Tender your Central GoldTrust and Silver Bullion Trust Units to the Offer | Sprott Asset Management| Tender Offer Sprott Physical Gold Trust | Sprott Physical Silver Trust Offer Expires: 5:00 P.M. (Toronto Time) on July 6, 2015 unless extended or withdrawn |

|

|

|

|

| | | |

Central GoldTrust (“GTU”)

TSX: GTU.U ($US Denominated) TSX: GTU.UN ($ CDN Denominated) NYSE MKT: GTU Transfer Agent: CST Trust Company | Silver Bullion Trust (“SBT”) TSX: SBT.U ($US Denominated) TSX: SBT.UN ($CDN Denominated) Transfer Agent: CST Trust Company | Sprott Physical Gold Trust TSX: PHY.U NYSE Arca: PHYS Transfer Agent: TMX Equity | Sprott Physical Silver Trust (“PSLV”) TSX: PHS.U NYSE Arca: PSLV Transfer Agent: TMX Equity |

Questions & Answers

Sprott Asset Management

Sprott Asset Management is a Toronto-based alternative asset manager that offers a wide variety of investment solutions to Canadian and international investors. Their product offerings include mutual funds, alternative strategies, physical bullion trusts and tax-efficient funds. For more information please visit http://www.sprott.com/about-sprott/.

Sprott Physical Gold Trust

The Trust was created to invest and hold substantially all of its assets in physical gold bullion. Its purpose is to provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical gold bullion without the inconvenience that is typical of a direct investment in physical gold. The Trust does not speculate with regard to short-term changes in gold prices. For more information please visit http://sprottphysicalbullion.com/sprott-physical-gold-trust/.

Sprott Physical Gold Trust

The Trust was created to invest and hold substantially all of its assets in physical silver bullion. Its purpose is to provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical silver bullion without the inconvenience that is typical of a direct investment in physical silver. The Trust does not speculate with regard to short-term changes in silver prices. For more information please visit http://sprottphysicalbullion.com/sprott-physical-silver-trust/.

Central GoldTrust

The Trust (established on April 28, 2003) is a passive, self-governing, single purpose trust, which invests primarily in long-term holdings of gold bullion and does not speculate in gold prices. At April 21, 2015, the Units were 99.0% invested in unencumbered, allocated and physically segregated gold bullion. Units may be purchased or sold on the Toronto Stock Exchange and NYSE MKT. For more information, please visit http://www.gold-trust.com/.

Silver Bullion Trust

The Trust (established on July 9, 2009) is a passive, self-governing, single purpose trust, which invests primarily in long-term holdings of silver bullion and does not speculate in silver prices. At April 24, 2015, the Units of Silver Bullion Trust were 98.8% invested in unencumbered, allocated and physically segregated silver bullion. Units may be purchased or sold on the Toronto Stock Exchange and over-the-counter in the United States. For more information please visit http://www.silverbulliontrust.com/.

Tender your Central GoldTrust and Silver Bullion Trust Units to the Offer

Prepared by:

For more information on the offer, please see http://sprottadvantage.com/.

Q Who is offering to purchase Central GoldTrust/ Silver Bullion Trust Units?

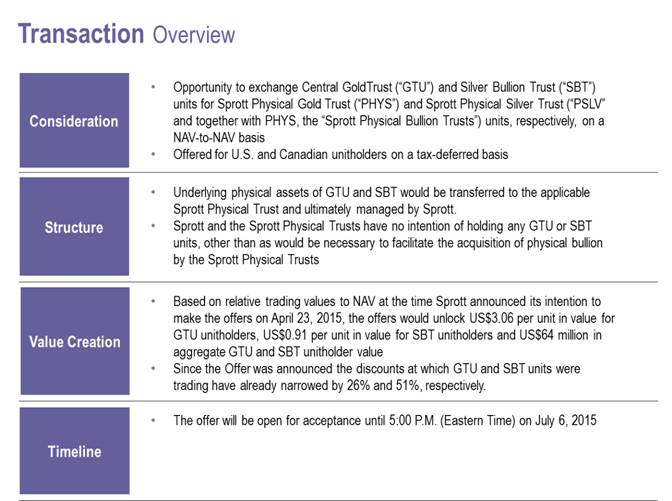

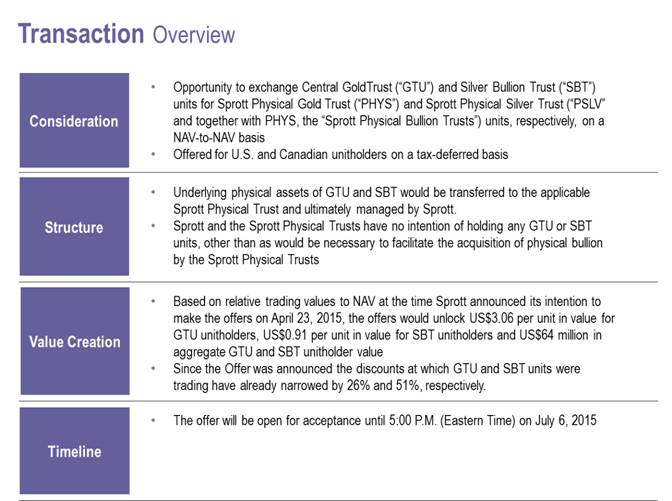

A: Sprott Asset Management is pleased to offer unitholders of Central GoldTrust and Silver Bullion Trust an opportunity to exchange their Central GoldTrust and Silver Bullion Trust units for units of the Sprott Physical Gold Trust or Sprott Physical Silver Trust, respectively.

Q When will the Net Asset Value to Net Asset Value (NAV to NAV) be determined for both Central GoldTrust and Silver Bullion Trust?

A: In the case if both the Exchange Offer Election and the Merger Election, the number of Sprott Physical GoldTrust Units and Sprott Physical Silver Trust units to be distributed to each unit holder will be determined based on a NAV to NAV Exchange Ratio on the Expiry Date (July 6, 2015).

Q: What would I receive in exchange for my Central GoldTrust/ Silver Bullion Trust Units under the Offer?

A:

Central GoldTrust Units

Central GoldTrust unitholders can exchange their units for Sprott Physical Gold Trust units based on the NAV to NAV Exchange Ratio.

By way of example, based on the NAV per unit of Sprott Physical Gold Trust and Central GoldTrust units as of May 22, 2015 (calculated in a manner consistent with the NAV to NAV Exchange Ratio), a Central GoldTrust unitholder would receive 4.4464 Sprott Physical Gold Trust units for each Central GoldTrust unit held.

No fractional Sprott Physical Gold Trust units will be issued pursuant to the Offer or the Merger Transaction. Where the aggregate number of Sprott Physical Gold Trust units to be issued to a Central GoldTrust unitholder under the Offer would result in a fraction of a Sprott Physical Gold Trust unit being issuable, the number of Sprott Physical Gold Trust units to be received by such Central GoldTrust unitholder will be rounded down to the nearest whole Sprott Physical Gold Trust unit.

Silver Bullion Trust Units

Silver Bullion Trust unitholders can exchange their Silver Bullion Trust units for Sprott Physical Silver Trust units based on the NAV to NAV Exchange Ratio.

By way of example, based on the Net Asset Value per unit of Sprott Physical Silver Trust and Silver Bullion Trust as of May 22, 2015 (calculated in a manner consistent with the NAV to NAV Exchange Ratio), a Silver Bullion Trust unitholder would receive 1.5009 Sprott Physical Silver Trust units for each Sprott Physical Silver Trust unit held.

No fractional Sprott Physical Silver Trust units will be issued pursuant to the Offer or the Merger Transaction. Where the aggregate number of Sprott Physical Silver Trust units to be issued to a Silver Bullion Trust unitholder under the Offer would result in a fraction of a Sprott Physical Silver Trust unit being issuable, the number of Sprott Physical Silver Trust units to be received by such Silver Bullion Trust unitholder will be rounded down to the nearest whole Sprott Physical Silver Trust unit.

Q: Is there a default election?

A:

If for any reason you deposit your SBT Units or GTU in the Offer but make no election (i.e. an Exchange Offer Election or a Merger Election), you will be deemed to have made a Merger Election in respect of such SBT Units or GTU Units.

Q: What are the Special Resolutions?

A:

The execution of a Letter of Transmittal (or, in the case of GTU Units deposited by book-entry transfer, the making of a book-entry transfer) irrevocably appoints and authorizes, the Offeror, each director and officer of SAM GP Inc. and any other person designated by the Offeror, as the true and lawful agent, attorney and attorney-in-fact with full power of substitution, in the name of and on behalf of such GTU Unitholder to vote, execute and deliver in respect of, the Special Resolutions.

In order to permit the Merger Transaction, prior to the Offeror taking up and paying for any Tendered SBT/GTU Units under the Offer, the Offeror currently intends to pass the Special Resolutions which will, among other things:

· (i) effect certain amendments to the SBT/GTU Declaration of Trust;

· (ii) authorize the Merger Transaction; and

· (iii) in order to ensure the completion of the Merger, remove the current SBT/GTU Trustees (other than the Administrator Nominees) and appoint persons designated by the Offeror to replace such SBT/GTU Trustees.

The Special Resolutions Power of Attorney granted in the Letter of Transmittal to vote, execute and deliver any instruments of proxy, authorizations, requisitions, resolutions, consents or directions in respect of the Special Resolutions will only be used and relied upon if the Offeror intends to proceed with the take up of, and payment for, Tendered GTU Units.

Q: Why should unitholders participate in the Offer?

A:

Central GoldTrust Units

Best-in-class platform and commitment to product marketing

· Sprott believes that Central GoldTrust units persistently trade at a discount to NAV because management does not reinvest the fees it collects to support the product.

· Central GoldTrust features a punitive redemption feature that forces unitholders to redeem their units for less than market value. Unlike Sprott Physical Gold Trust, Central GoldTrust does not allow its unitholders to redeem for physical gold.

· Sprott is a global leader in precious metals investing and is committed to creating value for investors in its products. Sprott has a proven track record and best-in-class platform, which it believes can assist in addressing the persistent trading discounts endured by Central GoldTrust unitholders. Sprott actively markets Sprott Physical Gold Trust to retail and institutional investors. Sprott believes that this commitment to marketing creates buying demand that supports the price of Sprott Physical Gold Trust units. These efforts are further supported by Sprott Physical Gold Trust’s industry-leading physical redemption feature.

· By supporting the Offer, Central GoldTrust unitholders will have an opportunity to move into an investment vehicle that has consistently outperformed Central GoldTrust, while also benefitting from a significantly larger asset base and increased liquidity.

Potential to unlock value

· Based on the closing prices of the Central GoldTrust units and the Sprott Physical Gold Trust units on April 22, 2015 on NYSE MKT and NYSE Arca, respectively, the last trading day prior to the public announcement of the Manager’s intention to commence the Offer, the Central GoldTrust units were trading at a — 7.6% discount to NAV while the Sprott Physical Gold Trust units were trading at a much smaller — 0.37% discount to NAV. These spreads have been relatively consistent over a prolonged period of time.

· Since Sprott announced its intention to commence the Offer on April 23, 2015, the discount to NAV at which the Central GoldTrust units have traded has narrowed by approximately 26%. The Offer unlocks approximately U.S. $59.1 million in Central GoldTrust unitholder value (based on the closing prices of the GTU Units and the PHYS Units on NYSE MKT and NYSE Arca, respectively, on April 22, 2015).

· Sprott believes that the narrowing of this spread is a result of the announcement of the Manager’s intention to commence the Offer. If the Offer is successful, Sprott believes that Central GoldTrust unitholders, by owning Sprott Physical Gold Trust units, will see a meaningful reduction in the persistent NAV discount impacting their current investment in Central GoldTrust units.

Central GoldTrust Unit Support

· Sprott has become aware that a number of significant Central GoldTrust unitholders, including Central GoldTrust’s largest unitholder, Pekin Singer Strauss Asset Management, Inc., which controls approximately 7% of the outstanding Central GoldTrust Units on behalf of separately managed accounts and Polar Securities, which owns or controls approximately 5.7% of the outstanding Central GoldTrust units, support the Offer.

Gold Custodied by the Royal Canadian Mint

· Unlike Central GoldTrust, which stores its gold in a commercial bank vault, the gold held by the Sprott Physical Gold Trust is stored outside of the banking system, at the Royal Canadian Mint, a Canadian crown corporation.

Commitment to Small Investors and Potential for Coin Delivery

· Sprott is committed to refining its existing physical redemption features to make physical redemption more accessible to smaller investors. Sprott is currently exploring adding a coin delivery alternative to Sprott Physical

Gold Trust to make its existing physical redemption feature more accessible to smaller investors. Adding coin delivery to the Sprott Physical Gold Trust would be subject to approval by the unitholders of the Sprott Physical Gold Trust.

Unique Opportunity to Exit GTU, an Underperforming and Conflicted Vehicle

· The incumbent Trustees of Central GoldTrust have publicly asserted that Central GoldTrust’s expense ratio is “among the lowest” relative to comparable U.S. and Canadian bullion products. However, Central GoldTrust’s expense ratio is out of line given the Administrator’s extraordinarily limited scope of duties, responsibilities and actions, including the lack of any duties or responsibilities in connection with redeeming units for physical bullion.

· The incumbent Trustees of Central GoldTrust have publicly asserted that the only “solution” for maximizing Central GoldTrust unitholder value is to wait for gold prices to rebound. To support such assertion, the incumbent Central GoldTrust Trustees used a small and selective sample size from an extreme bull market. There is no reasonable reason to believe that a bull market similar to the bull market used to support Central GoldTrust’s assertion is in the near or long-term future. Even during such a bull market, there is no guarantee that Central GoldTrust units will decrease their discount to NAV or trade at a premium given the persistent trading discounts and the availability of products such as Sprott Physical Gold Trust.

· The incumbent Trustees of Central GoldTrust, including the independent committee formed in response to the Polar Proposal, claim that they are independent from the Administrator and its owner J.C. Stefan Spicer; however, all of the incumbent Central GoldTrust Trustees also sit, or have sat, on at least one of the boards of two other bullion funds managed by J.C. Stefan Spicer. In addition, a number of the incumbent Trustees have participated in a variety of business ventures with Mr. Stefan Spicer. Central GoldTrust unitholders should be cautious in accepting the claim by Central GoldTrust that its incumbent trustees are independent from Mr. Spicer and the Administrator.

Silver Bullion Trust Units

Best-in-class platform and commitment to product marketing

· Silver Bullion Trust units persistently trade at a discount to NAV because management does not reinvest the fees it collects to support the product. Additionally, Silver Bullion Trust features a punitive redemption feature that forces unitholders to redeem their units for less than market value. Unlike Sprott Physical Silver Trust, Silver Bullion Trust does not allow its unitholders to redeem for physical silver.

· Sprott is a global leader in precious metals investing and is committed to creating value for investors in its products. Sprott has a proven track record and best-in-class platform which it believes can assist in addressing the persistent trading discounts endured by Silver Bullion Trust unitholders. Sprott actively markets Sprott Physical Silver Trust to retail and institutional investors. Sprott believes that this commitment to marketing creates buying demand that supports the price of Sprott Physical Silver Trust units. These efforts are further supported by Sprott Physical Silver Trust’s industry-leading physical redemption feature.

· By supporting the Offer, Silver Bullion Trust unitholders will have an opportunity to move into an investment vehicle that has consistently outperformed Silver Bullion Trust, while also benefitting from a significantly larger asset base and increased liquidity.

Potential to unlock value

· Based on the closing prices of the Silver Bullion Trust units and the Sprott Physical Silver Trust units on the TSX (SBT.U) and NYSE Arca, respectively, on April 22, 2015, being the last trading day prior to the public announcement of Sprott’s intention to commence the Offer, the Silver Bullion Trust units were trading at a 10.3% discount to NAV while the Sprott Physical Silver Trust units were trading at a 1.07% PREMIUM to NAV. These spreads have been relatively consistent over a prolonged period of time.

· Since Sprott announced its intention to commence the Offer on April 23, 2015, the discount to NAV at which the Silver Bullion Trust units have traded has narrowed by approximately 51%. The Offer unlocks approximately U.S.$4.95 million in Silver Bullion Trust unitholder value (based on the closing prices of the Silver Bullion Trust units and the Sprott Physical Silver Trust units on the TSX (SBT.UN) and NYSE Arca, respectively, on April 22, 2015 and the Bank of Canada noon rate of exchange for the U.S. dollar on May 22, 2015).

· Sprott believes that the narrowing of this spread is a result of the announcement of the Manager’s intention to commence the Offer. If the Offer is successful, Sprott believes that Silver Bullion Trust unitholders, by owning

Sprott Physical Silver Trust units, will see a meaningful reduction in the persistent NAV discount impacting their current investment in Silver Bullion Trust units.

Silver Custodied by the Royal Canadian Mint

· Unlike Silver Bullion Trust, which stores its silver in a commercial bank vault, the silver held by Sprott Physical Silver Trust is stored more securely outside of the banking system, at the Royal Canadian Mint, under the guarantee and protection of the Canadian Federal Government.

Unique Opportunity to Exit SBT, an Underperforming and Conflicted Vehicle

· The incumbent trustees of Silver Bullion Trust have publicly asserted that Silver Bullion Trust’s expense ratio is ‘‘among the lowest’’ relative to comparable U.S. and Canadian bullion products. However, Sprott believes Silver Bullion Trust’s expense ratio is high given the Silver Bullion Trust Trustees’ and the Administrator’s limited scope of duties, responsibilities and actions, including the lack of any duties or responsibilities in connection with redeeming units for physical bullion.

· The incumbent Trustees of Silver Bullion Trust, including the independent committee formed in response to the Polar Proposal, claim that they are independent from the Administrator and its owner J.C. Stefan Spicer. However, all of the incumbent Silver Bullion Trust Trustees also sit, or have sat, on at least one of the boards of two other bullion funds managed by Mr. Spicer. In addition, a number of the incumbent Silver Bullion Trust Trustees have participated in a variety of business ventures with Mr. Spicer. Silver Bullion Trust unitholders should evaluate for themselves whether the incumbent Silver Bullion Trust Trustees are independent from Mr. Spicer and the Administrator.

Q: How long do I have to decide whether to tender my Central GoldTrust/Silver Bullion Trust units to the Offer?

A:

The Offer is open for acceptance until 5:00 P.M. (Toronto time) on July 6, 2015, unless extended or withdrawn.

Q: What are some significant conditions to the Offer?

A: Sprott has the right to withdraw or terminate the Offer and not take up and pay for any Units deposited under the Offer, and/or to extend the period of time during which the Offer is open for acceptance and postpone taking up and paying for any Units deposited under the Offer, and/or to amend the Offer, unless all of the conditions described in Section 4 of the Offer, ‘‘Conditions of the Offer’’, are satisfied or waived by the Offeror at or before the Expiry Time.

These conditions include, among others:

· (i) the number of GTU/SBT Units held by Depositing Unitholders, together with the number of Units held as of the Expiry Time by or on behalf of the Offeror, if any, representing at least 662/3% of the then issued and outstanding Units;

· (ii) all governmental or regulatory approvals (including those of any stock exchange or other securities regulatory authorities) that are necessary to complete the Offer and the Merger Transaction, including the listing on the TSX and NYSE Arca of the PHYS/PSLV Units issuable pursuant to the Offer and the Merger Transaction, having been obtained or concluded on terms and conditions reasonably satisfactory to the Offeror;

· (iii) the Special Resolutions Power of Attorney having been validly granted in respect of at least 662/3% of the then issued and outstanding GTU/SBT Units and the Special Resolutions having been validly passed;

· (iv) GTU/SBT and Sprott Physical Gold Trust/Sprott Physical Silver Trust not being prohibited by applicable Law, or their respective constating documents, from completing the Merger Transaction; and

· (v) the absence of any Material Adverse Change in relation to GTU/SBT.

Q: How do I tender my Central GoldTrust & Silver Bullion Trust units to the Offer?

A:

Registered Unitholders

If you hold units in your own name as a registered unitholder, you may deposit your units to the Offer by depositing certificates representing your units, together with a properly completed and signed Letter of Transmittal and all other documents required by the instructions to the Letter of Transmittal, at the office of the Depositary specified in the Letter of Transmittal (Kingsdale Shareholder Services).

Beneficial Unitholder

If your units are registered in the name of a nominee (commonly referred to as being “in street name” or “street form”) as a beneficial unitholder, you should contact your investment advisor, stock broker, bank, trust company or other nominee for assistance in depositing your units to the Offer. You should request your nominee to effect the transaction. Unitholders may also deposit their units to the Offer pursuant to the procedures for book-entry transfer detailed in the Offer and Circular and have your units deposited by your nominee through CDS or DTC, as applicable. Unitholders are invited to contact the Information Agent, Kingsdale Shareholder Services, for further information regarding how to accept the Offer. The Information Agent can be contacted at 1-888-518-6805 toll free in North America or at 1-416-867-2272 outside of North America or by e-mail at contactus@kingsdaleshareholder.com.

Q: What if I have lost my Central GoldTrust unit/ Silver Bullion Trust unit certificate(s), but wish to deposit my units to the Offer and support the Merger Transaction?

A:

If any certificate representing units has been lost, stolen or destroyed, the registered holder of such units should complete the Letter of Transmittal as fully as possible and forward it, together with an affidavit regarding the loss, theft or destruction, to the Depositary. The Depositary will assist in making arrangements for the necessary affidavit (which will include a bonding requirement) for payment in accordance with the Offer. Further details are set out in the Letter of Transmittal. The registered holder will be required to indemnify various parties with respect to such lost, stolen or destroyed certificate(s).

Q: What happens if I do not tender my units to the Offer but holders of more than 662/3% of Central GoldTrust and Silver Bullion Trust tender their units?

A: If unitholders representing more than 662/3% of the issued and outstanding units deposit their units in the Offer (whether making the Exchange Offer Election or the Merger Election) and do not withdraw them prior to 4:58 p.m. (Toronto time) on the Expiry Date, then the Special Resolutions will be approved. If the Special Resolutions are approved and the Merger is completed then unitholders that have not deposited units in the Offer, or Non-Depositing unitholders, will receive units under the Merger as if they had deposited and made a Merger Election.

Q: What are the tax implications associated with accepting the offer?

A:

Unitholders who deposit GTU or SBT Units and participate in the Offer may make the Exchange Offer Election or the Merger Election. GTU or SBT Unitholders that elect the Merger Election can exchange their Units for Sprott Units based on the NAV to NAV Exchange Ratio on a tax-deferred basis for U.S. and Canadian income tax purposes.

Unitholders who wish to crystallize the realization of any gain (or loss) for Canadian income tax purposes may elect the Exchange Offer Election in order to exchange their GTU or SBT Units for PHYS or PSLV Units based on the NAV to NAV Exchange Ratio and have the transaction treated as a taxable disposition for Canadian income tax purposes. The exchange of GTU or SBT Units under the Exchange Offer Election will only be treated as a taxable disposition for U.S. income tax purposes if the Merger does not occur and otherwise the exchange of Units should be treated with the Merger as a tax deferred transaction for U.S. income tax purposes.

More information can be found in Central GoldTrust’s and Silver Bullion Trust’s Management Information Circular.

Q: Will I be able to withdraw previously deposited Central GoldTrust and Silver Bullion Trust units?

A:

Yes. You may withdraw units previously deposited by you: (i) at any time before units deposited under the Offer are taken up by the Offeror under the Offer; (ii) if your units have not been paid for by the Offeror within three business days after having been taken up; and (iii) in certain other circumstances described in Section 8 of the Offer. You must send a notice of

withdrawal to the Depositary prior to the occurrence of certain events and within the time periods set forth in Section 8 of the Offer, and the notice must contain the specific information outlined therein.

Q: Who is the Depositary under the Offer?

A:

Kingsdale Shareholder Services is acting as the Depositary under the Offer. The Depositary will be responsible for receiving certificates representing units and accompanying Letters of Transmittal and other documents. The Depositary is also responsible for giving notices, if required, and making payment for all units purchased by the Offeror under the terms of the Offer and for all units to be redeemed as part of the Merger Transaction. The Depositary will also facilitate book-entry deposits of units. See Section 27 of the Circular, ‘‘Depositary’’. Kingsdale Shareholder Services North American Toll Free Phone Number: 1-888-518-6805.

Proxy Solicitation Agent and Depositary

The Exchange Tower

130 King Street West,

Suite 2950, P.O. Box 361

Toronto, Ontario M5X 1E2

North American Toll Free Phone:

1-888-518-6805

Email: contactus@kingsdaleshareholder.com

Facsimile: 416-867-2271

Toll Free Facsimile: 1-866-545-5580

Outside North America, Banks and Brokers Call Collect: 416-867-2272

This Q&A does not constitute an offer to buy or the solicitation of an offer to sell any of the securities of GTU, SBT, Sprott Physical Gold Trust or Sprott Physical Silver Trust. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The securities registered pursuant to a Registration Statement are not offered for sale in any jurisdiction in which such offer or sale is not permitted. Full details of each Offer are set out in a takeover bid circular and accompanying offer documents (collectively, the “Offer Documents”), which Sprott filed with the Canadian securities regulatory authorities. In connection with each Offer, the applicable Sprott Physical Trust filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-10 (the “Registration Statement”), which contains a prospectus relating to the applicable Offer (the “Prospectus”). Sprott and Sprott Physical Gold Trust also filed a tender offer statement on Schedule TO (the “Schedule TO”) with respect to the GTU Offer. This Q&A is not a substitute for the Offer Documents, the Prospectuses, the Registration Statements or the Schedule TO. GTU AND SBT UNITHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THESE DOCUMENTS, ALL DOCUMENTS INCORPORATED BY REFERENCE, ALL OTHER APPLICABLE DOCUMENTS AND ANY AMENDMENTS OR SUPPLEMENTS TO ANY SUCH DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE EACH CONTAINS IMPORTANT INFORMATION ABOUT SPROTT, THE SPROTT PHYSICAL GOLD TRUST, THE SPROTT PHYSICAL SILVER TRUST, GTU, SBT AND THE OFFER. Materials filed with the Canadian securities regulatory authorities will be available electronically without charge at www.sedar.com<http://www.sedar.com>>. Materials filed with the SEC will be available electronically without charge at the SEC’s website at www.sec.gov<http://www.sec.gov>>.