U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2014

| ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number

Tianyin Pharmaceutical Co., Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer

Identification No.) |

23rd Floor, Unionsun Yangkuo Plaza

No. 2, Block 3, Renmin Road South

Chengdu, P. R. China, 610041

+86 028 8551 6696

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerate filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ |

| | | | | |

| Non-accelerated filer | ☐ (do not check if a smaller reporting company) | | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934) Yes ☐ No ☒

As of December 31, 2014, we are authorized to issue up to 50,000,000 shares of Common Stock, par value US$.001 per share of which 29,546,276 shares issued and 29,432,791 shares outstanding; and 10,000,000 shares of Series A Preferred Stock, of which -0- shares are currently issued and outstanding.

TABLE OF CONTENTS

| | | Page |

| PART I - FINANCIAL INFORMATION | | |

| | | |

| Item 1. Financial Statements | | |

| | | |

| Consolidated Balance Sheets at September 30, 2014 (unaudited) and June 30, 2014 | | 3 |

| | | |

| Unaudited Consolidated Statements of Operations for the three months ended September 30, 2014 and 2013 | | 4 |

| | | |

| Unaudited Consolidated Statements of Comprehensive Income for the three months ended September 30, 2014 and 2013 | | 5 |

| | | |

| Unaudited Consolidated Statements of Cash Flows for the three months ended September 30, 2014 and 2013 | | 6 |

| | | |

| Unaudited notes to Consolidated Financial Statements | | 7 |

| | | |

| Item 2. Management’s Discussion and Analysis or Plan of Operation | | 11 |

| | | |

| Item 3. Quantitative and Qualitative Disclosure About Market Risk | | 14 |

| | | |

| Item 4. Controls and Procedures | | 15 |

| | | |

| PART II – OTHER INFORMATION | | 15 |

| | | |

| Item 1. Legal Proceedings | | 15 |

| | | |

| Item 2. Unregistered Sales of Equity Securities And Use Of Proceeds | | 15 |

| | | |

| Item 3. Defaults Upon Senior Securities | | 15 |

| | | |

| Item 4.Mine Safety Disclosures | | 15 |

| | | |

| Item 5. Other Information | | 15 |

| | | |

| Item 6. Exhibits | | 16 |

| Tianyin Pharmaceutical Co., Inc. |

| Consolidated Balance Sheets |

| | | September 30, | | | June 30, | |

| | | 2014 | | | 2014 | |

| | | (Unaudited) | | | | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 15,599,314 | | | $ | 16,120,041 | |

| Restricted cash | | | 489,841 | | | | 994,017 | |

| Accounts receivable, net of allowance for doubtful accounts of $102,401 at September 30, 2014 and June 30, 2014 | | | 4,138,462 | | | | 9,074,576 | |

| Inventory | | | 5,616,924 | | | | 3,841,712 | |

| Loan receivable | | | - | | | | 1,981,280 | |

| Deferred tax assets | | | 996,207 | | | | 1,180,510 | |

| Prepaid R&D expenses - current portion | | | 3,518,667 | | | | - | |

| Other current assets | | | 376,503 | | | | 376,504 | |

| Total current assets | | | 30,735,918 | | | | 33,568,640 | |

| | | | | | | | | |

| Property and equipment, net | | | 46,825,853 | | | | 45,378,356 | |

| | | | | | | | | |

| Intangibles, net | | | 27,495,028 | | | | 27,699,733 | |

| | | | | | | | | |

| Prepaid R&D expenses | | | 1,935,267 | | | | - | |

| | | | | | | | | |

| Goodwill | | | 211,120 | | | | 211,120 | |

| | | | | | | | | |

| Total assets | | $ | 107,203,186 | | | $ | 106,857,849 | |

| | | | | | | | | |

| Liabilities and Equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 1,921,918 | | | $ | 1,592,459 | |

| Accounts payable – construction related | | | 1,507,082 | | | | 2,238,927 | |

| Short-term bank loans | | | 4,547,200 | | | | 4,547,200 | |

| Due for acquisition of non-controlling interests | | | 2,436,000 | | | | - | |

| Income tax payable | | | 71,328 | | | | 35,832 | |

| Other taxes payable | | | 9,072 | | | | 179,610 | |

| Other current liabilities | | | 427,510 | | | | 522,995 | |

| Total current liabilities | | | 10,920,110 | | | | 9,117,023 | |

| | | | | | | | | |

| Total liabilities | | | 10,920,110 | | | | 9,117,023 | |

| | | | | | | | | |

| Equity | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Preferred stock, $0.001 par value, 25,000,000 shares authorized, no shares issued and outstanding at September 30, 2014 and June 30, 2014 | | | - | | | | - | |

| Common stock, $0.001 par value, 50,000,000 shares authorized, 29,546,276 shares issued, 29,432,791 shares outstanding at September 30, 2014 and June 30, 2014 | | | 29,546 | | | | 29,546 | |

| Additional paid-in capital | | | 27,809,515 | | | | 30,189,802 | |

| Treasury stock, 113,485 shares at cost | | | (135,925 | ) | | | (135,925 | ) |

| Statutory reserve | | | 7,114,169 | | | | 6,976,412 | |

| Retained earnings | | | 51,041,326 | | | | 50,193,258 | |

| Accumulated other comprehensive income | | | 10,424,445 | | | | 10,423,712 | |

| Total stockholders’ equity | | | 96,283,076 | | | | 97,676,805 | |

| | | | | | | | | |

| Noncontrolling interest | | | - | | | | 64,021 | |

| | | | | | | | | |

| Total equity | | | 96,283,076 | | | | 97,740,826 | |

| | | | | | | | | |

| Total liabilities and equity | | $ | 107,203,186 | | | $ | 106,857,849 | |

| Tianyin Pharmaceutical Co., Inc. | | | | | | |

| Consolidated Statements of Operations | | | | | | |

| (Unaudited) | | | | | | |

| | | | | | | |

| | | For the Three Months Ended

September 30, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Sales | | $ | 9,733,381 | | | $ | 14,748,548 | |

| | | | | | | | | |

| Cost of sales | | | 4,655,463 | | | | 8,755,033 | |

| | | | | | | | | |

| Gross profit | | | 5,077,918 | | | | 5,993,515 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 1,628,848 | | | | 2,539,244 | |

| General and administrative expenses | | | 936,056 | | | | 1,028,766 | |

| Research and development | | | 1,092,643 | | | | 251,314 | |

| Total operating expenses | | | 3,657,547 | | | | 3,819,324 | |

| | | | | | | | | |

| Income from operations | | | 1,420,371 | | | | 2,174,191 | |

| | | | | | | | | |

| Other income (expenses): | | | | | | | | |

| Interest income | | | 817 | | | | 22,310 | |

| Interest expense | | | (88,838 | ) | | | (102,901 | ) |

| Total other income (expenses) | | | (88,021 | ) | | | (80,591 | ) |

| | | | | | | | | |

| Income before provision for income taxes | | | 1,332,350 | | | | 2,093,600 | |

| | | | | | | | | |

| Provision for income taxes | | | 354,828 | | | | 634,108 | |

| | | | | | | | | |

| Net income | | | 977,522 | | | | 1,459,492 | |

| | | | | | | | | |

| Less: Net income (loss) attributable to noncontrolling interest | | | (8,303 | ) | | | (55,631 | ) |

| | | | | | | | | |

| Net income attributable to Tianyin Pharmaceutical Co., Inc. | | $ | 985,825 | | | $ | 1,515,123 | |

| | | | | | | | | |

| Basic and diluted earnings per share | | $ | 0.03 | | | $ | 0.05 | |

| | | | | | | | | |

| Weighted average number of common shares outstanding: | | | | | | | | |

| Basic and diluted | | | 29,432,791 | | | | 29,382,791 | |

| Tianyin Pharmaceutical Co., Inc. | | | | | | |

| Consolidated Statements of Comprehensive Income | | | | | | |

| (Unaudited) | | | | | | |

| | | | | | | |

| | | For the Three Months Ended

September 30, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Net income | | $ | 977,522 | | | | 1,459,492 | |

| | | | | | | | | |

| Other comprehensive income (loss) | | | | | | | | |

| Foreign currency translation adjustment | | | 728 | | | | 612,662 | |

| | | | | | | | | |

| Total other comprehensive income | | | 728 | | | | 612,662 | |

| | | | | | | | | |

| Total Comprehensive income | | | 978,250 | | | | 2,072,154 | |

| | | | | | | | | |

| Less: Comprehensive income (loss) attributable to the noncontrolling interest | | | (8,308 | ) | | | (54,474 | ) |

| | | | | | | | | |

| Comprehensive income attributable to Tianyin Pharmaceutical Co., Inc. | | $ | 986,558 | | | $ | 2,126,628 | |

Tianyin Pharmaceutical Co., Inc.

Consolidated Statements of Cash Flows

(Unaudited)

| | | For the Three Months Ended September 30, | |

| | | 2014 | | | 2013 | |

| Cash flows from operating activities: | | | | | | |

| Net Income | | $ | 977,522 | | | $ | 1,459,492 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation and amortization | | | 643,900 | | | | 647,294 | |

| Deferred tax assets | | | 184,303 | | | | - | |

| Changes in current assets and current liabilities: | | | | | | | | |

| Accounts receivable | | | 4,933,075 | | | | 285,687 | |

| Inventory | | | (1,774,119 | ) | | | 397,873 | |

| Prepaid R&D expenses | | | (5,450,575 | ) | | | - | |

| Other current assets | | | - | | | | 313,900 | |

| Accounts payable and accrued expenses | | | 329,256 | | | | 41,043 | |

| Accounts payable – construction related | | | (731,394 | ) | | | (2,728,333 | ) |

| Income tax and other taxes payable | | | (134,958 | ) | | | (193,381 | ) |

| Other current liabilities | | | (95,427 | ) | | | 22,011 | |

| | | | | | | | | |

| Net cash provided by (used in) operating activities | | | (1,118,417 | ) | | | 245,586 | |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Addition of Contruction in process | | | (1,885,926 | ) | | | - | |

| Collection of loans receivable | | | 1,980,060 | | | | - | |

| | | | | | | | | |

| Net cash provided by investing activities | | | 94,134 | | | | - | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Changes in restricted cash | | | 503,866 | | | | - | |

| Repayment of short-term bank loans | | | - | | | | (1,623,000 | ) |

| | | | | | | | | |

| Net cash provided by (used in) financing activities | | | 503,866 | | | | (1,623,000 | ) |

| | | | | | | | | |

| Effect of foreign currency translation on cash | | | (310 | ) | | | 159,558 | |

| | | | | | | | | |

| Net decrease in cash and cash equivalents | | | (520,727 | ) | | | (1,217,856 | ) |

| | | | | | | | | |

| Cash and cash equivalents – beginning of period | | | 16,120,041 | | | | 26,827,008 | |

| | | | | | | | | |

| Cash and cash equivalents – ending of period | | $ | 15,599,314 | | | $ | 25,609,152 | |

| | | | | | | | | |

| Supplemental disclosures of cash activities | | | | | | | | |

| Cash paid for interest | | $ | 83,617 | | | $ | 102,862 | |

| Cash paid for income taxes | | $ | 135,052 | | | $ | 702,609 | |

TIANYIN PHARMACEUTICAL CO., INC.

Notes To Consolidated Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS

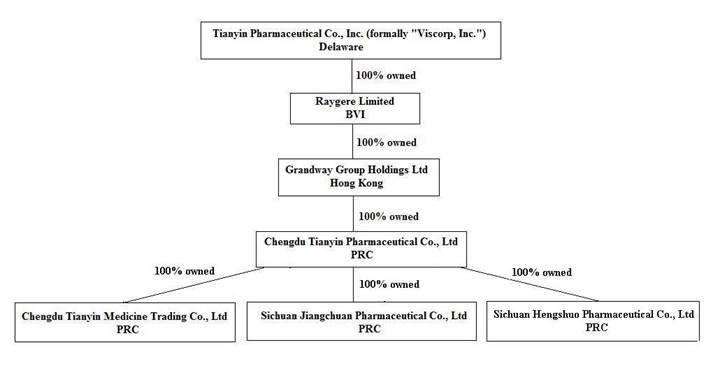

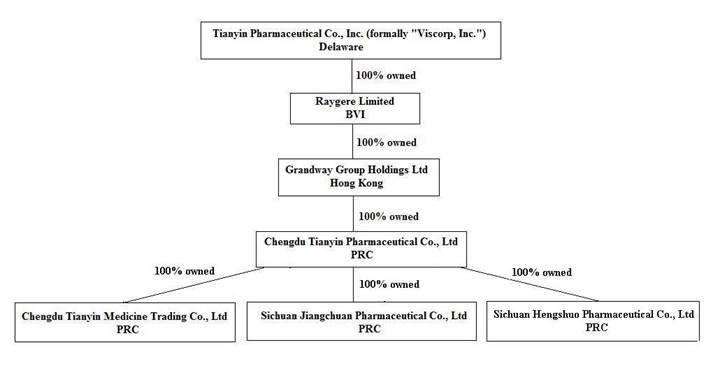

Tianyin Pharmaceutical (the “Company” or “TPI”), was established under the laws of Delaware. The Company’s primary business is to research, manufacture and sell pharmaceutical products in China through its wholly owned subsidiaries.

The following chart describes the Company’s current corporate structure:

NOTE 2 – BASIS OF PRESENTATION AND CONSOLIDATION

The unaudited consolidated financial statements include the accounts of TPI and its wholly-owned subsidiaries. All inter-company transactions and balances have been eliminated in consolidation. The accompanying unaudited financial statements have been prepared in accordance with US GAAP applicable to interim financial information and the requirements of Form 10-Q and Article 8 of Regulation S-X of the Securities and Exchange Commission. Accordingly, they do not include all of the information and disclosures required by US GAAP for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion of management, all adjustments, which include only normal recurring adjustments, considered necessary for a fair presentation of the financial position and the results of operations and cash flows for the interim periods have been included.

These interim unaudited consolidated financial statements should be read in conjunction with the consolidated financial statements for the year ended June 30, 2014, included in the Company’s annual report on Form 10-K filed with the U.S. Securities Exchange Commission on December 9, 2014, as not all disclosures required by US GAAP for annual financial statements are presented. The interim consolidated financial statements follow the same accounting policies and methods of computations as the audited consolidated financial statements for the year ended June 30, 2014.

In preparing the accompanying unaudited consolidated financial statements, we evaluated the period from September 30, 2014 through the date the financial statements were issued for material subsequent events requiring recognition or disclosure. No such events were identified for this period.

The Company uses the United States dollar (“U.S. Dollar” or “US$” or “$”) for financial reporting purposes. The subsidiaries within the Company maintain their books and records in their respective functional currency, being the primary currency of the economic environment in which their operations are conducted. Assets and liabilities of a subsidiary with functional currency other than U.S. Dollar are translated into U.S. Dollars using the applicable exchange rates prevailing at the balance sheet date. Items on the statements of comprehensive income and cash flows are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as a component of accumulated other comprehensive income.

NOTE 3 – ACQUISITION OF NON-CONTROLING INTEREST

On September 30, 2014, the Company’s subsidiary, Chengdu Tianyin, acquired the remaining 13% of Sichuan Jiangchuan Pharmaceutical Co. Ltd (“JCM”) for RMB 15 million (approximately $2.4 million) from an unrelated individual.Total payment of RMB 15 million was made on October 8, 2014.JCM became a wholly owned subsidiary of Chengdu Tianyin on September 30, 2014.

NOTE 4 – INVENTORY

Inventory as of September 30, 2014 and June 30, 2013 consists of the following:

| | | September 30,

2014 | | | June 30,

2014 | |

| | | | | | | |

| Raw materials | | $ | 1,467,933 | | | $ | 690,355 | |

| Packaging supplies | | | 483,334 | | | | 387,599 | |

| Work in process | | | 1,088,359 | | | | 1,088,880 | |

| Finished goods | | | 2,577,298 | | | | 1,674,878 | |

| | | $ | 5,616,924 | | | $ | 3,841,712 | |

NOTE 5 – PREPAID R&D EXPENSE

In July 2014, the Company’s subsidiary, Chengdu Tianyin, entered into a research and development agreement with a pharmaceutical research company, Kang Lu Biomedical Co. (KL).Pursuing to the agreement, KL will provide research and development expanding formulation varieties from Gingko Mihuan Oral Liquid (GMOL) to Capsule formulation. The total contract price is RMB 65 million (approximately $10.5 million). The first payment of RMB39 million (approximately $6.3 million) was paid in July 2014. The project is expected to be completed before August 2017. The total contract price will be amortized over three year period of the agreement on a straight line basis.

NOTE 6 – SHORT-TERM BANK LOANS

Short-term bank loans consist of the following:

| | | September 30, | | | June 30, | |

| | | 2014 | | | 2014 | |

| | | | | | | |

| On October 30, 2013, the Company obtained a loan from China CITIC Bank, which matures on October 30, 2014. The interest is calculated using an annual fixed interest rate of 7.20% and paid monthly. The loan was guaranteed by the Company’s CEO, Dr. Jiang and a third party. The loan was extended in October, 2014 and will be due in January 30, 2015. | | $ | 4,547,200 | | | $ | 4,547,200 | |

| | | | | | | | | |

| Total short-term bank loans | | $ | 4,547,200 | | | $ | 4,547,200 | |

NOTE 7 – INCOME TAXES

The Company's subsidiary, Raygere, is incorporated in the British Virgin Islands. Under the corporate tax laws of British Virgin Islands, it is not subject to tax on income or capital gain.

The operating subsidiaries in China are all subject to 25% income tax rate. The tax write- offs and loss profit credit could only be applied to the individual subsidiaries of TPI.

In July 2006, the FASB issued ASC 740 that clarifies the accounting for income taxes by prescribing a minimum probability threshold that a tax position must meet before a financial statement benefit is recognized. The minimum threshold is defined as a tax position that is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The Company did not recognize any benefits in the financial statements for the fiscal year ended June 30, 2014 and for the three months ended September 30, 2014.

The comparison of income tax expense at the U.S. statutory rate of 35% in 2014 and 2013, to the Company’s effective tax is as follows:

| | | Three months ended

September 30, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| U.S. Statutory rate | | $ | 466,322 | | | $ | 732,760 | |

| Tax rate difference between China and U.S. | | | (133,184 | ) | | | (208,899 | ) |

| Change in valuation allowance | | | 21,690 | | | | 110,247 | |

| Effective tax | | $ | 354,828 | | | $ | 634,108 | |

| The provisions for income taxes are summarized as follows: | | | |

| | | Three months ended

September 30, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Current | | $ | 170,525 | | | $ | 634,108 | |

| Deferred | | | 162,613 | | | | - | |

| Valuation allowance | | | 21,690 | | | | - | |

| Total | | $ | 354,828 | | | $ | 634,108 | |

NOTE 8 – RISK FACTORS

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be adversely influenced by the political, economic and legal environments in the PRC as well as by the general state of the PRC’s economy. Specifically, the Company's business may be negatively influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

NOTE 9 – RISK OF CONCENTRATIONS AND CREDIT RISK

Concentrations

For the quarters ended September 30, 2014 and 2013, no single customer accounted for more than 10% of the Company’s sales. In terms of individual product sales, our major product Gingko Mihuan Oral Liquid (GMOL) represented 58% or $5.6 million (23% increase year over year) of total sales for the three months ended September 30, 2014 of compared with 35% or $5.1 million of total sales for the three months ended September 30, 2013.

Credit Risk

Financial instruments, which potentially subject the Company to credit risk consist principally of cash on deposit with financial institutions. Management believes that the financial institutions that hold the Company’s cash and cash equivalents are financially sound and minimal credit risk exists with respect to these investments.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of financial condition and results of operations relates to the operations and financial condition reported in the financial statements of Tianyin Pharmaceutical Co., Inc. for the periods ended September 30, 2014 and 2013 and should be read in conjunction with such financial statements and related notes included in this report and the Company’s Annual Report on Form 10-K for the year ended June 30, 2014.

The information set forth below includes forward-looking statements. Certain factors that could cause results to differ materially from those projected in the forward-looking statements are set forth below. Readers are cautioned not to put undue reliance on forward-looking statements. The Company disclaims any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

We are engaged in the development, manufacturing, marketing and sale of patented biopharmaceutical, modernized traditional Chinese medicines (mTCM), branded generics and other pharmaceuticals in China. We currently manufacture and market a portfolio of 58 products, 24 of which are listed in the National Medical Reimbursement program, including the patent protected Ginkgo Mihuan Oral Liquid (GMOL) and a series of drug candidates that target various high incidence healthcare conditions in China. Established in 1994, Chengdu Tianyin Pharmaceutical Co., Ltd (“Chengdu Tianyin”) is a pharmaceutical company that manufactures and sells mTCMs and branded generics. The current management acquired 100% of the equity interest of Chengdu Tianyin in 2003. On October 30, 2007, Grandway Groups Holdings Ltd. (“Grandway”) completed the acquisition of the 100% of the equity interest and now owns 100% of the equity interest of Chengdu Tianyin.

In June 2009, Chengdu Tianyin invested approximately $0.7 million (RMB 5 million) to establish a wholly-owned trading subsidiary, Chengdu Tianyin Medicine Trading Co., Ltd (“TMT”) for the sale and distribution of pharmaceutical products to optimize our business model through our distribution channels.

On August 21, 2009, Chengdu Tianyin, Sichuan Mingxin Pharmaceutical (“Sichuan Mingxin”) and an individual investor established Sichuan Jiangchuan Pharmaceutical Co., Ltd (“JCM”), whose major business is to produce macrolide antibiotic active pharmaceutical ingredients (API). Total registered capital of JCM is approximately $3.2 million (equivalent of RMB 20 million), of which Chengdu Tianyin accounts for 87%, after increasing its stake in JCM from 77% at the inception of JCM by purchasing another 10% ownership from Sichuan Mingxin in the fiscal year 2012. JCM is designed as a broader strategy to establish the Company’s presence in the API industry in China. By September 30, 2014, Chengdu Tianyin had purchased the remaining 13% of the ownership of JCM from the individual investor for approximately $2.4 million (RMB 15 million). Consequently, JCM became a wholly owned subsidiary of Chengdu Tianyin.

On August 29, 2012, Chengdu Tianyin entered into a Share Transfer Agreement with the shareholders of Sichuan Hengshuo Pharmaceutical Co., Ltd (“Sichuan Hengshuo” or “HSP”), a pharmaceutical distribution company, to acquire 100% ownership of HSP for approximately $0.2 million (RMB 1.3 million). The purpose of the acquisition was to facilitate the relocation of Company’s manufacturing facility to Qionglai since HSP was registered at Qionglai. The share transfer was closed on November 30, 2012, pursuant to which Chengdu Tianyin now owns 100% of HSP and Guoqing Jiang, Chairman and CEO of Chengdu Tianyin has become the legal representative of HSP.

Competitive Environment

The market for pharmaceutical products is highly competitive. Our operations may be affected by technological advances by competitors, industry consolidation, patents granted to competitors, competitive combination products, new products offered by our competitors, as well as new information provided by other marketed products and/or other post-market studies.

Development and Growth Strategy

Research and Development (R&D)

We have a proven cooperative partnership model for the R&D which is cost effective, efficient, and value adding for our organic growth. We focused on innovative products as well as modifications and improvements of existing marketed products with substantial market potential. Our R&D partners include a number of most prestigious academic institutions in China, including China Pharmaceutical University, Sichuan University-affiliated West China Center of Medical Sciences, and Shaanxi University of Chinese Medicines. The partnership-based R&D strategy supports TPI to commercialize, produce, and broaden our product pipeline and to market those products through our sales and marketing infrastructure. In July 2014, the TPI’s subsidiary, Chengdu Tianyin, entered into a research and development agreement with a pharmaceutical research company to expand formulation varieties from Gingko Mihuan Oral Liquid (GMOL) to Capsule formulation. The project is expected to be completed before August 2017.

R&D for additional indications of flagship product Gingko Mihuan (GMOL)

Our flagship product GMOL (CFDA certification number: H20013079; patent number: 20061007800225) contributes a significant share to our total quarterly revenue. Our R&D partnership research has been recently explored for further development of capsulation and tablets formulations for GMOL. The in-house research group at TPI together with the partnership research institutes will collaborate in developing, testing and filing for the CFDA approval application. Due to the increased stringency by CFDA approval, the time span and costs for the R&D of new products have increased significantly since twenty years ago when Chengdu Tianyin was founded.

Jiangchuan Macrolide Facility (JCM)

In January 2012, the JCM facility for R&D, manufacturing and sale of macrolide APIs received its Good Manufacturing Practice (“GMP”) certification designated as "CHUAN M0799," which is valid until December 31, 2015. As a result, JCM started the production of the macrolide API for TPI’s Azithromycin Dispersible Tablets (SFDA No: H20074145). The API produced by JCM is to supply for TPI’s own Azithromycin Tablets as well as for both domestic and international third party sales.

In April 2014, JCM has developed a new line of Azithromycin API products that support steady monthly export orders to South Asia. Following a series of tests on quality, purity, intermediates contents, stereochemistry, stability in comparison with the international standards of Azithromycin API, JCM has received monthly orders for manufacturing one of the major intermediates of Azithromycin, Azithromycin Amine (AA) at a competitive international price which varies from month to month according to the market demands and the foreign exchange rate. The current monthly orders for Azithromycin APIs were 5-8 tons per month.

Tianyin Medicine Trading Distribution Business (TMT)

TMT is established to distribute products manufactured by both TPI and other pharmaceutical companies to fuel our expanding sales network as well as to provide synergy to our existing organic product portfolio. TMT has been distributing mainly TPI's own products since its inception in 2009. Since 2010, TPI has signed and later extended distribution contracts with Jiangsu Lianshui Pharmaceutical (“Lianshui”) to distribute Lianshui-branded generic injection products including cough suppressant, antibiotics, anti-inflammatory medicines and other healthcare indications.

Pre-extraction and formulation plant development at Qionglai Facility (QLF)

In preparation for the new GMP standards stipulated by the PRC government in early 2011, TPI initiated a process to optimize the manufacturing facilities and production lines of the Company in compliance with the new GMP standards. We received our current GMP certificate for both of our pre-extraction plant and formulate facilities until December 2015. In addition, under the guidance by provincial government, our facility is scheduled to be relocated to Qionglai County, south of Chengdu, which is designated for the pharmaceutical industry. The relocation project includes our TCM pre-extraction plant. Both the pre-extraction plant and the formulation plant will subsequently be relocated to form a combined QLF, occupying an area of 80 mu (13 acres). The combined QLF, designed and constructed according to the latest GMP standards, is expected to relieve the current capacity saturation at the current facilities. The re-location cost for Phase I, which includes both the pre-extraction and formulation plant is estimated at $25 million, which is to boost the current capacity by at least 30-50%. The Phase II QLF, an additional $10 million may be invested to double the current capacity. By the first quarter of fiscal year 2015, the QLF construction project has been completed. TPI expects to receive the GMP certification at the end of December 2014.

Fiscal 2015 Guidance

The following factors, in our opinion, will influence the Company’s growth perspectives for fiscal year 2015:

| | 1) | Market expansion and revenue growth of TPI’s core product portfolio led by flagship product Gingko Mihuan Oral Liquid (GMOL) and other major products; |

| | 2) | JCM revenue at both domestic and international markets in the fiscal year 2015; |

| | 3) | Generic sale stabilization and recovery along with our strategy to cope with pricing restrictions and market competition under the ongoing healthcare reform; and |

| | 4) | QLF GMP certification/relocation and smooth transition of production capacity. |

We forecast that the organic revenue growth for TPI may range from 5-10% for the fiscal year 2015. Management will continue to evaluate the Company's business outlook and communicate any changes on a quarterly basis or as when appropriate.

Discussion on Operating Results

The following table shows the results of our business. All references to the results of operations and financial conditions are on a consolidated basis that includes Chengdu Tianyin, TMT, JCM and HSP.

Comparison of results for the three months ended September 30, 2014 and 2013:

| | | Three Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2014 | | | 2013 | |

| | | (In $ millions) | |

| Sales | | | 9.7 | | | | 14.7 | |

| Cost of sales | | | 4.7 | | | | 8.8 | |

| Gross profit | | | 5.1 | | | | 6.0 | |

| Income from Operation | | | 1.4 | | | | 2.2 | |

| Provision for income taxes | | | 0.4 | | | | 0.6 | |

| Net income | | | 1.0 | | | | 1.5 | |

Salesfor the quarter ended September 30, 2014 was $9.7 million as compared to $14.7 million for the quarter ended September 30, 2013. The sales decrease was a result of continuous pricing pressure and restrictive sales policies on generic products compared with the same period last year.

Cost of Sales for the quarter ended September 30, 2014 was $4.7 million or 48% of sales, as compared to $8.8 million or 60% of sales for the quarter ended September 30, 2013. Our cost of sales primarily consists of the costs of direct raw materials (85% of the cost of goods sold) and production cost (15% of cost of goods sold). The percentage decrease in our cost of sales from the previous period was mainly attributable to a greater percentage of higher margin products and a decrease of our lower margin generic segment.

Gross Margin for the quarter ended September 30, 2014 was 52% as compared to 40% for the quarter ended September 30, 2013. As discussed above, our gross margin improved, predominately as a result of an increased higher margin products being sold during the period. We see the trend to continue for the rest of fiscal 2015.

Income from Operations was $1.4 million for the quarter ended September 30, 2014, as compared to $2.2 million for the quarter ended September 30, 2013. The decrease of income from operations was mainly due to the amount of research & development costs towards cardiovascular portfolio centered on GMOL.

Net Income was $1.0 million with net margin of 10% for the quarter ended September 30, 2014, as compared to net income of $1.5 million with net margin of 10% for the quarter ended September 30, 2013.

Foreign Currency Translation Adjustment. Our reporting currency is the US dollar. We have evaluated the determination of its functional currency based on the guidance in ASC Topic, “Foreign Currency Matters,” which provides that an entity’s functional currency is the currency of the primary economic environment in which the entity operates; normally, that is the currency of the environment in which an entity primarily generates and expends cash. We have conducted financings in U.S. dollars, paid operating expenses primarily in U.S. dollars, paid dividends to our shareholders of common stock and expect to receive any dividends that may be declared by our subsidiaries in U.S. dollars. Therefore, we have determined that our functional currency is the U.S. dollar based on the expense and financing indicators, in accordance with the guidance in ASC 830-10-85-5. However, the functional currency of our indirectly owned operating subsidiary in China is Renminbi (RMB). Results of operations and cash flow are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Currency translation adjustments are included in accumulated other comprehensive income in the consolidated statement of Comprehensive Income and amounted to $728 and $612,662 for the three months ended September 30, 2014 and 2013, respectively. The balance sheet amounts with the exception of equity as of September 30, 2014 were translated at 6.1576 RMB to 1.00 US dollar as compared to 6.1350 RMB to 1.00 US dollar as of September 30, 2013. The equity accounts were stated at their historical rate. The average translation rates applied to income statement accounts for the quarters ended September 30, 2014 and 2013 were the average exchange rates during the years.

Liquidity and Capital Resources

Discussion of Cash Flow ($ in millions)

| | | For the three months ended

September 30, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Cash provided by (used in) operating activities | | $ | (1.1 | ) | | $ | 0.2 | |

| Cash provided by investing activities | | $ | 0.1 | | | $ | - | |

| Cash provided by (used in) financing activities | | $ | 0.5 | | | $ | (1.6 | ) |

Operating activities

As of September 30, 2014, we had working capital totaling $19.8 million, including cash and cash equivalents of $15.6 million. Net cash used in operating activities was $1.1 million for the three months ended September 30, 2014 as compared with net cash provided by operating activities of $0.2 million for the three months ended September 30, 2013. We believe that TPI is adequately funded to meet all of our working capital and capital expenditure needs for fiscal year 2015.

Investing activities

We had $0.1 million and zero cash provided by investing activities for the three months ended September 30, 2014 and 2013, respectively. We do not expect further investing activities in construction upon the completion of the QLF.

Financing Activities

Net cash provided by financing activities for the three months ended September 30, 2014, totaled $0.5 million as compared to net cash used in financing activities for the same period of 2013 of $1.6 million.

Borrowings and Credit Facilities

The short-term bank borrowings outstanding as of September 30, 2014 and 2013 were $4.5 million and $4.3 million, respectively. We paid an average interest rate of 7.20% and 6.927% per annum in 2014 and 2013, respectively. These loans were made from CITIC Bank, secured by Chengdu Tianyin's certificate of deposit and guaranteed by Guoqing Jiang, our CEO. The loans do not contain any additional financial covenants or restrictions. The borrowings have one-year terms which do not contain specific renewal terms.

Changes in Equity

During the three months ended September 30, 2014, there have been no activities related to warrants exercise or option exercises.

Critical Accounting Policies and Estimates

Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in our Annual Report on Form 10-K for the year ended June 30, 2014, for disclosures regarding TPI’s critical accounting policies and estimates, as well as updates further disclosed in our interim financial statements as described in this Form 10-Q.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Others

While Inflation is not often expected to impact significantly on our operations, we could realize inflationary pressures that could increase our costs which we may not be able to pass onto our customers as a result of costs controls that could be affected by governmental healthcare pricing initiatives and policies.

Item 3. Quantitative and Qualitative Disclosure About Market Risk

Not applicable

Item 4. Controls and Procedures

(a) Evaluation of disclosure controls and procedures

We maintain disclosure controls and procedures designed to provide reasonable assurance that material information required to be disclosed by us in the reports we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that the information is accumulated and communicated to our management, as appropriate to allow timely decisions regarding required disclosure. We performed an evaluation, under the supervision and with the participation of our management, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Based on this evaluation, our management has concluded as of June 30, 2014 and as of September 30, 2014, due to the existence of material weaknesses, that our disclosure controls and procedures were not effective in ensuring that information required to be disclosed in reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified by the Securities and Exchange Commission, and were not effective in providing reasonable assurance that information required to be disclosed by the Company in such reports is accumulated and communicated to the Company’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

We do not expect that our disclosure controls and procedures will prevent all errors and all instances of fraud. Disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met. Further, the design of disclosure controls and procedures must reflect the fact that there are resource constraints, and the benefits must be considered relative to their costs. Because of the inherent limitations in all disclosure controls and procedures, no evaluation of disclosure controls and procedures can provide absolute assurance that we have detected all our control deficiencies and instances of fraud, if any. The design of disclosure controls and procedures also is based partly on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

(b) Changes in internal control over financial reporting

There were no changes in our internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fiscal quarter covered by this report that has materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. We are not aware of any pending or threatened legal proceeding that, if determined in a manner adverse to us, could have a material adverse effect on our business and operations.

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds (a) Not applicable. (b) Not applicable. (c) Not applicable. |

| ITEM 3. | Defaults upon Senior Securities (a) Not Applicable. (b) Not Applicable. |

| ITEM 4. | Mine Safety Disclosures |

Not applicable.

| ITEM 5. | OTHER INFORMATION (a) Not applicable. (b) Not applicable. |

(a) The following exhibits are filed as part of this report.

| Exhibit No. | | Document |

| | | |

| 3.1 | | Articles of Incorporation, as amended (Incorporated by reference to Exhibit 3.1 to our Annual Report on Form 10-K filed on September 29, 2008). |

| | | |

| 3.2 | | Bylaws (Incorporated by reference to Exhibit 3.2 to our Annual Report on Form 10-K filed on September 29, 2008). |

| | | |

| 31.1 | | Certification of Chief Executive Officer required by Rule 13a-14/15d-14(a) under the Exchange Act (Filed herewith) |

| | | |

| 31.2 | | Certification of Chief Accounting Officer required by Rule 13a-14/15d-14(a) under the Exchange Act (Filed herewith) |

| | | |

| 32.1 | | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Filed herewith) |

| | | |

| 32.2 | | Certification of Acting Chief Accounting Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Filed herewith) |

| | | |

| 101 | | Interactive Data Files (Filed herewith) |

| 101.SCH | | XBRL Taxonomy Extension Schema Document |

| 101.SCH | | XBRL Taxonomy Extension Schema Document |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.LAB | | XBRL Taxonomy Extension Labels Linkbase Document |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 10-Q for the quarter ended September 30, 2014 to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 31, 2014

| TIANYIN PHARMACEUTICAL CO., INC. |

| |

| By: | /s/ Dr. Guoqing Jiang | |

| Name: | Dr. Guoqing Jiang | |

| Title : | Chairman, Chief Executive Officer,

Chief Accounting Officer | |

| By: | /s/ Dr. James Jiayuan Tong | |

| Name: | Dr. James Jiayuan Tong | |

| Title : | Chief Financial Officer, | |

| | Director | |

17