Exhibit 99.1

November 3, 2020

FOR IMMEDIATE RELEASE

Contact:

Aircastle Advisor LLC

Frank Constantinople, SVP Investor Relations

Tel: +1-203-504-1063

fconstantinople@aircastle.com

Aircastle Reports Financial Results for the Three-Month Period Ended September 30, 2020

Key Financial Metrics for the Three Months ended September 30, 2020

1.Total revenues were $192.4 million

2.Net income of $5.8 million

3.Adjusted EBITDA(1) was $181.1 million

Highlights

1.Issued $650 million of 5.25%, senior unsecured notes due in 2025

2.In September, Moody’s affirmed Aircastle’s senior unsecured debt rating at Baa3

3.For the three months ended September 30, 2020 collections represented approximately 73% of lease rental and direct financing and sales-type lease revenues

4.Agreements in place to sell 21 narrow body aircraft as they come off lease

Liquidity

5.As of October 30, 2020, total liquidity of $2.1 billion includes $1.25 billion of undrawn credit facilities, unrestricted cash of $432 million, $120 million of contracted asset sales, and $340 million of projected operating cash flows through October 30, 2021

6.226 unencumbered aircraft with a net book value of $5.5 billion

7.$771 million of total adjusted contractual commitments through October 30, 2021; includes $500 million of notes due in March 2021

Refer to the selected financial information accompanying this press release for a reconciliation of GAAP to Non-GAAP numbers.

Mike Inglese, Aircastle’s Chief Executive Officer, commented, “We are optimistic about the eventual recovery of global aviation and the global airline industry. While it is impossible to predict the timing of recovery, we are confident passengers will return, and we are confident about the increasingly important role operating leasing will play in facilitating the industry’s recovery.”

Mr. Inglese continued, “Aircastle’s fleet of predominantly mid-age, single-aisle, fuel efficient aircraft represents a strong value proposition for capital constrained, sensibly managed airlines around the globe. Our management team is deep and experienced, and we enjoy the strong shareholder support of Marubeni Corporation and Mizuho

Leasing. Driven by our strategic ownership, management’s track record, minimal forward commitments, strong liquidity and conservative balance sheet, Aircastle’s investment grade credit rating was recently affirmed at Baa3 by Moody’s.”

Aviation Assets

As of September 30, 2020, Aircastle owned 262 aircraft and other flight equipment having a net book value of $7.0 billion. We also manage nine aircraft with a net book value of $318 million dollars on behalf of our joint venture with Mizuho Leasing.

| | | | | | | | | | | | | | | | | | | | | | | |

| Owned Aircraft | As of Sept. 30, 2020(1) | | As of Sept. 30, 2019(1) |

| Net Book Value of Flight Equipment ($ mils.) | $ | 7,041 | | | $ | 7,735 | |

| Net Book Value of Unencumbered Flight Equipment ($ mils.) | $ | 5,456 | | | $ | 5,873 | |

| Number of Aircraft | 262 | | | 268 | |

| Number of Unencumbered Aircraft | 226 | | | 226 | |

| Number of Lessees | 81 | | | 87 | |

| Number of Countries | 45 | | | 48 | |

Weighted Average Fleet Age (years)(2) | 10.4 | | | 9.8 | |

Weighted Average Remaining Lease Term (years)(2) | 4.2 | | | 4.8 | |

Weighted Average Fleet Utilization for the quarter ended(3) | 93.8 | % | | 98.8 | % |

| | | |

| Managed Aircraft on behalf of Joint Ventures | | | |

| Net Book Value of Flight Equipment ($ mils.) | $ | 318 | | | $ | 331 | |

| Number of Aircraft | 9 | | | 9 | |

_______________

(1)Calculated using net book value of flight equipment held for lease and net investment in leases at period end.

(2)Weighted by net book value.

(3)Aircraft on-lease days as a percent of total days in period weighted by net book value. The decrease from our historical utilization rate was primarily due to the early termination of leases.

Deferrals

In the current environment airlines have sought support from their lessor partners. These requests have generally come in the form of payment deferrals and lease restructurings. Through mid-October, forty-three airlines across the globe have either entered bankruptcy proceedings or completely ceased or suspended operations. We are confident that the major US and global carriers, as well as the largest low-cost carriers, have the means to survive the crisis. We also anticipate that there will be further airline bankruptcies and liquidations in the winter.

We continue to grant deferrals to help certain clients manage through the crisis. As of October 30, 2020, we had executed documents or had approved deferral arrangements with 40 lessees representing approximately 50% of our customer base. The amount deferred currently approximates $101 million, including $80 million that appear in our September 30, 2020 Consolidated Balance Sheet. This represented approximately 14% of our reported lease rental and direct financing and sales-type lease revenues for the trailing twelve months ended September 30, 2020.

New Fiscal Year End

Aircastle previously announced that we changed our fiscal year end to the twelve-month period ending on the last day in February. This change better aligns our financial reporting with the financial reporting cycle of our shareholders, Marubeni Corporation and Mizuho Leasing Company, Limited. To assist investors with the

transition to the new fiscal year, we expect to file a Transition Report on Form 10-Q with the Securities Exchange Commission for the two-month period ending February 29, 2020.

Conference Call

In connection with this press release, management will host a conference call on Thursday, November 12, 2020, at 10:00 A.M. Eastern time. All interested parties are welcome to participate on the live call. The conference call can be accessed by dialing (800) 437-2398 (from within the U.S. and Canada) or (786) 204-3966 (from outside of the U.S. and Canada) ten minutes prior to the scheduled start and referencing the passcode “2739140”.

A simultaneous webcast of the conference call will be available to the public on a listen-only basis at www.aircastle.com. Please allow extra time prior to the call to visit the site and download the necessary software required to listen to the internet broadcast.

For those who are not available to listen to the live call, a replay will be available until 11:30 A.M. Eastern time on Saturday, December 12, 2020, by dialing (888) 203-1112 (from within the U.S. and Canada) or (719) 457-0820 (from outside of the U.S. and Canada); please reference passcode “2739140”.

About Aircastle Limited

Aircastle Limited acquires, leases and sells commercial jet aircraft to airlines throughout the world. As of September 30, 2020, Aircastle owned and managed on behalf of its joint ventures 271 aircraft leased to 81 customers located in 45 countries.

Safe Harbor

All statements in this press release, other than characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not necessarily limited to, statements relating to our proposed public offering of notes and our ability to acquire, sell, lease or finance aircraft, raise capital, pay dividends, and increase revenues, earnings, EBITDA and Adjusted EBITDA and the global aviation industry and aircraft leasing sector. Words such as "anticipates," "expects," "intends," "plans," "projects," "believes," "may," "will," "would," "could," "should," "seeks," "estimates" and variations on these words and similar expressions are intended to identify such forward-looking statements. These statements are based on our historical performance and that of our subsidiaries and on our current plans, estimates and expectations and are subject to a number of factors that could lead to actual results materially different from those described in the forward-looking statements; Aircastle can give no assurance that its expectations will be attained. Accordingly, you should not place undue reliance on any such forward-looking statements which are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of this press release. These risks or uncertainties include, but are not limited to, those described from time to time in Aircastle's filings with the SEC and previously disclosed under "Risk Factors" in Item 1A of Aircastle's 2019 Annual Report on Form 10-K and in our Form 10-Q for the quarterly period ended March 31, 2020. In addition, new risks and uncertainties emerge from time to time, and it is not possible for Aircastle to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Such forward-looking statements speak only as of the date of this press release. Aircastle expressly disclaims any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances.

Aircastle Limited and Subsidiaries

Consolidated Balance Sheets

(Dollars in thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2020 | | December 31, 2019 |

| (Unaudited) | | |

| ASSETS | | | |

| Cash and cash equivalents | $ | 383,920 | | | $ | 140,882 | |

| Restricted cash and cash equivalents | 5,342 | | | 14,561 | |

| Accounts receivable | 69,655 | | | 18,006 | |

| Flight equipment held for lease, net of accumulated depreciation of $1,895,914 and $1,501,664, respectively | 6,725,615 | | | 7,375,018 | |

| Net investment in leases, net of allowance for credit losses of $2,948 and $0, respectively | 315,879 | | | 419,396 | |

| Unconsolidated equity method investments | 35,055 | | | 32,974 | |

| Other assets | 284,507 | | | 201,209 | |

| Total assets | $ | 7,819,973 | | | $ | 8,202,046 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES | | | |

| Borrowings from secured financings, net of debt issuance costs and discounts | $ | 949,181 | | | $ | 1,129,345 | |

| Borrowings from unsecured financings, net of debt issuance costs and discounts | 4,128,133 | | | 3,932,491 | |

| Accounts payable, accrued expenses and other liabilities | 167,059 | | | 172,114 | |

| Lease rentals received in advance | 55,518 | | | 108,060 | |

| Security deposits | 85,714 | | | 124,954 | |

| Maintenance payments | 592,941 | | | 682,398 | |

| Total liabilities | 5,978,546 | | | 6,149,362 | |

| | | |

| Commitments and Contingencies | | | |

| | | |

| SHAREHOLDERS’ EQUITY | | | |

| Preference shares, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding | — | | | — | |

| Common shares, $0.01 par value, 250,000,000 shares authorized, 14,048 shares issued and outstanding at September 30, 2020; and 75,122,129 shares issued and outstanding at December 31, 2019 | — | | | 751 | |

| Additional paid-in capital | 1,485,777 | | | 1,446,664 | |

| Retained earnings | 355,650 | | | 605,269 | |

| Total shareholders’ equity | 1,841,427 | | | 2,052,684 | |

| Total liabilities and shareholders’ equity | $ | 7,819,973 | | | $ | 8,202,046 | |

The preliminary financial information presented in this press release has not been reviewed by an independent registered public accounting firm because, due to the change of Aircastle’s fiscal year-end to the last day in February, the quarterly period no longer ends on September 30, 2020.

Aircastle Limited and Subsidiaries

Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Revenues: | | | | | | | |

| Lease rental revenue | $ | 152,323 | | | $ | 203,005 | | | $ | 523,623 | | | $ | 577,062 | |

| Direct financing and sales-type lease revenue | 4,744 | | | 8,229 | | | 16,047 | | | 24,993 | |

| Amortization of lease premiums, discounts and incentives | (5,355) | | | (5,895) | | | (17,455) | | | (16,951) | |

| Maintenance revenue | 37,720 | | | 11,095 | | | 156,440 | | | 54,063 | |

| Total lease revenue | 189,432 | | | 216,434 | | | 678,655 | | | 639,167 | |

| Gain (loss) on sale of flight equipment | (232) | | | 13,083 | | | 26,538 | | | 25,431 | |

| Other revenue | 3,162 | | | 7,348 | | | 25,119 | | | 9,610 | |

| Total revenues | 192,362 | | | 236,865 | | | 730,312 | | | 674,208 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Depreciation | 86,942 | | | 90,997 | | | 264,764 | | | 265,310 | |

| Interest, net | 57,492 | | | 65,261 | | | 175,225 | | | 195,101 | |

| Selling, general and administrative (including non-cash share-based payment expense of $0 and $3,300 for the three months ended, and $38,727 and $9,203 for the nine months ended September 30, 2020 and 2019, respectively) | 13,977 | | | 17,956 | | | 89,923 | | | 54,273 | |

| Impairment of flight equipment | 19,464 | | | — | | | 362,209 | | | 7,404 | |

| Maintenance and other costs | 3,259 | | | 7,250 | | | 12,256 | | | 19,867 | |

| Total operating expenses | 181,134 | | | 181,464 | | | 904,377 | | | 541,955 | |

| | | | | | | |

| Other expense: | | | | | | | |

| Loss on extinguishment of debt | — | | | (7,577) | | | (4,020) | | | (7,577) | |

| Merger expenses | (405) | | | — | | | (32,835) | | | — | |

| Other | (175) | | | (258) | | | (286) | | | (4,229) | |

| Total other expense | (580) | | | (7,835) | | | (37,141) | | | (11,806) | |

| | | | | | | |

| Income (loss) from continuing operations before income taxes and earnings of unconsolidated equity method investments | 10,648 | | | 47,566 | | | (211,206) | | | 120,447 | |

| Income tax provision | 5,482 | | | 5,505 | | | 10,302 | | | 14,595 | |

| Earnings of unconsolidated equity method investments, net of tax | 605 | | | 1,274 | | | 2,081 | | | 3,405 | |

| Net income (loss) | $ | 5,771 | | | $ | 43,335 | | | $ | (219,427) | | | $ | 109,257 | |

| | | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Net derivative loss reclassified into earnings | — | | | — | | | — | | | 184 | |

| Other comprehensive income | — | | | — | | | — | | | 184 | |

| Total comprehensive income (loss) | $ | 5,771 | | | $ | 43,335 | | | $ | (219,427) | | | $ | 109,441 | |

The preliminary financial information presented in this press release has not been reviewed by an independent registered public accounting firm because, due to the change of Aircastle’s fiscal year-end to the last day in February, the quarterly period no longer ends on September 30, 2020.

Aircastle Limited and Subsidiaries

Consolidated Statements of Cash Flows

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (219,427) | | | $ | 109,257 | |

| Adjustments to reconcile net income (loss) to net cash and restricted cash provided by operating activities: | | | |

| Depreciation | 264,764 | | | 265,310 | |

| Amortization of deferred financing costs | 10,472 | | | 10,778 | |

| Amortization of lease premiums, discounts and incentives | 17,455 | | | 16,951 | |

| Deferred income taxes | 6,961 | | | 10,513 | |

| Non-cash share-based payment expense | 38,727 | | | 9,203 | |

| Cash flow hedges reclassified into earnings | — | | | 184 | |

| Collections on net investment in leases | 15,537 | | | 17,260 | |

| Security deposits and maintenance payments included in earnings | (155,940) | | | (37,281) | |

| Gain on sale of flight equipment | (26,538) | | | (25,431) | |

| Loss on extinguishment of debt | 4,020 | | | 7,577 | |

| Impairment of flight equipment | 362,209 | | | 7,404 | |

| Provision for credit losses | 4,777 | | | — | |

| Other | (2,102) | | | 641 | |

| Changes in certain assets and liabilities: | | | |

| Accounts receivable | (52,719) | | | (11,994) | |

| Other assets | (52,723) | | | 2,437 | |

| Accounts payable, accrued expenses and other liabilities | (8,310) | | | (2,118) | |

| Lease rentals received in advance | (54,990) | | | 12,398 | |

| Net cash and restricted cash provided by operating activities | 152,173 | | | 393,089 | |

| Cash flows from investing activities: | | | |

| Acquisition and improvement of flight equipment | (55,209) | | | (892,186) | |

| Proceeds from sale of flight equipment | 157,507 | | | 229,061 | |

| Aircraft purchase deposits and progress payments, net of returned deposits and aircraft sales deposits | (8,327) | | | 15,829 | |

| Unconsolidated equity method investments and associated costs | — | | | (15,176) | |

| Other | (650) | | | 3,539 | |

| Net cash and restricted cash provided by (used in) investing activities | 93,321 | | | (658,933) | |

| Cash flows from financing activities: | | | |

| Repurchase of shares | (27,906) | | | (21,297) | |

| Parent contribution at Merger | 25,536 | | | — | |

| Proceeds from secured and unsecured debt financings | 1,293,871 | | | 2,066,848 | |

| Repayments of secured and unsecured debt financings | (1,283,928) | | | (1,637,269) | |

| Debt extinguishment costs | (2,750) | | | (7,183) | |

| Deferred financing costs | (6,205) | | | (13,711) | |

| Security deposits and maintenance payments received | 70,492 | | | 147,490 | |

| Security deposits and maintenance payments returned | (56,760) | | | (99,109) | |

| Dividends paid | (24,025) | | | (67,444) | |

| Net cash and restricted cash (used in) provided by financing activities | (11,675) | | | 368,325 | |

| Net increase in cash and restricted cash: | 233,819 | | | 102,481 | |

| Cash and restricted cash at beginning of period | 155,443 | | | 167,853 | |

| Cash and restricted cash at end of period | $ | 389,262 | | | $ | 270,334 | |

The preliminary financial information presented in this press release has not been reviewed by an independent registered public accounting firm because, due to the change of Aircastle’s fiscal year-end to the last day in February, the quarterly period no longer ends on September 30, 2020.

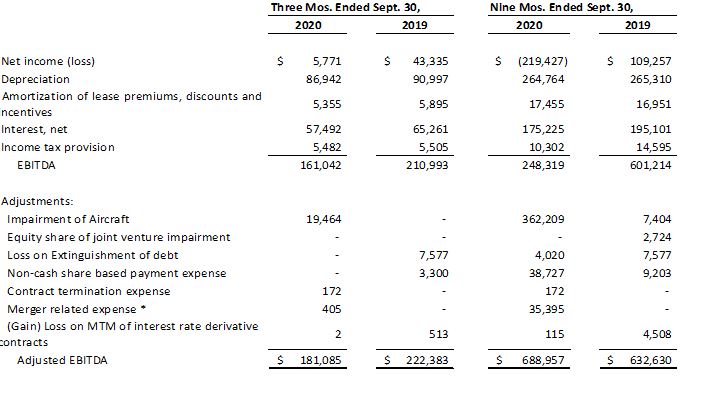

Aircastle Limited and Subsidiaries

Reconciliation of GAAP to non-GAAP Measures

EBITDA and Adjusted EBITDA Reconciliation

(Dollars in thousands)

(Unaudited)

* Included $32.8 million in Other expense and $2.6 million in Selling, general and administrative expenses.

We define EBITDA as income (loss) from continuing operations before income taxes, interest expense, and depreciation and amortization. We use EBITDA to assess our consolidated financial and operating performance, and we believe this non-U.S. GAAP measure is helpful in identifying trends in our performance.

This measure provides an assessment of controllable expenses and affords management the ability to make decisions which are expected to facilitate meeting current financial goals, as well as achieving optimal financial performance. It provides an indicator for management to determine if adjustments to current spending decisions are needed.

EBITDA provides us with a measure of operating performance because it assists us in comparing our operating performance on a consistent basis as it removes the impact of our capital structure (primarily interest charges on our outstanding debt) and asset base (primarily depreciation and amortization) from our operating results. Accordingly, this metric measures our financial performance based on operational factors that management can impact in the short-term, namely the cost structure, or expenses, of the organization. EBITDA is one of the metrics used by senior management and the Board of Directors to review the consolidated financial performance of our business.

We define Adjusted EBITDA as EBITDA (as defined above) further adjusted to give effect to adjustments required in calculating covenant ratios and compliance as that term is defined in the indenture governing our senior unsecured notes. Adjusted EBITDA is a material component of these covenants.

The preliminary financial information presented in this press release has not been reviewed by an independent registered public accounting firm because, due to the change of Aircastle’s fiscal year-end to the last day in February, the quarterly period no longer ends on September 30, 2020.