UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| (Mark one) |

x Annual Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2011

o Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _______ to _______

Commission File Number: 0-52072 |

Marketing Acquisition Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 62-1299374 |

| (State of Incorporation) | (I. R. S. Employer ID Number) |

12890 Hilltop Road, Argyle, Texas 76226

(Address of principal executive offices)

(972) 233-0300

(Registrant’s Telephone Number)

| Securities registered pursuant to Section 12 (b) of the Act - None |

| Securities registered pursuant to Section 12(g) of the Act: - Common Stock - $0.001 par value |

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | ||

| Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes x No o

The aggregate market value of voting and non-voting common equity held by non-affiliates as of March 21, 2012 was approximately $95,135 based upon 186,539 shares held by non-affiliates and a closing market price of $0.51 per share, as listed on www.otcmarkets.com.

As of March 21, 2012, there were 1,853,207 shares of Common Stock issued and outstanding.

1

Marketing Acquisition Corporation

Form 10-K for the year ended December 31, 2011

Index to Contents

Page Number

| Part I | ||

| Item 1 | Business | 3 |

| Item 1A | Risk Factors | 6 |

| Item 1B | Unresolved Staff Comments | 6 |

| Item 2 | Properties | 4 |

| Item 3 | Legal Proceedings | 6 |

| Item 4 | Mine Safety Disclosures | 7 |

| Part II | ||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 7 |

| Item 6 | Selected Financial Data | 8 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 8 |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 11 |

| Item 8 | Financial Statements and Supplementary Data | F-1 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 11 |

| Item 9A | Controls and Procedures | 12 |

| Item 9B | Other Information | 13 |

| Part III | ||

| Item 10 | Directors, Executive Officers and Corporate Governance | 13 |

| Item 11 | Executive Compensation | 17 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 17 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 18 |

| Item 14 | Principal Accounting Fees and Services | 18 |

| Part IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 19 |

| Signatures | 31 | |

2

Caution Regarding Forward-Looking Information

Certain statements contained in this annual filing, including, without limitation, statements containing the words "believes", "anticipates", "expects" and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions: demographic changes; the ability of the Company to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this Form 10-K and investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

PART I

Item 1 - Business

General

Marketing Acquisition Corporation (the “Company”) was originally incorporated on July 26, 1990 in accordance with the laws of the State of Florida as Marketing Educational Corp.

The Company was originally formed for the purpose of direct marketing of certain educational materials and photography packages. The educational materials marketed by the Company consisted of encyclopedias, learning books, educational audio and video tapes which were designed to be used in various combinations to accommodate the educational levels and needs of families with children of all ages. During 1991, the Company completed a public offering of 150,000 units of common stock, through a Registration Statement on Form S-18 (Registration No.33-37039-A).

The Company has had no operations since 1992 and is currently a “shell company” as defined in Rule 405 under the Securities Act of 193 (“Securities Act”) and Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). We are defined as a shell company because we have no operations and no or nominal assets.

Business Plan

Our current business plan is to identify a privately-held operating company desiring to become a publicly held company by combining with us through a reverse merger or acquisition type transaction. Private companies wishing to have their securities publicly traded may seek to merge or effect an exchange transaction with a shell company with a significant stockholder base. As a result of the merger or exchange transaction, the stockholders of the private company will hold a majority of the issued and outstanding shares of the shell company. Typically, the directors and officers of the private company become the directors and officers of the shell company. Often the name of the private company becomes the name of the shell company.

We have no capital and must depend on Halter Financial Investments, L. P. (“HFI”) , our controlling stockholder, to provide us with the necessary funds to implement our business plan.

Our management consists of only one person. Timothy P. Halter, our president and sole director. Mr. Halter is primarily responsible for conducting our day-to-day operations and is responsible for implementing our business plan. We will rely solely on the judgment of Mr. Halter when selecting a target company. Mr. Halter will only devote as much of his time as he deems necessary to assist us with the implementation of our business plan. Mr. Halter has not entered into a written employment or consulting agreement with us and he is not expected to do so. The loss of the services of Mr. Halter would adversely affect our ability to implement our business plan.

Neither we, or anyone acting on our behalf, have contacted any third parties or had any substantial discussions, formal or otherwise, with respect to a possible business combination, nor have we, or anyone acting on our behalf, identified or located any suitable target candidate, conducted any research or taken any measures, directly or indirectly, to locate or contact a target business. We can give no assurances that we will be successful in finding or acquiring a desirable business opportunity, given the limited funds that are expected to be available to us for implementation of our business plan. Furthermore, we can give no assurances that any combination or acquisition, if they occur, will be on terms that are favorable to us or our current stockholders.

3

We do not propose to restrict our search for a candidate to any particular geographical area or industry, and therefore, we are unable to predict the nature of our future business operations. Our management's discretion in the selection of business opportunities is unrestricted, subject to the availability of such opportunities, economic conditions, and other factors.

In conjunction with completion of a business acquisition, we anticipate that we will issue an amount of our authorized but unissued common stock that will represent a significant majority of the voting power and equity of our Company, which will, in all likelihood, result in stockholders of a target company obtaining a controlling interest in us and thereby reducing the ownership interest of our current stockholders. We may also issue preferred stock to the stockholders of a target company. Holders of preferred stock may have rights, preferences and privileges senior to those of our existing holders of common stock. As a condition of the business combination, HFI, our majority stockholder, may agree to sell or transfer all or a portion of the common stock it owns to provide the target company with majority control. The resulting change in control will likely result in the removal of our present officer and director and a corresponding reduction in, or elimination of, his participation in future business activities.

We may effectuate a business combination with a merger target whose business operations or even headquarters, place of formation or primary place of business are located outside the United States of America. In such event, we may face the significant additional risks associated with doing business in that country. In addition to the language barriers, different presentations of financial information, different business practices, and other cultural differences and barriers that may make it difficult to evaluate such a merger target, we may encounter ongoing business risks associated with uncertain legal systems and applications of law, prejudice against foreigners, corrupt practices, uncertain economic policies and potential political and economic instability that may be exacerbated in various foreign countries.

Federal and state tax consequences will, in all likelihood, be major considerations in any business combination that we may undertake. Currently, such transactions may be structured so as to result in tax-free treatment to both companies and their stockholders, pursuant to various federal and state tax provisions. We intend to structure any business combination so as to minimize the federal and state tax consequences to both our Company and the target entity and their stockholders. However, there can be no assurance that such business combination will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the intended tax-free treatment upon a transfer of stock or assets. A non-qualifying reorganization could result in the imposition of both federal and state taxes, which may have an adverse effect on both parties to the transaction.

Although there are no restrictions for us to engage in a business combination with an entity that is affiliated or controlled by either HFI or Mr. Halter, we do not currently intend and do not foresee that we will enter into a merger or acquisition transaction with any business which is controlled by or affiliated with HFI or Timothy P. Halter.

Investigation and Selection of Business Opportunities

We intend to seek a merger or other business combination transaction with a viable operating business. Management has not determined any other criteria in seeking a target business candidate.

Certain types of business acquisition transactions may be completed without requiring us to first submit the transaction to our stockholders for their approval. If the proposed transaction is structured in such a fashion our stockholders (other than HFI our majority stockholder) will not be provided with financial or other information relating to the candidate prior to the completion of the transaction. Generally, equity securities may be issued in a stock exchange, direct stock purchase for cash or property or in a reverse triangle merger, that is the merger of a target business into a subsidiary of the company, without approval of the stockholders of the company. Statutory mergers, that is the merger of a target company directly into the company, typically requires stockholder approval in accordance with the applicable state laws; however, it is anticipated that such a structure will not be used to effect a combination transaction with an operating business. If a proposed business combination or business acquisition transaction is structured that requires our stockholder approval, and we are a reporting company, we will be required to provide our stockholders with information as applicable under Regulations 14A and 14C under the Exchange Act.

Additionally, when we engage in a transaction that changes our status as a shell company, such as a business combination, we will be required to file a detailed report on Form 8-K with the SEC containing the information, including financial information, that is required in a Registration Statement on Form 10, with the information reflecting the business and financial statements of the surviving entity upon completion of the transaction. We will also be required to report the material terms of the business combination in the Form 8-K report. Also we will be ineligible to file a Registration Statement on Form S-8 until 60 days after we cease to be a shell company; provided we have timely filed the required Form 8-K report. Until we cease being a shell company, we will be required to indicate on the cover page of Form 10-Q and Form 10-K our identification as a shell company.

4

The analysis of business opportunities will be undertaken by or under the supervision of Timothy P. Halter. Although we have not set or determined any criteria for the target business other than that it is an existing operating business, in analyzing potential merger candidates, we will likely consider, among other things, the following factors:

| * | Potential for future earnings and appreciation of value of securities; |

| * | Perception of how any particular business opportunity will be received by the investment community and by our stockholders; |

| * | Eligibility of a candidate, following the business combination, to qualify its securities for listing on a national exchange or on a national automated securities quotation system, such as NASDAQ; |

| * | Historical results of operation; |

| * | Liquidity and availability of capital resources; |

| * | Competitive position as compared to other companies of similar size and experience within the industry segment as well as within the industry as a whole; |

| * | Strength and diversity of existing management or management prospects that are scheduled for recruitment; |

| * | Amount of debt and contingent liabilities; and |

| * | The products and/or services and marketing concepts of the target company. |

There is no single factor that will be controlling in the selection of a business opportunity. We will attempt to analyze all factors appropriate to each opportunity and make a determination based upon reasonable investigative measures and available data. Potentially available business opportunities may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Because of our limited capital available for investigation and our dependence on Mr. Halter, we may not discover or adequately evaluate adverse facts about the business opportunity to be acquired.

We will also seek candidates desiring to create a public market for their securities in order to enhance liquidity for current stockholders, candidates which have long-term plans for raising capital through public sale of securities and believe that the prior existence of a public market for their securities would be beneficial, and candidates which plan to acquire additional assets through issuance of securities rather than for cash, and believe that the development of a public market for their securities will be of assistance in that process. Companies which have a need for an immediate cash infusion are not likely to find a potential business combination with us to be a prudent business transaction alternative.

We have no current arrangement, agreement or understanding with respect to engaging in a business combination with a specific entity. We may not be successful in identifying and evaluating a suitable merger candidate or in consummating a business combination. We have not selected a particular industry or specific business within an industry for a target company. We have not established a specific length of operating history or a specified level of earnings, assets, net worth or other criteria that we will require a target company to have achieved, or without which we would not consider a business combination with such business entity.

We are unable to predict when we may participate in a business opportunity. We expect, however, that the analysis of specific proposals and the selection of a business opportunity may take an extended period of time.

Prior to making a decision to participate in a business transaction, we will generally request that we be provided with written materials regarding the business opportunity containing as much relevant information as possible, including, but not limited to, a description of products, services and company history; management resumes; financial information; available projections, with related assumptions upon which they are based; an explanation of proprietary products and services; evidence of existing patents, trademarks, or service marks, or rights thereto; present and proposed forms of compensation to management; a description of transactions between such company and its affiliates during the relevant periods; a description of present and required facilities; an analysis of risks and competitive conditions; a financial plan of operation and estimated capital requirements; audited financial statements, or if audited financial statements are not available, unaudited financial statements, together with reasonable assurance that audited financial statements would be able to be produced to comply with the requirements of a Current Report on Form 8-K to be filed with the Commission upon consummation of the business combination.

As part of our investigation, Timothy P. Halter may meet personally with management and key personnel, may visit and inspect material facilities, obtain independent analysis or verification of certain provided information, check references of management and key personnel, and take other reasonable investigative measures, to the extent of our limited financial and management resources.

5

Timothy P. Halter is not required to commit his full time to our affairs, which may result in a conflict of interest in allocating his time between our operations and other businesses. We do not intend to have any full time employees prior to the consummation of a business combination. Mr. Halter is engaged in several other business endeavors and is not obligated to contribute any specific number of hours to our affairs. If his other business affairs require him to devote more substantial amounts of time to such interests, it could limit his ability to devote time to our affairs and could have a negative impact on our ability to consummate a business combination Mr. Halter has not devoted any significant time or services to our business operations as of the date of this filing.

Mr. Halter and/or HFI are affiliated with other shell companies with business activities similar to those intended to be conducted by us. Mr. Halter or HFI may become aware of business opportunities which may be appropriate for presentation to us as well as the other entities to which they have fiduciary obligations. Accordingly, there may be conflicts of interest in determining to which entity a particular business opportunity should be presented.

To implement our business plan we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. The selection of any such advisors will be made by Mr. Halter and their fees may be paid by HFI. We anticipate that such persons may be engaged on an as needed basis without a continuing fiduciary or other obligation to us.

Competition

We are and will continue to be an insignificant participant in the business of seeking mergers with and acquisitions of privately held business entities. We expect to encounter substantial competition in our efforts to locate potential business combination opportunities. The competition may in part come from business development companies, venture capital partnerships and corporations, small investment companies and brokerage firms. Most of these organizations are likely to be in a better position than us to obtain access to potential business acquisition candidates because they have greater experience, resources and managerial capabilities than we do. We also will experience competition from other public companies with similar business purposes, some of which may also have funds available for use by an acquisition candidate.

Employees

We have no employees. Our president and sole director, Timothy P. Halter, will be responsible for managing our administrative affairs, including our reporting obligations pursuant to the requirements of the Exchange Act. It is anticipated that HFI or Mr. Halter may engage consultants, attorneys and accountants as necessary for us to conduct our business operations and to implement and successfully complete our business plan. We do not anticipate employing any full-time employees until we have achieved our business purpose.

Item 1A - Risk Factors

Smaller reporting companies are not required to provide the information required by this item.

Item 1B - Unresolved Staff Comments

None

Item 2 - Properties

The Company currently maintains a mailing address at 12890 Hilltop Road, Argyle, Texas 76226. The Company’s telephone number there is (972) 233-0300. Other than this mailing address, the Company does not currently maintain any other office facilities, and does not anticipate the need for maintaining office facilities at any time in the foreseeable future. The Company pays no rent or other fees for the use of the mailing address as these offices are used virtually full-time by other businesses of the Company’s sole officer and director.

It is likely that the Company will not establish an office until it has completed a business acquisition transaction, but it is not possible to predict what arrangements will actually be made with respect to future office facilities.

Item 3 - Legal Proceedings

The Company is not a party to any pending legal proceedings, and no such proceedings are known to be contemplated.

6

Item 4 - Mine Safety Disclosures

None

PART II

Item 5 - Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s securities are eligible for trading on the OTC Bulletin Board under the Commission’s Rule 15c2-11, Subsection (a)(5). The Company’s trading symbol is MAQC. As of the date of this report, there have been limited and sporadic trades of the Company’s securities. The last reported trade and posted closing price of the Company’s common stock, per www.otcmarkets.com, was on January 9, 2012 for 100 shares at approximately $0.51per share.

As of March 21, 2012, there were a total of 1,853,207 shares of our common stock held by approximately 365 stockholders of record. There are no shares of our preferred stock outstanding at the date of this report.

The following table sets forth the quarterly average high and low closing bid prices per share for the Common Stock:

| High | Low | |||||||

| Fiscal year ended December 31, 2011 | ||||||||

| Quarter ended March 31, 2011 | $ | 1.01 | $ | 0.25 | ||||

| Quarter ended June 30, 2011 | $ | 0.25 | $ | 0.025 | ||||

| Quarter ended September 30, 2011 | $ | 0.025 | $ | 0.025 | ||||

| Quarter ended December 31, 2011 | $ | 4.50 | $ | 0.018 | ||||

| Fiscal year ended December 31, 2011 | ||||||||

| Quarter ended March 31, 2011 | $ | 2.75 | $ | 0.018 | ||||

| Quarter ended June 30, 2011 | $ | 1.14 | $ | 0.30 | ||||

| Quarter ended September 30, 2011 | $ | 1.01 | $ | 0.30 | ||||

| Quarter ended December 31, 2011 | $ | 1.01 | $ | 0.51 | ||||

| Fiscal year ending December 31, 2012 | ||||||||

| Quarter ending March 31, 2012 (through March 21, 2012) | $ | 0.51 | $ | 0.51 | ||||

The source for the high and low closing bids quotations was www.otcmarkets.com.

Common Stock

Our authorized capital stock consists of 100,000,000 shares of $0.001 par value common stock and 50,000,000 shares of $0.001 par value preferred stock. Each share of common stock entitles a stockholder to one vote on all matters upon which stockholders are permitted to vote. No stockholder has any preemptive right or other similar right to purchase or subscribe for any additional securities issued by us, and no stockholder has any right to convert the common stock into other securities. No shares of common stock are subject to redemption or any sinking fund provisions. All the outstanding shares of our common stock are fully paid and non-assessable. Subject to the rights of the holders of the preferred stock, if any, our stockholders of common stock are entitled to dividends when, as and if declared by our board from funds legally available therefore and, upon liquidation, to a pro-rata share in any distribution to stockholders. We do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

Preferred Stock

The Company is also authorized to issue up to 50,000,000 shares of $0.001 par value Preferred Stock and no shares are issued and outstanding as of the date of this Report.

Pursuant to our Articles of Incorporation, our board has the authority, without further stockholder approval, to provide for the issuance of up to 50 million shares of our preferred stock in one or more series and to determine the dividend rights, conversion rights, voting rights, rights in terms of redemption, liquidation preferences, the number of shares constituting any such series and the designation of such series. Our Board has the power to afford preferences, powers and rights (including voting rights) to the holders of any preferred stock preferences, such rights and preferences being senior to the rights of holders of common stock. No shares of our preferred stock are currently outstanding. Although we have no present intention to issue any shares of preferred stock, the issuance of shares of preferred stock, or the issuance of rights to purchase such shares, may have the effect of delaying, deferring or preventing a change in control of our company.

7

Restricted Securities

We currently have 1,666,668 outstanding shares which may be deemed restricted securities as defined in Rule 144. We do not intend to issue any securities prior to consummating a reverse merger transaction. The securities we issue in a merger transaction will most likely be restricted securities.

Generally, restricted securities can be resold under Rule 144 once they have been held for the required statutory period, provided that the securities satisfies the current public information requirements of the Rule.

Dividends

Dividends, if any, will be contingent upon the Company’s revenues and earnings, if any, and capital requirements and financial conditions. The payment of dividends, if any, will be within the discretion of the Company’s Board of Directors. The Company presently intends to retain all earnings, if any, and accordingly the Board of Directors does not anticipate declaring any dividends prior to a business combination.

Transfer Agent

Our independent stock transfer agent is Securities Transfer Corporation, located in Frisco, Texas. The mailing address and telephone number are: 2591 Dallas Parkway, Suite 102, Frisco, Texas 75034; (469) 633-0101.

Reports to Stockholders

The Company plans to furnish its stockholders with an annual report for each fiscal year ending December 31 containing financial statements audited by its registered independent public accounting firm. In the event the Company enters into a business combination with another Company, it is the present intention of management to continue furnishing annual reports to stockholders. Additionally, the Company may, in its sole discretion, issue unaudited quarterly or other interim reports to its stockholders when it deems appropriate. The Company intends to maintain compliance with the periodic reporting requirements of the Exchange Act.

Item 6 - Selected Financial Data

Not applicable

Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Caution Regarding Forward-Looking Information

Certain statements contained in this annual filing, including, without limitation, statements containing the words "believes", "anticipates", "expects" and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions: demographic changes; the ability of the Company to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this Form 10-K and investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

General

The Company was originally incorporated as Marketing Educational Corp. on July 26, 1990 in accordance with the Laws of the State of Florida.

The Company was originally formed for the purpose of direct marketing of certain educational materials and photography packages. The educational materials marketed by the Company consisted of encyclopedias, learning books, educational audio and video tapes which were designed to be used in various combinations to accommodate the educational levels and needs of families with children of all ages.

8

Effective at the close of business on September 30, 1992, as reported on a Form 8-K, filed October 7, 1992, the Company experienced a change in management. As a result of this event, the Company effectively liquidated all operations and assets and became a dormant entity at that point. The Company suspended its reporting under the Exchange Act due to a lack of operating capital.

Since September 30, 1992, the Company has had no operations, significant assets or liabilities.

The Company’s current principal business activity is to seek a suitable reverse acquisition candidate through acquisition, merger or other suitable business combination method.

Results of Operations

The Company had no revenue for either of the years ended December 31, 2011 and 2010, respectively.

General and administrative expenses for each of the years ended December 31, 2011 and 2010 were approximately $18,000 and $28,000, respectively. These expenses were primarily related to the maintenance of the corporate entity and the preparation and filing of periodic reports pursuant to the Exchange Act.

In June 2010, the Company paid Halter Financial Group, LP, an entity affiliated with the Company’s controlling stockholder and controlled by the Company’s sole officer and director, the sum of $23,000 for management and consulting services. The agreement was for an unspecified period of time and was amortized through March 31, 2011.

Earnings per share for the respective years ended December 31, 2011 and 2010 were $(0.01) and $(0.02) based on the weighted-average shares issued and outstanding at the end of each respective period.

It is anticipated that future expenditure levels will remain in line relatively consistent until such time that the Company completes a business combination transaction. Upon completion of a business combination transaction, it is anticipated that the Company’s expenses will increase significantly.

The Company does not expect to generate any meaningful revenue or incur operating expenses for purposes other than fulfilling the obligations of a reporting company under the Exchange Act unless and until such time that the Company begins meaningful operations.

Plan of Business

General

The Company’s current purpose is to seek, investigate and, if such investigation warrants, merge or acquire an interest in business opportunities which desire to seek the perceived advantages of an Exchange Act registered corporation.

Pending negotiation and consummation of a combination, the Company anticipates that it will have, aside from carrying on its search for a combination partner, no business activities, and, thus, will have no source of revenue. Should the Company incur any significant liabilities prior to a combination with a private company, it may not be able to satisfy such liabilities as are incurred.

If the Company’s management pursues one or more combination opportunities beyond the preliminary negotiations stage and those negotiations are subsequently terminated, it is foreseeable that such efforts will exhaust the Company’s ability to continue to seek such combination opportunities before any successful combination can be consummated. In that event, the Company’s common stock will become worthless and holders of the Company’s common stock will receive a nominal distribution, if any, upon the Company’s liquidation and dissolution.

Management

The Company is a shell corporation, and currently has no full-time employees. Timothy P. Halter is the Company’s sole officer, director, and controlling stockholder. All references herein to management of the Company are to Mr. Halter. Mr. Halter, as President of the Company, has agreed to allocate a limited portion of his time to the activities of the Company without compensation. Potential conflicts may arise with respect to the limited time commitment by Mr. Halter and his involvement in other comparable ventures.

9

The amount of time spent by Mr. Halter on the activities of the Company is not predictable. Such time may vary widely from an extensive amount when reviewing a target company to an essentially quiet time when activities of management focus elsewhere, or some amount in between. It is impossible to predict with any precision the exact amount of time Mr. Halter will actually be required to spend to locate a suitable target company. Mr. Halter estimates that the business plan of the Company can be implemented by devoting less than 4 hours per month but such figure cannot be stated with precision.

Liquidity and Capital Resources

At December 31, 2011 and 2010, respectively, the Company had working capital of $(1,500) and $146, respectively.

The Company's ultimate existence is dependent upon its ability to generate sufficient cash flows from operations to support its daily operations as well as provide sufficient resources to retire existing liabilities and obligations on a timely basis. Further, the Company faces considerable risk in it’s business plan and a potential shortfall of funding due to our inability to raise capital in the equity securities market. If no additional operating capital is received during the next twelve months, the Company will be forced to rely on existing cash in the bank and additional funds loaned by management and/or significant stockholders.

The Company’s business plan is to seek an acquisition or merger with a private operating company which offers an opportunity for growth and possible appreciation of our stockholders’ investment in the then issued and outstanding common stock. However, there is no assurance that the Company will be able to successfully consummate an acquisition or merger with a private operating company or, if successful, that any acquisition or merger will result in the appreciation of our stockholders’ investment in the then outstanding common stock.

The Company anticipates offering future sales of equity securities. However, there is no assurance that the Company will be able to obtain additional funding through the sales of additional equity securities or, that such funding, if available, will be obtained on terms favorable to or affordable by the Company.

The Company’s Articles of Incorporation authorize the issuance of up to 50,000,000 shares of preferred stock and 100,000,000 shares of common stock. The Company’s ability to issue preferred stock may limit the Company’s ability to obtain debt or equity financing as well as impede potential takeover of the Company, which takeover may be in the best interest of stockholders. The Company’s ability to issue these authorized but unissued securities may also negatively impact our ability to raise additional capital through the sale of our debt or equity securities.

In the event that insufficient working capital to maintain the corporate entity and implement our business plan is not available, the Company’s majority stockholder intends to maintain the corporate status of the Company and provide all necessary working capital support on the Company's behalf. However, no formal commitments or arrangements to advance or loan funds to the Company or repay any such advances or loans exist. There is no legal obligation for either management or significant stockholders to provide additional future funding.

Further, the Company is at the mercy of future economic trends and business operations for the Company’s majority stockholder to have the resources available to support the Company.

In such a restricted cash flow scenario, the Company would be unable to complete its business plan steps, and would, instead, delay all cash intensive activities. Without necessary cash flow, the Company may become dormant during the next twelve months, or until such time as necessary funds could be raised in the equity securities market.

While the Company is of the opinion that good faith estimates of the Company’s ability to secure additional capital in the future to reach its goals have been made, there is no guarantee that the Company will receive sufficient funding to sustain operations or implement any future business plan steps.

The Company’s need for capital may change dramatically as a result of any business acquisition or combination transaction. There can be no assurance that the Company will identify any such business, product, technology or company suitable for acquisition in the future. Further, there can be no assurance that the Company would be successful in consummating any acquisition on favorable terms or that it will be able to profitably manage the business, product, technology or company it acquires.

The Company has no current plans, proposals, arrangements or understandings with respect to the sale or issuance of additional securities prior to the location of a merger or acquisition candidate. Accordingly, there can be no assurance that sufficient funds will be available to the Company to allow it to cover the expenses related to such activities.

Regardless of whether the Company’s cash assets prove to be inadequate to meet the Company’s operational needs, the Company might seek to compensate providers of services by issuances of stock in lieu of cash.

10

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (GAAP). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenue and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Our significant accounting policies are summarized in Note D of our financial statements. While all these significant accounting policies impact our financial condition and results of operations, we view certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause effect on our consolidated results of operations, financial position or liquidity for the periods presented in this report.

Effect of Climate Change Legislation

The Company currently has no known or identified exposure to any current or proposed climate change legislation which could negatively impact the Company’s operations or require capital expenditures to become compliant. Additionally, any currently proposed or to-be-proposed-in-the-future legislation concerning climate change activities, business operations related thereto or a publicly perceived risk associated with climate change could, potentially, negatively impact the Company’s efforts to identify an appropriate target company which may wish to enter into a business combination transaction with the Company.

Item 7A - Quantitative and Qualitative Disclosures about Market Risk

The carrying amount of cash, accounts receivable, accounts payable and notes payable, as applicable, approximates fair value due to the short term nature of these items and/or the current interest rates payable in relation to current market conditions.

Interest rate risk is the risk that the Company’s earnings are subject to fluctuations in interest rates on either investments or on debt and is fully dependent upon the volatility of these rates. The Company does not use derivative instruments to moderate its exposure to interest rate risk, if any.

Financial risk is the risk that the Company’s earnings are subject to fluctuations in interest rates or foreign exchange rates and are fully dependent upon the volatility of these rates. The Company does not use derivative instruments to moderate its exposure to financial risk, if any.

Item 8 - Financial Statements and Supplementary Data

The required financial statements begin on page F-1 of this document.

Item 9 - Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Resignation of S. W. Hatfield, CPA

On May 4, 2010, the Board of Directors of the Company was notified by its registered independent certified public accounting firm, S. W. Hatfield, CPA (“SWHCPA”) of Dallas, Texas that, due to the partner rotation rules and regulations of the U. S. Securities and Exchange Commission and Sarbanes-Oxley Act of 2002, SWHCPA is unable to continue as the Company’s auditor and had resigned, effective immediately. The Company’s Board of Directors accepted the resignation of SWHCPA.

No accountant's report on the financial statements for either of the past two (2) years contained an adverse opinion or a disclaimer of opinion or was qualified or modified as to uncertainty, audit scope or accounting principles, except for a going concern opinion expressing substantial doubt about the ability of the Company to continue as a going concern.

11

During the Company's two most recent fiscal years (ended December 31, 2009 and 2008) and from January 1, 2010 to May 4, 2010, there were no disagreements with SWHCPA on any matter of accounting principles or practices, financial disclosure, or auditing scope or procedure. For the years ended December 31, 2009 and 2008, and from January 1, 2010 through May 4,2010, there were no “reportable events” as that term is described in Item 304(a)(1)(v) of Regulation S-K.

The Company provided SWHCPA with a copy of the foregoing disclosure and SWHCPA furnished to the Company a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements made therein. A copy of SWHCPA’s letter, dated May 4, 2010, was filed as Exhibit 16.1 to our Current Report on Form 8-K.

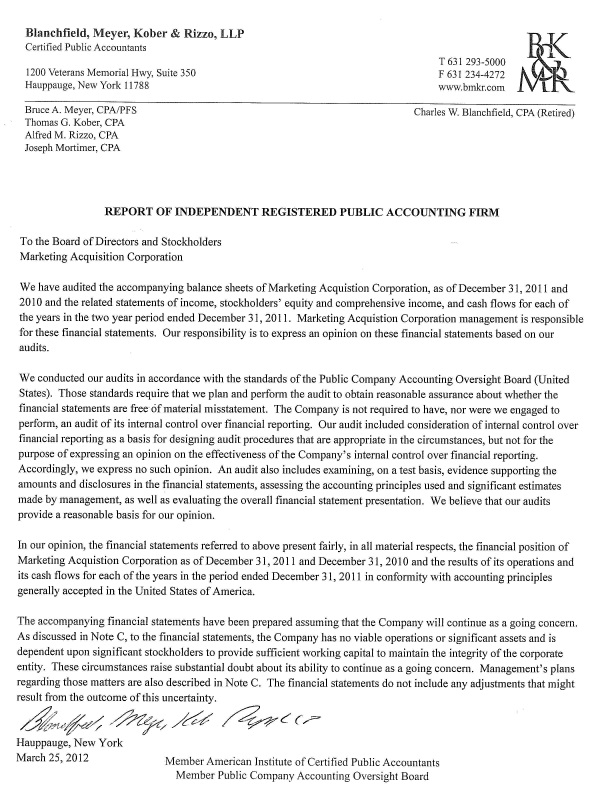

Appointment of Blanchfield, Meyer, Kober & Rizzo, LLP

On May 4, 2010, the Company's Board of Directors approved the engagement of Blanchfield, Meyer, Kober & Rizzo, LLP of Hauppauge, NY (“BMK&R”) as the Company's new registered independent public accounting firm to audit the Company's financial statements for the year ending December 31, 2010 and subsequent periods. Pursuant to SEC Release 34-42266, BMK&R will also review the Company's financial statements to be included in Quarterly Reports on Form 10-Q.

The Company did not consult with BMK&R at any time prior to May 4, 2010, including the Company's two most recent fiscal years ended December 31, 2009 and 2008, and the subsequent interim period from January 1, 2010 through the date of this Report, with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, or any other matters or reportable events set forth in Item 304(a)(1)(v) of Regulation S-K.

Item 9A - Controls and Procedures

Disclosure Controls and Procedures. Our management, under the supervision and with the participation of our Chief Executive and Financial Officer (“Certifying Officer”), has evaluated the effectiveness of our disclosure controls and procedures as defined in Rules 13a-15 promulgated under the Exchange Act as of the end of the period covered by this Annual Report. Disclosure controls and procedures are controls and procedures designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms and include controls and procedures designed to ensure that information we are required to disclose in such reports is accumulated and communicated to management, including our Certifying Officer, as appropriate, to allow timely decisions regarding required disclosure. Based upon that evaluation, our Certifying Officer concluded that as of such date, our disclosure controls and procedures were not effective to ensure that the information required to be disclosed by us in our reports is recorded, processed, summarized and reported within the time periods specified by the SEC due to a weakness in our controls described below. However, our Certifying Officer believes that the financial statements included in this report fairly present, in all material respects, our financial condition, results of operations and cash flows for the respective periods presented.

Management’s Annual Report on Internal Control over Financial Reporting. Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rule 13a-15(f) of the Exchange Act.

Internal control over financial reporting is defined under the Exchange Act as a process designed by, or under the supervision of, our CEO and CFO and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| -- | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; |

| -- | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| -- | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

Because of its inherent limitation, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluations of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate. Accordingly, even an effective system of internal control over financial reporting will provide only reasonable assurance with respect to financial statement preparation.

12

Management's assessment of the effectiveness of the Company's internal control over financial reporting is as of the year ended December 31, 2011. We are currently considered to be a shell company in as much as we have no current operations, revenues or employees. Because we have only one officer and director, the Company's internal controls are deficient for the following reasons, (1) there are no entity level controls because there is only one person serving in the dual capacity of sole officer and sole director, (2) there are no segregation of duties as that same person approves and directs the payment of the Company's bills, and (3) there is no separate audit committee. As a result, the Company's internal controls have an inherent weakness which may increase the risks of errors in financial reporting under current operations and accordingly are deficient as evaluated against the criteria set forth in the Internal Control - Integrated Framework issued by the committee of Sponsoring Organizations of the Treadway Commission. Based on our evaluation, our management concluded that our internal controls over financial reporting were not effective as of December 31, 2011.

This Annual Report does not include an attestation report of our registered public accounting firm regarding our internal control over financial reporting, pursuant to the current appropriate laws and regulations.

Changes in Internal Control over Financial Reporting. There was no change in our internal control over financial reporting that occurred during the quarter ended December 31, 2011 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting which internal controls will remain deficient until such time as the Company completes a merger transaction or acquisition of an operating business at which time management will be able to implement effective controls and procedures.

Item 9B - Other Information

None

PART III

Item 10 - Directors, Executive Officers and Corporate Governance

The directors and executive officers serving the Company are as follows:

| Name | Age | Position Held and Tenure | ||

| Timothy P. Halter | 45 | President, Chief Executive Officer | ||

| Chief Financial Officer and Director |

The director named above will serve until the next annual meeting of stockholders or until their successors are duly elected and have qualified. Directors are elected for one-year terms at the annual stockholders meeting. Officers will hold their positions at the pleasure of the board of directors, absent any employment agreement, of which none currently exists or is contemplated. There is no arrangement or understanding between Mr. Halter or any other person pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management stockholders will exercise their voting rights to continue to elect directors to our board. There are also no arrangements, agreements or understandings between non-management stockholders that may directly or indirectly participate in or influence the management of our affairs. Our board of directors does not have any committees at this time.

The directors and officers will devote their time to the Company's affairs on an as needed basis, which, depending on the circumstances, could amount to as little as two hours per month, or more than forty hours per month, but more than likely encompass less than four (4) hours per month. There are no agreements or understandings for any officer or director to resign at the request of another person, and none of the officers or directors are acting on behalf of, or will act at the direction of, any other person.

Biographical Information

Timothy P. Halter. Mr. Halter, age 45, has served as our sole officer and director since March 2007. Mr. Halter is primarily responsible for implementing our business plan. Since 1995, Mr. Halter has been the president and the sole stockholder of Halter Financial Group, Inc., a Dallas, Texas based consulting firm specializing in the area of mergers, acquisitions and corporate finance. In September 2005, Mr. Halter and other minority partners formed HFI. HFI conducts no business operations. Mr. Halter currently serves as a director of DXP Enterprises, Inc., a public corporation which provides pumping products and services to a variety of industries(NASDAQ: DXPE), and is an officer and director of Marketing Acquisition Corp.,_SMSA Humble Acquisition Corp., SMSA Katy Acquisition Corp. and SMSA Dallas Acquisition Corp., each a Nevada corporation. Except for DXP Enterprises, each of the afore-referenced companies for which Mr. Halter acts as an officer and director may be deemed shell corporations. Mr Halter is also an officer and director of WLT Brothers Holding, Inc., a private holding company. Mr. Halter will devote as much of his time to our business affairs as he deems may be necessary to implement our business plan.

13

Mr. Halter has significant experience acting in the capacity of the principal stockholder, a director and an executive officer of blank check and/or shell companies. As demonstrated by the number of reverse merger transactions detailed in the below table, we believe that Mr. Halter possesses the attributes, experience, and qualifications necessary to effect the Company's stated business plan. Furthermore, given Mr. Halter's abilities and the Company's limited financial resources, the Company has determined that it is in its best interests for Mr. Halter to serve as both the Company's principal executive officer as well as Chairman of the Board of Directors. Since Mr. Halter serves as the Company's sole director there is no designated lead director, and therefore, any and all risk oversight and risk management matters are the responsibility of Mr. Halter.

Mr. Halter was not affiliated with any of the operating businesses prior to the consummation of the reverse merger transaction and resigned as an officer and director upon consummation of the transaction. After each merger transaction, Mr. Halter did not participate in the management of any of the companies and ceased being a principal stockholder. As noted in the table below Mr. Halter sold, in some cases, all or a portion of his securities in such companies after the change in control. Mr. Halter has also sold such securities for cash in open market transactions.

Mr. Halter is no longer a controlling stockholder, officer or director of any of the below listed entities and his involvement terminated upon the fulfillment of the respective plan of operation involving a business combination transaction with a private entity wishing to become publicly owned. In most instances, when a business combination was transacted with one of these companies, that entity was required to file a current Report on Form 8-K describing the transaction. We refer the reader to the respective Form 8-K, if filed, for any of the companies listed below for detailed information concerning the business combination entered into by that company.

| Year combination | ||

| transaction | ||

Entity | File/CIK # | occurred |

| International Stem Cell Corp. | 000-51891 | 2006 |

| MGCC Investment Strategies, Inc. | 000-50883 | 2006 |

| RTO Holdings, Inc. | 000-15579 | 2006 |

| Zeolite Exploration Company | 333-74670 | 2006 |

| Athersys, Inc. | 000-52108 | 2007 |

| BTHC VII, Inc. | 000-52123 | 2007 |

| China Ritar Power Corp. | 000-25901 | 2007 |

| Energroup Holdings Corp. | 0-32873 | 2007 |

| Hong Kong Winalite Group, Inc. | 333-83375 | 2007 |

| Millennium Quest, Inc. | 000-31619 | 2007 |

| Point Acquisition Corp. | 000-51527 | 2007 |

| Redpoint Bio Corp. | 000-51708 | 2007 |

| Sutor Technology, Inc. | 333-83351 | 2007 |

| Fashion Tech International, Inc. | 2-93231-NY | 2008 |

| Nevstar Corporation | 000-21071 | 2008 |

| Latin America Ventures, Inc. | 000-53132 | 2008 |

| Yuhe International, Inc. | 333-83125 | 2008 |

| BTHC VIII, Inc. | 000-52232 | 2009 |

| BTHC X, Inc. | 000-52237 | 2009 |

| SMSA El Paso II Acquisition Corp. | 000-53334 | 2009 |

| SMSA Palestine Acquisition Corp. | 000-53343 | 2009 |

| BTHC XIV, Inc. | 000-52722 | 2010 |

| BTHC XV, Inc. | 000-52808 | 2010 |

| SMSA Crane Acquisition Corp. | 000-53800 | 2010 |

| SMSA Gainesville Acquisition Corp. | 000-53803 | 2010 |

| SMSA Treemont Acquisition Corp. | 000-54096 | 2011 |

It is specifically noted that the relative success or failure of any of these entities subsequent to Mr. Halter's involvement in them is not an indication of the possibility of success or failure of the Company upon the completion of it's current plan of operations. Additional information about these companies can be researched at www.sec.gov.

14

Indemnification of Officers and Directors.

We have the authority under the Nevada General Corporation Law to indemnify our directors and officers to the extent provided for in such statute. Set forth below is a discussion of Nevada law regarding indemnification which we believe discloses the material aspects of such law on this subject. The Nevada law provides, in part, that a corporation may indemnify a director or officer or other person who was, is or is threatened to be made a named defendant or respondent in a proceeding because such person is or was a director, officer, employee or agent of the corporation, if it is determined that such person:

| * | conducted himself in good faith; |

| * | reasonably believed, in the case of conduct in his official capacity as a director or officer of the corporation, that his conduct was in the corporation's best interest and, in all other cases, that his conduct was at least not opposed to the corporation's best interests; and |

| * | in the case of any criminal proceeding, had no reasonable cause to believe that his conduct was unlawful. |

A corporation may indemnify a person under the Nevada law against judgments, penalties, including excise and similar taxes, fines, settlement, unreasonable expenses actually incurred by the person in connection with the proceeding. If the person is found liable to the corporation or is found liable on the basis that personal benefit was improperly received by the person, the indemnification is limited to reasonable expenses actually incurred by the person in connection with the proceeding, and shall not be made in respect of any proceeding in which the person shall have been found liable for willful or intentional misconduct in the performance of his duty to the corporation. The corporation may also pay or reimburse expenses incurred by a person in connection with his appearance as witness or other participation in a proceeding at a time when he is not a named defendant or respondent in the proceeding.

Our Articles of Incorporation provides that none of our directors shall be personally liable to us or our stockholders for monetary damages for an act or omission in such directors' capacity as a director; provided, however, that the liability of such director is not limited to the extent that such director is found liable for (a) a breach of the directors' duty of loyalty to us or our stockholders, (b) an act or omission not in good faith that constitutes a breach of duty of the director to us or an act or omission that involves intentional misconduct or a knowing violation of the law, (c) a transaction from which the director received an improper benefit, whether or not the benefit resulted from an action taken within the scope of the director's office, or (d) an act or omission for which the liability of the director is expressly provided under Nevada law. Limitations on liability provided for in our Articles of Incorporation do not restrict the availability of non-monetary remedies and do not affect a director's responsibility under any other law, such as the federal securities laws or state or federal environmental laws.

We believe that these provisions will assist us in attracting and retaining qualified individuals to serve as executive officers and directors. The inclusion of these provisions in our Articles of Incorporation may have the effect of reducing a likelihood of derivative litigation against our directors and may discourage or deter stockholders or management from bringing a lawsuit against directors for breach of their duty of case, even though such an action, if successful, might otherwise have benefitted us or our stockholders.

Our Bylaws provide that we will indemnify our directors to the fullest extent provided by Nevada General Corporation Law and we may, if and to the extent authorized by our board of directors, so indemnify our officers and other persons whom we have the power to indemnify against liability, reasonable expense or other matters.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by such director, officer, or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires our executive officers and directors and person who own more than 10% of our common stock to file reports regarding ownership of and transactions in our securities with the Commission and to provide us with copies of those filings. Based solely on our review of the copies received by or a written representation from certain reporting persons we believe that during fiscal year ended December 31, 2011, we believe that all eligible persons are in compliance with the requirements of Section 16(a).

15

Conflicts of Interest

The sole officer of the Company will not devote more than a small portion of his time to the affairs of the Company. There will be occasions when the time requirements of the Company’s business conflict with the demands of the officer’s other business and investment activities. Such conflicts may require that the Company attempt to employ additional personnel. There is no assurance that the services of such persons will be available or that they can be obtained upon terms favorable to the Company.

The officer, director and principal stockholder of the Company may actively negotiate for the purchase of a portion of their common stock as a condition to, or in connection with, a proposed merger or acquisition transaction. It is anticipated that a substantial premium may be paid by the purchaser in conjunction with any sale of shares by the Company’s officer, director and principal stockholder made as a condition to, or in connection with, a proposed merger or acquisition transaction. The fact that a substantial premium may be paid to the Company’s sole officer and director to acquire his shares creates a conflict of interest for him and may compromise his state law fiduciary duties to the Company’s other stockholders. In making any such sale, the Company’s sole officer and director may consider his own personal pecuniary benefit rather than the best interests of the Company and the Company’s other stockholders, and the other stockholders are not expected to be afforded the opportunity to approve or consent to any particular buy-out transaction involving shares held by Company management.

The Company has adopted a policy under which any consulting or finders fee that may be paid to a third party for consulting services to assist management in evaluating a prospective business opportunity would be paid in stock rather than in cash. Any such issuance of stock would be made on an ad hoc basis. Accordingly, the Company is unable to predict whether, or in what amount, such stock issuance might be made.

It is not currently anticipated that any salary, consulting fee, or finders fee shall be paid to any of the Company’s directors or executive officers, or to any other affiliate of the Company.

Although management has no current plans to cause the Company to do so, it is possible that the Company may enter into an agreement with an acquisition candidate requiring the sale of all or a portion of the Common Stock held by the Company’s current stockholders to the acquisition candidate or principals thereof, or to other individuals or business entities, or requiring some other form of payment to the Company’s current stockholders, or requiring the future employment of specified officers and payment of salaries to them. It is more likely than not that any sale of securities by the Company’s current stockholders to an acquisition candidate would be at a price substantially higher than that originally paid by such stockholders. Any payment to current stockholders in the context of an acquisition involving the Company would be determined entirely by the largely unforeseeable terms of a future agreement with an unidentified business entity.

Involvement on Certain Material Legal Proceedings During the Past Five (5) Years

| (1)No director, officer, significant employee or consultant has been convicted in a criminal proceeding, exclusive of traffic violations or is subject to any pending criminal proceeding. |

| (2)No bankruptcy petitions have been filed by or against any business or property of any director, officer, significant employee or consultant of the Company nor has any bankruptcy petition been filed against a partnership or business association where these persons were general partners or executive officers. |

| (3)No director, officer, significant employee or consultant has been permanently or temporarily enjoined, barred, suspended or otherwise limited from involvement in any type of business, securities or banking activities. |

| (4)No director, officer or significant employee has been convicted of violating a federal or state securities or commodities law. |

(Remainder of this page left blank intentionally)

16

Item 11 - Executive Compensation

The current management and oversight of the Company requires less than four (4) hours per month. As the Company’s sole officer and director is engaged in other full-time income producing activities, the Company’s sole officer or director has received any compensation from the Company. In future periods, subsequent to the consummation of a business combination transaction, the Company anticipates that it will pay compensation to its officer(s) and/or director(s).

SUMMARY COMPENSATION TABLE

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |

Timothy P. Halter, Principal Executive Officer | 2011 2010 2009 | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0- | $-0- $-0- $-0 |

The Company has no other executive compensation issues which would require the inclusion of other mandated table disclosures.

Item 12 - Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of the date of this Annual Report, the number of shares of Common Stock owned of record and beneficially by executive officers, directors and persons who hold 5% or more of the outstanding Common Stock of the Company. Also included are the shares held by all executive officers and directors as a group.

| Shares Beneficially Owned (1) | ||

Name and address (2) | Number of Shares | Percentage (3) |

| Halter Financial Investments, L. P. | 1,250,000 | 67.45% |

| 12890 Hilltop Road | ||

| Argyle, TX 76226 | ||

| Timothy P. Halter (4) | 1,250,000 | 67.45% |

| 12890 Hilltop Road | ||

| Argyle, TX 76226 | ||

| Glenn A. Little | 416,668 | 22.48% |

| 211 West Wall Street | ||

| Midland, Texas 79701 | ||

| All Directors and | 1,250,000 | 67.45% |

| Executive Officers (1 person) | ||

| (1) | On March 21, 2012, there were 1,853,207 shares of our common stock outstanding and no shares of preferred stock issued and outstanding. We have no outstanding stock options or warrants. |

| (2) | Under applicable Commission rules, a person is deemed the "beneficial owner" of a security with regard to which the person directly or indirectly, has or shares (a) the voting power, which includes the power to vote or direct the voting of the security, or (b) the investment power, which includes the power to dispose, or direct the disposition, of the security, in each case irrespective of the person's economic interest in the security. Under Commission rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of another security. |

| (3) | In determining the percent of voting stock owned by a person on December 31, 2011 (a) the numerator is the number of shares of common stock beneficially owned by the person, including shares the beneficial ownership of which may be acquired within 60 days upon the exercise of options or warrants or conversion of convertible securities, and (b) the denominator is the total of (i) the 1,853,207 shares of common stock outstanding on December 31, 2011, and (ii) any shares of common stock which the person has the right to acquire within 60 days upon the exercise of options or warrants or conversion of convertible securities. Neither the numerator nor the denominator includes shares which may be issued upon the exercise of any other options or warrants or the conversion of any other convertible securities. |

17

| (4) | Mr. Halter is our president and director. He also is a member of Halter Financial Investments GP, LLC, the general partner of Halter Financial Investments L.P. Halter Financial Investments, L.P. ("HFI") is a Texas limited partnership of which Halter Financial Investments GP, LLC, a Texas limited liability company ("HFI GP"), is the sole general partner. The limited partners of HFI are: (i) TPH Capital, LP., a Texas limited partnership of which TPH Capital GP, LLC, a Texas limited liability company ("TPH GP"), is the general partner and Timothy P. Halter is the sole member of TPH GP, (ii) Bellifield, LP, a Texas limited partnership of which Bellifield Capital Management, LLC, a Texas limited liability company ("Bellifield LLC") is the sole general partner and David Brigante is the sole member of Bellifield LLC; (iii) Colhurst Capital LP, a Texas limited partnership of which Colhurst Capital GP LLC, a Texas limited liability company ("Colhurst LLC"), is the general partner and George L. Diamond is the sole member of Colhurst LLC; and (iv) Rivergreen Capital, LLC, a Texas limited liability company ("Rivergreen LLC"), of which Marat Rosenberg is the sole member. As a result, each of the foregoing persons may be deemed to be a beneficial owner of the shares held of record by HFI. HFI's address is 12890 Hilltop Road, Argyle, TX 76226. |

Changes in Control

There are currently no arrangements which may result in a change in control of the Company.

Item 13 - Certain Relationships and Related Transactions, and Director Independence

The Company currently maintains a mailing address at 12890 Hilltop Road, Argyle, Texas 76226. The Company’s telephone number there is (972) 233-0300. Other than this mailing address, the Company does not currently maintain any other office facilities, and does not anticipate the need for maintaining office facilities at any time in the foreseeable future. The Company pays no rent or other fees for the use of the mailing address as these offices are used virtually full-time by other businesses of the Company’s sole officer and director.

Item 14 - Principal Accounting Fees and Services

The Company paid or accrued the following fees in each of the prior two fiscal years to it’s principal accountant, Blanchfield, Meyer, Kober & Rizzo, LLP of Hauppauge, New York or S. W. Hatfield, CPA of Dallas, Texas.

| Year ended | Year ended | |||||||

| December 31, | December 31, | |||||||

| 2011 | 2010 | |||||||

1. Audit fees | ||||||||

| Blanchfield, Meyer, Kober & Rizzo, LLP | $ | 8,100 | $ | 8,100 | ||||

| S. W. Hatfield, CPA | - | 2,250 | ||||||

2. Audit-related fees | - | - | ||||||

3. Tax fees | - | 235 | ||||||

4. All other fees | - | - | ||||||

| Totals | $ | 8,100 | $ | 10,585 | ||||

We have considered whether the provision of any non-audit services, currently or in the future, is compatible with Blanchfield, Meyer, Kober & Rizzo, LLP maintaining its independence and have determined that these services do not compromise their independence.

Financial Information System Design and Implementation: Neither Blanchfield, Meyer, Kober & Rizzo, LLP or S. W. Hatfield, CPA charged Company any fees for financial information system design and implementation fees.