HERC HOLDINGS INC. ©2021 Herc Rentals Inc. All Rights Reserved. Q2 and First Half 2021 Earnings Conference Call July 22, 2021

2NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Herc Rentals Team Aaron Birnbaum Senior Vice President & Chief Operating Officer Larry Silber President & Chief Executive Officer Elizabeth Higashi Vice President, Investor Relations & Sustainability Mark Irion Senior Vice President & Chief Financial Officer

3NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Safe Harbor Statements and Non-GAAP Financial Measures Information Regarding Non-GAAP Financial Measures In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this presentation that is not calculated according to GAAP (“non-GAAP”), such as adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA, adjusted EBITDA margin, REBITDA, REBITDA margin, REBITDA flow- through and free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non- GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the appendix that accompanies this presentation. Forward-Looking Statements This presentation includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy, projected profitability, performance or cash flows, future capital expenditures, our growth strategy, anticipated financing needs, business trends, the impact of and our response to COVID-19, liquidity and capital management, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and, there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

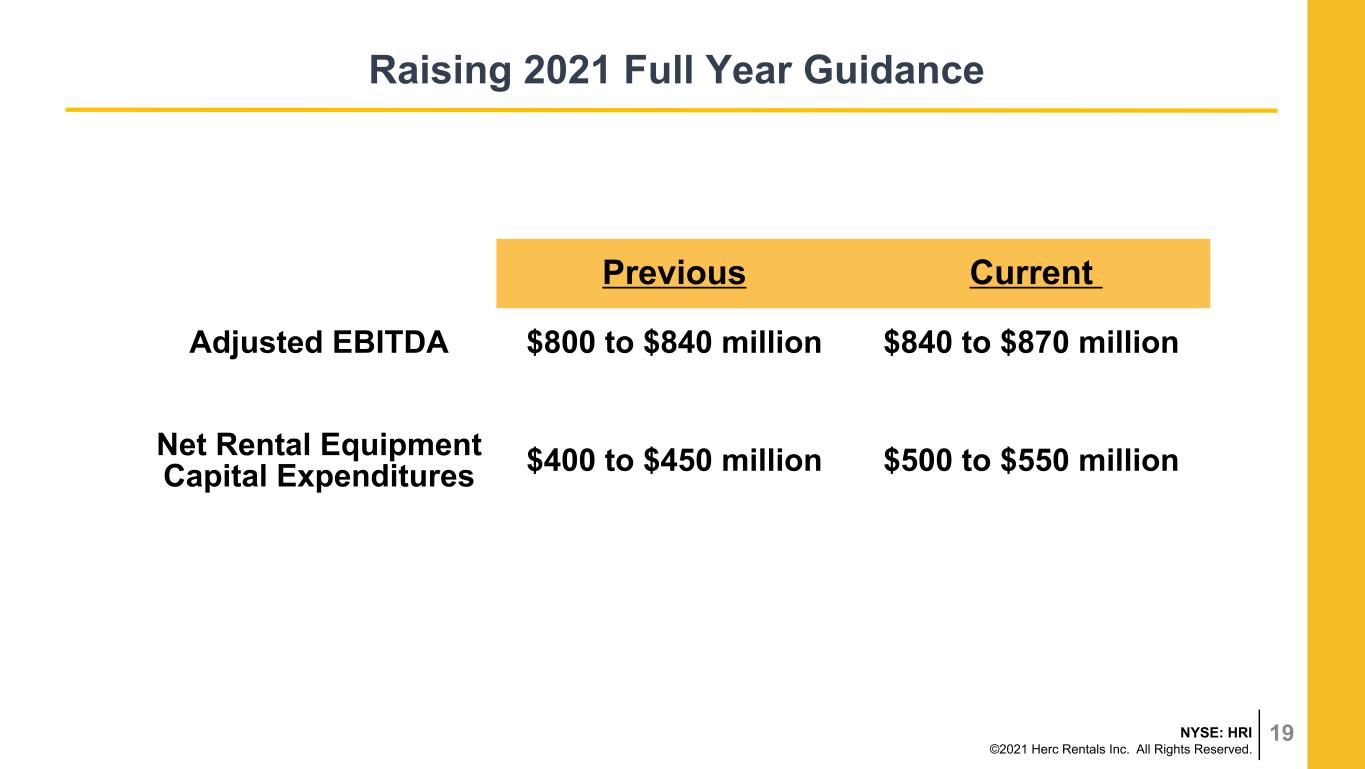

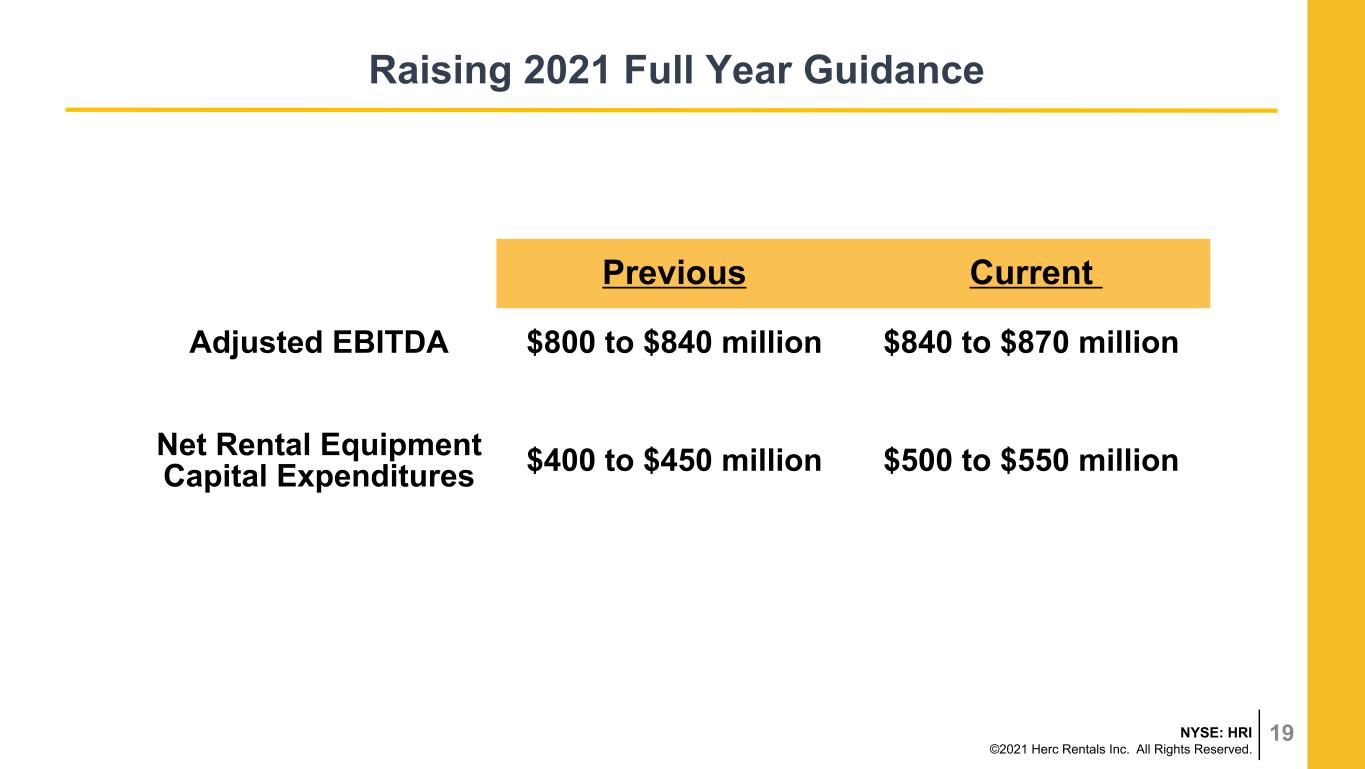

4NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Industry leading rate management delivers results in favorable operating environment Strong Q2 performance provides momentum for balance of 2021 Given the current operating environment, we are raising net fleet capital expenditures for the year by $100 million from prior guidance We are also raising 2021 guidance for adjusted EBITDA a second time this year to $840 to $870 million Q2 2021 Takeaways - Raising Full Year Guidance Tight Supply + Steady Demand = Good Operating Environment

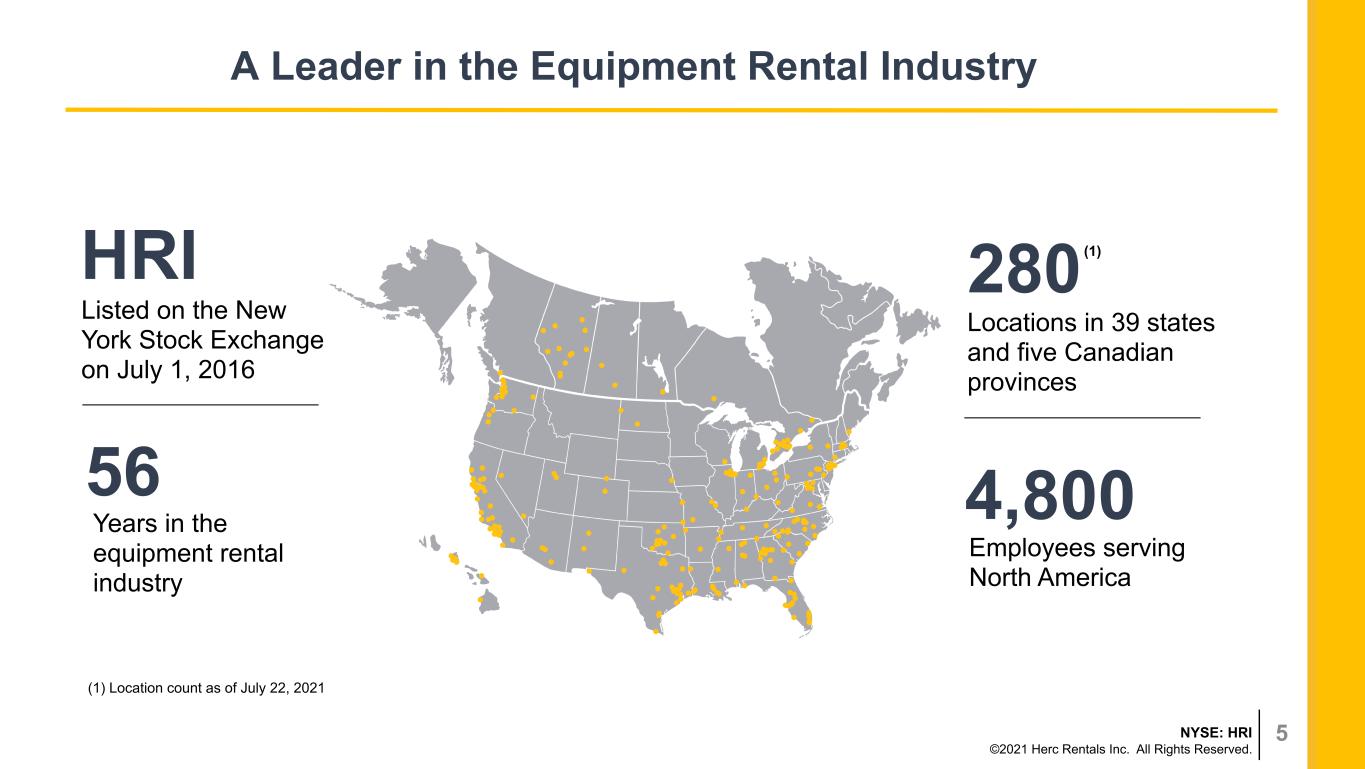

5NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. A Leader in the Equipment Rental Industry 56 Years in the equipment rental industry HRI Listed on the New York Stock Exchange on July 1, 2016 Locations in 39 states and five Canadian provinces Employees serving North America 280 4,800 (1) Location count as of July 22, 2021 (1)

6NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Second Quarter 2021 Financial Highlights 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 Equipment Rental Revenue $448.0M 36.8% over 2020 9.9% over 2019 Total Revenues $490.9M 33.4% over 2020 3.3% over 2019 Adjusted EBITDA1 $207.7M 39.0% over 2020 18.8% over 2019 Net Income $47.1M Earnings Per Diluted Share $1.55 Adjusted EBITDA Margin1 42.3% +170bps over 2020 + 550bps over 2019 $45.1M over 2020 $37.4M over 2019 $1.48 over 2020 $1.22 over 2019

7NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. We recently published our 2021 Corporate Citizenship Report, which aligns to the Global Reporting Initiative Standards We established three major goals for 2030 using 2019 as the base year: • Reducing our GHG emissions intensity by 25% • Reducing our non-toxic waste to landfill by 25% • Continuing to improve safety annually with a target TRIR of 0.49 or lower Commitment to Sustainability

Operations Review

9NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Driving Solid Operational Performance Q2 rental revenue growth continued to show positive performance compared to the same quarter in 2020 and 2019 Business activity solid and all of our end markets are showing positive momentum Growth in core equipment rental revenue was enhanced by ProSolutions® and entertainment services performance Integration of acquisitions on track and developing M&A pipeline Herc Operating Model continues to drive operational performance

10NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Focused on Health and Safety Continued focus on health and safety of our employees, customers and communities New Health & Safety Management System implemented this year helps us work more safely and streamlines reviews and audits Achieved 98% Perfect Days at our branches in Q2 2021 Enhancing the well-being of our team by investing in training and new tools for working safely

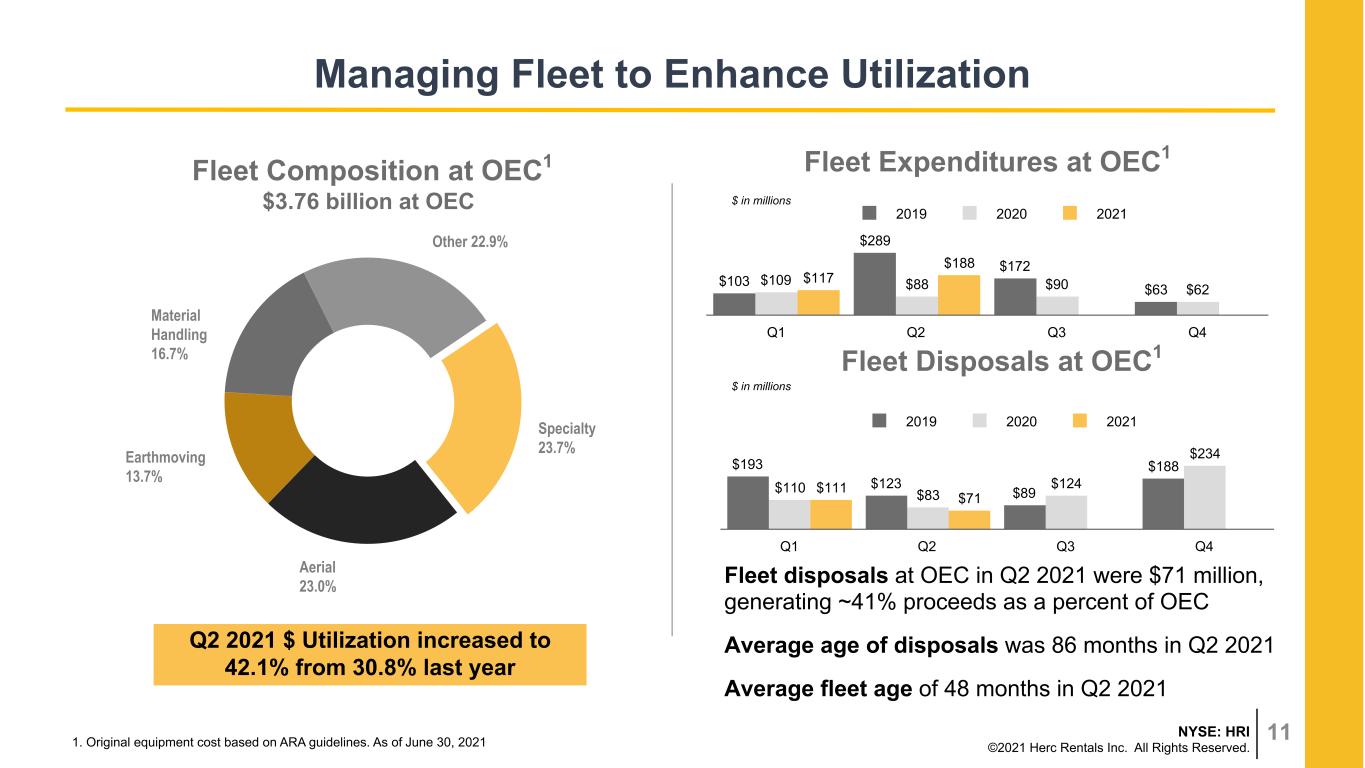

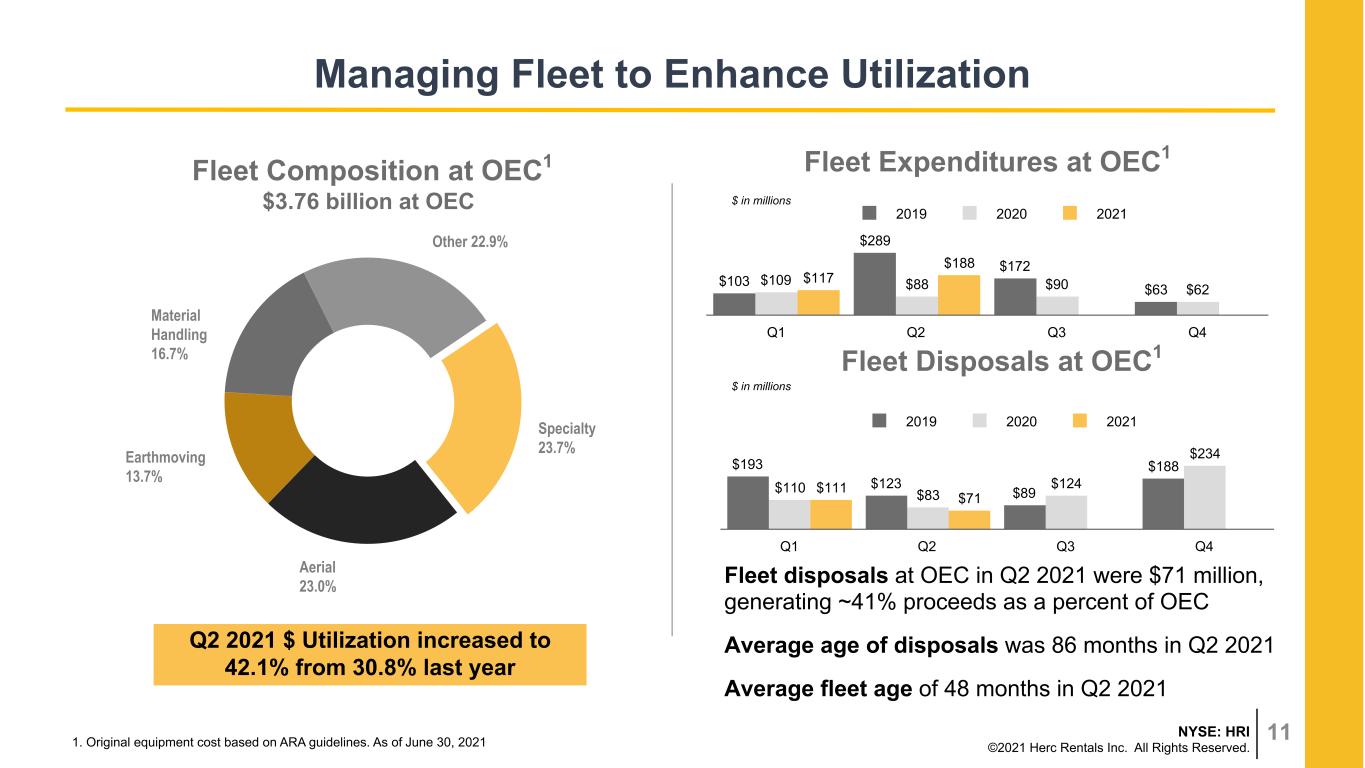

11NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Managing Fleet to Enhance Utilization Fleet Composition at OEC1 $3.76 billion at OEC 1. Original equipment cost based on ARA guidelines. As of June 30, 2021 Fleet Expenditures at OEC1 Fleet Disposals at OEC1 Fleet disposals at OEC in Q2 2021 were $71 million, generating ~41% proceeds as a percent of OEC Average age of disposals was 86 months in Q2 2021 Average fleet age of 48 months in Q2 2021 $ in millions $ in millions Specialty 23.7% Aerial 23.0% Earthmoving 13.7% Material Handling 16.7% Other 22.9% $103 $289 $172 $63 $109 $88 $90 $62 $117 $188 2019 2020 2021 Q1 Q2 Q3 Q4 $193 $123 $89 $188 $110 $83 $124 $234 $111 $71 2019 2020 2021 Q1 Q2 Q3 Q4 Q2 2021 $ Utilization increased to 42.1% from 30.8% last year

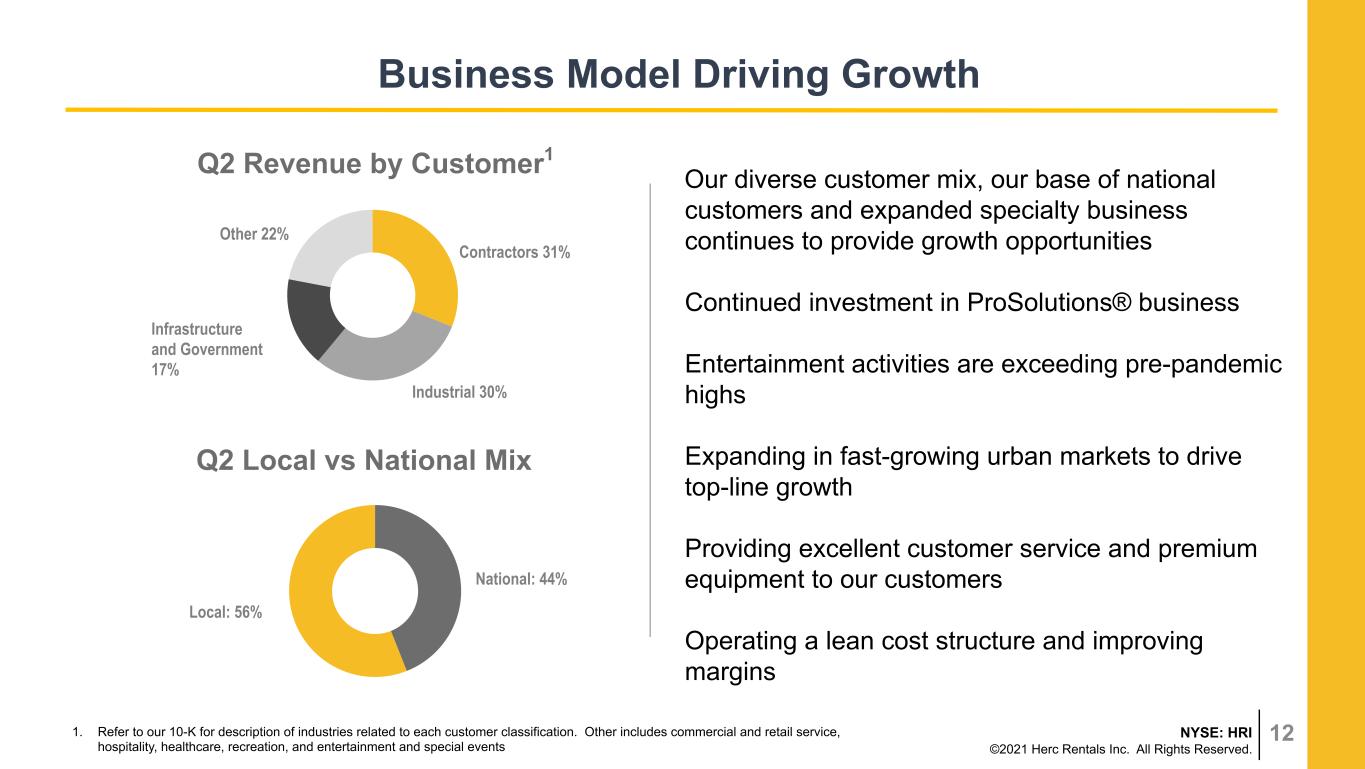

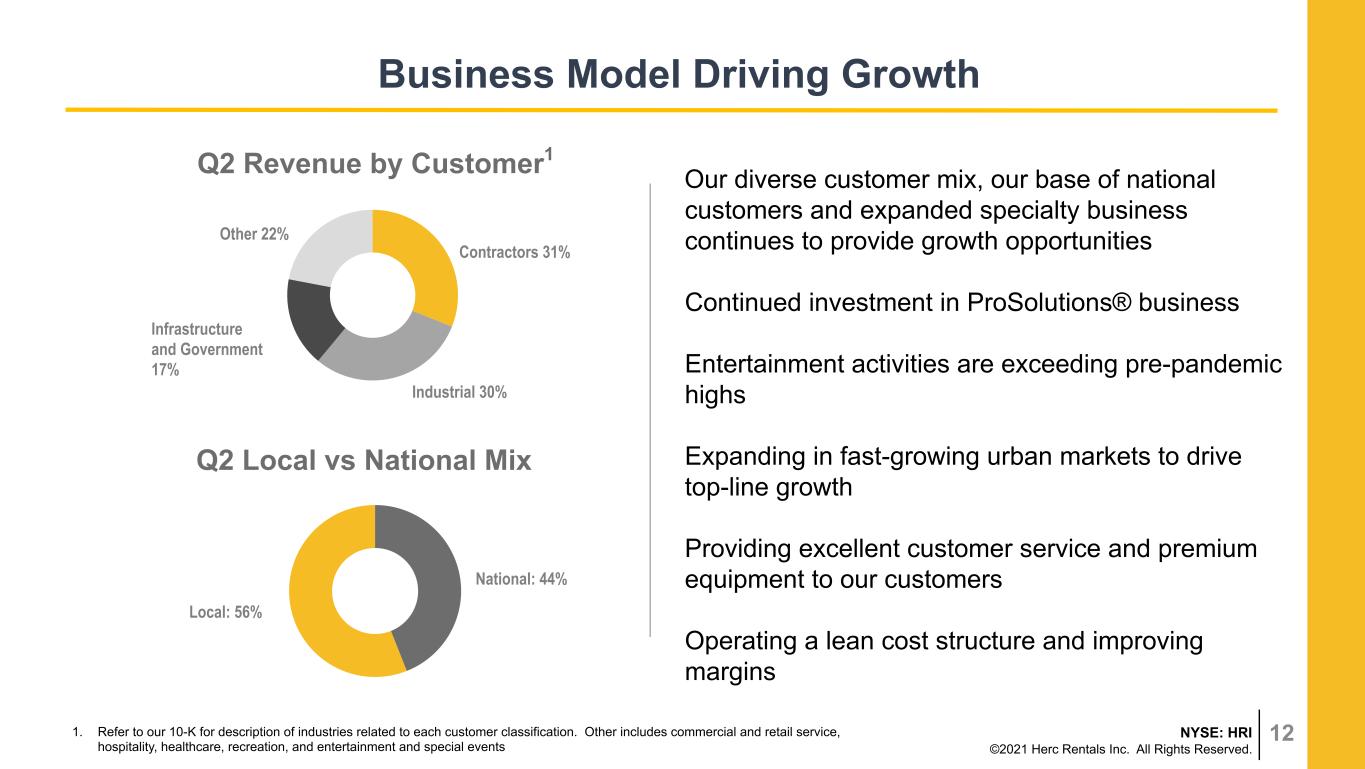

12NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Contractors 31% Industrial 30% Infrastructure and Government 17% Other 22% Business Model Driving Growth 1. Refer to our 10-K for description of industries related to each customer classification. Other includes commercial and retail service, hospitality, healthcare, recreation, and entertainment and special events Q2 Revenue by Customer1 Q2 Local vs National Mix National: 44% Local: 56% Our diverse customer mix, our base of national customers and expanded specialty business continues to provide growth opportunities Continued investment in ProSolutions® business Entertainment activities are exceeding pre-pandemic highs Expanding in fast-growing urban markets to drive top-line growth Providing excellent customer service and premium equipment to our customers Operating a lean cost structure and improving margins

Financial Review

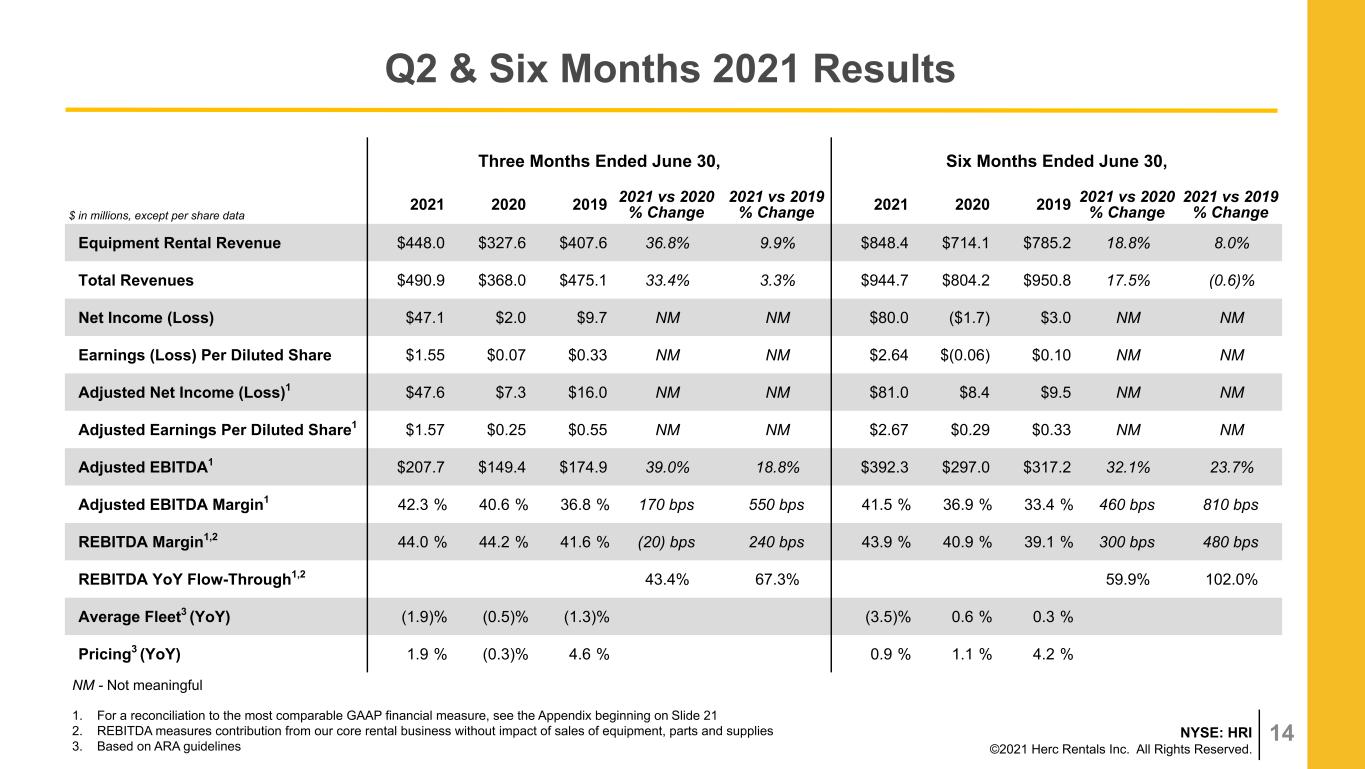

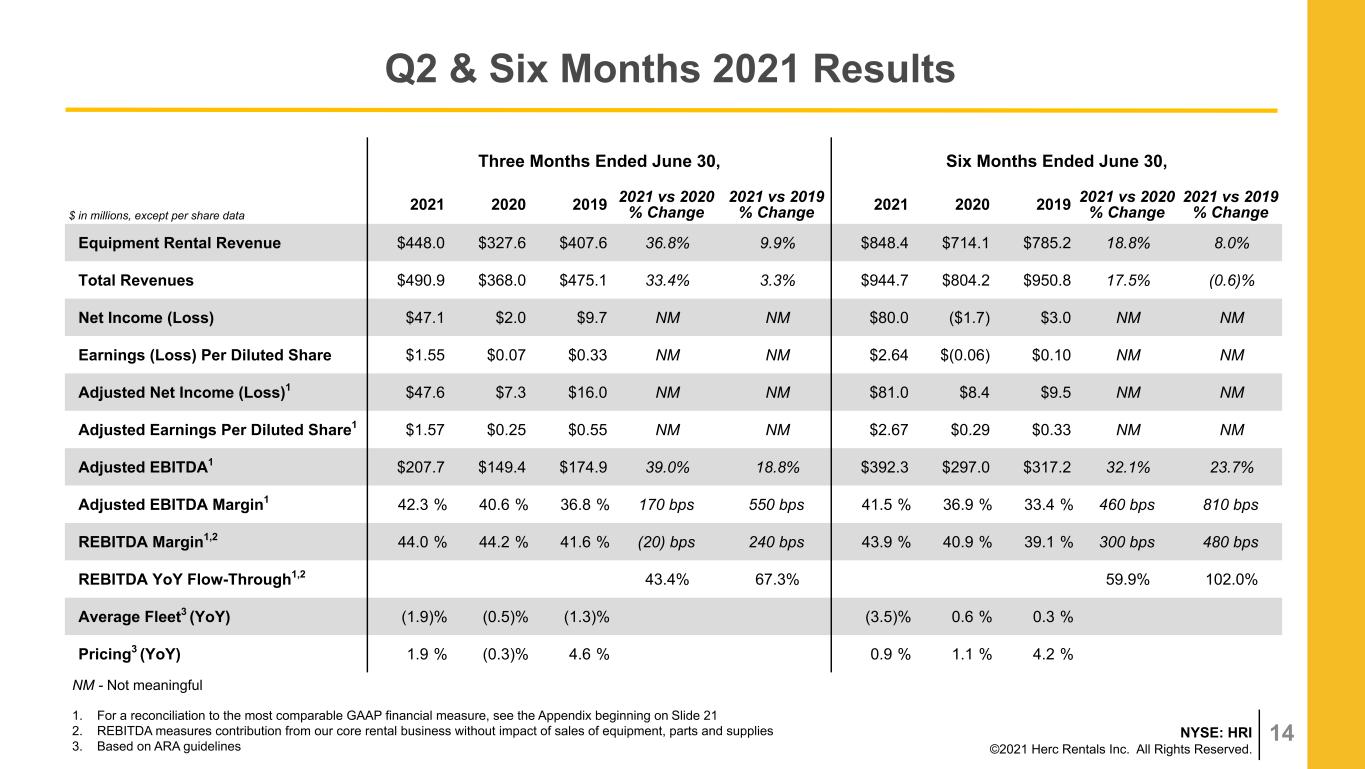

14NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Q2 & Six Months 2021 Results Three Months Ended June 30, Six Months Ended June 30, $ in millions, except per share data 2021 2020 2019 2021 vs 2020 % Change 2021 vs 2019 % Change 2021 2020 2019 2021 vs 2020 % Change 2021 vs 2019 % Change Equipment Rental Revenue $448.0 $327.6 $407.6 36.8% 9.9% $848.4 $714.1 $785.2 18.8% 8.0% Total Revenues $490.9 $368.0 $475.1 33.4% 3.3% $944.7 $804.2 $950.8 17.5% (0.6)% Net Income (Loss) $47.1 $2.0 $9.7 NM NM $80.0 ($1.7) $3.0 NM NM Earnings (Loss) Per Diluted Share $1.55 $0.07 $0.33 NM NM $2.64 $(0.06) $0.10 NM NM Adjusted Net Income (Loss)1 $47.6 $7.3 $16.0 NM NM $81.0 $8.4 $9.5 NM NM Adjusted Earnings Per Diluted Share1 $1.57 $0.25 $0.55 NM NM $2.67 $0.29 $0.33 NM NM Adjusted EBITDA1 $207.7 $149.4 $174.9 39.0% 18.8% $392.3 $297.0 $317.2 32.1% 23.7% Adjusted EBITDA Margin1 42.3 % 40.6 % 36.8 % 170 bps 550 bps 41.5 % 36.9 % 33.4 % 460 bps 810 bps REBITDA Margin1,2 44.0 % 44.2 % 41.6 % (20) bps 240 bps 43.9 % 40.9 % 39.1 % 300 bps 480 bps REBITDA YoY Flow-Through1,2 43.4% 67.3% 59.9% 102.0% Average Fleet3 (YoY) (1.9) % (0.5) % (1.3) % (3.5) % 0.6 % 0.3 % Pricing3 (YoY) 1.9 % (0.3) % 4.6 % 0.9 % 1.1 % 4.2 % 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines NM - Not meaningful

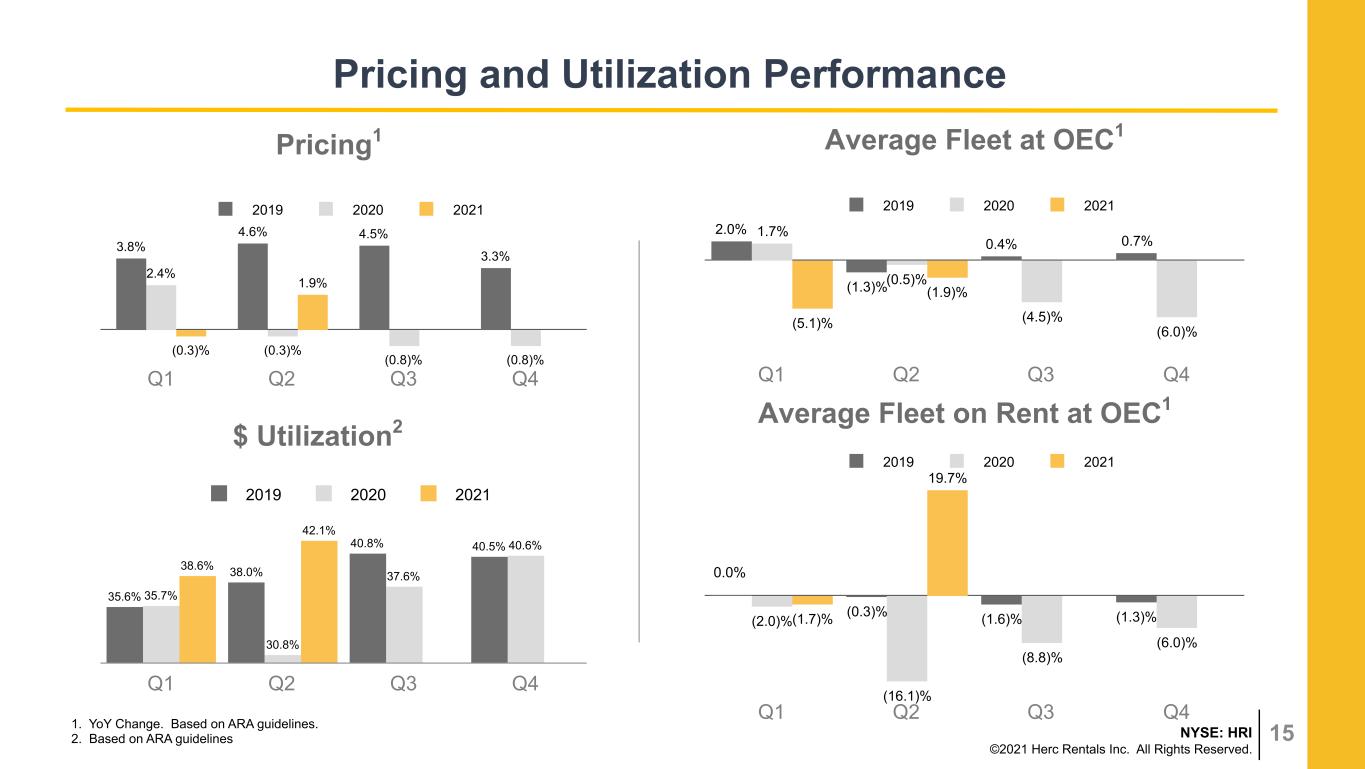

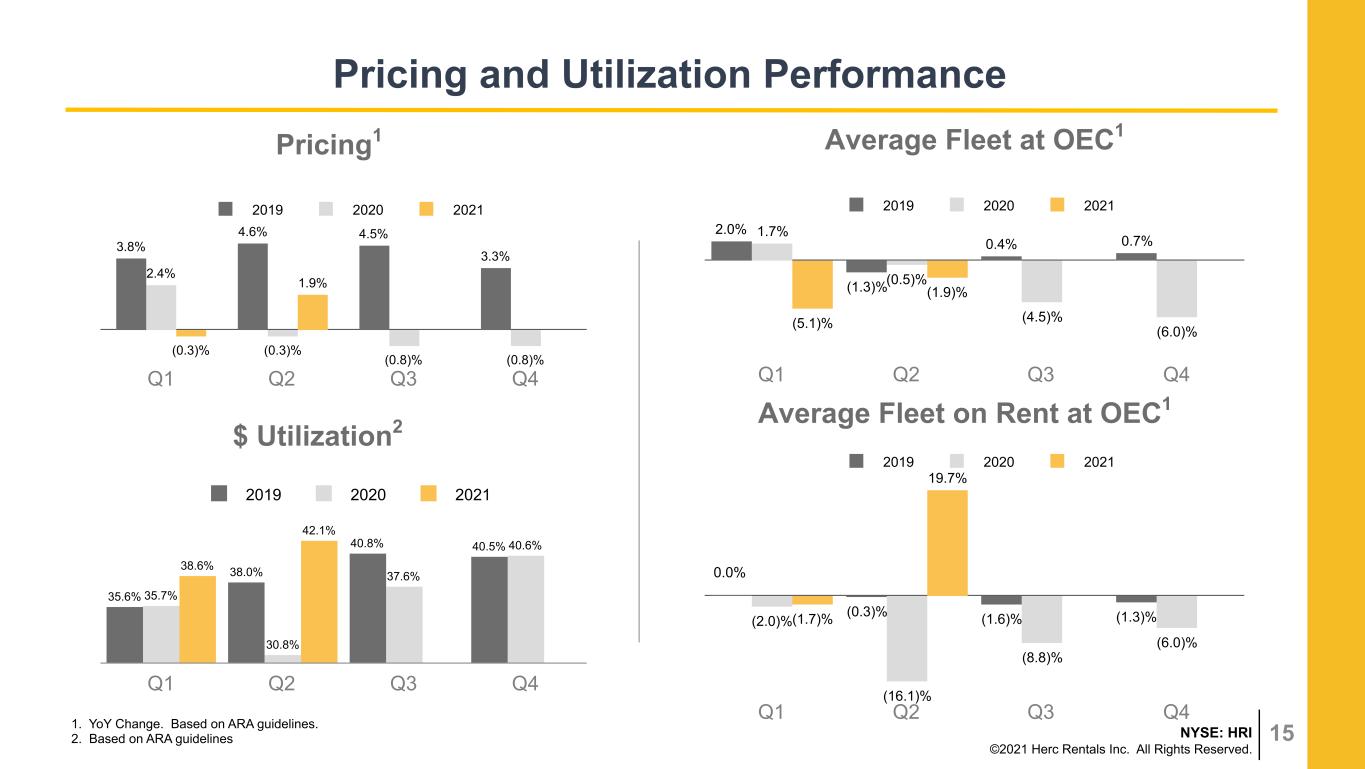

15NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. (0.3)% (1.6)% (1.3)%(2.0)% (16.1)% (8.8)% (6.0)% (1.7)% 19.7% 2019 2020 2021 Q1 Q2 Q3 Q4 2.0% (1.3)% 0.4% 0.7% 1.7% (0.5)% (4.5)% (6.0)%(5.1)% (1.9)% 2019 2020 2021 Q1 Q2 Q3 Q4 Pricing1 35.6% 38.0% 40.8% 40.5% 35.7% 30.8% 37.6% 40.6% 38.6% 42.1% 2019 2020 2021 Q1 Q2 Q3 Q4 Pricing and Utilization Performance 1. YoY Change. Based on ARA guidelines. 2. Based on ARA guidelines 3.8% 4.6% 4.5% 3.3% 2.4% (0.3)% (0.8)% (0.8)% (0.3)% 1.9% 2019 2020 2021 Q1 Q2 Q3 Q4 0.0% Average Fleet at OEC1 Average Fleet on Rent at OEC1 $ Utilization2

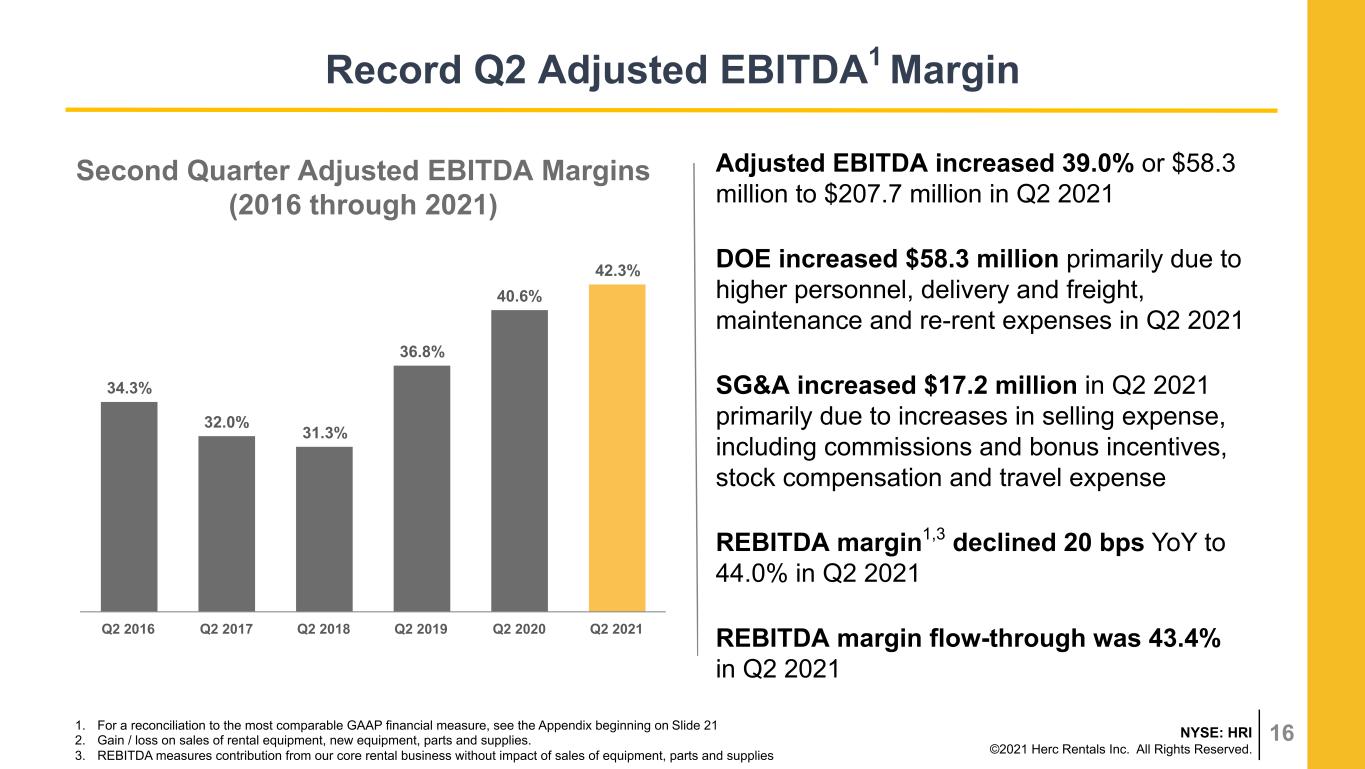

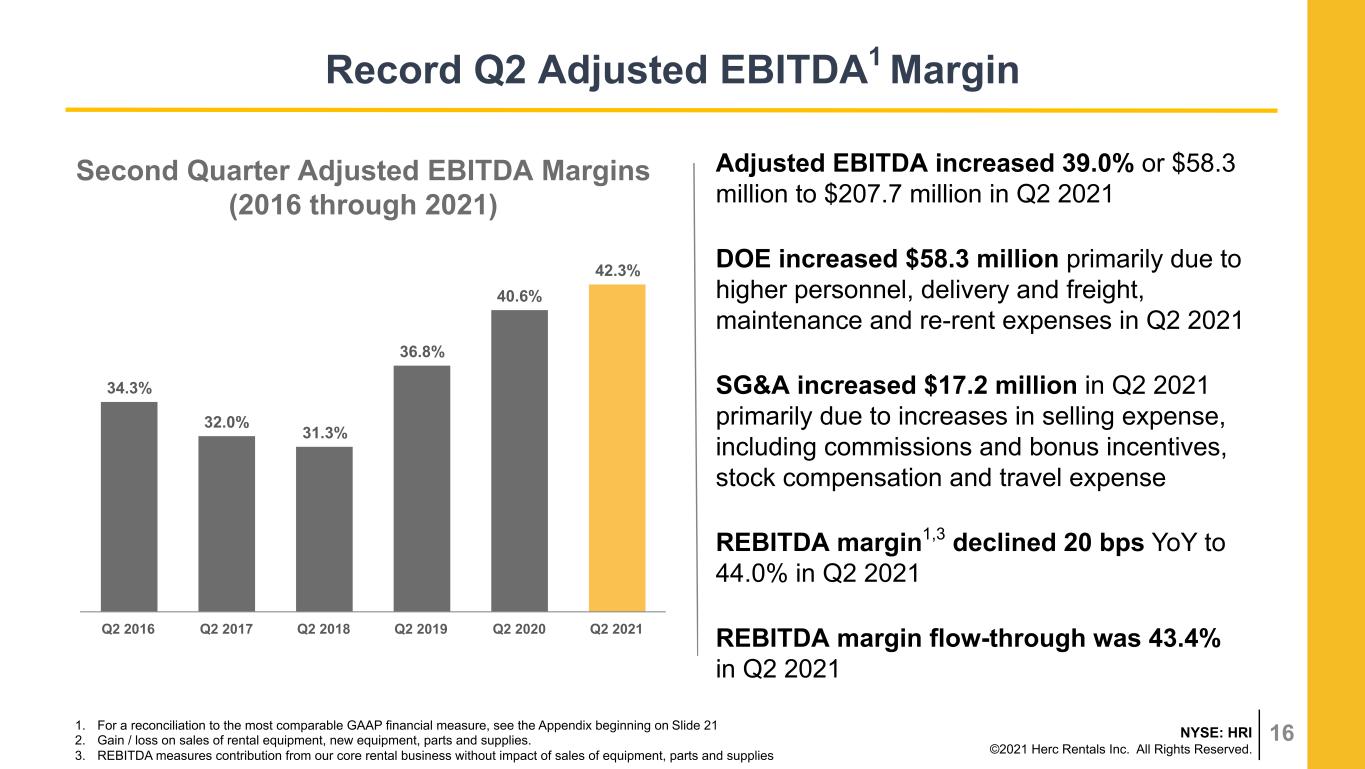

16NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Adjusted EBITDA increased 39.0% or $58.3 million to $207.7 million in Q2 2021 DOE increased $58.3 million primarily due to higher personnel, delivery and freight, maintenance and re-rent expenses in Q2 2021 SG&A increased $17.2 million in Q2 2021 primarily due to increases in selling expense, including commissions and bonus incentives, stock compensation and travel expense REBITDA margin1,3 declined 20 bps YoY to 44.0% in Q2 2021 REBITDA margin flow-through was 43.4% in Q2 2021 Record Q2 Adjusted EBITDA1 Margin 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 2. Gain / loss on sales of rental equipment, new equipment, parts and supplies. 3. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 34.3% 32.0% 31.3% 36.8% 40.6% 42.3% Q2 2016 Q2 2017 Q2 2018 Q2 2019 Q2 2020 Q2 2021 Second Quarter Adjusted EBITDA Margins (2016 through 2021)

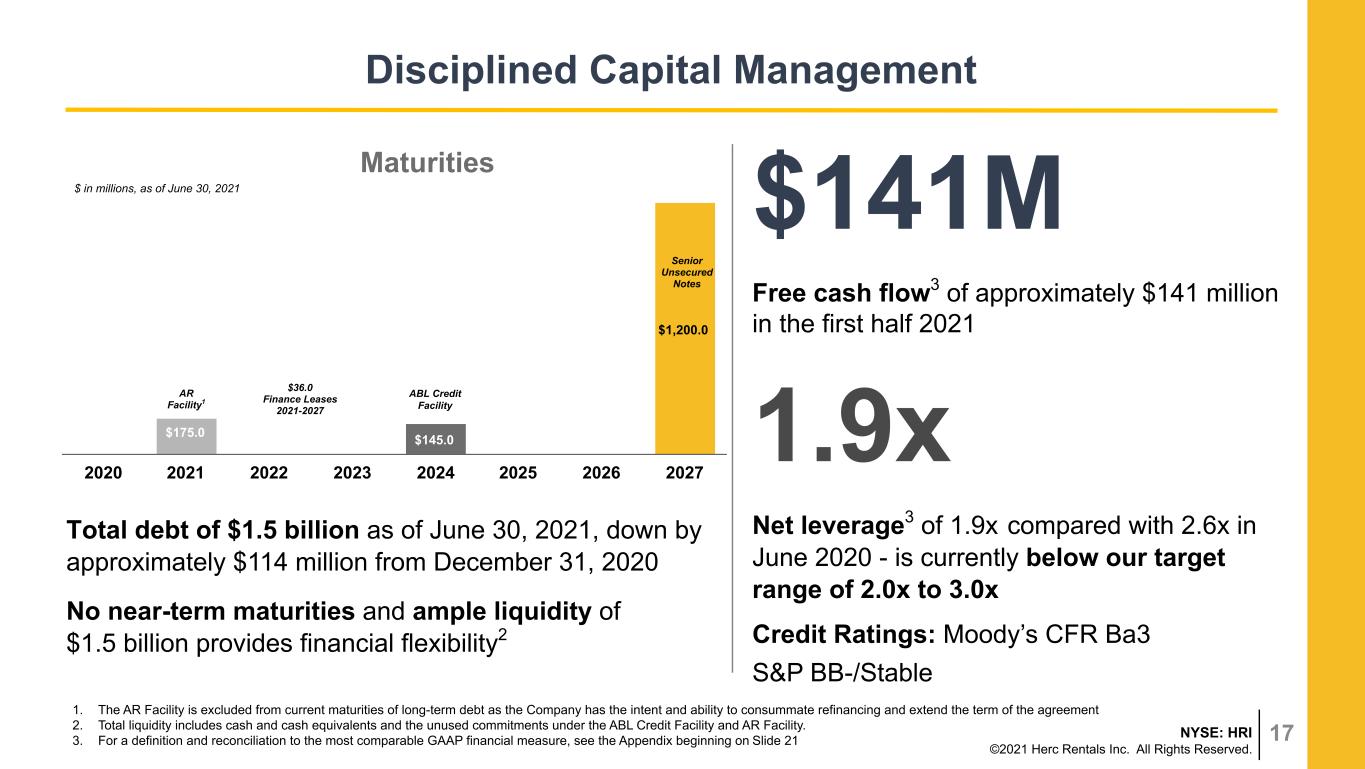

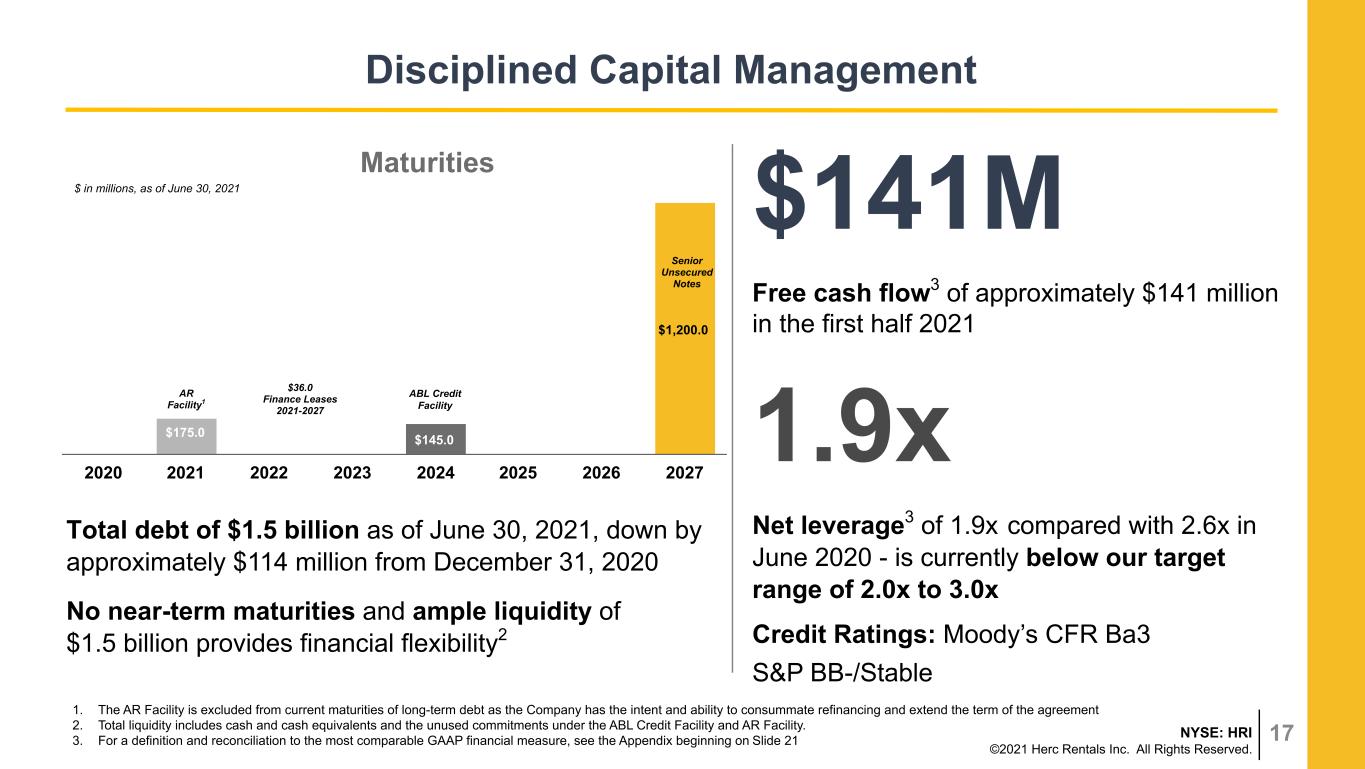

17NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $141M Free cash flow3 of approximately $141 million in the first half 2021 1.9x Net leverage3 of 1.9x compared with 2.6x in June 2020 - is currently below our target range of 2.0x to 3.0x Credit Ratings: Moody’s CFR Ba3 S&P BB-/Stable $1,200.0 $145.0$175.0 2020 2021 2022 2023 2024 2025 2026 2027 Disciplined Capital Management 1. The AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to consummate refinancing and extend the term of the agreement 2. Total liquidity includes cash and cash equivalents and the unused commitments under the ABL Credit Facility and AR Facility. 3. For a definition and reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 $ in millions, as of June 30, 2021 ABL Credit Facility Senior Unsecured Notes Total debt of $1.5 billion as of June 30, 2021, down by approximately $114 million from December 31, 2020 No near-term maturities and ample liquidity of $1.5 billion provides financial flexibility2 AR Facility1 Maturities $36.0 Finance Leases 2021-2027 ABL Credit Facility

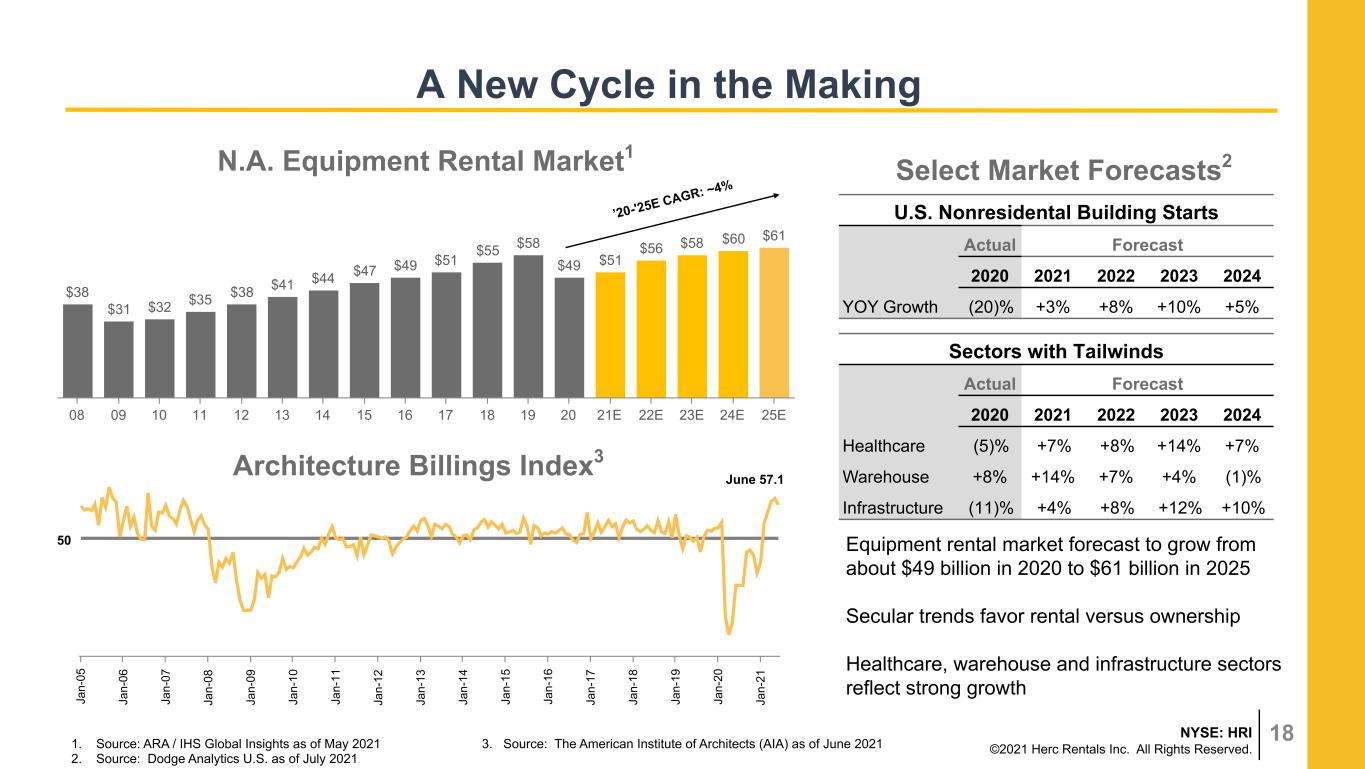

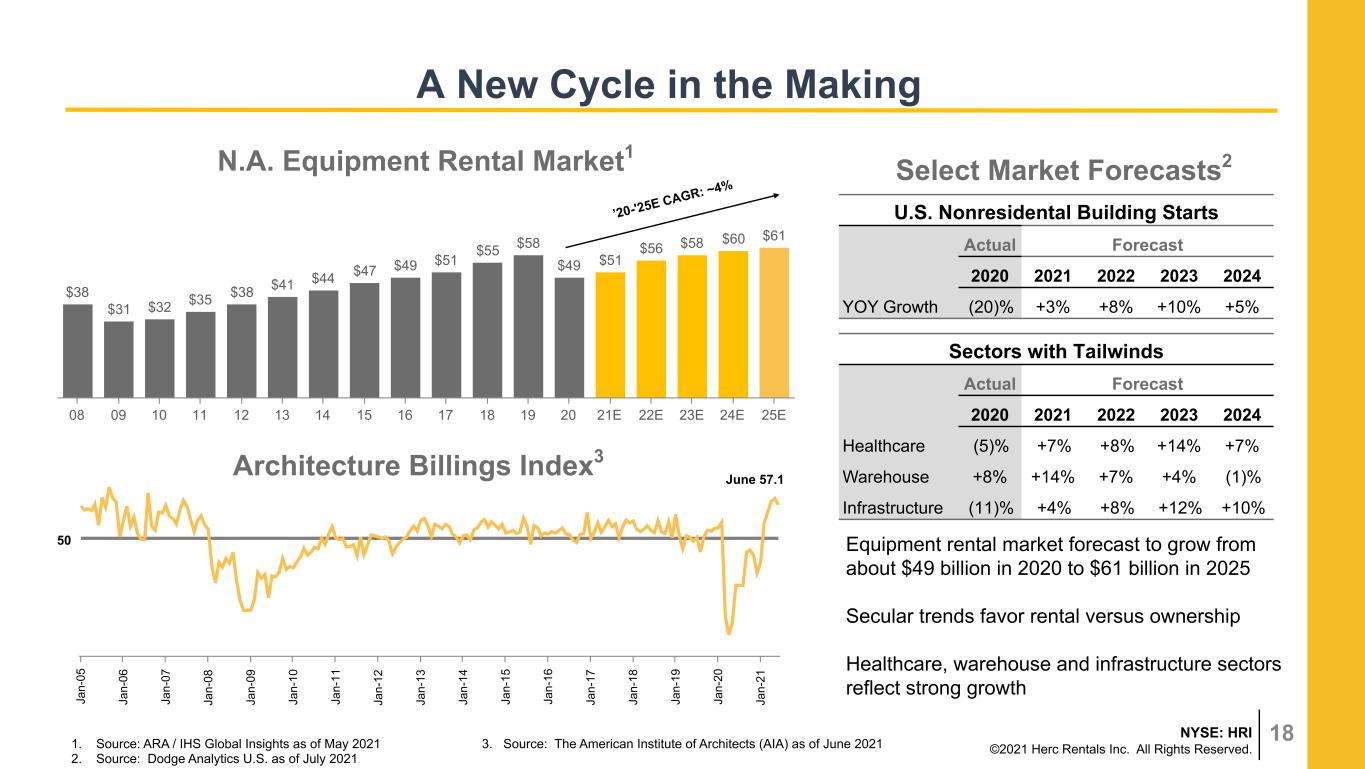

18NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Ja n- 05 Ja n- 06 Ja n- 07 Ja n- 08 Ja n- 09 Ja n- 10 Ja n- 11 Ja n- 12 Ja n- 13 Ja n- 14 Ja n- 15 Ja n- 16 Ja n- 17 Ja n- 18 Ja n- 19 Ja n- 20 Ja n- 21 A New Cycle in the Making 50 1. Source: ARA / IHS Global Insights as of May 2021 3. Source: The American Institute of Architects (AIA) as of June 2021 2. Source: Dodge Analytics U.S. as of July 2021 Architecture Billings Index3 Equipment rental market forecast to grow from about $49 billion in 2020 to $61 billion in 2025 Secular trends favor rental versus ownership Healthcare, warehouse and infrastructure sectors reflect strong growth Select Market Forecasts2 U.S. Nonresidental Building Starts Actual Forecast 2020 2021 2022 2023 2024 YOY Growth (20)% +3% +8% +10% +5% Sectors with Tailwinds Actual Forecast 2020 2021 2022 2023 2024 Healthcare (5)% +7% +8% +14% +7% Warehouse +8% +14% +7% +4% (1)% Infrastructure (11)% +4% +8% +12% +10% June 57.1 $38 $31 $32 $35 $38 $41 $44 $47 $49 $51 $55 $58 $49 $51 $56 $58 $60 $61 08 09 10 11 12 13 14 15 16 17 18 19 20 21E 22E 23E 24E 25E N.A. Equipment Rental Market1 ’20-'25E CAGR: ~4%

19NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Previous Current Adjusted EBITDA $800 to $840 million $840 to $870 million Net Rental Equipment Capital Expenditures $400 to $450 million $500 to $550 million Raising 2021 Full Year Guidance

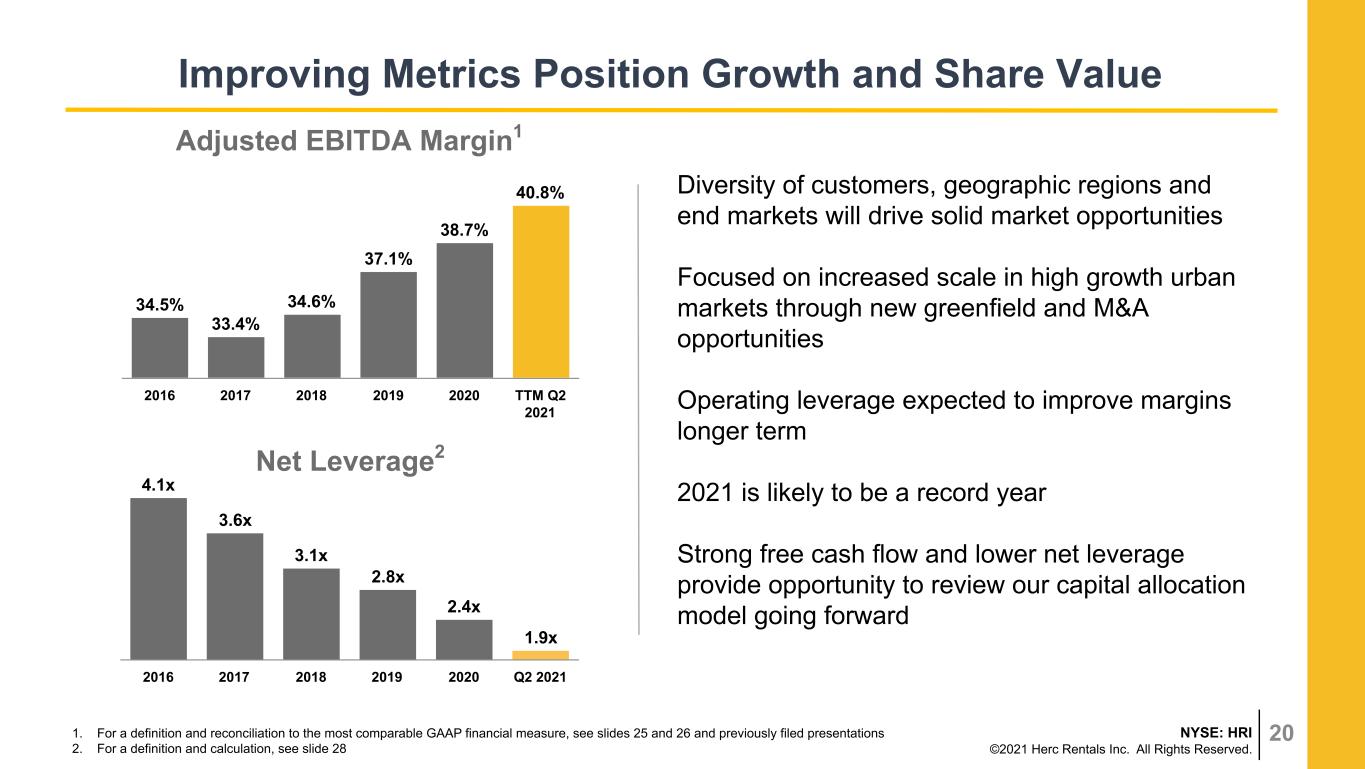

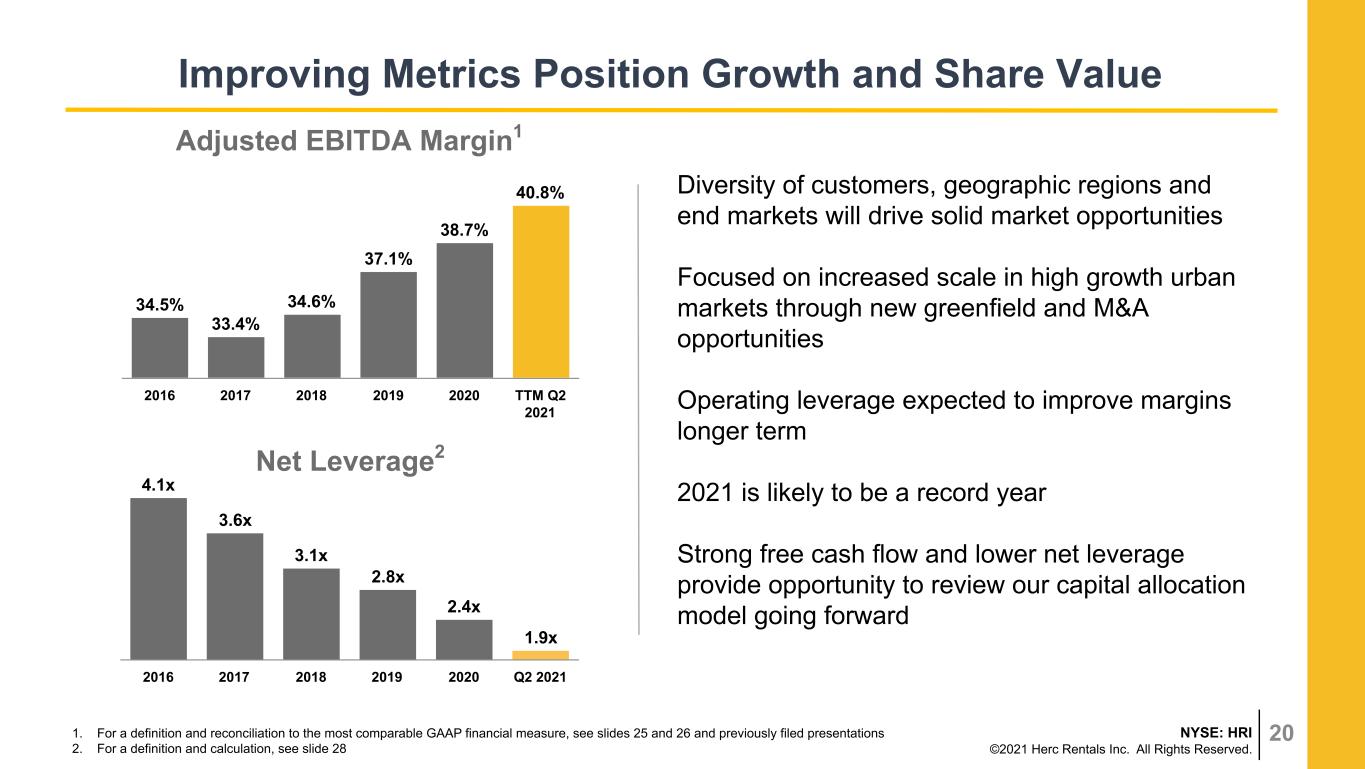

20NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Improving Metrics Position Growth and Share Value 4.1x 3.6x 3.1x 2.8x 2.4x 1.9x 2016 2017 2018 2019 2020 Q2 2021 34.5% 33.4% 34.6% 37.1% 38.7% 40.8% 2016 2017 2018 2019 2020 TTM Q2 2021 Net Leverage2 Adjusted EBITDA Margin1 1. For a definition and reconciliation to the most comparable GAAP financial measure, see slides 25 and 26 and previously filed presentations 2. For a definition and calculation, see slide 28 Diversity of customers, geographic regions and end markets will drive solid market opportunities Focused on increased scale in high growth urban markets through new greenfield and M&A opportunities Operating leverage expected to improve margins longer term 2021 is likely to be a record year Strong free cash flow and lower net leverage provide opportunity to review our capital allocation model going forward

Appendix

22NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Develop Our People and Culture Attract and retain diverse talent Align performance to shared purpose Support a safe and healthy work place culture Expand continuous learning to all employees Our Strategic Initiatives are Delivering Results Improve Operating Effectiveness Improve sales force effectiveness Improve safety and labor productivity Increase density in large urban markets Improve vendor management and fleet availability Enhance Customer Experience Provide premium products and solutions-based services Introduce innovative technology solutions Maintain COVID-19 protocols to protect customers and employees Disciplined Capital Management Drive EBITDA margin growth Maximize fleet management and utilization Operate within new net leverage target range of 2.0x to 3.0x Expand and Diversify Revenues Broaden customer base Expand products and services Grow pricing and ancillary revenues Seek accretive M&A in selective geographies, verticals and selected products

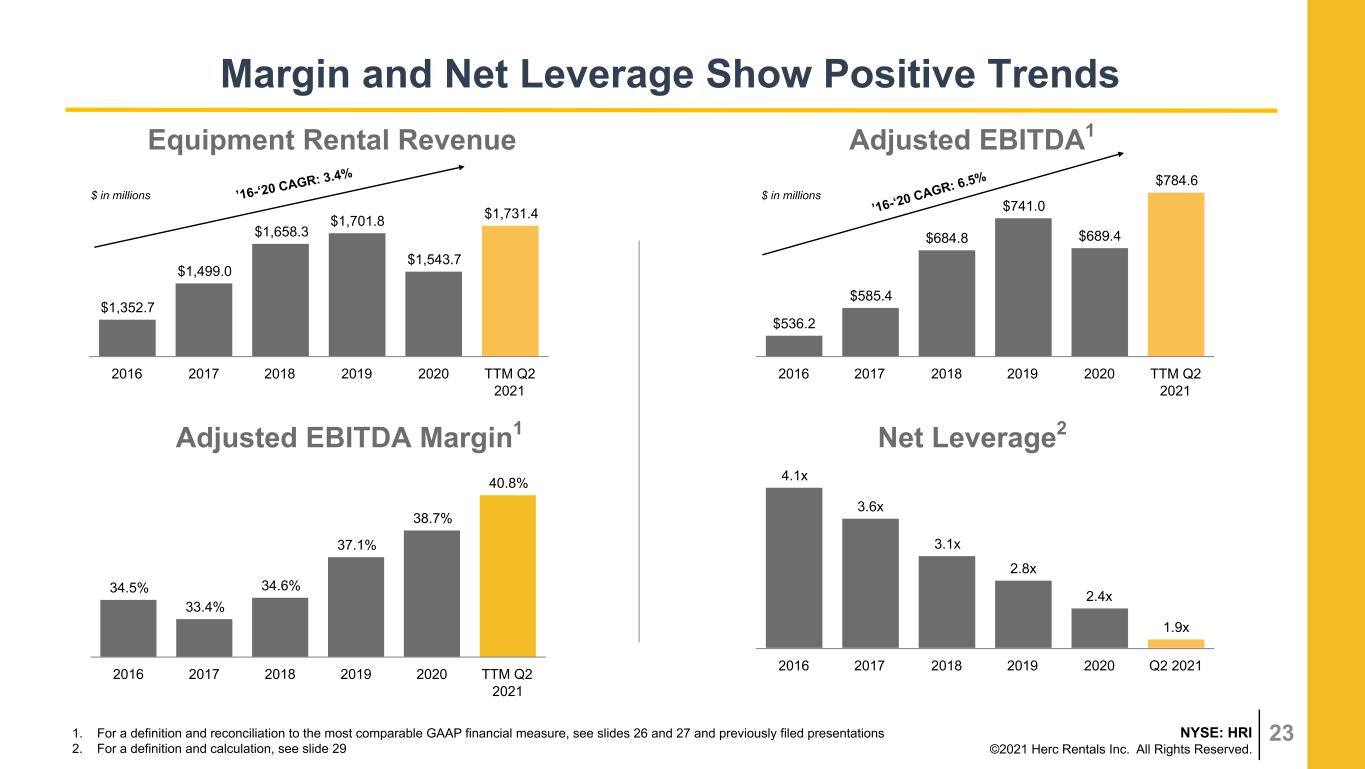

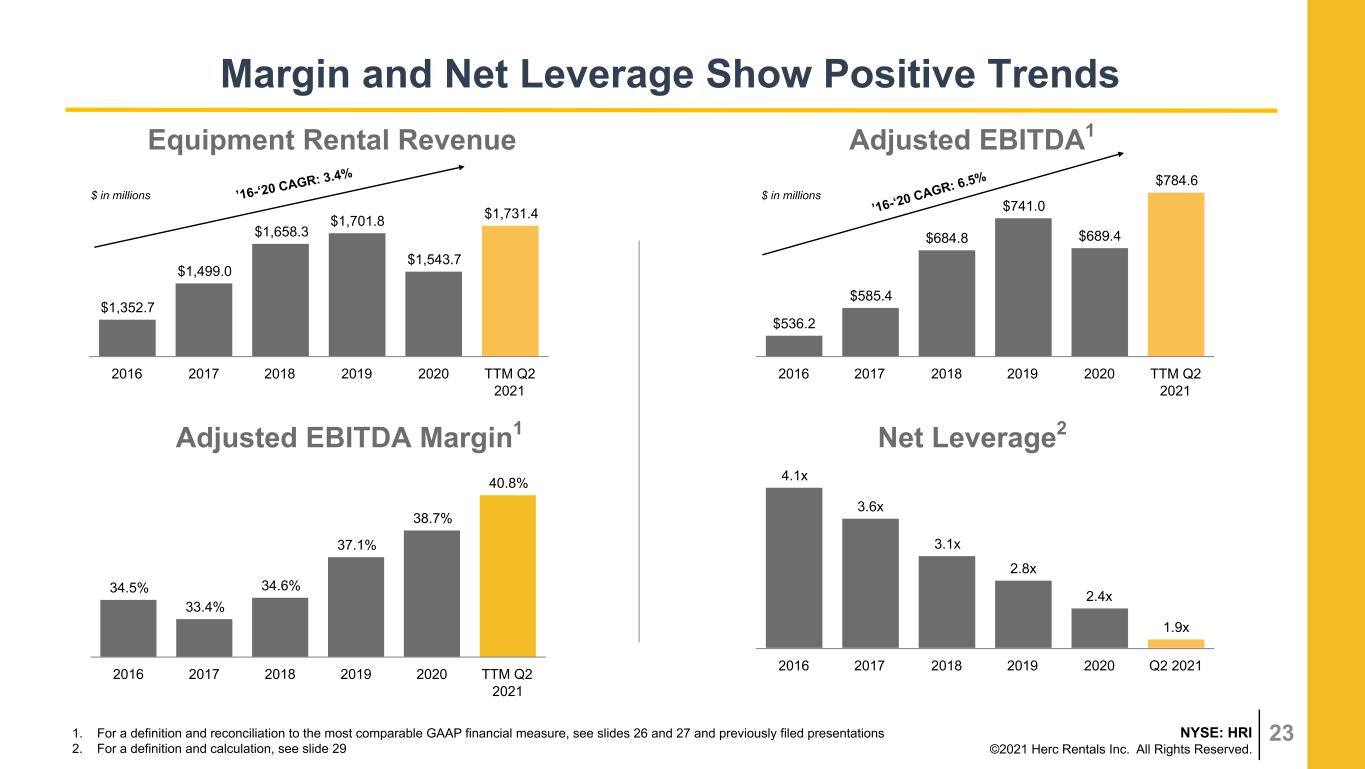

23NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $536.2 $585.4 $684.8 $741.0 $689.4 $784.6 2016 2017 2018 2019 2020 TTM Q2 2021 Margin and Net Leverage Show Positive Trends Equipment Rental Revenue 4.1x 3.6x 3.1x 2.8x 2.4x 1.9x 2016 2017 2018 2019 2020 Q2 2021 34.5% 33.4% 34.6% 37.1% 38.7% 40.8% 2016 2017 2018 2019 2020 TTM Q2 2021 Net Leverage2Adjusted EBITDA Margin1 Adjusted EBITDA1 1. For a definition and reconciliation to the most comparable GAAP financial measure, see slides 26 and 27 and previously filed presentations 2. For a definition and calculation, see slide 29 $ in millions $ in millions $1,352.7 $1,499.0 $1,658.3 $1,701.8 $1,543.7 $1,731.4 2016 2017 2018 2019 2020 TTM Q2 2021 ’16-‘20 CAGR: 3.4% ’16-‘20 CAGR: 6.5%

24NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental Association (ARA), which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date). Fleet Age: The OEC weighted age of the entire fleet, based on ARA guidelines. Glossary of Terms Commonly Used in the Industry Net Fleet Capital Expenditures: Capital expenditures of rental equipment minus the proceeds from disposal of rental equipment. Dollar Utilization ($ UT): Dollar utilization is an operating measure calculated by dividing equipment rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on ARA guidelines. Pricing: Change in pure pricing achieved in one period versus another period. This is applied both to year-over-year and sequential comparisons. Rental rates are based on ARA guidelines and are calculated based on the category class rate variance achieved either year-over-year or sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

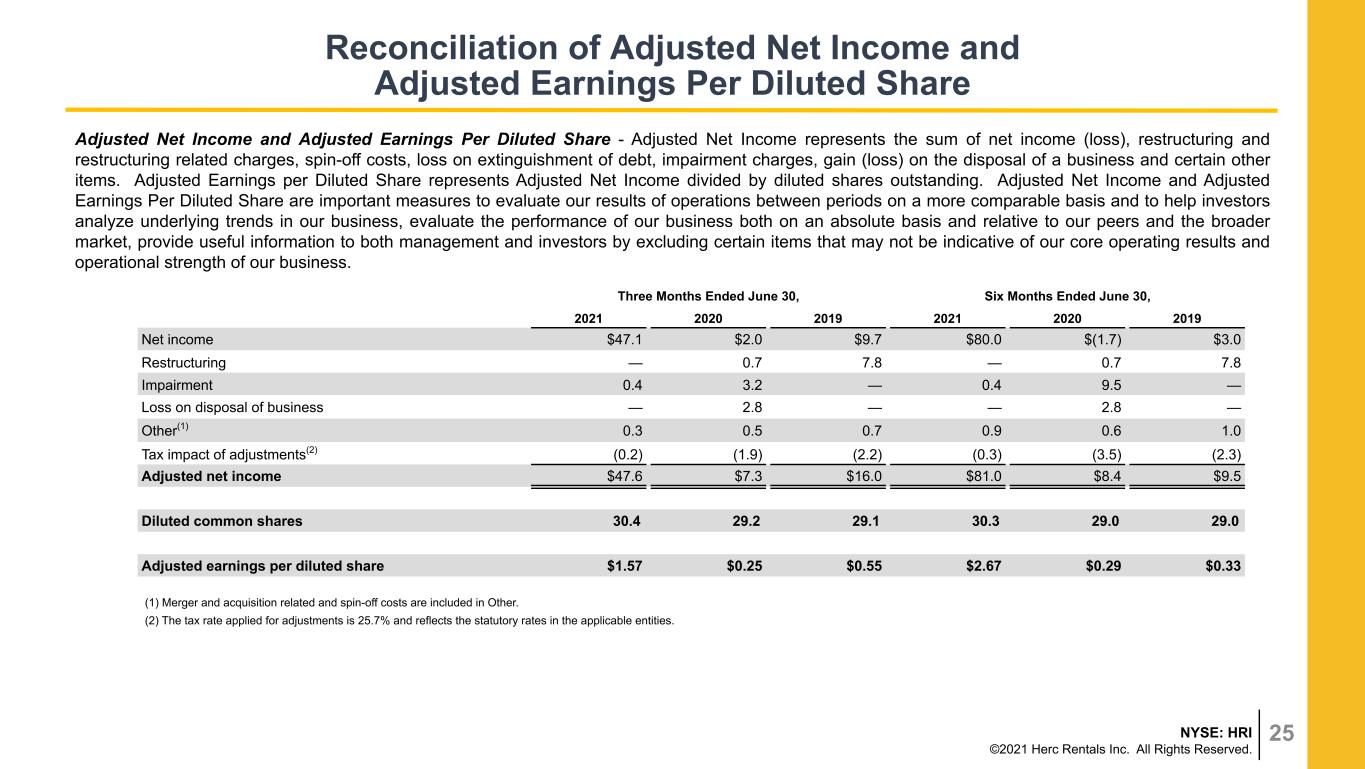

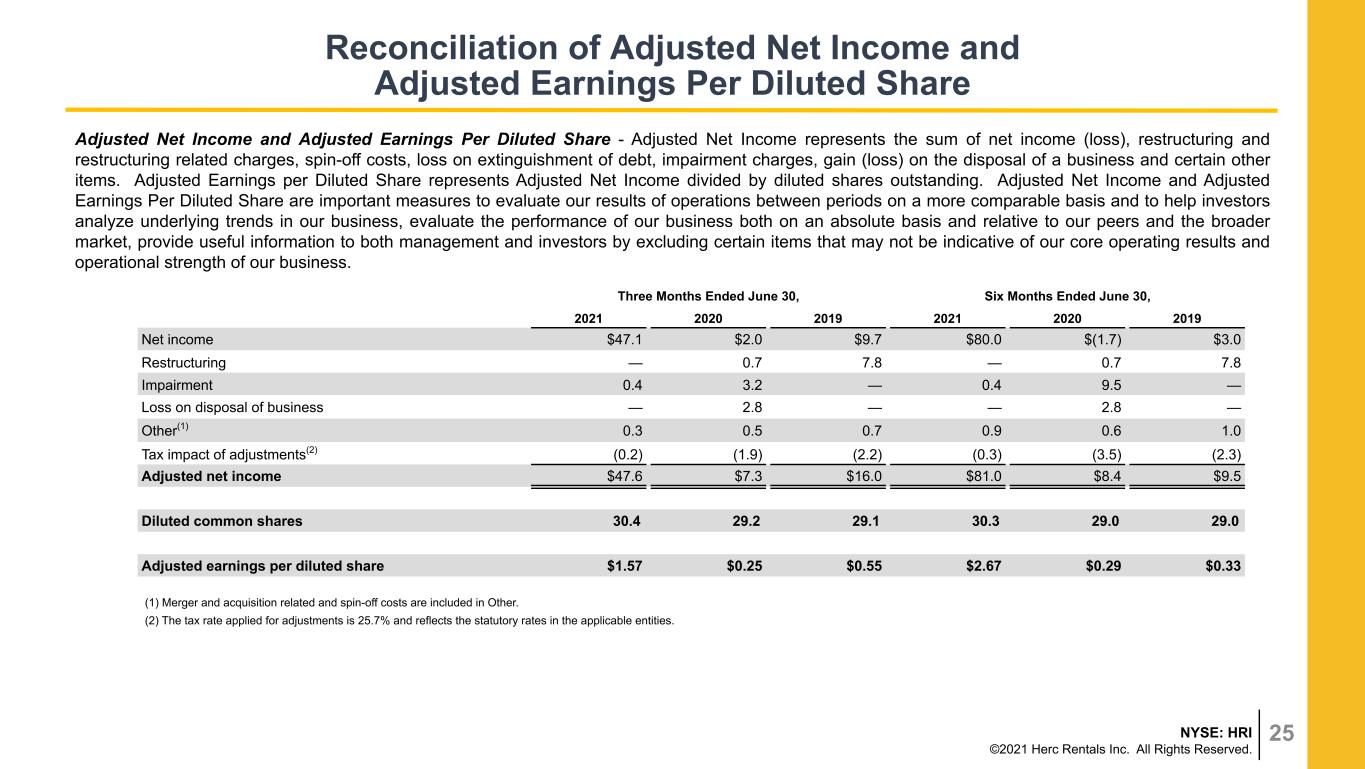

25NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2019 2021 2020 2019 Net income $47.1 $2.0 $9.7 $80.0 $(1.7) $3.0 Restructuring — 0.7 7.8 — 0.7 7.8 Impairment 0.4 3.2 — 0.4 9.5 — Loss on disposal of business — 2.8 — — 2.8 — Other(1) 0.3 0.5 0.7 0.9 0.6 1.0 Tax impact of adjustments(2) (0.2) (1.9) (2.2) (0.3) (3.5) (2.3) Adjusted net income $47.6 $7.3 $16.0 $81.0 $8.4 $9.5 Diluted common shares 30.4 29.2 29.1 30.3 29.0 29.0 Adjusted earnings per diluted share $1.57 $0.25 $0.55 $2.67 $0.29 $0.33 Reconciliation of Adjusted Net Income and Adjusted Earnings Per Diluted Share Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income (loss), restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. (1) Merger and acquisition related and spin-off costs are included in Other. (2) The tax rate applied for adjustments is 25.7% and reflects the statutory rates in the applicable entities.

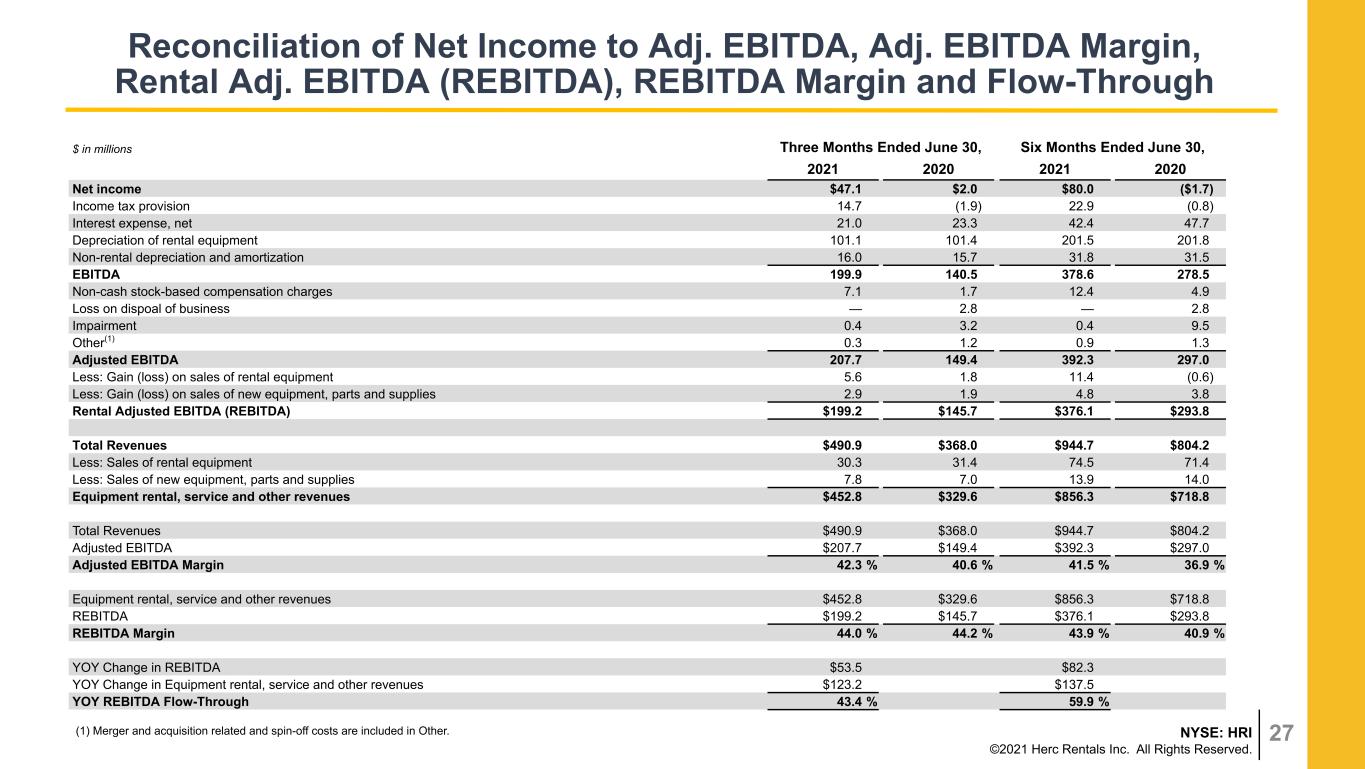

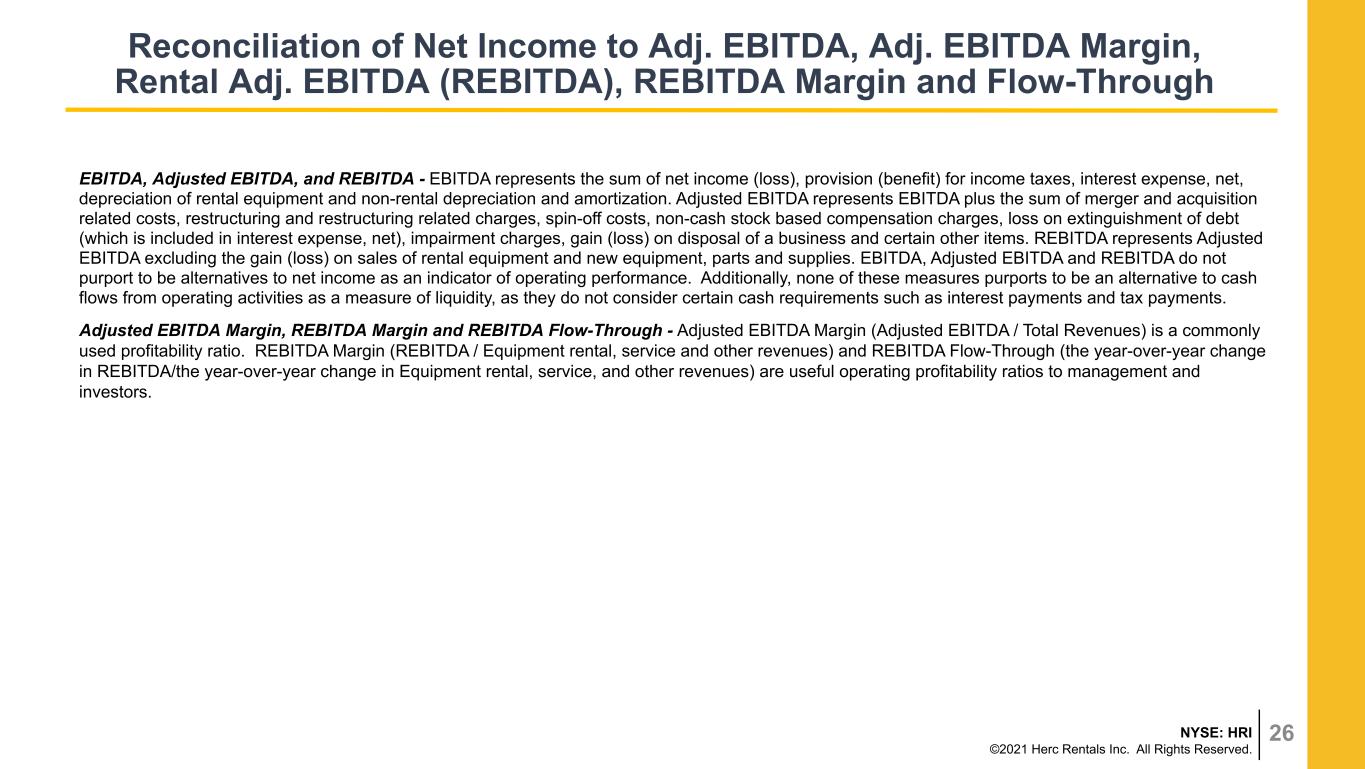

26NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Reconciliation of Net Income to Adj. EBITDA, Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through EBITDA, Adjusted EBITDA, and REBITDA - EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of merger and acquisition related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on disposal of a business and certain other items. REBITDA represents Adjusted EBITDA excluding the gain (loss) on sales of rental equipment and new equipment, parts and supplies. EBITDA, Adjusted EBITDA and REBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, none of these measures purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments. Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through - Adjusted EBITDA Margin (Adjusted EBITDA / Total Revenues) is a commonly used profitability ratio. REBITDA Margin (REBITDA / Equipment rental, service and other revenues) and REBITDA Flow-Through (the year-over-year change in REBITDA/the year-over-year change in Equipment rental, service, and other revenues) are useful operating profitability ratios to management and investors.

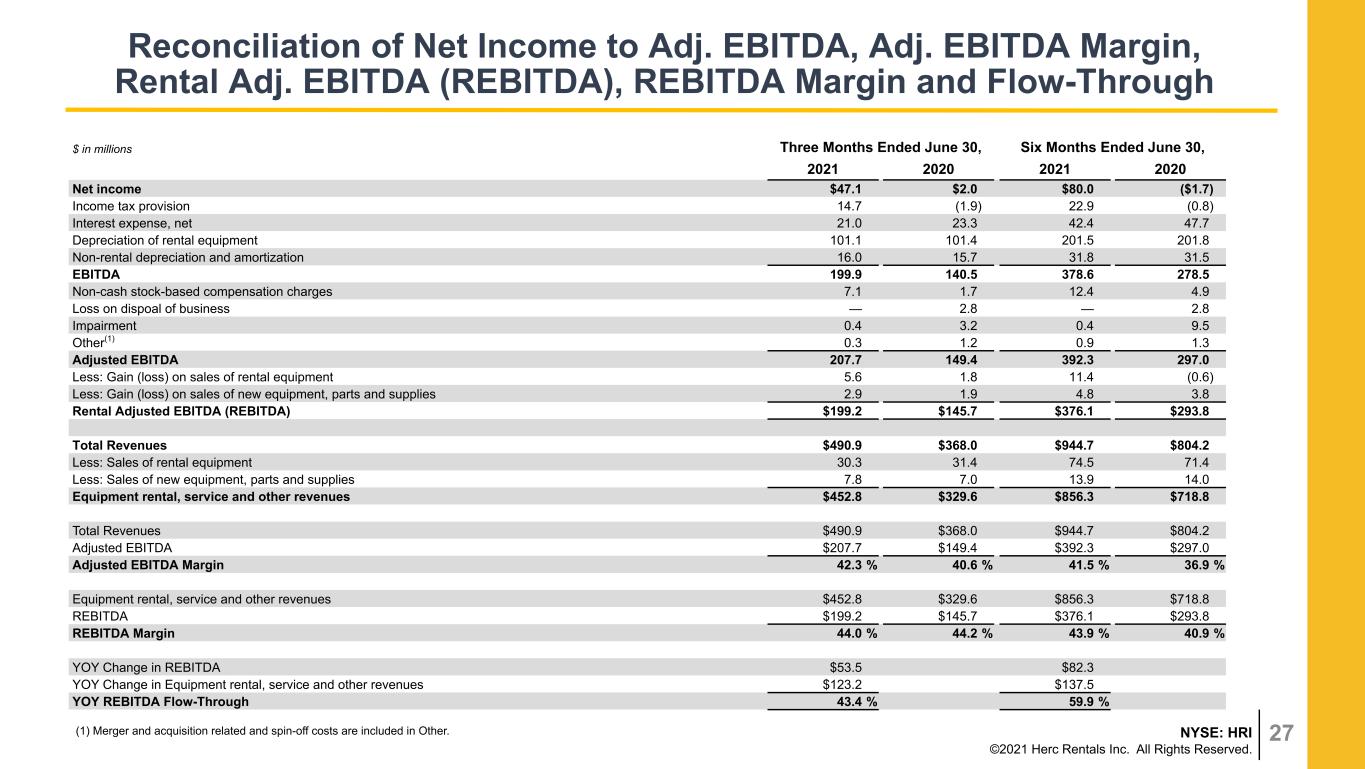

27NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $ in millions Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net income $47.1 $2.0 $80.0 ($1.7) Income tax provision 14.7 (1.9) 22.9 (0.8) Interest expense, net 21.0 23.3 42.4 47.7 Depreciation of rental equipment 101.1 101.4 201.5 201.8 Non-rental depreciation and amortization 16.0 15.7 31.8 31.5 EBITDA 199.9 140.5 378.6 278.5 Non-cash stock-based compensation charges 7.1 1.7 12.4 4.9 Loss on dispoal of business — 2.8 — 2.8 Impairment 0.4 3.2 0.4 9.5 Other(1) 0.3 1.2 0.9 1.3 Adjusted EBITDA 207.7 149.4 392.3 297.0 Less: Gain (loss) on sales of rental equipment 5.6 1.8 11.4 (0.6) Less: Gain (loss) on sales of new equipment, parts and supplies 2.9 1.9 4.8 3.8 Rental Adjusted EBITDA (REBITDA) $199.2 $145.7 $376.1 $293.8 Total Revenues $490.9 $368.0 $944.7 $804.2 Less: Sales of rental equipment 30.3 31.4 74.5 71.4 Less: Sales of new equipment, parts and supplies 7.8 7.0 13.9 14.0 Equipment rental, service and other revenues $452.8 $329.6 $856.3 $718.8 Total Revenues $490.9 $368.0 $944.7 $804.2 Adjusted EBITDA $207.7 $149.4 $392.3 $297.0 Adjusted EBITDA Margin 42.3 % 40.6 % 41.5 % 36.9 % Equipment rental, service and other revenues $452.8 $329.6 $856.3 $718.8 REBITDA $199.2 $145.7 $376.1 $293.8 REBITDA Margin 44.0 % 44.2 % 43.9 % 40.9 % YOY Change in REBITDA $53.5 $82.3 YOY Change in Equipment rental, service and other revenues $123.2 $137.5 YOY REBITDA Flow-Through 43.4 % 59.9 % Reconciliation of Net Income to Adj. EBITDA, Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through (1) Merger and acquisition related and spin-off costs are included in Other.

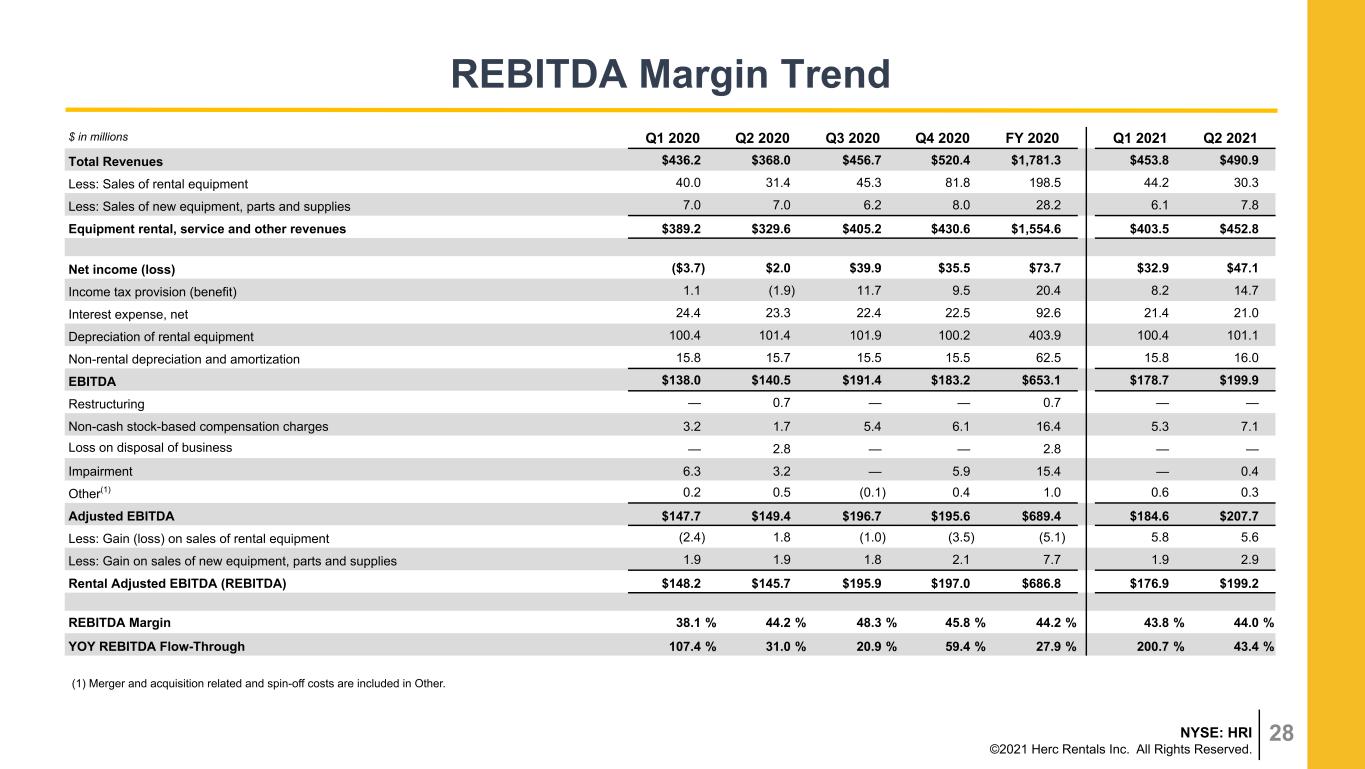

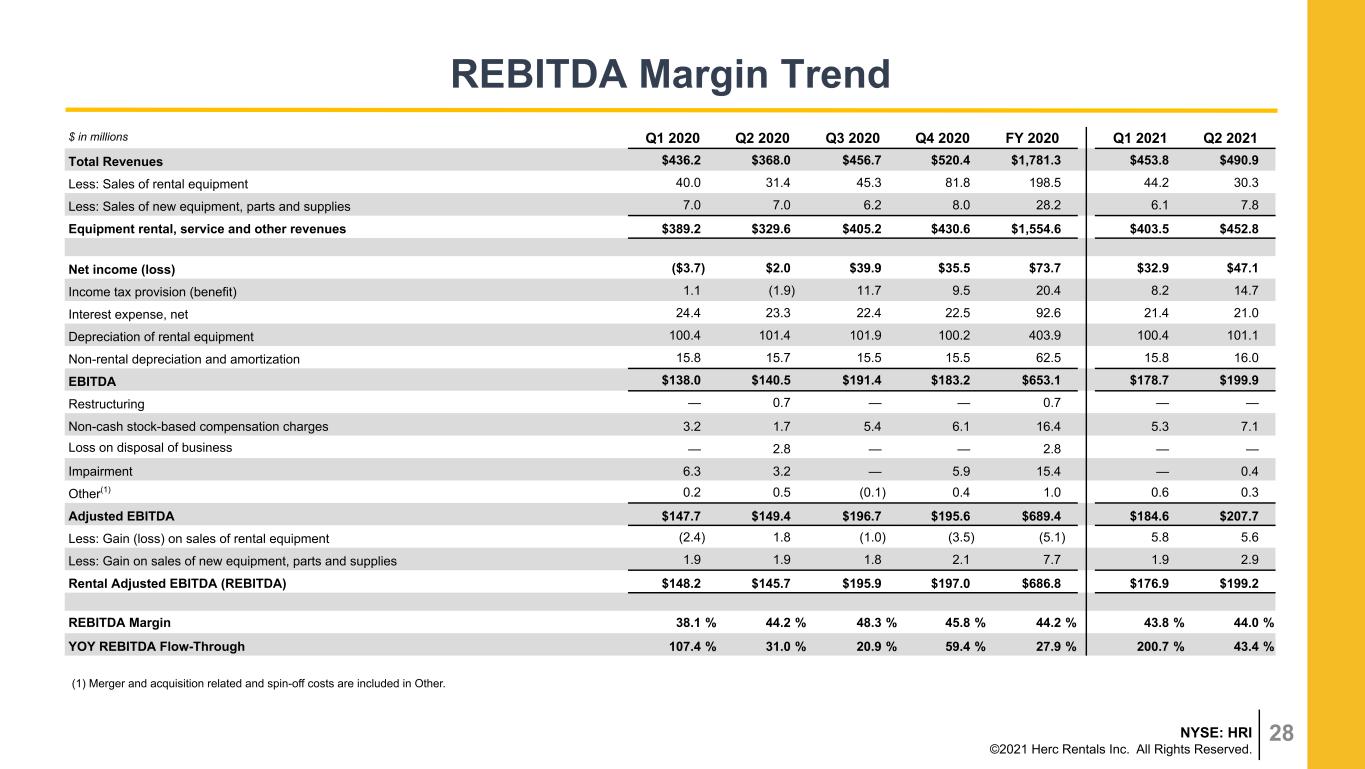

28NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $ in millions Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2021 Q2 2021 Total Revenues $436.2 $368.0 $456.7 $520.4 $1,781.3 $453.8 $490.9 Less: Sales of rental equipment 40.0 31.4 45.3 81.8 198.5 44.2 30.3 Less: Sales of new equipment, parts and supplies 7.0 7.0 6.2 8.0 28.2 6.1 7.8 Equipment rental, service and other revenues $389.2 $329.6 $405.2 $430.6 $1,554.6 $403.5 $452.8 Net income (loss) ($3.7) $2.0 $39.9 $35.5 $73.7 $32.9 $47.1 Income tax provision (benefit) 1.1 (1.9) 11.7 9.5 20.4 8.2 14.7 Interest expense, net 24.4 23.3 22.4 22.5 92.6 21.4 21.0 Depreciation of rental equipment 100.4 101.4 101.9 100.2 403.9 100.4 101.1 Non-rental depreciation and amortization 15.8 15.7 15.5 15.5 62.5 15.8 16.0 EBITDA $138.0 $140.5 $191.4 $183.2 $653.1 $178.7 $199.9 Restructuring — 0.7 — — 0.7 — — Non-cash stock-based compensation charges 3.2 1.7 5.4 6.1 16.4 5.3 7.1 Loss on disposal of business — 2.8 — — 2.8 — — Impairment 6.3 3.2 — 5.9 15.4 — 0.4 Other(1) 0.2 0.5 (0.1) 0.4 1.0 0.6 0.3 Adjusted EBITDA $147.7 $149.4 $196.7 $195.6 $689.4 $184.6 $207.7 Less: Gain (loss) on sales of rental equipment (2.4) 1.8 (1.0) (3.5) (5.1) 5.8 5.6 Less: Gain on sales of new equipment, parts and supplies 1.9 1.9 1.8 2.1 7.7 1.9 2.9 Rental Adjusted EBITDA (REBITDA) $148.2 $145.7 $195.9 $197.0 $686.8 $176.9 $199.2 REBITDA Margin 38.1 % 44.2 % 48.3 % 45.8 % 44.2 % 43.8 % 44.0 % YOY REBITDA Flow-Through 107.4 % 31.0 % 20.9 % 59.4 % 27.9 % 200.7 % 43.4 % REBITDA Margin Trend (1) Merger and acquisition related and spin-off costs are included in Other.

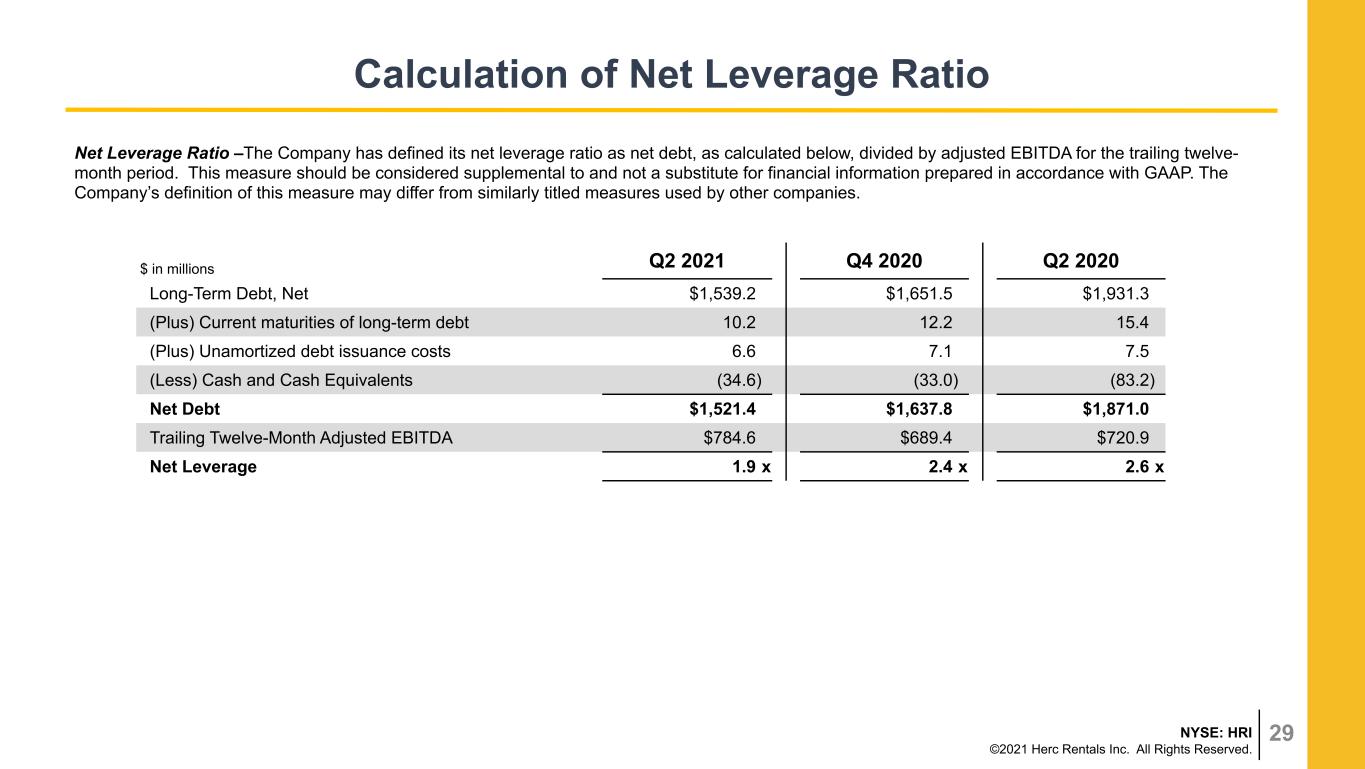

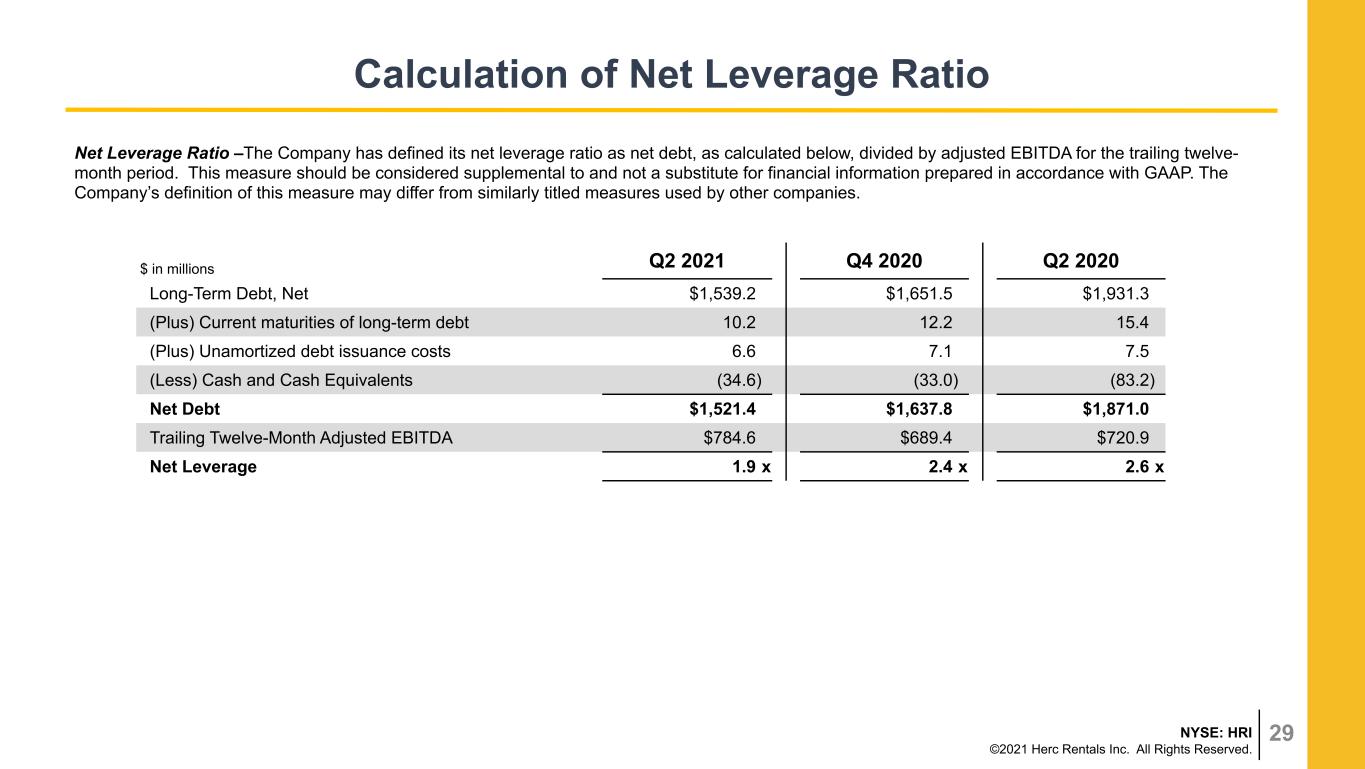

29NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Calculation of Net Leverage Ratio $ in millions Q2 2021 Q4 2020 Q2 2020 Long-Term Debt, Net $1,539.2 $1,651.5 $1,931.3 (Plus) Current maturities of long-term debt 10.2 12.2 15.4 (Plus) Unamortized debt issuance costs 6.6 7.1 7.5 (Less) Cash and Cash Equivalents (34.6) (33.0) (83.2) Net Debt $1,521.4 $1,637.8 $1,871.0 Trailing Twelve-Month Adjusted EBITDA $784.6 $689.4 $720.9 Net Leverage 1.9 x 2.4 x 2.6 x Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve- month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies.

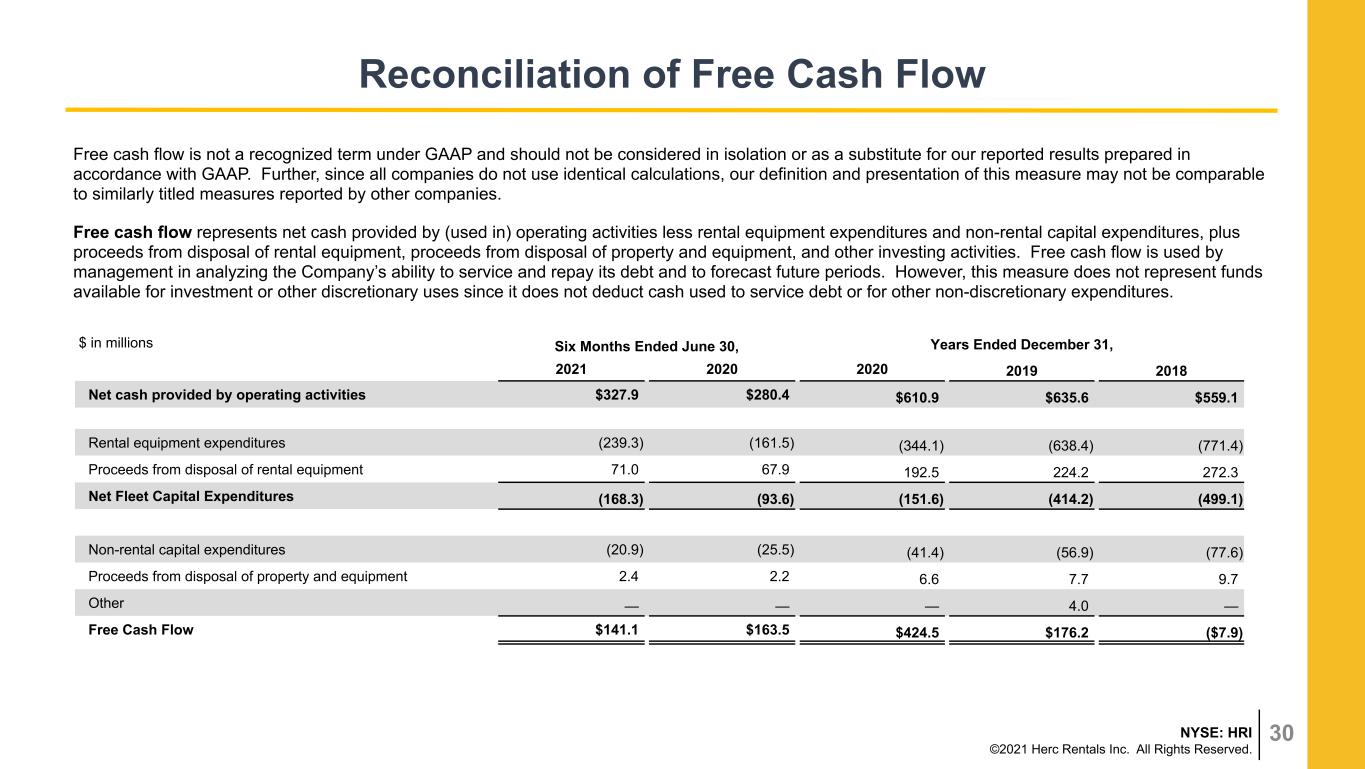

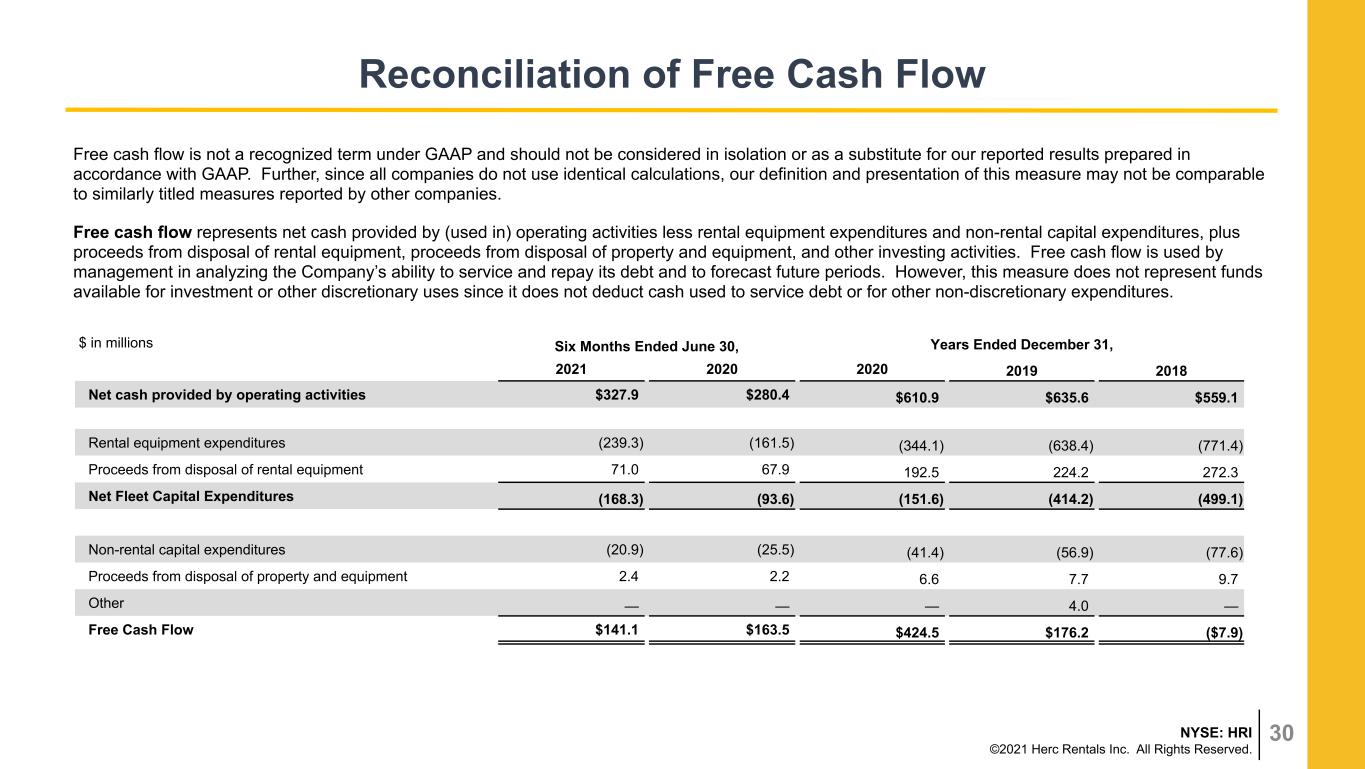

30NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Reconciliation of Free Cash Flow Free cash flow is not a recognized term under GAAP and should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP. Further, since all companies do not use identical calculations, our definition and presentation of this measure may not be comparable to similarly titled measures reported by other companies. Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures. $ in millions Six Months Ended June 30, Years Ended December 31, 2021 2020 2020 2019 2018 Net cash provided by operating activities $327.9 $280.4 $610.9 $635.6 $559.1 Rental equipment expenditures (239.3) (161.5) (344.1) (638.4) (771.4) Proceeds from disposal of rental equipment 71.0 67.9 192.5 224.2 272.3 Net Fleet Capital Expenditures (168.3) (93.6) (151.6) (414.2) (499.1) Non-rental capital expenditures (20.9) (25.5) (41.4) (56.9) (77.6) Proceeds from disposal of property and equipment 2.4 2.2 6.6 7.7 9.7 Other — — — 4.0 — Free Cash Flow $141.1 $163.5 $424.5 $176.2 ($7.9)

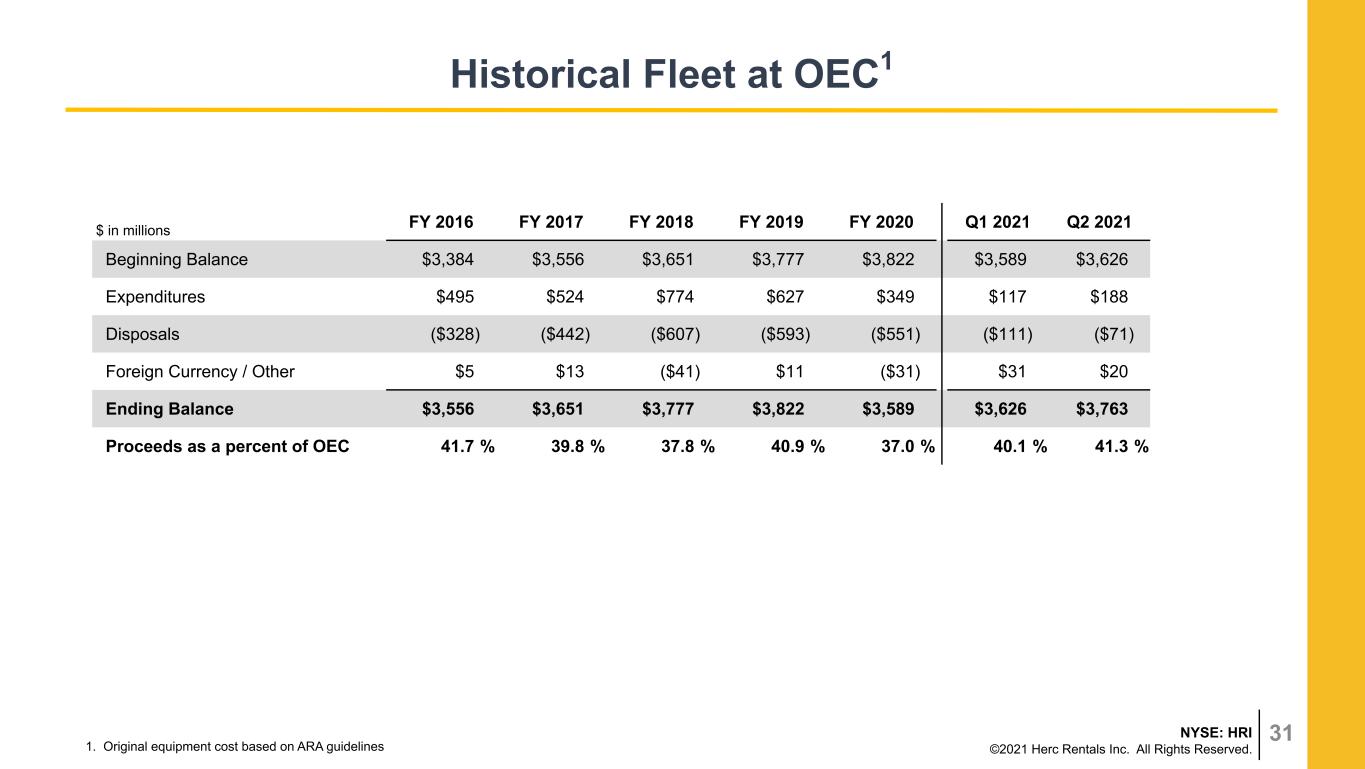

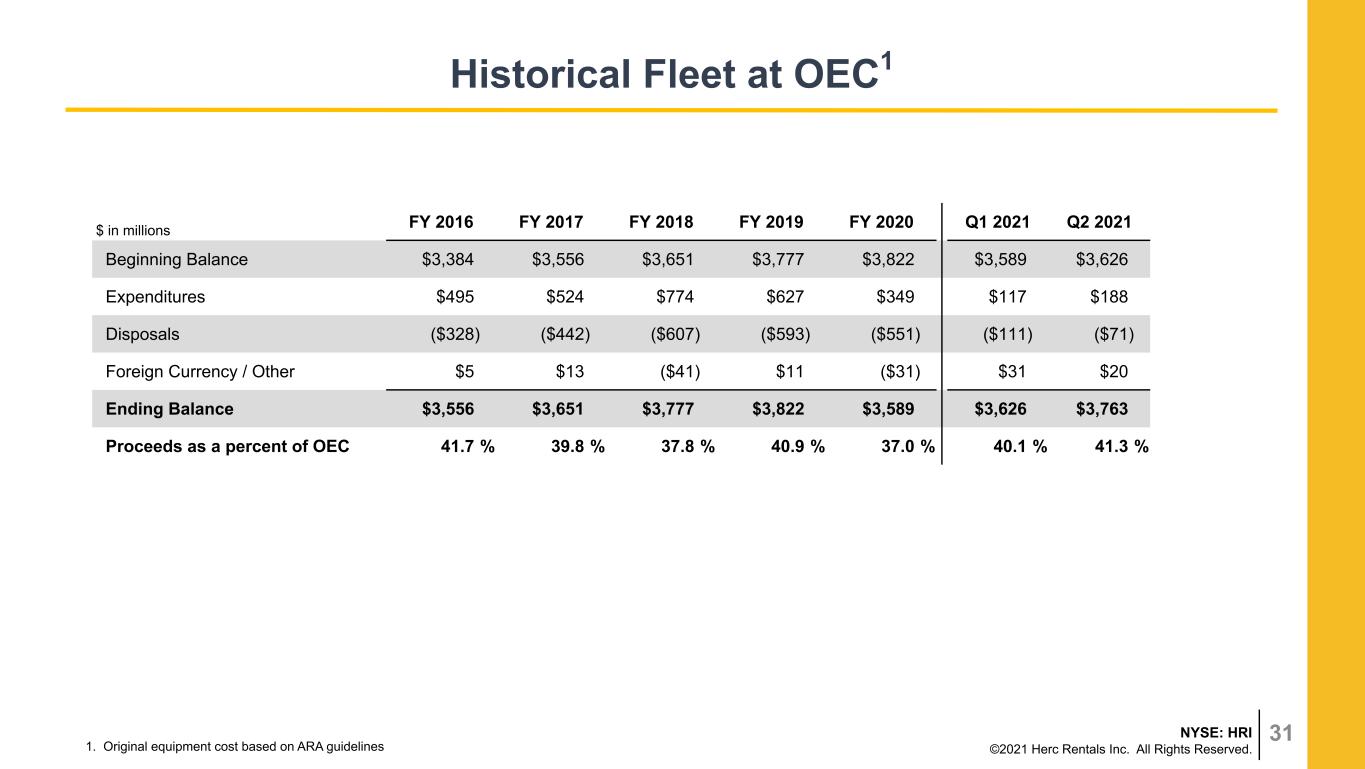

31NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Historical Fleet at OEC1 $ in millions FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Q1 2021 Q2 2021 Beginning Balance $3,384 $3,556 $3,651 $3,777 $3,822 $3,589 $3,626 Expenditures $495 $524 $774 $627 $349 $117 $188 Disposals ($328) ($442) ($607) ($593) ($551) ($111) ($71) Foreign Currency / Other $5 $13 ($41) $11 ($31) $31 $20 Ending Balance $3,556 $3,651 $3,777 $3,822 $3,589 $3,626 $3,763 Proceeds as a percent of OEC 41.7 % 39.8 % 37.8 % 40.9 % 37.0 % 40.1 % 41.3 % 1. Original equipment cost based on ARA guidelines

NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Investor Contact: Elizabeth M. Higashi, CFA Vice President, Investor Relations & Sustainability elizabeth.higashi@hercrentals.com