- SPR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Spirit AeroSystems (SPR) DEF 14ADefinitive proxy

Filed: 20 Mar 20, 7:32am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

SPIRIT AEROSYSTEMS HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Thomas C. Gentile III PRESIDENT AND CHIEF EXECUTIVE OFFICER

Robert D. Johnson CHAIRMAN | March 20, 2020 On behalf of the Board of Directors, we are delighted to invite you to attend the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Spirit AeroSystems Holdings, Inc. (the “Company” or “Spirit”). We hope you can join us on Wednesday, April 22, 2020, at 11:00 a.m. at the Grand Hyatt DFW, 2337 S. International Pkwy., Dallas, TX 75261. Details of the business to be conducted at the Annual Meeting are included in the attached Notice and accompanying Proxy Statement. 2019 was an unprecedented year for the Company due to the worldwide grounding of the B737 MAX, our largest program. Spirit faced many challenges resulting from the grounding, including needing to reduce costs designed for a production rate of 57 aircraft per month, designing storage plans for grounded aircraft, and having to face difficult decisions about rightsizing our workforce. Last year was also one of growth for Spirit as we continued to execute our diversification strategy. We announced our acquisition of select Bombardier aerostructures and aftermarket assets, which represents a new frontier for Spirit and will expand our Airbus work content and give us a very significant work package on the A220 - a fully integrated wing. We also expanded our defense profile by acquiring Fiber Materials Inc. (the acquisition closed in January 2020), which provides us additional exposure to defense customers and brings us key work content in the rapidly expanding hypersonics space. We continued to improve our governance profile and expand our capabilities when we welcomed Stephen A. Cambone onto the Board in October. Steve is a seasoned defense leader and well-versed in cyber matters. His contributions to the Board are tremendous, and we are grateful for his experience as we navigate defense growth and our increasingly interconnected marketplace. We are excited about the Company’s future as we expand our capabilities and expertise. Due to the continued grounding of the B737 MAX and the resulting lower production rates, challenges will continue. However, we have the right leadership and Board in place to conquer these challenges and help us emerge as a stronger, more diversified company. We thank you for your continued support of Spirit and look forward to the Annual Meeting.

|

| |

3801 S. Oliver St.

Wichita, KS 67210-2112

March 20, 2020

The 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Spirit AeroSystems Holdings, Inc. (“Spirit” or the “Company”) will be held:

WEDNESDAY, APRIL 22, 2020

11:00 a.m. Central Time

Grand Hyatt DFW

2337 S. International Pkwy.

Dallas, TX 75261

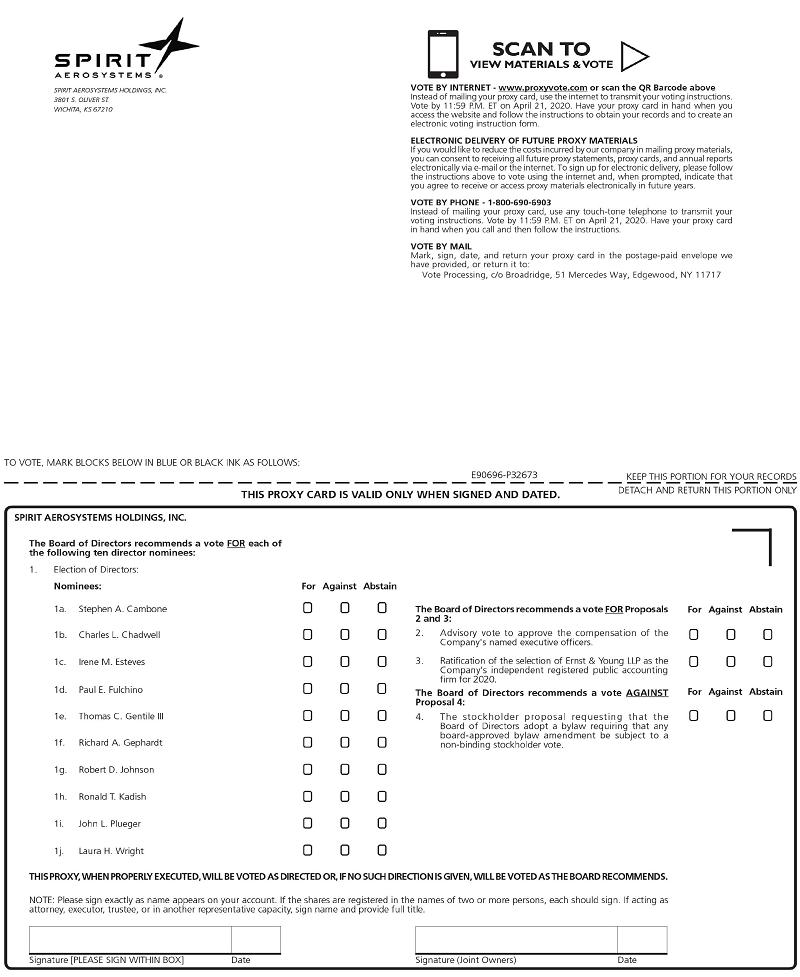

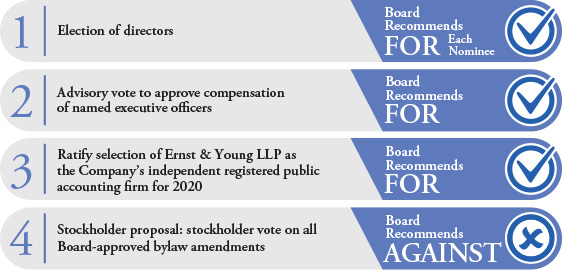

Items of business include:

Election of 10 nominees as directors;

Advisory vote to approve the compensation of the Company’s named executive officers;

Ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2020;

The stockholder proposal requesting that the Board of Directors adopt a bylaw requiring that any Board-approved bylaw amendment be subject to a non-binding stockholder vote; and

The transaction of any other business that properly comes before the meeting.

The record date for the Annual Meeting is February 24, 2020 (the “Record Date”). Only stockholders of record of our Class A Common Stock (the “Common Stock”) as of the close of business on the Record Date are entitled to vote at the Annual Meeting. You may vote in person at the Annual Meeting, or by internet, phone, or mail (by returning your proxy card or voting instruction form). For more detailed information on voting, see the section titled “General Information.” Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible.

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), the Company has elected to send you a full set of proxy materials (and notify you of the availability of the Company’s proxy materials on the internet). On March 20, 2020, we commenced mailing proxy materials and our Annual Report to our stockholders.

***

While we intend to hold the meeting in person at this time, we are closely monitoring the coronavirus, or COVID-19, situation. If it becomes necessary for us to hold the meeting by means of remote communication, we will announce that decision promptly, and details on how to participate will be available at https://www.spiritaero.com/2020-annual-meeting.

***

By order of the Board of Directors.

Sincerely,

Stacy Cozad

Senior Vice President, General Counsel, Chief Compliance Officer, and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 22, 2020:

The Proxy Statement and Annual Report are available at http://www.proxyvote.com

This summary highlights certain information contained elsewhere in the accompanying Proxy Statement. This summary does not contain all the information you should consider before voting your shares. For more complete information regarding the proposals to be voted on at the Annual Meeting and our 2019 performance, please review the entire Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

We use the terms “Spirit,” the “Company,” “we,” “us,” and “our” in this Proxy Statement to refer to Spirit AeroSystems Holdings, Inc. and its consolidated subsidiaries.

Matters to Be Voted On at the Annual Meeting

Stockholders of record of our Common Stock as of February 24, 2020, may vote their shares using any of the following methods:

|  |  |  |  |

BY INTERNET Visit www.proxyvote.com | MOBILE DEVICE Use your tablet or smartphone

| BY MAIL Complete | BY PHONE Call 1-800-690-6903 | IN PERSON Vote in person at the |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 6

| |

HEADQUARTERS | Wichita, Kansas |

WORLDWIDE EMPLOYEES | Approximately 15,000 |

LOCATIONS | Kansas, Maine, North Carolina, Oklahoma and Texas, U.S.; U.K.; France; Malaysia |

MAJOR CUSTOMERS | Airbus, Boeing, Bell Helicopter, Lockheed Martin (Sikorsky), Mitsubishi Aircraft Corporation, Northrop Grumman, Rolls-Royce |

Spirit is a leading tier-one global aerostructures provider. We manufacture large aerostructures, including fuselages, wing structures, engine nacelles, pylons, fan cowls, thrust reversers, and systems integration for the world’s premier aircraft. Spirit’s capabilities include metal manufacturing and assembly, precision assembly, and composites manufacturing.

Our engineering capabilities, combined with our capacity for high-volume production, have positioned Spirit as a leading aerostructures supplier to both Airbus and Boeing. For Boeing, we manufacture the B737 fuselage, the front section of the B787 fuselage, and otherwise manufacture parts for every Boeing commercial aircraft currently in production. Further, for Airbus, we supply fuselage and wing aerostructures content on the A350 XWB and wing aerostructures content on the A320 and A330. We are adding new Airbus content and contracts with other customers with the previously announced Asco and Bombardier acquisitions. Spirit also supplies aerostructures for various regional and business jet programs, including pylons on the A220 and Mitsubishi Regional Jet, as well as nacelles for Rolls-Royce engines used on Gulfstream aircraft.

In addition to producing aerostructures for commercial aircraft, Spirit designs, engineers, and manufactures structural components for military programs. We have been awarded a significant amount of work for Boeing’s P-8, C-40, and KC-46 tanker, all of which are commercial aircraft modified for military use. We are also involved in the development and production of various parts for the Sikorsky CH-53K heavy-lift helicopter and Bell V-280 tiltrotor aircraft. In addition, Spirit is proud to be a member of the Northrop Grumman B-21 Raider industry team. Spirit has invested heavily in research and development labs that enable us to deliver innovation and value on defense programs.

Spirit recently acquired Fiber Materials Inc. (“FMI”), an industry-leading technology company specializing in multi-directional reinforced composites that enable high-temperature applications such as thermal protection systems, re-entry vehicle nose tips, as well as rocket motor throats and nozzles. FMI's unique capabilities have positioned it as a leader in carbon-carbon high-temperature materials for hypersonic missiles, which the U.S. Department of Defense has identified as a national priority.

Spirit expects to complete its previously announced acquisitions of Asco and Bombardier aerostructures in 2020, which will increase its exposure to Airbus, business and regional jets, and defense work.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 7

Spirit Values and Fundamental Behaviors

At Spirit, we believe that culture and values play an important role in the success of corporate strategy. Values are demonstrated in the way we think, act, and ultimately achieve results. The following values guide our ways of working:

| Transparency I am open, honest, and respectful with my communication. I speak up to share my ideas and build trust by making my intentions clear. |

| Collaboration I align my actions with others, so we work together to achieve the best outcome in everything we do. |

| Inspiration I encourage the best from others, and I lead by example to ensure innovation is a component of our success. |

| Safety | Our employees are our greatest asset. We are committed to conducting our operations in a manner that prioritizes the safety and continued health of our employees and other workers. We are committed to continual assessment, training, and investment to execute our safety goals and reduce injuries and incidents. |

|

| Quality | We are committed to continually improving our quality and meeting or exceeding our customers’ quality expectations. |

|

| On-Time Delivery | We are committed to successful on-time delivery. The success of our customers depends on our ability to meet their delivery expectations consistently. |

|

| Customer Focused | Being a trusted partner to our customers is essential to our ability to win profitable new business. We focus on our customers by meeting our operating commitments and working alongside our customers to develop innovative solutions to their challenges. We are committed to continually investing in new technologies to improve quality, lower costs, and increase production capabilities, in a mutually beneficial way. |

|

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 8

About Spirit’s Director Nominees and Governance Practices

Name | Age | Director Since |

| Principal Occupation | Independent | Committee Memberships |

Stephen A. Cambone | 67 | 2019 |

| Associate Vice Chancellor for Cyber Initiatives, Texas A&M University System | Yes | Audit |

Charles L. Chadwell | 79 | 2008 |

| Retired VP/GM of Commercial Engine Operations, GE Aircraft Engines | Yes | Governance (Chair) |

Irene M. Esteves | 61 | 2015 |

| Retired CFO, Time Warner Cable Inc. | Yes | Audit (Chair) |

Paul E. Fulchino | 73 | 2006 |

| Retired Chairman, President and CEO, Aviall, Inc. | Yes | Compensation (Chair) |

Thomas C. Gentile III | 55 | 2016 |

| President and CEO, Spirit AeroSystems Holdings, Inc. | No |

|

Richard A. Gephardt | 79 | 2006 |

| President and CEO, Gephardt Group | No |

|

Robert D. Johnson, Chairman | 72 | 2006 |

| Retired CEO, Dubai Aerospace Enterprise Ltd. | Yes | Compensation |

Ronald T. Kadish | 71 | 2006 |

| Retired EVP, Booz Allen Hamilton | Yes | Risk (Chair) |

John L. Plueger | 65 | 2014 |

| President and CEO, Air Lease Corporation | Yes | Audit |

Laura H. Wright | 60 | 2018 |

| Retired SVP and CFO, Southwest Airlines | Yes | Audit |

| Cambone | Chadwell | Esteves | Fulchino | Gentile | Gephardt | Johnson | Kadish | Plueger | Wright |

Public Company CEO |

|

|

| • | • |

|

|

| • |

|

Public Company CFO |

|

| • |

|

|

|

|

|

| • |

Aviation Operations Management |

| • |

| • | • |

| • | • | • | • |

Public Company Board |

| • | • | • | • | • | • | • | • | • |

Executive Compensation |

| • |

| • | • |

| • |

| • | • |

Risk Management | • |

| • |

| • |

| • | • |

| • |

M&A |

|

| • | • | • |

| • |

|

| • |

Senior Government | • |

|

|

|

| • |

| • |

|

|

Cyber | • |

|

|

|

|

|

| • |

|

|

International | • |

|

|

| • |

| • |

| • |

|

Defense | • | • |

|

| • |

| • | • |

|

|

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 9

Corporate Governance Highlights

Board Practices |

| Stockholder Protections |

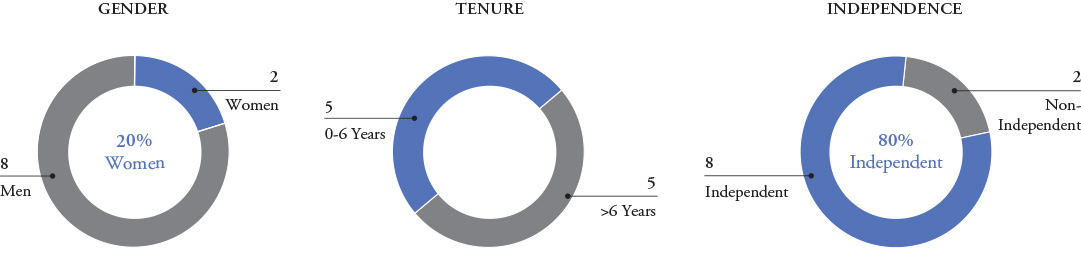

8 out of 10 director nominees are independent 8 out of 10 director nominees are independent |

|  Right to call special meetings Right to call special meetings |

All committees are composed solely of independent directors All committees are composed solely of independent directors |

|  No poison pill or similar plan No poison pill or similar plan |

Separate chairman and CEO Separate chairman and CEO |

|  Active stockholder engagement program Active stockholder engagement program |

Regular executive sessions of non-management directors Regular executive sessions of non-management directors |

|  Annual say-on-pay vote Annual say-on-pay vote |

Annual Board and committee evaluations Annual Board and committee evaluations |

|  Annual election of all directors Annual election of all directors |

Robust stock ownership requirements for directors Robust stock ownership requirements for directors |

|  Majority voting standard in uncontested director elections Majority voting standard in uncontested director elections |

Regularly analyze Board and committee composition and succession Regularly analyze Board and committee composition and succession |

|  Right to act by written consent Right to act by written consent |

Risk oversight process with separate committee roles Risk oversight process with separate committee roles |

|  Market-standard proxy access right Market-standard proxy access right |

Overboarding policy Overboarding policy |

|  Insiders are not permitted to short sell, hedge, or pledge Company securities Insiders are not permitted to short sell, hedge, or pledge Company securities |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 10

About Spirit’s Executive Compensation Program

Overview of Spirit’s Executive Compensation Program

Highlights of our executive compensation program are below. For a full understanding of the compensation we pay to our named executive officers, please review our “Compensation Discussion and Analysis” and the related compensation tables in this Proxy Statement.

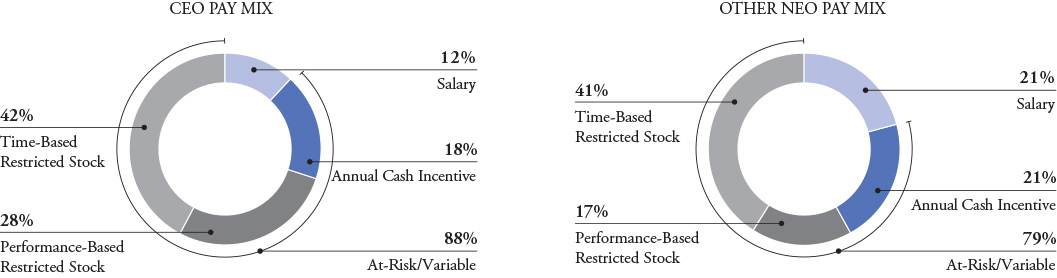

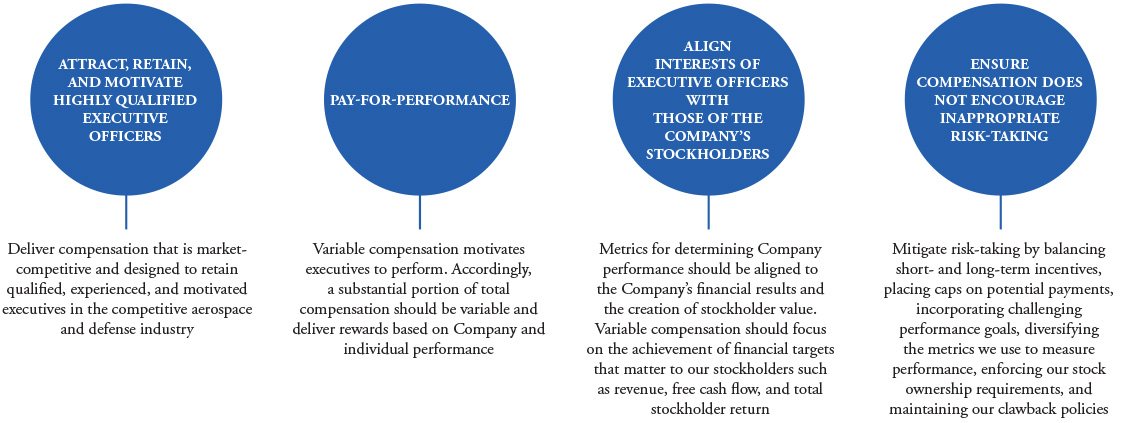

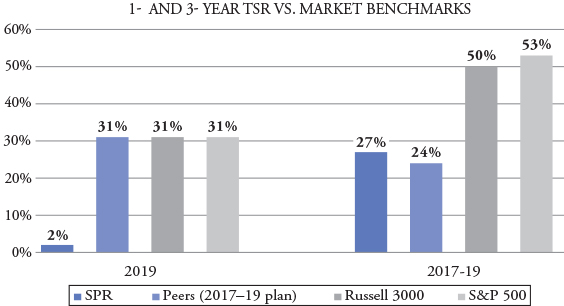

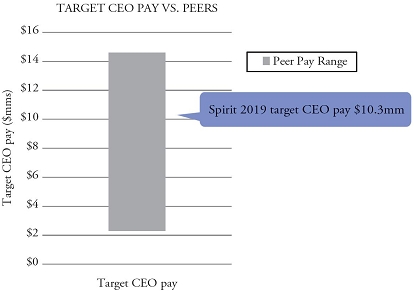

Our compensation objectives are to (i) attract, retain, and motivate highly qualified executive officers, (ii) pay-for-performance using short-term and long-term incentives, (iii) align interests of the Company’s executive officers with the Company’s stockholders by using compensation performance measures that are meaningful to our stockholders, and (iv) ensure compensation does not encourage inappropriate risk-taking by diversifying performance measures, using payment caps, and maintaining clawback policies, among other things. The 2019 compensation structure (excluding perquisite and “other” compensation, and excluding Mr. Kapoor) for our CEO and the other named executive officers (“NEOs”) is below. As the charts below demonstrate, 88% of our CEO’s direct compensation was variable based on performance goals, while 79% of the other NEOs’ direct compensation was variable based on performance.

2019 Pay-for-Performance Metrics

| Incentive Program | Financial Metrics | Weighting |

ANNUAL CASH INCENTIVE | Company Portion of | Adjusted Free Cash Flow* | 50%

|

Adjusted EBIT* | 30%

| ||

Revenue | 20%

| ||

Individual Portion of Annual Cash Incentive (20-25%) | None; based on individual performance goals | 100%

| |

LONG-TERM INCENTIVES | Time-Based Restricted Stock | Stock Price | 60%

|

Performance-Based Restricted Stock | Free Cash Flow as a Percentage of Revenue* | 20%

| |

Total Stockholder Return | 20%

| ||

* Please see Appendix A for an explanation and reconciliation of these non-GAAP measures. | |||

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 11

Best Practices | What the Company Doesn’t Do |

Align pay and performance - substantial portion of pay is delivered through variable, at-risk compensation Align pay and performance - substantial portion of pay is delivered through variable, at-risk compensation |  No ongoing new defined-benefit Supplemental Executive Retirement Plan accruals No ongoing new defined-benefit Supplemental Executive Retirement Plan accruals |

Payout of annual cash incentive and performance-based restricted stock awards is capped at 200% Payout of annual cash incentive and performance-based restricted stock awards is capped at 200% |  No short selling, pledging, or hedging stock No short selling, pledging, or hedging stock |

Performance goals are relevant, challenging, and tied to key measures of profitability and performance Performance goals are relevant, challenging, and tied to key measures of profitability and performance |  No enhanced health and welfare benefit plans for executives No enhanced health and welfare benefit plans for executives |

Long-term incentives paid entirely in stock Long-term incentives paid entirely in stock |  No accumulation of dividends on unvested performance-based restricted stock awards No accumulation of dividends on unvested performance-based restricted stock awards |

Clawback policies Clawback policies |  No dividend payments on time-based restricted stock awards until they vest No dividend payments on time-based restricted stock awards until they vest |

Robust stock ownership requirements Robust stock ownership requirements |  No tax gross-ups related to a change-in-control No tax gross-ups related to a change-in-control |

Double-trigger change-in-control provisions Double-trigger change-in-control provisions |  No guaranteed payouts on performance-based compensation (except for upon death, disability, or qualifying retirement) No guaranteed payouts on performance-based compensation (except for upon death, disability, or qualifying retirement) |

Stockholders cast an annual advisory say-on-pay vote Stockholders cast an annual advisory say-on-pay vote |  No share recycling (other than in the context of forfeited shares) No share recycling (other than in the context of forfeited shares) |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 12

ELECTION OF DIRECTORS

The Board of Directors is elected each year at the Company’s annual meeting of stockholders. Spirit currently has 10 directors. Each director elected at the Annual Meeting will serve until the 2021 annual meeting of stockholders and until the election and qualification of his or her respective successor, subject to the director’s earlier death or disability.

Based on the recommendations of the Company’s Corporate Governance and Nominating Committee (the “Governance Committee”), the Board has nominated each of the persons listed below for election as directors. Except for Dr. Cambone, who joined the Board on October 22, 2019, all nominees have served as directors of the Company since the 2019 annual meeting of stockholders.

Each of the nominees has agreed to serve if elected and, as of the date of this Proxy Statement, the Company has no reason to believe that any nominee will be unavailable to serve. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders’ intention is to vote the proxies for such other person as may be designated by the present Board to fill such vacancy.

The following information with respect to the 10 nominees is based on information furnished to the Company by each nominee and highlights the specific experience, qualifications, attributes, and skills of the individual nominees that have led the Board to conclude that each should continue to serve on the Board.

| Stephen A. Cambone | |

Age 67 Director Since 2019 Independent Director | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• Associate Vice Chancellor for Cyber Initiatives, Texas A&M University System (2017-present) • Trustee, Rumsfeld Foundation (2012-present) • Founder, Adirondack Advisors, LLC (2012-2018) • Senior positions at QinetiQ, Inc. (2007-2012), including Executive Vice President, Strategic Development, and President, Missions Solution Group • Undersecretary of Defense for Intelligence, U.S. Department of Defense (2003-2006) (served in other roles with the U.S. Department of Defense from 2001-2003) | • Spirit AeroSystems Holdings, Inc. (2019-present) Committee Assignments: • Audit • Risk | |

| Qualifications, Experience, Key Attributes, and Skills: Dr. Cambone brings to the Board extensive governmental affairs, defense, and intelligence expertise, along with executive leadership experience in the defense technology industry. Dr. Cambone yields world-class knowledge of cybersecurity matters and invaluable insight into strategic development given his years of experience in the private sector and government. | |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 13

| Charles L. Chadwell | |

Age 79 Director Since 2008 Independent Director | ||

Pre-Retirement Professional Experience: | Current Public Company Directorships: | |

• Vice President and General Manager of Commercial Engine Operations, General Electric Aircraft Engines (“GE Aviation”)(1994-2002) • Vice President, Operations, GE Aviation (1990-1994) • Vice President, Human Resources, GE Aviation (1988-1990) | • Spirit AeroSystems Holdings, Inc. (2008-present) | |

Former Public Company Directorships Held in the Past Eight Years: | ||

• B/E Aerospace (2007-2012) | ||

| Committee Assignments: | |

| • Governance (Chair) • Compensation | |

| Qualifications, Experience, Key Attributes, and Skills: Mr. Chadwell brings to the Board critical supply chain and manufacturing operations expertise, and executive leadership experience, within the commercial and defense aviation industry. Mr. Chadwell provides the Board with compensation, governance, and human resources expertise, and valuable insight and perspective into aviation industry trends, developments, and challenges. Mr. Chadwell also brings to the Board experience as a public company director. | |

| Irene M. Esteves | |

Age 61 Director Since 2015 Independent Director | ||

Pre-Retirement Professional Experience: | Current Public Company Directorships: | |

• Chief Financial Officer, Time Warner Cable Inc. (2011-2013) • Executive Vice President and Chief Financial Officer, XL Group plc (2010-2011) • Senior Vice President and Chief Financial Officer, Regions Financial Corporation (2008-2010) | • Spirit AeroSystems Holdings, Inc. (2015-present) • RR Donnelley & Sons Co. (2017-present) • Aramark Holdings Corp. (2015-present) • KKR Real Estate Finance Trust Inc. (2018-present) | |

Former Public Company Directorships Held in Past Six Years: | ||

• Level 3 Communications (2014-2017) • TW Telecom Inc. (2014) | ||

Committee Assignments: | ||

• Audit (Chair) • Risk | ||

| Qualifications, Experience, Key Attributes, and Skills: Ms. Esteves has experience in global finance, corporate strategy, human resources, treasury, accounting, tax, risk management, mergers and acquisitions, and investor relations across multiple industries. Ms. Esteves also brings to the Board experience as a public company director. In addition, Ms. Esteves qualifies as an audit committee financial expert under SEC rules. | |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 14

| Paul E. Fulchino | |

Age 73 Director Since 2006 Independent Director | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• Operating Partner, AE Industrial Partners (“AEI”) (2015-present) • Senior Advisor, The Boeing Company (“Boeing”) (2010-2014) • Chairman, President and Chief Executive Officer, Aviall, Inc. (2000-2010) (Aviall became a wholly owned subsidiary of Boeing in September 2006) • President and Chief Operating Officer, B/E Aerospace, Inc. (1996-1999) • President and Vice Chairman, Mercer Management Consulting (1990-1996) | • Spirit AeroSystems Holdings, Inc. (2006-present) | |

Former Public Company Directorships Held in Past Five Years: | ||

• Wesco Aircraft Holdings, Inc. (2008-2020; Wesco filed a securities termination registration notice in January 2020) | ||

| Committee Assignments: | |

| • Compensation (Chair) • Governance | |

| Qualifications, Experience, Key Attributes, and Skills: Mr. Fulchino provides the Board with executive leadership experience, and extensive knowledge and expertise regarding the commercial aviation industry, the Company’s customers and supply base, compensation and human resource matters, and mergers and acquisitions. Mr. Fulchino also brings to the Board experience as a public company director. | |

| Thomas C. Gentile III | |

Age 55 Director Since 2016 | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• President and Chief Executive Officer, Spirit AeroSystems Holdings, Inc. (2016-present) • Executive Vice President and Chief Operating Officer, Spirit AeroSystems Holdings, Inc. (April 2016-August 2016) • President and Chief Operating Officer, General Electric Capital Corporation (2014-2016) • President and Chief Executive Officer, General Electric Healthcare Systems (2011-2014) • President and Chief Executive Officer, General Electric Aviation Services (2008-2011) | • Spirit AeroSystems Holdings, Inc. (2016-present) Former Public Company Directorships Held in Past Five Years: • Synchrony Financial Bank (2015) | |

| ||

| ||

| Qualifications, Experience, Key Attributes, and Skills: Mr. Gentile has demonstrated success in managing large, complex global technology businesses across multiple industries. He brings to the Board a deep understanding of aviation program management, product development, strategy, and business development. Mr. Gentile also brings to the Board experience as a public company director. | |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 15

| Richard A. Gephardt | |

Age 79 Director Since 2006 | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• President and Chief Executive Officer, Gephardt Consulting Group (“GCG”) (2007-present) • President and Chief Executive Officer, Gephardt Governmental Affairs (“GGA” and, together with GCG, the “Gephardt Group”) (2005-present) • Member, U.S. House of Representatives (1977-2005). During this time, he served as the House Minority Leader (1995-2003) and House Majority Leader (1989-1995) | • Spirit AeroSystems Holdings, Inc. (2006-present) • Centene Corp. (2006-present) | |

Former Public Company Directorships Held in Past Five Years: | ||

• Century Link, Inc. (2007-2016) • Ford Motor Company (2009-2015) • U.S. Steel Corporation (2005-2015) | ||

| Qualifications, Experience, Key Attributes, and Skills: Mr. Gephardt brings governmental affairs and public relations experience to the Board, along with labor management and union expertise. He provides the Board with a perspective on public policy, political affairs, and the regulatory environment. Mr. Gephardt also brings to the Board experience as a public company director. | |

| Robert D. Johnson, Chairman | |

Age 72 Director Since 2006 Independent Director | ||

Pre-Retirement Professional Experience: | Current Public Company Directorships: | |

• Chief Executive Officer, Dubai Aerospace Enterprise Ltd. (2006-2008) • Chairman, Honeywell Aerospace (2005-2006) • President and Chief Executive Officer, Honeywell Aerospace (known as Allied Signal Aerospace until 2000) (1999-2005) • President and Chief Executive Officer, Electronic and Avionics Systems, Honeywell Aerospace (known as Allied Signal Aerospace at the time) (1997-1999) | • Spirit AeroSystems Holdings, Inc. (2006-present) • Roper Technologies, Inc. (2005-present) • Spirit Airlines, Inc. (2010-present) | |

Former Public Company Directorships Held in Past Eight Years: | ||

• Ariba, Inc. (2003-2012) | ||

Committee Assignments: | ||

• Compensation • Governance | ||

| Qualifications, Experience, Key Attributes, and Skills: Mr. Johnson, Chairman of the Board, has aviation industry executive leadership experience and executive compensation and human resource experience, and provides the Board with valuable insight and perspective resulting from his expertise in marketing, sales, supply chain, and production operations. Mr. Johnson also brings to the Board experience as a public company director. | |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 16

| Ronald T. Kadish | |

Age 71 Director Since 2006 Independent Director | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• Consultant, Raytheon (2018-2019) • Senior Executive Advisor, Booz Allen Hamilton (“BAH”) (2015-2019) • Executive Vice President, BAH (2005-2015) • Director, U.S. Missile Defense Agency (2002-2004) • Director, Ballistic Missile Defense Organization, U.S. Department of Defense (1999-2001) • Commander, Electronic Systems Center, Hanscom Air Force Base (1996-1999) | • Spirit AeroSystems Holdings, Inc. (2006-present) | |

Former Public Company Directorships Held in Past Five Years: | ||

• Northrop Grumman Innovation Systems, Inc. (formerly known as Orbital ATK, Inc.) (2015-2019) • Orbital Sciences Corp. (2005-2015) | ||

Committee Assignments: | ||

• Risk (Chair) • Governance | ||

| Qualifications, Experience, Key Attributes, and Skills: Mr. Kadish provides the Board with unique expertise in military, program management, security, international, and governmental matters, including having served three decades in the U.S. Air Force, rising to the rank of Lieutenant General. He delivers critical insight to the Board with respect to enterprise risk management, cybersecurity, global security, and our defense customers’ needs and expectations. Mr. Kadish also brings to the Board experience as a public company director. | |

| John L. Plueger | |

Age 65 Director Since 2014 Independent Director | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• Chief Executive Officer and President, Air Lease Corporation (“ALC”) (2016-present) • President and Chief Operating Officer, ALC (2010-2016) • President and Chief Executive Officer, International Lease Finance Corporation (“ILFC”) (2010) • President and Chief Operating Officer, ILFC (2002-2010) | • Spirit AeroSystems Holdings, Inc. (2014-present) • ALC (2010-present) Committee Assignments: • Audit • Risk | |

| Qualifications, Experience, Key Attributes, and Skills: Mr. Plueger provides the Board with valuable insight into the aviation industry and aviation operations management stemming from his executive leadership roles at ILFC and ALC. In addition, Mr. Plueger has significant experience in finance and accounting matters as a certified public accountant, having received his training as an auditor from PricewaterhouseCoopers. Mr. Plueger qualifies as an audit committee financial expert under SEC rules. Mr. Plueger also brings to the Board experience as a public company director. | |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 17

| Laura H. Wright | |

Age 60 Director Since 2018 Independent Director | ||

Recent Professional Experience: | Current Public Company Directorships: | |

• Senior Vice President and Chief Financial Officer, Southwest Airlines Co. (“SWA”) (2004-2012) • Vice President, Finance, and Treasurer, SWA (2001-2004) • Treasurer, SWA (1998-2001) | • Spirit AeroSystems Holdings, Inc. (2018-present) • TE Connectivity Ltd. (2014-present) • CMS Energy Corp. (and its wholly-owned subsidiary, Consumers Energy Company) (2013-present) | |

Former Public Company Directorships Held in Past Five Years: | ||

• Pebblebrook Hotel Trust (2009-2019) | ||

Committee Assignments: | ||

• Audit • Risk | ||

| Qualifications, Experience, Key Attributes, and Skills: Ms. Wright has experience in corporate finance and accounting, commercial aviation operations, risk management, and mergers and acquisitions as a result of her position as Senior Vice President and Chief Financial Officer of SWA, and various other financial positions held during her 25-year career at SWA. Ms. Wright worked for Arthur Young & Co. from 1982-1988 prior to joining SWA. Ms. Wright is a certified public accountant and qualifies as an audit committee financial expert under SEC rules, and also brings to the Board experience as a public company director. | |

The Company’s bylaws provide for simple majority voting in an uncontested election of directors. In order for a director nominee to be elected, the votes that stockholders cast “FOR” the director nominee must exceed the votes that stockholders cast “AGAINST” the director nominee. In the event that an incumbent nominee does not receive the requisite majority of votes cast in this election, the Company will follow the procedure described under “General Information — What Happens if an Incumbent Director Nominee is Not Elected at the Annual Meeting?” Any shares not voted (whether by abstention, broker non-vote, or otherwise) will have no impact on the election of directors. Your broker may not vote your shares on this proposal unless you give voting instructions.

The Board recommends that you vote FOR each of the director nominees.

The Board recommends that you vote FOR each of the director nominees.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 18

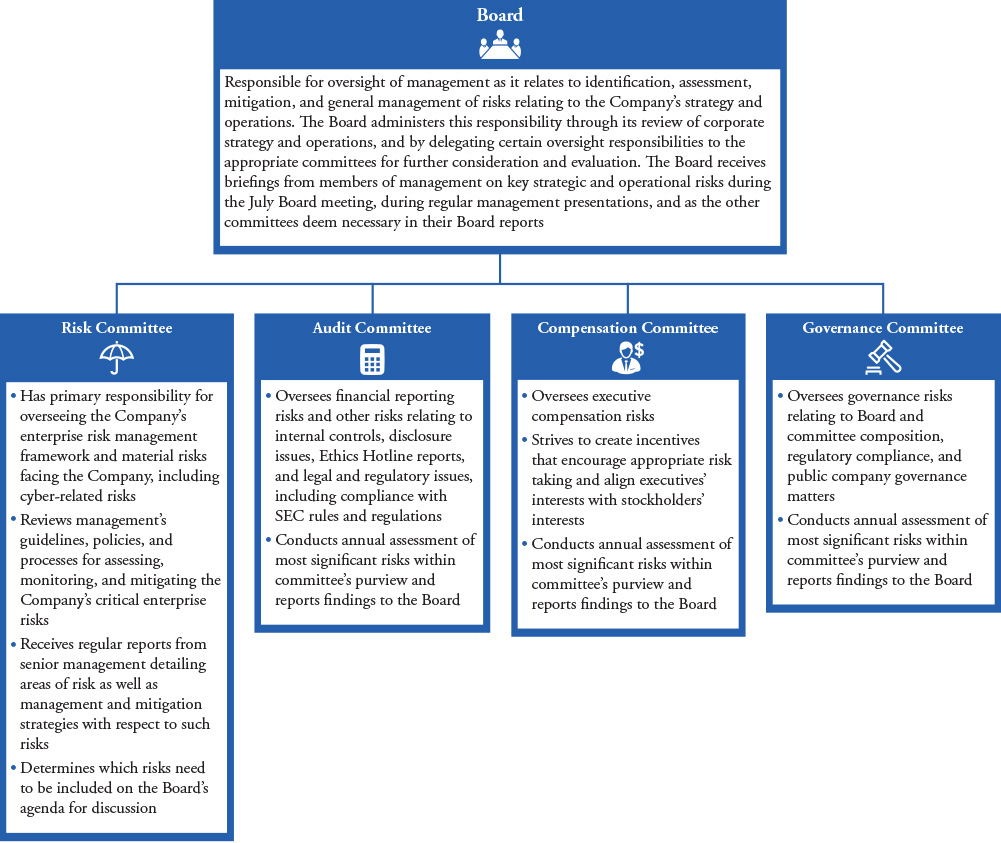

The Company is governed by its Board of Directors. Other than with respect to matters reserved to stockholders, the Board is the ultimate decision-making body of the Company. The Board is responsible for overseeing the Company’s strategy and performance, and protecting stockholder interests and value. Further, the Board is responsible for selecting and overseeing the Company’s executive officers, who set and execute the Company’s business strategy and handle the Company’s day-to-day operations.

In carrying out its responsibilities, the Board has created and delegated certain responsibilities to four standing committees: the Audit Committee, the Compensation Committee, the Governance Committee, and the Risk Committee. Additional information about these committees and their responsibilities is described under “Committees.”

Corporate Governance Guidelines

The Board is committed to maintaining corporate governance practices that maximize stockholder value. To further its commitment, the Board has adopted the Company’s Corporate Governance Guidelines (the “Governance Guidelines”) to ensure that the Board has the necessary authority and practices in place to effectively review and evaluate the Company’s strategy and operations, to make decisions that are independent of the Company’s management, to oversee management, and to monitor adherence to the Company’s standards and policies. The Governance Guidelines speak to a number of different matters including Board responsibilities, management succession, director conflicts of interest, director compensation, and director attendance at meetings, among other things. The Governance Guidelines are available at http://investor.spiritaero.com/govdocs.

Pursuant to our bylaws, the Board of Directors is required to consist of three or more directors and may be increased or decreased at any time by the Board of Directors. Currently, the Board of Directors consists of 10 directors. Pursuant to its charter, the Governance Committee is responsible for reviewing the size of the Board and recommending to the Board any changes it deems appropriate with respect to Board size.

The Company has separated the roles of Chief Executive Officer (“CEO”) and Chairman of the Board in recognition of the differences between the two roles and the value of independent leadership oversight. The Board believes that separation of the roles is appropriate for the Company as it maximizes the ability of the CEO to focus on Company strategy and operations without distraction, while benefiting from the Chairman’s perspective and insight. Because Mr. Johnson, the Chairman of the Board, is an independent director, the Board has not deemed it necessary to appoint a lead independent director.

While the CEO is responsible for implementing strategy and managing the day-to-day operations and performance of the Company, the Chairman of the Board performs the following duties:

Sets the agenda for Board meetings;

Presides over meetings of the full Board and executive sessions of independent directors;

Presides over stockholder meetings;

Serves as a liaison between the CEO and the independent directors;

Provides feedback to the CEO on behalf of the independent directors regarding business issues and Board management; and

Engages with the CEO weekly to discuss Company performance and matters of significance.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 19

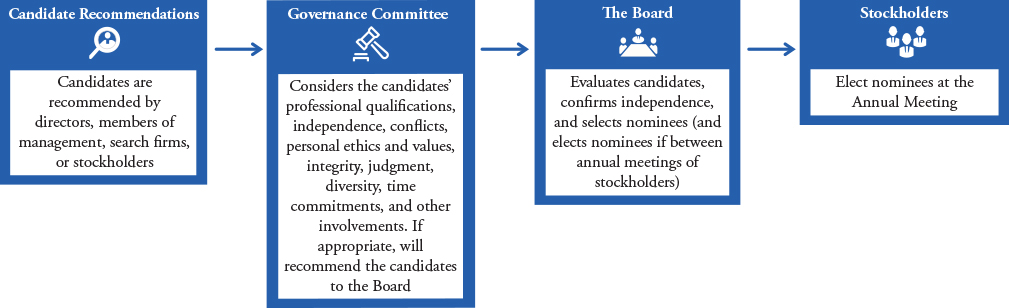

Selecting qualified individuals to serve as directors is key to the Board’s performance. The Governance Committee is responsible for evaluating qualified potential candidates to serve on the Board, and recommending to the Board for its selection nominees to stand for election as directors at the Company’s annual meeting of stockholders. This responsibility is further described in the Governance Committee’s charter, which is available at: http://investor.spiritaero.com/govdocs. In evaluating candidates, the Governance Committee and Board consider the qualifications and expertise of director candidates individually and in the broader context of the Board’s overall composition, taking into account any particular needs that the Company may have based on its strategic initiatives, risks, and opportunities. The Company has engaged a third-party international executive search firm to assist the Governance Committee in identifying and evaluating potential director candidates.

In evaluating individual candidates, the Governance Committee considers the personal ethics and values, experience, judgment, and diversity of the candidates, among other things. It is the policy of the Board that the Board reflect diversity of viewpoint, professional experience, education, skill, expertise, industry knowledge, and such other factors as the Governance Committee and Board believe would enhance the effectiveness of the Board. Nominees must have high standards of integrity and ethics, and convey a commitment to act in the best interest of the Company and its stockholders.

In addition, the Governance Committee considers the candidates’ employment and other commitments, and evaluates whether the candidates have sufficient time available to efficiently and effectively carry out the duties of directors. For additional information, see section “Overboarding Policy.”

It is the Governance Committee’s policy to consider candidates nominated by stockholders in compliance with applicable laws, regulations, and the procedures described in the Company’s bylaws and Proxy Statement. If a stockholder desires to recommend a director candidate for nomination by the Governance Committee, the stockholder should follow the procedures described under “Stockholder Proposals and Director Nominations for the 2021 Annual Meeting.” Director candidates recommended by stockholders will be considered and evaluated in the same manner as candidates discovered through other sources.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 20

Director Tenure and Refreshment

While the Company has added five new directors to its Board in the past six years, five of the nominees have served on the Board for more than 10 years. Through its annual evaluation process, the Board has determined that each of these five nominees provides diversity of experience and perspective, and plays an integral and necessary role in the boardroom. The Board has periodically evaluated age and term limits along with retirement policies, and has determined that such limits and policies may arbitrarily restrict valuable Board members from service. Instead, the Board has determined to continue evaluating its members on their merits based on the contributions they make in the boardroom and their ability to enhance overall Board effectiveness. The Board is committed to routine Board and director refreshment as needed to enhance Board effectiveness, and primarily uses Board and committee evaluations and composition discussions as its refreshment mechanisms.

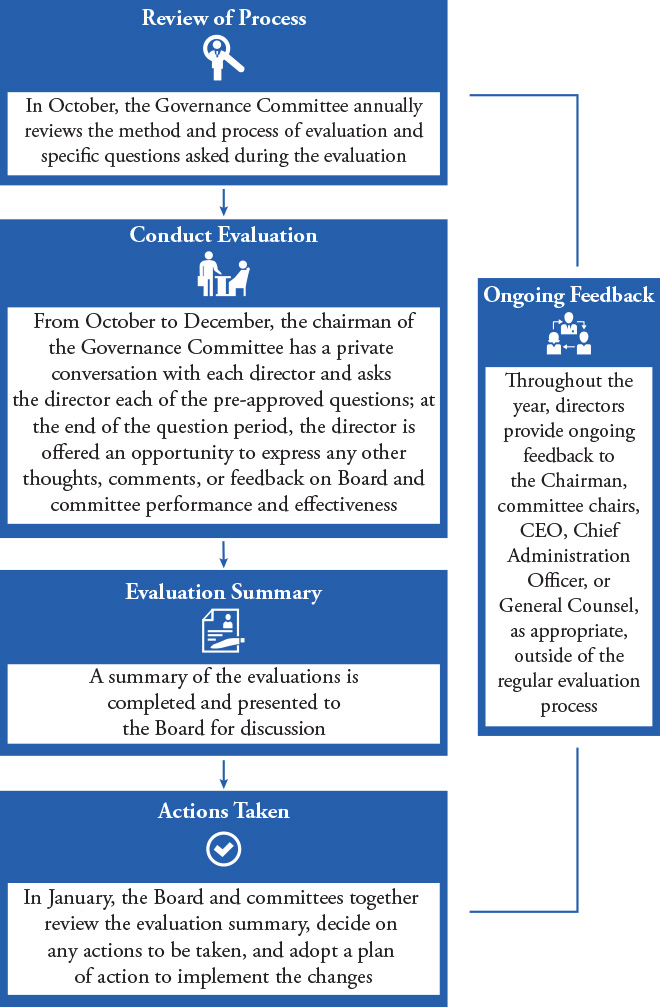

Board and Committee Evaluations

Each year, the Governance Committee oversees an evaluation of the Board and each committee. The 2019 evaluation covered the following topics, among other things:

Composition of the Board and committees and whether the composition is appropriate in light of the Company’s strategic priorities;

Effectiveness of Board and committee leadership;

Strengths of the Board and committees and opportunities for improvement;

Quality of information provided to the Board;

Effectiveness of structures and practices;

Quality of the directors’ relationships with each other; and

Quality of the Board’s relationship with management.

A summary of the evaluation process is below:

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 21

Our director education program is multifaceted and includes occasional site visits and tours, in-depth education seminars on topics of interest by senior management and external advisors, background material on the Company’s operations and strategy, and the regular provision of resources from various educational institutions to directors. Each new Board member receives onboarding programming that involves meetings with senior management, business overviews, and presentations on the Code of Business Conduct, insider trading, and various other policies and procedures. We encourage our directors to attend reputable director education programs sponsored by external advisors and educational institutions.

The Company’s Common Stock is listed on the New York Stock Exchange (the “NYSE”), and the Company uses the NYSE’s listing standards to determine director independence. Under the NYSE’s listing standards and the Governance Guidelines, the Board must consist of a majority of independent directors, and the Audit, Governance, and Compensation Committees must consist solely of independent directors. For a director to qualify as independent, the Board must determine that the director has no material relationship with the Company (either directly, or as a partner, stockholder, or officer of an organization that has a relationship with the Company). The Board performs an independence assessment of each director annually, with the assistance of the Governance Committee, and as circumstances may otherwise require.

In assessing the existence of a material relationship with the Company, the Board considers all relevant transactions, relationships, and arrangements required by the NYSE’s independence standards, as applicable to non-employee directors generally and as applicable to each committee. The Board examined each director’s involvement through directorships, employment, consulting relationships, or otherwise, with entities the Company does business with. In particular, the Board evaluated the following:

Topic | Transaction Evaluated | Outcome |

Paul E. Fulchino | When considering the independence of Mr. Fulchino, the Board considered his role as an operating partner of AEI, a private equity firm that has ownership interests in several of the Company’s suppliers. In his role at AEI, Mr. Fulchino assists with the acquisition, development, and value creation of portfolio companies. Mr. Fulchino receives a retainer from AEI and does not own any equity in AEI. However, Mr. Fulchino receives a modest carrying interest upon the sale of certain portfolio companies. Mr. Fulchino has no agreements with AEI, is not covered under AEI’s benefit plans or programs, receives a Form 1099 from AEI, and is free to be employed by other companies. | The Board affirmatively determined, based on available facts and circumstances, that Mr. Fulchino was not an employee of AEI (for purposes of the independence determination). Further, with respect to the Company’s transactions with all but one of the AEI-owned suppliers, each transaction arose as a result of the respective entity submitting the most competitive bid out of all bidding suppliers, and, thus, the transactions were not reportable under Item 404 of Regulation S-K. Finally, with respect to the final supplier, the Board determined that Mr. Fulchino’s relationship with AEI did not give rise to a material interest. For these and other reasons, the Board determined that Mr. Fulchino’s relationship with AEI does not give rise to a material relationship that impacts his independence or creates a related person transaction. |

Richard A. Gephardt | When considering Mr. Gephardt’s independence, the Board considered his role as President and Chief Executive Officer of the Gephardt Group, a consulting firm that provides services to the Company in connection with labor matters. Mr. Gephardt holds a 40% equity interest in the Gephardt Group, and Mr. Gephardt’s son, Chief Operating Officer of the Gephardt Group, holds a 10% equity interest. The Company’s transactions with the Gephardt Group in 2019 amounted to $297,513. | The Board affirmatively determined that, in light of Mr. Gephardt’s significant ownership and involvement in the Gephardt Group, Mr. Gephardt has a material relationship with the Company and is, therefore, not independent. |

Based on this analysis, the Board has determined that all the director nominees are independent under the NYSE’s criteria, with the exclusion of Messrs. Gentile and Gephardt. All the committees of the Board are comprised solely of independent directors.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 22

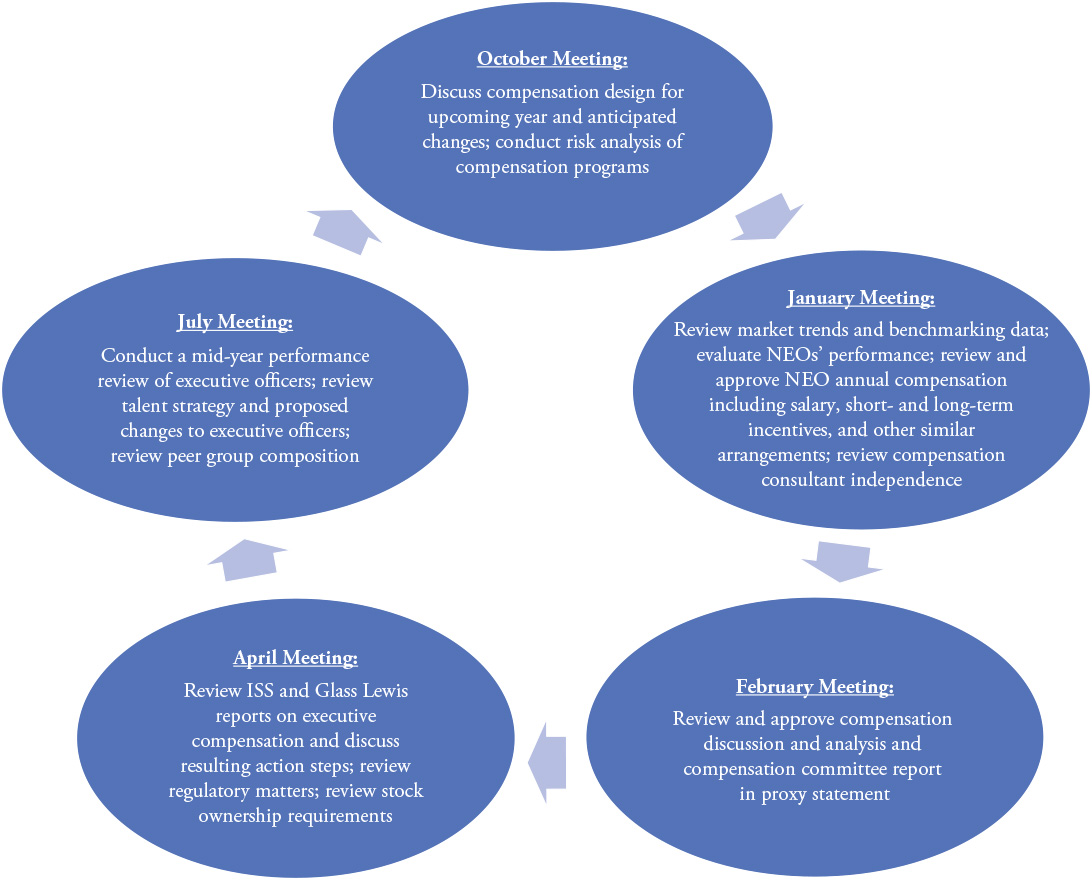

The Board has four committees: the Audit Committee, Compensation Committee, Governance Committee, and Risk Committee. The Board has adopted written charters for each committee, which are available at http://investor.spiritaero.com/govdocs. Information on each committee is set forth in the table below.

Committee | Members | Primary Responsibilities | No. of Meetings in 2019 |

Audit Committee* | Irene M. Esteves (Chair) Stephen A. Cambone** John L. Plueger Laura H. Wright | (1) Oversee the quality and integrity of the Company’s financial reporting. (2) Oversee the Company’s compliance with legal and regulatory requirements. (3) Engage, compensate, and oversee performance of the independent auditor. (4) Oversee performance of the Company’s internal audit function. (5) Review and discuss with management and the independent auditors the Company’s earnings releases and quarterly and annual reports on Forms 10-Q and 10-K, and the audit generally. (6) Consider the effectiveness of the Company’s internal controls over financial reporting and participate in the resolution of internal control issues, where identified. (7) Oversee financial-related risk exposures, and related policies and processes attempting to mitigate such risks. (8) Oversee the Company’s Code of Business Conduct and the Company’s ethics and compliance program. | 8 |

Compensation Committee | Paul E. Fulchino (Chair) Robert D. Johnson Charles L. Chadwell | (1) Review and approve the compensation of the Company’s executive officers. (2) Oversee the administration of the Company’s compensation plans, policies, and programs. (3) Prepare the Compensation Committee Report in this Proxy Statement. (4) Oversee compensation-related risk exposures, and related policies and processes attempting to mitigate such risks. (5) Review and make recommendations to the Board with respect to non-employee director compensation. | 5 |

Governance Committee | Charles L. Chadwell (Chair) Robert D. Johnson Paul E. Fulchino Ronald T. Kadish | (1) Assist the Board in identifying qualified individuals to become Board members. (2) Determine the composition of the Board and its committees. (3) Lead the Board in its annual review of the Board’s performance. (4) Develop and implement the Governance Guidelines and recommend to the Board any changes thereto. (5) Review and approve, deny, or ratify transactions under the Company’s Related Person Transaction Policy. (6) Oversee risks related to the Company’s governance structure. | 4 |

Risk Committee | Ronald T. Kadish (Chair) Stephen A. Cambone** John L. Plueger Irene M. Esteves Laura H. Wright | (1) Provide oversight of management’s guidelines, policies, and processes for assessing, monitoring, and mitigating the Company’s critical enterprise risks, including the major strategic, operating, financial, and compliance risks inherent in the Company’s business and core strategies. (2) Oversee the effectiveness of the Company’s cybersecurity programs and its practices for identifying, assessing, and mitigating cybersecurity risks. (3) Oversee management’s review and assessment of key risks that have the potential to significantly affect the Company’s ability to execute its strategy, and determine which risks should be included on the Board’s agenda for discussion. | 4 |

* The Board has determined that Mses. Esteves and Wright and Mr. Plueger are “audit committee financial experts,” as such term is defined in Item 407(d)(5) of Regulation S-K. ** Dr. Cambone was appointed to these committees on October 22, 2019. | |||

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 23

The Board’s Role in Risk Oversight

Management’s Role in Risk Management

The Company’s management is responsible for the identification, assessment, mitigation, and management of risks relating to the Company’s strategy and operations. Apart from reporting to the Board, management engages in a robust enterprise risk management process that involves: (i) risk-assessment surveys and interviews; (ii) reviewing, repositioning, and prioritizing identified risks by a risk council composed of executive leadership (the “Risk Council”); (iii) assigning risks to risk owners based on responsibilities with respect to the Company’s strategic objectives; (iv) developing and reporting mitigation plans by the risk owners and risk management team to the Risk Council; and (v) oversight by the Company’s internal audit function. On a quarterly basis, the status of the top risks identified in management’s enterprise risk management process, along with their associated mitigation plans, is presented to the Risk Committee. Recent risks that the Company have focused on include the B737 MAX situation and the coronavirus, or COVID-19.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 24

The Risk Committee of the Board is charged with reviewing the Company’s cybersecurity matters, and the Company reports to the Risk Committee quarterly regarding cyber practices and procedures. The Company requires cybersecurity education at all levels of the organization.

Stockholders and other interested persons may communicate with the Board, the Chairman of the Board and individual members of the Board and its committees through the following:

|  |  |

BY EMAIL to CorporateSecretary@spiritaero.com | BY MAIL to Corporate Secretary Spirit AeroSystems Holdings, Inc. 3801 S. Oliver St. Wichita, KS 67210-2112 | IN PERSON at the Annual Meeting

|

The Corporate Secretary will forward communications received to the appropriate party. Receipt of communications clearly not appropriate for consideration by members of the Board, such as unsolicited advertisements, inquiries concerning the Company’s products and services, and harassing communications, are not forwarded to members of the Board.

Commitment to Stockholder Engagement and Responsiveness

We value the feedback and insight we gain from our engagement with stockholders. The Company’s management and subject-matter experts frequently meet with investors to discuss Company performance, governance practices, strategy, operations, and other matters of importance to our stockholders. In 2019, members of the Company’s management held more than 850 in-person and telephonic meetings with investors and analysts, and traveled throughout the continental U.S. and internationally to attend the meetings. The Company is committed to maintaining a robust stockholder outreach program in addition to regular participation at investor and community events and meeting with analysts. The Company welcomes feedback from all stockholders. Stockholders can contact the Company’s Investor Relations team by calling 316-523-7040 or emailing investorrelations@spiritaero.com.

2019 Board and Committee Meetings and Attendance

During 2019, there were four in-person meetings and eight telephonic meetings of the Board. All the Company’s directors attended 75% or more of the aggregate of all meetings of the Board and of committees on which they served in 2019 (with Dr. Cambone’s attendance being measured from his date of election, October 22, 2019). The Company’s Governance Guidelines provide that director attendance is expected at annual meetings of stockholders. With respect to the 2019 annual meeting, all of the then-current directors attended the meeting except for Messrs. Fulchino and Gephardt, who were unable to attend due to personal reasons.

In addition to scheduled Board meetings, the Board receives monthly reports from Mr. Gentile detailing financial results, operating highlights and challenges, and updates on strategic initiatives.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 25

As part of each quarterly in-person Board meeting in 2019, the Company’s non-employee directors met without management present in an executive session. During executive sessions, the non-employee directors reviewed management’s performance, compensation, talent development and succession planning, strategic considerations, corporate governance matters, and other matters of importance.

Per our Governance Guidelines, directors are expected to ensure that other commitments, including outside board memberships, do not interfere with their duties and responsibilities as members of the Board. A director may not serve on the boards of more than four other public companies or, if the director is an active CEO or equivalent of another public company, on the boards of more than two other public companies. In addition, directors must notify the Governance Committee before accepting an invitation to serve on the board of any other public company or other for-profit entity. The director must not accept such service until being advised by the Governance Committee chair that such committee has determined that service on such other board would not create regulatory issues or potential conflicts of interest and would not conflict with the Company’s policies. All directors are in compliance with the Company’s overboarding policy as of the date of this Proxy Statement.

The Company is committed to the highest ethical standards and to complying with all laws and regulations applicable to the Company’s business. To support and articulate its commitment and responsibility in this regard, the Company has adopted the Code of Business Conduct (the “Code”). The Code addresses a number of topics, including the Foreign Corrupt Practices Act, conflicts of interest, safeguarding assets, insider trading, and general adherence to laws and regulations. All directors and employees, including executive officers, must comply with the Code. The Code is available on the Company’s website at http://investor.spiritaero.com/govdocs.

Policy Prohibiting Short Selling, Hedging, and Pledging

The Company has adopted a policy prohibiting the Company’s insiders from engaging in short selling, hedging, and pledging the Company’s securities. As it relates to hedging, insiders of the Company are prohibited from purchasing or selling, or making any offer to purchase or offer to sell, derivative securities related to the Company’s securities, such as exchange traded options to purchase or sell the Company’s securities or financial instruments that are designed to hedge or offset any decrease in the market value of the Company’s securities (including but not limited to prepaid variable forwards, equity swaps, collars, and exchange funds). Company insiders include all employees and directors of the Company as well as their spouses, domestic partners, minor children, economic dependents, other persons living in their households, or any corporations, partnerships, trusts, or other entities that they beneficially own, and any person over whom, or trust or other entity over which, they have control.

The Board is responsible for overseeing management succession planning. At least twice annually, the Board reviews candidates for succession with respect to the CEO role and other senior management roles. Succession plans have been developed for both ordinary course succession and contingency planning due to an unforeseen event.

The Board receives updates on the development of the succession candidates regularly. Directors engage with potential succession candidates during formal presentations at Board and committee meetings, and informal events with candidates present.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 26

Compensation of Non-Employee Directors

Non-employee directors receive annual cash and equity compensation as described below. Equity compensation is granted under the Director Stock Program adopted under the 2014 Omnibus Incentive Plan, as amended (the “OIP”). The Compensation Committee reviews and approves non-employee director compensation amounts and practices annually. As part of their review, the Compensation Committee evaluates non-employee director compensation data from the companies in Spirit’s proxy peer group, including data regarding the size of equity awards. In addition, the Compensation Committee confers with its independent compensation consultant on the magnitude and type of non-employee director compensation, and reviews market data and benchmarking surveys provided by the consultant. Based upon that information, the Compensation Committee makes a recommendation to the Board. The Board approves the form and amount of compensation after considering the Compensation Committee’s recommendation.

In developing its recommendations, the Compensation Committee is guided by the following goals with respect to non-employee director compensation:

Compensation should be market-competitive in relation to comparably-situated companies, including the Company’s proxy peer group;

Compensation should align directors’ interests with the long-term interests of the Company’s stockholders; and

The compensation structure should be simple, transparent, and easy for stockholders to understand.

The following table describes the elements of the 2019 non-employee director compensation program:

Element | Amount | |

Annual Board Cash Retainer | $105,000 | |

Annual Board Equity Retainer | $125,000 | |

Additional Retainer for Chairman of the Board | $100,000 | |

Additional Retainer for Chairman of the Audit Committee | $25,000 | |

Additional Retainer for Chairman of the Compensation Committee | $18,000 | |

Additional Retainer for Chairmen of Other Committees | $12,000 | |

Each Board member receives an annual cash retainer, which is paid quarterly. Further, the Chairman of the Board and each committee chairman receives an additional cash retainer. Directors may elect to have their retainers received in shares of restricted stock or restricted stock units (“RSUs”) in lieu of cash.

Each Board member receives an annual equity retainer, which may be paid annually in the form of restricted stock or RSUs. Both types of awards vest if the non-employee director remains continuously in service for the entire term to which the grant relates. If the non-employee director incurs a termination for any reason before the end of the term (before the annual meeting of stockholders following the grant), the awards are forfeited without any payment. The Board may, in its discretion, waive this one-year service condition (in whole or in part) if it deems it to be appropriate and in the best interests of the Company to do so. Upon vesting, shares of restricted stock are delivered to the directors; however, vested RSUs are not paid to the director until the date that the director leaves the Board. Restricted stock confers voting and dividend rights; dividends accrue during the restricted period and are paid out upon vesting. RSUs do not confer voting rights, but do confer dividend equivalent rights; dividend equivalents accrue during the restricted period and thereafter, and are paid out upon settlement. If the awards are forfeited, dividends or dividend equivalents, as applicable, are also forfeited.

Directors are reimbursed for out-of-pocket expenses incurred in connection with their Board service. The Company does not provide perquisite allowances to non-employee directors.

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 27

Non-Employee Director Stock Ownership Requirements

Non-employee directors are required to own stock equal to five times the annual Board cash retainer, which currently amounts to $525,000. Non-employee directors have four years of Board service to meet the minimum stockholder requirements. Restricted stock and RSUs held by directors are counted in determining whether the minimum stockholding requirements are satisfied. Information regarding the current stock ownership of the Company’s non-employee directors can be found below under “Stock Ownership — Beneficial Ownership of Directors and Executive Officers.”

As of March 9, 2020, all non-employee directors other than Ms. Wright, Dr. Cambone, and Mr. Gephardt were in compliance with the stock ownership requirements. Ms. Wright, who joined our Board on February 20, 2018, has until February 20, 2022 to meet the requirements. Dr. Cambone, who joined the Board on October 22, 2019, has until October 22, 2023 to meet the requirements. Mr. Gephardt’s non-compliance was due to the Company’s recent stock price movement (when the Company’s Common Stock price dropped below $52.68 per share on March 3, 2020, he became non-compliant with the requirements). The Company expects that Mr. Gephardt will become compliant with the requirements after receiving the 2020 annual non-employee director equity grant (subject to his election to the Board at the Annual Meeting).

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 28

2019 Director Compensation Table

The following table sets forth non-employee director compensation for the fiscal year ended December 31, 2019 (note that Mr. Gentile’s compensation is set forth in the “Summary Compensation Table” and not included below).

Name | Fees Earned or Paid in Cash ($) | (1)

| Stock Awards ($) | (2)

| All Other Compensation ($) | (3)

| Total ($) |

Stephen A. Cambone |

|

| 115,321 | (4) |

|

| 115,321 |

Charles L. Chadwell | 117,000 |

| 125,035 |

|

|

| 242,035 |

Irene M. Esteves |

|

| 255,047 | (5) |

|

| 255,047 |

Paul E. Fulchino |

|

| 248,062 | (6) |

|

| 248,062 |

Richard A. Gephardt | 105,000 |

| 125,035 |

| 297,513 |

| 527,548 |

Robert D. Johnson | 205,000 |

| 125,035 |

| 16,197 |

| 346,232 |

Ronald T. Kadish | 117,000 |

| 125,035 |

|

|

| 242,035 |

John L. Plueger |

|

| 230,075 | (7) |

|

| 230,075 |

Laura H. Wright | 84,000 |

| 146,078 | (8) |

|

| 230,078 |

(1) Includes annual cash retainer and committee chair retainers (unless deferred). (2) Includes stock retainer and any annual cash or committee chair retainers that were deferred by election. Except for Dr. Cambone (see footnote (4) below): Represents the aggregate grant date fair value of the stock awards computed in accordance with authoritative guidance on stock-based compensation accounting issued by the Financial Accounting Standards Board (the “FASB”). On May 6, 2019, each non-employee director received an annual grant of 1,432 shares of restricted stock or RSUs with an aggregate value of $125,000 based on $87.315 per share, the average of the opening and closing prices of Common Stock on the grant date. As a result of rounding up fractional share amounts, the grants were valued at $125,035. In addition, certain directors elected to defer a portion or all of their annual cash retainer and committee chair retainer, as applicable. Please see footnotes (5), (6), (7), and (8) for more information. As of December 31, 2019, the balance of each non-employee director’s unvested restricted stock RSUs was as follows: Mr. Chadwell: 1,432 shares of restricted stock; Ms. Esteves: 2,921 RSUs (includes 1,489 RSUs for deferred annual cash and committee chair retainers); Mr. Fulchino: 2,841 shares of restricted stock (includes 1,409 shares of restricted stock for deferred annual cash and committee chair retainers); Mr. Gephardt: 1,432 shares of restricted stock; Mr. Johnson: 1,432 shares of restricted stock; Mr. Kadish: 1,432 shares of restricted stock; Mr. Plueger: 2,635 shares of restricted stock (includes 1,203 shares of restricted stock for deferred annual cash retainer); and Ms. Wright: 1,673 shares of restricted stock (includes 241 shares of restricted stock for deferred annual cash retainer). (3) The amount of perquisites and other personal benefits has been excluded for all non-employee directors other than Messrs. Gephardt and Johnson, as the total value of each director’s perquisites and other personal benefits was less than $10,000. For Mr. Gephardt, this amount reflects consulting fees paid to the Gephardt Group for labor consulting services rendered in 2019, as further described under “Director Independence.” For Mr. Johnson, this amount reflects $3,412 in personal aircraft usage (as calculated in Footnote 9 of the “Summary Compensation Table”), and $12,785 in spousal travel expenses. (4) Represents the aggregate grant date fair value computed in accordance with authoritative guidance on stock-based compensation accounting issued by the FASB of the prorata stock award issued to Dr. Cambone on November 5, 2019. On this date, Dr. Cambone received a prorata grant of the annual equity retainer of 737 RSUs with an aggregate value of $62,672 based on $85.045, the average of the opening and closing prices of Common Stock on November 5, 2019. As a result of rounding up the fractional share amount, the grant was valued at $62,678. In addition, Dr. Cambone elected to defer all of his prorata annual cash retainer of $52,645. As of December 31, 2019, the balance of Dr. Cambone’s unvested RSUs is 1,356 RSUs (including 619 RSUs for deferred annual cash retainer). (5) Includes $105,000 in deferred annual cash retainer, and $25,000 in deferred committee chair retainer per Ms. Esteves’ election to receive all compensation in RSUs. (6) Includes $105,000 in deferred annual cash retainer, and $18,000 in deferred committee chair retainer per Mr. Fulchino’s election to receive all compensation in restricted stock. (7) Includes $105,000 in deferred annual cash retainer per Mr. Plueger’s election to receive all compensation in restricted stock. (8) Includes $21,000 in deferred annual cash retainer per Ms. Wright’s election to receive a portion in restricted stock. | |||||||

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 29

Related Person Transaction Policy and Process

The Board has adopted a written Related Person Transaction Policy (the “RPT Policy”) that can be found on the Company’s website at http://www.investor.spiritaero.com/govdocs. The purpose of the RPT Policy is to ensure the proper evaluation, approval, or ratification, and reporting of related person transactions. Such transactions are only appropriate if they are fair to, and in the best interests of, the Company.

Under the RPT Policy, a related person transaction is any transaction in which the Company was, is, or will be a participant, where the amount involved exceeds $120,000, and in which a Related Person has, had, or will have a direct or indirect material interest. A Related Person is a director, director nominee, officer, or 5% stockholder, or any of their immediate family members. The existence of a direct or indirect material interest depends upon individual facts and circumstances and is determined by our General Counsel or the Governance Committee.

The Governance Committee is responsible for reviewing these transactions and determining whether they are fair to, and in the best interests of, the Company. After review of the relevant facts and circumstances, if the Governance Committee concludes the related person transaction is fair to, and in the best interests of, the Company, it may approve or ratify the transaction.

If the Governance Committee declines to approve or ratify any related person transaction, the Company’s General Counsel will review the transaction, determine whether it should be terminated or amended in a manner that is acceptable to the Governance Committee, and advise the Governance Committee of their recommendation. The Governance Committee will then consider the recommendation at its next meeting. If the General Counsel does not ultimately recommend the transaction to the Governance Committee or if the Governance Committee does not approve the transaction, the proposed transaction will not be pursued; or, if the transaction has already been entered into, the Governance Committee will determine an appropriate course of action with respect to the transaction.

Certain Related Person Transactions

Below are the transactions that occurred between January 1, 2019, and March 9, 2020, and fall within the definition of related person transaction in the RPT Policy or under Item 404 of Regulation S-K. With respect to each transaction, the Governance Committee reviewed the transaction in accordance with the RPT Policy and approved it on the basis that it was fair to, and in the best interests of, the Company.

Related Person | Facts |

Richard A. Gephardt | As described under “Board and Governance Matters — Director Independence,” above, the Company entered into an agreement with the Gephardt Group for labor consulting services in 2018 and paid $297,513 pursuant to this agreement during 2019. |

John A. Pilla | John Pilla, Senior Vice President and Chief Technology Officer, has two sons employed by the Company, Anthony Pilla, Cyber Protection Specialist (employed with the Company since June 3, 2016), and Nicolas Pilla, Systems Engineer (employed with the Company since May 31, 2013). Combined, Mr. Pilla’s sons received $187,593 in compensation from the Company in 2019; such compensation was established in accordance with the Company’s compensation practices applicable to employees with equivalent responsibilities, experience, and qualifications. Mr. Pilla’s sons are also eligible to participate in employee benefit programs in the same manner as other eligible employees. |

SPIRIT AEROSYSTEMS - 2020 Proxy Statement 30

Beneficial Ownership of Directors and Executive Officers

The following table sets forth, as of March 9, 2020, the shares of Common Stock beneficially owned by each director and named executive officer, individually, and by all the Company’s directors and executive officers as a group. Individually, each beneficially owns less than 1.0% of our Common Stock. Together, they beneficially own 1.04% of our Common Stock (including unvested time-based and performance-based restricted stock). The table also includes information about RSUs credited to the accounts of certain non-employee directors, which are not beneficially owned. For purposes of the table, shares are considered to be beneficially owned if the person, directly or indirectly, has sole or shared voting or investment power with respect to the shares. In addition, a person is deemed to beneficially own shares if that person has the right to acquire such shares within 60 days after March 5, 2020.

Name | Common Stock Beneficially Owned |

| Shares Vesting within 60 Days of Record Date(1) | Time-Based and Performance- Based Restricted Stock(2) |

| Total Common Stock Beneficially Owned | RSUs(3) |

| Total Common Stock Beneficially Owned And RSUs |

DIRECTORS Stephen A. Cambone |

|

|

|

|

|

|

1,356 |

|

1,356 |

Charles L. Chadwell | 13,821 |

| 1,432 |

|

| 15,253 | 4,884 |

| 20,137 |

Irene M. Esteves |

|

|

|

|

|

| 18,386 |

| 18,386 |

Paul E. Fulchino | 12,234 |

| 2,841 |

|

| 15,075 |

|

| 15,075 |

Richard A. Gephardt | 2,744 |

| 1,432 |

|

| 4,176 | 5,790 |

| 9,966 |

Robert D. Johnson | 11,735 |

| 1,432 |

|

| 13,167 |

|

| 13,167 |

Ronald T. Kadish | 18,673 |

| 1,432 |

|

| 20,105 |

|

| 20,105 |

John L. Plueger | 9,284 |

| 2,635 |

|

| 11,919 | 13,026 |

| 24,945 |

Laura H. Wright | 3,187 |

| 1,673 |

|

| 4,860 |

|

| 4,860 |

EXECUTIVE OFFICERS Thomas C. Gentile III |

125,760 |

|

|

181,737 |

|

307,497 |

|

|

307,497 |

Mark J. Suchinski(4) | 21,181 |

|

| 15,942 |

| 37,123 |

|

| 37,123 |

Jose I. Garcia(4) | 12,281 |

|

| 3,131 |

| 15,412 |

|

| 15,412 |

Sanjay Kapoor(4) | 127,987 |

| 1,000 |

|

| 128,987 |

|

| 128,987 |

Samantha J. Marnick | 53,525 |

|

| 30,100 |

| 83,625 |

|

| 83,625 |

Duane F. Hawkins | 44,214 |

|

| 32,248 |

| 76,462 |

|

| 76,462 |

John A. Pilla(5) | 90,055 |

|

| 27,505 |

| 117,560 |

|

| 117,560 |

All directors and executive officers as a group (22 persons) | 688,207 |

| 13,877 | 382,836 |

| 1,084,920 | 43,442 |

| 1,128,362 |