Table of Contents

As filed with the Securities and Exchange Commission on July 27, 2007

Registration No.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EAGLE ROCK ENERGY PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 1311 | 69-0629883 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

16701 Greenspoint Park Drive, Suite 200

Houston, TX 77060

(281) 408-1200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Alfredo Garcia

16701 Greenspoint Park Drive, Suite 200

Houston, Texas 77060

(281) 408-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Barry Davis

Thomas R. Lamme

Thompson & Knight LLP

333 Clay Street, Suite 3300

Houston, TX 77002

(713) 654-8111

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

| Proposed | Proposed Maximum | Amount of | ||||||||||

| Title of Class of | Amount | Maximum Price | Aggregate Offering | Registration | ||||||||

| Securities to be Registered | to be Registered | Per Unit(1) | Price(1) | Fee | ||||||||

| Common units representing limited partner interests | 14,803,789 | $25.90 | $383,418,136 | $11,771 | ||||||||

| (1) | Calculated in accordance with Rule 457(c) on the basis of the average of the high and low sales price of the common units on July 25, 2007. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement incorporates by reference the Registrant’s Annual Report onForm 10-K for the year ended December 31, 2006, as filed with the Securities and Exchange Commission on April 2, 2007, amended Annual Report onForm 10-K/A for the year ended December 31, 2006, as filed with the Securities and Exchange Commission on July 26, 2007, Current Report onForm 10-Q filed with the Securities and Exchange Commission on May 15, 2007, and Current Reports onForms 8-K as filed with the Securities and Exchange Commission on January 12, 2007, January 29, 2007, February 1, 2007, February 14, 2007, April 4, 2007, May 4, 2007, May 18, 2007, May 22, 2007, July 17, 2007, and July 18, 2007.

Table of Contents

| The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted. |

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JULY 27, 2007

PROSPECTUS

14,803,789 Common Units

Representing Limited Partner Interests

Representing Limited Partner Interests

This prospectus relates to up to 14,803,789 common units of limited partner interests of Eagle Rock Energy Partners, L.P., which may be offered for sale by the selling unitholders named in this prospectus. The selling unitholders acquired the common units offered by this prospectus in private equity purchases. We are registering the offer and sale of the common units to satisfy registration rights we have granted.

We are not selling any common units under this prospectus and will not receive any proceeds from the sale of common units by the selling unitholders. The common units to which this prospectus relates may be offered and sold from time to time directly from the selling unitholders or alternatively through underwriters or broker-dealers or agents. The common units may be sold in one or more transactions, at fixed prices, at prevailing market prices at the time of sale or at negotiated prices. Please read “Plan of Distribution.”

Because all of the common units being offered under this prospectus are being offered by selling unitholders, we cannot currently determine the price or prices at which our shares of common stock may be sold under this prospectus. Our common units are traded on the NASDAQ Global Market under the trading symbol “EROC.” The last reported sale of our common units on the NASDAQ Global Market on July 25, 2007 was at a price of $25.74 per common unit. Future prices will likely vary from that price and these sales may not be indicative of prices at which our common units will trade.

Investing in our common units involves risks. You should read the section entitled “Risk Factors” beginning on page 9 of this prospectus, for a discussion of certain risk factors that you should consider when investing in our common stock.

You should rely only on the information contained in or incorporated by reference into this prospectus or any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

TABLE OF CONTENTS

| Page | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 6 | ||||||||

| 9 | ||||||||

| 32 | ||||||||

| 33 | ||||||||

| 33 | ||||||||

| 34 | ||||||||

| 37 | ||||||||

| 46 | ||||||||

| 48 | ||||||||

| 51 | ||||||||

| 55 | ||||||||

| 70 | ||||||||

| 74 | ||||||||

| 75 | ||||||||

| 78 | ||||||||

| 78 | ||||||||

| 78 | ||||||||

| 79 | ||||||||

| 82 | ||||||||

| 88 | ||||||||

| 90 | ||||||||

| 101 | ||||||||

| 103 | ||||||||

| 116 | ||||||||

| 117 | ||||||||

| 118 | ||||||||

| 119 | ||||||||

| 119 | ||||||||

| 119 | ||||||||

| 120 | ||||||||

| Partnership Interests Purchase and Contribution Agreement | ||||||||

| Partnership Interests Contribution Agreement | ||||||||

| Asset Contribution Agreement | ||||||||

| Registration Rights Agreement | ||||||||

| Opinion of Thompson & Knight LLP | ||||||||

| Common Unit Purchase Agreement | ||||||||

| List of Subsidiaries | ||||||||

| Consent of Deloitte & Touche LLP | ||||||||

| Consent of Deloitte & Touche LLP | ||||||||

| Consent of Deloitte & Touche LLP | ||||||||

| Consent of Cawley, Gillespie & Associates | ||||||||

Table of Contents

Table of Contents

SUMMARY

This summary highlights information contained herein and incorporated by reference in this prospectus. It is not complete and does not contain all of the information you may wish to consider before investing in our common units. We urge you to read this entire prospectus and the information incorporated herein by reference carefully, including the “Risk Factors” beginning on page 8 of this prospectus and the financial statements incorporated by reference in this prospectus from our amended Annual Report onForm 10-K/A for the year ended December 31, 2006.

References in this prospectus to “Eagle Rock Energy Partners, L.P.,” “we,” “our,” “us” or like terms, when used in a historical context, refer to both Eagle Rock Pipeline, L.P. and its subsidiaries. When used in the present tense or prospectively, those terms refer to Eagle Rock Energy Partners, L.P. and its subsidiaries. References to “Natural Gas Partners” refer to Natural Gas Partners VII, L.P. and Natural Gas Partners VIII, L.P. in the context of any description of our investors, and in other contexts refer to Natural Gas Partners, L.L.C. d/b/a NGP Energy Capital Management, which manages a series of energy investment funds, including Natural Gas Partners VII, L.P. and Natural Gas Partners VIII, L.P. References to the “NGP Investors” refer to Natural Gas Partners and some of our directors and current and former members of our management team. References to “Holdings” or “Eagle Rock Holdings” refer to Eagle Rock Holdings, L.P., our largest holder of our securities, which is owned by Natural Gas Partners and members and former members of our management team.

In connection with our recently completed Montierra Acquisition, described below, J.A. Mills became the Chief Executive Officer and Chairman of the Board of Eagle Rock Energy G&P, LLC, which is the general partner of our general partner. Mr. Mills remains as chief executive officer of Montierra, which is controlled by Natural Gas Partners. When we refer to “affiliates of our general partner”, we are not referring to Montierra, which is under common control with us through Natural Gas Partners’ control of Montierra. Any percentage of limited partner interests with respect to our general partner and affiliates of our general partner described in this prospectus do not include interest owned by Montierra. Additionally, any description of incentive distribution rights in this prospectus is qualified by the fact that, in connection with the Montierra Acquisition, Holdings transferred the economic equivalent interests in certain of the incentive distribution rights to Montierra. See “Certain Relationships and Related Party Transactions — Montierra and Co-Invest Agreement” for a discussion of the transaction.

We have provided definitions for some of the industry terms used in this prospectus in the “Glossary of Oil and Natural Gas Terms” beginning in Appendix A of this prospectus.

Eagle Rock Energy Partners, L.P.

General

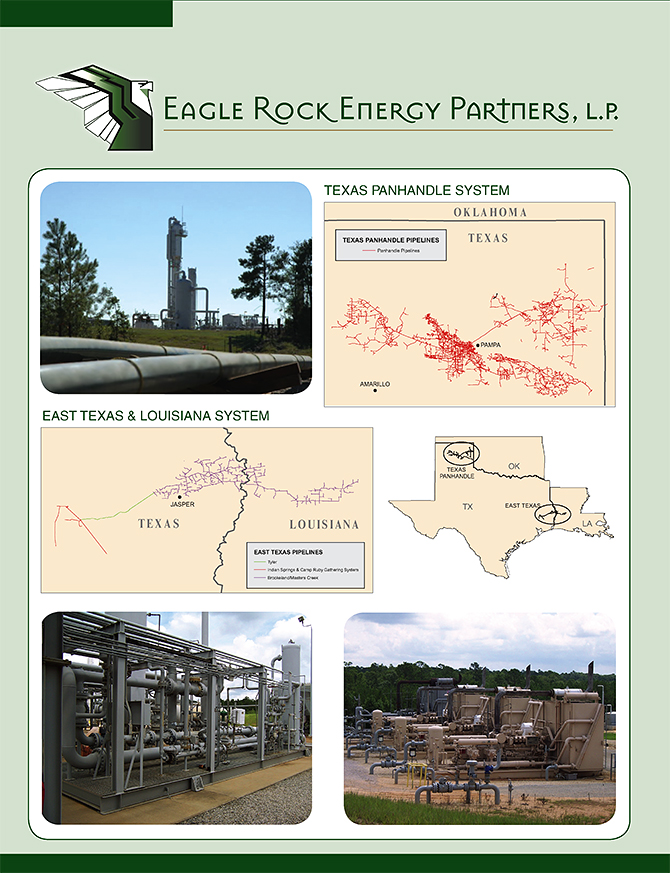

We are a growth-oriented Delaware limited partnership engaged in the business of gathering, compressing, treating, processing, transporting and selling natural gas, fractionating and transporting natural gas liquids, or NGLs, what we call our midstream business, and the business of acquiring, developing and producing oil and natural gas properties interests, what we call our upstream business. Our midstream assets are strategically located in four significant natural gas producing regions in the Texas Panhandle, south Texas, southeast Texas and Louisiana. Our upstream assets include interests in over 2,500 wells located in multiple producing trends across 17 states. Currently, based on revenues generated during the second quarter 2007, our midstream business comprises approximately 87% of our business and our upstream business comprises approximately 13%. We intend to acquire and construct additional assets in both our midstream and upstream businesses and we have an experienced management team dedicated to growing, operating and maximizing the profitability of our assets. Our management team is experienced in gathering and processing natural gas, as well as in the operation of oil and natural gas properties and assets.

We completed the acquisition of certain fee minerals, royalties, overriding royalties and working interest properties from Montierra Minerals & Production, L.P. (a Natural Gas Partners VII, L.P. portfolio company)

1

Table of Contents

and NGP-VII Income Co-Investment Opportunities, L.P. (a Natural Gas Partners affiliate) (“the Montierra Acquisition”) on April 30, 2007. The assets conveyed include interests in approximately 5.6 million gross mineral acres or 430,000 net mineral acres, and interests in over 2,500 wells with net proved producing reserves of approximately 4.5 billion cubic feet of natural gas and 2.5 million barrels of crude oil. Additionally, on May 3, 2007, we completed our acquisition of Laser Midstream Energy, L.P. and certain of its subsidiaries (“Laser”). The assets include over 405 miles of gathering systems and related compression and processing facilities in South Texas, East Texas and North Louisiana. Concurrent with the Laser transaction, we completed a private placement of 7,005,495 common units to third-party investors. The units were purchased at a price of $18.20 per unit resulting in gross proceeds of approximately $127.5 million.

On October 24, 2006, we completed our initial public offering, or IPO. We issued 12,500,000 common units to the public, representing a 29.6% limited partner interest. Eagle Rock Holdings, L.P., upon contribution of certain assets and ownership of operating subsidiaries, received 3,459,236 common units and 20,691,495 subordinated units, totaling an aggregate initially of 57.2% limited partner interest (which reduced to 54.0% after the exercise of the overallotment option and including restricted common units issued to employees under our Long Term Incentive Plan in connection with our IPO), and all of the equity interests in the Partnership’s general partner, Eagle Rock Energy GP, L.P., which initially owned a 2% general partner interest. Additional private investors, after conversion of their ownership in Eagle Rock Pipeline, L.P., received 4,732,259 common units, representing initially an 11.2% limited partner interest in the Partnership (which reduced to 10.7% after the exercise of the overallotment option and including restricted common units issued to employees in connection with our IPO). On November 21, 2006, 1,463,785 common units were redeemed as part of the exercise of the underwriters’ overallotment option we granted in conjunction with our IPO. In connection with the IPO, Eagle Rock Pipeline, L.P. was merged with and into our newly formed subsidiary with Eagle Rock Pipeline, L.P. being the surviving entity.

As a result of the initial public offering, our partnership structure is such that Eagle Rock Energy G&P, LLC is the general partner of Eagle Rock Energy GP, L.P., which is the general partner of Eagle Rock Energy Partners, L.P. Eagle Rock Holdings, L.P., which is owned by members of management and private equity funds controlled by Natural Gas Partners, is the sole member of Eagle Rock G&P, LLC.

We commenced operations in 2002 when certain current and former members of our management team formed Eagle Rock Energy, Inc., an affiliate of our predecessor, to provide midstream services to natural gas producers. Since 2002, we have grown through a combination of organic growth and acquisitions. In connection with the acquisition in 2003 of the Dry Trail plant, a CO2 tertiary recovery plant located in the Oklahoma panhandle, members of our management team formed Eagle Rock Holdings, L.P., the successor to Eagle Rock Energy, Inc., to own, operate, acquire and develop complementary midstream energy assets. Eagle Rock Holdings, L.P., has benefited from the equity sponsorship of Natural Gas Partners, one of the largest private equity fund sponsors of companies in the energy sector, which since 2003 has provided us with significant support in pursuing acquisitions.

Risk Factors

An investment in our common units involves risks associated with our business, regulatory and legal matters, our limited partnership structure and the tax characteristics of our common units. Please read carefully the risks described under Risk Factors, starting on page 8 of this prospectus.

Management of Eagle Rock Energy Partners, L.P.

Eagle Rock Energy GP, L.P., our general partner, has sole responsibility for conducting our business and for managing our operations. Because our general partner is a limited partnership, its general partner, Eagle Rock Energy G&P, LLC, conducts our business and operations, and the board of directors and executive officers of Eagle Rock Energy G&P, LLC makes decisions on our behalf. Neither our general partner, nor any of its affiliates, receive any management fee or other compensation in connection with the management of our business, but they are entitled to reimbursement for all direct and indirect expenses they incur on our behalf.

2

Table of Contents

Neither our general partner nor the board of directors of Eagle Rock Energy G&P, LLC is elected by our unitholders. Unlike shareholders in a publicly traded corporation, our unitholders are not entitled to elect the directors of Eagle Rock Energy G&P, LLC. Because of its ownership of a majority interest in Eagle Rock Holdings, L.P., Natural Gas Partners has the right to elect all of the members of the board of directors of Eagle Rock Energy G&P, LLC. References herein to the officers or directors of our general partner refer to the officers and directors of Eagle Rock Energy G&P, LLC. In addition, certain references to our general partner refer to Eagle Rock Energy GP, L.P. and Eagle Rock Energy G&P, LLC, collectively.

As is common with publicly traded limited partnerships and in order to maximize operational flexibility, we conduct our operations through subsidiaries. We have one direct subsidiary, Eagle Rock Pipeline, L.P., a limited partnership that will conduct business through itself and its subsidiaries.

Natural Gas Partners, which controls our general partner, is headquartered in Irving, Texas. Founded in 1988, Natural Gas Partners is among the oldest of the private equity firms that specialize in the energy industry. Through its family of eight institutionally-backed investment funds, Natural Gas Partners has sponsored over 100 portfolio companies and has controlled invested capital and additional commitments totaling $2.9 billion.

Our General Partner’s Rights to Receive Distributions

1.46% General Partner Interest. Our general partner is currently entitled to receive 1.46% of our declared quarterly cash distributions. The general partner’s interest in these distributions is reduced when we issue additional units and our general partner does not elect to contribute a proportionate amount of capital to us to maintain its then current general partner interest. All references in this prospectus to the general partner’s 2% general partner interest assume that the general partner has elected to make these additional capital contributions to maintain its initial right to receive 2% of these cash distributions.

Incentive Distributions. In addition to its 1.46% general partner interest, our general partner holds the incentive distribution rights, which are non-voting limited partner interests that represent the right to receive an increasing percentage of quarterly distributions of available cash as higher target distribution levels of cash have been distributed to the unitholders. The following table shows how our available cash from operating surplus is allocated among our unitholders and the general partner as higher target distribution levels are met:

| Total Quarterly | Marginal Percentage | |||||||||

| Distribution per Unit | Interest in Distributions* | |||||||||

| General Partner | ||||||||||

| Target Distribution Level | Unitholders | Interest | ||||||||

| Minimum Quarterly Distribution | $0.3625 | 98 | % | 2 | % | |||||

| First Target Distribution | up to $0.4169 | 98 | % | 2 | % | |||||

| Second Target Distribution | Above $0.4169 up to $0.4531 | 85 | % | 15 | % | |||||

| Third Target Distribution | Above $0.4531 up to $0.5438 | 75 | % | 25 | % | |||||

| Thereafter | above $0.5438 | 50 | % | 50 | % | |||||

| * | Assuming there are no arrearages on common units and that our general partner maintains its 2% initial general partner interest and continues to own the incentive distribution rights. |

For a more detailed description of the incentive distribution rights, please read “Provisions of Our Partnership Agreement Relating to Cash Distributions — General Partner Interest and Incentive Distribution Rights.”

Summary of Conflicts of Interest and Fiduciary Duties

General. Eagle Rock Energy GP, L.P., our general partner, has a legal duty to manage us in a manner beneficial to holders of our common units and subordinated units. This legal duty originates in statutes and judicial decisions and is commonly referred to as a “fiduciary duty.” The officers and directors of Eagle Rock Energy G&P, LLC also have fiduciary duties to manage Eagle Rock Energy G&P, LLC and our general partner in a manner beneficial to their owners. As a result of this relationship, conflicts of interest may arise in

3

Table of Contents

the future between us and holders of our common units and subordinated units, on the one hand, and our general partner and its affiliates on the other hand. For example, our general partner will be entitled to make determinations that affect our ability to make cash distributions, including determinations related to:

| • | the manner in which our business is operated; | |

| • | the level and amount of our borrowings; | |

| • | the amount, nature and timing of our capital expenditures; | |

| • | asset purchases and sales and other acquisitions and dispositions; and | |

| • | the amount of cash reserves necessary or appropriate to satisfy general, administrative and other expenses and debt service requirements, and otherwise provide for the proper conduct of our business. |

These determinations will have an effect on the amount of cash distributions we make to the holders of common units, which in turn has an effect on whether our general partner receives incentive cash distributions as discussed above.

Partnership Agreement Modifications to Fiduciary Duties. Our partnership agreement limits the liability and reduces the fiduciary duties of our general partner to holders of our common units and subordinated units. Our partnership agreement also restricts the remedies available to holders of our common units and subordinated units for actions that might otherwise constitute a breach of our general partner’s fiduciary duties owed to holders of our common units and subordinated units. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement and, pursuant to the terms of our partnership agreement, each holder of common units consents to various actions contemplated in the partnership agreement and conflicts of interest that might otherwise be considered a breach of fiduciary or other duties under applicable state law.

Our general partner’s affiliates may engage in competition with us. Our partnership agreement provides that our general partner will be restricted from engaging in any business activities other than those incidental to its ownership of interests in us. Except as provided in our partnership agreement, Eagle Rock Holdings and the NGP Investors are not prohibited from engaging in, and are not required to offer us the opportunity to engage in, other businesses or activities, including those that might be in direct competition with us.

For a more detailed description of the conflicts of interest and fiduciary duties of our general partner, please read “Conflicts of Interest and Fiduciary Duties.”

Recent Developments

During the first and second quarters of 2007, we entered into several significant transactions, which closed during the second and third quarters of 2007. Those transactions are described below.

Laser Acquisition. On March 30, 2007, Eagle Rock Energy Partners, L.P. entered into a Partnership Interest Purchase and Contribution Agreement with Laser Midstream Energy II, LP, a Delaware limited partnership, Laser Gas Company I, LLC, a Delaware limited liability company, Laser Midstream Company, LLC, a Texas limited liability company, and Laser Midstream Energy, LP, a Delaware limited partnership. Pursuant to the Purchase and Contribution Agreement, we acquired all of the non-corporate interests of Laser Midstream Energy, LP and certain subsidiaries, for a total purchase price of approximately $136.8 million, consisting of $110.0 million in cash and 1,407,895 of our common units.

The assets subject to the transaction include over 405 miles of gathering systems and related compression and processing facilities in South Texas, East Texas and North Louisiana. The Laser acquisition closed May 3, 2007.

Montierra Acquisition. On March 31, 2007, we entered into a Partnership Interest Contribution Agreement to acquire certain fee minerals, royalties and working interest properties from Montierra Minerals & Production, L.P., a Texas limited partnership, and NGP-VII Income Co-Investment Opportunities, L.P., a Delaware limited partnership, for an aggregate purchase price of $127.4 million, subject to price adjustments.

4

Table of Contents

Upon closing on April 30, 2007, Montierra and NGP received as consideration a total of 6,390,400 of our common units and $6.0 million in cash. As part of this transaction, a 39.34% economic interest in the incentive distribution rights was conveyed from Eagle Rock Holdings, L.P. to Montierra Minerals & Production, L.P.

The assets conveyed in the Montierra acquisition include fee mineral acres and royalty overriding royalty interests in oil and natural gas producing wells with net proved producing reserves of approximately 4.5 billion cubic feet of natural gas and 2.5 million barrels of oil.

EAC Acquisition. On July 11, 2007, Eagle Rock Energy Partners, L.P., a Delaware limited partnership (“Eagle Rock,” or the “Partnership”) announced it had signed a definitive purchase agreement with AmGu Holdings, LLC to acquire Escambia Asset Co., LLC and Escambia Operating Company, LLC (collectively, “EAC”) for an aggregate purchase price of approximately $220.0 million, comprised of approximately $203.5 million in cash and 689,857 in Eagle Rock common units, subject to working capital and other price adjustments, in a privately negotiated transaction. The assets subject to this transaction include 33 operated wells in Escambia County, Alabama with net production of approximately 3,300 Boepd and proved reserves of approximately 12.2 MMBoe, of which 89% is proved developed producing. The transaction also includes two treating facilities with 100 MMcfd of capacity, one natural gas processing plant with 40 MMcfd of capacity and related gathering systems. The acquisition has an effective date of April 1, 2007, and is subject to customary closing conditions. The EAC acquisition is expected to contribute approximately $58.1 million of annual adjusted EBITDA with maintenance capital estimated to be approximately $11.0 million on an annual basis.

Redman Acquisition. On July 11,2007, Eagle Rock signed definitive purchase agreements to acquire Redman Energy Holdings, L.P. and Redman Energy Holdings II, L.P. (Natural Gas Partners VII, L.P. and Natural Gas Partners VIII, L.P. portfolio companies, respectively) and certain assets owned by NGP Income Co-Investment Opportunities Fund II, L.P. (a Natural Gas Partners affiliate) (collectively, “Redman”) in a privately negotiated transactions. For a combined value of $180.0 million, Redman will receive as consideration a total of 4,426,591 newly-issued Eagle Rock common units and $74.1 million in cash, subject to working capital and other customary closing adjustments. The assets conveyed in the Redman transaction include 76 operated and 95 non-operated wells mainly located in East and South Texas with a net production of 1,810 Boepd and combined proved reserves of 8.3 MMBoe, of which 78% is proved developed producing. This acquisition is expected to generate approximately $24.8 million of annual adjusted EBITDA, with $1.5 million in maintenance capital requirements on an annual basis.

One or more Natural Gas Partners private equity funds (“NGP”) directly or indirectly owns a majority of the equity interests in Eagle Rock and Redman. Because of the potential conflict of interest between the interests of Eagle Rock Energy G&P, LLC (the “Company”) and the public unitholders of Eagle Rock, the Board of Directors authorized the Company’s Conflicts Committee to review, evaluate, and, if determined appropriate, approve the Redman acquisition. The Conflicts Committee, consisting of independent Directors of the Company, determined that the Redman acquisition was fair and reasonable to Eagle Rock and its public unitholders and recommended to the Board of Directors of the Company that the transaction be approved and authorized. In determining the purchase consideration for the Redman acquisition, the Board of Directors considered the valuation of the properties involved in the transaction, the valuation of the units to be offered as consideration in the transaction, and the cash flow of Redman.

Private Placement of Equity. On July 11, 2007, the Partnership entered into a common unit purchase agreement to sell in a private placement 9,230,770 common units to third-party investors for total cash proceeds of approximately $204 million if the Partnership closes both the EAC acquisition and the Redman acquisition. The Partnership also has agreed to file a registration statement with the Securities and Exchange Commission registering for resale the newly-issued common units within 90 days after the closing. The Partnership anticipates that the private placement will close simultaneously with the EAC and Redman acquisitions.

Common Unit Purchase Agreement. On March 30, 2007, we entered into a Common Unit Purchase Agreement with several institutional purchasers in connection with the private placement of 7,005,495

5

Table of Contents

common units. The units were purchased at a price of $18.20 per unit resulting in gross proceeds of $127.5 million. The proceeds from the private offering were used to fully fund the cash portion of the purchase price of the Laser acquisition. The offering closed simultaneously with the Laser acquisition.

As part of this transaction, we agreed to file a registration statement with the SEC registering for resale the common units within 90 days after the closing of the issuance of the common units.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 16701 Greenspoint Park Drive, Suite 200, Houston, TX 77060 and our telephone number is(281) 408-1200. Our website is located atwww.eaglerockenergy.com. We make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, which we refer to as the SEC, available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

The Offering

| Common units offered by selling unitholders | 14,803,789 common units. | |

| Units outstanding after this offering | 36,284,759 common units, including 450,021 restricted common units issued under our Long-Term Incentive Plan, and 20,691,495 subordinated units. | |

| Use of proceeds | We will not receive any proceeds from sales of common units by the selling unitholders. | |

| Cash distributions | Our general partner has adopted a cash distribution policy that requires us to pay cash distributions at an initial distribution rate of $0.3625 per common unit per quarter ($1.45 per common unit on an annualized basis) to the extent we have sufficient cash from operations after establishment of cash reserves and payment of fees and expenses, including payments to our general partner and its affiliates, such as general and administrative expenses associated with being a publicly traded partnership. Our ability to pay cash distributions at this initial distribution rate is subject to various restrictions and other factors described in more detail under the caption “Our Cash Distribution Policy and Restrictions on Distributions.” | |

| Our partnership agreement requires us to distribute all of our cash on hand at the end of each quarter, less reserves established by our general partner. We refer to this cash as “available cash,” and we define its meaning in our partnership agreement and in the glossary of terms attached as Appendix A. Our partnership agreement also requires that we distribute all of our available cash from operating surplus each quarter in the following manner: | ||

| • first, 98% to the holders of common units and 2% to our general partner, until each common unit has received a minimum quarterly distribution of $0.3625 plus any arrearages from prior quarters; |

6

Table of Contents

| • second, 98% to the holders of subordinated units and 2% to our general partner, until each subordinated unit has received a minimum quarterly distribution of $0.3625; and | ||

| • third, 98% to all unitholders, pro rata, and 2% to our general partner, until each unit has received a distribution of $0.4169. | ||

| If cash distributions to our unitholders exceed $0.4169 per common unit in any quarter, our general partner will receive, in addition to distributions on its 2% general partner interest, increasing percentages, up to 50%, of the cash we distribute in excess of that amount. We refer to these distributions as “incentive distributions.” Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions.” | ||

| Subordinated units | Eagle Rock Holdings, L.P. owns all of our subordinated units. The principal difference between our common units and subordinated units is that in any quarter during the subordination period, holders of the subordinated units are entitled to receive the minimum quarterly distribution of $0.3625 per unit only after the common units have received the minimum quarterly distribution plus any arrearages in the payment of the minimum quarterly distribution from prior quarters. Subordinated units will not accrue arrearages. | |

| Conversion of subordinated units | The subordination period will end on the first business day after we have earned and paid at least $1.45 (the minimum quarterly distribution on an annualized basis) on each outstanding limited partner unit and general partner unit for any three consecutive, non-overlapping four quarter periods ending on or after September 30, 2009. Alternatively, the subordination period will end on the first business day after we have earned and paid at least $0.5438 per quarter (150% of the minimum quarterly distribution, which is $2.175 on an annualized basis) on each outstanding limited partner unit and general partner unit for any four consecutive quarters ending on or after September 30, 2007. | |

| In addition, the subordination period will end upon the removal of our general partner other than for cause if the units held by our general partner and its affiliates are not voted in favor of such removal. | ||

| When the subordination period ends, all remaining subordinated units will convert into common units on a one-for-one basis, and the common units will no longer be entitled to arrearages. | ||

| Issuance of additional units | We can issue an unlimited number of units without the consent of our unitholders. Please read “Units Eligible for Future Sale” and “The Partnership Agreement — Issuance of Additional Securities.” | |

| Limited voting rights | Our general partner manages and operates us. Unlike the holders of common stock in a corporation, you will have only limited voting rights on matters affecting our business. You will have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 662/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Our general partner and its |

7

Table of Contents

| affiliates own an aggregate of 40.2% of our common and subordinated units. This gives our general partner the ability to prevent its involuntary removal. Please read “The Partnership Agreement — Voting Rights.” | ||

| Limited call right | If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner has the right, but not the obligation, to purchase all of the remaining common units at a price not less than the then-current market price of the common units. | |

| Estimated ratio of taxable income to distributions | We estimate that if you owned the common units from the date of our initial public offering, October 24, 2006, through the record date for distributions for the period ending December 31, 2009, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be 20% or less of the cash distributed to you with respect to that period. For example, if you receive an annual distribution of $1.45 per unit, we estimate that your average allocable federal taxable income per year will be no more than $0.29 per unit. Please read “Material Tax Consequences — Tax Consequences of Unit Ownership — Ratio of Taxable Income to Distributions.” | |

| Material tax consequences | For a discussion of other material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material Tax Consequences.” | |

| Exchange listing | Our common units are listed on the NASDAQ Global Market under the symbol “EROC.” |

8

Table of Contents

RISK FACTORS

Limited partner interests are inherently different from capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in similar businesses. You should consider carefully the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common units.

If any of the following risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected. In that case, we might not be able to pay the minimum quarterly distribution on our common units, the trading price of our common units could decline and you could lose all or part of your investment.

Certain risks apply to both our midstream business and our upstream business. To the extent any risk applies to one or the other, we have indicated the specific risk in the appropriate risk factor.

Risks Related to Our Business

Because of the natural decline in production from existing wells, our success depends on our ability to obtain new sources of production and supplies of oil, natural gas and NGLs, which are dependent on certain factors beyond our control. Our success is also dependent on developing current reserves. Any decrease in production or supplies of oil, natural gas or NGLs could adversely affect our business and operating results.

Our gathering and transportation pipeline systems are connected to or dependent on the level of production from natural gas wells, from which production will naturally decline over time. As a result, our cash flows associated with these wells will also decline over time. In order to maintain or increase throughput levels on our gathering and transportation pipeline systems and NGL pipelines and the asset utilization rates at our natural gas processing plants, we must continually obtain new supplies of natural gas. The primary factors affecting our ability to obtain new supplies of natural gas and NGLs and attract new customers to our assets include: (1) the level of successful drilling activity by producers near our systems and (2) our ability to compete for volumes from successful new wells.

The level of drilling activity is dependent on economic and business factors beyond our control. The primary factor that impacts drilling decisions is natural gas prices. Currently, natural gas prices are high in relation to historical prices. For example, the rolling twelve-month average NYMEX daily settlement price of natural gas has increased from $5.49 per MMBtu as of December 31, 2003 to $7.23 per MMBtu as of December 31, 2006. If the high price for natural gas were to decline, the level of drilling activity could decrease. A sustained decline in natural gas prices could result in a decrease in exploration and development activities in our fields and the fields served by our gathering and pipeline transportation systems and our natural gas treating and processing plants, which would lead to reduced utilization of these assets. Other factors that impact production decisions include producers’ capital budgets, the ability of producers to obtain necessary drilling and other governmental permits and regulatory changes. Because of these factors, even if new natural gas reserves are discovered in areas served by our assets, we and other producers may choose not to develop those reserves. If we are not able to obtain new supplies of natural gas to replace the natural decline in volumes from existing wells due to reductions in drilling activity or competition, throughput on our pipelines and the utilization rates of our treating and processing facilities would decline, which could have a material adverse effect on our business, results of operations, financial condition and ability to make cash distributions.

Now that we have entered the exploration and production business in addition to our midstream business, we have additional risks inherent with declining reserves. Producing reservoirs are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our decline rate may change when additional wells are drilled, make acquisitions and under other circumstances. Our future cash flows and income and our ability to maintain and to increase distributions to unitholders are partly dependent on our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves. We may not be able to develop, find or acquire additional reserves

9

Table of Contents

to replace our current and future production at acceptable costs, which would adversely affect our business, financial condition and results of operations. Factors that may hinder our ability to acquire additional reserves or develop current reserves include competition, access to capital, prevailing oil and natural gas prices, the costs incurred by the operators to develop and exploit current and future oil and natural gas reserves and the number and attractiveness of properties for sale.

Natural gas, NGLs, Crude Oil and other commodity prices are volatile, and a reduction in these prices could adversely affect our cash flow and our ability to make distributions.

We are subject to risks due to frequent and often substantial fluctuations in commodity prices. NGL prices generally fluctuate on a basis that correlates to fluctuations in crude oil prices. In the past, the prices of natural gas and crude oil have been extremely volatile, and we expect this volatility to continue. A drop in prices can significantly affect our financial results and impede our growth, including our ability to maintain or increase our borrowing capacity, to repay current or future indebtedness and to obtain additional capital on attractive terms, all of which can affect our ability to pay distributions. Changes in crude oil and natural gas prices have a significant impact on the value of our reserves and on our cash flows. The NYMEX daily settlement price for natural gas for the prompt month contract in 2006 ranged from a high of $9.87 per MMBtu to a low of $3.63 per MMBtu. The NYMEX daily settlement price for crude oil for the prompt month contract in 2006 ranged from a high of $77.03 per barrel to a low of $55.81 per barrel. The markets and prices for natural gas and NGLs depend upon factors beyond our control. These factors include demand for oil, natural gas and NGLs, which fluctuate with changes in market and economic conditions and other factors, including:

| • | the impact of weather or force majeure events on the demand for oil and natural gas; | |

| • | the level of domestic oil and natural gas production and demand; | |

| • | the level of imported oil and natural gas availability and demand; | |

| • | the level of consumer product demand; | |

| • | political and economic conditions and events in, as well as actions taken by foreign oil and natural gas producing nations; | |

| • | overall domestic and global economic conditions; | |

| • | the availability of local, intrastate and interstate transportation systems including natural gas pipelines and other transportation facilities to our production; | |

| • | the availability and marketing of competitive fuels; | |

| • | delays or cancellations of crude oil and natural gas drilling and production activities; | |

| • | the impact of energy conservation efforts, including technological advances affecting energy consumption; and | |

| • | the extent of governmental regulation and taxation. |

Lower oil or natural gas prices may not only decrease our revenues and net proceeds, but also reduce the amount of oil or natural gas that we can economically produce. As a result, the operator of any of the properties could determine during periods of low commodity prices to shut in or curtail production, or to plug and abandon marginal wells that otherwise may have been allowed to continue to produce for a longer period under conditions of higher prices. This may result in our having to make substantial downward adjustments to our estimated proved reserves. If this occurs, or if our estimates of development costs increase, production data factors change or drilling results deteriorate, accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our oil and natural gas properties for impairments. We are required to perform impairment tests on our assets whenever events or changes in circumstances lead to a reduction of the estimated useful life or estimated future cash flows that would indicate that the carrying amount may not be recoverable or whenever management’s plans change with respect to those assets. We may

10

Table of Contents

incur impairment charges in the future, which could have a material adverse effect on our results of operations in the period taken and our ability to borrow funds under our credit facility, which may adversely affect our ability to make cash distributions to our unitholders.

Our natural gas gathering and processing businesses operate under two types of contractual arrangements that expose our cash flows to increases and decreases in the price of natural gas and NGLs: percentage-of-proceeds and keep-whole arrangements. Under percentage-of-proceeds arrangements, we generally purchase natural gas from producers and retain an agreed percentage of the proceeds (in cash or in-kind) from the sale at market prices of pipeline-quality gas and NGLs or NGL products resulting from our processing activities. Under keep-whole arrangements, we receive the NGLs removed from the natural gas during our processing operations as the fee for providing our services in exchange for replacing the thermal content removed as NGLs with a like thermal content in pipeline-quality gas or its cash equivalent. Under these types of arrangements our revenues and our cash flows increase or decrease as the prices of natural gas and NGLs fluctuate. The relationship between natural gas prices and NGL prices may also affect our profitability. When natural gas prices are low relative to NGL prices, under keep-whole arrangements it is more profitable for us to process natural gas. When natural gas prices are high relative to NGL prices, it is less profitable for us and our customers to process natural gas both because of the higher value of natural gas and of the increased cost (principally that of natural gas as a feedstock and a fuel) of separating the mixed NGLs from the natural gas. As a result, we may experience periods in which higher natural gas prices relative to NGL prices reduce our processing margins or reduce the volume of natural gas processed at some of our plants. For a detailed discussion of these arrangements, please read Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Our Operations in our annual report onForm 10-K for the year ended December 31, 2006.

Our hedging activities may have a material adverse effect on our earnings, profitability, cash flows and financial condition.

We are exposed to risks associated with fluctuations in commodity prices. The extent of our commodity price risk is related largely to the effectiveness and scope of our hedging activities. In order to reduce our exposure to commodity price risk, we directly hedged substantially all of our share of expected NGL volumes in 2006 and 2007 under percent-of-proceed and keep-whole contracts. This has been accomplished primarily through the purchase of NGL put contracts but also through executing NGL costless collar contracts and swap contracts. We have also hedged substantially all of our share of expected NGL volumes from 2008 through 2010 under percent-of-proceed contracts through a combination of direct NGL hedging as well as indirect hedging through crude oil costless collars. Additionally, to mitigate the exposure to natural gas prices from keep-whole volumes, we have purchased natural gas calls from 2006 to 2007 to cover our short natural gas position. Finally, we have entered into hedging arrangements for a significant portion of our oil and natural gas production. Our management will evaluate whether to enter into any new hedging arrangements, but there can be no assurance that we will enter into any new hedging arrangement or that our future hedging arrangements will be on terms similar to our existing hedging arrangements.

To the extent we hedge our commodity price and interest rate risk, we may forego the benefits we would otherwise experience if commodity prices or interest rates were to change in our favor. Furthermore, because we have entered into derivative transactions related to only a portion of the volume of our expected oil and natural gas production, natural gas supply and production of NGLs and condensate from our processing plants, we will continue to have direct commodity price risk to the unhedged portion. Our actual future supply and production may be significantly higher or lower than we estimate at the time we entered into the derivative transactions for that period. If the actual amount is higher than we estimate, we will have less commodity price risk than we intended. If the actual amount is lower than the amount that is subject to our derivative financial instruments, we might be forced to satisfy all or a portion of our derivative transactions without the benefit of the underlying physical commodity, resulting in a reduction of our liquidity.

As a result of these factors, our hedging activities may not be as effective as we intend in reducing the volatility of our cash flows, and in certain circumstances may actually increase the volatility of our cash flows. In addition, even though our management monitors our hedging activities, these activities can result in

11

Table of Contents

substantial losses. Such losses could occur under various circumstances, including if a counterparty does not perform its obligations under the applicable hedging arrangement, the hedging arrangement is imperfect or ineffective, or our hedging policies and procedures are not properly followed or do not work as planned. The steps we take to monitor our hedging activities may not detect and prevent violations of our risk management policies and procedures, particularly if deception or other intentional misconduct is involved.

As a result of our hedging activities and our practice of marking to market the value of our hedging instruments, we will also experience significant variations in our unrealized derivative gains/(losses) from period to period. These variations from period to period will follow variations in the underlying commodity prices and interest rates. As this item is of a non-cash nature, it will not impact our cash flows or our ability to make our distributions. However, it will impact our earnings and other profitability measures. To illustrate, during the twelve months ended December 31, 2006, we experienced positive movements in our underlying commodities’ prices which led to an unrealized derivative loss of $26.3 million. This $26.3 million loss had a direct impact on our net income (loss) line resulting in a net loss of $23.1 million. For additional information regarding our hedging activities, please read Item 7A. Quantitative and Qualitative Disclosures about Market Risk in our annual report onForm 10-K for the year ended December 31, 2006.

Our estimated oil and natural gas reserve quantities and future production rates are based on many assumptions that may prove to be inaccurate. Any material inaccuracies in these reserve estimates or the underlying assumptions will materially affect the quantities and present value of our reserves.

Numerous uncertainties are inherent in estimating quantities of oil and natural gas reserves. Our estimates of our net proved reserve quantities are based upon reports of petroleum engineers. The process of estimating oil and natural gas reserves is complex, requiring significant decisions and assumptions in the evaluation of available geological, engineering and economic data for each reservoir, and these reports rely upon various assumptions, including assumptions regarding future oil and natural gas prices, production levels and operating and development costs. As a result, estimated quantities of proved reserves and projections of future production rates and the timing of development expenditures may prove to be inaccurate. Over time, we may make material changes to reserve estimates taking into account the results of actual drilling and production. Any significant variance in our assumptions by actual figures could greatly affect our estimates of reserves, the economically recoverable quantities of oil and natural gas attributable to any particular group of properties, the classifications of reserves based on risk of recovery and estimates of the future net cash flows. In addition, our wells are characterized by low production rates per well. As a result, changes in future production costs assumptions could have a significant effect on our proved reserve quantities.

The standardized measure of discounted future net cash flows of our estimated net proved reserves is not necessarily the same as the current market value of our estimated net proved reserves. We base the discounted future net cash flows from our estimated net proved reserves on prices and costs in effect on the day of the estimate. Actual prices received for production and actual costs of such production will be different than these assumptions, perhaps materially.

The timing of both our production and our incurrence of expenses in connection with the development and production of our properties will affect the timing of actual future net cash flows from proved reserves, and thus their actual present value. In addition, the discount factor we use when calculating discounted future net cash flows may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the natural gas and oil industry in general. Any material inaccuracy in our reserve estimates or underlying assumptions will materially affect the quantities and present value of our reserves which could adversely affect our business, results of operations, financial condition and our ability to make cash distributions to our unitholders.

Furthermore, due to the nature of ownership of royalties, overriding royalties and fee minerals, we will not usually be able to control the timing of drilling by the operators who have taken an oil and gas lease on our lands. This leads to uncertainty in the timing of future reserve additions and production increases resulting from new drilling across our assets. Any material inaccuracy in our reserve estimates or underlying assumptions will materially affect the quantities and present value of our reserves which could adversely affect

12

Table of Contents

our business, results of operations, financial condition and our ability to make cash distributions to our unitholders.

Our operations will require substantial capital expenditures, which will reduce our cash available for distribution. We may be unable to obtain needed capital or financing on satisfactory terms, which could lead to a decline in our cash flows.

The oil and natural gas industry is capital intensive. We make and expect to continue to make substantial capital expenditures in our business for the maintenance, construction and acquisition of midstream assets and oil and natural gas reserves. We intend to finance our future capital expenditures with cash flows from operations, borrowings under our credit facility and the issuance of debt and equity securities. The incurrence of debt will require that a portion of our cash flows from operations be used for the payment of interest and principal on our debt, thereby reducing our ability to use cash flows to fund working capital, capital expenditures and acquisitions. Our cash flows from operations and access to capital are subject to a number of variables, including:

| • | volume throughput through our pipelines and processing facilities; | |

| • | the estimated quantities of our oil and natural gas reserves; | |

| • | the amount of oil and natural gas produced from existing wells; | |

| • | the prices at which we sell our production or that of our midstream customers; and | |

| • | our ability to acquire, locate and produce new reserves. |

If our revenues or the borrowing base under our credit facility decrease as a result of lower commodity prices, operating difficulties, declines in reserves or for any other reason, we may have limited ability to obtain the capital necessary to sustain our operations at current levels. Our credit facility may restrict our ability to obtain new financing. If additional capital is needed, we may not be able to obtain debt or equity financing on terms favorable to us, or at all. If cash generated by operations or available under our credit facility is not sufficient to meet our capital requirements, the failure to obtain additional financing could result in a curtailment of our operations relating to development of our capital projects, which in turn could lead to a possible decline in our gathering and processing available capacity or in our natural gas and crude oil reserves and production, which could adversely effect our business, results of operation, financial conditions and ability to make distributions to our unitholders. In addition, we may lose opportunities to acquire oil and natural gas properties and businesses.

We typically do not obtain independent evaluations of other producer’s natural gas reserves dedicated to our gathering and pipeline systems; therefore, volumes of natural gas on our systems in the future could be less than we anticipate.

We typically do not obtain independent evaluations of other producer’s natural gas reserves connected to our systems due to the unwillingness of producers to provide reserve information as well as the cost of such evaluations. Accordingly, we do not have independent estimates of total reserves dedicated to our systems or the anticipated life of such reserves. If the total reserves or estimated life of the reserves connected to our gathering systems is less than we anticipate and we are unable to secure additional sources of natural gas, then the volumes of natural gas on our systems in the future could be less than we anticipate. A decline in the volumes of natural gas on our systems could have a material adverse effect on our business, results of operations, financial condition and our ability to make cash distributions.

The loss of any of our significant customers could result in a decline in our volumes, revenues and cash available for distribution.

Midstream. We rely on certain natural gas producer customers for a significant portion of our natural gas and NGL supply. Themake-up of gas suppliers can change from time to time based upon a number of reasons, some of which are success of the producer’s drilling programs, additions or cancellations of new

13

Table of Contents

agreements and acquisition of new systems. As of December 31, 2006, our two largest suppliers were affiliates of Chesapeake Energy Corporation and Prize Operating Company, accounting for approximately 12% and 10% respectively, of our natural gas supply. We may be unable to negotiate long-term contracts or extensions or replacements of existing contracts, on favorable terms, if at all. The loss of all or even a portion of the natural gas volumes supplied by these customers, as a result of competition or otherwise, could have a material adverse effect on our business, results of operations and financial condition, unless we were able to acquire comparable volumes from other sources.

Upstream. To the extent any significant customer reduces the volume of its oil or natural gas purchases from us, we could experience a temporary interruption in sales of, or a lower price for, our oil and natural gas production and our revenues and cash available for distribution could decline which could adversely affect our ability to make cash distributions to our unitholders.

We may not successfully balance our purchases and sales of natural gas, which would increase our exposure to commodity price risks.

We purchase from producers and other customers a substantial amount of the natural gas that flows through our natural gas gathering, processing and transportation systems for resale to third parties, including natural gas marketers and end-users. We may not be successful in balancing our purchases and sales. A producer or supplier could fail to deliver contracted volumes or deliver in excess of contracted volumes, or a purchaser could purchase less than contracted volumes. Any of these actions could cause our purchases and sales to be unbalanced. If our purchases and sales are unbalanced, we will face increased exposure to commodity price risks and could have increased volatility in our operating income and cash flows.

If third-party pipelines and other facilities interconnected to our systems become unavailable to transport or produce natural gas and NGLs, our revenues and cash available for distribution could be adversely affected.

We depend upon third-party pipelines, natural gas gathering systems and other facilities that provide delivery options to and from our pipelines and facilities for the benefit of our customers. Since we do not own or operate any of these pipelines or other facilities, their continuing operation is not within our control. If any of these third-party pipelines and other facilities become unavailable or limited in their ability to transport or produce natural gas and NGLs, our revenues and cash available for distribution could be adversely affected.

Our access to transportation options may affect our revenues and cash available for distribution.

Our access to transportation options can also be affected by U.S. federal and state regulation of oil and natural gas production and transportation, general economic conditions and changes in supply and demand. These factors and the availability of markets are beyond our control. If market factors dramatically change, the impact on our revenues could be substantial and could adversely affect our ability to produce and market oil and natural gas, the value of our units and our ability to pay distributions on our units.

Our industry is highly competitive, and increased competitive pressure could adversely affect our business and operating results.

We compete with similar enterprises in our respective areas of operation. Some of our competitors are large oil and natural gas companies that have greater financial resources and access to supplies of natural gas and NGLs than we do.

Midstream. Some of these competitors may expand or construct gathering, processing and transportation systems that would create additional competition for the services we provide to our customers. In addition, our customers who are significant producers of natural gas may develop their own gathering, processing and transportation systems in lieu of using ours. Likewise, our customers who produce NGLs may develop their own processing facilities in lieu of using ours. Our ability to renew or replace existing contracts with our customers at rates sufficient to maintain current revenues and cash flows could be adversely affected by the

14

Table of Contents

activities of our competitors and our customers. All of these competitive pressures could have a material adverse effect on our business, results of operations, financial condition and ability to make cash distributions.

Upstream. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. Many of our larger competitors not only drill for and produce oil and natural gas, but also carry on refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay more for natural gas properties and evaluate, bid for and purchase a greater number of properties than our financial or human resources permit. In addition, these companies may have a greater ability to continue drilling activities during periods of low oil and natural gas prices, to contract for drilling equipment, to secure trained personnel and to absorb the burden of present and future federal, state, local and other laws and regulations. The oil and natural gas industry has periodically experienced shortages of drilling rigs, equipment, pipe and personnel, which has delayed development drilling and other exploitation activities and has caused significant price increases.

In both the midstream and upstream businesses, competition has been strong in hiring experienced personnel, particularly in the engineering, accounting and financial reporting, tax and land departments. In addition, competition is strong for attractive midstream assets as well as oil and natural gas producing properties, oil and natural gas companies and undeveloped leases and drilling rights. We may be often outbid by competitors in our attempts to acquire assets, properties or companies. Our inability to compete effectively with larger companies could have a material adverse impact on our business activities, financial condition and results of operations.

A change in the jurisdictional characterization of some of our assets by federal, state or local regulatory agencies or a change in policy by those agencies may result in increased regulation of our assets, which may cause our revenues to decline and operating expenses to increase.

Our natural gas gathering and intrastate transportation operations are generally exempt from Federal Energy Regulatory Commission, or FERC, regulation under the Natural Gas Act of 1938, or NGA, except for Section 311 as discussed below, but FERC regulation still affects these businesses and the markets for products derived from these businesses. FERC’s policies and practices across the range of its oil and natural gas regulatory activities, including, for example, its policies on open access transportation, ratemaking, capacity release and market center promotion, indirectly affect intrastate markets. In recent years, FERC has pursued pro-competitive policies in its regulation of interstate oil and natural gas pipelines. However, FERC may not continue this approach as it considers matters such as pipeline rates and rules and policies that may affect rights of access to oil and natural gas transportation capacity. In addition, the distinction between FERC-regulated transmission services and federally unregulated gathering services has been the subject of regular litigation, so, in such a circumstance, the classification and regulation of some of our gathering facilities and intrastate transportation pipelines may be subject to change based on future determinations by FERC and the courts.

Other state and local regulations also affect our business. Common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes restrict our right as an owner of gathering facilities to decide with whom we contract to purchase or transport oil or natural gas. Federal law leaves any economic regulation of natural gas gathering to the states. The states in which we operate have adopted complaint-based regulation of oil and natural gas gathering activities, which allows oil and natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to oil and natural gas gathering access and rate discrimination. Other state regulations may not directly regulate our business, but may nonetheless affect the availability of natural gas for purchase, processing and sale, including state regulation of production rates and maximum daily production allowable from gas wells. While our proprietary gathering lines currently are subject to limited state regulation, there is a risk that state laws will be changed, which may give producers a stronger basis to challenge proprietary status of a line, or the rates, terms and conditions of a gathering line providing transportation service. Please read Item 1. Business — Regulation of Operations in our annual report onForm 10-K for the year ended December 31, 2006, and “Business — Regulation of Operations” in this prospectus.

15

Table of Contents

We are subject to compliance with stringent environmental laws and regulations that may expose us to significant costs and liabilities.

Our operations are subject to stringent and complex federal, state and local environmental laws and regulations governing the discharge of materials into the environment or otherwise to environmental protection. These laws and regulations may impose numerous obligations that are applicable to our operations including the acquisition of permits to conduct regulated activities, the incurrence of capital expenditures to limit or prevent releases of materials from our pipelines and facilities and the imposition of substantial liabilities for pollution resulting from our operations. Failure or delay in obtaining regulatory approvals or drilling permits by us or our operators could have a material adverse effect on our ability to develop our properties, and receipt of drilling permits with onerous conditions could increase our compliance costs. In addition, regulations regarding conservation practices and the protection or correlative rights affect our operations by limiting the quantity of oil and natural gas that may be produced and sold.

Numerous governmental authorities, such as the U.S. Environmental Protection Agency, also known as the “EPA,” and analogous state agencies, have the power to enforce compliance with these laws and regulations and the permits issued under them, oftentimes requiring difficult and costly actions. Failure to comply with these laws, regulations and permits may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations, assessment of monetary penalties and the issuance of injunctions limiting or preventing some or all of our operations.

These costs and liabilities could arise under a wide range of federal, state and local environmental laws and regulations, including, for example:

| • | the federal Clean Air Act and comparable state laws and regulations that impose obligations related to air emissions; | |

| • | the federal Clean Water Act and comparable state laws and regulations that impose obligations related to discharges of pollutants into regulated bodies of water; | |

| • | the federal Resource Conservation and Recovery Act, or RCRA, and comparable state laws that impose requirements for the handling and disposal of waste from our facilities; and | |

| • | the Comprehensive Environmental Response, Compensation and Liability Act of 1980, or CERCLA, also known as “Superfund,” and comparable state laws that regulate the cleanup of hazardous substances that may have been released at properties currently or previously owned or operated by us or at locations to which we have sent waste for disposal. |

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements, and the issuance of orders enjoining future operations. Certain environmental statutes, including the RCRA, CERCLA, the federal Oil Pollution Act and analogous state laws and regulations, impose strict, joint and several liability for costs required to clean up and restore sites where hazardous substances have been disposed of or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances or other waste products into the environment.

There is inherent risk of incurring significant environmental costs and liabilities in connection with our operations due to our handling of petroleum hydrocarbons and wastes, operation of our wells, gathering systems and other facilities, air emissions and water discharges related to our operations and historical industry operations and waste disposal practices. Joint and several, strict liability may be incurred under these environmental laws and regulations in connection with discharges or releases of petroleum hydrocarbons and wastes on, under or from our properties and facilities, many of which have been used for midstream activities for a number of years, oftentimes by third parties not under our control. Private parties, including the owners of properties through which our gathering systems pass and facilities where our petroleum hydrocarbons or wastes are taken for reclamation or disposal, may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for

16

Table of Contents

personal injury or property damage. In addition, changes in environmental laws and regulations occur frequently, and any such changes that result in more stringent and costly waste handling, storage, transport, disposal, or remediation requirements could have a material adverse effect on our operations or financial position. We may not be able to recover some or any of these costs from insurance. See Item 1. Business — Environmental Matters in our annual report onForm 10-K for the year ended December 31, 2006, and “Business — Environmental Matters” in this prospectus.

Our construction of new assets may not result in revenue increases and is subject to regulatory, environmental, political, legal and economic risks, which could adversely affect our results of operations and financial condition.