April 24, 2014

Via E-mail US Securities and Exchange Commission Office of Beverages, Apparel, and Mining 100 F Street, NE Washington, DC 20549 |

| Att: | John Reynolds Assistant Director |

| RE: | California Gold Corp. Revised Preliminary Proxy Statement on Schedule 14A Filed April 3, 2014 File No. 000-54706 |

Dear Mr. Reynolds:

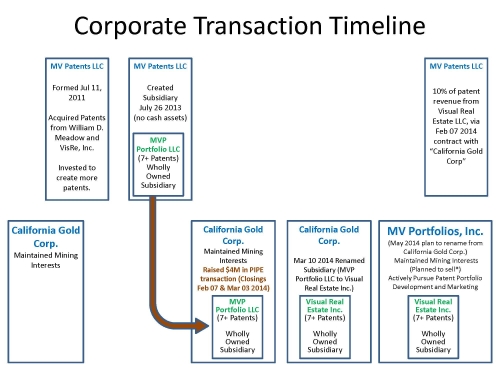

As an initial matter, to assist in analyzing the below responses to the Staff’s comment letter dated April 11, 2014, I included the below table. The similar names of the various entities are associated with the recent transactions have created some misunderstanding of the transaction and acquisition. Attached is a diagram with a timeline showing the discrete entities to help clarify. I also inserted [bracketed] text where the entity names may cause some confusion. Please note as well, MVP Portfolio, LLC has, since March 10, 2014, been renamed Visual Real Estate, Inc.

General:

| 1. | Please refer to comment 1 in our letter dated March 20, 2014. We note that you continue to refer to disclosure in your Form 8-K filed February 10, 2014, including on pages 24, 25, and 31. Please revise or advise, as previously requested. Your disclosure should also provide a complete description of the MVP acquisition. We note on page 5 you state you are providing a summary and on page 16 you refer investors to an 8-K regarding whether the transaction was a change of control. |

Response:

The references to incorporated documents associated with certain Exhibits to the Schedule 14A that had been included in prior filings have been removed. Only the associated documents included as Exhibits with the Schedule 14A are now referenced. In addition, the Description of Business on page 5 has been relocated and enhanced under “Background Information”.

| 2. | Additionally, please provide complete descriptions of the agreements and disclosure required by Item 11 of Schedule 14A. Each description may not be “qualified in its entirety by reference” to the agreement or attached exhibit, as you state on pages 21, 24 |

and elsewhere.

Response:

The requested revisions have been made in Amendment No. 5 to the Schedule 14A.

Financial Information, page 31

| 3. | Please tell us the basis on which you rely to incorporate by reference financial information as you appear to be attempting to do in this section. Refer to Item 14(e) of Schedule 14A. Tell us the extent to which you are relying on Item 14(e)(2). |

Response:

The noted references which may suggest financial information has been incorporated by reference have been removed. No financial statement information is being incorporated by reference. The Annual and Quarterly Reports will be included with the Schedule 14A mailed to shareholders.

Exhibit N – Pro Forma Information

| 4. | Please present a revised pro forma balance sheet that consists of two separate columns representing the historical balance sheets of California Gold as of October 31, 2013 (we note the Form 10-K for the year ended January 31, 2014 has not been filed) and MVP Patents and Subsidiary as of December 31, 2013, a column representing adjustments that give effect to the Transaction and a column representing the post-merger balance sheet on a pro forma basis. Provide explanatory notes as well. You may update the pro forma information to January 31 when the 10-K is filed. |

Response:

The Staff's references above to “MVP Patents and Subsidiary” should instead refer to the pre-acquisition Companies “MV Patents, LLC,” a Florida limited liability company ("MV Patents"), and its wholly-owned subsidiary “MVP Portfolio, LLC” ("MVP Portfolio"). As used herein the following responses will refer to MV Patents and MVP Portfolio as the pre-acquisition enterprises for clarity.

The pro forma balance sheet presentation in columnar format shows “historical” “adjustment” and “Pro Forma” information. MVP Portfolio (the name of the pre-acquisition subsidiary of MV Patents) does not have any account balances (no assets, liabilities or equity) to be shown in its balance sheet items. The nature of the historical California Gold Corp. consolidated balance sheet is discussed in the 4th paragraph on the first page of the Pro Forma FS document, in the section titled “Unaudited Pro Forma Combined Financial Information”. We used the January 31 balances since this is/was the latest information available and relates directly to the requirement under 17 CFR 210.8-05(b)(2) to provide “a pro forma balance sheet giving effect to the combination as of the date of the most recent balance sheet,” which is January 31, 2014. Further, by way of explanation, for the period prior to the formation of MVP Portfolio, the references are to MV Patents, as MVP Portfolio was not in existence until July 26, 2013, as stated elsewhere in the Preliminary 14A filing.

| 5. | Since you are discontinuing the pre-Transaction business, i.e., the gold mining business, and planning to sell the mining assets, and are continuing the business of MVP Patents on a post-merger basis, purchase business combination does not appear to be the appropriate method of accounting for the Transaction. The Transaction should instead be accounted for as a reverse recapitalization, and it should be accounted for at net book value with no change in basis or recognition of goodwill. Please revise the pro forma balance sheet and notes accordingly. |

Response:

The Staff’s comment presumes that California Gold Corp. is a non-operating public shell, which is incorrect. In fact, the mining business is being evaluated, and currently is in negotiations with Mexivada, Inc., its joint venture partner, for continuation, suspension or modification, and continues to incur franchise fees payable to Mexico for its lands under a contract. The pro forma financial statements accordingly presume that California Gold Corp. is in fact an operating company that continues its mining business through and following closing and that is not a non-operating shell. Since California Gold Corp. is an operating company that meets the definition of a business under ASC 805-10-55-4, reverse acquisition treatment under GAAP is appropriate under ASC 805-40. This position that reverse acquisition treatment is appropriate was separately confirmed through a direct call by the Company’s accountants with the AICPA.

| 6. | You disclose you are not presenting a pro forma statement of operations because MVP Portfolio LLC did not have any operations during the year ended January 31, 2014. The staff does not agree with this statement in view of the filed consolidated statement of operations of MVP Patent and MVP Portfolio for the six months ended December 31, 2013 and the consolidated statement of operations of MVP Patents (the predecessor entity) for the year ended June 30, 2013. Please revise to present a pro forma statement of operations with applicable adjustments and explanatory notes. |

Response:

As noted above, since MVP Portfolio did not have any accounts, our position is that a pro forma Profit and Loss statement is not needed. The Staff’s comment stems from the references that are made to “MV Patents” as part of the transaction. We do not consider MV Patents to be a party to this reverse acquisition as the share transfer did not include MV Patents membership interests. MV Patents continues to exist as a standalone entity with assets that were not acquired by either MVP Portfolio or California Gold Corp.

The foregoing responses are provided on behalf of California Gold, by the undersigned, the present Chief Executive Officer of the Company. Please note in addition, we currently are represented by new counsel as well, noted below, as to which all correspondence including emails should be directed.

Very truly yours,

William D. Meadow, CEO

| cc: | Shea Ralph David Rector Harvey Kesner, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, NY 10006 Fax: 212-930-9725 Hkesner@srff.com |