SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File No. 001-33016

EAGLE ROCK ENERGY PARTNERS, L.P.

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Delaware | 68-0629883 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1415 Louisiana Street, Suite 2700

Houston, Texas 77002

(Address of principal executive offices, including zip code)

(281) 408-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | Name of Each Exchange on Which Registered |

| Common Units of Limited Partner Interests | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 13(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer ¨ | Accelerated Filer x |

Non-accelerated Filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2009, the aggregate market value of the registrant’s common units held by non-affiliates of the registrant was $130,901,290, based on the closing sale price as reported on NASDAQ Global Select Market.

The issuer had 55,980,185 common units and 21,536,046 subordinated and general partner units outstanding as of March 1, 2010.

DOCUMENTS INCORPORATED BY REFERENCE:

None

| | | |

| | | Page |

| PART I |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 38 |

| Item 1B. | Unresolved Staff Comments | 53 |

| Item 2. | Properties | 53 |

| Item 3. | Legal Proceedings | 53 |

| Item 4. | Reserved | 53 |

| PART II |

| Item 5. | Market for Registrant’s Common Equity, Related Unitholder Matters and Issuer Purchases of Equity Securities | 54 |

| Item 6. | Selected Financial Data | 56 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 62 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 92 |

| Item 8. | Financial Statements and Supplementary Data | 96 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 96 |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | 98 |

| PART III |

| Item 10. | Directors, Executive Officers and Corporate Governance | 98 |

| Item 11. | Executive Compensation | 103 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters | 113 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 113 |

| Item 14. | Principal Accountant Fees and Services | 118 |

| PART IV |

| Item 15. | Exhibits and Financial Statement Schedules | 119 |

FORWARD-LOOKING STATEMENTS

This report may include forward-looking statements. All statements, other than statements of historical facts, included in this report that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are based on certain assumptions made by us based on our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, which may cause our actual results to differ materially from those implied or expressed by the forward-looking statements. For a complete description of these risks, please see our risk factors set forth under Item 1A of this annual report. These factors include but are not limited to:

| · | Risks Related to the Recapitalization and Related Transactions; |

| · | Drilling and geological / exploration risks; |

| · | Assumptions regarding oil and natural gas reserve levels and costs to exploit and timing of development; |

| · | Ability to obtain credit and access capital markets; |

| · | Ability to remain in compliance with the covenants set forth in our revolving credit facility; |

| · | Conditions in the securities and/or capital markets; |

| · | Future processing volumes and throughput; |

| · | Loss of significant customers; |

| · | Availability and cost of processing and transportation of natural gas liquids (“NGLs”); |

| · | Competition in the oil and natural gas industry; |

| · | Relevant legislative or regulatory changes, including retroactive royalty or production tax regimes, changes in environmental regulation, environmental risks and liability under federal, state and foreign environmental laws and regulations; |

| · | Ability to make favorable acquisitions and integrate operations from such acquisitions; |

| · | Shortages of personnel and equipment; |

| · | Increases in interest rates; |

| · | Creditworthiness of our counterparties; |

| · | Weather, including the occurrence of any adverse weather conditions and/or natural disasters affecting our business; |

| · | Any other factors that impact or could impact the exploration of oil or natural gas resources, including but not limited to the geology of a resource, the total amount and costs to develop recoverable reserves, legal title, regulatory, natural gas administration, marketing and operations factors relating to the extraction of oil and natural gas; and |

| · | Tax risk associated with pass-through investment, including potential reduction in tax shield or creation of phantom income in the event distributions are not enough to support the tax burden. |

GLOSSARY OF OIL AND GAS TERMS

The following is a description of the meanings of some of the oil and gas industry terms that may be used in this report. The definitions of proved reserves, proved developed reserves, and proved undeveloped reserves have been abbreviated from the applicable definitions contained in Rule 4-10(a) (2-4) of Regulation S-X.

Bbl: One stock tank barrel, or 42 U.S. gallons liquid volume, of crude oil or other liquid hydrocarbons.

Bbl/d: One stock tank barrel, or 42 U.S. gallons liquid volume, of crude oil or other liquid hydrocarbons per day.

Bbtu: One billion British thermal units.

Bcf: One billion cubic feet of natural gas.

Bcf/d: One billion cubic feet of natural gas per day.

Bcfe: One billion cubic feet of natural gas equivalent, using a ratio of six Mcf of natural gas to one Bbl of crude oil and NGLs.

Boe: One barrel of oil equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of crude oil.

Boe/d: One barrel of oil equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of crude oil and NGLs per day.

btu: British thermal unit.

development well: A well drilled within the proved area of a natural gas or oil reservoir to the depth of a stratigraphic horizon known to be productive.

dry gas: Natural gas that does not require plant processing prior to delivery to the interstate or intrastate pipeline systems.

dry hole: A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production would exceed production expenses, taxes and future capital.

equity liquids or gallons: Natural gas liquid and condensate production that equates to an entity’s contractual share of the production.

exploitation: A drilling, recompletion, workover or other project which may target proven or unproven reserves (such as probable or possible reserves), but which generally has a lower risk than with exploration projects.

exploratory well: A well drilled to find and produce oil or natural gas reserves in an unproved area, to find new reservoir in a field previously found to be productive or oil or natural gas in another reservoir or to extend a known reservoir.

fee-based arrangements: Under these arrangements, the oil and gas producer pays to the gatherer a fixed cash fee per unit volume for performing the gathering and processing service. This fee is directly related to the volume of natural gas that flows through the gatherer’s pipeline systems and is not directly dependent on commodity prices.

fee mineral or fee mineral interest: A perpetual ownership of all or a portion of the oil, natural gas and other naturally-occurring substances that lie beneath the surface of the earth in a specific area.

field: An area consisting of a single reservoir or multiple reservoirs, all grouped on or related to the same individual geological structural feature and/or stratigraphic condition.

finding and development cost (F&D): Total capital costs, including leasing and exploration expenses, spent to place reserves into production; often expressed as a unit cost, such as $/Mcfe or $/Boe, which are derived by dividing the costs by the reserves.

fixed recovery arrangements: Under these arrangements, raw natural gas is gathered from producers at the wellhead, transported through our gathering system, and processed and sold as processed natural gas and/or NGLs at prices based on published index prices. The price paid to the producers is based on an agreed to theoretical product recovery factor to be applied against the wellhead production and then a percentage of the theoretical proceeds based on an index or actual sales prices multiplied to the theoretical production. To the extent that the actual recoveries differ from the theoretical product recovery factor, this will affect the margin.

frac spread: The difference between the value of the NGLs produced and the cost of the processed gas used to replace the thermal equivalent value of those NGLs in a keep-whole arrangement.

gpm: Gallons of natural gas liquids per million cubic feet of gas.

gross acres or gross wells: The total acres or wells, as the case may be, in which a working interest is owned.

Hp: Horsepower.

keep-whole arrangements: Under these arrangements, raw natural gas is processed to extract NGLs and pay to the producer the full thermal equivalent volume of raw natural gas received from the producer in the form of either processed natural gas or its cash equivalent. The processors are generally entitled to retain the processed NGLs and to sell them for their account. Accordingly, the margin is a function of the frac spread.

LT/d: Long tons per day.

MBbls: One thousand barrels of crude oil or other liquid hydrocarbons.

MBO/d: One thousand barrels of crude oil or other liquid hydrocarbons per day.

MBoe: One thousand barrels of oil equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of crude oil.

MBoe/d: One thousand barrels of oil equivalent per day.

Mcf: One thousand cubic feet of natural gas.

Mcf/d: One thousand cubic feet of natural gas per day.

Mcfe: One thousand cubic feet of natural gas equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of crude oil and NGLs.

MMBbls: One million barrels of crude oil or other liquid hydrocarbons.

MMBoe: One million barrels of oil equivalent.

MMBtu: One million British thermal units.

MMcf: One million cubic feet of natural gas.

MMcf/d: One million cubic feet of natural gas per day.

natural gas liquids or NGLs: The combination of ethane, propane, isobutene, normal butane and natural gasoline that may be removed from natural gas as a liquid under certain levels of pressure and temperature. Most NGLs are gases at room temperature and pressure.

net acres or net wells: The sum of the fractional working interests owned in gross acres or wells, as the case may be.

NYMEX: New York Mercantile Exchange.

oil: Crude oil and condensate.

overriding royalty or overriding royalty interest: A non-cost bearing interest in the production from a well that is carved out of the working interest. It expires when the underlying oil and/or natural gas lease expires.

percent-of-proceeds arrangements: Under these arrangements, generally raw natural gas is gathered from natural gas producers at the wellhead, moved through the gathering system, processed and sold as processed natural gas and/or NGLs at prices based on published index prices. The price paid to producers is based on an agreed percentage of one of the following: (1) the actual sale proceeds; and (2) the proceeds based on an index price.

probable locations: Locations that are near proved undeveloped locations, but do not meet the definition of a proved location.

productive well: A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceeds production expenses and taxes.

proved developed reserves: Proved reserves that can be expected to be recovered from existing wells with existing equipment and operating methods.

proved locations: Locations that geological and engineering data demonstrate with reasonable certainty to recover reserves in future years from known reservoirs under existing economic and operating conditions.

proved reserves: The estimated quantities of crude oil, natural gas and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. Prices include consideration of changes in existing prices provided only by contractual arrangements, but not on escalations based on future conditions.

proved undeveloped reserves or PUDs. Proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

recompletion: The completion for production of an existing wellbore in another formation from that which the well has been previously completed.

reserve life index: The number of years required to produce the proved reserves at the current annual production rate.

reservoir: A porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reserves.

royalty or royalty interest: A non-cost bearing interest in the production from a well that is created from a mineral interest when the minerals are leased to an operator. The royalty interest generally is retained by the mineral interest owner as part of the compensation for leasing the minerals.

standardized measure: The present value of estimated future net revenue to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the SEC (using prices and costs in effect as of the date of estimation), less future development, production and income tax expenses, and discounted at 10% per annum to reflect the timing of future net revenue. Standardized measure does not give effect to derivative transactions.

Tcf: One trillion cubic feet of natural gas.

undeveloped acreage: Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of natural gas or oil regardless of whether or not such acreage contains proved reserves.

unit development cost (UDC): The capital expenditures required to develop proved reserves per unit of reserves added or transferred from undeveloped acreage non-producing acreage to proved developed producing reserves, expressed in $/Mcfe or $/Boe.

West Texas Intermediate or WTI: Light, sweet crude oil with high API gravity and low sulfur content used as the benchmark for U.S. crude oil refining and trading. NYMEX futures contracts for light, sweet crude oil specify the delivery of WTI at Cushing, Oklahoma.

wet gas: Natural gas that requires plant processing in order to meet the interstate and intrastate gas quality specifications.

working interest: The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property/lease and to receive a share of production.

workover: Operations on a producing well to restore or increase production.

In this report, unless the context requires otherwise, references to “Eagle Rock Energy Partners, L.P.,” “Eagle Rock,” the “Partnership,” “we,” “our,” “us,” or like terms, refer to Eagle Rock Energy Partners, L.P. and its subsidiaries. References to our “general partner” refer to Eagle Rock Energy GP, L.P., our general partner, and Eagle Rock Energy G&P, LLC, the general partner of our general partner. References to “Natural Gas Partners” or “NGP” refer to Natural Gas Partners VII, L.P. and Natural Gas Partners VIII, L.P. in the context of any description of our investors, and in other contexts refer to NGP Energy Capital Management, which manages a series of energy investment funds, including Natural Gas Partners VII, L.P. and Natural Gas Partners VIII, L.P. References to the “NGP Investors” refer to Natural Gas Partners and some of our directors and current and former members of our management team. References to “Holdings” or “Eagle Rock Holdings” refer to Eagle Rock Holdings, L.P., the largest holder of our securities (common units and subordinated units) and sole owner of the general partner of our general partner, which is owned by the NGP Investors. References to our “Board of Directors” refer to the board of directors of the general partner of our general partner.

PART I

Overview

We are based in the United States and are a domestically-focused, growth-oriented limited partnership engaged in the business of (i) gathering, compressing, treating, processing and transporting natural gas; fractionating and transporting natural gas liquids (“NGLs”); and marketing natural gas, condensate and NGLs, which collectively we call our “Midstream Business;” (ii) acquiring, developing and producing interests in oil and natural gas properties, which we call our “Upstream Business;” and (iii) acquiring and managing fee mineral, overriding royalty and royalty interests, either through direct ownership or through investment in other partnerships, which we call our “Minerals Business.” We have entered into an agreement to sell our Minerals Business, subject to unitholder approval of certain transactions described under “Recapitalization and Related Transactions” below. If the transactions are approved, we expect to complete the sale in the second quarter of 2010.

Our objective is to grow our business in a manner that increases our potential to distribute cash to our unitholders. To do so, we focus on achieving operational excellence in our businesses and executing accretive low-risk acquisitions and organic growth opportunities. We also may allocate a portion of our cash flows to fund growth-related capital expenditures that would otherwise be paid as distributions. In the first quarter of 2009, because of low commodity prices and decreases in volumes through our systems, we significantly reduced our distribution to preserve cash to pay down debt. Upon completion of the Recapitalization and Related Transactions, if approved by our unitholders, we believe our simplified capital structure and reduced debt levels will improve our potential to distribute cash to our unitholders.

We are uniquely positioned as a publicly-traded partnership, or master limited partnership (“MLP”), that is engaged in both the midstream and upstream sectors of the oil and natural gas value chain. We have an experienced management team with expertise in gathering and processing natural gas, operating oil and natural gas properties and assets, managing mineral interests, and evaluating and executing acquisition opportunities. Generally, our MLP structure gives us a lower cost of capital than a corporation through the avoidance of double taxation of our earnings. Our diversification across our three businesses was adopted to broaden the spectrum of potential acquisition opportunities, give us an advantage in acquiring asset packages that involve both midstream and upstream assets, provide us with a natural hedge on a portion of our natural gas volumes in our Upstream Business (to the extent of the volumes of natural gas purchased by us under our natural gas purchase agreements in our Midstream Business that is not offset by our long position in our Midstream Business), and exploit vertical integration synergies and market intelligence in selected regions of our operations.

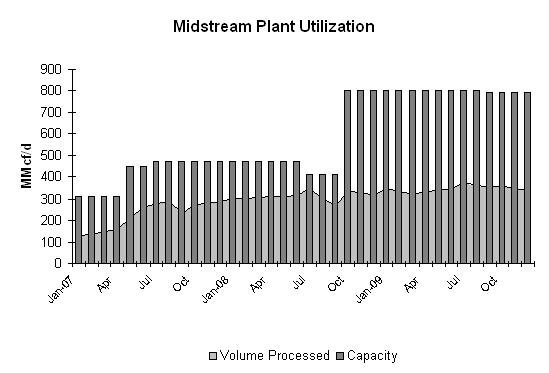

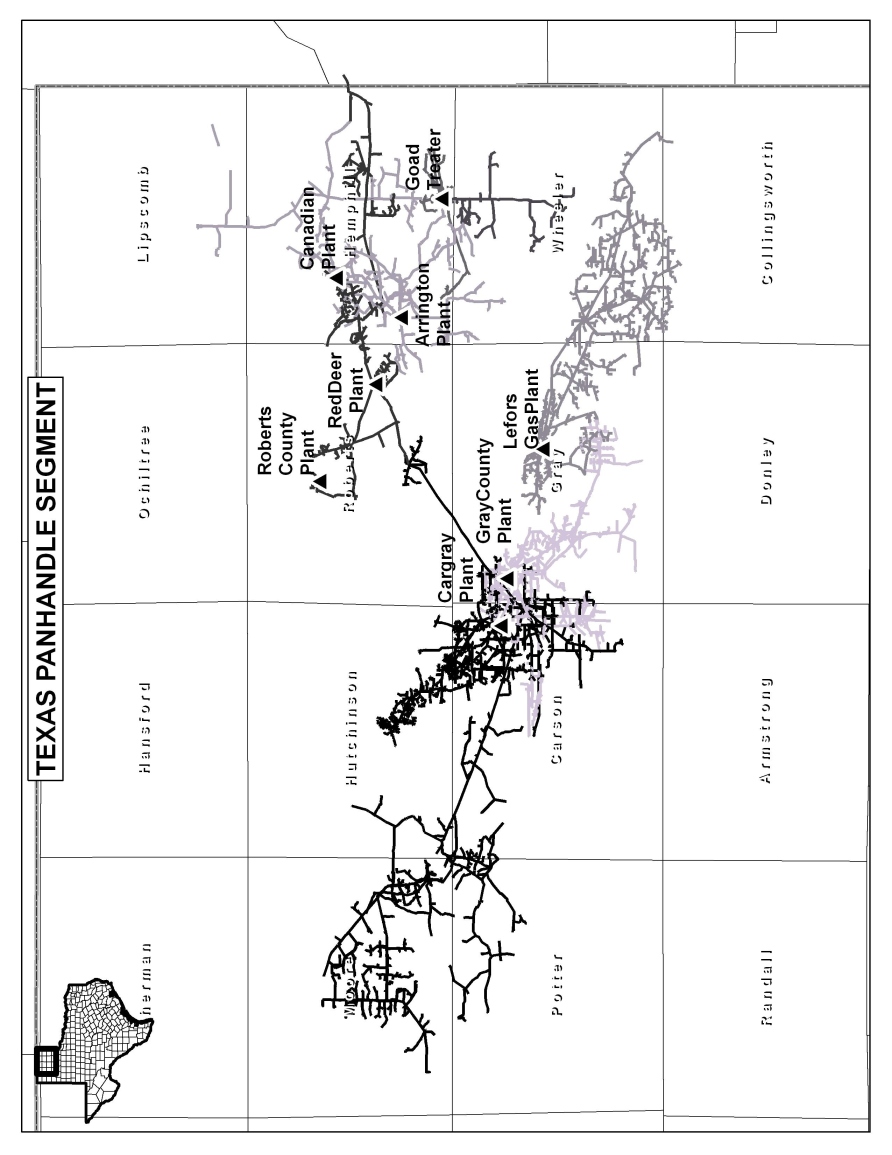

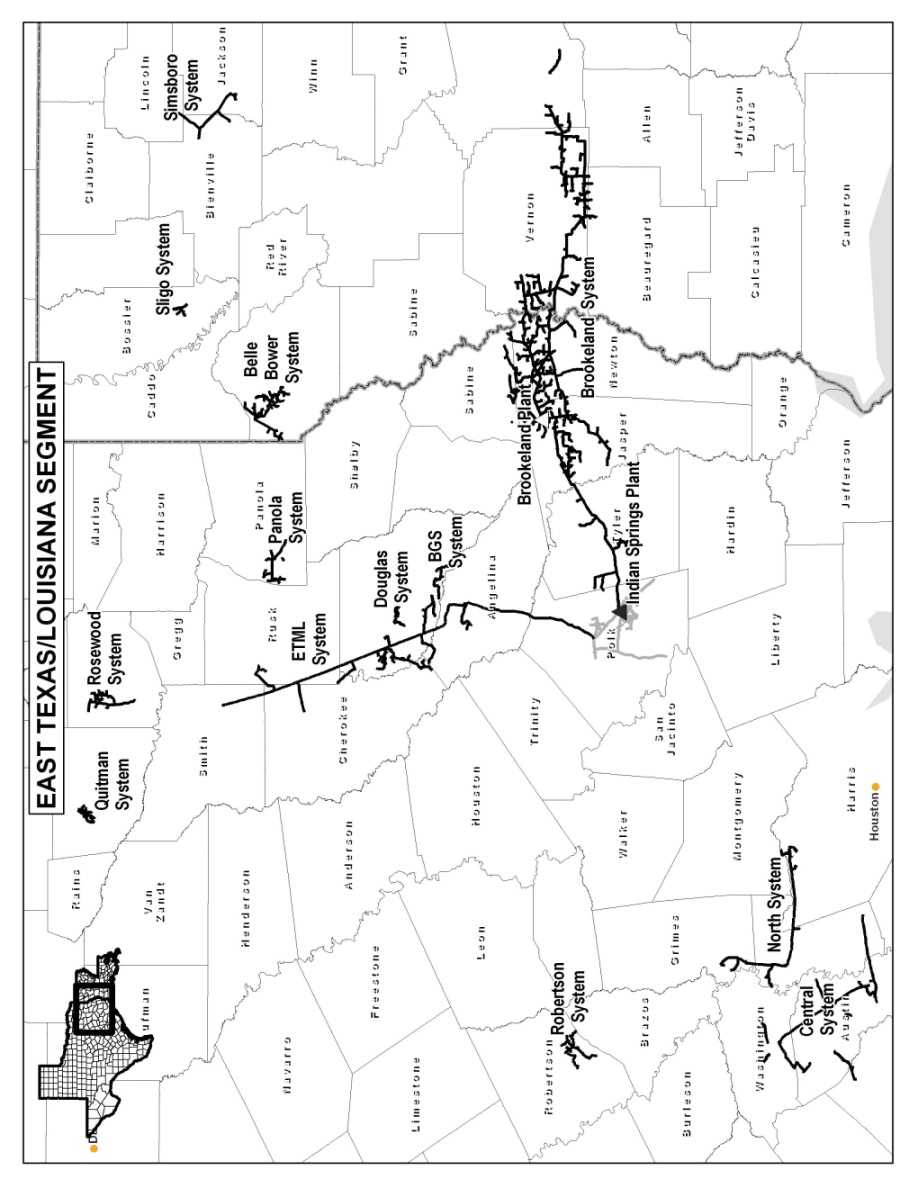

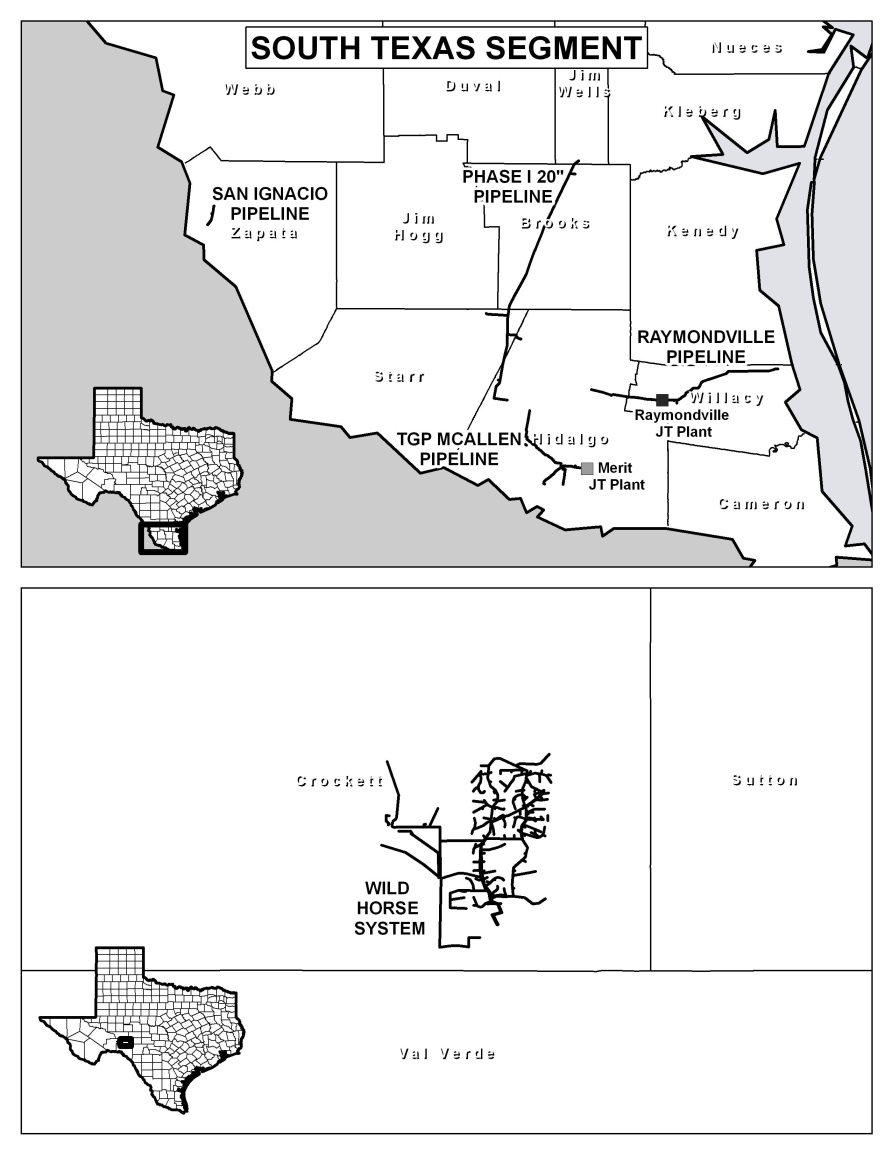

Our Midstream Business is strategically located in five significant natural gas producing regions: (i) the Texas Panhandle; (ii) East Texas/Louisiana; (iii) South Texas; (iv) West Texas; and (v) the Gulf of Mexico. These five regions are productive, mature, natural gas producing basins that have historically experienced significant drilling activity. Eagle Rock’s natural gas gathering systems within these regions are comprised of approximately 5,200 miles of natural gas gathering pipelines with approximately 2,700 well connections, 19 natural gas processing plants with approximately 757 MMcf/d of plant processing capacity and 203,580 horsepower of compression. Our Midstream Business averaged 587 MMcf/d of gathered volumes and 348 MMcf/d of processed volumes during 2009.

Our Upstream Business has long-lived, high working interest properties located in four significant natural gas producing regions: (i) Southern Alabama (where we also operate the associated gathering and processing assets); (ii) East Texas; (iii) South Texas; and (iv) West Texas. As of December 31, 2009, these working interest properties included 260 operated productive wells and 149 non-operated wells with net production to us of approximately 5,300 Boe/d and proved reserves of approximately 33.8 Bcf of natural gas, 7.5 MMBbls of crude oil, and 6.1 MMBbls of natural gas liquids, of which 88% are proved developed.

Our Minerals Business, which is subject to a current sales agreement, is a diversified set of fee mineral, overriding royalty interests and royalty interests comprised of interests in multiple trends over 5.6 million gross mineral acres (430,000 net mineral acres) and interests in over 2,800 productive wells across 17 states in the United States. As of December 31, 2009, these interests had proved reserves of approximately 4.8 Bcf of natural gas and 2.9 MMBbls of crude oil (100% proved developed producing). These interests produced an average of approximately 1,048 Boe/d (net to our interest) during 2009.

We report on our businesses in seven accounting segments. See Note 13 of our consolidated financial statements included in Part II, Item 8. Financial Statements and Supplementary Data starting on page F-1 of this Annual Report.

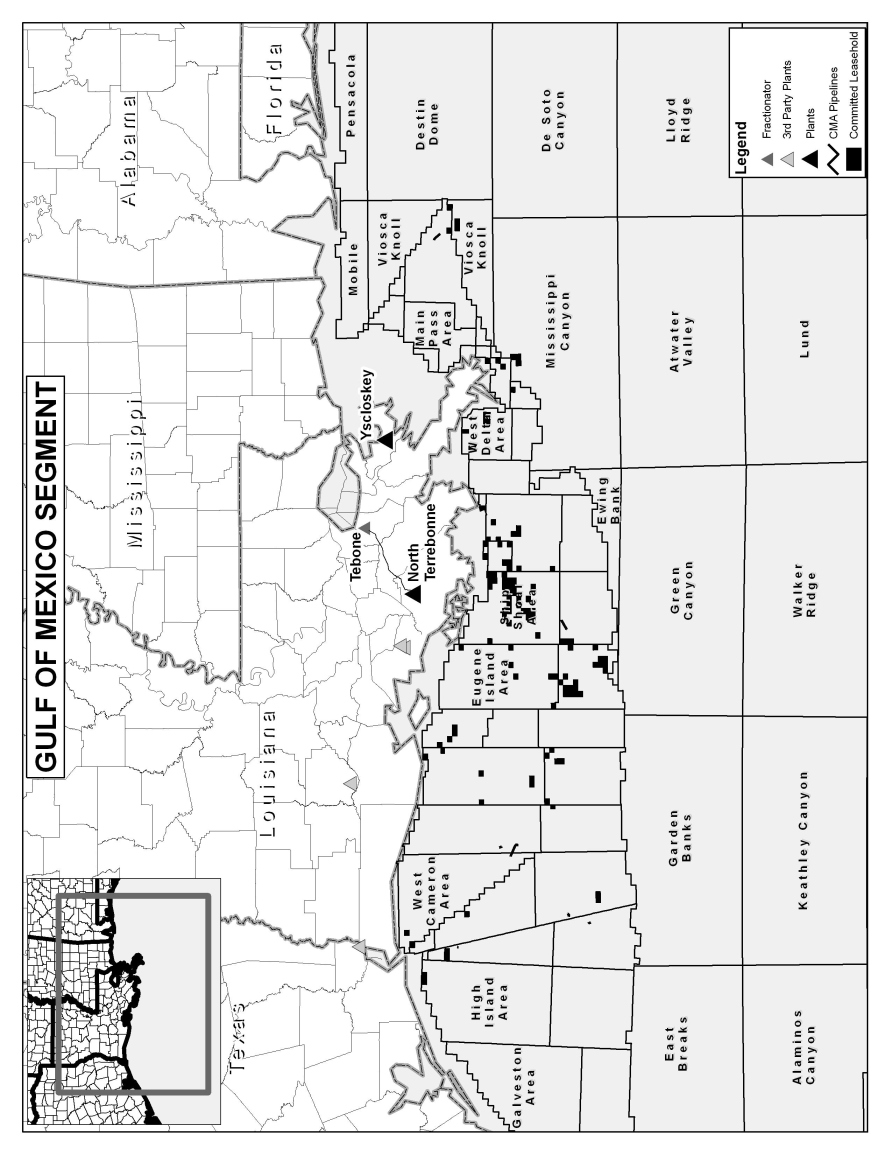

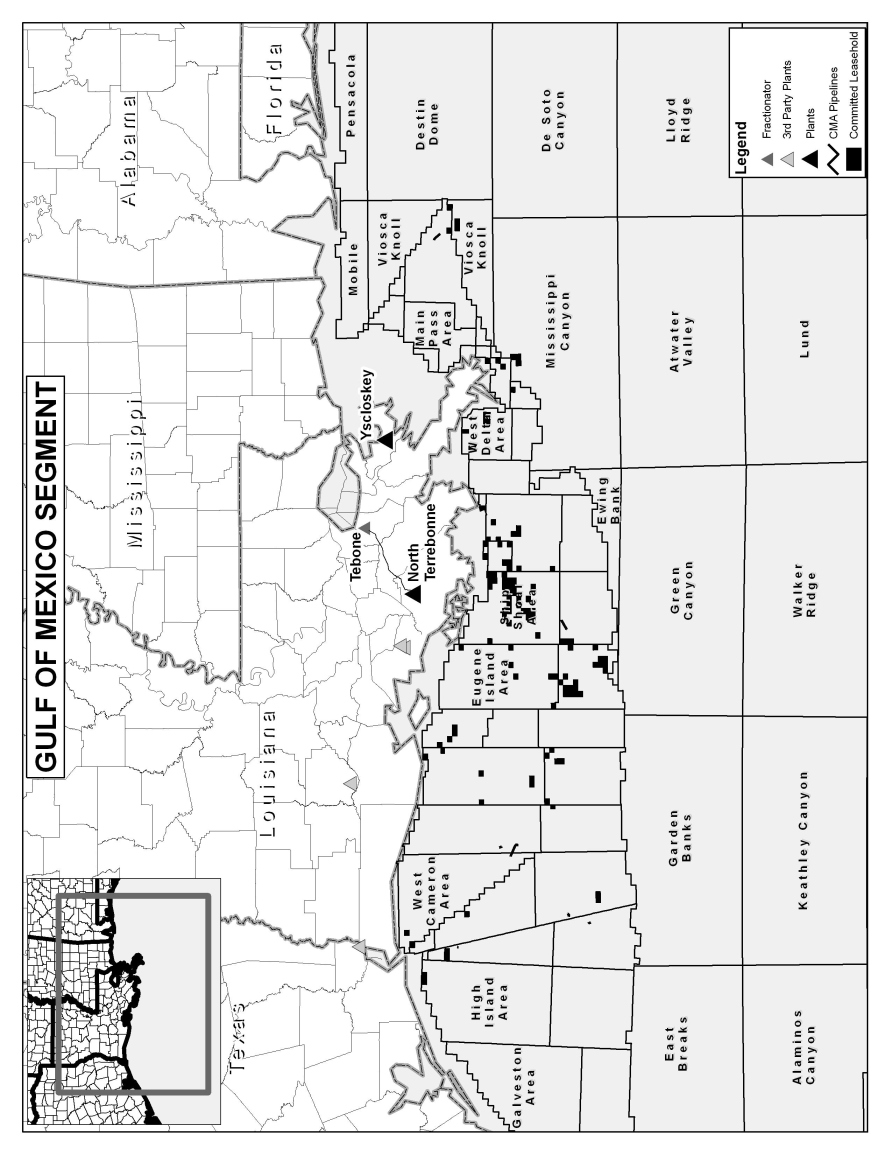

We conduct, evaluate and report on our Midstream Business within four distinct segments—the Texas Panhandle Segment, the East Texas/Louisiana Segment (prior to the filing of our 2007 Annual Report, known as our Southeast Texas and North Louisiana Segment), the South Texas Segment, and the Gulf of Mexico Segment. These Midstream segments include our gathering, processing and related compression assets grouped geographically by major operating area. Our South Texas Segment includes our Wild Horse system in West Texas, and our Gulf of Mexico Segment includes interests in gathering systems and related compression and processing facilities in Southern Louisiana, the Gulf of Mexico and Galveston Bay.

We conduct, evaluate and report our Upstream Business as one segment. Our Upstream Segment includes operated wells in Escambia County, Alabama as well as two treating facilities, one natural gas processing plant and related gathering systems that are inextricably intertwined with ownership and operation of the wells. The Upstream Segment also includes operated and non-operated wells that are primarily located in Rains, Van Zandt, Limestone, Freestone, Henderson, Ward, Crane, Pecos and Atascosa Counties, Texas.

We conduct, evaluate, and report our Minerals Business as one segment. A significant portion of the mineral interests that we own is managed by a non-affiliated private partnership, Black Stone Minerals Company, L.P. (“Black Stone”), that controls the executive rights associated with the minerals. As discussed under “Recapitalization and Related Transactions” below, we have entered into an agreement to sell our Minerals Business to Black Stone, subject to unitholder approval of certain other transactions.

Our final reporting segment is our Corporate Segment, in which we account for our commodity hedging activity and our general corporate costs.

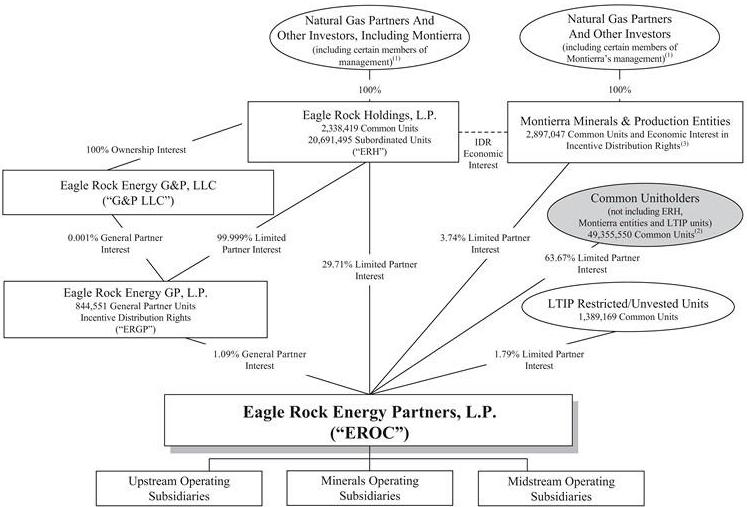

Ownership Structure

The diagram below depicts our ownership structure as of March 31, 2010. The ownership percentages shown below are calculated on a fully-diluted basis:

| (1) | For a discussion of management’s ownership, see Part III, Item 12 -Security Ownership of Certain Beneficial Owners and Management. |

| (2) | Includes a total of 7,074,580 common units beneficially owned by Natural Gas Partners and its affiliates, but excludes all common units beneficially owned by ERH, Montierra and the general partner of Montierra. |

| (3) | Includes 2,869,556 common units directly owned by Montierra and 28,491 common units directly owned by the general partner of Montierra. Additionally, Montierra owns a 39.34% economic interest in our incentive distribution rights, through an agreement with ERH. |

Recapitalization and Related Transactions

On December 21, 2009, we announced that we, through certain of our affiliates, had entered into definitive agreements with affiliates of NGP and Black Stone to improve our liquidity and simplify our capital structure. The definitive agreements include: (i) a Securities Purchase and Global Transaction Agreement, entered into between Eagle Rock and NGP, including Eagle Rock’s general partner entities controlled by NGP, and (ii) a Purchase and Sale Agreement (the “Minerals Business Sale Agreement”), entered into between Eagle Rock and Black Stone for the sale of our Minerals Business. The Securities Purchase and Global Transaction Agreement was amended on January 12, 2010 to allow for greater flexibility in the payment of the contemplated transaction fee to Holdings, which is controlled by NGP (we refer to the amended Securities Purchase and Global Transaction Agreement throughout this document as the “Global Transaction Agreement”).

The Global Transaction Agreement and Minerals Business Sale Agreement include the following key provisions, which we refer to collectively as the “Recapitalization and Related Transactions.”

| | • | An option in favor of us, exercisable until December 31, 2012, by the issuance of 1,000,000 newly-issued common units, to capture the value of the controlling interest in us through (i) acquiring our general partner, and such general partner’s general partner, and thereby acquiring the 844,551 general partner units outstanding, and (ii) reconstituting our board of directors to allow our common unitholders not affiliated with NGP to elect the majority of our directors (the "GP Acquisiton Option"); |

| | • | The sale of our Minerals Business to Black Stone for total consideration of $174.5 million in cash, subject to customary adjustments; |

| | • | The simplification of our capital structure through the contribution, and resulting cancellation, of our existing incentive distribution rights currently held by our general partner (which is ultimately controlled and 100% beneficially owned by Holdings) and our approximately existing 20.7 million subordinated units currently held by Holdings; |

| | • | A rights offering in which Holdings and NGP will fully participate with respect to approximately 9.5 million common and general partner units owned or controlled by Holdings and NGP as well as with respect to common units it receives as payment of the transaction fee, if any; and |

| | • | For a period of up to five months following unitholder approval of the amended Global Transaction Agreement, NGP’s commitment to back-stop (primarily through Holdings) up to $41.6 million, at a price of $3.10 per unit, of an Eagle Rock equity offering to be undertaken at the sole option of the Partnership’s Conflicts Committee. |

In exchange for NGP’s and Holdings’ contributions and commitments under the Global Transaction Agreement, Eagle Rock will pay Holdings a transaction fee of $29 million in newly-issued common units valued at the greater of (i) 90% of the volume-adjusted trailing 10-day average of the trading price of Eagle Rock’s common units calculated on the 20th day prior to the date of the special meeting to obtain unitholder approval of the Global Transaction Agreement and related proposals; and (ii) $3.10 per common unit. As an alternative, the Conflicts Committee of Eagle Rock’s Board of Directors may, at its sole discretion, cause the Partnership to pay the transaction fee in cash by election made no later than 20 days prior to the date of the special meeting.

Completion of the Recapitalization and Related Transactions is expected to occur in the first half of 2010, subject to customary closing conditions including approval of the Global Transaction Agreement and the transactions contemplated therein, including certain partnership agreement amendments, by a majority of the common units held by non-affiliates of NGP. The transactions contemplated by the Global Transaction Agreement are conditioned upon the consummation of the transactions contemplated in the Minerals Business Sale Agreement, which is conditioned on unitholder approval of the Global Transaction Agreement and related amendments to the Eagle Rock partnership agreement.

We filed a copy of the Minerals Business Sale Agreement, and the Global Transaction Agreement and related ancillary agreements, on Form 8-K with the SEC on December 21, 2009 and January 12, 2010, respectively.

On March 8, 2010, we amended our Revolving Credit Facility to modify the definition of “Change in Control” so the exercise of the GP Acquisition Option would no longer trigger a “Change in Control” event and potential default. In light of the amendment, our Conflicts Committee currently intends to cause us to exercise the GP Acquisition Option as soon as practicable after the required unitholder approvals of the Recapitalization and Related Transactions prior to July 31, 2010, the deadline in the credit facility amendment. See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview – Recapitalization and Related Transactions for a discussion of the amendment to our Revolving Credit Facility.

Revised Distribution Policy

If the Recapitalization and Related Transactions are consummated, and subject to market conditions at that time, the Eagle Rock management team intends to recommend to our Board of Directors an increase to the distribution per unit. Currently, we anticipate recommending a quarterly distribution at an annualized rate in the range of $0.40 to $0.60 per unit commencing no later than the distribution with respect to the fourth quarter of 2010. We expect this distribution level will allow us to retain a meaningful percentage of our available cash to fund potential organic growth projects and to further reduce our total leverage ratio (defined in our revolving credit facility as the ratio of our debt to our Adjusted EBITDA) to our targeted range of less than 3.50. Our estimated range for the distribution is subject to change should commodity prices, factors affecting the general business climate or our specific operations differ from our current expectations. All actual distributions paid will be determined and declared at the discretion of our Board of Directors.

If the Recapitalization and Related Transactions are not consummated, and absent other unforeseen events, the Eagle Rock management team does not anticipate recommending to our Board of Directors an increase to the distribution per unit until we have reached our targeted range for our total leverage ratio, either through growth of our Adjusted EBITDA or repayment of debt.

We plan to institute a new distribution policy after we have reached our targeted range for our total leverage ratio. This policy will include a “baseline distribution” that we believe would be sustainable in low commodity price environments. The initial baseline distribution would be established by our Board of Directors and would be adjusted when appropriate to reflect the long-term impact of subsequent significant acquisitions and organic growth projects. Furthermore, under the policy, if we generate distributable cash flow (which we define as Adjusted EBITDA less interest expense, cash taxes and maintenance capital expenditures) in excess of that required to make the baseline distribution, we would distribute 50% of the excess distributable cash flow above the amount required to cover the actual distribution by at least 120% (i.e., a coverage ratio of at least 1.20). We anticipate, at this point, the initial baseline distribution will be below the Minimum Quarterly Distribution (“MQD”) of $0.3625 per unit specified in our current partnership agreement. Should the Recapitalization and Related Transactions not be consummated and the subordinated units remain outstanding, payment of an initial baseline distribution below the MQD will result in arrearages on our common units continuing to build.

In making the determination to establish the baseline distribution and future distribution coverage ratios, our Board of Directors will take into account our projected capital requirements, its view of future commodity prices, economic conditions present and forecasted in the United States and other economies around the world, and other variables that it believes could impact the near and long term sustainability of the baseline distribution. In order to reduce the volatility in our distributions, our Board of Directors may decide to make the baseline distribution, even in quarters in which we do not generate sufficient distributable cash flow to fund such distributions, by using borrowings from our revolving credit facility. Under our new distribution policy, we plan to continue with our strategy of utilizing derivatives to mitigate the impact of changes in commodity prices on our financial results.

Our Board of Directors will evaluate our distribution policy from time to time as conditions warrant in the future.

Relationship to Natural Gas Partners

We are affiliated with Natural Gas Partners, a leading private equity capital source for the energy industry. Natural Gas Partners owns a significant equity position in Eagle Rock Holdings, L.P., which owns 2,338,419 common units, 20,691,495 subordinated units and all of the equity interests in our general partner (directly and through ownership of all equity interests of our general partner’s general partner), which holds the incentive distribution rights in us. Should the Recapitalization and Related Transactions be consummated, Holdings will contribute to us all of the subordinated units and cause our general partner to contribute to us all of our incentive distribution rights. We anticipate Holdings will continue to be a substantial owner of our common units if the Recapitalization and Related Transactions are completed.

Historically, we have benefited from increased exposure to acquisition opportunities through our affiliation with Natural Gas Partners, including the consummation of several transactions with portfolio companies of Natural Gas Partners (the Midstream Gas Services, Montierra, Redman and Stanolind Acquisitions, as more fully described under “History” below). We expect that our relationship with Natural Gas Partners will continue to provide us with several significant benefits, including increased exposure to acquisition opportunities and access to a significant group of transactional and financial professionals with a successful track record of investing in energy assets. However, if we exercise the option to acquire our general partner interests, Natural Gas Partners will no longer control us through its control of our general partner, which may change our relationship with Natural Gas Partners. Founded in 1988, Natural Gas Partners represents a $7.2 billion family of investment funds organized to make direct equity investments in private energy enterprises.

Business Strategies

Our primary business objective is to increase our cash distribution per unit potential over time. We intend to accomplish this objective by continuing to execute the following business strategies:

| · | Maintaining a disciplined financial policy. We will pursue a disciplined financial policy by maintaining a prudent capital structure, managing our exposure to interest rate and commodity price risk, and conservatively managing our cash reserves, especially in light of the state of the financial, credit and equity markets as they now exist and may exist in the future. We target a total leverage ratio, as defined in our revolving credit facility, of 3.50 or less, and upon achieving that level, we plan to institute a new cash distribution policy that will allow us to retain a portion of our distributable cash flow for reinvestment. Maintaining a balanced capital structure may allow us to use our available capital to selectively pursue accretive investments or acquisition opportunities. |

| · | Expanding our operations through organic growth projects. In our Midstream Business, we intend to leverage our existing infrastructure and customer relationships by expanding our existing asset base to meet new or increased demand for midstream services. We also look for opportunities to invest in attractive “Greenfield” projects in areas outside our existing asset base. In our Upstream Business, we intend to continue to identify and execute infill drilling and recompletion opportunities as the primary source of organic growth. We employ sound petroleum engineering practices to identify and quantify these opportunities, and we pursue the opportunities in a manner that reduces risk and cost. We measure the success of these projects by unit development cost and internal rate of return. We currently target an 18% internal rate of return or higher for our Midstream Business’s projects and commercial contracts and a 25% internal rate of return or higher for our Upstream Business’s infill drilling, recompletion and workover activities. |

| · | Continuing to reduce our exposure to commodity price risk. We intend to continue to operate our business in a manner that reduces our exposure to commodity price risk in the near term and on an opportunistic basis over the long term. We manage our portfolio of equity volumes from our three lines of business as a single portfolio. As a result, the volumes of natural gas that we purchase in conjunction with our midstream keep-whole arrangements are more than offset by our long natural gas position associated with midstream percent-of-proceeds arrangements and natural gas production from our upstream and mineral assets. We use a variety of hedging instruments to accomplish our risk management objectives. Based on the production estimates in our current forecast, we have hedged approximately 88% of our expected hedgeable crude, condensate and natural gas liquids (heavier than propane) and 96% of our expected hedgeable natural gas and ethane production through 2010. Similarly, based on the production estimates in our current forecast, we have hedged approximately 63% of our 2011 expected hedgeable crude, condensate and natural gas liquids (heavier than propane) volumes and 73% of our natural gas and ethane production. We actively monitor our hedge portfolio for opportunities to enter into additional hedges to support our cash flow objectives. Our hedging strategy also may include resetting existing hedges to higher price levels in order to meet our cash flow requirements, stay in compliance with our credit facility covenants and continue to execute on our distribution objectives. |

| · | Maximizing the profitability of our existing assets. In our Midstream Business, we intend to maximize the profitability of our existing assets by marketing to, and contracting with, new customers to add new volumes of natural gas to our gathering and processing assets under economically favorable terms to us. We also strive to provide superior customer service while undertaking additional initiatives to enhance utilization, minimize excess processing capacity, and improve operating margins and efficiencies across our midstream assets. In our Upstream Business, we utilize best practices and technologies to improve the recoveries of oil and natural gas from our existing wellbores, as well as focus on reducing our overall and per unit operating expenses. We manage our assets to maximize the amount of hydrocarbons and valuable by-products we can profitably extract. We pursue these opportunities at a measured pace to attempt to maintain constant or slightly growing production rates and cash flows. The performance measures we use to assess the success of our asset performance and production enhancement activities are increased throughput volumes, improved run times on our equipment, internal rate of return and unit operating cost. |

| · | Pursuing acquisitions. We will continue to employ a disciplined acquisition strategy that capitalizes on the operational experience of our management team as well as bringing new expertise to the Partnership. Due to our unique structure and expertise in managing midstream, upstream and mineral assets, we can pursue acquisitions that involve all three types of assets and thereby provide a seller the ability to complete a sale in a single transaction. Strategically, we will focus our acquisition efforts on midstream and upstream assets which we believe are best-suited to accomplish our objective of growing our distributable cash flow. If we are successful in selling our Minerals Business, we do not foresee making acquisitions of mineral-only asset or packages. We will remain opportunistic on our acquisition activity. |

In our Midstream Business, we seek to acquire assets that: (i) serve producing areas with high levels of drilling activity; (ii) have a stable contract mix profile characterized by relatively low commodity price exposure and relatively long contract terms; (iii) are complementary to our existing asset base and which provide operating cost savings, diversified market outlets and a diversified customer base; and (iv) allow us to serve as operator, which gives us greater flexibility with respect to future capital investments and allows us to better manage the associated risks.

In our Upstream Business, we seek to acquire assets that: (i) have low decline rates; (ii) have a relatively high level of developed producing reserves; (iii) have meaningful low-risk development opportunities; (iv) contain a balanced mix of oil and natural gas current production and future reserves; (v) serve attractively priced markets; (vi) produce from numerous wellbores so as to minimize the impact of a single negative well event; and (vii) allow us to serve as operator, which gives us greater flexibility with respect to future capital investments and allows us to better manage the associated risks.

The primary measures we use to assess the success of our acquisition program are sustained accretion and internal rate of return. We currently target a 12% internal rate of return or higher for our acquisitions.

Competitive Strengths

We believe that we are well positioned to execute our business strategies successfully because of the following competitive strengths:

| · | We have a uniquely diversified business model. The combination of our Midstream, Upstream and Minerals Businesses along the oil and gas value chain provides us with significant benefits. While the Midstream Business provides us with relatively stable, and potentially growing, throughput volumes and cash flows, the performance of gathering and processing assets is tied, among other things, to our gas-producing customers’ drilling plans, well performance and financial situation. Each of these factors is beyond our control. In contrast, in our Upstream Business we are able to manage our infill drilling plans, recompletion and workover activities to varying degrees with a company-wide view of maximizing and/or stabilizing our overall cash flow. |

An additional benefit to our diversified business model is our ability to bid for acquisition opportunities which include assets or properties in two or more of our segments and potentially in two or more of our businesses. This provides us with a competitive advantage against other potential single-focus bidders, as we are able and willing to assign value and identify potential operational improvements of all the assets included in the package.

If we are successful in selling our Minerals Business, we do not foresee a negative impact to our diversified business model as the benefits of our model is primarily realized through the juxtaposition of our Midstream and Upstream Businesses.

| · | We have an experienced, knowledgeable management team with a proven record of performance. Our management team has a proven record of enhancing value through the investment in, and the acquisition, exploitation and integration of, natural gas midstream, upstream and mineral assets. Our senior management team has an average of approximately 20 years of industry-related experience and a substantial economic interest in us through direct ownership of our common units and, in certain cases, indirect ownership through Holdings. Our senior management team’s extensive experience and contacts within the energy industry provide a strong foundation for managing and enhancing our operations, accessing strategic acquisition opportunities and constructing new assets. We have a staff of engineers, commercial, operational and support staff who are experts at drilling and operating oil and gas wells and managing gathering and processing assets. |

| · | We have a highly flexible, low cost and long term credit facility in place. We currently have a $971 million senior secured revolving credit facility that expires in December 2012, carries an attractive borrowing rate and offers us financial flexibility. The credit facility accommodates, through the use of a borrowing base for our Upstream Business and traditional cash-flow based covenants for our Midstream and Minerals Businesses, the allocation of indebtedness to either our Upstream Business (to be measured against the borrowing base) or to our Midstream and Minerals Businesses (to be measured against the cash-flow based covenant). We have a well-diversified lender group consisting of 19 domestic and international financial institutions with the highest concentration in any one financial institution being 13.9% of aggregate commitments. We have the ability to upsize total commitments by an additional $19.5 million, in addition to the $180 million upsizing we executed during 2008. As a result of Lehman Brothers’ bankruptcy filing, the amount of available commitments was reduced by the unfunded portion of Lehman Brothers’ commitment in an amount of approximately $9.1 million. As of December 31, 2009, we had approximately $60.5 million of available capacity under our credit facility expiring in 2012. Our current credit availability and our ability to draw from our credit facility may be limited by our financial results during 2010 and beyond if the energy industry endures a prolonged lower commodity price environment. We believe that the Recapitalization and Related Transactions will improve our liquidity and increase our access to capital markets to raise additional funds for future acquisitions and organic growth projects. |

| · | We are affiliated with NGP. We expect our relationship with NGP to continue to provide us with several significant benefits, including increased exposure to acquisition opportunities and access to a significant group of transactional and financial professionals with a proven track record of investing in midstream and upstream assets. If we are successful in consummating the transactions described in Recapitalization and Related Transactions above, and we exercise the option to purchase our general partner from NGP affiliates, our relationship with NGP could change dramatically. |

History

Our Partnership, formed in May 2006, is the legal successor to Eagle Rock Pipeline, L.P. (“Eagle Rock Pipeline”) which continues to exist in our organization as a subsidiary as a result of our initial public offering in October 2006.

The following is a detailed chronology of our history of significant transactions, including acquisitions, divestures, organic growth projects and equity financings.

Dry Trail Plant

| | • | On December 5, 2003, Eagle Rock Pipeline commenced operations with the acquisition of the Dry Trail plant carbon dioxide recovery plant from Williams Field Services in the amount of approximately $18.0 million which was financed through equity of $6.0 million and debt of $12.0 million; |

| | • | On July 1, 2004, Eagle Rock Pipeline sold the Dry Trail plant to Celero Energy, L.P. for approximately $37.4 million, of which $12.0 million was used to repay the debt incurred to purchase the Dry Trial plant, and resulted in a pre-tax realized gain in the disposition of approximately $19.5 million in 2004; |

Entrance into East Texas Segment with Indian Springs Processing Plant and Camp Ruby Gathering System Acquisition (Indian Springs Acquisition)

| | • | On July 1, 2004, Eagle Rock Pipeline acquired a 25% interest in the Indian Springs processing plant and a 20% interest in the Camp Ruby gathering system, for an aggregate purchase price of approximately $20.0 million, financed with proceeds received from the sale of the Dry Trail plant; |

Entrance into Texas Panhandle Segment (ONEOK Acquisition)

| | • | On December 1, 2005, Eagle Rock Pipeline acquired ONEOK Texas Field Services, L.P (“Eagle Rock Predecessor”) for approximately $531.1 million, which was financed through an additional equity contribution of $133 million and incurrence of debt of $400 million; |

Tyler County Pipeline

| | • | On February 28, 2006, Eagle Rock Pipeline completed the first phase of construction of the 23-mile, 10 inch Tyler County Pipeline in Tyler County, Texas and Polk County, Texas, costing approximately $8 million, financed from operating cash flow, connecting the Indian Springs Plant and a significant producer in Tyler County; |

Creation of East Texas/Louisiana Segment with Acquisition of Brookeland gathering system and processing plant, Masters Creek gathering system, and Jasper NGL Pipeline from Duke and Swift (Brookeland Acquisition)

| | • | On March 27, 2006, Eagle Rock Pipeline completed a private placement of 5,455,050 common units for $98.3 million among a group of private investors; |

| | • | On March 31, 2006 and April 7, 2006, a wholly-owned subsidiary of Eagle Rock Pipeline acquired certain natural gas gathering and processing assets from Duke Energy Field Services, L.P. and Swift Energy Corporation, consisting of the Brookeland gathering system and processing plant, the Masters Creek gathering system and the Jasper NGL pipeline. This acquisition was financed with approximately $96 million out of the proceeds received from the private equity placement closed on March 27, 2006; |

Expansion of Texas Panhandle Segment assets with addition of Roberts County Plant

(Midstream Gas Services Acquisition)

| | • | On June 2, 2006, Eagle Rock Pipeline acquired all of the partnership interests in Midstream Gas Services, L.P., an NGP affiliate, which owned a plant and a small gathering system in Roberts County, Texas, for approximately $25.0 million, consisting of $4.7 million of cash flow from operations and $20.3 million in Eagle Rock Pipeline partnership units; |

Creation of Quinduno Pipeline Connecting East and West Panhandle Systems in Texas Panhandle Segment

| | • | On August 1, 2006, Eagle Rock Pipeline completed the construction of the 10-mile, 10-inch Quinduno pipeline, costing approximately $3.1 million, financed from operating cash flow, connecting our East and West Panhandle Systems in the Texas Panhandle Segment; |

Initial Public Offering

| | • | On October 24, 2006, we completed our initial public offering with the issuance of 12,500,000 common units to the public, representing a 29.6% limited partner interest. In connection with that offering, Eagle Rock Holdings, L.P. contributed certain assets and ownership of operating subsidiaries to us and received 3,459,236 common units and 20,691,495 subordinated units; |

| | • | On November 21, 2006, 1,463,785 common units held by Eagle Rock Holdings, L.P. and certain private investors were redeemed as part of the exercise of the underwriters’ overallotment option granted in conjunction with our IPO; |

Tyler County Pipeline Extension

| | • | On March 31, 2007, we completed the construction of the 13-mile, 10-inch Tyler County Pipeline Extension in Tyler County and Jasper County, Texas, costing approximately $24.2 million, financed with proceeds from a draw on our credit facility, extending the Tyler County Pipeline to our Brookeland Gathering System; |

Creation of Minerals Segment (Montierra Acquisition)

| | • | On April 30, 2007, we acquired all outstanding equity of entities owning certain fee minerals, royalties and working interest properties, from Montierra Minerals & Production, L.P., an NGP affiliate, and we acquired certain fee minerals, royalties and working interest properties directly from NGP-VII Income Co-Investment Opportunities, L.P., another NGP affiliate, for an aggregate purchase price of $139.2 million, consisting of 6,458,946 (recorded value of $133.8 million) of our common units and $5.4 million in cash; |

East Texas/Louisiana Segment Expansion and Entrance to South Texas Segment (Laser Acquisition)

| | • | On May 3, 2007, we acquired Laser Midstream Energy, LP, including certain of its subsidiaries, for a total purchase price of $142.6 million, consisting of $113.4 million in cash and 1,407,895 (recorded value of $29.2 million) of our common units; |

| | • | On May 3, 2007, we completed the private placement of 7,005,495 common units to several institutional purchasers in a private offering resulting in gross proceeds of $127.5 million. The proceeds from this offering were used to fully fund the cash portion of the purchase price of the Laser Acquisition and the Montierra Acquisition and were used for other general company purposes; |

Acquisition of Complementary Assets to Minerals Segment (MacLondon Acquisition)

| | • | On June 18, 2007, the Partnership completed the acquisition of certain royalty and mineral assets owned by MacLondon Energy, L.P. for a purchase price of $18.2 million, consisting of 757,065 (recorded value of $18.1 million) of our common units, and cash of $0.1 million; |

Construction of Red Deer Processing Plant in East Panhandle System in Texas Panhandle Segment

| | • | On June 21, 2007, the Red Deer processing plant, with a 20 MMcf/d processing capacity, was put into service in Roberts County, Texas in the East Panhandle System in the Texas Panhandle Segment, at a cost of $16.2 million financed with proceeds from a draw on our credit facility; |

Entrance into Upstream Segment with Acquisition of oil and gas producing properties in East and South Texas and in Alabama (including certain related natural gas gathering and processing assets) (Escambia and Redman Acquisitions)

| | • | On July 31, 2007, we acquired Escambia Asset Co. LLC and Escambia Operating Co. LLC (collectively “Escambia”) for an aggregate purchase price of approximately $241.8 million, comprised of approximately $224.6 million in cash and 689,857 (recorded value of $17.2 million) in Eagle Rock common units; |

| | • | On July 31, 2007, we acquired Redman Energy Holdings, L.P. and Redman Energy Holdings II, L.P., each an NGP affiliate, and certain assets owned by NGP Income Co-Investment Opportunities Fund II, L.P., and NGP affiliate, (collectively, “Redman”) for a combined value of $192.8 million, comprised of 4,426,591 (recorded value of $108.2 million) common units and $84.6 million in cash; |

| | • | On July 31, 2007, we completed the private placement of 9,230,770 common units to third-party investors for total cash proceeds of approximately $204 million. The proceeds were used to finance a portion of the cash used in the Escambia and Redman acquisitions, with the other portion being financed from a draw on our credit facility; |

Upstream Segment expansion with Acquisition of oil and gas producing properties in West Texas (Stanolind Acquisition)

| | • | On April 30, 2008, we acquired Stanolind Oil and Gas Corp. (“Stanolind”), an affiliate of NGP, for an aggregate purchase price of approximately $81.9 million of cash; |

| | • | In 2008, subsequent to the Stanolind Acquisition, we drilled and completed five wells in the Permian Basis at a cost of $6.5 million financed through cash from operations; |

| | Stinnett-Cargray Consolidation Project |

| | • | In July 2008, we complete the shutdown of our Stinnett Plant and began to move the natural gas to our Cargray Plant for processing. This project cost us $6.1 million financed through cash from operations; |

| | East Texas/ Louisiana Segment and South Texas Segment expansion and entrance into Gulf of Mexico Segment (Millennium Acquisition) |

| | • | On October 1, 2008, we acquired Millennium Midstream Partners, L.P. (“MMP”) for an aggregate purchase price of approximately $210.6 million, comprised of approximately $183.4 million in cash and 3,031,676 (recorded value of $27.2 million) common units. The purchase price includes the release of 849,858 units from the escrow account to the sellers as well as other post-closing adjustments made subsequent to October 1, 2008. As of December 31, 2009, the escrow account held 391,304 common units which are available for claims by the Partnership and will not be available for release to the former owners of MMP until April 1, 2010. As of March 9, 2010, we had recovered an additional 3,759 common units from the escrow account. |

For a further discussion of our acquisitions, see Note 4 to our consolidated financial statements included in Part II, Item 8. Financial Statements and Supplementary Data starting on page F-1 of this Annual Report.

The following are charts and tables that depict the foregoing history of acquisitions/dispositions and organic growth projects by date, transaction type, cost, financing sources and business:

Table of Acquisitions/Dispositions

| | | | | | | | | | |

Closing Date | | Acquisition/Dispositions | | Cost ($ in Millions) | | | Financing Sources ($ in Millions) | | Business |

| | Cash | | | Debt | | | Equity to Sellers | | | Cash from private equity/ PIPEs(4) | |

| | 12-05-03 | | Dry Trail Acquisition(1) | | $ | 18.0 | | | | — | | | $ | 12.0 | | | | — | | | $ | 6.0 | | Midstream |

| | 7-01-04 | | Dry Trail Disposition | | $ | (37.4 | ) | | | — | | | | — | | | | — | | | | — | | NA |

| | 7-01-04 | | Indian Springs Acquisition(2) | | $ | 20.0 | | | $ | 20.0 | | | | — | | | | — | | | | — | | Midstream |

| | 12-01-05 | | ONEOK Acquisition(1) | | $ | 531.1 | | | | — | | | $ | 400.0 | | | | — | | | $ | 133.0 | | Midstream |

| 3-31-06 & 4-07-06 | | Brookeland Acquisition | | $ | 95.8 | | | | — | | | | — | | | | — | | | $ | 98.3 | | Midstream |

| | 6-02-06 | | Midstream Gas Services Acquisition | | $ | 25.0 | | | $ | 4.7 | | | | — | | | $ | 20.3 | | | | — | | Midstream |

| | 4-30-07 | | Montierra Acquisition | | $ | 139.2 | | | | — | | | | — | | | $ | 133.8 | | | $ | 5.4 | | Minerals |

| | 5-03-07 | | Laser Acquisition | | $ | 142.6 | | | | — | | | | — | | | $ | 29.2 | | | $ | 113.4 | | Midstream |

| | 6-18-07 | | MacLondon Acquisition | | $ | 18.2 | | | $ | 0.1 | | | | — | | | $ | 18.1 | | | | — | | Minerals |

| | 7-31-07 | | Escambia Acquisition | | $ | 241.8 | | | | — | | | $ | 113.0 | | | $ | 17.2 | | | $ | 111.6 | | Upstream |

| | 7-31-07 | | Redman Acquisition | | $ | 192.8 | | | | — | | | | — | | | $ | 108.2 | | | $ | 84.6 | | Upstream |

| | 4-30-08 | | Stanolind Acquisition | | $ | 81.9 | | | $ | 5.9 | | | $ | 76.0 | | | | — | | | | — | | Upstream |

| | 10-01-08 | | Millennium Acquisition(3) | | $ | 210.6 | | | $ | 7.0 | | | $ | 176.4 | | | $ | 27.2 | | | | — | | Midstream |

(1) | Private equity funding provided by Natural Gas Partners. |

(2) | Cash provided by the disposition of Dry Trail. |

(3) | Cost excludes 391,304 units held in an escrow account as of December 31, 2009. |

(4) | Private Investment in Public Equity (“PIPE”) by institutional investors. |

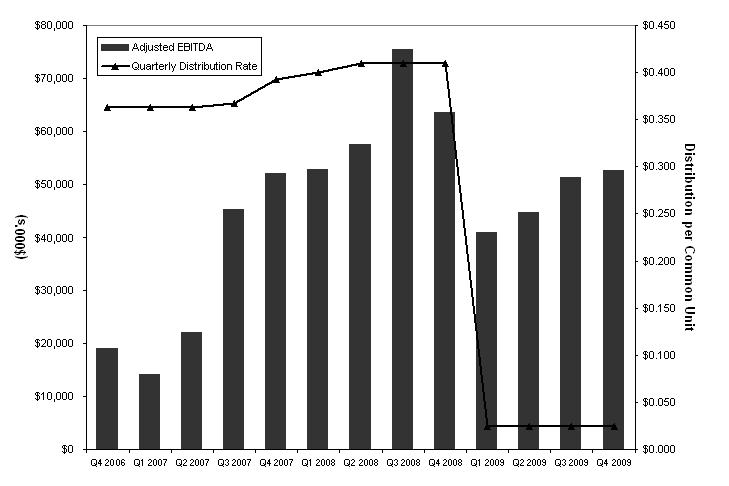

The following graph depicts our historical trends in Adjusted EBITDA and quarterly distribution rate per common unit, from our initial public offering on October 24, 2006 to December 31, 2009:

Note: Q4 2006 represents a prorated distribution to the common unitholders from the IPO date of October 24, 2006 through December 31, 2006. In addition, hedge resets contributed $4.2 million and $46.8 million to Adjusted EBITDA for the fourth quarter 2008 and the year ended December 31, 2009, respectively.

For a definition of Adjusted EBITDA and reconciliation to GAAP, see Part II, Item 6. Selected Financial Data-Non-GAAP Financial Measures.

From the time of our initial public offering through the third quarter of 2008, we increased our Adjusted EBITDA and the distribution per unit paid to our unitholders. Our financial results during this period benefited from our acquisition activity, as described above, and from the positive impact of increasing commodity prices, including the resulting increased producer drilling activity in our core Midstream Business areas. Beginning in the third quarter of 2008, however, commodity prices began to fall significantly, caused in part by the worldwide credit crisis and ensuing reduction in demand for crude oil, natural gas, natural gas liquids, and sulfur. This downward trend in commodity prices continued throughout the first quarter of 2009, and resulted in a substantial slowdown in the drilling activity of virtually all the major producer customers of our Midstream Business. Against this backdrop of declining midstream volumes and cash flows, our Board of Directors elected to substantially reduce our distribution beginning with the distribution with respect to the first quarter of 2009. This decision was made in order to enhance our liquidity and financial flexibility, and to avoid breaching the covenants in our revolving credit facility. Our Adjusted EBITDA benefited substantially in 2009 from our hedge portfolio, including from “hedge resets,” in which we pay our hedge counterparties to increase the strike price of existing swaps. Such hedge resets contributed approximately $46.8 million to our Adjusted EBITDA.

An investment in our common units involves risks associated with our business, regulatory and legal matters, our limited partnership structure and the tax characteristics of our common units. Please read carefully the risks described under Part I, Item 1A. Risk Factors.

Our Three Lines of Business and Our Seven Reporting Segments

Midstream Business

Midstream Industry Overview

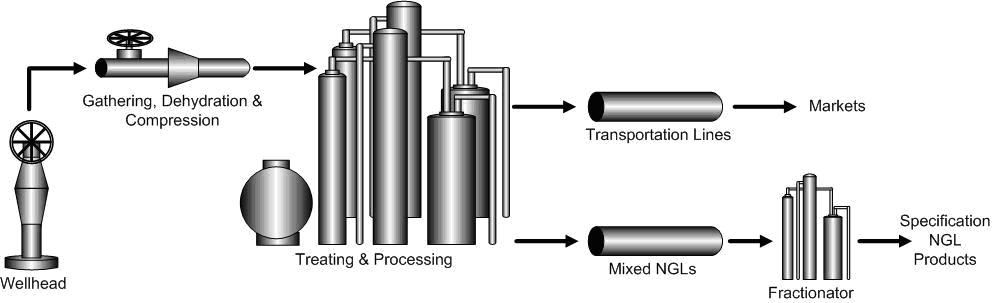

General. Raw natural gas produced from the wellhead is gathered and delivered to a processing plant or markets located near the production field, where it is treated, dehydrated, and/or processed. Processing natural gas involves the separation and treating of raw natural gas resulting in a pipeline quality natural gas, primarily methane, and mixed NGLs for sale. Natural gas treating entails the removal of impurities, such as water, sulfur compounds, carbon dioxide and nitrogen. Interstate and intrastate pipelines deliver the processed natural gas to markets. Mixed NGLs are typically transported via NGL pipelines or by truck to a fractionator which separates the NGLs into its components such as ethane, propane, normal butane, isobutane and natural gasoline. The component NGLs are then sold to end users.

The following diagram shows the process of gathering, processing, marketing and transporting natural gas and NGLs. Our Midstream Business is in all of the depicted segments other than the wellhead (which is captured in our Upstream Business Segment).

Gathering. A gathering system typically consists of a network of small diameter pipelines and a compression system which together collect natural gas from producing wells and delivers it to larger pipelines for further transportation. We own and operate large gathering systems in four geographic regions of the United States.

Compression. Gathering systems are operated at design pressures that seek to maximize the total through-put volumes from all connected wells. Since wells produce at progressively lower field pressures as they age, the raw natural gas must be compressed to deliver the remaining production against higher pressure that exists in the connected gathering system or transport pipelines. Natural gas compression is a mechanical process in which a volume of natural gas at a lower pressure is boosted, or compressed, to a desired higher pressure, allowing natural gas that no longer naturally flows into a higher pressure downstream pipeline to be brought to market. Field compression is used to lower the wellhead pressure while maintaining the exit pressure of a gathering system to deliver natural gas into higher pressure downstream pipelines. We own and operate compression on a number of our systems

Treating and processing. Raw natural gas produced at the wellhead is often unsuitable for pipeline transportation or commercial use and must be processed and/or treated to remove the heavier hydrocarbon components and/or contaminants. The principal components of pipeline-quality natural gas are methane and ethane, but most raw natural gas also contains varying amounts of heavier hydrocarbon components (such as propane, normal butane, isobutane, and natural gasoline) and impurities, such as water, sulfur compounds, carbon dioxide, or nitrogen. We own and operate natural gas processing and/or treating plants in five geographic regions.

Fractionation. NGL fractionation facilities separate mixed NGL streams into discrete NGL products: ethane, propane, normal butane, isobutane and natural gasoline. Ethane is primarily used in the petrochemical industry as feedstock for ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Propane is used both as a petrochemical feedstock and as a heating fuel, an engine fuel and an industrial fuel. Normal butane is used as a petrochemical, and as a blend stock for motor gasoline. Isobutane is typically fractionated from mixed butane (a stream of normal butane and isobutane in solution), principally for use in enhancing the octane content of motor gasoline. Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is used primarily as motor gasoline blend stock or petrochemical feedstock. We operate a fractionation facility to produce propane at one of our facilities in the Texas Panhandle Segment. In our Gulf of Mexico Segment we own a 5.16% interest in the Tebone Fractionator, a fractionation facility operated by Enterprise Products Partners L.P. in southern Louisiana, acquired as a part of our recently closed Millennium Acquisition.

Marketing. Natural gas marketing involves the sale of the pipeline-quality natural gas either produced by processing plants or purchased from gathering systems or other pipelines. NGL marketing involves the sale of the unfractionated or y-grade products or fractionated products recovered at the processing plants. We perform a limited marketing function for our account and for the accounts of our customers based upon the location of our assets.

Transportation. Natural gas transportation consists of moving pipeline-quality natural gas from gathering systems, processing plants and other pipelines and delivering it to wholesalers, utilities and other pipelines. Other than our North and Central systems we acquired in the Millennium Acquisition, we do not own any natural gas transportation assets.

Natural gas is gathered and processed in the industry pursuant to a variety of arrangements generally categorized (by the nature of the commodity price risk) as fee-based, percent-of-proceeds, fixed recovery and keep-whole, described in greater detail as follows:

| · | Fee-Based Arrangements. Under these arrangements, we generally are paid a fixed cash fee per unit volume for performing the gathering and processing service. This fee is directly related to the volume of natural gas that flows through our systems and is not directly dependent on commodity prices. A sustained decline, however, in commodity prices could result in a decline in volumes and, thus, a decrease in fee revenues. These arrangements provide stable cash flows, but minimal, if any, upside in higher commodity price environments. |

| · | Percent-of-Proceeds Arrangements. Under these arrangements, generally raw natural gas is gathered from producers at the wellhead, moved through the gathering system, and processed and sold at prices based on published index prices. We pay a portion of the sale price to the producers. These arrangements provide upside in high commodity price environments, but result in lower margins in low commodity price environments. The price paid to producers is based on an agreed percentage of the products produced multiplied by one of the following: (1) the actual sale price; or (2) the index price. Contracts in which the gatherer/processor shares only in specified percentages of the proceeds from the sale of NGLs and in which the producer receives 100% of the proceeds from natural gas sales, are referred to as “percent-of-liquids” arrangements. Contracts in which the gatherer/processor share only in specified percentages of the proceeds from the sale of the natural gas and in which the producer receives 100% of the proceeds from the NGL sales are referred to as a “percent-of-index” arrangements. Under percent-of-proceeds arrangements, the margin correlates directly with the prices of natural gas and NGLs; under percent-of-liquids arrangements, the margin correlates directly with the prices of NGLs; and under percent-of-index arrangements, the margin correlates directly with the prices of natural gas (although there is often a fee-based component to all of these forms of contracts in addition to the commodity sensitive component). |

| · | Fixed Recovery Arrangements. Under these arrangements, raw natural gas is gathered from producers at the wellhead, moved through our gathering system and processed and sold as processed natural gas and/or NGLs at prices based on published index prices. The price paid to the producers is based on an agreed to theoretical product recovery factor to be applied against the wellhead production and then a percentage of the theoretical proceeds based on an index or actual sales prices multiplied to the theoretical production. To the extent that the actual recoveries differ from the theoretical product recovery factor, this will affect the margin. These arrangements provide upside in high commodity price environments, but result in lower margins in low commodity price environments. |

| · | Keep-Whole Arrangements. Under these arrangements, raw natural gas is processed to extract NGLs, and the processor pays to the producer the full thermal equivalent volume of raw natural gas received from the producer in the form of either processed natural gas or its cash equivalent. The processors are generally entitled to retain the processed NGLs and to sell them for their account. Accordingly, the margin is a function of the difference between the value of the NGLs produced and the cost of the processed gas used to replace the thermal equivalent value of those NGLs (i.e. the frac spread). The profitability of these arrangements is subject not only to the commodity price risk of natural gas and NGLs, but also to the price of natural gas relative to NGL prices. These arrangements can provide improved profit margins in favorable commodity price environments, but also can be subject to losses if the cost of natural gas exceeds the value of its thermal equivalent of NGLs. Many keep-whole arrangements include provisions that reduce commodity price exposure, including (1) conditioning floors that require the keep-whole arrangements to convert to a fee-based arrangement if the NGLs have a lower value than their thermal equivalent in natural gas, (2) discounts to the applicable natural gas index price under which we may reimburse the producer an amount in cash for the thermal equivalent volume of raw natural gas acquired from the producer, or (3) fixed cash fees for ancillary services, such as gathering, treating and compressing. |

Midstream Business Overview

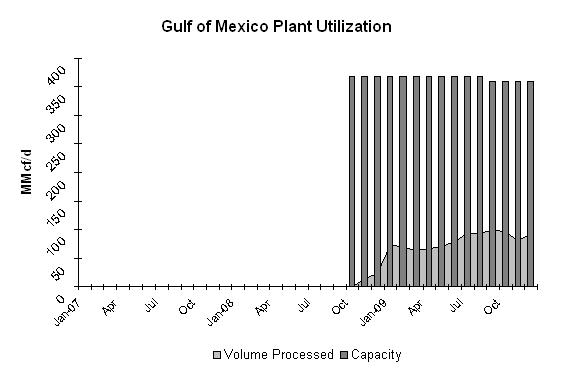

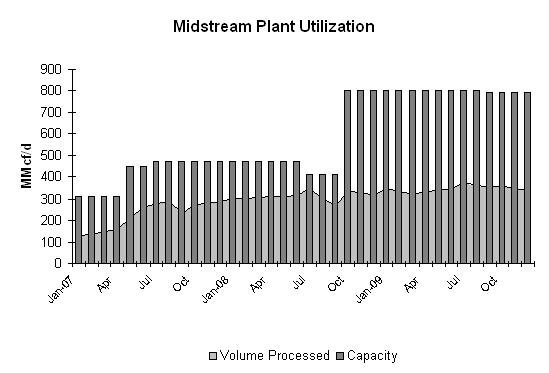

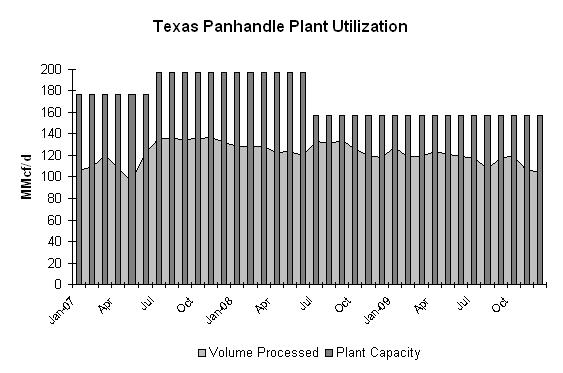

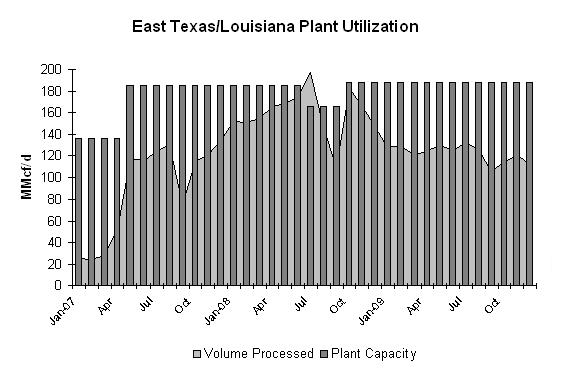

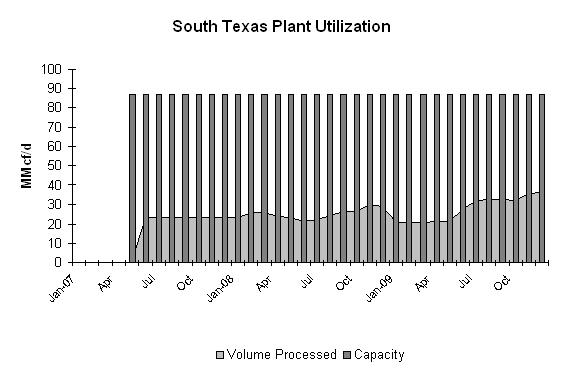

We own strategically-positioned natural gas gathering and processing assets in five significant natural gas producing regions: the Texas Panhandle, East Texas/Louisiana, West Texas, South Texas and the Gulf of Mexico. Our gathering and processing assets are located in basins that have experienced consistent growth in natural gas land leases, drilling and production. These core basins are known as the Anadarko basin, East Texas basin, Permian and South Texas basin and the Outer Continental Shelf. While the reduction in oil, natural gas and natural gas liquids prices from their historic highs during 2008 to their current levels has resulted in a significant reduction in current drilling activity behind a number of our gathering systems particularly in the East Texas/Louisiana segment and South Texas segment, we continue to believe our strategically-positioned assets will benefit us when the drilling activity resumes in these areas. During 2009 we remained focused on contracting new gas to our systems and continuing our cost reduction efforts. We did execute on a number of smaller organic growth projects during the 2009 calendar year which included laying additional gathering lines in East Texas and adding compressors where drilling activity was occurring in the Texas Panhandle. Given the significant dislocations in the equity and capital markets throughout 2009 and the rise and fall of oil prices and the deterioration of natural gas prices, we did not execute on any acquisitions.