UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended:March 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No.333-134287

CHINA INTERACTIVE EDUCATION, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0643339 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Block C, Zhennan Road, South District

Zhongshan City, Guangdong Province

People’s Republic of China

(Address of principal executive offices)

(86) 0760-2819888

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The number of shares outstanding of each of the issuer’s classes of common equity, as of May 19, 2010, is as follows:

| Class of Securities | Shares Outstanding |

| Common Stock, $0.0001 par value | 65,000,000 |

EXPLANATORY NOTE

China Interactive Education, Inc. (the "Company") is filing this Quarterly Report on Form 10-Q/A (the "Form 10-Q/A") to amend its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2010, filed with the Securities and Exchange Commission (the "SEC") on May 24, 2010 (the Original Filing") in order to correct certain errors in the Company's Financial Statements included in the Original Filing and to make corresponding changes under the Results of Operations heading.

Except as described above, no other changes have been made to the Original Filing, and this Form 10-Q/A does not modify or update any other information in the Original Filing. Information not affected by the changes described above is unchanged and reflects the disclosures made at the time of the Original Filing. Accordingly, this Form 10-Q/A should be read in conjunction with our filings made with the Securities and Exchange Commission subsequent to the date of the Original Filing.

TABLE OF CONTENTS

| PART I | FINANCIAL INFORMATION. | |

| ITEM 1. | FINANCIAL STATEMENTS | 3 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 19 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. | 25 |

| ITEM 4. | CONTROLS AND PROCEDURES. | 25 |

| | | |

| PART II | OTHER INFORMATION | |

| ITEM 1. | LEGAL PROCEEDINGS. | 26 |

| ITEM 1A. | RISK FACTORS. | 26 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. | 26 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES. | 26 |

| ITEM 4. | (REMOVED AND RESERVED). | 26 |

| ITEM 5. | OTHER INFORMATION. | 26 |

| ITEM 6. | EXHIBITS. | 26 |

PART I

FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS.

CHINA INTERACTIVE EDUCATION, INC.

(FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.)

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| | Page(s) |

| Condensed Consolidated Balance Sheets | 1 |

| Condensed Consolidated Statements of Operation and Comprehensive Income | 2 |

| Condensed Consolidated Statements of Cash Flows | 3 |

| Condensed Consolidated Statements of Stockholders’ Equity | 4 |

| Notes to Consolidated Financial Statements | 5-15 |

- 3 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (AMOUNTS EXPRESSED IN US DOLLAR) |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | $ | 180,762 | | $ | 351,544 | |

Accounts receivable, net of allowance of $710,828

(unaudited) and nil as of March 31, 2010 and December 31,

2009 respectively | |

8,437,780 | | |

11,006,809 | |

| Inventories | | 2,240,470 | | | 1,152,365 | |

| Deposits, prepayment and other receivables | | 1,171,525 | | | 656,236 | |

| | | | | | | |

| Total current assets | | 12,030,537 | | | 13,166,954 | |

| | | | | | | |

| Other Assets | | | | | | |

| Property, plant and equipment, net | | 441,332 | | | 402,897 | |

| Intangible assets, net | | 529,702 | | | 581,604 | |

| | | | | | | |

| Total assets | $ | 13,001,571 | | $ | 14,151,455 | |

| | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| Current Liabilities | | | | | | |

| Accounts payable | $ | 4,082,595 | | $ | 4,687,232 | |

| Other payables and accrued expenses | | 251,032 | | | 160,449 | |

| Advances from customers | | 641,030 | | | 255,852 | |

| Value added and other taxes payable | | 1,900,253 | | | 1,737,623 | |

| Income tax payable | | 850,197 | | | 742,937 | |

| Due to related parties | | 964,829 | | | 1,357,954 | |

| | | | | | | |

| Total current liabilities | | 8,689,936 | | | 8,942,047 | |

| | | | | | | |

| Total liabilities | | 8,689,936 | | | 8,942,047 | |

| | | | | | | |

| Commitments and Contingencies (Note 13) | | | | | | |

| | | | | | | |

| Shareholders’ Equity | | | | | | |

Preferred stock, $0.001 par, 10,000,000 shares authorized;

none issued and outstanding | |

- | | |

- | |

Common stock, $0.001 par, 200,000,000 shares authorized,

65,000,000 shares issued and outstanding | |

65,000 | | |

65,000 | |

| Additional paid in capital | | 1,128,000 | | | 1,128,000 | |

| Retained earnings | | 2,499,624 | | | 3,540,507 | |

| Statutory reserve | | 87,884 | | | 87,884 | |

| Accumulated other comprehensive income | | 531,127 | | | 388,017 | |

| | | | | | | |

| Total shareholders’ equity | | 4,311,635 | | | 5,209,408 | |

| | | | | | | |

| Total liabilities and shareholders’ equity | $ | 13,001,571 | | $ | 14,151,455 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

- 4 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATION AND COMPREHENSIVE INCOME |

| (UNAUDITED) |

| (AMOUNTS EXPRESSED IN US DOLLAR) |

| | | For the Three Months Ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| REVENUE | $ | 3,572,989 | | $ | 3,162,404 | |

| Cost of sales | | (2,365,652 | ) | | (1,188,260 | ) |

| Gross profit | | 1,207,337 | | | 1,974,144 | |

| Operating expenses: | | | | | | |

| Selling and promotion expenses | | (2,007,901 | ) | | (38,899 | ) |

| General and administrative expenses | | (240,377 | ) | | (91,610 | ) |

| Research and development expenses | | - | | | (208,573 | ) |

| Total operating expenses | | (2,248,278 | ) | | (339,082 | ) |

| (Loss) income from operations | | (1,040,941 | ) | | 1,635,062 | |

| Bank interest income | | 58 | | | 186 | |

| (Loss) income before income tax | | (1,040,883 | ) | | 1,635,248 | |

| Provision for income tax | | - | | | (287,730 | ) |

| NET (LOSS) INCOME | | (1,040,883 | ) | | 1,347,518 | |

| OTHER COMPREHENSIVE INCOME: | | | | | | |

| Foreign currency translation adjustment | | 143,110 | | | 166,239 | |

| TOTAL COMPREHENSIVE (LOSS) INCOME | $ | (897,773 | ) | $ | 1,513,757 | |

| (Loss) Earning per shares – Basic and diluted | $ | (0.016 | ) | $ | 0.0223 | |

| Weighted average of common shares outstanding | | | | | | |

| Basic and diluted | | 65,000,000 | | | 60,400,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

- 5 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (UNAUDITED) |

| (AMOUNTS EXPRESSED IN US DOLLAR) |

| | | For the Three Months Ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net (loss) income | $ | (1,040,883 | ) | $ | 1,347,518 | |

Adjustments to reconcile net income to cash provided by

operating activities: | |

| | |

| |

| Depreciation of property, plant and equipment | | 23,382 | | | 3,511 | |

| Amortization of intangible assets | | 54,827 | | | 54,817 | |

| Decrease (increase) in assets: | | | | | | |

| Accounts receivable | | 2,594,517 | | | 111,649 | |

| Inventories | | (1,087,469 | ) | | (50,377 | ) |

| Deposits, prepayment and other receivables | | (394,673 | ) | | 88,621 | |

| Increase (decrease) in liabilities: | | | | | | |

| Accounts payable | | (606,280 | ) | | - | |

| Advances from customers | | 384,582 | | | 293,796 | |

| Other payable and accruals | | 90,500 | | | - | |

| Valued added and other taxes payable | | 381,727 | | | | |

| Income tax payable | | (112,709 | ) | | (17,943 | ) |

| Net cash provided by operating activities | | 287,521 | | | 1,831,592 | |

| | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | |

| Purchase of property, plant and equipment | | (61,715 | ) | | (52,876 | ) |

| Purchase of intangible assets | | (3,222 | ) | | - | |

| Repayment from related parties | | 22,017 | | | - | |

| Advance to related parties | | - | | | (243,079 | ) |

| Net cash used in investing activities | | (42,920 | ) | | (295,955 | ) |

| | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | |

| Repayment of advance from directors | | (415,530 | ) | | (1,794,015 | ) |

| Net cash used in financing activities | | (415,530 | ) | | (1,794,015 | ) |

| | | | | | | |

| Effect of foreign currency translation | | 147 | | | (7,857 | ) |

| | | | | | | |

| Decrease in cash and cash equivalents | | (170,782 | ) | | (266,235 | ) |

| | | | | | | |

| Cash and cash equivalents, beginning of period | | 351,544 | | | 440,000 | |

| | | | | | | |

| CASH AND CASH EQUIVALENTS, end of period | $ | 180,762 | | $ | 173,765 | |

| | | | | | | |

| SUPPLEMENTAL DISCLOSURE INFORMATION | | | | | | |

| Interest paid | $ | - | | $ | - | |

| Income tax paid | $ | 112,710 | | $ | - | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

- 6 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY |

| (UNAUDITED) |

| (AMOUNTS EXPRESSED IN US DOLLAR EXCEPT FOR NUMBER OF SHARE) |

| | | | | | | | | | | | | | | | | | Accumulated | | | | |

| | | Ordinary Shares | | | Additional | | | | | | | | | other | | | | |

| | | Number of | | | | | | paid-in | | | Statutory | | | Retained | | | comprehensive | | | | |

| | | shares | | | Amount | | | Capital | | | Reserves | | | Earnings | | | Income | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2009 (Audited) | | 65,000,000 | | $ | 65,000 | | $ | 1,128,000 | | $ | 87,884 | | $ | 3,540,507 | | $ | 388,017 | | $ | 5,209,408 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the three months ended March 31, 2010 | | - | | | - | | | - | | | - | | | (1,040,883 | ) | | - | | | (1,040,883 | ) |

| Foreign currency translation adjustment | | - | | | - | | | - | | | - | | | - | | | 143,110 | | | 143,110 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2010 (Unaudited) | | 65,000,000 | | $ | 65,000 | | $ | 1,128,000 | | $ | 87,884 | | $ | 2,499,624 | | $ | 531,127 | | $ | 4,311,635 | |

The accompanying notes are an integral part of these consolidated financial statements.

- 7 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 1 | DESCRIPTION OF BUSINESS AND ORGANIZATION |

China Interactive Education, Inc (“CIE” or the “Company”) was incorporated in the State of Delaware on August 28, 2000 for the purpose of developing online internet community portals. On December 4, 2009, the Company changed its legal domicile from Delaware to Nevada by merging into a wholly-owned subsidiary, China Interactive Education, Inc., which the Company established in the State of Nevada for the sole purpose of effecting the change of domicile to Nevada, which the Company deeded to be a more favorable jurisdiction with a well recognized body of corporate law and no state income tax. The Company’s name was changed from Find the World Interactive, Inc. to China Interactive Education, Inc. On December 11, 2009, the Company completed a reverse acquisition of MenQ Technology Group Limited (“MenQ”).

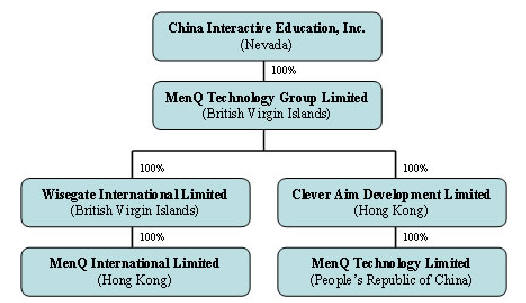

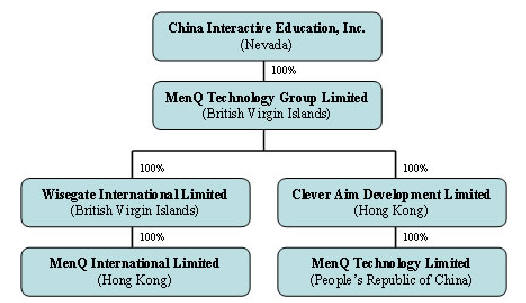

As of March 31, 2010, details of the Company’s wholly-owned subsidiaries are as follows:

| | Place and date of | | |

| Subsidiaries’ names | incorporation | Paid-up capital | Principal activities |

| | | | |

| MenQ Technology Group Limited (“MenQ”) | British Virgin Islands (“BVI”)

July 2, 2009 | $50,000 | Intermediate holding company |

| Wisegate International Limited (“Wisegate”) | BVI

May 30, 2007 | $50,000 | Licensing of a patent of a global positioning systems (GPS) technology and as an intermediate holding company |

| Menq International Limited (“MenQ HK”) | Hong Kong

July 28, 2006 | HK$10,000 | Development and sales of electronic products |

| Clever Aim Development Limited (“Clever Aim”) | Hong Kong

August 3, 2009 | HK$10,000 | Intermediate holding company |

| MenQ Technology Limited (“MenQ China”) | People’s Republic of China (“PRC”)

December 25, 2008 | RMB1,000,000 | Development and sales of electronic learning products |

Reverse Acquisition

On December 11, 2009, the Company entered into a share exchange agreement (“Share Exchange Agreement”) under which the Company issued 60,400,000 shares of the Company, to the sole shareholder of MenQ in exchange for all the issued and outstanding shares of MenQ (the “Share Exchange”). Immediately following the Share Exchange, the shareholder of MenQ owned approximately 92.9% of the Company’s total issued and outstanding share capital on an as-if converted and fully-diluted basis.

As a result, the Share Exchange has been accounted for as a reverse acquisition using the purchase method of accounting, whereby MenQ is deemed to be the accounting acquirer and the CIE to be the accounting acquiree. The financial statements before the date of Share Exchange are those of MenQ with the results of CIE being consolidated from the date of Share Exchange. The equity section and the earnings per share have been retroactively restated to reflect the reverse acquisition and no goodwill has been recorded.

MenQ Technology Group Limited (“MenQ”) is a company incorporated with limited liability on July 2, 2009 in the British Virgin Islands, with a registered and paid up capital of $50,000.

On September 8, 2009, the Company changed its name from Mighty Genius Holdings Limited to MenQ Technology Group Limited.

- 8 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 1 | DESCRIPTION OF BUSINESS AND ORGANIZATION (CONTINUED) |

MenQ of its own has not carried out any substantive operations except for investment holding. Through its wholly-owned subsidiaries, MenQ primarily engages in the development and sales of electronic products based on a computer programming technology.

Since their incorporation, 100% of the equity interests in Wisegate and Clever Aim have always been held by MenQ.

Restructuring

On September 7, 2009, pursuant to a restructuring plan (“Restructuring”), MenQ through Wisegate, acquired 100% equity interests in MenQ HK from Mr. Chen Ruofei and another minority shareholder, who are both PRC residents.

On October 10, 2009, also pursuant to the Restructuring, MenQ through Clever Aim, acquired 100% equity interests in MenQ China from Mr. Chen Ruofei, Mr. Chen Tiannan and other minority shareholders, who are all PRC residents. On October 10, 2009, the local government of the PRC issued the certificate of approval regarding the change in shareholding of MenQ China and its transformation from a PRC domestic company to a wholly-foreign owned enterprise.

On September 21, 2009, as part of the Restructuring, Mr. Chen Ruofei, Mr. Chen Tiannan and other minority shareholders (“MenQ HK and MenQ China Former Shareholders”) through Future Billion Limited (“Future Billion”, a company incorporated in the BVI, established and controlled by MenQ HK and MenQ China Former Shareholders), entered into an option agreement (“Option Agreement”) with Mr. Liu Hai Qi (the “Granter”, the sole legal shareholder and director of MenQ).

Pursuant to the Option Agreement, Future Billion obtained the right and option to acquire all outstanding shares (“Option Shares”) in MenQ at an exercise price of $1 per share during the exercise period of five years commencing on the ninetieth day after the effectiveness of a registration statement under the Securities Act to be filed by a United States public reporting shell company, with which MenQ intends to enter into a share exchange agreement for the purposes of a reverse merger with that shell company.

Pursuant to the Option Agreement, the Granter further agrees, among others, that throughout the exercise period of the Option Agreement, without the prior written approval of Future Billion:

(i) he will not increase the number of authorized shares of the MENQ’s common stock;

(ii) he will keep available the services of current officers and employees of MENQ and its subsidiaries;

(iii) MENQ and its subsidiaries do not declare, accrue, set aside or pay any dividend or make any other distribution, nor do they repurchase, redeem or otherwise reacquire any equity of shares of capital stock or other securities;

(iv) MENQ and its subsidiaries do not sell or otherwise issue any equity, shares of capital stock or any other securities.

The primary purpose of the Option Agreement is to enable MenQ HK and MenQ China Former Shareholders to reacquire ultimate controlling legal ownership of MenQ HK and MenQ China in compliance with regulatory requirements of the PRC.

During and after the Restructuring, there has been no change to the composition of the board of directors of MenQ HK and MenQ China. The boards of directors of MenQ HK and MenQ China have continued to comprise representatives of HK Menq and MenQ China Former Shareholders. Therefore, MenQ HK and MenQ China are still under the same operating and management control of MenQ HK and MenQ China Former Shareholders. As a result of the Option Agreement, MenQ HK and MenQ China Former Shareholders, through Future Billion, continue to bear the residual risks and rewards relating to MenQ HK and MenQ China. As a result, the Restructuring has been accounted for as a recapitalization of MenQ HK and MenQ China with no adjustment to the historical basis of their assets and liabilities. The Restructuring has been accounted for using the "as if" pooling method of accounting and the operations were consolidated as if the Restructuring had occurred as of the beginning of the earliest period presented and the current corporate structure had been in existence throughout the periods covered by these financial statements.

- 9 -

CHINA INTERACTIVE EDUCATION, INC.

(FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

| NOTE 2 | SUMMARIES OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of preparation and consolidation

These interim condensed consolidated financial statements are unaudited. In the opinion of management, all adjustments and disclosures necessary for a fair presentation of these interim condensed consolidated financial statements have been included. The result reported in the condensed consolidated financial statements for any interim periods are not necessarily indicative of the results that may be reported for the entire year. The accompanying condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission and do not include all information and footnotes necessary for a complete presentation of financial statements in conformity with accounting principles generally accepted in the United States. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying footnotes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009.

These condensed consolidated financial statements include the financial statements of CIE and its subsidiaries. All significant inter-company balances or transactions have been eliminated on consolidation.

Research and development expenses

Research and development costs are charged to expense when incurred.

Advertising and promotion costs

The Company expenses advertising and promotion costs as incurred. Advertising and promotion expenses charged to operations were $1,205,748 (unaudited) and $38,899 (unaudited) for the periods ended March 31, 2010 and 2009, respectively.

Shipping and handling cost

Technological products sold by the Company are normally collected by customers at the Company’s premises. During the periods ended March 31, 2010 and 2009, shipping and handling costs were insignificant.

Foreign Currency

The Company uses the United States dollars (“U.S. Dollar” or “US$” or “$”) for financial reporting purposes. The PRC subsidiaries within the Company maintain their books and records in their functional currency, Chinese Renminbi (“RMB”) and Hong Kong dollars (“HK$), being the lawful currency in the PRC and Hong Kong. Assets and liabilities are translated into US Dollars using the applicable exchange rates prevailing at the balance sheet date. Items on the statement of operations are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements are based on the rates as published on the website of People’s Bank of China and are as follows:-

| | As of March 31, 2010 | As of December 31, 2009 |

| Balance sheet items, except for equity accounts | US$1=RMB6.8259 | US$1=RMB6.8282 |

| | US$1=HK$7.7642 | US$1=HK$7.7850 |

| | Period ended March 31, |

| | 2010 | 2009 |

| Items in the statements of income and cash flows | US$1=RMB6.8270 | US$1=RMB6.8283 |

| | US$1=HK$7.7746 | US$1=HK$7.7417 |

No representation is made that the RMB amounts could have been, or could be, converted into U.S. dollars at the above rates.

- 10 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 2 | SUMMARIES OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Foreign Currency - continued

The value of RMB against U.S. dollars and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of RMB may materially affect the Company’s financial condition in terms of U.S. dollar reporting.

Fair value

ASC Topic 820,Fair Value Measurement and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. This topic also establishes a fair value hierarchy which requires classification based on observable and unobservable inputs when measuring fair value. There are three levels of inputs that may be used to measure fair value:

| Level1- | Quoted prices in active markets for identical assets or liabilities. |

| Level2- | Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| Level3- | Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

The carrying values of cash and cash equivalents, trade and other receivables and payables, and short-term debts approximate fair values due to their short maturities.

There were no assets and liabilities measured at fair value on a nonrecurring basis as of March 31, 2010 and December 31, 2009.

Recent accounting pronouncements

Effective January 1, 2010, the Company adopted the provisions in ASU 2009-17, “Consolidation (ASC Topic 810): Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities”, which changes how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The adoption of the provisions in ASU 2009-17 did not have an impact on the Company’s consolidated financial statements.

Effective January 1, 2010, the Company adopted ASU 2010-01, “Equity (ASC Topic 505): Accounting for Distributions to Shareholders with Components of Stock and Cash”, which clarifies that the stock portion of a distribution to shareholders that allow them to elect to receive cash or stock with a potential limitation on the total amount of cash that all shareholders can elect to receive in the aggregate is considered a share issuance that is reflected prospectively in earnings per share and is not considered a stock dividend for purposes of ASC Topic 505 and ASC Topic 260. The adoption of the provisions in ASU 2010-01 did not have an impact on the Company’s consolidated financial statements.

Effective January 1, 2010, the Company adopted the provisions in ASU 2010-06, “Fair Value Measurements and Disclosures (ASC Topic 820): Improving Disclosures about Fair Value Measurements, which requires new disclosures related to transfers in and out of levels 1 and 2 and activity in level 3 fair value measurements, as well as amends existing disclosure requirements on level of disaggregation and inputs and valuation techniques. The adoption of the provisions in ASU 2010-06 did not have an impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s Consolidated Financial Statements upon adoption.

- 11 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 3 | ACCOUNTS RECEIVABLE, NET |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| Accounts receivable | $ | 9,148,608 | | $ | 11,006,809 | |

| Less: Allowance for doubtful accounts | | (710,828 | ) | | | |

| | | | | | | |

| Accounts receivable, net | $ | 8,437,780 | | $ | 11,006,809 | |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| Raw materials | $ | 1,142,674 | | $ | 566,125 | |

| Work in progress | | 212,578 | | | 246,152 | |

| Finished goods | | 885,218 | | | 340,088 | |

| | | | | | | |

| Total | $ | 2,240,470 | | $ | 1,152,365 | |

| NOTE 5 | DEPOSITS, PREPAYMENT AND OTHER RECEIVABLES |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| Deposits and prepayment | | 1,098,851 | | | 603,636 | |

| Other receivables, net of $nil allowance | | 72,674 | | | 52,600 | |

| | | | | | | |

| Total | $ | 1,171,525 | | $ | 656,236 | |

- 12 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 6 | PROPERTY, PLANT AND EQUIPMENT, NET |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| Furniture, fixtures and equipment | $ | 59,200 | | $ | 59,058 | |

| Leasehold improvement | | 132,524 | | | 132,479 | |

| Motor vehicles | | 213,384 | | | 151,729 | |

| Plant and machinery | | 98,626 | | | 98,582 | |

| | | | | | | |

| Total cost | | 503,734 | | | 441,848 | |

| Less: Accumulated depreciation and amortization | | (62,402 | ) | | (38,951 | ) |

| | | | | | | |

| Net | $ | 441,332 | | $ | 402,897 | |

Depreciation expenses in aggregate for the periods ended March 31, 2010 and 2009 were $23,382 and $3,511 respectively.

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| Exclusive rights to computer programming technology | $ | 1,099,471 | | $ | 1,096,361 | |

| Less: Accumulated amortization | | (569,769 | ) | | (514,757 | ) |

| | | | | | | |

| Net | $ | 529,702 | | $ | 581,604 | |

Each of the exclusive rights has a term of five years and relates to a computer programming technology under several patents based on which the Company develops its electronic products. These exclusive rights were acquired from Mr. Chen Ruofei and Mr. Zhou Yi.

Amortization expenses for the periods ended March 31, 2010 and 2009 were $54,827 and $54,817 respectively.

- 13 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

The Company is subject to income tax on an entity basis on income arising from the tax jurisdiction in which they operate.

CIE is subject to taxes in the U.S.

MENQ, being incorporated the British Virgin Islands (“BVI”) is not subject to any income tax in the BVI.

Wisegate is incorporated in the British Virgin Islands (“BVI”) and is, therefore, not subject to any income tax in the BVI. However, during the three months ended March 31, 2009, Wisegate generated patent license fees and related service revenue from PRC resident enterprises. According to the PRC Income Tax Law on Foreign Invested Enterprises and Foreign Enterprises, which was effective for periods before January 1, 2008, and the PRC Unified Enterprise Income Tax Law, which has been effective from January 1, 2008, the Company is generally subject to a withholding income tax at 20% on its patent license fees and on service revenue generated from PRC resident enterprises. As Wisegate has no permanent establishment within the PRC, it is allowed a reduced withholding income tax rate of 10% according to the relevant regulation on the implementation of the PRC income tax law.

MenQ HK and Clever Aim are Hong Kong-incorporated companies and are, therefore, subject to a Hong Kong profits tax of 16.5% on its income generated from Hong Kong for the three months ended March 31, 2010 and 2009, respectively.

MenQ China is a PRC-registered company is, therefore, subject to PRC income tax at 25% on its income generated from the PRC for the three months ended March 31, 2010 and 2009, respectively.

The Company’s income tax expense consisted of:

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| | | | | | | |

| Current | $ | - | | $ | 287,730 | |

| Deferred | | - | | | - | |

| | | | | | | |

| | $ | - | | $ | 287,730 | |

A reconciliation of the provision for income taxes determined at the US statutory corporate income tax rate to the Company’s effective income tax rate is as follows:

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| | | | | | | |

| Pre-tax (loss) income | $ | (1,040,883 | ) | $ | 1,635,248 | |

| US statutory rate | | 35% | | | 35% | |

| Income tax expense computed at U.S. federal rate | | (364,309 | ) | | 572,337 | |

| Reconciling items: | | | | | | |

| Rate differential for domestic earnings | | 126,333 | | | (148,639 | ) |

| Non-deductible expenses | | 13,178 | | | 179,706 | |

| Loss not recognized as deferred tax assets | | 224,798 | | | - | |

PRC tax concession on non-resident enterprises

without permanent establishment in the PRC | |

- | | |

(287,730 | ) |

| Others | | - | | | (27,944 | ) |

| | | | | | | |

| Effective tax expense | $ | - | | $ | 287,730 | |

- 14 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 8 | INCOME TAXES (CONTINUED) |

Significant components of the net deferred tax assets were as follows:

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| | | | | | | |

| Net operating loss carryforwards | $ | 224,798 | | $ | - | |

| Less: Valuation allowance | | (224,798 | ) | | - | |

| | | | | | | |

| Net deferred tax assets | $ | - | | $ | - | |

As of March 31, 2010 and 2009, valuation allowance of $224,798 and $Nil, respectively, was provided to the deferred tax assets, due to the uncertainty surrounding their realization.

| NOTE 9 | STOCKHOLDER’S EQUITY |

On December 11, 2009, which was the date of the Share Exchange as set out in Note 1, the Company issued 60,400,000 shares of the Company, to the sole shareholder of MenQ in exchange for all the issued and outstanding shares of MenQ.

| NOTE 10 | STATUTORY RESERVES |

In accordance with the PRC Companies Law, the Company’s PRC subsidiaries were required to transfer 10% of their profits after tax, as determined in accordance with accounting standards and regulations of the PRC, to the statutory surplus reserve and a percentage of not less than 5%, as determined by management, of the profits after tax to the public welfare fund. With the amendment of the PRC Companies Law which was effective from January 1, 2006, enterprises in the PRC were no longer required to transfer any profit to the public welfare fund. Any balance of public welfare fund brought forward from December 31, 2005 should be transferred to the statutory surplus reserve. The statutory surplus reserve is non-distributable.

Basic earnings per common share is computed by dividing income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted income per common share is computed similarly to basic income per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potentially dilutive common shares had been issued.

All per share data including earnings per share (EPS) has been retroactively restated to reflect the reverse acquisition on December 11, 2009 whereby the 60,400,000 shares of common stock issued by the Company (nominal acquirer) to the shareholder of CIE (nominal acquiree) are deemed to be the number of shares outstanding for the period prior to the reverse acquisition. For the period after the reverse acquisition, the number of shares considered to be outstanding is the actual number of shares outstanding during that period.

- 15 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 11 | EARNING PER SHARE (CONTINUED) |

The following table is a reconciliation of the net income and the weighted average shares used in the computation of basic and diluted earnings per share for the periods presented:

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| Net (loss) income | $ | (1,040,883 | ) | $ | 1,347,518 | |

| | | | | | | |

| Weighted average number of shares | | | | | | |

| Basic and diluted | | 65,000,000 | | | 60,400,000 | |

| | | | | | | |

| Net (loss) income per share | | | | | | |

| Basic and diluted | $ | (0.016 | ) | $ | 0.0223 | |

| NOTE 12 | RELATED PARTY TRANSACTIONS |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| Amount due to directors: | | | | | | |

| | | | | | | |

- Mr. Chen Ruofei (a)(b), director, Chief Executive Officer

and President of the Company |

$ |

644,462 |

|

$ |

255,318 |

|

| - Mr. Chen Tiannam (a) (b), Chairman of the Company | | 283,205 | | | 1,037,266 | |

| - Mr. Lam Hak Kwun (a), Former director | | 16,652 | | | 65,370 | |

| - Mr. He Wei Dong (a), director of the Company | | 20,510 | | | - | |

| | | | | | | |

| | $ | 964,829 | | $ | 1,357,954 | |

(a) The amounts are unsecured, non-interest bearing and without fixed repayment term.

(b) Mr. Chan Ruofei and Mr. Chen Tiannam are also two of the major shareholders of Future Billion (see Note 1 for further details).

- 16 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

| NOTE 13 | COMMITMENTS AND CONTINGENCIES |

Operating Leases Commitments as of March 31, 2010

In the normal course of business, the Company entered into operating lease agreements to rent office space and plant and equipment. The Company was obligated under operating leases requiring minimum rentals as of March 31, 2010 as follows:

| | | (Unaudited) | |

| Payable within: | | | |

| - 2010 | $ | 73,523 | |

| - 2011 | | 45,972 | |

| - 2012 | | 13,409 | |

| | | | |

| Total minimum lease payments | $ | 132,904 | |

During the periods ended March 31, 2010 and 2009, rental expenses under operating leases amounted to $7,664 and $8,416, respectively.

The lease agreement for plant and equipment expired at May 30, 2010, in accordance with the lease term. The Company is in the progress of negotiating the renewal of lease of this lease as well as a definite plan for the manufacturing process.

Commitments pursuant to a partnership agreement

On May 20, 2009, the Company entered into a three-year term partnership agreement with Beijing Normal University for research and development purposes. Under the partnership agreement, the Company is obligated to pay the requiring research and development expense not less than approximately $147,000 annually.

| NOTE 14 | CONCENTRATION OF RISKS |

Credit risk

As of March 31, 2010 and December 31, 2009, 88% of the Company’s cash included cash on hand and deposits in accounts maintained within the PRC where there is currently no rule or regulation in place for obligatory insurance to cover bank deposits in the event of bank failure. However, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Except for a single external customer who accounted for 99%, of the Company’s revenue for the three months ended March 31, 2010, there was no other single customer who accounted for more than 10% of the Company’s revenue for the periods ended March 31, 2010 and 2009.

As of March 31, 2010, two customers accounted for 81% and 27% of total accounts receivable of the Company. As of December 31, 2009, three customers accounted for 46%, 25% and 21% of accounts receivable of the Company. Except as disclosed, no other customer accounted for 10% or more of the Company’s accounts receivable as of March 31, 2010 and December 31, 2009.

Currency convertibility risk

Substantially all of the Company’s businesses are transacted in RMB, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the People’s Bank of China or other banks authorized to buy and sell foreign currencies at the exchange rates quoted by the People’s Bank of China. Approval of foreign currency payments by the People’s Bank of China or other regulatory institutions requires submitting a payment application form together with suppliers’ invoices, shipping documents and signed contracts. These requirements imposed by the PRC government authorities may restrict the ability of the Company’s PRC subsidiaries to transfer funds to the parent through loans, advances or cash dividends.

- 17 -

| CHINA INTERACTIVE EDUCATION, INC. |

| (FORMERLY KNOWN AS FIND THE WORLD INTERACTIVE, INC.) |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| (UNAUDITED) |

The Company believes that throughout the three months ended March 31, 2010 and 2009, it operated in one operating segment – development and sale of electronic products based on a computer programming technology.

The following table sets out the analysis of the Company’s revenue by products and services.

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| Revenue from external customers: | | | | | | |

| Licensing of patent and related technology development services | $ | - | | $ | 2,877,302 | |

| Electronic learning products | | 3,531,698 | | | - | |

| Other electronic products | | 41,291 | | | 285,102 | |

| | | | | | | |

| Total | $ | 3,572,989 | | $ | 3,162,404 | |

The following table sets out the analysis of the Company’s revenue by customers located in different geographical areas.

| | | Three months ended | |

| | | March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| Revenue from external customers: | | | | | | |

| PRC | $ | 3,531,698 | | $ | 2,877,302 | |

| Other countries | | 41,291 | | | 285,102 | |

| | | | | | | |

| Total | $ | 3,572,989 | | $ | 3,162,404 | |

- 18 -

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OFOPERATIONS. |

Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” described in our Annual Report on Form 10-K for our fiscal year ended December 31, 2009, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to (i) the “Company,” “we,” “us,” and “our” are to the combined business of China Interactive Education, Inc., a Nevada corporation, and its consolidated subsidiaries; (ii) “MenQ BVI” are to MenQ Technology Group Limited, a BVI limited company; (iii) “Wisegate” are to Wisegate International Limited, a BVI limited company; (iv) “MenQ HK” are to MenQ International Limited, a Hong Kong limited company; (v) “Clever Aim” are to Clever Aim Development Limited, a Hong Kong limited company; (vi) “MenQ China” are to MenQ Technology Limited, a PRC limited company; (vii) “SEC” are to the United States Securities and Exchange Commission; (viii) “Securities Act” are to Securities Act of 1933, as amended; (ix) “Exchange Act” are to the Securities Exchange Act of 1934, as amended; (x) “PRC” and “China” are to People’s Republic of China excluding Hong Kong, Macao, and Taiwan; (xi) “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China; (xii) “Renminbi” and “RMB” are to the legal currency of China; and (xiii) “U.S. dollar,” “$” and “US$” are to United States dollars.

Overview of Our Business

Through our Hong Kong and PRC subsidiaries, we are an education solutions company that provides new era educational concepts, equipment and products to educational institutions including elementary, middle and high schools, professional training schools, and to individual students in China. We were organized to meet what we believe is an unmet need for educational resources throughout the PRC. Based on the PRC government’s statistical yearbook for 2007, the government invests more than $104 billion on education each year.However, just as economic development is not even throughout the PRC, there is an uneven allocation of educational resources in the PRC. In general, only students who pass the numerous national examinations, which are given at various stages of the educational process, can obtain better educational opportunities at a higher level. We believe that this examination-oriented education has created a market for products to improve the efficiency and performance of students and teachers.

Our principal businesses include (1) the provision of new era e-classroom and e-library solutions, (2) the distribution of computer based ELPs embedded with Beijing Normal University’s educational materials in computer programs and with self developed wireless technology and (3) the design and manufacture of GPS products via ODMs and OEMs based on self-developed technology.

On May 20, 2009, we entered into a three-year partnership agreement with Beijing Normal University, one of the top teaching universities in China with a 100-year history. Under this joint strategic partnership, we cooperate in the development of various aspects of IT applied in education. As a result of this collaboration, we founded the IT Applied in Education Institute in May, 2009 to conduct joint research and development of cutting edge interactive education methodologies and content, applying computer and internet technologies for use in education. The IT Applied in Education Institute focuses on the computerization of education systems and the digitization of supplemental study systems, including, but not limited to: (a) cost effective mini intelligent terminals and software suitable for access of high-speed 3G wireless networks; (b) terminals with embedded educational software platforms; (c) virtual experiment labs and sensor-based lab networks; and (d) specific internet service platforms for teachers and students. Under the partnership agreement, Beijing Normal University has authorized us to exclusively promote and distribute our jointly researched and developed products. We share the right to use such products, and we share 50% of the net profits from our sale of our jointly researched and developed products.

- 19 -

A majority of our revenues are derived from (1) sales of comprehensive sets of ELPs, including hardware with educational content certified and authorized by Beijing Normal University under the partnership agreement and (2) development fees from customers for providing educational content in computer programs. In the past, the majority of our revenue was generated from distributing our self-developed technologies in GPS and education products to overseas customers. Starting from 2009, we have been shifting our focus to the education market in the PRC. We plan to expand our sales network to all primary and secondary schools in all provinces of China with the help of educational policies, such as “The Tenth Five-Year Development Outline for Educational Information Technology,” for the development of IT in education and computerized teaching matters, and to the individual electronic ELP market.

The chart below presents our corporate structure.

Our company headquarters is located in southern China, in the City of Zhongshan in Guangdong Province and our sales offices are located in the Shenzhen Special Economic Zone and City of Guangzhou in Guangdong Province.

We file annual, quarterly and other reports, proxy statements and other information with the SEC. You may obtain and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the SEC’s public reference facilities by calling the SEC at 1-800-SEC-0330. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC at its principal office at 100 F Street, NE, Room 1580, Washington, D.C. 20549-1004. The SEC maintains an Internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings, including exhibits filed therewith, are accessible through the Internet at that website. You may also request a copy of our SEC filings, at no cost to you, by writing or telephoning us at: China Interactive Education, Inc., Block C, Zhennan Road, South District, Zhongshan City, Guangdong Province, 518040 People’s Republic of China, attention Corporate Secretary, telephone (+86) 0760-2819888. We will not send exhibits to the documents, unless the exhibits are specifically requested and you pay our fee for duplication and delivery.

2010 Financial Performance Highlights

The following are some financial highlights for the three months ended March 31, 2010:

- 20 -

Net Sales: Net sales increased $0.4 million, or 13%, to $3.6 million for the three months ended March 31, 2010 from $3.2 million for the same period in 2009.

Gross Margin: Gross margin was 34% for the three months ended March 31, 2010, as compared to 62% for the same period in 2009.

Net Income: Net income decreased $2.4 million, or 177%, to $(1.0) million for the three months ended March 31, 2010, from $1.4 million for the same period in 2009.

Fully diluted earnings per share: Fully diluted earnings per share were $(0.016) for the three months ended March 31, 2010, as compared to $0.0223 for the same period in 2009.

Results of Operations

The following table sets forth key components of our results of operations for the periods indicated, both in dollars and as a percentage of our net sales.

| | | Three Months Ended | | | Three Months Ended | |

| | | March 31, 2010 | | | March 31, 2009 | |

| | | | | | % of | | | | | | % of | |

| | | Amount | | | Net Sales | | | Amount | | | Net Sales | |

| Net sales | $ | 3,572,989 | | | 100% | | $ | 3,162,404 | | | 100% | |

| Cost of sales | | 2,365,652 | | | 66% | | | 1,188,260 | | | 38% | |

| Gross profit | | 1,207,337 | | | 34% | | | 1,974,144 | | | 62% | |

| Selling, General and Administrative Expenses | | 2,248,278 | | | 63% | | | 339,082 | | | 11% | |

| (Loss) income from operations | | (1,040,941 | ) | | (29% | ) | | 1,635,062 | | | 52% | |

| Other income | | 58 | | | 0% | | | 186 | | | 0% | |

| (Loss) income before income taxes | | (1,040,883 | ) | | (29% | ) | | 1,635,248 | | | 52% | |

| Income taxes | | - | | | 0% | | | 287,730 | | | 9% | |

| Net (loss) income | $ | (1,040,883 | ) | | (29% | ) | $ | 1,347,518 | | | 43% | |

Net Sales. Our sales revenue increased to $3.6 million in the three months ended March 31, 2010, from $3.2 million for the same period in 2009, representing a 13% increase. During the 2010 period, the Company changed its principal business from providing product and licensing fees, or PLFs, to providing educational learning products, or ELPs, under its own “Five Best Students” brand. The increase in revenue reflects acceptance of this change by our customers.

Cost of Sales. Our cost of sales increased $1.2 million, or 99%, to $2.4 million in the three months ended March 31, 2010, from $1.2 million for the same period in 2009. The cost of goods sold per sales ratio changed from 38% to 66% for the three months ended March 31, 2010 and 2009, respectively. The increment in cost of sales represents the difference in cost structure in providing licensing revenue and product revenue, in connection with the Company’s change from providing PLFs to providing ELPs during the 2010 period.

Gross Profit and Gross Margin. Our gross profit decreased $0.8 million, or 39%, to $1.2 million in the three months ended March 31, 2010, from $2.0 million for the same period in 2009. Gross profit as a percentage of net revenue was 34% and 62% for the three months ended March 31, 2010 and 2009, respectively. The decrease in gross profit represents the different gross margin in providing licensing revenue in the 2009 period and product revenue in the 2010 period.

- 21 -

Selling, General and Administrative Expenses. In the three months ended March 31, 2010, our selling, general and administrative expenses increased $1.9 million, or 563%, to $2.2 million, from $0.3 million for the same period in 2009. During the 2010 period, the Company incurred expense on a marketing campaign regarding its change in business and to build up its own “Five Best Students” brand. The cost of advertisement related to brand building in the first quarter of 2010 totaled approximately $1.2 million.

Other Income.Other income decreased $128, or 69%, to $58 in the three months ended March 31, 2010, from $186 during the same period in 2009. The decrease in other income represents less bank income earned from a decreased bank balance in the 2010 period.

(Loss) income Before Income Taxes. Our income before income taxes decreased by $2.6 million, or 164%, to ($1.0) million in the three months ended March 31, 2010, from $1.6 million for the same period in 2009, primarily due to increased marketing expenses during the 2010 period.

Income Taxes. We incurred income tax expenses of $nil and $0.3 million in the three months ended March 31, 2010 and 2009, respectively, a 100% decrease. See “Taxation” above for more information. The Company generated negative income before income tax in the first quarter of 2010 and so no income taxes were incurred during the period.

Net Income. In the three months ended March 31, 2010, we generated a net loss of $1.0 million, a decrease of $2.4 million, or 177%, from $1.3 million for the same period in 2009, as a result of the factors described above.

Liquidity and Capital Resources

As of March 31, 2010, we had cash and cash equivalents of $180,762, primarily consisting of cash on hand and demand deposits. The following table provides detailed information about our net cash flow for all financial statement periods presented in this report. To date, we have financed our operations primarily through cash flows from operations, augmented by short-term bank borrowings and equity contributions by our stockholders.

Cash Flow

(all amounts in U.S. dollars)

| | | Three Months Ended March 31, | |

| | | 2010 | | | 2009 | |

| Net cash provided by operating activities | $ | 287,521 | | $ | 1,831,592 | |

| Net cash used in investing activities | | (42,920 | ) | | (295,955 | ) |

| Net cash used in financing activities | | (415,530 | ) | | (1,794,015 | ) |

| Effects of Exchange Rate Change in Cash | | 147 | | | (7,857 | ) |

| Net Decrease in Cash and Cash Equivalents | | (170,782 | ) | | (266,235 | ) |

| Cash and Cash Equivalent at Beginning of the Year | | 351,544 | | | 440,000 | |

| Cash and Cash Equivalent at End of the Year | $ | 180,762 | | $ | 173,765 | |

Operating activities

Net cash provided by operating activities was $0.3 million for the three months ended March 31, 2010, as compared to $1.8 million net cash provided by operating activities for the same period in 2009. The decrease from period to period was primarily attributable to the Company’s transition of principal business during the 2010 period, from providing PLFs to providing ELPs and the expense incurred in marketing activities related to the change.

- 22 -

Investing activities

Net cash used in investing activities for the three months ended March 31, 2010 was $42,920, as compared to $295,955 for the same period in 2009. During the first quarter of 2010, the net cash used in investing was mainly attributable to acquisition of plant and equipment.

Financing activities

Net cash used in financing activities for the three months ended March 31, 2010 was $0.4 million, as compared to $1.8 million for the same period. During the first quarter of 2010, the net cash used in financing was mainly attributable to repayment of amount due from directors. The amount contributed by directors was used to finance the Company’s working capital with interest-free.

We believe that our cash on hand and cash flow from operations will meet our present cash needs for the next 12 months. We may, however, in the future, require additional cash resources due to changed business conditions, implementation of our strategy to ramp up our marketing efforts and increase brand awareness, or acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

Obligations under Material Contracts

On May 20, 2009, we entered into a partnership agreement with Beijing Normal University. Pursuant to the partnership agreement, we are required to pay no less than RMB 1 million (approximately USD$147,060) per year to Beijing Normal University for research and development purposes. We were required to pay RMB 300,000 (approximately USD$44,200) within 15 working days after the establishment of the IT Applied in Education Institute and are required pay the remaining amount in no less than RMB 150,000 (approximately USD$22,060) increments every three months. This agreement is for a term of three years. On August 2, 2009, we entered into a supplemental agreement with Beijing Normal University, pursuant to which we agreed to share 50% of the net profits from our sale of jointly researched and developed products under the partnership agreement.

Inflation

Inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing prices will materially affect our business in the foreseeable future. However, our management will closely monitor the price change in travel industry and continually maintain effective cost control in operations.

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity or capital expenditures or capital resources that is material to an investor in our securities.

Seasonality

We may experience seasonal fluctuations in our revenue in some regions in the PRC, based on the academic year and the tendency of parents and students to make purchases relating to their education just prior to or at the beginning of the school year in the autumn. Moreover, our revenues are usually higher in the second half of the year than in the first half of the year and the second quarter is usually the slowest quarter because China’s educational institutions normally procure ELP in first and third quarters. Any seasonality may cause significant pressure on us to monitor the development of materials accurately and to anticipate and satisfy these requirements.

- 23 -

Critical Accounting Policies

These interim condensed consolidated financial statements are unaudited. In the opinion of management, all adjustments and disclosures necessary for a fair presentation of these interim condensed consolidated financial statements have been included. The result reported in the condensed consolidated financial statements for any interim periods are not necessarily indicative of the results that may be reported for the entire year. The accompanying condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission and do not include all information and footnotes necessary for a complete presentation of financial statements in conformity with accounting principles generally accepted in the United States. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying footnotes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009.

These condensed consolidated financial statements include the financial statements of CIE and its subsidiaries. All significant inter-company balances or transactions have been eliminated on consolidation

Research and development expenses

Research and development costs are charged to expense when incurred.

Advertising and promotion costs

The Company expenses advertising and promotion costs as incurred. Advertising and promotion expenses charged to operations were $1,205,748 (unaudited) and $38,899 (unaudited) for the periods ended March 31, 2010 and 2009, respectively.

Shipping and handling cost

Technological products sold by the Company are normally collected by customers at the Company’s premises. During the periods ended March 31, 2010 and 2009, shipping and handling costs were insignificant.

Foreign Currency

The Company uses the United States dollars (“U.S. Dollar” or “US$” or “$”) for financial reporting purposes. The PRC subsidiaries within the Company maintain their books and records in their functional currency, Chinese Renminbi (“RMB”) and Hong Kong dollars (“HK$), being the lawful currency in the PRC and Hong Kong. Assets and liabilities are translated into US Dollars using the applicable exchange rates prevailing at the balance sheet date. Items on the statement of operations are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements are based on the rates as published on the website of People’s Bank of China and are as follows:-

| | As of March 31, 2010 | As of December 31, 2009 |

| Balance sheet items, except for equity accounts | US$1=RMB6.8259 | US$1=RMB6.8282 |

| | US$1=HK$7.7642 | US$1=HK$7.7850 |

| | Period ended March 31, |

| | 2010 | 2009 |

| Items in the statements of income and cash flows | US$1=RMB6.8270 | US$1=RMB6.8283 |

| | US$1=HK$7.7746 | US$1=HK$7.7417 |

No representation is made that the RMB amounts could have been, or could be, converted into U.S. dollars at the above rates.

- 24 -

The value of RMB against U.S. dollars and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of RMB may materially affect the Company’s financial condition in terms of U.S. dollar reporting.

Recent Accounting Pronouncements

Effective January 1, 2010, the Company adopted the provisions in ASU 2009-17, “Consolidation (ASC Topic 810): Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities”, which changes how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The adoption of the provisions in ASU 2009-17 did not have an impact on the Company’s consolidated financial statements.

Effective January 1, 2010, the Company adopted ASU 2010-01, “Equity (ASC Topic 505): Accounting for Distributions to Shareholders with Components of Stock and Cash”, which clarifies that the stock portion of a distribution to shareholders that allow them to elect to receive cash or stock with a potential limitation on the total amount of cash that all shareholders can elect to receive in the aggregate is considered a share issuance that is reflected prospectively in earnings per share and is not considered a stock dividend for purposes of ASC Topic 505 and ASC Topic 260. The adoption of the provisions in ASU 2010-01 did not have an impact on the Company’s consolidated financial statements.

Effective January 1, 2010, the Company adopted the provisions in ASU 2010-06, “Fair Value Measurements and Disclosures (ASC Topic 820): Improving Disclosures about Fair Value Measurements, which requires new disclosures related to transfers in and out of levels 1 and 2 and activity in level 3 fair value measurements, as well as amends existing disclosure requirements on level of disaggregation and inputs and valuation techniques. The adoption of the provisions in ASU 2010-06 did not have an impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s Consolidated Financial Statements upon adoption.

ITEM 3.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

ITEM 4.

CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) that are designed to ensure that information that would be required to be disclosed in Exchange Act reports is recorded, processed, summarized and reported within the time period specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including to our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

As required by Rule 13a-15 under the Exchange Act, our management, including our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of the design and operation of our disclosure controls and procedures as of March 31, 2010. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that as of March 31, 2010, and as of the date that the evaluation of the effectiveness of our disclosure controls and procedures was completed, our disclosure controls and procedures were effective to satisfy the objectives for which they are intended.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting during the three months ended March 31, 2010 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

- 25 -

PART II

| ITEM 1. | LEGAL PROCEEDINGS. |

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse affect on our business, financial condition or operating results.

Not applicable.

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

We have not sold any equity securities during the quarter ended March 31, 2010 which sale was not previous disclosed in a current report on Form 8-K filed during that period.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES. |

None.

| ITEM 4. | (REMOVED AND RESERVED). |

| ITEM 5. | OTHER INFORMATION. |

We have no information to include that was required to be but was not disclosed in a report on Form 8-K during the period covered by this Form 10-Q. There have been no material changes to procedures by which security holders may recommend nominees to our board of directors.

The following exhibits are filed as part of this report or incorporated by reference:

- 26 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | CHINA INTERACTIVE EDUCATION, INC. |

| | |

| | |

| Dated: June 15, 2010 | /s/ Ruofei Chen |

| | Ruofei Chen |

| | Chief Executive Officer |

| | |

| | |

| | |

| Dated: June 15, 2010 | /s/ Ting Pong Cheung |

| | Ting Pong Cheung |

| | Chief Financial Officer |

- 27 -

EXHIBIT INDEX

- 28 -