United States Securities and Exchange Commission

Form 20-F for the year ended December 31, 2008

Last correspondence filed on September 3, 2009

Ladies and Gentlemen:

On behalf of China TopReach Inc. (the “Company”), we are electronically transmitting hereunder this letter in response to a comment letter received from the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”), dated November 5, 2009.

In this letter, we have listed the Staff’s comments in italics and have followed each comment with the Company’s response.

Annual Report on Form 20-F for the year ended December 31, 2008

Unaudited pro forma Consolidated Financial Statement, page 57

Pro Forma Adjustments, page 57

| 1. | We note your response to our prior comment 3. As previously requested, please provide us with a reconciliation of the total number of warrants outstanding as of fiscal year ended December 31, 2008 as more fully described in Note 3 to your financial statements on page F-14 and F-15 to the 5,013,500 used by you in calculating incremental shares of 1,224,389 as reflected in your response to our comment 9 in your letter dated July 29, 2009. Furthermore, we note that the 5,013,500 warrants are still outstanding and held mostly by the funds that invested in ChinaGrowth South during the IPO. Please provide us with a complete listing of shares outstanding, including the number of shares and holder of such shares and their relationship to OMH, before and after the OMH recapitalization transaction occurred. Your response should include on a separate basis all outstanding shares of common stock, shares contingently issuable, as well as shares that can be issued upon exercise of warrants and the owners of such shares, warrants or options and the owners' relationship with OMH. We may have further comment upon receipt of your response. |

Response:

The Company has not repurchased any warrants since the initial public offering of ChinaGrowth South. None of the management members of the Company nor any of the original shareholders of OMH own any warrants. The 5,913,500 warrants used in calculating incremental shares of 1,224,389 consist of 5,013,500 warrants issued to public shareholders and 900,000 warrants issued to the management of ChinaGrowth South shortly prior to the consummation of the initial public offering of ChinaGrowth South. We have added a “note” to this effect on p. 58 in the section where the calculation of the incremental shares of 1,224,389 is set forth.

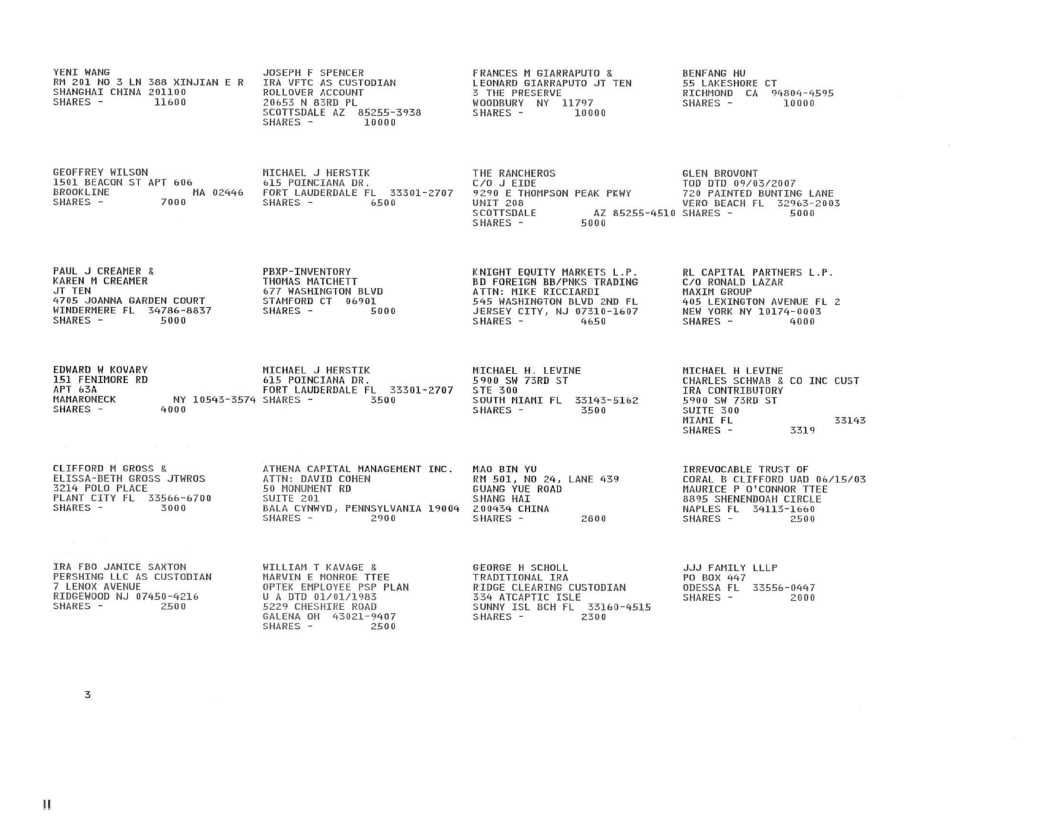

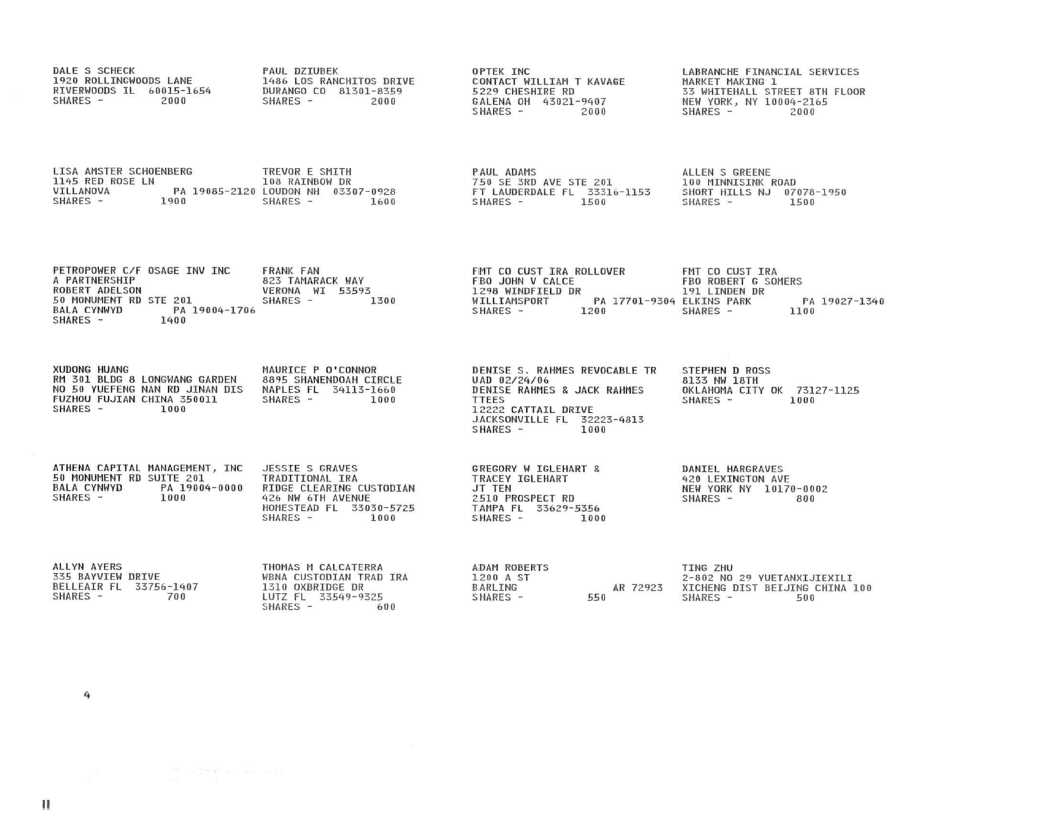

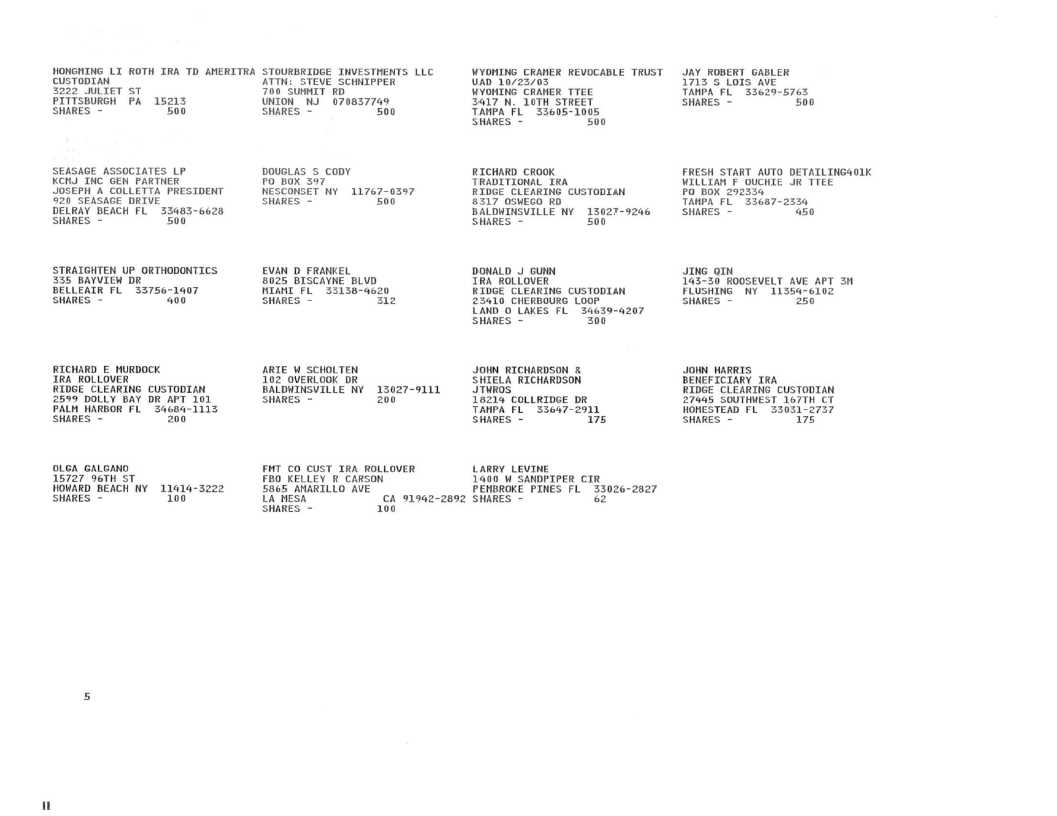

As per the Staff’s request, in the attached supplemental worksheets we have provided the list of ordinary shareholders before and after the recapitalization, the shares contingently issuable, as well as shares that can be issued upon exercise of warrants and the owners of such shares, warrants or options and the owners' relationship with OMH and the reconciliation of the warrants. Due to certain unavoidable practical limitations, it is very difficult and time consuming to obtain a complete list of warrant holders. For the staff’s information, we have attached a partial list of warrant holders received in July 2009.

| 2. | We note from your response to our prior comment 8 that you will reclassify the payment and utilization of deposits as operating activities on the cash flow statements. Please confirm that you will include such reclassification in your amended filing of Form 20-F for the year ended December 31, 2008. Your revised disclosure should also include the required disclosure of paragraphs 25 and 26 of SFAS 154. |

Response:

Pursuant to the Staff’s comment, we confirm that we will include the above referenced reclassification in our amended filing of the Form 20-F for the year ended December 31, 2008 and that our revised disclosure will also include the required disclosure of paragraphs 25 and 26 of SFAS 154. We have added footnotes to the financial statements on pp. F-26 and 38 in the form set forth below.

Restated Statements of Cash Flows

The Company reclassified the deposits paid/utilized with Newspapers from investing activities to operating activities, and deferred offering costs from investing activities to financing activities. As a result of the foregoing, the Company has restated its consolidated Statements of Cash Flows respectively.

A summary of the effects of the restatement on the Consolidated Statements of Cash Flows as of December 31, 2008 is as follows:

| | As of December 31, 2008 | |

| As Previously Reported | | Adjustments | | As Restated | |

| Net cash provided by operating activities | | $ | 1,713,214 | | | $ | (6,843,571 | ) | | $ | (5,130,357 | ) |

| Net cash used in investing activities | | | (8,780,806 | ) | | | 7,365,284 | | | | (1,415,522 | ) |

| Net cash provided by financing activities | | $ | 6,883,716 | | | $ | (521,713 | ) | | $ | 6,362,003 | |

| 3. | In a related matter, please confirm that your amended 20-F will contain the following revisions with regards to your response letter dated September 3, 2009: |

| l | Comment 1- adjustments to stockholders equity and revisions to disclosures to clarify that par value method is used for treasury stock; |

| l | Comment 2 – revisions to the shares in the OMH transaction to eliminate the contingent consideration shares until paid; |

| l | Comment 4 – revised Item 11 disclosure; |

| l | Comment 5 – revision to disclosure controls and procedures; |

| l | Comment 9 – revised revenue recognition disclosures; |

And will also contain the following revisions with regard to your response letter dated July 29, 2009:

| l | Comment 1- revised critical accounting policies disclosure; |

| l | Comment 2 – through 8 and Comment 10 – applicable revisions to the pro forma financial statements as discussed in each response; |

| l | Comment 13 – revised internal control over financial reporting disclosure; |

| l | Comment 14 – revised Item 16C disclosure; |

| l | Comment 16 – enhanced disclosures concerning OMH transactions; |

| l | Comment 17 and 18 – revised MD&A disclosures; |

| l | Comment 19 – cash flow statement reclassification; |

| l | Comment 26 – revised disclosure concerning advances; |

| l | Comment 27 – revised intangible assets footnote; |

Where applicable, your revised 20-F financial statements should contain all disclosures required for the correction of an error under SFAS 154 for accounting errors.

Response:

Pursuant to the Staff’s comment, we confirm that our amended 20-F will contain the following revisions with regards to our response letter dated September 3, 2009 or July 29,2009, respectively, and that we have made the corresponding revisions on the amended 20-F:

The revisions with regards to our response letter dated September 3, 2009:

| l | Comment 1- adjustments to stockholders equity and revisions to disclosures to clarify that par value method is used for treasury stock; Please refer to pp.58. |

| l | Comment 2 – revisions to the shares in the OMH transaction to eliminate the contingent consideration shares until paid; Please refer to pp.58. |

| l | Comment 4 – revised Item 11 disclosure; Please refer to pp.72. |

| l | Comment 5 – revision to disclosure controls and procedures; Please refer to pp.73. |

| l | Comment 9 – revised revenue recognition disclosures; Please refer to pp.38. |

And will also contain the following revisions with regard to our response letter dated July 29, 2009:

| l | Comment 1- revised critical accounting policies disclosure; Please refer to pp.39-40. |

| l | Comment 2 – through 8 and Comment 10 – applicable revisions to the pro forma financial statements as discussed in each response; Please refer to pp.57-58. |

| l | Comment 13 – revised internal control over financial reporting disclosure; Please refer to pp.73. |

| l | Comment 14 – revised Item 16C disclosure; Please refer to p.74. |

| l | Comment 16 – enhanced disclosures concerning OMH transactions; Please refer to pp. F-18 and F-38. |

| l | Comment 17 and 18 – revised MD&A disclosures; |

| l | Comment 19 – cash flow statement reclassification; Please refer to pp. F-24. |

| l | Comment 26 – revised disclosure concerning advances; Please refer to pp. F-32. |

| l | Comment 27 – revised intangible assets footnote; Please refer to p.32. |

In submitting this comment response letter, the Company has authorized me to acknowledge on its behalf that (i) the Company is responsible for the adequacy and accuracy of the disclosure in the Form 20-F, (ii) Staff comments or changes made in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings and (iii) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please feel free to contact William Haddad (212-335-4998) should you have any questions. Thank you.

| Very truly yours, |

| |

| /s/ William N. Haddad |

| |

| William N. Haddad |

China TopReach Inc - Equity Summary

Previously named as ChinaGrowth South Acquisition Corporation

Shareholder | | Final Beneficial Owners | | Position in the Company / Relationship with the Company | | Number of Shares (before recapitalization in Jan. 2009) | | | Number of Shares (after recapitalization) | | | Add: Earn-out and exercise of warrant | | | Total (Pro forma) | |

| INDEX ASIA PACIFIC LIMITED | | Index Holdings, a listed Japanese company in Japan (Quote: 4835) | | Strategic Investor | | | - | | | | 1,143,179 | | | | | | | 1,143,179 | |

| TOPBIG INTERNATIONAL DEVELOPMENT LIMITED | | Chen Zhi | | CEO & Director | | | - | | | | 916,438 | | | | | | | 916,438 | |

| BLAZING SUN HOLDINGS LTD | | Hong Peifeng | | Chairman of the Board | | | - | | | | 361,002 | | | | | | | 361,002 | |

| LUCK SMART LIMITED | | Lin Yutong | | Management | | | - | | | | 1,754 | | | | | | | 1,754 | |

| WING KEEN MANAGEMENT LIMITED | | Zhang Jingui | | Management | | | - | | | | 360 | | | | | | | 360 | |

| ADORATION MANAGEMENT LIMITED | | Chen Ziquan | | Management | | | - | | | | 6,596 | | | | | | | 6,596 | |

| KEEP PROFIT INTERNATIONAL CAPITAL LIMITED | | Yu Shiquan, Li Gang, Xu Kaining | | Management | | | - | | | | 311 | | | | | | | 311 | |

| AOTIAN HOLDINGS LTD | | Lv Ying, Shi Chanjuan | | Management | | | - | | | | 325,257 | | | | | | | 325,257 | |

| Other Employees | | | | Management and Employees | | | - | | | | 625,035 | | | | | | | 625,035 | |

| Jiangyuan International Development Limited | | | | Financial Investor | | | - | | | | 108,068 | | | | | | | 108,068 | |

| Release escrowed shares to original shareholders of OMH | | | | the above parties as a group | | | | | | | | | | | 2,000,000 | | | | 2,000,000 | |

| Earn-out shares issued to original shareholders of OMH | | | | the above parties as a group | | | | | | | | | | | 9,500,000 | | | | 9,500,000 | |

| Centurion Credit Funding LLC | | | | Lender of Bridge Loan | | | - | | | | 165,972 | | | | | | | | 165,972 | |

| Rong Deng | | | | Consultant | | | - | | | | 120,000 | | | | | | | | 120,000 | |

| Kingoal Investments Limited | | | | Consultant | | | - | | | | 1,000 | | | | | | | | 1,000 | |

| ChinaGrowth Management Team | | | | ChinaGrowth Founders | | | 1,125,000 | | | | 725,000 | | | | | | | | 725,000 | |

| Exercise of ChinaGrowth Management warrants | | | | ChinaGrowth Founders | | | | | | | | | | | 900,000 | | | | 900,000 | |

| Exercise of Option to undrewriter | | Morgan Joseph Co | | Morgan Joseph Co | | | | | | | | | | | 630,000 | | | | 630,000 | |

| Public Shareholders | | * | | Public | | | 5,013,500 | | | | 171,087 | | | | - | | | | 171,087 | |

| Exercise of public warrants | | | | Public | | | | | | | | | | | 5,013,500 | | | | 5,013,500 | |

| China Science & Kingwing (HK) Investment Management Limited | | | | Financial Investor | | | - | | | | 1,020,000 | | | | | | | | 1,020,000 | |

| Total Shares | | | | | | | 6,138,500 | | | | 5,691,059 | | | | 18,043,500 | | | | 23,734,559 | |

China TopReach Inc - Summary of Warrants

Previously named as ChinaGrowth South Acquisition Corporation

| Shareholder | | Final Beneficial Owners | | Position in the Company / Relationship with the Company | | Number of Warrants (before recapitalization in Jan. 2009) | | | Number of Warrants (after recapitalization) | |

| Management/employees of OMH | | Management | | Management | | | - | | | | - | |

| ChinaGrowth Management Team | | | | ChinaGrowth Founders | | | 900,000 | | | | 900,000 | |

| Public warrant holders | | | | Public | | | 5,013,500 | | | | 5,013,500 | |

| | | | | | | | | | | | | |

| Total Shares | | | | | | | 5,913,500 | | | | 5,913,500 | |