UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

Amendment No. 2

[X] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ____________

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

OR

[ ] SHELL COMPANY PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

For the transition period from ____________ to ____________

Commission file number N/A

GOLDEN OASIS EXPLORATION CORP.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 750 – 580 Hornby Street

Vancouver, British Columbia, Canada V6C 3B6

(Address of principal executive offices)

Copy of communications to:

Ethan Minsky, Esq.

Clark Wilson LLP

Barristers and Solicitors

Suite 800 – 885 West Georgia Street

Vancouver, British Columbia, Canada V6C 3H1

Telephone: 604-687-5700 Facsimile: 604-687-6314

- ii -

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Class | Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as

of the close of the period covered by the annual report.

There were 18,054,471 common shares without par value issued and outstanding on January 31, 2008.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] YES [X] NO

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. [ ] YES [ ] NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ ] YES [X] NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated

filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

(Check one): Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which financial statement item the registrant has elected to follow.

[X] ITEM 17 [ ] ITEM 18

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] YES [X] NO

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act). [ ] YES [ ] NO

TABLE OF CONTENTS

- ii -

FORWARD-LOOKING STATEMENTS

Except for the statements of historical fact contained herein, some information presented in this registration statement constitutes forward-looking statements. When used in this registration statement, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “predict”, “may”, “should”, the negative thereof or other variations thereon or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of our company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, lack of commercially exploitable mineral reserves, future prices of precious metals and minerals, as well as those factors discussed in the section entitled “Risk Factors” beginning on page 5, below. Although our company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause actual results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements. The forward-looking statements in this registration statement speak only as to the date hereof. Except as required by applicable law, including the securities laws of the United States, we do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

As used in this registration statement, the terms “we”, “us” and “our” mean Golden Oasis Exploration Corp. and our wholly owned subsidiary, Golden Oasis Exploration, unless otherwise indicated.

PART I

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

The financial statements and summaries of financial information contained in this document are reported in Canadian dollars (“$”) unless otherwise stated. All such financial statements have been prepared in accordance with United States generally accepted accounting principles.

Our financial statements for the year ended July 31, 2007 and 2006 have been reported on by Morgan & Company, Chartered Accountants, P.O. Box 10007 Pacific Centre, Suite 1488 – 700 West Georgia Street, Vancouver, British Columbia V7Y 1A1, Canada. Our financial statements for the period from November 2, 2004 (date of incorporation) to July 31, 2005 have been reported on by Amisano Hanson, Chartered Accountants, 750 West Pender Street, Suite 604, Vancouver, British Columbia V6C 2T7, Canada. Our financial statements for the three months ended October 30, 2007 have been prepared by management and have neither been reviewed nor audited by Morgan & Company.

- 2 -

Item 1 Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

The Directors and the senior management of our company as of December 31, 2007 are as follows:

| Name | Business Address | Function |

| Robert Eadie | Suite 750, 580 Hornby Street

Vancouver, British Columbia

V6C 3B6

Canada | As our Chief Executive Officer, Mr. Eadie is responsible for strategic planning and operations, as well as managing our relations with our lawyers, regulatory authorities and investor community; as a director, Mr. Eadie participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. Mr. Eadie was one of the founders of our company. |

| Richard Kern | 4235 Christy Way

Reno, NV 89519

U.S.A. | As our President, Mr. Kern is responsible for our exploration, development and mining operations and for management of our Nevada operations; as a director, Mr. Kern participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. Mr. Kern was also one of the founders of our company. |

| Gary Arca | Suite 750, 580 Hornby Street

Vancouver, British Columbia

V6C 3B6

Canada | As our Chief Financial Officer, Mr. Arca is responsible for the management and supervision of all of the financial aspects of our business and corporate governance and standards; as a director, Mr. Arca participates in management oversight and helps to ensure compliance with our corporate governance policies and standards |

| Gary Hawthorn | 2806 Thorncliffe Dr.

North Vancouver, British

Columbia

V7R 2S7

Canada | As an independent director, Mr. Hawthorn supervises our management and helps to ensure compliance with our corporate governance policies and standards. Mr. Hawthorn was also a founder of our company. |

| Peter Barnes(1) | Suite 1560, 200 Burrard Street

Vancouver, British Columbia

V6C 3L6

Canada | As an independent director, Mr. Barnes supervises our management and helps to ensure compliance with our corporate governance policies and standards. Mr. Barnes was also one of the founders of our company. |

(1) On January 18, 2008, Peter Barnes resigned as a director of the Company.

B. Advisers

Our legal advisers are Clark Wilson LLP, Barristers & Solicitors, with a business address at Suite 800, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3H1 and Lang Michener LLP, 1500 – 1055 West Georgia Street, P.O. Box 1117, Vancouver, British Columbia, Canada V6E 2N7.

C. Auditors

Our auditors are Morgan & Company, Chartered Accountants, with a business address at Suite 1488 – 700 West Georgia Street, Vancouver, British Columbia V7Y 1A1, Canada. Morgan & Company are members of the Institute of Chartered Accountants of British Columbia and are registered with both the Canadian Public Accountability Board (CPAB) and the U.S. Public Company Accounting Oversight Board (PCAOB). Our previous auditors, Amisano Hanson, Chartered Accountants, with a business address at Suite 604 – 750 West Pender Street, British

- 3 -

Columbia V6C 2T7, Canada, resigned as our auditors effective September 15, 2006. Amisano Hanson, Chartered Accountants are members of the Institute of Chartered Accountants of British Columbia and are registered with both the Canadian Public Accountability Board (CPAB) and the U.S. Public Company Accounting Oversight Board (PCAOB).

Item 2 Offer Statistics and Expected Timetable

Not Applicable.

Item 3 Key Information

A. Selected Financial Data

The following table summarizes selected financial data for our company for the year ended July 31, 2007 and 2006 and for the period from November 2, 2004 (date of incorporation) to July 31, 2005 respectively. The information in the table was extracted from the detailed financial statements and related notes included in this registration statement and should be read in conjunction with those financial statements and the other information appearing under the heading “Item 5 – Operating and Financial Review and Prospects” beginning at page 37, below.

Selected Financial Data

(Stated in CANADIAN Dollars)

Fiscal Years Ended July 31, 2007, 2006 and Period from November 2, 2004 (date of incorporation)

to July 31, 2005 (Audited)

| US GAAP | 2007 | 2006 | 2005 |

| Net Sales or Operating Revenue | NIL | NIL | NIL |

| Net Loss | $1,825,818 | $1,226,555 | $286,097 |

| Net Loss from Operations | $1,825,818 | $1,226,555 | $286,097 |

| Basic and Diluted Loss per Share | $0.10 | $0.11 | $0.05 |

US GAAP

| At

July 31,

2007 | At

July 31,

2006 | At

July 31,

2005 |

| Assets | $1,653,901 | $3,384,036 | $331,341 |

| Current Assets | $1,311,271 | $3,219,457 | $239,382 |

| Share Capital | $4,183,285 | $4,121,285 | $501,001 |

Common Stock

| 17,754,471

common

shares | 17,554,471

common

shares | 7,710,001

common

shares |

| Cash Dividends per Common Share | NIL | NIL | NIL |

The following table summarizes selected financial data for our company for the three months ended October 31, 2007 and the three months ended October 31, 2006. While the information is unaudited, it includes all adjustments which are, in the opinion of management, necessary to present fairly the financial position and results of operations for these interim periods. The information in this table should be read in conjunction with those financial statements and the other information appearing under the heading “Item 5 – Operating and Financial Review and Prospects” beginning at page 37, below.

- 4 -

Selected Financial Data

(Stated in CANADIAN Dollars)

Three months Ended October 31, 2007 and 2006 (Unaudited)

US GAAP

| Three months

Ended

October 31,

2007 | Three months

Ended

October 31,

2006 |

| Net Sales or Operating Revenue | NIL | NIL |

| Net Loss | $583,215 | $734,106 |

| Net Loss from Operations | $583,215 | $734,106 |

| Basic and Diluted Loss per Share | $0.03 | $0.04 |

US GAAP

| At

October 31,

2007 | At

July 31,

2007 |

| Assets | $1,183,467 | $1,653,901 |

| Current Assets | $611,691 | $1,311,271 |

| Share Capital | $4,285,285 | $4,183,285 |

Common Stock

| 18,054,471

common shares | 17,754,471

common shares |

| Cash Dividends per Common Share | NIL | NIL |

Disclosure of Exchange Rate History

On February 29, 2008, the exchange rate in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates in New York City by the Federal Reserve Bank of New York) was $1.0208. For the full financial years ended July 31, 2007 and 2006, the period beginning November 2, 2004 (date of incorporation) and ending July 31, 2005, and for the three month period ending October 31, 2007, the following average exchange rates were in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates in New York City, for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York):

| Year Ended | Average |

| July 31, 2005 (from November 2, 2004) | $1.2278 |

| July 31, 2006 | $1.1553 |

| July 31, 2007 | $1.1256 |

| Three months Ended | Average |

| October 31, 2007 | $1.0196 |

- 5 -

During each of the most recent six months, the high and low exchange rates that were in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (and based on the noon buying rates in New York City, for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York) was:

| Months Ended | Low | High |

| September 30, 2007 | $0.9449 | $1.0088 |

| October 31, 2007 | $0.9988 | $1.0593 |

| November 30, 2007 | $0.9980 | $1.1030 |

| December 31, 2007 | $0.9756 | $1.0250 |

| January 31, 2008 | $0.9644 | $1.0151 |

| February 29, 2008 | $0.9805 | $1.0298 |

B. Capitalization and Indebtedness

Our authorized capital consists of unlimited number of shares of common stock without par value. As of January 31, 2008, we had 18,054,471 shares of our common stock issued and outstanding.

The table below sets forth our total indebtedness in Canadian dollars and shows the capitalization of our company as of October 31, 2007. You should read this table in conjunction with our audited and unaudited financial statements, together with the accompanying notes and the other information appearing under the heading “Item 5 – Operating and Financial Review and Prospects” beginning at page 37, below.

As at October 31, 2007

| | Liabilities | | | |

| | Current, unsecured | $ | 47,121 | |

| | Long-term, Asset retirement obligation | | 23,914 | |

| | | | | |

| | | $ | 71,035 | |

| | Shareholders’ Equity | | | |

| | Share capital | $ | 4,285,285 | |

| | Contributed Surplus | | 746,718 | |

| | Deficit and Accumulated Other Comprehensive Income | | (1,755,201 | ) |

| | | $ | 3,276,802 | |

We have not issued any dividends since our incorporation on November 2, 2004.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this registration statement in evaluating our company and our business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are not the only ones facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

- 6 -

Risks Associated with Mining

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

All three of our Mineral properties have been examined by a professional geologist hired by our company. A geologist’s report is available for the Toiyabe property. It is publicly available by searching our company’s name and Toiyabe 43-101 on SEDAR’s website at www.sedar.com.

Despite exploration work on our mineral properties, we have not established that any of them contain any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote; in all probability our mineral resource properties do not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

- 7 -

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence could have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral resource properties or from the extraction and sale of precious and base metals such as gold, silver and copper. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We compete with other exploration companies looking for mineral resource properties. While we compete with these other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

- 8 -

Our title to our resource properties may be challenged by third parties or the licenses that permit us to explore our properties may expire if we fail to timely renew them and pay the required fees.

We have investigated the status of our title to our mineral resource properties and we are satisfied that, except as described below, our title to these properties is properly registered in the name of our company. There can be no assurance, however, that our right to explore our properties will not be revoked or altered to our detriment in the future, as the ownership and validity of mining claims and concessions are often uncertain and may be contested. We believe that approximately 31 acres (1.7%) of the land covered by the mineral claims comprising our Toiyabe property may be subject to prior mineral claims and our ability to exploit those lands may therefore be subject to some doubt. Until competing interests in these mineral lands have been determined, we can give no assurance as to the validity of our title to those lands. Should anybody challenge the boundaries or the validity of our title to our properties, the resolution of dispute or the process of confirming our title could take substantial time and money. Further, the preservation of title to our mineral properties will require that we continue to expend money or work the claims. If we fail to expend the necessary amount of money or if we fail to work our mineral claims, then our title to our mineral properties could expire or be forfeit.

Risks Related To Our Company

We have a limited operating history on which to base an evaluation of our business and prospects.

Although we have been in the business of exploring mineral resource properties since the date of our incorporation in 2004, we have not yet located any mineral reserve. As a result, we have never had any revenues from our operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserve or, if they do, that we will be able to build or operate a mine successfully. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful and we cannot provide investors with any assurance that we will generate any operating revenues or ever achieve profitable operations.

We have not generated any revenue from our business and we may need to raise additional funds in the near future. If we are not able to obtain future financing when required, we might be forced to scale back or discontinue our business.

We have not generated any operating revenues since our incorporation and we will, in all likelihood, continue to incur operating expenses without revenues until our mining properties are fully developed and in commercial production. We had cash and equivalents in the amount of $590,855 as of October 31, 2007. As at October 31, 2007 we had working capital of $540,656 and as at January 31, 2008 our working capital was approximately $117,208.

During the 12 month period ending January 31, 2009, we expect to spend approximately US$1,000,000 on the maintenance and exploration of our mineral properties and $420,000 to $660,000 on the operation of our company. We do not expect to earn any revenue from operations during this period. We anticipate that we will need to raise approximately $800,000 in order to continue to explore our properties and pay our overhead during this 12 month period. We will probably find it difficult to raise debt financing from traditional lending sources and we have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will be able to continue to do so or, if we can, that we would be able to do so on terms acceptable to our company. We can therefore not give any assurance that additional funding will be available to us for further exploration and development of our projects or to fulfil our obligations under any applicable agreements. If we fail to obtain financing when required, we may be forced to delay or postpone further exploration and development of our projects or we could lose one or more of our properties.

- 9 -

The fact that we have not generated any operating revenues since our incorporation raises substantial doubt about our ability to continue as a going concern.

We have not generated any operating revenues since our incorporation and we will, in all likelihood, continue to incur operating expenses without revenues until our mining properties are fully developed and in commercial production. From inception until October 31, 2007, we have accumulated losses, calculated under U.S. GAAP, of $3,919,571. Our ability to continue as a going concern depends on our ability to obtain the necessary financing to meet our obligations and pay our liabilities arising from normal business operations when they come due. Our financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should we be unable to continue as a going concern and therefore be required to realize on our assets and discharge our liabilities and commitments at amounts different from those reported in the financial statements.

These circumstances raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements for the year ended July 31, 2007 do not reflect this doubt because the circumstances that raise it did not exist until after the date that they were prepared.

Conflicts of interest may arise as a result of our directors and officers being directors and officers of other natural resource companies.

Although none of our officers or directors currently have any conflict of interest, each of our directors and officers are engaged in and will continue to be engaged in the search for additional business opportunities on behalf of other companies, and there is a possibility that these other companies will compete with our company for business opportunities, primarily in the identification and pursuit of attractive mineral resource properties. This could result in a conflict of interest. In addition to conflicts of interest that could arise in respect of the allocation of corporate opportunities, conflicts of interest could arise from the conflicting demands for the allocation of time spent by each of our directors and officers between our company and these other companies.

Although we intend to deal with any conflict of interest through application of our policy on conflicts of interests and the relevant provisions of the Business Corporations Act (British Columbia), there can be no assurance that any conflict of interest will not have an adverse effect on our company. For further information regarding our policy on conflicts of interest and the relevant provisions of the Business Corporations Act (British Columbia) please refer to the discussion in this registration statement beginning at page 50, below.

Our Articles of Incorporation indemnify our officers and directors against all costs, charges and expenses incurred by them.

Our Articles of Incorporation contain provisions limiting the liability of our officers and directors for their acts, receipts, negligence or defaults and for any other loss, damage or expense incurred by them which occurs during the execution of their duties as officers or directors of our company, unless they failed to act honestly and in good faith with a view to the best interests of our company. Such limitations on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to our company, though such an action, if successful, might otherwise have been of benefit to our company and our shareholders.

Exchange rate fluctuations may increase the costs of our operations.

Exchange rate fluctuations may affect the costs that we incur in our operations. We have historically conducted our financing activities in Canadian dollars, but many of our expenditures, including primarily those that we propose to incur on our mineral exploration projects in the United States, will be in U.S. dollars. Exchange rate fluctuations could increase the costs of our U.S. activities in Canadian dollars.

- 10 -

Risks Relating to our Securities

Trading in our common shares on the TSX Venture Exchange is limited and sporadic, making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed on the TSX Venture Exchange under the symbol “GOT-V’. The volume of trading in our common shares on the TSX Venture Exchange is often thin and has been and may continue to be subject to wide price fluctuations. Our trading volume and the prices of our common shares may fluctuate in response to a number of factors, many of which are beyond our control. In addition, the stock market in general, and the market for base metal exploration companies has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of such companies. These broad market and industry factors may adversely affect the market price of our shares and may make it difficult for our shareholders to sell their shares or liquidate their investments, regardless of our operating performance. If you invest in our common shares, you could lose some or all of your investment.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares.

We are currently without a source of revenue and will most likely be required to issue additional shares to finance our operations or to acquire additional properties. If we are required to issue additional shares to raise financing, your interests in our company will be diluted and you may suffer dilution in your net book value per share depending on the price at which such securities are sold.

We have granted and may in the future continue to grant to some or all of our directors, officers, insiders, and key employees options to purchase our common shares as non-cash incentives to those persons. Such options may be granted at exercise prices equal to market prices, or at such other price as may be permitted under the policies of any stock exchange upon which our securities are traded (currently, our common shares are listed for trading on the TSX Venture Exchange). The issuance of additional shares will cause our existing shareholders to experience dilution of their ownership interests.

We do not expect to declare or pay any dividends.

We have not declared or paid any dividends on our common shares since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers.

It may be difficult to bring and enforce suits against us. Some of our directors and officers are residents of countries other than the United States. Consequently, it may be difficult for United States investors to effect service of process in the United States upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgments of any court of the United States.

Trading of our stock may be restricted by the SEC’s “Penny Stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market.

- 11 -

The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

U.S. investors could suffer adverse tax consequences if we are characterized as a passive foreign investment company.

We may be treated as a passive foreign investment company for United States federal income tax purposes during the 2004 tax year or in subsequent years. We may be deemed a passive foreign investment company because previous financings combined with proceeds of future financings may produce, or be deemed to be held to produce, passive income. Additionally, U.S. citizens should review the section entitled “Taxation-U.S. Federal Income Taxation – Passive Foreign Investment Companies” contained in this registration statement for a more detailed description of the passive foreign investment company rules and how those rules may affect their ownership of our capital shares.

If we are or become a passive foreign investment company, our U.S. shareholders may be subject to the following adverse tax consequences:

they will be taxed at the highest ordinary income tax rates in effect during their holding period on certain distributions on our capital shares, and gains from the sale or other disposition of our capital shares;

they will be required to pay interest on taxes allocable to prior periods; and

the tax basis of our capital shares will not be increased to fair market value at the date of their date.

Item 4 Information on our Company

A. History and Development of our Company

We were incorporated pursuant to the Business Corporations Act (British Columbia) on November 2, 2004 under the name 707729 B.C. Ltd. On February 18, 2005, we changed our name to Golden Oasis Exploration Corp. We have one active subsidiary, Golden Oasis Exploration, which was incorporated on February 9, 2005, in the state of Nevada for the purpose of carrying out our U.S. operations.

Our principal place of business is located at Suite 750 – 580 Hornby Street, Box 113, Vancouver, British Columbia, Canada V6C 3B6. Our telephone number at this address is: (604) 602-4935.

Our common shares are listed on the on the TSX Venture Exchange under the symbol “GOT-V”.

B. Our Business

We are a mineral resource company engaged in the gold/silver exploration business. The mineral resource business generally consists of three stages: exploration, development and production. We are a mineral resource company in the exploration stage because we have not yet found mineral resources in commercially exploitable quantities and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral

- 12 -

resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage.

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land or the acquisition of specific, but limited, rights to the land (e.g., a license, lease or concession). After acquisition, exploration would probably begin with a surface examination by a prospector or professional geologist with the aim of identifying areas of potential mineralization, followed by detailed geological sampling and mapping of this showing with possible geophysical and geochemical grid surveys to establish whether a known trend of mineralization continues underground, possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonly includes systematic regularly spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, as well as gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. If minerals are found, exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

Our primary natural resource property is the Toiyabe property, situated in the northern Toiyabe Range in eastern Lander County, Nevada. We also have options to acquire two other properties, the Lone Ranch property and the Empress Project. We have not established the existence of any commercially viable mineral deposits at any of our mineral properties.

There is no assurance that a commercially viable mineral deposit exists on any of our properties and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled “Risk Factors”, beginning on page 5 of this registration statement, for additional information about the risks of mineral exploration.

Revenues

We have not generated any revenues from any of our properties.

Principal Market

We do not currently have any market, as we have not yet identified any commercially viable mineral deposit on any of our properties. If we succeed in identifying a commercially viable mineral deposit, our principal markets should consist of metals refineries and base metal traders and dealers.

Seasonality of our Business

Exploration at our properties can be conducted year-round.

Patents and Licenses; Industrial, Commercial and Financial Contracts; and New Manufacturing Processes

We are not dependent on any patented or license processes, technology, industrial, commercial or financial contract or new manufacturing processes.

- 13 -

Competitive Conditions

We compete with other mining companies for the acquisition of mineral interests and for the recruitment and retention of qualified employees. Some of our competitors have greater financial resources and technical facilities than our company. While we compete with these other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

Governmental Regulations

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral exploration and mineral processing operations and establish requirements for decommissioning of mineral exploration properties after operations have ceased. With respect to the regulation of mineral exploration and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mineral exploration properties following the cessation of operations and may require that some former mineral properties be managed for long periods of time.

Our exploration activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. These laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act and the equivalents of these federal laws that have been adopted by the state of Nevada.

The state of Nevada adopted the Mined Land Reclamation Act in 1989 that established design, operation, monitoring and closure requirements for all mining operations in the state. The Mined Land Reclamation Act has increased the cost of designing, operating, monitoring and closing new mining facilities and could affect the cost of operating, monitoring and closing existing mining facilities. New facilities are also required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. The Mined Land Reclamation Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance.

We plan to secure all necessary permits for our exploration activities on an ‘as-needed’ basis from time-to-time during the conduct of our exploration programs. These permits are usually obtained from either the Bureau of Land Management (BLM) or the United States Forest Service. Obtaining such permits usually requires the posting of small bonds for subsequent remediation of trenching, drilling and bulk-sampling. We currently have two exploration permits in place. Both are with the Bureau of Land Management. Called a “Notice of Intent”, these permits allow the current drilling programs at our Toiyabe and Empress projects to proceed. As part of these permits, we have provided bonds to the BLM that cover the cost of reclamation of any surface disturbance done by the company. The bond for Toiyabe is $28,555 and the bond for Empress is $38,265. After reclamation is completed to the satisfaction of the BLM the bonds are returned.

We do not anticipate discharging water into active streams, creeks, rivers, lakes or any other bodies of water without an appropriate permit. We also do not anticipate disturbing any endangered species or archaeological sites nor do we anticipate that we will cause any damage to our properties. Re-contouring and re-vegetation of disturbed surface areas will be completed pursuant to the applicable permits if and as required. The cost of remediation work will vary according to the degree of physical disturbance. It is difficult to estimate the cost of compliance with environmental laws since the full nature and extent of our proposed activities cannot be determined at present.

- 14 -

Mining Claims

In the state of Nevada, mineral interests may be owned by (a) the United States, (b) the state itself, or (c) private parties.

Where prospective mineral properties are owned by private parties or by the state, some type of property acquisition agreement is necessary in order for us to explore or develop such property. Generally, these agreements take the form of long term mineral leases under which we would acquire the right to explore and develop the property in exchange for periodic cash payments during the exploration and development phase and a royalty, usually expressed as a percentage of gross production or net profits derived from the leased properties if and when mines on the properties are brought into production. Other forms of acquisition agreements might be required if and when mines on the properties are brought into production. These other forms of acquisition agreements might include exploration agreements coupled with an option to purchase, joint venture agreements and similar arrangements.

Where prospective mineral properties are held by the Untied States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. If the statutory requirements for the location of a mining claim are met, the locator obtains a valid possessory right to develop and produce minerals from the claim. The right can be freely transferred and, provided that the locator is able to prove the discovery of locatable minerals on the claims, is protected against appropriation by the governmental without just compensation. The claim locator also acquires the right to obtain a patent or fee title to his claim from the federal government upon compliance with certain additional procedures.

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by Federal Bureau of Land Management or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised when a patent application is submitted or when the government seeks to include the land in an area to be dedicated to another use.

The nature of the mining claims in which our company has or has an option to acquire are discussed below, in

Property, Plants and Equipment.

C. Organizational Structure

We have one active subsidiary, Golden Oasis Exploration, which was incorporated on February 9, 2005, in Nevada to carry out U.S. operations.

D. Property, Plants and Equipment

Our executive office is located at Suite 750 – 580 Hornby Street, Vancouver, British Columbia, Canada V6C 3B6. We lease 25% of a 2,441 square foot office that we share with other tenants. Our share of the annual rent for this space will be $15,012 for each of our fiscal years ending on July 31, 2008 and 2009, respectively, and it will be $8,757 for the first seven months of our fiscal year 2010 until the lease for this space expires on February 28, 2010. This office space accommodates all of our executive and administrative personnel and we believe that it is adequate for our current needs. Should we require additional space, we believe that such space can be secured on commercially reasonable terms.

Mineral Properties

We have options to acquire interests in three mineral properties known as (i) the Toiyabe property; (ii) the Lone Ranch Property; and (iii) the Empress Project. Each of these properties is discussed in detail below.

- 15 -

To date, we have concentrated the bulk of our exploration efforts and expenditures on the Toiyabe Property, which is located in the northern Toiyabe Range, eastern Lander County, Nevada. During the next 12 months, we intend to continue to focus our efforts primarily on this property.

There is no assurance that a commercially viable mineral deposit exists on any of our properties, including the Toiyabe Property, or that we will be able to identify any mineral resource on any of these properties that can be developed profitably. Even if we do discover commercially exploitable levels of mineral resources on any of our properties, which is unlikely, there can be no assurance that we will be able to enter into commercial production of our mineral properties.

The following is a brief description of each of our mineral properties.

The Toiyabe Property

Acquisition

On January 23, 2005, we entered into an option agreement with MinQuest Inc. of Reno Nevada, a private company controlled by Richard Kern, who is the President and a director of our company. This agreement was amended on May 15, 2005 and again on November 30, 2005. Under the agreement, as amended, MinQuest granted us the right to earn an undivided 100% interest in the Toiyabe Property, subject to a 3% net smelter royalty in favour of MinQuest. In order to earn our interest in the Toiyabe Property, we were required to reimburse MinQuest for all costs associated with their acquisition of the property (US$41,856, all of which have been paid), pay US$1,000,000 in cash, issue 500,000 common shares and spend at least US$2,500,000 on the exploration of the property in stages as follows:

| | (a) | pay US$25,000 upon signing the agreement (we have paid this amount) and issue 50,000 shares of our common stock (we have issued these shares) on or before August 15, 2005; |

| | (b) | pay US$30,000 (we have paid this amount), issue 100,000 shares of our common stock (we have issued these shares) and incur at least US$125,000 in exploration expenditures by August 15, 2006 (we have incurred this amount); |

| | (c) | pay US$45,000 (we have paid this amount), issue 150,000 shares of our common stock (we have issued these shares) and incur at least US$175,000 in exploration expenditures by August 15, 2007 (we have incurred this amount); |

| | (d) | pay US$60,000, issue 200,000 shares of our common stock and incur at least US$200,000 in exploration expenditures (we have incurred this amount) by August 15, 2008; |

| | (e) | pay US$80,000 and incur at least US$275,000 in exploration expenditures (we have incurred this amount) by August 15, 2009; |

| | (f) | pay US$100,000 and incur at least US$325,000 in exploration expenditures (we have incurred this amount) by August 15, 2010; |

| | (g) | pay US$120,000, and incur at least US$375,000 in exploration expenditures (we have incurred this amount) by August 15, 2011; |

| | (h) | pay US$140,000 and incur at least US$400,000 in exploration expenditures by August 15, 2012; and |

| | (i) | pay US$400,000 and incur at least US$625,000 in exploration expenditures by August 15, 2013. |

We have the right to purchase up to one half of the net smelter royalty for US$2,000,000 for each 1% of the royalty purchased (total of $3,000,000 for the entire 1.5%) . During the term of the option agreement we are responsible for maintaining the claims in good standing, including paying all required taxes, fees and rentals, and completing all necessary assessment work. We estimate that it will cost our company approximately US$22,110 per year in rental fees to maintain the claims in good standing.

On July 25, 2005, we entered into an agreement with Newmont USA Limited and Newmont Capital Limited pursuant to which Newmont USA provided us with certain proprietary technical information relating to the Toiyabe property. As consideration for the data, we granted to Newmont Capital a right of first refusal, exercisable for 90 years, with respect to any offer, joint venture, lease, sale, grant or other disposition of the Toiyabe property by our company.

- 16 -

In May 2006, we obtained a right to acquire an additional 77 unpatented claims, under the option agreement with MinQuest Inc., in the Toiyabe area, giving us an additional 1,540 acres or 2.5 square miles of ground to explore and develop pursuant to the option agreement described above.

Mineral Claims

The Toiyabe property consists of 165 unpatented, Federal, lode contiguous, and unsurveyed mineral claims, each claim covering 20.66 acres, for a total of 3,409 acres. Certain of these claims may cover pre-existing claims that have rights to the land in conflict with our rights. The actual location of unpatented mineral claims can only be confirmed by a field inspection of the location of claim monuments and how they relate to the monuments of older, pre-existing claims. In fact some of the conflicts may not actually exist and there may be other conflicts that are not apparent from the printed documents. We are currently conducting a field inspection of all company claims and other older claims. Field inspection to date indicates that up to approximately 31 acres of the Toiyabe block may belong to unrelated third parties.

Unpatented mining claims are generally considered subject to greater title risks than patented mining claims or real property interests that are owned in fee simple. To remain valid, unpatented claims are subject to annual maintenance fees of $125 per claim. The $125 per claim fees for 2007-2008 have been paid.

The Toiyabe property is described as follows:

| CLAIM NAME | DATE RECORDED | NMC NUMBER | EXPIRATION |

| Pinto 5 | Oct. 19, 2004 | 879982 | Sept. 1, 2008 |

| Pinto 6 | Oct. 19, 2004 | 879983 | Sept. 1, 2008 |

| Pinto 7 | Oct. 19, 2004 | 879984 | Sept. 1, 2008 |

| Pinto 8 | Oct. 19, 2004 | 879985 | Sept. 1, 2008 |

| Pinto 9 | Oct. 19, 2004 | 879986 | Sept. 1, 2008 |

| Pinto 10 | Oct. 19, 2004 | 879987 | Sept. 1, 2008 |

| Pinto 11 | Oct. 19, 2004 | 879988 | Sept. 1, 2008 |

| Pinto 12 | Oct. 19, 2004 | 879989 | Sept. 1, 2008 |

| Pinto 21 | Oct. 19, 2004 | 879990 | Sept. 1, 2008 |

| Pinto 22 | Oct. 19, 2004 | 879991 | Sept. 1, 2008 |

| Pinto 23 | Oct. 19, 2004 | 879992 | Sept. 1, 2008 |

| Pinto 24 | Oct. 19, 2004 | 879993 | Sept. 1, 2008 |

| Pinto 25 | Oct. 19, 2004 | 879994 | Sept. 1, 2008 |

| Pinto 26 | Oct. 19, 2004 | 879995 | Sept. 1, 2008 |

| Pinto 27 | Oct. 19, 2004 | 879996 | Sept. 1, 2008 |

| Pinto 28 | Oct. 19, 2004 | 879997 | Sept. 1, 2008 |

| Pinto 29 | Oct. 19, 2004 | 879998 | Sept. 1, 2008 |

| Pinto 30 | Oct. 19, 2004 | 879999 | Sept. 1, 2008 |

| Pinto 31 | Oct. 19, 2004 | 880000 | Sept. 1, 2008 |

| Pinto 32 | Oct. 19, 2004 | 880001 | Sept. 1, 2008 |

| Pinto 33 | Oct. 19, 2004 | 880002 | Sept. 1, 2008 |

| Pinto 49 | Oct. 19, 2004 | 880003 | Sept. 1, 2008 |

| Pinto 50 | Oct. 19, 2004 | 880004 | Sept. 1, 2008 |

| Pinto 70 | Oct. 19, 2004 | 880005 | Sept. 1, 2008 |

| Pinto 77 | Oct. 19, 2004 | 880006 | Sept. 1, 2008 |

| Pinto 78 | Oct. 19, 2004 | 880007 | Sept. 1, 2008 |

| Pinto 82 | Oct. 19, 2004 | 880008 | Sept. 1, 2008 |

- 17 -

| CLAIM NAME | DATE RECORDED | NMC NUMBER | EXPIRATION |

| Pinto 83 | Oct. 19, 2004 | 880009 | Sept. 1, 2008 |

| Pinto 84 | Oct. 19, 2004 | 880010 | Sept. 1, 2008 |

| Pinto 85 | Oct. 19, 2004 | 880011 | Sept. 1, 2008 |

| Pinto 86 | Oct. 19, 2004 | 880012 | Sept. 1, 2008 |

| Pinto 87 | Oct. 19, 2004 | 880013 | Sept. 1, 2008 |

| Pinto 88 | Oct. 19, 2004 | 880014 | Sept. 1, 2008 |

| Pinto 98 | Oct. 19, 2004 | 880015 | Sept. 1, 2008 |

| Pinto 99 | Oct. 19, 2004 | 880016 | Sept. 1, 2008 |

| Pinto 100 | Oct. 19, 2004 | 880017 | Sept. 1, 2008 |

| Pinto 101 | Oct. 19, 2004 | 880018 | Sept. 1, 2008 |

| Pinto 102 | Oct. 19, 2004 | 880019 | Sept. 1, 2008 |

| Pinto 103 | Oct. 19, 2004 | 880020 | Sept. 1, 2008 |

| Panda 13 | Oct. 19, 2004 | 880021 | Sept. 1, 2008 |

| Panda 14 | Oct. 19, 2004 | 880022 | Sept. 1, 2008 |

| Panda 15 | Oct. 19, 2004 | 880023 | Sept. 1, 2008 |

| Panda 16 | Oct. 19, 2004 | 880024 | Sept. 1, 2008 |

| Panda 17 | Oct. 19, 2004 | 880025 | Sept. 1, 2008 |

| Panda 18 | Oct. 19, 2004 | 880026 | Sept. 1, 2008 |

| Panda 19 | Oct. 19, 2004 | 880027 | Sept. 1, 2008 |

| Panda 20 | Oct. 19, 2004 | 880028 | Sept. 1, 2008 |

| Panda 51 | Oct. 19, 2004 | 880029 | Sept. 1, 2008 |

| Panda 52 | Oct. 19, 2004 | 880030 | Sept. 1, 2008 |

| Panda 71 | Oct. 19, 2004 | 880031 | Sept. 1, 2008 |

| Panda 72 | Oct. 19, 2004 | 880032 | Sept. 1, 2008 |

| Panda 73 | Oct. 19, 2004 | 880033 | Sept. 1, 2008 |

| Panda 74 | Oct. 19, 2004 | 880034 | Sept. 1, 2008 |

| Panda 75 | Oct. 19, 2004 | 880035 | Sept. 1, 2008 |

| Panda 76 | Oct. 19, 2004 | 880036 | Sept. 1, 2008 |

| Spigot 14 | Oct. 19, 2004 | 880037 | Sept. 1, 2008 |

| Spigot 16 | Oct. 19, 2004 | 880038 | Sept. 1, 2008 |

| Spigot 18 | Oct. 19, 2004 | 880039 | Sept. 1, 2008 |

| Spigot 20 | Oct. 19, 2004 | 880040 | Sept. 1, 2008 |

| Spigot 22 | Oct. 19, 2004 | 880041 | Sept. 1, 2008 |

| Spigot 24 | Oct. 19, 2004 | 880042 | Sept. 1, 2008 |

| Spigot 26 | Oct. 19, 2004 | 880043 | Sept. 1, 2008 |

| Spigot 28 | Oct. 19, 2004 | 880044 | Sept. 1, 2008 |

| Spigot 30 | Oct. 19, 2004 | 880045 | Sept. 1, 2008 |

| Spigot 32 | Oct. 19, 2004 | 880046 | Sept. 1, 2008 |

| Spigot 40 | Oct. 19, 2004 | 880047 | Sept. 1, 2008 |

| Spigot 42 | Oct. 19, 2004 | 880048 | Sept. 1, 2008 |

| Spigot 45 | Oct. 19, 2004 | 880050 | Sept. 1, 2008 |

| Spigot 46 | Oct. 19, 2004 | 880051 | Sept. 1, 2008 |

| Spigot 48 | Oct. 19, 2004 | 880052 | Sept. 1, 2008 |

| Spigot 57 | Oct. 19, 2004 | 880053 | Sept. 1, 2008 |

- 18 -

| CLAIM NAME | DATE RECORDED | NMC NUMBER | EXPIRATION |

| Spigot 58 | Oct. 19, 2004 | 880054 | Sept. 1, 2008 |

| Spigot 59 | Oct. 19, 2004 | 880055 | Sept. 1, 2008 |

| Spigot 60 | Oct. 19, 2004 | 880056 | Sept. 1, 2008 |

| Spigot 61 | Oct. 19, 2004 | 880057 | Sept. 1, 2008 |

| Spigot 65 | Oct. 19, 2004 | 880058 | Sept. 1, 2008 |

| Spigot 66 | Oct. 19, 2004 | 880059 | Sept. 1, 2008 |

| Spigot 67 | Oct. 19, 2004 | 880060 | Sept. 1, 2008 |

| Spigot 69 | Oct. 19, 2004 | 880061 | Sept. 1, 2008 |

| Spigot 71 | Oct. 19, 2004 | 880062 | Sept. 1, 2008 |

| Spigot 73 | Oct. 19, 2004 | 880063 | Sept. 1, 2008 |

| Spigot 90 | Oct. 19, 2004 | 880064 | Sept. 1, 2008 |

| Spigot 91 | Oct. 19, 2004 | 880065 | Sept. 1, 2008 |

| Spigot 92 | Oct. 19, 2004 | 880066 | Sept. 1, 2008 |

| Spigot 93 | Oct. 19, 2004 | 880067 | Sept. 1, 2008 |

| Spigot 44 | Nov. 18, 2005 | 911747 | Sept. 1, 2008 |

| TYE 53 | Nov. 18, 2005 | 911748 | Sept. 1, 2008 |

| TYE 54 | Nov. 18, 2005 | 911749 | Sept. 1, 2008 |

| TYE 55 | Nov. 18, 2005 | 911750 | Sept. 1, 2008 |

| TYE 56 | Nov. 18, 2005 | 911751 | Sept. 1, 2008 |

| TYE 57 | Nov. 18, 2005 | 911752 | Sept. 1, 2008 |

| TYE 73 | Nov. 18, 2005 | 911753 | Sept. 1, 2008 |

| TYE 74 | Nov. 18, 2005 | 911754 | Sept. 1, 2008 |

| TYE 75 | Nov. 18, 2005 | 911755 | Sept. 1, 2008 |

| TYE 76 | Nov. 18, 2005 | 911756 | Sept. 1, 2008 |

| TYE 77 | Nov. 18, 2005 | 911757 | Sept. 1, 2008 |

| TYE 78 | Nov. 18, 2005 | 911758 | Sept. 1, 2008 |

| TYE 79 | Nov. 18, 2005 | 911759 | Sept. 1, 2008 |

| TYE 80 | Nov. 18, 2005 | 911760 | Sept. 1, 2008 |

| TYE 81 | Nov. 18, 2005 | 911761 | Sept. 1, 2008 |

| TYE 82 | Nov. 18, 2005 | 911762 | Sept. 1, 2008 |

| TYE 83 | Nov. 18, 2005 | 911763 | Sept. 1, 2008 |

| TYE 84 | Nov. 18, 2005 | 911764 | Sept. 1, 2008 |

| TYE 85 | Nov. 18, 2005 | 911765 | Sept. 1, 2008 |

| TYE 86 | Nov. 18, 2005 | 911766 | Sept. 1, 2008 |

| TYE 87 | Nov. 18, 2005 | 911767 | Sept. 1, 2008 |

| TYE 88 | Nov. 18, 2005 | 911768 | Sept. 1, 2008 |

| TYE 89 | Nov. 18, 2005 | 911769 | Sept. 1, 2008 |

| TYE 90 | Nov. 18, 2005 | 911770 | Sept. 1, 2008 |

| TYE 91 | Nov. 18, 2005 | 911771 | Sept. 1, 2008 |

| TYE 92 | Nov. 18, 2005 | 911772 | Sept. 1, 2008 |

| TYE 93 | Nov. 18, 2005 | 911773 | Sept. 1, 2008 |

| TYE 58 | Nov. 18, 2005 | 911774 | Sept. 1, 2008 |

| TYE 59 | Nov. 18, 2005 | 911775 | Sept. 1, 2008 |

| TYE 60 | Nov. 18, 2005 | 911776 | Sept. 1, 2008 |

- 19 -

| CLAIM NAME | DATE RECORDED | NMC NUMBER | EXPIRATION |

| TYE 61 | Nov. 18, 2005 | 911777 | Sept. 1, 2008 |

| TYE 62 | Nov. 18, 2005 | 911778 | Sept. 1, 2008 |

| TYE 63 | Nov. 18, 2005 | 911779 | Sept. 1, 2008 |

| TYE 64 | Nov. 18, 2005 | 911780 | Sept. 1, 2008 |

| TYE 65 | Nov. 18, 2005 | 911781 | Sept. 1, 2008 |

| TYE 66 | Nov. 18, 2005 | 911782 | Sept. 1, 2008 |

| TYE 67 | Nov. 18, 2005 | 911783 | Sept. 1, 2008 |

| TYE 68 | Nov. 18, 2005 | 911784 | Sept. 1, 2008 |

| TYE 69 | Nov. 18, 2005 | 911785 | Sept. 1, 2008 |

| TYE 70 | Nov. 18, 2005 | 911786 | Sept. 1, 2008 |

| TYE 71 | Nov. 18, 2005 | 911787 | Sept. 1, 2008 |

| TYE 72 | Nov. 18, 2005 | 911788 | Sept. 1, 2008 |

| TY 1 | July 11, 2006 | 930560 | Sept. 1, 2008 |

| TY 2 | July 11, 2006 | 930561 | Sept. 1, 2008 |

| TY 3 | July 11, 2006 | 930562 | Sept. 1, 2008 |

| TY 4 | July 11, 2006 | 930563 | Sept. 1, 2008 |

| TY 5 | July 11, 2006 | 930564 | Sept. 1, 2008 |

| TY 6 | July 11, 2006 | 930565 | Sept. 1, 2008 |

| TY 7 | July 11, 2006 | 930566 | Sept. 1, 2008 |

| TY 8 | July 11, 2006 | 930567 | Sept. 1, 2008 |

| TY 9 | July 11, 2006 | 930568 | Sept. 1, 2008 |

| TY 10 | July 11, 2006 | 930569 | Sept. 1, 2008 |

| TY 11 | July 11, 2006 | 930570 | Sept. 1, 2008 |

| TY 12 | July 11, 2006 | 930571 | Sept. 1, 2008 |

| TY 13 | July 11, 2006 | 930572 | Sept. 1, 2008 |

| TY 14 | July 11, 2006 | 930573 | Sept. 1, 2008 |

| TY 15 | July 11, 2006 | 930574 | Sept. 1, 2008 |

| TY 16 | July 11, 2006 | 930575 | Sept. 1, 2008 |

| TY 17 | July 11, 2006 | 930576 | Sept. 1, 2008 |

| TY 18 | July 11, 2006 | 930577 | Sept. 1, 2008 |

| TY 19 | July 11, 2006 | 930578 | Sept. 1, 2008 |

| TY 20 | July 11, 2006 | 930579 | Sept. 1, 2008 |

| TY 21 | July 11, 2006 | 930580 | Sept. 1, 2008 |

| TY 22 | July 11, 2006 | 930581 | Sept. 1, 2008 |

| TY 23 | July 11, 2006 | 930582 | Sept. 1, 2008 |

| TY 24 | July 11, 2006 | 930583 | Sept. 1, 2008 |

| TY 25 | July 11, 2006 | 930584 | Sept. 1, 2008 |

| TY 26 | July 11, 2006 | 930585 | Sept. 1, 2008 |

| TY 27 | July 11, 2006 | 930586 | Sept. 1, 2008 |

| TY 28 | July 11, 2006 | 930587 | Sept. 1, 2008 |

| TY 29 | July 11, 2006 | 930588 | Sept. 1, 2008 |

| TY 30 | July 11, 2006 | 930589 | Sept. 1, 2008 |

| TY 31 | July 11, 2006 | 930590 | Sept. 1, 2008 |

| TY 32 | July 11, 2006 | 930591 | Sept. 1, 2008 |

- 20 -

| CLAIM NAME | DATE RECORDED | NMC NUMBER | EXPIRATION |

| TY 33 | July 11, 2006 | 930592 | Sept. 1, 2008 |

| TY 34 | July 11, 2006 | 930593 | Sept. 1, 2008 |

| TY 35 | July 11, 2006 | 930594 | Sept. 1, 2008 |

| TY 36 | July 11, 2006 | 930595 | Sept. 1, 2008 |

| TY 37 | July 11, 2006 | 930596 | Sept. 1, 2008 |

| TY 38 | July 11, 2006 | 930597 | Sept. 1, 2008 |

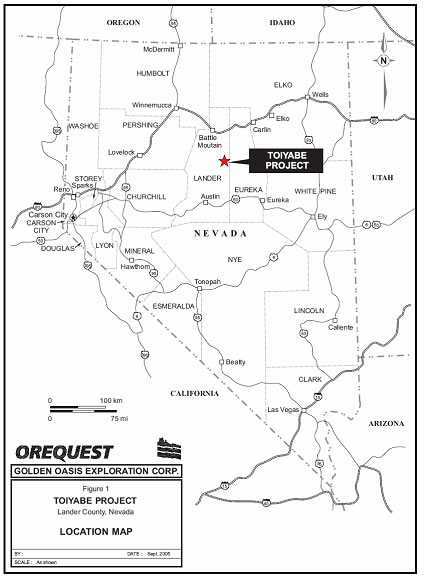

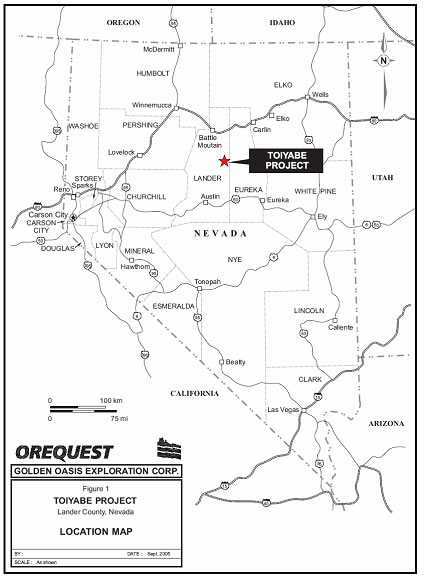

Location

The Toiyabe property is situated in the northern Toiyabe Range, eastern Lander County, Nevada, approximately 78 miles southwest of Elko, Nevada. It covers parts of Sections 1 and 12, T25N, R46E, Sections 6 and 7, T25N, R47E, Section 36, T26N, R46E and Section 31, T26N, R47E, MDB&M. Elevations range between 6,600 and 8,000 feet above sea level. The following map shows the location of the Toiyabe property.

- 21 -

Accessibility

Access to the property from Elko is available by paved road for approximately 67 miles, and a further 18 miles on gravel roads and two track routes. The property is approximately 42 miles south of the Union Pacific Railway that parallels Interstate 80. Interstate 80 is shown on the map, above.

Infrastructure

No utilities are available on or near the property. The hilly nature of the Toiyabe property could restrict the ability of a mine operator to place mine site facilities on the project ground depending on the size of the operation.

All essential services such as fuel, food and lodging are available in Elko or Battle Mountain. Most supplies, equipment and services are available at Battle Mountain, Carlin or Elko. The closest regularly scheduled airline services are located in Elko. There is a highly trained mining-industrial workforce available in Battle Mountain, Carlin and Elko.

Climate

The climate of the property is characterized by warm, dry summers and cool, moist winters. There is a large diurnal range for temperature. The temperatures are cool to cold during the winter (to 0 Fahrenheit), with occasional moderate snow cover, and are warm during the summer (to over 100 Fahrenheit) with cool nights. The area is fairly dry with infrequent rains and occasional snowfalls in the respective seasons.

Physiography

The vegetation varies depending on elevation and moisture. Sagebrush and sparse grasses thrive on the valley floors while mountain mahogany, juniper and pinon trees grow on the lower slopes of the ranges. The lower slopes of the Toiyabe property area are covered with open pinon and juniper stands on the slopes. The vegetation on the valley floor of the property consists mostly of sagebrush and grasses.

Geological Setting

North-Central Nevada is underlain by Paleozoic, Mesozoic and Cenozoic sedimentary and igneous rocks. Two distinct depositional environments are evident in the Paleozoic units. These are known as the Upper and Lower Plate assemblages that represent the upper and lower plates of the Roberts Mountain Thrust, a major structural feature. In Nevada, the Upper Plate assemblage consists of deep water siliceous sedimentary and minor volcanic rocks. The lower plate of the Roberts Mountain Thrust is almost entirely composed of shallow marine carbonates.

Mineralization

Recent shallow drilling by Golden Oasis has identified at least two northwest trending, southwest dipping mineralized faults. Gold values are shown in the table of drill results included below under the heading “Our Work on the Toiyabe Property to Date”. The gold is associated with elevated arsenic, mercury, antimony and silver geochemistry. which aids in the search for these deposits. Gold commonly occurs where narrow fracture systems intersect only certain sheared, permeable and reactive carbonates that result in larger, shear-breccia hosted gold systems. Additionally, significant zones of gold mineralization on the subject property are associated with lesser argillic alteration.

Prior Work

Homestake (now Barrick), Getty Oil (now Energold Mining), Freeport Exploration (now Freeport-McMoran Copper & Gold Inc), Degerstrom Inc, Santa Fe Pacific Mining (now Newmont) each performed some exploration work on portions of the Toiyabe property during the period 1964-1991. Much of the work consisted of drilling. Some of the work includes:

- 22 -

- approximately 10,000 regional and local collected stream silt samples by Homestake in 1979

- approximately 9,500 regional and local collected stream sediment samples by Inland in 1988

- Airphoto and landsat studies

- Geological mapping

- Rock sampling by Inland and Freeport in the lower plate rock exposures

- 6 square miles of soil surveys on 200ftX200 ft grid, 3 square miles of soil surveys on 400ftX400 ft grid completed by Santa Fe in 1990

- Airborne magnetometer surveys in 1990 completed by Homestake

- 4,165 rock chip samples completed by Santa Fe in 1991

- Reverse Circulation drilling of 159 holes from 1979-1991 on the current Toiyabe property as part of more than 1,000 holes drilled in the area

- Bouguer gravity surveys were completed by Newmont in 1993 over parts of the Toiyabe property

MinQuest, a private company controlled by Richard Kern, our officer and director, and Herb Duerr, staked the claims comprising the Toiyabe property in 2004, at a cost to MinQuest of US$41,883.

Our Work on the Toiyabe Property to Date

The Toiyabe property is largely covered by rocks deemed to be unsuitable for large gold/silver deposits by our geologists. However, beneath these surface rocks are strata that host major mines which are 6 and 7 miles to the north of the our property. We are targeting the intersection of these favorable host rocks and large fault zones that may be feeder faults for mineralization at depth.

During 2005 we conducted a new airborne geophysical interpretation of purchased private airborne magnetic data. The objective of the new interpretation was to locate possible structures which may be associated with mineralization at depth. After this interpretation was completed in June, 2005, we conducted a one hole reverse circulation drill program in the south-western portion of the Toiyabe property. We drilled this hole in July, 2005 primarily to determine the stratigraphy of that area of the property. The hole confirmed the presence of the important lower plate stratigraphy, but we believed that further work was needed to determine if the lower plate rock contains the right structural complexities and traps to host an economic gold occurrence.

In 2006 we conducted a two-phase exploration program on the Toiyabe property to test the theory that recorded near surface mineralization is the result of leakage upward along favorable structures from a deep seated source that could be enriched in gold. The first phase consisted of:

a detailed review of all historic data;

entering all of the historic data into an electronic database to determine if any trends exist in the old anomalous drill results, and to help with the interpretation and selection of future areas to drill;

a Tensor IP Survey focused over an area of the property containing the most favorable stratigraphy to date (principally the area where the lower plate Roberts Mountain formation occurs in the southern half of the property in the old California-Courtney target areas); and

a Controlled Source Magneto Telluric geophysical survey was conducted to help define major faults in the area.

- 23 -

The second phase of our 2006 exploration program consisted of a 31 hole angle drilling program that we began in August, 2006, for which we announced results in February, 2007. Drilling totalled 11,120 feet and results are shown in the table below.

TOIYABE SUMMARY DRILLING RESULTS (+1 g/t gold intercepts only)

HOLE #

| Azimuth

(Degrees) | Dip