Exhibit (a)(7)

The Sprott Offer is opportunistic and not in the best interests of Central GoldTrust and its Unitholders.

The Sprott offer does not provide any meaningful premium but asks Unitholders to exchange their Units for units of Sprott Physical Gold Trust, which involve higher costs, increased tax risks and reduced governance rights.

Unitholders should DO NOTHING - NO ACTION IS REQUIRED to reject the Sprott Offer

THE SPROTT DISADVANTAGE

FOR GOLDTRUST UNITHOLDERS

| | SPROTT PHYSICAL

GOLD TRUST | | CENTRAL

GOLDTRUST |

Superior Long-Term Performance & Leverage to Bullion Price | | NO | | YES |

| | | | |

Low Total Expense Ratio | | NO | | YES |

| | | | |

Sliding Scale Administration Fee | | NO | | YES |

| | | | |

Gold Bullion Held in the Most Secure Canadian Underground Level 3

Rated Treasury Vault | | NO | | YES |

| | | | |

Most Tax-Efficient Structure | | NO | | YES |

| | | | |

Independent (6 of 7) Board of Trustees,

Audit Committee, and

Corporate Governance Committee | | NO | | YES |

| | | | |

Trustees Elected by Unitholders,

Annual Voting and Other Unitholder Rights | | NO | | YES |

| | | | |

Ability to Replace Manager / Administrator | | NO | | YES |

| | | | |

Long-Term Track Record of Soundly Stewarding Investor Capital | | NO | | YES |

QUESTIONS & ANSWERS

Should I accept or reject the Sprott Offer?

The Special Committee of Independent Trustees UNANIMOUSLY recommends that Unitholders REJECT the Sprott Offer, TAKE NO ACTION with respect to the Sprott Offer and DO NOT TENDER their Units for exchange, and the Board of Trustees has adopted that recommendation.

A summary of the reasons for the recommendation of the Board of Trustees is included above, and a fulsome description is included below under the heading “Reasons for Rejecting the Sprott Offer” of this Trustees’ Circular.

How do I reject the Sprott Offer?

DO NOTHING.

Unless you have already tendered your Units to the Sprott Offer, you do not need to do anything to reject the Sprott Offer. If you are solicited by Sprott or its solicitation agent about your Units of Central GoldTrust, DO NOT TENDER your Units. Do not complete a Letter of Transmittal or any other document that Sprott or its solicitation agent may provide.

Can I withdraw my Units if I have already tendered to the Sprott Offer?

YES. According to the Sprott Offer and the Offer Circular:

· if you have tendered your Units and made the Exchange Offer Election (as defined in the Offer Circular), you can withdraw your Units: (i) at any time before your Units have been taken up by the Offeror pursuant to the Sprott Offer; (ii) at any time if your Units have not been paid for by the Offeror within three business days after having been taken up; or (iii) at any time before the expiration of ten days from the date upon which certain notices of change or notices of variation in the terms of the Sprott Offer that may be required are delivered to you by the Offeror; and

· if you have tendered your Units and made the Merger Election, unlike a traditional take-over bid your operative consenting action with respect to the Sprott Offer is not the tendering of your Units but the granting of the power of attorney to the Offeror to complete the Merger Transaction. As a result, your operative withdrawal action is not the withdrawal of your tendered Units, but the withdrawal of your power of attorney. The power of attorney becomes irrevocable at 4:58 p.m. (Toronto time) on the Expiry Date, and so in order to effectively withdraw consent to the Sprott Offer and Merger Transaction, tendering Unitholders who have made the Merger Election must withdraw prior to 4:58 p.m. (Toronto time) on the Expiry Date. If the conditions to the Sprott Offer are met or waived, withdrawals of tendered Units thereafter will not be effective to withdraw such Unitholders’ consent to the Sprott Offer.

How do I withdraw my Units if I have already tendered to the Sprott Offer?

We recommend you contact D. F. King & Co., Inc. (“D.F. King”), GoldTrust’s information agent, at

1-800-251-7519 or inquiries@dfking.com, or your broker or dealer directly, for information on how to withdraw your Units.

Why does the Board believe that the Sprott Offer should be rejected?

The Board believes that the Sprott Offer is not in the best interests of Central GoldTrust and its Unitholders. The Board took into account numerous factors including, but not limited to, the Board’s reasons set out under the heading “Reasons for Rejecting the Sprott Offer” in adopting the UNANIMOUS recommendation of the Special Committee of Independent Trustees that Unitholders REJECT the Sprott Offer and NOT TENDER their Units into the Sprott Offer.

Unitholders are strongly encouraged to carefully review the full explanation of the reasons for the Board’s recommendation set out in this Trustees’ Circular.

My broker advised me to tender my Units. Should I?

While the investment decision is between you and your investment advisor, the Special Committee of Independent Trustees has UNANIMOUSLY recommended that Unitholders REJECT the Sprott Offer and NOT TENDER their Units into the Sprott Offer, and the Board has adopted that recommendation. The Offer Circular states that Sprott may pay brokers a fee for soliciting tenders to the Sprott Offer, so their advice with respect to a decision to tender may not be impartial.

The media has referred to this as a ‘‘hostile’’ take-over bid. Is that true?

YES. In a friendly take-over, the two trusts or companies work together to come to an agreement that would enhance securityholder value. However, Sprott did not contact or approach GoldTrust or its representatives with respect to the proposed bid prior to the date on which it announced its intention to make its offer, and it initiated its offer without the support of the Board. As such, the Sprott Offer should be considered a hostile offer, and the Board, together with its financial and legal advisors, has been working to provide Unitholders with a recommendation consistent with GoldTrust’s focus on achieving a result that is in the best interests of ALL Unitholders.

Have other Unitholders indicated an intention NOT to tender to the Sprott Offer?

YES. Each of the Trustees and Senior Officers and other insiders of GoldTrust that owns or exercises control or direction over Units of GoldTrust has indicated that he or she intends to REJECT the Sprott Offer and WILL NOT TENDER any of his or her Units.

Do I have to decide now?

NO. Unless you have already tendered your Units, you do not have to take any action at this time. The Sprott Offer is scheduled to expire at 5:00 p.m. (Toronto time) on July 6, 2015 (unless extended or withdrawn), and is subject to a number of conditions that have not yet been satisfied. In any event, the Board of Trustees recommends that Unitholders take no action with respect to the Sprott Offer.

If you have already tendered your Units to the Sprott Offer and decide to withdraw those Units, you must allow sufficient time to complete the complicated withdrawal process prior to the expiry of the Sprott Offer. For more information on how to withdraw your Units, see “Rights of Withdrawal” in the accompanying Trustees’ Circular, contact your broker or dealer, or contact D. F. King at 1-800-251-7519 or inquiries@dfking.com.

Who do I ask if I have more questions?

ANY QUESTIONS OR REQUESTS FOR ASSISTANCE MAY BE DIRECTED TO GOLDTRUST’S INFORMATION AGENT:

North American Toll Free Phone:

1-800-251-7519

Email: inquiries@dfking.com

RECOMMENDATION TO UNITHOLDERS

After a thorough review of the Sprott Offer, and following the receipt of advice from its financial, tax and legal advisors, and the UNANIMOUS recommendation of the members of the Special Committee, the Board of Trustees reached the conclusion that the Sprott Offer appears opportunistic, not in the best interests of GoldTrust and its Unitholders, and simply represents a self-serving attempt by SAM to increase assets under management and generate higher management fees, while subjecting Unitholders to the significant tax and other risks associated with the Sprott Offer and the holding of Sprott PHYS units. Accordingly your Trustees are of the view that the Sprott Offer should be REJECTED by Unitholders.

The Special Committee of Independent Trustees of Central GoldTrust has UNANIMOUSLY concluded that the Sprott Offer is NOT in the best interests of GoldTrust Unitholders. The Board of Trustees has adopted the recommendation of the Special Committee and recommends that Unitholders: x REJECT the Sprott Offer; x TAKE NO ACTION with respect to the Sprott Offer; and x DO NOT TENDER their Units to the Sprott Offer |

REJECT THE SPROTT OFFER

Sprott’s claims of “unlocking value” are disingenuous and Sprott offers no meaningful premium in exchange for increased fees, higher risk and reduced governance rights |

|

GoldTrust’s Unitholders recently overwhelmingly rejected the adoption of a physical bullion redemption feature, available only to Unitholders with large holdings, a material structural difference between GoldTrust and Sprott PHYS |

|

Sprott charges significantly higher fees than GoldTrust, which will erode net asset value over time and materially reduce the purported “unlocked” value of the Sprott Offer |

|

Accepting the Sprott Offer could expose certain non-redeeming U.S. Unitholders to potential future tax liabilities due to Sprott PHYS’ frequently-used physical bullion redemption feature |

|

Sprott PHYS, in stark contrast to GoldTrust, provides investors with virtually no voting or governance rights |

|

Sprott PHYS offers less bullion security and safeguards than GoldTrust |

|

GoldTrust’s existing low-cost, tax efficient structure has provided superior leverage to rising gold prices for long-term investors |

|

Sprott has a very poor track record as a manager of investor capital and solicits investors with conflicting, self-serving messages |

|

The Exchange Offer Election and Merger Transaction may not qualify as a tax-deferred reorganization for United States federal income tax purposes as stated by Sprott and, as a result, may be a fully taxable transaction for all U.S. Unitholders |

|

The Sprott Offer has been structured to circumvent traditional |

legal statutory securityholder protections |

LETTER TO UNITHOLDERS

June 9, 2015 Dear Fellow Unitholders, | |

On May 27, 2015 you were mailed an offer (the “Sprott Offer”) by Sprott Asset Management Gold Bid LP to acquire all of the outstanding Units of Central GoldTrust (“GoldTrust”). Sprott Asset Management Gold Bid LP is an affiliate of Sprott Asset Management LP and Sprott Inc., which we will collectively refer to as “Sprott.” Sprott is offering to acquire all of the outstanding Units of GoldTrust in exchange for units of Sprott Physical Gold Trust (“Sprott PHYS”) on a net asset value (“NAV”) for NAV basis, with the actual values to be finalized on the expiry date of the Sprott Offer, which is July 6, 2015 (unless extended or withdrawn).

At first glance, the Sprott Offer sounds simple and appears to be marginally attractive. The truth is that the Sprott Offer is anything but simple and the Board of Trustees believes that there is no assurance that it will ultimately benefit Unitholders. Upon careful review, the clear prime beneficiary of the Sprott Offer is in fact Sprott Asset Management LP, which stands to gain significant ongoing management fees by virtue of managing a larger pool of bullion assets on behalf of the Sprott PHYS entity and the elimination of a gold bullion investment alternative for investors.

Sprott is not offering compelling value to Unitholders. The Sprott Offer does not provide any meaningful premium, but asks Unitholders to exchange their Units for units of Sprott PHYS, which involve higher costs, increased tax risks, and reduced governance rights; all of which are completely at odds with the founding principles of GoldTrust. These principles were carefully designed to provide the optimal structure for long-term gold bullion investors. On balance, your Trustees believe that any benefits claimed by Sprott regarding their offer are unproven and marginal at best, and are significantly outweighed by the increased costs, greater risks and loss of Unitholder rights associated with holding Sprott PHYS units.

Attached to this letter is your Trustees’ Circular which includes the formal recommendation of your Trustees that Unitholders should REJECT the Sprott Offer and NOT tender their Units.

The accompanying Trustees’ Circular includes considerable detail about why your Trustees have reached this recommendation.

Some of the reasons why your Trustees are recommending that Unitholders REJECT the Sprott Offer are summarized below:

1. Sprott is not offering ANY meaningful premium and the ultimate price Unitholders would receive for their Units is unclear

The Sprott Offer appears opportunistic and solely based on the current difference in trading prices relative to NAV of GoldTrust Units and Sprott PHYS units, a difference which is small and a result of the current bear market for gold. GoldTrust Units have traded at significant premiums to NAV in strong gold markets and have outperformed Sprott PHYS units in such markets. The Trustees believe the long-term outlook for gold is positive, and positive gold markets in the past have yielded significant improvement in the trading value of Units relative to their NAV.

In addition, the Sprott Offer provides no certainty of value for GoldTrust Unitholders, as it is based on a future NAV for NAV exchange ratio determined on the expiry date of the Sprott Offer. In the

past, Sprott PHYS units have traded at discounts of up to 4.2% of NAV. Under the Sprott Offer, Unitholders would receive Sprott PHYS units on closing. If these units are trading at a discount to their NAV, any value purported to be “unlocked” by the Sprott Offer could be materially reduced or eliminated. The Sprott Offer appears to be an opportunistic attempt by Sprott to replace management fees as a result of significant redemptions experienced by Sprott PHYS in recent years.

2. GoldTrust Unitholders recently overwhelmingly rejected the adoption of a physical redemption feature, a material feature of the Sprott Offer

Sprott PHYS has a physical bullion redemption feature, available only to investors with very large holdings, which Sprott claims limits trading discounts to NAV. Such a physical redemption feature would potentially expose certain non-redeeming U.S. Unitholders to increased future tax liabilities and effectively reduce leverage to rising gold prices. Sprott PHYS’ physical redemption feature is substantially the same as the one that Polar Securities proposed that GoldTrust adopt — a proposal that was overwhelmingly rejected by over 80% of votes cast (excluding Polar) at GoldTrust’s Annual and Special Meeting of Unitholders held just last month. Unitholders are encouraged to review GoldTrust’s Management Information Circular dated April 6, 2015, available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov, as well as on GoldTrust’s website, www.gold-trust.com and www.goldtrust.ca, which provides detailed information regarding Polar’s proposal, which the Trustees believe to be relevant to the Sprott Offer as well.

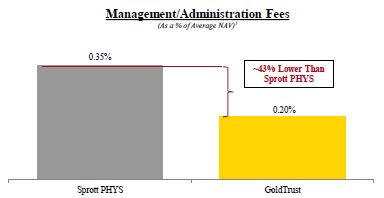

3. Sprott PHYS charges investors significantly higher fees than GoldTrust, which will erode NAV over time and materially reduce the purported “unlocked” value of the Sprott Offer

Sprott PHYS’ annual expense ratio is over 40% higher than GoldTrust’s and includes a fixed management expense ratio, whereas GoldTrust’s is based on a sliding scale which passes on the benefits of asset growth to Unitholders. On a present value basis, the increase in fees relating to the Sprott Offer represents US$28 million1 in lost value for GoldTrust Unitholders, or approximately 3.4% of GoldTrust’s total NAV today.

4. Sprott PHYS’ physical redemption feature may result in significant tax liabilities for certain non-redeeming U.S. Unitholders

If the Sprott Offer is successful, Sprott PHYS’ redemption feature would expose certain non-redeeming U.S. Unitholders to potentially increased ongoing future tax liabilities if Sprott PHYS delivers gold to satisfy a physical redemption request from a unitholder and the price of gold exceeds Sprott PHYS’ undisclosed Canadian dollar cost base for its gold holdings. As a result, if any Unitholder elects to redeem when gold prices exceed the Canadian dollar cost base of Sprott PHYS’ gold bullion, certain non-redeeming U.S. Unitholders could incur tax liabilities even though they took no action themselves. These potential tax liabilities would increase if the gold price were to increase in Canadian dollar terms due to a decrease in the Canadian / U.S. dollar exchange rate or increases in gold prices.

5. Sprott PHYS provides investors with almost no voting or other governance rights

GoldTrust is overseen by a Unitholder-elected, majority independent Board of Trustees and offers a Unitholder-friendly and responsible governance structure. In stark contrast to GoldTrust, Sprott PHYS offers its investors virtually no voting or other governance rights. Sprott PHYS does not have an elected Board, does not hold annual meetings, requires minimum holdings of 50% of NAV of Sprott PHYS to requisition a unitholder meeting and does not allow unitholders to elect Sprott

1 Based on a 5% discount rate, in perpetuity.

PHYS’ manager. If the Sprott Offer were successful, Sprott PHYS’ limited governance rights would represent a complete deviation from GoldTrust’s best-in-class governance structure, including a complete disenfranchisement of voting rights.

6. Sprott PHYS offers less bullion security and safeguards than GoldTrust

GoldTrust stores its bullion on an unencumbered, fully allocated and physically segregated basis in an underground Level 3 (the highest security rating possible) Canadian chartered bank vault. Sprott PHYS does not offer the same high level of bullion safeguards as GoldTrust. GoldTrust’s industry-leading bullion safeguards are very important to many of GoldTrust’s long-term Unitholders.

7. Sprott has a very poor track record of managing investor capital and the effectiveness of their marketing platform is questionable

Sprott manages a large number of investment funds with a demonstrated track record of poor performance. As a manager of investor capital, Sprott has lost over $1 billion of investor capital while at the same time receiving hundreds of millions in management fees from these same investors. Upon reviewing Sprott’s investment performance, which is summarized in the accompanying Trustee’s Circular, your Trustees believe that you will agree that Sprott does not seem suited to steward Unitholders’ capital based on its historical performance.

Sprott touts its superior marketing platform as a key benefit of the Sprott Offer to GoldTrust Unitholders. In fact, Sprott PHYS has faced significant redemptions from investors, with over 20%, or approximately US$440 million, of Sprott PHYS’ units having been redeemed in the past two years, resulting in a higher expense ratio for non-redeeming, long-term investors.

8. The Exchange Offer Election and Merger Transaction may not qualify as a tax-deferred reorganization and, as a result, may be a fully taxable transaction for all U.S. Unitholders

The Offeror states in its Offer Circular that “[b]ecause the determination of whether the exchange pursuant to the Exchange Offer Election and the Merger Transaction qualifies as a Reorganization [under Section 368 of the Code] depends on the resolution of complex issues and facts, some of which will not be known until the completion of the Offer and the Merger Transaction, there can be no assurance that the exchange pursuant to the Exchange Offer Election and the Merger Transaction will qualify as a Reorganization” (emphasis added).

9. The Sprott Offer has been structured to bypass traditional statutory securityholder protections

One of the key conditions to the Sprott Offer is the passing of a special resolution, using the powers of attorney granted by tendering Unitholders making the Merger Election, that would amend the Declaration of Trust to lower the threshold required to be achieved by a bidder in order to effect a compulsory acquisition or redemption of remaining Units, from 90% to 662/3%. The Declaration of Trust originally set the threshold at 90% to track the parallel requirements in corporate law designed to protect minority securityholders and their dissent rights. Sprott would lower this traditional threshold in order to be able to compel full completion of the Merger Transaction, having only obtained tenders from 662/3%, in a single step.

The Sprott Offer appears opportunistic, being made at what is hopefully the bottom of a prolonged bear market for gold, and essentially asks Unitholders to accept materially higher ongoing fees, reduced bullion security and safeguards, increased tax risk and materially limited voting and governance rights. In return, the

Sprott Offer provides no meaningful premium and only a theoretical, marginal benefit that cannot be determined by Unitholders as it is based on an unknown future exchange ratio.

GoldTrust was created in 2003 with a singular, self-governing and passive purpose to provide all Unitholders, be they individual or institutional, with the safest, most secure and cost effective way to hold unencumbered, fully-allocated and physically segregated gold bullion and benefit from the long term appreciation in the price of gold. GoldTrust continues to fulfill this mandate for Unitholders. Of interest, Eric Sprott and John Embry (Sprott’s CIO at the time) were both Trustees of GoldTrust at its inception and participated in developing the structure of GoldTrust, which deliberately excluded a physical bullion redemption feature due to the potential for material adverse tax consequences associated with such a feature. The adverse tax consequences inherent to the adoption of a physical redemption feature are the same today as they were in 2003 when GoldTrust was founded.

Your Trustees understand that the unusually elevated discounts to NAV at which GoldTrust Units have recently traded are of concern to investors; however, Sprott’s opportunistic offer is not the solution. Your Trustees are actively considering a number of potential measures, including possible amendments to the existing cash redemption feature of GoldTrust, which could potentially reduce future trading price discounts to NAV. Among the factors guiding the Trustees’ analysis of such measures are the accessibility of any amended features to all Unitholders, the necessity that any such measures be accretive to non-redeeming Unitholders and the potential tax liabilities to Unitholders in connection therewith. Upon completion of a favourable analysis by financial, legal and tax advisors, the Trustees will consider whether to adopt such measures if appropriate.

Your Trustees continue to believe that current economic conditions, which include ultra-low interest rates, unprecedented money-printing and debt creation by the major industrial economies and accelerating devaluation turbulence among global currencies are supportive factors for higher gold prices over time. Given our positive outlook for the gold price, we do not believe this is the time to be exchanging your GoldTrust Units for alternative products which are at odds with the founding investment principles of GoldTrust.

As a result of the above and after very careful consideration of all available information, including the unanimous recommendation of the Special Committee of Independent Trustees, your Trustees are strongly recommending that all Unitholders REJECT the Sprott Offer.

Thank you for your consideration of these concerns.

With great respect and appreciation for your confidence in Central GoldTrust,

J.C. Stefan Spicer, | | Ian M.T. McAvity, |

Founder, Chairman and CEO, | | Lead Independent Trustee |

Central GoldTrust | | Central GoldTrust |

REASONS FOR REJECTING THE SPROTT OFFER

After a thorough review of the Sprott Offer, and following the receipt of advice from its financial, tax and legal advisors, and the UNANIMOUS recommendation of the members of the Special Committee, the Board of Trustees reached the conclusion that the Sprott Offer appears opportunistic, not in the best interests of GoldTrust and its Unitholders and simply represents a self-serving attempt by SAM to increase assets under management, and generate higher management fees, while subjecting Unitholders to the significant tax and other risks associated with the Sprott Offer and the holding of Sprott PHYS units. Accordingly your Trustees are of the view that the Sprott Offer should be REJECTED by Unitholders.

Reject the Sprott Offer

Sprott’s claims of “unlocking value” are disingenuous and Sprott offers no meaningful premium in exchange for increased fees, higher risk and reduced governance rights |

|

GoldTrust’s Unitholders recently overwhelmingly rejected the adoption of a physical bullion redemption feature, available only to Unitholders with large holdings, a material structural difference between GoldTrust and Sprott PHYS |

|

Sprott charges significantly higher fees than GoldTrust, which will erode net asset value over time and materially reduce the purported “unlocked” value of the Sprott Offer |

|

Accepting the Sprott Offer could expose certain non-redeeming U.S. Unitholders to potential future tax liabilities due to Sprott PHYS’ frequently-used physical bullion redemption feature |

|

Sprott PHYS, in stark contrast to GoldTrust, provides investors with virtually no

voting or governance rights |

|

Sprott PHYS offers less bullion security and safeguards than GoldTrust |

|

GoldTrust’s existing low-cost, tax efficient structure has provided superior leverage to rising

gold prices for long-term investors |

|

Sprott has a very poor track record as a manager of investor capital and solicits investors with conflicting, self-serving messages |

|

The Exchange Offer Election and Merger Transaction may not qualify as a tax-deferred reorganization for United States federal income tax purposes as stated by Sprott and, as a result, may be a fully taxable transaction for all U.S. Unitholders |

|

The Sprott Offer has been structured to circumvent traditional

legal statutory securityholder protections |

In recommending that Unitholders REJECT the Sprott Offer by TAKING NO ACTION and NOT TENDERING GoldTrust Units to the Sprott Offer, the Board of Trustees considered, among other things, the following significant factors:

1. Sprott’s claims of “unlocking value” are disingenuous and Sprott offers no meaningful premium in exchange for increased fees, higher risk and reduced governance rights

Sprott claims that its offer will unlock value of US$3.06 per Unit, or US$59 million in aggregate, for GoldTrust Unitholders. This statement presents an incomplete picture, and Sprott conveniently omits several factors which materially reduce the purported value of the Sprott Offer:

· Sprott’s annual expense ratio is over 40% higher than GoldTrust’s — on a present value basis, this increased expense ratio is equivalent to US$28 million1 in lost value for Unitholders, representing approximately 47% of Sprott’s purported “unlocked value”.

· In addition, the Sprott Offer provides no certainty of value for GoldTrust Unitholders, as it is based on a future NAV for NAV exchange ratio to be calculated on the Expiry Date. In the past, Sprott PHYS units have traded at discounts of up to 4.2% of NAV. Under the Sprott Offer, Unitholders would receive Sprott PHYS units on the Expiry Date — if these units are trading at a discount to their NAV, any value “unlocked” by the Sprott Offer could be materially reduced or eliminated.

· If the Sprott Offer is successful, certain non-redeeming Unitholders resident in the U.S. could be exposed to ongoing increased tax liabilities going forward as a result of Sprott PHYS’ physical bullion redemption feature. This potential tax liability would increase if the gold price were to increase over time.

On balance, your Trustees believe that any benefits claimed by Sprott regarding its offer are unproven and marginal at best, and are significantly outweighed by the increased costs, greater risks and loss of unitholder rights associated with holding Sprott PHYS units.

2. Unitholders recently overwhelmingly rejected the adoption of a physical bullion redemption feature, a key tenet of the Sprott Offer

One of the key structural characteristics that distinguishes Sprott PHYS from GoldTrust is that Sprott PHYS offers a physical bullion redemption feature, one that is substantially the same as the redemption feature proposed by Polar to be adopted by GoldTrust at the GoldTrust Meeting. At the GoldTrust Meeting, the Polar Proposal was overwhelmingly rejected by Unitholders, with over 80% of votes cast by Unitholders (other than Polar) recommending against its adoption.

The Trustees believe that the result of the vote at the GoldTrust Meeting clearly demonstrates the attitude of Unitholders towards a physical bullion redemption feature, yet Sprott has put this feature forward as a

primary reason to accept the Sprott Offer. Instead of accepting the very recent, clear, public result of the vote at the GoldTrust Meeting, Sprott has decided to immediately re-open the physical redemption issue, at tremendous cost to GoldTrust and its Unitholders.

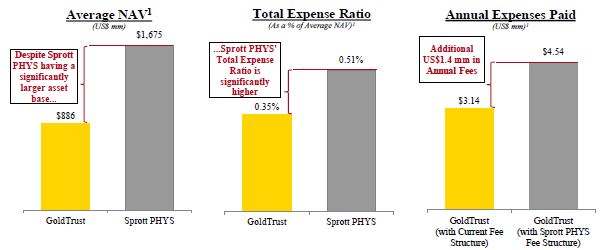

3. Sprott PHYS charges investors significantly higher fees than GoldTrust, which erode asset value over time and materially reduce the claimed value of the Sprott Offer

If the Sprott Offer were successful, GoldTrust Unitholders would be faced with significantly higher ongoing expenses as Sprott PHYS unitholders, which would increase the erosion of the NAV of Sprott PHYS over time and reduce leverage to increasing gold prices. This is in direct contrast to GoldTrust’s existing low-cost structure, which the Trustees believe provides long-term investors with maximum leverage to rising bullion prices.

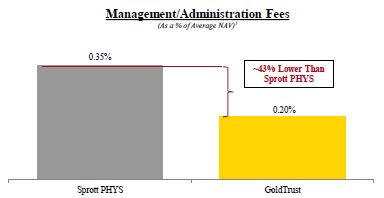

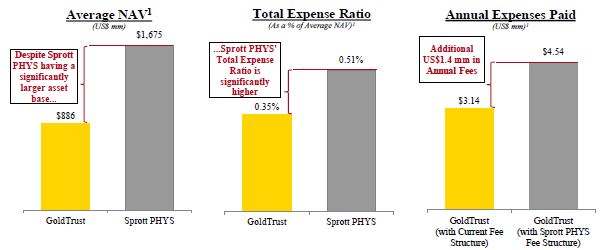

As illustrated below, GoldTrust’s administration fee is the lowest among alternative products, and is approximately 43% lower than that of Sprott PHYS. GoldTrust’s administration fee also covers investor relations expenses, whereas Sprott PHYS’ investor relations expenses are paid by unitholders in addition to their significantly higher management fee.

In addition, GoldTrust is the only entity among competing products with a sliding scale structure for administration fees, reducing administration fees to 0.15% of NAV for total assets above US$200 million. This administration fee structure passes on the benefits of asset growth to the Unitholders in the form of progressively lower fees. Sprott PHYS, on the other hand, has a fixed management fee of 0.35% of NAV, meaning that the primary beneficiary of growth in their asset base is their manager, SAM. The acquisition of the underlying assets of GoldTrust would increase the annual management fee payable by Sprott PHYS to SAM by approximately US$3 million.2

1. Calculated based on expenses incurred over the last twelve months as of March 31, 2015, and “Average NAV” calculated as the average end-of-month NAVs over the same period.

(Source: Public filings.)

GoldTrust’s total expense ratio for the twelve months ended March 31, 2015 of 0.35%3 of NAV is over 30% lower than Sprott PHYS’ expense ratio of 0.51% of NAV over the same period, even though Sprott PHYS’ asset base is significantly larger than GoldTrust’s and Sprott PHYS does not incur costs

related to an Independent Board of Trustees, Audit Committee, and Corporate Governance and Nominating Committee. If the Sprott Offer were successful, GoldTrust Unitholders would be subject to additional annual fees and expenses of approximately US$1.4 million. On a present value basis, this increase in annual expenses is equivalent to approximately US$28 million4 in lost value, or approximately 3.4% of GoldTrust’s NAV as of June 5, 2015.

1. Total Expense Ratio calculated based on expenses incurred over the last twelve months as of March 31, 2015, divided by “Average NAV” calculated as the average of the end of months net asset values over the same period.

(Source: Bloomberg Financial Markets and public disclosure.)

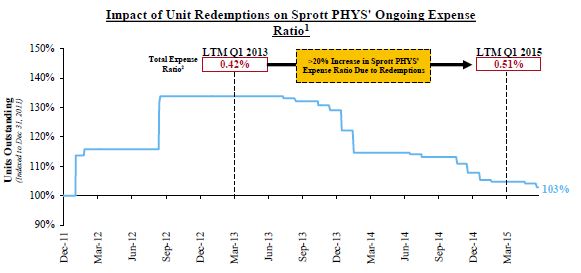

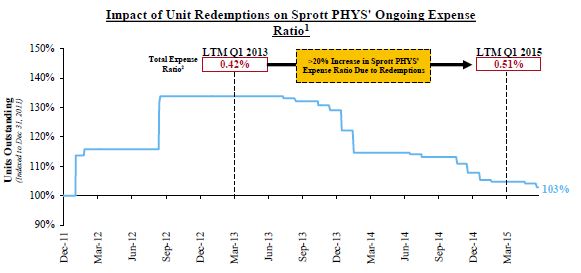

In addition to paying a significantly higher ongoing expense ratio, holders of Sprott PHYS units are also exposed to further expense increases as a result of Sprott PHYS’ redemption features. Over the past two years, there have been significant net redemptions of Sprott PHYS units, with over 22% of total outstanding units having been redeemed since the first quarter of 2013. As a result, Sprott PHYS’ annual expense ratio has increased by over 20% over the same period. Sprott has claimed that GoldTrust Unitholders will benefit from their superior marketing activities funded by their higher management fees. Given the significant redemptions of Sprott PHYS units (estimated at approximately US$440 million) observed over the past two years, one must question the effectiveness and utility of Sprott’s marketing activities.

If the current weak commodity price environment were to persist, Sprott PHYS may continue to face significant unit redemptions, which would further increase its total expense ratio, and possibly trigger significant negative tax consequences for non-redeeming U.S. Unitholders.

1. Market data as of June 5, 2015.

2. Calculated based on expenses incurred over the last twelve months as of March 31st, and an “Average NAV” calculated as the average end-of-month net asset values over the same period.

(Source: Bloomberg Financial Markets and public disclosure.)

4. Accepting the Sprott Offer could expose certain non-redeeming U.S. Unitholders to future U.S. tax liabilities due to Sprott PHYS’ physical redemption feature

GoldTrust specifically determined not to institute a physical bullion redemption feature when GoldTrust was founded due to the risk of negative tax consequences

When GoldTrust was initially structured, a physical bullion redemption option was deliberately excluded from the structure of GoldTrust because, among other things, it would have resulted in material adverse tax consequences for certain non-redeeming U.S. Unitholders (as defined under the heading “Certain United States Tax Considerations” below). Eric Sprott and John Embry, the former CEO and former Chief Investment Strategist at SAM, respectively, were both members of the Board of Trustees when GoldTrust was founded and approved the GoldTrust structure as the most prudent for long-term gold bullion investors.

The adverse tax consequences inherent to the adoption of a physical redemption feature are the same today as they were in 2003 when GoldTrust was founded.

The Offer Circular does not include a tax opinion on U.S. tax consequences upon which U.S. Unitholders (as defined below) can rely in making their determination as to the risk of tendering their Units from a tax perspective, meaning that all such risk is borne entirely by a tendering U.S. Unitholder.

Redemptions that require a disposition of gold bullion, whether upon physical redemption or upon a sale to generate proceeds to pay a cash redemption, could result in tax liability for certain non-redeeming U.S. Unitholders

Any redemption by a Sprott PHYS unitholder that requires the sale and/or delivery of physical bullion by Sprott PHYS will result in a taxable event for certain non-redeeming U.S. Unitholders due to the deemed

disposition (sale) by Sprott PHYS as it exchanges physical bullion for units redeemed and/or when it is required to sell its gold bullion to satisfy a cash redemption. This deemed disposition by Sprott PHYS will give rise to a taxable gain on the physical bullion dependent on the amount of realized proceeds (in Canadian dollars) from the sale and/or delivery of gold bullion and adjusted Canadian dollar tax base that Sprott PHYS has recorded for its gold bullion. To date, the Board understands that since Sprott PHYS has been in a loss position on its bullion holdings, redemptions by Sprott PHYS unitholders have resulted in losses; therefore, Sprott PHYS’ investors have yet to be exposed to any negative tax consequences. However, this will change at higher gold prices, or lower Canadian/U.S. exchange rate levels, as any gains generated by Sprott units being redeemed at gold prices above the Canadian dollar cost base of Sprott’s gold bullion would be subject to taxation and the resultant negative tax consequences would be borne by certain non-redeeming U.S. Unitholders. As a result, if any Unitholder elects to redeem, when gold prices exceed the Canadian dollar cost base of Sprott’s gold bullion, certain non-redeeming U.S. Unitholders would incur a tax liability even though they took no action themselves. Non-redeeming U.S. Unitholders that recognize a gain as a result of a redemption will be able to increase the basis in their Units by the amount of gain taken into income.

Sprott has not disclosed, in the Offer Circular or anywhere in its public disclosure or to its unitholders, the Canadian dollar cost base of Sprott PHYS’ gold bullion holdings. The calculations presented below are estimates made using reasonable assumptions drawn from publicly available information. Failing to disclose the Canadian dollar cost base of its bullion holdings denies ALL Unitholders the opportunity to fully analyze the potential tax consequences of the Sprott Offer.

Based on estimates prepared using publicly available information, if Sprott PHYS were to acquire the gold bullion holdings of GoldTrust, it is estimated that the average cost base of its total bullion holdings (including those of GoldTrust) would be approximately C$1,299 per ounce5, compared to the market price of gold on June 5th, 2015 of C$1,454 per ounce. This would imply an embedded taxable gain of C$155 per ounce on Sprott PHYS’ bullion holdings. Any such taxable gain would increase if the gold price were to increase over time, or if the Canadian / U.S dollar exchange rate weakens further.

As a result, a redemption of 20% of the outstanding units of Sprott PHYS, similar to the level of net redemptions experienced since the fourth quarter of 2013, at a time when the spot gold price was US$1,600 per ounce would, for example, result in a taxable gain to Sprott PHYS of approximately C$200 million, or 7.0% of the resulting merged Sprott PHYS’ pro forma net assets. For U.S. tax purposes, such gain realized by Sprott PHYS would generally flow through, on a pro rata basis, to all U.S. unitholders (including U.S. mutual funds that hold units) who have made a QEF Election (as defined below). Thus, a non-redeeming U.S. unitholder that holds 5,000 units of Sprott PHYS, and who has previously made a QEF Election would generally recognize a taxable gain of approximately US$3,396 (C$4,241) without having done anything.

The table below is provided for informational purposes only to illustrate the potential tax liability owed by a non-redeeming QEF Electing Unitholder (as defined below) who is an individual subject to taxation in New York City as a result of a redemption of 20% of the outstanding units of the resulting merged Sprott PHYS by other redeeming unitholders. Certain facts and assumptions relied on in making these calculations are summarized in the footnote to the following table. This table is not intended to be, and

should not be interpreted as, a conclusive determination of the U.S. income tax consequences of a redemption to a QEF Electing Unitholder. QEF Electing Unitholders should also consult their own tax advisors regarding the U.S. federal income tax consequences of a redemption of units by other investors.

U.S. Tax Payable by Sprott PHYS non-redeeming unitholder who has made a QEF Election assuming Redemption of 20% of the units of Sprott PHYS (All amounts, unless otherwise provided, are reflected in US$)1

| | Gold Price (per ounce) | |

Units Held | | $ | 1,400 | | $ | 1,600 | | $ | 1,800 | | $ | 2,000 | |

5,000 | | $ | 984 | | $ | 1,339 | | $ | 1,616 | | $ | 1,838 | |

10,000 | | $ | 1,967 | | $ | 2,679 | | $ | 3,232 | | $ | 3,675 | |

15,000 | | $ | 2,951 | | $ | 4,018 | | $ | 4,848 | | $ | 5,513 | |

20,000 | | $ | 3,935 | | $ | 5,358 | | $ | 6,465 | | $ | 7,350 | |

1. The foregoing calculation is based on the following facts and assumptions: (i) the combination of Sprott PHYS and GoldTrust will have an average cost base in the gold bullion it holds equal to US$1,282 per ounce (C$1,299 per ounce) and that all gold bullion sold to fund redemptions will have a cost base equal to US$1,282 per ounce (C$1,299 per ounce); (ii) the combination of Sprott PHYS and GoldTrust will have 235,359,630 units outstanding; (iii) a total NAV of $2.3 billion (C$2.9 billion); (iv) a currency exchange rate of US$1/C$1.2489; and (v) an assumed effective tax rate of 39.4% (the blended rate equivalent to the sum of the 28% collectibles rate, the 3.8% Medicare surcharge rate, the 8.82% New York State rate and the 3.876% New York City rate, all as applicable to individuals, assuming that such New York taxes are deductible for U.S. federal income tax purposes at a rate of 39.6%). State and local taxes payable by QEF Electing Unitholders who are individuals subject to taxation in jurisdictions other than New York City, or QEF Electing Unitholders who are trusts or estates, will vary from these amounts.

A physical bullion redemption option increases the risk that capital gains tax treatment for Unitholders could be called into question by U.S. tax authorities

Should all GoldTrust Units be exchanged for Sprott PHYS units, there is a risk that the Internal Revenue Service could take the position for U.S. federal income tax purposes that gains recognized on future dispositions of units by QEF Electing Unitholders who are individuals, estates and trusts are subject to the 28% “collectibles” rate, rather than the 20% long-term capital gains rate, based on certain substance over form or other theories that might support recharacterization of the units of Sprott PHYS. There is no clear authority on this issue and U.S. Unitholders should consult their own tax advisors regarding this risk.

Further Information on Tax Considerations

For further details, see “Certain United States Tax Considerations”. See also under the heading “Canadian Federal Income Tax Considerations” and “United States Federal Income Tax Considerations” in GoldTrust’s Management Information Circular dated April 6, 2015 in respect of the Annual and Special Meeting of Unitholders dated May 1, 2015, as well as the Annual Information Form for the year ended December 31, 2014, dated February 11, 2015.

5. Unitholders would lose significant voting and governance rights under Sprott PHYS

In stark contrast to GoldTrust’s Unitholder-friendly governance structure, Sprott PHYS offers its investors virtually no voting or other governance rights. Under the Sprott Trust Agreement, Sprott PHYS is not required to (and does not) hold annual meetings of unitholders, nor does it have independent trustees

elected by unitholders. In order to requisition a meeting of Sprott PHYS unitholders, a minimum unit position of 50% of the NAV of Sprott PHYS is required. If the Sprott Offer is successful, GoldTrust Unitholders are expected to hold approximately 36% of Sprott PHYS’ pro forma units outstanding. Finally, Sprott PHYS unitholders do not have the right to elect the trust’s manager, and have the right to remove the current manager (SAM) only in exceptionally limited circumstances.

The disadvantage of the substantially reduced governance rights offered by Sprott PHYS is evidenced very clearly by the Sprott Offer itself. Notwithstanding the fact that the NAV to NAV Exchange Ratio would require, if the Sprott Offer were successful and the Merger Transaction completed, Sprott PHYS to issue Sprott PHYS units in an amount equal to over 50% of the current issued and outstanding Sprott PHYS units and approximately 36% of the pro forma issued and outstanding Sprott PHYS units, Sprott PHYS unitholders are not permitted to vote on the Sprott Offer or Merger Transaction. Such a substantial issuance of securities would, if Sprott PHYS unitholders held voting rights in the ordinary course, require unitholder approval under TSX rules.

THE SPROTT GOLD DISADVANTAGE

| | CENTRAL

GOLDTRUST | | SPROTT PHYSICAL

GOLD TRUST |

Annual Meetings of Unitholders | | þ | | x |

Meeting Requisition Threshold | | 10% | | 50% |

Unitholder Election of Trustees | | þ | | x |

Audit Committee | | þ | | x |

Corporate Governance Committee | | þ | | x |

Unitholder Ability to Obtain Securityholder List | | þ | | x |

Unitholder Vote to Terminate Trust | | þ | | x |

Trustee Performance Inspector Requisition Threshold | | 25% | | x |

6. GoldTrust’s industry-leading bullion safeguards are superior to those offered by Sprott PHYS

GoldTrust’s gold bullion is currently held on an unencumbered, fully allocated and physically segregated basis in an underground Level 3 (the highest security rating possible) Canadian chartered bank vault. The segregated area within this vault is closed and the caging within it houses GoldTrust’s bullion, which is sealed with the exception of when bullion inspections take place in the presence of GoldTrust’s independent external auditor. Many Unitholders consider the high level of security, safeguards and internal controls maintained by GoldTrust to be paramount.

By comparison, Sprott PHYS outsources custodial and bullion storage services to the Royal Canadian Mint (the “Mint”) and it is unclear whether this arrangement involves the same level of physical security as GoldTrust offers. The Mint also has discretion to appoint a sub-custodian to hold Sprott PHYS’ physical bullion and fulfill its other obligations under the Sprott Trust Agreement, without Sprott PHYS unitholder approval, which could have further implications for the security of the physical bullion.

7. GoldTrust’s existing low-cost, tax efficient structure has provided superior leverage to rising gold prices for long-term investors

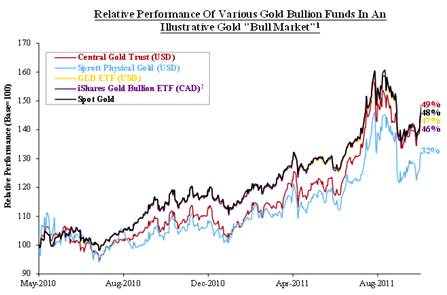

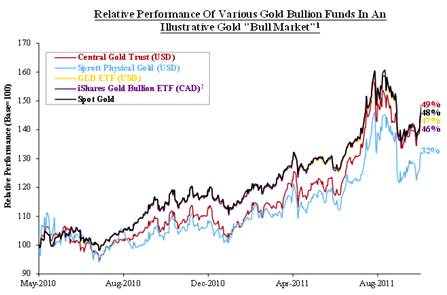

GoldTrust believes that its Unitholders are primarily investors who seek exposure to the passive, long-term appreciation of the gold price, and choose GoldTrust for its proven experience, industry-leading bullion security, and low cost structure, which provides maximum leverage to rising bullion prices. GoldTrust generally has traded at a meaningful premium to NAV in a rising gold price environment. During the last bull market for gold, the return provided by GoldTrust Units outperformed alternative gold bullion investment products, including Sprott PHYS. This is clearly demonstrated in the following chart which compares GoldTrust’s relative performance to PHYS, iShares Gold Bullion ETF (TSX-listed) and SPDR Gold Shares ETF (“GLD ETF”), during the period from May 2010 to October 2011.

1.Values shown for the period between May 3, 2010 and October 27, 2011.

2. Listed on the TSX, and separate from the U.S. listed iShares Gold Trust.

(Source: Bloomberg Financial Markets.)

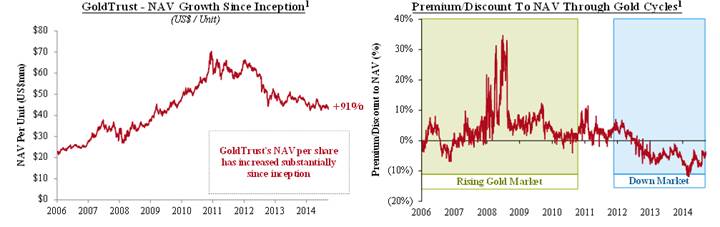

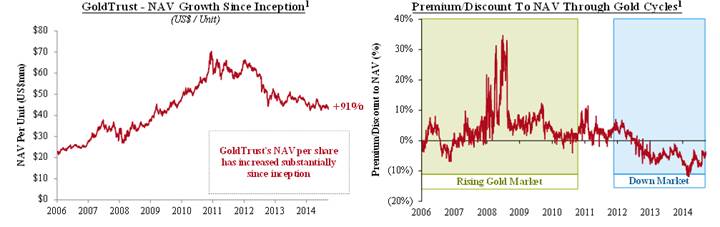

8. GoldTrust Units have traded at a premium to NAV during rising gold markets and only recently traded at a discount during a prolonged bear market in gold

GoldTrust historically has traded at substantial premiums to NAV in strong gold markets and at discounts to NAV in weak gold markets as illustrated below. Historically, weak gold markets were short-lived and Units rarely traded at discounts for extended periods. However, the current gold bear market has lasted longer than any other in the past decade, as evidenced by the 55% decline, as of June 5, 2015, experienced by the S&P/TSX Global Gold Index since October 1, 2012. As a result, GoldTrust Units

have traded at a greater discount to NAV than previously experienced. However, the Trustees remain confident that GoldTrust remains best positioned to benefit from any future recovery in gold prices given its tax-efficient, low cost, and secure structure. Even in light of the recent depressed market for gold and gold investments, Unitholders have experienced material NAV per Unit growth of 91% since GoldTrust’s U.S. listing in September 2006.

1. Period shown from September 22, 2006, when GoldTrust was listed in the U.S., to June 5, 2015.

(Source: Bloomberg Financial Markets.)

The Board of Trustees continues to believe that current economic conditions, which include ultra-low interest rates, unprecedented money-printing and debt creation by the major industrial economies and accelerating devaluation turbulence among global currencies are supportive factors for higher gold prices over time. Given our positive outlook for the gold price and its positive effect on the trading price of GoldTrust Units, we believe that the Sprott Offer, which would result in, among other things, less bullion security and safeguards, higher ongoing expenses and exposure to potential future tax liabilities, is not in the best interests of Unitholders.

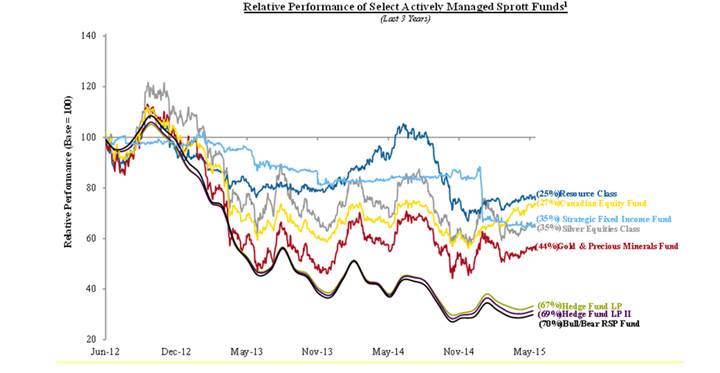

9. Sprott has a poor track record as a manager of investor capital

Sprott Inc., the parent company of SAM, has a poor track record as a fund manager, having lost billions of dollars in investor capital while at the same time pocketing hundreds of millions of dollars in management fees. Given Sprott’s poor record of performance, Sprott’s assertion that SAM has a proven track record of value creation and a “best in class platform” is highly dubious. When combined with the governance structure of Sprott PHYS, which severely limits voting and other governance rights, the Trustees believe that Sprott is not well suited to serve as stewards of GoldTrust Unitholders’ capital.

The following table illustrates this pattern and summarizes some examples which include Sprott Inc., the publicly-traded parent entity, actively managed Sprott funds still in existence, as well as other Sprott funds that have been terminated or merged due to their poor performance.

| | Total Value Lost by

Investors | | Fees/Proceeds to

Sprott1 | |

Sprott Inc. (Since Initial Public Offering)2 | | ($1,068 million) | | $200 million | |

Select Group of Poorly Performing Sprott Funds | | ($467 million)3,4 | | $112 million5,6 | |

Select Group of Defunct Sprott Funds7 | | ($209 million)8 | | $50 million9 | |

Total | | ($1,744 million) | | $362 million | |

1. Fees / Proceeds to Sprott based on public disclosure.

2. Figures shown only reflect the initial public offering in May 15, 2008, and exclude subsequent private placements.

3. Includes the following Sprott funds: Resource Class, Canadian Equity Fund, Strategic Fixed Income Fund, Silver Equities Fund, and Gold & Precious Minerals Fund.

4. “Value Lost” is shown for the last three years (as of June 5, 2015) and is calculated as the product of i) the percent change in the fund’s NAV per share (or share price if publicly traded) on its Series A shares and ii) the fund’s average shares outstanding. Average shares outstanding based on semi-annual filings available for the same period.

5. Includes the following Sprott funds: Resource Class, Canadian Equity Fund, Strategic Fixed Income Fund, Silver Equities Fund, Gold & Precious Minerals Fund, Hedge Fund LP, and Hedge Fund LP II.

6. Fees are shown on an aggregate basis for the last three fiscal years as disclosed in financial statements.

7. Includes Sprott Molybdenum Participation Corp., Sprott Growth Fund, and Sprott Global Equity Fund.

8. “Value Lost” is shown from inception to termination and is calculated as the product of: (i) the percent change in the fund’s NAV per share (or share price if publicly traded) on its Series A shares and (ii) it’s average shares outstanding.

9. Fees are shown on an aggregate basis from inception to termination as disclosed in financial statements.

(Source: Bloomberg Financial Markets and public disclosure)

Sprott Inc. completed its initial public offering on May 15, 2008, in which Eric Sprott and other employees of SAM sold their own shares to the public, raising $200 million in proceeds, none of which was reinvested in Sprott Inc. at that time. Those same shares sold to the public are worth only approximately $58 million today. Overall, Sprott Inc. has lost approximately $1.1 billion or 71% of its total market capitalisation since its IPO in 2008.

Shares of Sprott Inc. have also persistently underperformed the S&P/TSX Composite Index (Total Return Index) since its IPO in 2008, with a cumulative underperformance of nearly 100% to date. A $100 investment in Sprott Inc. at its inception would now be worth approximately $29, while a $100 investment in the S&P/TSX Composite Index would now be worth approximately $125.

1. Period shown from May 15, 2008 to current, as of June 5, 2015.

(Source: Bloomberg Financial Markets and public disclosure)

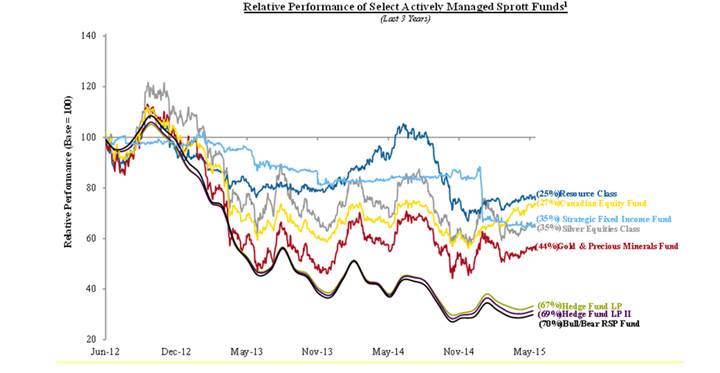

A large number of Sprott Inc. actively managed funds also suffer from chronic underperformance, while Sprott Inc. continues to generate very significant management fees from these funds. The table below shows that over the past three years the selected group of poorly performing Sprott funds underperformed by approximately 13% on average against their respective Sprott-selected benchmark indices, while Sprott Inc. and SAM have collected over approximately $110 million in management fees from these funds over the same three year period.

| | Performance | | Perf. Relative | | | | | | |

Fund | | Fund | | Benchmark2 | | to Benchmark | | Fees Earned3,4 | | Value Lost5 | | Fund Size ($ mm)6 |

| | (%) | | (%) | | (%) | | (C$ mm) | | (C$ mm) | | (C$ mm) |

Resource Class | | (25%) | | (19%) | | (6%) | | $2 | | ($4) | | $15 |

Canadian Equity Fund | | (27%) | | 43% | | (69%) | | $59 | | ($202) | | $321 |

Strategic Fixed Income Fund | | (35%) | | (24%) | | (11%) | | $1 | | ($40) | | $29 |

Silver Equities Class | | (35%) | | (54%) | | 19% | | $1 | | ($9) | | $33 |

Gold and Precious Minerals Fund | | (44%) | | (49%) | | 5% | | $23 | | ($211) | | $177 |

Hedge Fund LP | | (67%) | | — | | — | | $14 | | not avail. | | $84 |

Hedge Fund LP II | | (69%) | | — | | — | | $13 | | not avail. | | $43 |

Bull/Bear RSP Fund | | (70%) | | — | | — | | — | | not avail. | | $10 |

| | Avg. Perf.

(46%) | | | | Avg. Rel. Perf.

(13%) | | Total Fees

$112 | | Total Growth / (Loss)

($467) | | |

1. Market data as of June 5, 2015. Hedge Funds and Bull/Bear RSP Fund as at May 29, 2015.

2. Resource Class comparative benchmark relative performance based on 50/50 weighting of S&P/TSX Materials TRI and S&P/TSX Capped Energy TRI. Canadian Equity Fund comparative benchmark relative performance based on S&P/TSX Composite TRI. Strategic Fixed Income Fund comparative benchmark relative performance based on the 3-Month Canadian Bankers’ Acceptance Rate. Silver Equities Class comparative benchmark relative performance based on MSCI ACWI Select Silver Miners Investable Market Index. Gold and Precious Minerals Fund comparative benchmark relative performance based on S&P/TSX Global Gold TRI.

3. Fees Earned are based on the last three fiscal years reported and include both management fees and incentive/performance fees. Based on company disclosure.

4. Fees Earned by Hedge Fund LP and Hedge Fund LP II have been estimated based on the 2% management fee applicable to the funds’ average assets under management, estimated for each of the last three fiscal years using data from Bloomberg.

5. “Value Lost” is shown for the last three years (as of June 5, 2015) and is calculated as the product of (i) the percent change in the fund’s NAV per share (or share price if publicly traded) on its Series A shares and (ii) the fund’s average shares outstanding. Average shares outstanding based on semi-annual filings available for the same period.

6. Fund size based on AUM as of April 30, 2015 and from fund filings.

(Source: Bloomberg Financial Markets, Thomson One Analytics and public disclosure.)

In fact, as illustrated in the table below, several Sprott funds were wound up or merged into other Sprott funds following persistent poor performance. Despite the significant underperformance and loss of value experienced by investors in these instances, Sprott still managed to extract approximately $50 million in fees from these defunct funds. Based on Sprott PHYS’ fixed management fee of 0.35% of NAV, SAM stands to gain an additional approximately US$3.1 million in additional annual management fees if it is successful in taking over the underlying assets of GoldTrust to the detriment of GoldTrust’s Unitholders.

Fund | | Description | | Inception

Date | | Wind-up /

Merger Date | | Fund Size1

($ mm) | | Value Lost

($ mm)2 | | Fees

Earned

($ mm) | | Performance Chart3 |

Sprott Molybdenum Participation Corp. | | · Designed to invest in Molybdenum assets · Impacted by crash in Molybdenum prices during late 2008 | | Apr 2007 | | Jul 2009 | | $262.9

($68.1) | | ($168) | | $23.3 | |

|

| | | | | | | | | | | | | | |

Sprott Absolute Return Fund | | · Multi-strategy long/short fixed income and currency fund designed to maximize absolute returns with low volatility · Suffered a loss of 18% as a result of the Swiss National Bank’s unpegging of the Swiss Franc to the Euro | | Aug 2010 | | Jan 2015 | | n.a.

(n.a.)4 | | n.a. | | n/a | |

|

| | | | | | | | | | | | | | |

Sprott Growth Fund | | · Objective was to achieve long term capital growth by investing in growth oriented equities · Impacted by global financial crisis in 2008/2009 · In 2011, the Sprott Growth Fund was merged into the Sprott Small Cap Equity Fund | | Jan 2006 | | Aug 2011 | | $81.8

($50.9) | | ($24) | | $23.6 | |

|

| | | | | | | | | | | | | | |

Sprott Global Equity Fund | | · Objective was to achieve long term capital growth by investing primarily in equities and equity-related securities of companies around the world · Impacted by volatility in global markets and re-positioned in 2009 to be more defensive by overweighting materials and investing in gold bullion · In 2010, the Sprott Global Equity Fund was merged into the Sprott All Cap Fund, which was subsequently rolled into the Sprott Canadian Equity Fund in 2012 | | Apr 2007 | | Nov 2010 | | $67.9

($10.4) | | ($17) | | $3.1 | |

|

1. Fund size at inception based on the first year-end report. Figure in brackets represents fund size near merger/liquidation, based on the last quarterly filing.

2. “Value Lost” is shown from inception to liquidation/amalgamation and is calculated as the product of (i) the percent change in the fund’s NAV per share (or share price if publicly traded) on its Series A shares and (ii) it’s average shares outstanding.

3. Performance chart for Sprott Growth Fund and Global Equity Fund show performance of surviving funds after merger.

4. No filings available at inception or termination date.

(Source: Bloomberg Financial Markets and public disclosure)

When looking at the broader group of Sprott funds where information is publicly available, similarly poor returns were observed relative to their respective benchmarks. As shown below, these funds over the past three years have underperformed, on average, 11% below their respective benchmarks.

Relative Performance of All Sprott Funds (Where Disclosure is Available)

| | Sprott Performance1

(%) | | Benchmark

Performance1,2

(%) | | Relative

Underperformance

(%) | |

All Sprott Funds3 (Where Disclosure is Available) | | (9.3 | )% | 1.2 | % | (10.5 | )% |

Excluding Bond Funds4 | | (12.4 | )% | (0.2 | )% | (12.1 | )% |

1. Based on last three years of performance as at December 31, 2014. Sprott Fund performance calculated based on fund filings and benchmark performance calculated based on Bloomberg data. Fund performance calculated based on NAV per share of the Class A Shares, where multiple series of shares exist.

2. Benchmarks are based on those used by Sprott in determining the performance fees for its funds. For those without a stated benchmark, comparable benchmarks were selected.

3. “All Sprott Funds” include: Canadian Equity Fund, Canadian Equity Class, Enhanced Equity Class, Small Cap Equity Fund, Energy Fund, Global Infrastructure Fund, Gold & Precious Minerals Fund, Gold & Precious Minerals Class, Real Asset Class, Resource Class, Silver Equities Class, Timber Fund, Enhanced Balanced Fund, Enhanced Balanced Class, Tactical Balanced Fund, Tactical Balanced Class, Diversified Bond Fund, Diversified Bond Class, Short-term Bond Fund, Short-term Bond Class and Strategic Fixed Income Fund.

4. Includes funds within “All Sprott Funds,” with the exception of the following: Diversified Bond Fund, Diversified Bond Class, Short-term Bond Fund, Short-term Bond Class and Strategic Fixed Income Fund.

(Source: Bloomberg Financial Markets and public disclosure)

10. Sprott pitches investors conflicting and self-serving messages

There have been numerous occasions where Sprott has provided conflicting and contradictory messages to investors, which brings into question whether Sprott is indeed truly aligned with investors.

Conflicting Gold Price Predictions

In October 2014, John Embry, Chief Portfolio Strategist at SAM, stated with regards to gold: “In my opinion, what it has set up is probably the finest buying opportunity [for gold] I have seen in my 51 years in the business”6.

Despite this recent statement, and with the current price of gold being largely unchanged from October 2014, the Offer Circular asserts that a bull market similar to the most recent one experienced was extreme, and that there is no “reasonable reason to believe that a [similar] bull market” for gold would exist in the “near or long-term future”. The Trustees find it difficult to reconcile statements made by Sprott representatives when promoting their own investment vehicles with those made in an effort to discredit the future prospects of GoldTrust and by inference the prospects of Sprott’s own bullion funds.

Incorrect Statements on Redemptions

In May 2015, Rick Rule, CEO of Sprott US Holdings, stated with regards to Sprott fund redemptions, “if my memory serves me correctly, we probably have had $50 million worth of redemptions in five

years — unpleasant, but certainly manageable.”7 Mr. Rule’s assertion is inaccurate as the quantum of Sprott PHYS redemptions in the last two years alone is approximately US$440 million, or 20% of the issued and outstanding Sprott PHYS units, over eight times higher than Mr. Rule’s assertion.

Contradictory Actions

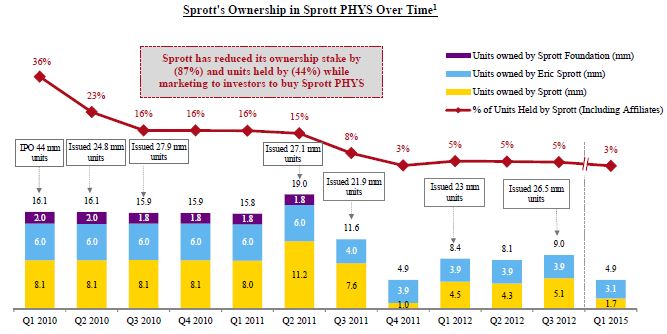

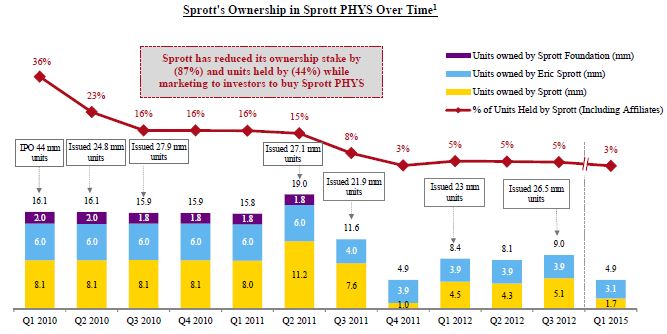

Over the period from 2010 to 2012, various Sprott entities were selling their unit positions in Sprott PHYS while at the same time Sprott was actively marketing Sprott PHYS to public investors in order to raise new capital. This is yet another example of Sprott’s misalignment with the interests of its investors. The chart below shows the declining positions in Sprott PHYS units of certain Sprott entities and affiliated persons, including Mr. Sprott himself, alongside issuance of Sprott PHYS units from 2010 through to 2012. Mr. Sprott himself, along with affiliated entities, decreased their ownership in Sprott PHYS units by 87% while marketing and encouraging other investors to purchase no fewer than seven public new issues of Sprott PHYS units over the same time frame.

1. Financings shown based on completed amount (including the exercise of over-allotment options).

(Source: Bloomberg Financial Markets and company filings.)

11. GoldTrust’s Trustees and Senior Officers have a long, successful track record of stewarding gold bullion investment vehicles

GoldTrust’s administrative team and certain of GoldTrust’s Trustees have been stewarding and administering gold bullion investments for over 32 years.

The Administrator’s staff and its consultants have almost 200 years of collective proven experience in soundly administering publicly traded precious metals entities. The Board of Trustees has in excess of

50 years’ collective experience in proven stewardship of GoldTrust. Since inception, GoldTrust has consistently had a strong, majority independent Board of Trustees which has adopted sound governance practices. The Trust has always served all of its Unitholders and it will continue to secure the hard earned capital entrusted to it by its owners at all times.

The Trustees understand that the unusually elevated discounts to NAV at which GoldTrust Units have recently traded are of concern to investors; however, Sprott’s opportunistic offer is not the solution. Your Trustees are actively considering a number of potential measures, including possible amendments to the existing cash redemption feature of GoldTrust, which could potentially reduce future trading price discounts to NAV. Among the factors guiding the Trustees’ analysis of such measures are the accessibility of any amended features to all Unitholders, the necessity that any such measures be accretive to non-redeeming Unitholders and the potential tax liabilities to Unitholders in connection therewith. Upon completion of a favourable analysis by financial, legal and tax advisors, the Trustees will consider whether to adopt such measures if appropriate.

12. The Exchange Offer Election and Merger Transaction may not qualify as a tax-deferred reorganization for United States federal income tax purposes and, as a result, may be a fully taxable transaction for all U.S. Unitholders

Sprott states in its Offer Circular that “[b]ecause the determination of whether the exchange pursuant to the Exchange Offer Election and the Merger Transaction qualifies as a Reorganization [under Section 368(a) of the Code] depends on the resolution of complex issues and facts, some of which will not be known until the completion of the Offer and the Merger Transaction, there can be no assurance that the exchange pursuant to the Exchange Offer Election and the Merger Transaction will qualify as a Reorganization” (emphasis added).

If a gain is required to be recognized by a U.S. Unitholder because the Exchange Offer Election and the Merger Transaction fail to qualify as a tax-free reorganization, U.S. Unitholders that exchange their GoldTrust Units for Sprott PHYS units would generally recognize any gain on such exchange equal to the difference, if any, between:

(i) the fair market value of the Sprott PHYS units (determined as of the Expiry Date) received in exchange for GoldTrust Units; and

(ii) the U.S. Unitholder’s adjusted tax basis in the GoldTrust Units exchanged therefor. Any gain realized on the exchange would be subject to the PFIC (as defined under the heading “Certain United States Income Tax Considerations” below) excess distribution rules discussed in the next paragraph.

Generally, under the excess distribution rules, if GoldTrust were treated as a PFIC for any taxable year during which a U.S. Unitholder held or holds GoldTrust Units, unless the U.S. Unitholder has made a timely and effective Mark-to-Market Election (as defined below) or a QEF Election:

(i) any gain recognized by a U.S. Unitholder on the exchange of GoldTrust Units pursuant to the Exchange Offer Election or the Merger Transaction would be allocated ratably over the U.S. Unitholder’s holding period for its GoldTrust Units;

(ii) the amounts allocated to the taxable year of the gain would be taxed as ordinary income in the current year; and

(iii) the amount allocated to each other taxable year would be subject to tax at the highest ordinary income rate in effect for individuals or corporations in such taxable year, as appropriate, and an interest charge would be imposed on the amount allocated to that taxable year. Such interest charge is not deductible by non-corporate U.S. Unitholders.

The highest combined U.S. federal, state, local and Medicare surcharge tax rate applicable to ordinary income for 2015 is approximately 51.1% for individuals who reside in New York City. For QEF Electing Unitholders the highest combined U.S. federal, state, local and Medicare surcharge tax rate is approximately 31.5% for individuals who reside in New York City with respect to long-term capital gains.

For further details, see “Certain United States Tax Considerations” below.

13. Even if the Exchange Offer Election and Merger Transaction qualify as a reorganization for United States federal income tax purposes the PFIC rules may cause such transactions to be fully taxable, thereby causing certain U.S. Unitholders to incur tax at the highest federal and state ordinary income tax rates

Sprott states in its Offer Circular that “U.S. [Unit]holders may be required to recognize gain, if any, on the exchange [under the PFIC rules], even if the exchange pursuant to the Exchange Offer Election and the Merger Transaction otherwise qualifies as a Reorganization” (emphasis added). If a gain is required to be recognized as a result of the PFIC rules, U.S. Unitholders (other than QEF Electing Unitholders) that exchange their GoldTrust Units for Sprott PHYS units would generally recognize any gain on such exchange equal to the difference, if any, between:

(i) the fair market value of the Sprott PHYS units (determined as of the Expiry Date) received in exchange for GoldTrust Units; and

(ii) the U.S. Unitholder’s adjusted tax basis in the GoldTrust Units exchanged therefor. Any gain realized on the exchange would be subject to the PFIC excess distribution rules discussed in the next paragraph.

Generally, under the excess distribution rules, if GoldTrust were treated as a PFIC for any taxable year during which a U.S. Unitholder held or holds GoldTrust Units, unless the U.S. Unitholder, as referred to above, has made a timely and effective Mark-to-Market Election or a QEF Election:

(i) any gain recognized by a U.S. Unitholder on the exchange of GoldTrust Units pursuant to the Exchange Offer Election or the Merger Transaction would be allocated ratably over the U.S. Unitholder’s holding period for its GoldTrust Units;

(ii) the amounts allocated to the taxable year of the gain would be taxed as ordinary income in the current year; and

(iii) the amount allocated to each other taxable year would be subject to tax at the highest ordinary income rate in effect for individuals or corporations in such taxable year, as appropriate, and an interest charge would be imposed on the amount allocated to that taxable year. Such interest charge is not deductible by non-corporate U.S. Unitholders.

The highest combined U.S. federal, state, local and Medicare surcharge tax rate applicable to ordinary income for 2015 is approximately 51.1% for individuals who reside in New York City.

For further details, see “Certain United States Tax Considerations” below.

14. The Sprott Offer has been structured to bypass traditional statutory protections typically available to securityholders

Circumvention of Squeeze-Out Threshold

Notwithstanding that GoldTrust is a mutual fund trust, and therefore not subject to the provisions of corporate statutes that govern corporations and the rights afforded to shareholders thereof, the Declaration of Trust was drafted, when GoldTrust was founded, based on the same governance principles that underlie such statutes, most notably the Canada Business Corporations Act. (“CBCA”). The Trustees believe these provisions are based upon corporate governance best practices and that certain aspects of the Sprott Offer are clearly designed to circumvent such best practices, which is not in the best interests of Unitholders.

In particular, the compelled and compulsory acquisition provisions set out in Section 13.6 of the Declaration of Trust, entitling an offeror who has made an offer that is accepted by at least 90% of the Units of GoldTrust to acquire or redeem the remaining 10% of Units, is explicitly based upon and tracks the parallel provisions of Section 206 of the CBCA. However, the structure of the Merger Transaction proposed by Sprott would allow the Offeror, using the irrevocable power of attorney granted by a tendering Unitholder that has made the Merger Election, to amend the Declaration of Trust to lower this threshold to 662/3%, thereby allowing Sprott PHYS to effect a compulsory acquisition or redemption at a threshold far lower than what is permitted under the parallel corporate laws.

Circumvention of Unitholder Approval

Pursuant to the rules of the TSX, an entity proposing to issue more than 25% of its current issued and outstanding securities in consideration for an acquisition — as Sprott PHYS would be required to do to effect the completion of the Merger Transaction — is typically required to submit the transaction for approval of its unitholders. However, since Sprott PHYS unitholders do not have the right to vote on anything in the normal course, as highlighted above, Sprott PHYS is not obtaining unitholder approval for the Sprott Offer and Merger Transaction.

Circumvention of Withdrawal Rights

The Trustees believe that making the Merger Election, which Sprott states has been made available to tendering Unitholders in order to effect a tax-deferred rollover of their GoldTrust Units to Sprott PHYS units attempts to convince Unitholders into giving up certain fundamental rights to withdraw their

tendered Units enshrined in securities law under the Securities Act (Ontario) and the U.S. Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). Under normal circumstances — and indeed in the case of a tendering Unitholder making the Exchange Offer Election — a tendering Unitholder has the right to withdraw tendered Units: (i) at any time before they are taken up by an offeror; (ii) at any time before the expiration of 10 days from the date of a notice of change to a take-over bid circular, such as the Offer Circular; (iii) if, after they are taken up, they are not paid for within three business days; or (iv) at any time after 60 days from the date of commencement.

Tendering GoldTrust Unitholders who make the Exchange Offer Election do retain such withdrawal rights. However Sprott has characterized the Merger Election as, in effect, a tender to the Offer, when in fact tendering Unitholders making the Merger Election are granting the Offeror a proxy over their tendered Units to effect fundamental structural changes to GoldTrust and its Declaration of Trust that the Offeror deems necessary to complete the Merger Transaction. Units ‘tendered’ by Unitholders making the Merger Transaction are never intended to be taken up by the Offeror, because it is necessary that they be withdrawn to complete the tax-deferred rollover exchange for Sprott PHYS units.

In a typical take-over bid subject to the Securities Act (Ontario) and the U.S. Exchange Act, the operative action for a target securityholder is the act of tendering voting securities to an offer. The withdrawal rights set out in the Securities Act (Ontario) and U.S. Exchange Act are intended to protect securityholders who have taken such action but wish to subsequently withdraw. However under the Sprott Offer, the operative act for Unitholders making the Merger Election is not, in fact, a ‘tender’, but rather the granting of a power of attorney, which becomes irrevocable at 4:58 p.m. (Toronto time) on the Expiry Date. Thereafter, a Unitholder who has made the Merger Election will be unable to withdraw his or her consent to the passing of the Special Resolutions or completion of the Merger Transaction.

As a result, a Unitholder that wishes to withdraw tendered Units for which the Merger Election has been made, and prevent such Units from being counted towards the Threshold Condition, must do so before 4:58 p.m. (Toronto time) on the Expiry Date. If the Merger Transaction fails to be completed within three business days of the Expiry Date, for example, tendering Unitholders who made the Merger Election would not, technically, have been paid for their Units, but would not have the traditional securities law rights of withdrawal, because such Units were never actually taken up.

The Trustees believe that the disclosure with respect to the foregoing in the Offer Circular does not present a clear picture of the mechanics to Unitholders. With respect to the Merger Election, Sprott has disguised a power of attorney proxy solicitation, which would otherwise require a meeting of Unitholders, as a take-over bid exchange offer, in an attempt to convince Unitholders to give up their withdrawal rights in respect of the period following 4:58 p.m. (Toronto time) on the Expiry Date.

15. The Offer Circular contains inadequate disclosure regarding certain conditions and contingencies of the Sprott Offer

Waiver and Take-Up

The Offer Circular contemplates a scenario in which the Offeror waives the Threshold Condition and takes up tendered GoldTrust Units in an amount less than the required 662/3%. However, there are

numerous potential legal impediments to doing so and Sprott has not disclosed the structure or manner in which it would do so.

If the Offeror waived the Threshold Condition, it would also be required to waive the condition that the Special Resolutions be passed. This arises because, pursuant to the Declaration of Trust, the Offeror would not have power of attorney over sufficient voting rights to pass any resolutions effecting amendments to the Declaration of Trust (which require approval by Unitholders representing more than 662/3% of the outstanding Units represented in person or by a proxy at a meeting of Unitholders duly called for the purposes of considering such resolutions or approved in writing by Unitholders holding more than 662/3% of the outstanding Units). As a result, the Merger Transaction could not be completed.