Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

BLK similar filings

- 4 Apr 12 Entry into a Material Definitive Agreement

- 27 Feb 12 Amendments to Articles of Incorporation or Bylaws

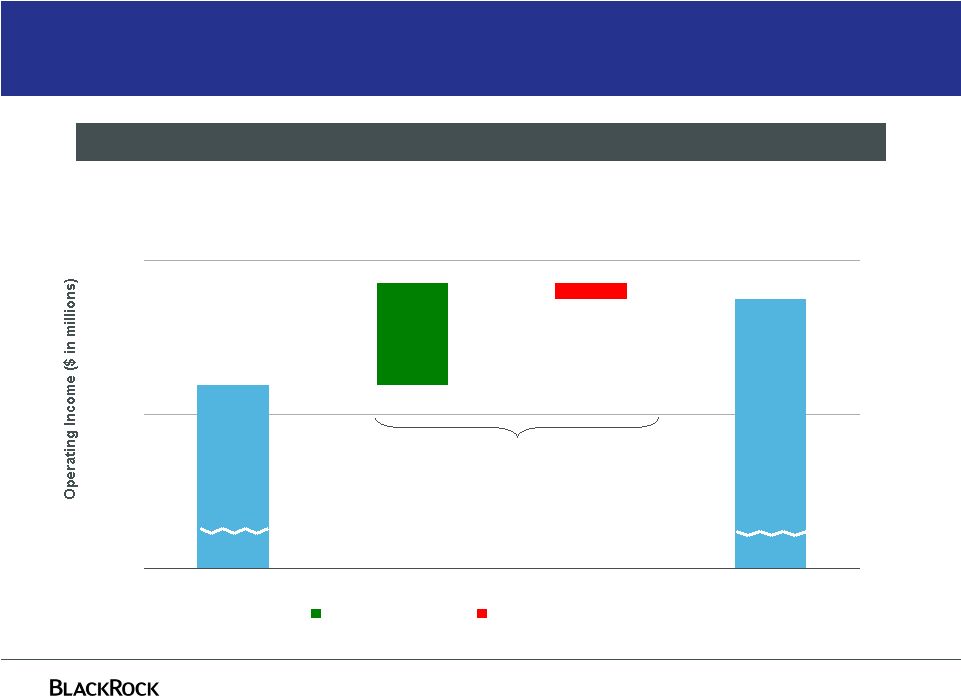

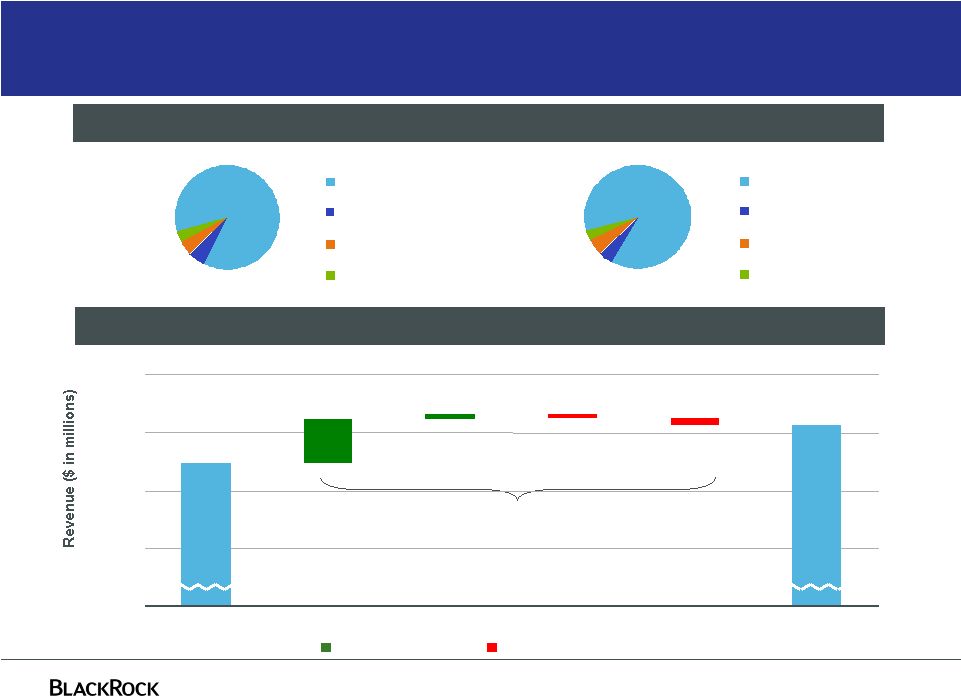

- 19 Jan 12 Operating Margin of 36.3% (40.0% as adjusted) for Fourth Quarter 2011

- 19 Oct 11 Operating Margin of 34.9% (40.1% as adjusted) for Third Quarter 2011

- 29 Sep 11 Declares Dividend on Common Stock of $1.375

- 16 Sep 11 Unregistered Sales of Equity Securities

- 20 Jul 11 Results of Operations and Financial Condition

Filing view

External links