- BLK Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BlackRock (BLK) DEF 14ADefinitive proxy

Filed: 4 Apr 24, 4:24pm

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Generating Long-Term

Shareholder Value

BlackRock, Inc. (“BlackRock” or the “Company”) is a global asset manager with approximately 19,800 employees in more than 30 countries as of December 31, 2023. BlackRock’s focus remains on delivering the best investment solutions for each and every client – in-line with their objectives and goals – and our diverse platform provides our clients with more choices to address their unique priorities.

BlackRock’s diversified platform of active, index and cash management investment strategies across asset classes enables us to offer choice and asset allocation solutions for clients. Our investment platform is supported by our technology and risk management system, Aladdin®, and we offer technology services to a broad base of institutional and wealth management clients. Our diversification and whole portfolio approach help us build deeper and broader relationships with more clients across market environments.

We have continuously invested in our business to build the industry’s most comprehensive and integrated investment and technology platform, and we believe the stability of our platform drives strong, long-term performance, which enhances BlackRock’s ability to:

| Generate | Leverage our scale | Return capital to | ||||||

| differentiated | for the benefit of our | shareholders on | ||||||

| organic growth | stakeholders | a consistent and | ||||||

predictable basis | ||||||||

Over the long term, we have demonstrated our ability to generate organic growth and execute with scale. We have prioritized investment in our business to first drive growth and then return excess cash flow to shareholders. Our capital return strategy has been balanced between dividends, where we target a 40-50% payout ratio, and a consistent share repurchase program.

Our framework for generating long-term shareholder value was developed in close collaboration with our Board of Directors (the “Board”), and the Board actively oversees our broader strategy and our ability to successfully execute it.

Since our founding, BlackRock has led by listening to our clients and evolving to help them achieve long-term outcomes. This approach has been central to delivering differentiated growth for shareholders. In January, we announced two transformational moves we believe will accelerate future growth: the strategic re-architecture of our organization and our planned acquisition of Global Infrastructure Partners (“GIP”). As part of the re-architecture, we created a new strategic Global Product Solutions group which will work to deliver our clients solutions across all our investment strategies, asset classes and fund structures while embedding our ETF and index expertise across the firm. We also introduced a new international business structure to drive scale, provide unified leadership and allow us to be simultaneously more global and more local in international markets.

Through the planned combination of BlackRock’s infrastructure platform and GIP, we aim to connect our clients with long-term investment opportunities, while also accelerating growth, diversifying revenue and generating earnings for our shareholders.

BlackRock’s strategy, which has always been guided by our clients’ needs, remains centered on growing Aladdin, ETFs and private markets, keeping alpha at the heart of BlackRock; leading in sustainable investing; and advising clients on their whole portfolio.

In 2024, we will continue to focus on the long term and strategically and efficiently invest in BlackRock to deliver growth to benefit our stakeholders. Looking ahead, we have deep conviction in our strategy and ability to execute with scale and expense discipline.

| BlackRock, Inc. 50 Hudson Yards New York, New York, 10001 |

April 4, 2024

To Our Shareholders:

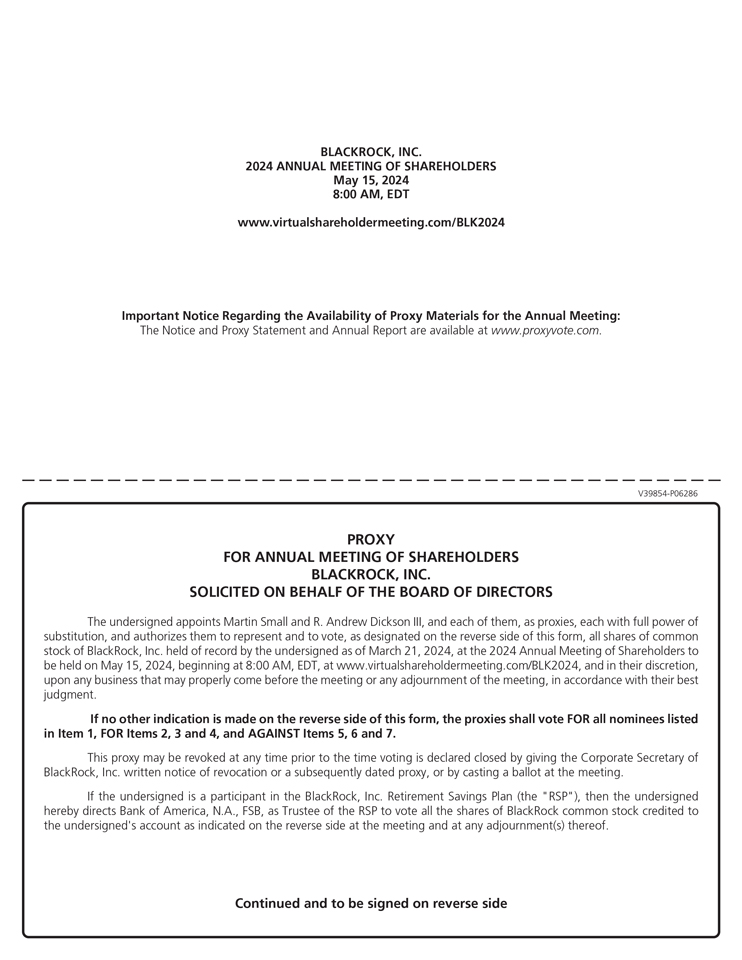

Just as BlackRock is a fiduciary to our clients, helping them invest for the future, I recognize many of you are investing in BlackRock to achieve your own investment goals, and I want to thank you for your continued support and confidence in our company.

We welcome you to join us virtually on May 15, 2024, at 8:00 a.m. EDT for BlackRock’s Annual Meeting of Shareholders at www.virtualshareholdermeeting.com/BLK2024. You may vote your shares via the Internet and submit questions before and during the meeting. As we do each year, we will address the voting items in this year’s Proxy Statement and take your questions. Regardless of whether you plan to join the meeting, your vote is important, and we encourage you to review the enclosed materials and submit your proxy.

Clients have always been at the center of BlackRock’s growth strategy, and we are more connected with our clients than ever. Thousands of clients on behalf of millions of individuals around the world have entrusted BlackRock with over $1.9 trillion in net new business over the last five years. Thousands more use our technology to support the growth and commercial agility of their own businesses. Years of organic growth, alongside the long-term growth of the capital markets, underpins our $10 trillion of client assets as of December 31, 2023, which grew by over $1.4 trillion last year.

In 2023, our steadfast commitment to serving our clients resulted in $289 billion of net inflows and 1% organic base fee growth, even as most of the industry experienced sustained outflows. And across the cycle, we have delivered consistent growth – achieving our 5% organic base fee growth target on average over the last five years.

2023 net inflows were positive across each of our three regions, led by $156 billion of net inflows from clients in the United States. iShares net inflows of $186 billion led the ETF industry, and institutional net inflows of $32 billion reflected ongoing demand for whole-portfolio solutions and significant outsourcing mandates. Our private markets platform continued to scale and generated $14 billion of net inflows, led by infrastructure and private credit. We also generated technology services revenue of $1.5 billion. Clients are looking to grow and expand with Aladdin, as reflected by over 50% of Aladdin sales being multi-product.

BlackRock’s industry leadership comes from delivering sustained performance, innovating, and staying ahead of the needs of our clients. In January, we announced two transformational changes in anticipation of the evolution we see ahead for asset management and the capital markets. The strategic re-architecture of our organization will simplify and improve how we work and deliver for clients. And we expect our acquisition of Global Infrastructure Partners will enable us to propel our success in the fast-growing market for hard-asset infrastructure. We believe this ambitious transformation of our firm positions us better than ever. Our clients, shareholders and employees will be its biggest beneficiaries.

As we look ahead, the re-risking of client portfolios creates strong prospects for both our public and private markets franchises. We will continue to prioritize investments to drive differentiated organic growth and operating leverage. After investing for future growth, we remain committed to systematically returning excess cash to shareholders, and expect to achieve this through a combination of dividends and share repurchases. In 2023, we returned $4.5 billion to shareholders, including $1.5 billion of share repurchases.

| Thousands of clients on behalf of millions of individuals around the world have entrusted BlackRock with over $1.9 trillion in net new business over the last five years. Thousands more use our technology to support the growth and commercial agility of their own businesses. Years of organic growth, alongside the long-term growth of the capital markets, underpins our $10 trillion of client assets as of December 31, 2023, which grew by over $1.4 trillion last year. | |

Our diverse and engaged Board of Directors is central to our success. Our directors bring a wide breadth of experience and backgrounds as advisors to our operations, strategy and management. It has always been important that our Board functions as a key strategic governing body that both challenges and advises our leadership team and guides BlackRock into the future. It is also critical that we have a robust corporate governance framework to ensure we are executing on our strategy, fulfilling our fiduciary responsibilities to clients, and serving all of our stakeholders over the long term.

When we founded BlackRock, it was with deep conviction in the long-term growth of the capital markets, and the importance of being invested in them. Since then, BlackRock has continuously innovated to make investing easier and more accessible, with the purpose of helping more and more people experience financial well-being. Our clients’ needs remain our compass, and I see greater opportunities ahead for BlackRock, our clients and our shareholders than ever before.

Thank you again for your continued commitment to BlackRock.

| Sincerely,

Laurence D. Fink Chairman and Chief Executive Officer |

| BLACKROCK, INC. 2024 PROXY STATEMENT |

Notice of 2024

Annual Meeting of

Shareholders

Annual Meeting of Shareholders

|

|

| ||||||||||||

| Date & Time |

| Location |

| Record Date | |||||||||

Wednesday, May 15, 2024 |

www.virtualshareholdermeeting.com/ |

Thursday, March 21, 2024 | ||||||||||||

| 8:00 a.m. EDT | BLK2024 | |||||||||||||

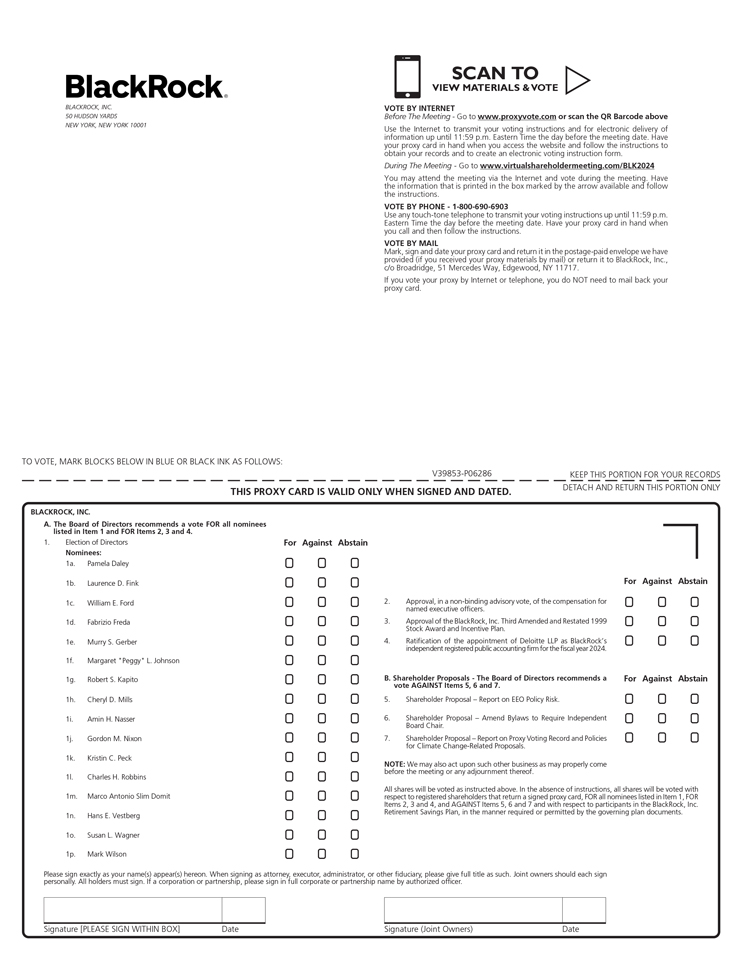

Voting Matters

At or before the 2024 Annual Meeting of Shareholders (“Annual Meeting”), we ask that you vote on the following items:

Proposal | Board Recommendation | Page Reference | ||||||

Item 1 Election of Directors |  | Vote FOR each director nominee | 11 | |||||

Item 2 Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers |  | Vote FOR | 52 | |||||

Item 3 Approval of the BlackRock, Inc. Third Amended and Restated 1999 Stock Award and Incentive Plan |  | Vote FOR | 100 | |||||

Item 4 Ratification of the Appointment of the Independent Registered Public Accounting Firm |  | Vote FOR | 107 | |||||

Item 5 Shareholder Proposal – Report on EEO Policy Risk |  | Vote AGAINST | 110 | |||||

Item 6 Shareholder Proposal – Amend Bylaws to Require Independent Board Chair |  | Vote AGAINST | 112 | |||||

Item 7 Shareholder Proposal – Report on Proxy Voting Record and Policies for |  | Vote AGAINST | 114 | |||||

BLACKROCK, INC. 2024 PROXY STATEMENT

Your vote is important — How to vote:

| ||||||||||||

Visit the website listed on your proxy card. You will need the control number that appears on your proxy card when you access the web page.

|

Complete and sign the proxy card and return it in the enclosed postage pre-paid envelope. | |||||||||||

If your shares are held in the name of a broker, bank or other nominee: follow the telephone voting instructions, if any, provided on your voting instruction card.

If your shares are registered in your name: call 1-800-690-6903 and follow the telephone voting instructions. You will need the control number that appears on your proxy card.

|

This year’s meeting will be virtual. For details on voting your shares during the Annual Meeting, see “Questions and Answers About the Annual Meeting and Voting.” | |||||||||||

Please note that we are furnishing proxy materials and access to our Proxy Statement to our shareholders via our website instead of mailing printed copies. This helps us save costs and reduce our impact on the environment.

Beginning on April 4, 2024, we will mail or otherwise make available to each of our shareholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy materials and vote online. If you attend the Annual Meeting virtually, you may withdraw your proxy and vote online during the Annual Meeting if you so choose.

Your vote is important, and we encourage you to vote promptly, whether or not you plan to attend the Annual Meeting.

| By Order of the Board of Directors, | ||||||

| ||||||

| R. Andrew Dickson III | BlackRock, Inc. | |||||

Corporate Secretary April 4, 2024 | 50 Hudson Yards New York, New York 10001 | |||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on Wednesday, May 15, 2024: our Proxy Statement and 2023 Annual Report are available free of charge on our website at https://ir.blackrock.com/.

| BLACKROCK, INC. 2024 PROXY STATEMENT |

[THIS PAGE INTENTIONALLY LEFT BLANK]

Contents

| Index of Frequently Requested Information | ||||||||

| BlackRock’s Impact

|

| 39

|

|

| |||

| Board and Committee Oversight of Cybersecurity

|

| 36

|

|

| |||

|

|

|

14

|

|

| |||

|

|

| 94

|

|

| |||

|

|

| 82

|

|

| |||

| Director Skills and Experience Matrix

| 15 |

| |||||

|

|

| 95

|

|

| |||

|

|

| 66

|

|

| |||

|

|

| 42

|

|

| |||

| Stock Ownership Guidelines for Directors

|

| 45

|

|

| |||

| Stock Ownership Guidelines for NEOs

|

| 81

|

|

| |||

|

|

| 38

|

|

| |||

BLACKROCK, INC. 2024 PROXY STATEMENT I

Helpful Resources

Where You Can Find

More Information

Annual Meeting

Proxy Statement:

https://ir.blackrock.com/financials/annual-reports-and-proxy

Annual Report:

https://ir.blackrock.com/financials/annual-reports-and-proxy

Voting Your Proxy via the Internet Before the

Annual Meeting:

www.proxyvote.com

Board of Directors

https://ir.blackrock.com/governance/board-of-directors

Communications with the Board

https://ir.blackrock.com/governance/governance-overview under the heading “Contact Our Board of Directors”

Governance Documents

https://ir.blackrock.com/governance/governance-overview

| • | Categorical Standards of Director Independence |

| • | Corporate Governance Guidelines |

| • | Committee Charters |

| • | Code of Business Conduct and Ethics |

| • | Code of Ethics for Chief Executive and Senior Financial Officers |

| • | Lead Independent Director Guidelines |

Investor Relations

https://ir.blackrock.com

Sustainability

www.blackrock.com/corporate/sustainability

Other

Public Policy “Insights”:

www.blackrock.com/corporate/insights/public-policy

Lobbying Disclosure Act:

https://lda.senate.gov/system/public/

Federal Election Commission:

www.fec.gov/data/reports/pac-party

Definition of Certain Terms

or Abbreviations

| AUM | Assets under Management | |

| CEO | Chief Executive Officer | |

| CFO | Chief Financial Officer | |

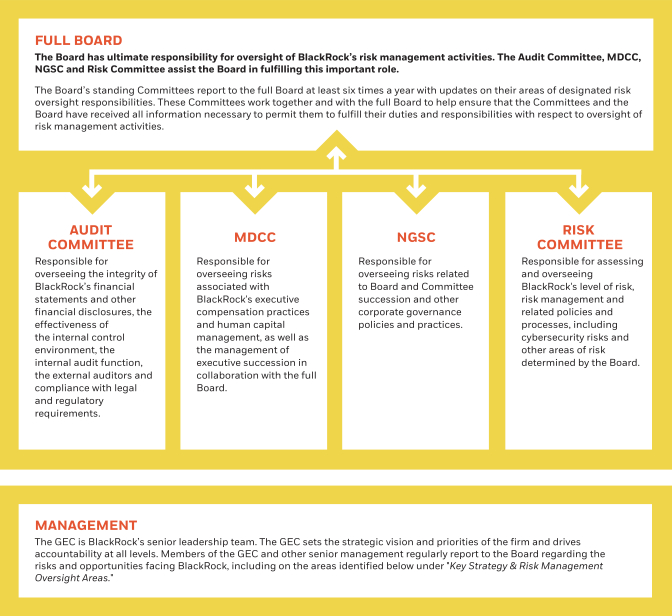

| Committees | The Audit; Management Development & Compensation; Nominating, Governance & Sustainability; Risk; and Executive Committees | |

| COO | Chief Operating Officer | |

| Deloitte | Deloitte & Touche LLP | |

| GAAP | Generally Accepted Accounting Principles in the United States | |

| GEC | Global Executive Committee | |

| MDCC | Management Development & Compensation Committee | |

| NEO | Named Executive Officer | |

| NGSC | Nominating, Governance & Sustainability Committee | |

| NTM | Next Twelve Months | |

| NYSE | New York Stock Exchange | |

| PAC | Political Action Committee | |

| RSU | Restricted Stock Unit | |

| SASB | Sustainability Accounting Standards Board | |

| SEC | Securities and Exchange Commission | |

| TCFD | Task Force for Climate-related Financial Disclosures | |

Traditional Peers | Traditional Peers refers to public company asset managers: Alliance Bernstein, Affiliated Managers Group, Franklin Resources, Invesco and T. Rowe Price | |

| II | BLACKROCK, INC. 2024 PROXY STATEMENT |

Proxy Summary

This summary provides an overview of selected information in this year’s Proxy Statement, which is first being sent or made available to shareholders on April 4, 2024. We encourage you to read the entire Proxy Statement before voting.

Annual Meeting of Shareholders

|

|

| ||||||||||||

|

Date & Time |

|

Location |

|

Record Date | |||||||||

Wednesday, May 15, 2024 |

www.virtualshareholdermeeting.com/ |

Thursday, March 21, 2024 | ||||||||||||

| 8:00 a.m. EDT | BLK2024 | |||||||||||||

Voting Matters

Shareholders will be asked to vote on the following matters at the Annual Meeting:

Proposal | Board Recommendation | Page Reference | ||||||

Item 1. Election of Directors

The Board believes that each of the director nominees has the knowledge, experience, skills and background necessary to contribute to an effective and well-functioning Board. |  |

Vote FOR each | 11 | |||||

Item 2. Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers

BlackRock seeks a non-binding advisory vote from its shareholders to approve the compensation of the NEOs as disclosed in this Proxy Statement. The Board values the opinions of our shareholders and will take into consideration the outcome of the advisory vote when considering future executive compensation decisions. |  |

Vote FOR | 52 | |||||

Item 3. Approval of the BlackRock, Inc. Third Amended and Restated 1999 Stock Award and Incentive Plan

BlackRock is asking shareholders to approve the BlackRock, Inc. Third Amended and Restated 1999 Stock Award and Incentive Plan (“Restated Plan”) to (i) extend the term of the Restated Plan, (ii) increase the number of shares of BlackRock common stock authorized for issuance under the Restated Plan, and (iii) make certain other clarifying and conforming plan changes. The extension of the plan term and the increase in the number of shares available for new awards under the Restated Plan will allow the MDCC to continue to grant equity-based long-term incentive awards as part of our pay-for-performance compensation program. |  |

Vote FOR | 100 | |||||

Item 4. Ratification of the Appointment of the Independent Registered Public Accounting Firm

The Audit Committee has appointed Deloitte to serve as BlackRock’s independent registered public accounting firm for the 2024 calendar year and this appointment is being submitted to our shareholders for ratification. The Audit Committee and the Board believe that the continued retention of Deloitte to serve as BlackRock’s independent auditor is in the best interests of the Company and its shareholders. |  |

Vote FOR | 107 | |||||

Item 5. Shareholder Proposal – Report on EEO Policy Risk

The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. |  |

Vote AGAINST | 110 | |||||

Item 6. Shareholder Proposal – Amend Bylaws to Require Independent Board Chair

The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. |  |

Vote AGAINST | 112 | |||||

Item 7. Shareholder Proposal – Report on Proxy Voting Record and Policies for Climate Change-Related Proposals

The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. |  |

Vote AGAINST | 114 | |||||

| BLACKROCK, INC. 2024 PROXY STATEMENT | 1 |

Proxy Summary | Governance Highlights

What’s New?

We continually review our approach to corporate governance, corporate sustainability and executive compensation to make certain that BlackRock is in a position to maintain a culture of high performance, collaboration, innovation and fiduciary responsibility. We believe providing a broader understanding of our perspectives on certain items will be beneficial to you as you consider this year’s voting matters. This year’s new or updated items include:

| ||||

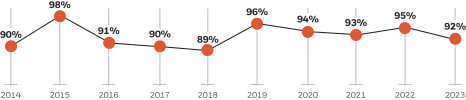

• Updates to the composition of the MDCC, NGSC and Risk Committee – see “Board Committee Refreshment” on page 32 | • Results of our annual say-on-pay proposal for the last 10 years – see “Shareholder Engagement on Executive Compensation” on page 55 | |||

Governance Highlights

Board Composition

(16 director nominees)

The Board believes that its size, albeit larger than the average S&P 500 public company board, helps to achieve the diversity of thought, experience and geographical expertise necessary to oversee our large and complex global business. The range of insights and experience of our Board supports BlackRock’s business and strategic growth areas, which include our diverse platform of alpha-seeking active, index and cash management investment strategies across asset classes, as well as technology services and advisory services and solutions.

The NGSC regularly reviews the overall composition of the Board and its Committees to assess whether it reflects the appropriate mix of skills, experience, backgrounds and qualifications that are relevant to BlackRock’s current and future global business and strategy.

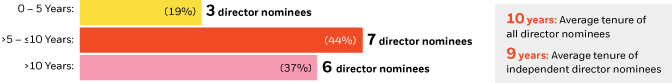

Board Tenure

The Board considers the tenure of our incumbent directors to help maintain an overall balance of experience, continuity and fresh perspective.

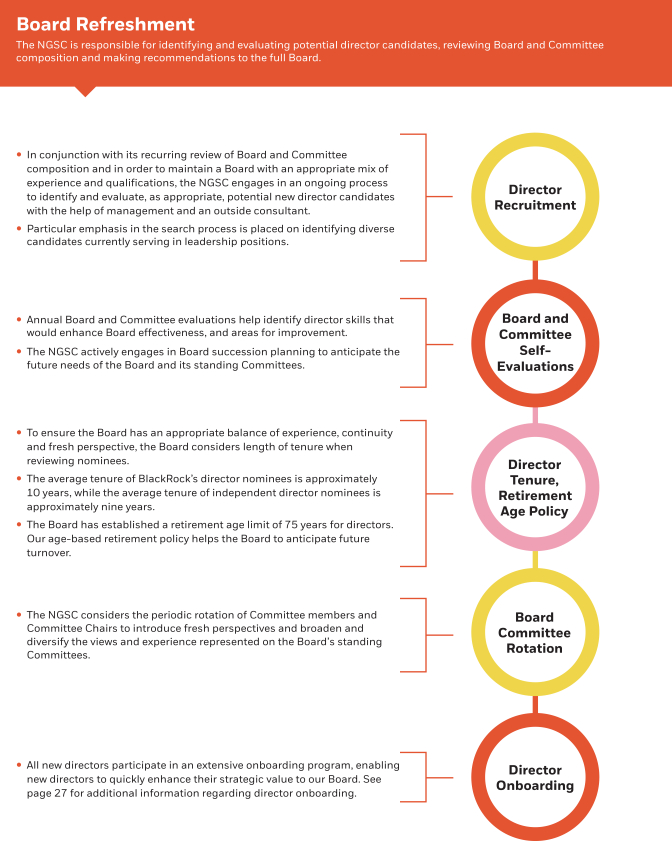

Board Refreshment

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience and qualifications, introduce new perspectives and broaden the views represented on the Board. |

|

| 2 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Proxy Summary | Governance Highlights

Board Independence and Leadership

Each year the Board reviews and evaluates our Board leadership structure. The Board has appointed Laurence D. Fink as its Chairman and Murry S. Gerber as its Lead Independent Director.

Board Profile

The NGSC and the Board take into consideration a number of factors and criteria when reviewing candidates for nomination to the Board. The Board believes that diversity in thought, experience, backgrounds, skills and viewpoints contributes to and enhances its capabilities. Moreover, the Board views diversity among its members as critical to the success of the Company and the Board’s ability to create long-term value for our shareholders. The diverse backgrounds of our individual directors help the Board better oversee BlackRock’s management and operations and assess risk and opportunities for the Company from a variety of perspectives.

Diversity among the Board’s members enhances its oversight of our multifaceted long-term strategy and inspires deeper engagement with management, employees and clients around the world.

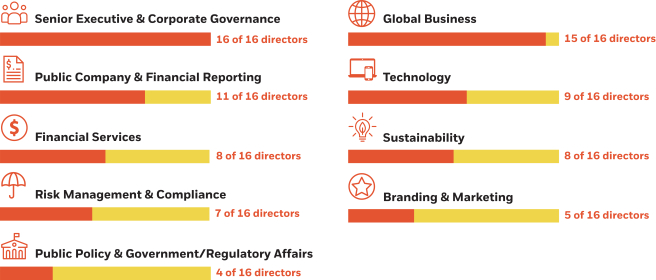

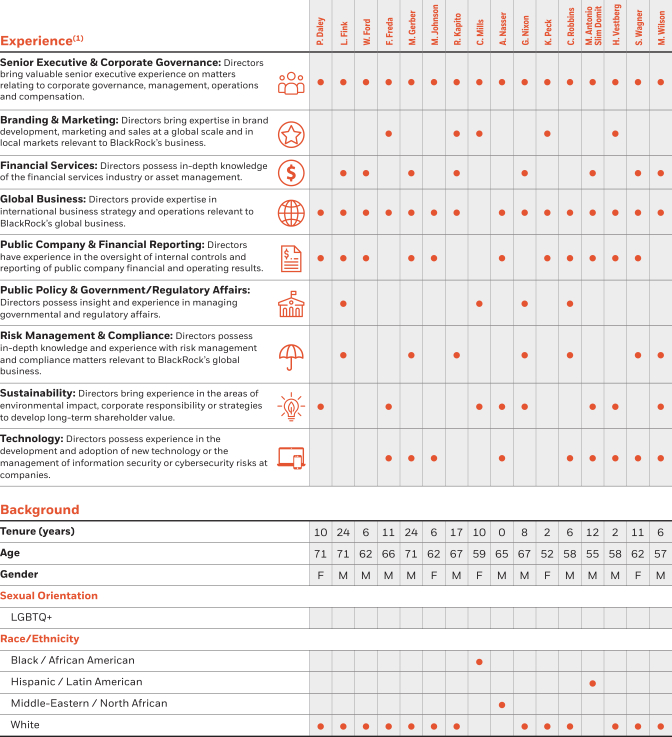

Core qualifications and areas of expertise represented by our director nominees include the following. For full descriptions of the below categories, see “Director Skills and Experience Matrix” on page 15.

The slate of director nominees includes five women and six non-U.S. or dual citizens.

| ||||||

Director self-identification of race/ethnicity:

• 1 Black / African American

• 1 Hispanic / Latin American

• 1 Middle Eastern / North African

|

| Several of our director nominees live and work overseas in countries and regions that are key areas of growth and investment for BlackRock, including Canada, Mexico, the Middle East and Europe. |

| BLACKROCK, INC. 2024 PROXY STATEMENT | 3 |

Proxy Summary | Governance Highlights

Our Director Nominees

Age at

| Committee Memberships (effective following the Annual Meeting)

| |||||||||||||||

Nominee | Director since | Audit | MDCC | NGSC | Risk | Executive | ||||||||||

| Pamela Daley Former Senior Vice President of Corporate Business

| 71 | 2014 | ● | ● | ● | ● | |||||||||

| Laurence D. Fink Chairman and CEO of BlackRock

| 71 | 1999 | ●

| ||||||||||||

| William E. Ford Chairman and CEO of General Atlantic | 62 | 2018 | ● | ● | ● | ||||||||||

| Fabrizio Freda President and CEO of Estée Lauder Companies Inc. | 66 | 2012 | ●

| ||||||||||||

| Murry S. Gerber | Lead Independent Director Former Chairman and CEO of EQT Corporation | 71 | 2000 | ●

| ●

| |||||||||||

| Margaret “Peggy” L. Johnson CEO of Agility Robotics | 62 | 2018 | ●

| ●

| |||||||||||

| Robert S. Kapito President of BlackRock | 67 | 2006 | |||||||||||||

| Cheryl D. Mills Founder and CEO of BlackIvy Group | 59 | 2013 | ●

| ●

| |||||||||||

| Amin H. Nasser President and CEO of Saudi Arabian Oil Co. (Aramco) | 65 | 2023 | ●

| ||||||||||||

| Gordon M. Nixon Former President and CEO of Royal Bank of Canada | 67 | 2015 | ●

| ●

| ●

| ||||||||||

| Kristin C. Peck CEO of Zoetis, Inc. | 52 | 2021 | ●

| ||||||||||||

| Charles H. Robbins Chairman and CEO of Cisco Systems, Inc. | 58 | 2017 | ●

| ||||||||||||

| Marco Antonio Slim Domit Chairman of Grupo Financiero Inbursa, S.A.B. de C.V.

| 55 | 2011 | ●

| ●

| |||||||||||

| Hans E. Vestberg Chairman and CEO of Verizon Communications, Inc. | 58 | 2021 | ●

| ●

| |||||||||||

| Susan L. Wagner Former Vice Chairman of BlackRock | 62 | 2012 | ●

| ●

| ●

| ||||||||||

| Mark Wilson Former CEO of Aviva plc and former President and CEO of AIA | 57 | 2018 | ●

| ●

| ●

| ||||||||||

Number of Committee Meetings in 2023: | 15 | 9 | 6 | 6 | 2 | |||||||||||

| ● Chairperson |

| 4 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Proxy Summary | Governance Highlights

Governance Practices

BlackRock has adopted robust corporate governance policies that facilitate strong Board leadership and strategic deliberation, prudent management practices and transparency.

Highlights of our governance practices include:

| • | Annual election of directors |

| • | Majority voting for directors in uncontested elections |

| • | Lead Independent Director may call special meetings of directors without management present |

| • | Executive sessions of independent directors |

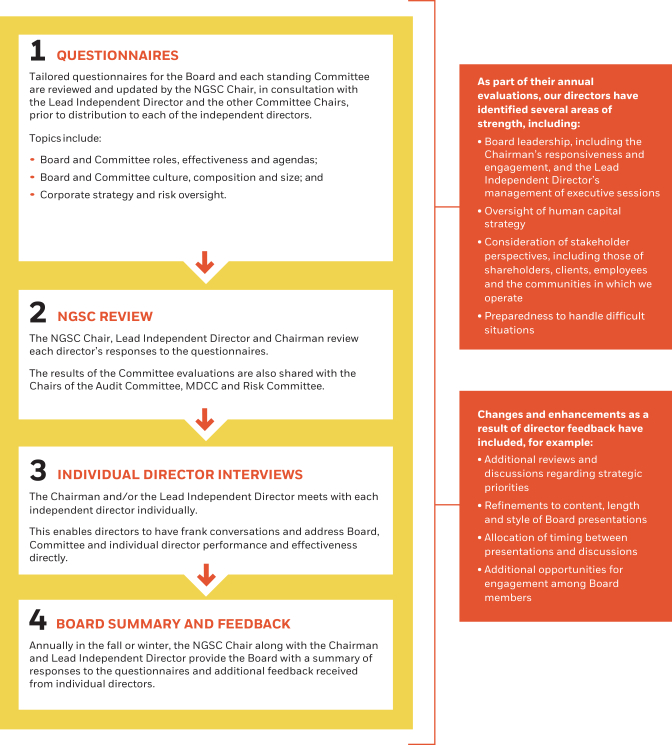

| • | Annual Board and Committee self-evaluations |

| • | Risk oversight by Board and Committees |

| • | Strong investor outreach program |

| • | Meaningful stock ownership requirements for directors and GEC members |

| • | Annual advisory vote on executive compensation |

| • | Proxy access for shareholders |

| • | Shareholder right to call special meetings |

| • | Annual review of Committee charters and Corporate Governance Guidelines |

| • | Human capital management oversight by the Board and its Committees |

| • | NGSC oversight of corporate and investment stewardship-related policies and programs relating to environmental and other sustainability matters; BlackRock’s philanthropic program and strategy; and corporate political activities |

Stock Ownership Guidelines

Our stock ownership guidelines require the Company’s GEC members to own shares with a target value of:

| • | $10 million for the CEO; |

| • | $5 million for the President; and |

| • | $2 million for all other GEC members. |

As of December 31, 2023, all NEOs exceeded our stock ownership guidelines.

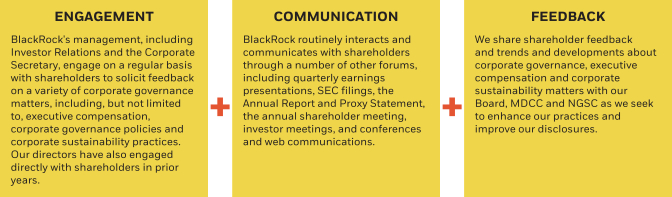

Shareholder Engagement and Outreach

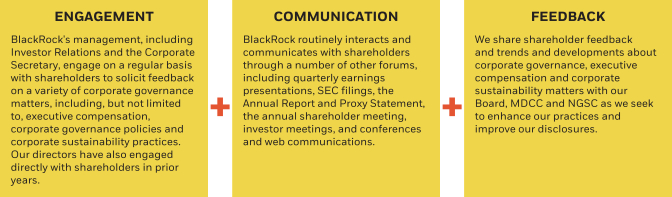

Our Shareholder Engagement Process

We conduct shareholder outreach throughout the year to engage with shareholders on issues that are important to them. We report back to our Board on this engagement as well as specific issues to be addressed.

In the fall of 2023, we reached out to stewardship officers at our 50 largest shareholders, representing over 60% of our outstanding shares, to discuss corporate governance, executive compensation and other topics outside of the proxy season. These engagements were led by our Corporate Secretary and Head of Investor Relations and included members from the Executive Compensation and Corporate Sustainability teams.

| BLACKROCK, INC. 2024 PROXY STATEMENT | 5 |

Proxy Summary | Compensation Discussion and Analysis Highlights

Compensation Discussion and

Analysis Highlights

Incentive Program – Pay-for-Performance Highlights

Our total annual compensation structure embodies our commitment to align pay with performance, as highlighted in the following Compensation Discussion and Analysis sections:

| What to Look for | Where to Find it | |||

| Compensation program objectives | “Our Compensation Program” beginning on page 60 | ||

| NEO pay determinations based on performance | “How We Determine Total Incentive Amounts for NEOs” on page 8 | ||

| Financial performance as the highest weighted input | “2023 Financial Performance” on page 56

“2023 NEO Compensation and Performance Summaries” beginning on page 67 | ||

| Total incentive outcomes tied formulaically to percentage | “Pay and Performance Alignment for NEOs – Total Incentive Award Determination” on page 57

“NEO Total Annual Compensation Summary” on page 58 | ||

| Disclosure of actual performance of historical long-term incentive awards and pre-set financial goals for newly granted awards | “2023 BPIP Award Determination Matrix” on page 62

“2020 BPIP Award: Actual Performance and Payout” on page 63 | ||

| Disclosure of pay versus performance outcomes | “Historical Outcomes – CEO and Other NEO Compensation Growth vs. BlackRock’s Financial Growth” on page 59

“Pay Versus Performance” on page 95 | ||

| 6 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Proxy Summary | Compensation Discussion and Analysis Highlights

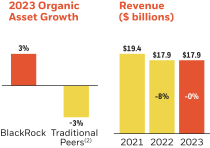

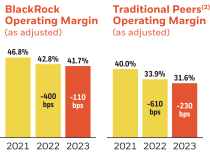

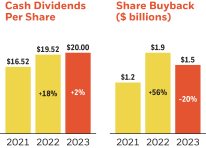

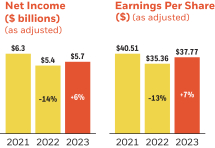

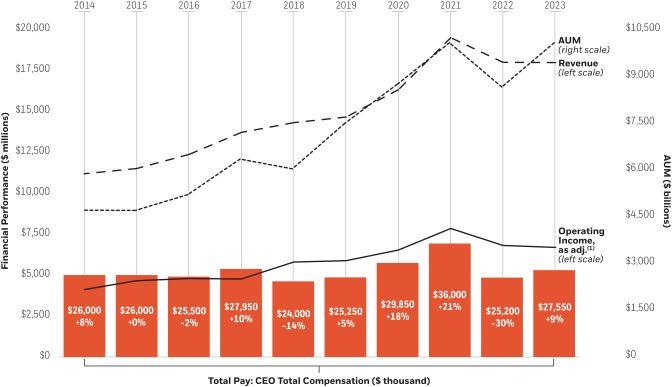

2023 Financial Performance(1)

BlackRock delivered differentiated organic growth and operating margin, even as most traditional peers saw sustained outflows and significant downward margin pressure. We generated $289 billion of total net inflows in 2023, representing 3% organic asset growth and 1% organic base fee growth, with organic growth accelerating into the end of the year. In addition, we demonstrated our commitment to prioritizing investments to drive future operating leverage. We returned over $4.5 billion to shareholders through a combination of dividends and share repurchases and grew earnings per share by 7%. Long-term investment performance results across our alpha-seeking and index strategies as of December 31, 2023 remained strong and are detailed in Part I, Item 1 – Business of our Annual Report on Form 10-K for the year ended December 31, 2023 (our “2023 Form 10-K”). BlackRock will continue to prudently invest in our business for the long term and seek to deliver value for our stakeholders, including strong outcomes for clients and durable returns for shareholders.

| Differentiated Organic Growth | Operating Leverage | |||

BlackRock generated 3% organic asset growth and 1% organic base fee growth in 2023, while revenue was flat compared to 2022, primarily driven by the negative impact of markets on average AUM, partially offset by higher technology services revenue | BlackRock’s 2023 Operating Margin, as adjusted, of 41.7% remains higher than peers | |||

|  | |||

| Consistent Capital Return | Earnings Per Share | |||

BlackRock returned $4.5 billion to shareholders in 2023, including $1.5 billion in share repurchases | BlackRock’s 2023 diluted earnings per share, as adjusted, of $37.77 increased by 7% versus 2022, primarily due to higher non-operating income | |||

|  |

| (1) | Amounts in this section, where noted, are shown on an “as adjusted” basis. For a reconciliation with GAAP, please see Annex A. Beginning in the first quarter of 2022, BlackRock updated the definitions of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted, to include new adjustments. Such measures have been recast for all prior periods to reflect the inclusion of such new adjustments. In addition, beginning in the first quarter of 2023, BlackRock updated the definitions of its non-GAAP financial measures to exclude the impact of market valuation changes on certain deferred cash compensation plans which the Company began economically hedging in 2023. |

| (2) | Traditional Peers refers to public company asset managers: Alliance Bernstein, Affiliated Managers Group, Franklin Resources, Invesco and T. Rowe Price. |

| BLACKROCK, INC. 2024 PROXY STATEMENT | 7 |

Proxy Summary | Compensation Discussion and Analysis Highlights

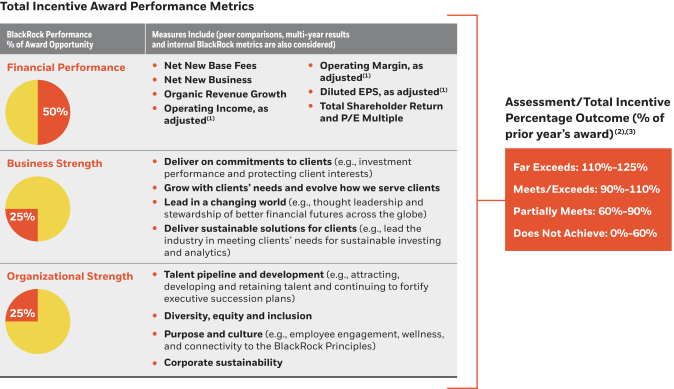

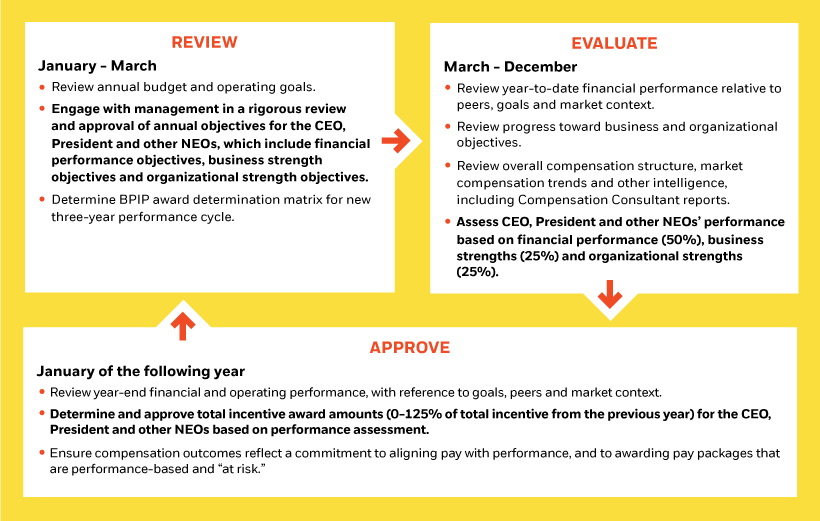

How We Pay NEOs

Each of BlackRock’s NEOs, through their various roles and responsibilities, contributes to the firmwide objectives summarized below. Under the NEO total incentive award determination framework, the MDCC assesses each NEO’s performance individually, based on three categories, with 50% of the award opportunity dependent on BlackRock’s achievement of financial performance goals, 25% dependent on BlackRock’s progress towards meeting our strategic objectives as measured by our business strength, and 25% dependent on BlackRock’s progress towards meeting its organizational priorities. The MDCC’s performance assessment is directly related to each NEO’s total incentive outcome, which includes all variable pay. As discussed on page 10, the MDCC did not specifically approve Gary Shedlin’s compensation nor formally assess his performance with respect to 2023 as he was not serving as an executive officer nor a member of the GEC at the end of the year.

For the performance assessments for each NEO (other than Mr. Shedlin), please refer to the section “2023 NEO Compensation and Performance Summaries” on page 67.

How We Determine Total Incentive Amounts for NEOs

BlackRock Performance % of Award Opportunity

| Measures

| Indicative BlackRock Performance Metrics

| ||||||||

2022 | 2023 | |||||||||

Financial Performance

| Net New Base Fee Growth | +0% |

| +1% |

| |||||

Net New Business ($ billions) | $307 |

| $289 |

| ||||||

Operating Income, as adjusted(1) ($ millions) | $6,711 |

| $6,593 |

| ||||||

Year-over-year change |

|

| (2)% |

| ||||||

Operating Margin, as adjusted(1) | 42.8% |

| 41.7% |

| ||||||

Year-over-year change |

|

| (110)bps |

| ||||||

Diluted Earnings Per Share, as adjusted(1) | $35.36 |

| $37.77 |

| ||||||

Year-over-year change |

|

| 7% |

| ||||||

| Shareholder Value Data | BlackRock | Traditional Peers(2) | S&P 500 Financials | S&P 500 | |||||

| NTM P/E Multiple(3) | 21.5x | 11.5x | 14.6x | 19.5x | |||||

| Total Shareholder Return(4) (1-year) | 17.9% | 3.5% | 12.1% | 26.3% | |||||

| Total Shareholder Return(4) (3-year) | 21.5% | 19.0% | 35.5% | 33.1% | |||||

|

| Total Shareholder Return(4) (5-year) | 135.7% | 45.9% | 76.0% | 107.2% | |||||

Business Strength

|

Deliver on our commitments to clients • Clients once again turned to BlackRock’s investment insights and expertise, entrusting the firm with $289 billion of net inflows in a year of rapid change and significant client portfolio de-risking, representing 3% organic asset growth year-over-year and positive growth across regions.

• Leveraged BlackRock’s differentiated, globally diverse investments platform to achieve this organic growth, with the firm generating an industry-leading $186 billion of net inflows in ETFs and nearly $60 billion of active inflows compared to active outflows in the broader industry.

• Kept alpha at the heart of BlackRock by generating more than $11 billion in gross alpha for clients from BlackRock’s alpha-seeking liquid active investment products.

Grow with our clients’ needs and evolve how we serve clients • Accelerated the firm’s future growth potential and ability to meet evolving client needs through strategic inorganic activity, including announcing the acquisition of Global Infrastructure Partners (“GIP”), the world’s largest independent infrastructure manager, closing the acquisition of Kreos Capital, and announcing the Jio BlackRock joint venture.

• Developed and delivered organizational changes to better serve clients, including the strategic reorganization of two of BlackRock’s fastest growing businesses (the Aladdin and Alternative investments platforms), the formation of a new Global Client Business group responsible for deepening relationships and partnerships with clients and staying ahead of their needs, and the formation of a new Global Markets group to create greater alignment and coordination across investment groups and drive investment and trading performance.

• Met client needs for integrated data and risk analytics, as well as for a whole portfolio approach across public and private markets, by continuing to innovate and expand the Aladdin technology platform that powers the firm and its client services. BlackRock achieved 10% annual contract value growth driven by strong net sales of Aladdin in 2023, and the firm generated a record $1.5 billion in technology services revenue.

|

| 8 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Proxy Summary | Compensation Discussion and Analysis Highlights

Lead in a changing world • Expanded BlackRock’s Voting Choice offering to more than $2.6 trillion of eligible Institutional Equity assets as of December 31, 2023, and announced its expansion to retail investors, launching for eligible account holders of BlackRock’s largest ETF in early 2024.

Deliver sustainable solutions to meet client demand • Continued to expand and innovate on the firm’s platform of sustainability-oriented offerings and partnerships for clients, who continued to select BlackRock as the fiduciary of choice for sustainable investing needs and entrusted the platform with more than $800 billion in sustainable AUM at year-end (+37% from year-end 2022, driven by organic growth achievement beyond market growth rates, market appreciation and fund conversions).

• Published the BII Transition Scenario, an analytical forecast report that will help clients navigate low-carbon transition-related risks and opportunities and enable the firm to strengthen its long-term client relationships by leveraging its insights in external engagements.

| ||

Organizational Strength

| Talent pipeline and development • Added a record eight new leaders to the GEC, including seven Managing Directors elevated from within the firm, which strengthened the firm’s executive talent development/pipeline and its ability to leverage horizontal leadership, while contributing to the effectiveness of the strategic reorganizations of several of the firm’s businesses.

• Continued to progress senior management succession plans, including reaching 95% coverage of GEC and key Managing Director roles that have “ready now” or “ready soon” potential internal successors identified, and completed successful transitions for the CFO and Global Head of Human Resources leveraging succession plans.

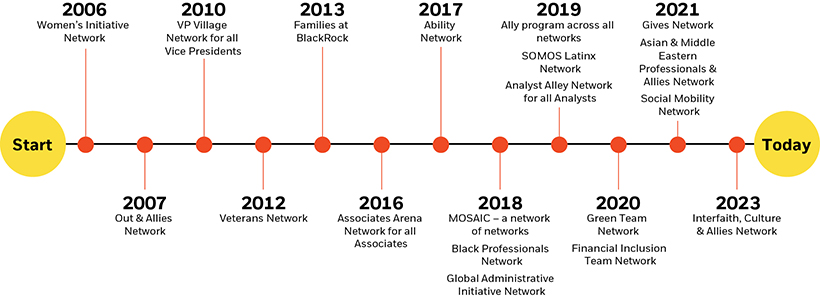

Diversity, equity and inclusion • Surpassed three of five of BlackRock’s 2024 aspirational workforce diversity goals (with respect to senior women, overall Black, and overall Latinx representation); gaps remain with respect to senior Black and senior Latinx aspirational goals as progress from the firm’s diverse talent pipeline has been affected by attrition of diverse senior talent.

• Conducted an annual pay fairness analysis across the firm’s workforce and committed to publishing results from the analysis for the first time publicly, in alignment with the firm’s commitment to equitable pay practices and transparency.

Purpose and culture • Deepened BlackRock’s investment in employee well-being, including expanding the firm’s global Mental Health Ambassadors program to over 500 trained employee volunteers who are available as peer resources for colleagues, hosting employee benefits fairs, and creating monthly “Wellness Bulletins.”

• Created new opportunities for in-person development and connectivity between colleagues and expanded employee listening initiatives through in-person leadership programming for senior leaders and high potential talent and launching streamlined onboarding and exit surveys to help reinforce key tenets of One BlackRock culture and employees’ sense of pride and belonging at BlackRock.

Corporate sustainability • Launched a dedicated Global Corporate Sustainability Controllers team to further support the firm’s position as a leading voice in corporate sustainability reporting.

|

| (1) | Amounts are shown on an “as adjusted” basis. For a reconciliation with GAAP, please see Annex A. |

| (2) | Traditional Peers refers to public company asset managers: Alliance Bernstein, Affiliated Managers Group, Franklin Resources, Invesco and T. Rowe Price. |

| (3) | NTM P/E multiple refers to the Company’s stock price as of December 31, 2023, divided by the consensus estimate of the Company’s expected earnings over the next 12 months. Sourced from FactSet. |

| (4) | Total Shareholder Return is defined as the change in stock price plus reinvested dividends, measured through December 31, 2023. |

| BLACKROCK, INC. 2024 PROXY STATEMENT | 9 |

Proxy Summary | Compensation Discussion and Analysis Highlights

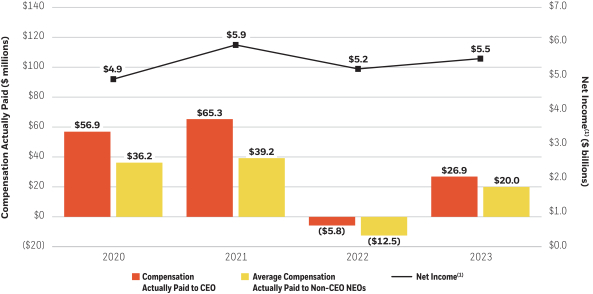

NEO Total Annual Compensation Summary

Following a review of full-year business and individual NEO performance, the MDCC determined 2023 total annual compensation outcomes for each NEO, other than Mr. Shedlin, as outlined in the table below.

2023 Total Incentive Award(1)(2)

| ||||||||||||||||

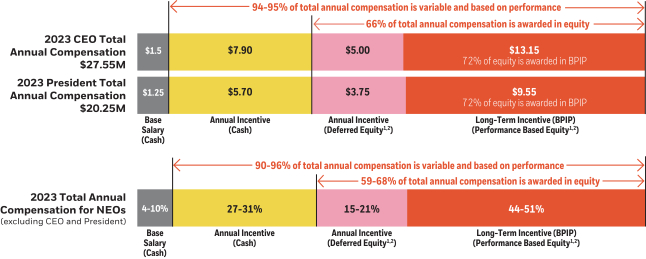

Name | Base Salary | Cash | Deferred Equity | Long-Term Incentive Award (BPIP) | Total Annual Compensation (TAC) | % change in TAC vs. 2022 | Performance- | |||||||||

Laurence D. Fink | $1,500,000 | $7,900,000 | $5,000,000 | $13,150,000 | $27,550,000 | 9% | – | |||||||||

Robert S. Kapito | $1,250,000 | $5,700,000 | $3,750,000 | $9,550,000 | $20,250,000 | 7% | – | |||||||||

Robert L. Goldstein | $500,000 | $3,335,000 | $2,565,000 | $5,700,000 | $12,100,000 | 23% | $8,500,000 | |||||||||

Mark K. Wiedman | $500,000 | $2,925,000 | $1,975,000 | $5,100,000 | $10,500,000 | – | $8,500,000 | |||||||||

Martin S. Small | $500,000 | $2,175,000 | $1,225,000 | $4,100,000 | $8,000,000 | – | $6,500,000 | |||||||||

Gary S. Shedlin | $500,000 | $1,555,000 | $745,000 | $2,200,000 | $5,000,000 | (28)% | $2,000,000 | |||||||||

| (1) | In determining the 2023 Total Incentive Awards for Messrs. Goldstein, Wiedman and Small, the MDCC considered additional factors beyond their performance assessment. This included the negative discretion applied to the 2022 Total Incentive Award for Mr. Goldstein, and new, larger roles taken in 2023 by Messrs. Wiedman and Small. See “2023 NEO Compensation and Performance Summaries” beginning on page 67 for more detail. |

| (2) | The MDCC did not specifically approve Mr. Shedlin’s compensation nor formally assess his performance with respect to 2023 as he was not serving as an executive officer nor a member of the GEC at the end of the year. Mr. Shedlin served as CFO until February 24, 2023 and subsequently transitioned to serve as a Vice Chairman of BlackRock, and the CEO determined his compensation outcome. |

The amounts listed above as “2023 Total Incentive Award: Deferred Equity” and “2023 Total Incentive Award: Long-Term Incentive Award (BPIP)” were granted in January 2024 in the form of equity and are in addition to cash award amounts listed above as “2023 Total Incentive Award: Cash.” In accordance with SEC requirements, the “2023 Summary Compensation Table” on page 84 reports equity in the year granted, but cash in the year earned.

In May 2023, BlackRock implemented a key strategic part of our long-term management succession plans by granting non-recurring long-term incentive awards in the form of performance-based stock options to a select group of senior leaders who we believe will play critical roles in BlackRock’s future. The CEO and President did not receive performance-based stock options, consistent with the intent of the awards. We believe these awards are important to BlackRock’s leadership continuity and have potential for meaningful long-term appreciation in value for the selected participants. Because they are outside of our normal annual compensation determinations, we report on them separately. For more information, please see “Performance-Based Stock Options” on page 63.

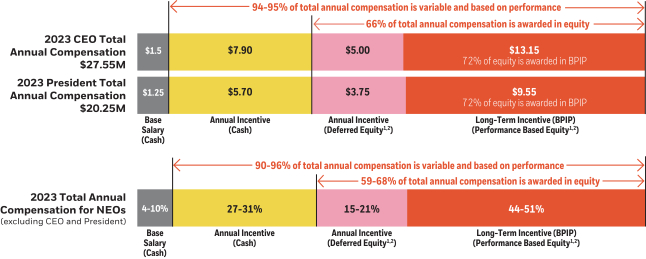

Pay-for-Performance Compensation Structure for NEOs

Our total annual compensation structure embodies our commitment to align pay with performance. More than 90% of our regular annual NEO compensation is performance based and “at risk.” Compensation mix percentages shown below are based on 2023 year-end compensation decisions by the MDCC for individual NEOs, other than Mr. Shedlin.

| (1) | Grants of BlackRock equity, including the portion of the annual incentive awards granted in RSUs and the portion granted under the BlackRock Performance Incentive Plan (“BPIP Awards”), our long-term incentive plan, are approved by the MDCC under the BlackRock, Inc. Second Amended and Restated 1999 Stock Award and Incentive Plan (“Stock Plan”), which has been previously approved by shareholders. The Stock Plan allows for multiple types of awards to be granted. |

| (2) | The value of the 2023 BPIP Awards and the value of the annual incentive deferred equity awards were converted into RSUs by dividing the award value by $798.83, which represented the average of the high and low prices per share of BlackRock common stock on January 16, 2024. |

| 10 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1:

Election of

Directors

“It has always been important that our Board functions as a key strategic governing body that both challenges and advises our leadership team and guides BlackRock into the future.”

Laurence D. Fink Chairman and Chief Executive Officer

| Director Nominees

Our Board has nominated 16 directors for election at this year’s Annual Meeting on the recommendation of our NGSC. Each director will serve until our next annual meeting and until his or her successor has been duly elected, or until his or her earlier death, resignation or retirement.

We expect each director nominee to be able to serve if elected. If a nominee is unable to serve, proxies will be voted in favor of the remainder of the director nominees and may be voted for substitute nominees, unless the Board decides to reduce its total size.

If all 16 director nominees are elected, our Board will consist of 16 directors, 14 of whom, representing approximately 88% of the Board, will be “independent” as defined in the NYSE listing standards.

Majority Vote Standard for Election of Directors

Directors are elected by receiving a majority of the votes cast in uncontested elections, which means the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that director nominee. In a contested election, directors are elected by receiving a plurality of the shares represented in person or by proxy at any meeting and entitled to vote on the election of directors. A contested election is a situation in which the number of nominees exceeds the number of directors to be elected. Whether an election is contested is determined seven days in advance of when we file our definitive Proxy Statement with the SEC.

Director Resignation Policy

Any incumbent director who fails to receive a majority of votes cast in an uncontested election must tender his or her resignation to the Board. The NGSC will then make a recommendation to the Board about whether to accept or reject the resignation or take other action. The Board will act on the NGSC’s recommendation and publicly disclose its decision and rationale within 90 days from the date the election results are certified. The director who tenders his or her resignation under the Director Resignation Policy will not participate in the Board’s decision. |

| BLACKROCK, INC. 2024 PROXY STATEMENT | 11 |

Item 1: Election of Directors | Director Nomination Process

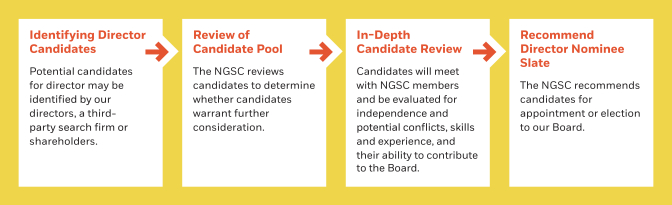

Director Nomination Process

The NGSC oversees the director nomination process. The NGSC leads the Board’s annual review of Board performance and reviews and recommends to the Board enhancements to BlackRock’s Corporate Governance Guidelines, which include the minimum criteria for Board membership. The NGSC also assists the Board in identifying individuals qualified to become Board members and recommends to the Board a slate of candidates, which may include both incumbent and new director nominees, to nominate for election at each annual meeting of shareholders. The NGSC also may recommend that the Board elect new members to the Board to serve until the next annual meeting of shareholders.

Identifying and Evaluating Candidates for Director

The NGSC seeks advice from current directors when identifying and evaluating new candidates for director. The NGSC also may engage third-party firms that specialize in identifying director candidates to assist with its search. Shareholders can recommend a candidate for election to the Board by submitting director recommendations to the NGSC. For information on the requirements for shareholder nominations for the election of directors, please see “Deadlines for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders” on page 119.

The NGSC reviews publicly available information regarding each potential director candidate to assess whether the candidate should be considered further. If the NGSC determines that a candidate warrants further consideration and the candidate expresses a willingness to be considered and capacity to serve on the Board, the NGSC typically requests information from and meets with the candidate. The NGSC also reviews the candidate’s accomplishments and qualifications against the criteria described under “Criteria for Board Membership.”

The NGSC’s evaluation process does not vary based on whether a candidate is recommended by a shareholder, although the NGSC may consider the number of shares held by the recommending shareholder and the length of time that such shares have been held.

Potential Director Candidates

In conjunction with its recurring review of Board and Committee composition and in order to maintain a Board with an appropriate mix of experience and qualifications, the NGSC engages in an ongoing process to identify and evaluate, as appropriate, potential new director candidates with the help of management and an outside consultant. Consistent with our long-term strategic goals and the qualifications and attributes described in this Item 1, search criteria include significant leadership experience, expertise in financial services, the technology sector or sustainability-related matters, or international experience. Particular emphasis in the search process is also placed on identifying diverse candidates currently serving in leadership positions.

In March 2023, the NGSC identified Amin H. Nasser as a candidate with significant leadership skills and experience in international business, sustainability and the energy transition, and the Middle East region and recommended him to the Board for consideration. Mr. Nasser was recommended for consideration to the NGSC by management. On July 17, 2023, Mr. Nasser was elected to the Board.

| 12 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1: Election of Directors | Criteria for Board Membership

Criteria for Board Membership

Director Independence

No director is considered independent unless the Board has determined that he or she has no material relationship with BlackRock.

If all 16 director nominees are elected, approximately 88% of the Board, or 14 out of 16 directors, will be “independent” as defined in the NYSE listing standards. | Director Qualifications and Attributes

Nominees for director are selected on the basis of experience, knowledge, skills, expertise, ability to make independent analytical inquiries, understanding of BlackRock’s business environment and a willingness to devote adequate time and effort to the responsibilities of the Board. | Board Diversity

The Board believes that diversity in thought, experience, backgrounds, skills and viewpoints contributes to and enhances the Board’s capabilities. | ||||||

| ||||||||

Board Tenure

The Board considers, among other factors, length of tenure when reviewing nominees to ensure that the Board has an appropriate balance of experience, continuity and fresh perspective. | Director Retirement Age and Board Size

As reflected in our Corporate Governance Guidelines, the Board has established a retirement age policy of 75 years for directors.

As part of the annual Board and Committee evaluation process, directors are asked to consider whether the size and composition of the Board and its standing Committees are appropriate. | Service on Other Public Company Boards

Neither BlackRock’s CEO nor President currently serves on the board of directors of any other public company, and none of our current directors serve on more than four public company boards, including BlackRock’s Board.

For current directors who are public company named executive officers, none serve on more than two public company boards, including BlackRock’s Board. | ||||||

Director Independence

Each year, the Board determines the independence of directors in accordance with NYSE listing standards. No director is considered independent unless the Board has determined that he or she has no material relationship with BlackRock.

The Board has adopted Categorical Standards of Director Independence (the “Categorical Standards”) to help determine whether certain relationships between the members of the Board and BlackRock or its affiliates and subsidiaries (either directly or as a partner, shareholder or officer of an organization that has a relationship with BlackRock) are material relationships for purposes of NYSE listing standards. The Categorical Standards provide that the following relationships are not material for such purposes:

| • | Relationships arising in the ordinary course of business, such as asset management, acting as trustee, lending, deposit, banking or other financial service relationships or other relationships involving the provision of products or services, so long as the products and services are being provided in the ordinary course of business and on substantially the same terms and conditions, including price, as would be available to similarly situated customers; |

| • | Relationships with companies of which a director is a shareholder or partnerships of which a director is a partner, provided the director is not a principal shareholder of the company or a principal partner of the partnership; |

| • | Contributions made or pledged to charitable organizations of which a director or an immediate family member of the director is an executive officer, director or trustee if (i) within the preceding three years, the aggregate amount of such contributions during any single fiscal year of the charitable organization did not exceed the greater of $1 million or 2% of the charitable organization’s consolidated gross revenues for that fiscal year and (ii) the charitable organization is not a family foundation created by the director or an immediate family member of the director; and |

| • | Relationships involving a director’s relative unless the relative is an immediate family member of the director. |

As part of its determination, the Board also considers the relationships described under “Certain Relationships and Related Transactions” on page 50.

| BLACKROCK, INC. 2024 PROXY STATEMENT | 13 |

Item 1: Election of Directors | Criteria for Board Membership

In March 2024, the NGSC made a recommendation to the Board regarding the independence of our director nominees based on its annual review. In making its independence determinations, the NGSC and the Board considered various transactions and relationships between BlackRock and the director nominees as well as between BlackRock and entities affiliated with director nominees, including the relationships described under “Certain Relationships and Related Transactions” on page 50. The NGSC also considered that Messrs. Robbins and Vestberg are employed by organizations that do business with BlackRock, where each of such transactional relationships was for the purchase or sale of goods and services in the ordinary course of BlackRock’s business, and the amount received by BlackRock or such company in each of the previous three years did not exceed the greater of $1 million or 2% of either BlackRock’s or such organization’s consolidated gross revenues. As a result of this review, the Board determined that Mses. Daley, Johnson, Mills, Peck and Wagner and Messrs. Ford, Freda, Gerber, Nasser, Nixon, Robbins, Slim, Vestberg and Wilson are “independent” as defined in the NYSE listing standards and that none of the relationships between these director nominees and BlackRock are material under the NYSE listing standards. In addition, the Board had previously determined that Bader M. Alsaad, who is not standing for re-election, was “independent” as defined in the NYSE listing standards.

Following the Annual Meeting, assuming all of the nominated directors are elected, BlackRock’s Board will consist of 16 directors, 14 of whom, representing approximately 88% of the Board, will be “independent” as defined in the NYSE listing standards.

Director Qualifications and Attributes

The NGSC and the Board take into consideration a number of factors and criteria when reviewing candidates for nomination to the Board. The Board believes that, at a minimum, a director nominee must demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of BlackRock. Equally important, a director nominee must have an impeccable record and reputation for honest and ethical conduct in his or her professional and personal activities.

Nominees for director are selected on the basis of experience, knowledge, skills, expertise, ability to make independent analytical inquiries, understanding of BlackRock’s business environment and a willingness to devote adequate time and effort to the responsibilities of the Board. In addition, in anticipation of its recommendation to the Board of each year’s nominees for election as director, the NGSC reviews directors’ independence, attendance at Board and Committee meetings and membership on other public company boards.

Board Diversity

The Board believes that diversity in thought, experience, backgrounds, skills and viewpoints contributes to and enhances its capabilities. Moreover, the Board views diversity among its members as critical to the success of the Company and the Board’s ability to create long-term value for our shareholders. The diverse backgrounds of our individual directors help the Board better oversee BlackRock’s management and operations and assess risk and opportunities for the Company from a variety of perspectives. Diversity among the Board’s members enhances its oversight of our multifaceted long-term strategy and inspires deeper engagement with management, employees and clients around the world.

Our Board has nominated 16 candidates for election, 14 of whom are independent. The slate of director nominees includes five women and six non-U.S. or dual citizens. Several of our nominees live and work overseas in countries and regions that are key areas of growth and investment for BlackRock, including Canada, Mexico, the Middle East and Europe.

Additionally, we ask each director nominee to self-identify as to his or her racial/ethnic diversity and other diversity characteristics. Based on the responses, three of our 14 independent director nominees self-identified as racially/ethnically diverse, with one identifying as Black/African American, one identifying as Hispanic/Latin American and one identifying as Middle Eastern/North African.

| 14 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1: Election of Directors | Criteria for Board Membership

As BlackRock’s business has evolved, so has our Board. Our slate of director nominees consists of senior leaders, including 13 current or former company CEOs, with substantial experience in financial services, consumer products, manufacturing, technology, pharmaceuticals, banking and energy.

Director Skills and Experience Matrix

| (1) | Information as of March 21, 2024. A “●” in the chart indicates a specific area of focus or expertise that is particularly relevant to a director’s service on BlackRock’s Board. The lack of a “●” does not mean that a director does not also possess meaningful experience or skill in that area. |

| BLACKROCK, INC. 2024 PROXY STATEMENT | 15 |

Item 1: Election of Directors | Criteria for Board Membership

Board Tenure, Retirement Age and Size

Board Tenure. To ensure the Board has an appropriate balance of experience, continuity and fresh perspective, the Board considers, among other factors, length of tenure when reviewing nominees. The average tenure of BlackRock’s director nominees is approximately 10 years and the average tenure of independent director nominees is approximately nine years.

Following the Annual Meeting, assuming all of the nominated directors are elected, there will be three directors, comprising 19% of the Board, who have joined the Board within the past five years and bring fresh perspective to Board deliberations. Seven directors, comprising 44% of the Board, have served between five and 10 years. Six directors (including our CEO and President), comprising 37% of the Board, have served more than 10 years and bring a wealth of experience and knowledge concerning BlackRock. The Board believes it is important to balance refreshment with the need to retain directors who have developed, over time, significant insight into the Company and its operations and who continue to make valuable contributions to the Company that benefit our shareholders.

Retirement Age. The Board has established a retirement age policy of 75 years for directors, as reflected in our Corporate Governance Guidelines. The Board believes that it is important to monitor its composition, skills and needs in the context of the Company’s long-term strategic goals, and, therefore, may elect to waive the policy as it deems appropriate.

Board Size. The Board has not adopted a policy that sets a target for Board size and believes the current size and composition of the Board is best suited to evaluate management’s performance and oversee BlackRock’s global strategy, complex operations and risk management. The range of insights and experience of our Board supports BlackRock’s business and strategic growth areas.

The NGSC and the Board evaluate Board and Committee performance and effectiveness on at least an annual basis and, as part of that process, ask each director to consider whether the size and composition of the Board and its standing Committees are appropriate. In response to the 2023 Board and Committee self-evaluations, directors praised the collaborative and highly engaged Board culture and agreed that the Board has the appropriate mix of members, representing diversity of thought, skills, experience and other characteristics, to be effective. Directors also commented that one of the Board’s strengths is the mix of experience, geographies and industries represented, and that each of the directors is able to contribute in a different way. See also “Board Self-Evaluation Process” on page 29.

Compliance with Regulatory and Independence Requirements

The NGSC takes into consideration regulatory requirements, including competitive restrictions, and independence requirements under the NYSE listing standards and our Corporate Governance Guidelines in its review of director candidates for the Board and its Committees. The NGSC also considers a director candidate’s current and past positions held, including past and present board and committee memberships, as part of its evaluation.

Service on Other Public Company Boards

Each of our directors must have the time and ability to make a constructive contribution to the Board as well as a clear commitment to fulfilling the fiduciary duties required of directors and serving the interests of the Company’s shareholders. Neither BlackRock’s CEO nor President currently serves on the board of directors of any other public company, and none of our current directors serve on more than four public company boards, including BlackRock’s Board (and for directors who are public company named executive officers, no more than two public company boards, including BlackRock’s Board).

Board Recommendation

For this year’s election, the Board has nominated 16 director candidates. The Board believes these director nominees provide BlackRock with the combined depth and breadth of skills, experience and qualities required to contribute to an effective and well-functioning Board.

The following biographical information about each director nominee highlights the particular experience, qualifications, attributes and skills possessed by such director nominee that led the Board to determine that he or she should serve as director. All director nominee biographical information is as of March 21, 2024.

| ||||||||

|

The Board of Directors recommends shareholders vote “FOR” the election of each of the following 16 director nominees. | |||||||

| 16 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1: Election of Directors | Director Nominee Biographies

Director Nominee Biographies

|

Pamela Daley

Independent Director

Ms. Daley retired from General Electric Company (GE) in January 2014, having most recently served as a Senior Advisor to its Chairman from April 2013 to December 2013. Prior to this role, Ms. Daley served as GE’s Senior Vice President of Corporate Business Development from 2004 to 2013 and as Vice President and Senior Counsel for Transactions from 1991 to 2004. As Senior Vice President, Ms. Daley was responsible for GE’s mergers, acquisitions and divestiture activities worldwide. Previously, Ms. Daley was a Partner of Morgan, Lewis & Bockius, a large U.S. law firm, where she specialized in domestic and cross-border tax-oriented financings and commercial transactions.

Qualifications

With over 35 years of transactional experience and more than 20 years as an executive at GE, one of the world’s leading multinational corporations, Ms. Daley brings significant experience and strategic insight to the Board in the areas of leadership development, international operations, strategic transactions, finance and financial reporting, business development and strategy.

Other Public Company Directorships (within the past 5 years)

• BP p.l.c. (2018 – present) • SecureWorks Corp. (2016 – present)

Committees

• Audit (Chair) • Executive • Risk | |||||||||||

Age

71

| Tenure

10 Years | |||||||||||

Experience

| ||||||||||||

|

Laurence D. Fink

Mr. Fink is Chairman and Chief Executive Officer of BlackRock. He also leads the firm’s Global Executive Committee. He is responsible for senior leadership development and succession planning, defining and reinforcing BlackRock’s vision and culture, and engaging with key strategic clients, industry leaders, regulators and policymakers. Under Mr. Fink’s leadership, the firm has grown into a global leader in investment management, risk management and advisory services for institutional and retail clients. Prior to founding BlackRock in 1988, Mr. Fink was a member of the Management Committee and a Managing Director of The First Boston Corporation.

Qualifications

As one of the founding principals and Chief Executive Officer of BlackRock since 1988, Mr. Fink brings exceptional leadership skills and in-depth understanding of BlackRock’s business, operations and strategy. His extensive and specific knowledge of BlackRock and its business enables him to keep the Board apprised of the most significant developments impacting the Company and to guide the Board’s discussion and review of the Company’s strategy.

Other Public Company Directorships (within the past 5 years)

• None

Committees

• Executive (Chair)

| |||||||||||

Age

71

| Tenure

24 Years | |||||||||||

Experience

| ||||||||||||

| BLACKROCK, INC. 2024 PROXY STATEMENT | 17 |

Item 1: Election of Directors | Director Nominee Biographies

|

William E. Ford

Independent Director

Mr. Ford has served as the Chief Executive Officer of General Atlantic since 2007 and is the firm’s Chairman. Mr. Ford is involved with a number of educational and not-for-profit organizations. He is Chair of the Investment Committee of The Rockefeller University, and a member of the Council on Foreign Relations and Tsinghua University’s School of Economics and Management’s Advisory Board. He also currently serves as a member of the Executive Committee for the Partnership for New York City and as a Trustee of the Center for Strategic & International Studies.

Qualifications

Mr. Ford brings to the Board extensive global investment management experience and financial expertise acquired over his three decades of experience at General Atlantic, one of the world’s leading growth equity investment firms. His professional background also provides the Board with expertise and insight into matters relating to compensation, corporate governance, financial reporting and strategy across a range of industries and regions.

Other Public Company Directorships (within the past 5 years)

• Royalty Pharma plc (2020 – 2022) • IHS Markit Ltd. (2016 – 2022)

Committees

• MDCC (Chair) • NGSC • Executive | |||||||||||

Age

62

| Tenure

6 Years | |||||||||||

Experience

| ||||||||||||

|

Fabrizio Freda

Independent Director

Mr. Freda has served as President, Chief Executive Officer and a member of the board of directors of The Estée Lauder Companies Inc. (Estée Lauder), a global leader in beauty, since 2009. Mr. Freda previously served as Estée Lauder’s President and Chief Operating Officer from March 2008 to July 2009. Prior to joining Estée Lauder, Mr. Freda held various senior positions at Procter & Gamble Company over the span of 20 years. From 1986 to 1988, Mr. Freda directed marketing and strategic planning for Gucci SpA. Mr. Freda serves on the Advisory Board of the Global Business Initiative at Georgetown University’s McDonough School of Business.

Qualifications

Mr. Freda’s extensive experience in product strategy, innovation and global branding brings valuable insights to the Board. His chief executive experience at Estée Lauder, an established multinational manufacturer and marketer of prestige brands, provides the Board with unique perspectives on the Company’s marketing, strategy and innovation initiatives.

Other Public Company Directorships (within the past 5 years)

• The Estée Lauder Companies Inc. (2009 – present)

Committees

• NGSC | |||||||||||

Age

66

| Tenure

11 Years | |||||||||||

Experience

| ||||||||||||

| 18 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1: Election of Directors | Director Nominee Biographies

|

Murry S. Gerber

Independent Director

Mr. Gerber was the Chairman and Chief Executive Officer of integrated energy producer, EQT Corporation (EQT), from 2000 to 2010 and 1998 to 2000, respectively. Prior to EQT, Mr. Gerber helped create Coral Energy (now Shell Trading North America) and was the Treasurer of Shell Oil. He is a member of the board of trustees of the Pittsburgh Cultural Trust. Mr. Gerber currently serves as BlackRock’s Lead Independent Director.

Qualifications

As a former leader of a large, publicly traded energy production company and as a current or former member of the board of directors of three large, publicly traded companies, Mr. Gerber brings to the Board extensive expertise and insight into corporate operations, management and governance matters. His expert knowledge of the energy and industrial sectors continues to provide important perspectives on evolving global business trends.

Other Public Company Directorships (within the past 5 years)

• Halliburton Company (2012 – present) • U.S. Steel Corporation (2012 – present)

Committees

• Executive • NGSC | |||||||||||

Age

71

| Tenure

24 Years | |||||||||||

Lead Independent Director

Experience

| ||||||||||||

|

Margaret “Peggy” L. Johnson

Independent Director

Ms. Johnson has served as the Chief Executive Officer of Agility Robotics since March 2024. Ms. Johnson previously served as the Chief Executive Officer of Magic Leap, Inc., an American augmented reality company, from August 2020 to October 2023. Prior to this role, she was Executive Vice President of Business Development at Microsoft Corporation from September 2014 to July 2020 and was responsible for driving strategic business deals and partnerships across various industries. Ms. Johnson joined Microsoft from Qualcomm Incorporated, where she served in various leadership positions across engineering, sales, marketing and business development. Ms. Johnson was an Advisor to Huntington’s Disease Society of America, San Diego Chapter from 2010 to 2020.

Qualifications

Ms. Johnson brings to the Board substantial experience in the field of technology, including emerging technologies; business and strategic development expertise acquired over her 31 years at Microsoft and Qualcomm; and insight into growth companies from her former role at Magic Leap and current role at Agility Robotics.

Other Public Company Directorships (within the past 5 years)

• Fox Corporation (2023 – present)

Committees

• Audit • MDCC | |||||||||||

Age

62

| Tenure

6 Years | |||||||||||

Experience

| ||||||||||||

| BLACKROCK, INC. 2024 PROXY STATEMENT | 19 |

Item 1: Election of Directors | Director Nominee Biographies

|

Robert S. Kapito

Mr. Kapito has been President of BlackRock since 2007 and is a member of BlackRock’s Global Executive Committee and Chairman of the Global Operating Committee. He also serves as a member of the board of directors of iShares, Inc. Mr. Kapito co-founded BlackRock in 1988. He is responsible for the day-to-day oversight of BlackRock’s key operating units including Investment Strategies, Client Businesses, Technology & Operations and Risk & Quantitative Analysis. Prior to 2007, Mr. Kapito served as Vice Chairman of BlackRock and Head of BlackRock’s Portfolio Management Group.

Qualifications

As one of our founding principals, Mr. Kapito has served as an executive leader of BlackRock since 1988. He brings to the Board industry and business acumen in addition to in-depth knowledge about BlackRock’s businesses, investment strategies and risk management, as well as extensive experience overseeing day-to-day operations.

Other Public Company Directorships (within the past 5 years)

• None

Committees

• None | |||||||||||

Age

67

| Tenure

17 Years | |||||||||||

Experience

| ||||||||||||

|

Cheryl D. Mills

Independent Director

Ms. Mills is the Founder and Chief Executive Officer of the BlackIvy Group, a private holding company that grows and builds businesses in Sub-Saharan Africa. Previously, she served as Chief of Staff to former Secretary of State Hillary Clinton and Counselor to the U.S. Department of State from 2009 to 2013. Ms. Mills was with New York University from 2002 to 2009, where she served as Senior Vice President for Administration and Operations, General Counsel and Secretary of the Board of Trustees. She also served as Deputy Counsel to President Clinton and as the White House Associate Counsel. Ms. Mills previously served on the boards of Cendant Corporation (now Avis Budget Group, Inc.), a consumer real estate and travel conglomerate, and Orion Power, an independent electric power generating company.

Qualifications

Ms. Mills brings to the Board a range of leadership experiences from private equity, government and academia, and through her prior service on the boards of corporations and non-profits, she provides expertise on issues concerning government relations, public policy, corporate administration and corporate governance.

Other Public Company Directorships (within the past 5 years)

• iHeartMedia, Inc. (2020 – Present)

Committees

• MDCC • NGSC | |||||||||||

Age

59

| Tenure

10 Years | |||||||||||

Experience

| ||||||||||||

| 20 | BLACKROCK, INC. 2024 PROXY STATEMENT |

Item 1: Election of Directors | Director Nominee Biographies

|

Amin H. Nasser

Independent Director