Exhibit 99.3

ATTENTION UNITHOLDERS:

VOTE THE ENCLOSEDWHITE PROXY

FOR THE ETF CONVERSION

A CLEARLY SUPERIOR ALTERNATIVE

TO SPROTT'S INADEQUATE OFFER

| The Choice is Clear for GoldTrust Unitholders |

| | ETF

Conversion | Sprott

Offer |

| Elimination of material discounts to NAV | ü | û |

| Greater liquidity for Unitholders | ü | û |

| Continued low management fees | ü | û |

| Industry-leading bullion security and safeguards | ü | û |

| Enhanced ability to grow assets | ü | û |

| Improved marketing at no additional cost | ü | û |

| Stewardship by experienced leaders in ETF and sound bullion investment administration | ü | û |

WITHDRAW YOUR UNITS IMMEDIATELY IF TENDERED TO

SPROTT’S INADEQUATE OFFER TO REVOKE YOUR POWER OF ATTORNEY

TABLE OF CONTENTS

| LETTER TO UNITHOLDERS | 1 |

| RECOMMENDATION TO UNITHOLDERS | 4 |

| REASONS FOR VOTING IN FAVOUR OF THE ETF CONVERSION | 5 |

| QUESTIONS AND ANSWERS | 15 |

| NOTICE OF SPECIAL MEETING OF UNITHOLDERS | 24 |

| MANAGEMENT INFORMATION CIRCULAR | 26 |

| SOLICITATION OF PROXIES | 26 |

| DELIVERY OF PROXIES | 26 |

| documents incorporated by reference | 26 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION | 27 |

| VOTING UNITS AND PRINCIPAL HOLDERS THEREOF | 28 |

| BUSINESS OF THE MEETING | 28 |

| Background to the PROPOSED ETF Conversion | 30 |

| Details of the PROPOSED ETF conversion | 35 |

| Risk Factors | 50 |

| Description of Definitive Agreement | 52 |

| Amendments to GoldTrust's Declaration of Trust | 58 |

| CONDITIons to implementing the etf conversion | 65 |

| CERTAIN CANADIAN TAX CONSIDERATIONS | 67 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 69 |

| MANAGEMENT CONTRACTS | 80 |

| INTEREST OF CERTAIN PERSONS IN MATERIAL TRANSACTIONS | 80 |

| auditors, custodian, transfer agent and ADMINISTRATOR | 80 |

| legal matters | 81 |

| ADDITIONAL INFORMATION | 81 |

| TRUSTEES' APPROVAL | 82 |

| APPENDIX "A" CONVERSION RESOLUTION | A1 |

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

| LETTER TO UNITHOLDERS |  |

December 4, 2015

Dear Fellow Central GoldTrust Unitholders,

Recently, we announced that Central GoldTrust ("GoldTrust") has entered into a definitive agreement with Purpose Investments Inc. ("Purpose") and GoldTrust's administrator, Central Gold Managers Inc. (the "Administrator"), regarding the proposed conversion of GoldTrust into a gold bullion exchange-traded fund ("ETF") to be managed by Purpose and administered by the Administrator. The proposed ETF conversion (the "ETF Conversion"), completion of which is subject to Unitholder approval, among other conditions, has the unanimous support of your Trustees who are independent of the Administrator and senior executive officers (the "IndependentTrustees") and represents an exciting opportunity for GoldTrust's unitholders ("Unitholders").

Purpose is a rapidly-growing, employee-owned Canadian asset manager which has current assets under management of over $1.4 billion across 17 funds. Purpose is one of Canada's most experienced ETF managers and also has significant experience in managing and marketing bullion funds. Purpose’s predecessor company, Claymore Investments Inc., which was acquired by BlackRock, Inc. in 2012, launched and managed the Claymore Gold Bullion Fund that was successfully converted into an ETF in 2010. For further information on Purpose, we encourage Unitholders to visit its website at www.purposeinvest.com.

Upon the successful completion of the ETF Conversion, the units of GoldTrust ("Units") are expected to trade in-line with their underlying net asset value ("NAV"). The ETF Conversion should eliminate any material future discounts to NAV and provide Unitholders with significantly enhanced liquidity, consistent with other gold bullion ETFs. At the same time, GoldTrust's industry-leading features will remain unchanged and Unitholders will continue to benefit from GoldTrust’s low administration fees, industry-leading bullion security and safeguards, and Canadian domiciled, tax-efficient structure.

In addition, following a successful vote on the ETF Conversion,GoldTrust’s redemption features will be amended to immediately provide significantly enhanced liquidity for ALL Unitholders, similar to the liquidity expected after completion of the ETF Conversion. The proposed changes to GoldTrust’s current cash redemption feature, intended to be effective immediately following Unitholder approval of the ETF Conversion and other required approvals, and during the interim period until the ETF Conversion is implemented, are as follows:

| 1. | | GoldTrust will immediately implement a cash redemption feature which will allowALLUnitholders to redeem their Units forcash at 100% of net asset value ("NAV")1on a bi-weekly basis. This redemption feature is superior to the physical redemption feature of Sprott Physical Gold Trust ("Sprott PHYS") which is only available monthly, and which would only be available to approximately 1% of current Unitholders; and |

| 2. | | GoldTrust will immediately implement a cash redemption featurewhich will allowALLUnitholders to redeem their Units forcash at 95% of NAV on a daily basis. This compares favourably with Sprott PHYS’ cash redemption feature which is at the lesser of (i) 95% of the market price of Sprott PHYS units, and (ii) NAV, and is only available on a monthly basis. The new GoldTrust daily cash redemption feature is identical to the enhanced redemption feature that was approved by the Trustees in June, but was blocked by the court actions of Sprott Asset Management Gold Bid LP, an affiliate of Sprott Asset Management LP and Sprott Inc. ("Sprott"). |

1 Net any costs associated with redemptions, including the liquidation of GoldTrust's physical gold bullion to fund redemptions.

Put simply: your Independent Trustees strongly believe the proposed ETF Conversion represents a superior alternative for all Unitholders compared to the inadequate unsolicited take-over bid by Sprott (the "Sprott Offer").

| Anticipated Benefits of the Proposed ETF Conversion |

Ø Expectedelimination of material trading discounts to NAV; Ø Significantly enhanced liquidity available immediately following Unitholder approval through enhanced redemption features; Ø Maintains GoldTrust’s existing low administration fees, which are 43% lower than those of Sprott PHYS2; Ø Retains GoldTrust’s industry-leading bullion security and safeguards, which are superior to those of Sprott PHYS; Ø Enhanced ability to grow GoldTrust's assets and thus reduce expenses on a per Unit basis as Units will be continuously offered; Ø Creates the only dual-listed (Canada and U.S.) physical gold bullion ETF; Ø Significantly improved marketing capability at no additional cost to Unitholders; Ø No expected material adverse tax effect on GoldTrust or its Unitholders and will preserve GoldTrust’s tax efficient structure; and Ø Provides stewardship by Purpose and the Administrator, highly experienced leaders in ETF management and marketing and bullion investment administration. |

As an ETF, GoldTrust would be managed and marketed by Purpose and administered by the Administrator. The Trustees believe that Purpose’s ETF management and marketing expertise will be beneficial to Unitholders as GoldTrust transitions to the ETF structure.Importantly, GoldTrust’s administration fees, which are 43% lower than those of Sprott PHYS, will remain the same after the conversion to an ETF.

In addition, to help compensate Unitholders for the costs GoldTrust has incurred in defending Unitholder interests with respect to the unsolicited Sprott Offer,Purpose and the Administrator have agreed to a 25% reduction of their already low administration fees until such time as up to $1.9 million3 of costs have been recovered for the benefit of Unitholders.

2The expense ratio is calculated based on the administrative/management fees incurred over the twelve-months ended September 30, 2015, divided by the average end-of-month NAV for each entity over the same period. This yields an expense ratio of 0.35% for Sprott Physical Gold Trust and 0.20% for GoldTrust. Administration/management fees are sourced from the respective financial statements of Sprott Physical Gold Trust and GoldTrust and historical monthly NAV data is sourced from Bloomberg.

3 Subject to pro-rata reduction based on exchanges or redemptions of Units during the first 30 days following the ETF Conversion.

Eight months and seven extensions later, the inadequate Sprott Offer has repeatedly failed to gain sufficient support from Unitholders to achieve their minimum tender condition of 66⅔% of all Units outstanding. Sprott now plans to use powers of attorney granted by tendering Unitholders to replace the Trustees of GoldTrust with Sprott insiders and force through the implementation of their inadequate offer without ever having achieved their minimum tender condition. If Sprott achieves sufficient tenders to the Sprott Offer, this could deny Unitholders their right to review and assess the merits of the proposed ETF Conversion.

The choice for Unitholders is clear; the proposed ETF Conversion with Purpose is superior to the inadequate Sprott Offer for ALL Unitholders. As an ETF, GoldTrust is expected to provide Unitholders with

| · | Better trading price relative to NAV than Sprott PHYS; |

| · | Better liquidity and redemption features than Sprott PHYS; |

| · | Better bullion security and safeguards than Sprott PHYS; |

| · | Better ability to grow than Sprott PHYS; and |

| · | Substantially lower fees than Sprott PHYS. |

For these reasons, and after very careful consideration of all available information, including the advice of GoldTrust’s financial, legal and tax advisors, and the recommendation of the Special Committee of the Board of Trustees,your Trustees are strongly recommending that UnitholdersWITHDRAW any Units tendered to the Sprott Offer in order to revoke their powers of attorney andvoteFOR the proposed ETF Conversion, which is in the best interests of ALL Unitholders. We urge you to vote theWHITE proxy only, as your Trustees recommend.

We thank Unitholders for their patience and their continued support of Central GoldTrust.

Sincerely,

|  |

Bruce Heagle Chair of the Special Committee of the Board of Trustees | J.C. Stefan Spicer Founder, Chairman and CEO |

RECOMMENDATION TO UNITHOLDERS

THE CHOICE IS CLEAR - ETF CONVERSION WITH PURPOSE IS THE SUPERIOR ALTERNATIVE TO SPROTT'S INADEQUATE OFFER

| THE BOARD OF TRUSTEES RECOMMENDS

THAT UNITHOLDERS VOTE FOR THE ETF CONVERSION |

| DO NOT TENDER TO SPROTT'S OFFER ANDWITHDRAW YOUR UNITS IF ALREADY TENDERED TO REVOKE YOUR POWER OF ATTORNEY |

IF YOU ARE A BENEFICIAL UNITHOLDER AND RECEIVE A VOTING INSTRUCTION FORM OR OTHER FORM OF PROXY FROM YOUR BROKER, THE BOARD RECOMMENDS THAT YOU VOTE IN THE MANNER INDICATED ABOVE.

FAILURE TO VOTE THEWHITE PROXY FORM IN RESPECT OF THE PROPOSED ETF CONVERSION COULD BE TANTAMOUNT TOVOTING FOR THE SPROTT OFFER.

YOU ARENOT REQUIRED TO TENDER ANY UNITS TO THE SPROTT OFFER REGARDLESS OF WHAT YOUR BROKER MAY INSTRUCT YOU. IF YOUR BROKER ADVISES YOU THAT TAKING NO ACTION IN RESPECT OF THE SPROTT OFFER OR SUBMITTING AWHITE PROXY IN RESPECT OF THE ETF CONVERSION IS NOT AN OPTION,THIS IS INCORRECTAND YOU SHOULD CONTACT D.F. KING IMMEDIATELY TOLL-FREE AT 1-800-251-7519.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

REASONS FOR VOTING IN FAVOUR OF THE ETF CONVERSION

After a thorough review of the proposed ETF Conversion, and following the receipt of advice from its financial, tax and legal advisors, and theUNANIMOUS recommendation of the members of the Special Committee, the Board of Trustees has determined that the ETF Conversion would be beneficial to ALL Unitholders and represents a superior alternative to the Sprott Offer. Accordingly, your Trustees recommend that UnitholdersVOTE FOR the ETF Conversion.

| Reasons to Vote FOR the ETF Conversion |

| Expected to eliminate material trading discounts to NAV and significantly enhance liquidity for Unitholders immediately following Unitholder approval through enhanced redemption features |

| Enhanced ability to grow GoldTrust's asset base and thus reduce expenses on a per Unit basis as Units will be continuously offered at NAV |

| Maintain GoldTrust’s existing low administration fees, which are 43% lower than those of Sprott Physical Gold Trust |

| Retains GoldTrust’s industry-leading bullion security and safeguards, which are superior to those of Sprott Physical Gold Trust |

| Creates the only dual-listed (Canada and U.S.) physical gold bullion ETF |

Significantly improved marketing capability at no additional cost to Unitholders |

No expected material adverse tax effect on GoldTrust or its Unitholders and will preserve GoldTrust’s tax efficient structure |

| Provides stewardship by Purpose and the Administrator, highly experienced leaders in ETF management and marketing and bullion investment administration |

| The Sprott Offer is self-serving - Sprott has a poor track record as a manager of investor capital and is desperate to reverse declines in its assets under management and fee income |

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

In recommending that UnitholdersVOTE FOR the ETF Conversion, the Board of Trustees considered, among other things, the following significant factors:

| 1. The ETF Conversion is expected to eliminate material trading discounts to NAV and significantly enhance liquidity for Unitholders |

If the ETF Conversion is approved by Unitholders, Units will be issued and sold on a continuous basis. Purpose, on behalf of GoldTrust, will enter into agreements with registered Canadian and registered U.S. broker-dealers ("dealers") pursuant to which the dealerswill, among other things, act as market-makers for the Units and provide enhanced two-way liquidity for the benefit of all Unitholders. The dealers would also have the ability to subscribe for and exchange Units at NAV on a daily basis to ensure that investors can efficiently buy any amount of additional Units or sell any amount of their Units daily at their current fair value approximately equal to the current NAV.As such, the ETF structure provides certainty to Unitholders that they can decrease or further increase their holdings of GoldTrust at any time at the current fair value of the Units.

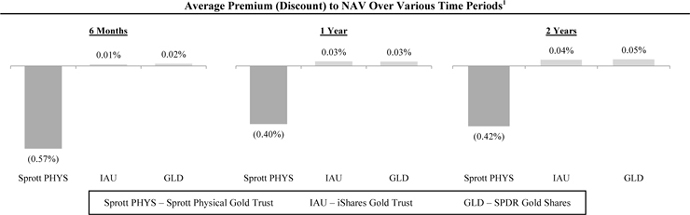

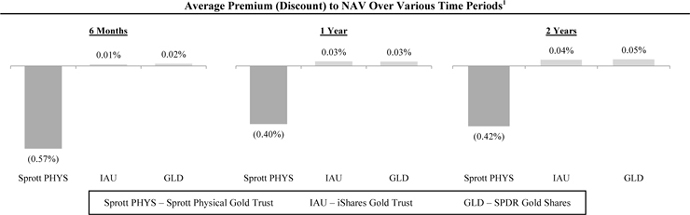

As a result, upon conversion, the Units are expected to trade at a market price approximately equal to their underlying NAV, consistent with other bullion ETFs as shown in the chart below. Both the SPDR Gold Shares ETF (NYSE Arca: GLD) and the iShares Gold Trust ETF (NYSE Arca: IAU), which are comparable ETFs, have consistently traded in-line with their respective underlying NAVs over the past two years, while SprottPhysical Gold Trust ("Sprott PHYS") has traded at an average discount of 0.42% (including discounts as large as 1.33%), over the same period. Sprott PHYS traded at a discount to NAV of 4.2% as recently as July 2013.

1 Market data as at December 2, 2015.

(Source: Bloomberg Financial Markets.)

In addition, once the ETF Conversion is approved by Unitholders, GoldTrust willimmediately offerALL Unitholders the option to redeem their Units for cash either biweekly at 100% of NAV or daily at 95% of NAV until the ETF Conversion is completed. These enhanced redemption features are designed to replicate the liquidity expected after the proposed ETF Conversion is completed. We would expect that the implementation of the enhanced redemption feature would result in the Units trading in-line with NAV following the approval of the ETF Conversion by Unitholders.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

If the ETF Conversion is not completed prior to the expiry of the Definitive Agreement (as defined in the accompanying Management Information Circular of GoldTrust), including any extensions thereof agreed to by the parties, the 100% cash redemption feature of NAV will be nullified, however the 95% cash redemption feature will remain in force.

| 2. As an ETF, GoldTrust will have an enhanced ability to grow its asset base and thus reduce expenses on a per Unit basis as Units will be continuously offered at NAV |

As described above, dealers will have the ability to subscribe for Units at NAV on a continuous basis to satisfy market demand without impacting the market price of the Units relative to their NAV. As a result of the ETF Conversion, GoldTrust will be better positioned to grow its asset base, and accordingly, GoldTrust Unitholders will benefit from lower expenses on a per Unit basis, as GoldTrust’s operating costs, a portion of which are fixed, would be spread over a larger asset base.

In addition, following the ETF Conversion, GoldTrust will be the only physical bullion ETF among competing physical gold bullion funds in the market todaywith a sliding scale structure for administration fees, reducing administration fees to 0.15% of NAV for total assets above U.S.$200 million. This administration fee structure passes on the benefits of asset growth to the Unitholders in the form of progressively lower fees.

Under its current structure, GoldTrust may not continuously distribute its Units and new issuances are effectively only possible when GoldTrust Units are trading at a material premium to NAV, and which generally has only occurred during bull markets for gold. The current prolonged bear market for gold bullion has resulted in GoldTrust (as well as Sprott PHYS) trading at discounts to their underlying NAV, effectively precluding any asset growth. As Sprott PHYS adopted a similar restriction to GoldTrust on dilutive new issuances, Sprott PHYS’ ability to grow is similarly compromised in bear markets for gold and dependent on Sprott PHYS trading at a material premium to NAV.

In fact, Sprott PHYS has seen its asset base shrink significantly as a direct result of its physical redemption feature, which allows certain large investors to redeem their units in exchange for physical bullion at NAV4.Since the first quarter of 2013, approximately 28% of the total outstanding units of Sprott PHYS have been redeemed5, resulting in the significant depletion of Sprott PHYS' gold bullion asset base. As a result, Sprott PHYS' annual expense ratio has increased by almost 18% over the same period6, with much of this significant increase being borne by long-term investors. If the current weak commodity price environment were to persist, Sprott PHYS may continue to face significant redemptions, which would further increase its total expense ratio and magnify the relative advantages of a GoldTrust ETF.

| 3. The ETF Conversion would maintain GoldTrust’s low administration fees, which are 43% lower than those of Sprott PHYS |

All of the anticipated benefits of the ETF Conversion, including the expected elimination of material discounts to NAV and enhanced trading liquidity, will come with no increase in ongoing costs to Unitholders. The new management agreements between GoldTrust, Purpose and the Administrator will have no impact on GoldTrust’s current low administration fees, which are currently 43% lower than those charged by Sprott PHYS, and will be maintained at current rates after the ETF Conversion.

4 Sprott PHYS’ physical redemption feature at NAV requires a minimum redemption value of 1 London Good Delivery Bar (approximately 400 ounces or U.S.$422,000; based on gold price per ounce as at December 2, 2015) net of costs associated with the redemption.

5Based on a comparison of total units outstanding as of December 2, 2015 and March 28, 2013, sourced from monthly data available on Bloomberg.

6 Calculated based on expenses incurred over the last twelve months as of September 30, 2015 and March 31, 2013, divided by the average end-of-month NAVs over the same respective periods.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

1 The expense ratio is calculated based on the administrative/management fees incurred over the twelve-months ended September 30, 2015, divided by the average end-of-month NAV for each entity over the same period. Administration/management fees are sourced from the respective financial statements of Sprott PHYS and GoldTrust and historical monthly NAV data is sourced from Bloomberg.

In addition, to help compensate Unitholders for the costs GoldTrust has incurred in defending Unitholder interests with respect to the unsolicited Sprott Offer, Purpose and the Administrator have agreed to a 25% reduction of their already low administration fees following the completion of the ETF Conversion until such time as up to $1.9 million7 in costs have been recovered for the benefit of Unitholders.

| 4. The ETF Conversion would maintain GoldTrust’s industry-leading bullion security and safeguards, which are superior to those of Sprott PHYS |

The ETF Conversion would preserve GoldTrust’s industry-leading bullion security and safeguards. GoldTrust's gold bullion is currently held on an unencumbered, fully allocated and physically segregated basis in an underground Class 3 (the highest security rating possible in Canada) Canadian chartered bank vault. The segregated area within this vault is closed and the caging within it houses GoldTrust's bullion, which is sealed except during bullion inspections that take place in the presence of GoldTrust's independent external auditor. Many Unitholders consider the high level of security, safeguards and internal controls maintained by GoldTrust to be paramount.

Sprott PHYS outsources custodial and bullion storage services to the Royal Canadian Mint (the "Mint"). However, the Mint has discretion to appoint a sub-custodian to hold Sprott PHYS' physical bullion and fulfill its other obligations under the Sprott Trust Agreement, without Sprott PHYS Unitholder approval, which could have further implications for the safety and security of the physical bullion.

Sprott has also failed to disclose its intentions with respect to the gold bullion currently held by GoldTrust in the event that the merger transaction under the Sprott Offer is completed. The relocation of such bullion or renegotiation of agreements by Sprott with GoldTrust's safekeeping custodian or the Mint could result in additional costs to be borne by Unitholders.

7 Subject to pro-rata reduction based on exchanges or redemptions of Units during the first 30 days following the ETF Conversion.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

| 5. Creation of the only dual-listed (Canada and U.S.) gold bullion ETF |

Once the ETF Conversion is approved by Unitholders and all required regulatory and stock exchange approvals are obtained, GoldTrust would become the only dual-listed (Canada and U.S.) gold bullion ETF. The U.S. listing would allow Units to be traded and available for purchase by U.S. residents in a trading-efficient ETF structure.As a Canadian domiciled trust, GoldTrust is expected to provide much more favourable tax treatment for those U.S. Unitholders who have made or make a timely and effective QEF election relative to a U.S. domiciled ETF. Under current U.S. tax law, non-corporate U.S. Unitholders who have held their Units as capital assets for longer than twelve months and who have made or make a timely and effective QEF election should be eligible for the lower U.S. tax rate applicable to long-term capital gains (currently 20%, plus the 3.8% Medicare tax, if applicable) upon a disposition of their Units, rather than the U.S. "collectibles" tax rate (currently 28%, plus the 3.8% Medicare tax, if applicable) generally applicable to a disposition by U.S. unitholders of their units in a U.S. domiciled ETF. Therefore, it is reasonable to expect that GoldTrust should be a very attractive and efficient option for physical gold bullion exposure which may generate significant demand from U.S. investors.This increased investor demand has the potential to significantly increase GoldTrust’s asset base.Any such increase in the asset base would further decrease the expense ratio of GoldTrust as described above for the benefit of all Unitholders.

This brief description of U.S. federal income tax consequences of a disposition of Units by certain U.S. Unitholders is qualified in its entirety by the longer discussion under "Certain United States Federal Income Tax Considerations" below, and neither this brief description nor the longer discussion is intended to be legal or tax advice to any particular U.S. Unitholder. Accordingly, U.S. Unitholders should consult their own tax advisors with respect to their particular circumstances.

| 6. The ETF Conversion is not expected to have any material adverse tax effect on GoldTrust or its Unitholders and will preserve GoldTrust’s tax efficient structure |

Anticipated Canadian Tax Treatment

The Proposed Amendments (as defined in the accompanying Management Information Circular of GoldTrust, or "Circular"), if approved, should not, individually or collectively, change the income tax status or treatment of GoldTrust, including the mutual fund trust status of GoldTrust or the taxation of GoldTrust, nor result in a disposition of GoldTrust Units by Unitholders under the Income Tax Act (Canada).

This brief description of Canadian federal income tax consequences of the Proposed Amendments is qualified in its entirety by the longer discussion under "Certain Canadian Tax Considerations" and neither this brief description nor the longer discussion is intended to be legal or tax advice to any particular Canadian Unitholder. Accordingly, Canadian Unitholders should consult their own advisors with respect to their particular circumstances.

Anticipated U.S. Tax Treatment

Each of the Proposed Amendments, if approved and adopted, should be treated as a non-taxable amendment of the terms of the Units or as a deemed exchange of the existing Units for new amended Units qualifying as a tax-free recapitalization and/or as a tax-free stock exchange for U.S. federal income tax purposes.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

If the Proposed Amendments, individually or collectively, are treated as a nontaxable amendment, such event(s) will not result in a disposition of Units by U.S. Unitholders and U.S. Unitholders will be treated as continuing to hold their Units with the same aggregate tax basis and the same holding period in their Units.

If the Proposed Amendments, individually or collectively, are treated as a recapitalization and/or as a tax-free stock exchange, then, subject to the discussion of the PFIC rules in the Circular under the heading "Certain United States Federal Income Tax Considerations", the following U.S. federal income tax consequences will result for U.S. Unitholders: (a) a U.S. Unitholder will not recognize gain or loss on the deemed exchange(s); (b) the aggregate tax basis of a U.S. Unitholder in the new amended Units will be equal to such U.S. Unitholder’s aggregate tax basis in the Units deemed exchanged therefor; (c) the holding period of a U.S. Unitholder for the new amended Units should include such U.S. Unitholder’s holding period for the Units surrendered in deemed exchange therefor; and (d) U.S. Unitholders generally will be required to report certain information to the U.S. Internal Revenue Service on their U.S. federal income tax returns for the tax year in which each of the Proposed Amendments occur, and to retain certain records related to the Proposed Amendments.

This brief description of U.S. federal income tax consequences of the Proposed Amendments is qualified in its entirety by the longer discussion under "Certain United States Federal Income Tax Considerations" below, and neither this brief description nor the longer discussion is intended to be legal or tax advice to any particular U.S. Unitholder. Accordingly, U.S. Unitholders should consult their own tax advisors with respect to their particular circumstances.

| 7. Stewardship by highly experienced leaders in ETF management and bullion investment administration |

As an ETF, GoldTrust would be managed and marketed by Purpose and its gold bullion administered by Central Gold Managers Inc., GoldTrust’s current administrator. Purpose, which was founded in December 2012, is one of Canada’s fastest growing and most innovative asset managers, with over $1.4 billion in assets under management across 17 funds. Purpose is focused on managing low-fee investment products for institutional and retail investors and is committed to enabling all investors to have access to great investment products at reasonable fees. Purpose is committed to democratizing the investment industry by giving all investors access to a range of investment strategies that have previously been out of their reach. Through innovative product development and carefully considered investment strategies, Purpose’s investment products are managed with prudence and a long-term perspective, consistent with GoldTrust's historical philosophy.

Senior management at Purpose are among Canada’s most experienced ETF managers and also have significant experience managing and marketing bullion funds through their in-house sales and marketing team and established contacts with various sales and distribution networks. Purpose also has an established track record of organically growing assets under management. Prior to the founding of Purpose, the senior management team founded and built Claymore Investments Inc. ("Claymore") from start-up to $8 billion in assets under management in just seven years before Claymore was sold to BlackRock, Inc. in 2012. In addition, Purpose has significant relevant experience in managing gold and silver bullion ETFs and in executing closed-end fund to ETF conversions. Claymore managed the Claymore Gold Bullion Fund that was successfully converted into an ETF in 2010.

The Trustees believe that Purpose’s ETF management and marketing expertise will be beneficial to Unitholders as GoldTrust transitions to the ETF structure.Importantly, these enhanced management and marketing capabilities will be provided at no additional cost to Unitholders, as GoldTrust’s existing low fees will be maintained post-ETF Conversion.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

Central Gold Managers Inc, GoldTrust's current Administrator and the industry’s most experienced steward of gold bullion investment vehicles, will continue to administer GoldTrust’s bullion holdings after the ETF Conversion by providing bullion inventory and asset valuation services.

| 8. The Sprott Offer is self-serving – Sprott has a poor track record as a manager of investor capital and is desperate to reverse rapid declines in its assets under management and fee income |

Sprott has made repeated claims in its take-over bid circular dated May 27, 2015, as amended, as well as in their continuing public disclosure, regarding the track record and alleged best-in-class platform of Sprott Asset Management LP ("SAM"), and Sprott repeatedly cites these claims as reasons why Unitholders should support the Sprott Offer. However, an examination of Sprott’s poor performance as a manager of investor capital completely contradicts Sprott’s claims.

The Trustees believe that the performance of Sprott managed funds, whether actively or passively managed, is relevant to Unitholders in assessing Sprott’s assertions that it offers a best-in-class platform, enjoys favourable global brand recognition and will deliver expertise and professional management.

The following table, which includes Sprott Inc., the publicly-traded parent entity (whose shareholders are funding Sprott’s hostile actions toward GoldTrust), actively managed Sprott funds still in existence, as well as other Sprott funds that have been terminated or merged due to their poor performance, calls into question Sprott’s claims of best-in-class platform and positive global brand recognition.

| The Facts Behind Sprott’s "Proven Track Record" |

| | Total Value Lost by

Investors | Fees/Proceeds to

Sprott1 |

| Sprott Inc. (Since Initial Public Offering)2 | ($1,178 million) | $200 million |

| Select Group of Poorly Performing Sprott Funds3 | ($884 million)4,5 | $119 million6,7 |

| Select Group of Defunct Sprott Funds3,8 | ($264 million)9 | $52 million10 |

| Total | ($2,326 million) | $371 million |

1 Fees / Proceeds to Sprott based on the most recently available public disclosure.

2 Figures shown as of December 2, 2015 based on share price performance since Sprott Inc.’s initial public offering on May 15, 2008.

3 The "Select Group of Poorly Performing Sprott Funds" represents the seven worst performing actively-managed Sprott funds relative to their respective benchmarks from 2012 onwards for which public disclosure is available. The "Select Group of Defunct Sprott Funds" represents the worst performing actively-managed Sprott funds that have been terminated or merged with other Sprott funds, for which public disclosure is available.

4 Includes the following Sprott funds: Resource Class, Canadian Equity Fund, Silver Equities Fund, and Gold & Precious Minerals Fund.

5 "Value Lost" is shown since December 31, 2011 (as of December 2, 2015) and is calculated as the product of i) the change in the fund's NAV per share (or share price if publicly traded) on its Series A shares and ii) the fund's average shares outstanding.

6 Includes the following Sprott funds: Resource Class, Canadian Equity Fund, Silver Equities Fund, Gold & Precious Minerals Fund, Hedge Fund LP, and Hedge Fund LP II.

7 Fees are shown on an aggregate basis since December 31, 2011 as disclosed in financial statements. Fees for Hedge Fund LP and Hedge Fund LP II have been estimated based on the 2% management fee applicable to the funds’ average assets under management, estimated since December 31, 2011 using data from Bloomberg.

8 Includes Sprott Molybdenum Participation Corp., Sprott Growth Fund, Sprott Global Equity Fund, and Sprott Strategic Fixed Income Fund.

9 "Value Lost" is shown from inception to termination and is calculated as the product of: (i) the change in the fund's NAV per share (or share price if publicly traded) on its Series A shares and (ii) its average shares outstanding.

10 Fees are shown on an aggregate basis from inception to termination as disclosed in financial statements.

(Source: Bloomberg Financial Markets and public disclosure)

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

Sprott Inc. completed its initial public offering ("IPO") on May 15, 2008 at $10.00 per share, in which Eric Sprott and other employees of SAM sold their own shares to the public, raising $200 million in proceeds. Those same shares sold to the public are worth approximately $43 million in the aggregate, or $2.15 per share as of December 2, 2015. Overall,Sprott Inc. has lost approximately $1.2 billion or 79% of its total market capitalization since its IPO in 2008.

Shares of Sprott Inc. have also persistently underperformed the S&P/TSX Composite Index since its IPO in 2008, with a cumulativeunderperformance of nearly 81% to date on a total returns basis, assuming all dividends are reinvested.

1 Period shown from May 15, 2008 to current, as of December 2, 2015.

2 Figures shown on a total returns basis, assuming all dividends are reinvested.

(Source: Bloomberg Financial Markets and public disclosure)

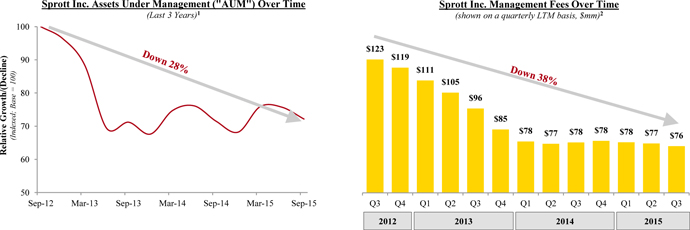

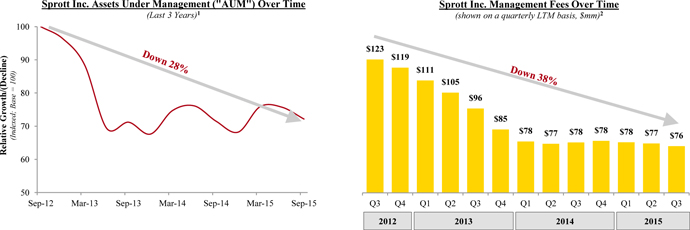

Not surprisingly, Sprott’s overall assets under management have declined by approximately 28% over the last three years (while at the same time global markets have reached record highs) and their fee income is down 38% over the same period8.Sprott’s interest in GoldTrust has nothing to do with benefiting GoldTrust’s Unitholders –the Sprott Offer appears to be nothing more than a desperate attempt to offset significant declines in their asset base and fee income over the past three years at the expense of Unitholders.

8 Based on a comparison of "Assets Under Management" as reported by Sprott Inc. as of September 30, 2015 and 2012.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

1 Based on quarterly data as reported by Sprott Inc.

2 "Quarterly LTM" refers to the last twelve months preceding each quarter-end.

(Source: Sprott Inc. filings)

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

| The Choice is Clear for GoldTrust Unitholders |

| | ETF

Conversion | Sprott

Offer |

| Elimination of material discounts to NAV | ü | û |

| Greater liquidity for Unitholders | ü | û |

| Continued low administration fees | ü | û |

| Industry-leading bullion security and safeguards | ü | û |

| Enhanced ability to grow assets | ü | û |

| Improved marketing at no additional cost | ü | û |

| Stewardship by experienced leaders in ETF management and marketing and best-in-class bullion investment administration | ü | û |

Use the WHITE Proxy to Vote FOR the ETF CONVERSION WITHDRAW your Units if Tendered to Sprott’s Inadequate Offer to Revoke your Power of Attorney |

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

QUESTIONS AND ANSWERS

When and where will the Meeting take place?

The special meeting of the holders of Units of GoldTrust (the "Meeting") will be held at 10:00 a.m. (Toronto time) on January 26, 2016, at the offices of Bennett Jones LLP, 3400 One First Canadian Place, Toronto, Ontario M5X 1A4.

What am I being asked to vote on?

The Meeting is being held:

| 1) | To consider and, if thought fit, to pass a special resolution approving the ETF Conversion (as defined in the accompanying Management Information Circular of GoldTrust (the "Circular")); and |

| 2) | To transact such other related business as may be properly brought before the Meeting or any adjournment or adjournments thereof. |

What does the Board recommend?

GoldTrust's Board of Trustees (the "Board of Trustees", "Board" or "Trustees") recommends that Unitholders use the enclosedWHITE proxy form to voteFOR THE ETF CONVERSION.

| Anticipated Benefits of the Proposed ETF Conversion |

Ø Expected elimination of material trading discounts to NAV; Ø Significantly enhanced liquidity available immediately following Unitholder approval through enhanced redemption features; Ø Maintains GoldTrust’s existing low administration fees, which are 43% lower than those of Sprott PHYS9; Ø Retains GoldTrust’s industry-leading bullion security and safeguards, which are superior to those of Sprott PHYS; Ø Enhanced ability to grow assets in all market conditions; Ø Creates the only dual-listed (Canada and U.S.) physical gold bullion ETF; Ø Significantly improves marketing capability at no additional cost to Unitholders; Ø No expected material adverse tax effect on GoldTrust or its Unitholders and will preserve GoldTrust’s tax efficient structure; and Ø Provides stewardship by highly experienced leaders in ETF management and marketing and bullion investment administration. |

9 The expense ratio is calculated based on the administrative/management fees incurred over the twelve-months ended September 30, 2015, divided by the average end-of-month NAV for the same entity over the same period. This yields an expense ratio of 0.35% for Sprott Physical Gold Trust and 0.20% for GoldTrust. Administration/management fees are sourced from the respective financial statements of Sprott Physical Gold Trust and GoldTrust and historical monthly NAV data is sourced from Bloomberg.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

What if I have already tendered my GoldTrust Units to the Sprott Offer?

Unitholders who have tendered their Units to the unsolicited take-over bid for all of the issued and outstanding Units of GoldTrust commenced by Sprott Asset Management Gold Bid LP, an affiliate of Sprott Asset Management LP and Sprott Inc. (collectively, "Sprott") (the "Sprott Offer") shouldimmediately withdraw their Units from the Sprott Offer and in doing so, revoke their power of attorney granted in favour of Sprott in connection with the Sprott Offer. Unitholders that have already tendered their Units to the Sprott Offer can withdraw their Units by contacting their broker, financial advisor or intermediary, or by calling D.F. King, North America Toll-Free at 1-800-251-7519; or via email at inquiries@dfking.com.

GoldTrust Unitholders who have tendered (and not subsequently withdrawn) their Units to the Sprott Offer and wish to vote in favour of the ETF Conversion as a superior alternative to the Sprott Offer can do so by executing a later-datedWHITE proxy form.

What other powers does theWHITE form of proxy confer on the proxyholder?

While Unitholders who have tendered their Units to the Sprott Offer shouldimmediately withdraw their Units from the Sprott Offer and in doing so, revoke their power of attorney granted in favour of Sprott in connection with the Sprott Offer, the form of proxy also provides that by executing theWHITE proxy, the Unitholder (A) revokes, with respect to all of the Units represented by theWHITEproxy, all prior proxies, powers of attorney and other authorizations (including, without limitation, all appointments of any agent, attorney or attorney-in-fact) or consents given by the Unitholder with respect to the Units (including, without limitation, any proxies, powers of attorney and other authorizations granted in respect of such Units by tendering such Units to the Sprott Offer) without any further act by the Unitholder, the proxyholder set forth in theWHITE proxy or any other person (and, for greater certainty, regardless of whether or not such Units are withdrawn from the Sprott Offer), and (B) approves, and constitutes, appoints and authorizes the proxyholder set forth in theWHITE proxy and any other person designated by such proxyholder, as the true and lawful agent, attorney and attorney-in-fact of the holder of the Units with respect to all of the Units represented by theWHITE proxy, with full power of substitution (such power of attorney, being coupled with an interest), to forthwith to execute such notices of withdrawal in respect of Units represented by theWHITE proxy that have been tendered to the Sprott Offer), and to execute and deliver all such other instruments and documents and take all such steps, in the name of and for and on behalf of the Unitholder, as in the discretion of the proxyholder are necessary to give effect such withdrawal and theWHITE proxy.

Who is eligible to vote at the Meeting?

Unitholders as of close of business on December 4, 2015,being the record date, are eligible to vote at the Meeting.

When is the proxy cut off?

In order for your vote to be counted at the Meeting, your completed enclosedWHITE proxy form must be received not later than 10:00 a.m. (Toronto time) on Friday, January 22, 2016 or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays), prior to the time of the adjournment or postponement. The time limit for deposit of proxies may be waived prior to or at the cut-off time by the Chair of the Meeting at his discretion without notice. If you require assistance voting your proxy, please contact D.F. King toll free at 1-800-251-7519 or by email atinquiries@dfking.com.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

What if I can't attend the Meeting in person?

If you cannot attend the Meeting in person please ensure that the enclosedWHITE proxy form is properly completed and received by GoldTrust's transfer agent, CST Trust Company ("CST"), by 10:00 a.m. (Toronto time) on Friday, January 22, 2016 or no later than 10:00 a.m. (Toronto time) on the date (excluding Saturdays, Sundays and statutory holidays) that is 48 hours preceding the date of an adjourned or postponed Meeting to ensure that as many Unitholders are represented and as many eligible votes as possible are counted at the Meeting. The enclosedWHITE proxy form includes instructions as to how you may vote by mail or fax. The Chair of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

Who is soliciting my proxy?

The Trustees and senior executive officers of GoldTrust are soliciting theWHITE proxy for use at the Meeting. In connection with this solicitation, the Trustees and senior executive officers of GoldTrust have provided the accompanying Circular.

How will the solicitation be made?

The solicitation will be made primarily by mail. In addition to the solicitation of proxies by mail, senior executive officers and Trustees of GoldTrust may solicit proxies personally by telephone or other electronic means but will not receive additional compensation for doing so. GoldTrust has also retained D.F. King & Co., Inc. ("D.F. King") to provide coordination of mailing and tabulation of Unitholder proxies in connection with the Meeting and related matters. GoldTrust may also reimburse brokers or other persons holding Units in nominee names or in the name of the Intermediaries (as defined below) for costs incurred in sending proxy materials to their principals or beneficial holders in order to obtain their proxies or voting instructions.

GoldTrust does not intend to pay intermediaries to forward the meeting materials to objecting beneficial holders. Objecting beneficial holders will not receive the meeting materials unless the objecting beneficial holder's intermediary assumes the cost of delivery.

Other than compensation payable to D.F. King for its services in connection with the Meeting as described above, which is not expected to exceed $150,000, GoldTrust has not agreed to pay any fees or commission to any stockbroker, dealer or other person for soliciting proxies in connection with the ETF Conversion. However, GoldTrust may make arrangements with soliciting dealers, dealer managers or information agents (collectively, "Soliciting Dealers"), either within or outside of Canada for customary compensation for soliciting proxies in connection with the ETF Conversion if it considers it appropriate to do so. No fee or commission would be payable by a Unitholder who makes use of the services of a Soliciting Dealer to tender their proxies in connection with the ETF Conversion.

Unitholders who have any questions or require assistance voting your proxy, please contact D.F. King toll free at 1-800-251-7519 or by email atinquiries@dfking.com.

What documents have been sent to Unitholders?

In addition to the Letter to Unitholders, Notice of Meeting and the Circular, GoldTrust has sent Unitholders aWHITE proxy form or voting instruction form ("VIF"). Copies of these documents (other than the VIF) are available under GoldTrust's profile atwww.sedar.com and on GoldTrust's website at www.gold-trust.com or www.goldtrust.ca.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

How do I submit my completedWHITE proxy form?

In order to be valid and acted upon at the Meeting, your completedWHITE proxy form must be received no later than 10:00 a.m. (Toronto time) on Friday, January 22, 2016 or no later than 10:00 a.m. (Toronto time) on the date (excluding Saturdays, Sundays and statutory holidays) that is 48 hours preceding the date of an adjourned or postponed Meeting. The Chair of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

How many Units are eligible to vote?

The number of Units outstanding at the close of business on December 4, 2015 (being the record date) (as set forth in the accompanying Notice of Meeting) will be equal to the number of eligible votes. As at the date of this Circular, GoldTrust has 19,299,000 Units outstanding.

What is the quorum for the Meeting?

A quorum for the transaction of business at the Meeting will consist of one person present in person, being a Unitholder entitled to vote thereat or a duly appointed proxy or proxyholder for an absent Unitholder so entitled, holding or representing in the aggregate not less than 10% of the Units holding voting rights at the Meeting.

Are there any Unitholders who hold 10% or more of the Units?

To the knowledge of the Board or the senior executive officers of GoldTrust, no one person or company beneficially owns, directly or indirectly, or exercises control or direction over Units carrying ten per cent (10%) or more of the voting rights attached to all Units of GoldTrust.

Who will count the votes?

Votes will be tabulated by CST, GoldTrust's transfer agent.

How do I vote?

If you held Units at the close of business on Friday, December 4, 2015, you are eligible to vote your Units in respect of the matters to be acted on (as noted in the accompanying Notice of Meeting) at the Meeting.

Each Unit is entitled to one vote.

If your Units are held in the name of an intermediary (being a bank, securities dealer or broker and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans) (an "Intermediary"), please see the instructions under the heading "Voting Instructions - Voting by Proxy - Beneficial Owners" in the accompanying Circular.

How do I determine what type of Unitholder I am?

There are several steps you must take in order to vote your Units at the Meeting. For the purpose of voting at the Meeting, you must first determine what type of Unitholder you are: a registered Unitholder or a beneficial (non-registered) Unitholder.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

Registered Unitholder. You are a "Registered Unitholder" if your Units are held in your personal name and you are in possession of a Unit certificate that indicates the same.

Beneficial (Non-registered) Unitholder. A majority of Unitholders are non-registered. You are a "Beneficial (Non-registered) Unitholder" if your Units are:

| · | deposited with a bank, a trust, a brokerage firm or other type of institution, and such Units have been transferred out of your name; or |

| · | held either (a) in the name of the Intermediary that the Unitholder deals with (being securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS & Co. Inc.) with which your Intermediary deals. |

Follow the steps in the appropriate category below once you have determined your Unitholder type.

How can a Beneficial (Non-Registered) Unitholder vote?

If you are a Beneficial (Non-registered) Unitholder, you may vote in person, by proxy or online only by following the procedures outlined below.

To Vote by Proxy:

Generally, you will either:

| (a) | be given a proxy supplied to you by your Intermediary that is similar to theWHITE proxy form provided to Registered Unitholders. However, its purpose is limited to instructing your Intermediary on how to vote on your behalf. You should carefully follow the instructions provided to you by your Intermediary for voting your Units; or |

| (b) | be given a Voting Instruction Form (VIF). Intermediaries now frequently delegate responsibility for obtaining proxy instructions from clients to Broadridge Investor Communications Financial Solutions Inc. ("Broadridge") in Canada and in the United States. Broadridge mails a VIF in lieu of a proxy provided by GoldTrust. The VIF will name the same persons as the Corporation'sWHITE proxy form to represent you at the Meeting. You have the right to appoint a person (who need not be a Unitholder), other than the persons designated in the VIF, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the VIF. The completed VIF must then be returned to Broadridge by mail or facsimile, or over the internet, in accordance with Broadridge's instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Units to be represented at the Meeting. If you receive a VIF from Broadridge, you cannot use it to vote Units directly at the meeting — the VIF must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the Units voted. |

Canadian Beneficial Unitholders

To Vote Online: visitwww.proxyvote.com and enter your 16-digit control number.

To Vote by Telephone: Call 1-800-474-7493 and provide your 16 digit control number located on the enclosedWHITE proxy.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

United States Beneficial Unitholders

To Vote Online: visitwww.proxyvote.com and enter your 16-digit control number.

To Vote by Telephone: Call 1-800-454-8683 and provide your 16 digit control number located on the enclosedWHITE proxy.

To Vote in Person:

If you are able to join us in person for the Meeting and wish to vote your Units in person, you may do so by either (i) inserting your own name in the space provided on the enclosed Voter Instruction Form (VIF) or form of proxy provided by your Intermediary; or (ii) submitting any other document in writing to your Intermediary that requests that the Beneficial (Non-registered) Unitholder or nominees thereof should be appointed as proxy. Then, follow the signing and return instructions provided by your Intermediary. If you do not properly follow the return instructions provided by your Intermediary, you may not be able to vote such Units. Before the official start of the Meeting on January 26, 2016, please register with the representatives(s) from CST, which will be acting as scrutineer at the Meeting, and who will be situated at a welcome table just outside the Meeting room. Once you are registered with CST, and, provided the instructions you provided to your Intermediary have been forwarded by your Intermediary to CST, your vote will be requested and counted at the Meeting.

GoldTrust may utilize Broadridge's QuickVote system, which involves non-objecting beneficial owners being contacted by D.F. King, which is soliciting proxies on behalf of senior executive officers and Trustees of GoldTrust, to obtain voting instructions over the telephone and relay them to Broadridge (on behalf of the Unitholder's intermediary). While representatives of D.F. King are soliciting proxies on behalf of senior executive officers and Trustees of GoldTrust, which is recommending that Unitholders vote in favour of the ETF Conversion, Unitholders are not required to vote in the manner recommended by the Trustees. The QuickVote system is intended to assist Unitholders in placing their votes; however, there is no obligation for any Unitholder to vote using the QuickVote system, and Unitholders may vote (or change or revoke their votes) at any other time and in any other applicable manner described in the accompanying Circular. Any voting instructions provided by a Unitholder will be recorded and such Unitholder will receive a letter from Broadridge (on behalf of the Unitholders intermediary) as confirmation that his/her/its voting instructions have been accepted.

Unitholders who have any questions or require assistance voting yourWHITE proxy, please contact D.F. King toll free at 1-800-251-7519 or by email atinquiries@dfking.com.

How can a Registered Unitholder Vote?

If you are a Registered Unitholder, you may vote in person, by proxy or by fax. Please see the enclosedWHITE proxy for details on protocol.

To Vote by Proxy

Proxies must be received no later than 10:00 a.m. (Toronto time) on Friday, January 22, 2016, or, if the Meeting is adjourned or postponed, no later than 10:00 a.m. (Toronto time) on the date (excluding Saturdays, Sundays and statutory holidays) that is 48 hours preceding the date of the adjourned or postponed Meeting. The Chair of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

Please note that your vote can only be counted if the person you appointed attends the Meeting and votes on your behalf and the enclosedWHITE proxy has been properly completed and executed.

To Vote in Person

If you are able to join us in person for the Meeting, and wish to vote your Units in person, you are still encouraged to complete and return the enclosedWHITE proxy in accordance with the instructions above.

Before the official start of the Meeting on January 26, 2016, please register with the representatives(s) from CST, which will be acting as scrutineer at the Meeting, who will be situated at a welcome table just outside the room in which the Meeting will be held. Once you are registered with the scrutineer, your proxy will be nullified and your vote will be requested and counted at the Meeting.

Unitholders who have any questions or require assistance voting yourWHITE proxy, please contact D.F. King toll free at 1-800-251-7519 or by email atinquiries@dfking.com.

How do I appoint someone else to vote for me?

If you are unable to attend the Meeting in person, or if you wish to appoint a representative to vote on your behalf,you have the right to appoint a person or company other than the person designated in the enclosedWHITE proxy, who may or may not be a Unitholder, to represent you at the Meeting and vote on your behalf. You do this by appointing them as your proxyholder as described below.

Use theWHITE proxy or another proper form of proxy. The persons named in the accompanyingWHITE proxy form are Trustees of GoldTrust. You can choose to have GoldTrust's appointee vote your Units or you may appoint a person of your choice by striking out the printed names and inserting the desired person's name and address in the blank space provided. You must then complete the balance of theWHITE proxy form, sign it and return it to CST in the manner specified in the enclosedWHITE proxy form. Please note that your vote can only be counted if the person you appointed attends the Meeting and votes on your behalf and the enclosedWHITE proxy form has been properly completed and executed.

You may not vote both by proxy and in person. If you have voted by proxy, you will not be able to vote your Units in person at the Meeting, unless you revoke your proxy. Following completion of the enclosedWHITE proxy form, return the completedWHITE proxy form in the manner and in accordance with requirements specified thereon. The Chair of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

How will myWHITE proxy form be voted?

On any ballot that may be called for, Units represented by proxies which are hereby solicited (if properly executed and deposited) will be voted for or against the ETF Conversion in accordance with the instructions of the Unitholder.

If either Bruce D. Heagle or John S. Elder, Q.C., GoldTrust's nominees as indicated on theWHITEproxy, are appointed as your proxyholder, and you do not specify how you wish your Units to be voted, your Units will be votedFOR THE ETF CONVERSION.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

What if I want to revoke my proxy?

If you have submitted a proxy and later wish to revoke it, you may do so by re-voting your proxy by fax or by completing and signing a new proxy form bearing a later date and sending it to CST. Your vote must be receivedno later than 10:00 a.m. (Toronto time)on Friday, January 22, 2016 or, if the Meeting is adjourned or postponed, no later than 10:00 a.m. (Toronto time) on the date (excluding Saturdays, Sundays and statutory holidays) that is 48 hours preceding the date of the adjourned or postponed Meeting. A later dated proxy form automatically revokes any previously submitted proxy. You may also send a written statement indicating you wish to have your proxy revoked. This written statement must be received (i) by CST, Attention: Proxy Department, 320 Bay Street, 3rd Floor, Toronto, Ontario, M5H 4A6, at any time up to 5:00 p.m. (Toronto time) on the last business day preceding the day of the Meeting, or any adjournment or postponement thereof, at which the proxy is to be used; (ii) by the Chair of the Meeting before the Meeting starts on the day of the Meeting or any adjournment or postponement thereof; or (iii) in any other manner permitted by law.

If you are a Beneficial (Non-registered) Unitholder, please contact your Intermediary for directions on how to revoke your voting instructions.

What will happen to my Units if the ETF Conversion is completed?

If the ETF Conversion is completed, you will retain your Units subject to certain changes in rights attaching to such Units pursuant to the anticipated amendments to the Amended and Restated Declaration of Trust dated April 24, 2008 of GoldTrust as described in further detail in the accompanying Circular.

The ETF Conversion should eliminate any material future discounts to net asset value ("NAV") and provide Unitholders with significantly enhanced liquidity, consistent with other gold bullion ETFs. At the same time, Unitholders will continue to benefit from GoldTrust’s low administration fees, industry-leading bullion security and safeguards and Canadian domiciled, tax-efficient structure. GoldTrust will continue to own the physical gold bullion it now owns and there will be noimmediate change to its holdings, subject to redemptions as further described in the accompanying Circular.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

If you have any questions or require any assistance in executing your proxy, please call D.F. King Canada at:

North American Toll Free Phone:

1-800-251-7519

Outside North America, Banks, Brokers and Collect Calls: 1-201-806-7301

Email:inquiries@dfking.com

North American Toll Free Facsimile: 1-888-509-5907

Facsimile: 1-647-351-3176

For up to date information and ease of voting we strongly encourage Unitholders to please visitwww.gold-trust.com or www.goldtrust.ca

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

CENTRAL GOLDTRUST

NOTICE OF SPECIAL MEETING OF UNITHOLDERS

NOTICE IS HEREBY GIVEN that a special meeting (the "Meeting") of the holders of units ("Units") of Central GoldTrust (hereinafter called "GoldTrust") will be held at 10:00 a.m. (Toronto time) on January 26, 2016, at the offices of Bennett Jones LLP, 3400 One First Canadian Place, Toronto, Ontario M5X 1A4 for the following purposes:

Business of the Meeting

At the Meeting, Unitholders will be asked:

| (1) | To consider and, if thought fit, to adopt a special resolution substantially in the form attached to the accompanying Management Information Circular of GoldTrust ("Circular") as Appendix "A", (i) authorizing the conversion (the "ETF Conversion") of GoldTrust from a closed-end fund into an exchange-traded physical gold bullion fund, including all amendments to the Amended and Restated Declaration of Trust dated April 24, 2008 of GoldTrust ("Declaration of Trust") considered necessary or desirable to facilitate the ETF Conversion (including certain proposed amendments to the redemption rights provisions of the Declaration of Trust), and (ii) authorizing the proposed amendments to the Administrative Services Agreement contemplated by the Definitive Agreement dated November 26, 2015 between, among others, GoldTrust, Central Gold Managers Inc. (the "Administrator") and Purpose Investments Inc., all as further described in the accompanying Circular; and |

| (2) | To transact such other related business as may be properly brought before the Meeting or any adjournment or adjournments thereof. |

The accompanying Circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this Notice of Special Meeting.

The Board of Trustees has fixed December 4, 2015as the record date for the Meeting (the "Record Date"). Only holders of Units ("Unitholders") of record at the close of business on the Record Date are entitled to vote at the Meeting or any adjournment or postponement thereof.

Your vote is important regardless of the number of Units you own. Please vote today using only the enclosedWHITE proxy form.

Any registered holder of Units who is unable to be present at this Meeting is requested to complete, date, sign and return the enclosedWHITE proxy form for delivery no later than 10:00 a.m. (Toronto time) on Friday, January 22, 2016, or in the case of an adjournment or postponement, no later than 48 hours (excluding Saturdays, Sundays and holidays) before any reconvened Meeting.

Unitholders who have tendered their Units to the unsolicited take-over bid for all of the issued and outstanding Units by Sprott Asset Management Gold Bid LP, an affiliate of Sprott Asset Management LP and Sprott Inc. ("Sprott") ("Sprott Offer"), should immediately withdraw their Units from the Sprott Offer and in doing so, revoke their power of attorney granted in favour of Sprott in connection with the Sprott Offer. Unitholders that have already tendered their Units to the Sprott Offer can withdraw their Units by contacting their broker, financial advisor or intermediary, or by calling D.F. King, North America Toll-Free at 1-800-251-7519; or via email at inquiries@dfking.com. GoldTrust Unitholders who have tendered (and not subsequently withdrawn) their Units to the Sprott Offer and wish to vote in favour of the ETF Conversion as a superior alternative to the Sprott Offer can do so by executing a later-dated WHITE proxy form.

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

Beneficial (non-registered) Unitholders should follow the instructions on the voting instruction form or other form of proxy provided by their intermediaries with respect to the procedures to be followed for voting. Beneficial (non-registered) Unitholders should refer to the information provided under the heading "How can a Beneficial (Non-registered) Unitholder vote?" in the Question and Answer section accompanying the enclosed Circular of GoldTrust for further details.

DATED this 4th day of December, 2015.

| BY ORDER OF THE BOARD OF TRUSTEES OF CENTRAL GOLDTRUST |

| | |

| |  |

| | John S. Elder, Q.C. |

| | Secretary |

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

MANAGEMENT INFORMATION CIRCULAR

The information contained in this Management Information Circular (together with the accompanying materials, the "Circular") is given as of December 4, 2015, except as otherwise noted.

The information contained in this Circular is furnished in connection with the solicitation of proxies on behalf of the senior executive officers and trustees of Central GoldTrust ("GoldTrust") for use at the special meeting of holders ("Unitholders") of trust units ("Units") of GoldTrust to be held at 10:00 a.m. (Toronto time) on Tuesday, January 26, 2016 at the Toronto offices of Bennett Jones LLP and at any adjournments or postponement thereof (the "Meeting"), which Meeting has been called for the purposes set forth in the accompanying Notice of Meeting.

References to currencies or "$" herein refer to Canadian dollars unless otherwise specified.

SOLICITATION OF PROXIES

TheWHITE proxy form accompanying this Circular is solicited on behalf of GoldTrust. Solicitation of proxies will be by mail but proxies may also be solicited personally or by telephone by senior executive officers or members of the Board of Trustees (the "Board of Trustees", "Board" or the "Trustees") of GoldTrust at nominal cost. In addition, GoldTrust has retained D.F. King & Co., Inc., 320 Bay Street, PO Box 10, Toronto, Ontario M5H 4A6 ("D.F. King") to solicit proxies at an anticipated cost of approximately $150,000.

GoldTrust may make arrangements with soliciting dealers, dealer managers or information agents (collectively, "Soliciting Dealers"), either within or outside of Canada for customary compensation for soliciting proxies in connection with the ETF Conversion if it considers it appropriate to do so. No fee or commission would be payable by a Unitholder who makes use of the services of a Soliciting Dealer to tender their proxies in connection with the ETF Conversion.

All reasonable expenses in connection with such solicitations of proxies will be borne by GoldTrust.

DELIVERY OF PROXIES

Proxies to be used at the Meeting must be deposited with GoldTrust or with GoldTrust's transfer agent CST Trust Company ("CST") at 320 Bay Street, Basement Level (B1 Level), Toronto, Ontario M5H 4A6 no later than 10:00 a.m. (Toronto time) on Friday, January 22, 2016, or in the case of an adjournment or postponement, no later than 48 hours (excluding Saturdays, Sundays and statutory holidays) before any reconvened Meeting. The time limit for the deposit of proxies may be waived by the Chair of the Meeting at his or her discretion.

If you have questions about the information contained in this Circular or require assistance registering your vote, please contact D.F. King at 1-800-311-8393 (toll free in North America) or 1-201-806-7301 (outside of North America) or email at inquiries@dfking.com.

documents incorporated by reference

Information regarding GoldTrust has been incorporated by reference into this Circular from documents filed with securities commissions or similar authorities in Canada and the United States. The following documents filed with the various provincial securities commissions or similar authorities in Canada and the United States Securities and Exchange Commission ("SEC") are specifically incorporated into and form an integral part of this Circular:

The Choice is Clear - ETF Conversion is the Superior Alternative for ALL GoldTrust Unitholders

Use theWHITE PROXY FORM to VoteFOR the ETF CONVERSION

Questions or assistance, please call D.F. King toll-free at 1-800-251-7519

or visit www.gold-trust.com for further details

| · | the annual financial statements of GoldTrust for the year ended December 31, 2014; |

| · | the interim financial statements of GoldTrust for the three and nine months ended September 30, 2015; and |

| · | the annual information form of GoldTrust for the year ended December 31, 2014. |

Any statement contained herein or in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Circular to the extent that a statement contained herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Circular. Information on any website maintained by GoldTrust, Purpose or the Administrator does not constitute a part of this Circular. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Copies of the documents incorporated by reference are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Copies of these documents will be provided to Unitholders by GoldTrust free of charge upon request. See "Additional Information". In addition to the documents incorporated by reference set forth above, as soon as reasonably practicable following the mailing of this Circular, GoldTrust will file a continuous offering preliminary long form prospectus for Units of the ETF and a registration statement for Units of the ETF in the United States which may be accessed by Unitholders of GoldTrust at www.sedar.com and www.sec.gov, respectively.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION