| Item 6. | Selected Financial Data. |

The following table shows selected historical financial data of our predecessor, ONEOK Texas Field Services L.P., and of Eagle Rock Pipeline, L.P. and Eagle Rock Energy Partners, L.P. ONEOK Texas Field Services, L.P. is treated as our and Eagle Rock Pipeline, L.P.’s predecessor and is referred to as “Eagle Rock Predecessor” throughout this report because of the substantial size of the operations of ONEOK Texas Field Services, L.P. as compared to Eagle Rock Pipeline, L.P. and the fact that all of Eagle Rock Pipeline, L.P.’s operations at the time of the acquisition of ONEOK Texas Field Services, L.P. related to an investment that was managed and operated by others. References in this report to “Eagle Rock Pipeline” refer to Eagle Rock Pipeline, L.P., which is the acquirer of Eagle Rock Predecessor and the entity contributed to us in connection with our initial public offering.

Our historical results of operations for the periods presented below may not be comparable either from period to period or going forward, for the following reasons:

| | • | On December 5, 2003, Eagle Rock Pipeline commenced operations by acquiring the Dry Trail plant from Williams Field Service Company for approximately $18.0 million, and in July 2004, Eagle Rock Pipeline sold the Dry Trail Plant to Celero Energy, L.P. for approximately $37.4 million, resulting in a pre-tax realized gain in the disposition of approximately $19.5 million in 2004. The Dry Trail operations are reflected as discontinued operations for Eagle Rock Pipeline for 2004. |

| | • | The purchase price paid in connection with the acquisition of Eagle Rock Predecessor on December 1, 2005 was “pushed down” to the financial statements of Eagle Rock Energy Partners, L.P. As a result of this “push-down” accounting, the book basis of our assets was increased to reflect the purchase price, which had the effect of increasing our depreciation expense. |

| | • | In connection with our acquisition of the Eagle Rock Predecessor, our interest expense subsequent to December 1, 2005 increased due to the increased debt incurred. |

| | • | After our acquisition of Eagle Rock Predecessor, we initiated a risk management program comprised of puts, costless collars and swaps for crude oil, natural gas and NGLs, as well as interest rate swaps that we account for using mark-to-market accounting. The amounts related to commodity hedges are included in unrealized/realized gain (loss) derivatives gains (losses) and the amounts related to interest rate swaps are included in interest expenses (income). |

| | • | The historical results of Eagle Rock Predecessor only include the financial results of ONEOK Texas Field Services L.P.. |

| | • | Our historical financial results for periods prior to December 31, 2005 do not include the full financial results from the operation of the Tyler County pipeline. |

| | • | On March 27, 2006, Eagle Rock Pipeline completed a private placement of 5,455,050 common units for $98.3 million. |

| | • | On March 31, 2006 and April 7, 2006, a wholly-owned subsidiary of Eagle Rock Energy Partners, L.P. acquired certain natural gas gathering and processing assets from Duke Energy Field Services, L.P. and Swift Energy Corporation, consisting of the Brookeland gathering system and processing plant, the Masters Creek gathering system and the Jasper NGL pipeline. We refer to this acquisition as the Brookeland Acquisition. As a result, our historical financial results for the periods prior to March 31, 2006 do not include the financial results from the operation of these assets. |

| | • | On June 2, 2006, we purchased all of the partnership interests in Midstream Gas Services, L.P., which we refer to as the MGS Acquisition, an NGP affiliate, for approximately $4.7 million in cash and 809,174 (recorded value of $20.3 million) common units in Eagle Rock Pipeline. As a result, financial results for the periods prior to June 2006 do not include the financial results from the operation of these assets. |

| | • | On April 30, 2007, we acquired certain fee minerals, royalties and working interest properties through purchases directly from Montierra Minerals & Production, L.P. and through purchases directly from NGP-VII Income Co-Investment Opportunities, L.P., which we refer to as the Montierra Acquisition, for 6,458,946 (recorded value of $133.8 million) of our common units and $5.4 million in cash. As a result, financial results for the periods prior to May 2007 do not include the financial results from these assets. |

| | • | On May 3, 2007, we acquired Laser Midstream Energy, L.P. and certain of its subsidiaries, which we refer to as the Laser Acquisition, for $113.4 million in cash and 1,407,895 (recorded value of $29.2 million) of our common units. As a result, financial results for the periods prior to May 2007 do not include the financial results from these assets. |

| | • | On May 3, 2007, we completed the private placement of 7,005,495 common units for $127.5 million. |

| | • | On June 18, 2007, we acquired certain fee minerals and royalties from MacLondon Energy, L.P., which we refer to as the MacLondon Acquisition, for $18.2 million, financed with 757,065 (recorded value of $18.1 million) of our common units and cash of $0.1 million. As a result, financial results for the periods prior to July 2007 do not include the financial results from these assets. |

| | • | On July 31, 2007, we completed the acquisition of Escambia Asset Co. LLC and Escambia Operating Co. LLC, which we refer to as the EAC Acquisition, for approximately $224.6 million in cash and 689,857 (recorded value of $17.2 million) of our common units, subject to post-closing adjustment. As a result, financial results for the periods prior to July 31, 2007 do not include the financial results from these assets. |

| | • | On July 31, 2007, we completed the acquisition of Redman Energy Holdings, L.P. and Redman Energy Holdings II, L.P. and certain assets owned by NGP Income Co-Investment Opportunities Fund II, L.P. (a Natural Gas Partners affiliate) which we refer to as the Redman Acquisition, for 4,428,334 (recorded value of $108.2 million) common units and $84.6 million. As a result, financial results for the periods prior to July 2007 do not include the financial results from these assets. |

| | • | On July 31, 2007, we completed the private placement of 9,230,770 common units for approximately $204.0 million. |

| | • | On April 30, 2008, we completed the acquisition of Stanolind Oil and Gas Corp., which we refer to as the Stanolind Acquisition, for an aggregate purchase price of $81.9 million in cash. As a result, financial results for the periods prior to May 2008 do not include the financial results from these assets. |

| | • | On October 1, 2008 we completed the acquisition of Millennium Midstream Partners, L.P., which we refer to as the Millennium Acquisition, for approximately $181.0 million in cash and 2,181,818 (recorded value of $24.2 million) of our common units. Additionally, 1,818,182 common units and $0.6 million in cash were placed into an escrow account. Prior to December 31, 2008, we recovered 40,880 common units and $0.3 million in cash from the escrow account. As a result, financial results for the periods prior to October 2008 do not include the financial results from these assets. |

The selected historical financial data as of and for the year ended December 31, 2004 and as of and for the eleven month period ended November 30, 2005 are derived from the audited financial statements of Eagle Rock Predecessor and as of and for the years ended December 31, 2004, and 2005 are derived from the audited financial statements of Eagle Rock Pipeline, L.P. The selected historical financial data as of and for the years ended December 31, 2006, 2007, and 2008 are derived from the audited financial statements of Eagle Rock Energy Partners, L.P.

The following table includes the non-GAAP financial measure of Adjusted EBITDA. We define Adjusted EBITDA as net income (loss) plus or (minus) income tax provision (benefit); interest-net, including realized interest rate risk management instruments and other expense; depreciation, depletion and amortization expense, impairment expense; other operating expense, non-recurring; other non-cash operating and general and administrative expenses, including non-cash compensation related to our equity-based compensation program; unrealized (gains) losses on commodity and interest rate risk management related instruments; and other (income) expense. Adjusted EBITDA is used as a supplemental financial measure by external users of Eagle Rock’s financial statements such as investors, commercial banks and research analysts. Adjusted EBITDA is useful in determining our ability to sustain or increase distributions. By excluding unrealized derivative gains (losses), a non-cash, mark-to-market benefit (charge) which represents the change in fair market value of our executed derivative instruments and is independent of our assets’ performance or cash flow generating ability, we believe Adjusted EBITDA reflects more accurately our ability to generate cash sufficient to pay interest costs, support our level of indebtedness, make cash distributions to our unitholders and general partner and finance our maintenance capital expenditures. We further believe that Adjusted EBITDA, by excluding unrealized derivative gains (losses), also describes more accurately the underlying performance of our operating assets by isolating the performance of our operating assets from the impact of an unrealized, non-cash measure designed to describe the fluctuating inherent value of a financial asset. Similarly, by excluding the impact of non-recurring discontinued operations, Adjusted EBITDA provides users of our financial statements a more accurate picture of our current assets’ cash generation ability, independently from that of assets which are no longer a part of our operations. Eagle Rock’s Adjusted EBITDA definition may not be comparable to Adjusted EBITDA or similarly titled measures of other entities, as other entities may not calculate Adjusted EBITDA in the same manner as Eagle Rock. For example, we include in Adjusted EBITDA the actual settlement revenue created from our commodity hedges by virtue of transactions undertaken by us to reset commodity hedges to higher prices or purchase puts or other similar floors despite the fact that we exclude from Adjusted EBITDA any charge for amortization of the cost of such commodity hedge reset transactions or puts. For a reconciliation of Adjusted EBITDA to its most directly comparable financial measures calculated and presented in accordance with GAAP (accounting principles generally accepted in the United States), please read “Summary—Non-GAAP Financial Measures.”

| | | | | | Eagle Rock Pipeline, L.P. | | | Eagle Rock Energy Partners, L.P. | |

| | | Year Ended December 31, 2004 | | | Period from January 1, 2005 to November 30, 2005 | | | Year Ended December 31, 2004 | | | Year Ended December 31, 2005(1) | | | Year Ended December 31, 2006 | | | Year Ended December 31, 2007 | | | Year Ended December 31, 2008 | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | |

Sales to external customers | | $ | 335,519 | | | $ | 396,953 | | | $ | 10,636 | | | $ | 66,382 | | | $ | 502,394 | | | $ | 775,857 | | | $ | 1,316,500 | |

| Unrealized derivative gains/(losses) | | | — | | | | — | | | | — | | | | 7,308 | | | | (26,306 | ) | | | (130,773 | ) | | | 207,824 | |

| Realized derivative gains/(losses) | | | — | | | | — | | | | — | | | | — | | | | 2,302 | | | | (3,061 | ) | | | (46,059 | ) |

| Total revenues | | | 335,519 | | | | 396,953 | | | | 10,636 | | | | 73,690 | | | | 478,390 | | | | 642,023 | | | | 1,478,265 | |

| Cost of natural gas and NGLs | | | 263,840 | | | | 316,979 | | | | 8,811 | | | | 55,272 | | | | 377,580 | | | | 553,248 | | | | 891,433 | |

Operating and maintenance expense | | | 25,219 | | | | 25,326 | | | | 34 | | | | 2,955 | | | | 32,905 | | | | 52,793 | | | | 73,620 | |

Non-income based taxes | | | 2,208 | | | | 2,192 | | | | — | | | | 149 | | | | 2,301 | | | | 8,340 | | | | 19,936 | |

| General and administrative expense | | | — | | | | — | | | | 2,406 | | | | 4,616 | | | | 10,860 | | | | 27,799 | | | | 45,701 | |

| Other operating | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,847 | | | | 10,699 | |

| Advisory termination fee | | | — | | | | — | | | | — | | | | — | | | | 6,000 | | | | — | | | | — | |

| Depreciation, depletion and amortization expense | | | 8,268 | | | | 8,157 | | | | 619 | | | | 4,088 | | | | 43,220 | | | | 80,559 | | | | 116,754 | |

| Impairment expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | 5,749 | | | | 174,851 | |

| Operating income (loss) | | | 35,984 | | | | 44,299 | | | | (1,234 | ) | | | 6,610 | | | | 5,524 | | | | (89,312 | ) | | | 145,271 | |

| Interest (income) expense | | | (646 | ) | | | (859 | ) | | | — | | | | 4,031 | | | | 28,604 | | | | 49,764 | | | | 65,022 | |

Other (income) expense | | | (23 | ) | | | (17 | ) | | | (24 | ) | | | (171 | ) | | | (996 | ) | | | 7,530 | | | | (4,373 | ) |

| Income (loss) from continuing operations before income taxes | | | 36,653 | | | | 45,175 | | | | (1,210 | ) | | | 2,750 | | | | (22,084 | ) | | | (146,606 | ) | | | 84,622 | |

| Income tax provision | | | 12,731 | | | | 15,811 | | | | — | | | | — | | | | 1,230 | | | | 158 | | | | (1,134 | ) |

Income (loss) from continuing operations | | | 23,922 | | | | 29,364 | | | | (1,210 | ) | | | 2,750 | | | | (23,314 | ) | | | (146,764 | ) | | | 85,756 | |

| Discontinued operations | | | — | | | | — | | | | 22,192 | | | | — | | | | — | | | | 1,130 | | | | 1,764 | |

| Net income (loss) | | $ | 23,922 | | | $ | 29,364 | | | $ | 20,982 | | | $ | 2,750 | | | $ | (23,314 | ) | | $ | (145,634 | ) | | $ | 87,520 | |

| Loss (income) per common unit - diluted | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (0.98 | ) | | $ | (2.13 | ) | | $ | 1.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property plant and equipment, net | | $ | 243,939 | | | $ | 242,487 | | | $ | 19,564 | | | $ | 441,588 | | | $ | 554,063 | | | $ | 1,207,130 | | | $ | 1,357,609 | |

| Total assets | | | 304,631 | | | | 376,447 | | | | 28,017 | | | | 700,659 | | | | 779,901 | | | | 1,609,927 | | | | 1,773,061 | |

| Long-term debt | | | — | | | | — | | | | — | | | | 408,466 | | | | 405,731 | | | | 567,069 | | | | 799,383 | |

| Net equity | | | 204,344 | | | | 233,708 | | | | 27,655 | | | | 208,096 | | | | 291,987 | | | | 726,768 | | | | 727,715 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating activities | | $ | 41,813 | | | $ | 47,603 | | | $ | 3,652 | | | $ | (1,667 | ) | | $ | 54,992 | | | $ | 106,945 | | | $ | 181,151 | |

| Investing activities | | | (5,567 | ) | | | (6,708 | ) | | | 16,918 | | | | (543,501 | ) | | | (134,873 | ) | | | (475,790 | ) | | | (334,603 | ) |

| Financing activities | | | (36,246 | ) | | | (40,895 | ) | | | (13,955 | ) | | | 556,304 | | | | 71,088 | | | | 426,816 | | | | 102,816 | |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash distributions per Common Unit (declared) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 0.2679 | | | $ | 1.485 | | | $ | 1.63 | |

| Adjusted EBITDA(2) | | $ | 44,275 | | | $ | 52,473 | | | $ | (591 | ) | | $ | 3,561 | | | $ | 81,192 | | | $ | 132,216 | | | $ | 247,445 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Includes historical financial and operating data for Eagle Rock Predecessor for the period from December 1, 2005 to December 31, 2005. Prior to the December 1, 2005 acquisition of the Eagle Rock Predecessor, the operations of Eagle Rock Pipeline, L.P. were minimal. |

| | (2) | See Part II Item 6. Selection Financial Data – Non-GAAP Financial Measures for reconciliation of “Adjusted EBITDA” to net cash flows from operating activities and net income (loss). |

Non-GAAP Financial Measures

We include in this filing the following non-GAAP financial measure: Adjusted EBITDA (as defined on page 80). We provide reconciliations of this non-GAAP financial measure to its most directly comparable financial measures as calculated and presented in accordance with GAAP.

Adjusted EBITDA should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP.

Adjusted EBITDA does not include interest expense, income taxes or depreciation and amortization expense. Because we have borrowed money to finance our operations, interest expense is a necessary element of our costs and our ability to generate net income. Because we use capital assets, depreciation and amortization are also necessary elements of our costs. Therefore, any measures that exclude these elements have material limitations. To compensate for these limitations, we believe that it is important to consider both net income determined under GAAP, as well as Adjusted EBITDA, to evaluate our liquidity. Our Adjusted EBITDA excludes some, but not all, items that affect net income and operating income and these measures may vary among companies. Therefore, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies. For example, we include in Adjusted EBITDA the actual settlement revenue created from our commodity hedges by virtue of transactions undertaken by us to reset commodity hedges to higher prices or purchase puts or other similar floors despite the fact that we exclude from Adjusted EBITDA any charge for amortization of the cost of such commodity hedge reset transactions or puts.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Eagle Rock Pipeline, L.P. | | | Eagle Rock Energy Partners, L.P. | |

| | | Year Ended December 31, 2004 | | | Period from January 1, 2005 to November 30, 2005 | | | Year Ended December 31, 2004 | | | Year Ended December 31, 2005(1) | | | Year Ended December 31, 2006 | | | Year Ended December 31, 2007 | | | Year Ended December 31, 2008 | |

| Reconciliation of “Adjusted EBITDA” to net cash flows provided by (used in) operating activities and net income (loss): | | | | | | | | | | | | | | | | | | | | | |

| Net cash flows provided by (used in) operating activities | | $ | 41,813 | | | $ | 47,603 | | | $ | 3,652 | | | $ | (1,667 | ) | | $ | 54,992 | | | $ | 106,945 | | | $ | 181,151 | |

| Add (deduct): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation, depletion, amortization and impairment | | | (8,268 | ) | | | (8,157 | ) | | | (1,174 | ) | | | (4,088 | ) | | | (43,220 | ) | | | (86,308 | ) | | | (291,605 | ) |

Amortization of debt issue cost | | | — | | | | — | | | | — | | | | (76 | ) | | | (1,114 | ) | | | (1,777 | ) | | | (958 | ) |

| Risk management portfolio value changes | | | — | | | | — | | | | — | | | | 5,709 | | | | (23,531 | ) | | | (136,132 | ) | | | 199,339 | |

| Reclassing financing derivative settlements | | | — | | | | — | | | | — | | | | — | | | | 978 | | | | (1,667 | ) | | | (11,063 | ) |

Other | | | (7,325 | ) | | | (1,559 | ) | | | — | | | | (6 | ) | | | (7,566 | ) | | | (8,235 | ) | | | (4,433 | ) |

Gain on sale of Dry Trail plant | | | — | | | | — | | | | 19,465 | | | | — | | | | — | | | | — | | | | — | |

| Accounts receivable and other current assets | | | 30,905 | | | | 56,599 | | | | (901 | ) | | | 43,179 | | | | 1,432 | | | | 16,579 | | | | (41,814 | ) |

| Accounts payable, due to affiliates and accrued liabilities | | | (34,705 | ) | | | (64,320 | ) | | | (169 | ) | | | (40,197 | ) | | | (8,777 | ) | | | (34,374 | ) | | | 57,762 | |

Other assets and liabilities | | | 1,502 | | | | (802 | ) | | | 109 | | | | (104 | ) | | | 3,492 | | | | (665 | ) | | | (859 | ) |

Net income (loss) | | | 23,922 | | | | 29,364 | | | | 20,982 | | | | 2,750 | | | | (23,314 | ) | | | (145,634 | ) | | | 87,520 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest (income) expense, net | | | (646 | ) | | | (859 | ) | | | — | | | | 2,432 | | | | 30,383 | | | | 44,587 | | | | 38,260 | |

| Depreciation, depletion, amortization and impairment | | | 8,268 | | | | 8,157 | | | | 619 | | | | 4,088 | | | | 43,220 | | | | 86,308 | | | | 291,605 | |

Income tax provision (benefit) | | | 12,731 | | | | 15,811 | | | | — | | | | — | | | | 1,230 | | | | 158 | | | | (1,134 | ) |

EBITDA | | | 44,275 | | | | 52,473 | | | | 21,601 | | | | 9,270 | | | | 51,519 | | | | (14,581 | ) | | | 416,251 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from discontinued operations | | | — | | | | — | | | | (22,192 | ) | | | — | | | | — | | | | (1,130 | ) | | | (1,764 | ) |

| Risk management portfolio value changes | | | — | | | | — | | | | — | | | | (5,709 | ) | | | 23,531 | | | | 144,176 | | | | (180,107 | ) |

| Restricted unit compensation expense | | | — | | | | — | | | | — | | | | — | | | | 142 | | | | 2,395 | | | | 7,694 | |

Other income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (696 | ) | | | (5,328 | ) |

Other operating expense (2) | | | — | | | | — | | | | — | | | | — | | | | 6,000 | | | | 2,847 | | | | 10,699 | |

Non-recurring operating items | | | — | | | | — | | | | — | | | | — | | | | — | | | | (795 | ) | | | — | |

ADJUSTED EBITDA | | $ | 44,275 | | | $ | 52,473 | | | $ | (591 | ) | | $ | 3.561 | | | $ | 81,192 | | | $ | 132,216 | | | $ | 247,445 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Includes historical financial and operating data for Eagle Rock Predecessor for the period from December 1, 2005 to December 31, 2005. |

| | (2) | Includes $6.0 million to terminate an advisory fee for the year ended December 31, 2006, a settlement of arbitration for $1.4 million, severance to a former executive for $0.3 million and $1.1 million for liquidated damage related to the late registration of our common units during the year ended December 31, 2007 and $10.7 million related to bad debt expense taken against our outstanding accounts receivable from SemGroup during the year ended December 31, 2008. |

The following table summarizes our quarterly financial data for 2008.

| | | | | | | | | | | | | |

| | | For the Quarters Ended | |

| | | December 31, 2008 | | | September 30, 2008(1) | | | June 30, 2008(1) | | | March 31, 2008(1) | |

| | | ($ in thousands, except earnings per unit) | |

Sales of natural gas, NGLs and condensate | | $ | 225,028 | | | $ | 341,700 | | | $ | 369,808 | | | $ | 297,383 | |

Gathering and treating services | | | 11,130 | | | | 12,513 | | | | 8,085 | | | | 7,143 | |

Minerals and royalty income | | | 8,388 | | | | 17,393 | | | | 10,255 | | | | 6,958 | |

Realized commodity derivative gains (losses) | | | 18,329 | | | | (24,105 | ) | | | (27,708 | ) | | | (12,575 | ) |

| Unrealized commodity derivative gains (losses) | | | 241,205 | | | | 255,956 | | | | (256,265 | ) | | | (33,072 | ) |

Other revenues | | | 106 | | | | 428 | | | | 122 | | | | 60 | |

Total operating revenues | | | 504,186 | | | | 603,885 | | | | 104,297 | | | | 265,897 | |

Cost of natural gas and NGLs | | | 165,033 | | | | 237,743 | | | | 272,156 | | | | 216,501 | |

Operating and maintenance expense | | | 23,809 | | | | 21,475 | | | | 17,731 | | | | 15,566 | |

General and administrative expense | | | 14,540 | | | | 15,258 | | | | 15,289 | | | | 15,589 | |

Other operating expense | | | 565 | | | | 3,920 | | | | 6,214 | | | | — | |

| Depreciation, depletion, amortization and impairment expense | | | 210,806 | | | | 28,597 | | | | 26,457 | | | | 25,745 | |

| Interest—net including realized risk management instrument | | | 9,499 | | | | 9,856 | | | | 9,418 | | | | 9,205 | |

| Unrealized risk management interest related instrument | | | 27,245 | | | | 501 | | | | (13,689 | ) | | | 13,660 | |

Income tax (benefit) provision | | | 363 | | | | (500 | ) | | | (891 | ) | | | (105 | ) |

Other expense (income) | | | (2,158 | ) | | | (441 | ) | | | (814 | ) | | | (1,633 | ) |

Discontinued operations | | | (313 | ) | | | (595 | ) | | | (553 | ) | | | (303 | ) |

Net income (loss) | | $ | 54,797 | | | $ | 288,071 | | | $ | (227,020 | ) | | $ | (28,328 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per unit—diluted | | | | | | | | | | | | | | | | |

Common units | | $ | 0.73 | | | $ | 3.94 | | | $ | (3.14 | ) | | $ | (0.39 | ) |

Subordinated units | | $ | 0.73 | | | $ | 3.94 | | | $ | (3.14 | ) | | $ | (0.39 | ) |

General partner | | $ | 0.73 | | | $ | 3.94 | | | $ | (3.14 | ) | | $ | (0.39 | ) |

| (1) | Prior quarterly periods’ financial data has been reclassified to conform to current period presentation. |

During our fiscal year ended December 31, 2008, we recorded the following unusual or infrequently occurring items,

| · | During our quarter ended December 31, 2008, we incurred impairment charges of $35.1 million in our Midstream Business, $107.0 million in our Upstream Segment and $1.7 million in our Minerals Segment. These impairment charges were necessary due to the substantial decline in commodity prices during the fourth quarter of 2008, as well as declining drilling activity. In addition, due to the impairment charge recorded in our Upstream Segment, we assessed our goodwill balance for impairment and recorded an impairment charge of $31.0 million. |

| · | We experienced significant fluctuations in our unrealized commodity derivative gains and losses from quarter to quarter as a result of the volatility that was experience by commodity prices during 2008. For example, we recorded a unrealized loss of $256.3 million during our quarter ended June 30, 2008, while in our quarters ended September 30, 2008 and December 31, 2008, we recorded unrealized gains of $256.0 million and $241.2 million, respectively. See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – General Trends and Outlook – Natural Gas Supply and Demand and Petroleum Supply, Demand and Outlook for further discussion regarding the volatility of commodity prices. |

| · | As a result SemGroup, L.P. and certain of its subsidiaries filing petitions for bankruptcy we recorded bad debt charges during our quarters ended June 30, 2008, September 30, 2008 and December 31, 2008 of $6.2 million, $3.9 million and $0.6 million, respectively. These amounts are recorded as Other operating expense. See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Summary of Consolidated Operating Results – Corporate Segment for a further discussion. |

| · | During our quarter ended June 30, 2008, we acquired Stanolind Oil and Gas Corp. for which operations were included within our Upstream Segment beginning on May 1, 2008. |

| · | During our quarter ended December 31, 2008, we acquired Millennium Midstream Partners, L.P. for which operations related to these assets were included within our Midstream Business starting on October 2, 2008. |

| | | | | | | | | | | | | |

| | | For the Quarters Ended | |

| | | December 31, 2007(1) | | | September 30, 2007(1) | | | June 30, 2007(1) | | | March 31, 2007(1) | |

| | | ($ in thousands, except earnings per unit) | |

| Sales of natural gas, NGLs and condensate | | $ | 269,798 | | | $ | 207,127 | | | $ | 146,280 | | | $ | 110,121 | |

| Gathering and treating services | | | 8,148 | | | | 8,103 | | | | 6,883 | | | | 4,283 | |

| Minerals and royalty income | | | 5,803 | | | | 6,009 | | | | 3,192 | | | | — | |

| Realized commodity derivative gains (losses) | | | (7,385 | ) | | | (177 | ) | | | 1,502 | | | | 2,999 | |

| Unrealized commodity derivative gains (losses) | | | (100,240 | ) | | | 8,865 | | | | (28,757 | ) | | | (10,641 | ) |

| Other revenues | | | 130 | | | | (20 | ) | | | — | | | | — | |

| Total operating revenues | | | 176,254 | | | | 229,907 | | | | 129,100 | | | | 106,762 | |

| Cost of natural gas and NGLs | | | 192,996 | | | | 150,338 | | | | 119,278 | | | | 90,636 | |

| Operating and maintenance expense | | | 20,754 | | | | 19,629 | | | | 12,124 | | | | 8,626 | |

| General and administrative expense | | | 11,212 | | | | 7,196 | | | | 5,171 | | | | 4,220 | |

| Other operating expense | | | 916 | | | | 220 | | | | — | | | | 1,711 | |

| Depreciation, depletion, amortization and impairment expense | | | 35,424 | | | | 25,105 | | | | 14,149 | | | | 11,630 | |

| Interest—net including realized risk management instrument | | | 10,826 | | | | 10,075 | | | | 8,025 | | | | 7,435 | |

| Unrealized risk management interest related instrument | | | 9,848 | | | | 8,429 | | | | (6,485 | ) | | | 1,611 | |

| Income tax (benefit) provision | | | (607 | ) | | | 347 | | | | 254 | | | | 164 | |

| Other expense (income) | | | 6,866 | | | | (352 | ) | | | 619 | | | | 397 | |

| Discontinued operations | | | (431 | ) | | | (456 | ) | | | (254 | ) | | | — | |

| Net (loss) income | | $ | (111,554 | ) | | $ | 9,371 | | | $ | (23,783 | ) | | $ | (19,668 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per unit—diluted | | | | | | | | | | | | | | | | |

| Common units | | $ | (1.86 | ) | | $ | 0.16 | | | $ | (0.25 | ) | | $ | (0.22 | ) |

| Subordinated units | | $ | (2.00 | ) | | $ | 0.09 | | | $ | (0.76 | ) | | $ | (0.70 | ) |

| General partner | | $ | (2.00 | ) | | $ | 0.09 | | | $ | (0.76 | ) | | $ | (0.70 | ) |

| (1) | Prior quarterly periods’ financial data has been reclassified to conform to current period presentation. |

During our fiscal year ended December 31, 2007, we recorded the following unusual or infrequently occurring items,

| · | During our quarter ended December 31, 2007, we incurred impairment charges of $5.7 million in our Minerals Segment as a result of steeper decline rates in certain fields. |

| · | We experience significant fluctuations in our unrealized commodity derivative gains and losses from quarter to quarter as a result of the volatility that was experience by commodity prices during 2008. For example, we recorded an unrealized gain of $8.9 million during our quarter ended September 30, 2007, while in our quarters ended March 31, 2007, June 30, 2007 and December 31, 2007, we recorded unrealized losses of $10.6 million, $28.8 million and $100.2 million, respectively. See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – General Trends and Outlook – Natural Gas Supply and Demand and Petroleum Supply, Demand and Outlook for further discussion regarding the volatility of commodity prices. |

| · | During our quarter ended March 31, 2007, we an expense of $1.4 million related to the settlement of arbitration. This amount was recorded as Other Operating Expense. |

| · | In our quarter ended June 30, 2007, we acquired certain fee minerals and royalties from Montierra Minerals and Production, L.P. and NGP-VII Income Co-Investment Opportunities, L.P., for which operations related to these assets were the start of our Mineral Segment beginning on May 1, 2007. |

| · | In our quarter ended June 30, 2007, we acquired all of the non-corporate interests of Laser Midstream Energy, LP and certain subsidiaries, for which operations were included as part of our Midstream Business beginning on May 3, 2007. |

| · | In our quarter ended September 30, 2007, we acquired completed our acquisitions of Escambia Asset Co. LLC, Escambia Operating Co. LLC, Redman Energy Holdings, L.P. and Redman Holdings II, L.P and certain assets owned by NGP Income Co-Investment Opportunities Fund II, L.P., for which operations related to these assets acquired were included as part of our Upstream Business beginning on August 1, 2007. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion analyzes our financial condition and results of operations. The following discussion of our financial condition and results of operations should be read in conjunction with our historical consolidated financial statements and notes included elsewhere in this Annual Report.

OVERVIEW

We are a domestically focused growth-oriented publicly traded Delaware limited partnership engaged in the following three businesses:

| | • | Midstream Business—gathering, compressing, treating, processing and transporting of natural gas; fractionating and transporting of natural gas liquids (“NGLs”); and the marketing of natural gas, condensate and NGLs; |

| | • | Upstream Business—acquiring, developing and producing oil and natural gas property interests; and |

| | • | Minerals Business—acquiring and managing fee minerals and royalty interests, either through direct ownership or through investment in other partnerships. |

We report on our businesses in seven accounting segments.

We conduct, evaluate and report on our Midstream Business within four distinct segments—the Texas Panhandle Segment, the East Texas/Louisiana Segment, the South Texas Segment and the Gulf of Mexico Segment. Our Texas Panhandle Segment consists of gathering and processing assets in the Texas Panhandle. Our East Texas/Louisiana Segment consists of gathering and processing assets in East Texas/Northern Louisiana. Our South Texas Segment consists of gathering systems and related compression and processing facilities in South Texas, Central Texas, and West Texas. Our Gulf of Mexico Segment consists of gathering and processing assets in Southern Louisiana, the Gulf of Mexico and Galveston Bay. During the year ended December 31, 2008, our Midstream Business generated operating income from continuing operations of $56.5 million, compared to operating income of $55.9 million generated during the year ended December 31, 2007, an increase of 1.0%. The operating income generated during the year ended December 31, 2008 was offset by an impairment charge to certain assets of $35.1 million.

We conduct, evaluate and report on our Upstream Business as one segment. Our Upstream Segment includes operated wells in Escambia County, Alabama as well as two treating facilities, one natural gas processing plant and related gathering systems that are inextricably intertwined with ownership and operation of the wells. The Upstream Segment also includes operated and non-operated wells that are primarily located in West, East and South Texas in Ward, Crane, Pecos, Henderson, Rains, Van Zandt, Limestone, Freestone and Atascosa Counties. During the year ended December 31, 2008, our Upstream Business generated an operating loss of $47.5 million, compared to operating income of $19.6 million generated during the year ended December 31, 2007. The operating loss generated during the year ended December 31, 2008 was primarily due to impairment charges of $107.0 million and $31.0 million to write down the value of certain fields and goodwill, respectively. Of important note, during 2008, our Upstream Business had eight months of operations from the assets acquired in the Stanolind Acquisition and a full year of the other assets acquired in acquisition during 2007 and our Upstream Business generated revenue of $37.8 million from the sale of sulfur during the year ended December 31, 2008 compared to revenue of $2.6 million during the year ended December 31, 2007.

We conduct, evaluate, and report our Minerals Business as one segment. Our Minerals Segment consists of fee mineral, royalty and overriding royalty interests located in multiple producing trends in the United States. A significant portion of the mineral interests that we own are managed by a non-affiliated private partnership (the “Minerals Manager”) that controls the executive rights associated with the minerals. For a more detailed discussion of this relationship, see Part I, Item 1. Business – Minerals Business. During the year ended December 31, 2008, our Minerals Segment generated operating income of $31.8 million, compared to $0.5 million generated during the year ended December 31, 2007. Included within these numbers is $16.8 million of lease bonus revenue generated during the year ended December 31, 2008 compared to $1.3 million of lease bonus revenue generated during the year ended December 31, 2007. During the year ended December 31, 2008, as a result of the regeneration phenomenon we received an initial royalty payment for 304 new wells. During the year ended December 31, 2008, we recorded an impairment charge of $1.7 million compared to an impairment charge of $5.7 million recorded during the year ended December 31, 2007.

The final segment that we report on is our Corporate Segment, which is where we account for our commodity derivative/hedging activity and our general and administrative expenses. During the year ended December 31, 2008, our Corporate Segment generated operating income of $104.6 million compared to an operating loss of $165.2 million generated during the year ended December 31, 2007. Within these numbers were gains, realized and unrealized, on commodity derivatives of $161.8 million during the year ended December 31, 2008 compared to a loss, realized and unrealized, on commodity derivatives of $133.8 million during the year ended December 31, 2007. The gain generated by our commodity derivatives during the year ended December 31, 2008 was the result of the decline in commodity prices during the fourth quarter of 2008.

Impairment

In connection with preparation and audit of our Consolidated Financial Statements for the year ended December 31, 2008, which are included in Part II, Item 8. Financial Statements and Supplementary Data starting on page F-1 of this Annual Report, we determined that we needed to record an impairment charge for certain plants and pipelines within our Midstream Business and certain fields within our proved properties within our Upstream and Minerals Segments. These impairment charges were necessary due to the substantial decline in commodity prices during the fourth quarter of 2008, as well as declining drilling activity. As a result, we incurred impairment charges of $35.1 million in our Midstream Business, $107.0 million in our Upstream Segment and $1.7 million in our Minerals Segment. Due to the impairment charge recorded in our Upstream Segment, we assessed our goodwill balance for impairment and recorded an impairment charge of $31.0 million.

Pursuant to generally accepted accounting principles in the United States, our impairment analysis does not take into account the value of our commodity derivative instruments, which generally increase as the estimates of future prices decline. Further declines in commodity prices and other factors could result in additional impairment charges and changes to the fair value of our derivative instruments.

Acquisitions

Historically, we have grown through acquisitions. With the Stanolind Acquisition, described below, completed at the beginning of the second quarter of 2008, we expanded our Upstream Business. At the beginning of the fourth quarter we completed the Millennium Acquisition, described below, which expanded our Midstream Business.

Going forward, we will continue to assess acquisition opportunities, regardless of whether such opportunity is in the Midstream, Upstream, or Minerals Business, for their potential accretive value. Our ability to complete acquisitions will depend on our ability to finance the acquisitions, either through the issuance of additional securities, debt or equity, or the incurrence of additional debt under our credit facilities, on terms acceptable to us.

Below is a summary of our important acquisition transactions completed during 2008.

Stanolind Acquisition - On April 30, 2008, we completed the acquisition of all of the outstanding capital stock of Stanolind Oil and Gas Corp. (“Stanolind”), for an aggregate purchase price of $81.9 million, subject to working capital and other purchase price adjustments (the “Stanolind Acquisition”). We funded the transaction from existing cash from operations, as well as with borrowings under our existing secured revolving credit facility. Stanolind operated crude oil and natural gas producing properties in the Permian Basin of West Texas, primarily in Ward, Crane and Pecos Counties.

Millennium Acquisition - On October 1, 2008, we completed the acquisition of 100% of the outstanding units of Millennium Midstream Partners, L.P. (“MMP”) for an aggregate purchase price of $205.2 million, comprised of approximately $181.0 million in cash and 2,181,818 (recorded value of $24.2 million) common units (the “Millennium Acquisition”). Additionally, 1,818,182 common units and $0.6 million in cash were placed into an escrow account. The cash portion of the consideration was funded through borrowings of $176.4 million under our secured revolving credit facility made prior to September 30, 2008 and through cash on hand. MMP is in the natural gas gathering and processing business, with assets located in East, Central and West Texas and South Louisiana. With respect to the South Louisiana assets acquired in the Millennium Acquisition, both the Yscloskey and North Terrebonne facilities were flooded with three to four feet of water as a result of the storm surges caused by Hurricanes Ike and Gustav. We have reported, are preparing to file claims for, and expect to receive payment on our business interruption insurance coverage related to hurricanes Ike and Gustav’s damage to these two facilities. The timing of collection of such insurance claims is unknown at this time. The North Terrebonne Plant restarted service in November 2008 and the Yscloskey Plant restarted service in January 2009. The former owners of MMP provided us indemnity coverage for Hurricanes Ike and Gustav to the extent losses are not covered by insurance and established an escrow account of 1,818,182 common units and $0.6 million in cash available for us to recover against for this purpose. Prior to December 31, 2008, we recovered 40,880 units and $0.3 million in cash from this escrow account. Subsequent to December 31, 2008, we recovered 65,841 common units and the remaining $0.3 million in cash from the escrow account and we expect to recover additional amounts in the future.

Below is a summary of the important acquisition transactions we completed during the year ended December 31, 2007. A more complete description of these acquisitions is contained in Note 4 of our consolidated financial statements included in Part II, Item 8, Financial Statements and Supplementary Data starting on page F-1 of this Annual Report.

Montierra Acquisition - On April 30, 2007, we completed the acquisition of (by direct acquisition or acquisition of certain entities) certain fee minerals, royalties, working interest properties and certain investments in partnerships from Montierra Minerals & Production, L.P. and NGP-VII Income Co-Investment Opportunities, L.P. (the “Montierra Acquisition”).

Laser Acquisition - On May 3, 2007, we acquired all of the non-corporate interests of Laser Midstream Energy, LP and certain subsidiaries (the “Laser Acquisition”).

MacLondon Acquisition - On June 18, 2007, we completed the acquisition of certain fee mineral and royalties owned by MacLondon Energy, L.P.

Escambia Acquisition - On July 31, 2007, we completed the acquisition of Escambia Asset Co. LLC and Escambia Operating Co. LLC (the “Escambia Acquisition”).

Redman Acquisition - On July 31, 2007, we completed the acquisition of Redman Energy Holdings, L.P. and Redman Energy Holdings II, L.P. and certain assets owned by NGP Income Co-Investment Opportunities Fund II, L.P. (the “Redman Acquisition”).

Prior to the above 2007 acquisitions the Partnership was solely a midstream company. The Montierra Acquisition, (followed quickly by the MacLondon Acquisition) provided the Partnership’s entry into the Minerals Business and the EAC and Redman acquisitions provided the Partnership’s entry into the Upstream Business.

Other Matters

Hurricanes Ike and Gustav - Hurricane Ike, which made landfall in Texas on September 13, 2008, caused no direct damage to our offices or facilities except for certain assets acquired in the Millennium Acquisition, as described above; however, the storm did cause temporary operational disruption to our operations located in East Texas, North Louisiana and South Texas due to third-party downstream infrastructure issues. Operations were either temporarily interrupted or curtailed during and immediately after the storm due to power disruptions suffered by third parties causing natural gas and natural gas liquids supply and market issues. All of our operations returned to pre-hurricane levels within ten days after the storm. Our assets, except for certain assets acquired in the Millennium Acquisition, as described above, were not impacted by Hurricane Gustav.

Recent Transactions

On January 8, 2009, we executed a series of hedging transactions that involved the unwinding of a portion of existing “in-the-money” 2011 and 2012 WTI crude oil swaps and collars, and the unwinding of two “in-the-money” 2009 WTI crude oil collars. With these transactions, and an additional $13.9 million of cash, we purchased a 2009 WTI crude oil swap on 60,000 barrels per month beginning January 1, 2009 at $97 per barrel. Both the unwound hedges and new hedges relate to expected volumes in our Midstream and Minerals segments. These transactions were executed to enhance our expected 2009 cash flows and our ability to maintain our current distribution level of $1.64 per unit on an annual basis and our ability to remain in compliance with our credit facility financial covenants. The actual distributions we will declare will be subject to our operating performance, prevailing market conditions (including forward oil, natural gas and sulfur commodity prices), the impact of unforeseen events and the approval of our Board of Directors and the actual distributions will be pursuant to our distribution policy described in Part II, Item 5 Market for Registrant’s Common Equity, Related Unitholder Matters and Issuer Purchases of Equity Securities – Cash Distribution Policy.

In addition to the hedging transactions discussed above, we also entered into a 125,000 MMBtu per month Henry Hub natural gas swap at $6.65/MMBtu on January 19, 2009 for our 2009 fiscal year, a 170,000 MMBtu per month Henry Hub natural gas swap at $6.14/MMBtu on February 17, 2009 for our 2010 fiscal year, a 45,000 barrel per month WTI crude oil swap at $53.55 per barrel on February 17, 2009 for our 2010 fiscal year and a 40,000 barrel per month WTI crude oil swap at $51.40 per barrel on February 19, 2009 for our 2010 fiscal year.

On April 1, 2009, we sold our producer services business (which is accounted for in its South Texas Segment) by assigning and novating the contracts under this business to a third-party purchaser. We sold the producer services business to a third-party purchaser as it was a low-margin business that was not core to our operations. We received an initial payment of $0.1 million for the sale of the business. In addition we will receive a contingency payment of up to $0.1 million in October 2009. We will continue to receive a monthly payment equivalent to $0.01 per MMbtu on the volume of gas that flows pursuant to the assigned contracts through March 31, 2011. Producer services was a business in which we would negotiate new well connections on behalf of small producers to pipelines other than its own. During the year ended December 31, 2008, this business generated revenues of $265.1 million and cost of natural gas and natural gas liquids of $263.3 million, as compared to revenues of $134.8 million and cost of natural gas and natural gas liquids of $133.6 million during the year ended December 31, 2007. There were no operations during the year ended December 31, 2006. The accompanying consolidated financial statements have been retrospectively adjusted to present these operations as discontinued operations.

How We Evaluate Our Operations

Our management uses a variety of financial and operational measurements to analyze our performance. We view these measurements as important factors affecting our profitability and review these measurements on a monthly basis for consistency and trend analysis. These measures include volumes, margin, operating expenses and Adjusted EBITDA (defined on page 80) on a company-wide basis.

Volumes (by Business)

Midstream Volumes. In our Midstream Business, we must continually obtain new supplies of natural gas to maintain or increase throughput volumes on our gathering and processing systems. Our ability to maintain existing supplies of natural gas and obtain new supplies is impacted by (1) the level of workovers or recompletions of existing connected wells and successful drilling activity in areas currently dedicated to our pipelines, (2) our ability to compete for volumes from successful new wells in other areas and (3) our ability to obtain natural gas that has been released from other commitments. We routinely monitor producer activity in the areas served by our gathering and processing systems to pursue new supply opportunities.

Upstream Volumes. In the Upstream Segment, we continually monitor the production rates of the wells we operate. This information is a critical indicator of the performance of our wells, and we evaluate and respond to any significant adverse changes. We employ an experienced team of engineering and operations professionals to monitor these rates on a well-by-well basis and to design and implement remediation activities when necessary. We also design and implement workover and drilling operations to increase production in order to offset the natural decline of our currently producing wells.

Minerals Volumes. Our Minerals Segment assets are comprised of royalty, overriding royalty, non-producing mineral, and therefore, we do not operate any of these properties. In order to maintain or increase our cash flows from our Minerals Segment, we rely upon the efforts of the operators of our interests. We do not control whether or when additional drilling or recompletion activity will be conducted on the properties in which we have an interest; however, when these activities do occur, we do not bear any of their costs. Nevertheless, at any time, there is often a significant amount of drilling and recompletion activity occurring on the properties in which we own an interest yielding us a cost-free “regeneration effect” on mineral and royalty interests. We monitor the additional production volumes that we realize from regeneration, and we use this information to make adjustments to our reserves estimates on a regular basis. These adjustments to our reserves (as a result of the regeneration effect) are important measures of the performance of our Minerals Segment. During the year ended December 31, 2008, as a result of the regeneration phenomenon we received an initial royalty payment for 304 new wells.

Commodity Pricing

Our margins in our Midstream Business may be positively impacted to the extent the price of NGLs increase in relation to the price of natural gas and may be adversely impacted to the extent the price of NGLs decline in relation to the price of natural gas. We refer to the price of NGLs in relation to the price of natural gas as the fractionation spread. In both our Upstream and Minerals Segments, increases in crude oil, natural gas and NGL prices will generally have a favorable impact on our revenues, conversely, decreases in crude oil, natural gas and NGL prices will generally unfavorably impact our revenue.

Risk Management

We conduct risk management activities to mitigate the effect of commodity price and interest rate fluctuations on our cash flows. Our primary method of risk management in this respect is entering into derivative contracts. To execute and evaluate the performance of these activities, we have formed a Risk Management Committee which is comprised of several members of our senior management team and other key employees. In addition to establishing the procedures and controls associated with risk management activities, the Risk Management Committee meets regularly to review the hedge portfolio and make recommendations for additional hedges. The Risk Management Committee routinely estimates the potential effect of price and interest rate fluctuations on the expected future cash flows associated with our operations, and the Risk Management Committee evaluates whether the hedges sufficiently mitigate the effect of these fluctuations. The impact of our risk management activities are captured in our Corporate Segment.

Operating Expenses

Midstream Operating Expenses. Midstream operating expenses are a separate measure we use to evaluate the performance of our field operations. Direct labor, insurance, repair and maintenance, utilities and contract services comprise the most significant portion of our operating expenses. These expenses are largely independent of the volumes through our systems, but fluctuate depending on the activities performed during a specific period.

Upstream Operating Expenses. We monitor and evaluate our Upstream Segment operating costs routinely, both on a total cost and unit cost basis. Many of the operating costs we incur are not directly related to the quantity of hydrocarbons that we produce, so we strive to maximize our production rates in order to improve our unit operating costs. The most significant portion of our Upstream Segment operating costs is associated with the operation of the Big Escambia treating and processing facilities. These facilities are overseen by members of our midstream engineering and operations staff. The majority of the cost of operating these facilities is independent of their throughput. This includes items such as labor, chemicals, utilities, materials, and insurance.

Minerals Operating Expenses. We do not incur any operating costs associated with our Minerals Segment due to the non-cost-bearing nature of the mineral and royalty assets.

Adjusted EBITDA

See discussion of Adjusted EBITDA in Part II, Item 6. Selected Financial Data.

General Trends and Outlook

We expect our business to continue to be affected by the following key trends. Our expectations are based on assumptions made by us and information currently available to us. To the extent our underlying assumptions about or interpretations of available information prove to be incorrect, our actual results may vary materially from our expected results.

The most significant external events impacting our business are the worldwide credit crisis that was precipitated by the United States subprime mortgage market collapse, and the resulting global economic recession. The recession has led to a significant reduction in demand for the commodities that we produce, transport and/or process.

The government of the United States and the governments of many other developed and developing nations have already taken, and are contemplating additional, significant actions to stabilize their banking systems and to increase consumption to stimulate economic growth. Although these actions are of unprecedented size and scope, we do not believe that they will restore demand for our products in 2009 to the levels that we observed in early 2008.

Natural Gas Supply and Demand

Natural gas is a significant source of energy and raw materials in the United States. Over the last several years, supply of natural gas remained fairly steady, while demand gradually increased. In the early part of the current decade, supply and demand came into balance and natural gas prices began to rise.

However, over the last half of 2008, the global economic recession resulted in greatly reduced demand for natural gas. This reduction in demand has occurred at the same time that large amounts of additional natural gas supply are being developed in various shale gas plays in the United States. The development of some of these shale gas plays has been so successful that the decline in United States per well natural gas production has been reversed for the first time in many years. The confluence of reduced demand and increased domestic supply caused natural gas prices to fall dramatically in the United States. Natural gas is currently about $4.50/mmbtu at Henry Hub.

We do not expect that significant economic growth will occur in the United States and global economies during 2009, and we believe it will be at least several months before reduced levels of drilling activity will lead to lower production rates. Therefore, with demand low and unlikely to increase quickly, and with supply strong and unlikely to decline quickly, we believe that natural gas prices will be low (relative to the last couple of years) throughout 2009 and at least throughout the first portion of 2010.

Other factors which we do not believe will affect the price of natural gas in the near term, but potentially could, are liquified natural gas (LNG) imports and the development of alternative energy sources. With respect to LNG imports, we have noted that the amount of LNG delivered to United States terminals has declined significantly, to the point where it can not be considered a meaningful source of supply. Nevertheless, despite the low prices we anticipate in the United States natural gas market, LNG exporters may find that prices in other markets have suffered, as well. Atlantic Basin LNG suppliers may view the United States as their most attractive market, and the additional supply they could bring would put additional downward pressure on prices.

Alternative energy sources are generally more expensive than fossil fuels and are unlikely to displace fossil fuels at their current prices. It is possible, however, that the expected investment in alternative energy sources contemplated in the United States economic stimulus legislation could result in either lower costs for these technologies (through successful research) or could result in economic subsidies intended to make these fuels more competitive. We do not think these scenarios are likely in 2009, however.

Petroleum Supply, Demand and Outlook

Petroleum, primarily in the form of crude oil, condensate, and NGLs, plays a critical role in the United States and world economies. It is a primary source of energy, especially for transportation, and its components are used in an extensive number of manufacturing processes. Many of the characteristics of modern civilization, particularly in the industrialized countries, are a result of the abundance, utility, and relatively low cost of petroleum. The supply and demand of petroleum is a very complex matter; however, we have made the following observations about current trends.

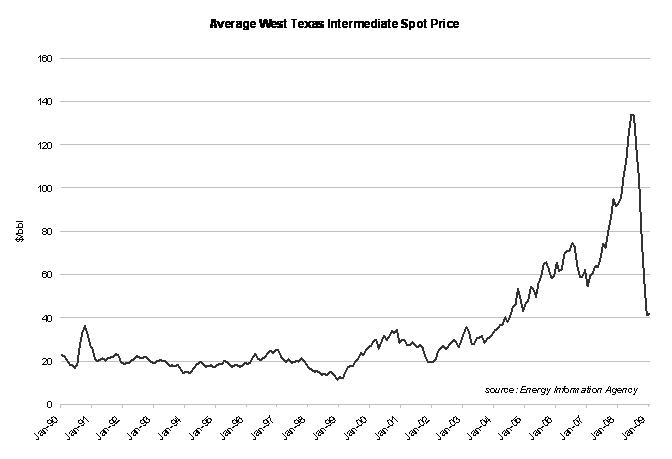

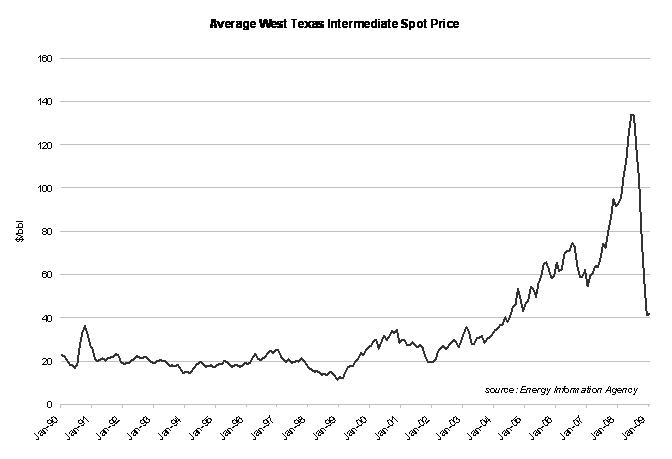

As was the case for many commodities in 2008, demand for crude oil reached all-time highs, and record high prices (both real and nominally) were observed. Much of the growth in demand for crude oil was fueled by the continued strong growth of several developing economies, particularly China, Russia, India, and certain countries in the Middle East. Nevertheless, the global economic recession has resulted in substantially lower demand for crude oil, and the price for the prompt month NYMEX futures contract has fallen from nearly $150/bbl in July 2008 to about $40/bbl in February 2009. As shown below, spot prices have experienced a similar rise and fall.

We expect crude oil demand to remain below last year’s levels until economic growth resumes. With respect to supply, however, we have observed that the members of the Organization of Petroleum Exporting Countries (“OPEC”) have made several recent reductions in their production quotas. We are uncertain how well OPEC’s members will adhere to their quotas, and how successful they will be in reducing crude oil supply to a level that will support higher prices. We believe that their efforts have had some measure of success, and that without their actions prices would be lower. Because OPEC’s members have had a mixed record of adhering to their production quotas, we are not optimistic that enough supply will be removed from the market to result in a significant price increase during 2009. We believe there is a reasonable probability that prices will decline below current prices before prices begin to strengthen.

Sulfur Supply, Demand and Outlook

Much of the natural gas that we produce in our Upstream Segment contains high, naturally-occurring concentrations of hydrogen sulfide. This is a corrosive, poisonous gas that must be removed from the natural gas before it can be processed for NGL extraction or sale. The process of removing the hydrogen sulfide yields a large amount of elemental sulfur, and we can sell this co-product or otherwise dispose of it. The process of removing hydrogen sulfide from natural gas, and similar processes for the removal of hydrogen sulfide from sour crude oils (prior to refining) are the primary sources of sulfur production in the United States and the world.

The primary use of sulfur is the production of sulfuric acid, and one of the major uses of sulfuric acid is the production of phosphoric acid. Phosphoric acid is a key raw material in the manufacture of phosphate fertilizers, so one of the major factors influencing the demand for sulfur is the demand for fertilizer. The region around Tampa, Florida contains a large amount of fertilizer manufacturing facilities, and Tampa also serves as an export port for sulfur. For many years, the supply of sulfur was greater than the available demand, such that Tampa prices fluctuated within a narrow band of $20 to $40 per long ton. Some North American sources of sulfur are large distances from Tampa, so those sellers might have received very little revenue for their sulfur, or actually had a net expense to move their sulfur co-product.

Beginning in the second half of 2007, demand for fertilizer increased significantly, and the Tampa prices also rose to record levels. By the fourth quarter of 2008, sulfur prices at Tampa were over $600 per long ton. The global economic recession has greatly reduced fertilizer demand, however, and consequently, demand for sulfur is also much lower than it was only a few months ago. By the end of 2008, Tampa sulfur prices had fallen to $0 (zero dollars) per long ton, resulting in a net expense for sellers to move their sulfur.

Our expectations are for sulfur demand to increase back to historical levels as fertilizer manufacturers deplete their excess inventories. Nevertheless, if the global economic recession worsens, sulfur prices could stay depressed throughout the year.

Outlook for Interest Rates and Inflation

The turmoil in worldwide capital markets makes it difficult to formulate a clear outlook of future interest and inflation rates. We have observed that many key benchmark interest rates are at very low levels, despite heavy borrowing by the U.S. Treasury. We believe this reflects a high degree of risk aversion by all types of investors due to the great uncertainty regarding the likely returns of virtually all other investment types. Despite this, we have observed that many interest rates of riskier securities (consumer and corporate debt, for instance) are very high by historical standards and these types of credit are difficult to obtain. We expect that both of these conditions will persist during 2009.

Nevertheless, we believe as order is restored in the financial system, and economic growth resumes, investors will seek opportunities to generate higher returns. This could lead to increased interest rates as the U.S. Treasury finds it harder to sell bonds at the current low rates. Also, a potential excess of dollars in the economy as a result of spending related to economic stimulus efforts may cause an increase in inflation. If this were to occur, the government may find that monetary policy actions are needed to reduce inflation, which would also lead to higher interest rates. It is difficult for us to predict if and when such a scenario might occur, and during the near term, we believe that the threat of inflation is very low. In fact, if the U.S. government’s efforts to restore the banking system and stimulate the economy are unsuccessful, deflation will be a possibility.

Impact of Credit and Capital Market Turmoil

As a direct consequence of the collapse of the sub-prime mortgage and housing markets that began in the summer of 2007 and their corollary impact on the banking and financial industry in general, bank lending and capital markets have experienced a significant contraction. This generalized and world-wide condition of reduced credit availability and downward pressure on the value of debt obligations and equity prices has persevered throughout 2008 and into 2009. Specifically among Master Limited Partnerships, which rely on credit and capital markets to finance their acquisition and organic growth projects, this diminished availability of external capital, made worse by a low commodity price environment has in the short term, effectively closed access to traditional external financing sources for all but the largest investment grade partnerships.

As governments around the world enact policies designed to restore the health of the banking industry and promote growth in their respective economies, we believe that credit and access to capital markets will gradually return. When such favorable conditions become prevalent again, we believe we will be able to obtain external financing in the credit and capital markets which will allow us to resume our growth strategy through acquisitions and organic growth projects. In the meantime, we have reduced our growth and maintenance capital expenditure budget for 2009 and are only pursuing highly accretive potential acquisitions which could be financed in the current financial market environment.

Impact of Regulation of Greenhouse Gas Emissions

The natural gas and oil industry is a source of emissions of certain greenhouse gases, namely carbon dioxide and methane Regulation of greenhouse gas emissions has not had an impact on our operations in the past and regulation of our greenhouse gas emissions as such has not occurred. However, there is a trend towards government-imposed limitations on greenhouse gas emissions at the state, regional, and federal level. Although there are still significant uncertainties regarding future federal regulation in the U.S., a reasonably broad-based consensus for federal legislation, involving either a cap-and-trade program or a carbon tax, is forming. Many significant uncertainties remain about the timing, nature, and effect of any such action. Consequently, at this time, we are unable to forecast how future regulation of greenhouse gas emissions would negatively impact our operations. We will continue to monitor regulatory developments and to assess our ability to reasonably predict the economic impact of these developments on our business.

Critical Accounting Policies

Conformity with accounting principles generally accepted in the United States requires management to make estimates and judgments that affect the amounts reported in the financial statements and notes. On an on-going basis, we make and evaluate estimates and judgments based on management’s best available knowledge of previous, current, and expected future events. Given that a substantial portion of our operations were acquired within the past 12 to 24 months, we base our estimates on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ from these estimates, and estimates are subject to change due to modifications in the underlying conditions or assumptions. Currently, we do not foresee any reasonably likely changes to our current estimates and assumptions which would materially affect amounts reported in the financial statements and notes. We have selected the following critical accounting policies that currently affect our financial condition and results of operations for discussion.

Successful Efforts. We utilize the successful efforts method of accounting for our oil and natural gas properties. Leasehold costs are capitalized when incurred. Costs incurred to drill and complete development wells, including dry holes, are capitalized. Unproved properties are assessed periodically within specific geographic areas and, if necessary, impairments are charged to expense. Geological and geophysical expenses and delay rentals are charged to expense as incurred. Exploratory drilling costs are initially capitalized, but charged to expense if the well is determined to be unsuccessful. We carry the costs of an exploratory well as an asset if the well finds a sufficient quantity of reserves to justify its capitalization as a producing well as long as we are making sufficient progress towards assessing the reserves and the economic and operating viability of the project.

Depletion of producing oil and natural gas properties is recorded based on units of production. Unit rates are computed for unamortized drilling and development costs using proved developed reserves and for acquisition costs using all proved reserves. Statement of Financial Accounting Standards (“SFAS”) No. 19, Financial Accounting and Reporting for Oil and Gas Producing Companies requires that acquisition costs of proved properties be amortized on the basis of all proved reserves (developed and undeveloped) and that capitalized development costs (wells and related equipment and facilities) be amortized on the basis of proved developed reserves. In the case of our Minerals Segment, we only claim proved, producing reserves because, as a mineral interest owner, we lack sufficient engineering and geological data to estimate the proved undeveloped and non-producing reserve quantities and because we cannot control the occurrence or the timing of the activities that would cause such reserves to become productive. Since our units of production depletion and amortization rate is a function of our proved reserves, we experience a higher depletion and amortization rate than we would if we claimed undeveloped or non-producing reserves.

Upon sale or retirement of complete fields of depreciable or depleted property, the book value thereof, less proceeds or salvage value, is charged or credited to income.

In accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, we assess proved oil and natural gas properties in our Upstream Segment for possible impairment when events or circumstances indicate that the recorded carrying value of the properties may not be pre-tax recoverable. We recognize an impairment loss as a result of a triggering event and when the estimated undiscounted pre-tax future cash flows from a property are less than the carrying value. If impairment is indicated, the fair value is compared to the carrying value for determining the amount of the impairment loss to record. Estimated future cash flows are based on management’s expectations for the future and include estimates of oil and natural gas reserves and future commodity prices and operating costs. Downward revisions in estimates of reserve quantities or expectations of falling commodity prices or rising operating costs could result in a reduction in undiscounted future cash flows and could indicate property impairment. During the year ended December 31, 2008, we incurred impairment charges related to certain fields of $107.0 million and $1.7 million in our Upstream and Minerals Segments, respectively, due to the substantial decline in commodity prices during the fourth quarter of 2008. During the year ended December 31, 2007, we incurred an impairment charge in our Minerals Segment of $5.7 million as a result of steeper decline rates in certain fields.

Unproved properties that are individually insignificant are amortized. Unproved properties that are individually significant are assessed for impairment on a property-by-property basis. If considered impaired, costs are charged to expense when such impairment is deemed to have occurred.

Our estimates of proved reserves are based on the quantities of oil and natural gas that engineering and geological analyses demonstrate, with reasonable certainty, to be recoverable from established reservoirs in the future under current operating and economic conditions. Annually, and on other occasions, Cawley, Gillespie & Associates, Inc. prepares an estimate of the proved reserves on all our properties, based on information provided by us.

Reserves and their relation to estimated future net cash flows impact our depletion and impairment calculations. As a result, adjustments to depletion and impairment are made concurrently with changes to reserve estimates. We prepare our reserve estimates, and the projected cash flows derived from these reserve estimates, in accordance with SEC guidelines. The independent engineering firm described above adheres to the same guidelines when preparing their reserve reports. The accuracy of our reserve estimates is a function of many factors including the following: the quality and quantity of available data, the interpretation of that data, the accuracy of various mandated economic assumptions and the judgments of the individuals preparing the estimates. The data for a given reservoir may change substantially over time as a result of numerous factors, including additional development activity, evolving production history and continual reassessment of the viability of production under varying economic conditions. Changes in oil and natural gas prices, operating costs and expected performance from a given reservoir also will result in revisions to the amount of our estimated proved reserves.

Our proved reserve estimates are a function of many assumptions, all of which could deviate significantly from actual results. As such, reserve estimates may materially vary from the ultimate quantities of natural gas, natural gas liquids and oil eventually recovered.

Revenue and Cost of Goods Sold Recognition. In our Midstream Business, we record revenue and cost of goods sold on the gross basis for those transactions where we act as the principal and take title to natural gas, NGLs or condensates that is purchased for resale. When our customers pay us a fee for providing a service such as gathering, treating or transportation we record the fees separately in revenues.

Risk Management Activities. We have structured our hedging activities in order to minimize our commodity pricing and interest rate risks. These hedging activities rely upon forecasts of our expected operations and financial structure over the next few years. If our operations or financial structure are significantly different from these forecasts, we could be subject to adverse financial results as a result of these hedging activities. We mitigate this potential exposure by retaining an operational cushion between our forecasted transactions and the level of hedging activity executed. We have currently hedged approximately 88% of our forecasted 2009 hedgeable crude, condensate and natural gas liquids (heavier than propane) and 93% of our net natural gas and ethane production. We have currently hedged approximately 90% of our anticipated 2010 hedgeable crude, condensate and natural gas liquids (heavier than propane) and 90% of our net natural gas and ethane production.

From the inception of our hedging program, we used mark-to-market accounting for our commodity hedges and interest rate swaps. There were no derivatives for the periods before September 30, 2005. We record monthly realized gains and losses on hedge instruments based upon cash settlements information. The settlement amounts vary due to the volatility in the commodity market prices throughout each month. We also record unrealized gains and losses monthly based upon the future value on mark-to-market hedges through their expiration dates. The expiration dates vary but are currently no later than December 2012 for our interest rate hedges and for our commodity hedges. Option premiums and costs incurred to reset contract prices or purchase swaps are amortized during the contract period through the unrealized risk management instruments in total revenue. We monitor and review hedging positions regularly.

Depreciation and Depletion Expense and Cost Capitalization Policies. Our midstream assets consist primarily of natural gas gathering pipelines and processing plants. We capitalize all construction-related direct labor and material costs, as well as indirect construction costs. Indirect construction costs include general engineering and the costs of funds used in construction. The cost of funds used in construction represents capitalized interest. These costs are then expensed over the life of the constructed asset through the recording of depreciation expense.

As discussed in Note 2 to our consolidated financial statements included in Part II, Item 8. Financial Statements and Supplementary Data starting on page F-1 of this Annual Report, depreciation of our midstream assets is generally computed using the straight-line method over the estimated useful life of the assets. The costs of renewals and betterments which extend the useful life of property, plant and equipment are also capitalized. The costs of repairs, replacements and maintenance projects are expensed as incurred.

The computation of depreciation expense requires judgment regarding the estimated useful lives and salvage value of assets. As circumstances warrant, depreciation estimates are reviewed to determine if any changes are needed. Such changes could involve an increase or decrease in estimated useful lives or salvage values which would impact future depreciation expense.