Filed Pursuant to Rule 424(b)(3)

Registration No. 333-134146

and 333-134146-01

Prospectus dated July 31, 2006

Offer to Exchange

$55,000,000 10.5% Senior Secured Notes due 2010

Registered Under the Securities Act of 1933

For

All of the Outstanding

$55,000,000 10.5% Senior Secured Notes due 2010

of

NATIONAL COAL CORP.

As Fully and Unconditionally Guaranteed by

National Coal Corporation

And

NC Railroad, Inc.

The notes will be our senior secured obligations and will rank senior in right of payment to all of our and our subsidiary guarantors’ subordinated indebtedness and will rank equal in right of payment with all of our and our subsidiary guarantors’ existing and future senior indebtedness. The notes and the related guarantees will be secured by a lien on substantially all of our and the subsidiary guarantors’ existing and future property and assets, including a pledge of 100% of the stock or other equity interests of our existing and future subsidiaries. We will be permitted to enter into a credit facility providing up to $10.0 million in term loans and revolving credit. Pursuant to the terms of an intercreditor agreement, the security interest in those assets that secure the notes and the subsidiary guarantees will be subordinated to a first-priority lien on the same collateral that will secure any such future credit facility, and the notes would then have a second-priority lien on that collateral. Holders of the notes will have the right, under certain circumstances, to purchase the indebtedness outstanding under the credit facility at a price equal to 100% of its principal amount, plus accrued and unpaid interest and any other obligations due to the lenders.

The principal features of the exchange offer are as follows:

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on August 29, 2006, unless extended. |

| | • | | All outstanding old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer will be exchanged. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | The terms of the new notes to be issued are substantially identical to your old notes, except that the new notes will not have transfer restrictions, and you will not have registration rights. |

| | • | | The exchange offer is subject only to the conditions that the exchange offer will not violate any applicable law or any interpretation of applicable law by the staff of the Securities and Exchange Commission. |

| | • | | There is no established trading market for the new notes, and we do not intend to apply for listing of the new notes on any securities exchange. |

| | • | | All broker-dealers must comply with the registration and prospectus delivery requirements of the Securities Act of 1933. See “Plan of Distribution.” |

For a discussion of important factors that you should consider before you participate in the exchange offer, see “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

IMPORTANT NOTICE TO READERS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should assume that the information contained in this prospectus or in any report incorporated by reference in this prospectus is accurate only as of the date of this prospectus or the respective report, as the case may be.

i

SUMMARY

This summary highlights material information contained in greater detail elsewhere in this registration statement. As a result, it does not contain all of the information that you should consider before investing in the notes. You should read the entire registration statement carefully, including the “Risk Factors” and “Forward-Looking Statements” sections. References to “National Coal”, “we”, “us” or “our” refer to National Coal Corp. or to National Coal Corp. and its subsidiaries, as the context requires.

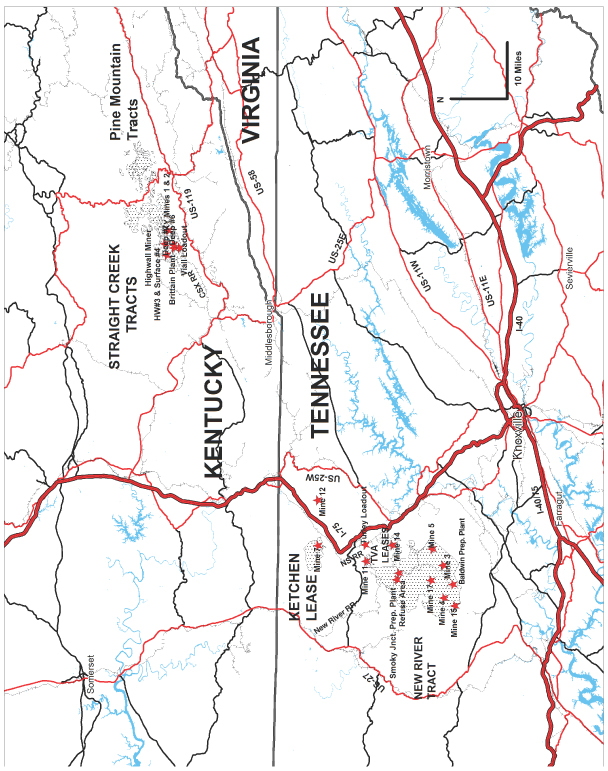

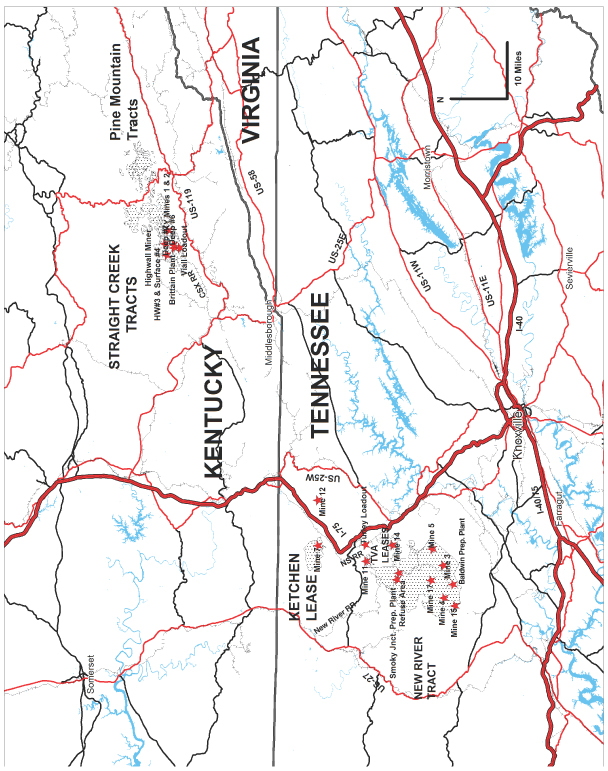

National Coal

We mine, process and sell high quality bituminous steam coal from mines located in East Tennessee and Southeastern Kentucky. We own the coal mineral rights to approximately 74,600 acres of land and lease the rights to approximately 40,900 additional acres. We have expanded our operations considerably since commencing operations at a single surface mine in Tennessee in July 2003. As of March 31, 2006, our mining complexes included three underground mines, two surface mines, and one highwall mine. In addition, we have four preparation plants, two active and two inactive, and four unit train loading facilities, two active and two inactive, served by the CSX and Norfolk Southern (“NS”) railroads. We hold permits that allow us to open five new mines close to our current operations. As of March 31, 2006, we controlled approximately 38.2 million estimated recoverable tons. For the three months ended March 31, 2006, we generated total revenues of $20.0 million and sold approximately 372,109 tons of coal. During the year ended December 31, 2005, we generated total revenues of $65.9 million and sold approximately 1,216,000 tons of coal. We expect our production to increase significantly as we continue to expand operations.

Since our inception, our revenues have resulted primarily from the sale of coal to electric utility companies in the Southeastern United States. According to the U.S. Department of Energy, Energy Information Administration (“EIA”), in 2004 the Southeast region accounted for 23% of coal generated electricity in the United States. Also according to the EIA, the long-term outlook for coal demand in the Southeast is favorable, as coal generated electricity in our region is expected to grow at a rate of 2.0% per year according to the EIA. In addition, the Southeast region is projected by the EIA to account for 27% of the expansion of coal generated electricity in the United States over the next 20 years. For the three months ended March 31, 2006, approximately 87.6% of our revenue was generated from coal sales to electric utility companies in the Southeastern United States and our largest customers were Georgia Power, South Carolina Public Authority (Santee Cooper) and East Kentucky Power, representing approximately 35.8%, 33.5% and 10.7% of our revenues, respectively.

In the three months ended March 31, 2006, our mines produced approximately 318,730 tons of coal. Approximately 61.4% of our production for 2005 was produced at underground mines and 38.6% was produced at our surface and highwall mine operations. We have taken advantage of a strong pricing environment to obtain long-term (greater than 12 months in duration) supply agreements with key customers at prices averaging over $50 per ton. We plan to continue to capitalize on the currently strong pricing environment by pursuing additional long-term contracts and selling coal on the spot market for the remainder of our production.

We are a Florida corporation and our executive offices are located at 8915 George Williams Road, Knoxville, Tennessee 37923.

1

Summary of the Exchange Offer

Issuer | National Coal Corp. |

Old notes | $55,000,000 aggregate principal amount of 10.5% Senior Secured notes due 2010. |

| | The old notes were issued in a transaction exempt from registration under the Securities Act. The form and terms of the new notes are identical in all material respects to those of the old notes, except that the transfer restrictions and registration rights provisions relating to the old notes do not apply to the new notes. |

New notes | We are offering to issue up to: |

| | $55,000,000 aggregate principal amount of 10.5% Senior Secured notes due 2010 to satisfy our obligations under the registration rights agreement that we entered into when the old notes were issued in transactions in reliance upon the exemptions from registration provided by Rule 144A under the Securities Act. |

Tenders, Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on August 29, 2006, unless extended in our sole and absolute discretion. |

| | By tendering your old notes, you represent that: |

| | • | | you are not an “affiliate,” as defined in Rule 405 under the Securities Act; |

| | • | | any new notes you receive in the exchange offer are being acquired by you in the ordinary course of your business; |

| | • | | at the time of commencement of the exchange offer, neither you nor, to your knowledge, anyone receiving new notes from you, has any arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the new notes in violation of the Securities Act; |

| | • | | if you are not a participating broker-dealer, you are not engaged in, and do not intend to engage in, the distribution of the new notes, as defined in the Securities Act; and |

| | • | | if you are a broker-dealer, you will receive the new notes for your own account in exchange for old notes that were acquired by you as a result of your market-making or other trading activities and that you will deliver a prospectus in connection with any resale of the new notes you receive. For further information regarding resales of the new notes by participating broker-dealers, see the discussion below under the heading “Plan of Distribution.” |

Withdrawal; Non-Acceptance | You may withdraw any old notes tendered in the exchange offer at any time prior to 5:00 p.m., New York City time, on August 29, 2006. If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at our |

2

| | expense promptly after the expiration or termination of the exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent’s account at The Depository Trust Company, which we sometimes refer to in this prospectus as DTC, any withdrawn or unaccepted old notes will be credited to the tendering holder’s account at DTC. For further information regarding the withdrawal of tendered old notes, see the discussion below under the headings “The Exchange Offer—Terms of the Exchange Offer; Period for Tendering Old notes” and “The Exchange Offer—Withdrawal Rights.” |

Conditions to the Exchange Offer | We are not required to accept for exchange or to issue new notes in exchange for any old notes and we may terminate or amend the exchange offer if any of the following events occur prior to our acceptance of the old notes: |

| | • | | the exchange offer violates any applicable law or applicable interpretation of the staff of the Securities and Exchange Commission; |

| | • | | an action or proceeding shall have been instituted or threatened in any court or by any governmental agency that might materially impair our ability to proceed with the exchange offer; |

| | • | | we do not receive all governmental approvals that we believe are necessary to consummate the exchange offer; or |

| | • | | there has been proposed, adopted, or enacted any law, statute, rule or regulation that, in our reasonable judgment, would materially impair our ability to consummate the exchange offer. |

| | • | | We may waive any of the above conditions in our reasonable discretion. All conditions to the exchange offer must be satisfied or waived prior to the expiration of the exchange offer. See the discussion below under the heading “The Exchange Offer—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Old Notes | Unless you comply with the procedures described below under the heading “The Exchange Offer—Guaranteed Delivery Procedures,” you must do one of the following on or prior to the expiration or termination of the exchange offer to participate in the exchange offer: |

| | • | | tender your old notes by sending the certificates for your old notes, in proper form for transfer, a properly completed and duly executed letter of transmittal, with any required signature guarantees, and all other documents required by the letter of transmittal, to Wells Fargo Bank, N.A., as exchange agent, at the address listed below under the heading “The Exchange Offer—Exchange Agent;” or |

| | • | | tender your old notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly |

3

| | executed letter of transmittal, with any required signature guarantees, or an agent’s message instead of the letter of transmittal, to the exchange agent. In order for a book-entry transfer to constitute a valid tender of your old notes in the exchange offer, Wells Fargo Bank, N.A., as exchange agent, must receive a confirmation of book-entry transfer of your old notes into the exchange agent’s account at DTC prior to the expiration or termination of the exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent’s message, see the discussion below under the heading “The Exchange Offer—Book-Entry Transfers.” |

Guaranteed Delivery Procedures | If you are a registered holder of old notes and wish to tender your old notes in the exchange offer, but |

| | • | | the old notes are not immediately available; |

| | • | | time will not permit your old notes or other required documents to reach the exchange agent before the expiration or termination of the exchange offer; or |

| | • | | the procedure for book-entry transfer cannot be completed prior to the expiration or termination of the exchange offer; |

| | • | | then you may tender old notes by following the procedures described below under the heading “The Exchange Offer—Guaranteed Delivery Procedures.” |

Special Procedures for Beneficial Owners | If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct that person to tender on your behalf. If you wish to tender in the exchange offer on your behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name or obtain a properly completed bond power from the person in whose name the old notes are registered. |

Material United States Federal Income Tax Considerations | The exchange of the old notes for new notes in the exchange offer will not be a taxable transaction for United States federal income tax purposes. See the discussion below under the heading “Certain United States Federal Income Tax Considerations” for more information regarding the United States federal income tax consequences of the exchange offer to you. You should consult your own tax advisor as to the tax consequences of the exchange to you. |

Use of Proceeds | We will not receive any cash proceeds from the exchange offer. |

4

Exchange Agent | Wells Fargo Bank, N.A. is serving as the exchange agent in connection with the exchange offer. You can find the address and telephone number of the exchange agent below under the heading “The Exchange Offer—Exchange Agent.” |

Resales of the Registered Notes | Based on interpretations by the staff of the Securities and Exchange Commission, as set forth in no-action letters issued to third parties, we believe that the new notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

| | • | | you are acquiring the new notes in the ordinary course of your business; |

| | • | | you are not a broker or dealer that purchased old notes from us to resell them in reliance on Rule 144A under the Securities Act or any other available exemption under the Securities Act; |

| | • | | you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the new notes; and |

| | • | | you are not an affiliate of ours. |

| | If you are an affiliate of ours or are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the new notes: |

| | • | | you cannot rely on the applicable interpretations of the staff of the Securities and Exchange Commission; and |

| | • | | you must comply with the registration requirements of the Securities Act in connection with any resale transaction. |

| | Each broker or dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer, resale, or other transfer of the new notes issued in the exchange offer, including information with respect to any selling holder required by the Securities Act in connection with any resale of the new notes. |

| | Furthermore, any broker-dealer that acquired any of its old notes directly from us: |

| | • | | may not rely on the applicable interpretation of the staff of the Securities and Exchange Commission’s position contained in Exxon Capital Holdings Corp., Securities and Exchange Commission no-action letter (April 13, 1988), Morgan, Stanley & Co. Inc., Securities and Exchange Commission no-action letter (June 5, 1991) and Shearman & Sterling, Securities and Exchange Commission no-action letter (July 2, 1983); and |

5

| | • | | must also be named as a selling noteholder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. |

Broker-Dealers | Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of new notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes which were received by such broker-dealer as a result of market-making activities or other trading activities. See the discussion below under the heading “Plan of Distribution” for more information. |

Registration Rights | When we issued the old notes in December 2005, we entered into a registration rights agreement with the initial purchasers of the old notes. Under the terms of the registration rights agreement, we agreed to file with the Securities and Exchange Commission and cause to become effective a registration statement relating to an offer to exchange the old notes for the new notes within 240 days. |

| | A copy of the registration rights agreement is filed as an exhibit to the registration statement of which this prospectus is a part. |

Consequences of Not Exchanging Old Notes

If you do not exchange your old notes in the exchange offer, you will continue to be subject to the transfer restrictions described in the legend on the certificate for your old notes. In general, you may offer or sell your old notes only:

| | • | | if they are registered under the Securities Act and applicable state securities laws; |

| | • | | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| | • | | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not intend to register the old notes under the Securities Act. For more information regarding the consequences of not tendering your old notes see the discussion below under the heading “The Exchange Offer Consequences of Exchanging or Failing to Exchange Old Notes.”

6

SUMMARY DESCRIPTION OF THE NEW NOTES

The terms of the new notes and the old notes are identical in all material respects, except for certain transfer restrictions and registration rights relating to the old notes.

The new notes will bear interest from the most recent date to which interest has been paid on the old notes or, if no interest has been paid on the old notes, from December 29, 2005. Accordingly, registered holders of new notes on the relevant record date for the first interest payment date following the consummation of the exchange offer will receive interest accruing from the most recent date to which interest has been paid or, if no interest has been paid, from December 29, 2005. Old notes accepted for exchange will cease to accrue interest from and after the date of consummation of the exchange offer. Holders of old notes whose old notes are accepted for exchange will not receive any payment in respect of interest on such old notes otherwise payable on any interest payment date which occurs on or after consummation of the exchange offer.

Summary of the Terms of the New Notes

For a more detailed description of the new notes, see the discussion below under the heading “Description of the New Notes.”

Issuer | National Coal Corp. |

Notes Offered | $55,000,000 aggregate principal amount of 10.5% Senior Secured notes due 2010. |

Maturity | December 15, 2010. |

Interest Rate | 10.5% per year. |

Interest Payment Dates | Interest will accrue from the issue date of the notes. Interest will be paid semi-annually on June 15 and December 15 of each year, starting on December 15, 2006. |

Guarantees | The notes will be unconditionally guaranteed on a senior secured basis by each of our existing and future domestic subsidiaries. |

Collateral | The notes and the related guarantees will be secured by a lien on substantially all of our and the guarantors’ property and assets, including a pledge of 100% of the capital stock or other equity interests of our domestic subsidiaries. We will be permitted to enter into a credit facility providing up to $10.0 million in term loans and revolving credit. The security interest in those assets that secure the notes and the related guarantees will be subordinated to a first-priority lien on the same collateral that will secure any such future credit facility, and the notes would then have a second-priority lien on that collateral. |

Optional Redemption | On or after December 15, 2008, we will have the right to redeem all or some of the notes at a redemption price that will decrease ratably from 105.250% of their principal amount to 100% of the principal |

7

| | amount on or after June 15, 2010, in each case plus accrued and unpaid interest. In addition, prior to December 15, 2008, we may redeem up to 35% of the aggregate principal amount of the notes originally issued at a price equal to 110.500% of their principal amount with the proceeds of certain equity offerings. |

Ranking | The notes will be our senior secured obligations and will rank equally with our existing and future senior debt, and senior to our existing and future subordinated debt. The guarantees of each of our domestic restricted subsidiaries will be a senior secured obligation and will rank equally with existing and future senior debt of that guarantor, and senior to its existing and future subordinated debt. The notes and the related guarantees effectively will be subordinated to all indebtedness and other obligations under a new credit facility, which will be secured by a first-priority lien on the same collateral that will secure the notes. |

Change of Control | If we undergo a change of control, we must give holders of the notes the opportunity to sell us their notes at 101% of their face amount, plus accrued and unpaid interest. |

Asset Sale Proceeds | If we engage in asset sales, we generally must either invest the net cash proceeds from such sales in our business within a period of time, repay the debt under our new revolving credit facility or make an offer to purchase a principal amount of the notes equal to the excess net cash proceeds. The purchase price of each Note so purchased will be 100% of its principal amount, plus accrued and unpaid interest. |

Indenture Provisions | The indenture governing the notes will, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| | • | | incur or guarantee additional indebtedness or issue preferred stock; |

| | • | | pay dividends or distributions on, or redeem or repurchase, capital stock; |

| | • | | issue or sell capital stock of restricted subsidiaries; |

| | • | | engage in transactions with affiliates; |

| | • | | grant or assume liens; and |

| | • | | consolidate, merge or transfer all or substantially all of our assets. |

| | These limitations will be subject to a number of important qualifications and exceptions. See “Description of the Notes” for more details. |

Risk Factors | See “Risk Factors” beginning on page 9 for discussion of risk factors you should carefully consider before deciding to participate in the exchange offer. |

8

RISK FACTORS

In addition to the other information contained in this prospectus, you should carefully consider the following risk factors and other information under the heading “Forward-Looking Statements,” which appears immediately following this section, before deciding whether to participate in the exchange offer. The risk factors set forth below generally are applicable to the old notes as well as the new notes.

Risks Related to the Exchange Offer

You may not be able to sell your old notes if you do not exchange them for new notes in the exchange offer.

If you do not exchange your old notes for new notes in the exchange offer, your old notes will continue to be subject to the restrictions on transfer as stated in the legend on the old notes. In general, you may not offer or sell the old notes unless they are:

| | • | | registered under the Securities Act; |

| | • | | offered or sold pursuant to an exemption from the Securities Act and applicable state securities laws; or |

| | • | | offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not currently anticipate that we will register the old notes under the Securities Act. In addition, holders who do not tender their old notes, except for certain instances involving the initial purchasers or holders of old notes who are not eligible to participate in the exchange offer or who do not receive freely transferable new notes pursuant to the exchange offer, will not have any further registration rights under the registration rights agreement or otherwise and will not have rights to receive additional interest.

The market for old notes may be significantly more limited after the exchange offer.

If old notes are tendered and accepted for exchange pursuant to the exchange offer, the trading market for old notes that remain outstanding may be significantly more limited. As a result, the liquidity of the old notes not tendered for exchange may be adversely affected. The extent of the market for old notes and the availability of price quotations will depend upon a number of factors, including the number of holders of old notes remaining outstanding and the interest of securities firms in maintaining a market in the old notes. An issue of securities with a similar outstanding market value available for trading, which is called the “float,” may command a lower price than would be comparable to an issue of securities with a greater float. As a result, the market price for old notes that are not exchanged in the exchange offer may be affected adversely as old notes exchanged pursuant to the exchange offer reduce the float. The reduced float also may make the trading price of the old notes that are not exchanged more volatile.

An active trading market may not develop for the new notes.

The new notes are new securities for which there is currently no market. We cannot assure you as to the liquidity of markets that may develop for the new notes, your ability to sell the new notes or the price at which you would be able to sell the new notes. If such markets were to exist, the new notes could trade at prices lower than their principal amount or purchase price depending on many factors, including prevailing interest rates and the markets for similar securities.

You must comply with certain procedural requirements in order to participate in the exchange offer.

Issuance of new notes in exchange for old notes pursuant to the exchange offer will be made only after timely receipt by the exchange agent of a properly completed and duly executed letter of transmittal, or an agent’s message in lieu thereof, including all other documents required by such letter of transmittal. Therefore, holders of old notes desiring to tender such old notes in exchange for new notes should allow sufficient time to

9

ensure timely delivery. We and the exchange agent are under no duty to give notification of defects or irregularities with respect to the tenders of old notes for exchange. Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. See the discussion below under the headings “The Exchange Offer—Resales of the New notes” and “Plan of Distribution” for more information.

Risks Related to the New Notes

Our substantial level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes.

We have, and will continue to have substantial indebtedness. At March 31, 2006, we had approximately $55.0 million principal value of total senior debt. Our indebtedness could be increased by an additional $10.0 million under a future credit facility, which will have priority over senior debt with respect to security interests in the collateral. Our high level of indebtedness could have important consequences, including the following:

| | • | | reducing our ability to obtain additional financing; |

| | • | | reducing our cash flow; |

| | • | | placing us at a competitive disadvantage compared to our competitors that may have proportionately less debt or greater financial resources; |

| | • | | hindering our flexibility in dealing with changes in our business and the industry; and |

| | • | | making us more vulnerable to economic downturns and adverse developments. |

Despite existing debt levels, we may still be able to incur substantially more debt, which would increase the risks associated with our leverage.

We may be able to incur substantial amounts of additional debt in the future, including debt under a future credit facility, which will have priority over the notes with respect to security interests in the collateral, and debt resulting from the issuance of additional notes. Although the terms of the notes and a future credit facility will limit our ability to incur additional debt, these terms do not and will not prohibit us from incurring substantial amounts of additional debt for specific purposes or under specified circumstances. The incurrence of additional debt could adversely impact our ability to service payments on the notes.

We may not be able to generate the significant amount of cash needed to pay interest and principal amounts on our debt.

We rely primarily on our ability to generate cash in the future to service our debt. If we do not generate sufficient cash flows to meet our debt service and working capital requirements, we may need to seek additional financing. If we are unable to obtain financing on terms that are acceptable to us, we could be forced to sell our assets or those of our subsidiaries to make up for any shortfall in our payment obligations under unfavorable circumstances.

The indenture and any future credit facility will limit our ability to sell assets and also restrict use of the proceeds from any such sale. Therefore, even if forced to do so, we may not be able to sell assets quickly enough or for sufficient amounts to enable us to meet our debt obligations.

The collateral securing the notes may be insufficient or unavailable in the event of a default.

No appraisal of the value of the collateral securing the notes has been made in connection with this offering. The value of the collateral in the event of liquidation will depend on market and economic conditions, the availability of buyers and other factors. Further, the lenders under a future credit facility will have a first priority

10

lien on the collateral, will control all decisions relating to the collateral, and will be entitled to be paid in full before any payment on the notes can be made from a sale of the collateral. By its nature, the collateral will be illiquid and may have no readily ascertainable market value.

Consequently, we may not be able to sell the collateral securing the notes in a short period of time, and even if we are able to do so, the proceeds obtained from these sales may not be sufficient to pay all amounts owing to the holders of the notes and to the lenders under any credit facility.

To the extent that third parties enjoy prior liens (including the lenders under a new credit facility with respect to its first-priority lien), such third parties may have rights and remedies with respect to the property subject to such liens that, if exercised, could adversely affect the value of the collateral.

Additionally, the terms of the indenture allow us to issue additional notes provided that we meet a specified consolidated fixed charge coverage ratio. The indenture does not require that we maintain the current level of collateral or maintain a specific ratio of indebtedness to asset values. Any additional notes issued pursuant to the indenture will rank equal to the notes sold in this offering and be entitled to the same rights and priority with respect to the collateral. Thus, the issuance of additional notes pursuant to the indenture may have the effect of significantly diluting your ability to recover payment in full from the then existing pool of collateral. Releases of collateral from the liens securing the notes are also permitted under some circumstances. In the event some of the collateral is released, the remaining collateral may not be sufficient to satisfy all amounts owing in respect of the notes and the loans under the new revolving credit facility. See “Description of the Notes—Collateral.”

Defects in our title to the collateral for the notes could adversely affect the value of the collateral or the trustee’s ability to realize upon the collateral.

Most of the collateral for the notes will be comprised of our coal properties, including our mineral rights (whether on owned or leased properties) and our preparation plants and train loading facilities. We will have title insurance on our headquarters in place when the notes are issued, but we will likely not have title insurance on all of our other properties at that time. However, we have agreed to use our commercially reasonable efforts to obtain title reports, opinions and insurance with respect to certain properties that we are mining, or intend to mine in the foreseeable future, as soon as reasonably practicable after the date of the indenture. We may not be able to obtain such title reports, opinions and insurance before the consummation of the offering or at all, in which case no title insurance proceeds would be available in the event of any loss arising out of a challenge to our title to the collateral. Even if we are able to obtain the title reports, opinions and insurance, there may still be defects or exceptions that could impair the value of the collateral or trustee’s ability to realize upon the collateral.

The ability of the trustee to foreclose on the collateral may be limited.

Your right to foreclose upon and sell the collateral securing the notes could be restricted under the Bankruptcy Code, which could prevent the trustee from repossessing and disposing of the collateral upon the occurrence of an event of default if a bankruptcy case is commenced by or against us before the trustee repossesses and disposes of the collateral. Furthermore, the Bankruptcy Code may permit a debtor to continue to retain and to use the collateral (and the proceeds, products, rents or profits of such collateral) so long as the secured creditor is afforded “adequate protection” of its interest in the collateral. Because the courts have not precisely defined the term “adequate protection” and have broad discretionary powers, it is impossible to predict how long payments under the notes could be delayed following commencement of a bankruptcy case, whether or when the trustee could repossess or dispose of the collateral, or whether or to what extent holders of the notes would be compensated for any delay in payment or loss of value of the collateral through the requirement of “adequate protection.”

Moreover, potential liabilities to third parties may preclude the trustee from foreclosing on collateral. For example, secured creditors that foreclose on real property may be held liable under environmental laws for the

11

costs of remediating or preventing release or threatened releases of hazardous substances at the real property. Consequently, the trustee may decline to foreclose on our real property or exercise other remedies available if it does not receive indemnification to its satisfaction from the holders of the notes.

Finally, the trustee’s ability to foreclose on the collateral on your behalf may be subject to lack of perfection, the consent of third parties, prior liens and practical problems associated with the realization of the trustee’s security interest in the collateral.

The indenture for the notes and any new credit facility will impose significant operating and financial restrictions, which may prevent us from pursuing certain business opportunities and may hamper our operations.

The indenture for the notes, and any new credit facility, will impose significant operating and financial restrictions on us. These restrictions restrict our ability to:

| | • | | incur additional indebtedness; |

| | • | | repay indebtedness (including the notes) prior to stated maturities; |

| | • | | pay dividends on or redeem or repurchase our stock; |

| | • | | issue capital stock of subsidiaries; |

| | • | | make certain payments or investments; |

| | • | | sell certain assets or merge with or into other companies; |

| | • | | enter into certain transactions with stockholders and affiliates; and |

| | • | | otherwise conduct necessary corporate activities. |

In addition, a future credit facility will require us to maintain specified financial ratios. If a default occurs, our lenders could elect to declare the indebtedness, together with accrued interest and other fees, to be immediately due and payable and proceed against any collateral securing that indebtedness. Acceleration of our other indebtedness could result in a default under the terms of the indenture governing the notes, and our assets may not be sufficient to satisfy our obligations under all of our indebtedness, including the notes.

We may not be able to satisfy our obligations to holders of the notes upon a change of control.

Upon the occurrence of a change of control, as defined in the indenture, we will be required to offer to purchase the notes at a price equal to 101% of the principal amount of the notes, together with any accrued and unpaid interest and penalty interest, if any, to the date of purchase. See “Description of the Notes—Repurchase at the Option of Holders—Change of Control.”

If a change of control occurs, we may not have available funds sufficient to meet our repurchase obligations. Our other agreements may preclude us from using available funds to pay you or from selling assets in order to do so. Accordingly, the holders of the notes may not receive the change of control purchase price for their notes. Our failure to make or consummate the change of control offer or pay the change of control purchase price when due will be an event of default under the indenture.

Our officers and directors own a substantial portion of our common stock, and their interests may not be aligned with your interests as a holder of the notes.

Our officers and directors own, as of March 31, 2006, 38.8% of our voting shares. As a result, they collectively are able to substantially influence stockholder decisions, such as electing our board of directors,

12

selecting our management team, determining our corporate and management policies and making decisions relating to fundamental corporate actions. Their interests as stockholders may not be aligned with your interests as a holder of the notes. For example, they might favor raising capital through additional debt offerings, rather than equity offerings, because they might be concerned about the dilutive effect of equity offerings, while your interests might be better served if we engaged in equity financing.

Because the notes were issued with original issue discount, U.S. holders of notes will be required to include accrued original issue discount in gross income for U.S. federal income tax purposes before such amounts are received in cash.

The old notes were sold as part of a unit, with each unit comprising one $1,000 principal amount note and one warrant to purchase 31.5024 shares of our common stock. Because the issue price of each unit was allocated between the note and the warrant, the notes will be treated for U.S. federal income tax purposes as having been issued with original issue discount and will be subject to provisions in the Internal Revenue Code and the Treasury Regulations thereunder applicable to original issue discount. As a result, each “U.S. holder,” as defined under the heading “Certain United States Federal Income Tax Consequences,” of a note generally will be required to include original issue discount in gross income in advance of the receipt of cash attributable to such income. In addition, such holders will be required to include in gross income increasingly greater amounts of original issue discount in each successive accrual period. See “Certain United States Federal Income Tax Consequences.”

Risks Related to Our Business

We face numerous uncertainties in estimating our economically recoverable coal reserves, and inaccuracies in our estimates could result in lower than expected revenues, higher than expected costs or decreased profitability.

We estimate that as of March 31, 2006, we control approximately 38.2 million tons of reserves that are recoverable at this time. We base our reserves estimates on engineering, economic and geological data assembled and analyzed by our staff, which includes various engineers and geologists, and aspects of which have been reviewed by outside firms. Our estimates of our proven and probable reserves and our recoverable reserves, as well as the Btu or sulfur content of our reserves, may be revised and updated to reflect the resolution of uncertainties and assumptions, the production of coal from the reserves and new drilling or other data received.

In January 2006, we engaged Marshall Miller & Associates, Inc., an independent mining engineering firm, to evaluate our reserves. Their evaluation efforts are ongoing and they have not yet submitted their final report. Future estimates of our reserves, including estimates prepared by Marshall Miller, could be materially different from current estimates. There are numerous uncertainties inherent in estimating quantities and qualities of and costs to mine recoverable reserves, including many factors beyond our control. Estimates of economically recoverable coal reserves and net cash flows necessarily depend upon a number of variable factors and assumptions, all of which may vary considerably from actual results such as:

| | • | | geological and mining conditions which may not be fully identified by available exploration data or which may differ from experience in current operations; |

| | • | | historical production from the area compared with production from other similar producing areas; |

| | • | | the assumed effects of regulation and taxes by governmental agencies; and |

| | • | | assumptions concerning coal prices, operating costs, mining technology improvements, severance and excise tax, development costs and reclamation costs. |

For these reasons, estimates of the economically recoverable quantities and qualities attributable to any particular group of properties, classifications of reserves based on risk of recovery and estimates of net cash

13

flows expected from particular reserves prepared by different engineers or by the same engineers at different times may vary substantially. Actual coal tonnage recovered from identified reserve areas or properties and revenues and expenditures with respect to our reserves may vary materially from estimates. As a result, the reserve estimates set forth in this report may differ materially from our actual reserves. Inaccuracies in our estimates related to our reserves could result in lower than expected revenues, higher than expected costs, or decreased profitability.

Our future success depends upon our ability to continue acquiring and developing coal reserves that are economically recoverable and to raise the capital necessary to fund our expansion.

Our recoverable reserves will decline as we produce coal. We have not yet applied for the permits required or developed the mines necessary to use all of the coal deposits under our mineral rights. Furthermore, we may not be able to mine all of our coal deposits as efficiently as we do at our current operations. Our future success depends upon our conducting successful exploration and development activities and acquiring properties containing economically recoverable coal deposits. In addition, we must also generate enough capital, either through our operations or through outside financing, to mine these additional reserves. Our current strategy includes increasing our coal deposits base through acquisitions of other mineral rights, leases, or producing properties and continuing to use our existing properties. Our ability to further expand our operations may be dependent on our ability to obtain sufficient working capital, either through cash flows generated from operations, or financing activities, or both. Mining coal in Central Appalachia can present special difficulties. Characteristics of the land and permitting process in Central Appalachia, where all of our mines are located, may adversely affect our mining operations, our costs and the ability of our customers to use the coal that we mine. The geological characteristics of Central Appalachian coal reserves, such as depth of overburden and coal seam thickness, make them complex and costly to mine. As mines become depleted, replacement reserves may not be available when required or, if available, may not be capable of being mined at costs comparable to those characteristic of the depleting mines. In addition, as compared to mines in the Powder River Basin, permitting, licensing and other environmental and regulatory requirements are more costly and time-consuming to satisfy. These factors could materially adversely affect our mining operations and costs, and our customers’ abilities to use the coal we mine.

Our ability to implement our planned development and exploration projects is dependent on many factors, including the ability to receive various government permits.

Our planned development and exploration projects and acquisition activities may not result in the acquisition of significant additional coal deposits and we may not have continuing success developing additional mines. For example, we may not be successful in acquiring contiguous properties that will leverage our existing facilities. In addition, in order to develop our coal deposits, we must receive various governmental permits. Before a mining permit is issued on a particular parcel, interested parties are eligible to file petitions to declare the land unsuitable for mining. For example, on November 10, 2005, two environmental groups filed a petition to halt the expansion of surface mining activities on the New River Tract and surrounding areas. We cannot predict whether we will continue to receive the permits necessary for us to expand our operations.

Defects in title or loss of any leasehold interests in our properties could adversely affect our ability to mine these properties.

We conduct, or plan to conduct, a significant part of our mining operations on properties that we lease. A title defect or the loss of any lease could adversely affect our ability to mine the associated reserves. Title to most of our owned or leased properties and mineral rights is not usually verified until we make a commitment to develop a property, which may not occur until after we have obtained necessary permits and completed exploration of the property. In some cases, we rely on title information or representations and warranties provided by our lessors or grantors. Our right to mine some of our reserves may be adversely affected if defects in title or boundaries exist or if a lease expires. Any challenge to our title could delay the exploration and development of the property and could ultimately result in the loss of some or all of our interest in the property

14

and could increase our costs. In addition, if we mine on property that we do not own or lease, we could incur liability for such mining. Some leases have minimum production requirements or require us to commence mining in a specified term to retain the lease. Failure to meet those requirements could result in losses of prepaid royalties and, in some rare cases, could result in a loss of the lease itself.

Due to variability in coal prices and in our cost of producing coal, as well as certain provisions in our long term contracts, we may be unable to sell coal at a profit.

We typically sell our coal for a specified tonnage amount and at a negotiated price pursuant to short-term and long-term contracts. For the three months ended March 31, 2006, 100% of the coal we produced was sold under long-term contracts. Price adjustment, “price reopener” and other similar provisions in long-term supply agreements may reduce the protection from short-term coal price volatility traditionally provided by such contracts. Two of our long-term contracts, representing 44.2% of our sales in the three months ended March 31, 2006 and which expire at the end of 2007 and 2008, contain provisions allowing the purchase price to be renegotiated or adjusted based on market prices at the time at periodic intervals. Any adjustment or renegotiation leading to a significantly lower contract price would result in decreased revenues and lower our gross margins. Coal supply agreements also typically contain force majeure provisions allowing temporary suspension of performance by us or our customers during the duration of specified events beyond the control of the affected party. Most of our coal supply agreements contain provisions requiring us to deliver coal meeting quality thresholds for certain characteristics such as Btu, sulfur content, ash content, hardness and ash fusion temperature. Failure to meet these specifications could result in economic penalties, including price adjustments, the rejection of deliveries or, in the extreme, termination of the contracts. Consequently, due to the risks mentioned above with respect to long-term supply agreements, we may not achieve the revenue or profit we expect to achieve from these sales commitments. In addition, we may not be able to successfully convert these sales commitments into long-term supply agreements.

The coal industry is highly cyclical, which subjects us to fluctuations in prices for our coal.

We are exposed to swings in the demand for coal, which has an impact on the prices for our coal. The demand for coal products and, thus, the financial condition and results of operations of companies in the coal industry, including us, are generally affected by macroeconomic fluctuations in the world economy and the domestic and international demand for energy. In recent years, the price of coal has been at historically high levels, but these price levels may not continue. Any material decrease in demand for coal could have a material adverse effect on our operations and profitability.

We depend heavily on a small number of large customers, the loss of any of which would adversely affect our operating results.

For the three months ended March 31, 2006, we derived approximately 79% of our coal revenues from sales to our three largest customers. At March 31, 2006, we had coal supply agreements with these customers that expire at various times through 2008. When these agreements expire, we may not be successful at renegotiating them and these customers may not continue to purchase coal from us pursuant to long-term coal supply agreements. If a number of these customers were to significantly reduce their purchases of coal from us, or if we were unable to sell coal to them on terms as favorable to us as the terms under our current agreements, our financial condition and results of operations could suffer materially.

Significant competition from entities with greater resources could result in our failure.

We operate in a highly competitive industry with national and international energy resources companies. Some of our competitors have longer operating histories and substantially greater financial and other resources than we do. Our competitors’ use of their substantially greater resources could overwhelm our efforts to operate successfully and could cause our failure.

15

There is no assurance that our limited revenues will be sufficient to operate profitably, or that we will generate greater revenues in the future.

We were formed to create a regional coal producer in Tennessee. We had no revenues from inception until the third quarter 2003 when we began mining operations. We are not profitable and have a limited operating history. We must be regarded as a risky venture with all of the unforeseen costs, expenses, problems, risks and difficulties to which such ventures are subject.

Our coal sales for calendar 2005 were approximately $65.3 million. There is no assurance that we can achieve greater sales or generate profitable sales. We expect that many coal producers could produce and sell coal at cheaper prices per ton than our production cost rates, which could adversely affect our revenues and profits, if any. There is no assurance that we will ever operate profitably. There is no assurance that we will generate continued revenues or any profits, or that the market price of our common stock will be increased thereby.

If we need to sell or issue additional shares of common stock or assume additional debt to finance future growth, our shareholders’ ownership could be diluted or our earnings could be adversely impacted.

Our business strategy may include expansion through internal growth, or by acquiring complementary businesses, or by establishing strategic relationships with targeted customers. In order to do so or to fund our other activities, we may issue additional equity securities that could dilute our shareholders’ stock percentage ownership. We may also assume additional debt and incur impairment losses related to goodwill and other tangible assets if we acquire another company and this could negatively impact our results of operations.

Our inability to diversify our operations may subject us to economic fluctuations within our industry.

Our limited financial resources reduce the likelihood that we will be able to diversify our operations. Our probable inability to diversify our activities into more than one business area will subject us to economic fluctuations within a particular business or industry and therefore increase the risks associated with our operations.

Certain provisions in our Series A convertible preferred stock may impact our ability to obtain additional financing in the future.

In addition to cash flows generated from operations, we may need to raise capital in the future through the issuance of securities. In order to issue securities that rank senior to our Series A convertible preferred stock in terms of liquidation preference, redemption rights or dividend rights, we must obtain the affirmative consent of holders of at least 75% of the outstanding shares of our Series A convertible preferred stock. If we are unable to obtain the consent of these holders in connection with future financings, we may be unable to raise additional capital on acceptable terms, or at all.

The loss of key management personnel could adversely affect our business.

We are heavily dependent upon the skills, talents, and abilities of our executive officers and board of directors to implement our business plan. Given the intense competition for qualified management personnel in our industry, the loss of the services of any key management personnel may significantly and detrimentally affect our business and prospects. We may not be able to retain some or all of our key management personnel, and even if replaceable, it may be time consuming and costly to recruit qualified replacement personnel.

Our director and officer indemnification policies in conjunction with the provisions of Florida law could result in substantial un-recoupable expenditures and reduced remedies against directors and officers.

Florida Revised Statutes provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to

16

which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us such amounts, if it is ultimately determined that such person was not entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

Florida Revised Statutes exclude personal liability of our directors to us and our stockholders for monetary damages for breach of fiduciary duty except in certain specified circumstances. Accordingly, we will have a much more limited right of action against our directors than otherwise would be the case. This provision does not affect the liability of any director under federal or applicable state securities laws. There is no assurance that we will find purchasers of our product at profitable prices. If we are unable to achieve supply contracts, or are unable to find buyers willing to purchase our coal at profitable prices, our revenues and operating profits could suffer.

The coal industry is intensely competitive, and our failure to compete effectively could reduce our revenue and margins, and delay or prevent our ability to service our debt.

We operate in a highly competitive industry with regional, national and international energy resources companies. We compete based primarily on price, and we believe that the principal factors that determine the price for which our coal can be sold are:

| | • | | competition from energy sources other than coal; |

| | • | | efficiency in extracting and transporting coal; and |

| | • | | proximity to customers. |

Some of our competitors have longer operating histories and substantially greater financial and other resources than we do. Our failure to compete effectively could reduce our revenues and margins, and delay or prevent our ability to make payments on our debt.

If transportation for our coal becomes unavailable or uneconomic for our customers, our ability to sell coal could suffer.

Transportation costs represent a significant portion of the total cost of delivered coal and, as a result, play a critical role in a customer’s purchasing decision. Increases in transportation costs could make our coal less competitive as a source of energy or could make some of our operations less competitive than other sources of coal.

Coal producers depend upon rail, barge, trucking, overland conveyor and other systems to deliver coal to its customers. While U.S. coal customers typically arrange and pay for transportation of coal from the mine to the point of use, disruption of these transportation services because of weather-related problems, strikes, lock-outs or other events could temporarily impair our ability to supply coal to our customers and thus could adversely affect our results of operations.

We face risks inherent to mining which could increase the cost of operating our business.

Our mining operations are subject to conditions beyond our control that can delay coal deliveries or increase the cost of mining at particular mines for varying lengths of time. These conditions include weather and natural disasters, unexpected maintenance problems, key equipment failures, variations in coal seam thickness, variations in the amount of rock and soil overlying the coal deposit, variations in rock and other natural materials and variations in geologic conditions. Any of these factors could increase the cost of operating our business, which would lower or eliminate our margins.

17

A shortage of skilled labor in the mining industry could pose a risk to achieving optimal labor productivity and competitive costs, which could adversely affect our profitability.

Efficient coal mining using modern techniques and equipment requires skilled laborers, preferably with at least a year of experience and proficiency in multiple mining tasks. In order to support our planned expansion opportunities, we intend to sponsor both in-house and vocational coal mining programs at the local level in order to train additional skilled laborers. In the event the shortage of experienced labor continues or worsens or we are unable to train the necessary amount of skilled laborers, there could be an adverse impact on our labor productivity and costs and our ability to expand production and therefore have a material adverse effect on our earnings. In addition, we have supplemented our direct workforce through the use of contract miners. If our contract miners are unable to perform their duties as expected, we may experience temporary disruptions in our production. For example, in October 2005, we terminated our agreement with one of our contract miners, and as a result we were required to purchase coal to satisfy our sales requirements. We do not expect that this will have a material effect on our results of operations for 2006. However, if difficulties with our contract miners arise in the future, there could be an adverse effect on our productivity and costs and our ability to expand production and therefore have a material adverse effect on our earnings.

The government extensively regulates our mining operations, which imposes significant costs on us, and future regulations could increase those costs or limit our ability to produce coal.

Federal, state and local authorities regulate the coal mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, air quality standards, water pollution, plant and wildlife protection, reclamation and restoration of mining properties after mining is completed, the discharge of materials into the environment, surface subsidence from underground mining and the effects that mining has on groundwater quality and availability. In addition, legislation mandating specified benefits for retired coal miners affects our industry.

Numerous governmental permits and approvals are required for mining operations. We are required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed exploration for or production of coal may have upon the environment. The costs, liabilities and requirements associated with these regulations may be costly and time-consuming and may delay commencement or continuation of exploration or production operations. The possibility exists that new legislation and/or regulations and orders may be adopted that may materially adversely affect our mining operations, our cost structure and/or our customers’ ability to use coal. New legislation or administrative regulations (or judicial interpretations of existing laws and regulations), including proposals related to the protection of the environment that would further regulate and tax the coal industry, may also require us or our customers to change operations significantly or incur increased costs.

The majority of our coal supply agreements contain provisions that allow a purchaser to terminate its contract if legislation is passed that either restricts the use or type of coal permissible at the purchaser’s plant or results in specified increases in the cost of coal or its use. These factors and legislation, if enacted, could have a material adverse effect on our financial condition and results of operations. In addition, the United States and over 160 other nations are signatories to the 1992 Framework Convention on Climate Change which is intended to limit emissions of greenhouse gases, such as carbon dioxide. In December 1997, in Kyoto, Japan, the signatories to the convention established a binding set of emission targets for developed nations. Although the specific emission targets vary from country to country, the United States would be required to reduce emissions to by 5% from 1990 levels over a five-year period from 2008 through 2012. Although the United States has not ratified the emission targets and no comprehensive regulations focusing on U.S. greenhouse gas emissions are in place, these restrictions, whether through ratification of the emission targets or other efforts to stabilize or reduce greenhouse gas emissions, could adversely impact the price of and demand for coal. According to the EIA’s “Emissions of Greenhouse Gases in the United States 2001,” coal accounts for approximately one-third of carbon dioxide emissions in the United States, and efforts to control carbon dioxide emissions could result in reduced

18

use of coal if electricity generators switch to sources of fuel with lower carbon dioxide emissions. Further developments in connection with regulations or other limits on carbon dioxide emissions could have a material adverse effect on our financial condition or results of operations.

If the coal industry experiences overcapacity in the future, our profitability could be impaired.

During the mid-1970s and early 1980s, a growing coal market and increased demand for coal attracted new investors to the coal industry, spurred the development of new mines and resulted in added production capacity throughout the industry, all of which led to increased competition and lower coal prices. Similarly, an increase in future coal prices could encourage the development of expanded capacity by new or existing coal producers. Any overcapacity could reduce coal prices in the future.

Our operations could be adversely affected if we fail to maintain required bonds.

Federal and state laws require bonds or cash deposits to secure our obligations to reclaim lands used for mining, to pay federal and state workers’ compensation, to secure coal lease obligations and to satisfy other miscellaneous obligations. At March 31, 2006, $257,500 was on deposit with OSM for reclamation bonds related to our Patterson Mountain mining operations. In addition, we have approximately $13.8 million of cash invested in certificates of deposit, against which irrevocable bank letters of credit are written in favor of OSM and have posted a $700,000 letter of credit secured by our executive office building in favor of OSM. Reclamation bonds are typically renewable on a yearly basis if they are not posted with cash. Our failure to maintain, or inability to acquire, bonds that are required by state and federal law would have a material adverse effect on us. That failure could result from a variety of factors including the following:

| | • | | lack of availability, higher expense or unfavorable market terms of new bonds; |

| | • | | restrictions on the availability of collateral for current and future third-party bond issuers under the terms of our indenture or new credit facility; and |

| | • | | the exercise by third-party bond issuers of their right to refuse to renew the bonds. |

Terrorist threats and environmental zealotry may negatively affect our business, financial condition and results of operations.

Our business is affected by general economic conditions, fluctuations in consumer confidence and spending, and market liquidity, which can decline as a result of numerous factors outside of our control, such as terrorist attacks and acts of war. Our business also may be affected by environmental activists who engage in activities intended to disrupt our business operations. In particular, environmental activists have conducted protests outside the homes of certain of our executives, including our Chief Executive Officer. We have spent approximately $236,000 during the three months ended March 31, 2006 on security measures and related legal fees, largely as a result of the actions of some environmental activists. Future terrorist attacks against U.S. targets, rumors or threats of war, actual conflicts involving the United States or its allies, or military or trade disruptions affecting our customers may materially adversely affect our operations. As a result, there could be delays or losses in transportation and deliveries of coal to our customers, decreased sales of our coal and extension of time for payment of accounts receivable from our customers. Strategic targets such as energy-related assets may be at greater risk of future terrorist attacks than other targets in the United States. In addition, disruption or significant increases in energy prices could result in government-imposed price controls. It is possible that any, or a combination, of these occurrences could have a material adverse effect on our business, financial condition and results of operations.

19

A substantial or extended decline in coal prices could reduce our revenues and the value of our coal reserves.

The prices we charge for coal depend upon factors beyond our control, including:

| | • | | the supply of, and demand for, domestic and foreign coal; |

| | • | | the demand for electricity; |

| | • | | the proximity to, capacity of, and cost of transportation facilities; |

| | • | | domestic and foreign governmental regulations and taxes; |

| | • | | air emission standards for coal-fired power plants; |

| | • | | regulatory, administrative and court decisions; |

| | • | | the price and availability of alternative fuels, including the effects of technological developments; and |

| | • | | the effect of worldwide energy conservation measures. |

Our results of operations are dependent upon the prices we charge for our coal as well as our ability to improve productivity and control costs. Decreased demand would cause spot prices to decline and require us to increase productivity and lower costs in order to maintain our margins. If we are not able to maintain our margins, our operating results could be adversely affected. Therefore, price declines may adversely affect operating results for future periods and our ability to generate cash flows necessary to improve productivity and invest in operations.

Our ability to collect payments from our customers could be impaired due to credit issues.

Our ability to receive payment for coal sold and delivered depends on the continued creditworthiness of our customers. Our customer base may not be highly creditworthy. If deterioration of the creditworthiness of customers or trading counterparties occurs, our business could be adversely affected.

20

FORWARD-LOOKING STATEMENTS

This registration statement includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that do not relate solely to historical facts. They include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. They may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” “will” or words or phrases of similar meaning. They may relate to, among other things:

| | • | | the worldwide demand for coal; |

| | • | | the price and available supply of coal; |

| | • | | the price and available supply of alternative fuel sources; |

| | • | | our coal reserves and our unproven deposits; |

| | • | | the costs to mine and transport coal; |

| | • | | the ability to obtain new mining permits; |

| | • | | the costs of reclamation of previously mined properties; |

| | • | | the expansion of coal production and production capacity of our existing and new mines; |

| | • | | our ability to bring new mining properties into operation on schedule; |

| | • | | industry competition and trends; |

| | • | | our ability to continue to execute our growth strategies; |

| | • | | availability of qualified workers; |

| | • | | environmental requirements, including those affecting our customers’ usage of coal; |

| | • | | general economic conditions; and |

| | • | | other factors discussed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” |

These forward-looking statements are not guarantees of future performance. Forward-looking statements, in many cases, including our statements about plans to expand production capacity, assume the completion of this offering. Forward-looking statements are based on management’s expectations that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause actual results to differ materially from trends, plans or expectations set forth in the forward-looking statements. These risks and uncertainties may include those discussed in “Risk Factors.” Other risks besides those listed in “Risk Factors” can adversely affect us. New risk factors can emerge from time to time. It is not possible for us to predict all of these risks, nor can we assess the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, we urge you to read this registration statement completely and with the understanding that actual future results may be materially different from what we plan or expect. We will not update these forward-looking statements even if our situation changes in the future unless required by law to do so.

21

USE OF PROCEEDS

We will not receive any cash proceeds from the completion of the exchange offer. We received $52 million from the sale of the old notes, after deducting expenses incurred in connection with the offering. We immediately used approximately $22,100,000 of the proceeds to repay existing indebtedness. The remaining proceeds will be used to collateralize reclamation bonds for new mining operations and for equipment acquisitions.

22

THE EXCHANGE OFFER

Terms of the Exchange Offer; Period for Tendering Old Notes

Subject to terms and conditions detailed in this prospectus, we will accept for exchange old notes that are properly tendered on or prior to the expiration date and not withdrawn as permitted below. When we refer to the term expiration date, we mean 5:00 p.m., New York City time, August 29, 2006. We may, however, in our sole discretion, extend the period of time that the exchange offer is open. The term expiration date means the latest time and date to which the exchange offer is extended.

As of the date of this prospectus, $55 million principal amount of old notes are outstanding. We are sending this prospectus, together with the letter of transmittal, to all holders of old notes of whom we are aware. We expressly reserve the right, at any time, to extend the period of time that the exchange offer is open, and delay acceptance for exchange of any old notes, by giving oral or written notice of an extension to the holders of old notes as described below. During any extension, all old notes previously tendered will remain subject to the exchange offer and may be accepted for exchange by us. Any old notes not accepted for exchange for any reason will be returned without expense to the tendering holder as promptly as practicable after the expiration or termination of the exchange offer.

The new notes will evidence the same continuing indebtedness as the old notes and the exchange will take place without novation.

Old notes tendered in the exchange offer must be in denominations of principal amount of $1,000 and any integral multiple thereof.

We expressly reserve the right to amend or terminate the exchange offer, and not to accept for exchange any old notes, upon the occurrence of any of the conditions of the exchange offer specified under “—Conditions to the Exchange Offer.” We will give oral or written notice of any extension, amendment, non-acceptance or termination to the holders of the old notes as promptly as practicable. In the case of any extension, we will issue a notice by means of a press release or other public announcement no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled expiration date.