all of those costs and expenses against a dissenter whose action in demanding payment under subsection 9 is found to be arbitrary, vexatious, or not in good faith.

12. If the court finds that the corporation has failed to comply substantially with this section, the court may assess all fees and expenses of any experts or attorneys as the court deems equitable. These fees and expenses may also be assessed against a person who has acted arbitrarily, vexatiously, or not in good faith in bringing the proceeding, and may be awarded to a party injured by those actions.

13. The court may award, in its discretion, fees and expenses to an attorney for the dissenters out of the amount awarded to the dissenters, if any.

EXHIBIT D

NOTICE TO SHAREHOLDERS OF DISSENTERS' RIGHTS OF APPRAISAL

PURSUANT TO NORTH DAKOTA BUSINESS CORPORATION ACT

SECTION 10-19.1-98

To all shareholders of Driver Passport, Inc.:

Section 10-19.1-87 of the North Dakota Business Corporation Act (hereinafter referred to as "NDBCA") provides that any shareholder, is entitled to dissent from and obtain payment of the fair value of shares held in the consummation of any plan of merger, consolidation, or reorganization if required by NDBCA Section 10-19.1-87, and the shareholder is entitled to vote on the merger, consolidation or reorganization.

A shareholder who wishes to assert dissenters' rights must comply with the procedural requirements of Section 10-19.1-88 of the NDBCA, included herein as Exhibit C, and send to the corporation written notice of intent to demand payment for shares if the proposed actions are effectuated before a vote on the action(s) is taken. Furthermore, any such shareholder may not vote any shares in favor of the proposed action(s). In order to assert dissenters' rights, a shareholder must have been a shareholder with respect to the shares for which payment is demanded as of the date the proposed corporate action creating dissenters' rights is approved by the shareholders, if such approval is required, or as of the effective date of the corporate action, if no such approval is required.

If you wish to assert dissenters' rights of appraisal with regard to the change of domicile of Driver Passport, Inc. ("Driver Passport") by merging Driver Passport with and into its recently formed and wholly owned Nevada subsidiary, Eco Global Corporation ("Eco Global"), you must return the Dissenting Shareholders' Payment Demand Form, included herein as Exhibit E, and your certified share certificate(s) to Driver Passport, Inc., 123 Worthington Street, Suite 203, Spring Valley, CA 91977, to the attention of Daniel Correa, President, by *, 2009.

By Order of the Board of Directors:

Daniel Correa, President

EXHIBIT E

DISSENTING SHAREHOLDERS' PAYMENT DEMAND FORM

Daniel Correa, President

Driver Passport, Inc.

123 Worthington Street, Suite 203

Spring Valley, CA 91977

Re: Proposed change of domicile of Driver Passport, Inc., a North Dakota corporation ("Driver Passport"), to the State of Nevada, by merger of Driver Passport with and into its wholly-owned subsidiary, Eco Global Global, Inc., a Nevada corporation ("Eco Global").

The undersigned hereby dissents with respect to the proposed change of domicile of the Company from the State of North Dakota to the State of Nevada.

I hereby demand payment for the fair value of my "certificated" shares, which are described below and enclosed herewith, and I demand that payment be forwarded to the address indicated below. I understand that this demand for payment must be received on or before *, 2009.

The undersigned represents and warrants that the undersigned was the owner of the shares covered by this demand on *, 2009, the Record Date for the mailing of the Information Statement to shareholders.

If the undersigned is other than the "record holder" of the shares for which demand for payment is made, the undersigned will provide evidence of the purchase of such shares and enclose such evidence herewith. The undersigned acknowledges that this Dissenting Shareholders' Payment Demand Form was accompanied by official notice of dissenters' rights by the company, a copy of the applicable provisions of the North Dakota Business Corporation Act relating to such dissenting stockholder's rights of appraisal, and an Information Statement describing the transactions to be effected by the Company.

| | | | | / / | |

| | Signature | | | Date | |

| | | | | | |

| | | | | | |

| | Print Name | | | Address | |

| | | | | City, State, Zip | |