UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

Douglas Emmett, Inc.

________________________________________________

(Name of Registrant as Specified in its Charter)

N/A

__________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to |

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined):

| |

| (4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

(4) Date Filed:

Douglas Emmett

ISS Report Response Sheet

May 20, 2019

We would like to address some concerns raised by ISS in its recent report. (Unfortunately, ISS does not provide a forum for dialog about its concerns.) Our CEO’s 2018 pay, which is unchanged from 2017, is appropriate given the factors summarized in our proxy statement, such as our strong FFO and AFFO growth, continued low G&A and leasing costs, and strong alignment between his pay and our total stockholder return. Moreover, ISS’s report rates us as among the best on environmental and social factors (p. 9).

The ISS report acknowledges that:

|

| |

• Our compensation structure in 2018 was unchanged, having been approved by our stockholders and earning favorable recommendations from ISS for many years. | |

• Our CEO’s pay in 2018 was not increased from 2017, effectively resulting in a relative decrease in compensation compared to the estimated 5% increase in CEO pay for our Benchmark Group.1 |

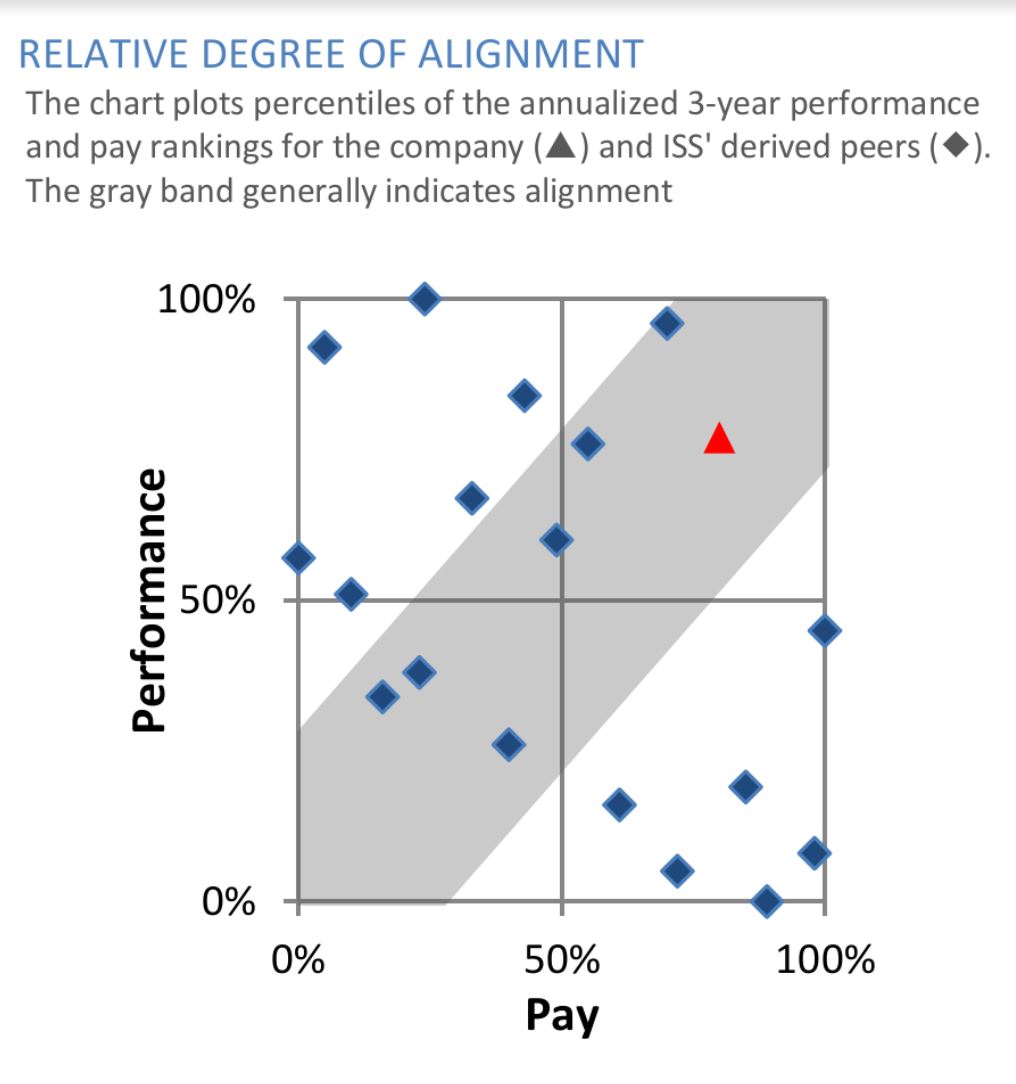

• Our CEO’s pay in 2018 continued to be aligned with performance. The ISS report concluded that our CEO’s pay is aligned with our performance (as reflected in the chart at right from p. 16), with “low” quantitative concern about that compensation alignment (p. 16). |

• ISS specifically acknowledges that our financial metrics improved in 2018, “including revenue, net income, EPS, ROE, and ROIC” (p. 19). Indeed, in 2018 we grew our FFO by 12.7% and our AFFO by 7.4%. |

To justify its changed recommendation, ISS mostly cites items that have not changed for many years:

| |

| • | Our CEO’s compensation continues to be based on a qualitative analysis of performance against a set of goals set by our Compensation Committee at the beginning of each year. ISS’s data shows that our Compensation Committee has properly exercised that discretion to align pay with performance over many years, but ISS objects to the mere existence of any discretion even if properly exercised. That policy is misguided. Mechanical formulas may simplify ISS’s own analysis, but they can be manipulated, have unintended consequences and actually increase misalignment. In contrast, our Compensation Committee believes that its discretion allows it to evaluate the totality of management performance, including risks taken. |

| |

| • | Our COO continues to be paid the same as our CEO, although ISS does not state why this has now become a problem. It has not resulted in excessive G&A; to the contrary, our G&A in 2018 was only 4.4% of revenues, lower than 20 of the 21 peers selected by ISS and DEI, and much less than the 7.8% average for our office REIT peers. In addition, ISS values our LTIP grants as if they were common stock, ignoring the inherent differences recognized by GAAP and by independent appraisals. |

| |

| • | Oddly, ISS complains about a car allowance that has been in place for decades, even though our CEO received a total of only $37,413-- 0.03% of his compensation--from all perquisites in 2018, an amount not only consistent with past years but less than half of the median of our peer group (p. 14). |

Two things cited in the ISS report have recently changed:

| |

| • | Our one-year TSR in 2018 was adversely affected by a temporary decline in our stock price at the end of 2018. Since that dip, our stock price has more than recovered, rising over 26%, strongly outpacing our peer group average (up 19%) and almost lapping the Russell 3000 increase (up 14%). However, even using our depressed TSR at the end of 2018, ISS found that our CEO’s pay continues to be aligned with our performance. |

| |

| • | In 2017, our stockholders rejected an ISS recommendation that they vote against the reelection of our Governance Committee members (ISS is making a similar recommendation this year). ISS objects to any requirement that a proposal have at least minimal stockholder support before wasting the time and expense of a stockholder vote. In adopting the SEC’s 3% proxy access standard, our Board struck a balance that avoids extraneous proposals from special interests while not creating a material barrier to proposals with any meaningful support. Based on recent filings, almost half of our stock is held by stockholders who individually hold more than 3% of our stock, and an overwhelming majority of our stock is held by stockholders who could form a group of 20 to reach a 3% threshold. Our Board continues to recommend a vote for the members of our Governance Committee. |

________________________________________

1Source: FTI Consulting, Inc.