Securities and Exchange Commission – Page 1

May 27, 2009

DIANE D. DALMY

ATTORNEY AT LAW

8965 W. CORNELL PLACE

LAKEWOOD, COLORADO 80227

303.985.9324 (telephone)

303.988.6954 (facsimile)

email: ddalmy@earthlink.net

May 27, 2009

Securities and Exchange Commission

450 Fifth Street N.W.

Washington, D.C. 20549

Attn: Julie F. Bell, Attorney Adviser

Effie Simpson, Staff Attorney

Jean Yu, Staff Attorney

Chanda DeLong, Staff Attorney

Re: Kinder Travel Inc.

Form 10-K for Fiscal Year Ended December 31, 2008

Filed April 13, 2009

Preliminary Information Statement on Schedule 14C

Filed April 22, 2009

File No. 000-52703

To Whom It May Concern:

On behalf of Kinder Travel Inc., a Nevada corporation (the “Company”), we submit the following responses which correspond to the numerical comments contained in the Securities and Exchange Commission letter dated May 19, 2009 (the “SEC Letter”) regarding the Form 10-K for fiscal year ended December 31, 2008 (the “Annual Report”) and the Preliminary Information Statement on Schedule 14C (the “Information Statement”). We have enclosed a marked-up copy of the PRE 14C to assist with your review.

Form 10-K

Cover Page

1. In accordance with the staff’s comments, we have revised the cover page to mark the box indicating that there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K. Please also be advised that the Global Developments Inc. has filed its Schedule 13D reflecting ownership of equity securities of the Company.

Forward-Looking Statements, page 4

2. In accordance with the staff’s comments, we have deleted the forward looking statement.

Securities and Exchange Commission – Page 2

May 27, 2009

3. In accordance with the staff’s comments, we have reviewed the signature page to include the signatures of the chief financial officer and at least a majority of the board of directors.

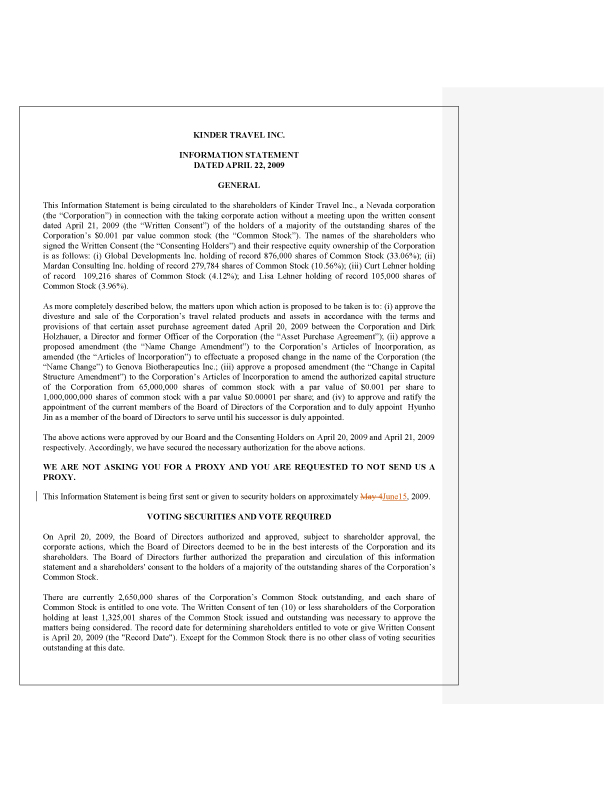

Information Statement on Form PRE 14C

General

4. In accordance with the staff’s comments, we have revised the Information Statement to include incorporation by reference to the Annual Report on Form 10-K of the Company’s audited financial statements for fiscal years ended December 31, 2008 and 2007.

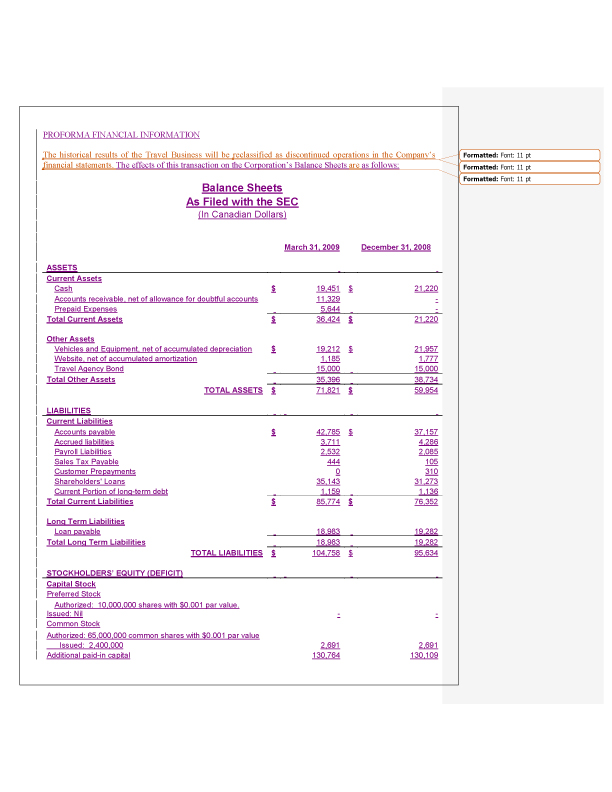

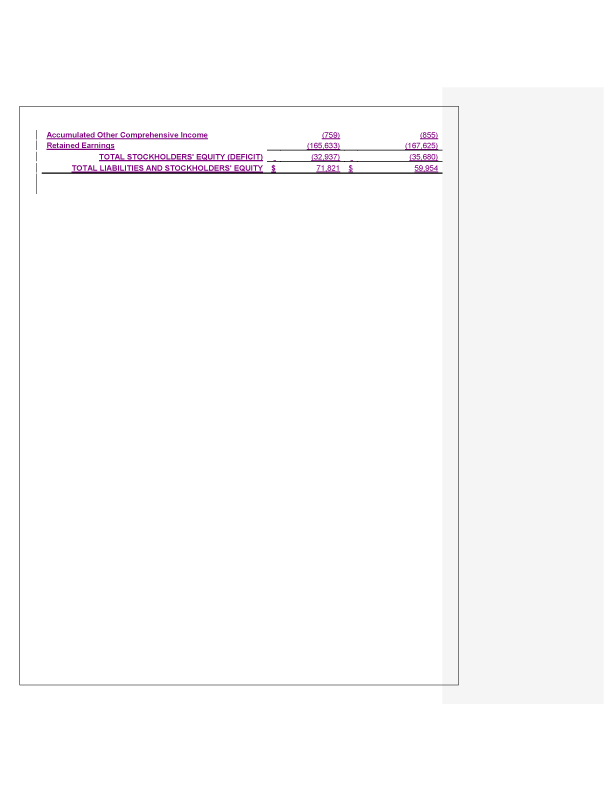

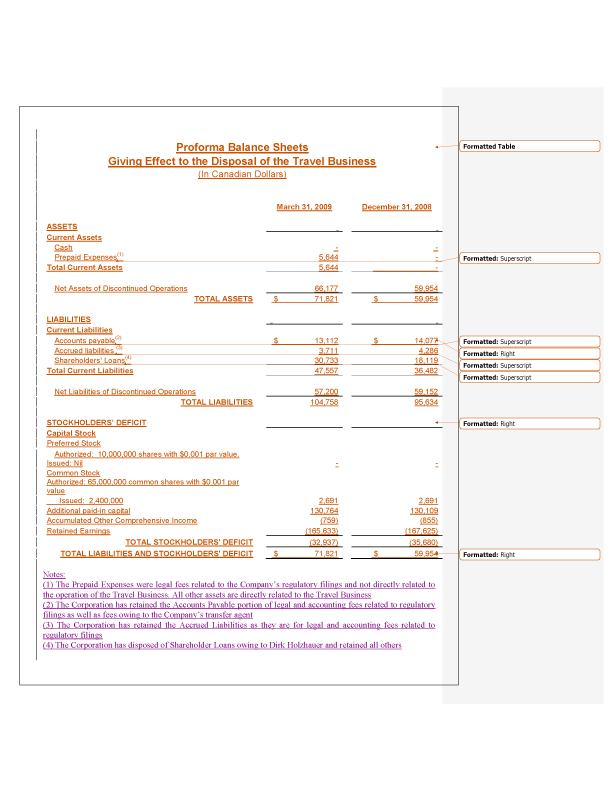

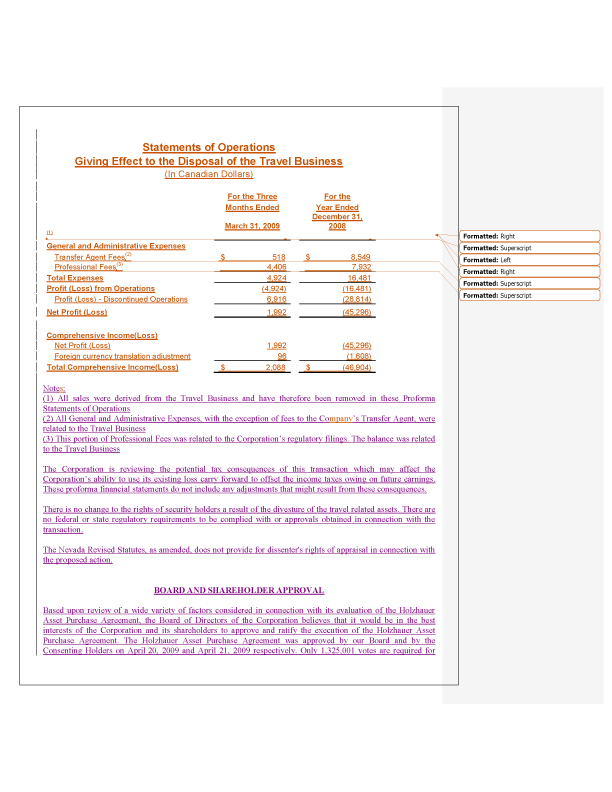

5. In accordance with the staff’s comments, we have revised the Information Statement to include pro forma financial information giving effect to the disposal of the travel related assets, including disclosure regarding adjustments for assets and liabilities that are not part of the disposal for fiscal year ended December 31, 2008 and the subsequent three-month period ended March 31, 2009.

6. In accordance with the staff’s comments, Global Developments Inc. (“GDI”) has filed a Schedule 13D reflecting ownership of equity securities of the Company held of record. Please be advised that in accordance with the terms and provisions of that certain asset purchase agreement dated April 15, 2009 (the “Agreement”) between the Company and Phoinos Oxford Lifesciences Limited (“Phoinos Oxford”), GDI acquired the 250,000 shares of the Company’s common stock. Phoinos Oxford agreed to assign the voting rights of the 250,000 shares of common stock to GDI and GDI agreed to hold such shares in escrow pursuant to which the shares will be subsequently transferred to Phoinos Oxford in ten quarterly installments. The shares were issued in the record name of GDI, but are being held by the escrow agent. A Schedule 13D is not required for Phoinos but one has been filed for GDI. We have also filed amendments to the Current Reports on Form, 8-K filed on April 17, 2009 and April 24, 2009 to more fully describe this transaction and issuance of shares.

7. In accordance with the staff’s comments, we have disclosed that under Nevada statutory law, there are no shareholder appraisal rights.

Directors, Executive Officers, Promoters and Control Persons, page 3

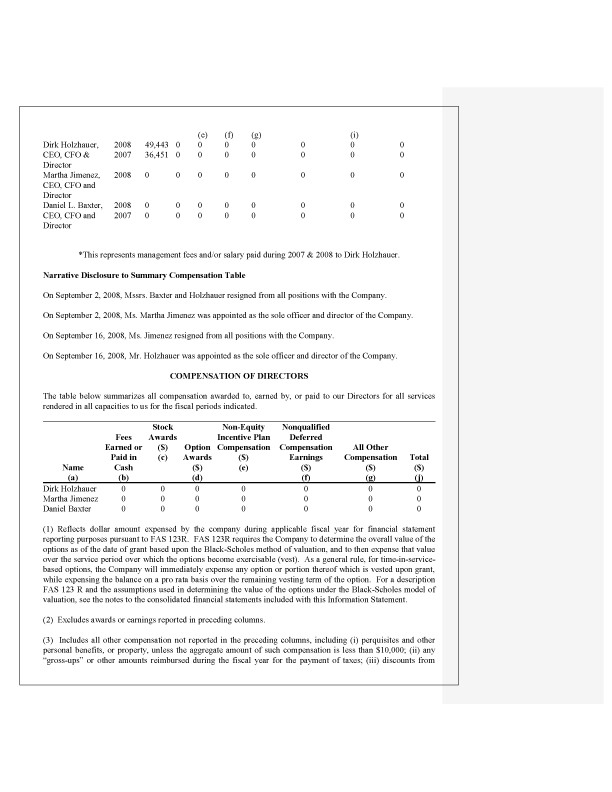

8. In accordance with the staff’s comments, the respective biographies of Hyunho Jin and Dirk Holzhauer have been revised to include the prior five years of experience.

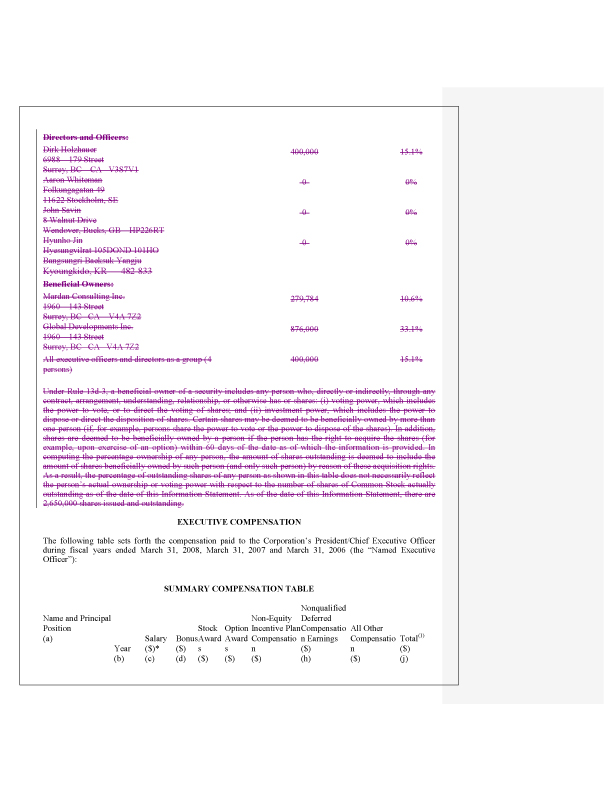

Security Ownership of Certain Beneficial Owners, page 4

9. In accordance with the staff’s comments, the beneficial ownership table has been revised to reflect GDI as shareholder of record with an explanatory note regarding the escrow arrangements.

10. In accordance with the staff’s comments, the beneficial ownership table has been revised to disclose those individual who have the voting and dispositive power of the shares held by corporate entities.

Securities and Exchange Commission – Page 3

May 27, 2009

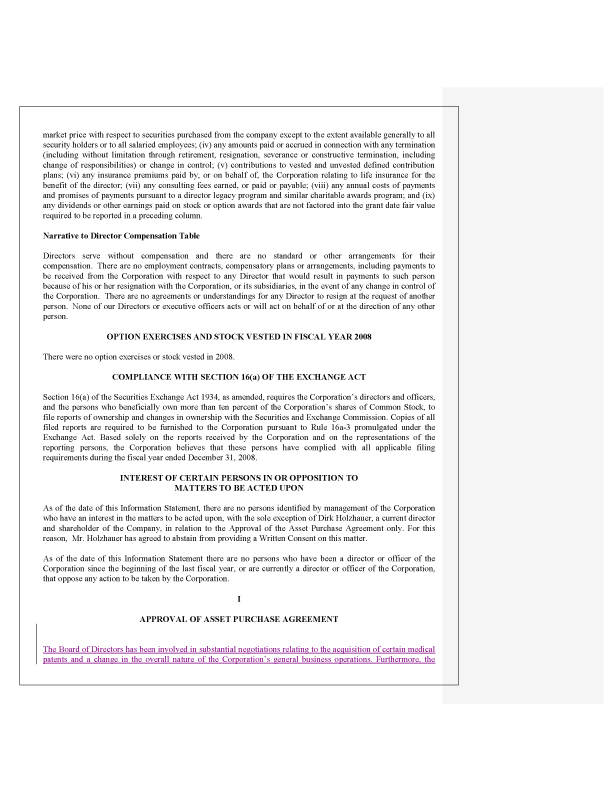

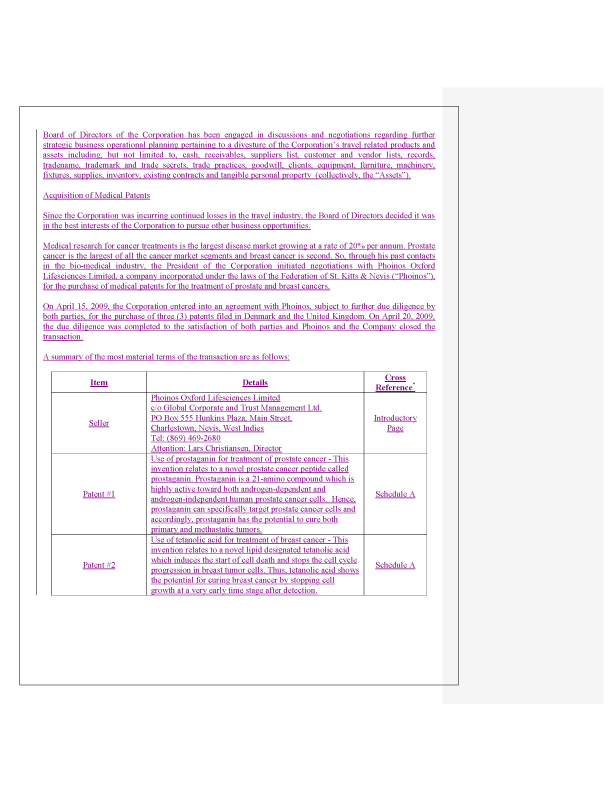

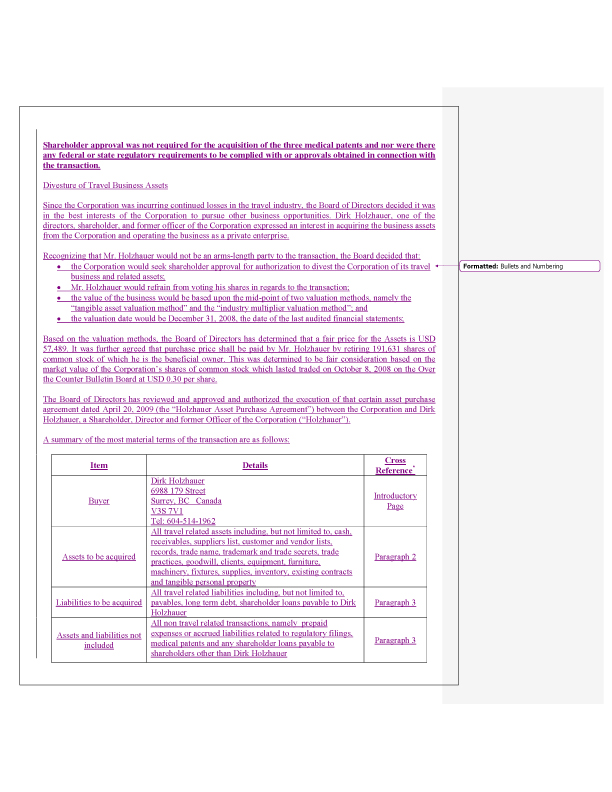

We have reformatted this section of the Information Statement to separate the transaction related to the acquisition of the medical patents from the transaction related to the sale of the travel business. This is to ensure that there is no confusion by the shareholders concerning which disclosures apply to each of the transactions, and which transaction requires shareholder approval.

11. In accordance with the staff’s comments, we have provided additional disclosure as required by Item 14(b) of Schedule 14A regarding the change in business operations or advised where it is not necessary as indicated in the following table:

| Paragraphs from Item 14(b) of Schedule 14A | Medical Patent | Travel Business |

| 1. Summary Term Sheet as required by Item 1001 of Regulation M-A | Added to the Medical Patent section | Added to the Travel Asset section |

| 2. Contact Information | Seller information Included in Term Sheet | Buyer information included in Term Sheet |

| 3. Description of Business Conducted | Patent descriptions included in Term Sheet | Description of assets and liabilities included in Term Sheet |

| 4. Terms of the transaction as required by Item 1004(a)(2) of Regulation M-A: | | |

| Brief description of the transaction | See Term Sheet | See Term Sheet |

| Consideration Offered | See Term Sheet | See Term Sheet |

| Reasons for engaging in the transaction | Added to the Medical Patent section | Added to the Travel Business section |

| Vote required for approval of the transaction | Added to the Medical Patent section | Added to the Travel Business section |

| Material differences to security holder rights, if applicable | Not applicable | Not applicable |

| Statement regarding accounting treatment | Added to the Medical Patent section | See Proforma Information provided in Travel Business section |

| Federal income tax consequences of the transaction, if material | Not material | Added to the Travel Business section |

| 5. A statement regarding regulatory approvals | Added to the Medical Patent section | Added to the Travel Business section |

6. A statement regarding 3rd party reports, opinions, and appraisals | Added to the Medical Patent section | Added to the Travel Business section |

| 7. A statement regarding past contact, transactions, or negotiations | Added to the Medical Patent section | Added to the Travel Business section |

| 8. Selected financial data required by Item 301 of Regulation S-K | Item 301 is not applicable to smaller reporting company | Item 301 is not applicable to smaller reporting company |

| 9. Proforma selected financial data required by Item 301 of Regulation S-K | Item 301 is not applicable to smaller reporting company | Item 301 is not applicable to smaller reporting company |

| 10. Proforma information required by Item 301 of Regulation S-K | Item 301 is not applicable to smaller reporting company | Item 301 is not applicable to smaller reporting company |

| 11. Financial information required by Article 11 of Regulation S-X | Narrative description of the effects as permitted under Rule 11-02(b)(1) added to the Medical Patent section | See Proforma Information provided in Travel Business section |

Securities and Exchange Commission – Page 4

May 27, 2009

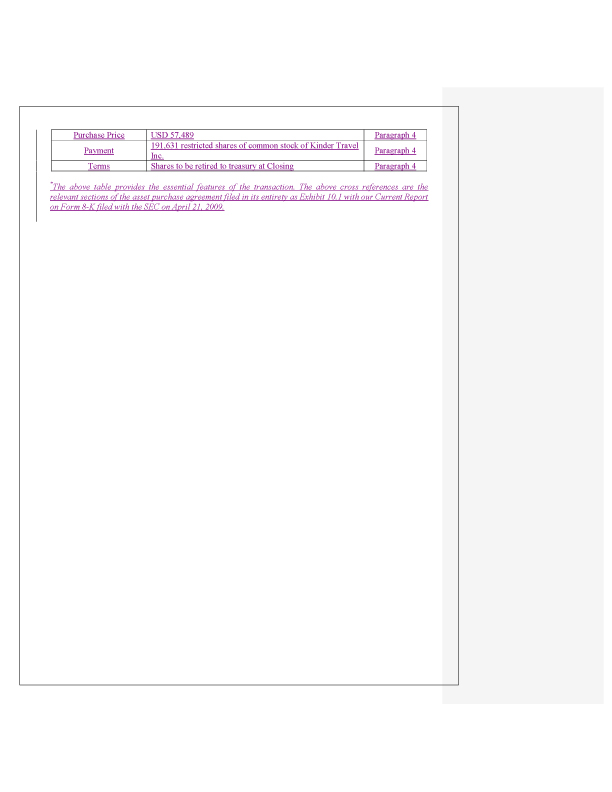

12. In accordance with the staff’s comments, additional disclosure has been provided as required by Item 15 of Schedule 14A as to the factors considered in determining the fairness of the consideration for the sale of the travel assets and the patents. Furthermore, we have disclosed all material features of the travel assets sale and patent purchase transactions and summarized the material portions of each respective agreement. Please refer to the following table:

| Paragraphs from Item 15 of Schedule 14A | Medical Patent | Travel Assets |

| a. Describe character and location of the property | Patent descriptions included in Term Sheet | Description of assets and liabilities included in Term Sheet |

| b. State the nature and amount of consideration and outline the fact bearing upon fairness of the consideration | 1. See Term Sheet. 2. Discussion regarding fairness of consideration added to Medical Patent section | 1. See Term Sheet. 2. Discussion regarding fairness of consideration added to Travel Asset section |

| c. Name and address of transferer and transferee and the nature of any material relationship | 1. Contact information of Seller included in Term Sheet. 2. Disclosure regarding relationships added to Medical Patent section. | 1. Contact information of Seller included in Term Sheet. 2. Disclosure regarding relationships added to Travel Asset section. |

| d. Other material features of the transaction | See Term Sheet | See Term Sheet |

13. In accordance with the staff’s comments, additional disclosure has been provided regarding the closing of the transaction for the acquisition of the medical patents.

Approval of an Amendment to the Articles of Incorporation, page 9

14. In accordance with the staff’s comments, additional disclosure has been provided to specifically explain the reason behind the Board of Directors approval to increase the authorized capital stock and that the Corporation does not have any current plans to issue additional shares of common stock.

15. In accordance with the staff’s comments, the Information Statement has been revised to include disclosure that the Board of Directors will have the authority without further shareholder approval to issue such shares.

16. In accordance with the staff’s comments, the Information Statement has been revised to inform the shareholders of the potential dilutive effect of any future issuances of common stock.

17. In accordance with the staff’s comments, the Information Statement has been revised to discuss the potential anti-takeover effects due to an increase in the number of authorized common shares.

Finally, we have enclosed the requested acknowledgement letter from the President of the Company.

Thank you for your attention in this matter.

Sincerely,

Diane D. Dalmy