Investor day November 2017

Forward looking statements This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company―) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward-looking statements, which may be based on assumptions and anticipated events that do not materialize.

Opening comments • Busy year – transition year • Management • Operations • Fleet • Sunseeker • People • Strategic business overview – leisure travel company • Competition – model still strong – airline is job 1, but . . . • Want more $ from current customer wallets • Need to expand product offerings – greater customer control • Leverage our position through use of data, IT, and branding 3

Sunseeker resorts

Addressing the skepticism Issue How we have addressed G4 – no experience in hotels or condos Hired world class leadership/developers Port Charlotte – not Miami or New York • Hotel room growth has lagged air travel • Opposite of Panama City • Does Miami need another resort? • Example of new destinations Mixed-use projects – hard to finance • Hotel is easier • Condo hotel is a de-risked approach Virtual sales model Does it work versus more traditional sales 5

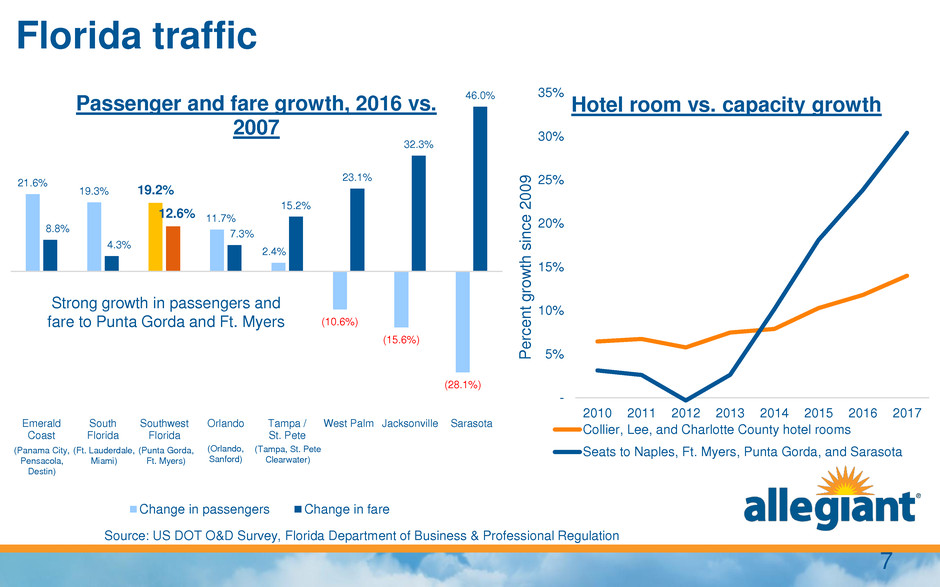

“This is the most exciting hotel resort opportunity I have come across, especially with the airline tie-in” – John Redmond • With the exception of Clearwater, most hotels in area are old • Lack of a true destination resort • Hotel room growth has not kept pace with air and drive-in traffic increases • Identified other opportunities – ―I like this one‖ • Port Charlotte site fully entitled on waterfront • Airport traffic – 10 million annual pax to area • Insurmountable barrier to entry • Lack of food and beverage and amenity diversity • More diversity in F&B and amenities means: • Increased demand • Longer length of stay/more time at resort • Large, diverse destination gives us ―street cred‖ to manage any resort • 90% of vacation spend not captured • Opportunity flexibility: extremely valuable, fully entitled, designed and approved project – highly desired • Partnerships – could be explored if plans change 6

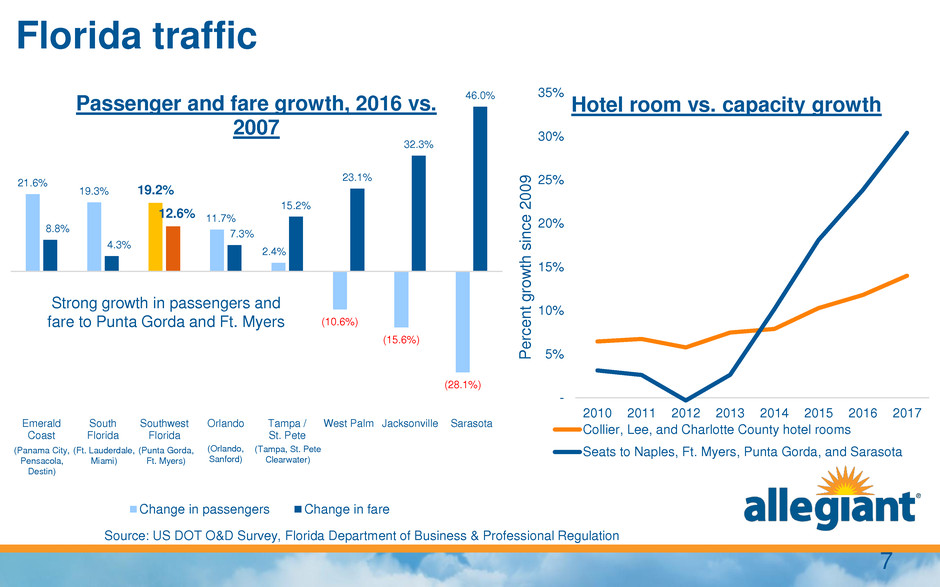

Florida traffic 21.6% 19.3% 19.2% 11.7% 2.4% (10.6%) (15.6%) (28.1%) 8.8% 4.3% 12.6% 7.3% 15.2% 23.1% 32.3% 46.0% Emerald Coast South Florida Southwest Florida Orlando Tampa / St. Pete West Palm Jacksonville Sarasota Passenger and fare growth, 2016 vs. 2007 Change in passengers Change in fare Strong growth in passengers and fare to Punta Gorda and Ft. Myers Source: US DOT O&D Survey, Florida Department of Business & Professional Regulation - 5% 10% 15% 20% 25% 30% 35% 2010 2011 2012 2013 2014 2015 2016 2017 P e rce n t g ro w th sinc e 2 0 0 9 Hotel room vs. capacity growth Collier, Lee, and Charlotte County hotel rooms Seats to Naples, Ft. Myers, Punta Gorda, and Sarasota(Panama City, Pensacola, Destin) (Ft. Lauderdale, Miami) (Punta Gorda, Ft. Myers) (Orlando, Sanford) (Tampa, St. Pete Clearwater) 7

Hotel demand • Sunseeker = additional ancillary hotel $ • Las Vegas demand level exceeds current Punta Gorda capacity • Four Points by Sheraton, Punta Gorda: $200 ADR in peak season 23% 33% 25% 19% 30% 27% 21% 22% Q1 Q2 Q3 Q4 G4 Hotel and air bookings by quarter Distribution of hotel bookings Distribution of passenger traffic 8

Potential take rates Condo Hotel Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Number of Developed Rooms 583 583 583 583 583 583 % of Rooms Put Into The Inventory Pool 75% 75% 75% 75% 75% 75% Number of Available Rooms 160,000 160,000 160,000 160,000 160,000 160,000 Occupancy % 100% 100% 100% 100% 100% 100% Condo Hotel Occupied Room Nights 160,000 160,000 160,000 160,000 160,000 160,000 Hotel Number of Available Rooms 76 76 76 76 76 76 Occupancy % 100% 100% 100% 100% 100% 100% Number of Occupied Rooms 28,000 28,000 28,000 28,000 28,000 28,000 Total Occupied Hotel and Condo Hotel Rms 188,000 188,000 188,000 188,000 188,000 188,000 Airline Data Number of Itineraries 283,000 285,800 288,700 291,600 294,500 297,400 Take Rate 10% 11% 12% 13% 14% 15% Number of Room Sales Transactions 28,300 31,400 34,600 37,900 41,200 44,600 Average Length of Stay (Num of Nights) 5.6 5.6 5.6 5.6 5.6 5.6 Potential Number of Room Nights 158,480 175,840 193,760 212,240 230,720 249,760 Occupancy 84% 94% 103% 113% 123% 133% 9

Destination demand • Punta Gorda geocode check-in data - wide catchment area • Significant drive-in market Map source: check-in data for August 2017 SRQ PGD RSW PIE Airport Allegiant destination Distance from resort Annual passengers Airlines PGD Punta Gorda ✔ 15 minutes south • 2017: G4 flew 1 million • 2018: 1.2 million projected RSW Ft. Myers 35 minutes south 8 million AAL, DAL, UAL, LUV, JBLU, FRNT, SAVE SRQ Sarasota 45 minutes north 1 million AAL, DAL, UAL, JBLU PIE St. Pete— Clearwater ✔ 90 minutes north • 2017: G4 flew 1.8 million • 2018: 2.2 million projected TPA Tampa 90 minutes north 18 million AAL, DAL, UAL, LUV, JBLU, FRNT, SAVE TPA 10

Sunseeker video 11

Construction and development team Paul Steelman Steelman Partners, Concept Architect Ben Mammina Executive Vice President, Design and Construction Farr Law Firm Local counsel Greenberg Traurig Condo counsel Future hires: Food & beverage expert Hotel expert Galaxy Phase II – Macau MGM Grand – Detroit L2 Studios Architects, Production Drawings Florida Premier Contractors & Manhattan Construction Group GC Joint Venture 12

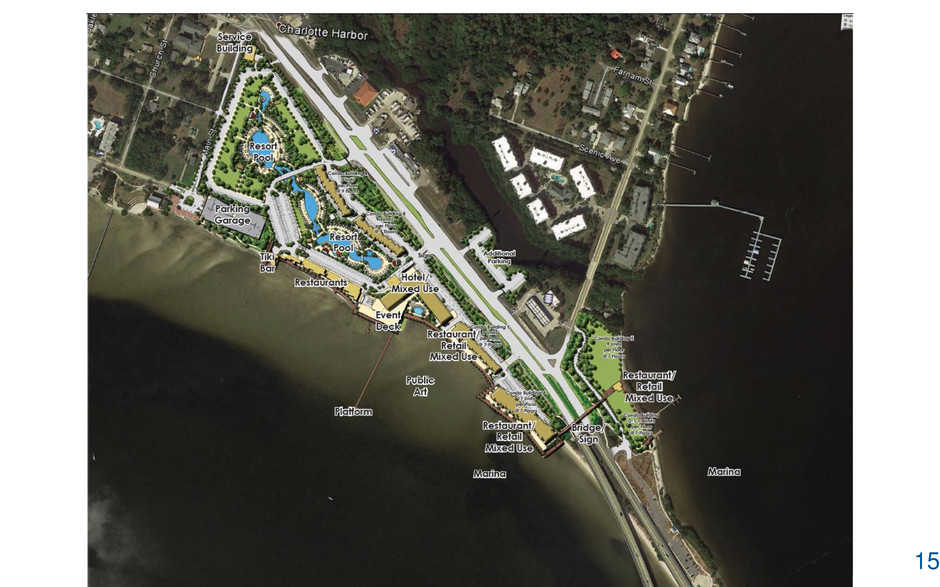

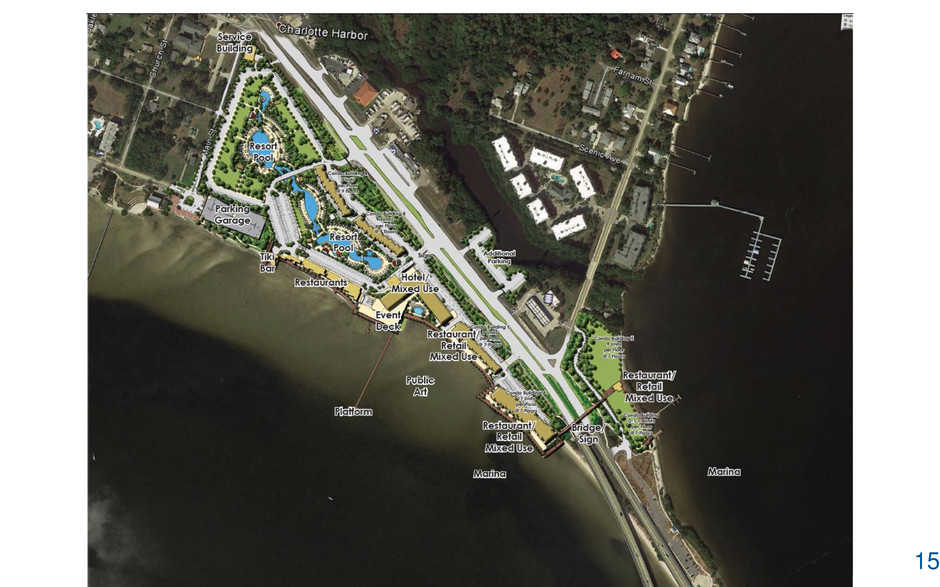

Site overview • Resort planned to include: • 10 condo towers dependent on deposits • 76 hotel rooms - additional 196 expansion rooms • 100+ marina slips • Resort and hotel pools • 12+ bars, restaurants, and shops • Catering/banquet facilities • Grocery/pharmacy, doctor’s office • More facilities – need more land • Expected return on capital similar to airline • Multiple approaches to develop given 10 separate towers • Ideal approach $425 to $450M: • Sunseeker hotel assets • 4 waterfront condo hotel towers • Sitework/infrastructure for remaining project including pool 13

14

15

Project financing • Florida law • Sales deposits can be used for construction costs • Plan: use 20% of the 30% deposits • De-risking sales: multi-step approach • Started with expression of interest – currently at about 7,000 • Now on registration phase, taking $5K deposits • Deposit plan: up to 30% by end of first year • De-risking design • Multiple towers/phases • Allows for building as demand warrants (as hotel or condo towers) 16

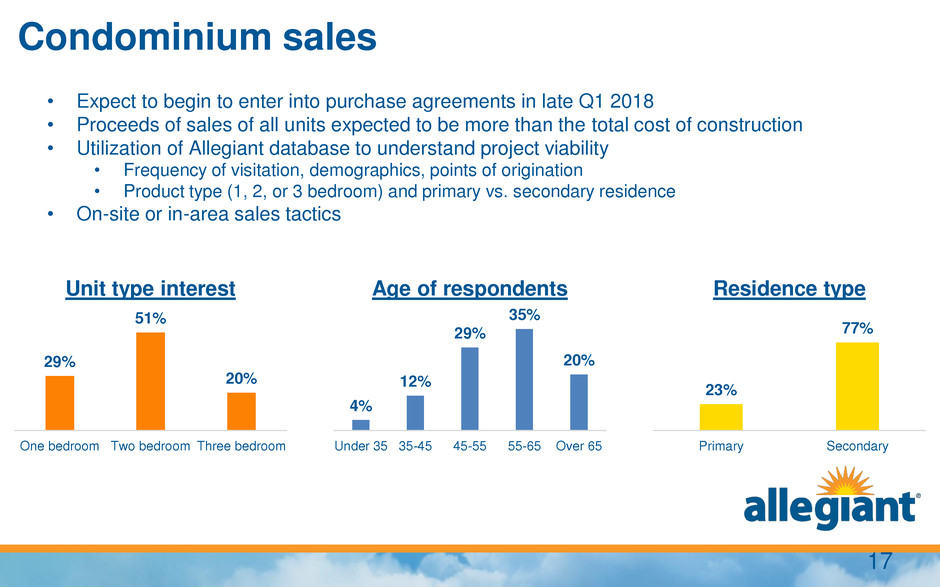

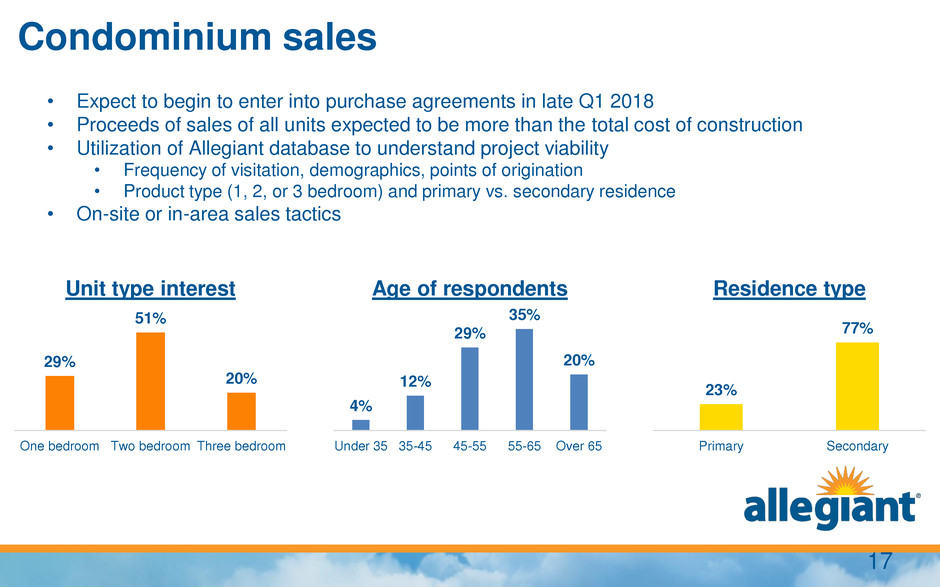

Condominium sales • Expect to begin to enter into purchase agreements in late Q1 2018 • Proceeds of sales of all units expected to be more than the total cost of construction • Utilization of Allegiant database to understand project viability • Frequency of visitation, demographics, points of origination • Product type (1, 2, or 3 bedroom) and primary vs. secondary residence • On-site or in-area sales tactics 29% 51% 20% One bedroom Two bedroom Three bedroom Unit type interest 4% 12% 29% 35% 20% Under 35 35-45 45-55 55-65 Over 65 Age of respondents 23% 77% Primary Secondary Residence type 17

Hotel scope • Large scale = greater operational efficiency • Variety of rooms and price points to drive occupancy • Food/beverage options will drive daily non-stay visitation • Synergy with airline • Potential impact on load factor/seasonality • Concentration of amenities • Target larger groups and business customers • Marketing as destination resort protects fares; mitigates risk of fare war • Drives credit card use - additional point redemption channel • Tie-in to charter business 18

Hotel and condo-hotel demand • Maximum annual available room nights: • 272 hotel rooms for 99,280 room nights • 835 condo units for 466,105 room nights (if all two bedrooms rented as two units) • Over 1,500 keys • Revenue split dependent on nights made available, time of year, and advance notice • 55% of $ expected average for Allegiant Typical King and Queen Rooms 14’2‖ bay, 425 SF 19

Food and beverage opportunities • 12+ bars and restaurants • Wide variety • All on waterfront • Average stay 5-6 days • Synergy between venues • Shared kitchen/staff • Decreases overhead costs Artist’s rendering 20

Additional ancillary revenue • Marina slips • Parking • HOA fees cover share of hotel amenities cost • Banquet hall/catering for weddings, corporate functions • Early check-in charge • Airport shuttle • Cleaning service • Short term car rental • Compare resort offerings to hotel brands such as Four Seasons, Hilton, and Holiday Inn 21

Estimated timeline • November 2017: asked for expressions of interest – almost 7,000 • End of 2017: all required land transactions closed • Late Q1 2018: expect to enter into purchase agreements • Late Q2 2018: expect construction of resort to start • December 2019: construction completed, unit closings begin/end • January 2020: resort open to hotel guests 22

Operations

Operations – Where to focus first? • Summer operations = priority #1 • Controllable cancellations had increased 26% YOY through 2Q17 • Cancellation drivers = increased AOS AC + increased AOS Hours Day 1 Mid August - November Fleet Transition • Leadership – substantial changes in most workgroups • Materials planning & support – proactive vs reactive • Enhanced parts/tooling coverage – less reliance on spare aircraft • 37 retirements, 30 inductions by Nov 18 • Single mixed AC base by summer 18, improved operational performance • Introduce first 186 seat (max pax) A320 into the fleet 24

5 55 105 155 205 255 305 Jan 17 Feb 17 Mar 17 Apr 17 May 17 Jun 17 Jul 17 Aug 17 Sep 17 Oct 17 Controllable Cancellations 2017 2016 5 10 15 20 25 Jan 17 Feb 17 Mar 17 Apr 17 May 17 Jun 17 Jul 17 Aug 17 Sep 17 Oct 17 Avg Daily AC AOS 2017 2016 Operations – Day 1 *Through 10/31/2017 5 1,005 2,005 3,005 4,005 5,005 6,005 Jan 17 Feb 17Mar 17 Apr 17 May 17 Jun 17 Jul 17 Aug 17Sep 17 Oct 17 Total AOS Hours 2017 2016 - 1.0% 2.0% 3.0% 4.0% Jan 17 Feb 17 Mar 17 Apr 17 May 17 Jun 17 Jul 17 Aug 17Sep 17 Oct 17 % of Customers Impacted by Controllable IROPs 2017 2016 25

26 Completion factor - attacking the critical issue 96% 97% 98% 99% 100% Controllable Completion - Rolling 30 Days 2017 2016

Focus on critical issues • Change the line MX culture • New leadership in most large bases (SFB, LAS, PIE) • Eliminated line maintenance contractors • Delayed training events during summer peak – more techs on the line • Dedicated AOS recovery team • Additional Airbus reps in MX control 35.7 38.8 42.9 50.8 41.3 43.0 40.8 46.6 55.8 41.3 41.1 31.2 20.4 15.5 - 10 20 30 40 50 60 May June July August September October November AOS hours per-100 cycles (2017 operations) 3.1 4.0 4.2 4.5 3.9 3.5 3.4 3.2 5.1 4.1 3.4 3.3 2.0 2.1 - 1 2 3 4 5 6 May June July August September October November AOS events per-100 cycles (2017 operations) 27

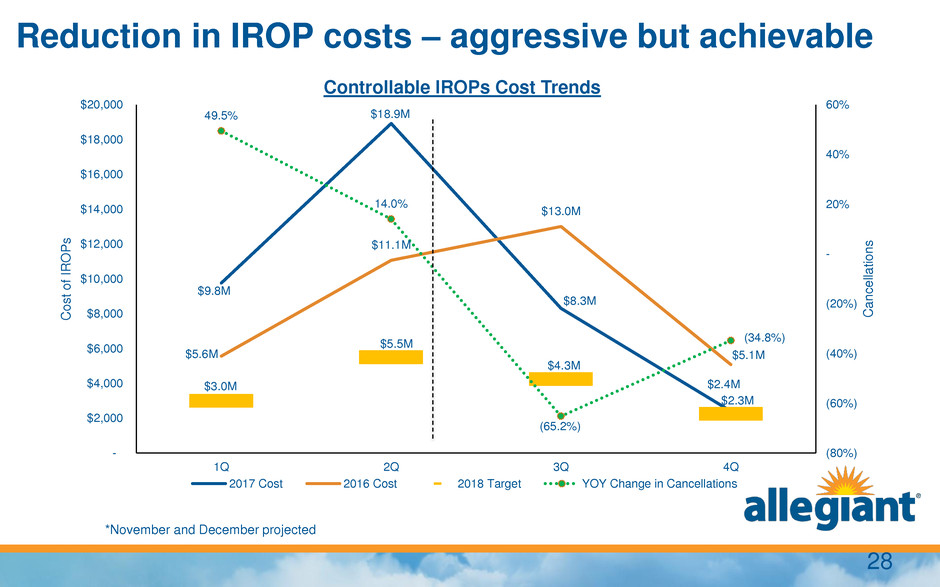

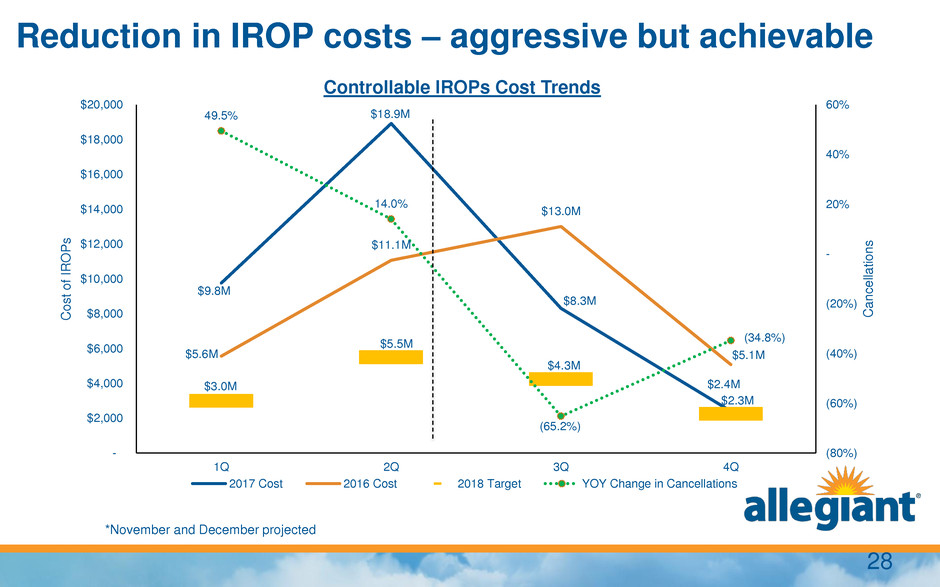

Reduction in IROP costs – aggressive but achievable *November and December projected $9.8M $18.9M $8.3M $2.4M $5.6M $11.1M $13.0M $5.1M $3.0M $5.5M $4.3M $2.3M 49.5% 14.0% (65.2%) (34.8%) (80%) (60%) (40%) (20%) - 20% 40% 60% - $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 1Q 2Q 3Q 4Q Can c e llat io n s Co s t o f IR O P s Controllable IROPs Cost Trends 2017 Cost 2016 Cost 2018 Target YOY Change in Cancellations 28

Post summer – aggressive management restructuring • ~65% of management changed/realigned in Maintenance, Stations, OCC, and Procurement departments 6 12 6 3 4 2 3 1 1 1 1 14 6 5 3 - 5 10 15 20 25 30 MX Stations OCC Procurement Manager Director VP Unchanged Positions 29

Materials planning – getting in front of the issue • Previous approach = reactive and disjointed • Little to no predictive analysis • Modeling failed to keep up with ALGT fleet growth and complexity • Change in philosophy • Turn unscheduled MX events into shorter, planned events • Reduced AC sparing requires increased dispatch reliability • New Approach = predictive and proactive • Get ahead of the issue (huge cost savings) rather than mitigate the damage • Detailed analytics on component degradation • Strategic investment in parts for airbus specific (critical or potentially critical) • Enhance parts coverage, turn cancellations into delays and eventually into on-time departures 30

31 33 52 73 82 0 10 20 30 40 50 60 70 80 90 2016 YE 2017 YE 2018 1H 2018 YE Airbus A320 Series 49 37 27 0 4 6 2 1 0 1 2 3 4 5 6 7 0 10 20 30 40 50 60 2016 YE 2017 YE 2018 1H 2018 YE MD 80 Series MD80 aircraft (period end) Mixed bases (period average) Fleet transition – solid execution, the end in sight • Unprecedented fleet transition in less than 2 years • Single mixed base by summer 2018 – SFB • Enhanced induction work scope – 1st max pax A320 1Q18, drives complexity • AC sparing levels – potentially impacted by AC damage, unscheduled power plant removals, etc.

2016 Fleet deployment – peak complexity 2016 Aircraft 85 Bases 14 Fleet Types 3 32

2017 Fleet deployment – mid transition 2017 Aircraft 89 Bases* 15 Fleet Types 2 * Added Destin and Indianapolis, removed Honolulu 33

2018 Fleet deployment – summer strategy 2018 Aircraft 82 Bases 15 Fleet Types* 2 * Concentrate MD80s in SFB 34

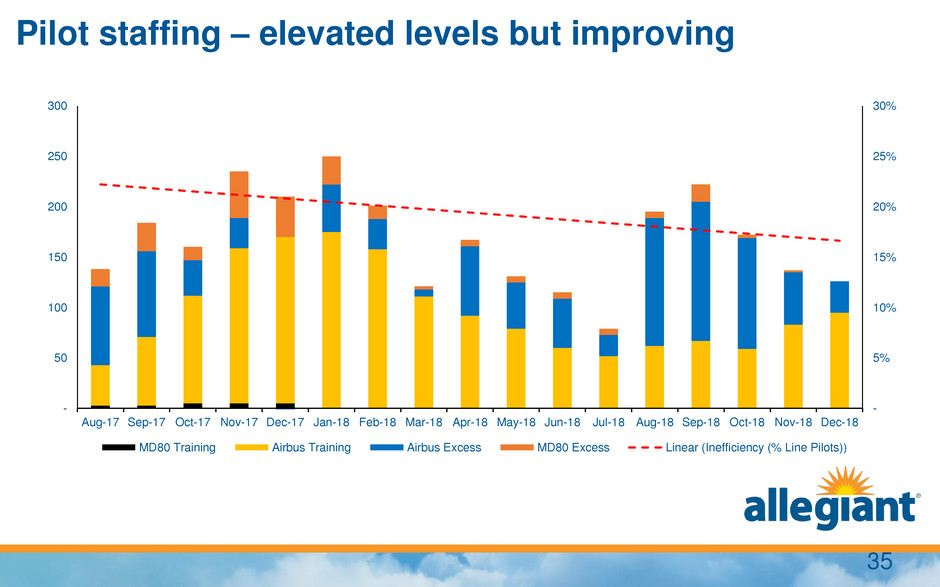

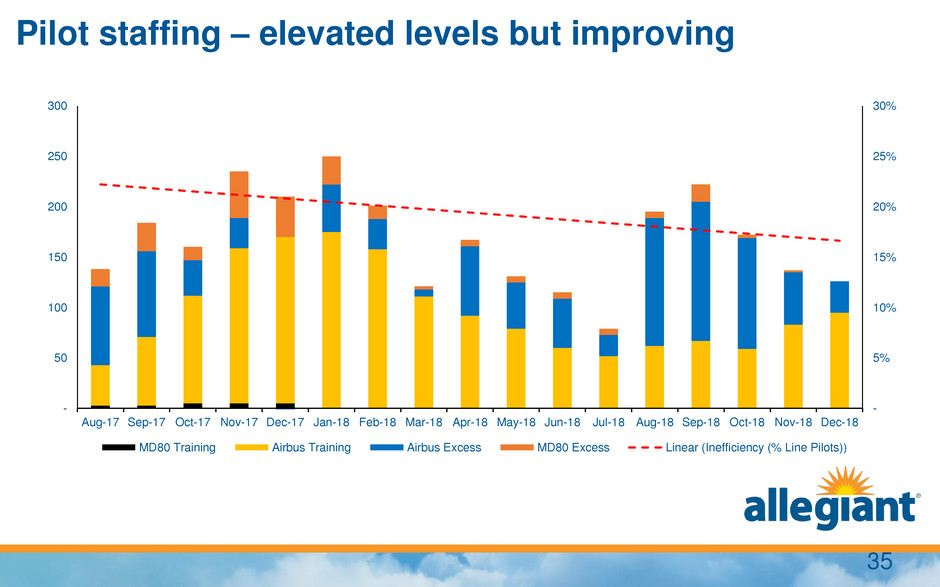

35 Pilot staffing – elevated levels but improving - 5% 10% 15% 20% 25% 30% - 50 100 150 200 250 300 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 MD80 Training Airbus Training Airbus Excess MD80 Excess Linear (Inefficiency (% Line Pilots))

36 Pilots per AC – returning to normalized levels 5.8 9.8 7.6 1.5 0.5 0.3 1.1 0.7 (1.1) (0.7) (0.4) - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 2012 Actual AC Utilization Part 117 Pilot Contract Training Overstaffing 2018 Forecast Training Overstaffing Single Fleet 2020 Forecast Pilots per AC Pilots/AC Increase Decrease 36

Fleet & Treasury

19 16 27 19 18 16 0 5 10 15 20 25 30 35 40 YE 2017 1Q18 2Q18 3Q18 YE 2018 MD80 series¹ MD80 - SFB MD80 - LAS 20 23 30 33 38 10 11 12 12 12 22 25 31 31 32 0 10 20 30 40 50 60 70 80 90 YE 2017 1Q18 2Q18 3Q18 YE 2018 Airbus series¹ A320s used A320s new A319s Fleet transition – 2018 32 27 19 0 37 52 59 73 76 82 All Airbus fleet by November 2018 1 Current MD80 bases LAS & SFB; in May 2018 all MD80s based in SFB a MD80 NBV - $38 million as of November 2018 (includes expendables) b 1 - Estimated aircraft at end of quarter 38

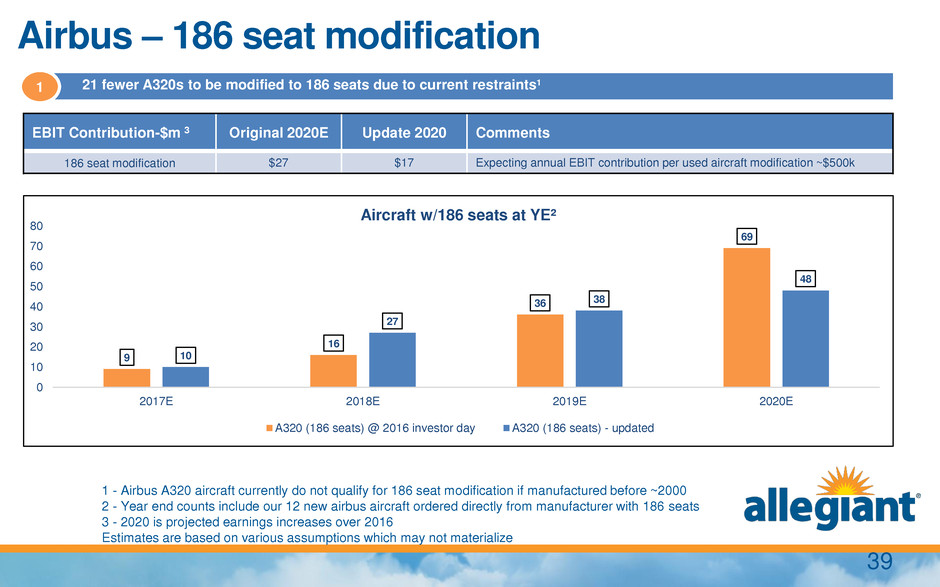

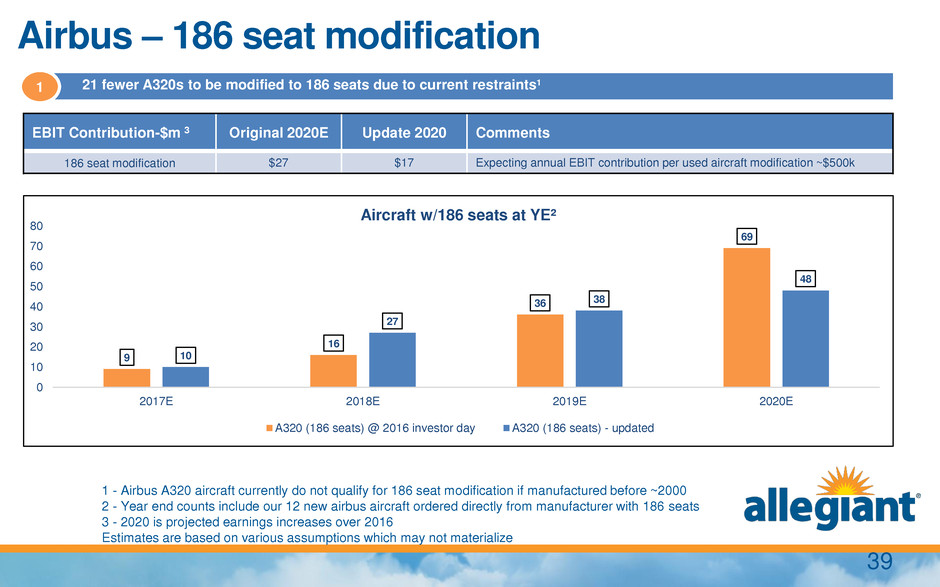

9 16 36 69 10 27 38 48 0 10 20 30 40 50 60 70 80 2017E 2018E 2019E 2020E Aircraft w/186 seats at YE² A320 (186 seats) @ 2016 investor day A320 (186 seats) - updated Airbus – 186 seat modification 1 - Airbus A320 aircraft currently do not qualify for 186 seat modification if manufactured before ~2000 2 - Year end counts include our 12 new airbus aircraft ordered directly from manufacturer with 186 seats 3 - 2020 is projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize EBIT Contribution-$m 3 Original 2020E Update 2020 Comments 186 seat modification $27 $17 Expecting annual EBIT contribution per used aircraft modification ~$500k 21 fewer A320s to be modified to 186 seats due to current restraints¹ 1 39

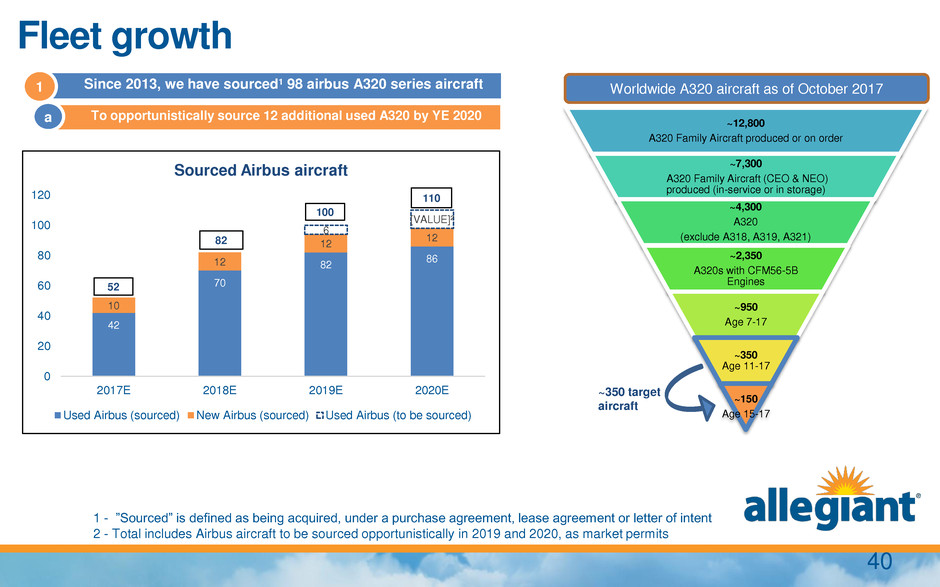

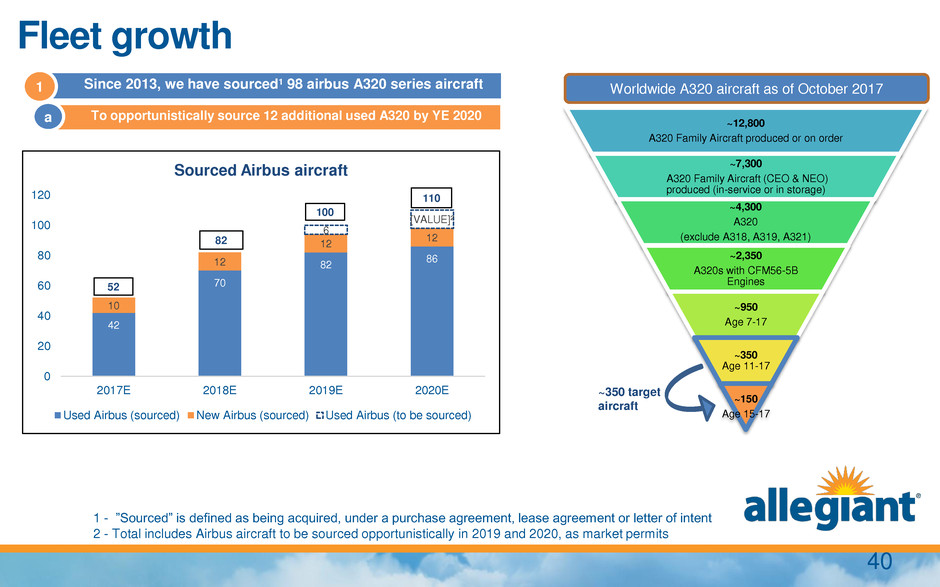

42 70 82 86 10 12 12 12 6 [VALUE]² 0 20 40 60 80 100 120 2017E 2018E 2019E 2020E Sourced Airbus aircraft Used Airbus (sourced) New Airbus (sourced) Used Airbus (to be sourced) Fleet growth ~12,800 A320 Family Aircraft produced or on order ~7,300 A320 Family Aircraft (CEO & NEO) produced (in-service or in storage) ~4,300 A320 (exclude A318, A319, A321) ~2,350 A320s with CFM56-5B Engines ~950 Age 7-17 ~350 Age 11-17 ~150 Age 15-17 52 82 100 110 1 - ‖Sourced‖ is defined as being acquired, under a purchase agreement, lease agreement or letter of intent 2 - Total includes Airbus aircraft to be sourced opportunistically in 2019 and 2020, as market permits Worldwide A320 aircraft as of October 2017 ~350 target aircraft Since 2013, we have sourced¹ 98 airbus A320 series aircraft 1 To opportunistically source 12 additional used A320 by YE 2020 a 40

37 22 32 37 37 20 23 25 25 10 27 38 48 0 20 40 60 80 100 120 2017E 2018E 2019E 2020E Aircraft by seat count MD80 (166 seats) A319 (156 seats) A320 (177 seats) A320 (186 seats) Fleet plan 89 82 100 110 + 30 airbus ac Estimated aircraft at end of year 1 41

520 195 210 185 20 15 10 75 75 75 75 35 45 90 125 35 $0 $100 $200 $300 $400 $500 $600 $700 2017E 2018E 2019E 2020E Capital expenditures ($ millions) Aircraft CAPEX 186 seat project Other CAPEX Airbus heavy maintenance Sunseeker land Capital expenditures $665 $335 $390 $395 Placeholder aircraft included in Aircraft capex amounts in 2019 and 2020 1 Sunseeker development costs excluded as expected to be funded via condo sales and short term financing 2 42

Debt 450 450 450 450 400 238 113 52 335 305 275 245 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2017E 2018E 2019E 2020E Debt balances ($ millions) Unsecured debt Secured debt - used ac/HQ Secured debt - new ac $1,185 $993 $838 $55 $300 $425 $465 8 35 55 64 0 25 50 75 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2017E 2018E 2019E 2020E Borrowing capacity ($ millions)¹ Borrowing capacity - secured by used ac Unencumbered aircraft (inc placeholders) 1 - LTV estimates for aircraft based on age and half-life maintenance value Revolver of $56 million currently drawn – assumes pay down in 2018 a Debt balances and borrowing capacity based on current commitments and reflect year-end amounts 1 Maturity of unsecured debt in July 2019 – assumes to refinance as unsecured debt b $747 43

Return to shareholders 17 25 54 2 5 84 139 128 66 85 15 39 42 62 68 46 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017E Shareholder returns ($ millions) Share repurchases Dividends (year of payment) $181 $84 $44 $0 $69 $25 $17 Current authority - $100 million a Share-repurchases cumulative - $605 million 1 Quarterly dividend - $0.70 per share a Dividends cumulative - $260 million 2 23 16 0 5 10 15 20 25 Total shares issued Current - O/S Shares Oustanding Shares (millions) 30% reduction $190 $134 $131 44

Let’s talk about costs

2017 guidance 5.94 0.26 0.06 0.08 0.04 0.06 0.03 0.05 0.19 0.25 0.04 5.7 5.9 6.1 6.3 6.5 6.7 6.9 2016 CASM ex-Fuel (¢) Pilot Contract Accel Dep Add'l AC Dep Heavy Mtx Dep MD80 Heavy Mtx 2017E CASM ex-Fuel (¢) Hurricane ASM Loss Other Credit Card Surcharge 2017E CASM ex-Fuel (¢) MD80 Impairment MD80 Depreciation 2017E CASM ex-Fuel (¢) U S Cen ts FY 2017 Guidance: +5% - 9% * FY 2017 Guidance: +11% - 12% ** Adj. FY 2017 Guidance: +14.5% - 15.5% *** 6.47 6.65 6.86 46 * given 4Q16 ** given 3Q17 *** adjusted for impairment Shaded area reflects the guided range

2018 costs Fuel Expense • Accelerated MD80 retirements & Airbus utilization increases ASMs per gallon • Current forward curve ~ $2.17 / gallon 69.4 70.2 71.6 72.5 – 73.0 77.5 – 79.5 65 70 75 80 2014 2015 2016 2017E 2018E ASMs per gallon Maintenance Expense • Accelerated MD80 retirements drive fewer non capitalized heavy maintenance events 105.2 103.4 110.7 105 - 110 95 – 105 97.0 102.0 107.0 112.0 2014 2015 2016 2017E 2018E Maintenance /Aircraft / Month ($000s) Depreciation Expense • Additional aircraft and heavy maintenance depreciation offset by $35m 2017 MD80 Impairment 101.1 109.6 104.9 90.0 105.0 120.0 135.0 2014 2015 2016 2017E 2018E Depreciation /Aircraft / Month ($000s) 120 – 130 115 – 120 Estimates are based on various assumptions which may not materialize 47

2018 costs Salaries & Benefits Expenses • Flight Attendant Tentative Agreement: • 5 year contract • Estimated 2018 ~ $8M • Estimated 5 year impact ~ $57M • Voting complete by end of December 60% 59% 53% 51% 54% 77% 78% 77% 75% 78% 35% 50% 65% 80% 95% 2014 2015 2016 2017E 2018E Crew productivity Pilots FAs Operating earnings impact -$m 1 Original 2017E Updated 2017E Comments Fuel benefit from ASM production $6 $6 On track Ex-fuel savings (costs) ($21) ($29) Pilot inefficiency & training due to accelerated fleet retirement Rate Increases 2018 2019 2020 2021 2022 Pilots 2.5% 1.5% 1.0% 1.0% 1.0% Flight Attendants (Tentative Agreement) 15.5% 1.5% 1.5% 2.0% 1.0% 1 - 2017 is projected earnings increases (decreases) over 2016 Estimates are based on various assumptions which may not materialize 48

Cost per passenger ($) $30 $24 $23 $9 $15 $14 $13 $7 $7 $26 $29 $26 $23 $24 $21 MD80 A319 A320 Fuel Ownership Maintenance Labor Other $47 $44 $48 $53 $49 $53 Aircraft Other Total Ex fuel costs = $72 Fuel cost = $30 Total MD-80 = $102 Ex fuel costs = $76 Fuel cost = $24 Total A319 = $100 Ex fuel costs = $69 Fuel cost = $23 Total A320 = $92 Assumptions Fully allocated costs over TTM A320 wtd. average seats at 178 Fuel cost - $1.84/gallon Load Factors – MD80 – 83.0%; A319 – 84.4%; A320 – 81.4% Added steady state Heavy Maintenance Depreciation 49

Estimated 2020 CASM ex-fuel 5.99 6.28 0.35 0.14 0.31 0.33 0.29 5.6 5.8 6.0 6.2 6.4 6.6 6.8 7.0 2017E CASM ex- Fuel (¢) AC/Hvy Mtx Depreciation MD80 Heavy Mtx Pilot Productivity Other Efficiencies 2020E CASM (¢) Credit Card Surcharge Adj 2020E CASM ex-Fuel (¢) U S Cen ts 6.43 midpoint of FY17 CASM ex guidance (ex CC Surcharge)* * As of 3Q17 Estimates are based on various assumptions which may not materialize 50

Commercial update

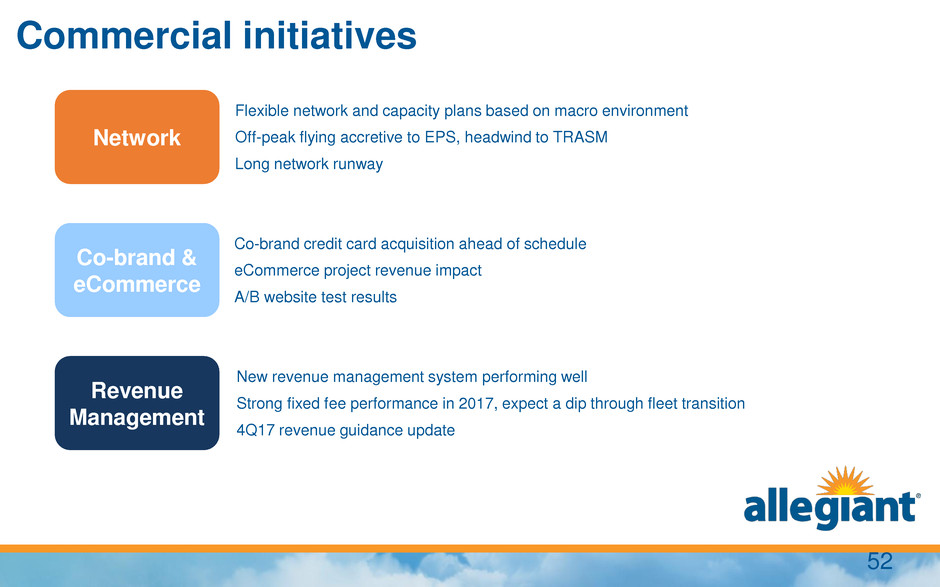

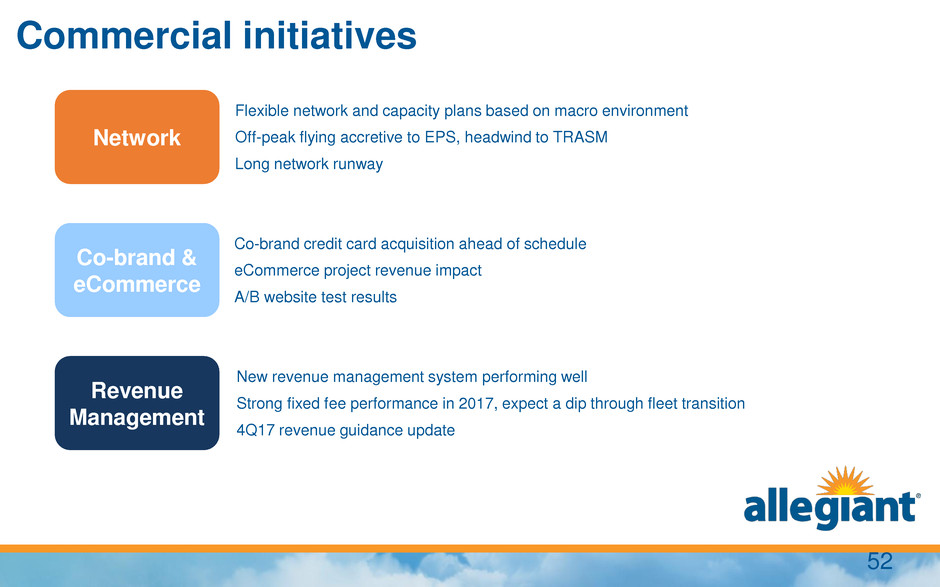

Commercial initiatives Flexible network and capacity plans based on macro environment Off-peak flying accretive to EPS, headwind to TRASM Long network runway Network Co-brand & eCommerce Co-brand credit card acquisition ahead of schedule eCommerce project revenue impact A/B website test results Revenue Management New revenue management system performing well Strong fixed fee performance in 2017, expect a dip through fleet transition 4Q17 revenue guidance update 52

Network

2018 capacity guidance • 2018 YoY ASM growth expected to be between 11 to 15% • Ability to grow despite decline in frames in part due to Airbus efficiency over MD80s • 4th Quarter 2018 will see least amount of growth as we end transition quickly 65 70 75 80 85 1Q 2Q 3Q 4Q Average lines of flying 2017 2018 54

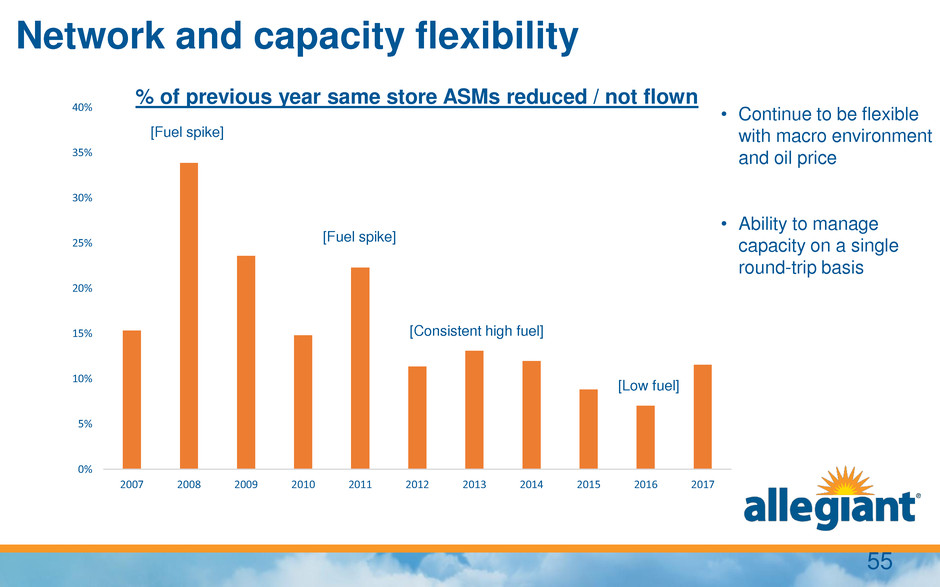

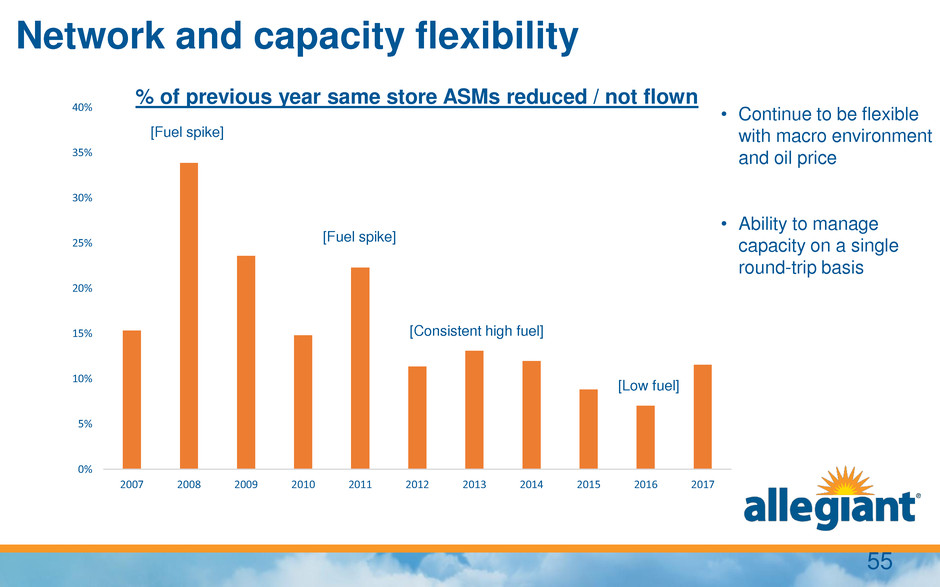

0% 5% 10% 15% 20% 25% 30% 35% 40% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Network and capacity flexibility • Continue to be flexible with macro environment and oil price • Ability to manage capacity on a single round-trip basis [Fuel spike] [Low fuel] [Fuel spike] [Consistent high fuel] % of previous year same store ASMs reduced / not flown 55

Future capacity growth Tiny Small Mid-size Large Origination city size Large Medium Small Medium Large Large Desti n ati o n cit y siz e - Future opportunity - Currently served Representative Cities Tiny Origination: Grand Island, NE Small Origination: Syracuse, NY Mid-size Origination: Cincinnati, OH Large Origination: Atlanta, GA Small Destination: Savannah, GA Mid-size Destination: Austin, TX Large Destination: Las Vegas, NV 56

- 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 EBIT / Aircraf t (i n $ m ill io n s) U ti liza ti o n ( B lo ck Ho u rs / Airc raf t D ay ) Projected profitability & utilization of a 100 aircraft single fleet MD80 Utilization Airbus Utilization MD80 EBIT / Aircraft Airbus EBIT / Aircraft Notes: Fuel price assumption of $2.17/gal Does not include 2020 earnings initiatives Fleet comparison: MD80 vs Airbus 57

0% 5% 10% 15% 20% 25% 30% 35% 2014 2015 2016 2017 2018 Percent off-peak ASMs (2.0%) (1.0%) - 1.0% 2.0% 3.0% (2.0%) (1.0%) - 1.0% 2.0% 3.0% Y/ Y Imp act o n E P S Y/ Y Imp act o n T RAS M Year / year impact of incremental off-peak flying Impact on TRASM Impact on EPS 2015 2016 2017 2018E Off-peak growth impact • Off-peak defined as Tuesday, Wednesday, Saturday flying • Growth in off-peak driven by lower fuel prices in 2015/16 and Airbus margin profile vs. MD80 • Off-peak flying still accretive to EPS. Will flex up/down based on macro environment 58

Co-branded credit card & eCommerce

• Strong, sustaining customer demand for the co- branded card benefited by • Robust and unique value proposition • Closed distribution • Small cities • Future tailwinds from • Cardholder acquisition optimization • Additional destinations from current cities • Non-card loyalty program 1 2 3 4 5 6 7 8 9 10 11 12 Program month Account acquisition vs projections Actual Accounts (cumulative) Projected Accounts (cumulative) Projected annual earnings impact 1 Original 2017E Updated 2017E Original 2020E Updated 2020E Program Contribution $10m $17m $45m $50m Co-branded credit card 1 - 2017 and 2020 numbers are projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize 60

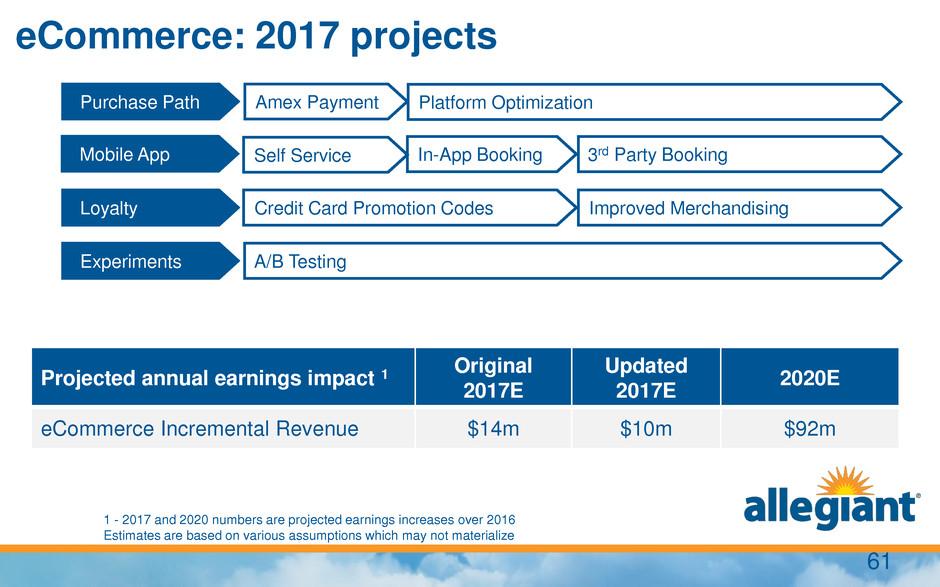

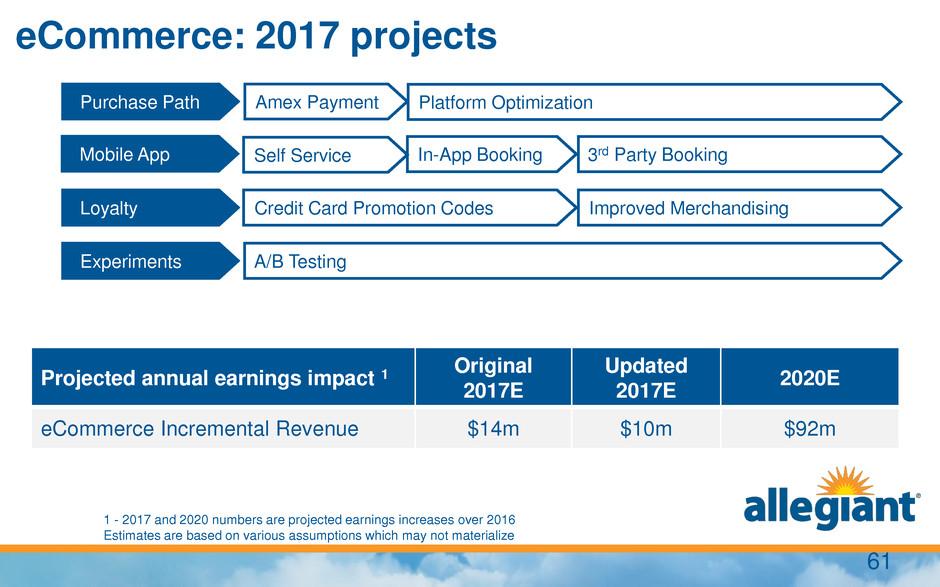

Projected annual earnings impact 1 Original 2017E Updated 2017E 2020E eCommerce Incremental Revenue $14m $10m $92m Mobile App Purchase Path Self Service In-App Booking 3rd Party Booking Amex Payment Loyalty Improved Merchandising Platform Optimization Credit Card Promotion Codes Experiments A/B Testing eCommerce: 2017 projects 1 - 2017 and 2020 numbers are projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize 61

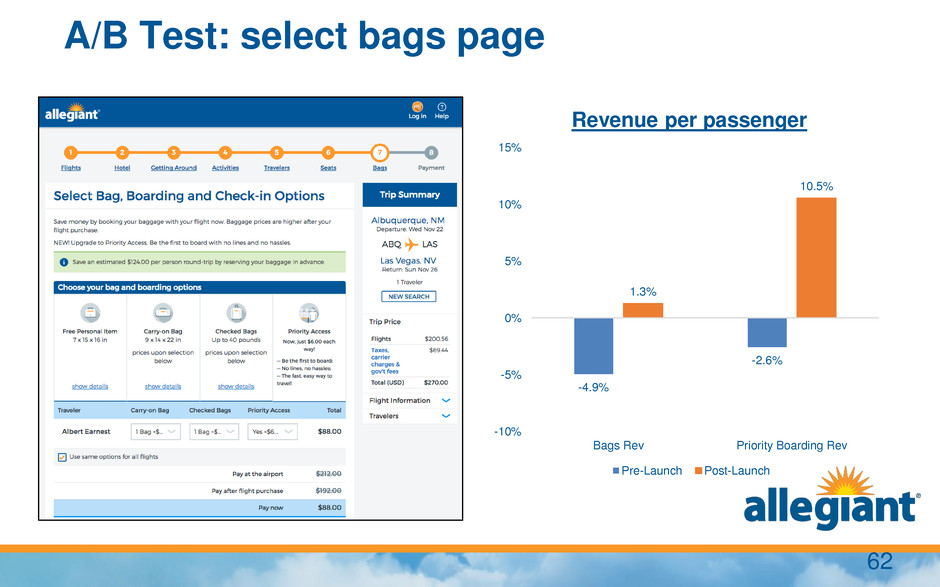

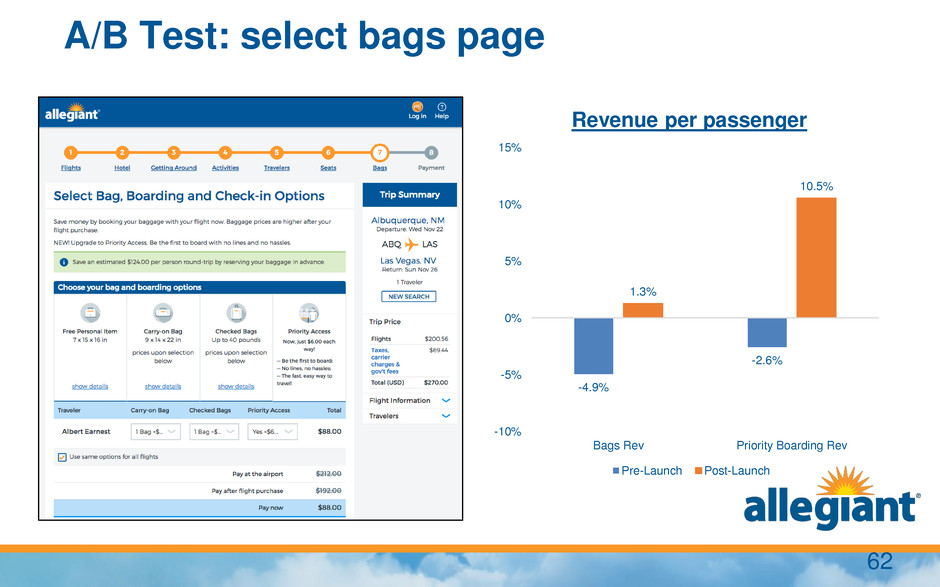

-4.9% -2.6% 1.3% 10.5% -10% -5% 0% 5% 10% 15% Bags Rev Priority Boarding Rev Revenue per passenger Pre-Launch Post-Launch A/B Test: select bags page 62

Revenue

• Testing on next-generation RM system began on flights in Aug 2016 • Slower than expected ASM rollout due to several major programming changes through 2017 • System utilizes advances in data science to: 1. Improve flight forecasting 2. Reacts faster when bookings deviate from forecast 3. Optimize pricing path calculated daily 0% 20% 40% 60% 80% 100% 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 ASM's on Next-Gen RM System Projected annual earnings impact 1 Original 2017E Updated 2017E 2020E Revenue Management System $7m $2m $49m Next-Gen revenue management system 1 - 2017 and 2020 numbers are projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize 64

First-Gen Allegiant system: Aggregate flight demand based on regions and haul Next-Gen Allegiant system: Aggregate flight demand into best-fit clusters Flight clustering example 65

First-Gen Next-Gen 0% 10% 20% 30% 40% 50% 60% 70% 80% <-25% -20% -10% 0% 10% 20% >25% P e rc e n t o f flig h ts % Error Booking days out accuracy of best fit booking curve First-Gen Next-Gen Clustering leads to improved accuracy 66

• Next-Gen system forecasts how flights would sell if they had not sold out • Unconstrained demand is used when calculating the optimal fare 0% 20% 40% 60% 80% 100% 120% 0 1 2 3 4 5 6 7 8 E x p e c te d L o a d F a c to r Months Until Departure Short Peak Long Peak Long Peak Unconstrained $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 0 1 2 3 4 5 6 7 8 F ar e Months Until Departure Short Peak Fare Long Peak Fare Long Peak Unconstrained Fare Unconstrained demand 67

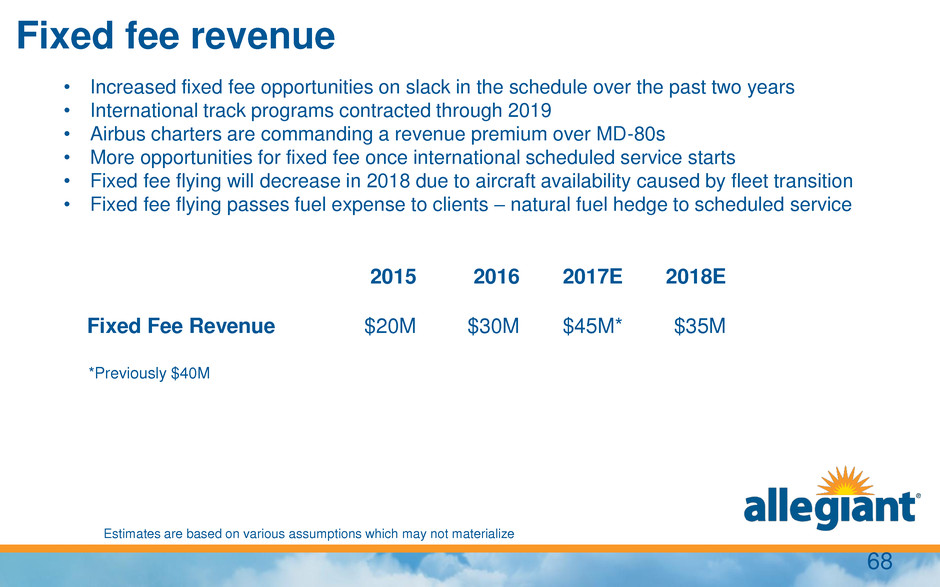

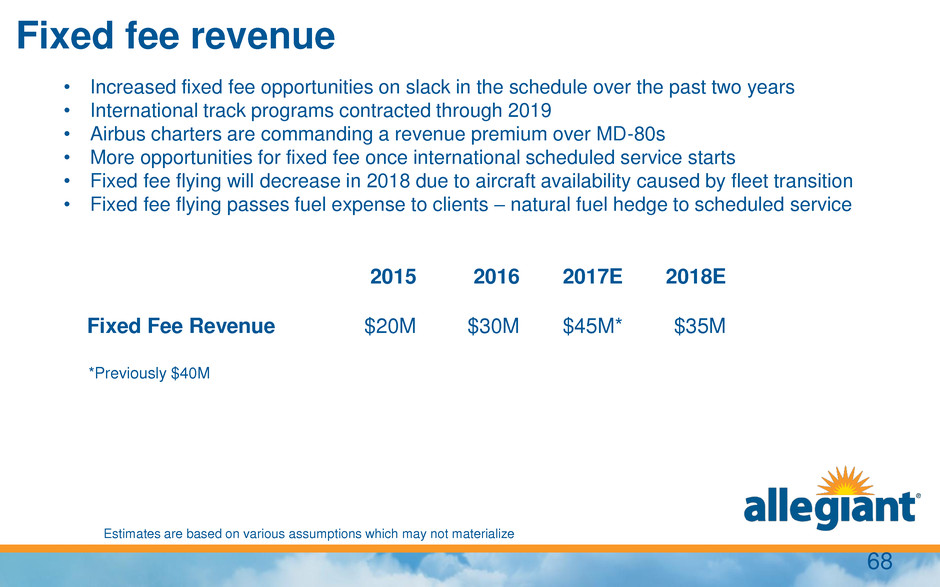

• Increased fixed fee opportunities on slack in the schedule over the past two years • International track programs contracted through 2019 • Airbus charters are commanding a revenue premium over MD-80s • More opportunities for fixed fee once international scheduled service starts • Fixed fee flying will decrease in 2018 due to aircraft availability caused by fleet transition • Fixed fee flying passes fuel expense to clients – natural fuel hedge to scheduled service 2015 2016 2017E 2018E Fixed Fee Revenue $20M $30M $45M* $35M *Previously $40M Fixed fee revenue 68 Estimates are based on various assumptions which may not materialize

Revenue guidance & initiatives

Commercial initiatives earnings impact ($m) Projected annual earnings impact 1 Original 2017E Updated 2017E Original 2020E Updated 2020E Co-brand Credit Card $10 $17 $45 $50 eCommerce Incremental Revenue $14 $10 $92 $92 Revenue Management System $7 $2 $49 $49 Fixed Fee $5 $8 $20 $20 Fleet Productivity $0 $0 $21 $33 Total $36 $37 $227 $244 1 - 2017 and 2020 numbers are projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize 70

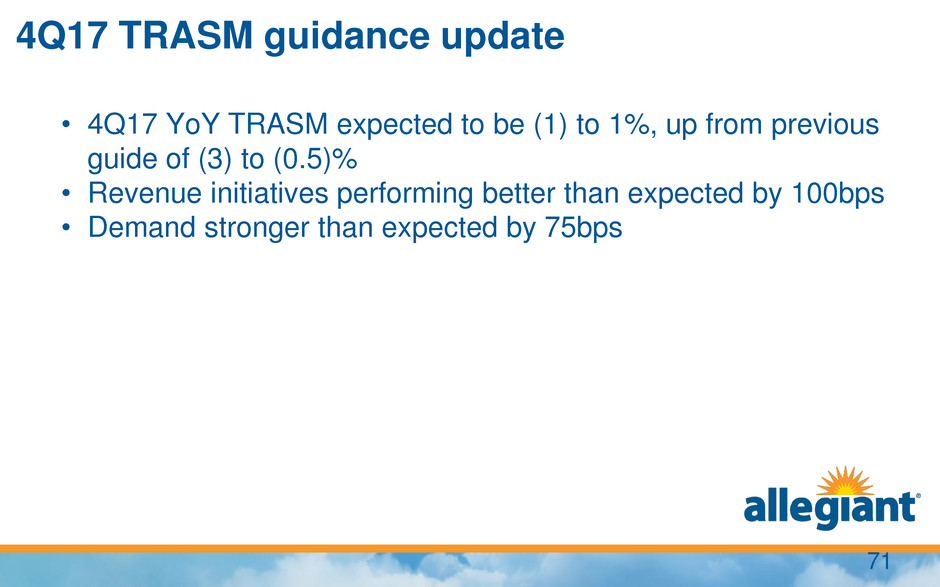

• 4Q17 YoY TRASM expected to be (1) to 1%, up from previous guide of (3) to (0.5)% • Revenue initiatives performing better than expected by 100bps • Demand stronger than expected by 75bps 4Q17 TRASM guidance update 71

2018 guidance & initiatives update

Updating how we will guide • Will provide full year EPS • In business to maximize EPS • Aligns the long term interests of the company with the street • Will not be providing • Quarterly TRASM • Quarterly or full year CASM ex fuel 73

2018 EPS guidance Guidance subject to change Fuel cost as of November 17, 2017 2018 FY EPS range $8 - $10 per share Assumptions FY 2018 fuel cost $2.17 FY 2018 ASMs/Gallon 77.5 to 79.5 FY 2018 interest expense $50m to $60m FY 2018 tax rate 37% to 38% FY 2018 share count 15.9m $35m MD-80 impairment taken in 4Q17 74

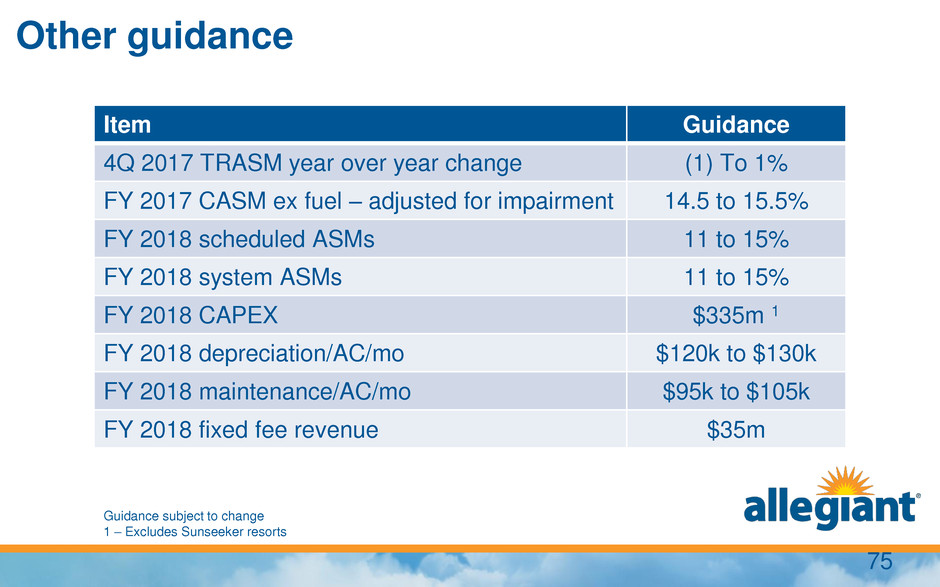

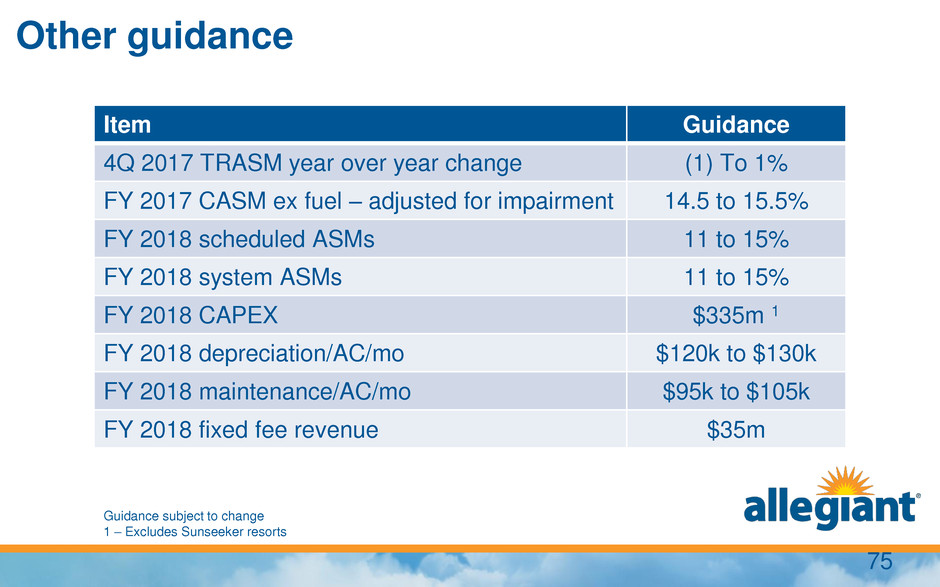

Other guidance Guidance subject to change 1 – Excludes Sunseeker resorts Item Guidance 4Q 2017 TRASM year over year change (1) To 1% FY 2017 CASM ex fuel – adjusted for impairment 14.5 to 15.5% FY 2018 scheduled ASMs 11 to 15% FY 2018 system ASMs 11 to 15% FY 2018 CAPEX $335m 1 FY 2018 depreciation/AC/mo $120k to $130k FY 2018 maintenance/AC/mo $95k to $105k FY 2018 fixed fee revenue $35m 75

Contribution of initiatives Operating earnings annual impact -$m 1 Original 2017E Update 2017E Original 2020E Update 2020E Fuel benefit from ASM production $6 $6 $21 $21 Ex-fuel savings (costs) (21) (29) 73 73 Credit card program 10 17 45 50 eCommerce initiatives 14 10 92 92 Pricing engine 7 2 49 49 Fixed fee 5 8 20 20 186 seat modification 0 0 27 17 Fleet productivity 0 0 21 33 Total $21m $14m $348m $355 1 - 2017 and 2020 numbers are projected earnings increases over 2016 Estimates are based on various assumptions which may not materialize 76