United States Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21904

(Investment Company Act File Number)

Federated Hermes MDT Series

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant’s Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 2024-07-31

Date of Reporting Period: 2024-07-31

| Item 1. | Reports to Stockholders |

Federated Hermes MDT Large Cap Growth Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Large Cap Growth Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A Shares | $113 | 0.99% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 1000 Growth Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of large-sized U.S. companies.

Top Contributors to Performance

■ An underweight position in companies with negative analyst conviction and flat to worsening earnings to price ratio contributed

positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Industrials aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA and

Vistra Corp. and an underweight position in Tesla, Inc.

Top Detractors from Performance

■ Poor stock selection among companies with a strong 1-year return, very high analyst conviction, and low structural earnings detracted

from Fund relative performance.

■ By sector, stock selection in Consumer Staples and Financials detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Zscaler, Inc.

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

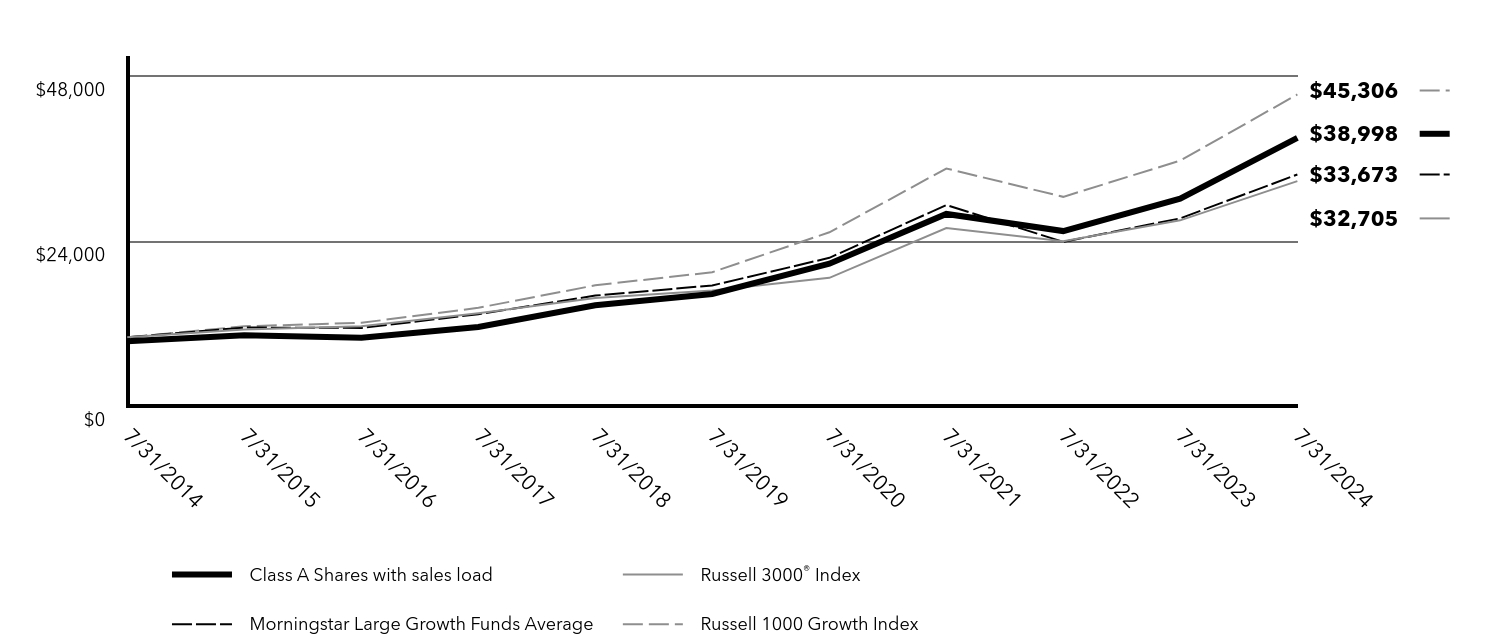

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class A Shares with sales load | Russell 3000® Index | Morningstar Large Growth Funds Average | Russell 1000 Growth Index |

|---|

| 7/31/2014 | $9,450 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,322 | $11,128 | $11,427 | $11,608 |

| 7/31/2016 | $9,948 | $11,623 | $11,380 | $12,113 |

| 7/31/2017 | $11,507 | $13,498 | $13,364 | $14,299 |

| 7/31/2018 | $14,658 | $15,711 | $16,073 | $17,566 |

| 7/31/2019 | $16,311 | $16,819 | $17,541 | $19,467 |

| 7/31/2020 | $20,700 | $18,657 | $21,565 | $25,275 |

| 7/31/2021 | $27,945 | $25,882 | $29,229 | $34,546 |

| 7/31/2022 | $25,450 | $23,979 | $23,887 | $30,426 |

| 7/31/2023 | $30,173 | $27,013 | $27,296 | $35,692 |

| 7/31/2024 | $38,998 | $32,705 | $33,673 | $45,306 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class A Shares with sales load | 22.12% | 17.71% | 14.58% |

| Class A Shares without sales load | 29.25% | 19.05% | 15.23% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Morningstar Large Growth Funds Average | 23.31% | 13.95% | 12.92% |

| Russell 1000 Growth Index | 26.94% | 18.40% | 16.31% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,507,393,159 |

| Number of Investments | 101 |

| Portfolio Turnover | 58% |

| Total Advisory Fees Paid | $4,997,886 |

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

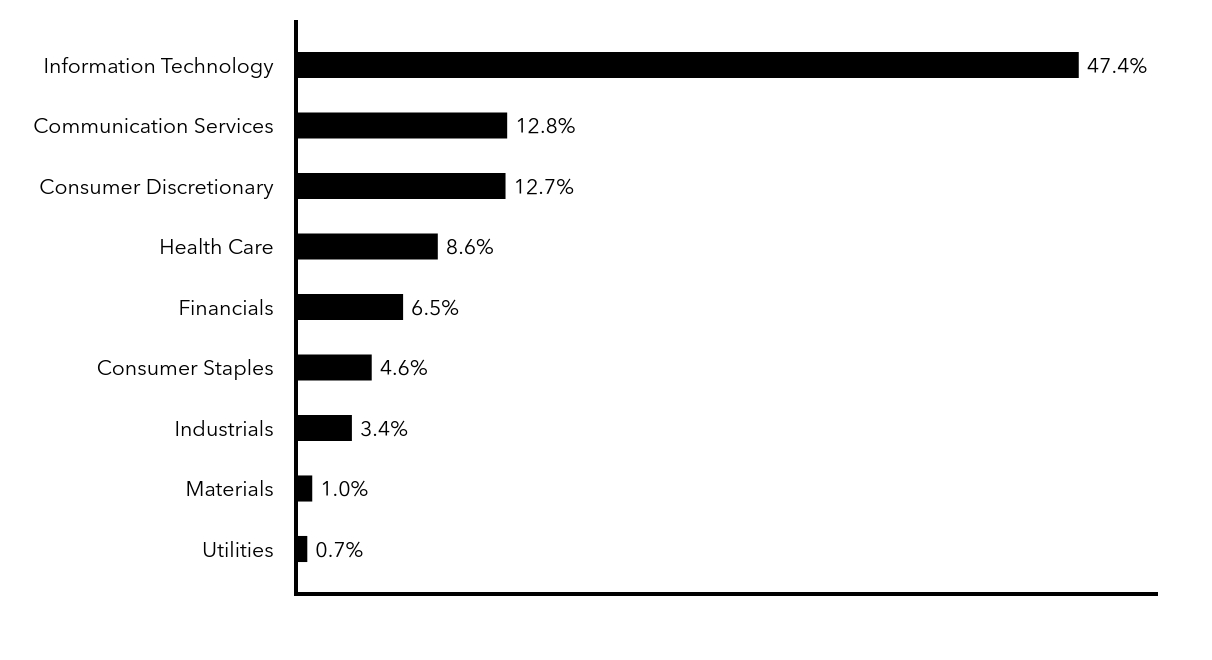

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 0.7% |

| Materials | 1.0% |

| Industrials | 3.4% |

| Consumer Staples | 4.6% |

| Financials | 6.5% |

| Health Care | 8.6% |

| Consumer Discretionary | 12.7% |

| Communication Services | 12.8% |

| Information Technology | 47.4% |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at www.FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective October 1, 2024, the Fund’s annual investment advisory fee payable to its investment adviser is reduced from 0.75% to 0.65% of the Fund’s average daily net assets.

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R700

37329-A (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Large Cap Growth Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Large Cap Growth Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C Shares | $199 | 1.74% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 1000 Growth Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of large-sized U.S. companies.

Top Contributors to Performance

■ An underweight position in companies with negative analyst conviction and flat to worsening earnings to price ratio contributed

positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Industrials aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA and

Vistra Corp. and an underweight position in Tesla, Inc.

Top Detractors from Performance

■ Poor stock selection among companies with a strong 1-year return, very high analyst conviction, and low structural earnings detracted

from Fund relative performance.

■ By sector, stock selection in Consumer Staples and Financials detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Zscaler, Inc.

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

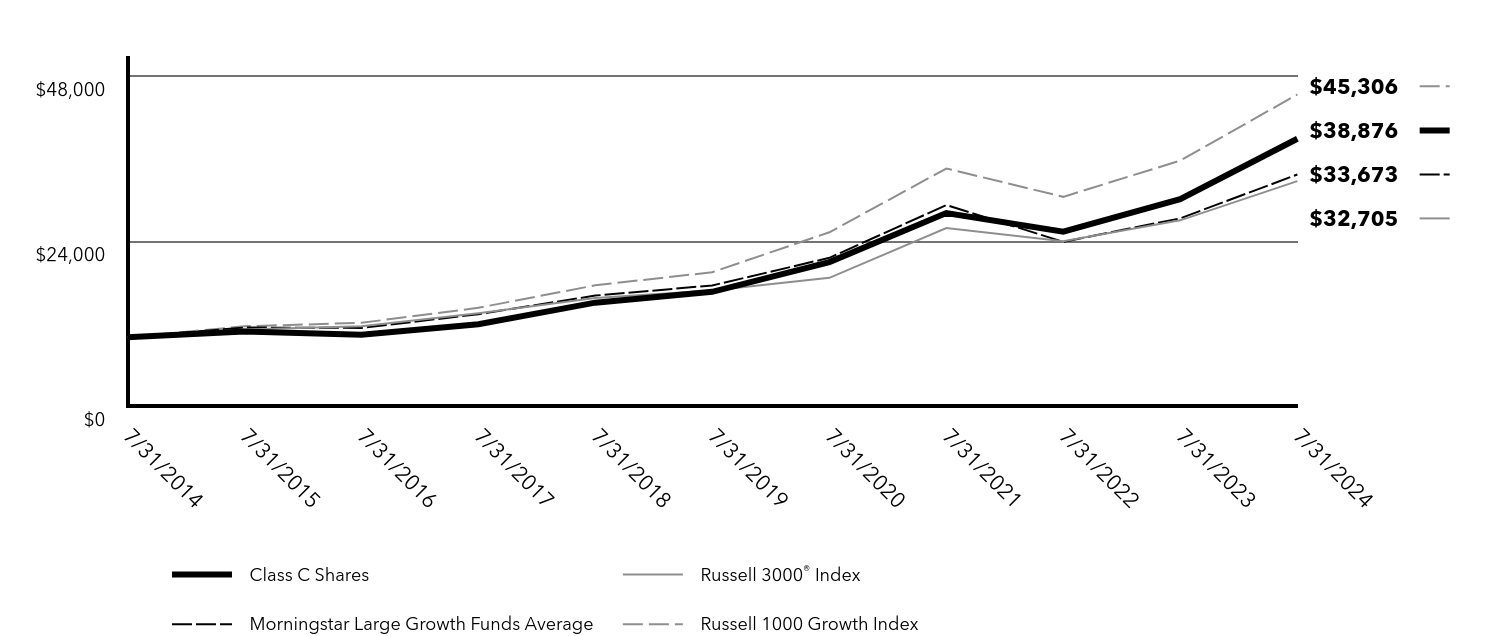

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class C Shares | Russell 3000® Index | Morningstar Large Growth Funds Average | Russell 1000 Growth Index |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,843 | $11,128 | $11,427 | $11,608 |

| 7/31/2016 | $10,366 | $11,623 | $11,380 | $12,113 |

| 7/31/2017 | $11,903 | $13,498 | $13,364 | $14,299 |

| 7/31/2018 | $15,048 | $15,711 | $16,073 | $17,566 |

| 7/31/2019 | $16,623 | $16,819 | $17,541 | $19,467 |

| 7/31/2020 | $20,942 | $18,657 | $21,565 | $25,275 |

| 7/31/2021 | $28,064 | $25,882 | $29,229 | $34,546 |

| 7/31/2022 | $25,370 | $23,979 | $23,887 | $30,426 |

| 7/31/2023 | $30,079 | $27,013 | $27,296 | $35,692 |

| 7/31/2024 | $38,876 | $32,705 | $33,673 | $45,306 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class C Shares with sales load | 27.27% | 18.17% | 14.54% |

| Class C Shares without sales load | 28.27% | 18.17% | 14.54% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Morningstar Large Growth Funds Average | 23.31% | 13.95% | 12.92% |

| Russell 1000 Growth Index | 26.94% | 18.40% | 16.31% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,507,393,159 |

| Number of Investments | 101 |

| Portfolio Turnover | 58% |

| Total Advisory Fees Paid | $4,997,886 |

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

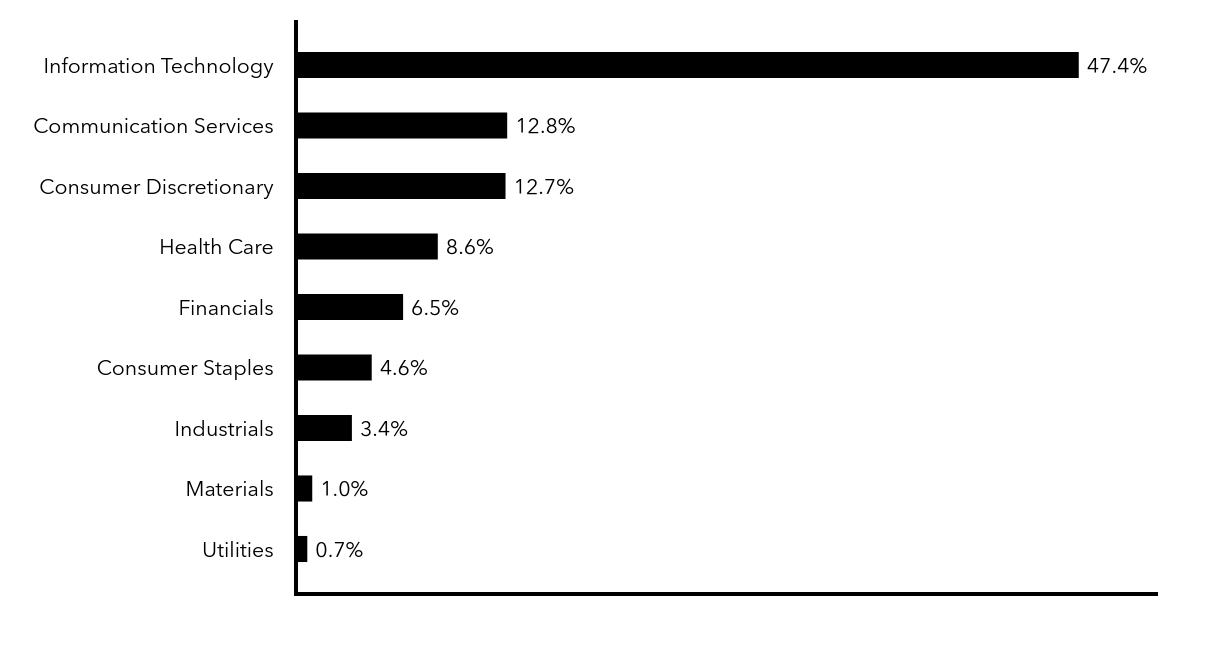

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 0.7% |

| Materials | 1.0% |

| Industrials | 3.4% |

| Consumer Staples | 4.6% |

| Financials | 6.5% |

| Health Care | 8.6% |

| Consumer Discretionary | 12.7% |

| Communication Services | 12.8% |

| Information Technology | 47.4% |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at www.FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective October 1, 2024, the Fund’s annual investment advisory fee payable to its investment adviser is reduced from 0.75% to 0.65% of the Fund’s average daily net assets.

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R809

37329-B (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Large Cap Growth Fund

Institutional Shares QILGX

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Large Cap Growth Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $85 | 0.74% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 1000 Growth Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of large-sized U.S. companies.

Top Contributors to Performance

■ An underweight position in companies with negative analyst conviction and flat to worsening earnings to price ratio contributed

positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Industrials aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA and

Vistra Corp. and an underweight position in Tesla, Inc.

Top Detractors from Performance

■ Poor stock selection among companies with a strong 1-year return, very high analyst conviction, and low structural earnings detracted

from Fund relative performance.

■ By sector, stock selection in Consumer Staples and Financials detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Zscaler, Inc.

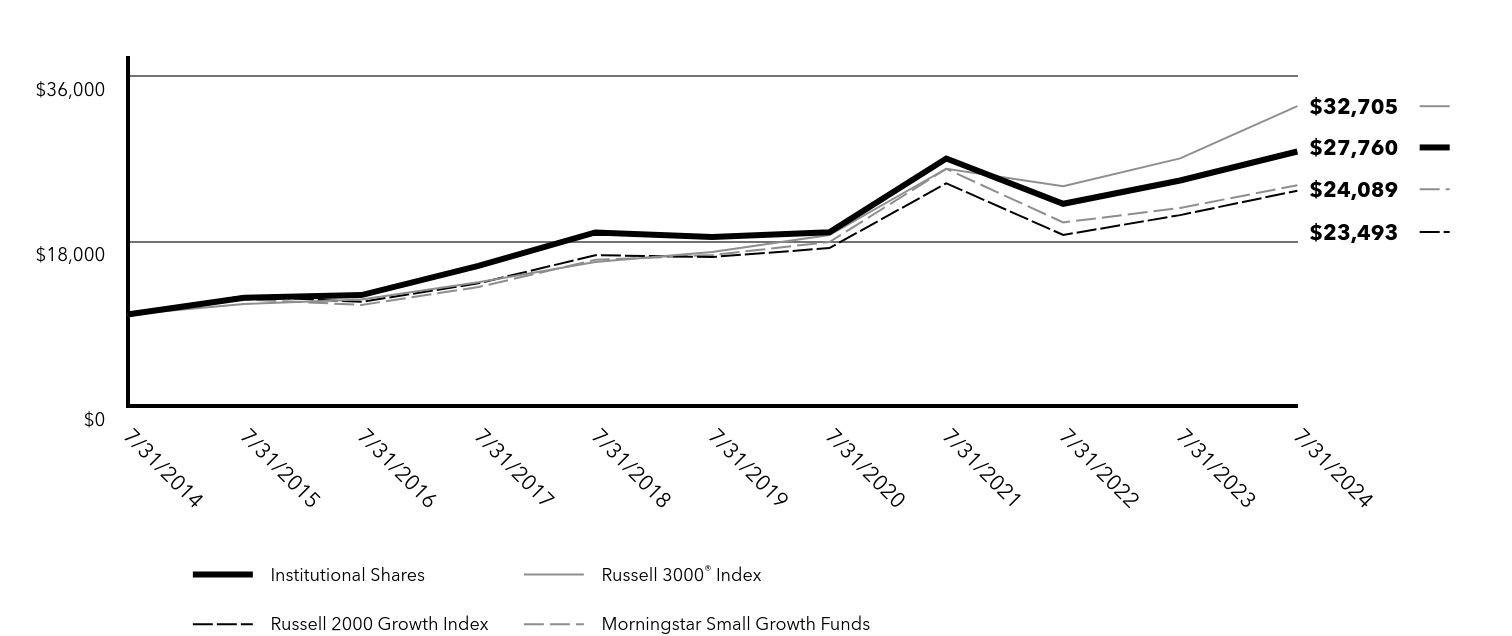

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

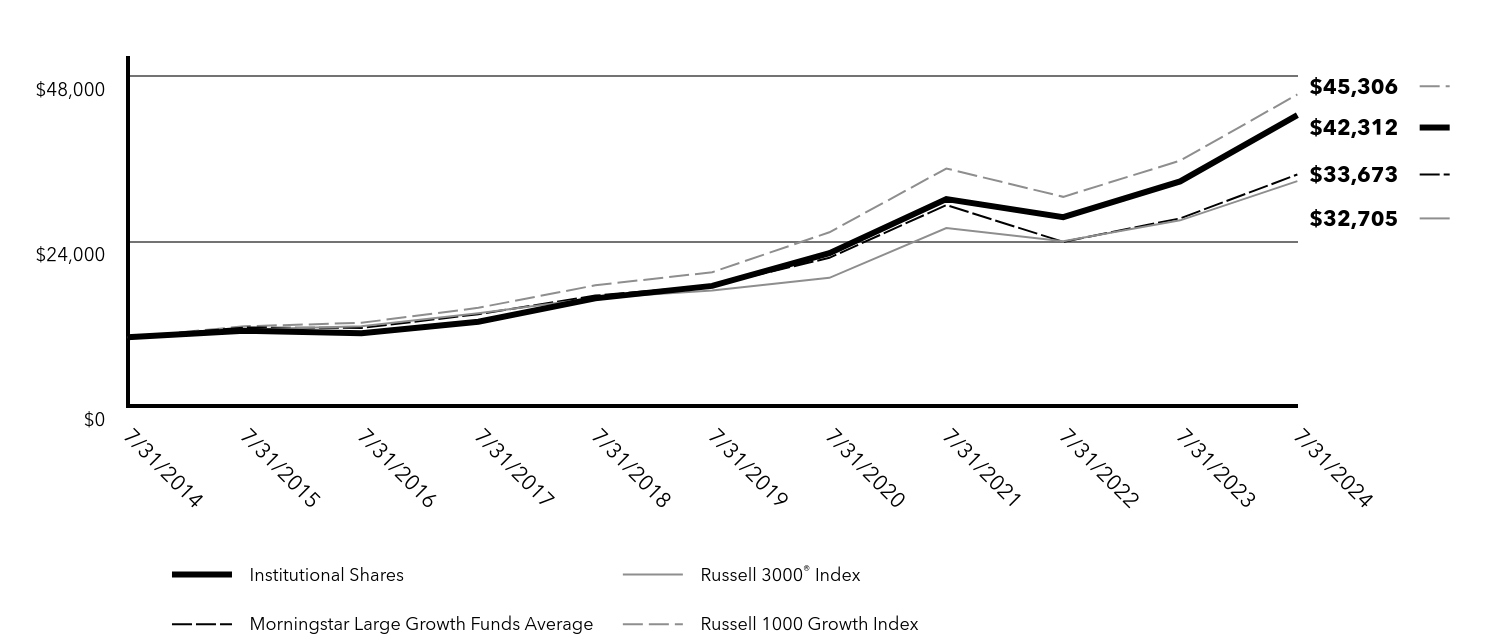

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Institutional Shares | Russell 3000® Index | Morningstar Large Growth Funds Average | Russell 1000 Growth Index |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,955 | $11,128 | $11,427 | $11,608 |

| 7/31/2016 | $10,583 | $11,623 | $11,380 | $12,113 |

| 7/31/2017 | $12,274 | $13,498 | $13,364 | $14,299 |

| 7/31/2018 | $15,668 | $15,711 | $16,073 | $17,566 |

| 7/31/2019 | $17,483 | $16,819 | $17,541 | $19,467 |

| 7/31/2020 | $22,242 | $18,657 | $21,565 | $25,275 |

| 7/31/2021 | $30,092 | $25,882 | $29,229 | $34,546 |

| 7/31/2022 | $27,477 | $23,979 | $23,887 | $30,426 |

| 7/31/2023 | $32,664 | $27,013 | $27,296 | $35,692 |

| 7/31/2024 | $42,312 | $32,705 | $33,673 | $45,306 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 29.54% | 19.33% | 15.52% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Morningstar Large Growth Funds Average | 23.31% | 13.95% | 12.92% |

| Russell 1000 Growth Index | 26.94% | 18.40% | 16.31% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,507,393,159 |

| Number of Investments | 101 |

| Portfolio Turnover | 58% |

| Total Advisory Fees Paid | $4,997,886 |

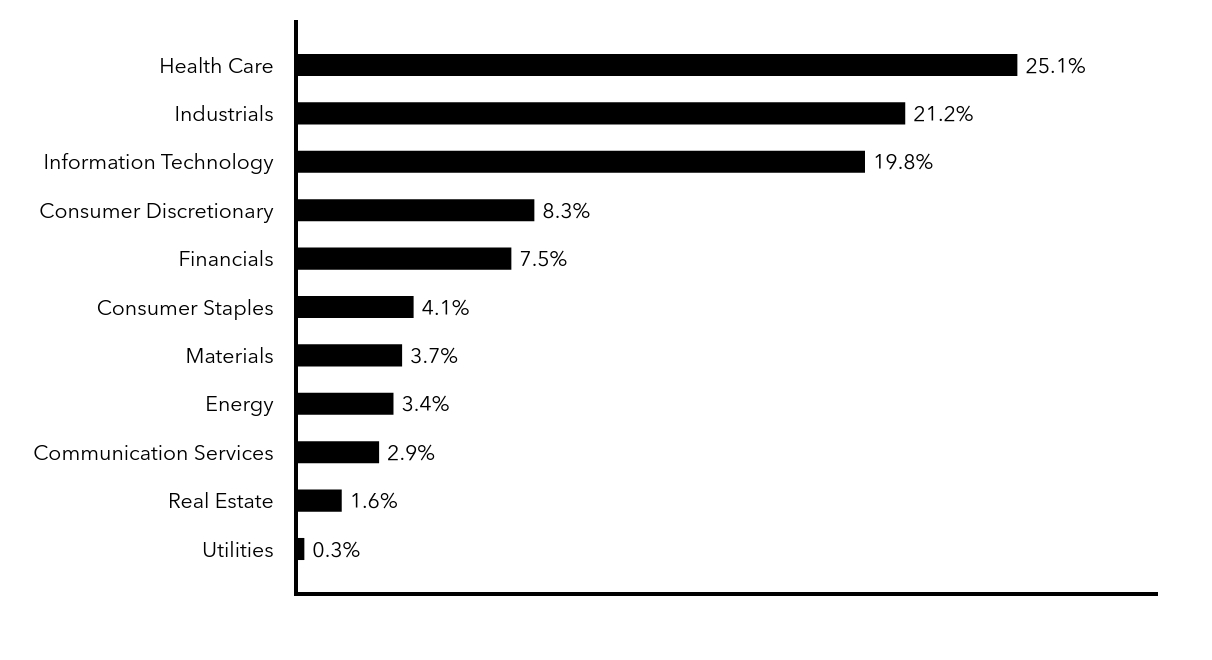

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

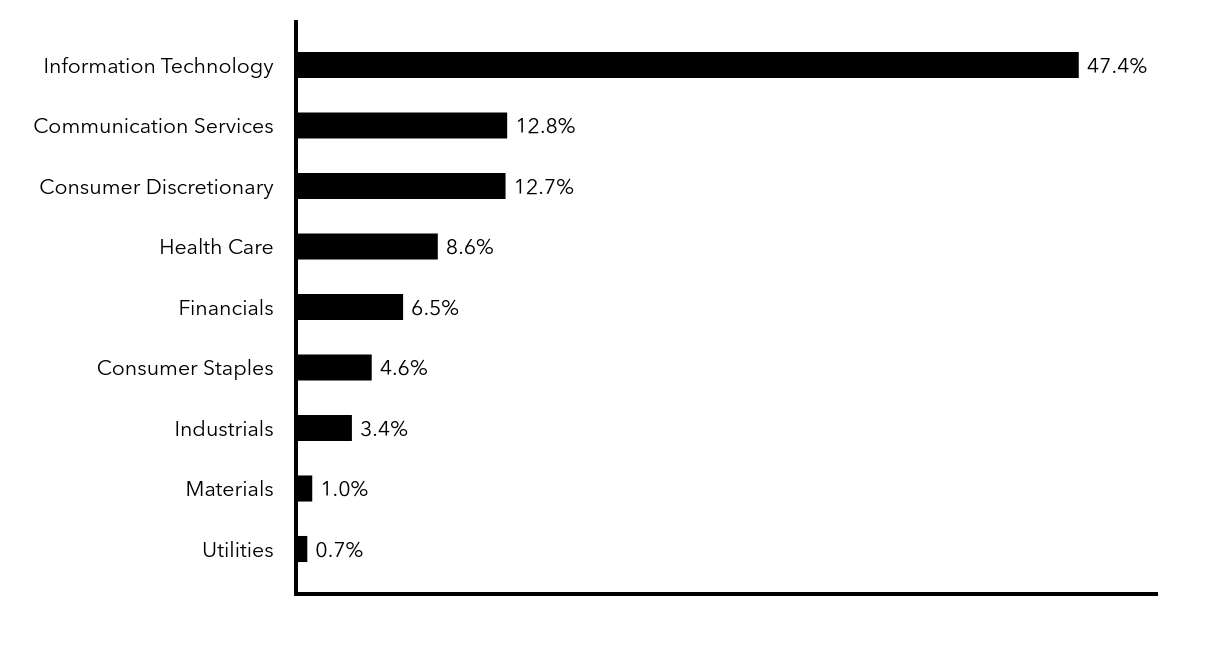

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 0.7% |

| Materials | 1.0% |

| Industrials | 3.4% |

| Consumer Staples | 4.6% |

| Financials | 6.5% |

| Health Care | 8.6% |

| Consumer Discretionary | 12.7% |

| Communication Services | 12.8% |

| Information Technology | 47.4% |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at www.FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective October 1, 2024, the Fund’s annual investment advisory fee payable to its investment adviser is reduced from 0.75% to 0.65% of the Fund’s average daily net assets.

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R882

37329-C (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Large Cap Growth Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Large Cap Growth Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 Shares | $12Footnote Reference* | 0.71% |

| Footnote | Description |

Footnote* | Based on operations for the period from May 29, 2024 to July 31, 2024. Expenses for the full year would be higher. |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 1000 Growth Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of large-sized U.S. companies.

Top Contributors to Performance

■ An underweight position in companies with negative analyst conviction and flat to worsening earnings to price ratio contributed

positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Industrials aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA and

Vistra Corp. and an underweight position in Tesla, Inc.

Top Detractors from Performance

■ Poor stock selection among companies with a strong 1-year return, very high analyst conviction, and low structural earnings detracted

from Fund relative performance.

■ By sector, stock selection in Consumer Staples and Financials detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Zscaler, Inc.

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

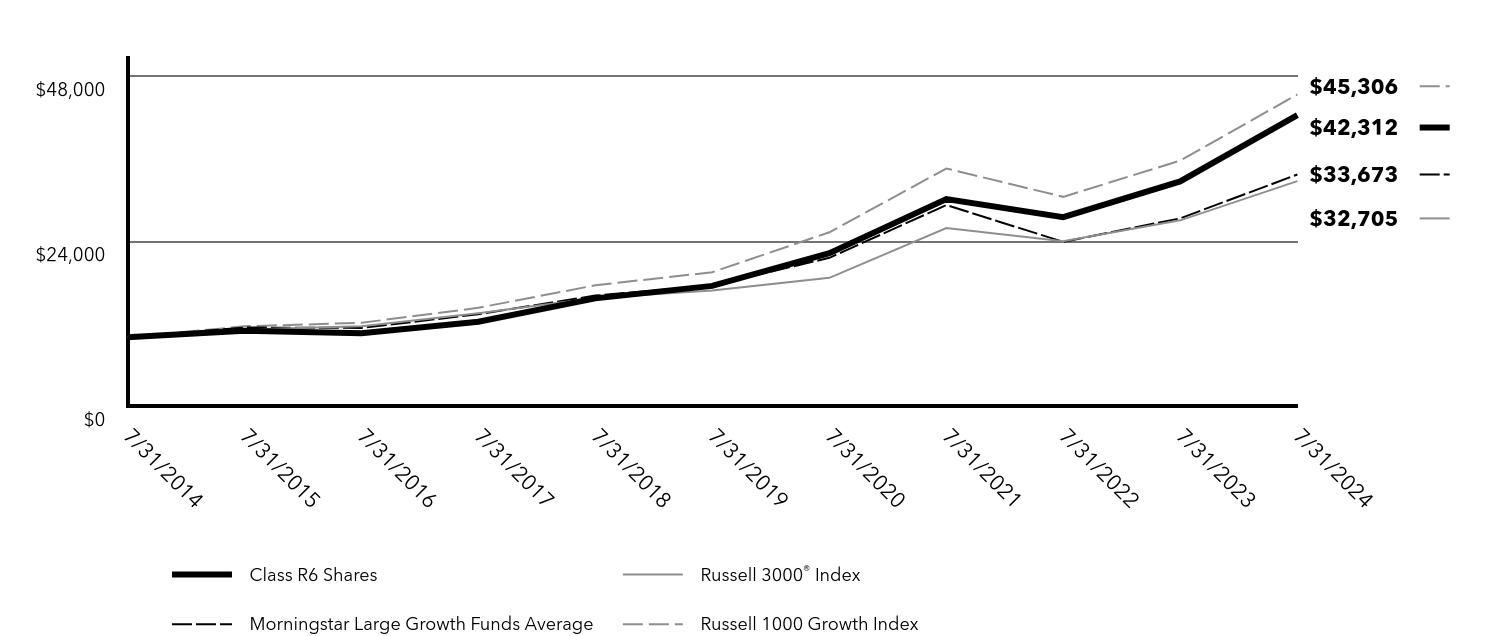

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class R6 Shares | Russell 3000® Index | Morningstar Large Growth Funds Average | Russell 1000 Growth Index |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,955 | $11,128 | $11,427 | $11,608 |

| 7/31/2016 | $10,583 | $11,623 | $11,380 | $12,113 |

| 7/31/2017 | $12,274 | $13,498 | $13,364 | $14,299 |

| 7/31/2018 | $15,668 | $15,711 | $16,073 | $17,566 |

| 7/31/2019 | $17,483 | $16,819 | $17,541 | $19,467 |

| 7/31/2020 | $22,242 | $18,657 | $21,565 | $25,275 |

| 7/31/2021 | $30,092 | $25,882 | $29,229 | $34,546 |

| 7/31/2022 | $27,477 | $23,979 | $23,887 | $30,426 |

| 7/31/2023 | $32,664 | $27,013 | $27,296 | $35,692 |

| 7/31/2024 | $42,312 | $32,705 | $33,673 | $45,306 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

Class R6 SharesFootnote Referencea | 29.54% | 19.33% | 15.52% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Morningstar Large Growth Funds Average | 23.31% | 13.95% | 12.92% |

| Russell 1000 Growth Index | 26.94% | 18.40% | 16.31% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Footnotea | The Fund's Class R6 Shares commenced operations on May 29, 2024. For the periods prior to the commencement of operations of the Fund's Class R6 Shares, the performance information shown is for the Fund's Institutional Shares. The performance of the Institutional Shares has not been adjusted to reflect the expenses of the Class R6 Shares, since the Class R6 Shares have a lower expense ratio than the Institutional Shares. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,507,393,159 |

| Number of Investments | 101 |

| Portfolio Turnover | 58% |

| Total Advisory Fees Paid | $4,997,886 |

Annual Shareholder Report

Federated Hermes MDT Large Cap Growth Fund

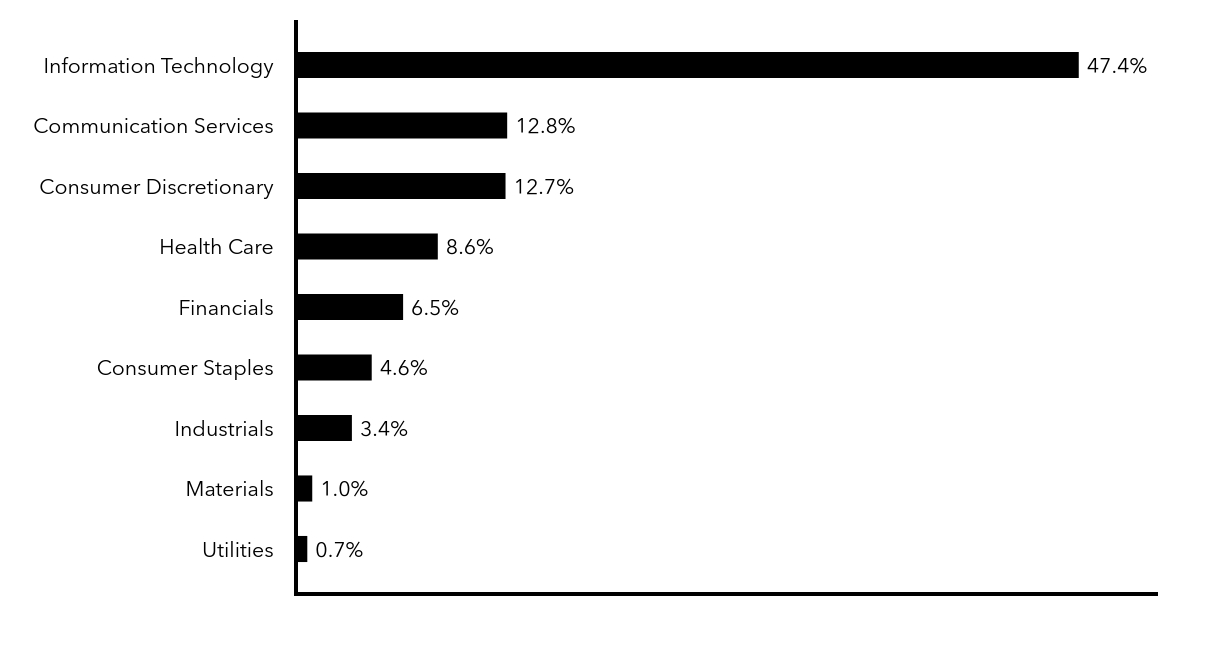

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 0.7% |

| Materials | 1.0% |

| Industrials | 3.4% |

| Consumer Staples | 4.6% |

| Financials | 6.5% |

| Health Care | 8.6% |

| Consumer Discretionary | 12.7% |

| Communication Services | 12.8% |

| Information Technology | 47.4% |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at www.FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective October 1, 2024, the Fund’s annual investment advisory fee payable to its investment adviser is reduced from 0.75% to 0.65% of the Fund’s average daily net assets.

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31425E101

37329-D (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT All Cap Core Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT All Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A Shares | $118 | 1.04% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 3000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term capital appreciation by investing primarily in the common stock of U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among companies with strong technical factors and neutral to high analyst conviction

contributed positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Utilities aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA, Vistra

Corp. and Dell Technologies, Inc. (Class C Shares).

Top Detractors from Performance

■ An underweight position in and weak stock selection among companies with negative analyst conviction and flat or improving earnings

to price ratios detracted from Fund relative performance.

■ By sector, stock selection in Consumer Staples detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Fortinet.

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

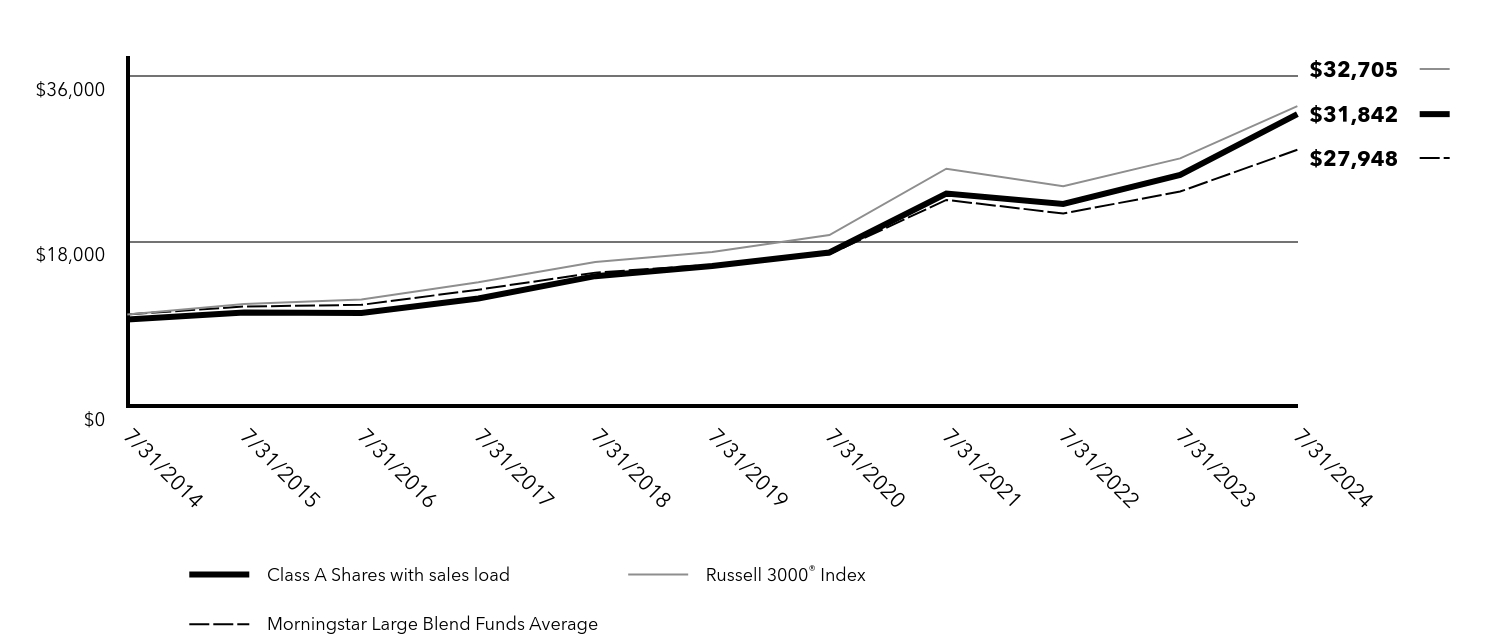

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class A Shares with sales load | Russell 3000® Index | Morningstar Large Blend Funds Average |

|---|

| 7/31/2014 | $9,451 | $10,000 | $10,000 |

| 7/31/2015 | $10,216 | $11,128 | $10,863 |

| 7/31/2016 | $10,154 | $11,623 | $11,045 |

| 7/31/2017 | $11,734 | $13,498 | $12,699 |

| 7/31/2018 | $14,172 | $15,711 | $14,558 |

| 7/31/2019 | $15,273 | $16,819 | $15,422 |

| 7/31/2020 | $16,754 | $18,657 | $16,566 |

| 7/31/2021 | $23,188 | $25,882 | $22,482 |

| 7/31/2022 | $22,040 | $23,979 | $21,008 |

| 7/31/2023 | $25,203 | $27,013 | $23,397 |

| 7/31/2024 | $31,842 | $32,705 | $27,948 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class A Shares with sales load | 19.40% | 14.53% | 12.28% |

| Class A Shares without sales load | 26.34% | 15.83% | 12.92% |

Russell 3000® Index | 21.07% | 14.22% | 12.58% |

| Morningstar Large Blend Funds Average | 19.29% | 12.56% | 10.80% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,066,272,970 |

| Number of Investments | 176 |

| Portfolio Turnover | 71% |

| Total Advisory Fees Paid | $4,344,724 |

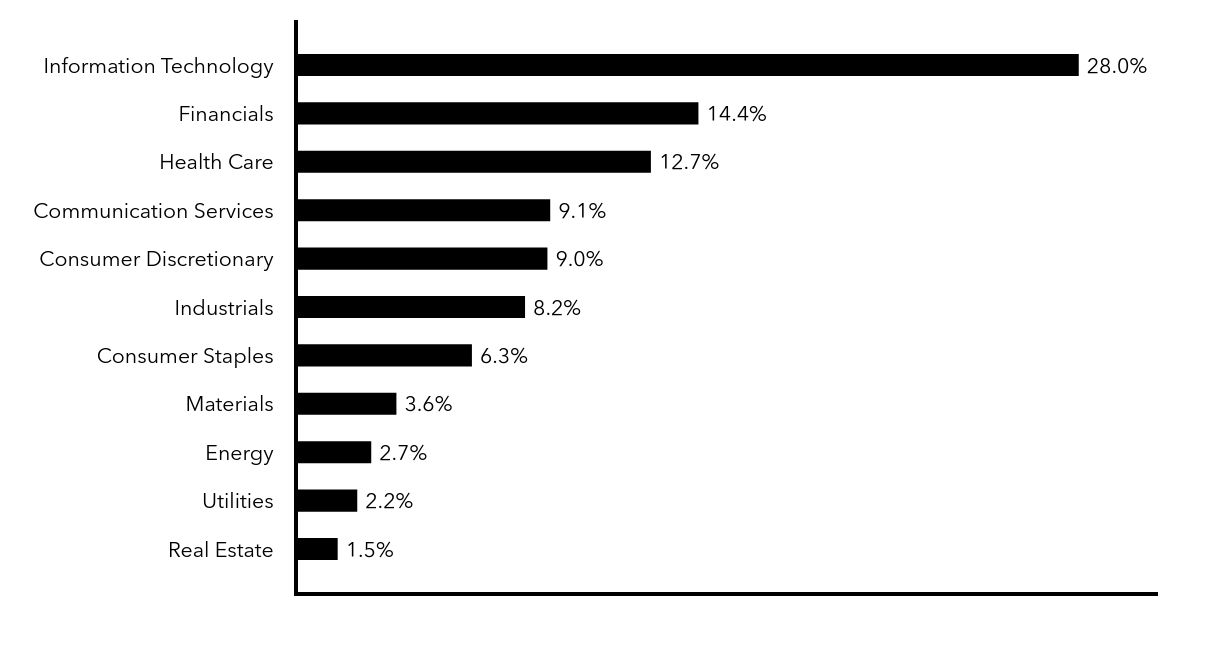

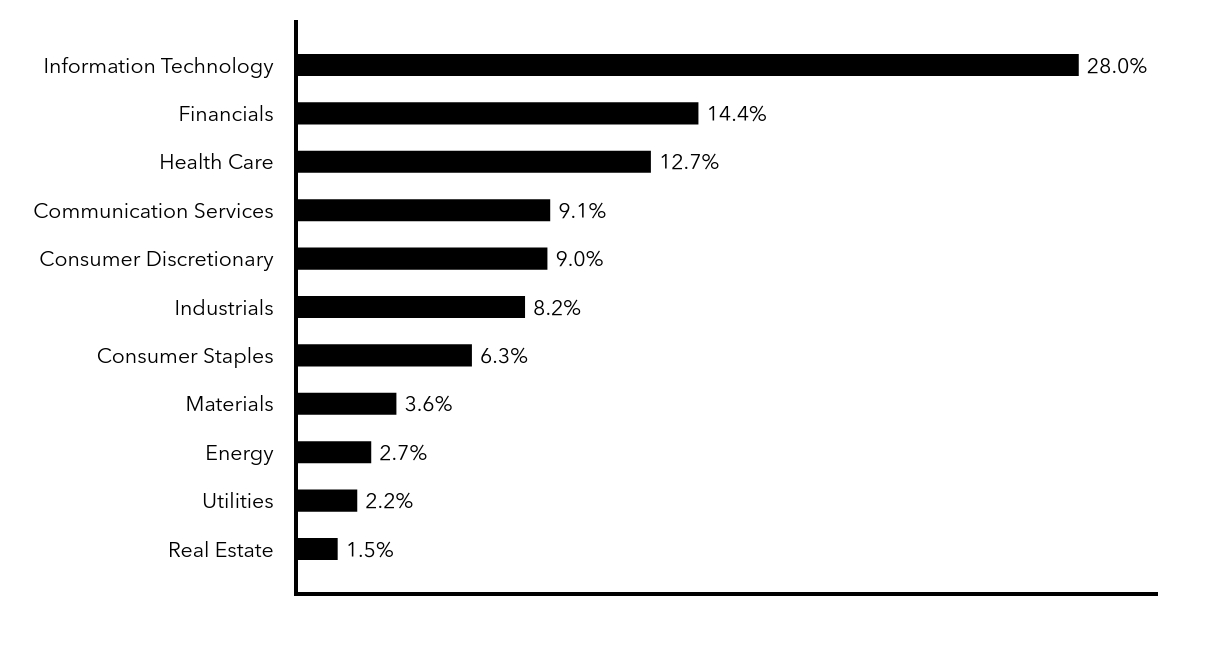

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

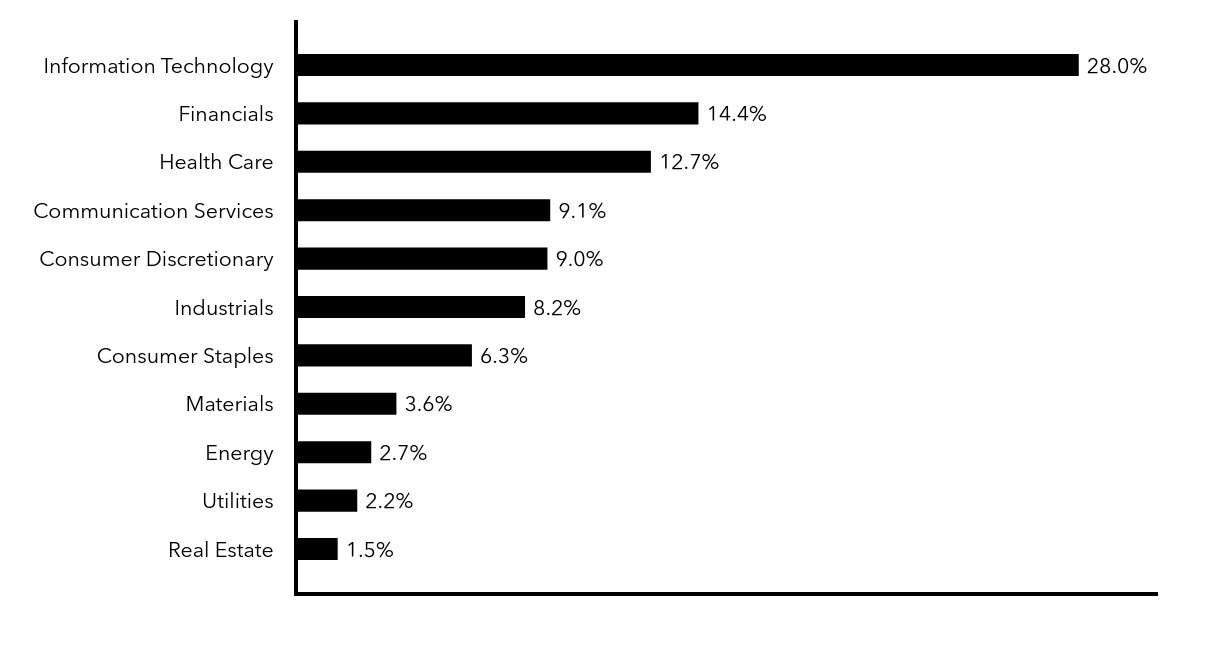

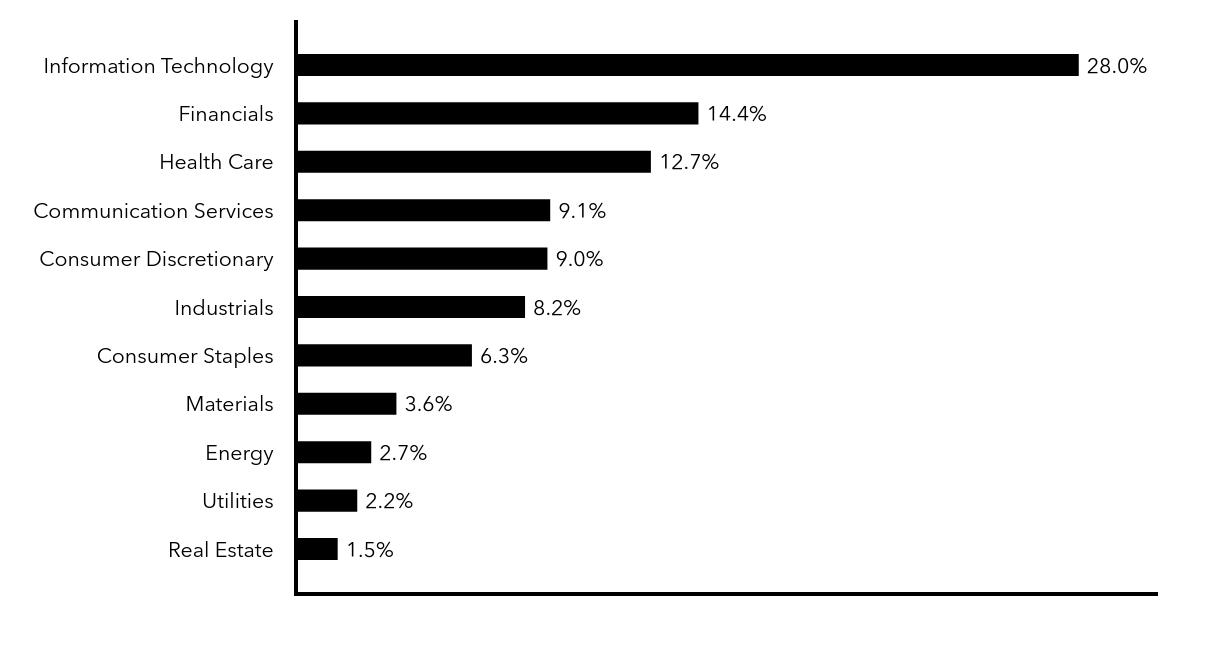

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Real Estate | 1.5% |

| Utilities | 2.2% |

| Energy | 2.7% |

| Materials | 3.6% |

| Consumer Staples | 6.3% |

| Industrials | 8.2% |

| Consumer Discretionary | 9.0% |

| Communication Services | 9.1% |

| Health Care | 12.7% |

| Financials | 14.4% |

| Information Technology | 28.0% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R106

37309-A (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT All Cap Core Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT All Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C Shares | $204 | 1.81% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 3000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term capital appreciation by investing primarily in the common stock of U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among companies with strong technical factors and neutral to high analyst conviction

contributed positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Utilities aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA, Vistra

Corp. and Dell Technologies, Inc. (Class C Shares).

Top Detractors from Performance

■ An underweight position in and weak stock selection among companies with negative analyst conviction and flat or improving earnings

to price ratios detracted from Fund relative performance.

■ By sector, stock selection in Consumer Staples detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Fortinet.

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class C Shares | Russell 3000® Index | Morningstar Large Blend Funds Average |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,731 | $11,128 | $10,863 |

| 7/31/2016 | $10,577 | $11,623 | $11,045 |

| 7/31/2017 | $12,134 | $13,498 | $12,699 |

| 7/31/2018 | $14,550 | $15,711 | $14,558 |

| 7/31/2019 | $15,562 | $16,819 | $15,422 |

| 7/31/2020 | $16,940 | $18,657 | $16,566 |

| 7/31/2021 | $23,270 | $25,882 | $22,482 |

| 7/31/2022 | $21,952 | $23,979 | $21,008 |

| 7/31/2023 | $25,102 | $27,013 | $23,397 |

| 7/31/2024 | $31,714 | $32,705 | $27,948 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class C Shares with sales load | 24.38% | 14.95% | 12.23% |

| Class C Shares without sales load | 25.38% | 14.95% | 12.23% |

Russell 3000® Index | 21.07% | 14.22% | 12.58% |

| Morningstar Large Blend Funds Average | 19.29% | 12.56% | 10.80% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,066,272,970 |

| Number of Investments | 176 |

| Portfolio Turnover | 71% |

| Total Advisory Fees Paid | $4,344,724 |

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Real Estate | 1.5% |

| Utilities | 2.2% |

| Energy | 2.7% |

| Materials | 3.6% |

| Consumer Staples | 6.3% |

| Industrials | 8.2% |

| Consumer Discretionary | 9.0% |

| Communication Services | 9.1% |

| Health Care | 12.7% |

| Financials | 14.4% |

| Information Technology | 28.0% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R205

37309-B (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT All Cap Core Fund

Institutional Shares QIACX

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT All Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $84 | 0.74% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 3000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term capital appreciation by investing primarily in the common stock of U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among companies with strong technical factors and neutral to high analyst conviction

contributed positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Utilities aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA, Vistra

Corp. and Dell Technologies, Inc. (Class C Shares).

Top Detractors from Performance

■ An underweight position in and weak stock selection among companies with negative analyst conviction and flat or improving earnings

to price ratios detracted from Fund relative performance.

■ By sector, stock selection in Consumer Staples detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Fortinet.

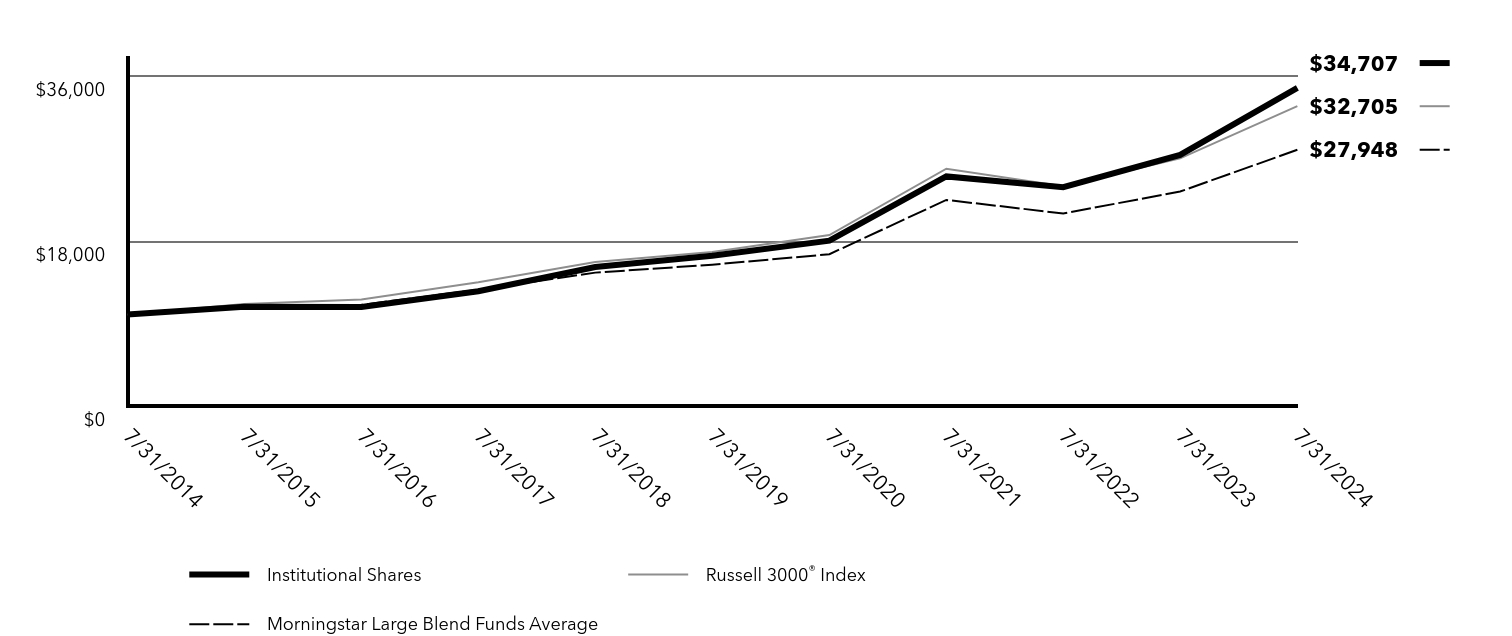

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Institutional Shares | Russell 3000® Index | Morningstar Large Blend Funds Average |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,845 | $11,128 | $10,863 |

| 7/31/2016 | $10,807 | $11,623 | $11,045 |

| 7/31/2017 | $12,525 | $13,498 | $12,699 |

| 7/31/2018 | $15,175 | $15,711 | $14,558 |

| 7/31/2019 | $16,401 | $16,819 | $15,422 |

| 7/31/2020 | $18,042 | $18,657 | $16,566 |

| 7/31/2021 | $25,048 | $25,882 | $22,482 |

| 7/31/2022 | $23,879 | $23,979 | $21,008 |

| 7/31/2023 | $27,387 | $27,013 | $23,397 |

| 7/31/2024 | $34,707 | $32,705 | $27,948 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 26.73% | 16.17% | 13.25% |

Russell 3000® Index | 21.07% | 14.22% | 12.58% |

| Morningstar Large Blend Funds Average | 19.29% | 12.56% | 10.80% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,066,272,970 |

| Number of Investments | 176 |

| Portfolio Turnover | 71% |

| Total Advisory Fees Paid | $4,344,724 |

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Real Estate | 1.5% |

| Utilities | 2.2% |

| Energy | 2.7% |

| Materials | 3.6% |

| Consumer Staples | 6.3% |

| Industrials | 8.2% |

| Consumer Discretionary | 9.0% |

| Communication Services | 9.1% |

| Health Care | 12.7% |

| Financials | 14.4% |

| Information Technology | 28.0% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R304

37309-C (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT All Cap Core Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT All Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 Shares | $83 | 0.73% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 3000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term capital appreciation by investing primarily in the common stock of U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among companies with strong technical factors and neutral to high analyst conviction

contributed positively to Fund relative performance.

■ By sector, stock selection in Consumer Discretionary and Utilities aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Spotify Technology SA, Vistra

Corp. and Dell Technologies, Inc. (Class C Shares).

Top Detractors from Performance

■ An underweight position in and weak stock selection among companies with negative analyst conviction and flat or improving earnings

to price ratios detracted from Fund relative performance.

■ By sector, stock selection in Consumer Staples detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in NVIDIA Corporation and overweight

positions in PepsiCo, Inc. and Fortinet.

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

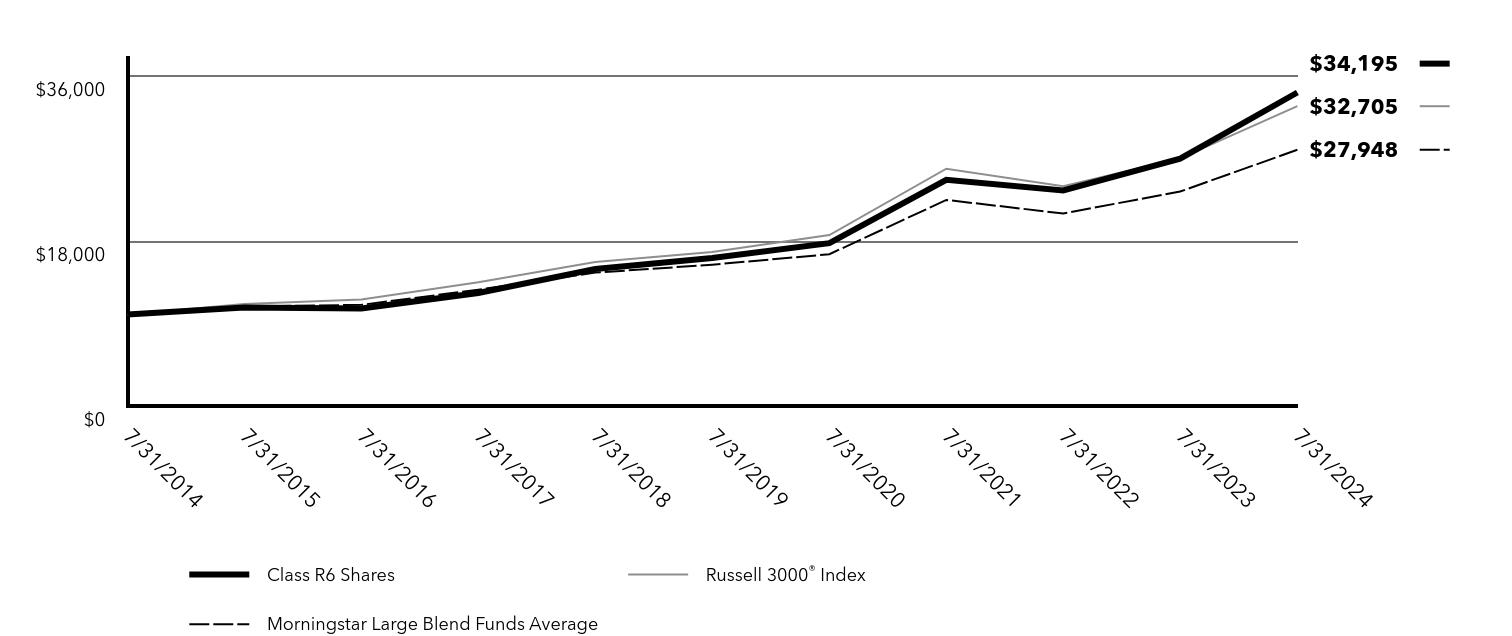

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class R6 Shares | Russell 3000® Index | Morningstar Large Blend Funds Average |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,765 | $11,128 | $10,863 |

| 7/31/2016 | $10,652 | $11,623 | $11,045 |

| 7/31/2017 | $12,335 | $13,498 | $12,699 |

| 7/31/2018 | $14,946 | $15,711 | $14,558 |

| 7/31/2019 | $16,154 | $16,819 | $15,422 |

| 7/31/2020 | $17,770 | $18,657 | $16,566 |

| 7/31/2021 | $24,671 | $25,882 | $22,482 |

| 7/31/2022 | $23,521 | $23,979 | $21,008 |

| 7/31/2023 | $26,985 | $27,013 | $23,397 |

| 7/31/2024 | $34,195 | $32,705 | $27,948 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 Shares | 26.72% | 16.18% | 13.08% |

Russell 3000® Index | 21.07% | 14.22% | 12.58% |

| Morningstar Large Blend Funds Average | 19.29% | 12.56% | 10.80% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,066,272,970 |

| Number of Investments | 176 |

| Portfolio Turnover | 71% |

| Total Advisory Fees Paid | $4,344,724 |

Annual Shareholder Report

Federated Hermes MDT All Cap Core Fund

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Real Estate | 1.5% |

| Utilities | 2.2% |

| Energy | 2.7% |

| Materials | 3.6% |

| Consumer Staples | 6.3% |

| Industrials | 8.2% |

| Consumer Discretionary | 9.0% |

| Communication Services | 9.1% |

| Health Care | 12.7% |

| Financials | 14.4% |

| Information Technology | 28.0% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R718

37309-D (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Balanced Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A Shares | $142 | 1.31% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to a 60%/40% blend of the S&P 500 Index and the Bloomberg US Aggregate Bond Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term growth of capital and income by investing in a combination of equity and fixed-income securities.

Top Contributors to Performance

■ Domestic equity security selection positively affected Fund relative performance.

■ By sector, domestic equity security selection in Utilities, Consumer Discretionary and Communication Services aided performance.

■ An overweight allocation to equities and underweight position in fixed income throughout the reporting period aided performance.

Top Detractors from Performance

■ The allocation to international equities detracted from Fund relative performance as these investments underperformed the

domestic equity market during the reporting period.

■ By sector, domestic equity security selection in Information Technology, Materials and Health Care detracted from performance.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report

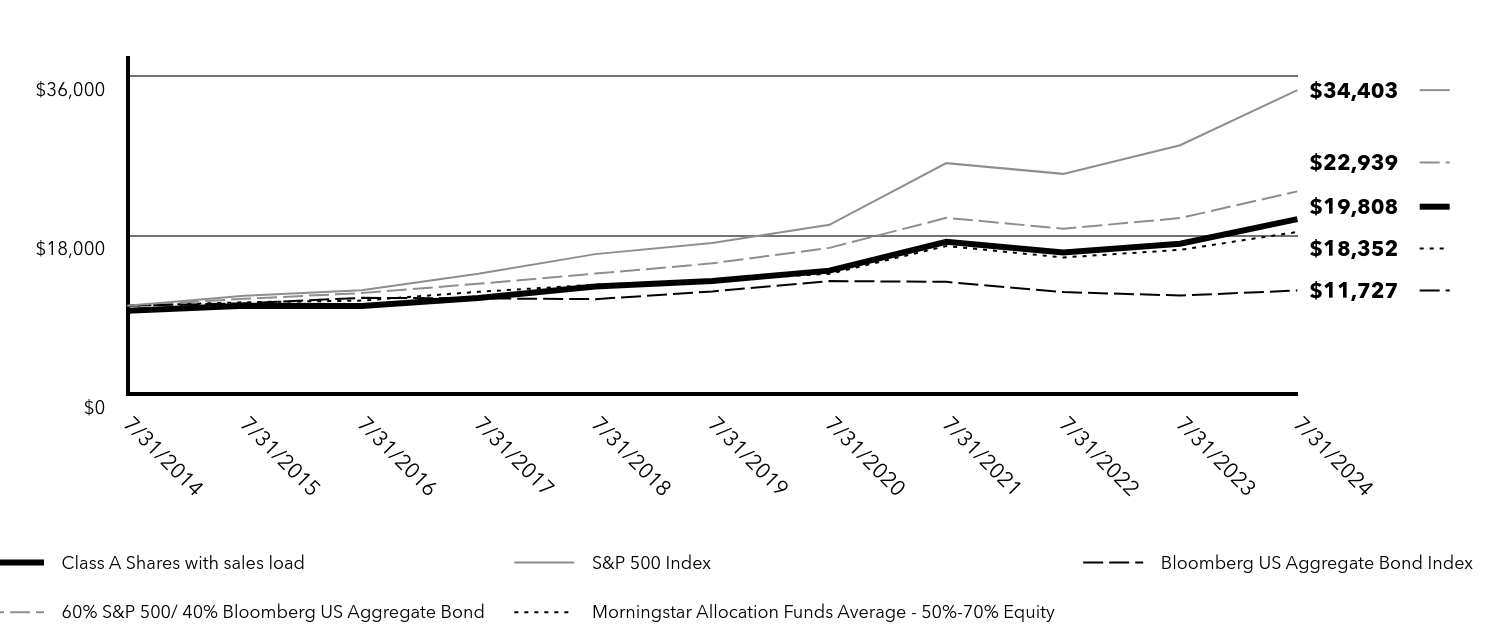

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class A Shares with sales load | S&P 500 Index | Bloomberg US Aggregate Bond Index | 60% S&P 500/ 40% Bloomberg US Aggregate Bond | Morningstar Allocation Funds Average - 50%-70% Equity |

|---|

| 7/31/2014 | $9,447 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,004 | $11,121 | $10,282 | $10,790 | $10,398 |

| 7/31/2016 | $9,966 | $11,745 | $10,893 | $11,437 | $10,583 |

| 7/31/2017 | $10,874 | $13,629 | $10,837 | $12,488 | $11,582 |

| 7/31/2018 | $12,170 | $15,843 | $10,750 | $13,641 | $12,378 |

| 7/31/2019 | $12,813 | $17,108 | $11,619 | $14,797 | $12,905 |

| 7/31/2020 | $13,976 | $19,153 | $12,795 | $16,549 | $13,608 |

| 7/31/2021 | $17,234 | $26,134 | $12,705 | $19,945 | $16,762 |

| 7/31/2022 | $16,018 | $24,921 | $11,547 | $18,717 | $15,464 |

| 7/31/2023 | $17,024 | $28,165 | $11,158 | $19,920 | $16,326 |

| 7/31/2024 | $19,808 | $34,403 | $11,727 | $22,939 | $18,352 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class A Shares with sales load | 9.93% | 7.88% | 7.07% |

| Class A Shares without sales load | 16.36% | 9.10% | 7.68% |

| S&P 500 Index | 22.15% | 14.99% | 13.15% |

| Bloomberg US Aggregate Bond Index | 5.10% | 0.19% | 1.61% |

| 60% S&P 500/ 40% Bloomberg US Aggregate Bond | 15.16% | 9.16% | 8.66% |

| Morningstar Allocation Funds Average - 50%-70% Equity | 12.37% | 7.20% | 6.28% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $227,569,976 |

| Number of Investments | 467 |

| Portfolio Turnover | 68% |

| Total Advisory Fees Paid | $1,554,001 |

Annual Shareholder Report

Federated Hermes MDT Balanced Fund

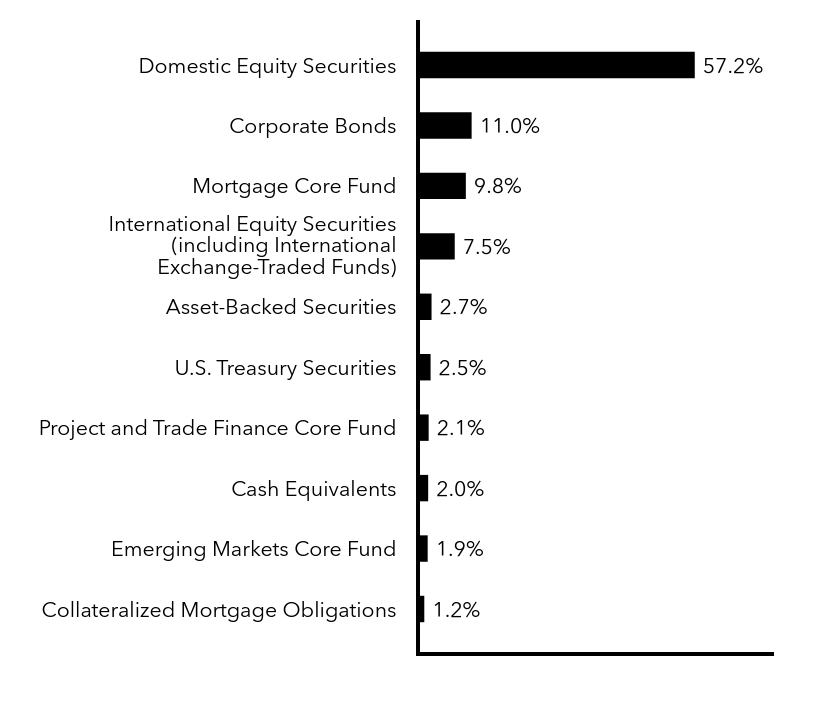

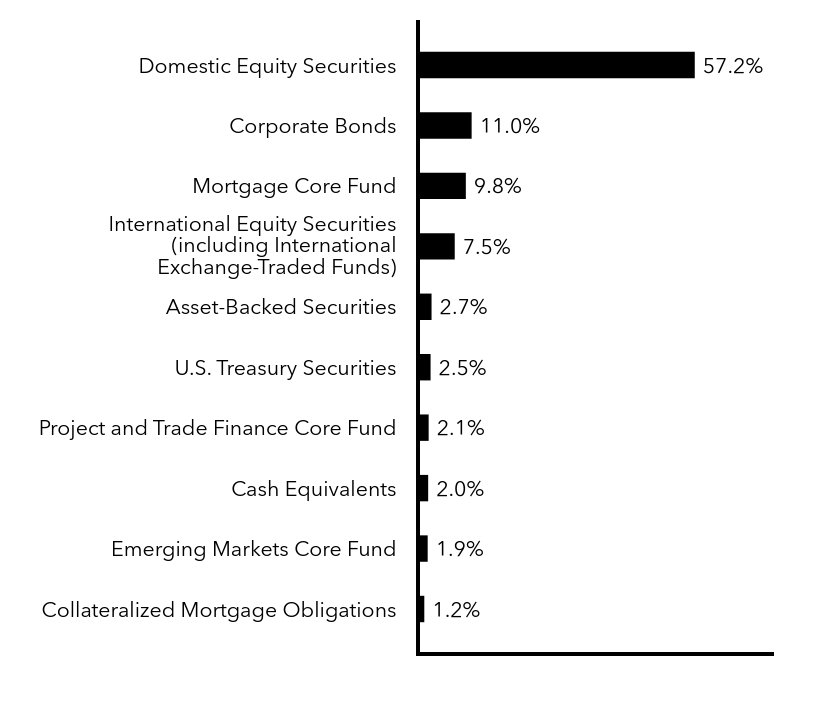

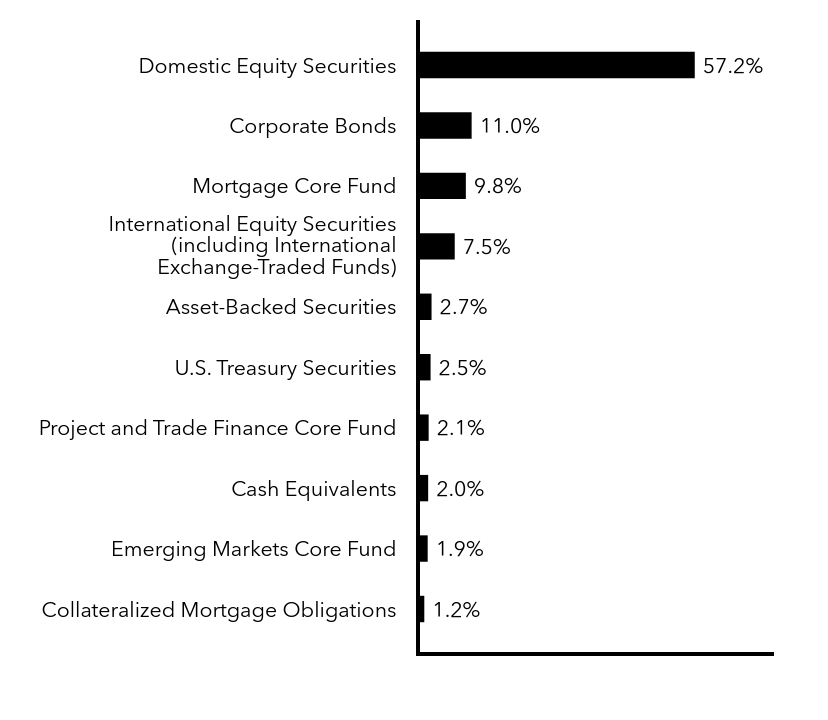

Top Security Types (% of Net Assets)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 1.2% |

| Emerging Markets Core Fund | 1.9% |

| Cash Equivalents | 2.0% |

| Project and Trade Finance Core Fund | 2.1% |

| U.S. Treasury Securities | 2.5% |

| Asset-Backed Securities | 2.7% |

| International Equity Securities (including International Exchange-Traded Funds) | 7.5% |

| Mortgage Core Fund | 9.8% |

| Corporate Bonds | 11.0% |

| Domestic Equity Securities | 57.2% |

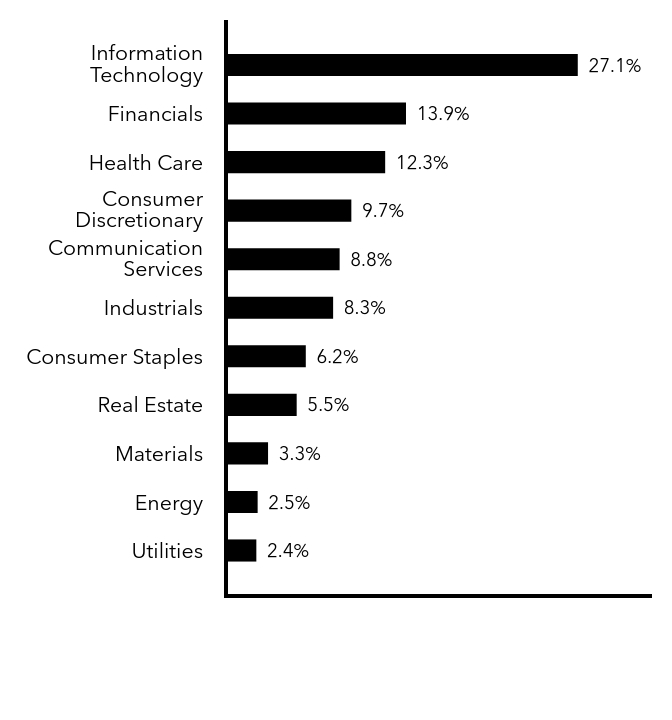

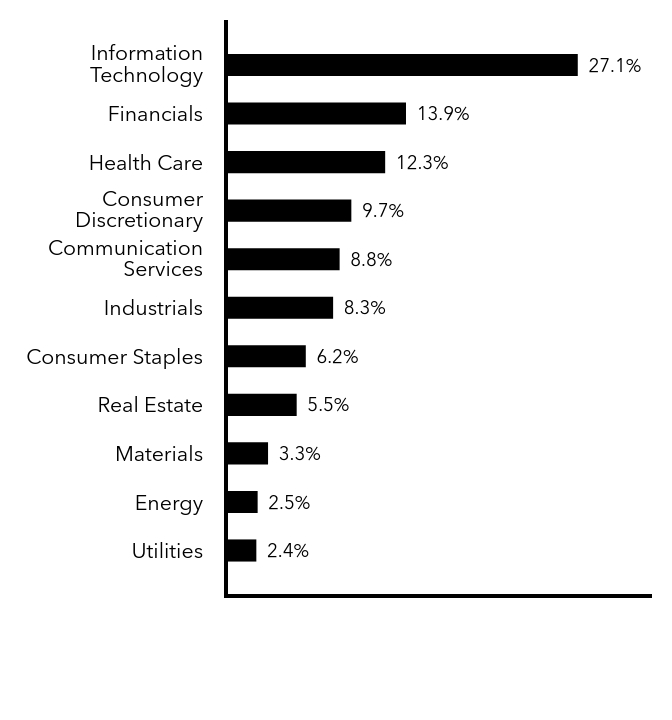

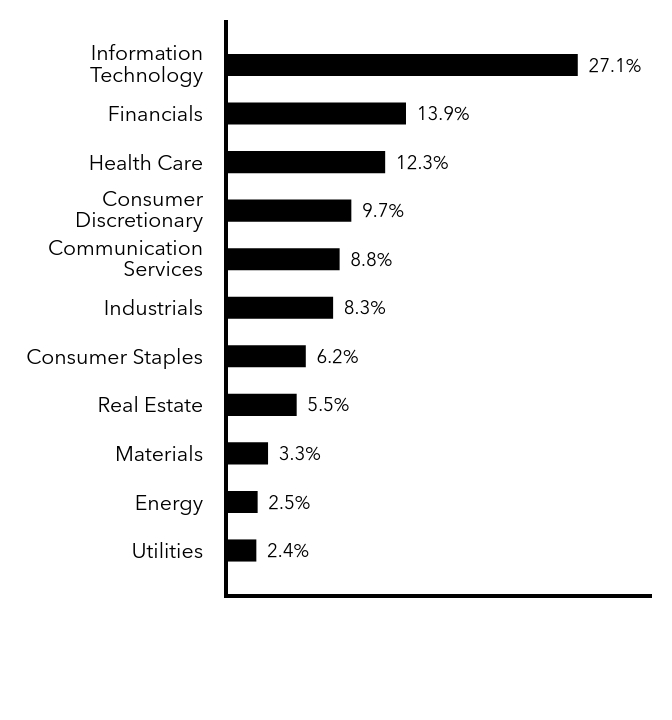

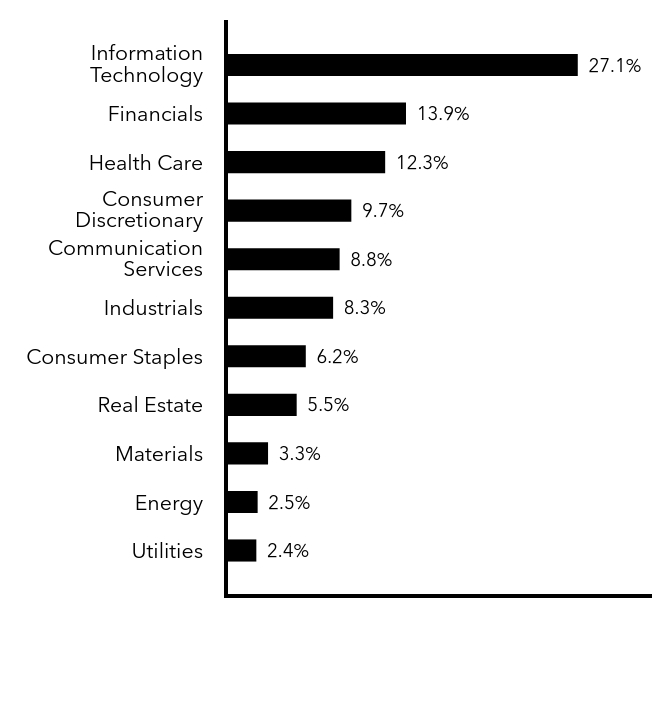

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|

| Utilities | 2.4% |

| Energy | 2.5% |

| Materials | 3.3% |

| Real Estate | 5.5% |

| Consumer Staples | 6.2% |

| Industrials | 8.3% |

| Communication Services | 8.8% |

| Consumer Discretionary | 9.7% |

| Health Care | 12.3% |

| Financials | 13.9% |

| Information Technology | 27.1% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R841

37326-A (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Balanced Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C Shares | $224 | 2.08% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to a 60%/40% blend of the S&P 500 Index and the Bloomberg US Aggregate Bond Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term growth of capital and income by investing in a combination of equity and fixed-income securities.

Top Contributors to Performance

■ Domestic equity security selection positively affected Fund relative performance.

■ By sector, domestic equity security selection in Utilities, Consumer Discretionary and Communication Services aided performance.

■ An overweight allocation to equities and underweight position in fixed income throughout the reporting period aided performance.

Top Detractors from Performance

■ The allocation to international equities detracted from Fund relative performance as these investments underperformed the

domestic equity market during the reporting period.

■ By sector, domestic equity security selection in Information Technology, Materials and Health Care detracted from performance.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report

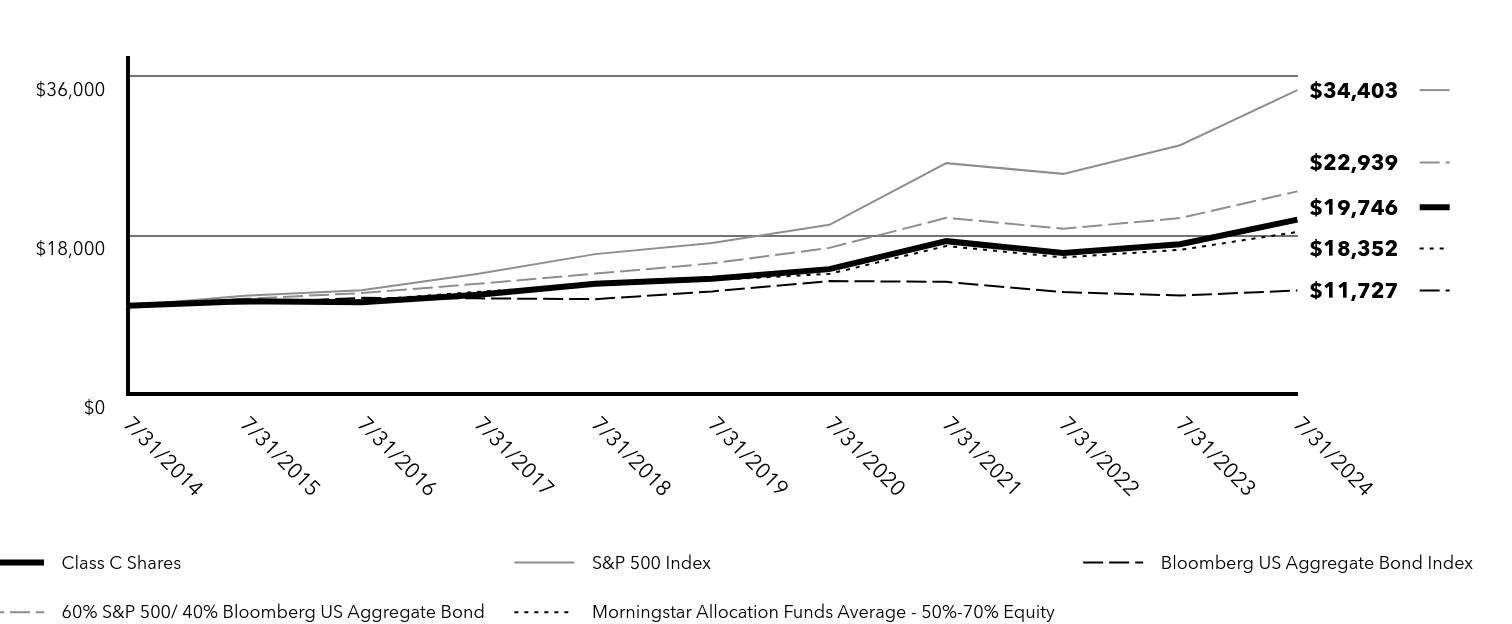

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class C Shares | S&P 500 Index | Bloomberg US Aggregate Bond Index | 60% S&P 500/ 40% Bloomberg US Aggregate Bond | Morningstar Allocation Funds Average - 50%-70% Equity |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,512 | $11,121 | $10,282 | $10,790 | $10,398 |

| 7/31/2016 | $10,397 | $11,745 | $10,893 | $11,437 | $10,583 |

| 7/31/2017 | $11,253 | $13,629 | $10,837 | $12,488 | $11,582 |

| 7/31/2018 | $12,500 | $15,843 | $10,750 | $13,641 | $12,378 |

| 7/31/2019 | $13,068 | $17,108 | $11,619 | $14,797 | $12,905 |

| 7/31/2020 | $14,146 | $19,153 | $12,795 | $16,549 | $13,608 |

| 7/31/2021 | $17,311 | $26,134 | $12,705 | $19,945 | $16,762 |

| 7/31/2022 | $15,968 | $24,921 | $11,547 | $18,717 | $15,464 |

| 7/31/2023 | $16,970 | $28,165 | $11,158 | $19,920 | $16,326 |

| 7/31/2024 | $19,746 | $34,403 | $11,727 | $22,939 | $18,352 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class C Shares with sales load | 14.46% | 8.27% | 7.04% |

| Class C Shares without sales load | 15.46% | 8.27% | 7.04% |

| S&P 500 Index | 22.15% | 14.99% | 13.15% |

| Bloomberg US Aggregate Bond Index | 5.10% | 0.19% | 1.61% |

| 60% S&P 500/ 40% Bloomberg US Aggregate Bond | 15.16% | 9.16% | 8.66% |

| Morningstar Allocation Funds Average - 50%-70% Equity | 12.37% | 7.20% | 6.28% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $227,569,976 |

| Number of Investments | 467 |

| Portfolio Turnover | 68% |

| Total Advisory Fees Paid | $1,554,001 |

Annual Shareholder Report

Federated Hermes MDT Balanced Fund

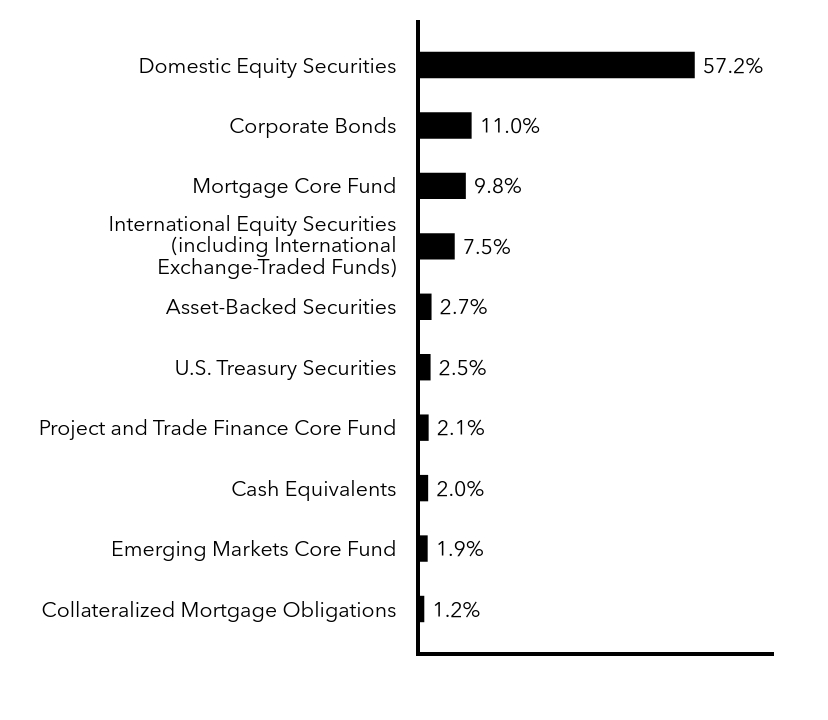

Top Security Types (% of Net Assets)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 1.2% |

| Emerging Markets Core Fund | 1.9% |

| Cash Equivalents | 2.0% |

| Project and Trade Finance Core Fund | 2.1% |

| U.S. Treasury Securities | 2.5% |

| Asset-Backed Securities | 2.7% |

| International Equity Securities (including International Exchange-Traded Funds) | 7.5% |

| Mortgage Core Fund | 9.8% |

| Corporate Bonds | 11.0% |

| Domestic Equity Securities | 57.2% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|

| Utilities | 2.4% |

| Energy | 2.5% |

| Materials | 3.3% |

| Real Estate | 5.5% |

| Consumer Staples | 6.2% |

| Industrials | 8.3% |

| Communication Services | 8.8% |

| Consumer Discretionary | 9.7% |

| Health Care | 12.3% |

| Financials | 13.9% |

| Information Technology | 27.1% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R833

37326-B (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Balanced Fund

Institutional Shares QIBGX

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Balanced Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $115 | 1.06% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to a 60%/40% blend of the S&P 500 Index and the Bloomberg US Aggregate Bond Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term growth of capital and income by investing in a combination of equity and fixed-income securities.

Top Contributors to Performance

■ Domestic equity security selection positively affected Fund relative performance.

■ By sector, domestic equity security selection in Utilities, Consumer Discretionary and Communication Services aided performance.

■ An overweight allocation to equities and underweight position in fixed income throughout the reporting period aided performance.

Top Detractors from Performance

■ The allocation to international equities detracted from Fund relative performance as these investments underperformed the

domestic equity market during the reporting period.

■ By sector, domestic equity security selection in Information Technology, Materials and Health Care detracted from performance.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

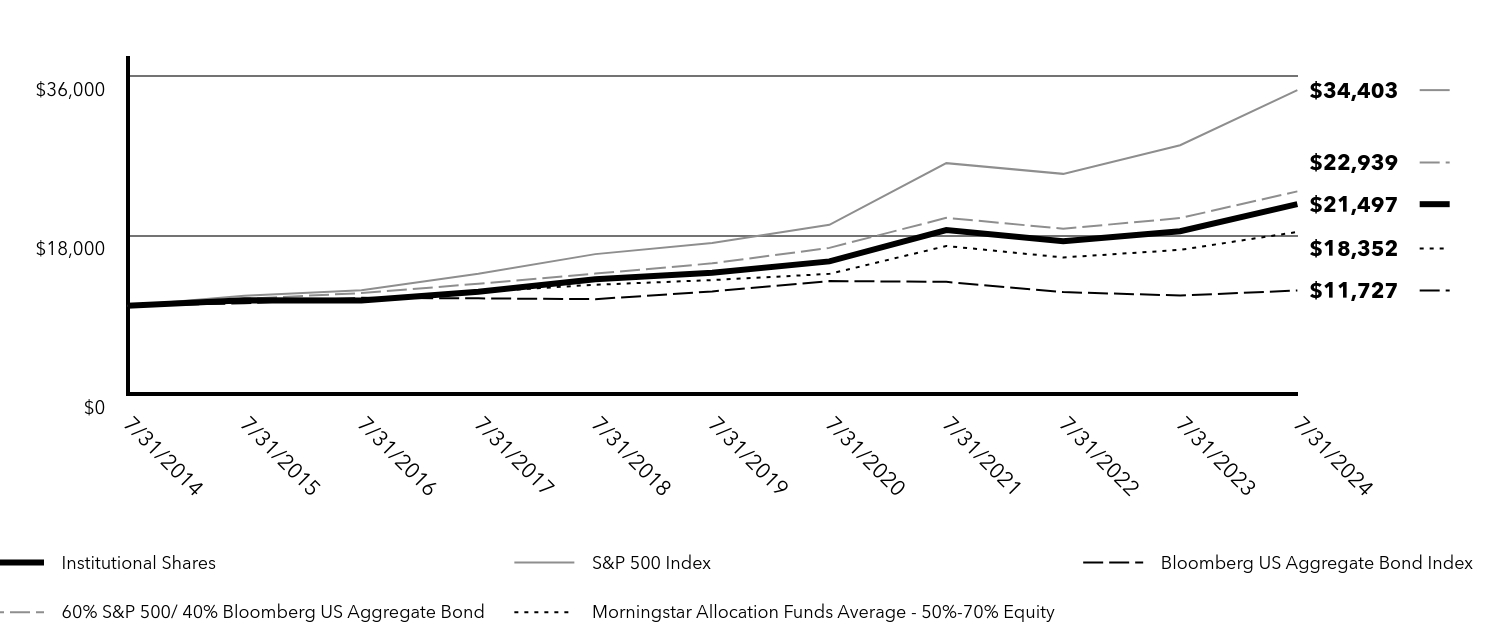

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Institutional Shares | S&P 500 Index | Bloomberg US Aggregate Bond Index | 60% S&P 500/ 40% Bloomberg US Aggregate Bond | Morningstar Allocation Funds Average - 50%-70% Equity |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,613 | $11,121 | $10,282 | $10,790 | $10,398 |

| 7/31/2016 | $10,606 | $11,745 | $10,893 | $11,437 | $10,583 |

| 7/31/2017 | $11,598 | $13,629 | $10,837 | $12,488 | $11,582 |

| 7/31/2018 | $13,008 | $15,843 | $10,750 | $13,641 | $12,378 |

| 7/31/2019 | $13,738 | $17,108 | $11,619 | $14,797 | $12,905 |

| 7/31/2020 | $15,020 | $19,153 | $12,795 | $16,549 | $13,608 |

| 7/31/2021 | $18,563 | $26,134 | $12,705 | $19,945 | $16,762 |

| 7/31/2022 | $17,297 | $24,921 | $11,547 | $18,717 | $15,464 |

| 7/31/2023 | $18,433 | $28,165 | $11,158 | $19,920 | $16,326 |

| 7/31/2024 | $21,497 | $34,403 | $11,727 | $22,939 | $18,352 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 16.62% | 9.37% | 7.95% |

| S&P 500 Index | 22.15% | 14.99% | 13.15% |

| Bloomberg US Aggregate Bond Index | 5.10% | 0.19% | 1.61% |

| 60% S&P 500/ 40% Bloomberg US Aggregate Bond | 15.16% | 9.16% | 8.66% |

| Morningstar Allocation Funds Average - 50%-70% Equity | 12.37% | 7.20% | 6.28% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $227,569,976 |

| Number of Investments | 467 |

| Portfolio Turnover | 68% |

| Total Advisory Fees Paid | $1,554,001 |

Annual Shareholder Report

Federated Hermes MDT Balanced Fund

Top Security Types (% of Net Assets)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 1.2% |

| Emerging Markets Core Fund | 1.9% |

| Cash Equivalents | 2.0% |

| Project and Trade Finance Core Fund | 2.1% |

| U.S. Treasury Securities | 2.5% |

| Asset-Backed Securities | 2.7% |

| International Equity Securities (including International Exchange-Traded Funds) | 7.5% |

| Mortgage Core Fund | 9.8% |

| Corporate Bonds | 11.0% |

| Domestic Equity Securities | 57.2% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|

| Utilities | 2.4% |

| Energy | 2.5% |

| Materials | 3.3% |

| Real Estate | 5.5% |

| Consumer Staples | 6.2% |

| Industrials | 8.3% |

| Communication Services | 8.8% |

| Consumer Discretionary | 9.7% |

| Health Care | 12.3% |

| Financials | 13.9% |

| Information Technology | 27.1% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R825

37326-C (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Balanced Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 Shares | $110 | 1.02% |

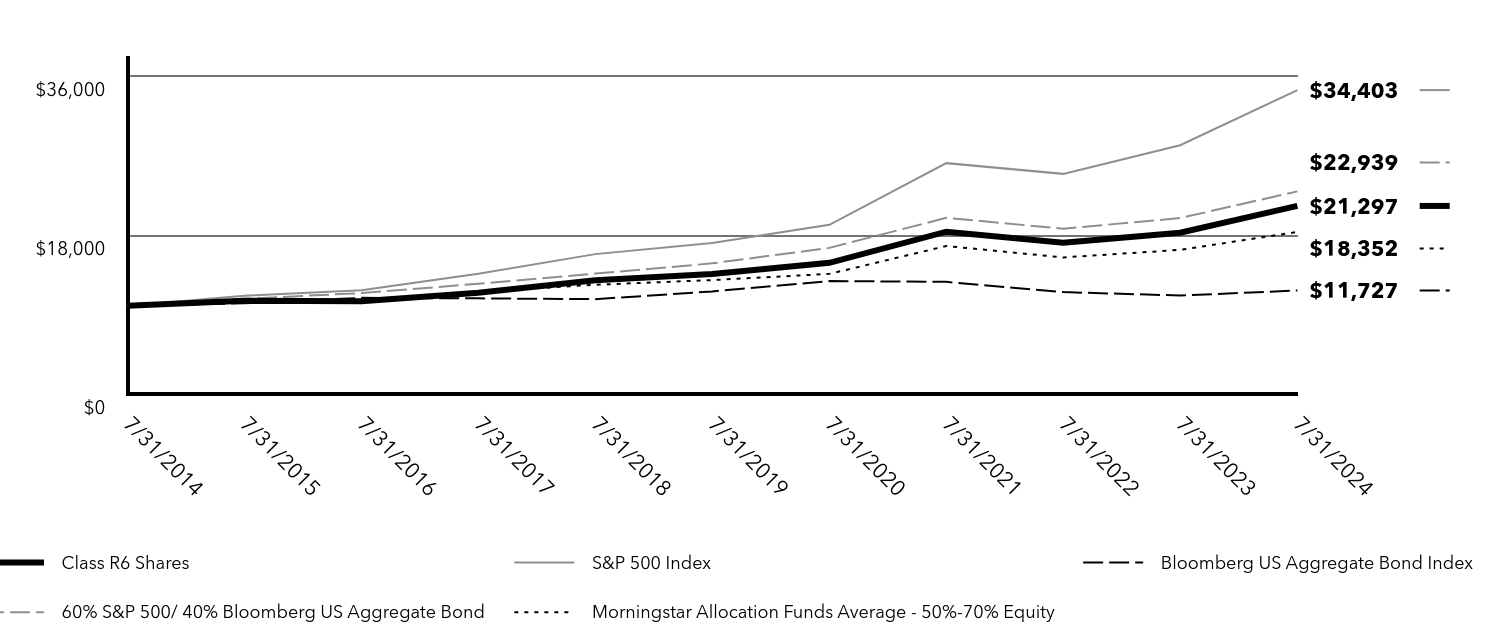

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to a 60%/40% blend of the S&P 500 Index and the Bloomberg US Aggregate Bond Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes. The Fund seeks to provide long-term growth of capital and income by investing in a combination of equity and fixed-income securities.

Top Contributors to Performance

■ Domestic equity security selection positively affected Fund relative performance.

■ By sector, domestic equity security selection in Utilities, Consumer Discretionary and Communication Services aided performance.

■ An overweight allocation to equities and underweight position in fixed income throughout the reporting period aided performance.

Top Detractors from Performance

■ The allocation to international equities detracted from Fund relative performance as these investments underperformed the

domestic equity market during the reporting period.

■ By sector, domestic equity security selection in Information Technology, Materials and Health Care detracted from performance.

Federated Hermes MDT Balanced Fund

Annual Shareholder Report

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class R6 Shares | S&P 500 Index | Bloomberg US Aggregate Bond Index | 60% S&P 500/ 40% Bloomberg US Aggregate Bond | Morningstar Allocation Funds Average - 50%-70% Equity |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,561 | $11,121 | $10,282 | $10,790 | $10,398 |

| 7/31/2016 | $10,499 | $11,745 | $10,893 | $11,437 | $10,583 |

| 7/31/2017 | $11,478 | $13,629 | $10,837 | $12,488 | $11,582 |

| 7/31/2018 | $12,883 | $15,843 | $10,750 | $13,641 | $12,378 |

| 7/31/2019 | $13,592 | $17,108 | $11,619 | $14,797 | $12,905 |

| 7/31/2020 | $14,859 | $19,153 | $12,795 | $16,549 | $13,608 |

| 7/31/2021 | $18,380 | $26,134 | $12,705 | $19,945 | $16,762 |

| 7/31/2022 | $17,128 | $24,921 | $11,547 | $18,717 | $15,464 |

| 7/31/2023 | $18,256 | $28,165 | $11,158 | $19,920 | $16,326 |

| 7/31/2024 | $21,297 | $34,403 | $11,727 | $22,939 | $18,352 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 Shares | 16.66% | 9.40% | 7.85% |

| S&P 500 Index | 22.15% | 14.99% | 13.15% |

| Bloomberg US Aggregate Bond Index | 5.10% | 0.19% | 1.61% |

| 60% S&P 500/ 40% Bloomberg US Aggregate Bond | 15.16% | 9.16% | 8.66% |

| Morningstar Allocation Funds Average - 50%-70% Equity | 12.37% | 7.20% | 6.28% |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $227,569,976 |

| Number of Investments | 467 |

| Portfolio Turnover | 68% |

| Total Advisory Fees Paid | $1,554,001 |

Annual Shareholder Report

Federated Hermes MDT Balanced Fund

Top Security Types (% of Net Assets)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 1.2% |

| Emerging Markets Core Fund | 1.9% |

| Cash Equivalents | 2.0% |

| Project and Trade Finance Core Fund | 2.1% |

| U.S. Treasury Securities | 2.5% |

| Asset-Backed Securities | 2.7% |

| International Equity Securities (including International Exchange-Traded Funds) | 7.5% |

| Mortgage Core Fund | 9.8% |

| Corporate Bonds | 11.0% |

| Domestic Equity Securities | 57.2% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|

| Utilities | 2.4% |

| Energy | 2.5% |

| Materials | 3.3% |

| Real Estate | 5.5% |

| Consumer Staples | 6.2% |

| Industrials | 8.3% |

| Communication Services | 8.8% |

| Consumer Discretionary | 9.7% |

| Health Care | 12.3% |

| Financials | 13.9% |

| Information Technology | 27.1% |

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R692

37326-D (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Small Cap Core Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Small Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A Shares | $124 | 1.13% |

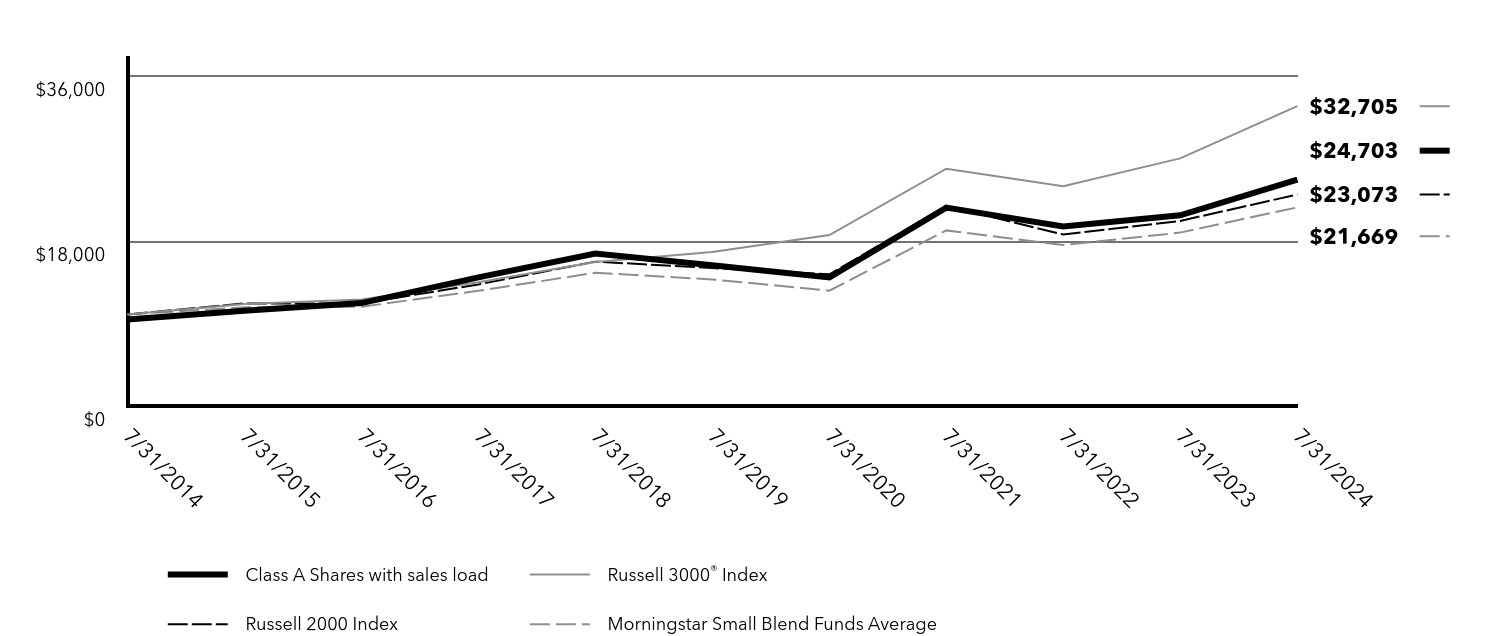

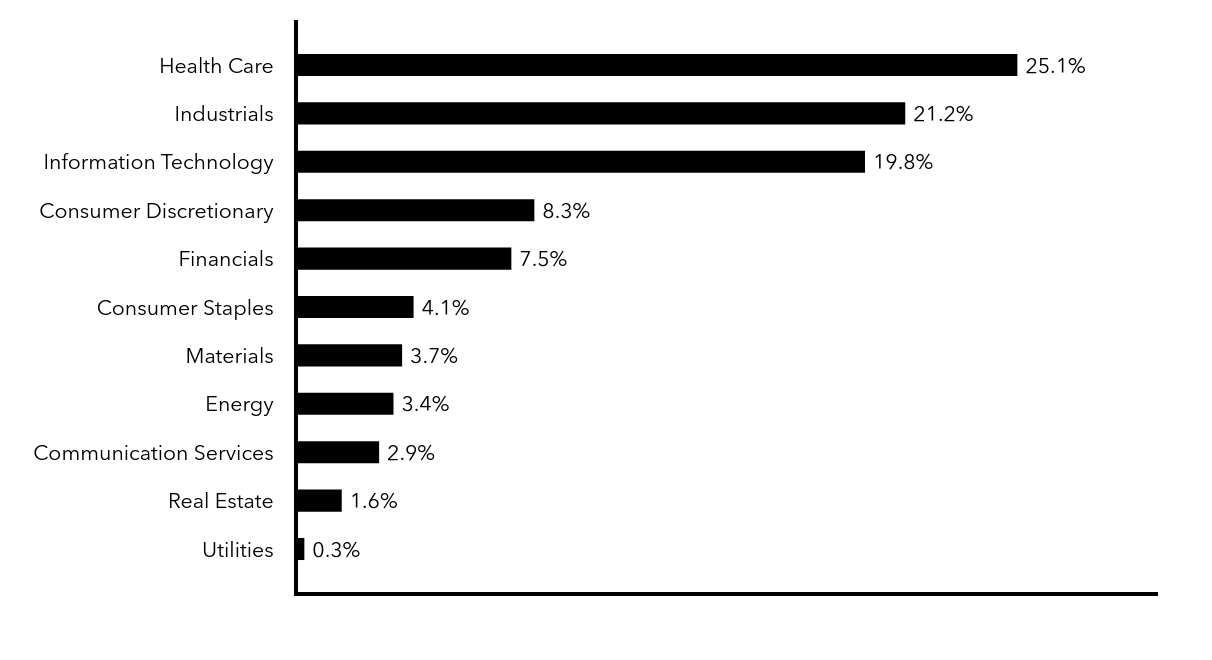

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 2000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stock of small U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among younger companies with strong technical factors contributed positively to

Fund relative performance.

■ By sector, stock selection in Industrials and Consumer Discretionary aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Abercrombie &

Fitch Co. (Class A), Jackson Financial Incorporation (Class A) and Murphy USA, Inc.

Top Detractors from Performance

■ An overweight position in and weak stock selection among companies with a highly depressed historical return and no significant

financing needs detracted from Fund relative performance.

■ By sector, stock selection in Information Technology and Real Estate detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in Super Micro Computer, Inc. and

overweight positions in Green Dot Corporation (Class A) and Redfin Corporation.

Annual Shareholder Report

Federated Hermes MDT Small Cap Core Fund

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

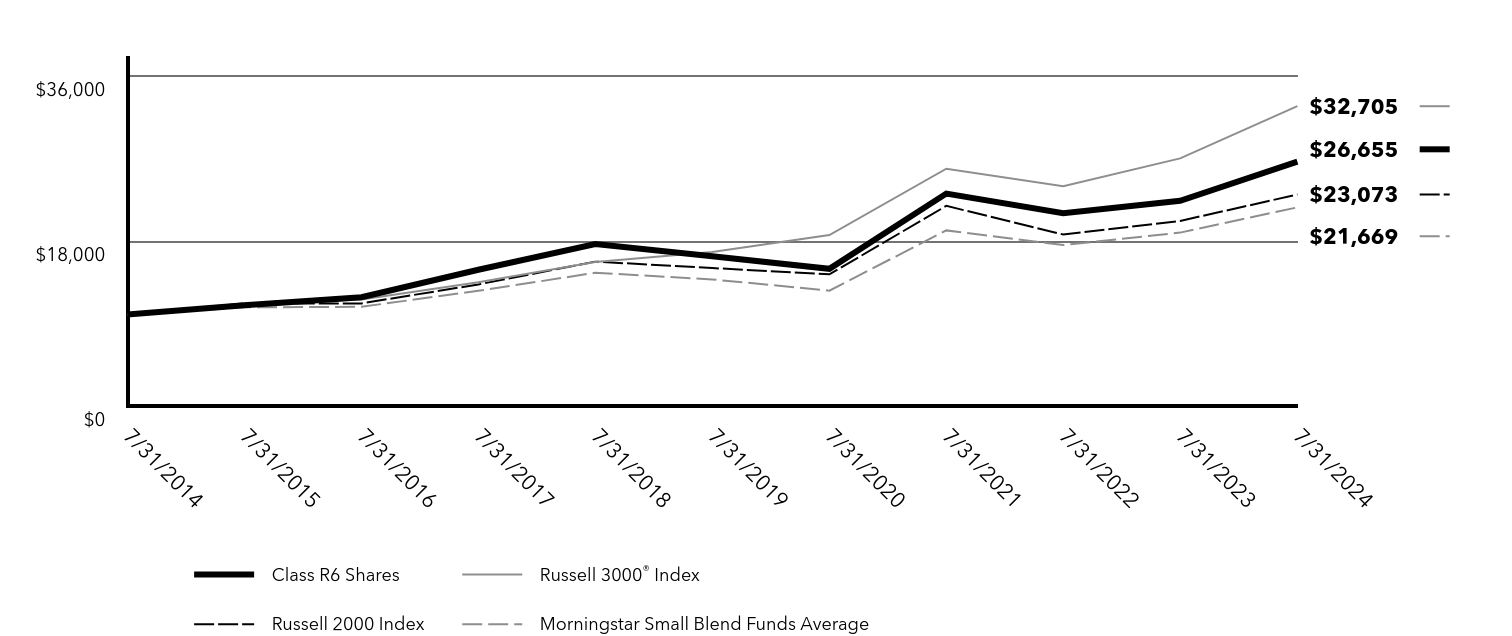

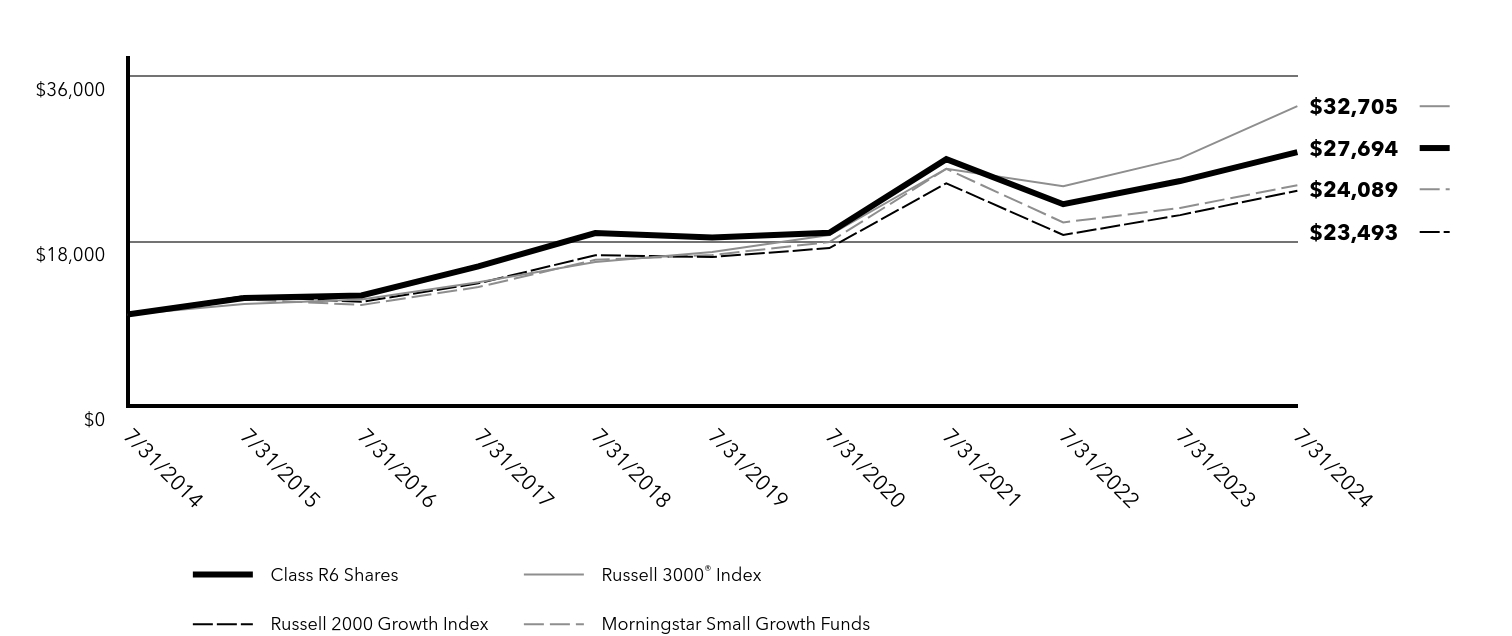

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class A Shares with sales load | Russell 3000® Index | Russell 2000 Index | Morningstar Small Blend Funds Average |

|---|

| 7/31/2014 | $9,448 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,414 | $11,128 | $11,203 | $10,772 |

| 7/31/2016 | $11,237 | $11,623 | $11,203 | $10,835 |

| 7/31/2017 | $14,043 | $13,498 | $13,270 | $12,570 |

| 7/31/2018 | $16,640 | $15,711 | $15,756 | $14,544 |

| 7/31/2019 | $15,360 | $16,819 | $15,060 | $13,818 |

| 7/31/2020 | $14,023 | $18,657 | $14,369 | $12,595 |

| 7/31/2021 | $21,648 | $25,882 | $21,836 | $19,162 |

| 7/31/2022 | $19,583 | $23,979 | $18,715 | $17,568 |

| 7/31/2023 | $20,803 | $27,013 | $20,195 | $18,921 |

| 7/31/2024 | $24,703 | $32,705 | $23,073 | $21,669 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class A Shares with sales load | 12.20% | 8.73% | 9.46% |

| Class A Shares without sales load | 18.75% | 9.97% | 10.09% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Russell 2000 Index | 14.25% | 8.90% | 8.72% |

| Morningstar Small Blend Funds Average | 14.47% | 9.29% | 7.97% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,373,502,858 |

| Number of Investments | 302 |

| Portfolio Turnover | 85% |

| Total Advisory Fees Paid | $8,597,351 |

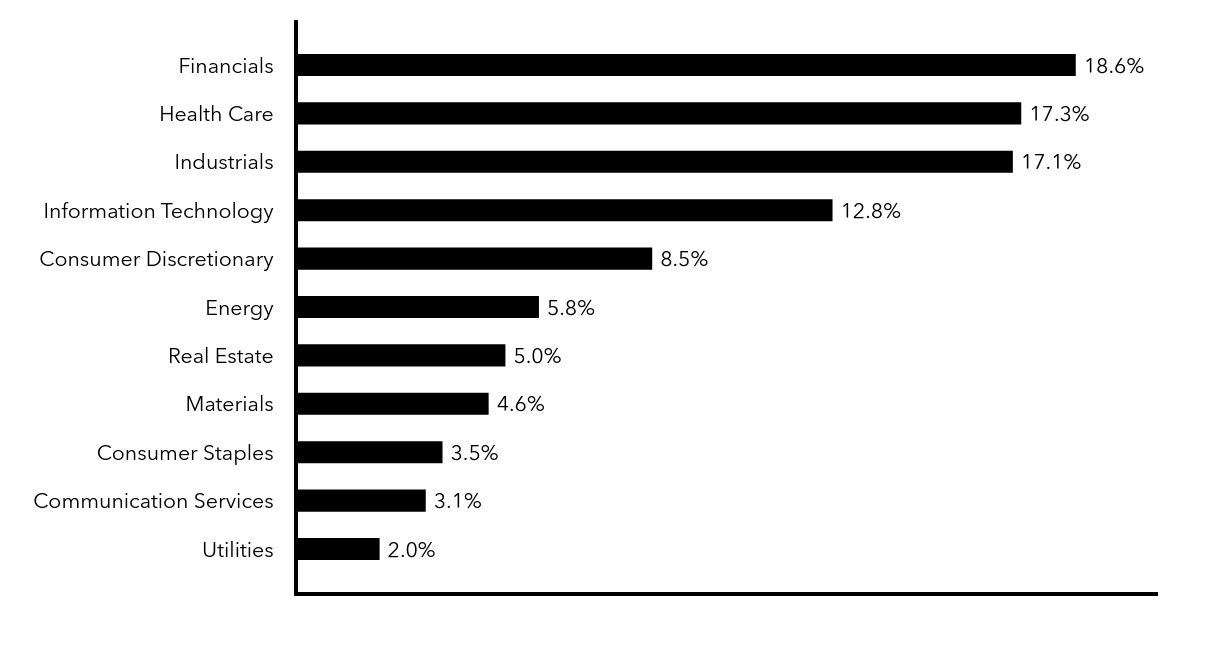

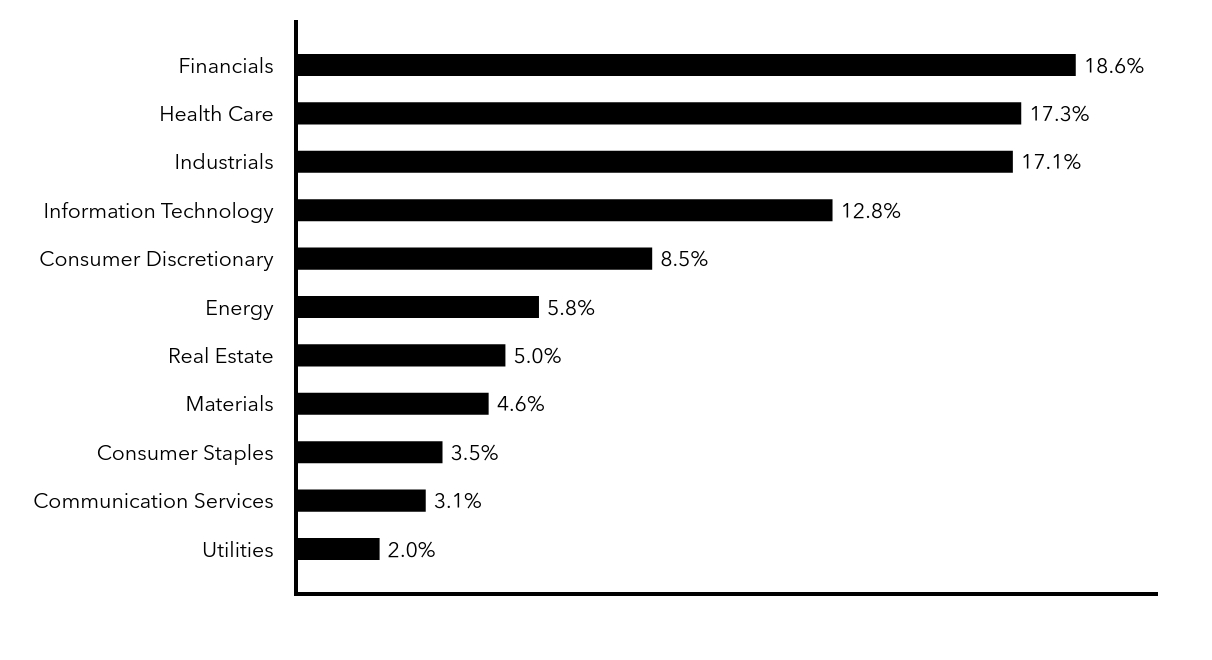

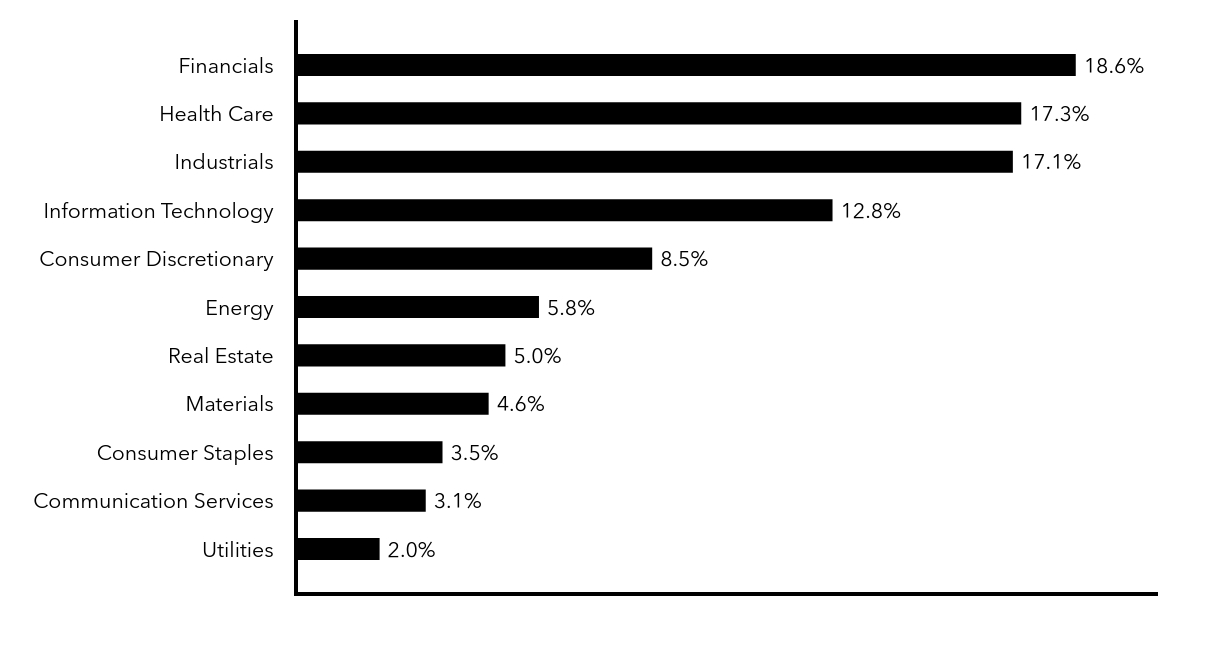

Annual Shareholder Report

Federated Hermes MDT Small Cap Core Fund

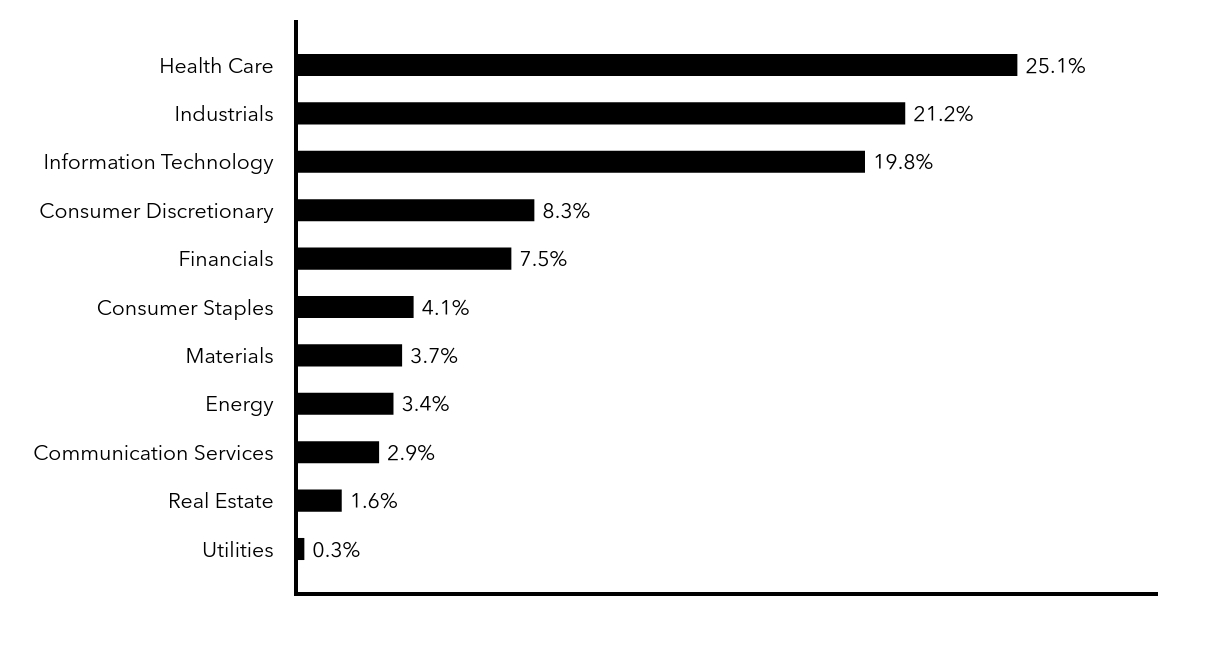

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 2.0% |

| Communication Services | 3.1% |

| Consumer Staples | 3.5% |

| Materials | 4.6% |

| Real Estate | 5.0% |

| Energy | 5.8% |

| Consumer Discretionary | 8.5% |

| Information Technology | 12.8% |

| Industrials | 17.1% |

| Health Care | 17.3% |

| Financials | 18.6% |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at www.FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective October 1, 2024, the Fund’s annual investment advisory fee payable to its investment adviser is reduced from 0.80% to 0.75% of the Fund’s average daily net assets.

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 31421R817

37328-A (09/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes MDT Small Cap Core Fund

Annual Shareholder Report - July 31, 2024

A Portfolio of Federated Hermes MDT Series

This annual shareholder report contains important information about the Federated Hermes MDT Small Cap Core Fund (the "Fund") for the period of August 1, 2023 to July 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C Shares | $216 | 1.98% |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the Russell 2000 Index to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the Russell 3000 Index, which represents approximately 98% of investable U.S. equities by market capitalization. The Fund seeks to provide long-term capital appreciation by investing primarily in common stock of small U.S. companies.

Top Contributors to Performance

■ An overweight position in and solid stock selection among younger companies with strong technical factors contributed positively to

Fund relative performance.

■ By sector, stock selection in Industrials and Consumer Discretionary aided performance.

■ Top individual Fund holdings that contributed positively to performance included overweight positions in Abercrombie &

Fitch Co. (Class A), Jackson Financial Incorporation (Class A) and Murphy USA, Inc.

Top Detractors from Performance

■ An overweight position in and weak stock selection among companies with a highly depressed historical return and no significant

financing needs detracted from Fund relative performance.

■ By sector, stock selection in Information Technology and Real Estate detracted from performance.

■ Top individual Fund holdings that detracted from performance were an underweight position in Super Micro Computer, Inc. and

overweight positions in Green Dot Corporation (Class A) and Redfin Corporation.

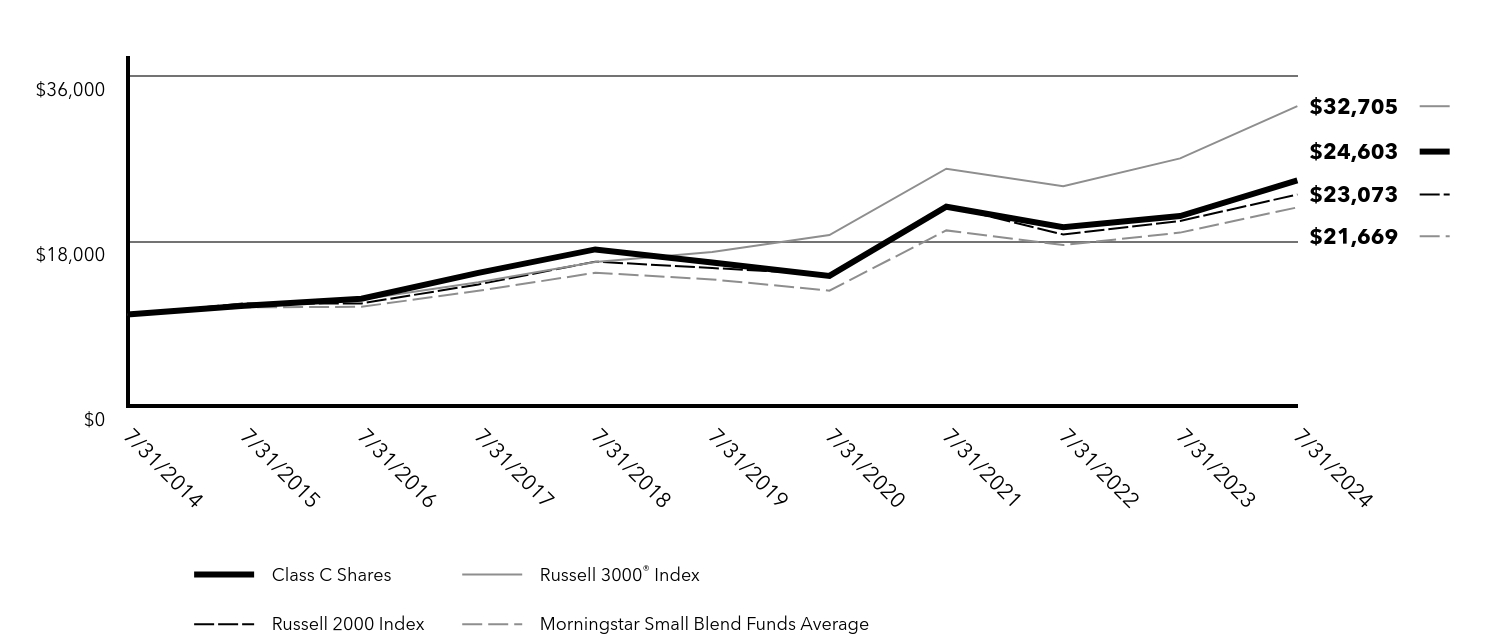

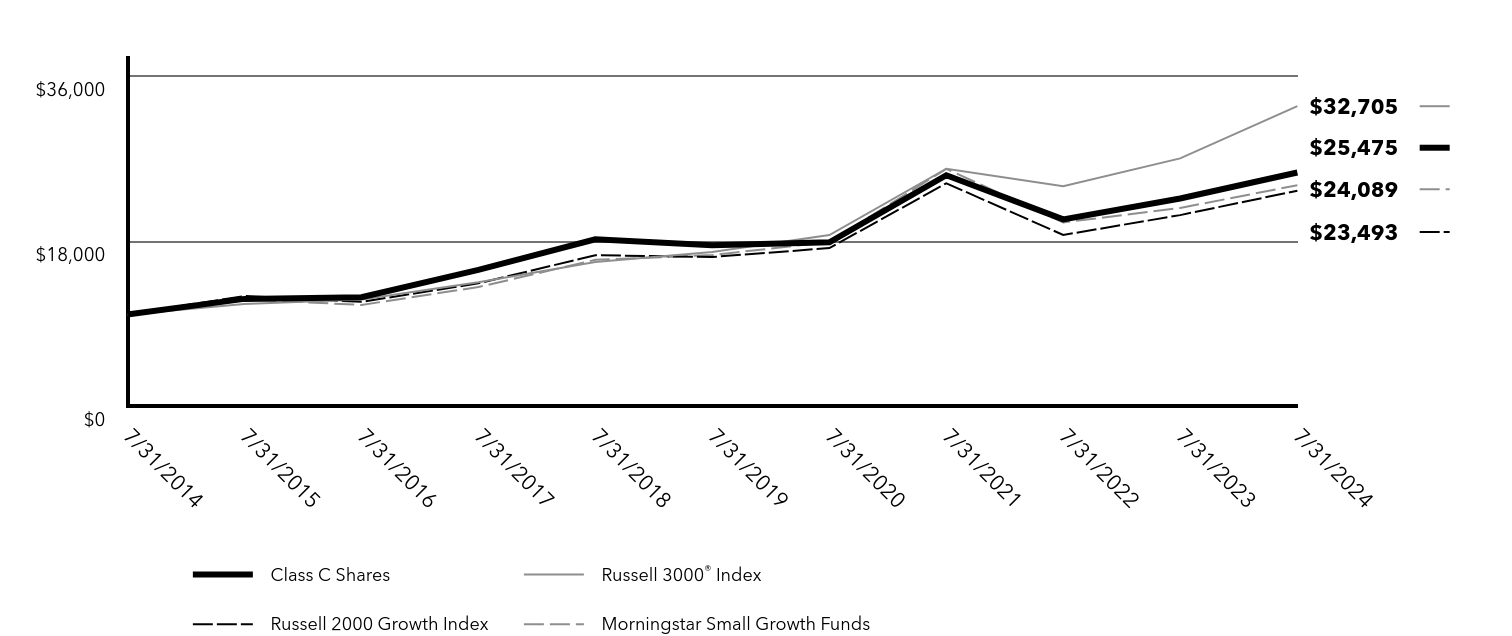

Annual Shareholder Report

Federated Hermes MDT Small Cap Core Fund

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: 7/31/2014 to 7/31/2024

Total Return Based on $10,000 Investment

| Class C Shares | Russell 3000® Index | Russell 2000 Index | Morningstar Small Blend Funds Average |

|---|

| 7/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2015 | $10,941 | $11,128 | $11,203 | $10,772 |

| 7/31/2016 | $11,720 | $11,623 | $11,203 | $10,835 |

| 7/31/2017 | $14,530 | $13,498 | $13,270 | $12,570 |

| 7/31/2018 | $17,087 | $15,711 | $15,756 | $14,544 |

| 7/31/2019 | $15,661 | $16,819 | $15,060 | $13,818 |

| 7/31/2020 | $14,197 | $18,657 | $14,369 | $12,595 |

| 7/31/2021 | $21,744 | $25,882 | $21,836 | $19,162 |

| 7/31/2022 | $19,504 | $23,979 | $18,715 | $17,568 |

| 7/31/2023 | $20,719 | $27,013 | $20,195 | $18,921 |

| 7/31/2024 | $24,603 | $32,705 | $23,073 | $21,669 |

Average Annual Total Returns

| Fund/Index | 1 Year | 5 Years | 10 Years |

|---|

| Class C Shares with sales load | 16.73% | 9.09% | 9.42% |

| Class C Shares without sales load | 17.73% | 9.09% | 9.42% |

Russell 3000® IndexFootnote Reference* | 21.07% | 14.22% | 12.58% |

| Russell 2000 Index | 14.25% | 8.90% | 8.72% |

| Morningstar Small Blend Funds Average | 14.47% | 9.29% | 7.97% |

| Footnote | Description |

Footnote* | The Fund has designated the Russell 3000® Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

Visit www.FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

| Net Assets | $1,373,502,858 |

| Number of Investments | 302 |

| Portfolio Turnover | 85% |

| Total Advisory Fees Paid | $8,597,351 |

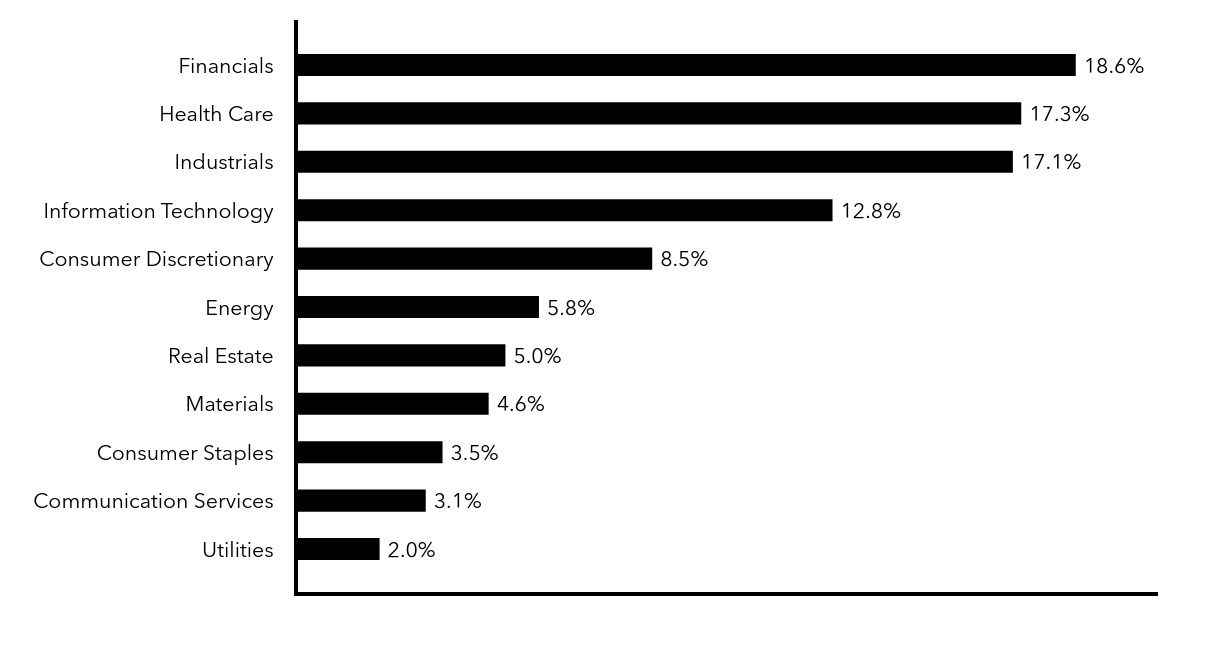

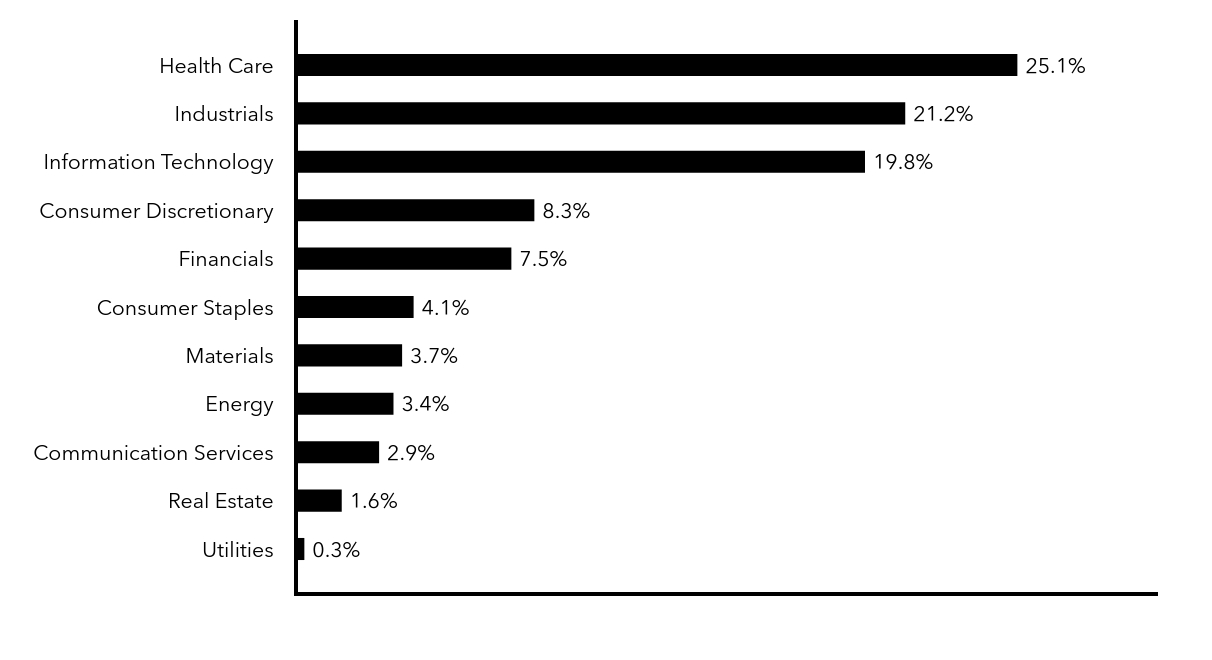

Annual Shareholder Report

Federated Hermes MDT Small Cap Core Fund

Top Sectors (% of Total Net Assets)

| Value | Value |

|---|

| Utilities | 2.0% |

| Communication Services | 3.1% |

| Consumer Staples | 3.5% |

| Materials | 4.6% |

| Real Estate | 5.0% |

| Energy | 5.8% |

| Consumer Discretionary | 8.5% |

| Information Technology | 12.8% |

| Industrials | 17.1% |

| Health Care | 17.3% |

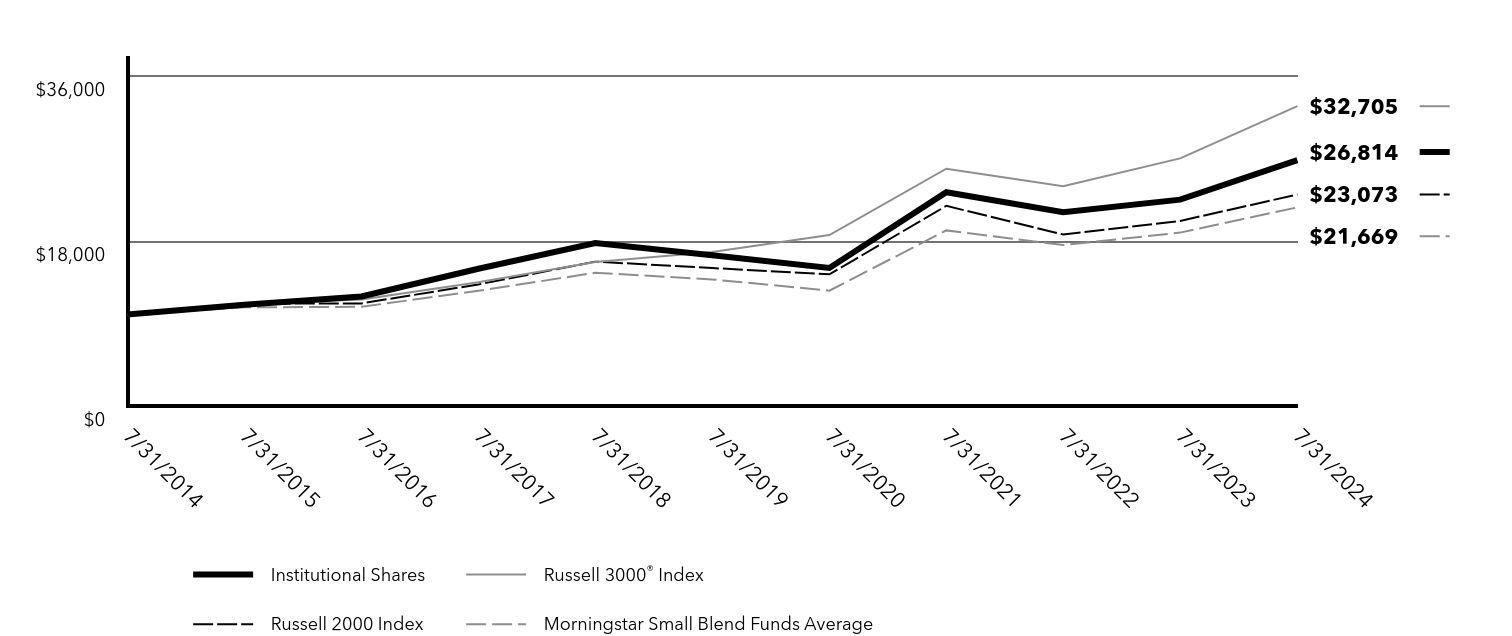

| Financials | 18.6% |