enstargroup.com ENSTAR GROUP LIMITED Investor Financial Supplement December 31, 2020

| enstargroup.com 2 Page Explanatory Notes 3 Financial Highlights 5 Book Value Per Share 6 Book Value & Share Price Performance 7 Summary Balance Sheets 8 Summary Earnings Statements 9 Earnings Per Share 10 Non-GAAP Operating Income 11 Reserve/Claims Savings 12 Investment Composition - GAAP 13 Investment Performance - GAAP 14 Investment Composition - Non-GAAP 15 Investment Composition - Non-GAAP Reconciliation 16 Capital Position & Credit Ratings 17 Results by Segment 18 Table of Contents

| enstargroup.com 3 Explanatory Notes About Enstar Enstar is a NASDAQ-listed leading global insurance group that offers innovative capital release solutions through its network of group companies in Bermuda, the United States, the United Kingdom, Continental Europe, Australia, and other international locations. A market leader in completing legacy acquisitions, Enstar has acquired over 100 companies and portfolios since its formation in 2001. For further information about Enstar, see www.enstargroup.com. Basis of Presentation In this Investor Financial Supplement, the terms "we," "us," "our," "Enstar," or "the Company" refer to Enstar Group Limited and its consolidated subsidiaries. All information contained herein is unaudited. Unless otherwise noted, amounts are in thousands of U.S. Dollars, except for share and per share amounts and ratio information. Certain prior period comparatives have been reclassified to conform to the current presentation. This Investor Financial Supplement is being provided for informational purposes only. It should be read in conjunction with documents filed by Enstar with the U.S. Securities and Exchange Commission, including its Annual Reports on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. Segment Change During the first quarter of 2021, we revised our segment structure to align with how our chief operating decision maker, who was determined to be our Chief Executive Officer, views our business, assesses performance and allocates resources to our business components. Effective January 1, 2021, our business is organized into three reportable segments: (i) Run-off: consists of our acquired property and casualty and other (re)insurance business and StarStone's non-U.S. operations ("StarStone International") (from January 1, 2021) following our decision to place it into an orderly run-off (the "StarStone International Run-off"). This segment also includes our consulting and management business, which manages the run-off portfolios of third parties through our service companies. Management’s primary objective with respect to the Run-off segment is to generate reserve/claims savings over time by settling claims in a timely, cost efficient manner using our claims management expertise including settling claims for lower than outstanding ultimate loss estimates, implementation of reinsurance and commutation strategies; (ii) Investments: consists of our investment activities and the performance of our investment portfolio, excluding those investable assets attributable to our Legacy Underwriting segment. Management’s primary objective of the Investments segment is to obtain the highest possible risk and capital adjusted returns while maintaining prudent diversification of assets and operating with the constraints of a global regulated (re)insurance company. We additionally consider the liquidity requirements and duration of our claims and contract liabilities; and (iii) Legacy Underwriting: consists of businesses that we have either, in the case of Atrium Underwriting Group Limited and its subsidiaries ("Atrium"), exited via the sale of the majority of our interest in or, in the case of StarStone International (included in the Legacy Underwriting segment through December 31, 2020), placed into run-off. Prior to January 1, 2021, this segment comprised SGL No. 1 Limited's ("SGL No. 1's") 25% net share of Atrium's Syndicate 609 business at Lloyd's and StarStone International (through December 31, 2020). From January 1, 2021, this segment comprises SGL No.1's 25% gross share of the 2020 and prior underwriting years of Atrium's Syndicate 609 at Lloyd's, offset by the contractual transfer of the results of that business to the Atrium entities that were divested in the Exchange Transaction. There is no net risk retention for Enstar on Atrium's 2020 and prior underwriting years. For further information on the Exchange Transaction and the StarStone International Run-off, refer to Note 5 - "Divestitures, Held-for-Sale Businesses and Discontinued Operations" in the notes to our consolidated financial statements included within Item 8 of Exhibit 99.2 to our Form 8-K filed on June 11, 2021 for further information on these items. In addition, our corporate and other activities, which do not qualify as an operating segment, includes income and expense items that are not directly attributable to our reportable segments. These include, (a) holding company income and expenses, (b) the amortization of deferred charge assets and deferred gain liabilities on retroactive reinsurance contracts, (c) the amortization of fair value adjustments associated with the acquisition of companies, (d) changes in the fair value of assets and liabilities related to our assumed retroactive reinsurance contracts for which we have elected the fair value option, (e) corporate expenses not allocated to our reportable segments, (f) debt servicing costs, (g) net foreign exchange (gains) losses, (h) gains (losses) arising on the sale of subsidiaries (if any), (i) income tax benefit (expense), (j) net earnings (losses) from discontinued operations, net of income tax (if any), (k) net (earnings) loss attributable to noncontrolling interest, and (l) preferred share dividends. Items (b), (c) and (d) highlighted above are included within corporate and other activities since they are not subject to any specific action or judgement by management. Refer to "(p) Acquisitions, Goodwill and Intangible Assets" and "(q) Retroactive Reinsurance" within Note 2 - "Significant Accounting Policies" in the notes to our consolidated financial statements included within Item 8 of Exhibit 99.2 to our Form 8-K filed on June 11, 2021 for further information on these items. Following the re-organization of our reportable segments during the first quarter of 2021 as described above, we restated the prior period comparatives to conform to the current period presentation. Discontinued Operations On June 10, 2020, we announced an agreement to recapitalize StarStone US Holdings, Inc. and its subsidiaries ("StarStone U.S.") and appoint a new management team and Board. As part of the recapitalization, we entered into a definitive agreement to sell StarStone U.S. to Core Specialty Insurance Holdings, Inc. ("Core Specialty"), a newly formed entity with equity backing from funds managed by SkyKnight Capital, L.P., Dragoneer Investment Group and Aquiline Capital Partners LLC. As a result, in the second quarter of 2020, the results of Starstone U.S. were retrospectively reclassified to net earnings (loss) from discontinued operations on our condensed consolidated statement of earnings for all periods presented. Non-GAAP Operating Income (Loss) Attributable to Enstar Ordinary Shareholders In addition to presenting net earnings (loss) attributable to Enstar ordinary shareholders and diluted earnings (loss) per ordinary share determined in accordance with U.S. GAAP, we believe that presenting non-GAAP operating income (loss) attributable to Enstar ordinary shareholders and diluted non-GAAP operating income (loss) per ordinary share, both of which are non- GAAP financial measures as defined in SEC Regulation G, provides investors with valuable measures of our performance.

| enstargroup.com 4 Explanatory Notes (continued) Non-GAAP operating income (loss) is net earnings attributable to Enstar ordinary shareholders excluding: (i) net realized and unrealized (gains) losses on fixed maturity investments and funds held - directly managed included in net earnings (loss), (ii) change in fair value of insurance contracts for which we have elected the fair value option, (iii) (gain) loss on sale of subsidiaries, if any, (vi) net (earnings) loss from discontinued operations, if any, (v) tax effect of these adjustments where applicable, and (vi) attribution of share of adjustments to noncontrolling interest where applicable. We eliminate the impact of net realized and unrealized (gains) losses on fixed maturity investments and funds held - directly managed, included in net earnings (loss), and change in fair value of insurance contracts for which we have elected the fair value option because these items are subject to significant fluctuations in fair value from period to period, driven primarily by market conditions and general economic conditions, and therefore their impact on our earnings is not reflective of the performance of our core operations. We eliminate the impact of gain (loss) on sale of subsidiaries and net earnings (loss) from discontinued operations because these are also not reflective of the performance of our core operations. Diluted Non-GAAP operating income (loss) per ordinary share is diluted net earnings per ordinary share excluding the per diluted share amounts of each of the adjustments used to calculate non-GAAP operating income (loss). Reserve/Claims Savings - Non-GAAP Reserve/Claims Savings is a non-GAAP measure calculated using components of amounts determined in accordance with U.S. GAAP for our Run-off segment. Reserve/Claims Savings is calculated by adding (i) the reduction (increase) in estimates of net ultimate losses relating to prior periods, included in net incurred losses and LAE, and (ii) the reduction (increase) in estimates of ultimate net defendant asbestos and environmental (“Defendant A&E”) liabilities relating to prior periods, included in other income (expense). Because the reduction (increase) in estimates of ultimate Defendant A&E liabilities for prior periods is presented as a component of other income (expense) in our consolidated statement of earnings, there is not a U.S. GAAP measure that is directly comparable to Reserve/Claims Savings presented on a non-GAAP basis. However, we believe Reserve/Claims Savings provides investors with a meaningful measure of claims management performance within our Run-off segment that is consistent with management’s view of the business because it combines the reduction (increase) in estimates of net ultimate losses related to our direct exposure to certain acquired asbestos and environmental liabilities with the reduction (increase) in estimates of net ultimate losses related to liabilities that we have insured. For a reconciliation showing the calculation of Reserve/Claims Savings using the applicable components of amounts determined in accordance with U.S. GAAP for our Run-off segment, refer to “Reserve/Claims Savings” on page 12. Investment Composition - Non-GAAP In certain instances, U.S. GAAP requirements result in classifications of our investment assets that may not correspond to management’s view of the underlying economic exposure of a particular investment. As such, we have prepared a non-GAAP view of our invested assets based on our assessment of the underlying economic exposure of each investment, which is consistent with the manner in which management views our investment portfolio composition. GAAP requires, in part, that invested assets be classified based upon the legal form of the investment without regard to the underlying economic exposure. Management’s view “looks through” the legal form of an investment and aggregates the classification based upon the underlying economic exposure of each investment. For example: 1. Enstar has certain private equity funds, privately held equity (which are direct investments in companies), private credit funds and real estate equity funds that are collectively held in a limited partnership. U.S. GAAP requires that the investment be classified as “Private equity funds” within “Other Investments.” For management reporting purposes, we disaggregate private equity funds, privately held equity, private credit funds and real estate equity funds and present them separately based on the underlying investment. 2. Enstar has certain public equity investments that are held directly on its balance sheet and some that are held in a fund. U.S. GAAP requires that the investment on our balance sheet be classified as “Equities” in our financial statements. Public equity held in fund format is classified as “Equity funds” within “Other Investments”. For management reporting purposes, we have aggregated all directly held public equity and public equity funds into one line item “Equities.” 3. Enstar has certain investments in public shares of exchange traded funds (“ETF”) where the underlying exposure of the ETF is an investment in investment grade fixed income securities. U.S. GAAP requires that the investment be classified as “Equities”. For management reporting, we have classified the investment as “Bond/loan funds.” 4. Enstar has certain investments in public equity investments where the underlying investments are CLO mezzanine debt. For management reporting purposes, we have classified these investments as “Bond/loan funds.” 5. Enstar has certain investments in direct CLO equities and some in fund format. For management reporting purposes, we have aggregated all CLO equities into one line item of “CLO equities.” We believe these non-GAAP measures enable readers of our consolidated financial statements to analyze our results in a way that is more aligned with the manner in which our management measures our underlying performance. We believe that presenting these non-GAAP financial measures, which may be defined and calculated differently by other companies, improves the understanding of our consolidated results of operations. These measures should not be viewed as substitutes for those calculated in accordance with U.S. GAAP. Cautionary Statement This investor financial supplement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding the intent, belief or current expectations of Enstar and its management team. Investors are cautioned that any such forward-looking statements speak only as of the date they are made, are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, including the ongoing COVID-19 pandemic and the related uncertainty and volatility in the financial markets. Important risk factors regarding Enstar can be found under the heading "Risk Factors" in our Form 10-K for the year ended December 31, 2020 and are incorporated herein by reference. Furthermore, Enstar undertakes no obligation to update any written or oral forward-looking statements or publicly announce any updates or revisions to any of the forward-looking statements contained herein, to reflect any change in its expectations with regard thereto or any change in events, conditions, circumstances or assumptions underlying such statements, except as required by law.

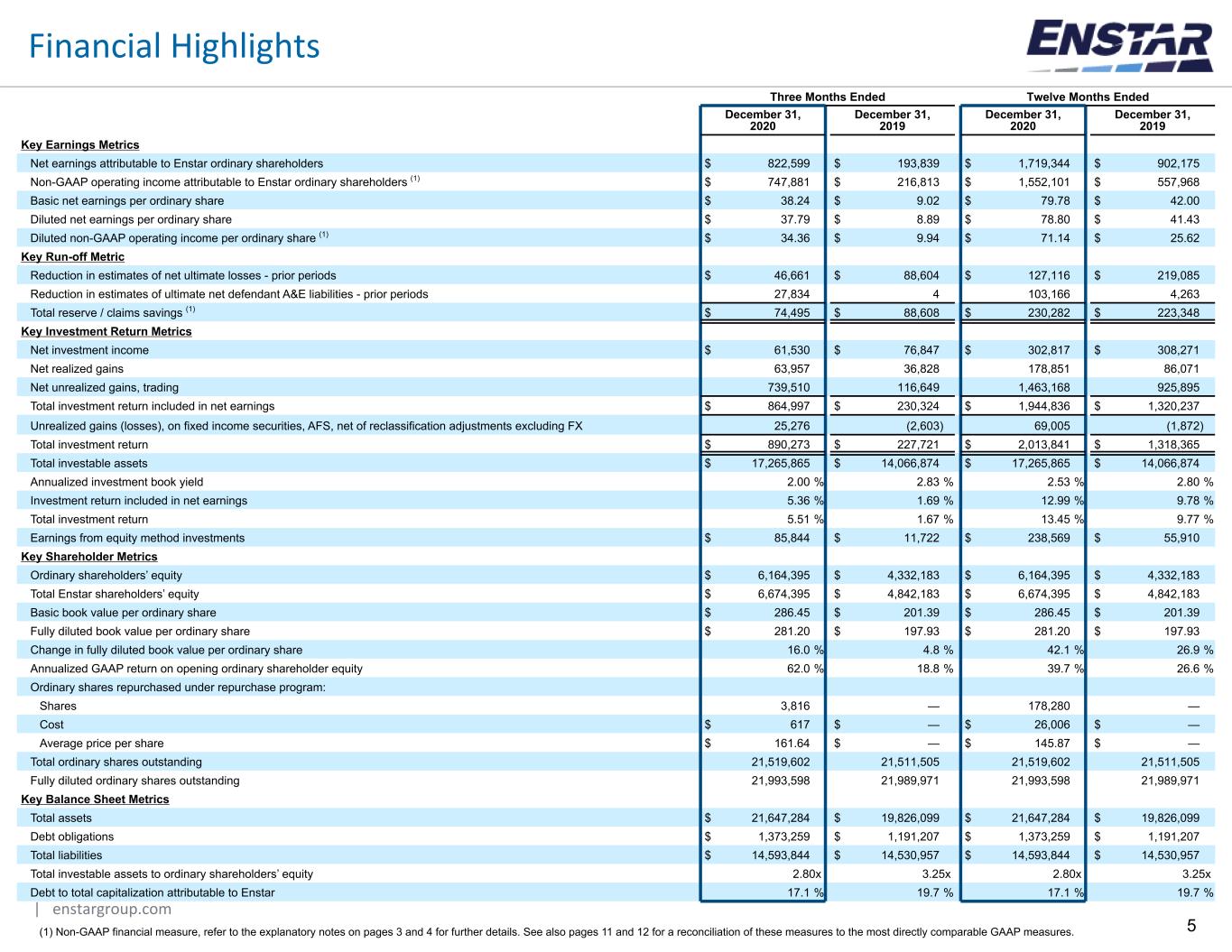

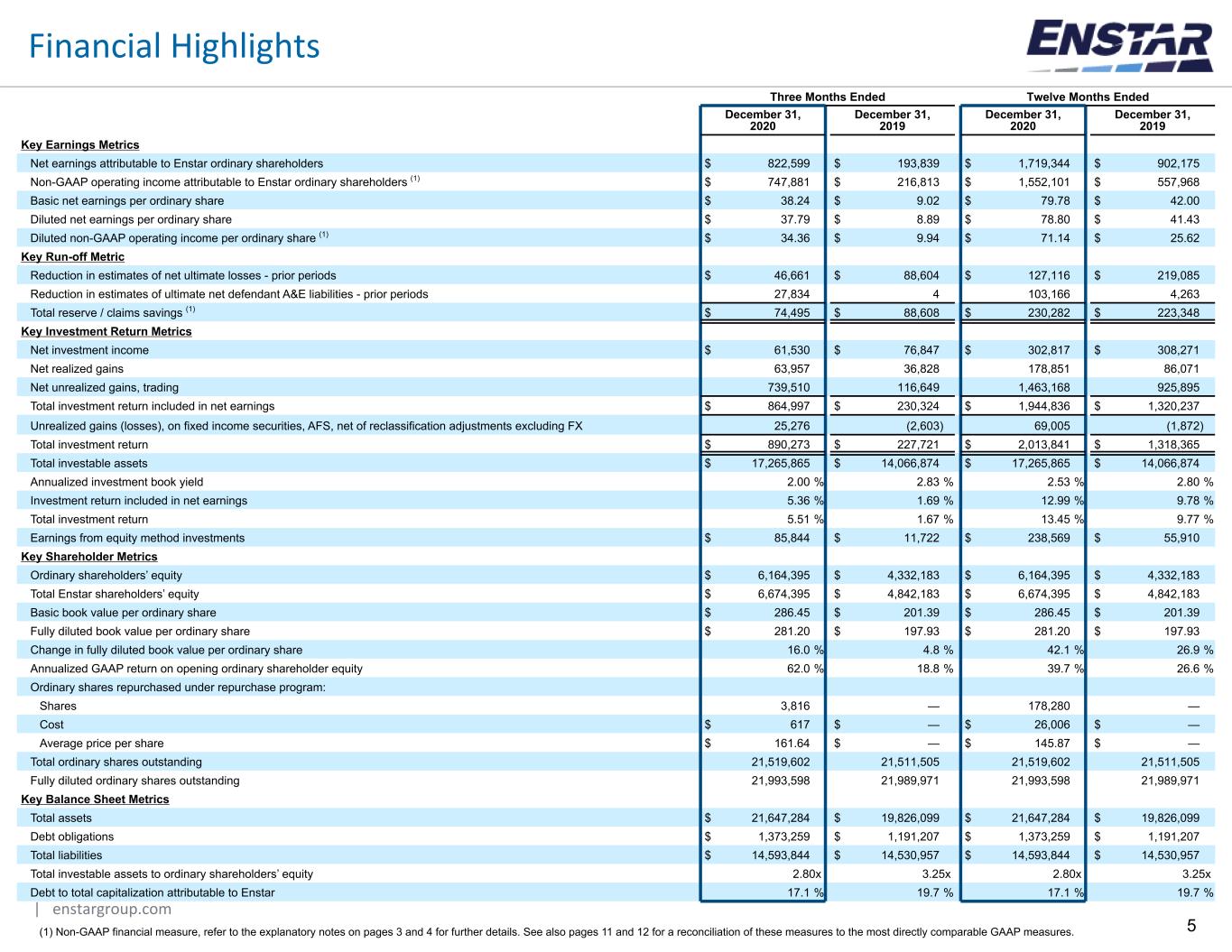

| enstargroup.com 5 Three Months Ended Twelve Months Ended December 31, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Key Earnings Metrics Net earnings attributable to Enstar ordinary shareholders $ 822,599 $ 193,839 $ 1,719,344 $ 902,175 Non-GAAP operating income attributable to Enstar ordinary shareholders (1) $ 747,881 $ 216,813 $ 1,552,101 $ 557,968 Basic net earnings per ordinary share $ 38.24 $ 9.02 $ 79.78 $ 42.00 Diluted net earnings per ordinary share $ 37.79 $ 8.89 $ 78.80 $ 41.43 Diluted non-GAAP operating income per ordinary share (1) $ 34.36 $ 9.94 $ 71.14 $ 25.62 Key Run-off Metric Reduction in estimates of net ultimate losses - prior periods $ 46,661 $ 88,604 $ 127,116 $ 219,085 Reduction in estimates of ultimate net defendant A&E liabilities - prior periods 27,834 4 103,166 4,263 Total reserve / claims savings (1) $ 74,495 $ 88,608 $ 230,282 $ 223,348 Key Investment Return Metrics Net investment income $ 61,530 $ 76,847 $ 302,817 $ 308,271 Net realized gains 63,957 36,828 178,851 86,071 Net unrealized gains, trading 739,510 116,649 1,463,168 925,895 Total investment return included in net earnings $ 864,997 $ 230,324 $ 1,944,836 $ 1,320,237 Unrealized gains (losses), on fixed income securities, AFS, net of reclassification adjustments excluding FX 25,276 (2,603) 69,005 (1,872) Total investment return $ 890,273 $ 227,721 $ 2,013,841 $ 1,318,365 Total investable assets $ 17,265,865 $ 14,066,874 $ 17,265,865 $ 14,066,874 Annualized investment book yield 2.00 % 2.83 % 2.53 % 2.80 % Investment return included in net earnings 5.36 % 1.69 % 12.99 % 9.78 % Total investment return 5.51 % 1.67 % 13.45 % 9.77 % Earnings from equity method investments $ 85,844 $ 11,722 $ 238,569 $ 55,910 Key Shareholder Metrics Ordinary shareholders’ equity $ 6,164,395 $ 4,332,183 $ 6,164,395 $ 4,332,183 Total Enstar shareholders’ equity $ 6,674,395 $ 4,842,183 $ 6,674,395 $ 4,842,183 Basic book value per ordinary share $ 286.45 $ 201.39 $ 286.45 $ 201.39 Fully diluted book value per ordinary share $ 281.20 $ 197.93 $ 281.20 $ 197.93 Change in fully diluted book value per ordinary share 16.0 % 4.8 % 42.1 % 26.9 % Annualized GAAP return on opening ordinary shareholder equity 62.0 % 18.8 % 39.7 % 26.6 % Ordinary shares repurchased under repurchase program: Shares 3,816 — 178,280 — Cost $ 617 $ — $ 26,006 $ — Average price per share $ 161.64 $ — $ 145.87 $ — Total ordinary shares outstanding 21,519,602 21,511,505 21,519,602 21,511,505 Fully diluted ordinary shares outstanding 21,993,598 21,989,971 21,993,598 21,989,971 Key Balance Sheet Metrics Total assets $ 21,647,284 $ 19,826,099 $ 21,647,284 $ 19,826,099 Debt obligations $ 1,373,259 $ 1,191,207 $ 1,373,259 $ 1,191,207 Total liabilities $ 14,593,844 $ 14,530,957 $ 14,593,844 $ 14,530,957 Total investable assets to ordinary shareholders’ equity 2.80x 3.25x 2.80x 3.25x Debt to total capitalization attributable to Enstar 17.1 % 19.7 % 17.1 % 19.7 % Financial Highlights (1) Non-GAAP financial measure, refer to the explanatory notes on pages 3 and 4 for further details. See also pages 11 and 12 for a reconciliation of these measures to the most directly comparable GAAP measures.

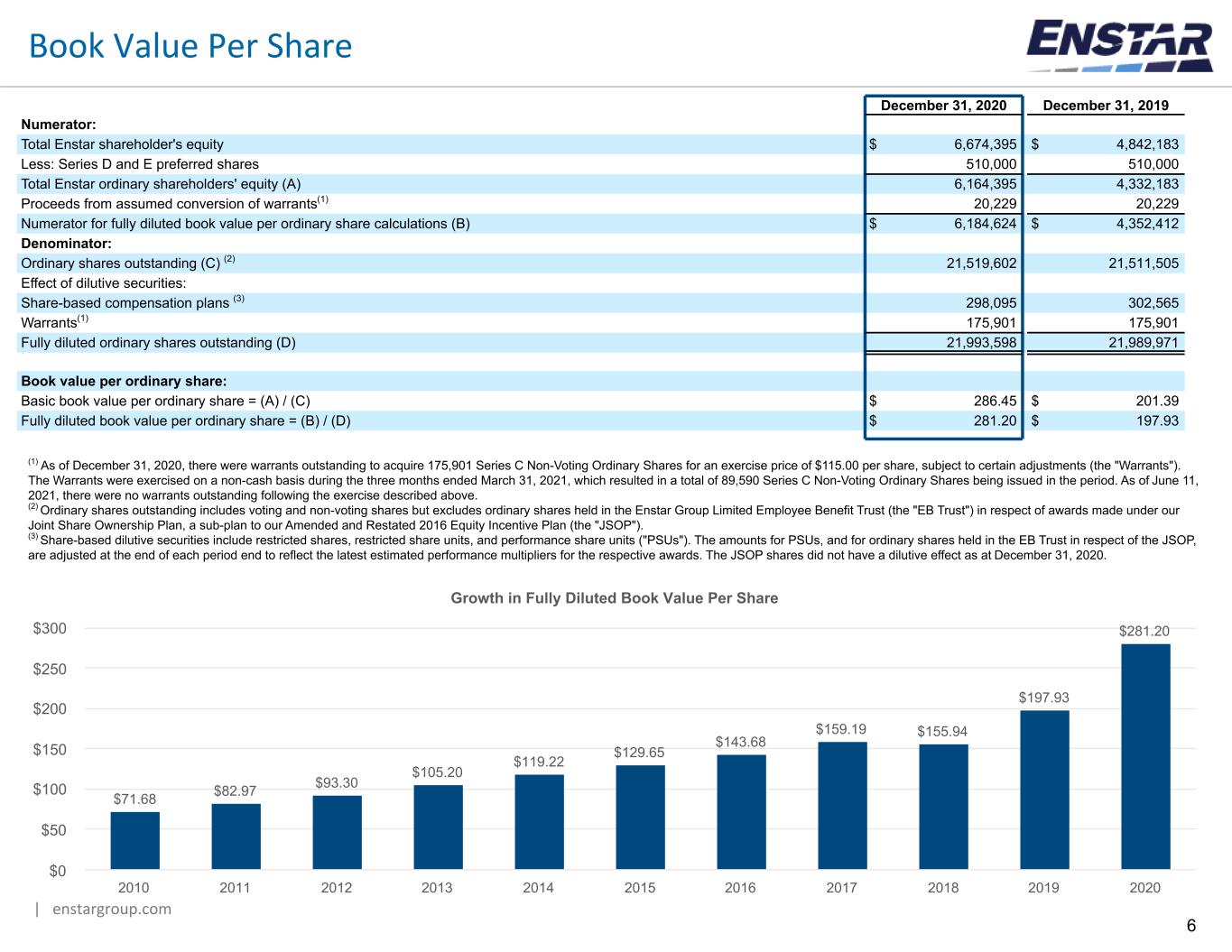

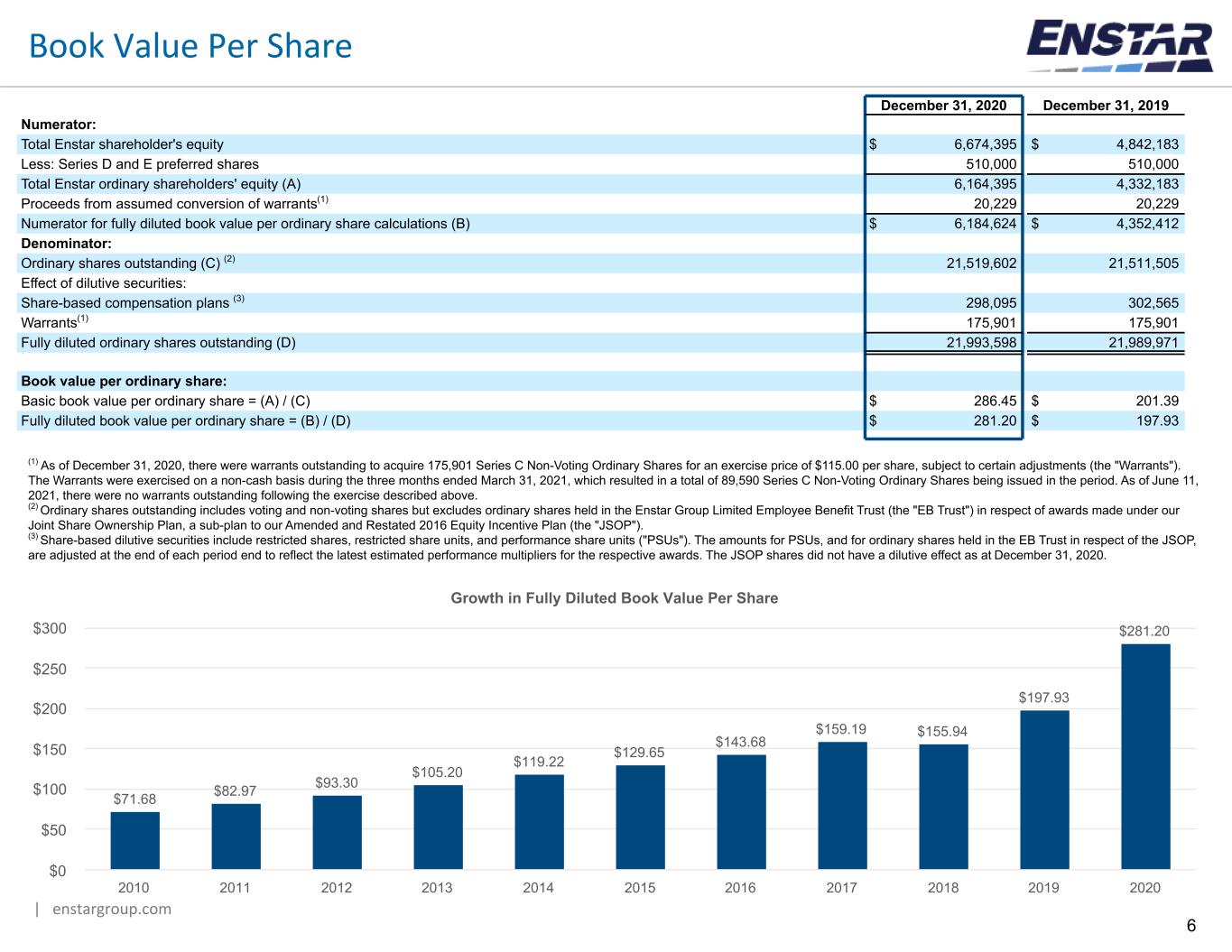

| enstargroup.com 6 Book Value Per Share December 31, 2020 December 31, 2019 Numerator: Total Enstar shareholder's equity $ 6,674,395 $ 4,842,183 Less: Series D and E preferred shares 510,000 510,000 Total Enstar ordinary shareholders' equity (A) 6,164,395 4,332,183 Proceeds from assumed conversion of warrants(1) 20,229 20,229 Numerator for fully diluted book value per ordinary share calculations (B) $ 6,184,624 $ 4,352,412 Denominator: Ordinary shares outstanding (C) (2) 21,519,602 21,511,505 Effect of dilutive securities: Share-based compensation plans (3) 298,095 302,565 Warrants(1) 175,901 175,901 Fully diluted ordinary shares outstanding (D) 21,993,598 21,989,971 Book value per ordinary share: Basic book value per ordinary share = (A) / (C) $ 286.45 $ 201.39 Fully diluted book value per ordinary share = (B) / (D) $ 281.20 $ 197.93 Growth in Fully Diluted Book Value Per Share $71.68 $82.97 $93.30 $105.20 $119.22 $129.65 $143.68 $159.19 $155.94 $197.93 $281.20 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 $0 $50 $100 $150 $200 $250 $300 (1) As of December 31, 2020, there were warrants outstanding to acquire 175,901 Series C Non-Voting Ordinary Shares for an exercise price of $115.00 per share, subject to certain adjustments (the "Warrants"). The Warrants were exercised on a non-cash basis during the three months ended March 31, 2021, which resulted in a total of 89,590 Series C Non-Voting Ordinary Shares being issued in the period. As of June 11, 2021, there were no warrants outstanding following the exercise described above. (2) Ordinary shares outstanding includes voting and non-voting shares but excludes ordinary shares held in the Enstar Group Limited Employee Benefit Trust (the "EB Trust") in respect of awards made under our Joint Share Ownership Plan, a sub-plan to our Amended and Restated 2016 Equity Incentive Plan (the "JSOP"). (3) Share-based dilutive securities include restricted shares, restricted share units, and performance share units ("PSUs"). The amounts for PSUs, and for ordinary shares held in the EB Trust in respect of the JSOP, are adjusted at the end of each period end to reflect the latest estimated performance multipliers for the respective awards. The JSOP shares did not have a dilutive effect as at December 31, 2020.

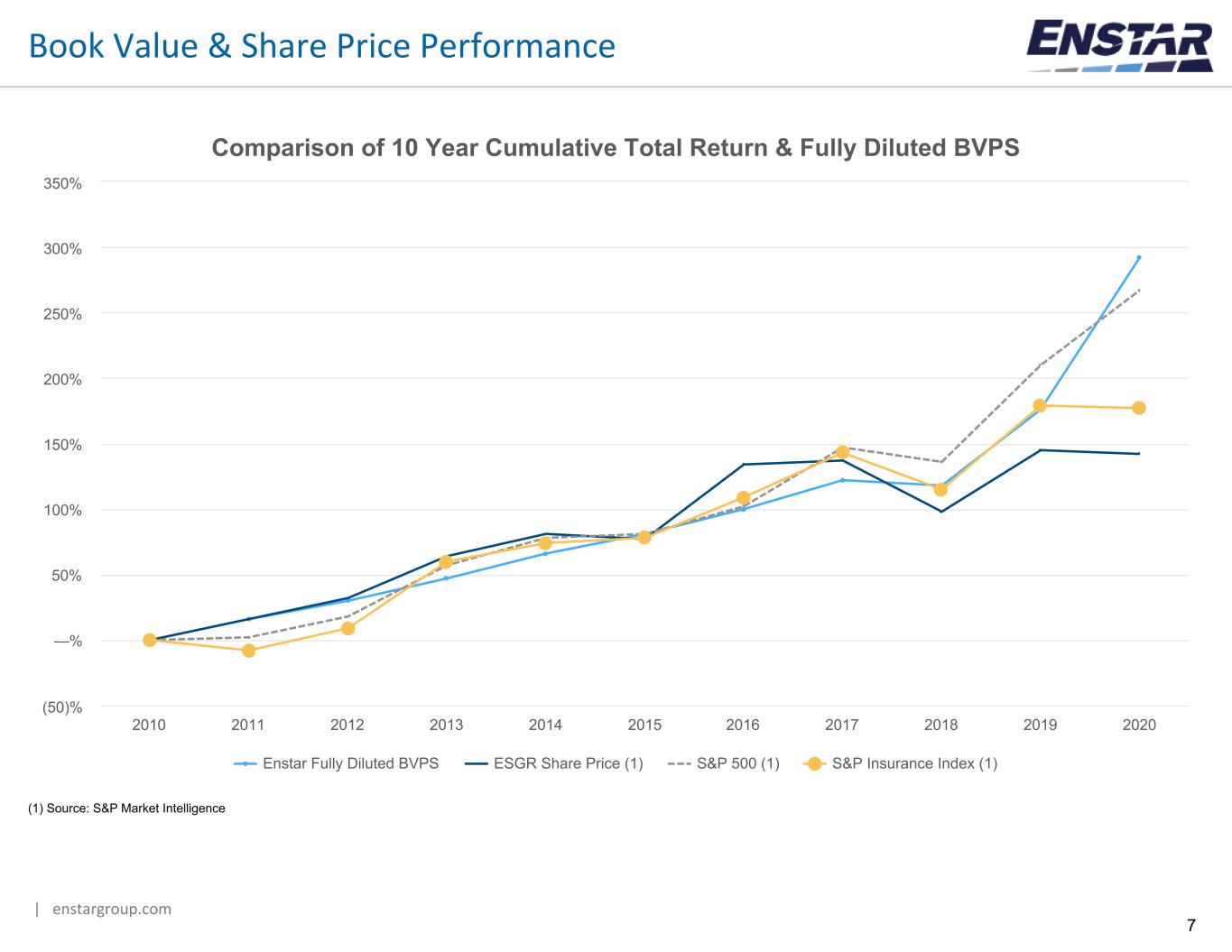

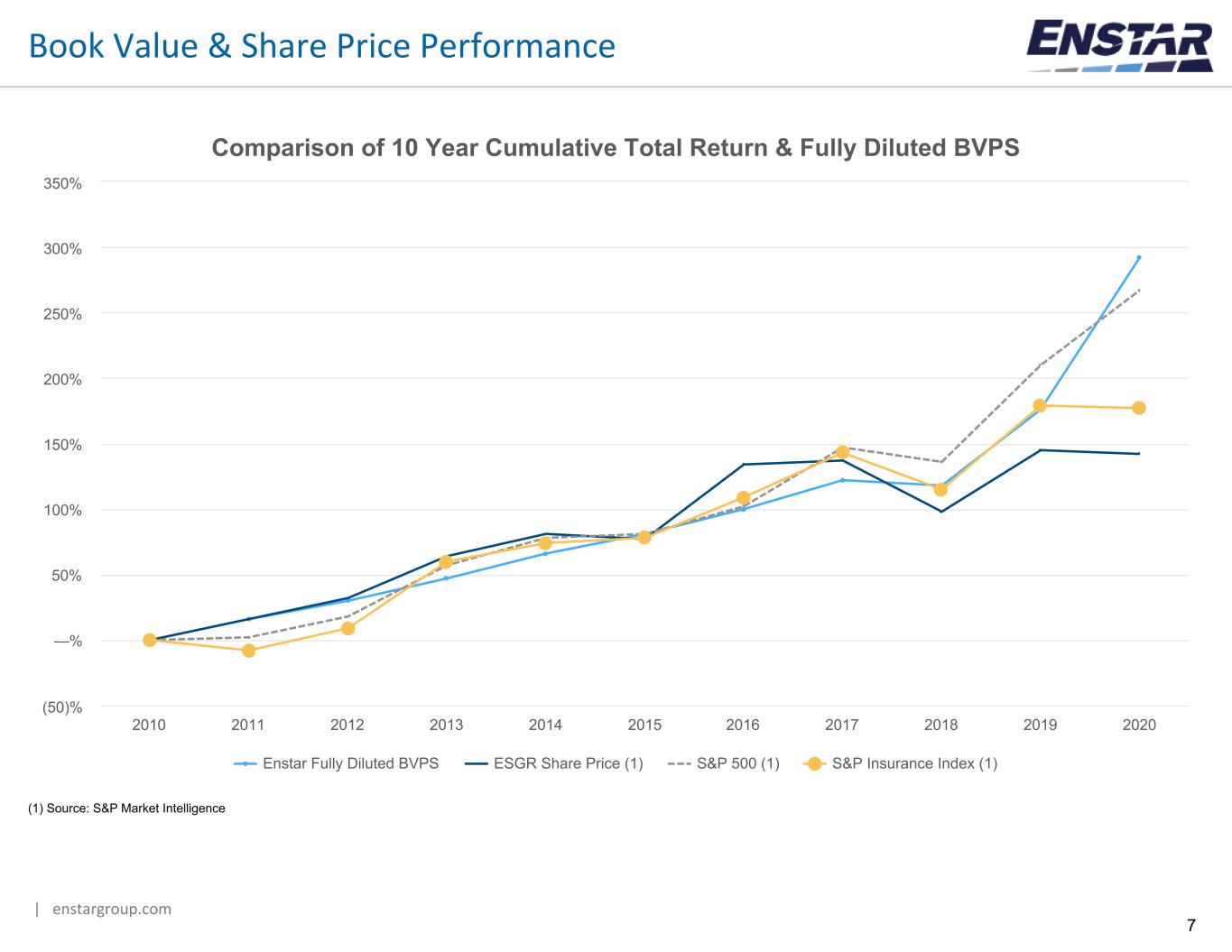

| enstargroup.com 7 Book Value & Share Price Performance (1) Source: S&P Market Intelligence Comparison of 10 Year Cumulative Total Return & Fully Diluted BVPS Enstar Fully Diluted BVPS ESGR Share Price (1) S&P 500 (1) S&P Insurance Index (1) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (50)% —% 50% 100% 150% 200% 250% 300% 350%

| enstargroup.com 8 Summary Balance Sheets December 31, 2020 September 30, 2020 December 31, 2019 ASSETS Short-term and fixed maturity investments, trading $ 4,600,021 $ 5,006,775 $ 6,194,825 Short-term and fixed maturity investments, AFS 3,658,895 3,161,647 1,666,387 Funds held - directly managed 1,074,890 1,066,639 1,187,552 Other investments, including equities 5,090,829 4,358,029 3,244,752 Equity method investments 832,295 516,795 326,277 Total investments 15,256,930 14,109,885 12,619,793 Cash and restricted cash 1,373,116 1,197,322 971,349 Premiums receivable 405,793 450,977 491,511 Reinsurance balances recoverable 2,089,163 1,881,656 2,181,134 Insurance balances recoverable 249,652 365,288 448,855 Funds held by reinsured companies 635,819 657,490 475,732 Other assets 925,533 951,482 1,162,955 Assets held for sale 711,278 2,156,488 1,474,770 TOTAL ASSETS $ 21,647,284 $ 21,770,588 $ 19,826,099 LIABILITIES Losses and loss adjustment expenses $ 10,593,282 $ 10,300,884 $ 9,868,404 Defendant asbestos and environmental liabilities 706,329 754,037 847,685 Insurance and reinsurance balances payable 494,412 581,615 420,546 Debt obligations 1,373,259 1,447,908 1,191,207 Other liabilities 942,905 820,717 994,584 Liabilities held for sale 483,657 1,653,343 1,208,531 TOTAL LIABILITIES 14,593,844 15,558,504 14,530,957 COMMITMENTS AND CONTINGENCIES REDEEMABLE NONCONTROLLING INTEREST 365,436 376,731 438,791 SHAREHOLDERS’ EQUITY Ordinary shareholders’ equity (1) 6,164,395 5,310,885 4,332,183 Series D & E preferred shares 510,000 510,000 510,000 Total Enstar shareholders’ equity 6,674,395 5,820,885 4,842,183 Noncontrolling interest 13,609 14,468 14,168 TOTAL SHAREHOLDERS’ EQUITY 6,688,004 5,835,353 4,856,351 TOTAL LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY $ 21,647,284 $ 21,770,588 $ 19,826,099 (1) Ordinary shareholders’ equity includes voting ordinary shares, non-voting convertible ordinary Series C and Series E shares, Series C preferred shares, treasury shares, joint share ownership plan voting ordinary shares, additional paid-in capital, accumulated other comprehensive income and retained earnings.

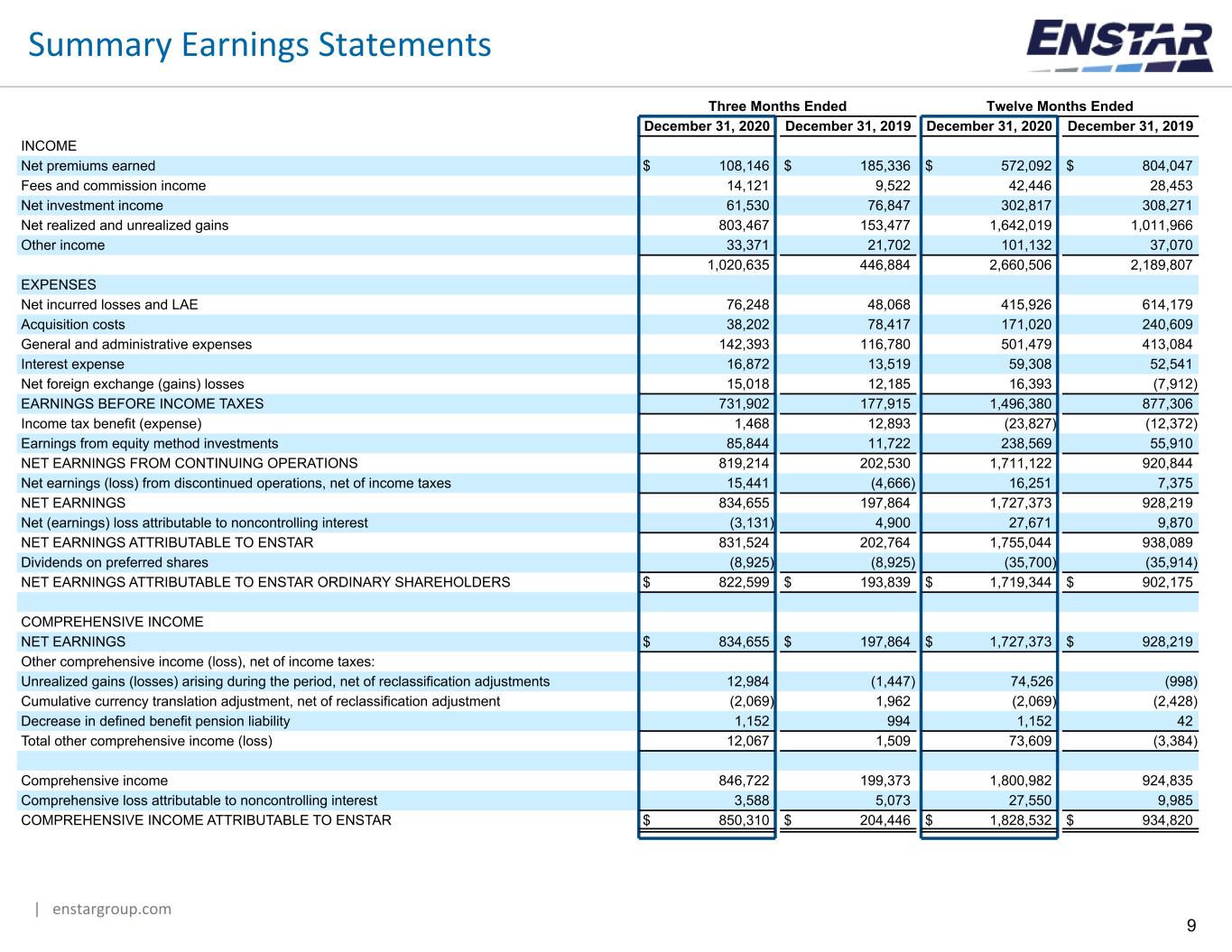

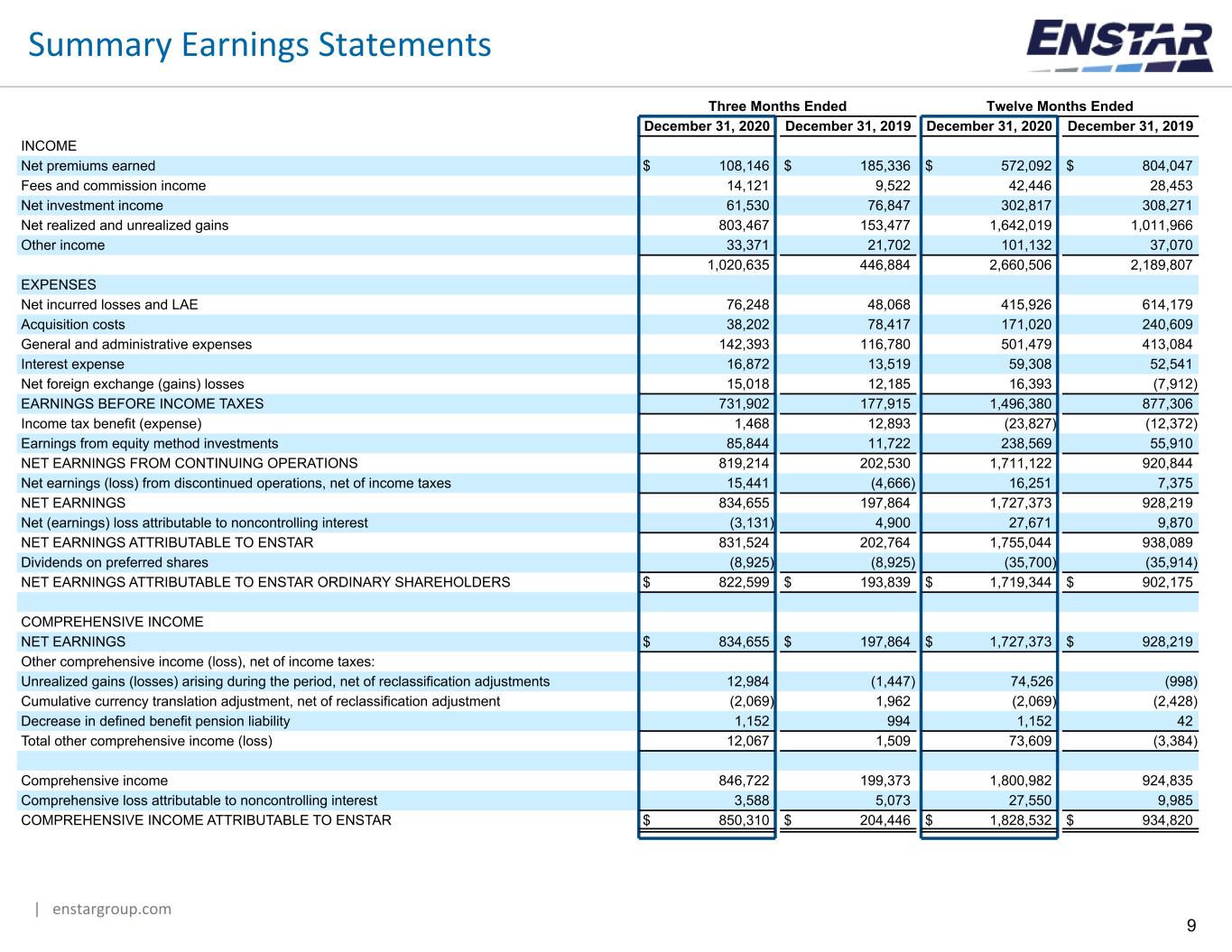

| enstargroup.com 9 Summary Earnings Statements Three Months Ended Twelve Months Ended December 31, 2020 December 31, 2019 December 31, 2020 December 31, 2019 INCOME Net premiums earned $ 108,146 $ 185,336 $ 572,092 $ 804,047 Fees and commission income 14,121 9,522 42,446 28,453 Net investment income 61,530 76,847 302,817 308,271 Net realized and unrealized gains 803,467 153,477 1,642,019 1,011,966 Other income 33,371 21,702 101,132 37,070 1,020,635 446,884 2,660,506 2,189,807 EXPENSES Net incurred losses and LAE 76,248 48,068 415,926 614,179 Acquisition costs 38,202 78,417 171,020 240,609 General and administrative expenses 142,393 116,780 501,479 413,084 Interest expense 16,872 13,519 59,308 52,541 Net foreign exchange (gains) losses 15,018 12,185 16,393 (7,912) EARNINGS BEFORE INCOME TAXES 731,902 177,915 1,496,380 877,306 Income tax benefit (expense) 1,468 12,893 (23,827) (12,372) Earnings from equity method investments 85,844 11,722 238,569 55,910 NET EARNINGS FROM CONTINUING OPERATIONS 819,214 202,530 1,711,122 920,844 Net earnings (loss) from discontinued operations, net of income taxes 15,441 (4,666) 16,251 7,375 NET EARNINGS 834,655 197,864 1,727,373 928,219 Net (earnings) loss attributable to noncontrolling interest (3,131) 4,900 27,671 9,870 NET EARNINGS ATTRIBUTABLE TO ENSTAR 831,524 202,764 1,755,044 938,089 Dividends on preferred shares (8,925) (8,925) (35,700) (35,914) NET EARNINGS ATTRIBUTABLE TO ENSTAR ORDINARY SHAREHOLDERS $ 822,599 $ 193,839 $ 1,719,344 $ 902,175 COMPREHENSIVE INCOME NET EARNINGS $ 834,655 $ 197,864 $ 1,727,373 $ 928,219 Other comprehensive income (loss), net of income taxes: Unrealized gains (losses) arising during the period, net of reclassification adjustments 12,984 (1,447) 74,526 (998) Cumulative currency translation adjustment, net of reclassification adjustment (2,069) 1,962 (2,069) (2,428) Decrease in defined benefit pension liability 1,152 994 1,152 42 Total other comprehensive income (loss) 12,067 1,509 73,609 (3,384) Comprehensive income 846,722 199,373 1,800,982 924,835 Comprehensive loss attributable to noncontrolling interest 3,588 5,073 27,550 9,985 COMPREHENSIVE INCOME ATTRIBUTABLE TO ENSTAR $ 850,310 $ 204,446 $ 1,828,532 $ 934,820

| enstargroup.com 10 Earnings Per Share Three Months Ended Twelve Months Ended December 31, December 31, 2020 2019 2020 2019 Numerator: Earnings attributable to Enstar ordinary shareholders: Net earnings from continuing operations (1) $ 815,543 $ 196,591 $ 1,711,810 $ 897,825 Net earnings (loss) from discontinued operations (2) 7,056 (2,752) 7,534 4,350 Net earnings attributable to Enstar ordinary shareholders: 822,599 193,839 1,719,344 902,175 Denominator: Weighted-average ordinary shares outstanding — basic (3) 21,512,574 21,500,512 21,551,408 21,482,617 Effect of dilutive securities: Share equivalents: Share-based compensation plans (4) 185,993 233,542 208,293 227,878 Warrants 68,667 74,738 58,593 64,571 Weighted-average ordinary shares outstanding — diluted 21,767,234 21,808,792 21,818,294 21,775,066 Earnings (loss) per ordinary share attributable to Enstar: Basic: Net earnings from continuing operations $ 37.91 $ 9.15 $ 79.43 $ 41.80 Net earnings (loss) from discontinued operations 0.33 (0.13) 0.35 0.20 Net earnings per ordinary share $ 38.24 $ 9.02 $ 79.78 $ 42.00 Diluted: Net earnings from continuing operations $ 37.47 $ 9.02 $ 78.45 $ 41.23 Net earnings (loss) from discontinued operations 0.32 (0.13) 0.35 0.20 Net earnings per ordinary share $ 37.79 $ 8.89 $ 78.80 $ 41.43 (1) Net earnings (loss) from continuing operations attributable to Enstar ordinary shareholders equals net earnings (loss) from continuing operations, plus net loss (earnings) from continuing operations attributable to noncontrolling interest, less dividends on preferred shares. (2) Net earnings (loss) from discontinued operations attributable to Enstar ordinary shareholders equals net earnings (loss) from discontinued operations, net of income taxes, plus net loss (earnings) from discontinued operations attributable to noncontrolling interest; refer to Note 5 - "Divestitures, Held-for-Sale Businesses and Discontinued Operations" to our consolidated financial statements included within Item 8 of Exhibit 99.2 to our Form 8-K filed on June 11, 2021 for a breakdown by period. (3) Weighted-average ordinary shares for basic earnings per share includes ordinary shares (voting and non-voting) but excludes ordinary shares held in the EB Trust in respect of JSOP awards. (4) Share-based dilutive securities include restricted shares, restricted share units, and performance share units. Certain share-based compensation awards, including the ordinary shares held in the EB Trust in respect of JSOP awards, were excluded from the calculation for the three and twelve months ended December 31, 2020 because they were anti-dilutive.

| enstargroup.com 11 Non-GAAP Operating Income (1) Represents the net realized and unrealized gains and losses related to fixed maturity securities included in net earnings (loss). Our fixed maturity securities are held directly on our balance sheet and also within the "Funds held - directly managed" balance. Refer to Note 6 - "Investments" to our consolidated financial statements included within Item 8 of Exhibit 99.2 to our Form 8-K filed on June 11, 2021 for further details on our net realized and unrealized gains and losses. (2) Represents an aggregation of the tax expense or benefit associated with the specific country to which the pre-tax adjustment relates, calculated at the applicable jurisdictional tax rate. (3) Represents the impact of the adjustments on the net earnings (loss) attributable to noncontrolling interest associated with the specific subsidiaries to which the adjustments relate. (4) Non-GAAP financial measure, refer to the explanatory notes on pages 3 and 4 for further details. Three Months Ended Twelve Months Ended December 31, December 31, 2020 2019 2020 2019 Net earnings attributable to Enstar ordinary shareholders (A) $ 822,599 $ 193,839 $ 1,719,344 $ 902,175 Adjustments: Net realized and unrealized (gains) losses on fixed maturity investments and funds held - directly managed (1) (99,187) 43,127 (306,284) (515,628) Change in fair value of insurance contracts for which we have elected the fair value option 22,198 (18,196) 119,046 117,181 Gain on sale of subsidiary (3,375) — (3,375) — Net (earnings) loss from discontinued operations (15,441) 4,666 (16,251) (7,375) Tax effects of adjustments (2) 8,464 (3,750) 27,534 47,091 Adjustments attributable to noncontrolling interest (3) 12,623 (2,873) 12,087 14,524 Non-GAAP operating income attributable to Enstar ordinary shareholders (B) (4) $ 747,881 $ 216,813 $ 1,552,101 $ 557,968 Diluted net earnings per ordinary share $ 37.79 $ 8.89 $ 78.80 $ 41.43 Adjustments: Net realized and unrealized (gains) on fixed maturity investments and funds held - directly managed (1) (4.55) 1.97 (14.04) (23.68) Change in fair value of insurance contracts for which we have elected the fair value option 1.02 (0.83) 5.46 5.38 Gain on sale of subsidiary (0.16) — (0.15) — Net (earnings) loss from discontinued operations (0.71) 0.21 (0.74) (0.34) Tax effects of adjustments (2) 0.39 (0.17) 1.26 2.16 Adjustments attributable to noncontrolling interest (3) 0.58 (0.13) 0.55 0.67 Diluted non-GAAP operating income per ordinary share (4) $ 34.36 $ 9.94 $ 71.14 $ 25.62 Weighted average ordinary shares outstanding: Basic 21,512,574 21,500,512 21,551,408 21,482,617 Diluted 21,767,234 21,808,792 21,818,294 21,775,066 Opening ordinary shareholders’ equity (C) $ 5,310,885 $ 4,127,800 $ 4,332,183 $ 3,391,933 Annualized GAAP return on opening ordinary shareholders’ equity = ((A) / # of Quarters * 4) / (C) 62.0 % 18.8 % 39.7 % 26.6 %

| enstargroup.com 12 Reserve/Claims Savings (1) Refer to the corresponding note to our consolidated financial statements included within Item 8 of Exhibit 99.2 to our Form 8-K filed on June 11, 2021 for further details. (2) Non-GAAP financial measure, refer to the explanatory notes on pages 3 and 4 for further details. Three Months Ended Twelve Months Ended December 31, December 31, FS Reference (1) 2020 2019 2020 2019 Reconciliation of reserve/claims savings to GAAP line items in the Run-off segment: Net incurred losses and LAE: Reduction in estimates of net ultimate losses - prior periods (A) Note 10 $ 46,661 $ 88,604 $ 127,116 $ 219,085 Increase in estimates of net ultimate losses - current period Note 10 (6,370) (16,308) (30,523) (123,119) Reduction in provisions for unallocated LAE Note 10 14,256 19,175 48,765 57,404 Net incurred losses and LAE - Run-off Note 10 $ 54,547 $ 91,471 $ 145,358 $ 153,370 Other income (expense): Change in estimate of net ultimate defendant A&E liabilities - prior periods (B) Note 11 $ 27,834 $ 4 $ 103,166 $ 4,263 Reduction in estimated future defendant A&E expenses Note 11 2,999 170 9,126 3,274 All other income (expense) - Run-off (2,206) 32,696 656 40,772 Other income - Run-off Note 24 $ 28,627 $ 32,870 $ 112,948 $ 48,309 Reserve / claims savings: total reduction in net ultimate losses (2) = (A) + (B) $ 74,495 $ 88,608 $ 230,282 $ 223,348

| enstargroup.com 13 December 31, 2020 December 31, 2019 Short-term and fixed maturity investments, trading and AFS and funds held - directly managed U.S. government & agency $ 951,048 5.5 % $ 696,077 4.9 % U.K. government 51,082 0.3 % 161,772 1.2 % Other government 502,153 2.9 % 702,856 5.0 % Corporate 5,686,732 33.0 % 5,448,270 38.7 % Municipal 162,669 0.9 % 140,687 1.0 % Residential mortgage-backed 553,945 3.2 % 400,914 2.9 % Commercial mortgage-backed 854,090 4.9 % 813,746 5.8 % Asset-backed 557,460 3.2 % 670,235 4.8 % Total 9,319,179 53.9 % 9,034,557 64.3 % Other assets included within funds held - directly managed 14,627 0.1 % 14,207 0.1 % Equities Publicly traded equities 260,767 1.5 % 327,875 2.3 % Exchange-traded funds 311,287 1.8 % 133,047 0.9 % Privately held equities 274,741 1.6 % 265,799 1.9 % Total 846,795 4.9 % 726,721 5.1 % Other investments Hedge funds 2,638,339 15.3 % 1,121,904 8.0 % Fixed income funds 552,541 3.2 % 481,039 3.4 % Private equity funds 363,103 2.1 % 323,496 2.3 % Private credit funds 192,319 1.1 % — — % Equity funds 190,767 1.1 % 410,149 2.9 % CLO equity funds 166,523 1.0 % 87,509 0.6 % CLO equities 128,083 0.7 % 87,555 0.6 % Other 12,359 0.1 % 6,379 0.1 % Total 4,244,034 24.6 % 2,518,031 17.9 % Equity method investments 832,295 4.8 % 326,277 2.3 % Total investments 15,256,930 88.3 % 12,619,793 89.7 % Cash and cash equivalents (including restricted cash) 1,373,116 8.0 % 971,349 6.9 % Funds held by reinsured companies 635,819 3.7 % 475,732 3.4 % Total investable assets $ 17,265,865 100.0 % $ 14,066,874 100.0 % Duration (in years) (1) 4.82 4.86 Average Credit Rating (1) A+ A+ Investment Composition - GAAP (1) Calculation includes cash and cash equivalents, short-term investments, fixed maturities and the fixed maturities within our funds held - directly managed portfolios at December 31, 2020 and December 31, 2019.

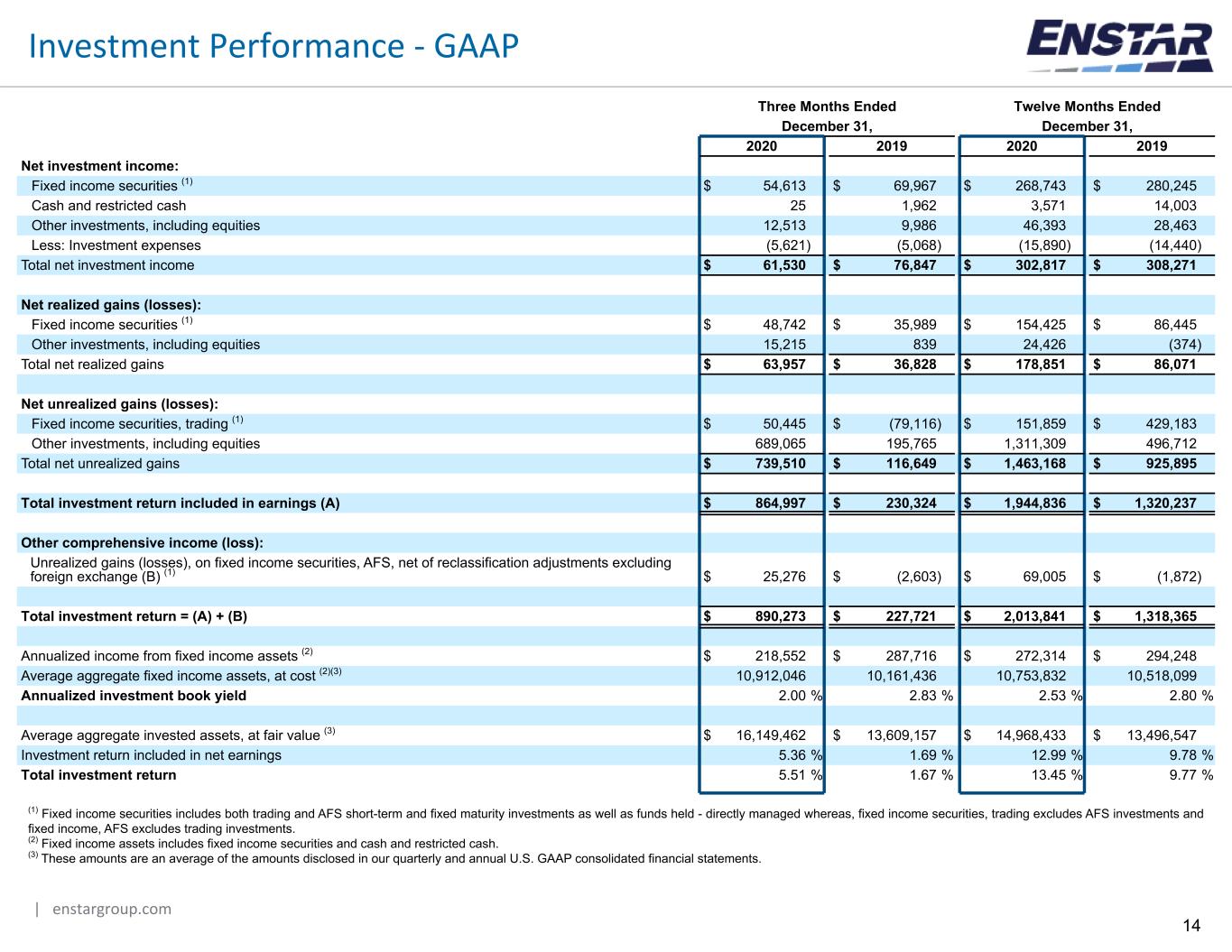

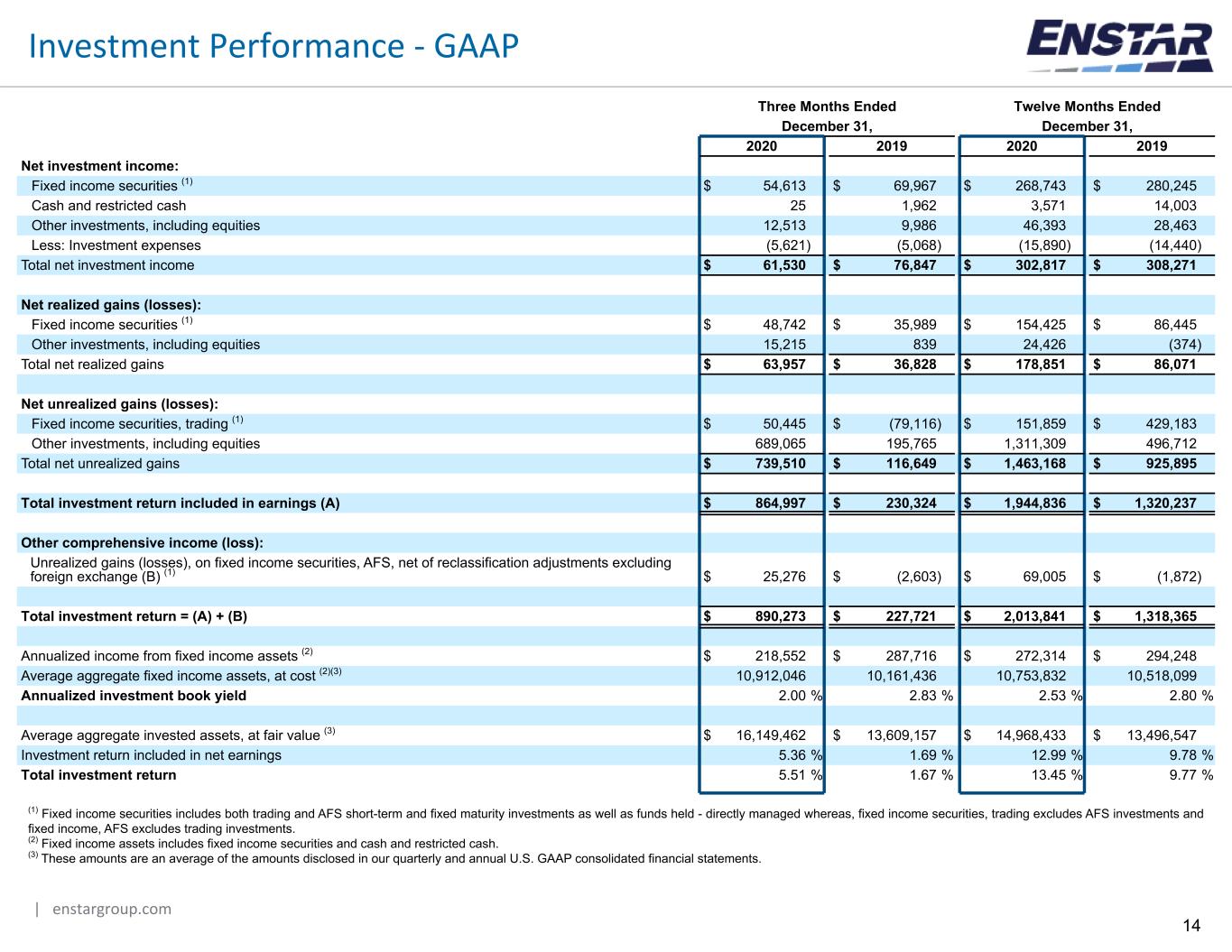

| enstargroup.com 14 Investment Performance - GAAP Three Months Ended Twelve Months Ended December 31, December 31, 2020 2019 2020 2019 Net investment income: Fixed income securities (1) $ 54,613 $ 69,967 $ 268,743 $ 280,245 Cash and restricted cash 25 1,962 3,571 14,003 Other investments, including equities 12,513 9,986 46,393 28,463 Less: Investment expenses (5,621) (5,068) (15,890) (14,440) Total net investment income $ 61,530 $ 76,847 $ 302,817 $ 308,271 Net realized gains (losses): Fixed income securities (1) $ 48,742 $ 35,989 $ 154,425 $ 86,445 Other investments, including equities 15,215 839 24,426 (374) Total net realized gains $ 63,957 $ 36,828 $ 178,851 $ 86,071 Net unrealized gains (losses): Fixed income securities, trading (1) $ 50,445 $ (79,116) $ 151,859 $ 429,183 Other investments, including equities 689,065 195,765 1,311,309 496,712 Total net unrealized gains $ 739,510 $ 116,649 $ 1,463,168 $ 925,895 Total investment return included in earnings (A) $ 864,997 $ 230,324 $ 1,944,836 $ 1,320,237 Other comprehensive income (loss): Unrealized gains (losses), on fixed income securities, AFS, net of reclassification adjustments excluding foreign exchange (B) (1) $ 25,276 $ (2,603) $ 69,005 $ (1,872) Total investment return = (A) + (B) $ 890,273 $ 227,721 $ 2,013,841 $ 1,318,365 Annualized income from fixed income assets (2) $ 218,552 $ 287,716 $ 272,314 $ 294,248 Average aggregate fixed income assets, at cost (2)(3) 10,912,046 10,161,436 10,753,832 10,518,099 Annualized investment book yield 2.00 % 2.83 % 2.53 % 2.80 % Average aggregate invested assets, at fair value (3) $ 16,149,462 $ 13,609,157 $ 14,968,433 $ 13,496,547 Investment return included in net earnings 5.36 % 1.69 % 12.99 % 9.78 % Total investment return 5.51 % 1.67 % 13.45 % 9.77 % (1) Fixed income securities includes both trading and AFS short-term and fixed maturity investments as well as funds held - directly managed whereas, fixed income securities, trading excludes AFS investments and fixed income, AFS excludes trading investments. (2) Fixed income assets includes fixed income securities and cash and restricted cash. (3) These amounts are an average of the amounts disclosed in our quarterly and annual U.S. GAAP consolidated financial statements.

| enstargroup.com 15 Composition of investable assets December 31, 2020 December 31, 2019 Fixed maturities $ 9,319,179 54.0 % $ 9,034,557 64.2 % Equities 830,600 4.8 % 936,876 6.7 % Bond/loan funds 763,140 4.4 % 684,691 4.9 % Hedge funds 2,638,339 15.3 % 1,121,904 8.0 % Private equities 225,921 1.3 % 222,515 1.6 % CLO equities 294,606 1.7 % 175,064 1.2 % Private credit 298,597 1.7 % 79,248 0.5 % Real estate 39,161 0.2 % 23,906 0.2 % Other 465 — % 548 — % Cash and cash equivalents (including restricted cash) 1,373,116 8.0 % 971,349 6.9 % Funds held 650,446 3.8 % 489,939 3.5 % Total managed cash and investments 16,433,570 95.2 % 13,740,597 97.7 % Equity method investments 832,295 4.8 % 326,277 2.3 % Total investable assets (2) $ 17,265,865 100.0 % $ 14,066,874 100.0 % (1) Non-GAAP financial measures, refer to the explanatory notes on pages 3 and 4 for further details. (2) Agrees to the total investable assets per GAAP on page 13. Investment Composition - Non-GAAP (1)

| enstargroup.com 16 December 31, 2020 December 31, 2019 Equities - GAAP $ 846,795 $ 726,721 Less: Exchange traded funds backed by fixed income securities (156,362) (133,047) Less: Bond fund held in equity format (54,248) (70,605) Plus: Equities held in fund format 190,767 410,149 Plus: Privately held equity in fund format 3,648 3,658 Equities - Non-GAAP 830,600 936,876 Fixed income funds - GAAP 552,541 481,039 Plus: Exchange traded funds backed by fixed income securities 156,362 133,047 Plus: Bond fund held in equity format 54,237 70,605 Bond/loan funds - Non-GAAP 763,140 684,691 Private equity funds - GAAP 363,103 323,496 Less: Private credit held in fund format (106,278) (79,248) Less: Real estate held in fund format (27,256) (18,106) Less: Privately held equity in fund format (3,648) (3,658) Plus: Other — 31 Private equities - Non-GAAP 225,921 222,515 CLO equities - GAAP 128,083 87,555 Plus: CLO equity funds 166,523 87,509 CLO equities - Non-GAAP 294,606 175,064 Private credit funds - GAAP 192,319 — Plus: Private credit held in fund format 106,278 79,248 Private credit - Non-GAAP 298,597 79,248 Funds held by reinsured companies - GAAP 635,819 475,732 Plus: Other assets and liabilities in funds held format 14,627 14,207 Funds held - Non-GAAP 650,446 489,939 Real estate - GAAP — — Plus: Real estate held in fund format 27,256 18,106 Plus: Real estate held in other 11,905 5,800 Real estate - Non-GAAP 39,161 23,906 Short-term and fixed maturity investments, trading and AFS and funds held - directly managed (2) 9,319,179 9,034,557 Other 465 548 Cash and cash equivalents (including restricted cash) 1,373,116 971,349 Hedge Funds 2,638,339 1,121,904 Total managed cash and investments 16,433,570 13,740,597 Equity method investments 832,295 326,277 Total investable assets $ 17,265,865 $ 14,066,874 Investment Composition - Non-GAAP Reconciliation (1) (1) Non-GAAP financial measures, refer to the explanatory notes on pages 3 and 4 for further details. (2) Agrees to fixed maturities - non-GAAP on page 15.

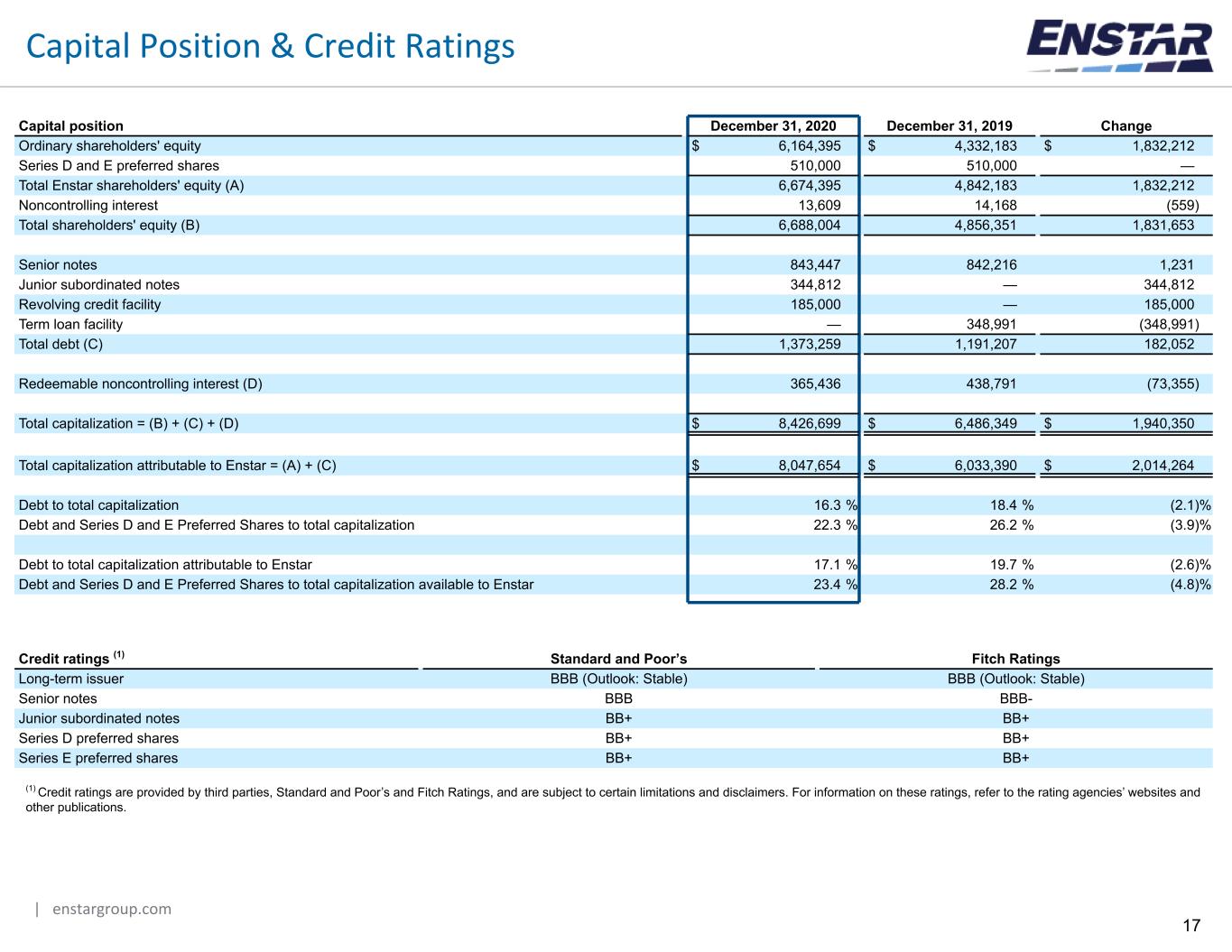

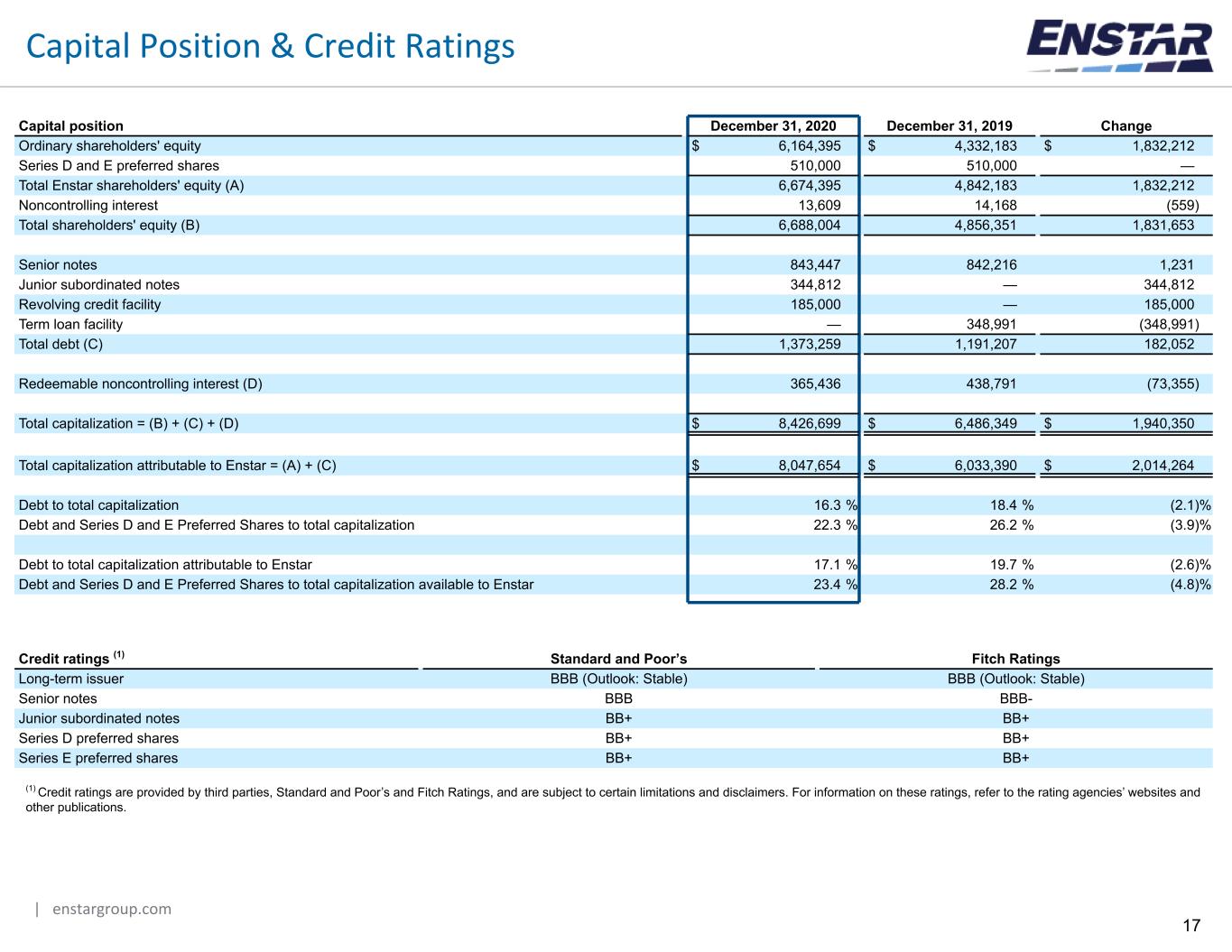

| enstargroup.com 17 Capital position December 31, 2020 December 31, 2019 Change Ordinary shareholders' equity $ 6,164,395 $ 4,332,183 $ 1,832,212 Series D and E preferred shares 510,000 510,000 — Total Enstar shareholders' equity (A) 6,674,395 4,842,183 1,832,212 Noncontrolling interest 13,609 14,168 (559) Total shareholders' equity (B) 6,688,004 4,856,351 1,831,653 Senior notes 843,447 842,216 1,231 Junior subordinated notes 344,812 — 344,812 Revolving credit facility 185,000 — 185,000 Term loan facility — 348,991 (348,991) Total debt (C) 1,373,259 1,191,207 182,052 Redeemable noncontrolling interest (D) 365,436 438,791 (73,355) Total capitalization = (B) + (C) + (D) $ 8,426,699 $ 6,486,349 $ 1,940,350 Total capitalization attributable to Enstar = (A) + (C) $ 8,047,654 $ 6,033,390 $ 2,014,264 Debt to total capitalization 16.3 % 18.4 % (2.1) % Debt and Series D and E Preferred Shares to total capitalization 22.3 % 26.2 % (3.9) % Debt to total capitalization attributable to Enstar 17.1 % 19.7 % (2.6) % Debt and Series D and E Preferred Shares to total capitalization available to Enstar 23.4 % 28.2 % (4.8) % Capital Position & Credit Ratings Credit ratings (1) Standard and Poor’s Fitch Ratings Long-term issuer BBB (Outlook: Stable) BBB (Outlook: Stable) Senior notes BBB BBB- Junior subordinated notes BB+ BB+ Series D preferred shares BB+ BB+ Series E preferred shares BB+ BB+ (1) Credit ratings are provided by third parties, Standard and Poor’s and Fitch Ratings, and are subject to certain limitations and disclaimers. For information on these ratings, refer to the rating agencies’ websites and other publications.

| enstargroup.com 18 Results by Segment - Year to Date Twelve Months Ended December 31, 2020 Twelve Months Ended December 31, 2019 Run-off Investments Legacy Underwriting Corporate & Other (1) Total Run-off Investments Legacy Underwriting Corporate & Other (1) Total INCOME Net premiums earned $ 58,695 $ — $ 513,397 $ — $ 572,092 $ 168,496 $ — $ 635,551 $ — $ 804,047 Fees and commission income 19,462 — 22,984 — 42,446 18,293 — 10,160 — 28,453 Net investment income — 269,832 32,985 — 302,817 — 266,826 41,445 — 308,271 Net realized and unrealized gains — 1,627,526 14,493 — 1,642,019 — 974,199 37,767 — 1,011,966 Other income (expense) 112,948 — 3,865 (15,681) 101,132 48,309 — 469 (11,708) 37,070 191,105 1,897,358 587,724 (15,681) 2,660,506 235,098 1,241,025 725,392 (11,708) 2,189,807 EXPENSES Net incurred losses and loss adjustment expenses (145,358) — 371,486 189,798 415,926 (153,370) — 562,051 205,498 614,179 Acquisition costs 20,177 — 150,843 — 171,020 73,642 — 166,967 — 240,609 General and administrative expenses 173,247 33,793 158,464 135,975 501,479 173,531 29,654 96,694 113,205 413,084 48,066 33,793 680,793 325,773 1,088,425 93,803 29,654 825,712 318,703 1,267,872 EARNINGS (LOSS) BEFORE INTEREST EXPENSE, FOREIGN EXCHANGE AND INCOME TAXES 143,039 1,863,565 (93,069) (341,454) 1,572,081 141,295 1,211,371 (100,320) (330,411) 921,935 Earnings from equity method investments — 238,569 — — 238,569 — 55,910 — — 55,910 SEGMENT INCOME (LOSS) 143,039 2,102,134 (93,069) (341,454) 1,810,650 141,295 1,267,281 (100,320) (330,411) 977,845 Interest expense (59,308) (59,308) (52,541) (52,541) Net foreign exchange gains (losses) (16,393) (16,393) 7,912 7,912 Income tax expense (23,827) (23,827) (12,372) (12,372) NET EARNINGS FROM CONTINUING OPERATIONS 1,711,122 920,844 Net earnings from discontinued operations, net of income taxes 16,251 16,251 7,375 7,375 NET EARNINGS 1,727,373 928,219 Net loss attributable to noncontrolling interest 27,671 27,671 9,870 9,870 NET EARNINGS ATTRIBUTABLE TO ENSTAR 1,755,044 938,089 Dividends on preferred shares (35,700) (35,700) (35,914) (35,914) NET EARNINGS (LOSS) ATTRIBUTABLE TO ENSTAR ORDINARY SHAREHOLDERS (432,760) 1,719,344 (406,081) 902,175 (1) Other income (expense) for corporate and other activities includes the amortization of fair value adjustments associated with the acquisition of DCo and Morse TEC. Net incurred losses and loss adjustment expenses for corporate and other activities includes amortization of deferred charge assets and deferred gain liabilities on retroactive reinsurance contracts and fair value adjustments associated with the acquisition of companies and the changes in the fair value of liabilities related to our assumed retroactive reinsurance agreements for which we have elected the fair value option.