Exhibit 99.1

HIGHLIGHTS

| | | | | | |

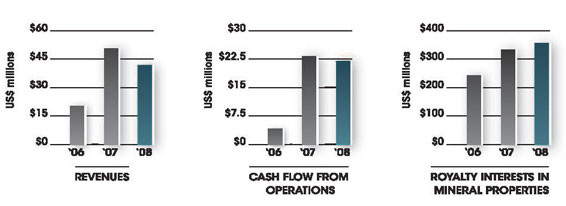

| (expressed in thousands of US$) | | 2008 | | 2007 | | 2006 |

| Revenues | $ | 41,719 | $ | 50,706 | $ | 20,346 |

| Earnings | | | | | | |

| from Operations | $ | 2,362 | $ | 19,126 | $ | 4,277 |

| Dividends | $ | 2,747 | $ | 2,027 | $ | 0 |

| Cash Flow | | | | | | |

| from Operations | $ | 22,338 | $ | 23,025 | $ | 3,940 |

| | | | | | | |

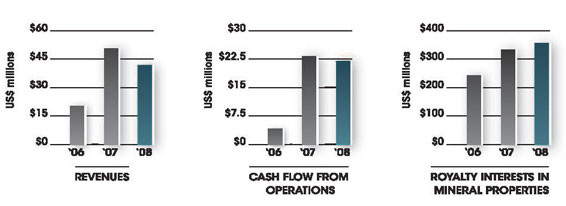

| Total Assets | $ | 376,570 | $ | 384,482 | $ | 262,731 |

| Long-Term Debt | $ | 24,662 | $ | 26,595 | $ | 22,028 |

| Total Liabilities | $ | 79,290 | $ | 88,803 | $ | 88,248 |

| Shareholders’ Equity | $ | 297,280 | $ | 295,679 | $ | 174,483 |

DESIGNED FOR THE TIMES

DEAR FELLOW SHAREHOLDERS

We deliberately designed our company to offer a mineral-related investment that would appeal strongly to a broad range of growth investors, but could also withstand any market downturn.

The founders of IRC spent the bulk of their careers in commodity-bust cycles. Because of this experience, we deliberately designed our company to offer a mineral-related investment that would appeal strongly to a broad range of growth investors, but could also withstand any market downturn. Such a company had to have low overhead and high operating margins; we believe our royalty business model achieves these goals. It provides investors access to the mineral commodity world, not through direct investments in producing properties (with their potential exposure to capital and operating cost increases and/or unforeseen environmental liabilities), but in a manner that maximizes upside potential while mitigating downside risk. It may have seemed foolish to have designed this product in the middle of a historic Super Cycle, but our experience provided us with deep perspective in the risks of the minerals industry.

Who would have ever thought that our conservative approach would be tested so quickly? Fueled by the emergence of a global middle class, January began in the midst of history’s greatest commodity Super Cycle. Massive Chinese infrastructure construction seemed to be consuming everything in sight, yet had to aggressively compete with other countries pursuing similar growth plans. The collective demandfor basic materials catapulted commodity prices to record highs. Many resource investors enjoyed massive gains as share prices ran in tandem with rising metal prices. Their investments provided critical capital for new project development and propelled mineral companies’ opportunities, share prices and market capitalizations to stratospheric levels. Speculators, in the form of hedge funds, pension managers and investment banks, brought the markets to a frothy boil. Those of us who have spent the last forty years of our lives trying to earn a living in the mining business had finally reached Nirvana, and there was no sign that our long-awaited good fortune would abate for years to come.

But our moment of joy began to dim in the third quarter. Dark clouds triggered by the sub-prime mortgage crisis began to spread across all investment sectors. Lightning, in the form of Bear Stearns and AIG, brought fear to the markets. That ominous thunderclap which precedes every cataclysmic storm arrived with the collapse of Lehman Brothers. Banks took cover by locking the doors to credit. Investors fled to safety but found they owned leaky portfolios, perforated by the myriad of ways in which aggressive credit and leverage tie to investment returns. Share prices plummeted as redemptions surged and led to a liquidity crisis of

2008 ANNUAL REPORT

Our solid cash flow allows IRC the luxury of being highly selective in new investments.

In such times of economic turmoil, we can confirm that the royalty business is a sound way to circumvent many of the negative aspects of the mining business. Typical royalties offer exposure to changes in commodity prices like ETFs, but also enjoy the added benefits of exploration success, production growth, and mine expansion possibilities. Most importantly, these benefits are received without the royalty owner having to commit additional investment capital to the project. By acquiring royalty positions in many properties, we spread our capital around, thereby diversifying and strengthening our portfolio. Construction of IRC’s royalty suite has been a deliberate effort to take advantage of the many upsides available in our industry while minimizing the downsides.

At the end of 2008, IRC owned 85 royalty interests in 17 commodities spread across 12 countries. Thirty-five of these projects are at the feasibility, development or production stage. Each advanced-stage project royalty that we acquire contributes to our organic growth prospects. During 2008, we acquired eight royalties: the producing Skyline coal royalty, three royalties on the Pinson gold project, and four precious metals royalties from Atna Resources, including the Wolverine silver-gold royalty.

We target our royalty search on low-cost mines as these operations will be the survivors when commodity prices decline. Voisey’s Bay is one of the lowest cost nickel mines in the world, producing nickel for negative cash costs, and serves as our flagship revenue generator. The development-stage Pascua gold project is expected by its operator, Barrick Gold Corporation, to host cash costs during the first years of operations of less than US$50 per ounce.2Our acquisition of a precious metals royalty on the Wolverine zinc project also meets this criteria, with projected cash cost (when in operation) of an estimated US$0.265 per pound zinc (net of by-product credits).3

Despite the metal price collapse during the second half of 2008, early 2009 prices remain above the long-term nickel, copper and cobalt values of US$4.00/lb, $1.00/lb and $15.00/lb, respectively, which we assumed in supporting the Voisey’s Bay royalty acquisition. Similarly, we used a long-term gold price of US$500 per ounce when we purchased the Pascua royalty. We have many other royalties whose acquisition analyses assumed lower long-term prices than what the commodity markets currently offer, thereby providing acceptable rates of return even in today’s depressed marketplace.

We are encouraged that 2009 will see several new sources of royalty revenue for IRC come into production. Inmet is pushing for a first quarter start up of their Las Cruces copper mine in Spain, Wega Mining is commissioning the Belahouro (Inata) gold mine in Burkina Faso, and the Legacy frac sand project is expected to hit its design specifications by June. St Barbara Limited’s Gwalia Deeps gold mine had its first gold pour in December 2008, and we are looking forward to its successful ramp-up and expansion possibilities.

Not all of our investments have weathered this financial crisis. The Avebury nickeloperation in Tasmania and the Meekatharra gold mine in Western Australia have been placed on care and maintenance. We also expect that work on several feasibility-stage projects will be slowed down as capital funding remains tight; we may see their projected commissioning dates extended.

| 1 | “Nickel Industry Cost Study, Data Volume (2000- 2020), Brook Hunt & Associates Ltd. |

| 2 | http://www.barrick.com/Theme/Barrick/files/docs_annualquarterly/2006_AnnualReview_BarrickProjects.pdf |

| 3 | Amended Technical Report on the Wolverine Property – Finlayson District, Yukon, Prepared by Wardrop for Yukon Zinc Corporation October 22, 2007. P.23-19 |

DESIGNED FOR THE TIMES

Our plan has always been to operate IRC on an annual budget less than or equal to no more than approximately one quarter of our revenues (even at depressed metal prices). Therefore, we are continually recharging our acquisition war chest. Because our royalties require no additional capital contributions from us, there are essentially no carrying costs for these assets. Our capital expenditures are virtually all discretionary, and when we elect to purchase a new royalty, we know that we can replace these expended funds in a timely manner. Additionally, we maintain a US$40 million line of credit which we tap judiciously and repay quickly.

Despite a high-margin business model, IRC has not lost its cost discipline. During our annual review process, a critical examination of all aspects of our business led to several hundred thousand dollars worth of G&A cost reductions.

An example of our expense reduction efforts is in the area of travel costs. The combination of fuel surcharges and the airlines reduced

capacity (smaller-size aircraft and cutting back route options), significantly increased our airfare expenses. IRC installed video conferencing capability during 2008 as a positive solution to manage these rising costs. We also encourage our shareholders and other interested parties to rely on our website for reports and information rather than paper copies of IRC documents, reducing both our costs and environmental impact. As another perspective on limiting our carbon footprint, we note that IRC operates with only eleven employees; other companies with revenues similar to IRC’s typically have hundreds of employees.

Going into 2009, our focus will be on the acquisition of royalties on mines currently in production so that we can continue to grow and diversify our revenue base. With the collapse of the equity markets, we are experiencing an acquisition opportunity boom, as mining companies well along in their new project construction activities have run short of funds. Unfortunately for them, this is at a time of depressed equity and log-jammed debt markets. Royalties, however, are an ideal form of mezzanine financing, as creation of a small royalty in return for funding does not dilute the operator’s shareholders, nor does it create the fixed repayment obligation of debt. These unique attributes of a royalty can create the best of both worlds for IRC and the project operators.

Our solid cash flow permits IRC the luxury of being highly selective in making new investments. With the increased cost of equity and debt in 2009’s financial markets, we anticipate achieving higher than normal rates of return on our new acquisitions, despite this period of low metal prices. IRC will continue to prefer long-life (15+ years) projects and focus on mines which have low-cost structures. Approximately half of the known mineral royalties globally are associated with precious metals, so we anticipate that more precious metals royalties will be purchased in the due course of our business, but only if they meet our investment criteria. This approach will position IRC well for the long haul, and should have the realistic potential to turbo-charge our returns when metal prices rise again.

As always, we appreciate and thank all of our fellow shareholders for their continued support, especially during these uniquely difficult global economic times.

Sincerely yours,

Douglas B. Silver

Chairman and CEO

March 10, 2009

2008 ANNUAL REPORT

MANAGEMENT AND BOARD OF DIRECTORS

| | |

| EXECUTIVE OFFICERS | BOARD OF DIRECTORS | |

| |

| DOUGLAS B.SILVER | DOUGLAS B.SILVER | DOUGLAS J.HURST |

| Chairman and Chief Executive Officer | Chairman and Chief Executive Officer | Chairman |

| | | Selkirk Power Corporation |

| PAUL H.ZINK | RENE G.CARRIER | |

| President | IRC Lead Director | GORDON J.BOGDEN |

| | President, Euro American | Managing Partner, |

| RAY W.JENNER | Capital Corporation | Gryphon Partners |

| Chief Financial Officer and Secretary | | |

| | CHRISTOPHER C.DALY | ROBERT W.SCHAFER |

| JAMES A.LYDIC | Chief Financial Officer | Vice President, Business Development |

| Vice President, Business Development | Coordinates Capital Corporation | Hunter Dickinson Inc. |

| |

| DAVID R.HAMMOND,PHD | GORDON J.FRETWELL | COLM ST.ROCH SEVIOUR |

| Vice President, Strategic Planning | Securities Lawyer | Senior Mining Law Partner |

| | Gordon J. Fretwell Law Corp. | Stewart McKelvey Stirling Scales |

| | |

| SHAREHOLDER INFORMATION | | |

| |

| ANNUAL MEETING | LEGAL COUNSEL | STOCK EXCHANGE LISTINGS |

| Wednesday, May 13, 2009 | Fasken Martineau DuMoulin LLP | Toronto Stock Exchange |

| 9:00 am | Toronto, Ontario | (Symbol: IRC) |

| Denver, CO | Dorsey & Whitney LLP | NYSE Alternext U.S. |

| Inverness Hotel and | Denver, Colorado | (Symbol: ROY) |

| Conference Center | | |

| 200 Inverness Drive West | AUDITOR | INVESTOR RELATIONS |

| Englewood, CO 80112 | PricewaterhouseCoopers LLP | Jack Perkins |

| | Vancouver, British Columbia | Phone: (303) 991-9500 |

| CORPORATE HEADQUARTERS | | (800)496-1629 |

| International Royalty Corporation | CANADIAN TRANSFER AGENT/REGISTRAR | jperkins@internationalroyalty.com |

| 10 Inverness Drive East, Suite 104, | CIBC Mellon Trust Company | info@internationalroyalty.com |

| Englewood, Colorado 80112 | Toronto, Ontario | www.internationalroyalty.com |

| Phone: (303) 799-9020 | | |

| Fax: (303) 799-9017 | U.S.TRANSFER AGENT/REGISTRAR | |

| | BNY Mellon Shareowner Services | |

| CANADIAN HEADQUARTERS | Jersey City, New Jersey | |

| Suite 1000 - 888 3rd Street SW | | |

| Calgary, Alberta T2P 5C5 | | |

| Phone: (403) 444-6961 | | |